|

David E. Rosewater 212.756.2208 | Writer's E-mail Address David.Rosewater@srz.com |

March 22, 2013

VIA EDGAR AND ELECTRONIC MAIL

Peggy Kim

Special Counsel

Office of Mergers and Acquisitions

Securities and Exchange Commission

Washington D.C. 20549 |

Re: Vivus, Inc. ("Vivus" or the "Company")

Soliciting Material filed pursuant to Rule 14a-12

Filed by First Manhattan Co. et al.

Filed March 8, 2013

File No. 1-33389

Dear Ms. Kim:

On behalf of First Manhattan Co., First Health, L.P., First Health Limited, First Health Associates, L.P., First BioMed Management Associates, LLC, First BioMed, L.P., First BioMed Portfolio, L.P. (collectively, "First Manhattan"), Michael James Astrue, Jon C. Biro, Samuel F. Colin, Johannes J.P. Kastelein, David York Norton and Herman Rosenman, (collectively, the "Nominees), Rolf Bass and Melvin L. Keating (collectively, the "Alternate/Additional Nominees" and, together with the Nominees and First Manhattan, the "Filing Persons"), we are responding to your letter dated March 12, 2013 (the "SEC Comment Letter") in connection with the soliciting material filed pursuant to Rule 14a-12 (the "Soliciting Material") on March 8, 2013 (the "Filing Date"). We have reviewed the comments of the staff (the "Staff") of the Securities and Exchange Commission (the "Commission") and respond below. For your convenience, the comments are restated below in italics, with our responses following. Capitalized terms used but not defined herein have the meaning ascribed to such terms in the Soliciting Material.

For your convenience, we are emailing to your attention a copy of this letter, including Exhibit A which contains all relevant supporting documentation referenced herein, highlighted per your request in the SEC Comment Letter.

Peggy Kim

March 22, 2013

Page 2

| 1. | We note the following statement about the issuer: “…in light of the failed Qsymia launch, which has led to a 65% decline in Vivus stock price. That translates to a $2B loss in shareholder value over the past eight months.” Please provide supplementally to us or revise to disclose, your support for any statements relating to the board’s or the issuer’s performance. In addition, to facilitate our review, where the bases are other documents, such as prior proxy statements, Forms 10-K and 10-Q, annual reports, analysts’ reports and newspaper articles, provide either complete copies of the documents or sufficient pages of information so that we can assess the context of the information upon which you rely. Please also mark or highlight the supporting documents provided to identify the specific information upon which you rely. |

In response to your comment, the Filing Persons are hereby providing supplemental support for the foregoing statements. The "65% decline in Vivus stock price" referenced in the foregoing statements is based on the 65.9% percent change calculated as follows: (A) the difference between (i) $29.931, the price of Vivus common stock on July 3, 2012 (approximately 76 days prior to the launch of Qsymia), which was the highest closing price of Vivus common stock in the eight months prior to the Filing Date; and (ii) $10.20, the price of Vivus common stock on March 4, 2013 (four days prior to the Filing Date);divided by (B) the initial price of $29.93. The "$2B loss in shareholder value" was based on the $1.98 billion decline calculated as follows: the difference between (x) $3.004 billion, the market capitalization2 of the Company on July 3, 2012 (prior to the launch of Qsymia), and (y) $1.027 billion, the market capitalization3 of the Company as of March 4, 2013 (four days prior to the Filing Date). Copies of the supporting documentation identifying the number of shares outstanding on the foregoing dates and containing the financial data cited above are attached hereto in Exhibit A.

| 2. | We note the following statements regarding FMC: “Only once in FMC’s history of investing in thousands of companies have we felt compelled to nominate directors. That company’s stock price more than doubled in approximately four months after three of our nominees were seated.” Please provide us with supplemental support for your statements. Please balance your disclosure by stating that the results that FMC may achieve for Vivus may not be the same as those achieved for the company discussed. |

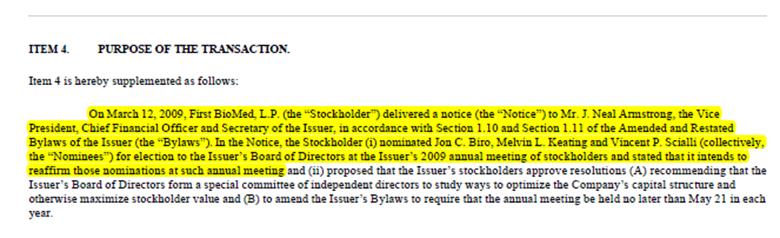

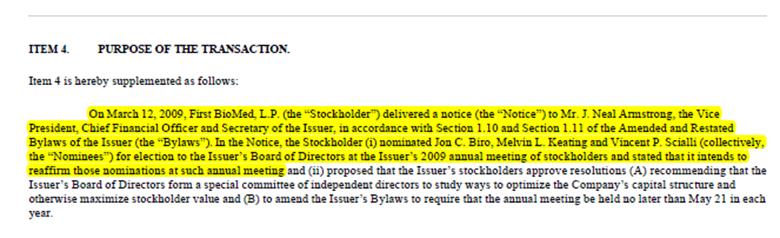

In response to your comment, the Filing Persons note that First Manhattan nominated three individuals for election to the board of directors of Aspect Medical Systems, Inc. ("Aspect") in March 2009, as disclosed in Amendment No. 1 to Schedule 13D filed with the SEC by First Manhattan Co., First BioMed Management Associates, LLC and

1 Unless otherwise indicated, all stock prices referenced herein were obtained from Bloomberg.

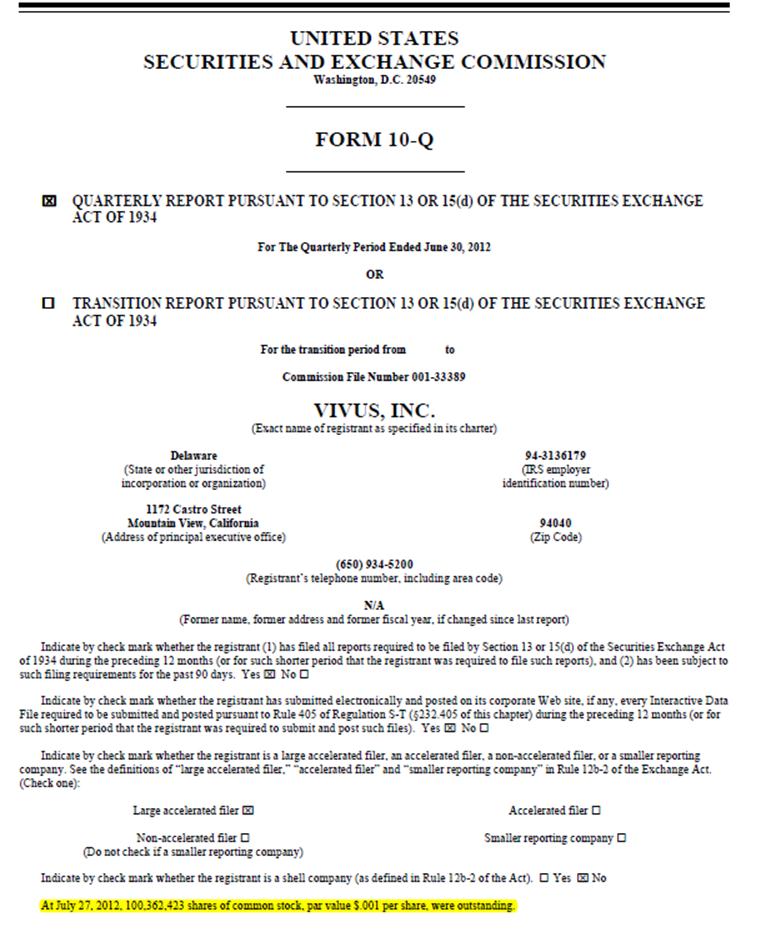

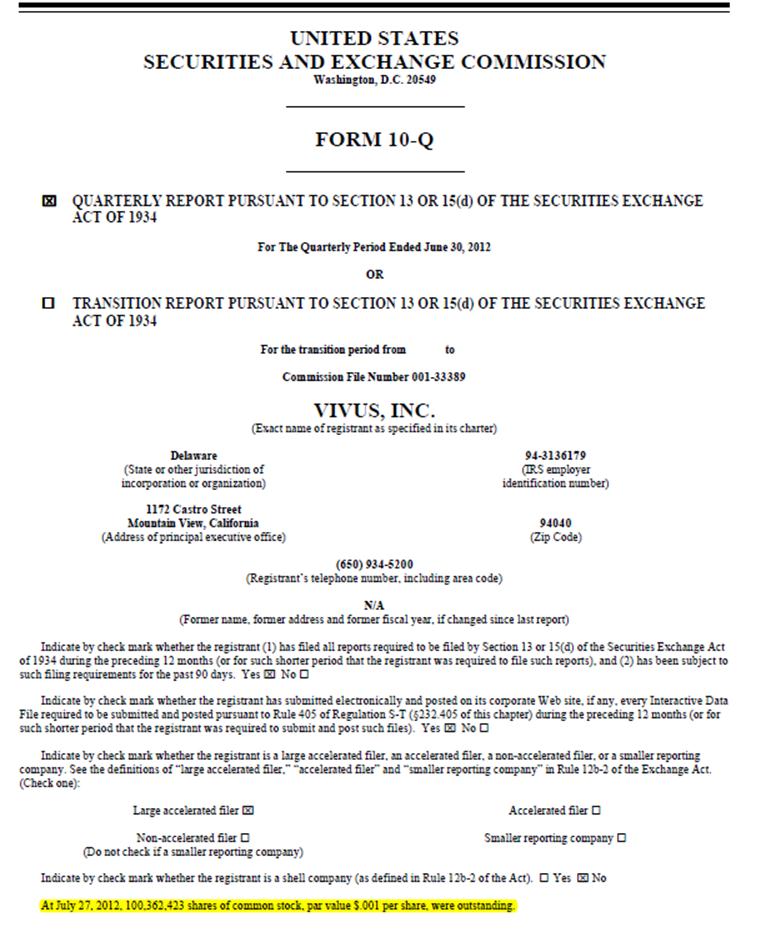

2 Market capitalization was calculated as follows: (i) $29.93, the closing price of Vivus common stock on July 3, 2012, multiplied by (ii) the 100,362,423 shares of Vivus common stock outstanding as of July 27, 2012, as reported in Company's Quarterly Report on Form 10-Q for the period ended June 30, 2012, filed with the SEC on August 7, 2012.

3 Market capitalization was calculated as follows: (i) $10.20, the closing price of Vivus common stock on March 4, 2013, multiplied by (ii) the 100,660,029 shares of Vivus common stock outstanding as of February 19, 2013, as reported in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed with the SEC on February 26, 2013.

Peggy Kim

March 22, 2013

Page 3

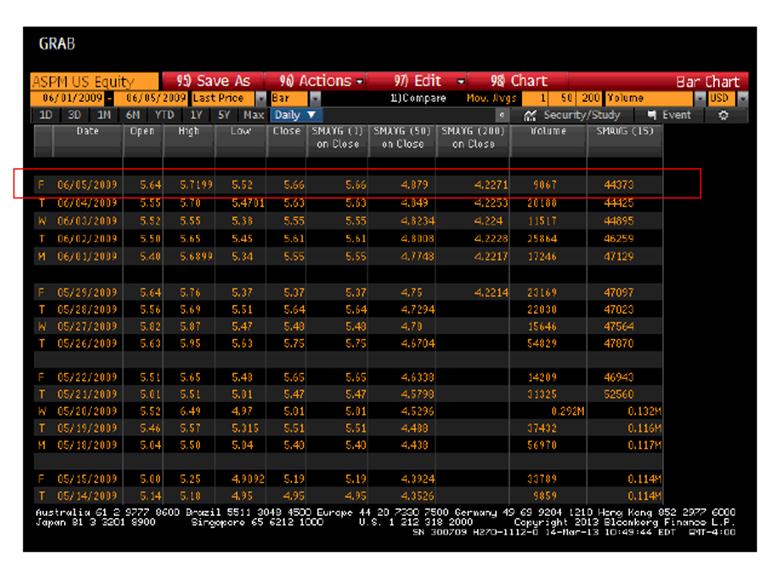

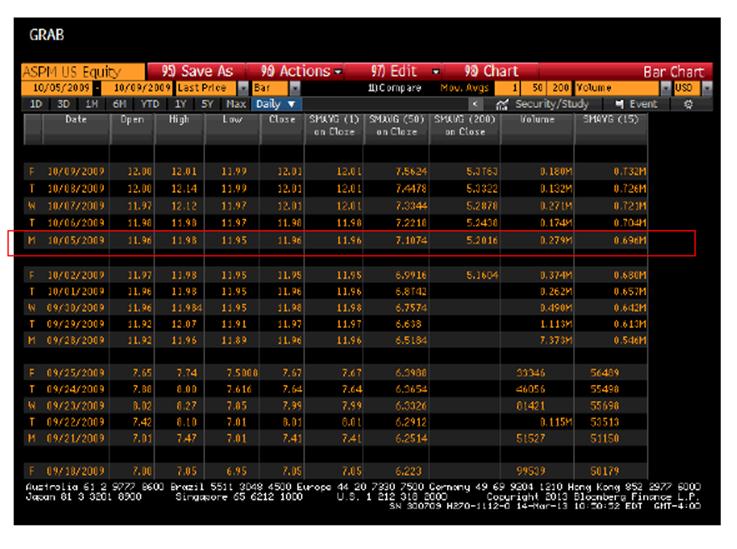

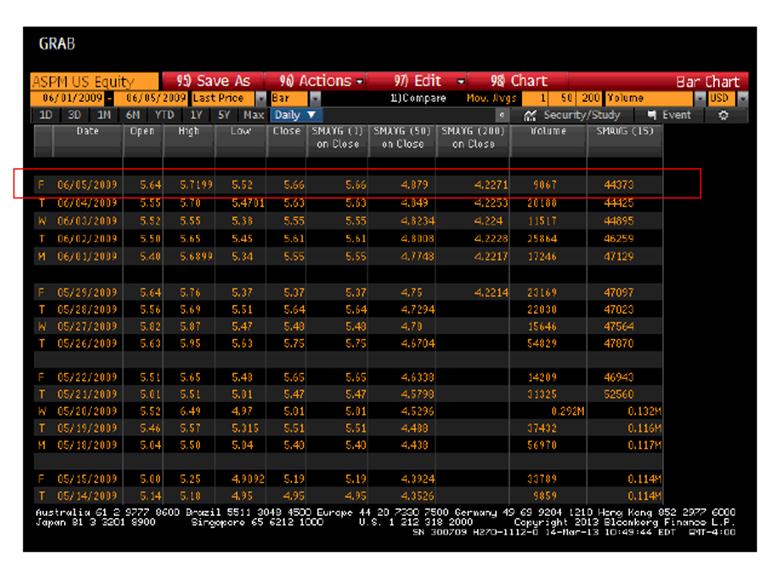

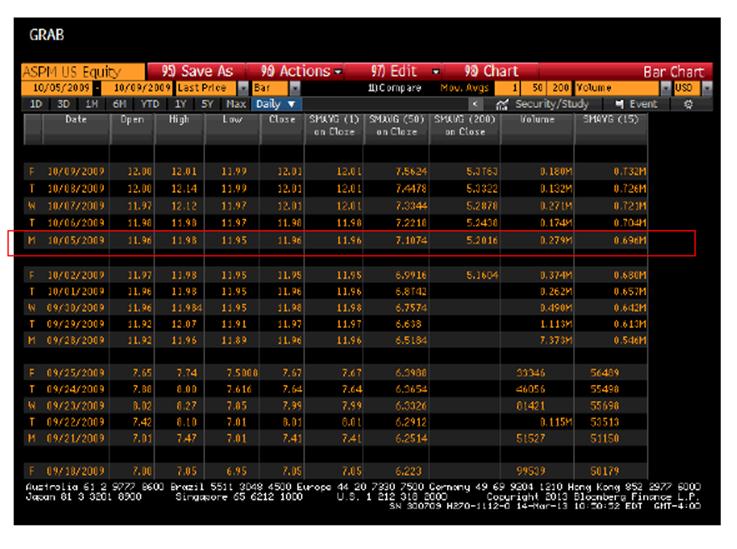

Vincent P. Scialli on March 12, 2009. As disclosed in Aspect's Current Report on Form 8-K, filed with the SEC on April 9, 2009, Aspect and First Manhattan Co., First BioMed Management Associates, LLC and First BioMed, L.P. entered into a settlement agreement, pursuant to which Aspect nominated three of First Manhattan's nominees to serve as directors on Aspect's board of directors. At the time First Manhattan's three nominees were elected to Aspect's board of directors on June 5, 2009, the price of common stock of Aspect was $5.66. On October 5, 2009, four months after First Manhattan's nominees were elected to Aspect's board of directors, the price of common stock of Aspect was $11.96, which equals 2.11 times the closing price of Aspect's common stock on June 5, 2009. Copies of the supporting documentation referenced above and containing the financial data cited above are attached hereto in Exhibit A. The Filing Persons respectfully note that, to the best of their knowledge, other than with respect to the foregoing nominations of individuals to the board of directors of Aspect, First Manhattan has never nominated individuals for election to the board of directors of any other company. In addition, the Filing Persons hereby confirm that, to the extent the results of Aspect are referenced in future soliciting materials in connection with the seating of First Manhattan's nominees on the Aspect board of directors, they will include a statement that there is no assurance that the results that First Manhattan may achieve for the Company will be the same as those achieved for Aspect.

| 3. | Regarding your nominees, we note the following statement: “They have fixed broken companies, refinanced distressed companies, successfully launched blockbuster drugs, and sold companies at favorable prices for shareholders.” Please provide us with supplemental support for your statement. Please balance your disclosure by stating that the results that the nominees may achieve for Vivus may not be the same as those achieved for the companies discussed. |

In response to your comment, the Filing Persons are hereby providing supplemental support for the foregoing statements. The following are examples of situations in which the Nominees have "fixed broken companies":

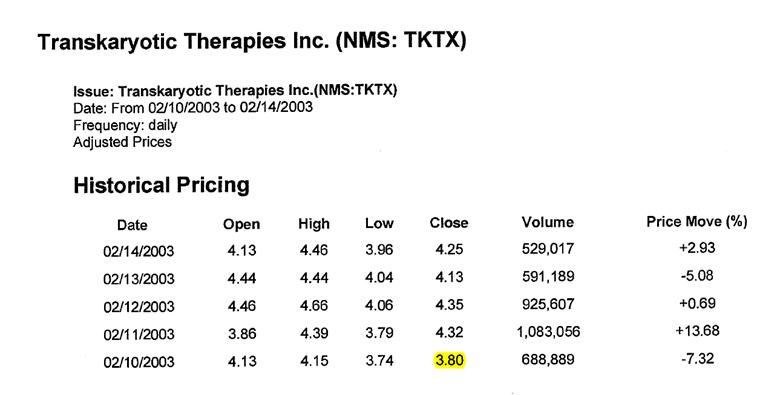

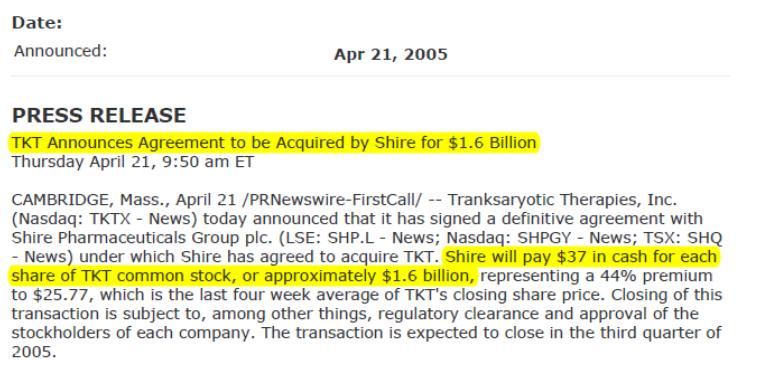

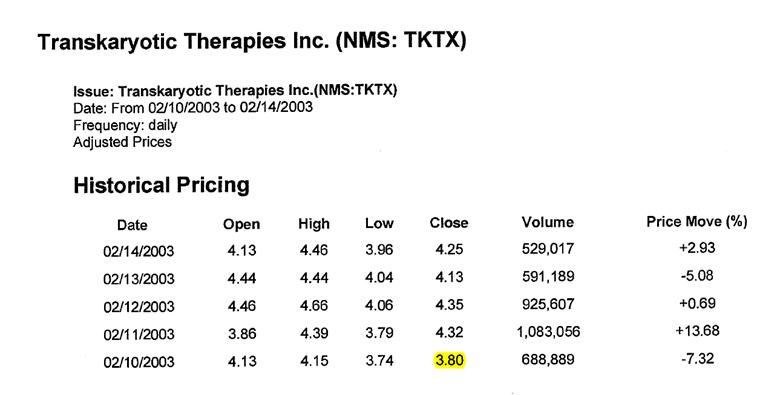

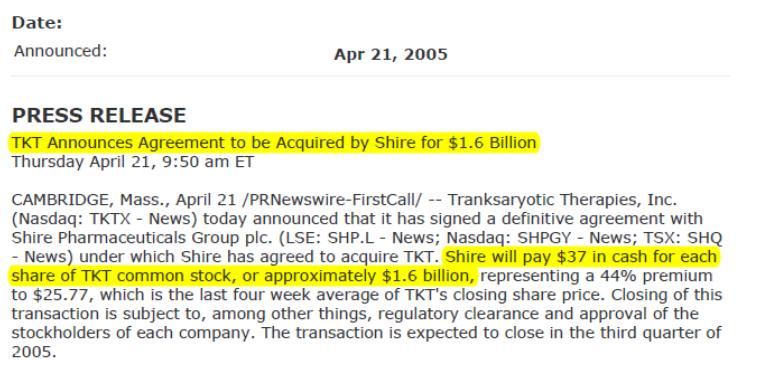

| · | Michael James Astrue served as President and Chief Executive Officer of Transkaryotic Therapies, Inc. from 2003 until 2005. Under his stewardship, Transkaryotic Therapies' share price increased from $3.80 at the start of his tenure to $37.00 when the company was sold two years later for $1.6 billion. |

| · | From 1994 until 2008, Jon C. Biro served in various capacities at ICO, Inc., including as Senior Vice President, Chief Financial Officer, Treasurer, a director and, for a time, interim Chief Executive Officer. While at ICO, he helped manage an operational turnaround, including the improvement of the balance sheet and overall capital structure, which helped to increase ICO's stock price from an average closing stock price of $5.03 in October 1994, when Mr. Biro began his tenure at ICO, to a closing stock price of $12.14 on January 11, 2008, the day that Mr. Biro retired. |

Peggy Kim

March 22, 2013

Page 4

The following is an example of a situation in which the Nominees have "refinanced distressed companies":

| · | Melvin L. Keating served as President and Chief Executive Officer of Alliance Semiconductor Corp. from 2005 until 2008. During that time, he transformed it from a distressed company with a current ratio of 1.6x and a debt-to-assets ratio of 38.7% in 2005, to one with a current ratio of 255.7x and a debt-to-assets ratio of 4.7% in 2008 by selling underperforming assets, decreasing the amount of losses suffered by the company and raising a large amount of capital. |

The following are examples of situations in which the Nominees have "successfully launched blockbuster drugs":

| · | David York Norton served in a number of positions at Johnson & Johnson from 1979 until 2011 in various capacities, including as a Managing Director, Vice President, President and Company Group Chairman, with a focus in Australia, Europe and the United States. Under his stewardship, Johnson & Johnson successfully commercialized numerous blockbuster products, including but not limited to: |

| – | Risperdal Consta (U.S. and Europe): Risperdal Consta was launched by Janssen-Cilag Ltd. (a subsidiary of Johnson & Johnson) in Europe in 2002 and in the United States in 2003. Risperdal Consta treats Bipolar I Disorder and schizophrenia and uses an innovative delivery system that allows it to be given once every two weeks. As Company Group Chairman, Pharmaceuticals Group – Europe, Middle East, Africa in 2002 and Company Group Chairman, Pharmaceuticals Group – North America in 2003, Mr. Norton was responsible for reviewing and challenging product launch plans, attended sales and marketing meetings and worked with the research and development group to assess and plan future development opportunities for Johnson & Johnson products, including Risperdal Consta. As disclosed in Johnson & Johnson's Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed with the SEC on February 26, 2013 (the "J&J 10-K"), Risperdal Consta sales were $1.4 billion in 2012. |

| – | Prezista (U.S. and Europe): Launched in 2007 by Janssen Pharmaceutica Products, L.P. (a subsidiary of Johnson & Johnson), Prezista is used for the treatment of HIV/AIDS. Although Prezista was part of the Virology Franchise, Mr. Norton had overall responsibility for the commercial |

Peggy Kim

March 22, 2013

Page 5

| | operations of all operating companies in Europe, the Middle East and Africa as Company Group Chairman, Worldwide Commercial & Operations, CNS/Internal Medicine Franchise. In addition, Mr. Norton was involved in the long-term development plans for various products within the company's Virology Franchise, including Prezista, as a member of the Pharmaceutical Group Operating Committee. Such development plans included clinical development, licensing and partnership arrangements, pricing and market access strategies. As disclosed in the J&J 10-K, Prezista sales were $1.4 billion in 2012. |

| – | Aciphex (U.S.): Launched in 1999 by Janssen Pharmaceutica, Inc. (a subsidiary of Johnson & Johnson) and Eisai, Inc., Aciphex is a proton pump inhibitor. As President of Janssen Pharmaceutica US, Mr. Norton was responsible for the launch and commercialization of Aciphex in the United States. He was also responsible for the development of the sales and marketing plan for Aciphex, for pre-marketing and launch activities and for various other sales and marketing activities. In addition, as co-head of the Janssen/Eisai Joint Steering Committee, Mr. Norton was responsible for the development of a long-term clinical development plan for Aciphex. As disclosed in Johnson & Johnson's sales and earnings release for the 2007 fourth quarter and fiscal year end, Aciphex sales peaked in 2007 at $1.357 billion. |

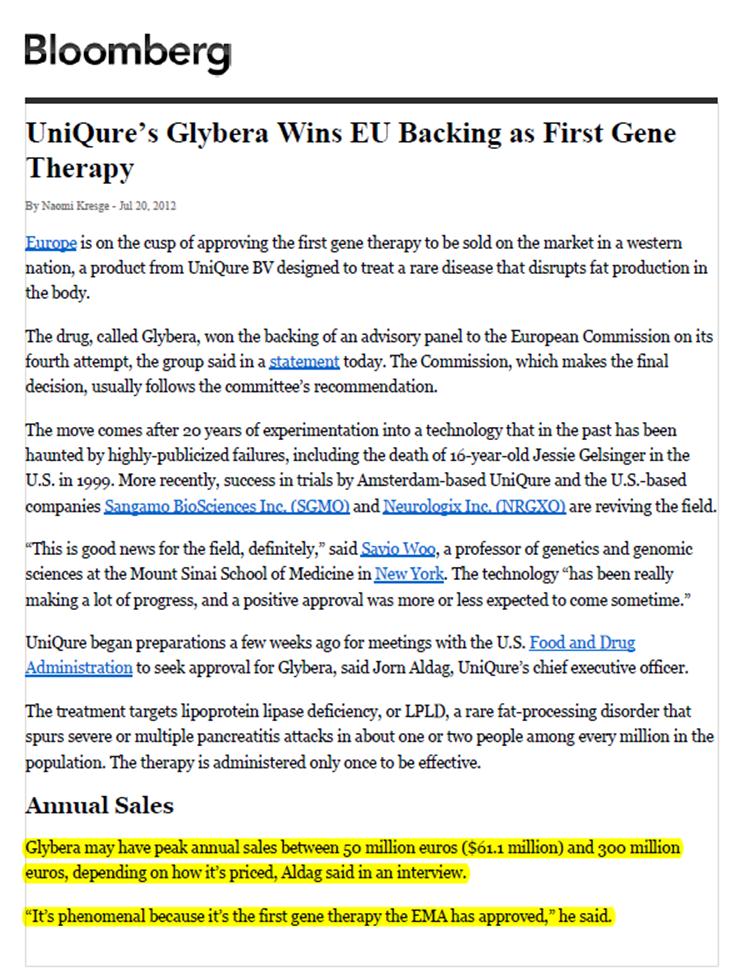

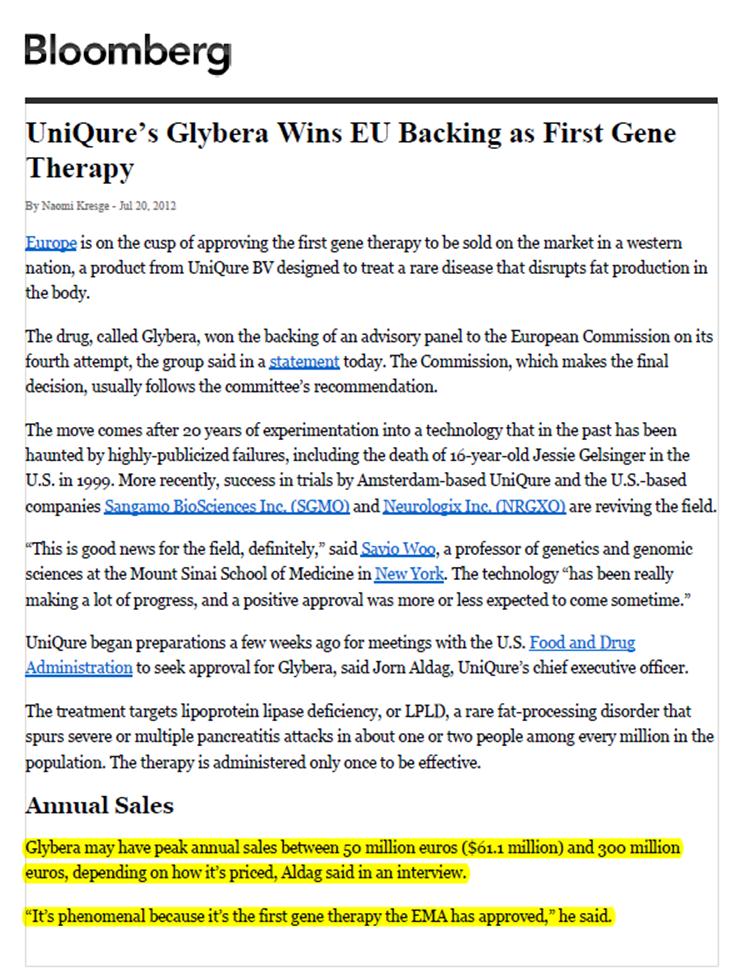

| · | Johannes J.P. Kastelein, M.D. co-founded Amsterdam Molecular Therapeutics, Inc. (currently UniQure, B.V.), where he helped secure approval in July 2012 from the European Medicines Agency Committee for Medicinal Products for Human Use for Glybera, the first gene therapy ever approved in Europe or the United States. Because Glybera was only recently approved there is no conclusive statement on the success of its sales, but the Chief Executive Officer of UniQure has estimated that Glybera may have peak annual sales between 50 million euros ($61.1 million) and 300 million euros ($390.1 million), depending on ultimate pricing. |

The following are examples of situations in which the Nominees have "sold companies at favorable prices for shareholders":

| · | Herman Rosenman was Senior Vice President of Finance and Chief Financial Officer at Gen-Probe Inc. from 2001 to 2012, where he helped manage a significant turnaround and sale of Gen-Probe that resulted in a significant increase in the company’s stock price, from a low closing stock price during the third quarter of 2002 (when stock price data for Gen-Probe first became publicly available) of $6.76 (adjusted to reflect the two-for-one stock split announced in September 2003) to a stock price of $82.75 in August 2012, when Gen-Probe was acquired by Hologic, Inc. for $3.72 billion. |

| · | Michael James Astrue served as President and Chief Executive Officer of Transkaryotic Therapies, Inc. from 2003 until 2005. Under his stewardship, Transkaryotic Therapies' share price increased from $3.80 at the start of his tenure to $37.00 when the company was sold two years later for $1.6 billion. |

Peggy Kim

March 22, 2013

Page 6

| · | Jon C. Biro and Melvin L. Keating joined the board of directors of Aspect on June 5, 2009, when the price of Aspect's common stock was $5.66. As directors, they oversaw the sale of Aspect to Covidien plc in September 2009 for $12.00 per share. |

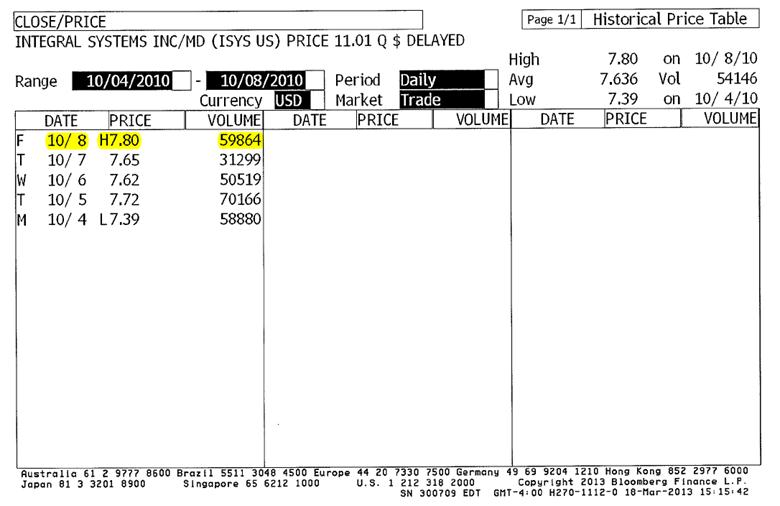

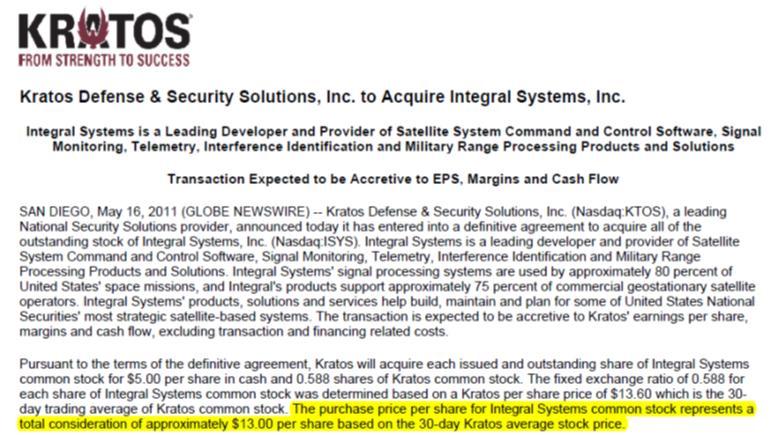

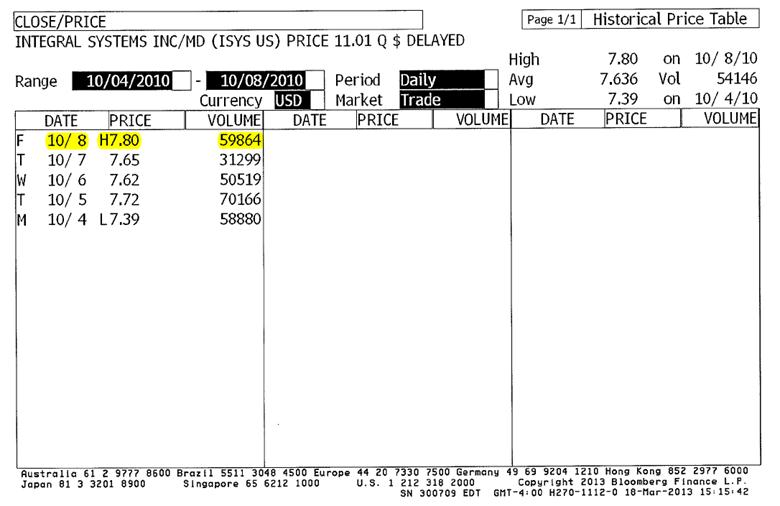

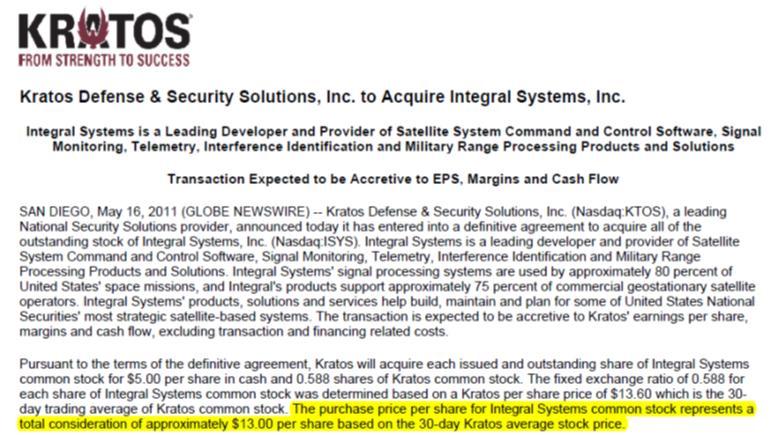

| · | Melvin L. Keating was appointed to the board of directors of Integral Systems, Inc. on October 8, 2010, when the price of Integral System's common stock was $7.80. Mr. Keating was also the Chairman of the Strategic Alternatives Committee of the board, which oversaw the sale of Integral Systems to Kratos Defense & Security Solutions, Inc. in 2011 for approximately $13.00 per share based on the 30-day average stock price of Kratos. |

| · | Melvin L. Keating was appointed to the board of directors of White Electronic Designs Corp. on February 9, 2009, when the price of its common stock was $4.01. As the only member of the Strategic Committee of the board, Mr. Keating led the sale of White Electronic Designs to Microsemi Corporation in March 2010 for $7.00 per share. |

In addition, the Filing Persons hereby confirm that, to the extent any results listed in this response to comment three of the SEC Comment Letter are referenced in future soliciting materials in connection with the Nominees, they will include a statement that there is no assurance that the results that the Nominees may achieve for the Company will be the same as those achieved for any company referenced in this response. Copies of the supporting documentation referenced above and containing the financial data cited above are attached hereto in Exhibit A.

| 4. | We note the various plans that the participants have for Vivus, including immediately electing a Lead Independent Director. Please revise to clarify that the nominees’ plans could change subject to their fiduciary duty to stock holders if elected. |

The Filing Persons hereby confirm that they will note in future soliciting materials that, if elected, the Nominees' plans, including the immediate election of a Lead Independent Director, may change subject to their fiduciary duties to stockholders.

Sincerely,

/s/ David E. Rosewater

David E. Rosewater

Peggy Kim

March 22, 2013

Page 7

Each of the undersigned (each a “participant”) hereby acknowledges that (i) the participant and/or filing person is responsible for the adequacy and accuracy of the disclosure in the filings on Schedule 14A; (ii) staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings and (iii) the participant and/or filing person may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

| Dated: March 22, 2013 | | |

| | | |

| FIRST MANHATTAN CO. | | FIRST HEALTH, L.P. |

| | | |

By: FIRST MANHATTAN LLC,

General Partner | | By: FIRST MANHATTAN CO., INC.,

General Partner |

| | | |

| By: | /s/ Neal K. Stearns | | By: | /s/ Neal K. Stearns |

| Name: Neal K. Stearns | | Name: Neal K. Stearns |

| Title: Managing Member | | Title: Vice President |

| | | |

| | | |

| FIRST HEALTH LIMITED | | FIRST HEALTH ASSOCIATES, L.P. |

| | | |

| By: | /s/ Neal K. Stearns | | By: FIRST MANHATTAN CO., INC.,

General Partner |

| Name: Neal K. Stearns |

| Title: Vice President | | |

| | | By: | /s/ Neal K. Stearns |

| | | Name: Neal K. Stearns |

| | | Title: Vice President |

| | | |

| | | |

| FIRST BIOMED MANAGEMENT ASSOCIATES, LLC | | FIRST BIOMED, L.P. |

By: FIRST MANHATTAN CO.,

Co-Managing Member | | By: FIRST BIOMED MANAGEMENT ASSOCIATES, LLC, General Partner

|

By: FIRST MANHATTAN LLC, General Partner | | By: FIRST MANHATTAN CO., Co-Managing Member

|

| | | By: FIRST MANHATTAN LLC, General |

| By: | /s/ Neal K. Stearns | | Partner |

| Name: Neal K. Stearns | | |

| Title: Managing Member | | By: | /s/ Neal K. Stearns |

| | | Name: Neal K. Stearns |

| | | Title: Managing Member |

| | | |

| | | | | | |

Peggy Kim

March 22, 2013

Page 8

| FIRST BIOMED PORTFOLIO, L.P. | | |

| | | |

| By: FIRST BIOMED MANAGEMENT ASSOCIATES, LLC, General Partner | | |

| | | |

By: FIRST MANHATTAN CO., Co-

Managing Member | | |

| | | |

| By: FIRST MANHATTAN LLC, General Partner | | |

| | | |

| By: | /s/ Neal K. Stearns | | |

| Name: Neal K. Stearns | | |

| Title: Managing Member | | |

| | | |

| | | |

| /s/ Michael James Astrue | | /s/ Jon C. Biro |

| Michael James Astrue | | Jon C. Biro |

| | | |

| | | |

| /s/ Samuel F. Colin | | /s/ Johannes J.P. Kastelein |

| Samuel F. Colin | | Johannes J.P. Kastelein |

| | | |

| | | |

| /s/ David York Norton | | /s/ Herman Rosenman |

| David York Norton | | Herman Rosenman |

| | | |

| | | |

| /s/ Rolf Bass | | /s/ Melvin L. Keating |

| Rolf Bass | | Melvin L. Keating |

| | | | |

EXHIBIT A

The following is supplemental support for the statements referenced in Comment 1 of the SEC Comment Letter.

Source: Bloomberg

Source: Bloomberg

Source: Vivus, Inc. Quarterly Report on Form 10-Q for the period ended June 30, 2012, filed with the SEC on August 7, 2012.

Source: Vivus, Inc. Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed with the SEC on February 26, 2013

The following is supplemental support for the statements referenced in Comment 2 of the SEC Comment Letter.

Source: Amendment No. 1 to Schedule 13D filed with the SEC by First Manhattan Co., First BioMed Management Associates, LLC and Vincent P. Scialli on March 12, 2009.

Source: Current Report on Form 8-K, filed by Aspect Medical Systems, Inc. with the SEC on April 9, 2009.

Source: Bloomberg

Source: Bloomberg

The following is supplemental support for the statements referenced in Comment 3 of the SEC Comment Letter.

Source: Mergent Online

Source: PRN Newswire

Source: Bloomberg

Source: Bloomberg

Source: Annual Report on Form 10-K for the fiscal year ended December 31, 2003, filed by Gen-Probe Incorporated on March 9, 2004.

Source: http://investors.hologic.com/2012-08-01-Hologic-Completes-Acquisition-Of-Gen-Probe

| Alliance Semiconductor Corp. (OTCPK:ALSC) |

| | |

| | |

| Ratios | |

| For the Fiscal Period Ending | 12 months

Mar-31-2005 |

| | |

| Short Term Liquidity | |

| Current Ratio | 1.6x |

| Quick Ratio | 1.4x |

| Cash from Ops. to Curr. Liab. | NM |

| Avg. Days Sales Out. | NA |

| Avg. Days Inventory Out. | NA |

| Avg. Days Payable Out. | NA |

| Avg. Cash Conversion Cycle | NA |

| | |

| Long Term Solvency | |

| Total Debt/Equity | NA |

| Total Debt/Capital | NA |

| LT Debt/Equity | NA |

| LT Debt/Capital | NA |

| Total Liabilities/Total Assets | 38.7% |

Source: Capital IQ

| Alliance Semiconductor Corp. (OTCPK:ALSC) |

| | | | | | | |

| | | | | | | |

| Ratios | | | | | | |

| For the Fiscal Period Ending | 12 months

Mar-31-2008 | | | | | |

| | | | | | | |

| Short Term Liquidity | | | | | | |

| Current Ratio | 255.7x | | | | | |

| Quick Ratio | 238.0x | | | | | |

| Cash from Ops. to Curr. Liab. | 7.9x | | | | | |

| Avg. Days Sales Out. | NA | | | | | |

| Avg. Days Inventory Out. | NA | | | | | |

| Avg. Days Payable Out. | NA | | | | | |

| Avg. Cash Conversion Cycle | NA | | | | | |

| | | | | | | |

| Long Term Solvency | | | | | | |

| Total Debt/Equity | NA | | | | | |

| Total Debt/Capital | NA | | | | | |

| LT Debt/Equity | NA | | | | | |

| LT Debt/Capital | NA | | | | | |

| Total Liabilities/Total Assets | 4.7% | | | | | |

Source: Capital IQ

Source: Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed by Johnson & Johnson on Febraury 22, 2013.

Source: Johnson & Johnson Sales and Earnings Release for the 2007 Fourth Quarter and Fiscal Year.

Source: Bloomberg

Source: http://investor.covidien.com/phoenix.zhtml?c=207592&p=irol-newsArticle&id=1335791

Source: Bloomberg

Source: http://ir.kratosdefense.com/releasedetail.cfm?releaseid=577550

Source: Bloomberg

Source: http://investor.microsemi.com/releasedetail.cfm?releaseid=455349