FIRST MANHATTAN CO. Vivus – Why Change Is Needed Now June 3, 2013

Forward - Looking Statements FIRST MANHATTAN CO. AND/OR ITS AFFILIATES (COLLECTIVELY, “FIRST MANHATTAN”) DO NOT ASSUME RESPONSIBILITY FOR INVESTMENT DECIS ION S. THIS PRESENTATION DOES NOT RECOMMEND THE PURCHASE OR SALE OF ANY SECURITY. UNDER NO CIRCUMSTANCES IS THIS PRESENTATION TO BE USED OR CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY. THE PARTICIPANTS INCLUDE FUNDS AND ACCOUNTS TH AT ARE IN THE BUSINESS OF TRADING - BUYING AND SELLING - PUBLIC SECURITIES. IT IS POSSIBLE THAT THERE WILL BE DEVELOPMENTS IN THE FUTURE THAT CAUSE ONE OR MORE OF THE PARTICIPANTS FROM TIME TO TIME TO SELL ALL OR A PORTION OF THEIR SHARES IN OPEN MARKET TRANSACTIONS OR OTHERWISE (IN CLUDING VIA SHORT SALES), BUY ADDITIONAL SHARES (IN OPEN MARKET OR PRIVATELY NEGOTIATED TRANSACTIONS OR OTHERWISE) OR TRADE IN OPTIONS, P UTS , CALLS OR OTHER DERIVATIVE INSTRUMENTS RELATING TO SUCH SHARES. FIRST MANHATTAN RESERVES THE RIGHT TO CHANGE ANY OF ITS OPINIONS EXPRESSED HEREIN AT ANY TIME AS IT DEEMS APPROPRIATE. FIRST MAN HATTAN DISCLAIMS ANY OBLIGATION TO UPDATE THE INFORMATION CONTAINED HEREIN. FIRST MANHATTAN HAS NOT SOUGHT OR OBTAINED CONSENT FROM ANY THIRD PARTY TO USE ANY STATEMENTS OR INFORMATION INDICATED IN THIS PRESENTATION AS HAVING BEEN OBTAINED OR DERIVED FROM STATEMENTS MAD E OR PUBLISHED BY THIRD PARTIES. ANY SUCH STATEMENTS OR INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD P ART Y FOR THE VIEWS EXPRESSED HEREIN. FIRST MANHATTAN MAY HAVE RELIED UPON CERTAIN QUANTITATIVE AND QUALITATIVE ASSUMPTIONS WHEN PREPARING THE ANALYSIS WHICH MAY N OT BE ARTICULATED AS PART OF THE ANALYSIS. THE REALIZATION OF THE ASSUMPTIONS ON WHICH THE ANALYSIS WAS BASED ARE SUBJECT TO SIGNIF ICA NT UNCERTAINTIES, VARIABILITIES AND CONTINGENCIES AND MAY CHANGE MATERIALLY IN RESPONSE TO SMALL CHANGES IN THE ELEMENTS THAT CO MPR ISE THE ASSUMPTIONS, INCLUDING THE INTERACTION OF SUCH ELEMENTS. FURTHERMORE, THE ASSUMPTIONS ON WHICH THE ANALYSIS WAS BASED MAY BE NECESSARILY ARBITRARY, MAY BE MADE AS OF THE DATE OF THE ANALYSIS, DO NOT NECESSARILY REFLECT HISTORICAL EXPERIENCE WITH RESP ECT TO SECURITIES SIMILAR TO THOSE THAT MAY BE THE CONTAINED IN THE ANALYSIS, AND DO NOT CONSTITUTE A PRECISE PREDICTION AS TO FUTURE EVENTS. BECAUSE OF THE UNCERTAINTIES AND SUBJECTIVE JUDGMENTS INHERENT IN SELECTING THE ASSUMPTIONS AND ON WHICH THE ANALYSIS WAS BAS ED AND BECAUSE FUTURE EVENTS AND CIRCUMSTANCES CANNOT BE PREDICTED, THE ACTUAL RESULTS REALIZED MAY DIFFER MATERIALLY FROM THOSE PRO JEC TED IN THE ANALYSIS. NOTHING INCLUDED IN THE ANALYSIS CONSTITUTES ANY REPRESENTATION OR WARRANTY BY FIRST MANHATTAN AS TO FUTURE PERFORMANCE. THE INFORMATION THAT IS CONTAINED IN THE ANALYSIS SHOULD NOT BE CONSTRUED AS FINANCIAL, LEGAL, INVESTMENT, TAX, OR OTHER ADVI CE. YOU ULTIMATELY MUST RELY UPON YOUR OWN EXAMINATION AND THAT OF YOUR PROFESSIONAL ADVISORS, INCLUDING LEGAL COUNSEL AND ACCOUNTANT S A S TO THE LEGAL, ECONOMIC, TAX, REGULATORY, OR ACCOUNTING TREATMENT, SUITABILITY, AND OTHER ASPECTS OF THE ANALYSIS. FIRST MANHATTAN CO. 2

Additional Information FIRST MANHATTAN CO., FIRST HEALTH, L.P., FIRST HEALTH LIMITED, FIRST HEALTH ASSOCIATES, L.P., FIRST BIOMED MANAGEMENT ASSOCIATES, LLC, FIRST BIOMED, L.P. AND FIRST BIOMED PORTFOLIO, L.P. (COLLECTIVELY, “FIRST MANHATTAN”) HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD TO BE USED TO SOLICIT PROXIES FROM THE STOCKHOLDERS OF VIVUS, INC. (THE "COMPANY") IN CONNECTION WITH THE COMPANY'S 2013 ANNUAL MEETING OF STOCKHOLDERS. ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT FILED BY FIRST MANHATTAN WITH THE SEC ON JUNE 3, 2013 AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY FIRST MANHATTAN, SARISSA CAPITAL MANAGEMENT LP, SARISSA CAPITAL OFFSHORE MASTER FUND LP, SARISSA CAPITAL DOMESTIC FUND LP, MICHAEL JAMES ASTRUE, ROLF BASS, JON C. BIRO, SAMUEL F. COLIN, ALEXANDER J. DENNER, JOHANNES J.P. KASTELEIN, MELVIN L. KEATING, DAVID YORK NORTON AND HERMAN ROSENMAN ( COLLECTIVELY, THE "PARTICIPANTS") FROM THE STOCKHOLDERS OF THE COMPANY BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND FORM OF PROXY WILL BE FURNISHED TO SOME OR ALL OF THE STOCKHOLDERS OF THE COMPANY AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, COPIES OF THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD MAY BE OBTAINED WITHOUT CHARGE UPON REQUEST BY CONTACTING MACKENZIE PARTNERS, INC. AT 1 - 800 - 322 - 2885 (TOLL - FREE) OR 1 - 212 - 929 - 5500 (COLLECT). FIRST MANHATTAN CO. 3

About First Manhattan Co. • First Manhattan Co. (FMC) is one of the largest shareholders of VIVUS, Inc. and currently owns 9,989,604 shares or 9.9% of the Company – an investment worth approximately $151 million 1 • We are long - term investors in high - quality assets, and we believe that our interests are fully aligned with Vivus’ shareholders – FMC has owned Vivus stock since 2008 and has continued to actively purchase stock • First Manhattan Co. has a 50 - year history of supporting managements to maximize value for all shareholders – Only once before has First Manhattan felt compelled to nominate a slate of Directors, and that company’s stock doubled within four months after the new Directors were seated. While there can be no assurance of a similar result at Vivus 2 , we are optimistic. We invested our clients’ as well as our own money because we believe in Vivus’ significant upside potential • Despite Qsymia’s enormous potential, we recognize that there is profound downside risk in the absence of a fully independent, first class Board • We believe that significant and immediate change to the Board is required to fix Vivus and that incremental change is a quick road to failure FIRST MANHATTAN CO. 1 As of May 30, 2013 2 Other factors may also have contributed to the increase in the stock price. 4

FMC’s Investment Thesis – The Upside Potential of Qsymia is Enormous • The potential obesity market is huge and growing – More than one third of adults in the United States are obese 1 – In the E.U., approximately 17% of adults are obese 2 – There are approximately 125 million obese adults in the US and EU • Sanofi - Aventis, Merck and Pfizer all saw blockbuster potential in a class of obesity products that were half as effective as Qsy mia – Sanofi spent hundreds of millions to develop Acomplia, a novel weight loss drug that it considered to be a blockbuster – “I can tell you that in my expectations $3 billion is not too much .” (Jean - Francois Dehecq, Chairman and CEO, Sanofi - Aventis) 3 – Both Merck and Pfizer had drugs of similar efficacy in late phase 2 development when Acomplia was rejected at FDA in 2007 • Qsymia is nearly twice as effective as the earlier obesity “blockbusters” and has a strong safety profile – With Acomplia, 25% of patients lose 10% or more of their weight – With Qsymia, 48% of patients lose 10% or more of their weight – None of Acomplia 4 , Belviq 5 , or Contrave 6 , have efficacy profiles where materially greater than 25% of patients lose 10% or more of their weight – Qsymia’s components have hundreds of millions of patient - years of safety and tolerability data at many times the dosage of Qsymi a • We believe Qsymia has strong IP protection – Pharmakon / Royalty Pharma, which provided the recent loan, apparently believes it too – Pablo Legorreta, co - founder and Managing Member of Pharmakon, is also the founder and CEO of Royalty Pharma. Royalty Pharma is t he industry leader in acquiring revenue - producing intellectual property…with assets of over $7 billion 7 – We believe that Royalty Pharma is the best judge of IP in the industry, with decades of experience buying royalty streams bas ed on IP protection QSYMIA IS BY FAR THE MOST EFFECTIVE WEIGHT LOSS AGENT EVER DEVELOPED FIRST MANHATTAN CO. 5 1 U.S. Department of Health & Human Services; January 2012 2 Organization for Economic Cooperation and Development (OECD) 3 Chain Drug Review; July 25, 2005 4 FDA Briefing Document for the June 13, 2007 meeting of the Endocrinologic and Metabolic Drugs Advisory Committee. 5 FDA Briefing Document for the September 16, 2010 meeting of the Endocrinologic and Metabolic Drugs Advisory Committee. 6 FDA Briefing Document for the December 7, 2010 meeting of the Endocrinologic and Metabolic Drugs Advisory Committee. 7 Press release, Pharmakon Advisors LP 10 - 17 - 11

Why is FMC Seeking A Board Overhaul at Vivus? • FMC has taken an activist approach towards Vivus as a last resort – Over our 50 year history, Vivus is not our first disappointing investment – But in this case, we believe there is a clear and achievable path to change that can unlock value for all shareholders • We believe there is an enormous disconnect between the value of Qsymia and its failed launch – That disconnect falls squarely on the shoulders of the Vivus Board and senior management, whose intertwined structure has resulted in a chronic lack of accountability, urgency, and focus on enhancing shareholder value • Vivus’ unstaggered Board provides an opportunity to fix the disconnect quickly – It allows for the immediate reconstitution of the Board from a management - friendly to a shareholder - friendly Board at a single meeting – We have an exceedingly high hurdle to pursue this; we would not have undertaken this action with a staggered Board • We have carefully assembled a team that we believe can create long - term value for shareholders and is totally independent of current management OUR INTERESTS ARE ALIGNED WITH SHAREHOLDERS FIRST MANHATTAN CO. 6

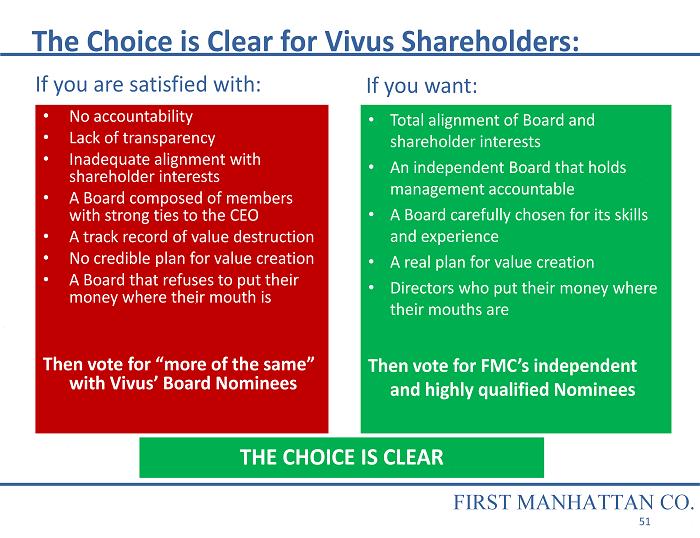

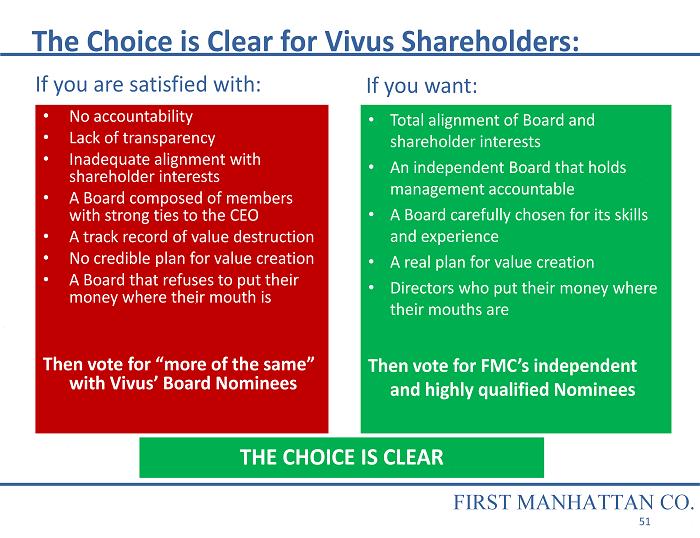

Vivus Shareholders Have A Clear Choice FMC’s Nominees • Offer the experience, ability and independence from management needed to unlock the enormous potential value at Vivus vs. The Vivus Board • Offers “more of the same” – a Board composed of members with strong ties to the CEO who we believe lack the independence and skills to correct the course of the failed Qsymia launch THE CHOICE IS CLEAR “Insanity: doing the same thing over and over and expecting a different result” – Albert Einstein FIRST MANHATTAN CO. 7

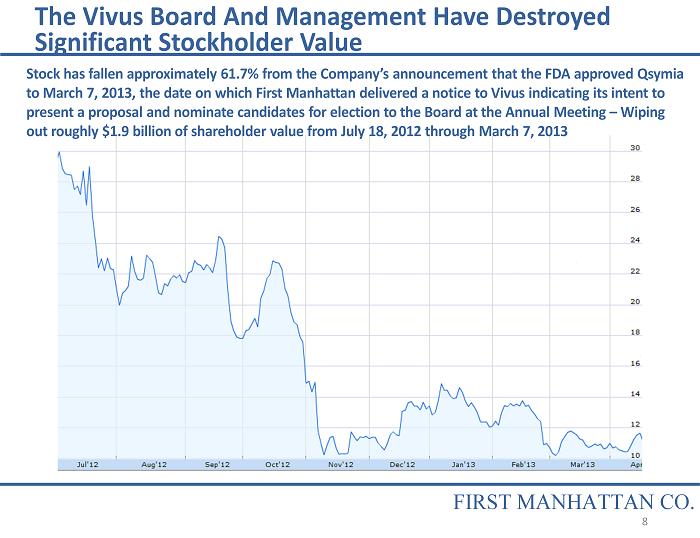

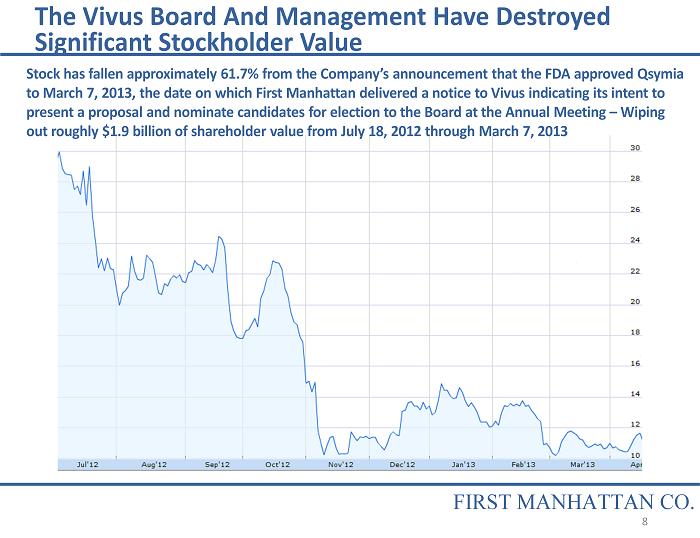

The Vivus Board And Management Have Destroyed Significant Stockholder Value FIRST MANHATTAN CO. Stock has fallen approximately 61.7% from the Company’s announcement that the FDA approved Qsymia to March 7, 2013, the date on which First Manhattan delivered a notice to Vivus indicating its intent to present a proposal and nominate candidates for election to the Board at the Annual Meeting – Wiping out roughly $1.9 billion of shareholder value from July 18, 2012 through March 7, 2013 8

The Vivus Board Has Destroyed Value We believe the Vivus Board: 1. Is underqualified 2. Is overpaid 3. Has excessive management representation 4. Is not economically aligned with shareholders’ interests 5. Has mismanaged the Qsymia launch 6. Is a poor steward of shareholders’ capital 7. Lacks transparency and has repeatedly withheld material information from the shareholders 8. Has consistently exercised poor judgment and does not hold management accountable for failure The following slides present each of these beliefs in detail along with the reasons for these beliefs. FIRST MANHATTAN CO. 9

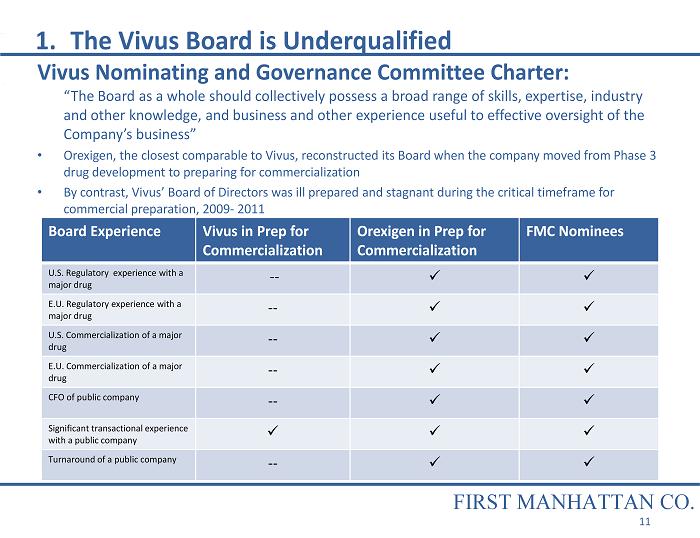

In our view, the Vivus Board is underqualified to guide a commercial stage obesity company • Vivus’ Board is led by a long - standing CEO and is composed of legacy Board members who we believe lack the independence, judgment and necessary skills to commercialize Qsymia That's why the Board has failed; that's why we are here • Compare the Vivus Board to Orexigen, a competitor in the obesity market 1. The Vivus Board is Underqualified WE BELIEVE THE FOUNDER CEO MENTALITY IS THE KEY OBSTACLE TO CREATING AN INDEPENDENT BOARD WORTHY OF QSYMIA FIRST MANHATTAN CO. 10

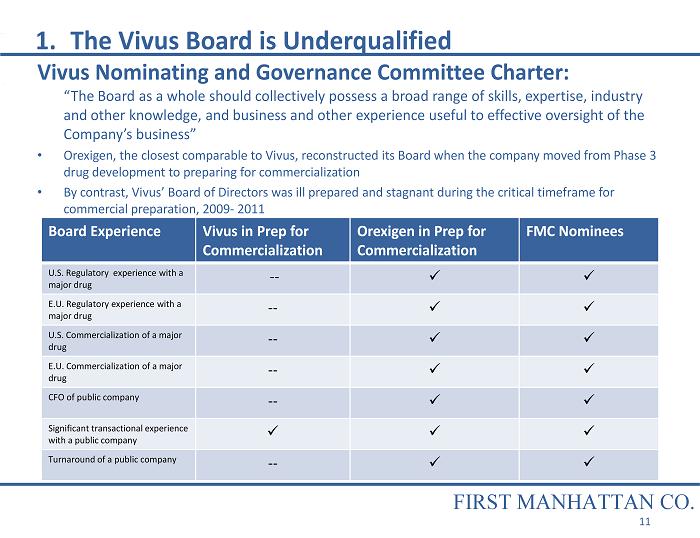

1. The Vivus Board is Underqualified Vivus Nominating and Governance Committee Charter: “The Board as a whole should collectively possess a broad range of skills, expertise, industry and other knowledge, and business and other experience useful to effective oversight of the Company’s business” • Orexigen, the closest comparable to Vivus, reconstructed its Board when the company moved from Phase 3 drug development to preparing for commercialization • By contrast, Vivus’ Board of Directors was ill prepared and stagnant during the critical timeframe for commercial preparation, 2009 - 2011 Board Experience Vivus in Prep for Commercialization Orexigen in Prep for Commercialization FMC Nominees U.S. Regulatory experience with a major drug -- x x E.U. Regulatory experience with a major drug -- x x U.S. Commercialization of a major drug -- x x E.U. Commercialization of a major drug -- x x CFO of public company -- x x Significant transactional experience with a public company x x x Turnaround of a public company -- x x FIRST MANHATTAN CO. 11

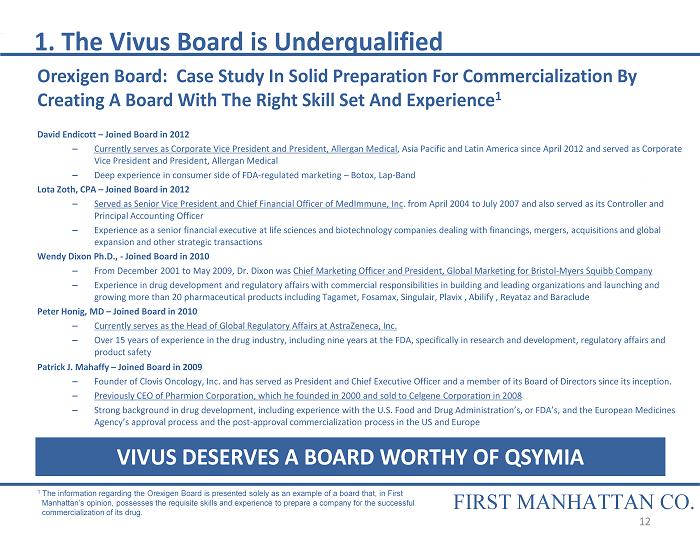

1. The Vivus Board is Underqualified Orexigen Board: Case Study In Solid Preparation For Commercialization By Creating A Board With The Right Skill Set And Experience 1 David Endicott – Joined Board in 2012 – Currently serves as Corporate Vice President and President, Allergan Medical , Asia Pacific and Latin America since April 2012 and served as Corporate Vice President and President, Allergan Medical – Deep experience in consumer side of FDA - regulated marketing – Botox, Lap - Band Lota Zoth, CPA – Joined Board in 2012 – Served as Senior Vice President and Chief Financial Officer of MedImmune, Inc . from April 2004 to July 2007 and also served as its Controller and Principal Accounting Officer – Experience as a senior financial executive at life sciences and biotechnology companies dealing with financings, mergers, acq uis itions and global expansion and other strategic transactions Wendy Dixon Ph.D., - Joined Board in 2010 – From December 2001 to May 2009, Dr. Dixon was Chief Marketing Officer and President, Global Marketing for Bristol - Myers Squibb Company – Experience in drug development and regulatory affairs with commercial responsibilities in building and leading organizations and launching and growing more than 20 pharmaceutical products including Tagamet, Fosamax, Singulair, Plavix , Abilify , Reyataz and Baraclude Peter Honig, MD – Joined Board in 2010 – Currently serves as the Head of Global Regulatory Affairs at AstraZeneca, Inc. – Over 15 years of experience in the drug industry, including nine years at the FDA, specifically in research and development, reg ulatory affairs and product safety Patrick J. Mahaffy – Joined Board in 2009 – Founder of Clovis Oncology, Inc. and has served as President and Chief Executive Officer and a member of its Board of Directo rs since its inception. – Previously CEO of Pharmion Corporation, which he founded in 2000 and sold to Celgene Corporation in 2008 – Strong background in drug development, including experience with the U.S. Food and Drug Administration’s, or FDA’s, and the E uro pean Medicines Agency’s approval process and the post - approval commercialization process in the US and Europe VIVUS DESERVES A BOARD WORTHY OF QSYMIA FIRST MANHATTAN CO. 1 The information regarding the Orexigen Board is presented solely as an example of a board that, in First Manhattan’s opinion, possesses the requisite skills and experience to prepare a company for the successful commercialization of its drug. 12

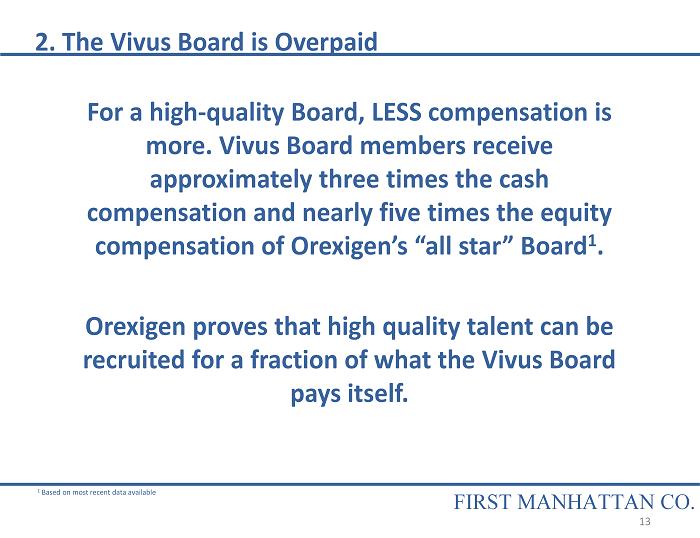

For a high - quality Board, LESS compensation is more. Vivus Board members receive approximately three times the cash compensation and nearly five times the equity compensation of Orexigen’s “all star” Board 1 . Orexigen proves that high quality talent can be recruited for a fraction of what the Vivus Board pays itself. 1 Based on most recent data available 2. The Vivus Board is Overpaid FIRST MANHATTAN CO. 13

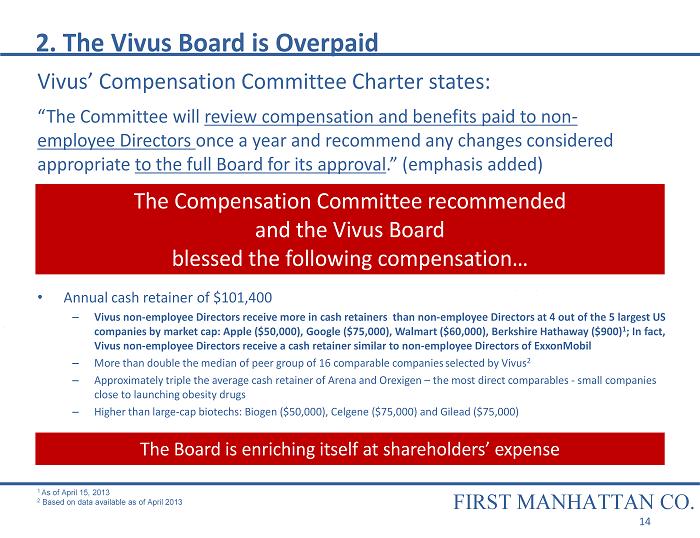

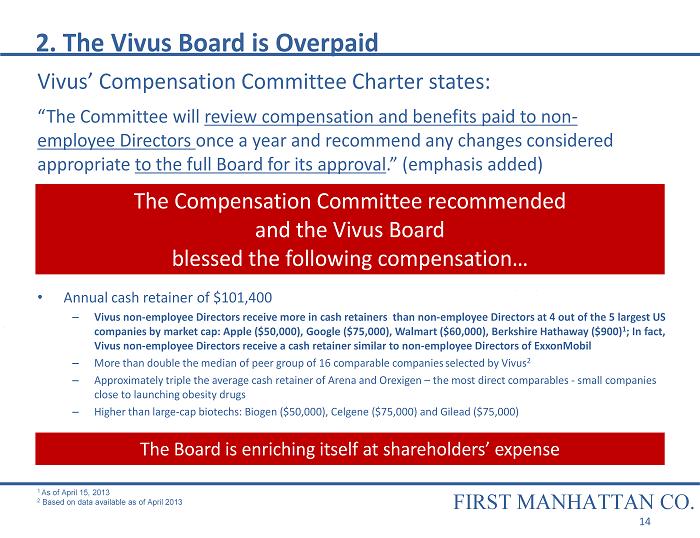

Vivus’ Compensation Committee Charter states: “The Committee will review compensation and benefits paid to non - employee Directors once a year and recommend any changes considered appropriate to the full Board for its approval .” (emphasis added) 2. The Vivus Board is Overpaid The Board is enriching itself at shareholders’ expense FIRST MANHATTAN CO. 14 • Annual cash retainer of $101,400 – Vivus non - employee Directors receive more in cash retainers than non - employee Directors at 4 out of the 5 largest US companies by market cap: Apple ($50,000), Google ($75,000), Walmart ($60,000), Berkshire Hathaway ($900) 1 ; In fact, Vivus non - employee Directors receive a cash retainer similar to non - employee Directors of ExxonMobil – More than double the median of peer group of 16 comparable companies selected by Vivus 2 – Approximately triple the average cash retainer of Arena and Orexigen – the most direct comparables - small companies close to launching obesity drugs – Higher than large - cap biotechs: Biogen ($50,000), Celgene ($75,000) and Gilead ($75,000) 1 As of April 15, 2013 2 Based on data available as of April 2013 The Compensation Committee recommended and the Vivus Board blessed the following compensation…

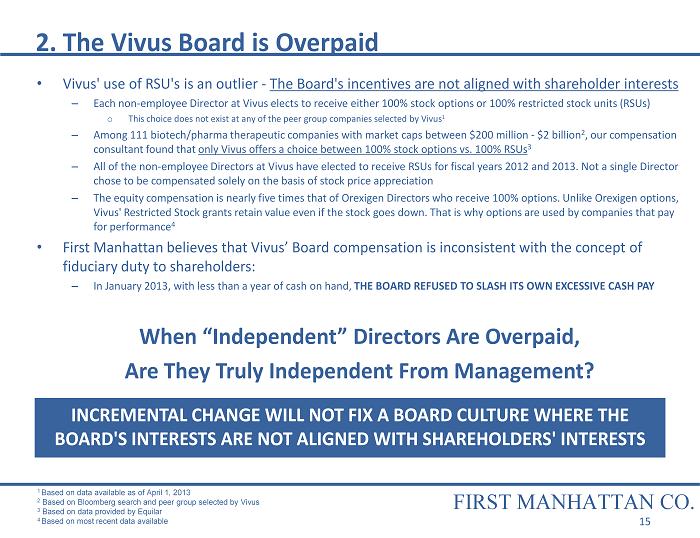

2. The Vivus Board is Overpaid • Vivus' use of RSU's is an outlier - The Board's incentives are not aligned with shareholder interests – Each non - employee Director at Vivus elects to receive either 100% stock options or 100% restricted stock units (RSUs) o This choice does not exist at any of the peer group companies selected by Vivus 1 – Among 111 biotech/pharma therapeutic companies with market caps between $200 million - $2 billion 2 , our compensation consultant found that only Vivus offers a choice between 100% stock options vs. 100% RSUs 3 – All of the non - employee Directors at Vivus have elected to receive RSUs for fiscal years 2012 and 2013. Not a single Director chose to be compensated solely on the basis of stock price appreciation – The equity compensation is nearly five times that of Orexigen Directors who receive 100% options. Unlike Orexigen options, Vivus' Restricted Stock grants retain value even if the stock goes down. That is why options are used by companies that pay for performance 4 • First Manhattan believes that Vivus’ Board compensation is inconsistent with the concept of fiduciary duty to shareholders: – In January 2013, with less than a year of cash on hand, THE BOARD REFUSED TO SLASH ITS OWN EXCESSIVE CASH PAY When “Independent” Directors Are Overpaid, Are They Truly Independent From Management? INCREMENTAL CHANGE WILL NOT FIX A BOARD CULTURE WHERE THE BOARD'S INTERESTS ARE NOT ALIGNED WITH SHAREHOLDERS' INTERESTS 1 Based on data available as of April 1, 2013 2 Based on Bloomberg search and peer group selected by Vivus 3 Based on data provided by Equilar 4 Based on most recent data available FIRST MANHATTAN CO. 15

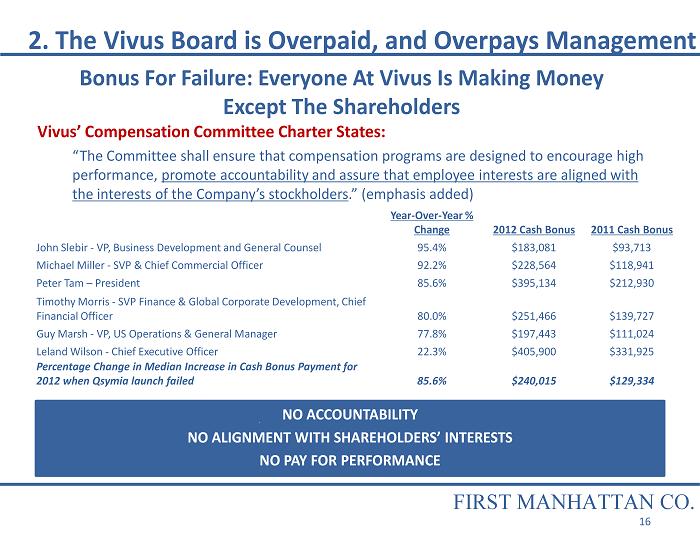

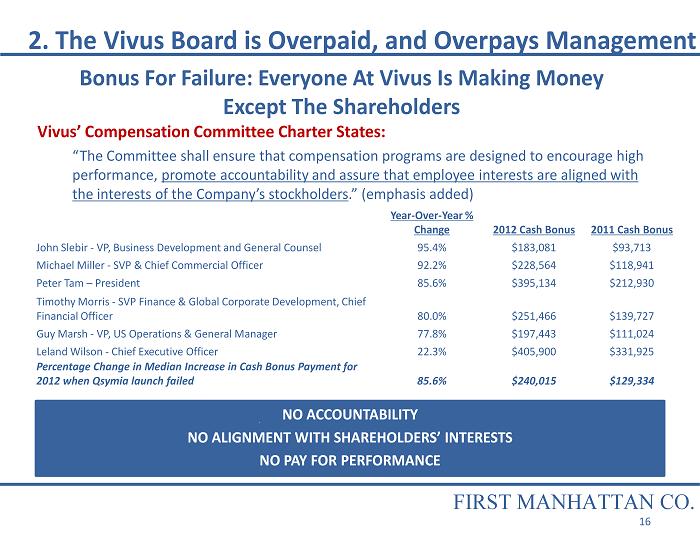

NO ACCOUNTABILITY NO ALIGNMENT WITH SHAREHOLDERS’ INTERESTS NO PAY FOR PERFORMANCE 2. The Vivus Board is Overpaid, and Overpays Management Year - Over - Year % Change 2012 Cash Bonus 2011 Cash Bonus John Slebir - VP, Business Development and General Counsel 95.4% $183,081 $93,713 Michael Miller - SVP & Chief Commercial Officer 92.2% $228,564 $118,941 Peter Tam – President 85.6% $395,134 $212,930 Timothy Morris - SVP Finance & Global Corporate Development, Chief Financial Officer 80.0% $251,466 $139,727 Guy Marsh - VP, US Operations & General Manager 77.8% $197,443 $111,024 Leland Wilson - Chief Executive Officer 22.3% $405,900 $331,925 Percentage Change in Median Increase in Cash Bonus Payment for 2012 when Qsymia launch failed 85.6% $240,015 $129,334 Bonus For Failure: Everyone At Vivus Is Making Money Except The Shareholders Vivus’ Compensation Committee Charter States: “The Committee shall ensure that compensation programs are designed to encourage high performance, promote accountability and assure that employee interests are aligned with the interests of the Company’s stockholders .” (emphasis added) FIRST MANHATTAN CO. 16

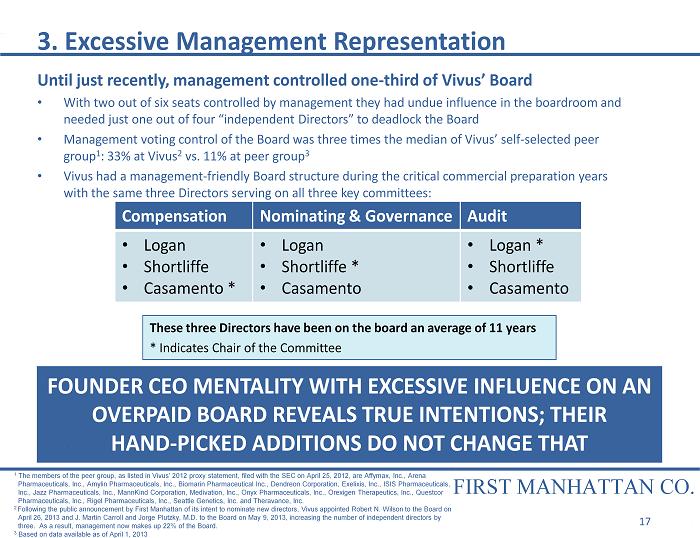

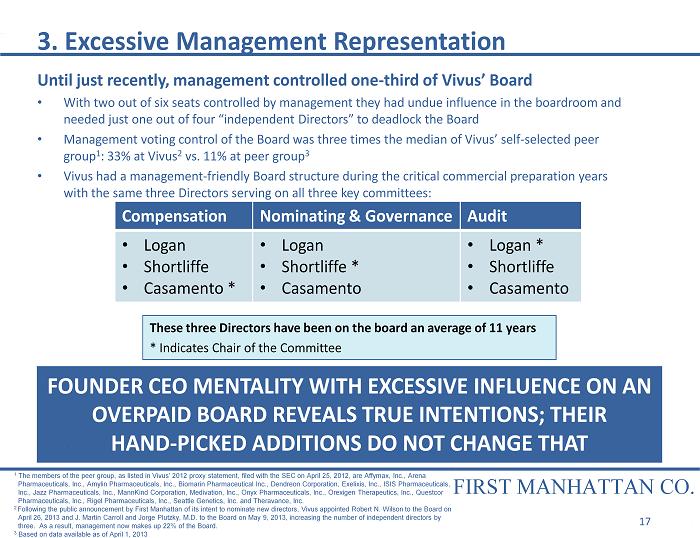

3. Excessive Management Representation Until just recently, management controlled one - third of Vivus’ Board • With two out of six seats controlled by management they had undue influence in the boardroom and needed just one out of four “independent Directors” to deadlock the Board • Management voting control of the Board was three times the median of Vivus’ self - selected peer group 1 : 33% at Vivus 2 vs. 11% at peer group 3 • Vivus had a management - friendly Board structure during the critical commercial preparation years with the same three Directors serving on all three key committees: FOUNDER CEO MENTALITY WITH EXCESSIVE INFLUENCE ON AN OVERPAID BOARD REVEALS TRUE INTENTIONS; THEIR HAND - PICKED ADDITIONS DO NOT CHANGE THAT These three Directors have been on the board an average of 11 years * Indicates Chair of the Committee Compensation Nominating & Governance Audit • Logan • Shortliffe • Casamento * • Logan • Shortliffe * • Casamento • Logan * • Shortliffe • Casamento FIRST MANHATTAN CO. 1 The members of the peer group, as listed in Vivus’ 2012 proxy statement, filed with the SEC on April 25, 2012, are Affymax, I nc ., Arena Pharmaceuticals, Inc., Amylin Pharmaceuticals, Inc., Biomarin Pharmaceutical Inc., Dendreon Corporation, Exelixis, Inc., ISIS Ph armaceuticals, Inc., Jazz Pharmaceuticals, Inc., MannKind Corporation, Medivation, Inc., Onyx Pharmaceuticals, Inc., Orexigen Therapeutics, Inc ., Questcor Pharmaceuticals, Inc., Rigel Pharmaceuticals, Inc., Seattle Genetics, Inc. and Theravance, Inc. 2 Following the public announcement by First Manhattan of its intent to nominate new directors, Vivus appointed Robert N. Wilso n t o the Board on April 26, 2013 and J. Martin Carroll and Jorge Plutzky, M.D. to the Board on May 9, 2013, increasing the number of independen t d irectors by three. As a result, management now makes up 22% of the Board. 3 Based on data available as of April 1, 2013 17

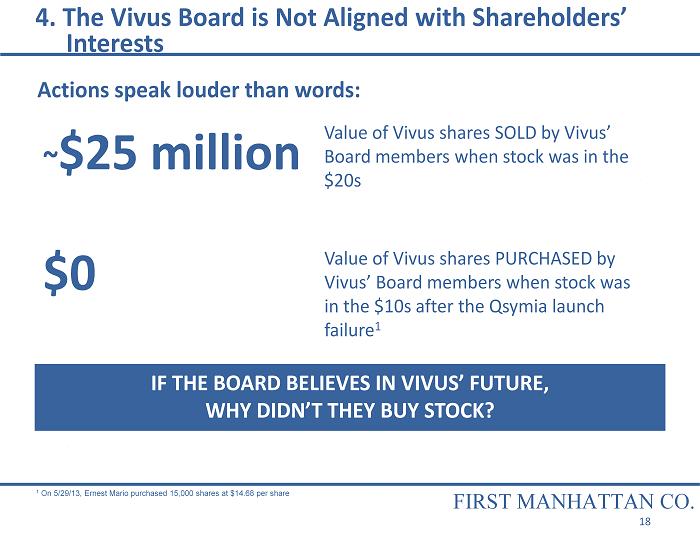

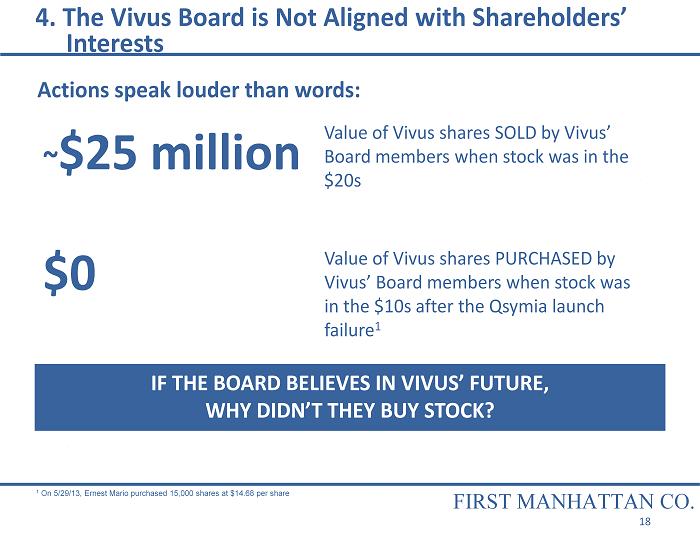

~ $25 million $0 Value of Vivus shares SOLD by Vivus’ Board members when stock was in the $20s Value of Vivus shares PURCHASED by Vivus’ Board members when stock was in the $10s after the Qsymia launch failure 1 IF THE BOARD BELIEVES IN VIVUS’ FUTURE, WHY DIDN’T THEY BUY STOCK? Actions speak louder than words: 4. The Vivus Board is Not Aligned with Shareholders ’ Interests FIRST MANHATTAN CO. 18 1 On 5/29/13, Ernest Mario purchased 15,000 shares at $14.68 per share

Qsymia has been ranked as one of the top ten blockbuster DUDS in biopharma 1 1 FierceBiotech “Analysts rank the top 10 blockbuster duds in biopharma” (April 10, 2013) 5. Mismanagement of Qsymia Launch FIRST MANHATTAN CO. 19

5. Mismanagement of Qsymia Launch Case Study #1: Qsymia Launch Incompetence • Vivus was dealt a tough hand with REMS, but we believe its wounds are largely self - inflicted and result from ineffective leadership • Vivus failed to understand the market – Launch ignored the single most important determinant of drug use: out - of - pocket cost to the patient – At least 70% of patients have no insurance coverage for obesity drugs, according to Vivus’ statements prior to launch – How do you launch Qsymia when the first contact with a patient requires over $200 out of pocket for the first six weeks? – Where was the market research on price sensitivity to determine what a patient is willing to pay BEFORE they experience significant weight loss? • Multiple attempts to fix the launch have failed x Plan A: No discount offered Result: no uptake x Plan B: Two weeks free Result: no uptake x Plan C: Two weeks free plus $75 cap in month 2 Result: no uptake x Plan D: ??? • If they trusted their own plan to fix the launch, why did management and the Board fail to buy a single share of stock at $10 - 13 for their own account for months after the Qsymia launch failure was announced on the Q3’12 earnings call on 11/6/12? 1 THE MANAGEMENT AND BOARD HAVE DEMONSTRATED ZERO CONFIDENCE IN THEIR PLAN TO FIX THE QSYMIA LAUNCH. WE AGREE WITH THEIR ACTIONS, NOT THEIR WORDS, ON THIS SUBJECT FIRST MANHATTAN CO. 20 1 On 5/29/13, Ernest Mario purchased 15,000 shares at $14.68 per share

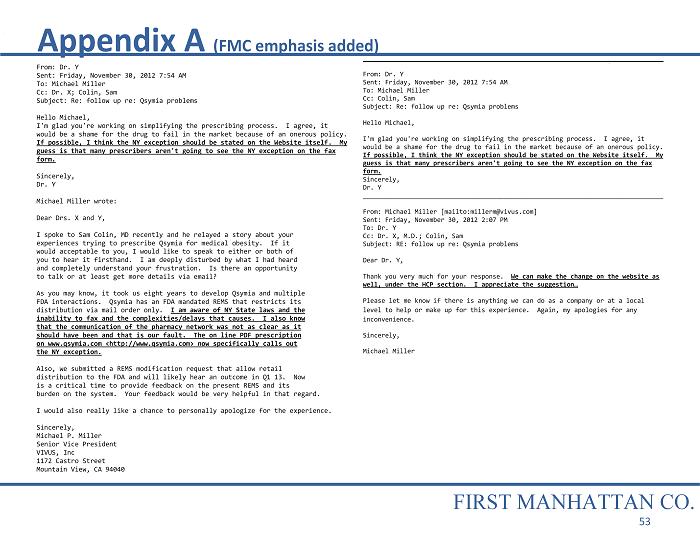

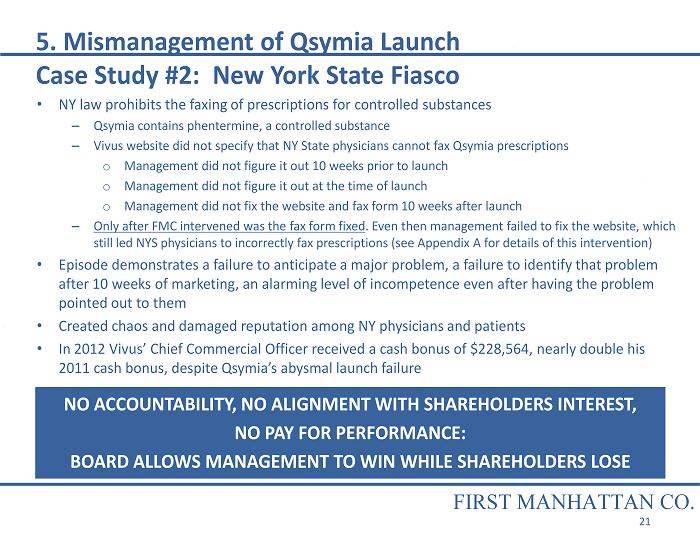

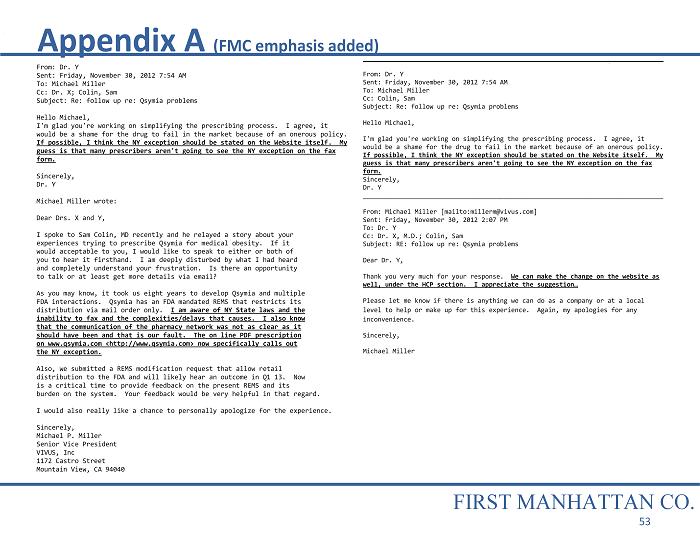

• NY law prohibits the faxing of prescriptions for controlled substances – Qsymia contains phentermine, a controlled substance – Vivus website did not specify that NY State physicians cannot fax Qsymia prescriptions o Management did not figure it out 10 weeks prior to launch o Management did not figure it out at the time of launch o Management did not fix the website and fax form 10 weeks after launch – Only after FMC intervened was the fax form fixed . Even then management failed to fix the website, which still led NYS physicians to incorrectly fax prescriptions (see Appendix A for details of this intervention) • Episode demonstrates a failure to anticipate a major problem, a failure to identify that problem after 10 weeks of marketing, an alarming level of incompetence even after having the problem pointed out to them • Created chaos and damaged reputation among NY physicians and patients • In 2012 Vivus’ Chief Commercial Officer received a cash bonus of $228,564, nearly double his 2011 cash bonus, despite Qsymia’s abysmal launch failure NO ACCOUNTABILITY, NO ALIGNMENT WITH SHAREHOLDERS INTEREST, NO PAY FOR PERFORMANCE: BOARD ALLOWS MANAGEMENT TO WIN WHILE SHAREHOLDERS LOSE 5. Mismanagement of Qsymia Launch Case Study #2: New York State Fiasco FIRST MANHATTAN CO. 21

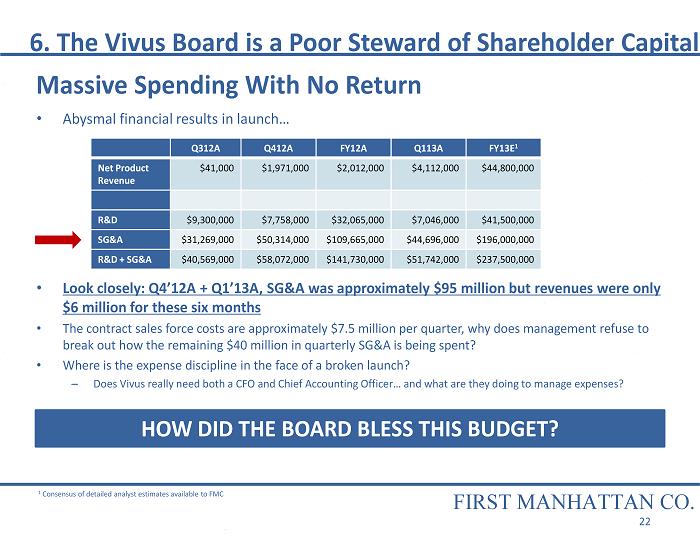

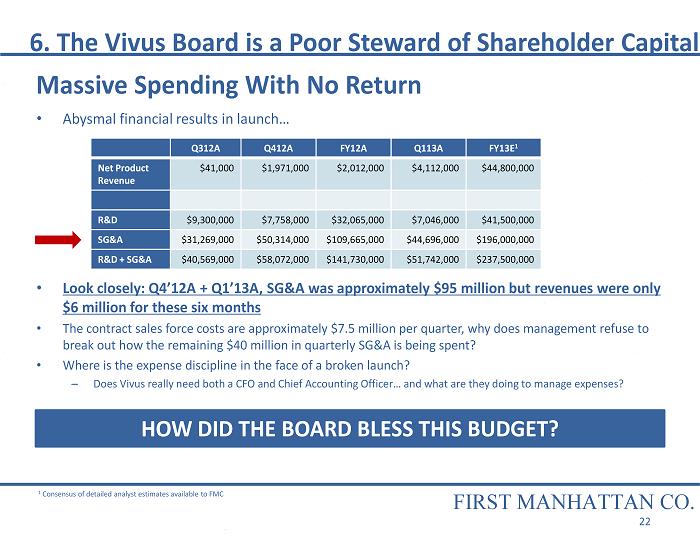

• Abysmal financial results in launch… • Look closely: Q4’12A + Q1’13A, SG&A was approximately $95 million but revenues were only $6 million for these six months • The contract sales force costs are approximately $7.5 million per quarter, why does management refuse to break out how the remaining $40 million in quarterly SG&A is being spent? • Where is the expense discipline in the face of a broken launch? – Does Vivus really need both a CFO and Chief Accounting Officer… and what are they doing to manage expenses? HOW DID THE BOARD BLESS THIS BUDGET? 1 Consensus of detailed analyst estimates available to FMC 6. The Vivus Board is a Poor Steward of Shareholder Capital Q312A Q412A FY12A Q113A FY13E 1 Net Product Revenue $41,000 $1,971,000 $2,012,000 $4,112,000 $44,800,000 R&D $9,300,000 $7,758,000 $32,065,000 $7,046,000 $41,500,000 SG&A $31,269,000 $50,314,000 $109,665,000 $44,696,000 $196,000,000 R&D + SG&A $40,569,000 $58,072,000 $141,730,000 $51,742,000 $237, 500,000 FIRST MANHATTAN CO. 22 Massive Spending With No Return

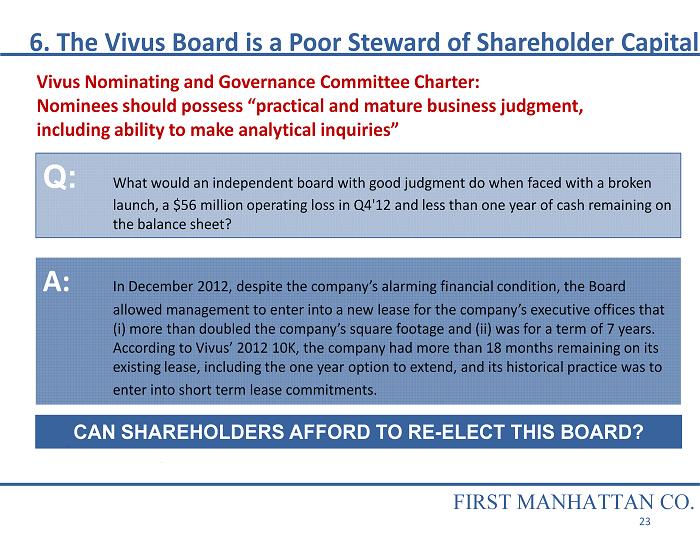

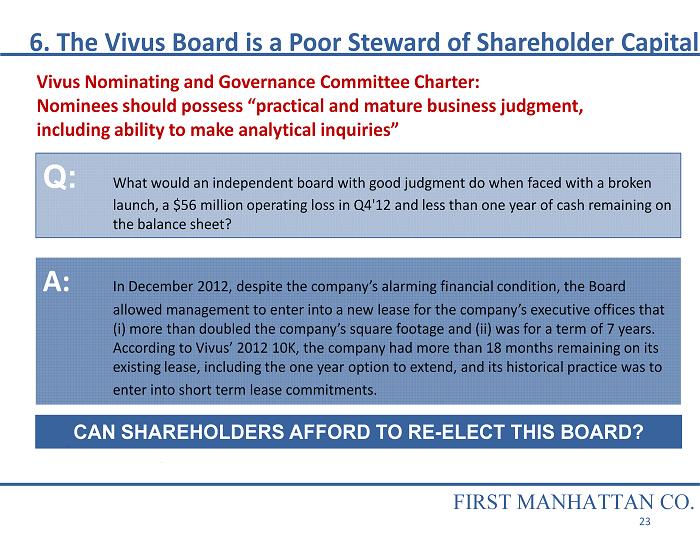

Vivus Nominating and Governance Committee Charter: Nominees should possess “practical and mature business judgment, including ability to make analytical inquiries” A: In December 2012, despite the company’s alarming financial condition, the Board allowed management to enter into a new lease for the company’s executive offices that (i) more than doubled the company’s square footage and (ii) was for a term of 7 years. According to Vivus’ 2012 10K, the company had more than 18 months remaining on its existing lease, including the one year option to extend, and its historical practice was to enter into short term lease commitments. CAN SHAREHOLDERS AFFORD TO RE - ELECT THIS BOARD? Q: What would an independent board with good judgment do when faced with a broken launch, a $56 million operating loss in Q4'12 and less than one year of cash remaining on the balance sheet? FIRST MANHATTAN CO. 23 6. The Vivus Board is a Poor Steward of Shareholder Capital

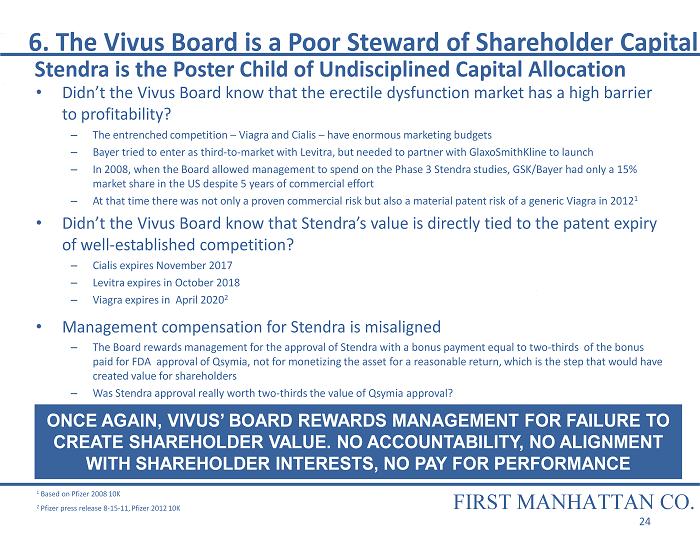

6. The Vivus Board is a Poor Steward of Shareholder Capital Stendra is the Poster Child of Undisciplined Capital Allocation • Didn’t the Vivus Board know that the erectile dysfunction market has a high barrier to profitability? – The entrenched competition – Viagra and Cialis – have enormous marketing budgets – Bayer tried to enter as third - to - market with Levitra, but needed to partner with GlaxoSmithKline to launch – In 2008, when the Board allowed management to spend on the Phase 3 Stendra studies, GSK/Bayer had only a 15% market share in the US despite 5 years of commercial effort – At that time there was not only a proven commercial risk but also a material patent risk of a generic Viagra in 2012 1 • Didn’t the Vivus Board know that Stendra’s value is directly tied to the patent expiry of well - established competition? – Cialis expires November 2017 – Levitra expires in October 2018 – Viagra expires in April 2020 2 • Management compensation for Stendra is misaligned – The Board rewards management for the approval of Stendra with a bonus payment equal to two - thirds of the bonus paid for FDA approval of Qsymia, not for monetizing the asset for a reasonable return, which is the step that would have created value for shareholders – Was Stendra approval really worth two - thirds the value of Qsymia approval? 1 Based on Pfizer 2008 10K 2 Pfizer press release 8 - 15 - 11, Pfizer 2012 10K ONCE AGAIN, VIVUS’ BOARD REWARDS MANAGEMENT FOR FAILURE TO CREATE SHAREHOLDER VALUE. NO ACCOUNTABILITY, NO ALIGNMENT WITH SHAREHOLDER INTERESTS, NO PAY FOR PERFORMANCE FIRST MANHATTAN CO. 24

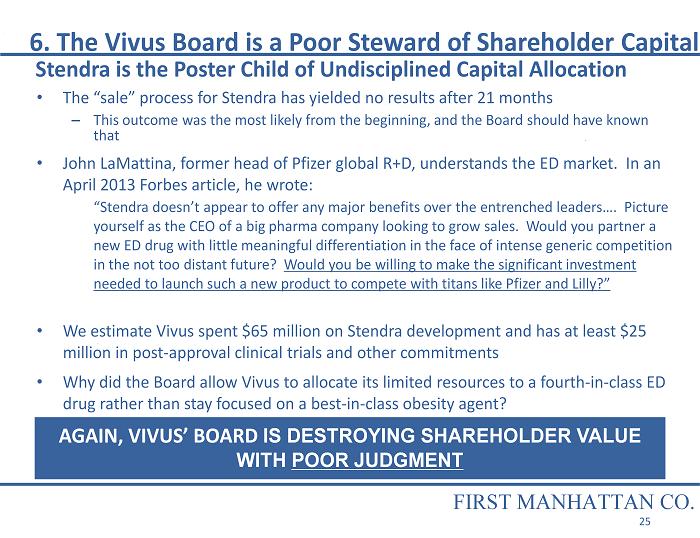

• The “sale” process for Stendra has yielded no results after 21 months – This outcome was the most likely from the beginning, and the Board should have known that • John LaMattina, former head of Pfizer global R+D, understands the ED market. In an April 2013 Forbes article, he wrote: “Stendra doesn’t appear to offer any major benefits over the entrenched leaders…. Picture yourself as the CEO of a big pharma company looking to grow sales. Would you partner a new ED drug with little meaningful differentiation in the face of intense generic competition in the not too distant future? Would you be willing to make the significant investment needed to launch such a new product to compete with titans like Pfizer and Lilly?” • We estimate Vivus spent $65 million on Stendra development and has at least $25 million in post - approval clinical trials and other commitments • Why did the Board allow Vivus to allocate its limited resources to a fourth - in - class ED drug rather than stay focused on a best - in - class obesity agent? AGAIN, VIVUS’ BOARD IS DESTROYING SHAREHOLDER VALUE WITH POOR JUDGMENT 6. The Vivus Board is a Poor Steward of Shareholder Capital Stendra is the Poster Child of Undisciplined Capital Allocation FIRST MANHATTAN CO. 25

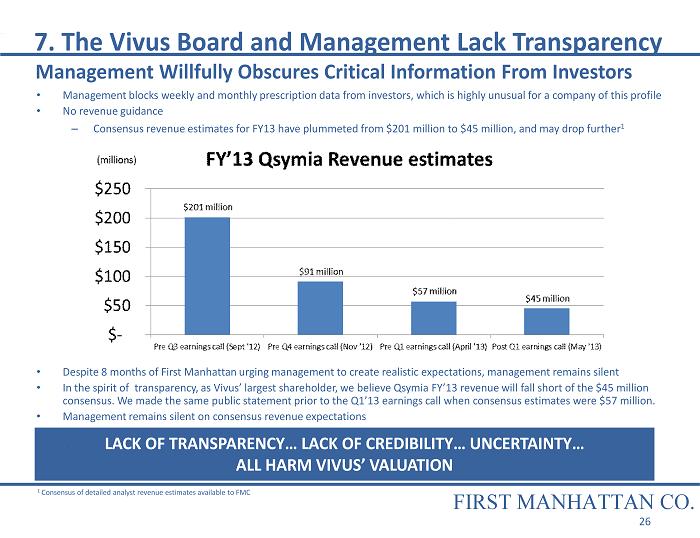

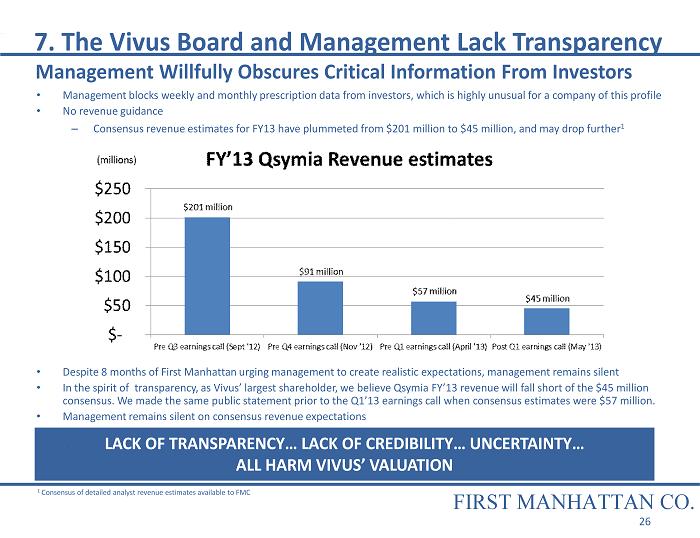

• Management blocks weekly and monthly prescription data from investors, which is highly unusual for a company of this profile • No revenue guidance – Consensus revenue estimates for FY13 have plummeted from $201 million to $45 million, and may drop further 1 • Despite 8 months of First Manhattan urging management to create realistic expectations, management remains silent • In the spirit of transparency, as Vivus’ largest shareholder, we believe Qsymia FY’13 revenue will fall short of the $45 mil lio n consensus. We made the same public statement prior to the Q1’13 earnings call when consensus estimates were $57 million. • Management remains silent on consensus revenue expectations LACK OF TRANSPARENCY… LACK OF CREDIBILITY… UNCERTAINTY… ALL HARM VIVUS’ VALUATION 7. The Vivus Board and Management Lack Transparency FIRST MANHATTAN CO. 26 1 Consensus of detailed analyst revenue estimates available to FMC Management Willfully Obscures Critical Information From Investors

7. The Vivus Board and Management Lack Transparency Management Willfully Obscures Critical Information From Investors (cont’d) • No expense guidance – Management has a budget. Why do they refuse to share it with the owners? – Expenses are exploding, yet management will not provide a breakdown of how shareholder money is being spent within SG&A • Redaction of limitations on future debt issuances from recent Pharmakon financing – This is basic financial information that is not competitively sensitive and is necessary to understand Vivus’ financial future – When future capital raise is likely, why create uncertainty in the market by withholding data typically shared with investors? – The ability to issue future debt directly impacts the company’s options with respect to future access to capital FIRST MANHATTAN CO. THE LACK OF TRANSPARENCY CREATES FURTHER UNCERTAINTY ABOUT A FUTURE DILUTIVE EQUITY CAPITAL RAISE 27

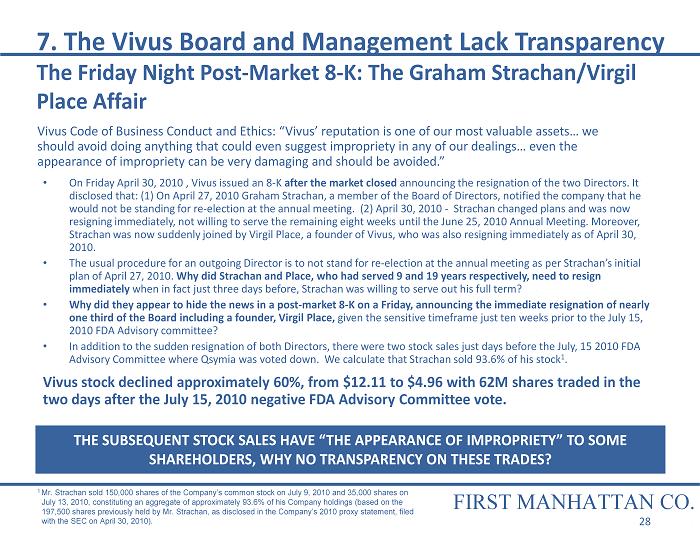

• On Friday April 30, 2010 , Vivus issued an 8 - K after the market closed announcing the resignation of the two Directors. It disclosed that: (1) On April 27, 2010 Graham Strachan, a member of the Board of Directors, notified the company that he would not be standing for re - election at the annual meeting. (2) April 30, 2010 - Strachan changed plans and was now resigning immediately, not willing to serve the remaining eight weeks until the June 25, 2010 Annual Meeting. Moreover, Strachan was now suddenly joined by Virgil Place, a founder of Vivus, who was also resigning immediately as of April 30, 2010. • The usual procedure for an outgoing Director is to not stand for re - election at the annual meeting as per Strachan’s initial plan of April 27, 2010. Why did Strachan and Place, who had served 9 and 19 years respectively, need to resign immediately when in fact just three days before, Strachan was willing to serve out his full term? • Why did they appear to hide the news in a post - market 8 - K on a Friday, announcing the immediate resignation of nearly one third of the Board including a founder, Virgil Place, given the sensitive timeframe just ten weeks prior to the July 15, 2010 FDA Advisory committee? • In addition to the sudden resignation of both Directors, there were two stock sales just days before the July, 15 2010 FDA Advisory Committee where Qsymia was voted down. We calculate that Strachan sold 93.6% of his stock 1 . Vivus stock declined approximately 60%, from $12.11 to $4.96 with 62M shares traded in the two days after the July 15, 2010 negative FDA Advisory Committee vote. 7. The Vivus Board and Management Lack Transparency The Friday Night Post - Market 8 - K: The Graham Strachan/Virgil Place Affair THE SUBSEQUENT STOCK SALES HAVE “THE APPEARANCE OF IMPROPRIETY ” TO SOME SHAREHOLDERS, WHY NO TRANSPARENCY ON THESE TRADES? Vivus Code of Business Conduct and Ethics: “Vivus’ reputation is one of our most valuable assets… we should avoid doing anything that could even suggest impropriety in any of our dealings… even the appearance of impropriety can be very damaging and should be avoided.” FIRST MANHATTAN CO. 28 1 Mr. Strachan sold 150,000 shares of the Company’s common stock on July 9, 2010 and 35,000 shares on July 13, 2010, constituting an aggregate of approximately 93.6% of his Company holdings (based on the 197,500 shares previously held by Mr. Strachan, as disclosed in the Company’s 2010 proxy statement, filed with the SEC on April 30, 2010).

First Manhattan made a demand to Vivus on April 11, 2013 under Delaware law asking for information to help answer these important questions… • Did Vivus’ exiting board members comply with all securities laws and regulations in connection with trades in Vivus stock days prior to the negative FDA AdCom on July 15, 2010? • Did Vivus fail to adequately disclose the risks to EU approval? • Why did Vivus’ management withhold normal disclosure on limitations to future debt financings in the recent Pharmakon financing 8 - K? • What did the Company know regarding the likelihood of success of partnering with a large pharma company to commercialize Qsymia when making bold statements on Q3’09 earnings call? SHAREHOLDERS ARE ASKING QUESTIONS THAT VIVUS’ BOARD FAILED TO ASK 7. The Vivus Board and Management Lack Transparency No Transparency to Shareholders, Even Upon Request FIRST MANHATTAN CO. 29

7. The Vivus Board and Management Lack Transparency …Vivus’ Response “FMC’s demand did not set forth a proper purpose to support FMC’s right of inspection under Delaware law.” IF VIVUS HAS NOTHING TO HIDE, WHY NOT PROVIDE THE FACTS? FIRST MANHATTAN CO. 30

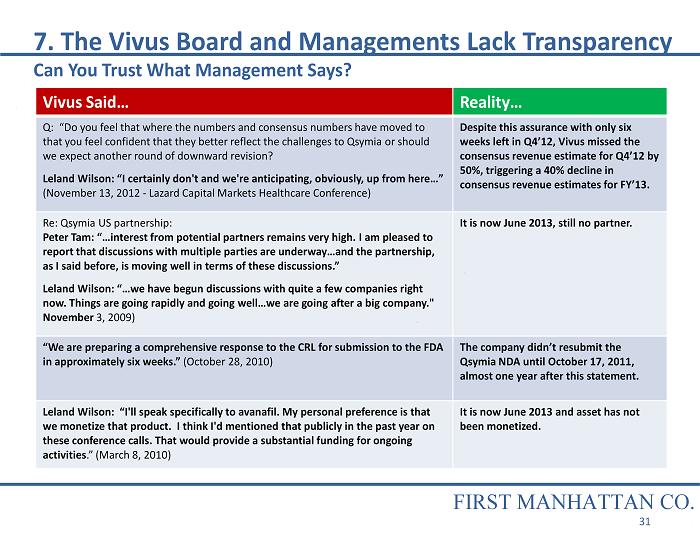

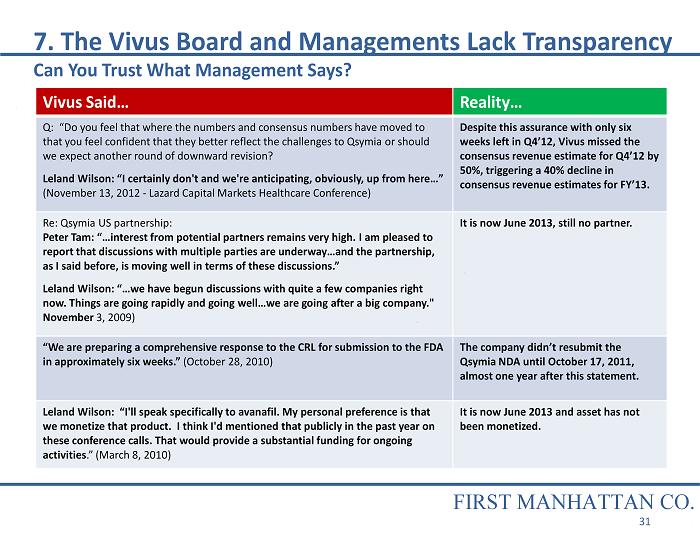

Vivus Said… Reality… Q: “Do you feel that where the numbers and consensus numbers have moved to that you feel confident that they better reflect the challenges to Qsymia or should we expect another round of downward revision? Leland Wilson: “I certainly don't and we're anticipating, obviously, up from here…” (November 13, 2012 - Lazard Capital Markets Healthcare Conference) Despite this assurance with only six weeks left in Q4’12, Vivus missed the consensus revenue estimate for Q4’12 by 50%, triggering a 40% decline in consensus revenue estimates for FY’13. Re: Qsymia US partnership: Peter Tam: “…interest from potential partners remains very high. I am pleased to report that discussions with multiple parties are underway…and the partnership, as I said before, is moving well in terms of these discussions.” Leland Wilson: “…we have begun discussions with quite a few companies right now. Things are going rapidly and going well…we are going after a big company." November 3, 2009) It is now June 2013, still no partner. “We are preparing a comprehensive response to the CRL for submission to the FDA in approximately six weeks.” (October 28, 2010) The company didn’t resubmit the Qsymia NDA until October 17, 2011, almost one year after this statement. Leland Wilson: “I'll speak specifically to avanafil. My personal preference is that we monetize that product. I think I'd mentioned that publicly in the past year on these conference calls. That would provide a substantial funding for ongoing activities .” (March 8, 2010) It is now June 2013 and asset has not been monetized. 7. The Vivus Board and Managements Lack Transparency Can You Trust What Management Says? FIRST MANHATTAN CO. 31

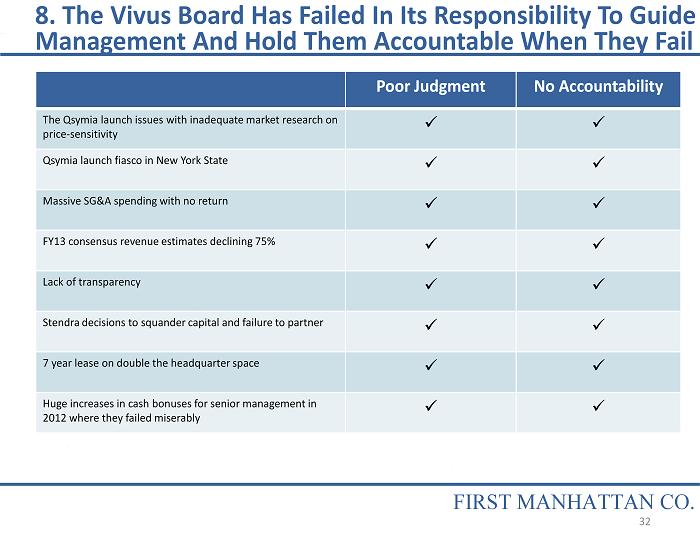

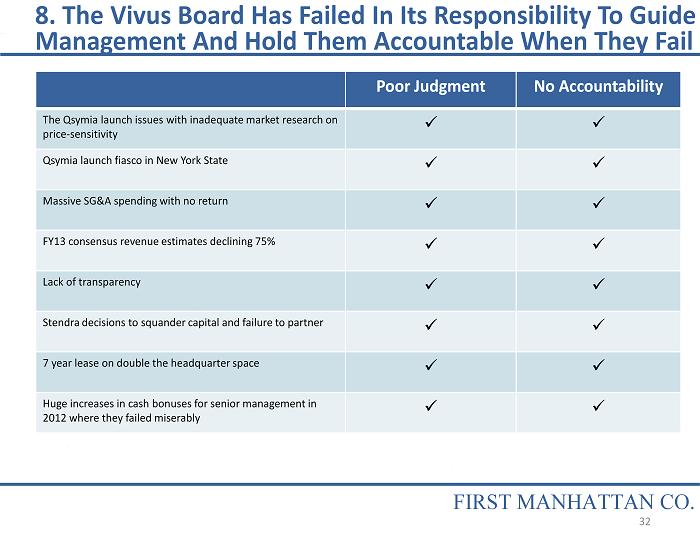

8. The Vivus Board Has Failed In Its Responsibility To Guide Management And Hold Them Accountable When They Fail FIRST MANHATTAN CO. Poor Judgment No Accountability The Qsymia launch issues with inadequate market research on price - sensitivity x x Qsymia launch fiasco in New York State x x Massive SG&A spending with no return x x FY13 consensus revenue estimates declining 75% x x Lack of transparency x x Stendra decisions to squander capital and failure to partner x x 7 year lease on double the headquarter space x x Huge increases in cash bonuses for senior management in 2012 where they failed miserably x x 32

First Manhattan is asking Vivus shareholders to reconstitute the Vivus Board with nine highly qualified and independent Nominees. FIRST MANHATTAN CO. 33

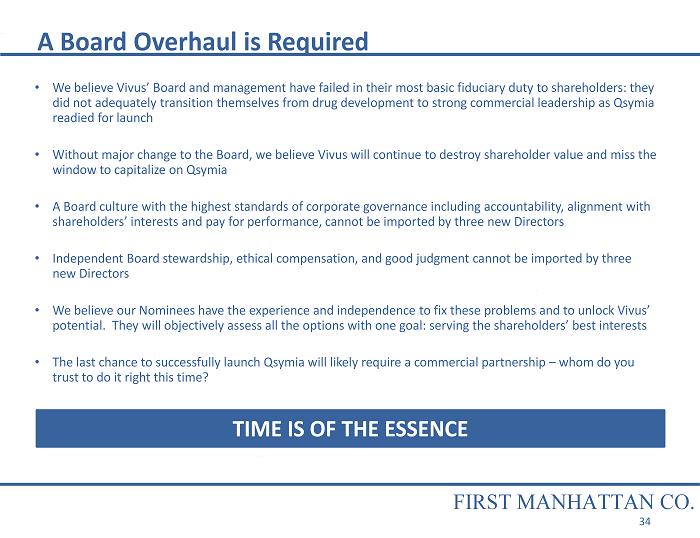

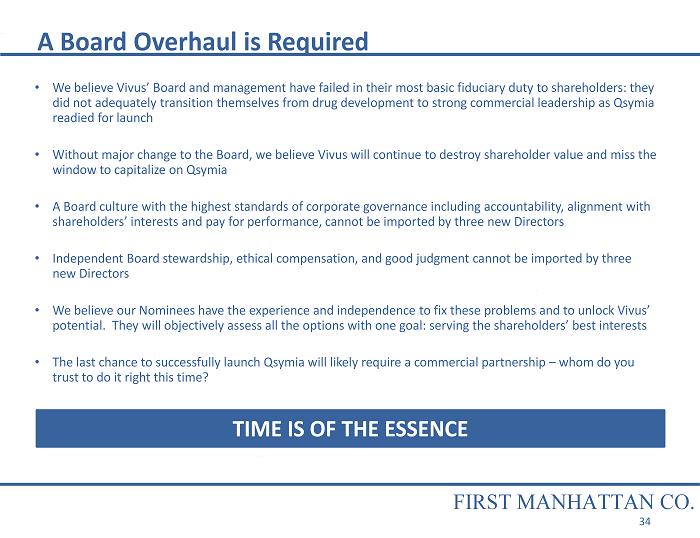

A Board Overhaul is Required • We believe Vivus’ Board and management have failed in their most basic fiduciary duty to shareholders: they did not adequately transition themselves from drug development to strong commercial leadership as Qsymia readied for launch • Without major change to the Board, we believe Vivus will continue to destroy shareholder value and miss the window to capitalize on Qsymia • A Board culture with the highest standards of corporate governance including accountability, alignment with shareholders’ interests and pay for performance, cannot be imported by three new Directors • Independent Board stewardship, ethical compensation, and good judgment cannot be imported by three new Directors • We believe our Nominees have the experience and independence to fix these problems and to unlock Vivus’ potential. They will objectively assess all the options with one goal: serving the shareholders’ best interests • The last chance to successfully launch Qsymia will likely require a commercial partnership – whom do you trust to do it right this time? TIME IS OF THE ESSENCE FIRST MANHATTAN CO. 34

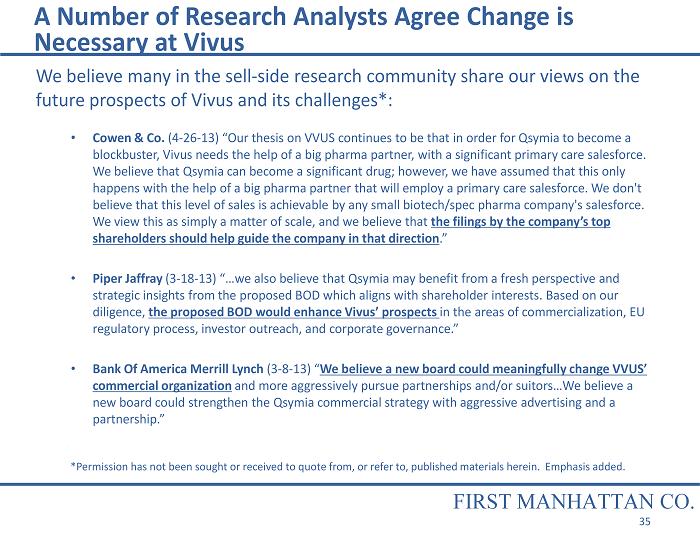

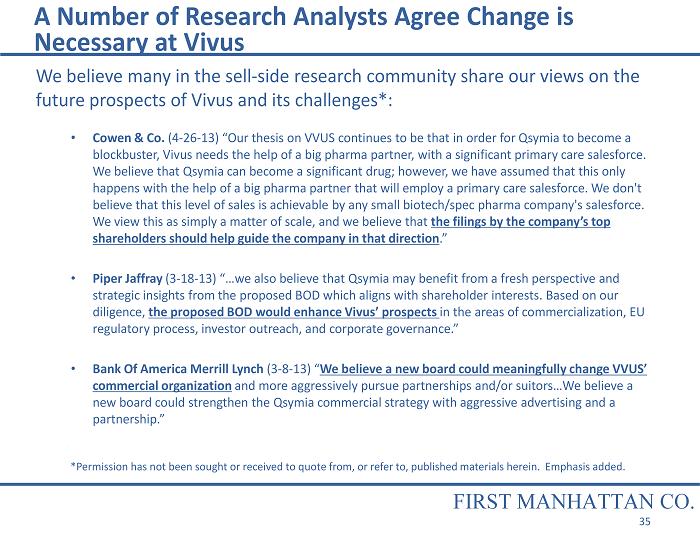

A Number of Research Analysts Agree Change is Necessary at Vivus We believe many in the sell - side research community share our views on the future prospects of Vivus and its challenges*: • Cowen & Co. (4 - 26 - 13) “Our thesis on VVUS continues to be that in order for Qsymia to become a blockbuster, Vivus needs the help of a big pharma partner, with a significant primary care salesforce. We believe that Qsymia can become a significant drug; however, we have assumed that this only happens with the help of a big pharma partner that will employ a primary care salesforce. We don't believe that this level of sales is achievable by any small biotech/spec pharma company's salesforce. We view this as simply a matter of scale, and we believe that the filings by the company’s top shareholders should help guide the company in that direction .” • Piper Jaffray (3 - 18 - 13) “…we also believe that Qsymia may benefit from a fresh perspective and strategic insights from the proposed BOD which aligns with shareholder interests. Based on our diligence, the proposed BOD would enhance Vivus’ prospects in the areas of commercialization, EU regulatory process, investor outreach, and corporate governance .” • Bank Of America Merrill Lynch (3 - 8 - 13) “ We believe a new board could meaningfully change VVUS’ commercial organization and more aggressively pursue partnerships and/or suitors…We believe a new board could strengthen the Qsymia commercial strategy with aggressive advertising and a partnership .” FIRST MANHATTAN CO. *Permission has not been sought or received to quote from, or refer to, published materials herein . Emphasis added. 35

Vivus Management Will Tell You: But the Truth Is: • Dramatic change will be disruptive • The deteriorating status quo is exactly what needs to be disrupted • We believe our best talent will likely be poached by competitors or quit under Vivus’ failing trajectory • Conversely, we believe a winning team and revamped strategy will be most likely to attract and retain talent • FMC is looking to make a quick profit • We’ve owned the stock since 2008 and have continued to add shares • FMC is not suggesting anything new in its plan • FMC Director Nominees will bring : • Accountability • Alignment with shareholders’ interests • Good judgment • Pay for performance and dramatic slash of board compensation • A Board that’s independent of management • A winning plan for Vivus - see slide 47 • A Board that is open to all paths for value creation, including a sale at a fulsome price • Current Board is open to a sale of the company • They did not sell after : • Positive FDA AdCom with a $22+ stock price • FDA approval in 7/12 with a $22+ stock price While management has led shareholders to believe that they are willing to sell the company, actions speak louder than words • FMC is seeking to takeover the board without paying a control premium • FMC will not control Vivus even if all of its nominees are elected - all but one are independent of FMC • Shareholders will share in 100 percent of the upside generated by a newly constituted board 36

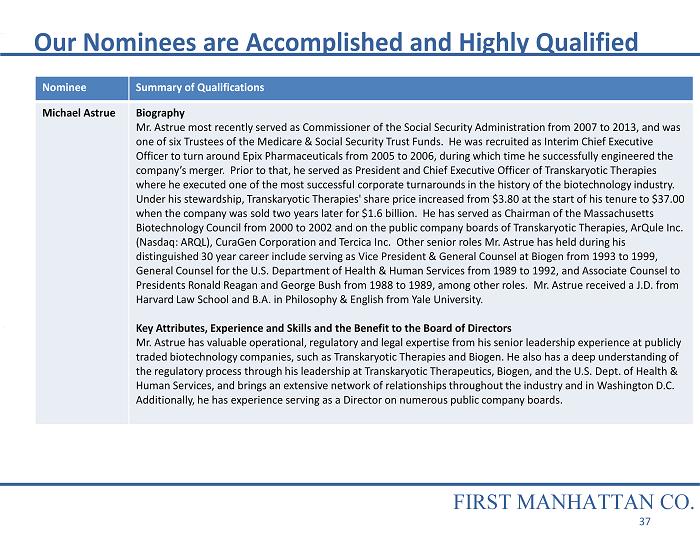

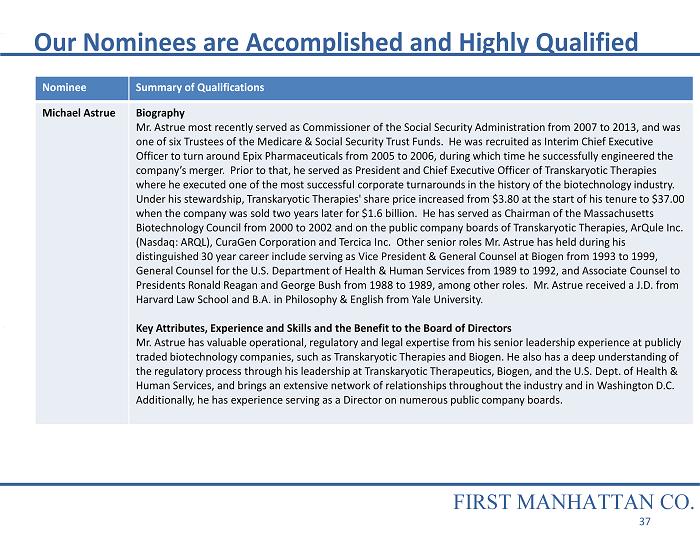

Our Nominees are Accomplished and Highly Qualified Nominee Summary of Qualifications Michael Astrue Biography Mr. Astrue most recently served as Commissioner of the Social Security Administration from 2007 to 2013, and was one of six Trustees of the Medicare & Social Security Trust Funds. He was recruited as Interim Chief Executive Officer to turn around Epix Pharmaceuticals from 2005 to 2006, during which time he successfully engineered the company’s merger. Prior to that, he served as President and Chief Executive Officer of Transkaryotic Therapies where he executed one of the most successful corporate turnarounds in the history of the biotechnology industry. Under his stewardship, Transkaryotic Therapies' share price increased from $3.80 at the start of his tenure to $37.00 when the company was sold two years later for $1.6 billion. He has served as Chairman of the Massachusetts Biotechnology Council from 2000 to 2002 and on the public company boards of Transkaryotic Therapies, ArQule Inc. (Nasdaq: ARQL), CuraGen Corporation and Tercica Inc. Other senior roles Mr. Astrue has held during his distinguished 30 year career include serving as Vice President & General Counsel at Biogen from 1993 to 1999, General Counsel for the U.S. Department of Health & Human Services from 1989 to 1992, and Associate Counsel to Presidents Ronald Reagan and George Bush from 1988 to 1989, among other roles. Mr. Astrue received a J.D. from Harvard Law School and B.A. in Philosophy & English from Yale University. Key Attributes, Experience and Skills and the Benefit to the Board of Directors Mr. Astrue has valuable operational, regulatory and legal expertise from his senior leadership experience at publicly traded biotechnology companies, such as Transkaryotic Therapies and Biogen. He also has a deep understanding of the regulatory process through his leadership at Transkaryotic Therapeutics, Biogen, and the U.S. Dept. of Health & Human Services, and brings an extensive network of relationships throughout the industry and in Washington D.C. Additionally, he has experience serving as a Director on numerous public company boards. FIRST MANHATTAN CO. 37

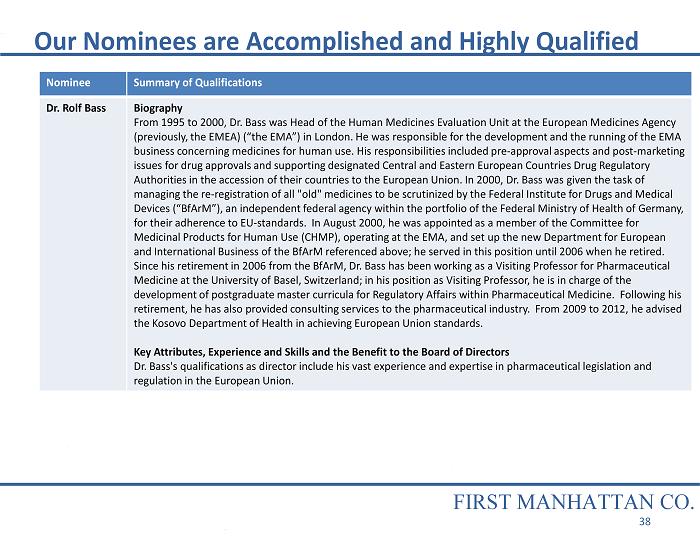

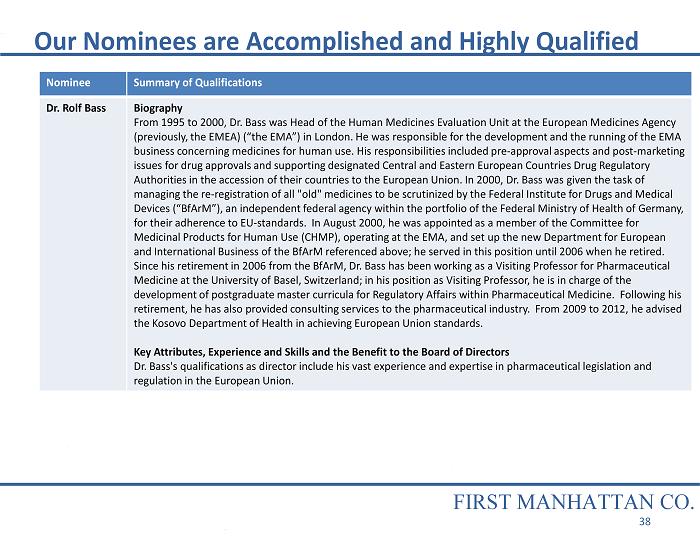

Our Nominees are Accomplished and Highly Qualified Nominee Summary of Qualifications Dr. Rolf Bass Biography From 1995 to 2000, Dr. Bass was Head of the Human Medicines Evaluation Unit at the European Medicines Agency (previously, the EMEA) (“the EMA”) in London. He was responsible for the development and the running of the EMA business concerning medicines for human use. His responsibilities included pre - approval aspects and post - marketing issues for drug approvals and supporting designated Central and Eastern European Countries Drug Regulatory Authorities in the accession of their countries to the European Union. In 2000, Dr. Bass was given the task of managing the re - registration of all "old" medicines to be scrutinized by the Federal Institute for Drugs and Medical Devices (“BfArM”), an independent federal agency within the portfolio of the Federal Ministry of Health of Germany, for their adherence to EU - standards. In August 2000, he was appointed as a member of the Committee for Medicinal Products for Human Use (CHMP), operating at the EMA, and set up the new Department for European and International Business of the BfArM referenced above; he served in this position until 2006 when he retired. Since his retirement in 2006 from the BfArM, Dr. Bass has been working as a Visiting Professor for Pharmaceutical Medicine at the University of Basel, Switzerland; in his position as Visiting Professor, he is in charge of the development of postgraduate master curricula for Regulatory Affairs within Pharmaceutical Medicine. Following his retirement, he has also provided consulting services to the pharmaceutical industry. From 2009 to 2012, he advised the Kosovo Department of Health in achieving European Union standards. Key Attributes, Experience and Skills and the Benefit to the Board of Directors Dr. Bass's qualifications as director include his vast experience and expertise in pharmaceutical legislation and regulation in the European Union. FIRST MANHATTAN CO. 38

Our Nominees are Accomplished and Highly Qualified Nominee Summary of Qualifications Jon Biro Biography Mr. Biro currently serves as Executive Vice President and Chief Financial Officer at Consolidated Graphics, Inc. (NYSE: CGX), a leading commercial printing services company. Prior to Consolidated Graphics, he spent over 13 years at ICO, Inc., a manufacturer of specialty resins and provider of polymer processing services, including serving as Senior Vice President, Chief Financial Officer, Treasurer, a Director, and for a time as interim Chief Executive Officer. At ICO, he helped manage an operational turnaround, including the improvement of the balance sheet and overall capital structure, which helped to increase the company’s stock price over six - fold. He also served as a Director of Aspect Medical from June to November 2009 during which the company’s stock doubled and the company was sold. He currently is a Director at and Crown Crafts, Inc. (Nasdaq: CRWS) and Houston market advisory board member for IBERIA Bank (Nasdaq: IBKC). Mr. Biro received an M.S. in Accounting from the University of Houston and a B.A. in Psychology from the University of Texas and is a CPA. Key Attributes, Experience and Skills and the Benefit to the Board of Directors As a veteran Chief Financial Officer at several public companies, Mr. Biro brings especially strong finance expertise and knowledge of the capital markets. He has executed many complex business initiatives such as capital - raisings (including convertible securities), turnarounds, divestitures and mergers and acquisitions. He also has experience serving as a Director at numerous public companies, including as an audit committee member. FIRST MANHATTAN CO. 39

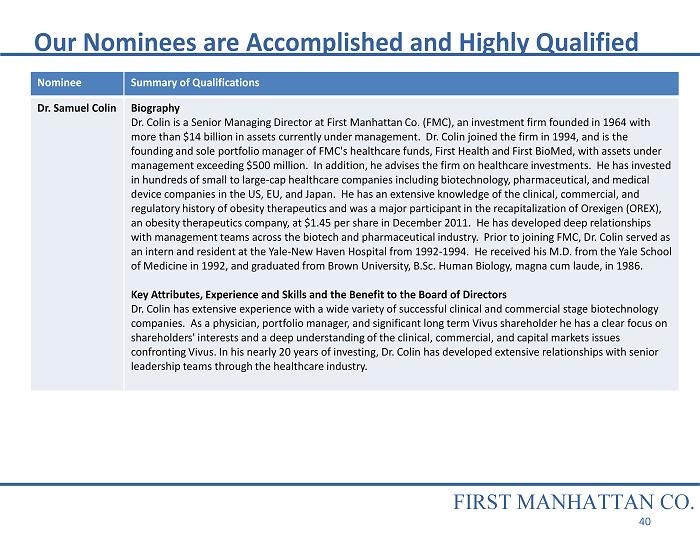

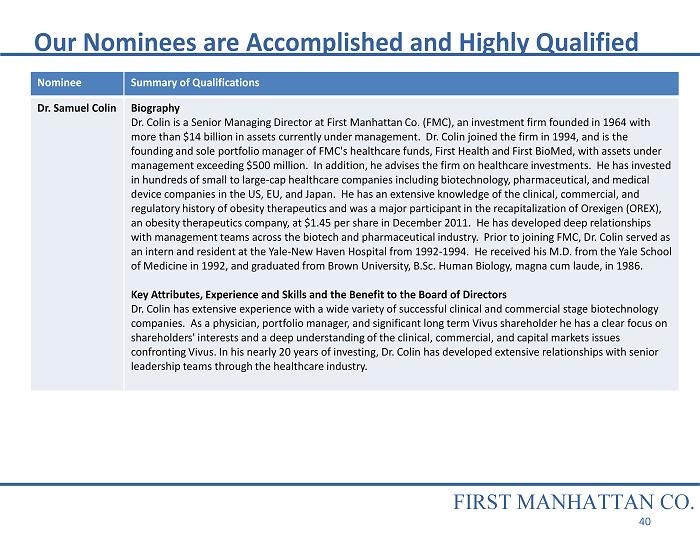

Nominee Summary of Qualifications Dr. Samuel Colin Biography Dr. Colin is a Senior Managing Director at First Manhattan Co. (FMC), an investment firm founded in 1964 with more than $14 billion in assets currently under management. Dr. Colin joined the firm in 1994, and is the founding and sole portfolio manager of FMC's healthcare funds, First Health and First BioMed, with assets under management exceeding $500 million. In addition, he advises the firm on healthcare investments. He has invested in hundreds of small to large - cap healthcare companies including biotechnology, pharmaceutical, and medical device companies in the US, EU, and Japan. He has an extensive knowledge of the clinical, commercial, and regulatory history of obesity therapeutics and was a major participant in the recapitalization of Orexigen (OREX), an obesity therapeutics company, at $1.45 per share in December 2011. He has developed deep relationships with management teams across the biotech and pharmaceutical industry. Prior to joining FMC, Dr. Colin served as an intern and resident at the Yale - New Haven Hospital from 1992 - 1994. He received his M.D. from the Yale School of Medicine in 1992, and graduated from Brown University, B.Sc. Human Biology, magna cum laude, in 1986. Key Attributes, Experience and Skills and the Benefit to the Board of Directors Dr. Colin has extensive experience with a wide variety of successful clinical and commercial stage biotechnology companies. As a physician, portfolio manager, and significant long term Vivus shareholder he has a clear focus on shareholders' interests and a deep understanding of the clinical, commercial, and capital markets issues confronting Vivus. In his nearly 20 years of investing, Dr. Colin has developed extensive relationships with senior leadership teams through the healthcare industry. Our Nominees are Accomplished and Highly Qualified FIRST MANHATTAN CO. 40

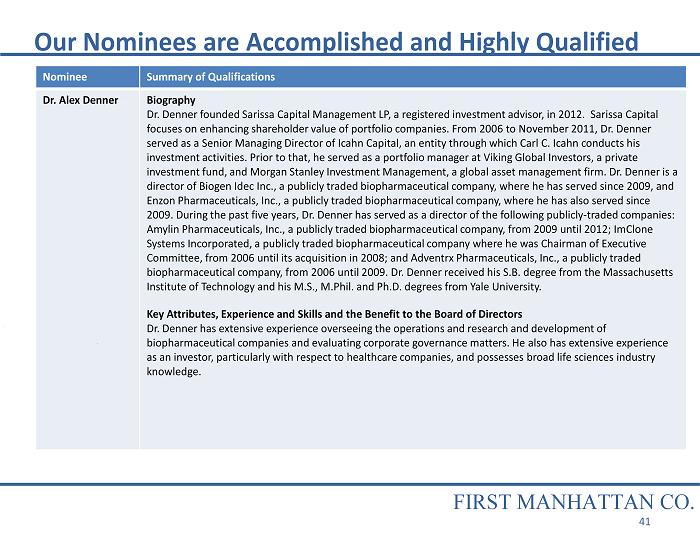

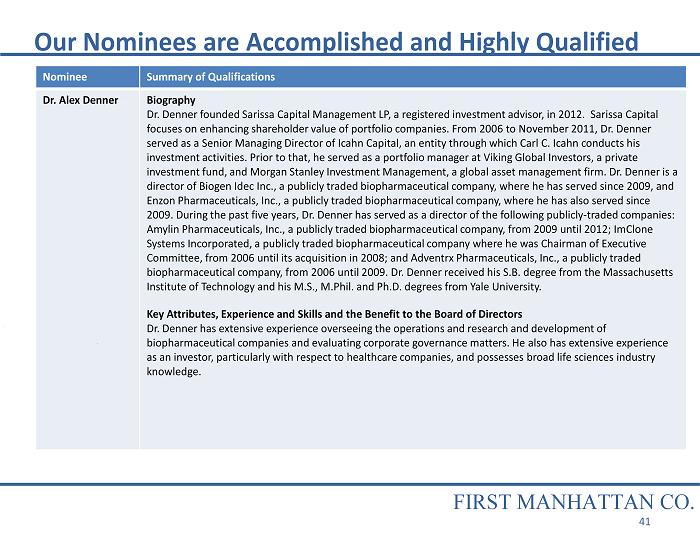

Nominee Summary of Qualifications Dr. Alex Denner Biography Dr. Denner founded Sarissa Capital Management LP, a registered investment advisor, in 2012. Sarissa Capital focuses on enhancing shareholder value of portfolio companies. From 2006 to November 2011, Dr. Denner served as a Senior Managing Director of Icahn Capital, an entity through which Carl C. Icahn conducts his investment activities. Prior to that, he served as a portfolio manager at Viking Global Investors, a private investment fund, and Morgan Stanley Investment Management, a global asset management firm. Dr. Denner is a director of Biogen Idec Inc., a publicly traded biopharmaceutical company, where he has served since 2009, and Enzon Pharmaceuticals, Inc., a publicly traded biopharmaceutical company, where he has also served since 2009. During the past five years, Dr. Denner has served as a director of the following publicly - traded companies: Amylin Pharmaceuticals, Inc., a publicly traded biopharmaceutical company, from 2009 until 2012; ImClone Systems Incorporated, a publicly traded biopharmaceutical company where he was Chairman of Executive Committee, from 2006 until its acquisition in 2008; and Adventrx Pharmaceuticals, Inc., a publicly traded biopharmaceutical company, from 2006 until 2009. Dr. Denner received his S.B. degree from the Massachusetts Institute of Technology and his M.S., M.Phil. and Ph.D. degrees from Yale University. Key Attributes, Experience and Skills and the Benefit to the Board of Directors Dr. Denner has extensive experience overseeing the operations and research and development of biopharmaceutical companies and evaluating corporate governance matters. He also has extensive experience as an investor, particularly with respect to healthcare companies, and possesses broad life sciences industry knowledge. Our Nominees are Accomplished and Highly Qualified FIRST MANHATTAN CO. 41

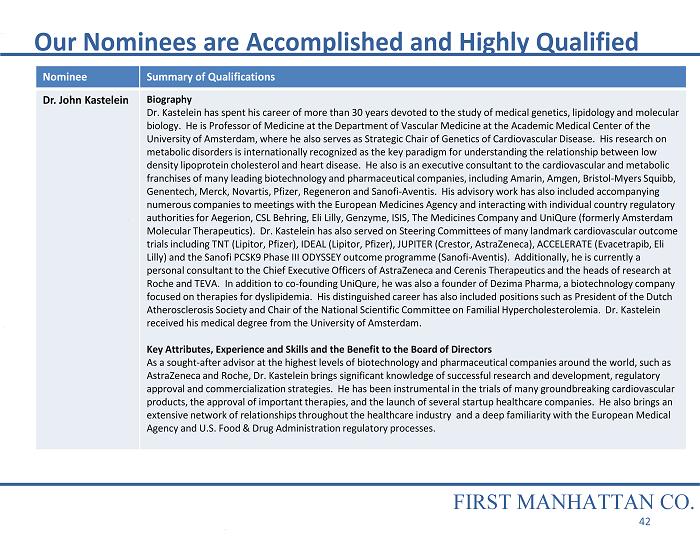

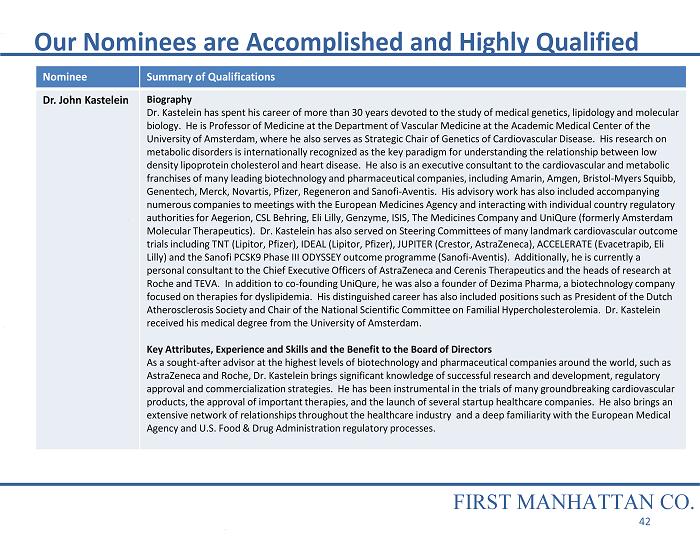

Nominee Summary of Qualifications Dr. John Kastelein Biography Dr. Kastelein has spent his career of more than 30 years devoted to the study of medical genetics, lipidology and molecular biology. He is Professor of Medicine at the Department of Vascular Medicine at the Academic Medical Center of the University of Amsterdam, where he also serves as Strategic Chair of Genetics of Cardiovascular Disease. His research on metabolic disorders is internationally recognized as the key paradigm for understanding the relationship between low density lipoprotein cholesterol and heart disease. He also is an executive consultant to the cardiovascular and metabolic franchises of many leading biotechnology and pharmaceutical companies, including Amarin, Amgen, Bristol - Myers Squibb, Genentech, Merck, Novartis, Pfizer, Regeneron and Sanofi - Aventis. His advisory work has also included accompanying numerous companies to meetings with the European Medicines Agency and interacting with individual country regulatory authorities for Aegerion, CSL Behring, Eli Lilly, Genzyme, ISIS, The Medicines Company and UniQure (formerly Amsterdam Molecular Therapeutics). Dr. Kastelein has also served on Steering Committees of many landmark cardiovascular outcome trials including TNT (Lipitor, Pfizer), IDEAL (Lipitor, Pfizer), JUPITER (Crestor, AstraZeneca), ACCELERATE (Evacetrapib, Eli Lilly) and the Sanofi PCSK9 Phase III ODYSSEY outcome programme (Sanofi - Aventis). Additionally, he is currently a personal consultant to the Chief Executive Officers of AstraZeneca and Cerenis Therapeutics and the heads of research at Roche and TEVA. In addition to co - founding UniQure, he was also a founder of Dezima Pharma, a biotechnology company focused on therapies for dyslipidemia. His distinguished career has also included positions such as President of the Dutch Atherosclerosis Society and Chair of the National Scientific Committee on Familial Hypercholesterolemia. Dr. Kastelein received his medical degree from the University of Amsterdam. Key Attributes, Experience and Skills and the Benefit to the Board of Directors As a sought - after advisor at the highest levels of biotechnology and pharmaceutical companies around the world, such as AstraZeneca and Roche, Dr. Kastelein brings significant knowledge of successful research and development, regulatory approval and commercialization strategies. He has been instrumental in the trials of many groundbreaking cardiovascular products, the approval of important therapies, and the launch of several startup healthcare companies. He also brings an extensive network of relationships throughout the healthcare industry and a deep familiarity with the European Medical Agency and U.S. Food & Drug Administration regulatory processes. Our Nominees are Accomplished and Highly Qualified FIRST MANHATTAN CO. 42

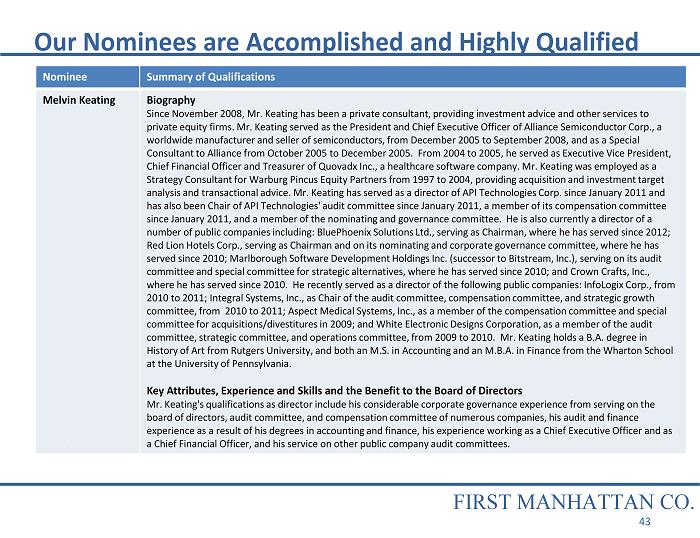

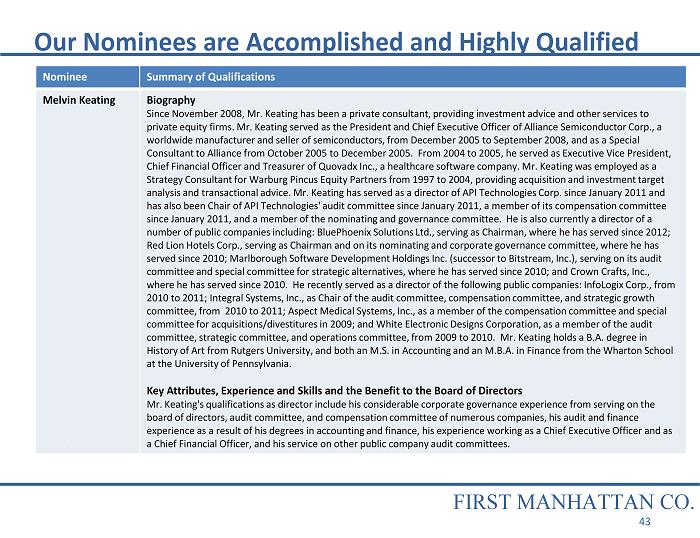

Nominee Summary of Qualifications Melvin Keating Biography Since November 2008, Mr. Keating has been a private consultant, providing investment advice and other services to private equity firms. Mr. Keating served as the President and Chief Executive Officer of Alliance Semiconductor Corp., a worldwide manufacturer and seller of semiconductors, from December 2005 to September 2008, and as a Special Consultant to Alliance from October 2005 to December 2005. From 2004 to 2005, he served as Executive Vice President, Chief Financial Officer and Treasurer of Quovadx Inc., a healthcare software company. Mr. Keating was employed as a Strategy Consultant for Warburg Pincus Equity Partners from 1997 to 2004, providing acquisition and investment target analysis and transactional advice. Mr. Keating has served as a director of API Technologies Corp. since January 2011 and has also been Chair of API Technologies' audit committee since January 2011, a member of its compensation committee since January 2011, and a member of the nominating and governance committee. He is also currently a director of a number of public companies including: BluePhoenix Solutions Ltd., serving as Chairman, where he has served since 2012; Red Lion Hotels Corp., serving as Chairman and on its nominating and corporate governance committee, where he has served since 2010; Marlborough Software Development Holdings Inc. (successor to Bitstream, Inc.), serving on its audit committee and special committee for strategic alternatives, where he has served since 2010; and Crown Crafts, Inc., where he has served since 2010. He recently served as a director of the following public companies: InfoLogix Corp., from 2010 to 2011; Integral Systems, Inc., as Chair of the audit committee, compensation committee, and strategic growth committee, from 2010 to 2011; Aspect Medical Systems, Inc., as a member of the compensation committee and special committee for acquisitions/divestitures in 2009; and White Electronic Designs Corporation, as a member of the audit committee, strategic committee, and operations committee, from 2009 to 2010. Mr. Keating holds a B.A. degree in History of Art from Rutgers University, and both an M.S. in Accounting and an M.B.A. in Finance from the Wharton School at the University of Pennsylvania. Key Attributes, Experience and Skills and the Benefit to the Board of Directors Mr. Keating's qualifications as director include his considerable corporate governance experience from serving on the board of directors, audit committee, and compensation committee of numerous companies, his audit and finance experience as a result of his degrees in accounting and finance, his experience working as a Chief Executive Officer and as a Chief Financial Officer, and his service on other public company audit committees. Our Nominees are Accomplished and Highly Qualified FIRST MANHATTAN CO. 43

Nominee Summary of Qualifications David Norton Biography Mr. Norton served in a variety of senior leadership positions during his more than 32 - year career at Johnson & Johnson (NYSE: JNJ), most recently as Company Group Chairman, Global Pharmaceuticals from 2009 until his retirement from the company in September 2011. As Company Group Chairman, he was responsible for leading and developing the strategic growth agenda, including the licensing, acquisitions and divestment strategies, and ensuring alignment between global strategic functions, research and development and the commercial organizations. Under his stewardship, J&J successfully commercialized numerous blockbuster products, including Prepulsid / Propulsid (Europe), Risperdal (Australia, Europe), Aciphex (US), Risperdal Consta (US and Europe), Durogesic / Duragesic (US and Europe), and Prezista (US and Europe). He also helped negotiate a novel pricing and reimbursement program for Velcade with the U.K. Department of Health, resulting in increased sales. Also under his supervision, J&J secured numerous acquisition, divestitures, in - licensing and collaboration agreements, including acquiring Cougar Biotechnology and Zytiga, in - licensing of Incivo (Hepatitis C compound for Europe), and selling J&J's Animal Health business to Eli Lilly. J&J’s Pharmaceutical Group’s revenues grew to $22 billion, 30% of the company’s total revenue, during his tenure. Previously, Mr. Norton served as U.S. Domestic President for Janssen Pharmaceuticals (a J&J unit), Company Group Chairman for Europe, Middle East and Africa, and Company Group Chairman of Worldwide Commercial and Operations for J&J’s CNS, Internal Medicine and Virology franchise. He currently is a Director at Savient Pharmaceuticals Inc. (Nasdaq: SVNT). Mr. Norton has studied Computer Programming Technology at the Control Data Institute in Sydney, Australia, as well as Marketing at the College of Distributive Trades at London and Preston Polytechnic in Preston, United Kingdom. Key Attributes, Experience and Skills and the Benefit to the Board of Directors Mr. Norton has tremendous experience running large and successful public healthcare company commercial operations in the U.S., U.K. and Europe based on his 32 - plus years at Johnson & Johnson. He oversaw numerous successful blockbuster product launches and secured important in - licensing, collaboration and mergers and acquisitions agreements to drive the growth of the Pharmaceuticals Group. He brings a deep understanding of the global healthcare industry and an exceptional network of relationships. He also has public company board experience. Our Nominees are Accomplished and Highly Qualified FIRST MANHATTAN CO. 44

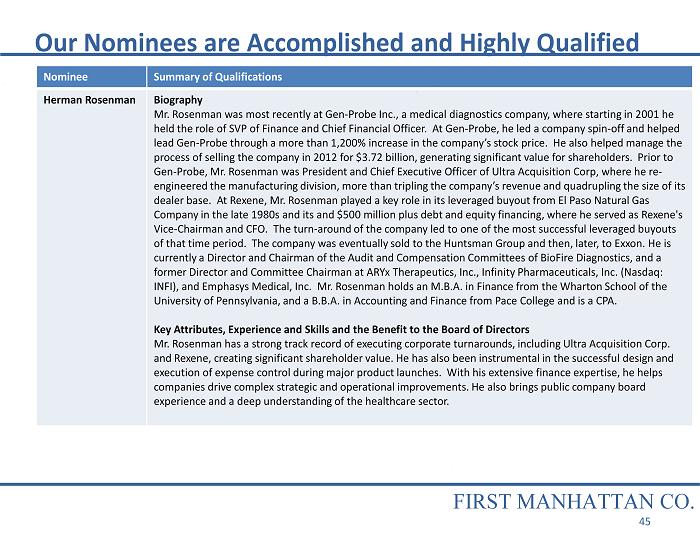

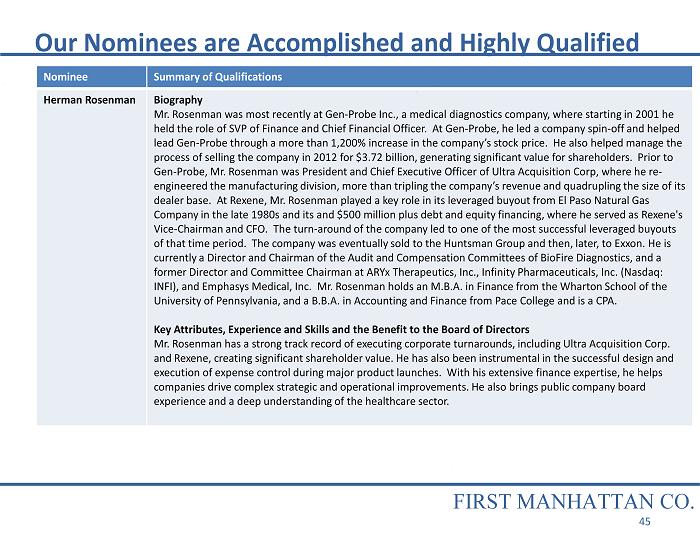

Nominee Summary of Qualifications Herman Rosenman Biography Mr. Rosenman was most recently at Gen - Probe Inc., a medical diagnostics company, where starting in 2001 he held the role of SVP of Finance and Chief Financial Officer. At Gen - Probe, he led a company spin - off and helped lead Gen - Probe through a more than 1,200% increase in the company’s stock price. He also helped manage the process of selling the company in 2012 for $3.72 billion, generating significant value for shareholders. Prior to Gen - Probe, Mr. Rosenman was President and Chief Executive Officer of Ultra Acquisition Corp, where he re - engineered the manufacturing division, more than tripling the company’s revenue and quadrupling the size of its dealer base. At Rexene, Mr. Rosenman played a key role in its leveraged buyout from El Paso Natural Gas Company in the late 1980s and its and $500 million plus debt and equity financing, where he served as Rexene's Vice - Chairman and CFO. The turn - around of the company led to one of the most successful leveraged buyouts of that time period. The company was eventually sold to the Huntsman Group and then, later, to Exxon. He is currently a Director and Chairman of the Audit and Compensation Committees of BioFire Diagnostics, and a former Director and Committee Chairman at ARYx Therapeutics, Inc., Infinity Pharmaceuticals, Inc. (Nasdaq: INFI), and Emphasys Medical, Inc. Mr. Rosenman holds an M.B.A. in Finance from the Wharton School of the University of Pennsylvania, and a B.B.A. in Accounting and Finance from Pace College and is a CPA. Key Attributes, Experience and Skills and the Benefit to the Board of Directors Mr. Rosenman has a strong track record of executing corporate turnarounds, including Ultra Acquisition Corp. and Rexene, creating significant shareholder value. He has also been instrumental in the successful design and execution of expense control during major product launches. With his extensive finance expertise, he helps companies drive complex strategic and operational improvements. He also brings public company board experience and a deep understanding of the healthcare sector. Our Nominees are Accomplished and Highly Qualified FIRST MANHATTAN CO. 45

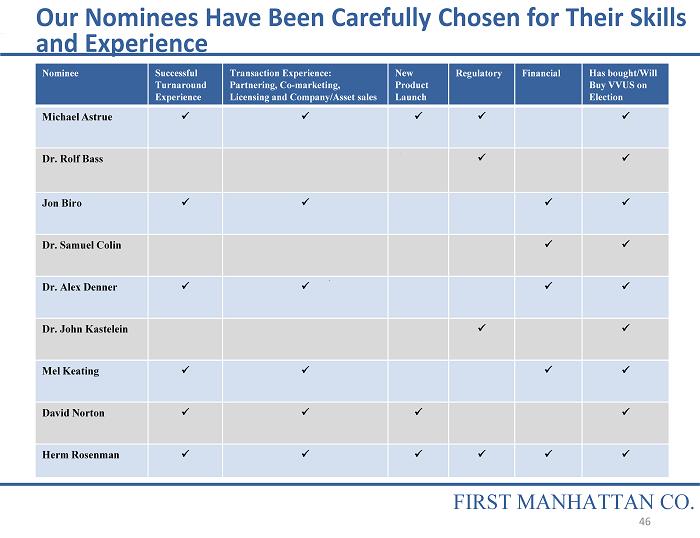

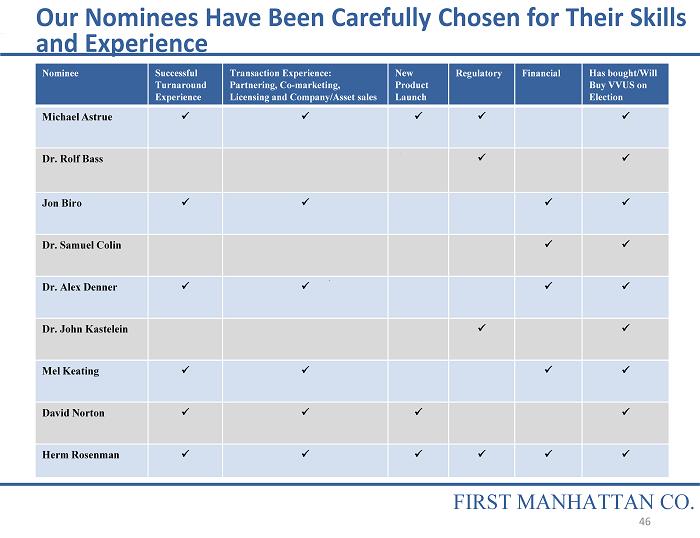

Our Nominees Have Been Carefully Chosen for Their Skills and Experience Nominee Successful Turnaround Experience Transaction Experience: Partnering, Co - marketing, Licensing and Company/Asset sales New Product Launch Regulatory Financial Has bought/Will Buy VVUS on Election Michael Astrue x x x x x Dr. Rolf Bass x x Jon Biro x x x x Dr. Samuel Colin x x Dr. Alex Denner x x x x Dr. John Kastelein x x Mel Keating x x x x David Norton x x x x Herm Rosenman x x x x x x FIRST MANHATTAN CO. 46

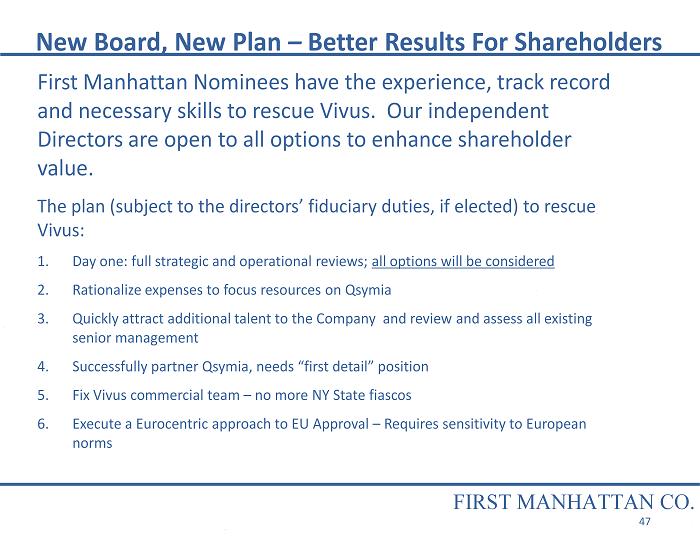

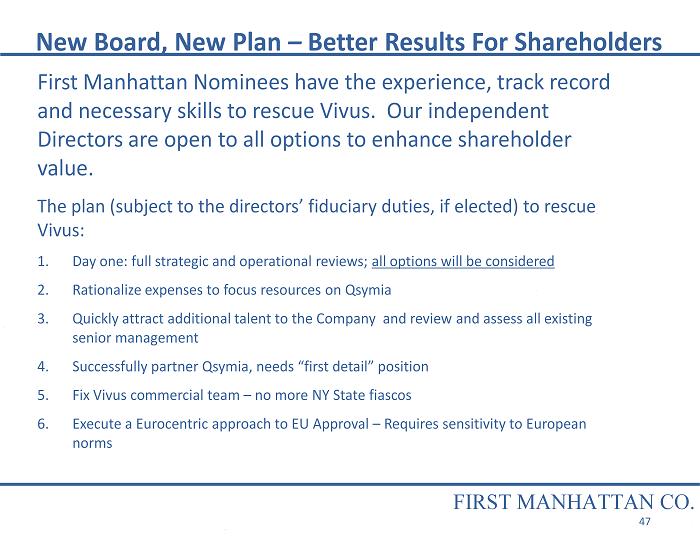

New Board, New Plan – Better Results For Shareholders First Manhattan Nominees have the experience, track record and necessary skills to rescue Vivus. Our independent Directors are open to all options to enhance shareholder value. The plan (subject to the directors’ fiduciary duties, if elected) to rescue Vivus: 1. Day one: full strategic and operational reviews; all options will be considered 2. Rationalize expenses to focus resources on Qsymia 3. Quickly attract additional talent to the Company and review and assess all existing senior management 4. Successfully partner Qsymia, needs “first detail” position 5. Fix Vivus commercial team – no more NY State fiascos 6. Execute a Eurocentric approach to EU Approval – Requires sensitivity to European norms FIRST MANHATTAN CO. 47

New Board, New Plan CREATE DURABLE VALUE FOR ALL SHAREHOLDERS Board commitment to best practices in Corporate Governance: 1. Total independence from current management 2. Only one management Director will be on the Board of Directors 3. Total alignment of the Board’s economic interests with shareholders 4. Work to immediately restore credibility and transparency with the investment community 5. Instill a greater sense of urgency and be open to dialogue directly with investors 6. Regularly refresh the Board with the right Directors that add skills and experience needed by the Board at the time FIRST MANHATTAN CO. 48

New Board, New Plan First Manhattan Nominees’ Interests are Aligned with Vivus Shareholders • FMC’s Nominees are buying stock • All nine of First Manhattan’s Nominees have committed to buying additional shares in Vivus upon election – Standards for stock ownership will be adopted to further ensure Director alignment with shareholder interests • First Manhattan’s Nominees will eat their own cooking, not yours – Committed to receiving compensation that is aligned with the creation of shareholder value and based on fair play and pay for performance – Immediately cut Director cash compensation by more than 50% – Eliminate RSUs for FMC Nominees, 100% options for equity compensation at peer norms FIRST MANHATTAN’S NOMINEES ARE COMMITTED TO PAY FOR PERFORMANCE FIRST MANHATTAN CO. 49

First Manhattan Interests are Fully Aligned with Vivus Shareholders Actions speak louder than words • First Manhattan is already a 9.9% shareholder – Long - term holder since 2008 – FMC has continued to buy stock after the failed Qsymia launch and has consistently purchased shares over the past five years – FMC’s cost basis is around $11.00 – FMC’s interests are fully aligned with Vivus shareholders If the Vivus Board and management team are so confident in their plan, why didn’t they buy stock? WE CONTINUE TO SEE AN OPPORTUNITY IN VIVUS AND HAVE THE TRACK RECORD OF BUYING STOCK OVER THE LAST FIVE YEARS TO PROVE IT FIRST MANHATTAN CO. 50

The Choice is Clear for Vivus Shareholders: • No accountability • Lack of transparency • Inadequate alignment with shareholder interests • A Board composed of members with strong ties to the CEO • A track record of value destruction • No credible plan for value creation • A Board that refuses to put their money where their mouth is Then vote for “more of the same” with Vivus’ Board Nominees • Total alignment of Board and shareholder interests • An independent Board that holds management accountable • A Board carefully chosen for its skills and experience • A real plan for value creation • Directors who put their money where their mouths are Then vote for FMC’s independent and highly qualified Nominees THE CHOICE IS CLEAR If you are satisfied with: If you want: FIRST MANHATTAN CO. 51

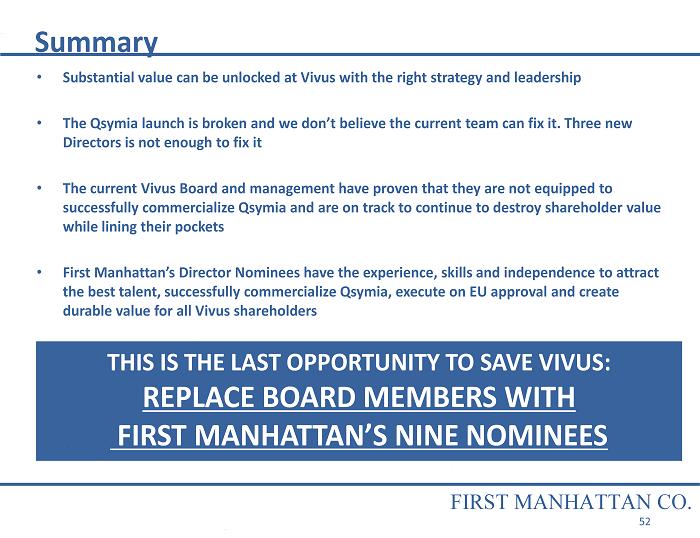

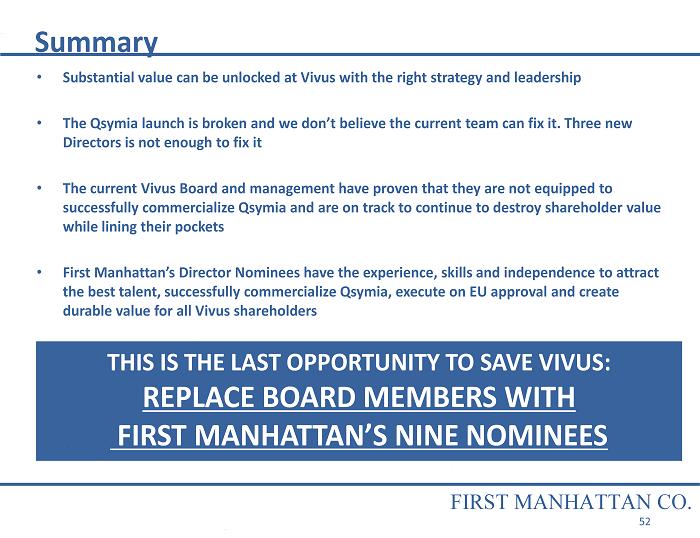

Summary • Substantial value can be unlocked at Vivus with the right strategy and leadership • The Qsymia launch is broken and we don’t believe the current team can fix it. T hree new Directors is not enough to fix it • The current Vivus Board and management have proven that they are not equipped to successfully commercialize Qsymia and are on track to continue to destroy shareholder value while lining their pockets • First Manhattan’s Director Nominees have the experience, skills and independence to attract the best talent, successfully commercialize Qsymia, execute on EU approval and create durable value for all Vivus shareholders THIS IS THE LAST OPPORTUNITY TO SAVE VIVUS: REPLACE BOARD MEMBERS WITH FIRST MANHATTAN’S NINE NOMINEES FIRST MANHATTAN CO. 52

Appendix A (FMC emphasis added) FIRST MANHATTAN CO. 53 From: Dr. Y Sent: Friday, November 30, 2012 7:54 AM To: Michael Miller Cc: Colin, Sam Subject: Re: follow up re: Qsymia problems Hello Michael, I'm glad you're working on simplifying the prescribing process. I agree, it would be a shame for the drug to fail in the market because of an onerous policy. If possible, I think the NY exception should be stated on the Website itself. My guess is that many prescribers aren't going to see the NY exception on the fax form. Sincerely, Dr. Y _________________________________________________________________________________ From: Michael Miller [mailto:millerm@vivus.com] Sent: Friday, November 30, 2012 2:07 PM To: Dr. Y Cc: Dr. X, M.D.; Colin, Sam Subject: RE: follow up re: Qsymia problems Dear Dr. Y, Thank you very much for your response. We can make the change on the website as well, under the HCP section. I appreciate the suggestion… Please let me know if there is anything we can do as a company or at a local level to help or make up for this experience. Again, my apologies for any inconvenience. Sincerely, Michael Miller From: Dr. Y Sent: Friday, November 30, 2012 7:54 AM To: Michael Miller Cc: Dr. X; Colin, Sam Subject: Re: follow up re: Qsymia problems Hello Michael, I'm glad you're working on simplifying the prescribing process. I agree, it would be a shame for the drug to fail in the market because of an onerous policy. If possible, I think the NY exception should be stated on the Website itself. My guess is that many prescribers aren't going to see the NY exception on the fax form. Sincerely, Dr. Y Michael Miller wrote: Dear Drs. X and Y, I spoke to Sam Colin, MD recently and he relayed a story about your experiences trying to prescribe Qsymia for medical obesity. If it would acceptable to you, I would like to speak to either or both of you to hear it firsthand. I am deeply disturbed by what I had heard and completely understand your frustration. Is there an opportunity to talk or at least get more details via email? As you may know, it took us eight years to develop Qsymia and multiple FDA interactions. Qsymia has an FDA mandated REMS that restricts its distribution via mail order only. I am aware of NY State laws and the inability to fax and the complexities/delays that causes. I also know that the communication of the pharmacy network was not as clear as it should have been and that is our fault. The on line PDF prescription on www.qsymia.com <http://www.qsymia.com> now specifically calls out the NY exception. Also, we submitted a REMS modification request that allow retail distribution to the FDA and will likely hear an outcome in Q1 13. Now is a critical time to provide feedback on the present REMS and its burden on the system. Your feedback would be very helpful in that regard. I would also really like a chance to personally apologize for the experience. Sincerely, Michael P. Miller Senior Vice President VIVUS, Inc 1172 Castro Street Mountain View, CA 94040