UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-03850 | |

| Exact name of registrant as specified in charter: | Delaware Group® Tax Free Fund | |

| Address of principal executive offices: | 2005 Market Street | |

| Philadelphia, PA 19103 | ||

| Name and address of agent for service: | David F. Connor, Esq. | |

| 2005 Market Street | ||

| Philadelphia, PA 19103 | ||

| Registrant’s telephone number, including area code: | (800) 523-1918 | |

| Date of fiscal year end: | August 31 | |

| Date of reporting period: | August 31, 2011 |

Item 1. Reports to Stockholders

Annual report Delaware Tax-Free USA Fund Delaware Tax-Free USA Intermediate Fund Delaware National High-Yield Municipal Bond Fund August 31, 2011 Fixed income mutual funds |

| Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectuses and, if available, their summary prospectuses, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing. |

You can obtain shareholder reports and prospectuses online instead of in the mail. Visit www.delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Tax-Free USA Fund, Delaware Tax-Free USA Intermediate Fund, and Delaware National High-Yield Municipal Bond Fund at www.delawareinvestments.com.

Manage your investments online

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware Tax-Free USA Fund, Delaware Tax-Free USA Intermediate Fund, and Delaware National High-Yield Municipal Bond Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Funds, the repayment of capital from the Funds, or any particular rate of return.

| Table of contents | ||

| Portfolio management review | 1 | |

| Performance summaries | 6 | |

| Disclosure of Fund expenses | 16 | |

| Security type/sector allocations | 19 | |

| Statements of net assets | 22 | |

| Statements of operations | 68 | |

| Statements of changes in net assets | 70 | |

| Financial highlights | 76 | |

| Notes to financial statements | 100 | |

| Report of independent registered | ||

| public accounting firm | 113 | |

| Other Fund information | 114 | |

| Board of trustees/directors and | ||

| officers addendum | 120 | |

| About the organization | 130 |

Unless otherwise noted, views expressed herein are current as of Aug. 31, 2011, and subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Funds’ distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2011 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

| Portfolio management review | |

| Delaware Investments® National Tax-Free Funds | September 6, 2011 |

| Performance preview (for the year ended August 31, 2011) | ||||

| Delaware Tax-Free USA Fund (Class A shares) | 1-year return | +1.65% | ||

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | +2.66% | ||

| Lipper General Municipal Debt Funds Average | 1-year return | +1.47% | ||

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free USA Fund, please see the table on page 6.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

The Lipper General Municipal Debt Funds Average compares funds that invest at least 65% of assets in municipal debt issues in the top four credit ratings.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

For complete, annualized performance for Delaware Tax-Free USA Fund, please see the table on page 6.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

The Lipper General Municipal Debt Funds Average compares funds that invest at least 65% of assets in municipal debt issues in the top four credit ratings.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| Delaware Tax-Free USA Intermediate Fund (Class A shares) | 1-year return | +1.10% | ||

| Barclays Capital 3–15 Year Blend Municipal Bond Index (benchmark) | 1-year return | +3.18% | ||

| Lipper Intermediate Municipal Debt Funds Average | 1-year return | +2.48% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free USA Intermediate Fund, please see the table on page 9.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

The Lipper Intermediate Municipal Debt Funds Average compares funds that invest in municipal debt issues with dollar-weighted average maturities of 5 to 10 years.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

For complete, annualized performance for Delaware Tax-Free USA Intermediate Fund, please see the table on page 9.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

The Lipper Intermediate Municipal Debt Funds Average compares funds that invest in municipal debt issues with dollar-weighted average maturities of 5 to 10 years.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| Delaware National High-Yield Municipal Bond Fund (Class A shares) | 1-year return | +0.23% | ||

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | +2.66% | ||

| Lipper High-Yield Municipal Debt Funds Average | 1-year return | +0.86% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware National High-Yield Municipal Bond Fund, please see the table on page 12.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

The Lipper High-Yield Municipal Debt Funds Average compares funds that invest at least 50% of assets in lower rated municipal debt issues.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

For complete, annualized performance for Delaware National High-Yield Municipal Bond Fund, please see the table on page 12.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

The Lipper High-Yield Municipal Debt Funds Average compares funds that invest at least 50% of assets in lower rated municipal debt issues.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

1

Portfolio management review

Delaware Investments® National Tax-Free Funds

Delaware Investments® National Tax-Free Funds

Economic backdrop

When the Funds’ fiscal year began in September 2010, many municipal bond investors appeared to be anticipating a moderately improving economy and, as a result, they were likely expecting interest rates to rise in 2011 (especially since rates had been trending at historically low levels). However, this optimism was soon muted as mounting data suggested a slowdown in U.S. economic growth and stimulated fears of a so-called double-dip recession.

Ultimately, lackluster reports on gross domestic product (GDP), which measures the total dollar value of goods and services produced by the economy, confirmed the economy’s disappointing performance. The data reflected persistent weakness in economic output, including the following readings:

- In the third and fourth quarters of 2010, U.S. GDP expanded by annualized rates of 2.5% and 2.3%, respectively.

- During the first quarter of 2011, GDP grew at an annualized rate of just 0.4% — the weakest showing in seven quarters.

- Growth in the second quarter of 2011 came in only slightly better, at an estimated annualized rate of 1.0%.

Data: U.S. Commerce Department

Arguably, employment continued to be the Achilles’ heel of the economy. Even early in the fiscal year, amid decent economic growth, employment continued to struggle. At the start of the Funds’ fiscal year, unemployment was at a high rate of 9.6% and ticked further upward to 9.8% within several months. A period of optimism followed as the jobless rate declined a full percentage point between November 2010 and March 2011. From there, however, the unemployment rate reversed course and rose to 9.0% in April, hovering close to that level for the remainder of the Funds’ fiscal year.

In the second half of the Funds’ fiscal year, the global economic picture worsened:

- In March 2011, the massive earthquake that struck Japan, followed by a devastating tsunami and nuclear crisis, hurt factory production and reduced worldwide economic output.

- The European debt crisis resurfaced and threatened to ensnare some of the continent’s larger economies, such as Italy and Spain.

- A political battle in Washington D.C. over government spending and the lifting of the federal debt ceiling increased investor uncertainty and anxiety.

- Citing these severe political disagreements in the face of rising debt, credit-rating agency Standard & Poor’s (S&P) downgraded the long-term rating on U.S. sovereign debt. In what was the first such downgrade in history, the United States’ S&P rating went to AA+, one notch down from its former rating of AAA.

These mounting challenges and economic crosscurrents led to significant volatility in the financial markets. Despite the rating downgrade of U.S. bonds, many fixed income investors flocked to the perceived safety of U.S. Treasury debt, pushing interest rates even lower.

2

Conditions within municipal bond markets

Municipal bonds benefited from a generally favorable market backdrop during the first two months of the Funds’ fiscal year. Inflation remained under control and interest rates trended downward, boosting the performance of fixed income securities. Two additional factors, more technical in nature, had a positive effect on municipal securities: supply of municipal bonds remained constrained, and demand remained healthy.

Beginning in November 2010, however, a number of factors combined to weigh on the municipal bond market:

- Many investors worried that renewed federal economic stimulus efforts would increase the risk of inflation.

- Expectations grew that Republican congressional election victories would mean the end of the federal Build America Bonds program and a potential increase in the supply of traditional tax-exempt debt.

- Worries mounted about the fiscal condition of many state and local governments and their ability to repay their debt. Investor anxiety about state finances was exacerbated by a heavy dose of negative headlines from various media outlets, including articles in The Wall Street Journal, The New York Times, and a particularly troubling segment that aired on the television program 60 Minutes in mid-December.

Amid these conditions, the municipal bond market experienced two violent selloffs during the fourth quarter of 2010, setting in motion a wave of negative sentiment that spilled into early 2011. Within a very short time, municipal bond mutual funds went from an environment of strong inflows to one of strong outflows.

After January 2011, however, the situation stabilized, and trends turned favorable for tax-exempt bond investors. Rates on municipal securities generally decreased throughout the rest of the fiscal year, following Treasury bond yields downward (though not to the same degree).

Across the yield curve, municipal bonds saw their prices rise and their yields decline. Overall, the municipal yield curve steepened modestly during the Funds’ fiscal year, meaning that the difference between short- and long-term municipal bond yields increased.

The strongest-performing parts of the yield curve were the middle maturities — bonds with maturities ranging from six to eight years. Very short investments did not gain as much ground, nor did bonds on the longer end of the maturity range.

With regard to credit quality, medium-grade securities, or A-rated bonds, were the market’s best performers. Bonds with the highest level of credit quality, namely those with AAA or AA credit ratings, were the second-strongest performing segment, while bonds rated BBB, the lowest tier of the investment grade bond universe, trailed all other investment grade bonds. Overall, this breakdown in performance reflected investors’ preference for bonds with less credit risk during what was largely an uncertain market climate.

A temporarily defensive approach

Going into 2011, we believed a heightened level of risk pervaded the market, and we took temporary steps to attempt to position

3

Portfolio management review

Delaware Investments® National Tax-Free Funds

Delaware Investments® National Tax-Free Funds

the Funds’ portfolios more defensively; this meant sacrificing some income-generation potential, but it ultimately translated to an increase in credit quality within each Fund.

Because we expected the supply of municipal bonds to build in the wake of the expiration of the Build America Bonds program — especially for bonds with longer maturities — we modestly reduced each Fund’s exposure to longer-dated bonds, while trimming each Fund’s position in lower-rated issues. In both cases, we did not believe these types of securities would perform well in an environment of increased bond supply. (We should stress that these changes took place at the margins of each Fund’s portfolio and only reflected minor adjustments.)

Initially, these adjustments did not work as well as we had hoped, given that mid-January was the high point for interest rates during the Funds’ fiscal year. At that time, investors’ credit fears generally started to subside, and rates began to move downward. This trend worked against the higher-quality, shorter-duration positioning we had recently moved toward.

Thus, in mid-March we decided that our conservative approach was not serving the Funds’ shareholders as well as we had anticipated. When it became clear that the bond market was recovering, we took steps that included, among other actions, reducing each Fund’s allocation to cash. In redeploying that cash, we followed our traditional credit-selection process and focused on the types of bonds we more routinely invest in — bonds that we believe offer very good potential value relative to their inherent risk. As a result, we gradually moved each Fund’s portfolio to a less defensive posture.

Notable holdings within the Funds

With a few exceptions, the best-performing individual bonds across the three Funds shared a number of characteristics. In general, bonds with short- to medium-term maturities tended to enjoy better performance throughout the Funds’ fiscal year. Also, bonds with lower credit ratings typically underperformed their higher-rated counterparts, amid an environment in which many investors reduced their exposure to bond issuers with weaker credit quality.

Another important performance factor was the timing of bond purchases. As we previously discussed, the high point for interest rates was in mid-January 2011, when bond prices were relatively low. The bonds that were introduced into the Funds during this period provided relatively good returns, given that their prices rebounded when market conditions subsequently improved.

For example, the strongest individual contributors within Delaware Tax-Free USA Fund included bonds issued by the New Jersey Economic Development Authority, rated Aa3 and A+ by Moody’s and S&P, respectively. With a 2023 maturity date, these bonds were within the strongest-performing maturity range within the municipal market. In addition, the bonds were purchased in mid-February when prices were generally low. Similarly, the Fund’s position in California Department of Water Resources bonds, with respective credit ratings of Aa3 and AA- (and a 2020 maturity), were purchased in late December and eventually appreciated when investor sentiment rebounded.

4

The weakest-performing securities for Delaware Tax-Free USA Fund were both lower-rated bond issues with long maturities — two characteristics that were not embraced by investors during the Fund’s fiscal year. For instance, bonds issued by Capital Trust Agency of Florida (rated Baa3 by Moody’s and nonrated by S&P, maturing in 2032) provided the weakest performance, declining by approximately 9% during the fiscal year. Another disappointment came from the Fund’s position in bonds issued by the New Jersey Economic Development Authority. These bonds, which were backed by cigarette taxes, also suffered from their lower credit ratings (Baa3 by Moody’s) and a relatively long maturity date.

The top-performing bonds in Delaware Tax-Free USA Intermediate Fund were issued by the New Jersey Economic Development Authority, similar to those held in Delaware Tax-Free USA Fund (but with a higher credit rating and shorter maturity date). These bonds were added to the Fund’s portfolio in mid-January 2011, when we believed they provided unusually attractive value relative to their risk characteristics. Another well-timed purchase involved bonds issued by the Massachusetts Health and Educational Facilities Authority (to finance activities at Massachusetts Institute of Technology). These bonds were rated Aaa and AAA by Moody’s and S&P, respectively.

In contrast, notably weaker performers within Delaware Tax-Free USA Intermediate Fund included bonds issued by the state of Pennsylvania on behalf of East Stroudsburg University. These securities underperformed due to their relatively long maturities and low-investment-grade credit ratings. These same factors dragged down performance for utility bonds issued by the Puerto Rico Electric Power Authority. In fact, a longer-maturity bond from the same issuer represented the weakest-returning security for Delaware National High-Yield Municipal Bond Fund. Other notable underperformers for this Fund included New York City Industrial Development Agency bonds issued to help finance a new stadium for the New York Mets professional baseball team. These bonds had 35 years until maturity and credit ratings of Baa1 and BB+ (by Moody’s and S&P respectively), neither of which were favorable characteristics given the market environment.

The best-performing securities within Delaware National High-Yield Municipal Bond Fund were tobacco-securitization bonds issued by the state of California. Although these bonds, which are backed by cigarette-company revenues, were lower rated and relatively long in maturity, these factors were more than offset by the positive effects of the timing of our purchase (they were added to the Fund’s portfolio in mid-December 2010, when tobacco bonds were broadly underperforming). Similarly, the Fund’s purchase of high-quality New York City Transitional Financial Authority bonds proved favorable. In addition to benefiting from credit ratings of Aa1 and AAA (by Moody’s and S&P, respectively) and maturities in 2018, these securities were purchased at what we viewed as a good price in early February 2011.

5

| Performance summaries | |

| Delaware Tax-Free Arizona Fund | August 31, 2011 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1,2 | Average annual total returns through Aug. 31, 2011 | |||||||

| 1 year | 5 years | 10 years | Lifetime | |||||

| Class A (Est. Jan. 11, 1984) | ||||||||

| Excluding sales charge | +1.65% | +3.99% | +4.57% | +6.96% | ||||

| Including sales charge | -2.94% | +3.02% | +4.09% | +6.79% | ||||

| Class B (Est. May 2, 1994) | ||||||||

| Excluding sales charge | +0.89% | +3.18% | +3.91% | +4.44% | ||||

| Including sales charge | -3.00% | +2.93% | +3.91% | +4.44% | ||||

| Class C (Est. Nov. 29, 1995) | ||||||||

| Excluding sales charge | +0.88% | +3.20% | +3.77% | +3.78% | ||||

| Including sales charge | -0.09% | +3.20% | +3.77% | +3.78% | ||||

| Institutional Class (Est. Dec. 31, 2008) | ||||||||

| Excluding sales charge | +1.83% | n/a | n/a | +9.97% | ||||

| Including sales charge | +1.83% | n/a | n/a | +9.97% | ||||

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 7. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.24% of average daily net assets.

Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied. Additionally, the Fund’s Class A shares are subject to a blended 12b-1 fee of 0.10% on all shares acquired prior to June 1, 1992, and 0.25% on all shares acquired on or after June 1, 1992.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Class B shares will automatically convert to Class A

6

shares on a quarterly basis approximately eight years after purchase. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses (excluding certain fees and expenses) from exceeding 0.56% of the Fund’s average daily net assets from Dec. 29, 2010, through Dec. 29, 2011. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | Class B | Class C | Institutional Class | ||||

| Total annual operating expenses | 0.95% | 1.71% | 1.71% | 0.71% | ||||

| (without fee waivers) | ||||||||

| Net expenses | 0.80% | 1.56% | 1.56% | 0.56% | ||||

| (including fee waivers, if any) | ||||||||

| Type of waiver | Contractual | Contractual | Contractual | Contractual |

7

Performance summaries

Delaware Tax-Free Arizona Fund

Delaware Tax-Free Arizona Fund

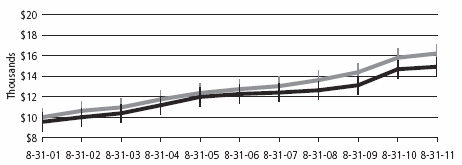

Performance of a $10,000 investment1

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

| For period beginning Aug. 31, 2001, through Aug. 31, 2011 | Starting value | Ending value | ||

| Barclays Capital Municipal Bond Index | $10,000 | $16,208 | ||

| Delaware Tax-Free USA Fund — Class A Shares | $9,550 | $14,913 | ||

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2001, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 7. Please note additional details on pages 6 through 8.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 2001. The Barclays Capital Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| Nasdaq symbols | CUSIPs | ||||||

| Class A | DMTFX | 245909106 | |||||

| Class B | DTFCX | 245909403 | |||||

| Class C | DUSCX | 245909700 | |||||

| Institutional Class | DTFIX | 24610H104 | |||||

8

| Delaware Tax-Free USA Intermediate Fund | August 31, 2011 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1,2 | Average annual total returns through Aug. 31, 2011 | ||||||

| 1 year | 5 years | 10 years | Lifetime | ||||

| Class A (Est. Jan. 7, 1993) | |||||||

| Excluding sales charge | +1.10% | +4.21% | +4.59% | +5.26% | |||

| Including sales charge | -1.65% | +3.64% | +4.29% | +5.11% | |||

| Class B (Est. May 2, 1994) | |||||||

| Excluding sales charge | +0.25% | +3.34% | +4.14% | +4.88% | |||

| Including sales charge | -1.71% | +3.34% | +4.14% | +4.88% | |||

| Class C (Est. Nov. 29, 1995) | |||||||

| Excluding sales charge | +0.25% | +3.33% | +3.70% | +4.06% | |||

| Including sales charge | -0.73% | +3.33% | +3.70% | +4.06% | |||

| Institutional Class (Est. Dec. 31, 2008) | |||||||

| Excluding sales charge | +1.28% | n/a | n/a | +7.65% | |||

| Including sales charge | +1.28% | n/a | n/a | +7.65% | |||

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 10. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 2.75%, and have an annual distribution and service fee of up to 0.30% of average daily net assets.

Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied. This fee has been contractually limited to 0.15% of average daily net assets from Dec. 29, 2010, through Dec. 29, 2011.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 2.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis

9

Performance summaries

Delaware Tax-Free USA Intermediate Fund

Delaware Tax-Free USA Intermediate Fund

approximately eight years after purchase. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately five years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses (excluding certain fees and expenses) from exceeding 0.60% of the Fund’s average daily net assets from Dec. 29, 2010, through Dec. 29, 2011. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | Class B | Class C | Institutional Class | |||||||

| Total annual operating expenses | 1.00 | % | 1.70 | % | 1.70 | % | 0.70 | % | |||

| (without fee waivers) | |||||||||||

| Net expenses | 0.75 | % | 1.60 | % | 1.60 | % | 0.60 | % | |||

| (including fee waivers, if any) | |||||||||||

| Type of waiver | Contractual | Contractual | Contractual | Contractual | |||||||

10

Performance of a $10,000 investment1

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

| For period beginning Aug. 31, 2001, through Aug. 31, 2011 | Starting value | Ending value | ||

| Barclays Capital 3–15 Year Blend Municipal Bond Index | $10,000 | $16,305 | ||

| Delaware Tax-Free USA Intermediate Fund — Class A Shares | $9,725 | $15,218 | ||

1 The “Performance of $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2001, and includes the effect of a 2.75% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 10. Please note additional details on pages 9 through 11.

The chart also assumes $10,000 invested in the Barclays Capital 3–15 Year Blend Municipal Bond Index as of Aug. 31, 2001.

The Barclays Capital 3–15 Year Blend Municipal Bond Index, sometimes also referred to as the Barclays Capital 3–15 Year Municipal Bond Index, measures the total return performance of investment grade, U.S. tax-exempt bonds with maturities from 2 to 17 years.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| Nasdaq symbols | CUSIPs | ||||||

| Class A | DMUSX | 245909304 | |||||

| Class B | DUIBX | 245909601 | |||||

| Class C | DUICX | 245909882 | |||||

| Institutional Class | DUSIX | 24610H203 | |||||

11

| Performance summaries | |

| Delaware National High-Yield Municipal Bond Fund | August 31, 2011 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1,2 | Average annual total returns through Aug. 31, 2011 | ||||||

| 1 year | 5 years | 10 years | Lifetime | ||||

| Class A (Est. Sept. 22, 1986) | |||||||

| Excluding sales charge | +0.23% | +3.86% | +4.60% | +6.21% | |||

| Including sales charge | -4.33% | +2.90% | +4.12% | +6.01% | |||

| Class B (Est. Dec. 18, 1996) | |||||||

| Excluding sales charge | -0.51% | +3.06% | +3.96% | +4.55% | |||

| Including sales charge | -4.33% | +2.81% | +3.96% | +4.55% | |||

| Class C (Est. May 26, 1997) | |||||||

| Excluding sales charge | -0.51% | +3.07% | +3.82% | +4.11% | |||

| Including sales charge | -1.46% | +3.07% | +3.82% | +4.11% | |||

| Institutional Class (Est. Dec. 31, 2008) | |||||||

| Excluding sales charge | +0.41% | n/a | n/a | +15.92% | |||

| Including sales charge | +0.41% | n/a | n/a | +15.92% | |||

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 13. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase.

12

Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses (excluding certain fees and expenses) from exceeding 0.60% of the Fund’s average daily net assets from Dec. 29, 2010, through Dec. 29, 2011. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | Class B | Class C | Institutional Class | |||||||

| Total annual operating expenses | 1.04 | % | 1.79 | % | 1.79 | % | 0.79 | % | |||

| (without fee waivers) | |||||||||||

| Net expenses | 0.85 | % | 1.60 | % | 1.60 | % | 0.60 | % | |||

| (including fee waivers, if any) | |||||||||||

| Type of waiver | Contractual | Contractual | Contractual | Contractual | |||||||

13

Performance summaries

Delaware National High-Yield Municipal Bond Fund

Delaware National High-Yield Municipal Bond Fund

Performance of a $10,000 investment1

Average annual total returns from Aug. 31, 2001, through Aug. 31, 2011

| For period beginning Aug. 31, 2001, through Aug. 31, 2011 | Starting value | Ending value | ||

| Barclays Capital Municipal Bond Index | $10,000 | $16,208 | ||

| Delaware National High-Yield Municipal Bond Fund — Class A Shares | $9,550 | $14,956 | ||

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2001, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 13. Please note additional details on pages 12 through 14.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 2001. The Barclays Capital Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| Nasdaq symbols | CUSIPs | ||||||

| Class A | CXHYX | 928928241 | |||||

| Class B | DVNYX | 928928233 | |||||

| Class C | DVHCX | 928928225 | |||||

| Institutional Class | DVHIX | 24610H302 | |||||

14

Disclosure of Fund expenses

For the six-month period from March 1, 2011 to August 31, 2011

For the six-month period from March 1, 2011 to August 31, 2011

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from March 1, 2011 to August 31, 2011.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

16

Delaware Tax-Free USA Fund

Expense analysis of an investment of $1,000

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||

| 3/1/11 | 8/31/11 | Expense Ratio | 3/1/11 to 8/31/11* | ||||||||||||

| Actual Fund return | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,062.70 | 0.80 | % | $ | 4.16 | |||||||

| Class B | 1,000.00 | 1,057.70 | 1.56 | % | 8.09 | ||||||||||

| Class C | 1,000.00 | 1,057.70 | 1.56 | % | 8.09 | ||||||||||

| Institutional Class | 1,000.00 | 1,062.70 | 0.56 | % | 2.91 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,021.17 | 0.80 | % | $ | 4.08 | |||||||

| Class B | 1,000.00 | 1,017.34 | 1.56 | % | 7.93 | ||||||||||

| Class C | 1,000.00 | 1,017.34 | 1.56 | % | 7.93 | ||||||||||

| Institutional Class | 1,000.00 | 1,022.38 | 0.56 | % | 2.85 | ||||||||||

Delaware Tax-Free USA Intermediate Fund

Expense analysis of an investment of $1,000

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||

| 3/1/11 | 8/31/11 | Expense Ratio | 3/1/11 to 8/31/11* | ||||||||||||

| Actual Fund return | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,051.30 | 0.75 | % | $ | 3.88 | |||||||

| Class B | 1,000.00 | 1,047.80 | 1.60 | % | 8.26 | ||||||||||

| Class C | 1,000.00 | 1,047.80 | 1.60 | % | 8.26 | ||||||||||

| Institutional Class | 1,000.00 | 1,052.60 | 0.60 | % | 3.10 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,021.42 | 0.75 | % | $ | 3.82 | |||||||

| Class B | 1,000.00 | 1,017.14 | 1.60 | % | 8.13 | ||||||||||

| Class C | 1,000.00 | 1,017.14 | 1.60 | % | 8.13 | ||||||||||

| Institutional Class | 1,000.00 | 1,022.18 | 0.60 | % | 3.06 | ||||||||||

17

Disclosure of Fund expenses

Delaware National High-Yield Municipal Bond Fund

Expense analysis of an investment of $1,000

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | |||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | ||||||||||||

| 3/1/11 | 8/31/11 | Expense Ratio | 3/1/11 to 8/31/11* | ||||||||||||

| Actual Fund return | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,069.40 | 0.85 | % | $ | 4.43 | |||||||

| Class B | 1,000.00 | 1,065.30 | 1.60 | % | 8.33 | ||||||||||

| Class C | 1,000.00 | 1,065.20 | 1.60 | % | 8.33 | ||||||||||

| Institutional Class | 1,000.00 | 1,070.30 | 0.60 | % | 3.13 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | |||||||||||||||

| Class A | $ | 1,000.00 | $ | 1,020.92 | 0.85 | % | $ | 4.33 | |||||||

| Class B | 1,000.00 | 1,017.14 | 1.60 | % | 8.13 | ||||||||||

| Class C | 1,000.00 | 1,017.14 | 1.60 | % | 8.13 | ||||||||||

| Institutional Class | 1,000.00 | 1,022.18 | 0.60 | % | 3.06 | ||||||||||

| * | “Expenses Paid During Period” are equal to the relevant Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

18

| Security type/sector allocations | ||

| Delaware Tax-Free USA Fund | As of August 31, 2011 | |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type/sector | Percentage of net assets | |

| Municipal Bonds | 98.84 | % |

| Corporate Revenue Bonds | 16.87 | % |

| Education Revenue Bonds | 10.51 | % |

| Electric Revenue Bonds | 2.14 | % |

| Healthcare Revenue Bonds | 9.89 | % |

| Housing Revenue Bonds | 1.28 | % |

| Lease Revenue Bonds | 4.98 | % |

| Local General Obligation Bonds | 4.71 | % |

| Pre-Refunded/Escrowed to Maturity Bonds | 10.44 | % |

| Special Tax Revenue Bonds | 13.74 | % |

| State General Obligation Bonds | 9.15 | % |

| Transportation Revenue Bonds | 11.27 | % |

| Water & Sewer Revenue Bonds | 3.86 | % |

| Short-Term Investment | 0.06 | % |

| Total Value of Securities | 98.90 | % |

| Receivables and Other Assets Net of Liabilities | 1.10 | % |

| Total Net Assets | 100.00 | % |

19

| Security type/sector allocations | |

| Delaware Tax-Free USA Intermediate Fund | As of August 31, 2011 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type/sector | Percentage of net assets | |

| Municipal Bonds | 98.10 | % |

| Corporate Revenue Bonds | 9.26 | % |

| Education Revenue Bonds | 7.46 | % |

| Electric Revenue Bonds | 2.54 | % |

| Healthcare Revenue Bonds | 9.48 | % |

| Housing Revenue Bonds | 0.60 | % |

| Lease Revenue Bonds | 4.28 | % |

| Local General Obligation Bonds | 7.39 | % |

| Pre-Refunded/Escrowed to Maturity Bonds | 3.43 | % |

| Resource Recovery Revenue Bonds | 0.27 | % |

| Special Tax Revenue Bonds | 10.16 | % |

| State General Obligation Bonds | 22.35 | % |

| Transportation Revenue Bonds | 14.50 | % |

| Water & Sewer Revenue Bonds | 6.38 | % |

| Short-Term Investments | 0.74 | % |

| Total Value of Securities | 98.84 | % |

| Receivables and Other Assets Net of Liabilities | 1.16 | % |

| Total Net Assets | 100.00 | % |

20

| Delaware National High-Yield Municipal Bond Fund | As of August 31, 2011 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Security type/sector | Percentage of net assets | ||||

| Municipal Bonds | 98.41 | % | |||

| Corporate Revenue Bonds | 20.23 | % | |||

| Education Revenue Bonds | 21.21 | % | |||

| Healthcare Revenue Bonds | 22.52 | % | |||

| Housing Revenue Bonds | 0.67 | % | |||

| Lease Revenue Bonds | 4.55 | % | |||

| Pre-Refunded/Escrow to Maturity Bonds | 0.79 | % | |||

| Resource Recovery Revenue Bonds | 0.44 | % | |||

| Special Tax Revenue Bonds | 14.91 | % | |||

| State General Obligation Bonds | 5.80 | % | |||

| Transportation Revenue Bonds | 6.60 | % | |||

| Water & Sewer Revenue Bonds | 0.69 | % | |||

| Total Value of Securities | 98.41 | % | |||

| Receivables and Other Assets Net of Liabilities | 1.59 | % | |||

| Total Net Assets | 100.00 | % | |||

21

| Statements of net assets | |

| Delaware Tax-Free USA Fund | August 31, 2011 |

| Principal amount | Value | |||||||

| Municipal Bonds – 98.84% | ||||||||

| Corporate Revenue Bonds – 16.87% | ||||||||

| Alliance Airport Authority, Texas Special Facilities Revenue | ||||||||

(American Airlines Project) Series B 5.25% 12/1/29 (AMT) | $ | 2,250,000 | $ | 1,495,733 | ||||

| Buckeye, Ohio Tobacco Settlement Financing Authority | ||||||||

Asset-Backed Series A-2 | ||||||||

5.875% 6/1/47 | 14,405,000 | 10,145,441 | ||||||

6.50% 6/1/47 | 6,000,000 | 4,643,160 | ||||||

| Cloquet, Minnesota Pollution Control Revenue | ||||||||

(Potlatch Corp. Project) 5.90% 10/1/26 | 1,695,000 | 1,598,199 | ||||||

| Harris County, Texas Industrial Development Corporation | ||||||||

Solid Waste Disposal Revenue | ||||||||

(Deer Park Refining Project) 5.00% 2/1/23 | 2,955,000 | 3,151,094 | ||||||

| Illinois Railsplitter Tobacco Settlement Authority | ||||||||

6.00% 6/1/28 | 6,000,000 | 6,150,659 | ||||||

6.25% 6/1/24 | 6,810,000 | 7,133,134 | ||||||

| Indiana State Finance Authority Environmental Revenue | ||||||||

(U.S. Steel Corp. Project) 6.00% 12/1/26 | 2,610,000 | 2,618,691 | ||||||

| Indianapolis, Indiana Airport Authority Revenue | ||||||||

Special Facilities (Federal Express Corp. Project) | ||||||||

5.10% 1/15/17 (AMT) | 2,750,000 | 3,073,538 | ||||||

Series 1998 5.50% 5/1/29 (AMT) | 2,000,000 | 1,938,340 | ||||||

| Iowa Finance Authority Pollution Control Facilities Revenue | ||||||||

(Interstate Power) 5.00% 7/1/14 (FGIC) | 3,640,000 | 3,976,118 | ||||||

| Maryland Economic Development Corporation Revenue | ||||||||

(CNX Marine Terminals Inc.) 5.75% 9/1/25 | 3,375,000 | 3,332,914 | ||||||

| Mason County, West Virginia Pollution Control Revenue | ||||||||

(Appalachian Power Co. Project) | ||||||||

Series K 6.05% 12/1/24 (AMBAC) | 3,000,000 | 3,022,530 | ||||||

| Mississippi Business Finance Corporation Pollution Control | ||||||||

Revenue (System Energy Resources, Inc. Project) | ||||||||

5.90% 5/1/22 | 3,000,000 | 2,999,700 | ||||||

| Missouri State Environmental Improvement & Energy | ||||||||

Resource Authority Pollution Control Revenue Refunding | ||||||||

(St. Joseph Light & Power Co. Project) | ||||||||

5.85% 2/1/13 (AMBAC) | 2,200,000 | 2,206,930 | ||||||

| • | Mobile, Alabama Industrial Development Board Pollution | |||||||

Control Revenue (Alabama Power Co.) | ||||||||

Series B 4.875% 6/1/34 | 4,750,000 | 5,049,013 | ||||||

22

| Principal amount | Value | |||||||

| Municipal Bonds (continued) | ||||||||

| Corporate Revenue Bonds (continued) | ||||||||

| M-S-R Energy Authority, California Gas Revenue Series A | ||||||||

6.125% 11/1/29 | $ | 1,915,000 | $ | 1,965,326 | ||||

6.50% 11/1/39 | 3,915,000 | 4,157,299 | ||||||

| New Jersey Economic Development Authority | ||||||||

Special Facility Revenue (Continental Airlines, Inc. Project) | ||||||||

6.25% 9/15/29 (AMT) | 2,000,000 | 1,871,620 | ||||||

| • | New York City, New York Industrial Development | |||||||

Agency Special Facilities Revenue | ||||||||

(American Airlines - JFK International Airport) | ||||||||

7.625% 8/1/25 (AMT) | 4,620,000 | 4,624,435 | ||||||

7.75% 8/1/31 (AMT) | 2,000,000 | 2,003,600 | ||||||

| New York Liberty Development Corporation Revenue | ||||||||

(Goldman Sachs Headquarters) 5.25% 10/1/35 | 3,000,000 | 2,948,340 | ||||||

| Ohio State Air Quality Development Authority Revenue | ||||||||

Environmental Improvement (First Energy Generation) | ||||||||

Series A 5.70% 8/1/20 | 4,750,000 | 5,139,263 | ||||||

| Pennsylvania Economic Development Financing Authority | ||||||||

Exempt Facilities Revenue (Allegheny Energy Supply Co.) | ||||||||

7.00% 7/15/39 | 6,340,000 | 6,801,995 | ||||||

| Petersburg, Indiana Pollution Control Revenue (Indianapolis | ||||||||

Power & Light Co. Project) 6.375% 11/1/29 (AMT) | 5,000,000 | 5,048,650 | ||||||

| Richmond County, Georgia Development Authority | ||||||||

Environmental Improvement Revenue (International | ||||||||

Paper Co.) Series B 5.95% 11/15/25 (AMT) | 5,000,000 | 5,046,900 | ||||||

| South Carolina Jobs-Economic Development Authority | ||||||||

Industrial Revenue (South Carolina Electric & Gas Co. | ||||||||

Project) Series B 5.45% 11/1/32 (AMBAC) (AMT) | 500,000 | 500,395 | ||||||

| Valdez, Alaska Marine (BP Pipelines Project) | ||||||||

Series B 5.00% 1/1/21 | 3,455,000 | 3,884,940 | ||||||

| 106,527,957 | ||||||||

| Education Revenue Bonds – 10.51% | ||||||||

| Bowling Green, Ohio Student Housing Revenue CFP I | ||||||||

(State University Project) 6.00% 6/1/45 | 5,390,000 | 5,114,032 | ||||||

| Broward County, Florida Educational Facilities Authority | ||||||||

Revenue (Nova Southeastern Project) | ||||||||

5.25% 4/1/27 (RADIAN) | 1,000,000 | 985,320 | ||||||

| California Statewide Communities Development Authority | ||||||||

School Facility Revenue (Aspire Public Schools) | ||||||||

6.125% 7/1/46 | 5,160,000 | 4,921,092 | ||||||

23

Statements of net assets

Delaware Tax-Free USA Fund

Delaware Tax-Free USA Fund

| Principal amount | Value | |||||||

| Municipal Bonds (continued) | ||||||||

| Education Revenue Bonds (continued) | ||||||||

| California Statewide Communities Development Authority | ||||||||

Student Housing Revenue (East Campus Apartments, LLC) | ||||||||

Series A 5.625% 8/1/34 (ACA) | $ | 3,400,000 | $ | 3,238,058 | ||||

| Connecticut State Health & Educational Facilities Authority | ||||||||

Revenue (Yale University) Series A-1 5.00% 7/1/25 | 3,000,000 | 3,369,090 | ||||||

| Delaware County, Pennsylvania Industrial Development | ||||||||

Authority Charter School Revenue (Chester Community | ||||||||

Charter School) Series A 6.125% 8/15/40 | 2,145,000 | 1,990,710 | ||||||

| Gainesville, Georgia Redevelopment Authority Educational | ||||||||

Facilities Revenue (Riverside Military Academy Project) | ||||||||

5.125% 3/1/37 | 2,850,000 | 2,083,008 | ||||||

| Marietta, Georgia Development Authority Revenue | ||||||||

(Life University Income Project) 7.00% 6/15/39 | 4,200,000 | 4,050,312 | ||||||

| Massachusetts Development Finance Agency | ||||||||

(Harvard University) Series B-2 5.25% 2/1/34 | 5,000,000 | 5,638,900 | ||||||

| Massachusetts State Health & Educational Facilities | ||||||||

Authority Revenue (Harvard University) Series A | ||||||||

5.00% 12/15/29 | 5,295,000 | 5,948,985 | ||||||

5.50% 11/15/36 | 4,515,000 | 5,068,629 | ||||||

| Missouri State Health & Educational Facilities Authority | ||||||||

Revenue (Washington University) Series A 5.375% 3/15/39 | 5,000,000 | 5,462,650 | ||||||

| New Jersey Economic Development Authority Revenue | ||||||||

(Providence Group - Montclair) 5.875% 6/1/42 | 4,285,000 | 4,215,669 | ||||||

| New Jersey State Educational Facilities Authority Revenue | ||||||||

(University of Medicine & Dentistry) Series B 7.50% 12/1/32 | 1,435,000 | 1,665,002 | ||||||

| New York City Trust For Cultural Resources | ||||||||

(Whitney Museum of American Art) 5.00% 7/1/31 | 1,500,000 | 1,512,150 | ||||||

| Pennsylvania State Higher Educational Facilities Authority | ||||||||

Student Housing Revenue (University Properties Inc. - | ||||||||

East Stroudsburg University of Pennsylvania) 5.00% 7/1/31 | 6,000,000 | 5,451,360 | ||||||

| Provo, Utah Charter School Revenue (Freedom Academy | ||||||||

Foundation Project) 5.50% 6/15/37 | 1,665,000 | 1,285,730 | ||||||

| San Juan, Texas Higher Education Finance Authority | ||||||||

Education Revenue (Idea Public Schools) Series A | ||||||||

6.70% 8/15/40 | 1,500,000 | 1,540,935 | ||||||

| St. Louis, Missouri Industrial Development Authority | ||||||||

Revenue (Confluence Academy Project) Series A | ||||||||

5.25% 6/15/25 | 1,150,000 | 974,614 | ||||||

5.35% 6/15/32 | 2,300,000 | 1,842,484 | ||||||

| 66,358,730 | ||||||||

24

| Principal amount | Value | |||||||

| Municipal Bonds (continued) | ||||||||

| Electric Revenue Bonds – 2.14% | ||||||||

| California State Department of Water Resources | ||||||||

| Series L 5.00% 5/1/20 | $ | 5,000,000 | $ | 5,999,450 | ||||

| Puerto Rico Electric Power Authority Revenue | ||||||||

| Series PP 5.00% 7/1/25 (NATL-RE) (FGIC) | 1,000,000 | 1,005,830 | ||||||

| Series WW 5.50% 7/1/38 | 2,100,000 | 2,107,539 | ||||||

| Series XX 5.75% 7/1/36 | 3,245,000 | 3,324,827 | ||||||

| Sikeston, Missouri Electric Revenue Refunding | ||||||||

| 6.00% 6/1/13 (NATL-RE) | 1,000,000 | 1,053,090 | ||||||

| 13,490,736 | ||||||||

| Healthcare Revenue Bonds – 9.89% | ||||||||

| Brevard County, Florida Health Facilities Authority Health | ||||||||

| Care Facilities Revenue (Heath First Inc. Project) | ||||||||

| 7.00% 4/1/39 | 1,610,000 | 1,767,410 | ||||||

| Butler County, Pennsylvania Hospital Authority Revenue | ||||||||

| (Butler Health System Project) 7.125% 7/1/29 | 2,500,000 | 2,773,925 | ||||||

| Cape Girardeau County, Missouri Industrial Development | ||||||||

| Authority Health Care Facilities Revenue Unrefunded | ||||||||

| Balance (St. Francis Medical Center) | ||||||||

| Series A 5.50% 6/1/32 | 1,000,000 | 1,008,030 | ||||||

| Cleveland-Cuyahoga County, Ohio Port Authority Revenue | ||||||||

| Senior Housing (St. Clarence - Geac) Series A 6.25% 5/1/38 | 1,500,000 | 1,190,295 | ||||||

| Colorado Health Facilities Authority Revenue | ||||||||

| (Evangelical Lutheran) Series A 5.25% 6/1/34 | 4,275,000 | 4,083,480 | ||||||

| Cuyahoga County, Ohio Revenue (Cleveland Clinic Health | ||||||||

| Systems) Series A 5.50% 1/1/29 | 4,000,000 | 4,170,080 | ||||||

| Fairfax County, Virginia Industrial Development Authority | ||||||||

| Revenue (Inova Health Services) Series A 5.50% 5/15/35 | 2,500,000 | 2,626,200 | ||||||

| Gainesville & Hall County, Georgia Development Authority | ||||||||

| Revenue Senior Living Facilities (Lanier Village Estates | ||||||||

| Project) Series C 7.25% 11/15/29 | 1,000,000 | 1,002,960 | ||||||

| Illinois Finance Authority Revenue | ||||||||

| (Silver Cross & Medical Centers) 7.00% 8/15/44 | 4,500,000 | 4,711,725 | ||||||

| Illinois Health Facilities Authority Revenue | ||||||||

| (Elmhurst Memorial Healthcare Project) 5.625% 1/1/28 | 2,000,000 | 1,961,120 | ||||||

| Koyukuk, Alaska Revenue (Tanana Chiefs Conference | ||||||||

| Health Care Facility Project) 7.75% 10/1/41 | 3,000,000 | 2,919,780 | ||||||

| Louisiana Public Facilities Authority Revenue (Ochsner Clinic | ||||||||

| Foundation Project) 6.50% 5/15/37 | 2,190,000 | 2,324,006 | ||||||

25

Statements of net assets

Delaware Tax-Free USA Fund

Delaware Tax-Free USA Fund

| Principal amount | Value | |||||||

| Municipal Bonds (continued) | ||||||||

| Healthcare Revenue Bonds (continued) | ||||||||

| Lucas County, Ohio Health Care Facility Revenue (Sunset | ||||||||

| Retirement Communities) Series A 6.625% 8/15/30 | $ | 2,000,000 | $ | 2,001,180 | ||||

| Maricopa County, Arizona Industrial Development Authority | ||||||||

| Health Facilities Revenue (Catholic Healthcare West) | ||||||||

| Series A 6.00% 7/1/39 | 3,690,000 | 3,827,194 | ||||||

| Michigan State Hospital Finance Authority Revenue | ||||||||

| (Ascension Health Credit Group) Series B 5.25% 11/15/26 | 3,500,000 | 3,579,555 | ||||||

| (Trinity Health Credit) Series C 5.375% 12/1/30 | 4,120,000 | 4,150,570 | ||||||

| New York State Dormitory Authority Revenue Non State | ||||||||

| Supported Debt | ||||||||

| (North Shore LI Jewish Health System) Series A 5.50% 5/1/37 | 3,000,000 | 3,059,880 | ||||||

| (Orange Regional Medical Center) 6.50% 12/1/21 | 2,745,000 | 2,883,595 | ||||||

| North Carolina Medical Care Commission Health Care | ||||||||

| Facilities Revenue | ||||||||

| (First Mortgage - Galloway Ridge Project) | ||||||||

| Series A 5.875% 1/1/31 | 1,555,000 | 1,501,757 | ||||||

| (First Mortgage - Presbyterian Homes) 5.40% 10/1/27 | 3,260,000 | 2,935,369 | ||||||

| Ohio State Higher Educational Facility Community Revenue | ||||||||

| (Cleveland Clinic Health System Obligation Group) | ||||||||

| Series A 5.25% 1/1/33 | 2,000,000 | 2,066,160 | ||||||

| ^ | Oregon Health & Science University Revenue | |||||||

| (Capital Appreciation Insured) | ||||||||

| Series A 5.75% 7/1/21 (NATL-RE) | 2,000,000 | 1,273,300 | ||||||

| Philadelphia, Pennsylvania Hospitals & Higher Education | ||||||||

| Facilities Authority Hospital Revenue (Temple University | ||||||||

| Health System) Series A 5.50% 7/1/30 | 2,700,000 | 2,485,809 | ||||||

| Tallahassee, Florida Health Facilities Revenue | ||||||||

| (Tallahassee Memorial Regional Medical Center) | ||||||||

| Series B 6.00% 12/1/15 (NATL-RE) | 2,140,000 | 2,146,206 | ||||||

| 62,449,586 | ||||||||

| Housing Revenue Bonds – 1.28% | ||||||||

| California Municipal Finance Authority Mobile Home Park | ||||||||

| Revenue (Caritas Projects) Series A 6.40% 8/15/45 | 4,750,000 | 4,658,278 | ||||||

| Florida Housing Finance Agency | ||||||||

| (Spinnaker Cove Apartments) Series G | ||||||||

| 6.50% 7/1/36 (AMBAC) (FHA) (AMT) | 500,000 | 499,330 | ||||||

| Missouri State Housing Development Commission Mortgage | ||||||||

| Revenue Single Family Homeowner Loan A 5.20% 9/1/33 | ||||||||

| (GNMA) (FNMA) (AMT) | 155,000 | 155,456 | ||||||

26

| Principal amount | Value | |||||||

| Municipal Bonds (continued) | ||||||||

| Housing Revenue Bonds (continued) | ||||||||

| Missouri State Housing Development Commission | ||||||||

| Multifamily Housing Revenue | ||||||||

| (Hyder) Series 3 5.60% 7/1/34 (FHA) (AMT) | $ | 1,435,000 | $ | 1,449,163 | ||||

| (San Remo) Series 5 5.45% 1/1/36 (FHA) (AMT) | 500,000 | 505,380 | ||||||

| Orange County, Florida Housing Finance Authority | ||||||||

| Homeowner Revenue | ||||||||

| Series B 5.25% 3/1/33 (GNMA) (FNMA) (AMT) | 95,000 | 95,325 | ||||||

| Oregon Health, Housing, Educational, & Cultural Facilities | ||||||||

| Authority Revenue (Pier Park Project) Series A | ||||||||

| 6.05% 4/1/18 (GNMA) (AMT) | 735,000 | 736,227 | ||||||

| 8,099,159 | ||||||||

| Lease Revenue Bonds – 4.98% | ||||||||

| Capital Area, Texas Cultural Education Facilities Finance | ||||||||

| Corporation Revenue (Roman Catholic Diocese) | ||||||||

| Series B 6.125% 4/1/45 | 2,045,000 | 2,097,659 | ||||||

| Capital Trust Agency Florida Revenue | ||||||||

| (Fort Lauderdale/Cargo Acquisition Project) | ||||||||

| 5.75% 1/1/32 (AMT) | 4,750,000 | 3,692,413 | ||||||

| (Orlando/Cargo Acquisition Project) 6.75% 1/1/32 (AMT) | 2,395,000 | 2,100,056 | ||||||

| Grapevine, Texas Industrial Development Corporate Revenue | ||||||||

| (Air Cargo) 6.50% 1/1/24 (AMT) | 850,000 | 752,293 | ||||||

| Houston, Texas Industrial Development Corporate Revenue | ||||||||

| (Air Cargo) 6.375% 1/1/23 (AMT) | 1,985,000 | 1,749,956 | ||||||

| Loudoun County, Virginia Industrial Development Authority Public | ||||||||

| Safety Facility Lease Revenue Series A 5.25% 12/15/23 (AGM) | 700,000 | 766,087 | ||||||

| Missouri State Development Finance Board Infrastructure | ||||||||

| Facilities Revenue | ||||||||

| (Branson Landing Project) Series A | ||||||||

| 5.25% 12/1/19 | 1,435,000 | 1,516,049 | ||||||

| 5.625% 12/1/28 | 2,365,000 | 2,437,227 | ||||||

| (Sewer System Improvement Project) Series C 5.00% 3/1/25 | 605,000 | 608,660 | ||||||

| (Triumph Foods Project) Series A 5.25% 3/1/25 | 500,000 | 501,640 | ||||||

| New Jersey Economic Development Authority | ||||||||

| (School Facilities Construction) | ||||||||

| Series EE 5.00% 9/1/18 | 6,000,000 | 6,864,539 | ||||||

| Series GG 5.75% 9/1/23 | 1,000,000 | 1,153,590 | ||||||

| New Jersey State Various Purpose 5.00% 6/1/17 | 3,000,000 | 3,572,490 | ||||||

| Puerto Rico Commonwealth Industrial Development Company | ||||||||

| General Purpose Revenue Series B 5.375% 7/1/16 | 1,000,000 | 1,001,890 | ||||||

27

Statements of net assets

Delaware Tax-Free USA Fund

Delaware Tax-Free USA Fund

| Principal amount | Value | |||||||

| Municipal Bonds (continued) | ||||||||

| Lease Revenue Bonds (continued) | ||||||||

| Puerto Rico Public Buildings Authority Revenue (Guaranteed | ||||||||

Government Facilities) Series F 5.25% 7/1/25 | $ | 930,000 | $ | 936,761 | ||||

| ^ | St. Louis, Missouri Industrial Development Authority | |||||||

Leasehold Revenue (Convention Center Hotel) | ||||||||

5.80% 7/15/20 (AMBAC) | 3,035,000 | 1,727,583 | ||||||

| 31,478,893 | ||||||||

| Local General Obligation Bonds – 4.71% | ||||||||

| Boerne, Texas Independent School District Building | ||||||||

5.25% 2/1/27 (PSF) | 4,000,000 | 4,177,280 | ||||||

| Fairfax County, Virginia Improvement | ||||||||

Series A 5.00% 4/1/18 | 6,000,000 | 7,330,620 | ||||||

| Georgetown, Texas Independent School District (School Building) | ||||||||

5.00% 8/15/22 (PSF) | 500,000 | 595,535 | ||||||

5.00% 8/15/24 (PSF) | 1,430,000 | 1,656,541 | ||||||

5.00% 8/15/25 (PSF) | 945,000 | 1,081,751 | ||||||

5.00% 8/15/26 (PSF) | 1,000,000 | 1,132,110 | ||||||

| Los Angeles, California Unified School District Election of | ||||||||

2005 Series F 5.00% 1/1/34 | 6,180,000 | 6,350,877 | ||||||

| New York City, New York Series I-1 5.375% 4/1/36 | 5,000,000 | 5,359,550 | ||||||

| Powell, Ohio 5.50% 12/1/32 (NATL-RE) (FGIC) | 2,000,000 | 2,091,720 | ||||||

| 29,775,984 | ||||||||

| §Pre-Refunded/Escrowed to Maturity Bonds – 10.44% | ||||||||

| Cape Girardeau County, Missouri Industrial Development | ||||||||

Authority Health Care Facilities Revenue (Southeast | ||||||||

Missouri Hospital) 5.25% 6/1/16 (NATL-RE) | 375,000 | 418,178 | ||||||

| Duluth, Minnesota Economic Development Authority Health | ||||||||

Care Facilities Revenue (Benedictine Health System - | ||||||||

St. Mary’s Hospital) 5.25% 2/15/33-14 | 4,000,000 | 4,472,840 | ||||||

| Golden State, California Tobacco Securitization Corporation | ||||||||

Settlement Revenue Series B 5.625% 6/1/38-13 | 7,500,000 | 8,187,900 | ||||||

| ^ | Greene County, Missouri Single Family Mortgage Revenue | |||||||

Municipal Multiplier (Private Mortgage Insurance) | ||||||||

6.10% 3/1/16 | 1,225,000 | 1,151,745 | ||||||

| Henrico County, Virginia Economic Development Authority | ||||||||

Revenue (Bon Secours Health System) | ||||||||

Series A 5.60% 11/15/30-12 | 130,000 | 138,358 | ||||||

| Illinois Educational Facilities Authority Student Housing | ||||||||

Revenue (Educational Advancement Fund - University | ||||||||

Center Project) 6.25% 5/1/30-12 | 5,000,000 | 5,251,300 | ||||||

28

| Principal amount | Value | |||||||

| Municipal Bonds (continued) | ||||||||

| §Pre-Refunded/Escrowed to Maturity Bonds (continued) | ||||||||

| Linn County, Oregon Community School District #9 | ||||||||

Lebanon 5.60% 6/15/30-13 (FGIC) | $ | 2,000,000 | $ | 2,190,060 | ||||

| Louisiana Public Facilities Authority Hospital Revenue | ||||||||

(Southern Baptist Hospital, Inc. Project) 8.00% 5/15/12 | 970,000 | 1,019,887 | ||||||

| Maryland State Economic Development Corporation, | ||||||||

Student Housing Revenue (University of Maryland | ||||||||

College Park Project) 5.625% 6/1/35-13 | 1,125,000 | 1,229,231 | ||||||

| Michigan State Hospital Finance Authority Revenue | ||||||||

(Trinity Health) 5.375% 12/1/30-12 | 380,000 | 404,130 | ||||||

| Milledgeville-Baldwin County, Georgia Development | ||||||||

Authority Revenue (Georgia College & State University | ||||||||

Foundation Student Housing Project) 6.00% 9/1/33-14 | 1,000,000 | 1,173,120 | ||||||

| New Jersey State Educational Facilities Authority Revenue | ||||||||

(Stevens Institute of Technology) Series B 5.25% 7/1/24-14 | 2,085,000 | 2,362,326 | ||||||

| New Jersey State Highway Authority Garden State Parkway | ||||||||

General Revenue (Senior Parkway) | ||||||||

5.50% 1/1/14 (FGIC) | 5,000,000 | 5,602,200 | ||||||

5.50% 1/1/16 (FGIC) | 1,000,000 | 1,210,470 | ||||||

| New York City, New York | ||||||||

Series I 5.125% 3/1/23-13 | 5,875,000 | 6,304,639 | ||||||

Series J 5.25% 6/1/28-13 | 1,495,000 | 1,625,573 | ||||||

| North Carolina Medical Care Commission Hospital Revenue | ||||||||

(Northeast Medical Center Project) 5.125% 11/1/34-14 | 1,250,000 | 1,435,575 | ||||||

| Oklahoma State Turnpike Authority Revenue (First Senior) | ||||||||

6.00% 1/1/22 | 13,535,000 | 17,992,210 | ||||||

| University of the Virgin Islands Series A 5.375% 6/1/34-14 | 500,000 | 572,975 | ||||||

| Virgin Islands Public Finance Authority Revenue | ||||||||

Series A 7.30% 10/1/18 | 2,020,000 | 2,477,328 | ||||||

| Wisconsin Housing & Economic Developing Authority | ||||||||

Revenue 6.10% 6/1/21-17 (FHA) | 600,000 | 723,546 | ||||||

| 65,943,591 | ||||||||

| Special Tax Revenue Bonds – 13.74% | ||||||||

| Brooklyn Arena Local Development Corporation, New York | ||||||||

Pilot Revenue (Barclays Center Project) 6.50% 7/15/30 | 8,230,000 | 8,657,218 | ||||||

| California State Economic Recovery | ||||||||

Series A 5.25% 7/1/21 | 3,130,000 | 3,683,979 | ||||||

| Florida Enterprise Community Development District Special | ||||||||

Assessment 6.10% 5/1/16 (NATL-RE) | 595,000 | 597,505 | ||||||

29

Statements of net assets

Delaware Tax-Free USA Fund

Delaware Tax-Free USA Fund

| Principal amount | Value | |||||||

| Municipal Bonds (continued) | ||||||||

| Special Tax Revenue Bonds (continued) | ||||||||

| Henderson, Nevada Local Improvement | ||||||||

| Districts #T-18 5.30% 9/1/35 | $ | 2,310,000 | $ | 1,208,176 | ||||

| Hollywood, Florida Community Redevelopment Agency | ||||||||

| Revenue (Beach CRA) 5.625% 3/1/24 | 1,200,000 | 1,241,448 | ||||||

| Jacksonville, Florida Excise Taxes Revenue | ||||||||

| Series B 5.00% 10/1/26 (AMBAC) | 1,000,000 | 1,032,360 | ||||||

| Lammersville, California School District Community Facilities | ||||||||

| District #2002 (Mountain House) 5.125% 9/1/35 | 4,125,000 | 3,484,429 | ||||||

| Middlesex County, New Jersey Improvement Authority Senior | ||||||||

| Revenue (Heldrich Center Hotel/Conference Project) Series A | ||||||||

| 5.00% 1/1/32 | 1,500,000 | 850,050 | ||||||

| 5.125% 1/1/37 | 1,500,000 | 850,110 | ||||||

| Missouri State Environmental Improvement & Energy Water | ||||||||

| Pollution Control Revenue (State Revolving Fund Project) | ||||||||

| Series A 6.05% 7/1/16 (AGM) | 705,000 | 708,187 | ||||||

| Missouri State Highways & Transportation Commission State | ||||||||

| Road Revenue Series B 5.00% 5/1/24 | 9,000,000 | 10,126,439 | ||||||

| Mosaic, Virginia District Community Development Authority | ||||||||

| Revenue Series A 6.875% 3/1/36 | 3,980,000 | 4,124,474 | ||||||

| New Jersey Economic Development Authority Revenue | ||||||||

| (Cigarette Tax) 5.75% 6/15/34 | 1,935,000 | 1,804,755 | ||||||