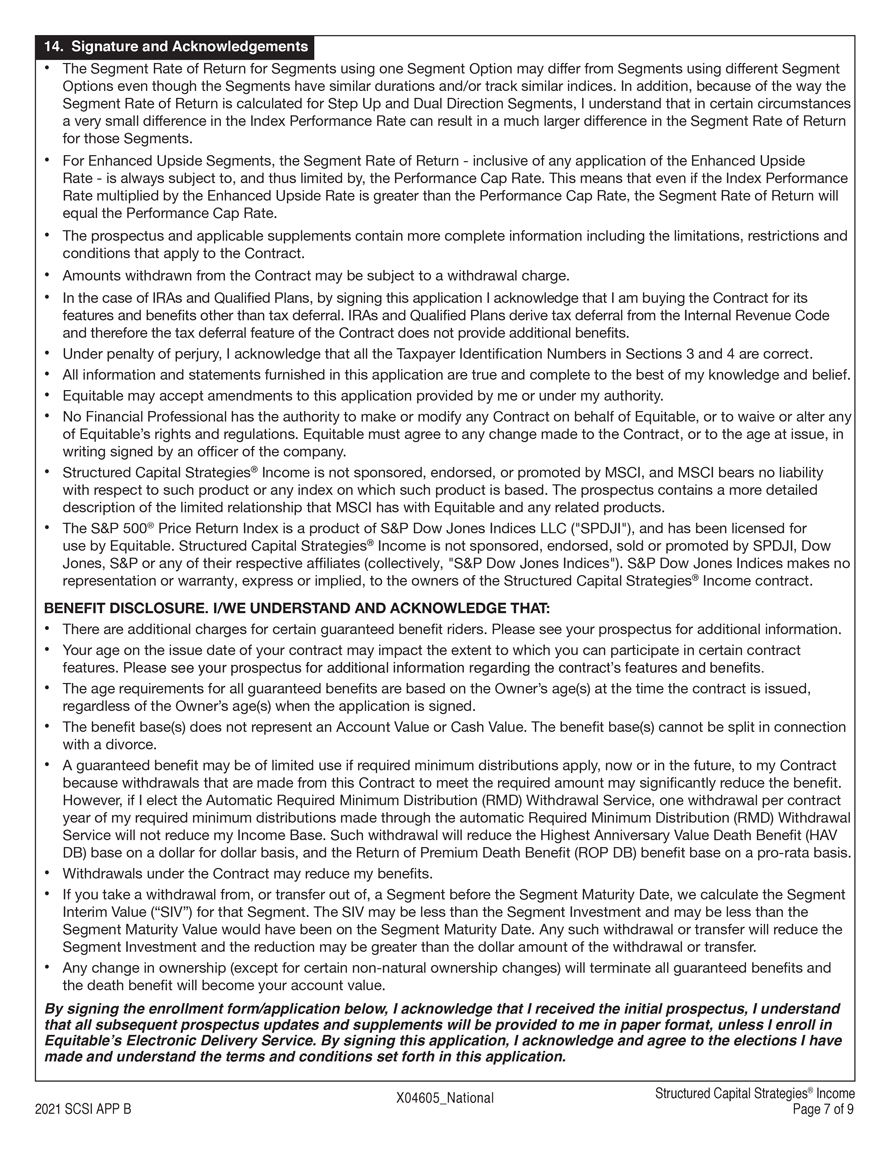

14. Signature and Acknowledgements

• The Segment Rate of Return for Segments using one Segment Option may differ from Segments using different Segment Options even though the Segments have similar durations and/or track similar indices. In addition, because of the way the Segment Rate of Return is calculated for Step Up and Dual Direction Segments, I understand that in certain circumstances a very small difference in the Index Performance Rate can result in a much larger difference in the Segment Rate of Return for those Segments.

• For Enhanced Upside Segments, the Segment Rate of Return—inclusive of any application of the Enhanced Upside Rate—is always subject to, and thus limited by, the Performance Cap Rate. This means that even if the Index Performance Rate multiplied by the Enhanced Upside Rate is greater than the Performance Cap Rate, the Segment Rate of Return will equal the Performance Cap Rate.

• The prospectus and applicable supplements contain more complete information including the limitations, restrictions and conditions that apply to the Contract.

• Amounts withdrawn from the Contract may be subject to a withdrawal charge.

• In the case of IRAs and Qualified Plans, by signing this application I acknowledge that I am buying the Contract for its features and benefits other than tax deferral. IRAs and Qualified Plans derive tax deferral from the Internal Revenue Code • and therefore the tax deferral feature of the Contract does not provide additional benefits.

• Under penalty of perjury, I acknowledge that all the Taxpayer Identification Numbers in Sections 3 and 4 are correct.

• All information and statements furnished in this application are true and complete to the best of my knowledge and belief.

• Equitable may accept amendments to this application provided by me or under my authority.

No Financial Professional has the authority to make or modify any Contract on behalf of Equitable, or to waive or alter any of Equitable’s rights and regulations. Equitable must agree to any change made to the Contract, or to the age at issue, in writing signed by an officer of the company.

• Structured Capital Strategies® Income is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to such product or any index on which such product is based. The prospectus contains a more detailed description of the limited relationship that MSCI has with Equitable and any related products.

• The S&P 500® Price Return Index is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Equitable. Structured Capital Strategies® Income is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P or any of their respective affiliates (collectively, “S&P Dow Jones Indices”). S&P Dow

Jones Indices makes no representation or warranty, express or implied, to the owners of the Structured Capital Strategies® Income contract.

•BENEFIT DISCLOSURE. I/WE UNDERSTAND AND ACKNOWLEDGE THAT:

• There are additional charges for certain guaranteed benefit riders. Please see your prospectus for additional information. Your age on the issue date of your contract may impact the extent to which you can participate in certain contract

• features. Please see your prospectus for additional information regarding the contract’s features and benefits.

The age requirements for all guaranteed benefits are based on the Owner’s age(s) at the time the contract is issued, • regardless of the Owner’s age(s) when the application is signed.

The benefit base(s) does not represent an Account Value or Cash Value. The benefit base(s) cannot be split in connection • with a divorce.

A guaranteed benefit may be of limited use if required minimum distributions apply, now or in the future, to my Contract because withdrawals that are made from this Contract to meet the required amount may significantly reduce the benefit. However, if I elect the Automatic Required Minimum Distribution (RMD) Withdrawal Service, one withdrawal per contract year of my required minimum distributions made through the automatic Required Minimum Distribution (RMD) Withdrawal Service will not reduce my Income Base. Such withdrawal will reduce the Highest Anniversary Value Death Benefit (HAV

• DB) base on a dollar for dollar basis, and the Return of Premium Death Benefit (ROP DB) benefit base on a pro-rata basis.

• Withdrawals under the Contract may reduce my benefits.

If you take a withdrawal from, or transfer out of, a Segment before the Segment Maturity Date, we calculate the Segment Interim Value (“SIV”) for that Segment. The SIV may be less than the Segment Investment and may be less than the Segment Maturity Value would have been on the Segment Maturity Date. Any such withdrawal or transfer will reduce the

• Segment Investment and the reduction may be greater than the dollar amount of the withdrawal or transfer. Any change in ownership (except for certain non-natural ownership changes) will terminate all guaranteed benefits and the death benefit will become your account value.

By signing the enrollment form/application below, I acknowledge that I received the initial prospectus, I understand that all subsequent prospectus updates and supplements will be provided to me in paper format, unless I enroll in

Equitable’s Electronic Delivery Service. By signing this application, I acknowledge and agree to the elections I have made and understand the terms and conditions set forth in this application.

X04605_National Structured Capital Strategies® Income 2021 SCSI APP B Page 7 of 9