Powering Growth, Delivering Value EEI Financial Conference l November 6-9, 2016 POWERING GROWTH DELIVERING VALUE

Powering Growth, Delivering Value2 FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining high reliability and customer service levels; variations in demand for electricity, including those due to weather seasonality, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, including in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

Powering Growth, Delivering Value3 PINNACLE WEST: WHO WE ARE We are a vertically integrated, regulated electric utility in the growing southwest United States Pinnacle West (NYSE: PNW) - Market Capitalization*: $8.5 billion - Enterprise Value*: $12.8 billion - Consolidated Assets: $15.5 billion - Indicated Annual Dividend*: $2.62 - Dividend Yield*: 3.4% Principal subsidiary: - Arizona Public Service Company, Arizona’s largest and longest-serving electric utility Customers: 1.2 million (89% residential) 2016 Peak Demand: 7,051 MW - All time high of 7,236 in July 2006 Generation Capacity: About 6,200 MW of owned or leased capacity (~8,600 MW with long-term contracts) - Including 29.1% interest in Palo Verde Nuclear Generating Station, the largest in the U.S. - Regulated utility provides stable, regulated earnings and cash flow base for Pinnacle West * As of October 31, 2016

Powering Growth, Delivering Value4 • Consolidated earned ROE more than 9.5% (weather-normalized) through 2016 • Annual dividend growth target of 5%, subject to declaration at Board of Director’s discretion • Strong credit ratings and balance sheet • Rate base growth of 6-7% (2015-2019); investing in a portfolio that is flexible, responsive, reliable and cost-effective Financial Strength • Arizona’s long-term growth fundamentals remain largely intact, including population growth, job growth and economic development Leverage to Economic Growth • Top quartile ratings in Power Quality and Reliability and Safety • APS operates the Palo Verde Nuclear Generating Station, the largest nuclear plant in the United States • Disciplined cost management Operational Excellence VALUE PROPOSITION • At the forefront of utilities studying and deploying advanced infrastructure to enable reliable and cost-efficient integration of emerging technologies into the grid and with customers Modern Grid • Working with Arizona Corporation Commission and key stakeholders to modernize rates Proactively Addressing Rate Design We are executing on our financial and operational objectives … … while also advocating to ensure Pinnacle West and Arizona have a sustainable energy future

Powering Growth, Delivering Value5 2016 HIGHLIGHTS & ACCOMPLISHMENTS Increased indicated annual dividend for fifth straight year, by 5% Began construction on the $500M Ocotillo Modernization Project, including air permit approval Completed major outages on Four Corners Units 4 and 5 and on-track with $400M SCR installation Developed 37MW of Microgrids, including 25MW for the Department of the Navy at Yuma Marine Corp Air Station Joined the CAISO Energy Imbalance Market, with go live operations effective October 1st On track for installation of our Advanced Distribution Management System, including advanced grid technology installations Completed development and entered testing phase of our new CIS system Launched a new customer mobile app Ranked in the top 10 nationally among large IOUs in the 2016 JD Power residential customer satisfaction survey for Power Quality and Reliability Completed the installation of 1,600 utility-owned residential rooftop solar systems Completed 3 new transmission lines worth $146.5M investment Successfully completed both Spring and Fall outages at Palo Verde Nuclear Generating Station Palo Verde site average capacity factor maintained above 95% Filed our first rate review in 5 years; proposing industry leading rate design Completed hearings on the Value and Cost of Distributed Generation generic docket and preparing for a final decision

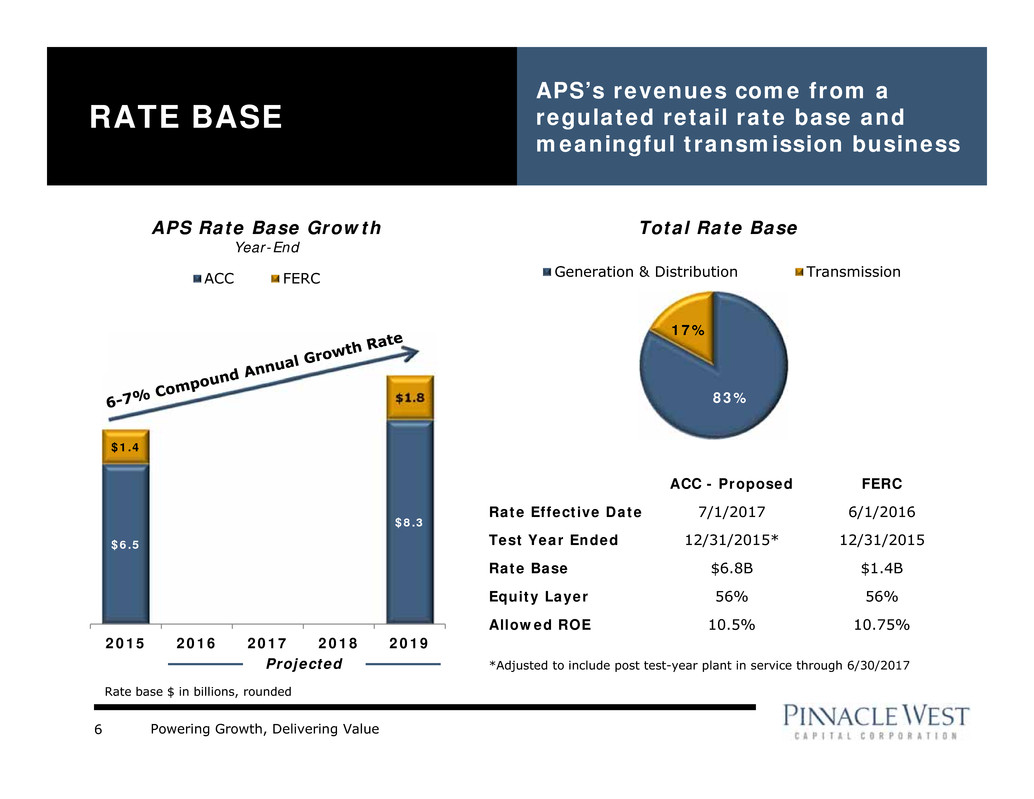

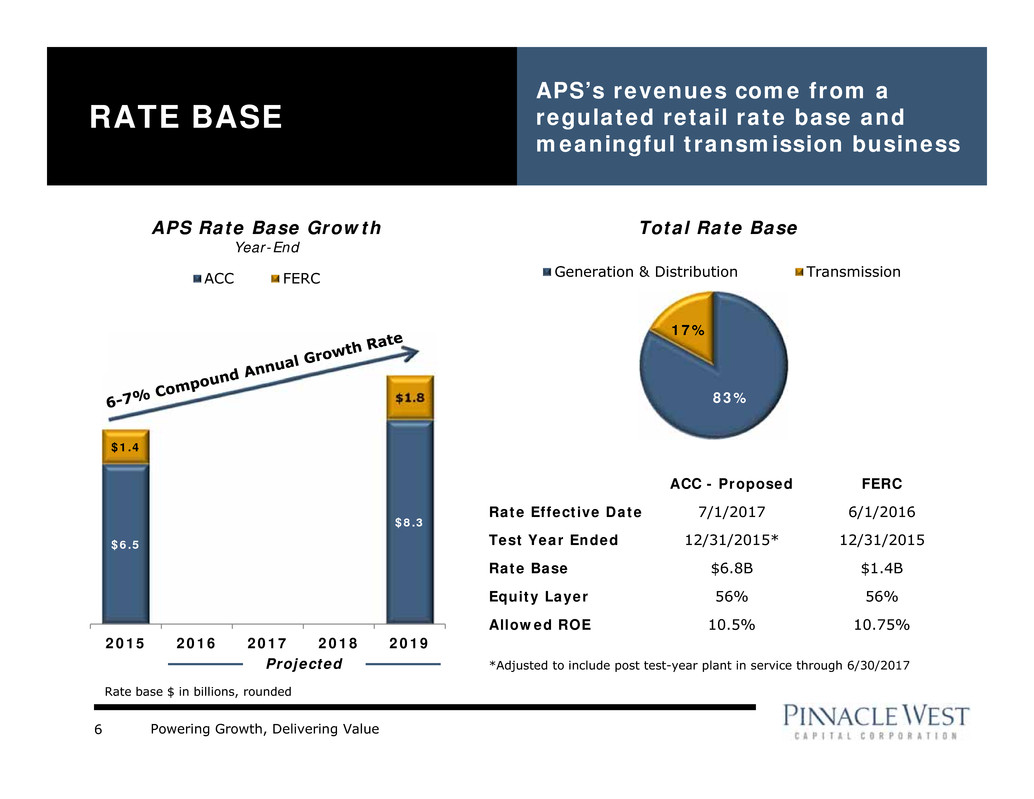

Powering Growth, Delivering Value6 RATE BASE APS’s revenues come from a regulated retail rate base and meaningful transmission business $6.5 $8.3 $1.4 $1.8 2015 2016 2017 2018 2019 APS Rate Base Growth Year-End ACC FERC Total Rate Base Projected Most Recent Rate Decisions ACC - Proposed FERC Rate Effective Date 7/1/2017 6/1/2016 Test Year Ended 12/31/2015* 12/31/2015 Rate Base $6.8B $1.4B Equity Layer 56% 56% Allowed ROE 10.5% 10.75% *Adjusted to include post test-year plant in service through 6/30/2017 83% 17% Generation & Distribution Transmission Rate base $ in billions, rounded

Powering Growth, Delivering Value7 $263 $223 $220 $279 $66 $77 $234 $117 $44 $224 $197 $103 $58 $104 $1 $1 $201 $136 $211 $136 $340 $380 $399 $411 $85 $89 $75 $77 2015 2016 2017 2018 CAPITAL EXPENDITURES Capital expenditures are funded primarily through internally generated cash flow ($ Millions) $1,233 $1,337 Other Distribution Transmission Renewable Generation Environmental(1) Traditional Generation Projected $1,124 New Gas Generation(2) $1,057 • The table does not include capital expenditures related to 4CA’s 7% interest in Four Corners Units 4 and 5 of $3 million in 2015, $30 million in 2016 and $27 million in 2017. • 2016 – 2018 as disclosed in Third Quarter 2016 Form 10-Q. (1) Includes Selective Catalytic Reduction controls at Four Corners with in-service dates of Q4 2017 (Unit 5) and Q1 2018 (Unit 4) (2) Ocotillo Modernization Project: 2 units scheduled for completion in Q4 2018, 3 units schedule for completion in Q1 2019

Powering Growth, Delivering Value8 RESOURCE PLANNING Future resources need projected in excess of 3,500 MW by 2022 and over 5,400 MW by 2027 Gas Coal Nuclear RE + DE EE Composition of Energy Mix by Resource* 36% 14%18% 18% 14%2032 Note: RE = Renewable Energy; DE = Distributed Energy; EE = Energy Efficiency *Data shown is based on the Updated 2017 Preliminary Integrated Resource Plan filed September 30, 2016. - 2,000 4,000 6,000 8,000 10,000 12,000 14,000 2017 2019 2021 2023 2025 2027 2029 2031 Existing Contracts Future Grid-Scale Generation Total Load Requirements MW Existing Owned Resources 2017-2032 Supply / Demand Gap 23% 27%26% 11% 13%2017

Powering Growth, Delivering Value9 ECONOMIC INDICATORS Arizona and Metro Phoenix remain attractive places to live and do business Single Family & Multifamily Housing Permits Maricopa County Above-average job growth in construction, financial services and wholesale trade sectors Arizona ranked 1st for projected job growth - Forbes September 2015 E Metro Phoenix growth rate 3rd fastest among top 15 metro areas - U.S. Census Bureau March 2016 Housing construction on pace to have its best year since 2007 Vacancy rates in office and retail space have fallen to pre-recessionary levels 0% 5% 10% 15% 20% 25% '07 '08 '09 '10 '11 '12 '13 '14 '15 16 Nonresidential Building Vacancy – Metro Phoenix Vacancy Rate Office Retail Industrial 3Q 0 10,000 20,000 30,000 40,000 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Single Family Multifamily

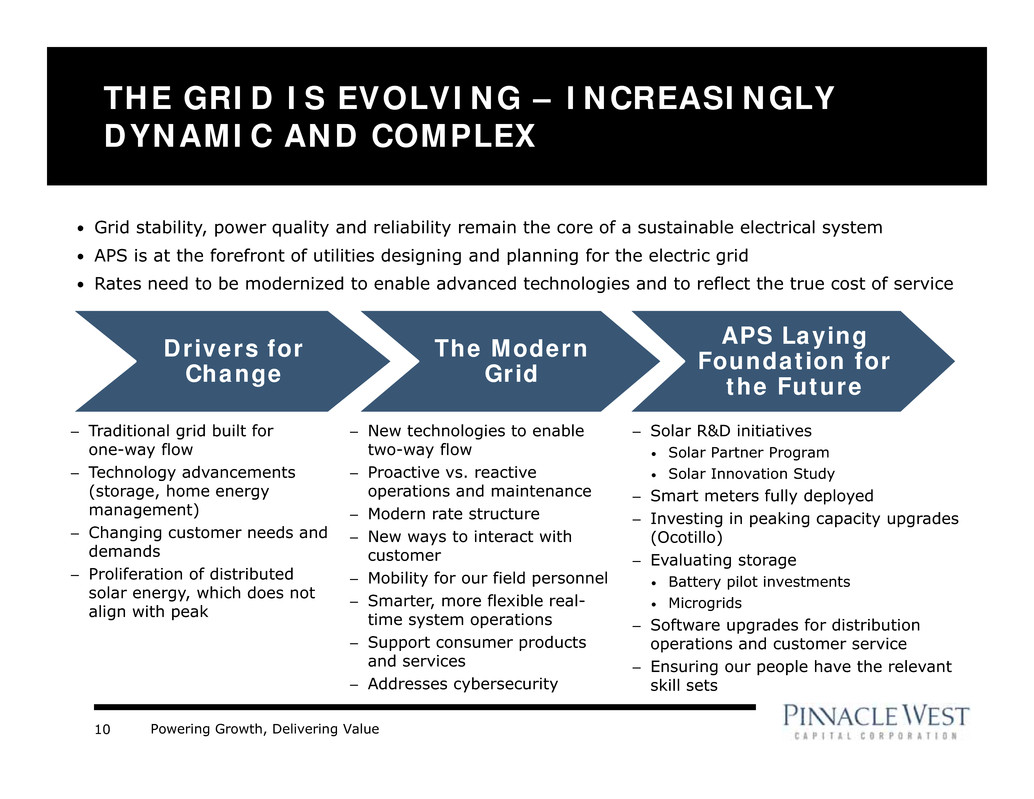

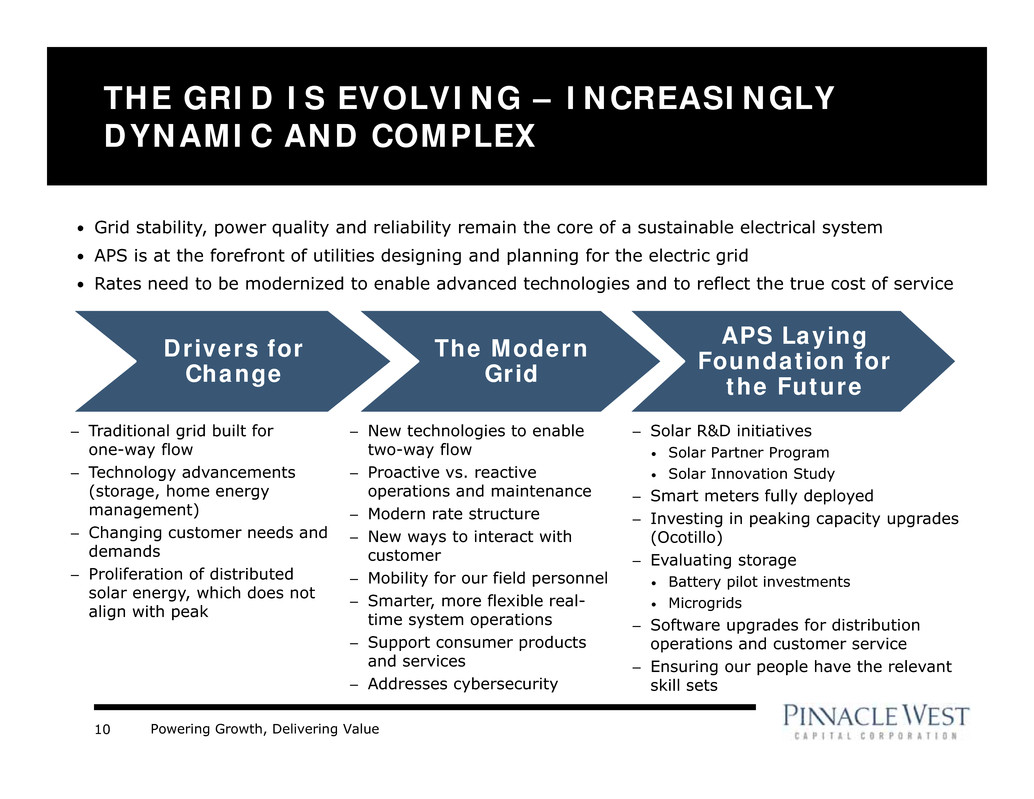

Powering Growth, Delivering Value10 THE GRID IS EVOLVING – INCREASINGLY DYNAMIC AND COMPLEX Drivers for Change – Traditional grid built for one-way flow – Technology advancements (storage, home energy management) – Changing customer needs and demands – Proliferation of distributed solar energy, which does not align with peak The Modern Grid – New technologies to enable two-way flow – Proactive vs. reactive operations and maintenance – Modern rate structure – New ways to interact with customer – Mobility for our field personnel – Smarter, more flexible real- time system operations – Support consumer products and services – Addresses cybersecurity APS Laying Foundation for the Future – Solar R&D initiatives • Solar Partner Program • Solar Innovation Study – Smart meters fully deployed – Investing in peaking capacity upgrades (Ocotillo) – Evaluating storage • Battery pilot investments • Microgrids – Software upgrades for distribution operations and customer service – Ensuring our people have the relevant skill sets • Grid stability, power quality and reliability remain the core of a sustainable electrical system • APS is at the forefront of utilities designing and planning for the electric grid • Rates need to be modernized to enable advanced technologies and to reflect the true cost of service

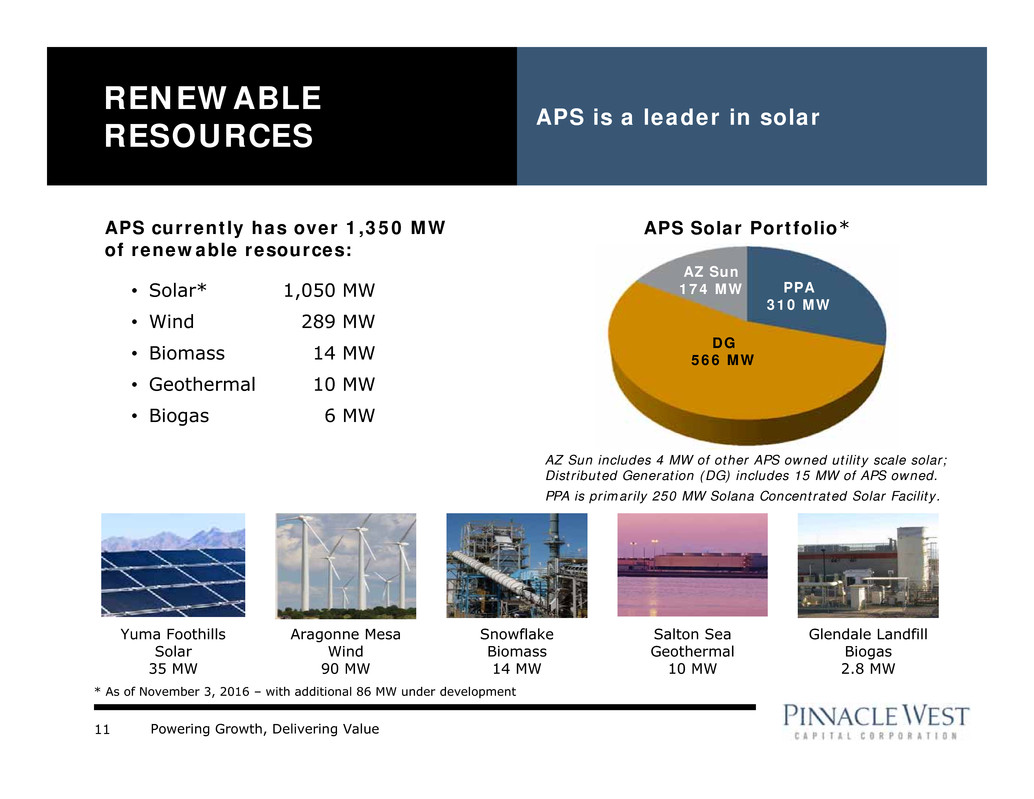

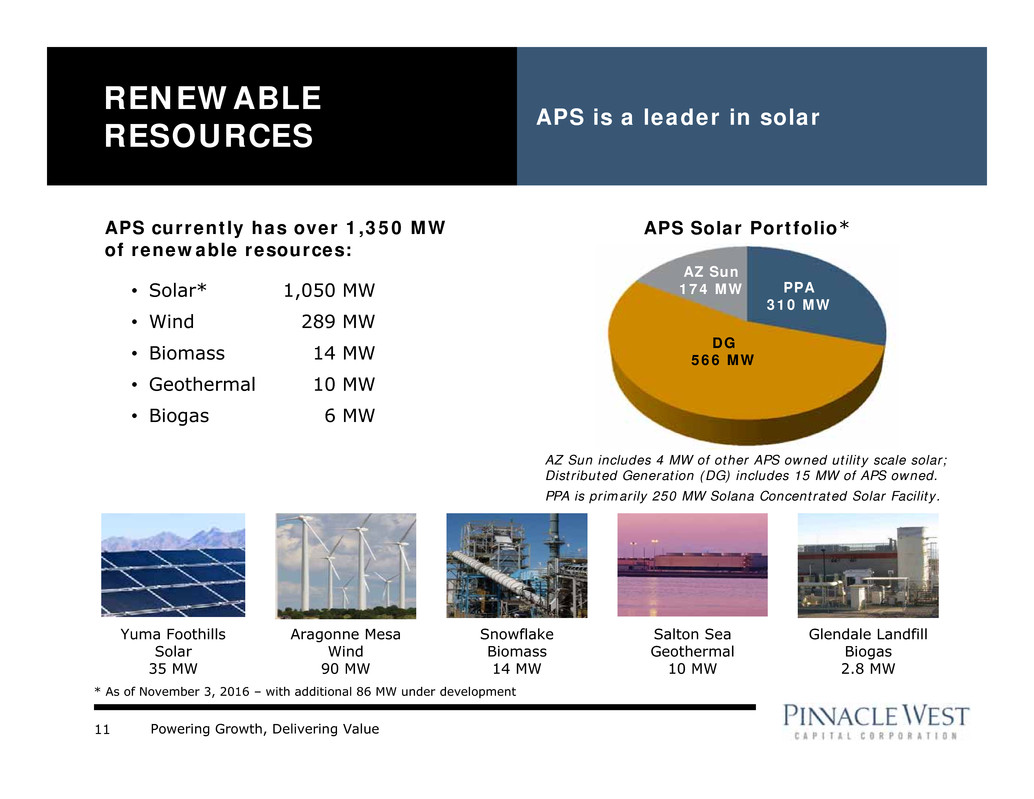

Powering Growth, Delivering Value11 RENEWABLE RESOURCES APS is a leader in solar Aragonne Mesa Wind 90 MW Snowflake Biomass 14 MW Glendale Landfill Biogas 2.8 MW Salton Sea Geothermal 10 MW • Solar* 1,050 MW • Wind 289 MW • Biomass 14 MW • Geothermal 10 MW • Biogas 6 MW APS currently has over 1,350 MW of renewable resources: AZ Sun includes 4 MW of other APS owned utility scale solar; Distributed Generation (DG) includes 15 MW of APS owned. PPA is primarily 250 MW Solana Concentrated Solar Facility. PPA 310 MW DG 566 MW AZ Sun 174 MW * As of November 3, 2016 – with additional 86 MW under development APS Solar Portfolio* Yuma Foothills Solar 35 MW

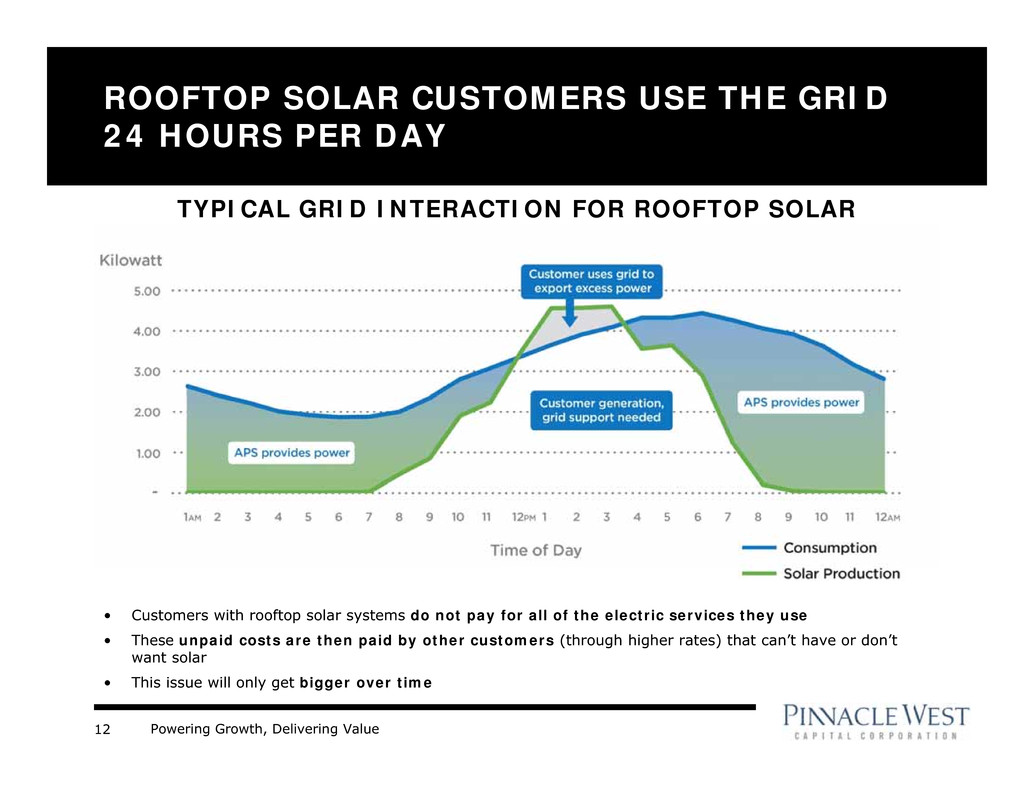

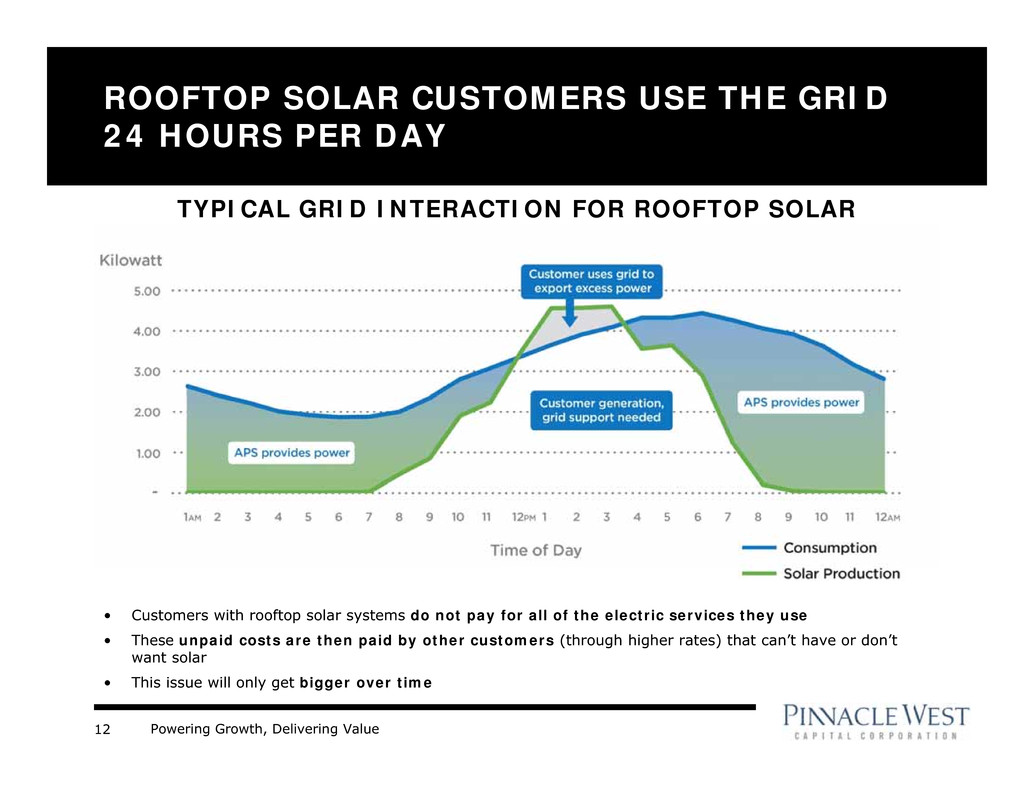

Powering Growth, Delivering Value12 ROOFTOP SOLAR CUSTOMERS USE THE GRID 24 HOURS PER DAY TYPICAL GRID INTERACTION FOR ROOFTOP SOLAR • Customers with rooftop solar systems do not pay for all of the electric services they use • These unpaid costs are then paid by other customers (through higher rates) that can’t have or don’t want solar • This issue will only get bigger over time

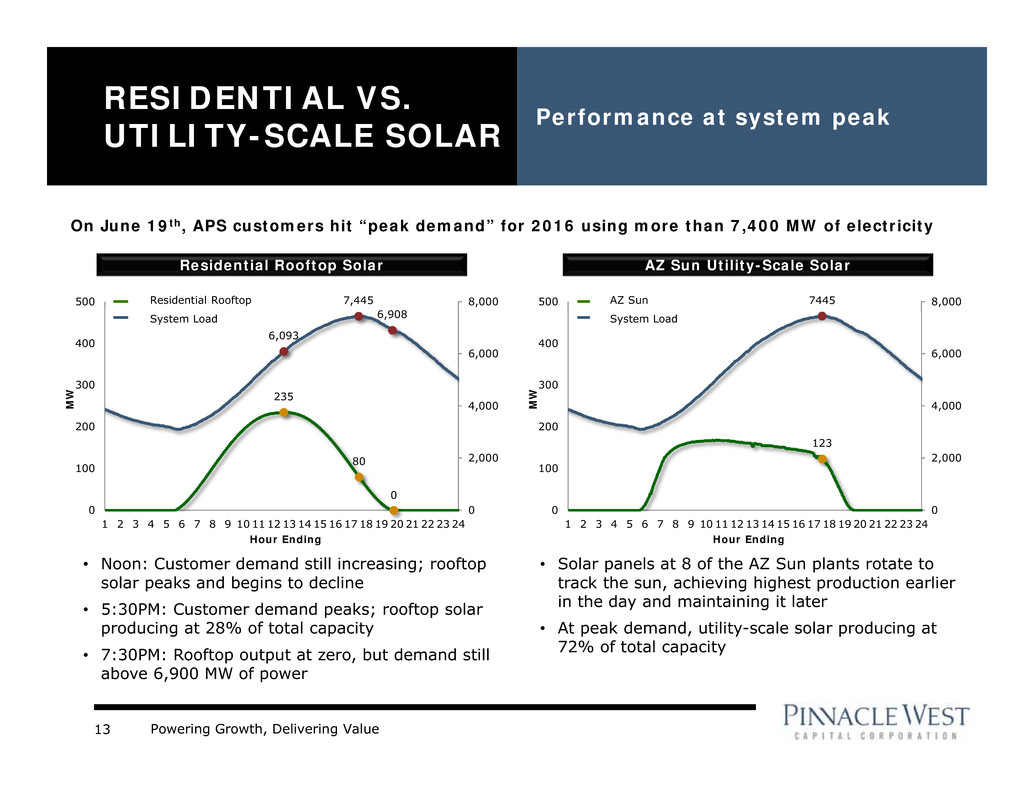

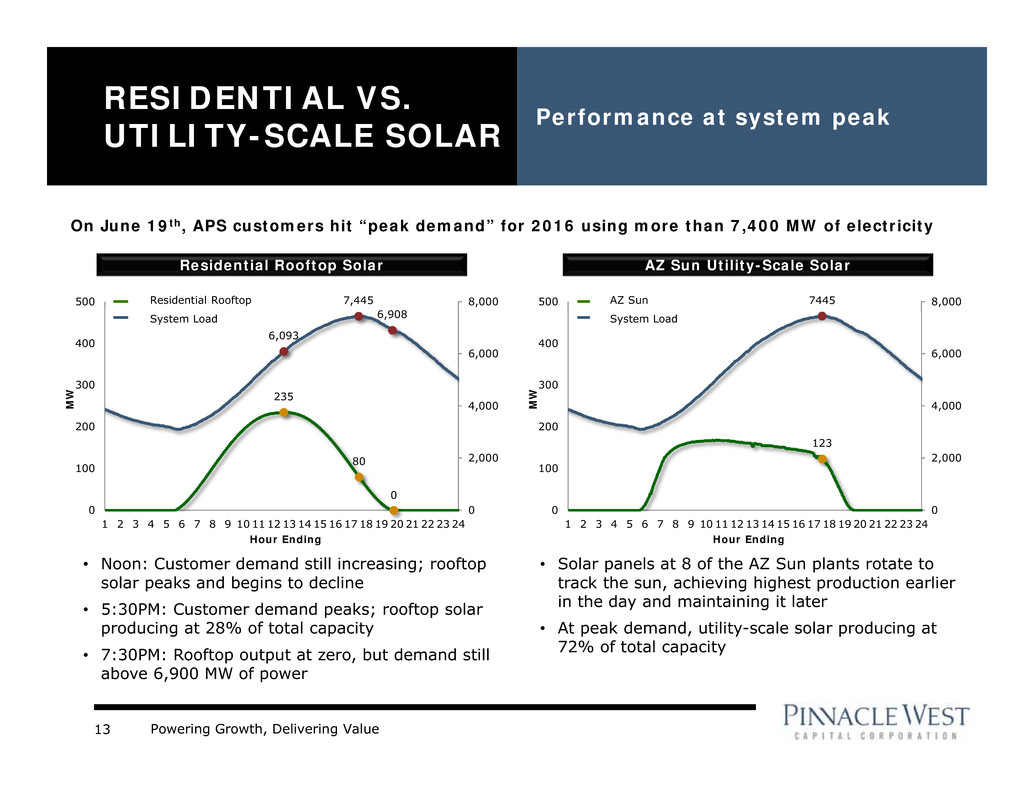

Powering Growth, Delivering Value13 RESIDENTIAL VS. UTILITY-SCALE SOLAR Performance at system peak On June 19th, APS customers hit “peak demand” for 2016 using more than 7,400 MW of electricity • Noon: Customer demand still increasing; rooftop solar peaks and begins to decline • 5:30PM: Customer demand peaks; rooftop solar producing at 28% of total capacity • 7:30PM: Rooftop output at zero, but demand still above 6,900 MW of power • Solar panels at 8 of the AZ Sun plants rotate to track the sun, achieving highest production earlier in the day and maintaining it later • At peak demand, utility-scale solar producing at 72% of total capacity Residential Rooftop Solar AZ Sun Utility-Scale Solar 235 80 0 6,093 7,445 6,908 0 2,000 4,000 6,000 8,000 0 100 200 300 400 500 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 M W Hour Ending 123 7445 0 2,000 4,000 6,000 8,000 0 100 200 300 400 500 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 M W Hour Ending AZ Sun System Load Residential Rooftop System Load

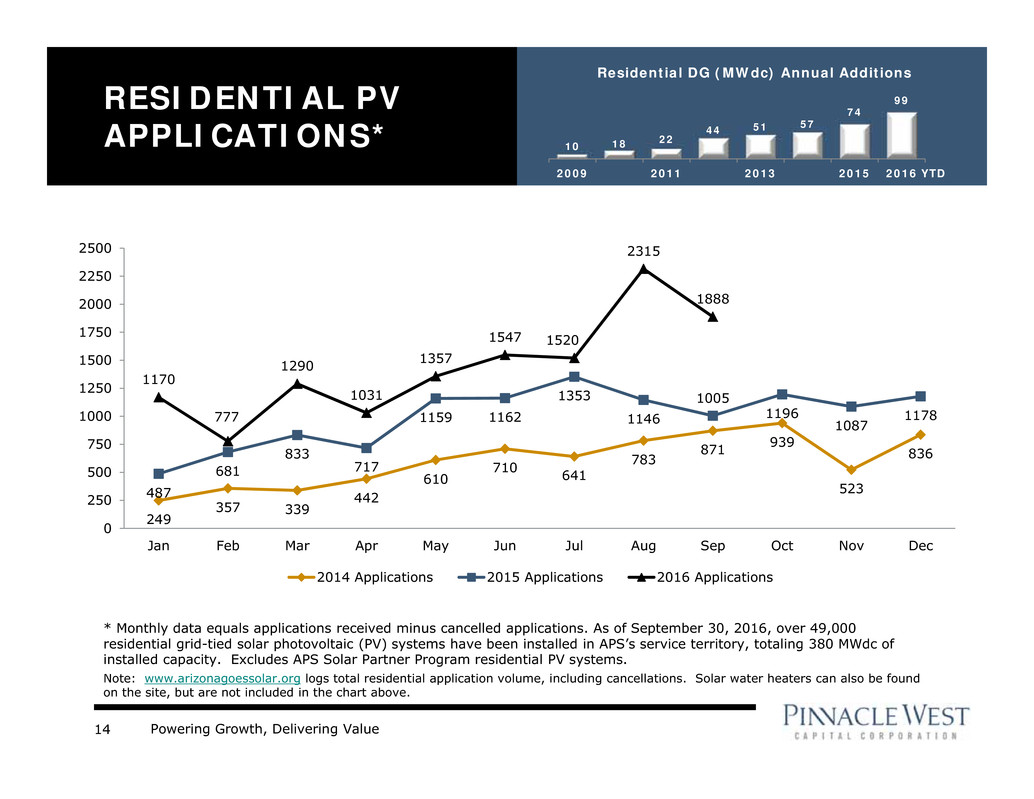

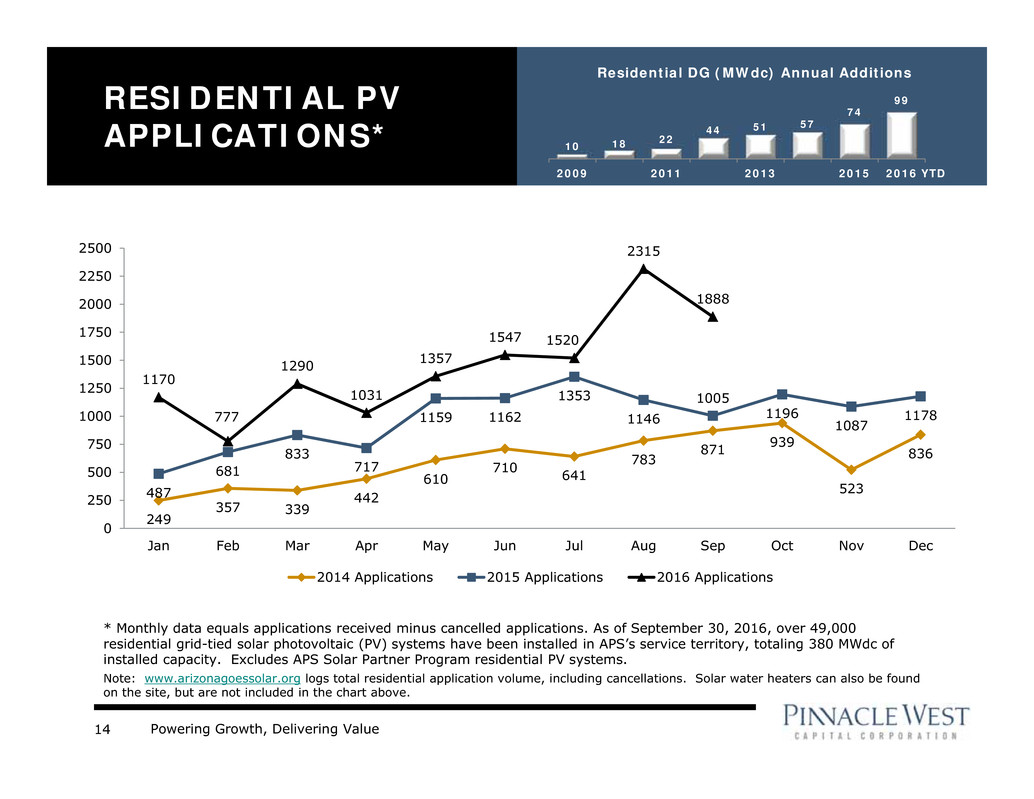

Powering Growth, Delivering Value14 249 357 339 442 610 710 641 783 871 939 523 836 487 681 833 717 1159 1162 1353 1146 1005 1196 1087 1178 1170 777 1290 1031 1357 1547 1520 2315 1888 0 250 500 750 1000 1250 1500 1750 2000 2250 2500 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2014 Applications 2015 Applications 2016 Applications * Monthly data equals applications received minus cancelled applications. As of September 30, 2016, over 49,000 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling 380 MWdc of installed capacity. Excludes APS Solar Partner Program residential PV systems. Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site, but are not included in the chart above. RESIDENTIAL PV APPLICATIONS* 10 18 22 44 51 57 74 99 2009 2011 2013 2015 2016 Residential DG (MWdc) Annual Additions YTD

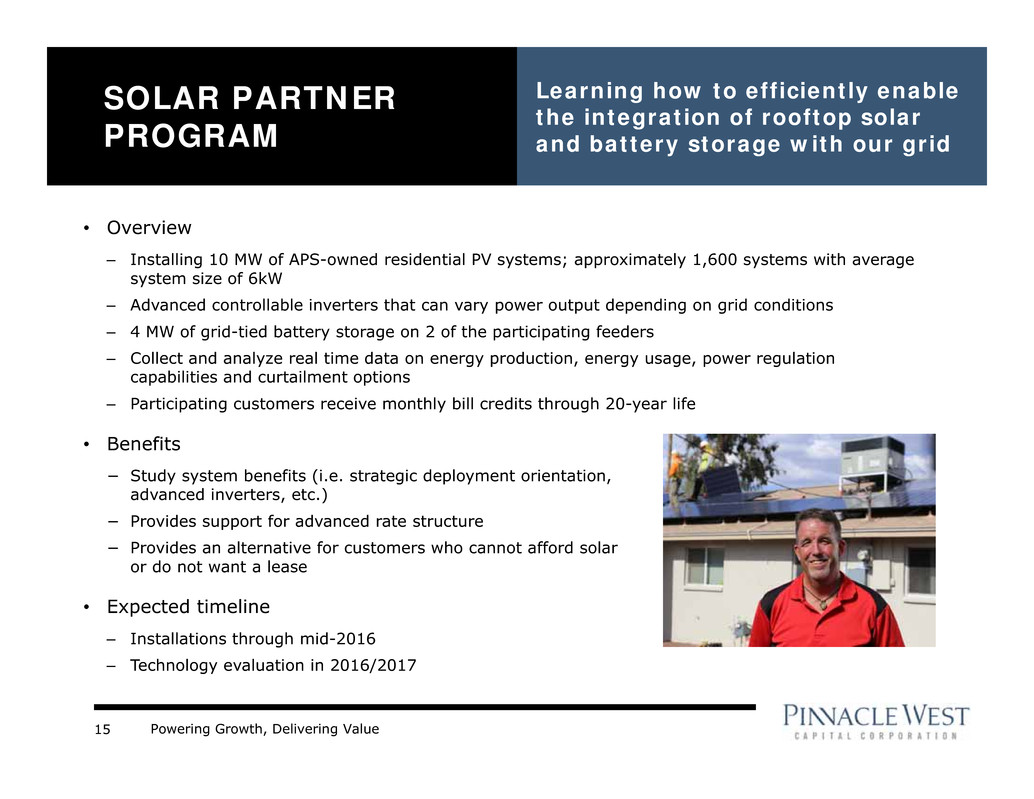

Powering Growth, Delivering Value15 SOLAR PARTNER PROGRAM Learning how to efficiently enable the integration of rooftop solar and battery storage with our grid • Overview – Installing 10 MW of APS-owned residential PV systems; approximately 1,600 systems with average system size of 6kW – Advanced controllable inverters that can vary power output depending on grid conditions – 4 MW of grid-tied battery storage on 2 of the participating feeders – Collect and analyze real time data on energy production, energy usage, power regulation capabilities and curtailment options – Participating customers receive monthly bill credits through 20-year life • Benefits − Study system benefits (i.e. strategic deployment orientation, advanced inverters, etc.) − Provides support for advanced rate structure − Provides an alternative for customers who cannot afford solar or do not want a lease • Expected timeline – Installations through mid-2016 – Technology evaluation in 2016/2017

Powering Growth, Delivering Value16 SOLAR INNOVATION STUDY Examining the integration of behind the meter advanced technologies with demand-based rates • Overview – Installing APS-owned residential PV systems on 75 homes with various configurations of battery storage, energy efficiency, demand controls and smart thermostats connected to a cloud based energy management system • Benefits – Identify effective technology packages that can shift load and minimize grid challenges – Gain insight into customer behavior and preferences in use of ‘next generation’ demand control and load shifting technologies – Identify strategies to support sustainable growth of renewable resources – Inform rate design in development of modernized demand based residential rates • Expected timeline – Design and installation in 2016/2017 – 5-year study

Powering Growth, Delivering Value17 • Total Capacity: 4,000 MW (3 units) – APS operated – APS share: 1,146 MW – Output: 32.5 million MWh in 2015 – Approximately 2,700 employees • Fukushima-related impacts – Project completed in Q2 2016 – Total Fukushima-related costs approximately $126 million (APS share is 29.1%) – National Strategic Alliance for FLEX Emergency Response (SAFER) Centers are located in Phoenix and Memphis, opened in 2014 PALO VERDE NUCLEAR GENERATING STATION Largest nuclear generating plant in the United States Palo Verde Phoenix Low risk of natural events at Palo Verde In Service License* Unit 1 1985 2045 Unit 2 1986 2046 Unit 3 1987 2047 * NRC approved 20-year license extensions in April 2011. Note: Each of the pressurized water reactor units has a planned refueling outage every 18 months (i.e. two total outages per year).

Powering Growth, Delivering Value 2016 APS RATE CASE

Powering Growth, Delivering Value19 Focus on Clean Energy Focus on Customers Focus on Innovation Focus on Sustainability • Generate power from diverse portfolio and support environmental improvements • Create sustainable path forward for flexible resource portfolio • Optimize customer service and reliability • Better align rates with the true cost of service • Provide rate gradualism and bill stability for customers by managing overall rate trajectory and the transition to new rate design • Prudently invest in new technologies • Implement new customer information system to enable adaptable customer programs and rates • Modernize rates to enable advanced technologies and grid services • Achieve an earned return that provides for financial stability and allows for sustainable investments in Arizona • Maintain structure of constructive regulatory support • Improve concurrent cost recovery of plant investments 2016 RATE CASE FRAMEWORK “A Bridge to the Future” Rate Case Objectives

Powering Growth, Delivering Value20 2016 APS RATE CASE APPLICATION • Filed June 1, 2016 • Propose new rates go into effect on July 1, 2017 • Docket Number: E-01345A-16-0036 • Additional details, including filing, can be found at http://www.azenergyfuture.com/rate-review/ Procedural Schedule Staff and Intervenor Direct Testimony (ex rate design) Staff and Intervenor Direct Testimony (rate design) APS Rebuttal Testimony Staff and Intervenor Surrebuttal Testimony Prehearing Conference APS Rejoinder Testimony Proposed Hearing Commencement Date December 21, 2016 January 27, 2017 February 17, 2017 March 10, 2017 March 13, 2017 March 17, 2017 March 22, 2017

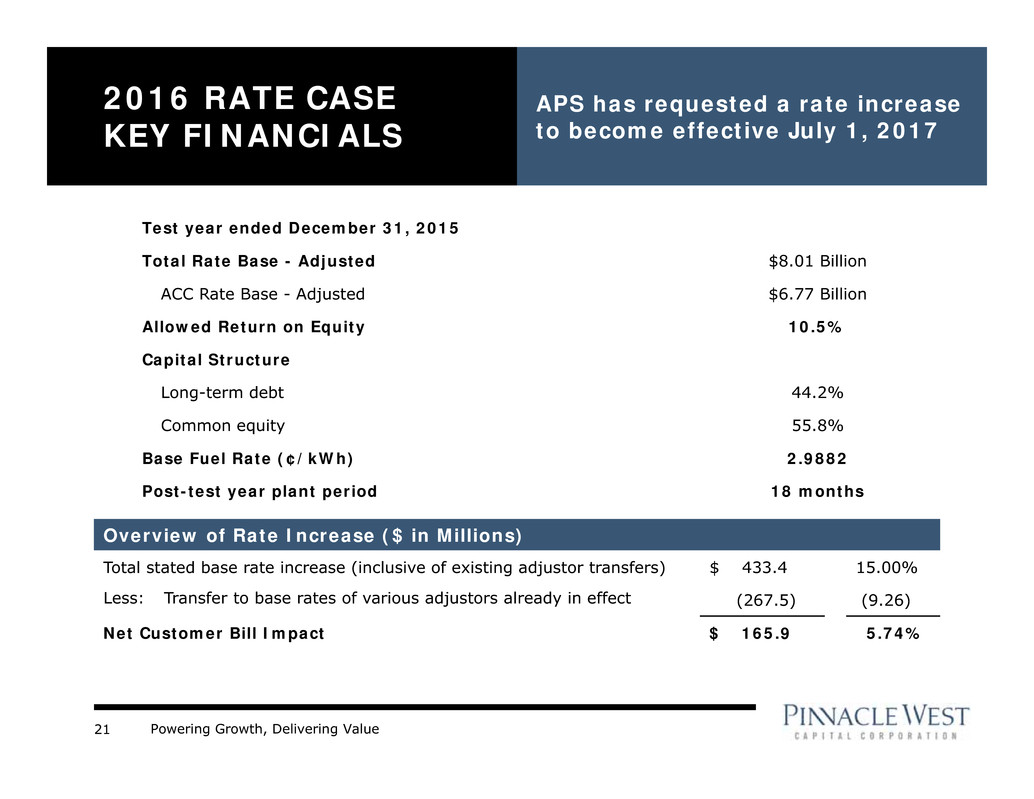

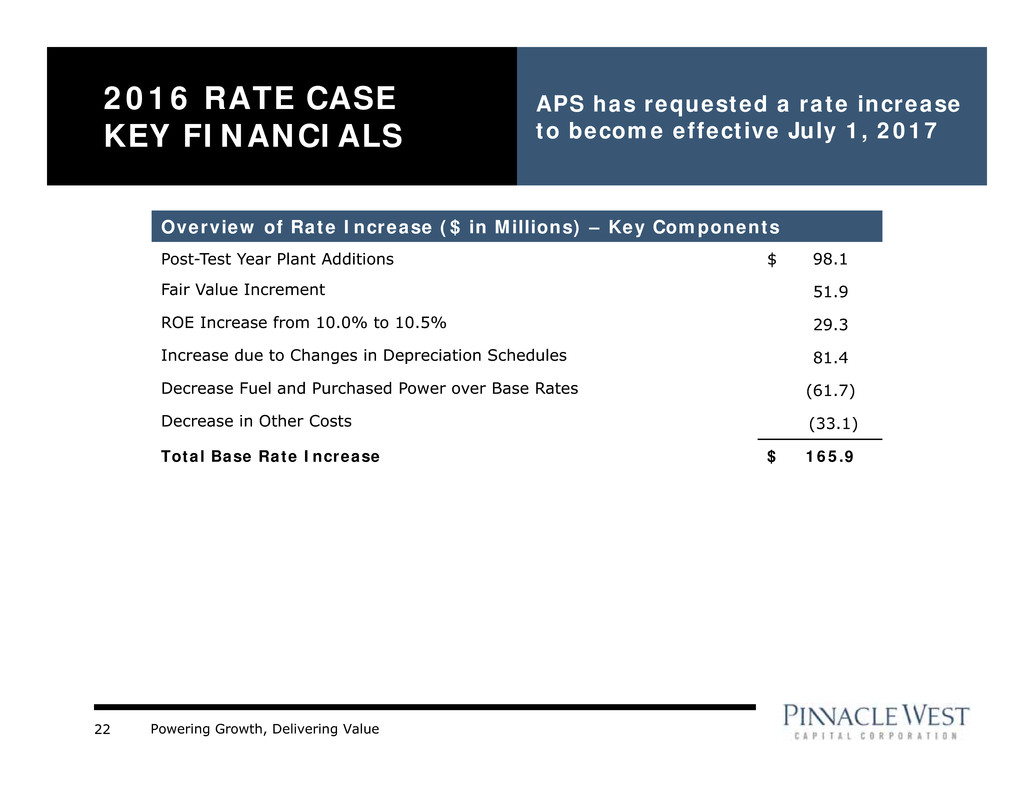

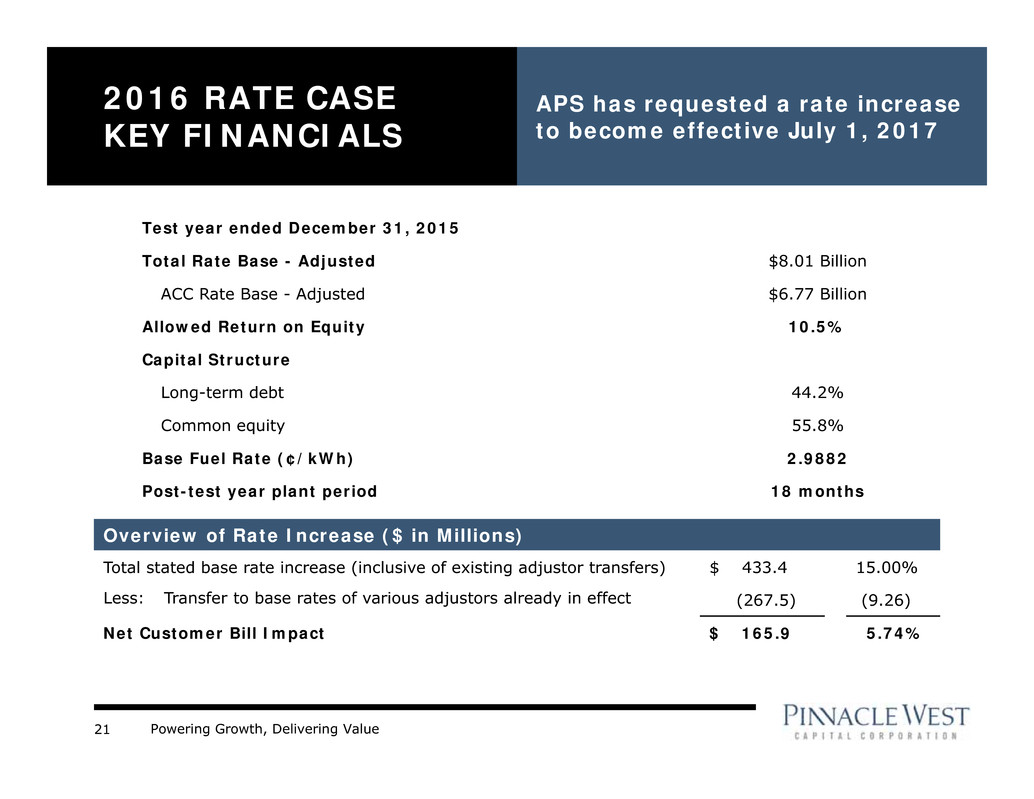

Powering Growth, Delivering Value21 2016 RATE CASE KEY FINANCIALS APS has requested a rate increase to become effective July 1, 2017 Test year ended December 31, 2015 Total Rate Base - Adjusted $8.01 Billion ACC Rate Base - Adjusted $6.77 Billion Allowed Return on Equity 10.5% Capital Structure Long-term debt 44.2% Common equity 55.8% Base Fuel Rate (¢/kWh) 2.9882 Post-test year plant period 18 months Overview of Rate Increase ($ in Millions) Total stated base rate increase (inclusive of existing adjustor transfers) $ 433.4 15.00% Less: Transfer to base rates of various adjustors already in effect (267.5) (9.26) Net Customer Bill Impact $ 165.9 5.74%

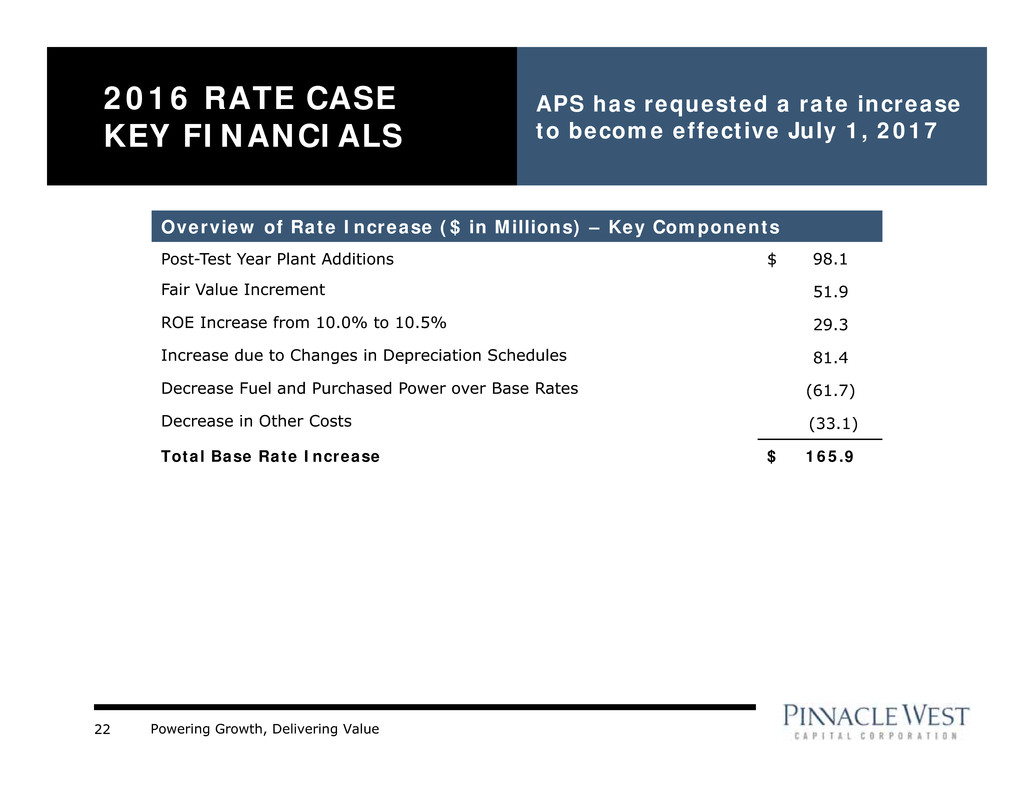

Powering Growth, Delivering Value22 2016 RATE CASE KEY FINANCIALS APS has requested a rate increase to become effective July 1, 2017 Overview of Rate Increase ($ in Millions) – Key Components Post-Test Year Plant Additions $ 98.1 Fair Value Increment 51.9 ROE Increase from 10.0% to 10.5% 29.3 Increase due to Changes in Depreciation Schedules 81.4 Decrease Fuel and Purchased Power over Base Rates (61.7) Decrease in Other Costs (33.1) Total Base Rate Increase $ 165.9

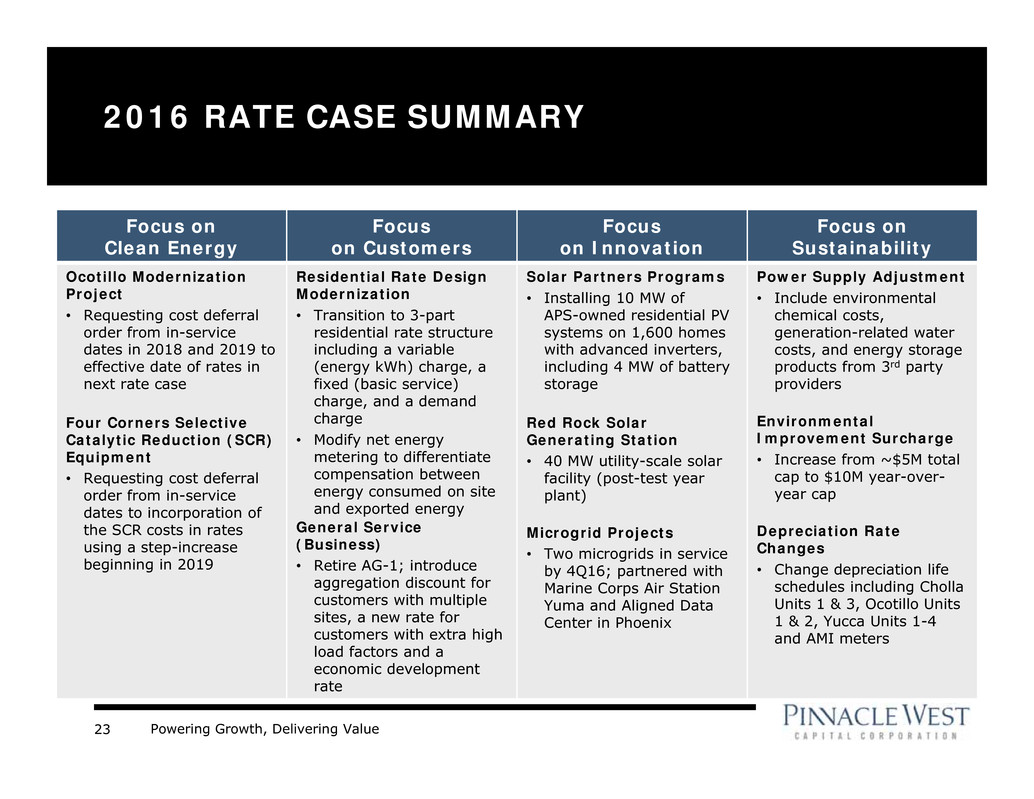

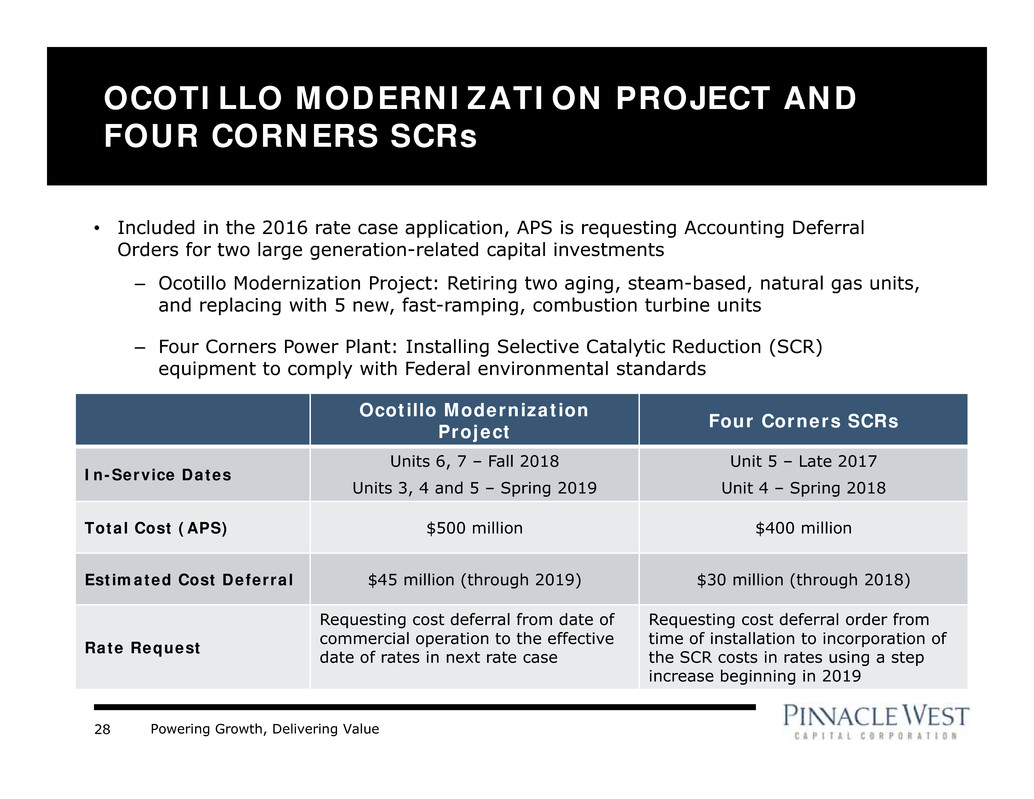

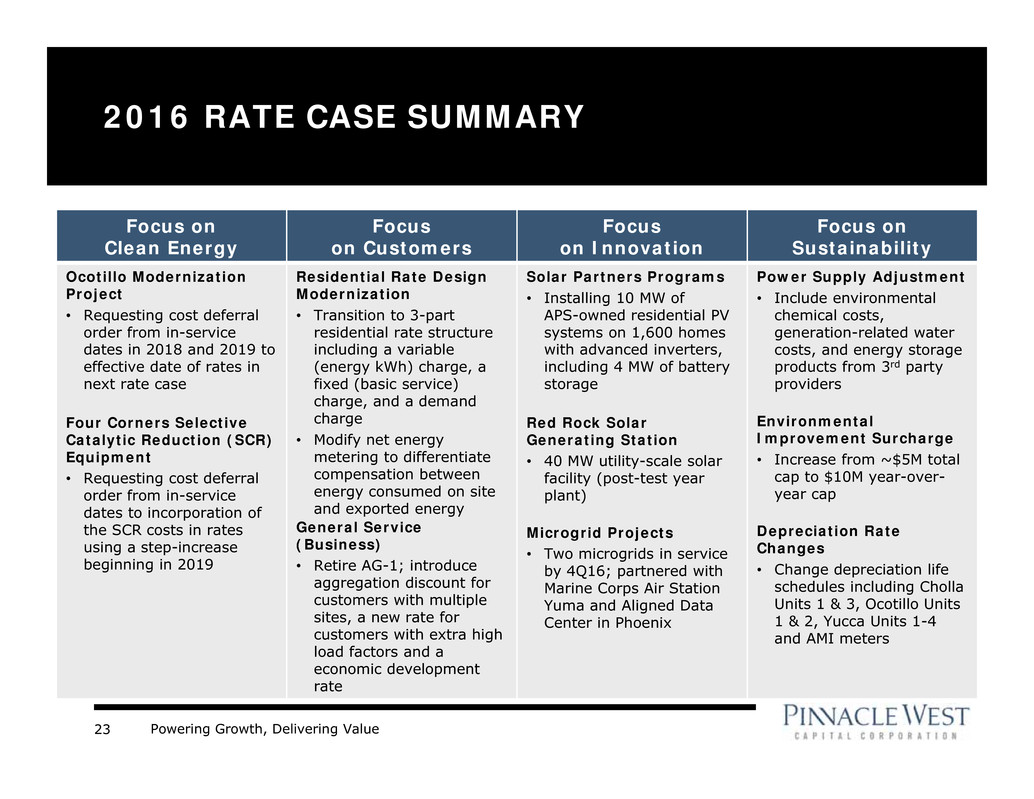

Powering Growth, Delivering Value23 2016 RATE CASE SUMMARY Focus on Clean Energy Focus on Customers Focus on Innovation Focus on Sustainability Ocotillo Modernization Project • Requesting cost deferral order from in-service dates in 2018 and 2019 to effective date of rates in next rate case Four Corners Selective Catalytic Reduction (SCR) Equipment • Requesting cost deferral order from in-service dates to incorporation of the SCR costs in rates using a step-increase beginning in 2019 Residential Rate Design Modernization • Transition to 3-part residential rate structure including a variable (energy kWh) charge, a fixed (basic service) charge, and a demand charge • Modify net energy metering to differentiate compensation between energy consumed on site and exported energy General Service (Business) • Retire AG-1; introduce aggregation discount for customers with multiple sites, a new rate for customers with extra high load factors and a economic development rate Solar Partners Programs • Installing 10 MW of APS-owned residential PV systems on 1,600 homes with advanced inverters, including 4 MW of battery storage Red Rock Solar Generating Station • 40 MW utility-scale solar facility (post-test year plant) Microgrid Projects • Two microgrids in service by 4Q16; partnered with Marine Corps Air Station Yuma and Aligned Data Center in Phoenix Power Supply Adjustment • Include environmental chemical costs, generation-related water costs, and energy storage products from 3rd party providers Environmental Improvement Surcharge • Increase from ~$5M total cap to $10M year-over- year cap Depreciation Rate Changes • Change depreciation life schedules including Cholla Units 1 & 3, Ocotillo Units 1 & 2, Yucca Units 1-4 and AMI meters

Powering Growth, Delivering Value24 APS COST OF SERVICE Appropriate to place residential solar customers into a unique sub-category of customers 108% 86% Percent of Cost to Serve* Residential Solar Customers Demand Rate 71% • Cost of service shows disparities in ratio of allocated costs to provide electric service, and what customer classes pay for the services received • Solar customers on an energy-based rate avoid approximately $72 per month based on proposed rates • Current rate structure results in 96% of customers paying more than they should to subsidize rooftop solar • APS is the first utility to conduct a full cost of service study considering solar customers as a separate class Energy Rate 38% Total General Service (Business) Customers Total Residential Customers * Test-year ended December 31, 2015 based on current rates

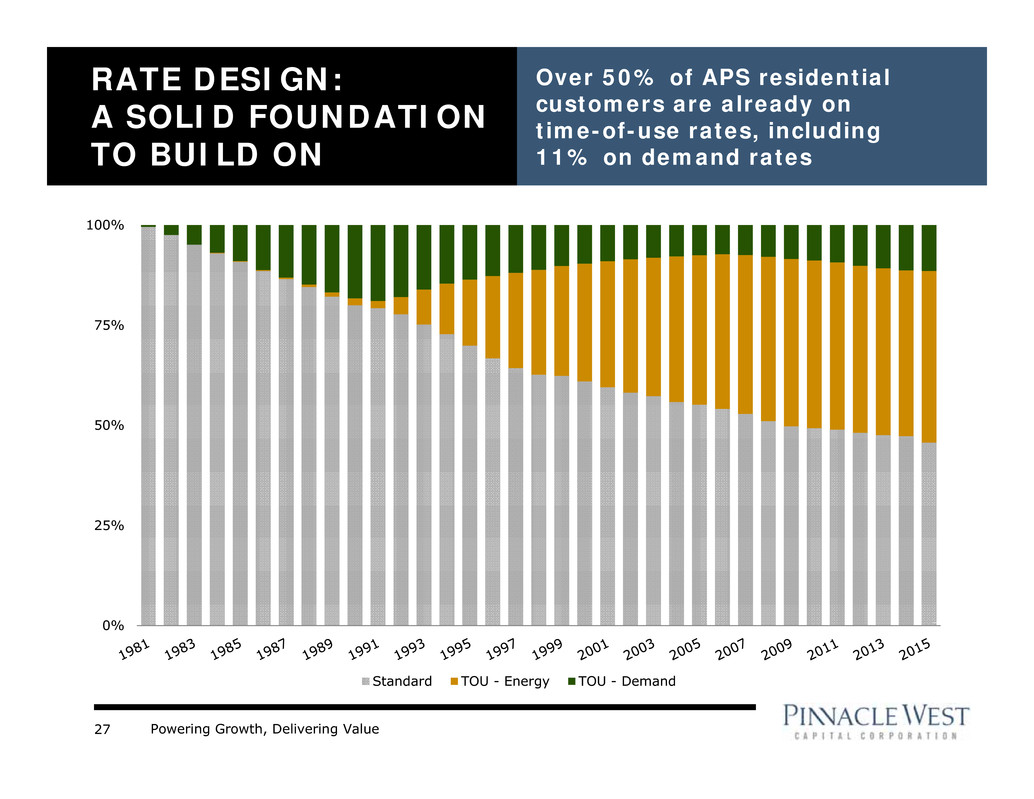

Powering Growth, Delivering Value25 Focus Area Current State Rate Case Objective Time-of-Use Rates (TOU) • > 50% of residential customers are on a TOU rate • On-peak hours from 12-7 PM (M-F) • TOU difference in on-peak prices that are 4 times the off-peak prices • Most residential customers on a TOU rate • On-peak hours from 3-8 PM (M-F) to better align with system peak • TOU difference in on-peak prices that are 2 times the off-peak prices Demand Rates • 11% of residential customers are on demand rates, more than any other electric utility • Most residential customers on demand rates • Calculated on the highest demand averaged over a one-hour period during the on-peak period each month Basic Service (Fixed) Charge • Customers pay basic service charge ranging from $8.67 - $16.91 per month • Set basic service charge for all rate classes ranging from $14 - $24 per month Net Metering • Excess power compensated at full retail price • Excess power compensated at export price aligned with avoided cost • Recovery of cost to purchase through existing PSA mechanism • Grandfather qualified rooftop solar customers Lost Fixed Cost Recovery (LFCR) • 1% year-over-year adjustment cap based on total revenues • Recovers portion of costs reduced by energy efficiency (EE) and distributed generation (DG) programs • Similar construct, but increase year-over-year adjustment cap to 2% based on total revenues • Increased portion of lost fixed costs eligible for recovery RATE DESIGN MODERNIZATION Rate design that better aligns pricing with cost to serve and leverages existing platform

Powering Growth, Delivering Value26 RATE DESIGN MODERNIZATION Key residential rate proposals designed to reduce cost shift among customers • Streamlined rate choices for residential customers including combinations of the following: – Reduced kWh charges for variable portion (energy rate) – Increased fixed charge component (basic service charge) – Variations of new demand (kW) charge applied to on-peak hours • Measured using a customer’s peak demand during on-peak hours (3-8 pm, Monday-Friday) • Peak demand then multiplied by a demand rate • Example: – 5kW demand during on-peak* – $6.60/kW demand rate (R-1 rate plan) – 5kW x $6.60 = $33.00 demand charge Variable Variable (energy rate per kWh) Fixed Fixed (basic service charge) Demand (demand rate per kW) Current Customer Bill Proposed Customer Bill * Peak demand is calculated on the highest demand averaged over a one-hour period during the on-peak period each month.

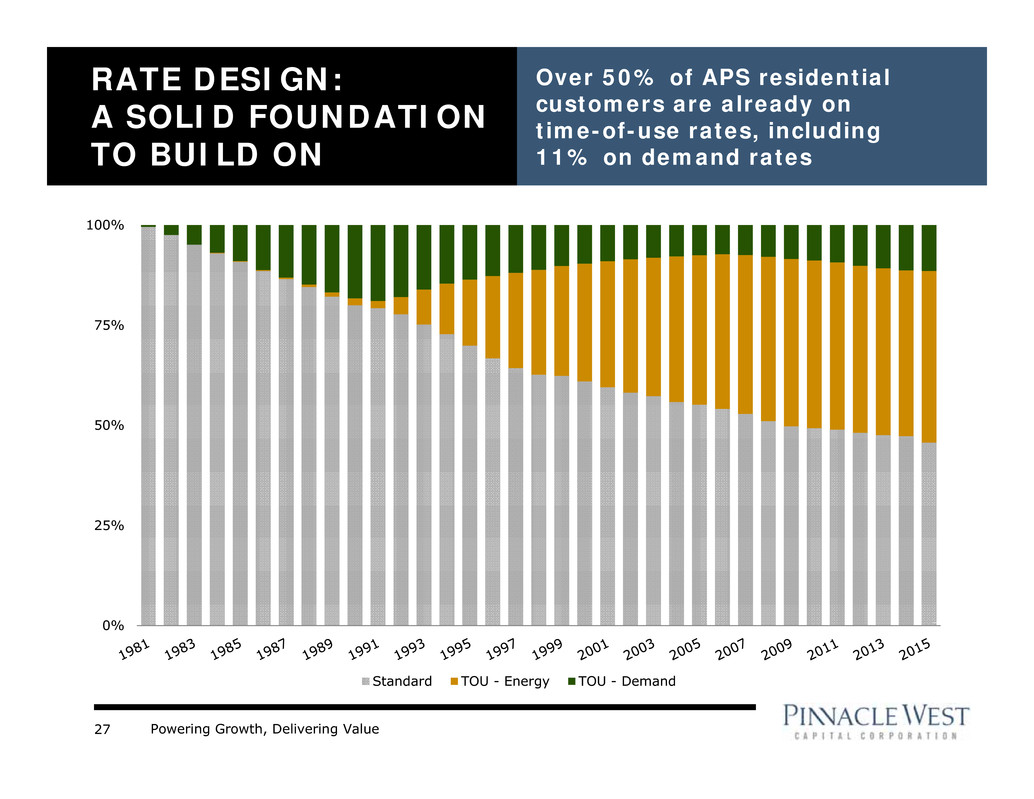

Powering Growth, Delivering Value27 RATE DESIGN: A SOLID FOUNDATION TO BUILD ON Over 50% of APS residential customers are already on time-of-use rates, including 11% on demand rates 0% 25% 50% 75% 100% Standard TOU - Energy TOU - Demand

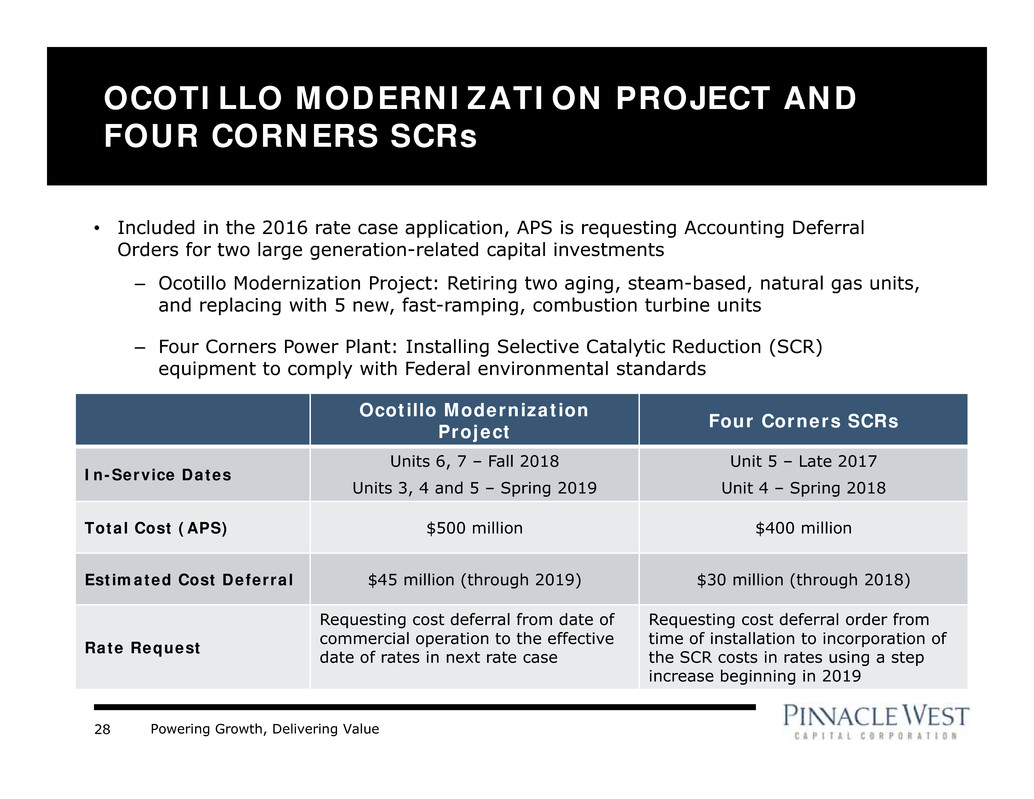

Powering Growth, Delivering Value28 OCOTILLO MODERNIZATION PROJECT AND FOUR CORNERS SCRs Ocotillo Modernization Project Four Corners SCRs In-Service Dates Units 6, 7 – Fall 2018 Units 3, 4 and 5 – Spring 2019 Unit 5 – Late 2017 Unit 4 – Spring 2018 Total Cost (APS) $500 million $400 million Estimated Cost Deferral $45 million (through 2019) $30 million (through 2018) Rate Request Requesting cost deferral from date of commercial operation to the effective date of rates in next rate case Requesting cost deferral order from time of installation to incorporation of the SCR costs in rates using a step increase beginning in 2019 • Included in the 2016 rate case application, APS is requesting Accounting Deferral Orders for two large generation-related capital investments – Ocotillo Modernization Project: Retiring two aging, steam-based, natural gas units, and replacing with 5 new, fast-ramping, combustion turbine units – Four Corners Power Plant: Installing Selective Catalytic Reduction (SCR) equipment to comply with Federal environmental standards

Powering Growth, Delivering Value APPENDIX

Powering Growth, Delivering Value30 LEADERSHIP TEAM Our top executives have more than 100 combined years of creating shareholder value in the energy industry Don Brandt Chairman & Chief Executive Officer Mark Schiavoni EVP & Chief Operating Officer Jeff Guldner SVP Public Policy Bob Bement EVP & Chief Nuclear Officer Jim Hatfield EVP & Chief Financial Officer

Powering Growth, Delivering Value31 Bob Stump (R)* Tom Forese (R) Doug Little (R) Chairman Terms to January 2019Terms to January 2017 Bob Burns (R) Other State Officials Andy Tobin (R) ARIZONA CORPORATION COMMISSION * Term limited - elected to four-year terms (limited to two consecutive) ** Submitted resignation to become effective December 2016 ACC Utility Division Director - Tom Broderick** RUCO Director - David Tenney

Powering Growth, Delivering Value32 2016 KEY DATES ACC Key Dates / Docket # Q1 Q2 Q3 Q4 Key Recurring Regulatory Filings Lost Fixed Cost Recovery E-01345A-11-0224 Jan 15 Transmission Cost Adjustor E-01345A-11-0224 May 15 Renewable Energy Adjustor E-01345A-16-0238 Jul 1 2017 DSM Implementation Plan E-01345A-16-0176 Nov 18: Workshop Dec 1: File energy storage plan APS Rate Case E-01345A-16-0036 Jan 29: NOI Filing Jun 1: Initial filing Dec 21: Direct Testimony Resource Planning and Procurement E-00000V-15-0094 Feb 9: Stakeholder Mtg. Mar 1: Prelim IRP filed Jul 18: Prelim IRP Workshop Sep 30: Update to Prelim IRP* Reducing System Peak Demand Costs E-00000J-16-0257 Aug 4: Initial workshop TBD: Second workshop Value and Cost of Distributed Generation E-00000J-14-0023 Feb 25: DG Methodologies & Supporting Testimony Apr 7: Rebuttal Testimony and Alternate Proposal Apr 15: Pre-hearing Apr 18: Hearing Jun 8-9 Hearing Jun 13: Responses Jul: Initial Briefs Aug 5: Reply Briefs Oct 7: ALJ ROO Dec 13: Scheduled for Consideration at ACC Open Meeting Review, Modernization and Expansion of Arizona Renewable Energy Standards E-00000Q-16-0289 TBD TBD ACC Open Meetings ACC Open Meetings Held Monthly * April 2017: Final IRP due Other K y Dates Q1 Q2 Q3 Q4 Arizona State Legislature In session Jan 11- May 7 (Adjourned) Elections Aug 30: Primary Nov 8: General All Source Request for Proposal (RFP) Mar 11: RFP Issued Jun 9: Responses Due TBD

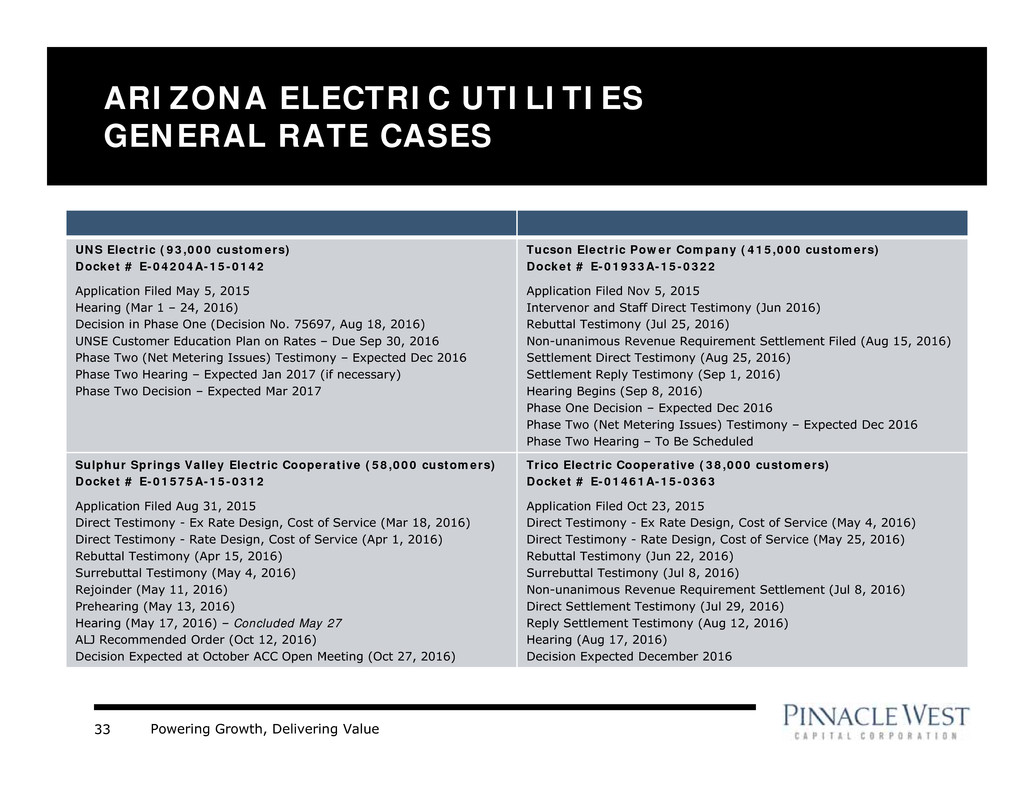

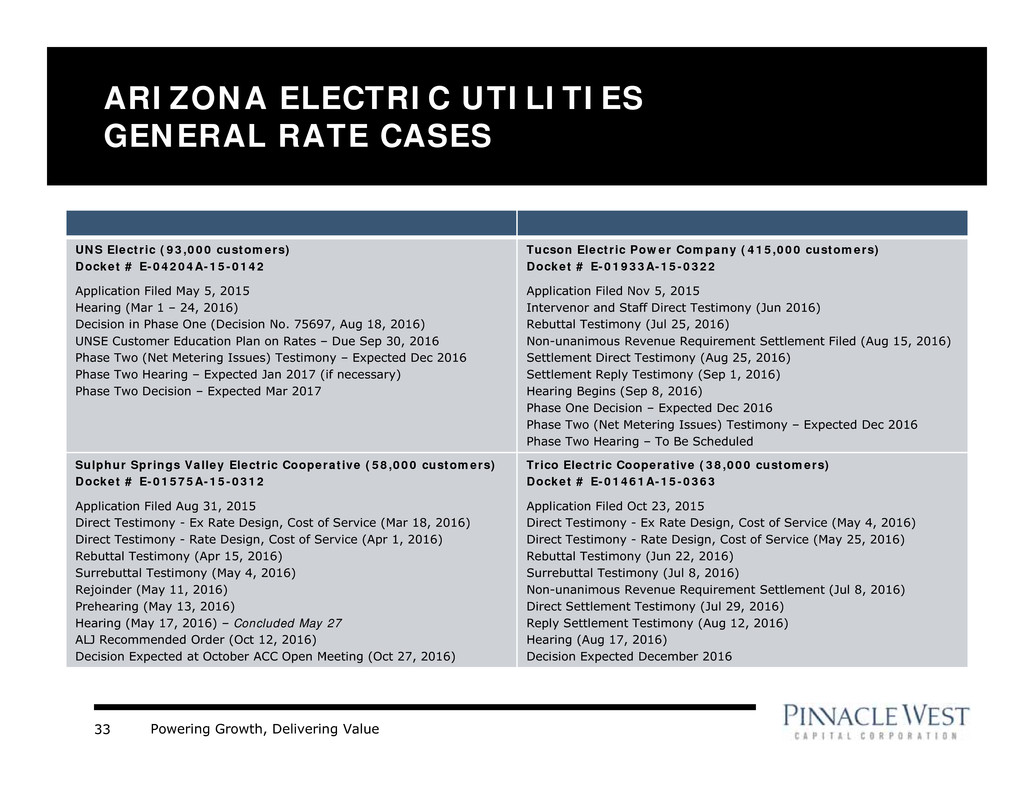

Powering Growth, Delivering Value33 ARIZONA ELECTRIC UTILITIES GENERAL RATE CASES UNS Electric (93,000 customers) Docket # E-04204A-15-0142 Application Filed May 5, 2015 Hearing (Mar 1 – 24, 2016) Decision in Phase One (Decision No. 75697, Aug 18, 2016) UNSE Customer Education Plan on Rates – Due Sep 30, 2016 Phase Two (Net Metering Issues) Testimony – Expected Dec 2016 Phase Two Hearing – Expected Jan 2017 (if necessary) Phase Two Decision – Expected Mar 2017 Tucson Electric Power Company (415,000 customers) Docket # E-01933A-15-0322 Application Filed Nov 5, 2015 Intervenor and Staff Direct Testimony (Jun 2016) Rebuttal Testimony (Jul 25, 2016) Non-unanimous Revenue Requirement Settlement Filed (Aug 15, 2016) Settlement Direct Testimony (Aug 25, 2016) Settlement Reply Testimony (Sep 1, 2016) Hearing Begins (Sep 8, 2016) Phase One Decision – Expected Dec 2016 Phase Two (Net Metering Issues) Testimony – Expected Dec 2016 Phase Two Hearing – To Be Scheduled Sulphur Springs Valley Electric Cooperative (58,000 customers) Docket # E-01575A-15-0312 Application Filed Aug 31, 2015 Direct Testimony - Ex Rate Design, Cost of Service (Mar 18, 2016) Direct Testimony - Rate Design, Cost of Service (Apr 1, 2016) Rebuttal Testimony (Apr 15, 2016) Surrebuttal Testimony (May 4, 2016) Rejoinder (May 11, 2016) Prehearing (May 13, 2016) Hearing (May 17, 2016) – Concluded May 27 ALJ Recommended Order (Oct 12, 2016) Decision Expected at October ACC Open Meeting (Oct 27, 2016) Trico Electric Cooperative (38,000 customers) Docket # E-01461A-15-0363 Application Filed Oct 23, 2015 Direct Testimony - Ex Rate Design, Cost of Service (May 4, 2016) Direct Testimony - Rate Design, Cost of Service (May 25, 2016) Rebuttal Testimony (Jun 22, 2016) Surrebuttal Testimony (Jul 8, 2016) Non-unanimous Revenue Requirement Settlement (Jul 8, 2016) Direct Settlement Testimony (Jul 29, 2016) Reply Settlement Testimony (Aug 12, 2016) Hearing (Aug 17, 2016) Decision Expected December 2016

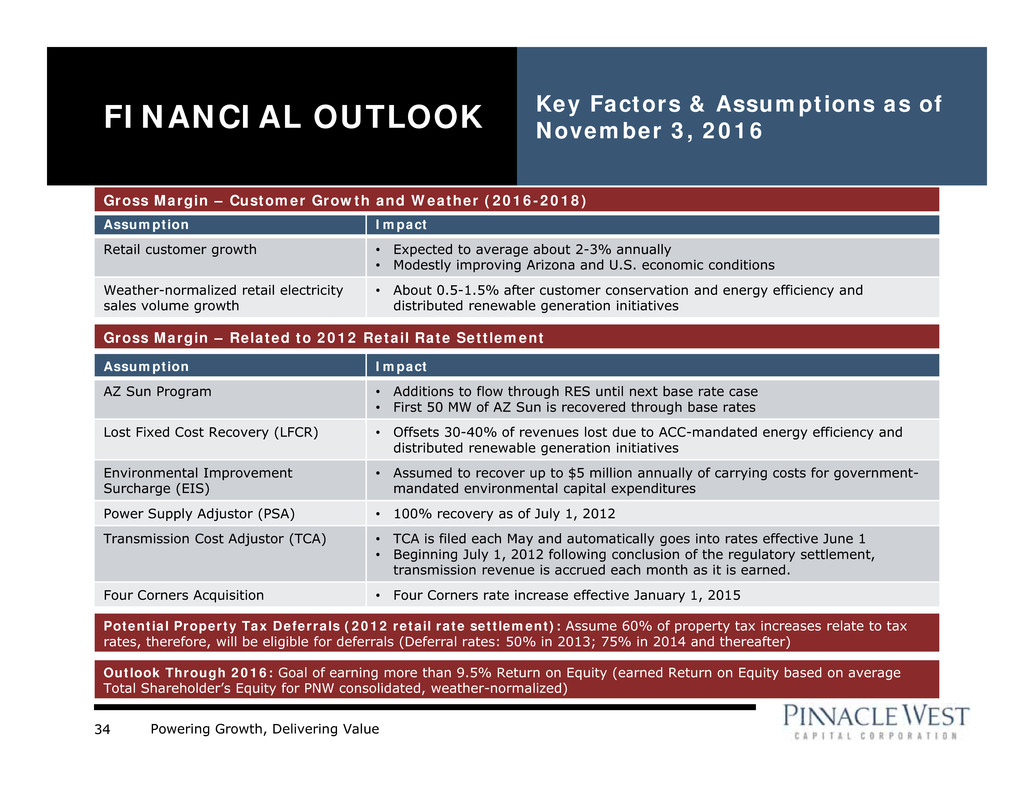

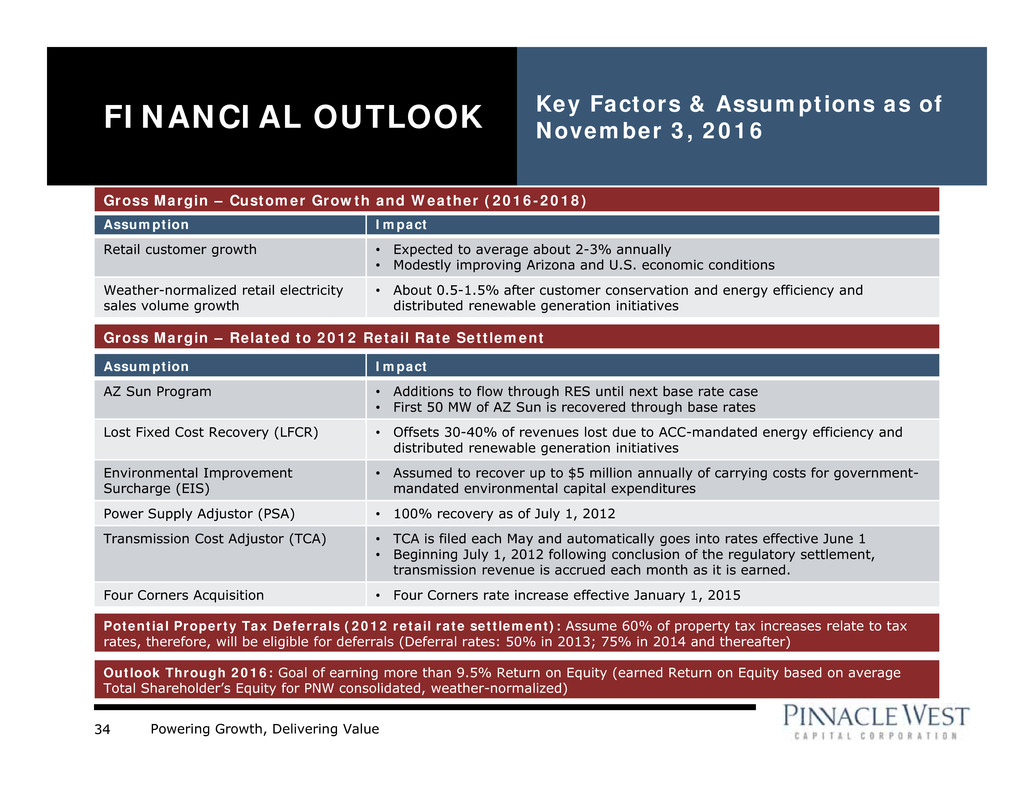

Powering Growth, Delivering Value34 FINANCIAL OUTLOOK Key Factors & Assumptions as of November 3, 2016 Assumption Impact Retail customer growth • Expected to average about 2-3% annually • Modestly improving Arizona and U.S. economic conditions Weather-normalized retail electricity sales volume growth • About 0.5-1.5% after customer conservation and energy efficiency and distributed renewable generation initiatives Assumption Impact AZ Sun Program • Additions to flow through RES until next base rate case • First 50 MW of AZ Sun is recovered through base rates Lost Fixed Cost Recovery (LFCR) • Offsets 30-40% of revenues lost due to ACC-mandated energy efficiency and distributed renewable generation initiatives Environmental Improvement Surcharge (EIS) • Assumed to recover up to $5 million annually of carrying costs for government- mandated environmental capital expenditures Power Supply Adjustor (PSA) • 100% recovery as of July 1, 2012 Transmission Cost Adjustor (TCA) • TCA is filed each May and automatically goes into rates effective June 1 • Beginning July 1, 2012 following conclusion of the regulatory settlement, transmission revenue is accrued each month as it is earned. Four Corners Acquisition • Four Corners rate increase effective January 1, 2015 Potential Property Tax Deferrals (2012 retail rate settlement): Assume 60% of property tax increases relate to tax rates, therefore, will be eligible for deferrals (Deferral rates: 50% in 2013; 75% in 2014 and thereafter) Gross Margin – Customer Growth and Weather (2016-2018) Gross Margin – Related to 2012 Retail Rate Settlement Outlook Through 2016: Goal of earning more than 9.5% Return on Equity (earned Return on Equity based on average Total Shareholder’s Equity for PNW consolidated, weather-normalized)

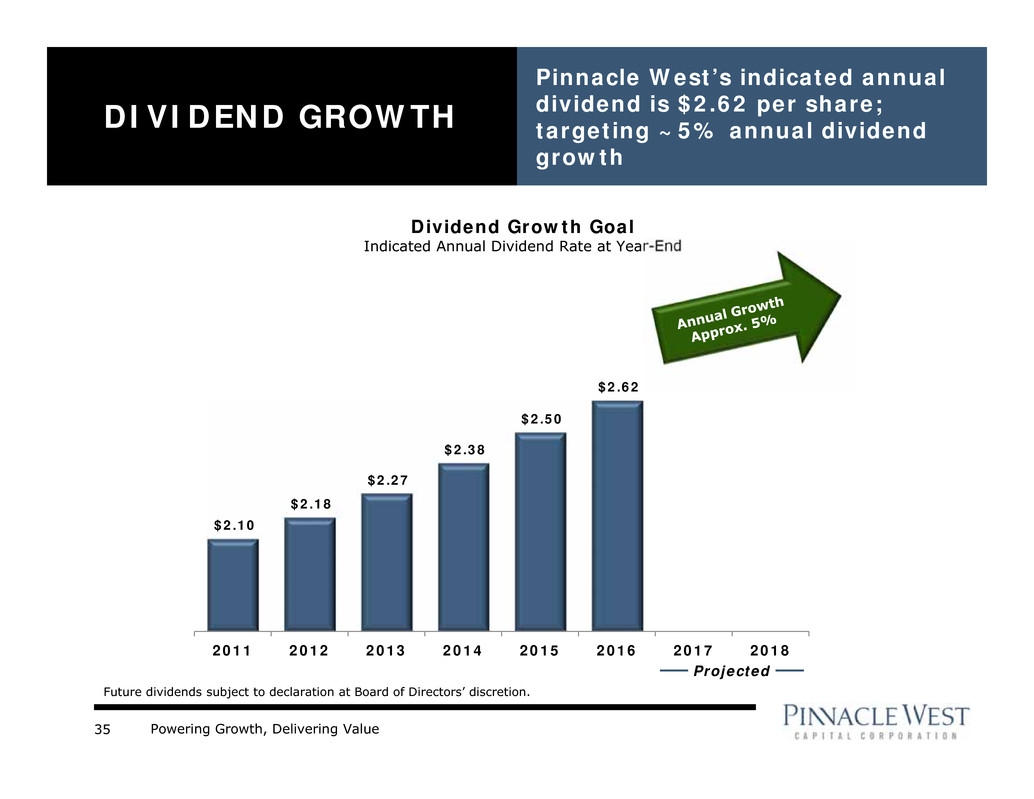

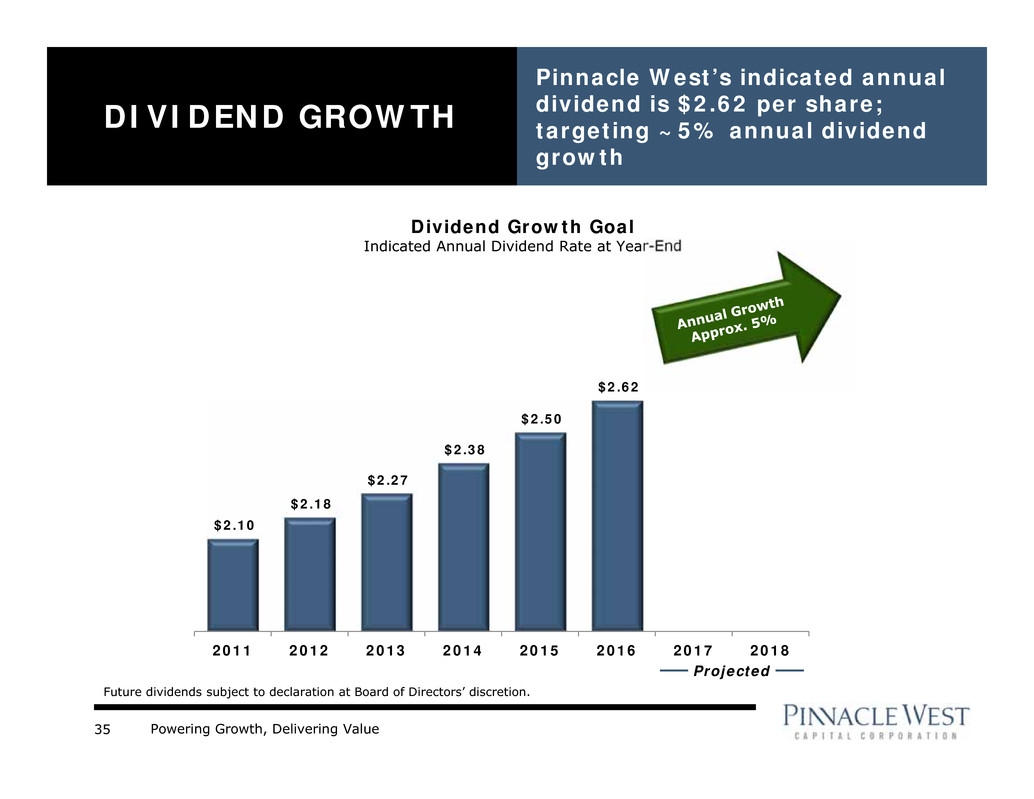

Powering Growth, Delivering Value35 DIVIDEND GROWTH Pinnacle West’s indicated annual dividend is $2.62 per share; targeting ~5% annual dividend growth $2.10 $2.18 $2.27 $2.38 $2.50 $2.62 2011 2012 2013 2014 2015 2016 2017 2018 Dividend Growth Goal Indicated Annual Dividend Rate at Year-End Projected Future dividends subject to declaration at Board of Directors’ discretion.

Powering Growth, Delivering Value36 Credit Ratings • A- rating or better at S&P, Moody’s and Fitch 2016 Major Financing Activities • $250 million 10-year 2.55% APS senior unsecured notes issued September 2016 • $350 million 30-year 3.75% APS senior unsecured notes issued May 2016 • $100 million term loan closed April 2016 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. BALANCE SHEET STRENGTH $50 $600 $250 $125 $- $100 $200 $300 $400 $500 $600 2017 2018 2019 2020 APS PNW ($Millions) Debt Maturity Schedule

Powering Growth, Delivering Value37 2010 2011 2012 2013 2014 2015 APS FFO / Debt 23.7% 23.6% 27.7% 31.5% 27.5% 29.7% FFO / Interest 3.3x 4.2x 4.8x 5.6X 5.5x 5.8x Debt / Capitalization 52.6% 52.9% 50.7% 47.7% 45.3% 45.8% Pinnacle West FFO / Debt 22.3% 23.0% 26.7% 29.8% 26.5% 28.9% FFO / Interest 3.1x 3.8x 4.4x 4.9X 5.2x 5.6x Debt / Capitalization 54.6% 54.4% 52.1% 49.1% 46.7% 47.0% CREDIT RATINGS AND METRICS Key credit metrics remain strong Source: Standard & Poor’s APS Parent Corporate Credit Ratings Moody’s A2 A3 S&P A- A- Fitch A- A- Senior Unsecured Moody’s A2 - S&P A- - Fitch A - Note: Moody’s, S&P, and Fitch all rate Outlook for APS and Parent as “Stable” We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds.

Powering Growth, Delivering Value38 OPERATIONS & MAINTENANCE OUTLOOK Goal is to keep O&M per kWh flat, adjusted for planned outages $754 $761 $788 $805 $772 $150 $124 $137 $103 $96 $83 2011 2012 2013 2014 2015 2016E PNW Consolidated RES/DSM* *Renewable energy and demand side management expenses are offset by adjustment mechanisms. ($ Millions) $825 - $845

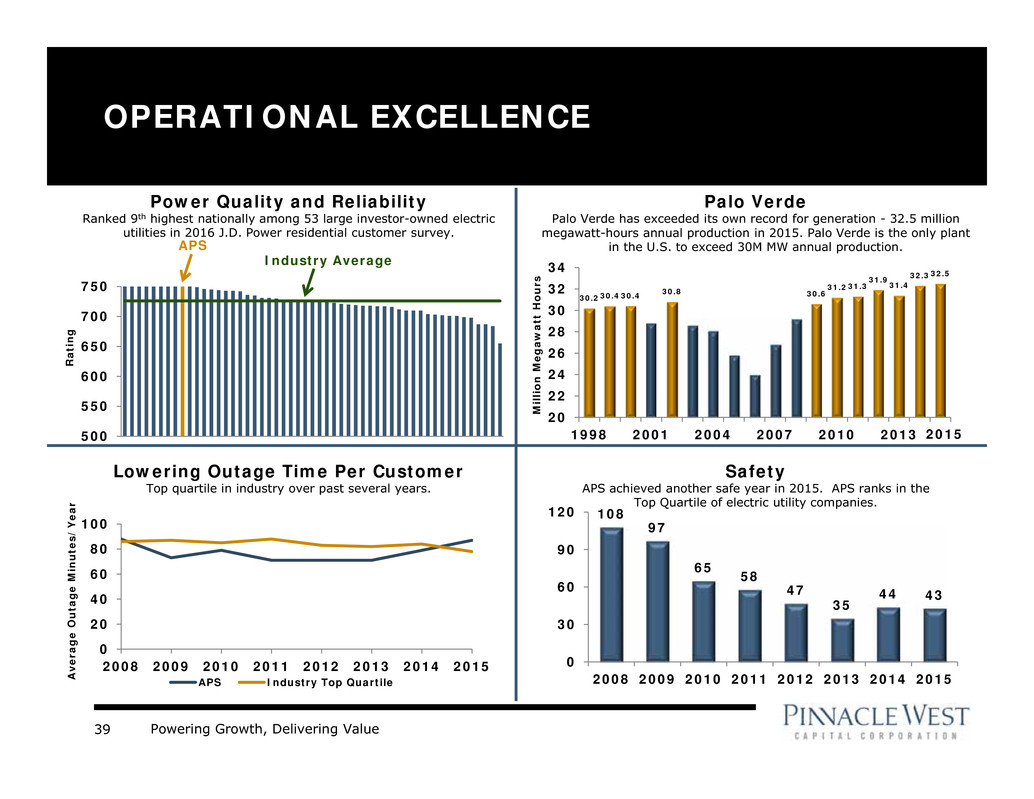

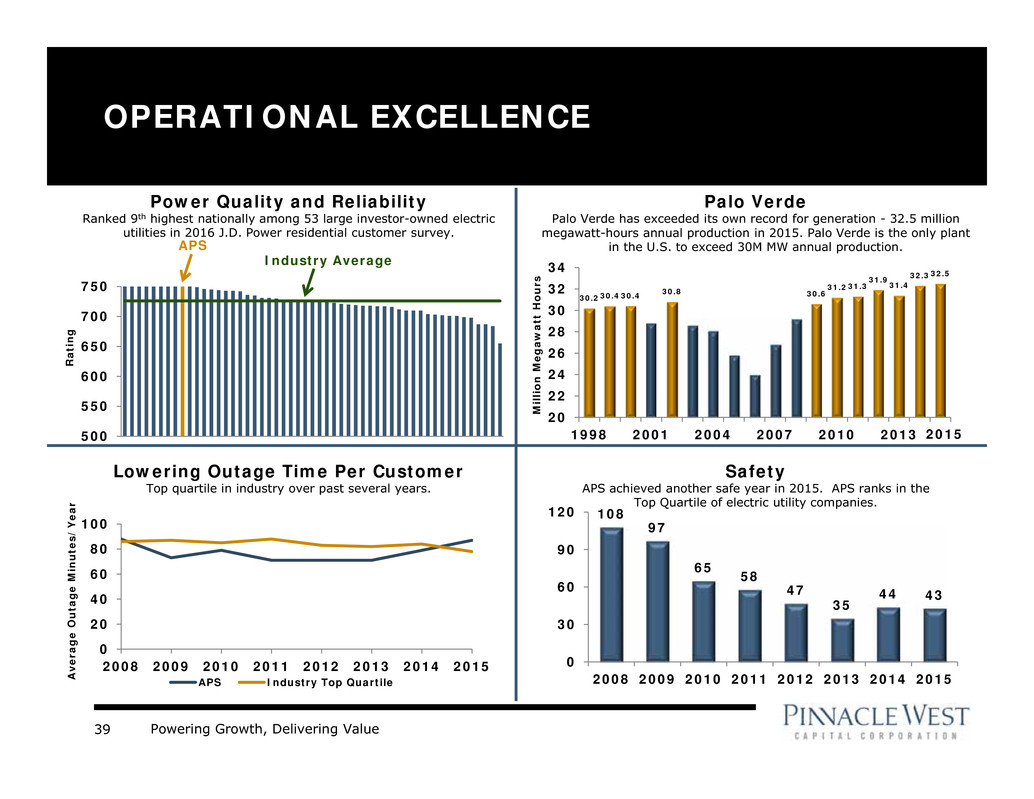

Powering Growth, Delivering Value39 500 550 600 650 700 750 OPERATIONAL EXCELLENCE 30.230.430.4 30.8 30.6 31.231.3 31.9 31.4 32.332.5 20 22 24 26 28 30 32 34 1998 2001 2004 2007 2010 2013 108 97 65 58 47 35 44 43 0 30 60 90 120 2008 2009 2010 2011 2012 2013 2014 2015 Palo Verde Palo Verde has exceeded its own record for generation - 32.5 million megawatt-hours annual production in 2015. Palo Verde is the only plant in the U.S. to exceed 30M MW annual production. Safety APS achieved another safe year in 2015. APS ranks in the Top Quartile of electric utility companies. 0 20 40 60 80 100 2008 2009 2010 2011 2012 2013 2014 2015 APS Industry Top Quartile Power Quality and Reliability Ranked 9th highest nationally among 53 large investor-owned electric utilities in 2016 J.D. Power residential customer survey. Lowering Outage Time Per Customer Top quartile in industry over past several years. A v e r a g e O u t a g e M i n u t e s / Y e a r M i l l i o n M e g a w a t t H o u r s R a t i n g Industry Average APS 2015

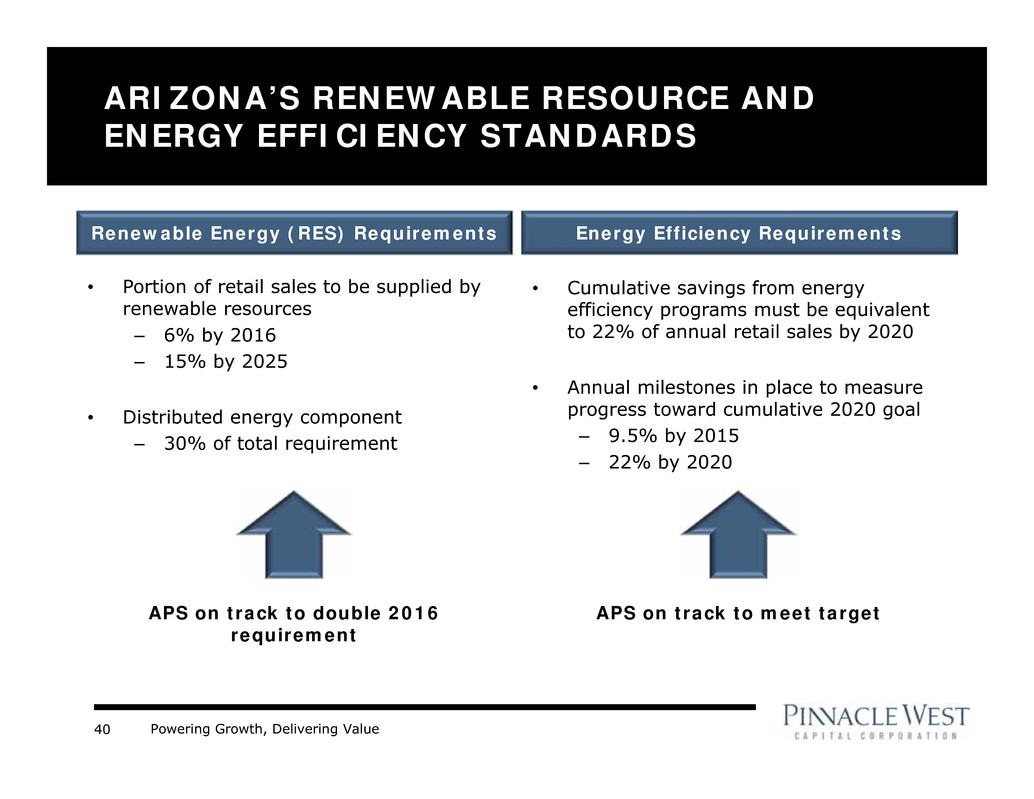

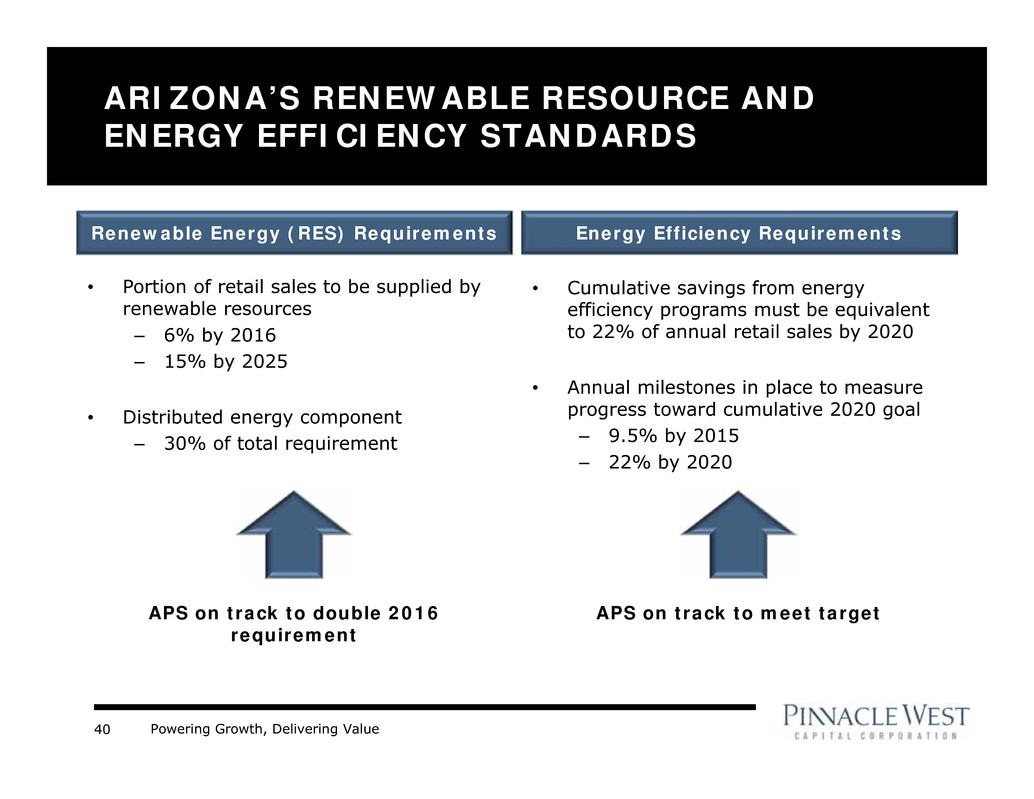

Powering Growth, Delivering Value40 • Cumulative savings from energy efficiency programs must be equivalent to 22% of annual retail sales by 2020 • Annual milestones in place to measure progress toward cumulative 2020 goal – 9.5% by 2015 – 22% by 2020 ARIZONA’S RENEWABLE RESOURCE AND ENERGY EFFICIENCY STANDARDS • Portion of retail sales to be supplied by renewable resources – 6% by 2016 – 15% by 2025 • Distributed energy component – 30% of total requirement Energy Efficiency RequirementsRenewable Energy (RES) Requirements APS on track to double 2016 requirement APS on track to meet target

Powering Growth, Delivering Value41 • 10-Year Transmission Plan filed January 2016 (115 kV and above) – 110 miles of new lines • Also includes: – Delaney-Palo Verde 500kV (2016) – Delaney-Sun Valley 500kV (2016) – Sun Valley-Trilby Wash 230kV (2016) – Morgan-Sun Valley 500kV (2018) – North Gila-Orchard 230kV (2021) • Projects to deliver renewable energy approved by ACC • Transmission investment diversifies regulatory risk – Constructive regulatory treatment – FERC formula rates and retail adjustor APS TRANSMISSION Strategic transmission investment is essential to maintain reliability and deliver diversified resources to customers Legend Planned lines Existing lines Solar potential area Wind potential area Phoenix Flagstaff Tucson

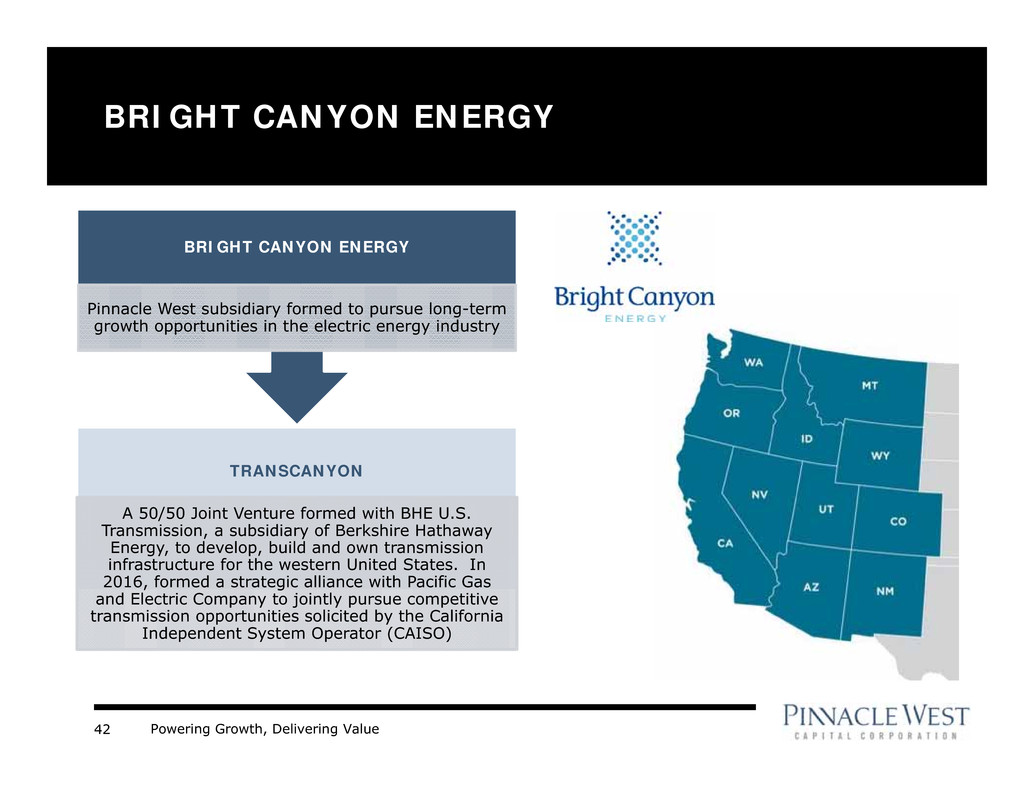

Powering Growth, Delivering Value42 BRIGHT CANYON ENERGY TRANSCANYON A 50/50 Joint Venture formed with BHE U.S. Transmission, a subsidiary of Berkshire Hathaway Energy, to develop, build and own transmission infrastructure for the western United States. In 2016, formed a strategic alliance with Pacific Gas and Electric Company to jointly pursue competitive transmission opportunities solicited by the California Independent System Operator (CAISO) BRIGHT CANYON ENERGY Pinnacle West subsidiary formed to pursue long-term growth opportunities in the electric energy industry

Powering Growth, Delivering Value43 Mechanism Adopted / Last Adjusted Description Power Supply Adjustor (“PSA”) April 2005 / February 2016 • Recovers variance between actual fuel and purchased power costs and base fuel rate • Includes forward-looking, historical and transition components Renewable Energy Surcharge (“RES”) May 2008 / February 2016 • Recovers costs related to renewable initiatives • Collects projected dollars to meet RES targets • Provides incentives to customers to install distributed renewable energy Demand-Side Management Adjustment Clause (“DSMAC”) April 2005 / March 2014 • Recovers costs related to energy efficiency and DSM programs above $10 million in base rates • Provides performance incentive to APS for net benefits achieved • Provides conservation education, rebates and other incentives to participating customers Environmental Improvement Surcharge (“EIS”) July 2007 / April 2016 • Allows recovery of certain carrying costs for government-mandated environmental capital projects • Capped at $5 million annually Transmission Cost Adjustor (“TCA”) April 2005 / June 2016 • Recovers FERC-approved transmission costs related to retail customers • Resets annually as result of FERC Formula Rate process (see below) FERC Formula Rates 2008 / June 2016 • Recovers transmission costs based on historical costs per FERC Form 1 and certain projected data Lost Fixed Cost Recovery (“LFCR”) July 2012 / May 2016 • Mitigates loss of portion of fixed costs related to ACC-approved energy efficiency and distributed renewable generation programs REGULATORY MECHANISMS We have achieved a supportive regulatory structure and improvements in cost recovery timing

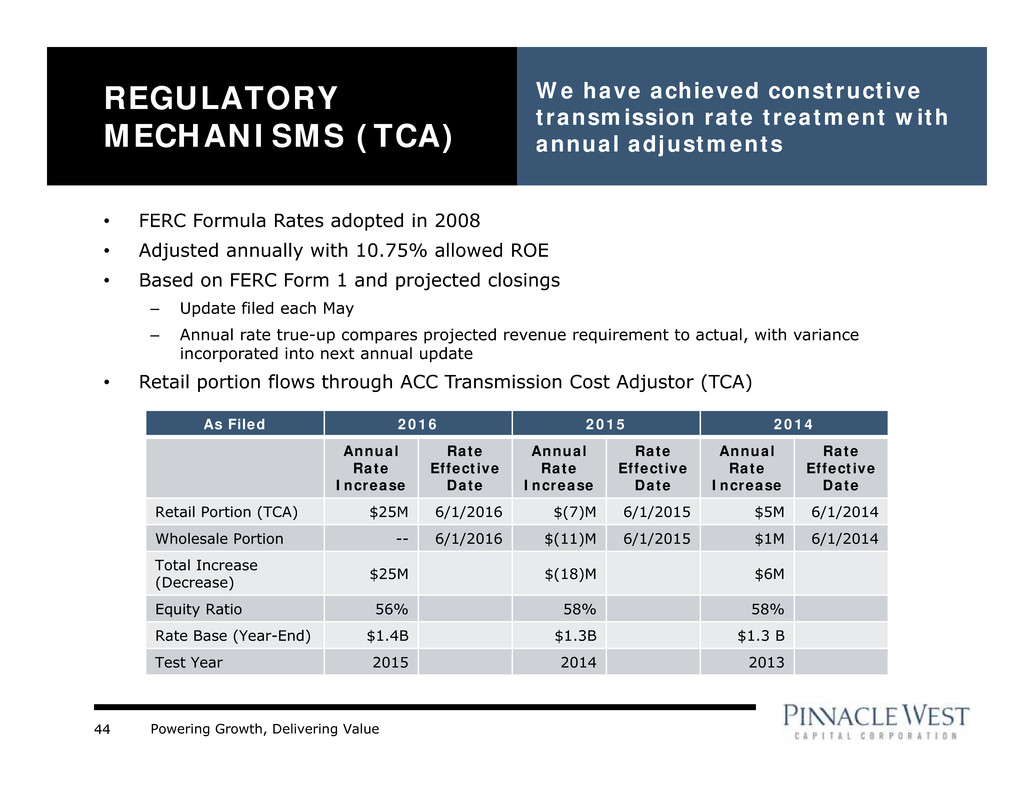

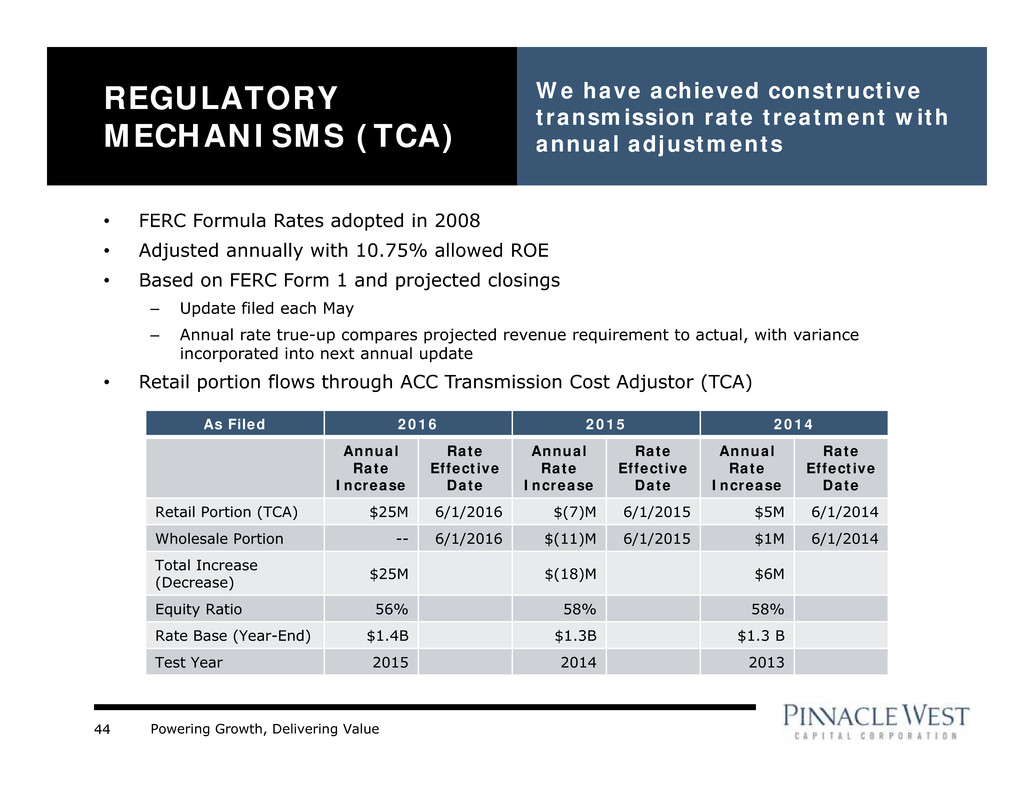

Powering Growth, Delivering Value44 • FERC Formula Rates adopted in 2008 • Adjusted annually with 10.75% allowed ROE • Based on FERC Form 1 and projected closings – Update filed each May – Annual rate true-up compares projected revenue requirement to actual, with variance incorporated into next annual update • Retail portion flows through ACC Transmission Cost Adjustor (TCA) REGULATORY MECHANISMS (TCA) We have achieved constructive transmission rate treatment with annual adjustments As Filed 2016 2015 2014 Annual Rate Increase Rate Effective Date Annual Rate Increase Rate Effective Date Annual Rate Increase Rate Effective Date Retail Portion (TCA) $25M 6/1/2016 $(7)M 6/1/2015 $5M 6/1/2014 Wholesale Portion -- 6/1/2016 $(11)M 6/1/2015 $1M 6/1/2014 Total Increase (Decrease) $25M $(18)M $6M Equity Ratio 56% 58% 58% Rate Base (Year-End) $1.4B $1.3B $1.3 B Test Year 2015 2014 2013

Powering Growth, Delivering Value45 6/1 Rate Goes Into Effect REGULATORY MECHANISMS (TCA) We have achieved constructive transmission rate treatment with annual adjustments 2015 2016 JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC 6/1 Rate Goes Into Effect ~5/15 File/Post FERC Rate ~5/1 File FERC Form 1 ~5/15 File/Post FERC Rate ~5/1 File FERC Form 1 • New accounting treatment began July 1, 2012, effective with 2012 Settlement Agreement • Quarterly true-ups can occur throughout the year 2015 Revenue 2015 Rates (Including True-Up) 2016 Rates (Including True-Up) 2016 Revenue Quarterly True-Ups Quarterly True-Ups

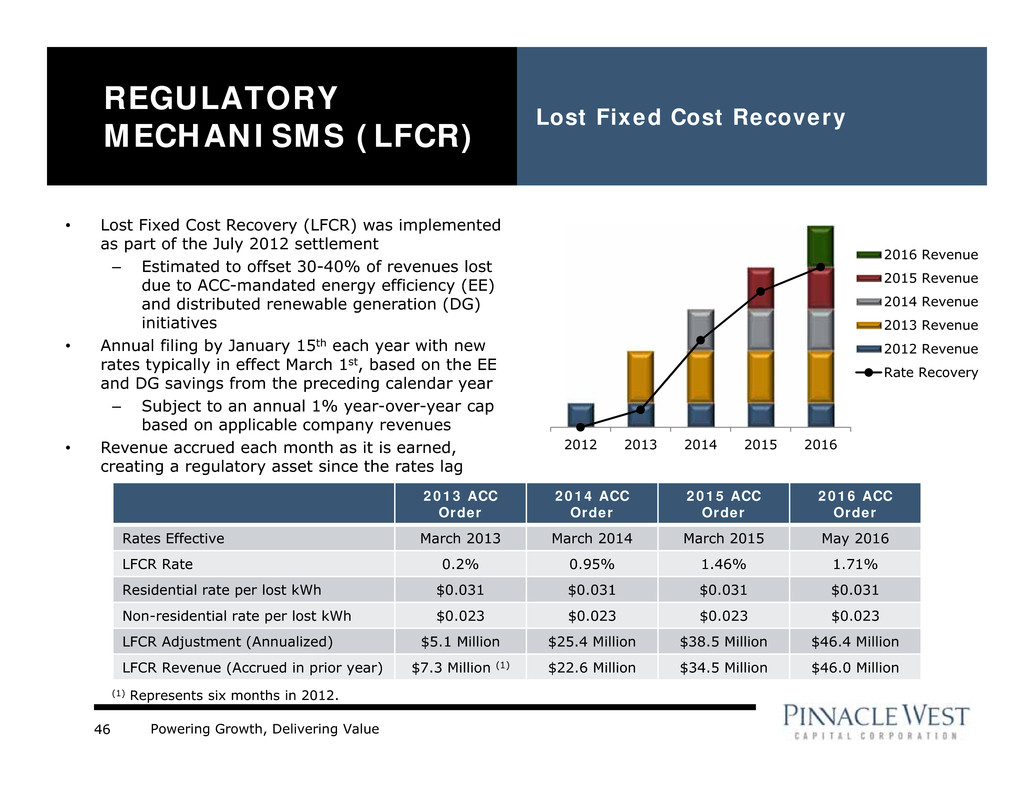

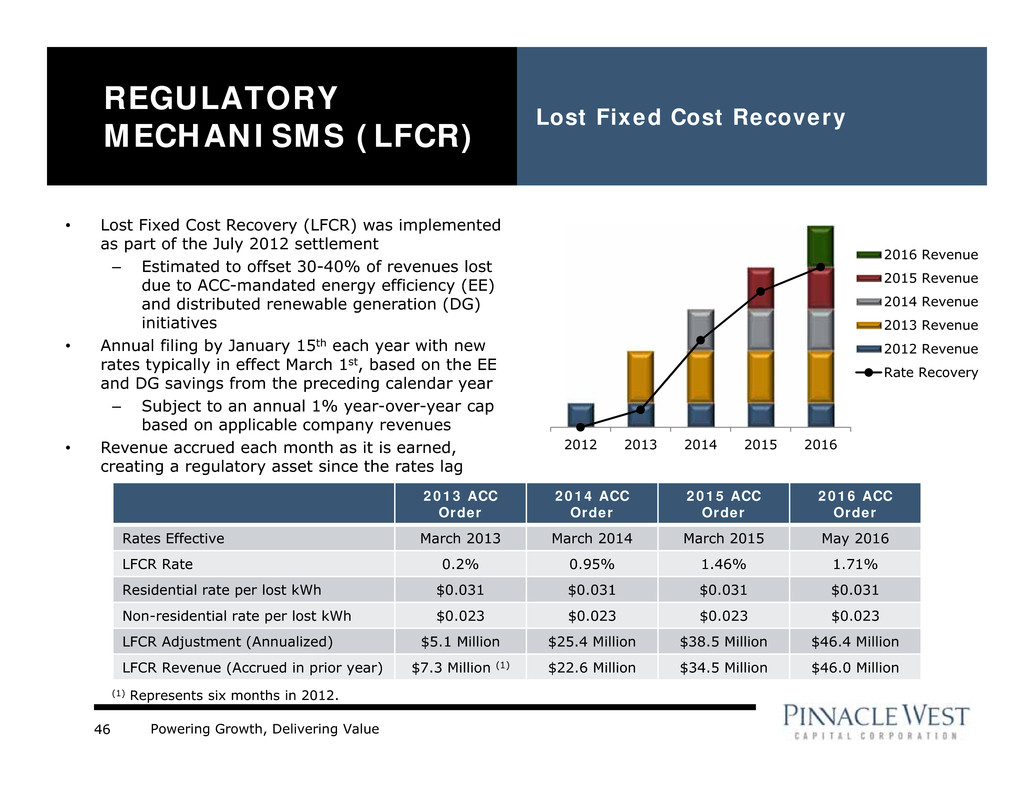

Powering Growth, Delivering Value46 2012 2013 2014 2015 2016 2016 Revenue 2015 Revenue 2014 Revenue 2013 Revenue 2012 Revenue Rate Recovery • Lost Fixed Cost Recovery (LFCR) was implemented as part of the July 2012 settlement – Estimated to offset 30-40% of revenues lost due to ACC-mandated energy efficiency (EE) and distributed renewable generation (DG) initiatives • Annual filing by January 15th each year with new rates typically in effect March 1st, based on the EE and DG savings from the preceding calendar year – Subject to an annual 1% year-over-year cap based on applicable company revenues • Revenue accrued each month as it is earned, creating a regulatory asset since the rates lag REGULATORY MECHANISMS (LFCR) Lost Fixed Cost Recovery 2013 ACC Order 2014 ACC Order 2015 ACC Order 2016 ACC Order Rates Effective March 2013 March 2014 March 2015 May 2016 LFCR Rate 0.2% 0.95% 1.46% 1.71% Residential rate per lost kWh $0.031 $0.031 $0.031 $0.031 Non-residential rate per lost kWh $0.023 $0.023 $0.023 $0.023 LFCR Adjustment (Annualized) $5.1 Million $25.4 Million $38.5 Million $46.4 Million LFCR Revenue (Accrued in prior year) $7.3 Million (1) $22.6 Million $34.5 Million $46.0 Million (1) Represents six months in 2012.

Powering Growth, Delivering Value47 ENVIRONMENTAL PLAN Regional Haze compliance is the biggest driver of environmental spend over the next few years Regional Haze / BART (SCR) Mercury and Other Hazardous Air Pollutants (ACI + Baghouse) Coal Combustion Residuals Cooling Water Intake Structures – CWA 316(b) EPA Ruling Announced in 1999, with site-specific requirements announced more recently MATS compliance by April 2015, with potential for one-year extension Announced on December 19, 2014 (Subtitle D) Announced in May 2014 Four Corners Units 4 & 5 Approximately $400M for SCRs in 2016-2018 (does not include CAPEX related to 4CA 7% interest) $0 APS estimates that its share of incremental costs to comply with the CCR rule for Four Corners is approximately $15 million, and its share of incremental costs for Cholla is in the range of $5 million to $40 million. APS expects to incur certain of these costs during 2016-2018 timeframe. Immaterial $0Cholla Unit 3 On September 11, 2014, APS announced a proposal to close Unit 2 by April 2016 and stop burning coal at the other APS-owned units (1 and 3) by the mid-2020’s. If EPA does not approve the plan, SCR for Unit 3 would cost approximately $100 million. $8M Navajo Plant Units 1-3 Up to ~$200M for SCRs and baghouses On July 28, 2014, EPA issued the final BART rule incorporating the better-than-BART alternative proposed by SRP and others Approximately $1 million Approximately $1 million To be determined Clean Power Plan: On August 3, 2015, the U.S. EPA issued its final rules to reduce carbon dioxide emissions from fossil fuel-fired power plants including those on Tribal lands. APS is reviewing the rules, while working closely with other utilities, the Arizona Department of Environmental Quality, the ACC, tribal officials and other impacted stakeholders to determine how best to proceed. On February 9, 2016, the U.S. Supreme Court granted a stay of the Clean Power Plan pending judicial review, which temporarily delays compliance obligations. Note: Dollars shown at ownership. Estimates as of September 30, 2016. • Cholla: Unit 1 is not BART-eligible; Unit 2 retired on October 1, 2015; Unit 4 is owned by PacifiCorp. • SO2 NAAQS and greenhouse gas-related costs will be determined based upon EPA rule makings, with no spend occurring before 2016. • ACI = Activated Carbon Injection; NAAQS = National Ambient Air Quality Standard; SCR = Selective Catalytic Reduction control technology

Powering Growth, Delivering Value48 Emissions • 820 MW of coal has been retired including 560 MW at Four Corners Units 1-3 in 2013 and 260 MW at Cholla Unit 2 as of October 1, 2015. • Four Corners: 2013 transaction to purchase Southern California Edison’s ownership in Units 4 and 5 and closure of units 1, 2 & 3 leads to expected reductions of emissions; particulates are expected to decline by 43%, NOx by 36%, CO2 by 30%, mercury by 61% and SO2 by 24%. • Cholla Power Plant: Closure of Unit 2 as of October 1, 2015 will reduce mercury emissions by 51%, particulates by 34%, NOx by 32%, and CO2 and SO2 by 23% each. We also announced plans to work with the U.S. EPA to stop burning coal at our remaining Cholla units by the mid-2020s • Navajo Generating Station: Plan proposed by a group of stakeholders, including SRP, the operating agent, was approved by the EPA in 2014. The plan will achieve even greater NOx emission reductions than the EPA’s proposal • Participated in Carbon Disclosure Project since 2006 COAL FLEET STRATEGY APS’s proactive approach to reducing emissions leads to coal’s expected share of the energy mix being reduced to 14% 13% 14% 11% 18% 26% 18% 27% 14% 23% 36% 2017 2032 P e r c e n t o f P o r t f o l i o M W h Note: RE = Renewable Energy; DE = Distributed Energy; EE = Energy Efficiency Data shown is based on the Updated 2017 Preliminary Integrated Resource Plan filed September 30, 2016. Gas Coal Nuclear RE + DE EE

Powering Growth, Delivering Value49 WATER STRATEGY APS, and Palo Verde in particular, has provided national and international leadership on the use of reclaimed water for power generation 68% 17% 15%Reclaimed Water Groundwater Surface Water APS 2015 Fleet Water Use By Source Type Vision: APS continues to strive for sustainable and cost-effective water supplies for energy production for APS customers. Mission: To execute a strategic water resource management program that provides APS timely and reliable information to manage our water resources portfolio efficiently and effectively, and helps ensure long-term water supplies and water contingency plans for each of our facilities, even in times of extended drought. • Each APS power plant has a unique water strategy, developed to promote efficient and sustainable use of water. Water Usage and Intensity: Goal is to maximize use of renewable water resources and minimize use of non-renewable resources. Our 2016 initiatives include: • Reducing consumption of non-renewable water resources by 8% over 2014 levels, and • Reducing water intensity company-wide by 20 percent over 2014 levels Palo Verde Nuclear Generating Station: The only nuclear plant in the world that does not sit on a large body of water. Instead, it uses treated effluent, or wastewater, from several area municipalities, recycling approximately 20 billion gallons of wastewater each year

Powering Growth, Delivering Value50 GENERATION PORTFOLIO* Plant Location No. of Units Dispatch COD Ownership Interest1 Net Capacity (MW) NUCLEAR 1,146 MW Palo Verde Wintersburg, AZ 3 Base 1986-1989 29.1% 1,146 COAL 1,672 MW Cholla Joseph City, AZ 2 Base 1962-1980 100 387 Four Corners Farmington, NM 2 Base 1969-1970 63 970 Navajo Page, AZ 3 Base 1974-1976 14 315 GAS - COMBINED CYCLE 1,871 MW Redhawk Arlington, AZ 2 Intermediate 2002 100 984 West Phoenix Phoenix, AZ 5 Intermediate 1976-2003 100 887 GAS - STEAM TURBINE 220 MW Ocotillo Tempe, AZ 2 Peaking 1960 100 220 GAS / OIL COMBUSTION TURBINE 1,088 MW Sundance Casa Grande, AZ 10 Peaking 2002 100 420 Yucca Yuma, AZ 6 Peaking 1971-2008 100 243 Saguaro Red Rock, AZ 3 Peaking 1972-2002 100 189 West Phoenix Phoenix, AZ 2 Peaking 1972-1973 100 110 Ocotillo Tempe, AZ 2 Peaking 1972-1973 100 110 Douglas Douglas, AZ 1 Peaking 1972 100 16 SOLAR 189 MW Hyder & Hyder II Hyder, AZ - As Available 2011-2013 100 30 Paloma Gila Bend, AZ - As Available 2011 100 17 Cotton Center Gila Bend, AZ - As Available 2011 100 17 Chino Valley Chino Valley, AZ - As Available 2012 100 19 Foothills Yuma, AZ - As Available 2013 100 35 Distributed Energy Multiple AZ Facilities - As Available Various 100 15 Gila Bend Gila Bend, AZ - As Available 2015 100 32 Luke Air Force Base Glendale, AZ - As Available 2015 100 10 Desert Star Buckeye, AZ - As Available 2015 100 10 Various Multiple AZ Facilities - As Available 1996-2006 100 4 Total Generation Capacity 6,186 MW 1 Includes leased generation plants* As disclosed in 2015 Form 10-K.

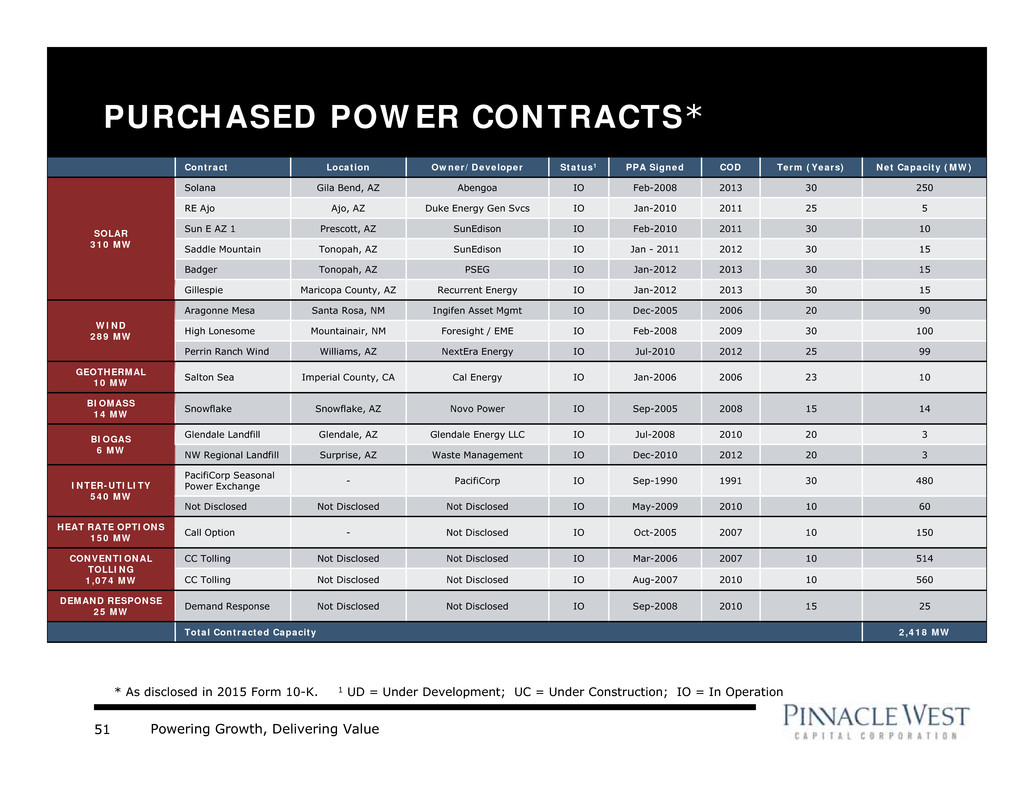

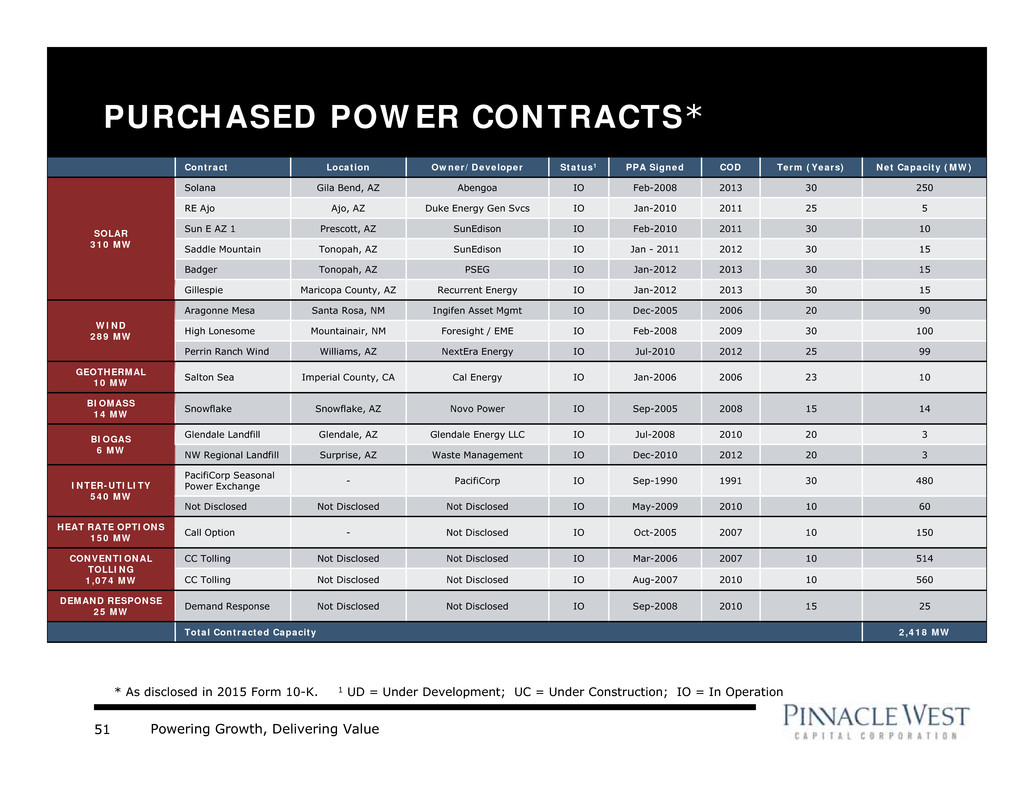

Powering Growth, Delivering Value51 PURCHASED POWER CONTRACTS* Contract Location Owner/Developer Status1 PPA Signed COD Term (Years) Net Capacity (MW) SOLAR 310 MW Solana Gila Bend, AZ Abengoa IO Feb-2008 2013 30 250 RE Ajo Ajo, AZ Duke Energy Gen Svcs IO Jan-2010 2011 25 5 Sun E AZ 1 Prescott, AZ SunEdison IO Feb-2010 2011 30 10 Saddle Mountain Tonopah, AZ SunEdison IO Jan - 2011 2012 30 15 Badger Tonopah, AZ PSEG IO Jan-2012 2013 30 15 Gillespie Maricopa County, AZ Recurrent Energy IO Jan-2012 2013 30 15 WIND 289 MW Aragonne Mesa Santa Rosa, NM Ingifen Asset Mgmt IO Dec-2005 2006 20 90 High Lonesome Mountainair, NM Foresight / EME IO Feb-2008 2009 30 100 Perrin Ranch Wind Williams, AZ NextEra Energy IO Jul-2010 2012 25 99 GEOTHERMAL 10 MW Salton Sea Imperial County, CA Cal Energy IO Jan-2006 2006 23 10 BIOMASS 14 MW Snowflake Snowflake, AZ Novo Power IO Sep-2005 2008 15 14 BIOGAS 6 MW Glendale Landfill Glendale, AZ Glendale Energy LLC IO Jul-2008 2010 20 3 NW Regional Landfill Surprise, AZ Waste Management IO Dec-2010 2012 20 3 INTER-UTILITY 540 MW PacifiCorp Seasonal Power Exchange - PacifiCorp IO Sep-1990 1991 30 480 Not Disclosed Not Disclosed Not Disclosed IO May-2009 2010 10 60 HEAT RATE OPTIONS 150 MW Call Option - Not Disclosed IO Oct-2005 2007 10 150 CONVENTIONAL TOLLING 1,074 MW CC Tolling Not Disclosed Not Disclosed IO Mar-2006 2007 10 514 CC Tolling Not Disclosed Not Disclosed IO Aug-2007 2010 10 560 DEMAND RESPONSE 25 MW Demand Response Not Disclosed Not Disclosed IO Sep-2008 2010 15 25 Total Contracted Capacity 2,418 MW 1 UD = Under Development; UC = Under Construction; IO = In Operation* As disclosed in 2015 Form 10-K.

Powering Growth, Delivering Value52 INVESTOR RELATIONS CONTACTS Paul J. Mountain, CFA General Manager, Investor Relations & Audit Services (602) 250-4952 paul.mountain@pinnaclewest.com Ted Geisler Director, Investor Relations (602) 250-3200 ted.geisler@pinnaclewest.com Chalese Haraldsen (602) 250-5643 chalese.haraldsen@pinnaclewest.com Pinnacle West Capital Corporation P.O. Box 53999, Mail Station 9998 Phoenix, Arizona 85072-3999 Visit us online at: www.pinnaclewest.com