Exhibit 10.1

COMMERCIAL LEASE

THIS COMMERCIAL LEASE (“Lease”) is entered into and made as of the 22 day of August, 2013, by and between4240 International Associates, LLC (operating under Denley Investment and Management Company, a California corporation) with a registered address of 5550 Lyndon B. Johnson Freeway, Suite 300, Dallas, Texas 75240, hereinafter “Landlord,” andInterphase Corporation, a Texas corporation with a current address of 2901 N. Dallas Parkway, Suite 200, Plano, Texas 75093, hereinafter “Tenant.”

WITNESSETH:

Landlord, in consideration of the rents and covenants hereinafter set forth, does hereby demise, let and lease to Tenant, and Tenant does hereby hire, take and lease from Landlord, on the terms and conditions hereinafter set forth, the following described space, hereinafter called the “Premises,” to have and to hold the same, with all appurtenances, unto Tenant for the term hereinafter specified.

1. | DESCRIPTION OF THE PREMISES |

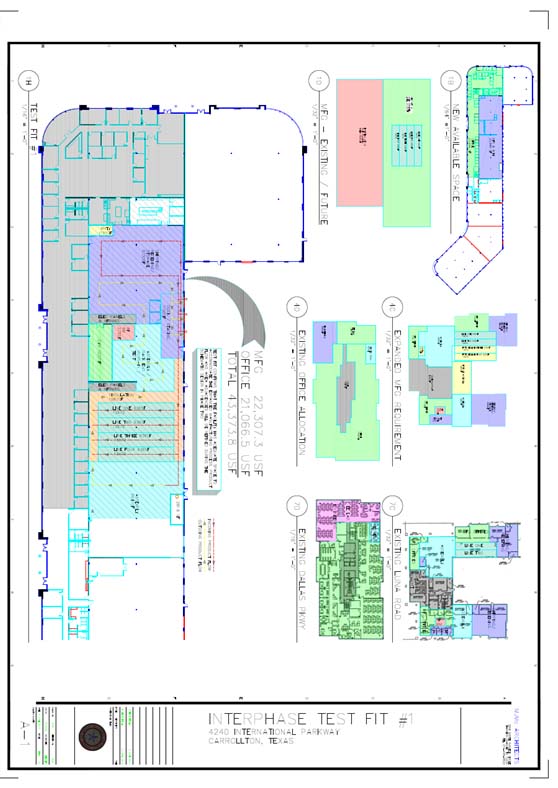

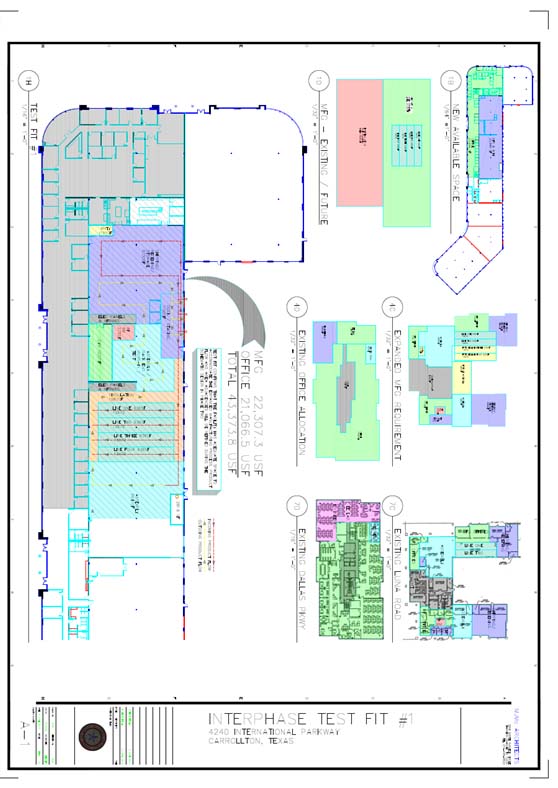

The Premises are contained within that structure (the “Building”) commonly known as International Tech Center located at 4240 International Parkway, in the city of Carrollton, Texas 75007, and the legal description of which is attached hereto asExhibit A. Landlord shall demise forty-three thousand three hundred seventy-four (43,374) uninterrupted useable square feet of the portion of the Building identified as Suite 105 to Tenant as the Premises, in accordance with the Space Plan attached hereto asExhibit B, dated June 3, 2013.

Tenant’s Proportionate Share is 36.6836%, (which is the percentage obtained by dividing the total useable square feet of the Premises by the total rentable square feet of the Building). In no event shall a re-measurement of the Premises result in an increase in Tenant’s Premises size for purposes of the calculation of either Monthly Base Rent or Tenant’s Proportionate Share. For the avoidance of doubt, if Tenant’s Premises expands through demising additional space, Tenant shall only pay rental on, and the Tenant’s Proportionate Share shall be based on, useable rather than rentable square feet.

(a) The term of this Lease shall commence on the Commencement Date (as such term is defined below) and shall terminate one hundred thirty-two (132) months thereafter (plus any partial month in which the Commencement Date occurs, if applicable) (the “Term”). The “Commencement Date” shall be March 1, 2014. (b) Tenant shall have a minimum of sixty (60) days prior access to the Premises without rent or other charges in order to install all furniture, fixtures, telephone/computer equipment, cabling, racking, stocking, and other make-ready work.

COMMERCIAL LEASE

Page 1 of 37

3. RENT AND OPERATING EXPENSES

(a) Free Rent. Tenant shall receive twelve (12) months of abated Base Rent (as specified and defined in Paragraph 3(b)). Additionally, the first five (5) months of Operating Expenses/NNN Expenses (as defined herein) shall be abated.

(b) Monthly Base Rent. Tenant shall pay as rent for the Premises the applicable Monthly Base Rent as follows, based upon a per-square foot calculation:

Period | Rental Rate | Monthly Rent |

Months 1-5 | $00.00 (abated pursuant to Paragraph 3(a); NNN expenses abated pursuant to Paragraph 3(a) | $0.00 |

Months 6-17 | $10.50 per square foot | $37,952.00 |

Months 18-19 | $00.00 (abated pursuant to Paragraph 3(a) | $0.00 |

Months 20-31 | $10.50 per square foot | $37,952.00 |

Months 32-33 | $00.00 (abated pursuant to Paragraph 3(a) | $0.00 |

Months 34-45 | $10.50 per square foot | $37,952.00 |

Months 46-47 | $00.00 (abated pursuant to Paragraph 3(a) | $0.00 |

Months 48-59 | $11.00 per square foot | $39,759.50 |

Month 60 | $00.00 (abated pursuant to Paragraph 3(a) | $0.00 |

Months 61-84 | $11.00 per square foot | $39,759.50 |

Months 85-120 | $11.50 per square foot | $41,566.75 |

Months 121-132 | $12.00 per square foot | $43,374.00 |

The Monthly Base Rent shall be payable in monthly installments equal to the applicable Monthly Base Rent shown in this Paragraph 3(b) in advance. The monthly installments shall commence on the Commencement Date and shall continue on the first (1st) day of each calendar month thereafter until the Expiration Date. If the Commencement Date is specified to occur or otherwise occurs on a day other than the first day of a calendar month, the Monthly Base Rent for such partial month shall be prorated. If any installment of Rent is not paid when due, Tenant shall pay to Landlord a late charge in an amount equal to 5% of the delinquent Rent, provided that Tenant shall be entitled to a grace period of 5 business days.

(c) Definitions: For purposes of this Lease, the following definitions shall apply:

| | (1) | Unless otherwise specifically stated, any charge payable by Tenant under this Lease other than Base Rent is called “Additional Rent”. Additional Rent is to be paid concurrently with and subject to the same terms and conditions of Base Rent. The term “rent” (or “Rent”) whenever used in this Lease means Base Rent, Additional Rent and/or any other monies payable by Tenant under the terms of this Lease. In the event any rent payable under this Lease commences or ends on a day other than the first day of a calendar month, the actual number of days in the prorated month will be used as the basis for the calculation. |

COMMERCIAL LEASE

Page 2 of 37

| | (2) | Operating Expenses. “Operating Expenses” as used herein shall include all direct costs and expenses related to the operation, maintenance, and repair of the Premises, Building, and/or Property, or any part thereof, incurred by Landlord including but not limited to: (1) Property supplies, materials, labor, equipment, and tools; (2) Landlord-incurred Utility and Service Costs (as further described in Section 3(c)(4) below), security, janitorial, and all applicable service and maintenance agreements; (3) Property - related legal, accounting, and consulting fees, costs and expenses; (4) Insurance Premiums for all policies deemed necessary by Landlord and/or its lenders, and all deductible amounts under such policies (as further described in Section 3(c)(5) below); (5) costs and expenses of operating, maintaining, and repairing Common Areas of the Property (including, but not limited to, resurfacing and striping), landscaped areas (including, but not limited to, tree trimming), walkways, building exteriors (including, but not limited to, painting and roof repairs), signs and directories, and elevators and stairways; (6) capital improvements and replacements (as opposed to additions or new improvements) and other nonstructural items located in the Common Areas (including all financing costs and interest charges) which are made to improve the operating efficiency of the Property or required to keep such areas in good condition, but only to the extent of cost savings achieved as a result of such capital improvements or replacements, amortized over the useful lives of such capital improvements or replacements; (7) compensation (including, but not limited to, any payroll taxes, worker’s compensation for employees, and customary employee benefits) of all persons, including independent contractors, who perform duties, or render services on behalf of, or in connection with the Property, or any part thereof, including but not limited to, Property operations, maintenance, repair, and rehabilitation, but excluding any compensation included as part of or subsumed in property management fees; (8) Property management fees, which shall not exceed four percent (4%) of the rent collected for the Building; (9) Real Property Taxes (as further described in Section 3(c)(3) below), provided, however, Landlord agrees that no cost or expense shall be charged more than once. All Operating Expenses other than Real Property Taxes, Utility and Service Costs, and Insurance Premiums, are herein referred to as “Common Area Expenses”, or “CAM”. |

The foregoing provisions are for definitional purposes and shall not impose any obligation upon Landlord to incur such expenses, nor limit other Operating Expenses that Landlord may incur for the Property. Landlord may retain independent contractors (or affiliated contractors at market rates) to provide any services or perform any work, in which case the costs thereof shall be deemed Operating Expenses. Operating Expenses shall, however, exclude the following items: costs (1) for capital improvements made to the Project, other than capital improvements described in Section 3(c)(2)(6) above and except for items which, though capital for accounting purposes, are properly considered maintenance and repair items, such as painting of common areas, replacement of carpet in elevator lobbies, and the like; (2) for repair, replacements and general maintenance made necessary by fire or other casualty, or paid by proceeds of insurance or by Tenant or other third parties, and alterations attributable solely to tenants of the Building other than Tenant; (3) for interest, amortization or other payments on loans to Landlord; (4) for depreciation of the Building; (5) for leasing commissions or marketing or promotional expenses; (6) for legal expenses, other than those incurred for the general benefit of the Building’s tenants (e.g., tax disputes); (7) for renovating or otherwise improving space for occupants of the Building or vacant space in the Building; (8) for correcting defects in the construction of the Building; (9) for overtime or other expenses of Landlord in curing defaults or performing work expressly provided in this Lease to be borne at Landlord’s expense; (10) for federal income taxes imposed on or measured by the income of Landlord from the operation of the Project; (11) repairs or replacements necessitated by Landlord’s gross negligence or willful misconduct; (12) amounts reimbursed to Landlord pursuant to any warranty or by Tenant or any other tenant or third party; (13) reserves for future expenses; (14) late charges or penalties incurred as a result of Landlord’s failure to pay any bills or charges when due; (15) general overhead of Landlord (not including any goods or services used or provided directly for the benefit of the Project); (16) amounts incurred to remediate any hazardous substances as defined by applicable environmental law unless caused in whole or in part by Tenant, its officers, employees, agents, contractors or customers; (17) for rent or other payment due under any ground lease for any or all the Land; (18) any expense to the extent Landlord actually receives or is entitled to reimbursement from insurance, condemnation awards, or any other source; and (19) costs or expenses related to Landlord’s cleaning, removal, remediation or compliance required due to the existence of any hazardous materials in, on or affecting the Building, but limited to items not directly or indirectly caused by Tenant.

COMMERCIAL LEASE

Page 3 of 37

| | (3) | “Real Property Taxes” as used herein shall include any fee, license, tax, late fee, levy, charge, assessment, , or surcharge (hereinafter individually and/or collectively referred to as “Tax”) imposed by any authority (including, but not limited to, any federal, state, county, or local government, or any school, agricultural, lighting, drainage, or other improvement district, or public or private association) having the direct or indirect power to tax and where such Tax is imposed against the Building, or any part thereof, or Landlord in connection with its specific ownership or operation of the Building, including but not limited to: (1) any Tax on Landlord’s right to receive, or the receipt of, rent or income from the Building, or any part thereof, or Tax against Landlord’s business of leasing the Building; (2) any Tax by any authority for services or maintenance provided to the Building, or any part thereof, including, but not limited to, fire protection, streets, sidewalks, and utilities; (3) any Tax on real estate or personal property levied with respect to the Building, or any part thereof, and any fixtures and equipment and other property of Landlord or the Building used in connection with the operation, maintenance or repair of the Building; (4) any Tax based upon a reassessment of the Building, and, (5) any Tax replacing, substituting for, or in addition to any Tax previously included with this definition. Real Property Taxes do not include: (1) Landlord’s federal or state income, franchise, inheritance, or estate taxes; or (2) Tenant’s personal property taxes (taxes charged against Tenant’s trade fixtures, furnishings, equipment, or other personal property) which are the sole responsibility of Tenant, and shall be billed directly to, and paid in a timely manner by Tenant. |

| | (4) | “Utility and Service Costs” as used herein shall include all Landlord incurred utility and service costs and expenses provided to the Building, including, but not limited to, water, electricity, gas, lighting, steam sewer, waste disposal. |

| | (5) | “Insurance Premiums” as used herein shall include all insurance premiums for all policies reasonably deemed necessary by Landlord and/or its lenders, for the operation of the Building, including, but not limited to, worker’s compensation, liability, commercial general liability, automobile, casualty insurance with extended coverage, riders under or attached to such policies, and the deductibles, fees and other charges and costs associated with the maintenance of the insurance for the Building carried by Landlord hereunder. |

| | (6) | Expense Comparison Year. The Base Year for calculating Operating Expenses shall be the calendar year 2014. Throughout the Term, Tenant will pay as Additional Rent its Proportionate Share of Operating Expenses, which will be equal to each calendar year’s total Operating Expenses multiplied by Tenant’s Proportionate Share, based on 95% occupancy. In the event Tenant is only responsible for a portion of a given calendar year, Tenant’s Proportionate Share will be based on the actual number of elapsed applicable days. |

(d) Payment. Tenant’s Proportionate Share of Operating Expenses shall be determined

and paid as follows:

| | (1) | This Lease is a Triple Net (“NNN”) Lease and Tenant is responsible for payment of all Real Property Taxes, Insurance Premiums, and Common Area Expenses. Tenant is further responsible for contracting and paying all Utility and Service Costs, including telephone/data and security of the Premises. Landlord shall be responsible for all expenses related to roof replacement, foundation of the Building, and structural soundness of the Building’s exterior walls and other Building support structures, columns, and trusses. |

COMMERCIAL LEASE

Page 4 of 37

| | (2) | Tenant’s Operating Expense estimates: Operating Expenses shall be calculated on a calendar year basis. On or about April 1st of each calendar year, Landlord will provide Tenant with a statement of: (1) Tenant’s annual share of estimated Operating Expenses for the then current calendar year; (2) Tenant’s new monthly Operating Expense estimate for the then current year; and, (3) Tenant’s retroactive estimate correction billing (for the period of January 1st through the date immediately prior to the commencement date of Tenant’s new monthly Operating Expense estimate) for the difference between Tenant’s new and previously billed monthly Operating Expense estimates for the then current year. |

Annual estimated share: Tenant’s annual share of estimated Operating Expenses for the then current calendar year shall be determined by multiplying Landlord’s estimated total Operating Expenses for the then current calendar year by Tenant’s Proportionate Share.

Monthly Operating Expense estimate: Tenant’s new monthly Operating Expense estimate for the then current calendar year shall be calculated by dividing Tenant’s annual share of estimated Operating Expenses, as determined above, by 12.

Retroactive estimate correction: Tenant’s share of the change in Operating Expense estimates retroactive to January 1st of each year shall be determined as follows: For the then current calendar year, the total of Tenant monthly Operating Expense estimates billed prior to the commencement of Tenant’s new monthly Operating Expense estimate shall be subtracted from Tenant’s new monthly Operating Expense estimate multiplied by the number of elapsed months within the same period.

Actual NNN lease expenses for the Premises for 2012 are $3.69 per square foot, and estimated 2013 NNN lease expenses for the Premises are estimated to be, on a per-square foot basis: CAM - $1.26; Insurance - $0.51; Taxes - $1.96; for a total of $3.73 per square foot.

Tenant’s share of actual annual Operating Expenses: On or about April 1st of each year, Landlord will provide Tenant with a statement, with all supporting documentation reasonably requested by Tenant, reflecting the total Operating Expenses for the calendar year just ended – including an itemized Operating Expenses report by category with calculation methodology for the 95% occupancy gross-up and Tenant’s Proportionate Share. If the total of Tenant’s Operating Expense estimates billed for the calendar year just ended are less than Tenant’s Proportionate Share of the actual Operating Expenses for the calendar year just ended, the statement will indicate the payment amount and date due, which in no event shall be less than 60 days following the date that Landlord delivers such statement. If Tenant has paid more than its Proportionate Share of Operating Expenses for the preceding calendar year, Landlord, at Tenant’s option, either shall promptly remit to Tenant or credit to Tenant the overpayment towards Tenant’s future Operating Expense obligations. If Landlord fails to provide Tenant with an Operating Expense statement by April 1st of any calendar year, or elects not to bill Tenant its share of actual Operating Expenses, and/or Operating Expenses estimate(s), or estimate increase(s) for any period of time, Landlord’s right to bill and collect these charges from Tenant at a later time is not waived, however Landlord shall provide such statements and invoices for such Operating Expenses no later than July 31st of any calendar year. If Landlord provides such statements after July 31st of any calendar year, Landlord shall still provide credit to Tenant for any overpayments of estimated expenses for the previous calendar year ended, however Landlord shall not be permitted to charge Tenant for any underpayment of Operating Expenses for the previous calendar year ended. Landlord reserves the right to separately compute and separately adjust credits and reimbursements for Real Property Taxes, Insurance, and other Operating Expenses.

COMMERCIAL LEASE

Page 5 of 37

Limitation. Tenant shall not be liable for any annual escalation in Operating Expenses over the prior year greater than five percent (5%) per annum (on a non-cumulative basis) during any calendar year throughout the Primary Lease Term. Such escalation cap shall be limited to Landlord’s controllable expenses (excluding taxes, insurance and utilities). Tenant and Landlord shall use the 2014 expenses as a Base Year to determine Tenant’s Operating Expenses Cap going forward.

(e) Rent. Under this Lease, monthly Operating Expense estimates, retroactive estimate corrections, and Tenant’s share of actual annual Operating Expenses are considered Additional Rent. Monthly Operating Expense estimates are due on the 1st of each month and shall commence in the month specified by Landlord. Tenant’s retroactive estimate correction and actual annual Operating Expense charges, if any, shall be due, in full, on the date(s) specified by Landlord provided Tenant is provided a minimum of thirty (30) days to pay from receipt of invoice or statement.

(f) Tax Protests. Tenant hereby assigns to Landlord any rights it may have in connection with the determination of the taxable value of the Building, including, without limitation, any rights Tenant may have to receive notice of any appraisal or reappraisal of the value of the Building or to protest the value of the Building pursuant to Section 41.413 of the Texas Property Tax Code. In the event Landlord protests successfully the determination of the taxable value of the Building before the applicable appraisal board, Landlord shall promptly remit or credit to Tenant Tenant’s Proportionate Share of any such protest award towards Tenant’s future Operating Expense obligations.

(g) Audit. In the event Tenant wishes to audit any Operating Expense charge, such an audit shall be limited to an audit of the current year shown in the annual statement. Any audit shall be conducted at a time and location mutually agreed by Landlord and Tenant, pursuant to a written request of Tenant made within ninety (90) days after receipt of the statement. Any such audit shall commence within thirty (30) days after Landlord makes Landlord’s books and records available and must be completed within ninety (90) days after commencement. Any audit shall be conducted only by Tenant or Tenant’s representatives – including an auditor of Tenant’s choice. Tenant shall maintain as strictly confidential and shall cause its auditor to execute in favor of Landlord a confidentiality agreement (in form prepared by Landlord and reasonably agreeable to such auditor) regarding all financial information audited, the results of any such audit, and the resolution of any disputed issues arising in connection with such audit. Should such audit reveal that Landlord has overestimated Operating Expenses by more than three percent (3%) of Landlord’s final annual statement, then Landlord shall pay for the cost of such audit and Landlord shall reimburse Tenant for any overpayment. If Landlord disputes the results of such audit, then Landlord and Tenant shall jointly appoint, within twenty (20) days of Tenant’s receipt of Landlord’s written disagreement, a reputable and qualified independent certified public accountant to conduct an independent audit (the “Independent Audit”). If the Independent Audit confirms Landlord’s original calculations, the costs of such audit shall be shared equally by the parties, and the results of which shall be binding upon the parties. In no event will this Lease be terminable nor shall Landlord be liable for damages based upon any disagreement regarding or adjustment of Operating Expenses.

(h) Intentionally omitted.

(i) Base Year Expense Report. Landlord shall provide Tenant an itemized 2014 Base Year Operating Expense report by category with calculation methodology for the 95% occupancy gross-up and Tenant’s Proportionate Share. This report shall provide the baseline for any future expense evaluation.

(j) Accounting. Landlord shall provide a consistent Operating Expense accounting method from year to year.

COMMERCIAL LEASE

Page 6 of 37

4. SECURITY DEPOSIT

Tenant shall pay Landlord the Security Deposit upon execution of this Lease by Tenant in an amount equivalent to the Base Rental of the last month of this Lease, $43,374.00, as defined in Paragraph 3. The Security Deposit shall be held by Landlord for the performance of Tenant’s obligations under this Lease. The Security Deposit is not an advance payment of Rent or a measure of Landlord’s damages in case of default by Tenant; it may be commingled with Landlord’s general funds, is not held in trust for Tenant, and does not bear interest. Upon the occurrence of any event of default (defined in Section 18) by Tenant under this Lease, Landlord may, from time to time, without prejudice to any other remedy, use the Security Deposit to the extent necessary to make good any arrears of Rent, or to repair any damage or injury, or pay any expense or liability incurred by Landlord as a result of the event of default, and any remaining balance of the Security Deposit shall be returned by Landlord to Tenant within a reasonable period of time following termination of this Lease, not to exceed ninety (90) days following such termination. If any portion of the Security Deposit is so used or applied, Tenant shall within ten (10) business days after demand, pay Landlord by cash or cashier’s check an amount sufficient to restore the Security Deposit to its original amount.

5. TENANT IMPROVEMENTS AND ACCEPTANCE OF THE PREMISES.

(a) Tenant Improvement Allowance: Tenant shall have a $14.00 per useable square foot Tenant Improvement Allowance which in the aggregate is $607,236 based on 43,374 useable square feet. Tenant shall have the availability of an additional $1.50 per useable square foot Contingency Tenant Improvement Allowance provided by Landlord for Tenant to draw against for Tenant’s use which shall be amortized at eight (8%) percent annualized interest rate over the term of the Lease and added to the monthly payment Tenant remits to Landlord. Together the Tenant Improvement Allowance and the Contingency Tenant Improvement Allowance shall be the “Tenant Improvement Allowances”.In addition to the above Tenant Improvement Allowances, Landlord shall be responsible for constructing the Demising Wall for the Premises. Such demising wall shall be in accordance with the Space Plan dated June 3, 2013, attached hereto asExhibit B. The Demising Wall shall be a minimum one-hour rated fire wall from floor to ceiling deck. All construction shall be in accordance with all local and state codes and ordinances.

(b) In addition to typical hard and soft construction costs, the Tenant Improvement Allowances shall be used interchangeably at Tenant’s discretion for construction/refurbishment of the Premises and Tenant’s occupancy needs and transaction costs therein including:

i. Purchase and installation of telephony/computer equipment, and related cabling;

ii. Move related expenses;

iii. Security systems, communication equipment, permit fees, power upgrades, or any other necessary improvements or equipment needed for Tenant’s functional occupancy;

iv. Consulting fees for technology, lighting, acoustical, etc.;

v. Legal Fees; and

vi. Furniture, Fixtures, and Equipment.

(c) Tenant shall use its own project/construction management firm and Landlord shall not charge any supervisory or management fee associated with the construction of the Tenant Improvements, however, Landlord reserves the right to approve and monitor all contractors and/or agents associated with the planning and construction of Tenant Improvements, including, but not limited to insurance compliance, at its own expense.

(d) Tenant has engaged Howard Templin of Collier International as its own project/construction manager (“Project Manager”) and can use up to five (5%) percent of the Tenant Improvement Allowances to fund Tenant’s project management services.

COMMERCIAL LEASE

Page 7 of 37

(e) Tenant’s Project Manager will competitively bid all Tenant Improvement work with mutually acceptable general contractors, and will select a qualified general contractor at Tenant’s reasonable discretion.

(f) Any unused portion of the Tenant Improvement Allowances may be used by Tenant for further improvements and/or repairs to the Premises and/or repair and/or replacement of mechanical systems servicing the Premises during the first seven (7) years of the Term.

(g) There shall be no charge to Tenant for electricity, utilities, HVAC, or other charges during Tenant’s construction and move in period prior to the Commencement Date of the Lease.

(h) Tenant shall deliver to Landlord a CAD drawing of the finished space plan as completed at the time of the issuance of the Certificate of Occupancy. In the event of any structural alternations, additions or improvements completed during any Lease Term, Tenant is to provide Landlord with an updated CAD drawing.

(i) Tenant is to provide Landlord a copy of the Certificate of Occupancy upon delivery.

6. DELIVERY OF PREMISES.

(a) Landlord Delivery of the Building. Landlord shall be responsible for delivering the Building in good workmanlike condition, including but not limited to; foundation, roof, structural walls and supports, mechanical systems, HVAC systems, plumbing and sewer systems, electrical systems, life safety systems, restrooms, exterior windows and doors, parking structures/lots, driveways, common areas, and other areas outside the Building.

(b) Landlord Delivery of the Premises (Base Building Conditions). Landlord shall be responsible for delivering the existing Premises in good workmanlike condition, including but not limited to; floor, ceiling grid-tiles, light fixtures, structural walls and supports, mechanical systems, HVAC systems, plumbing and sewer systems, electrical systems, life safety systems, restrooms, fixtures, exterior windows and doors.Tenant’s TI Allowance shall not be used to repair Landlord’s Base Building Conditions. All systems within the Premises shall be delivered in working condition; however, Tenant accepts the Premises in “as is” condition relative to location, distribution and code compliance of all systems in place prior to construction.

(c) Demising of the Premises. Per the Tenant Improvement Section (Paragraph 5(a)), Landlord shall be responsible for constructing the Demising Wall for the Premises. Such demising wall shall be in accordance with the attached Space Plan dated June 3, 2013. The Demising Wall shall be a minimum one-hour rated fire wall from floor to ceiling deck. All construction shall be in accordance with all local and state codes and ordinances.

(d) Intentionally omitted.

COMMERCIAL LEASE

Page 8 of 37

(e) Base Building Plans / As-Built Drawings. Landlord shall be responsible for providing CAD drawings of the current As-Built condition of the Premises and the current Base Building condition at Landlord’s sole cost and expense.

(f) Americans with Disabilities Act (ADA) / Texas Accessibility Standards (TAS) / Code Compliance. Landlord shall be responsible for ADA and TAS Compliance for the Building and Property. Compliance for the Premises shall be a component of the improvements to the Premises and shall be the responsibility of the contracting party for the construction process. All costs associated with ADA and TAS compliance for Tenant Improvement projects shall be included in the Tenant Improvement Allowance.

(g) Hazardous Materials. Landlord shall warrant, to the knowledge of Landlord and except to the extent Tenant or any Tenant Parties as defined in the Lease cause any violation, that the Building and Premises are free of asbestos and other hazardous and/or toxic materials and shall indemnify Tenant against any violation of such warranty.

7. USE OF THE PREMISES

(a) Specific Use. The Premises shall be occupied and used exclusively for general office, administrative, storage, shipping, electronics assembly and light manufacturing, and other lawful purposes consistent with similar types of tenant users in flex buildings, and shall not be used for any other purpose (the “Permitted Use”).

(b) Covenants Regarding Use. In connection with its use of the Premises, Tenant agrees to do the following:

(i) Tenant shall use the Premises and conduct its business thereon in a safe, careful, reputable and lawful manner; shall keep and maintain the Premises in as good a condition as they were when Tenant first took possession thereof (normal wear and tear excepted) and shall make all necessary repairs to the Premises other than those which Landlord is obligated to make as provided elsewhere herein.

(ii) Tenant shall not commit, nor allow to be committed, in, on or about the Premises, Project or the Building and appurtenant areas, any act of waste, including any act which might deface, damage or destroy the Premises, Project or the Building or appurtenant areas, or any part thereof; use or permit to be used on the Premises any hazardous substance, equipment or other thing which might cause injury to person or property or increase the danger of fire or other casualty in, on or about the Premises; permit any objectionable or offensive noises or odors to be emitted from the Premises; or do anything, or permit anything to be done, which would, in Landlord’s opinion, disturb or tend to disturb other tenants occupying leased space in the Building or Project. For the avoidance of doubt, both parties agree that Tenant’s current manufacturing assembly operations do not constitute objectionable or offensive noises or odors.

COMMERCIAL LEASE

Page 9 of 37

(iii) Tenant shall not overload the floors of the Premises beyond their designed weight-bearing capacity. Landlord reserves the right to direct the positioning of all heavy equipment, furniture and fixtures which Tenant desires to place in the Premises so as to distribute properly the weight thereof, and to require the removal of any equipment or furniture which exceeds the weight limit specified herein.

(iv) Tenant shall not use the Premises, nor allow the Premises to be used, for any purpose or in any manner which would, in Landlord’s opinion, invalidate any policy of insurance now or hereafter carried on the Building or Project or increase the rate of premiums payable on any such insurance policy. Should Tenant fail to comply with this covenant, Landlord may, at its option, require Tenant to stop engaging in such activity or to reimburse Landlord as Additional Rent for any increase in premiums charged during the Term of this Lease on the insurance carried by Landlord on the Premises and attributable to the use being made of the Premises by Tenant. For the avoidance of doubt, Landlord agrees that Tenant’s intended use of the Premises for manufacturing assembly is in compliance with this covenant and does not invalidate any of Landlord’s insurance policies or increase the rate of premiums payable thereon.

(v) Tenant shall not in any manner use, maintain or allow the use or maintenance of the Premises in violation of any law, ordinance, statute, regulation, rule or order (collectively “Laws”) of any governmental authority, including, but not limited to, Laws governing zoning, health, safety (including fire safety), occupational hazards, and pollution and environmental control. Tenant shall not use, maintain or allow the use or maintenance of the Premises or any part thereof to treat, store, dispose of, transfer, release, convey or recover hazardous, toxic or infectious waste nor shall Tenant otherwise, in any manner, possess or allow the possession of any hazardous, toxic or infectious waste on or about the Premises. Hazardous Materials shall be deemed not to include materials customarily used by office building tenants in typical office quantities and manufacturing assembly tenants in typical manufacturing assembly quantities that do not violate legal requirements regarding health, safety or the environment. As used herein, “Hazardous Materials” shall mean any substances, materials or wastes subject to regulation by law from time to time in effect concerning hazardous, toxic or radioactive materials, including without limitation any solid, liquid or gaseous waste, substance or emission or any combination thereof which may (i) cause or significantly contribute to an increase in mortality or in serious illness, or (ii) pose the risk of a substantial present or potential hazard to human health, to the environment or otherwise to animal or plant life, and shall include, without limitation, hazardous substances and materials described in the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended; the Resource Conservation and Recovery Act, as amended; and any other applicable federal, state or local Laws. Tenant shall immediately notify Landlord of the presence or suspected presence of any Hazardous Materials on or about the Premises and shall deliver to Landlord any notice received by Tenant relating thereto.

Landlord and its agents shall have the right, but not the duty, to inspect the Premises and conduct tests thereon at any time to determine whether or the extent to which there is Hazardous Materials on the Premises. Landlord shall have the right to immediately enter upon the Premises to remedy any contamination found thereon. In exercising its rights herein, Landlord shall use reasonable efforts to minimize interference with Tenant’s business but such entry shall not constitute an eviction of Tenant, in whole or in part, and Landlord shall not be liable for any interference, loss or damage to Tenant’s property or business caused thereby. If any lender or governmental agency shall ever require testing to ascertain whether there has been a release of Hazardous Materials, then the reasonable costs thereof shall be reimbursed by Tenant to Landlord upon demand as Additional Rent if such requirement arose in whole or in part because of Tenant’s use of the Premises. Tenant shall execute affidavits, representations and the like from time to time, at Landlord’s request, concerning Tenant’s knowledge and belief regarding the presence of any Hazardous Materials on the Premises or Tenant’s intent to store or use toxic materials on the Premises. The covenants and obligations of Tenant hereunder shall survive the expiration or earlier termination of this Lease.

COMMERCIAL LEASE

Page 10 of 37

Landlord shall be responsible, at its cost, and not as an Operating Cost, to maintain the Building and common areas free from Hazardous Materials, and shall not otherwise, in any manner, possess or allow the possession of any Hazardous Materials on or about the Building, and shall keep the Building free of all Hazardous Materials (as defined below) and indemnifies Tenant from all loss, liability, damage and expense arising from the presence of Hazardous Materials, except to the extent placed in the Building by Tenant or Tenant’s representatives, agents, employees or contractors.

(c) Compliance with Laws. Tenant shall not use or permit the use of any part of the Premises for any purpose prohibited by law. Tenant shall, at Tenant’s sole cost and expense, comply with all laws, statutes, ordinances, rules, regulations and orders of any federal, state, municipal or other governmental agency thereof having jurisdiction over and relating to the use, condition and occupancy of the Premises, except that Tenant shall not be responsible for or required to make structural repairs to the Building or the Premises unless, in the case of the latter, they are occasioned by its own use of the Premises or negligence. Landlord shall be responsible for compliance with Title III of the Americans with Disabilities Act of 1990, 42 U.S.C. 12181 et seq. and its regulations with respect to all aspects of exterior and common areas (e.g. sidewalks, lobby, elevators and parking areas) of the Building. Landlord represents that the Building and Landlord’s operation of the Building is in compliance with all applicable governmental statutes, laws, rules, regulations, codes and ordinances (collectively, “Laws”), and that Landlord shall be responsible for continued compliance with all laws during the Term, except to the extent that Tenant’s use of the Premises causes the Premises not to be in compliance with any Laws.

(d) Compliance with Zoning. Tenant knows the character of its operation in the Premises and that applicable zoning ordinances and regulations are of public record. Tenant shall have sole responsibility for its compliance therewith, and Tenant’s inability to so comply shall not be cause for Tenant to terminate this Lease.

(e) Definition of Tenant. For purposes of the Lease, including, but not limited to thisParagraph 7 of the Lease, in each instance where Tenant is required to comply with (i) any rules, ordinances, laws or regulations of the municipality, state or federal government and/or (ii) any term, condition or covenant of the Lease and the Rules and Regulations, the defined term “Tenant” shall be deemed to include Tenant’s officers, directors, employees, agents and invitees.

COMMERCIAL LEASE

Page 11 of 37

8. UTILITIES AND OTHER BUILDING SERVICES

(a) Building Operation and Landlord Services. Landlord shall be responsible for the good workmanlike repair, maintenance, and replacement costs of the Building and systems connecting to the Premises, including but not limited to; any construction defects, foundation, roof, structural walls and supports, mechanical systems (excluding rooftop HVAC units), plumbing and sewer systems, electrical systems, life safety systems, exterior windows and doors, parking structures/lots, driveways, common areas, and other areas outside the Building.

(b) Utilities. (1) Landlord shall be responsible for providing Essential Building Services such as: electricity, gas, water, etc. without interruption. If the essential Building Services are interrupted, Tenant shall give Landlord notice and Landlord shall have twenty-four (24) hours from the time of such notice to restore such essential Building Service(s). If Landlord does not restore such Service(s) within 24 hours, then Tenant shall abate a daily amount of Base Rent from the date of notice until such time as the Service(s) is restored to the reasonable satisfaction of Tenant. If it is beyond the Landlord’s reasonable control to restore such Service(s) within 24 hours, then Landlord shall immediately commence the cure and will have up to five (5) business days to restore such Service(s). If after 5 business days the Service(s) are not restored, then Tenant shall abate a daily amount of Base Rent retroactive to the date of notice and everyday thereafter until such time as the Service(s) is restored to the reasonable satisfaction of Tenant. For Non-Essential Building Services repairs, Tenant shall give Landlord notice and Landlord shall commence the repair unto completion within ten (10) days from the date of notice. If it is not within the Landlord’s reasonable control to make such repair within the ten (10) days period, then Landlord shall immediately commence such repair with all commercially reasonable efforts and shall diligently pursue unto completion. If such repair extends longer than thirty (30) days, then Tenant shall receive a daily abatement of Base Rent beginning the thirty first (31st) day following Landlord’s receipt of notice until such repair is completed to the reasonable satisfaction of Tenant.

(2) Tenant shall be responsible for payment of all utilities to the Premises. Without limiting the foregoing, Tenant shall heat the Premises as necessary to prevent any freeze damage to the Premises or any portion thereof. Tenant shall directly pay for all utilities used on the Premises which are separately metered, and reimburse Landlord for sub-metered utilities (if any) together with any maintenance charges for utilities prior to delinquency, for all water, gas, heat, electricity telephone, sewage, air conditioning, and ventilating, janitorial and other materials and services which may be furnished to or used in or about the Premises during the Term of this Lease. The cost of any utilities which are not separately metered or sub-metered to the Premises shall be an Operating Expense and charged to Tenant in accordance with Paragraph 3. Tenant’s use of electric current shall at no time exceed the capacity of the feeders or lines to the Building or the risers or wiring installation of the Building or the Premises. Landlord shall be responsible for interruptions in utility services as described in Paragraph 8(b)(1) only, and Tenant shall not be entitled to any abatement or reduction of Rent by reason of, any interruption failure of utilities or other services to the Premises outside the control of Landlord and shall not be construed as an eviction (constructive or actual) of Tenant or as a breach of the implied warranty of suitability, or relieve Tenant from the obligation to perform any covenant or agreement herein, and in no event shall Landlord be liable for damage to persons or property (including, without limitation, business interruption), or in default hereunder, as a result of any such interruption or failure outside the control of Landlord.

COMMERCIAL LEASE

Page 12 of 37

(3) It is expressly acknowledged that the responsibilities of Landlord with respect to maintenance and repair of all utilities in the Building are not applicable to damages or interruptions of service caused by Tenant, including but not limited to the overloading of electrical panels resulting from Tenant’s use of heavy equipment or other high-capacity electrical equipment. Such damages are exclusively the responsibility of Tenant with respect to repairs and interruption of service, and such damages shall not constitute an interruption of service on the part of Landlord as described in this Paragraph 8. In such event, Tenant shall be responsible for all costs related to repairs and shall not be eligible for a proration or reduction in rent as a result of same.

(c) Services. Except as expressly set forth in this Lease, Landlord is not required to make any improvements, replacements or repairs of any kind or character to the Premises during the Term. Landlord, at its sole cost and expense, shall maintain in a good state of repair the structural components of the roof, foundation and exterior walls (excluding glass windows and doors, however, Landlord shall be responsible for damage due to latent defects) and all structural portions of the Premises. Landlord shall, as an Additional Expense, maintain and repair non-structural portions of the Project and all Building Systems (excluding the Premises and Tenant’s Work). Landlord shall also perform maintenance and repairs on the Common Areas to keep the Common Areas clean and in a good state of repair. Landlord shall have a reasonable time within which to perform such repairs or maintenance as stated in Paragraph 8(b)(1) except in the case of emergencies that prevent Tenant from using the Premises which shall accelerate Landlord’s response time. All requests for repairs or maintenance that are the responsibility of Landlord pursuant to any provision of this Lease must be made in writing to Landlord pursuant to Paragraph 23(c). However, Notices sent via the normal property management operating procedures established by the Landlord for the reporting of service and maintenance issues at the Building shall be considered proper notice for purposes of Paragraph 8(b)(1). After its receipt of written notice from Tenant, Landlord shall perform the required maintenance or repairs within a reasonable time thereafter as stated in Paragraph 8(b)(1). Landlord will maintain all parking and service areas in a good state of repair as required by normal wear and tear.

(d) Tenant shall maintain at its sole cost and expense, in a clean and sanitary condition (including necessary janitorial services) and in a good state of repair the interior of the Premises, including Tenant’s Work, interior doors, floors, ceilings, interior walls and the interior surface of exterior walls, all fixtures, equipment owned by Landlord and its agents. Except for repairs caused by the negligent acts or omissions of Landlord and its agents, Tenant shall be responsible for all maintenance, repair and replacement of heating and air conditioning system and plumbing pertaining to the Premises.

COMMERCIAL LEASE

Page 13 of 37

(e) Telecommunications. (1) Tenant shall have the right to install telecommunications equipment and related appurtenances and cabling for communication purposes on the roof and through Building conduit at no expense and no rental costs. Tenant shall have access throughout the Term and any Renewal Term(s) to repair and replace such equipment as necessary. Such equipment shall be the property of Tenant, and installation and removal of such equipment shall be at Tenant’s expense and shall be coordinated with Landlord and/or Landlord’s engineer. If Tenant is receiving income from such equipment or appurtenances, such income shall be split in equal parts with Landlord.

(2) Tenant shall have the right to select its own telecom provider and/or fiber optic providers at Tenant’s cost during the Term and any Renewal Term(s). There shall be no fee or rental charge from Landlord to Tenant or to Tenant’s selected telecom and/or fiber optic provider for entry into the Building.

(3) Tenant shall have the right at Tenant’s sole cost and expense to install cable television, or to install satellite television on the roof of the Building and bring the line into the Building and Premises at no fee or rental charge by Landlord throughout the Term and any Renewal Term(s). Should Tenant choose to install cable or satellite television, a certificate of insurance from Tenant’s vendor shall be provided to Landlord prior to the commencement of installation. Tenant expressly agrees that any such installation shall not penetrate the roof of the Building, and that if penetration is required Landlord must expressly give its approval.

(f) HVAC. (1) Landlord shall be responsible for delivering all HVAC units servicing the Premises in good workmanlike condition. All HVAC units shall be assessed for replacement by a certified HVAC company reasonably acceptable to both Landlord and Tenant. Based on the recommendations of such report, Landlord shall replace any HVAC unit in need of replacement prior to Tenant occupancy. Tenant shall also be a beneficiary of any HVAC warranties.

(2) Tenant shall maintain a semiannual HVAC maintenance contract during the lease term and provide a copy of the agreement to the Landlord within three (3) months of the Commencement Date. Tenant expressly agrees that any failure of the HVAC system during the Term is the sole responsibility of Tenant for repair and, if necessary, replacement.

(3) Tenant shall have the right to locate a back-up generator and supplemental air condensers or HVAC units on the Building property (roof) and gain access into the Building with no fee or rental costs, subject to Landlord’s reasonable approval of location. Tenant expressly agrees that any such installation shall not penetrate the roof of the Building, and that if penetration is required Landlord must expressly give its approval.

(g) Landlord’s Right if Tenant Fails to Perform: Tenant’s Rights if Landlord Fails to Perform. (1) In the event Tenant fails to maintain the Premises pursuant to the above provisions, and such failure continues for a period of thirty (30) days after Landlord’s written notice of such failure is received by Tenant (or such longer period as is reasonably necessary under the circumstances if such maintenance cannot reasonably be performed within thirty (30) days), then Landlord shall have the right to do such acts and expend such funds at the expense of Tenant as are reasonably required to perform such work. Any amount so expended by Landlord shall be paid by Tenant promptly after demand. Landlord shall have no liability to Tenant for any damage, inconvenience or interference with the use of the Premises by Tenant as a result of performing any such work, unless caused by landlord’s gross negligence or misconduct.

COMMERCIAL LEASE

Page 14 of 37

(2) In the event Landlord fails to perform any of Landlord’s maintenance and repair obligations under this Lease, and such failure continues for a period longer than the response times outlined in Paragraph 8(b)(1) after Tenant’s written notice of such failure is received by Landlord (or such longer period as is reasonably necessary under the circumstances if such maintenance cannot reasonably be performed in accordance with the timeframes outlined in Paragraph 8(b)(1), the Tenant shall have the right to perform such maintenance and repair. Landlord shall pay exact amount so expended by Tenant promptly after demand provided Tenant provides supported documentation, and if Landlord fails to repay such amounts after 60 days, then Tenant may deduct such amounts from the next sums owing to Landlord.

(3) If maintenance or repair to be performed by Landlord under this Lease is required as a result of an emergency which materially interferes with Tenant’s use of the Premises and Tenant is unable, despite good faith effort, to contact Landlord or Landlord’s Property Manager, then Tenant may proceed with such repair on an emergency basis, and Landlord will reimburse Tenant the reasonable cost of Tenant’s emergency repair.

(h) Condition at End of Term. Upon the termination of this Lease or upon the expiration of the term of this Lease, Tenant shall surrender the Premises in good repair and condition, alterations approved by Landlord, normal wear and tear, damage by earthquake or act of God or the elements alone excepted. Tenant’s duties hereunder shall include the duty to clean the Premises and to deliver the current keys to Landlord. Failure to do so shall constitute a failure to perform under this Paragraph 8.

(i) Parking. Tenant requires, and Landlord acknowledges, a minimum of 3:1000useable square foot parking ratio. Tenant, at Tenant’s sole cost, may construct carports as approved in writing by Landlord and in a location approved by Landlord. Any carports or other parking structures shall also be in compliance with all city ordinances and codes, deed restrictions and any by-laws of any owners’ associations if appropriate. Any carports installed by Tenant shall immediately become the property of Landlord.

(i) Access. Subject to any Building rules and regulations, necessary repairs and maintenance, and any events beyond Landlord’s reasonable control which would prevent access, Tenant shall have access to the Premises twenty-four (24) hours a day, seven (7) days a week.

9. SIGNS

Tenant shall not inscribe, paint, affix or display any signs, advertisements or notices on or in the Premises, or Building visible from outside the Premises, except for such tenant identification information, as reasonably approved by Landlord, on the tenant access doors to the Premises. The foregoing notwithstanding, Tenant shall be entitled, to place signage on the Building, subject to Landlord’s reasonable approval of design, color, materials, and size. Building sign locations shall faceInternational Parkway/Midway Road/Hebron Parkway, and placement of graphics on Monument signs will be subject to the mutual agreement of Landlord and Tenant. Notwithstanding the preceding to the contrary, Tenant shall have the right to exterior Building signage mounted on the Building parapet facing Park Blvd/Hebron Parkway at Tenant’s sole expense, the exact location to be determined by Landlord. Tenant must select Building and Monument signage style and location within one hundred twenty (120) days of occupancy. All costs of the design, construction, permitting and installation of the Building and Monument sign shall be paid by Tenant. Landlord shall cooperate with Tenant and assist Tenant in obtaining all permits, licenses and other approvals required from all Governmental Authorities in connection with the installation of the Building and Monument sign. The Building and Monument Sign shall be removed by Tenant at the expiration or earlier termination of the Lease, and Tenant shall repair all damage caused by such removal at Tenant’s sole cost and expense.

COMMERCIAL LEASE

Page 15 of 37

10. | REPAIRS, MAINTENANCE, ALTERATIONS, IMPROVEMENTS AND FIXTURES |

(a) Tenant shall, at its own expense, keep and maintain the Premises, but not Building Systems serving the Premises and subject to Section 9 hereof, in good order, condition and repair at all times during the Term, and Tenant shall promptly repair all damage to the Premises and replace or repair all damaged or broken fixtures, equipment and appurtenances with materials equal in quality and class to the original materials, under the supervision and subject to the approval of Landlord, which approval shall not be unreasonably withheld, conditioned or delayed, and within any reasonable period of time specified by Landlord. If Tenant fails to do so, Landlord may, but need not, make such repairs and replacements, and Tenant shall pay Landlord the actual, verified and receipted cost to Landlord thereof, forthwith upon being billed for same.

(b) Alterations or Improvements. Except for alterations, additions or improvements that (i) cost less than $25,000.00 in the aggregate, (ii) are non-structural in nature, (iii) do not require a building permit and (iv) do not adversely affect the Building Systems, Tenant shall not make, nor permit to be made, alterations or improvements to the Premises, unless Tenant obtains the prior written consent of Landlord thereto which approval shall not be unreasonably withheld, conditioned or delayed. If Landlord permits Tenant to make any such alterations or improvements, Tenant shall make the same in accordance with all applicable laws and building codes, in a good and workmanlike manner and in quality equal to or better than the original construction of the Building and shall comply with such requirements as Landlord considers reasonably necessary or desirable, including without limitation the provision by Tenant to Landlord with security for the payment of all costs to be incurred in connection with such work, requirements as to the manner in which and the times at which such work shall be done and the contractor or subcontractors to be selected to perform such work and the posting and re-posting of notices of Landlord’s non-responsibility for mechanics’ liens. Tenant shall promptly pay all costs attributable to such alterations and improvements and shall release or cause to be bonded off any mechanics’ liens or other liens or claims filed or asserted as a result thereof and against any costs or expenses which may be incurred as a result of building code violations attributable to such work. Tenant shall promptly repair any damage to the Premises or the Building caused by any such alterations or improvements. Any alterations or improvements to the Premises, except movable office furniture and equipment and trade fixtures (including any of Tenant’s manufacturing equipment), shall, at Landlord’s election, either (i) become a part of the realty and the property of Landlord and shall not be removed by Tenant, or, (ii) upon thirty (30) days prior written notice to Tenant, be removed by Tenant upon the expiration or sooner termination hereof and any damage caused thereby repaired at Tenant’s cost and expense. In the event Tenant so fails to remove same, Landlord may have same removed and the Premises so repaired at Tenant’s expense.

COMMERCIAL LEASE

Page 16 of 37

(c) Trade Fixtures. Any trade fixtures installed on the Premises by Tenant at its own expense, such as movable partitions, counters, shelving, showcases, mirrors and the like, may, and at the request of Landlord shall, be removed on the Expiration Date or earlier termination of this Lease, provided that Tenant is not then in default, that Tenant bears the cost of such removal, and further that Tenant repair at its own expense any and all damage to the Premises resulting from the original installation of and subsequent removal of such trade fixtures. If Tenant fails to remove any and all such trade fixtures from the Premises on the Expiration Date or earlier termination of this Lease, all such trade fixtures shall become the property of Landlord unless Landlord elects to require their removal, in which case Tenant shall promptly remove same and restore the Premises to their prior condition. In the event Tenant so fails to remove same, Landlord may have same removed and the Premises so repaired to their prior condition at Tenant’s expense.

(d) Reserved Rights. Landlord reserves the right to decorate and to make, at any time or times, repairs, alterations, additions and improvements, structural or otherwise, in or to the Project or Building or part thereof, and to perform any acts related to the safety, protection or preservation thereof, and during such operations to take into and through the Project or Building all material and equipment required and to close or temporarily suspend operation of entrances, doors, corridors, elevators or other facilities, provided that Landlord shall cause as little inconvenience or annoyance to Tenant as is reasonably necessary in the circumstances, and shall not do any act which permanently reduces the size of the Premises. Landlord may do any such work during ordinary business hours and Tenant shall pay Landlord for overtime and for any other expenses incurred if such work is done during other hours at Tenant’s request.

11. FIRE OR OTHER CASUALTY; CASUALTY INSURANCE

(a) Repair Estimate. If the Premises or the Building are damaged by fire or other casualty (a “Casualty”), Landlord shall, within thirty (30) days after such Casualty, deliver to Tenant a good faith estimate (the “Damage Notice”) of the time needed to repair or replace the damage caused by such Casualty.

(b) Casualty - Tenant’s Rights. If a material portion of the Premises or the Building is damaged by Casualty such that Tenant is prevented from conducting its business in the Premises in a manner reasonably comparable to that conducted immediately before such Casualty and Landlord estimates that the damage caused thereby cannot be repaired within one hundred twenty (120) days after the date of casualty, then Tenant may terminate this Lease. Rent for the portion of the Premises rendered untenantable by the damage shall be abated on a proportionate basis from the date of damage until termination. Tenant may terminate this Lease by delivering written notice to Landlord of its election to terminate within thirty (30) days after the Damage Notice has been delivered to Tenant. If Tenant does not elect to terminate this Lease, then (subject to Landlord’s rights under Paragraph 11(c)), Landlord shall repair the Building or the Premises, as the case may be, as provided below. Upon the occurrence of a Casualty, Rent for the portion of the Premises rendered untenantable by the damage shall be abated on a proportionate basis from the date of damage until the completion of the repair or until such termination.

COMMERCIAL LEASE

Page 17 of 37

(c) Landlord’s Rights. If a Casualty damages a material portion of the Building, and Landlord makes a good faith determination that restoring the Premises would be uneconomical, or if Landlord is required to pay any insurance proceeds arising out of the Casualty to Landlord’s Mortgagee, then Landlord may terminate this Lease by giving written notice of its election to terminate within thirty (30) days after the Damage Notice has been delivered to Tenant, and Rent hereunder shall be abated as of the date of the Casualty.

(d) Repair Obligation. If neither party elects to terminate this Lease following a Casualty, then Landlord shall, within ninety (90) days after such Casualty, commence to repair the Building and the Premises and shall proceed with reasonable diligence to restore the Building and Premises to substantially the same condition as they existed immediately before such Casualty; however, Landlord shall not be required to repair or replace any part of the furniture, equipment, fixtures, and other improvements which may have been placed by, or at the request of, Tenant or other occupants in the Building or the Premises, and Landlord’s obligation to repair or restore the Building or Premises shall be limited to the extent of Landlord’s deductible amount, plus the insurance proceeds actually received by Landlord for the Casualty in question.

(e) Casualty Insurance. Landlord shall be responsible for insuring and shall, at all times during the Term, carry as an Operating Expense of the Building a policy of insurance which insures the Building, including the Premises, against loss or damage by fire or other casualty (“all risk” insurance provided, however, that Landlord shall not be responsible for, and shall not be obligated to insure against, any loss or damage to personal property (including, but not limited to, any furniture, machinery, equipment, goods or supplies) of Tenant or which Tenant may have on the Premises or any trade fixtures installed by or paid for by Tenant on the Premises or any additional improvements which Tenant may construct on the Premises. Tenant shall, at all times during the Term, carry at its own expense “all risk” property insurance covering the full value of plate glass, its personal property, leasehold improvements and trade fixtures installed by or paid for by Tenant, or any additional improvements which Tenant may construct on the Premises. All such insurance requirements must be reasonably satisfactory to Landlord. Tenant shall furnish Landlord with certificates of insurance evidencing that such coverages are in full force and effect.

(f) Waiver of Subrogation. Landlord and Tenant hereby release each other and each other’s employees, agents, customers and invitees from any and all liability for any loss, damage or injury to property occurring in, on or about or to the Premises, improvements to the Building or personal property within the Building, by reason of fire or other casualty which are covered by “all risks” property insurance policies. Because the provisions of this paragraph will preclude the assignment of any claim mentioned herein by way of subrogation or otherwise to an insurance company or any other person, each party to this Lease shall give to each insurance company which has issued to it one or more policies of fire and extended coverage insurance notice of the terms of the mutual releases contained in this paragraph, and have such insurance policies properly endorsed, if necessary, to prevent the invalidation of insurance coverages by reason of the mutual releases contained in this paragraph.

COMMERCIAL LEASE

Page 18 of 37

12. INDEMNIFICATION AND INSURANCE

(a) Indemnity. Subject to Section 11(e), each party shall indemnify and hold harmless the other from and against any and all claims, demands, liabilities, causes of action, suits, judgments and expenses (including attorneys’ fees) arising from or for injury to third persons or damage to property owned by third persons and caused by the negligence or intentional torts of the indemnifying party.

(b) Tenant shall, at all times during the Term, carry at its own expense for the protection of Tenant, Landlord and Landlord’s management agent, as their interests may appear, one or more policies of commercial general liability insurance including bodily injury (including death), property damage, personal injury, tenants legal liability, including cross liability and severability of interest, blanket contractual, and contractors protective insurance, issued by one or more insurance companies with a rating by AM Best of A VIII or better and acceptable to Landlord, covering Tenant’s use, occupancy and operations of the Premises providing minimum coverages of $1,000,000 combined single limit for bodily injury and property damage per occurrence with $3,000,000 aggregate coverage. Such insurance policy or policies shall name Landlord, its mortgagee, agents and employees, as additional insureds and such insurance coverage amounts shall not be canceled or materially changed on less than thirty (30) days prior written notice to Landlord. Tenant shall furnish Landlord with certificates evidencing such insurance. Tenant shall also provide Landlord with certificates evidencing workers’ compensation insurance coverages as required by law. Should Tenant fail to carry such insurance and furnish Landlord with copies of all such policies or certificates thereof after a request to do so, Landlord shall have the right to obtain such insurance upon thirty (30) days prior written notice to Tenant and collect the cost thereof from Tenant as Additional Rent. Within thirty (30) days of such written notice, Tenant shall provide Landlord with evidence of such adjustment. Tenant’s insurance coverages required hereby shall be deemed to be additional obligations of Tenant and shall not be a discharge or limitation of Tenant’s indemnity obligations contained inParagraph 12(a) hereof.

(c) Landlord shall, at all times during the Term, carry at its own expense for the protection of Landlord, Tenant and Tenant’s affiliates, as their interests may appear, and their respective directors, officers, employees, agents and invitees one or more policies of commercial general liability insurance including bodily injury (including death) property damage, personal injury, tenants legal liability, including cross liability and severability of interest, blanket contractual, and contractors protective insurance, issued by one or more insurance companies with a rating by AM Best of A VIII or better and acceptable to Tenant, covering Landlord’s ownership and operations providing of the Building providing coverages of $1,000,000 combined single limit for bodily injury and property damage per occurrence with $3,000,000 aggregate coverage. Such insurance policy or policies shall name Tenant, its affiliates, and their respective directors, officers, employees, agents and invitees, as additional insureds and shall provide that they may not be canceled or materially changed on less than thirty (30) days prior written notice to Tenant. Landlord shall furnish Tenant with certificates evidencing such insurance. Landlord’s insurance coverages required hereby shall be deemed to be additional obligations of Landlord and shall not be a discharge or limitation of Landlord’s indemnity obligations contained inParagraph 12(a) hereof.

COMMERCIAL LEASE

Page 19 of 37

13. TAKING

(a) Tenant’s Rights.If any part of the Project (including parking) is taken by right of eminent domain for a period exceeding ninety (90) days or conveyed in lieu thereof (a “Taking”),and such Taking prevents Tenant from conducting its business from the Premises in a manner reasonably comparable to that conducted immediately before such Taking, then Tenant may terminate this Lease by giving written notice to Landlord within thirty (30) days after such Taking. Upon the occurrence of a Taking, Rent shall be abated on a proportionate basis as to that portion of the Premises rendered untenantable by the Taking from the first day of the Taking until such termination. If Tenant does not terminate this Lease, then Rent shall be abated on a proportionate basis as to that portion of the Premises rendered untenantable by the Taking. If a portion of the Premises or Building are subject to a Taking and such Taking does not prevent Tenant from conducting its business in a manner reasonably comparable to that conducted immediately before such Taking, the Lease shall remain in full force and effect and Rent shall be adjusted on a proportionate basis from the first day of the Taking.

(b) Taking - Landlord’s Rights.If any material portion, but less than all, of the Project or related parking becomes subject to a Taking, or if Landlord is required to pay any of the proceeds received for a Taking to Landlord’s Mortgagee, then this Lease, at the option of Landlord or Tenant, exercised by written notice to the other party within thirty (30) days after such Taking, shall terminate and Rent shall be adjusted on a proportionate basis from the first day of the Taking until such termination. If a partial Taking occurs and the Lease does not terminate, Rent shall be adjusted on a proportionate basis from the first day of the taking.

(c) Award.If any Taking occurs, all proceeds shall belong to and be paid to Landlord, and Tenant shall not be entitled to any portion thereof except that Tenant shall have all rights permitted under the laws of the State of Texas to appear, claim and prove in proceedings relative to such taking (i) the value of any fixtures, furnishings, and other personal property which are taken but which under the terms of this Lease Tenant is permitted to remove at the end of the Term, (ii) the unamortized cost (such costs having been amortized on a straight-line basis over the Term excluding any renewal terms) of Tenant’s leasehold improvements which are taken that Tenant is not permitted to remove at the end of the Term and which were installed solely at Tenant’s expense (i.e., not made or paid for by Landlord from the Construction Allowance or otherwise), and (iii) relocation and moving expenses, but not the value of Tenant’s leasehold estate created by this Lease and only so long as such claims in no way diminish the award Landlord is entitled to from the condemning authority as provided hereunder.

14. LIENS

(a) If, because of any act or omission of Tenant or anyone claiming by, through, or under Tenant, any mechanic’s lien or other lien shall be filed against the Premises or the Building or against other property of Landlord (whether or not such lien is valid or enforceable as such), Tenant shall, at its own expense, cause the same to be discharged of record or bonded off within a reasonable time, not to exceed thirty (30) days after the date of filing thereof. If such lien is not discharged of record or bonded off within thirty (30) days after the date of filing thereof, Landlord may take all action reasonably necessary to release and remove such lien (without any duty to investigate the validity thereof) and Tenant shall promptly, upon notice, reimburse Landlord for all sums, costs and expenses (including reasonable attorneys’ fees and Landlord’s Costs) incurred by Landlord in connection with such lien.

COMMERCIAL LEASE

Page 20 of 37

(b) Landlord shall waive its statutory lien and any other supplemental lien(s) against Tenant’s personal property which is subject to financing or which is leased by Tenant.

15. RENTAL, PERSONAL PROPERTY AND OTHER TAXES

(a) Tenant shall pay before delinquency any and all taxes, assessments, fees or charges (hereinafter referred to as “taxes”), including any sales, gross income, rental, business occupation or other taxes, levied or imposed upon Tenant’s business operation in the Premises and any personal property or similar taxes levied or imposed upon Tenant’s trade fixtures, leasehold improvements or personal property located within the Premises. In the event any such taxes are charged to the account of, or are levied or imposed upon the property of Landlord, Tenant shall reimburse Landlord for the same as Additional Rent. Notwithstanding the foregoing, Tenant shall have the right to contest in good faith any such tax and to defer payment, if required, until after Tenant’s liability therefor is finally determined.

(b) If any trade fixtures, alterations or improvements or business machines and equipment located in, on or about the Premises, regardless of whether they are installed or paid for by Landlord or Tenant and whether or not they are affixed to and become a part of the realty and the property of Landlord, are assessed for real property tax purposes at a valuation higher than that at which other such property in other leased space in the Building is assessed, then Tenant shall reimburse Landlord as Additional Rent for the amount of real property taxes shown on the appropriate county official’s records as having been levied upon the Building or other property of Landlord by reason of such excess assessed valuation.

16. ASSIGNMENT AND SUBLETTING

(a) Transfers; Consent.Other than permitted transfers as described below, Tenant shall not, without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed, (1) advertise that any portion of the Premises is available for lease (excluding the engagement of a real estate broker to market sublease space), (2) assign, transfer, or encumber this Lease or any estate or interest herein whether directly or by operation of law, (3) if Tenant is an entity other than a corporation whose stock is publicly traded, permit the transfer of an ownership interest in Tenant so as to result in a change in the current control of Tenant, (4) sublet any portion of the Premises, (5) grant any license, concession, or other right of occupancy of any portion of the Premises, or (6) permit the use of the Premises by any parties other than Tenant (any of the events listed in Sections 16(a)(2) through 16(a)(6) being a “Transfer”). If Tenant requests Landlord’s consent to a Transfer, then Tenant shall provide Landlord with a written description of all terms and conditions of the proposed Transfer, copies of the proposed documentation, and the following information about the proposed transferee: name and address; reasonably satisfactory information about its business and business history; its proposed use of the Premises; and general references sufficient to enable Landlord to determine the proposed transferee’s reputation and character. Landlord shall respond in writing to Tenant’s request for a Transfer within ten (10) business days of receipt of written request therefor. Landlord’s failure to respond within such 10 business day period, shall be a deemed acceptance of Tenant’s request for Transfer. Tenant shall reimburse Landlord for its attorneys’ fees and other expenses incurred in connection with considering any request for its consent to a Transfer (not to exceed $250 per request). Landlord shall not unreasonably withhold, delay or condition its consent except that Landlord may withhold or condition its consent if it reasonably determines that the proposed transferee or its use (including not by limitation the number of employees, hours of operation, parking requirements, electrical or other Building system requirements, conflicts or competition with existing tenants) is unacceptable, would burden the Building, or are incompatible with the Building or its occupants. If Landlord consents to a proposed Transfer, then the proposed transferee shall deliver to Landlord a written agreement whereby it expressly assumes the Tenant’s obligations hereunder; however, any transferee of less than all of the space in the Premises shall be liable only for obligations under this Lease that are properly allocable to the space subject to the Transfer, and only to the extent of the rent it has agreed to pay Tenant therefor. Landlord’s consent to a Transfer shall not release Tenant from performing its obligations under this Lease, but rather Tenant and its transferee shall be jointly and severally liable therefor. Landlord’s consent to any Transfer shall not waive Landlord’s rights as to any subsequent Transfers. If an Event of Default occurs while the Premises or any part thereof are subject to a Transfer, then Landlord, in addition to its other remedies, may collect directly from such transferee all rents becoming due to Tenant and apply such rents against Rent. Tenant authorizes its transferees to make payments of rent directly to Landlord upon Tenant’s receipt of notice from Landlord to do so; however, Landlord shall not be obligated to accept separate Rent payments from any transferees and may require that all Rent be paid directly by Tenant.

COMMERCIAL LEASE

Page 21 of 37