POWERING GROWTH DELIVERING VALUE UBS European Tour l April 2-4, 2019 Powering Growth, Delivering Value

FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining high reliability and customer service levels; variations in demand for electricity, including those due to weather seasonality, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, including in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental, economic and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2018, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to earnings per share (EPS) refer to amounts attributable to common shareholders. We present “adjusted income taxes" that shows the impact of tax reform. Adjusted income taxes is a “non-GAAP financial measure,” as defined in accordance with SEC rules. The appendix contains a reconciliation to show the impact of tax reform. We believe the information provided in the reconciliation provides investors with useful indicators of our results that are comparable among periods because they exclude the effects of unusual items that may occur on an irregular basis, such as tax reform impacts. 2 Powering Growth, Delivering Value

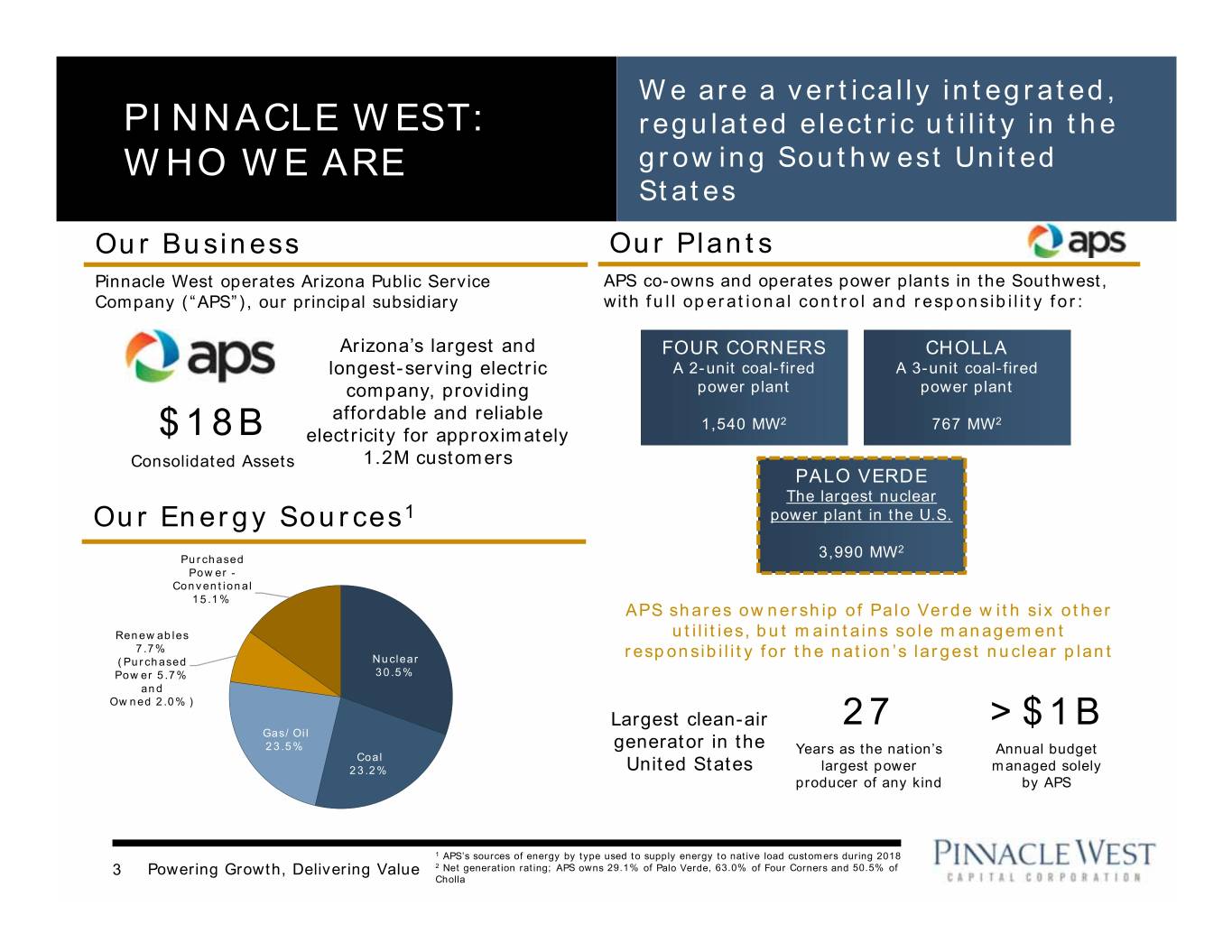

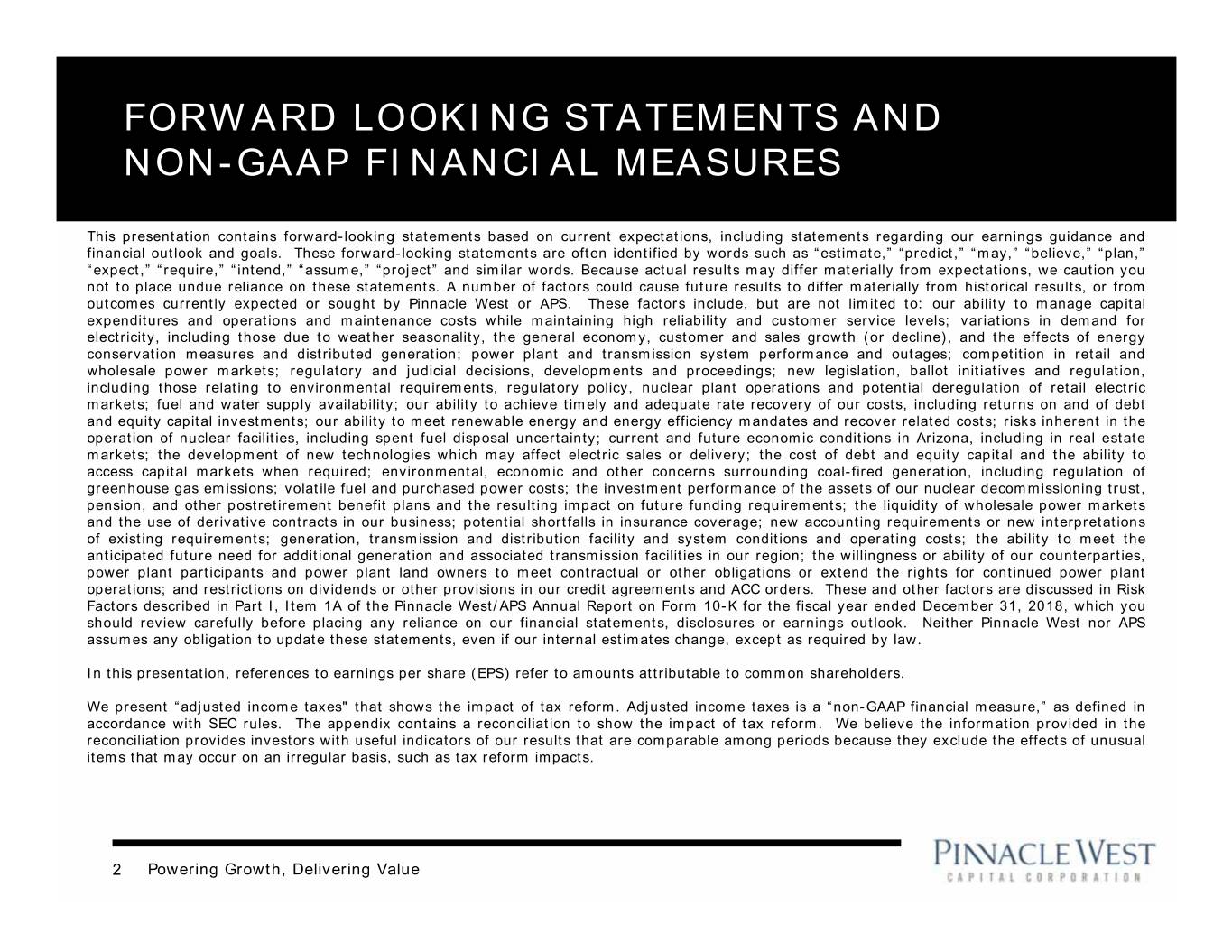

We are a vertically integrated, PINNACLE WEST: regulated electric utility in the WHO WE ARE growing Southwest United States Our Business Our Plants Pinnacle West operates Arizona Public Service APS co-owns and operates power plants in the Southwest, Company (“APS”), our principal subsidiary with full operational control and responsibility for: Arizona’s largest and FOUR CORNERS CHOLLA longest-serving electric A 2-unit coal-fired A 3-unit coal-fired company, providing power plant power plant affordable and reliable 1,540 MW2 767 MW2 $18B electricity for approximately Consolidated Assets 1.2M customers PALO VERDE The largest nuclear Our Energy Sources1 power plant in the U.S. 2 Purchased 3,990 MW Power - Conventional 15.1% APS shares ownership of Palo Verde with six other Renewables utilities, but maintains sole management 7.7% responsibility for the nation’s largest nuclear plant (Purchased Nuclear Power 5.7% 30.5% and Owned 2.0%) Largest clean-air 27 >$1B Gas/Oil 23.5% generator in the Years as the nation’s Annual budget Coal 23.2% United States largest power managed solely producer of any kind by APS 1 APS’s sources of energy by type used to supply energy to native load customers during 2018 3 Powering Growth, Delivering Value 2 Net generation rating; APS owns 29.1% of Palo Verde, 63.0% of Four Corners and 50.5% of Cholla

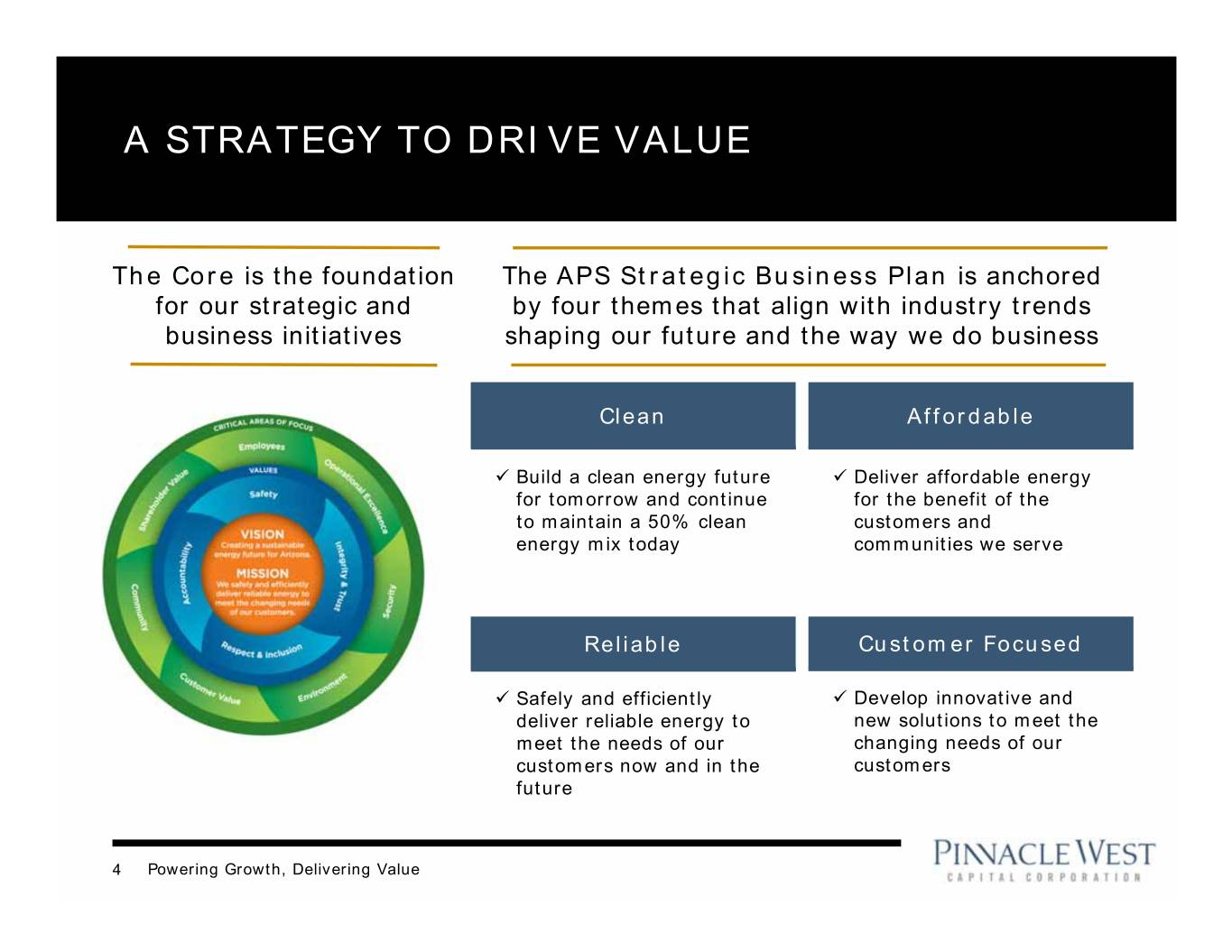

A STRATEGY TO DRIVE VALUE The Core is the foundation The APS Strategic Business Plan is anchored for our strategic and by four themes that align with industry trends business initiatives shaping our future and the way we do business Clean Affordable Build a clean energy future Deliver affordable energy for tomorrow and continue for the benefit of the to maintain a 50% clean customers and energy mix today communities we serve Reliable Customer Focused Safely and efficiently Develop innovative and deliver reliable energy to new solutions to meet the meet the needs of our changing needs of our customers now and in the customers future 4 Powering Growth, Delivering Value

PINNACLE WEST: We are making clean energy and infrastructure investments to OUR FUTURE support Arizona’s growth Our future includes: • More clean energy • A healthier environment • Palo Verde Generating Station, the largest clean energy producer in the country • Infrastructure to power Arizona’s growth To get there we will: • Continue Arizona’s solar leadership • Invest in battery storage and other clean technologies • Invest in infrastructure to support electric vehicles • Partner with customers to achieve their clean energy goals We expect 340,000 new customers and a 30% increase in our customer’s energy needs by 2030 5 Powering Growth, Delivering Value

CLEAN ENERGY Plans to invest in 950 MW of INVESTMENTS new clean technology by 2025 2018 Battery Storage RFP • 141 MW located on six APS solar plant sites • Utility owned • Anticipated in-service by mid-2020 2018 Peaking Capacity RFP • 150 MW of battery storage • 20 year power purchase agreements beginning June 2021 Future Investments • At least 660 MW of solar plus battery storage and stand-alone battery storage by mid-2025 • Utility owned • First 260 MW to be procured in 2019 • 60 MW on additional APS solar plant sites • 100 MW of solar plus 100 MW of battery storage 6 Powering Growth, Delivering Value

APS’s vision is to create a SUSTAINABILITY sustainable energy future for Arizona Five critical areas of our sustainability efforts Today, we serve customers with an energy mix that is 50% Carbon Management clean • Commitment to exit coal by 2038 • MSCI Environmental Sustainability and Governance A rating1 Energy Innovation • More than 1,400 MW of installed solar capacity • Plans to add at least 950 MW of new clean technologies by 2025 Our 10 grid-scale solar plants Safety & Security are powered by more than 1 million solar panels • Nearly 50% reduction in physical security false alarms since 2016 • Ongoing cyber threat awareness training and drills to enhance preparedness Water Resources • 13% reduction in groundwater use since 2014 • 20 billion gallons of wastewater recycled each year to cool Palo Verde Palo Verde Generating Station provides nearly 70% of People Arizona’s carbon-free energy and uses recycled wastewater • Average employee tenure of 12.5 years due to strong talent strategy to cool the plant • More than 20% of our employees are veterans 1 As of November 6, 2018 7 Powering Growth, Delivering Value

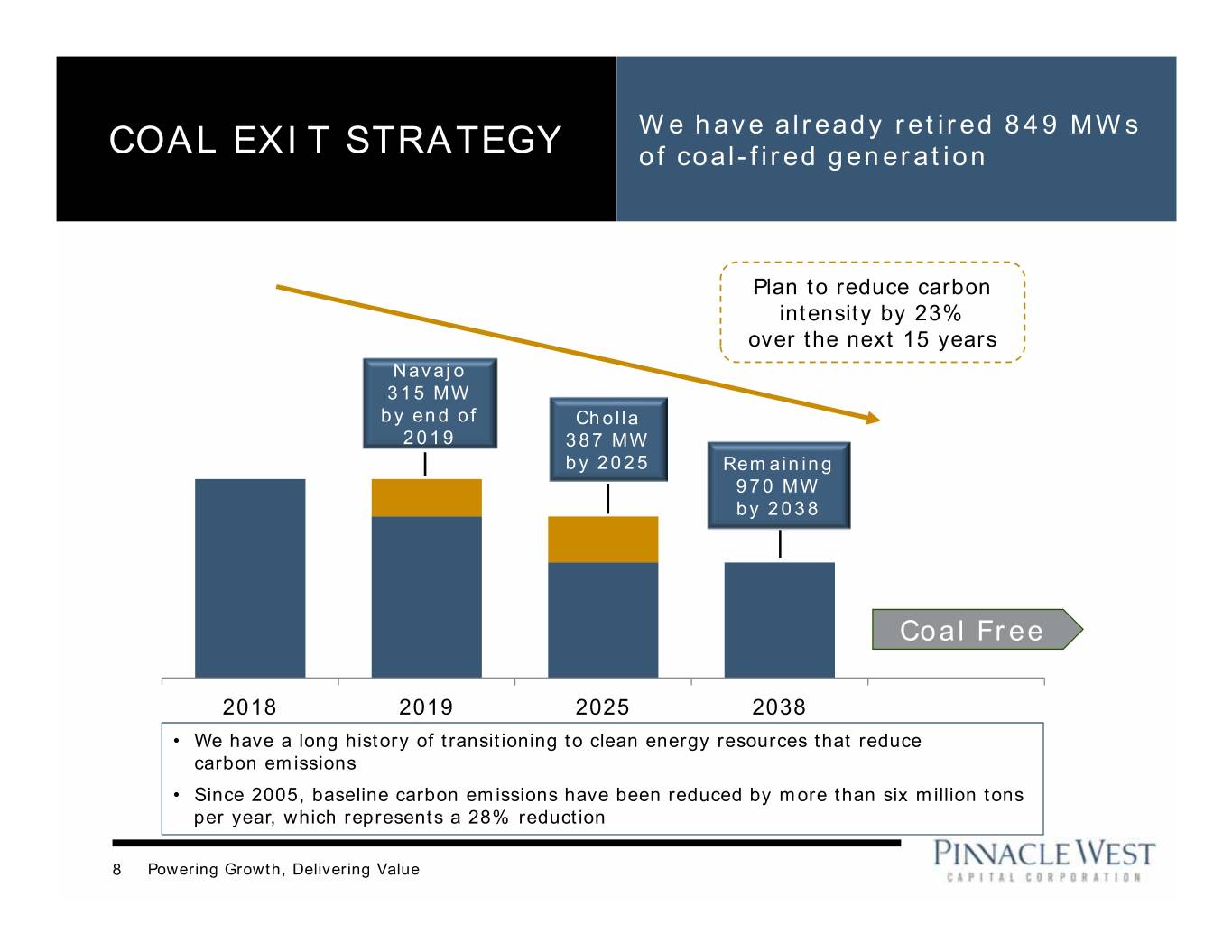

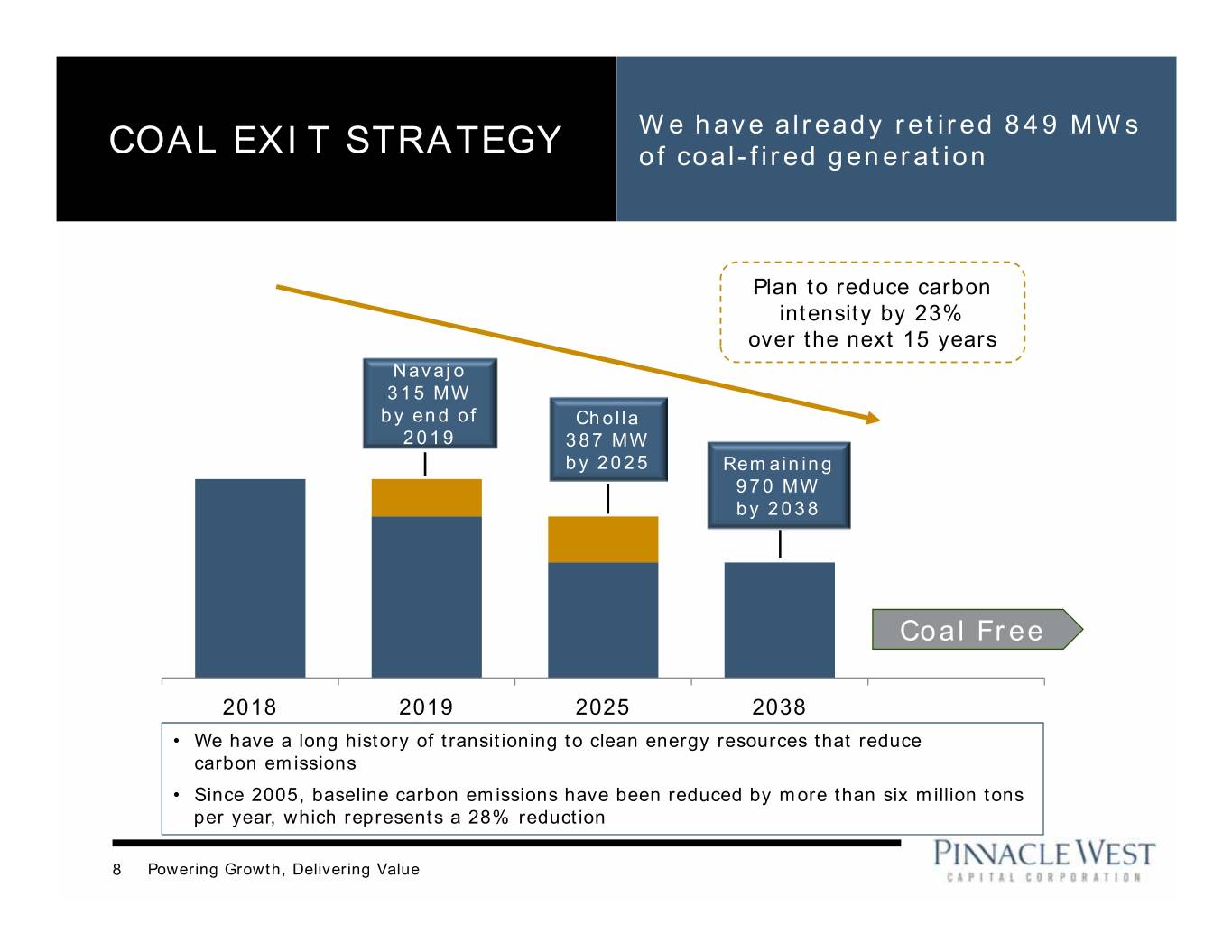

We have already retired 849 MWs COAL EXIT STRATEGY of coal-fired generation Plan to reduce carbon intensity by 23% over the next 15 years Navajo 315 MW by end of Cholla 2019 387 MW by 2025 Remaining 970 MW by 2038 Coal Free 2018 2019 2025 2038 • We have a long history of transitioning to clean energy resources that reduce carbon emissions • Since 2005, baseline carbon emissions have been reduced by more than six million tons per year, which represents a 28% reduction 8 Powering Growth, Delivering Value

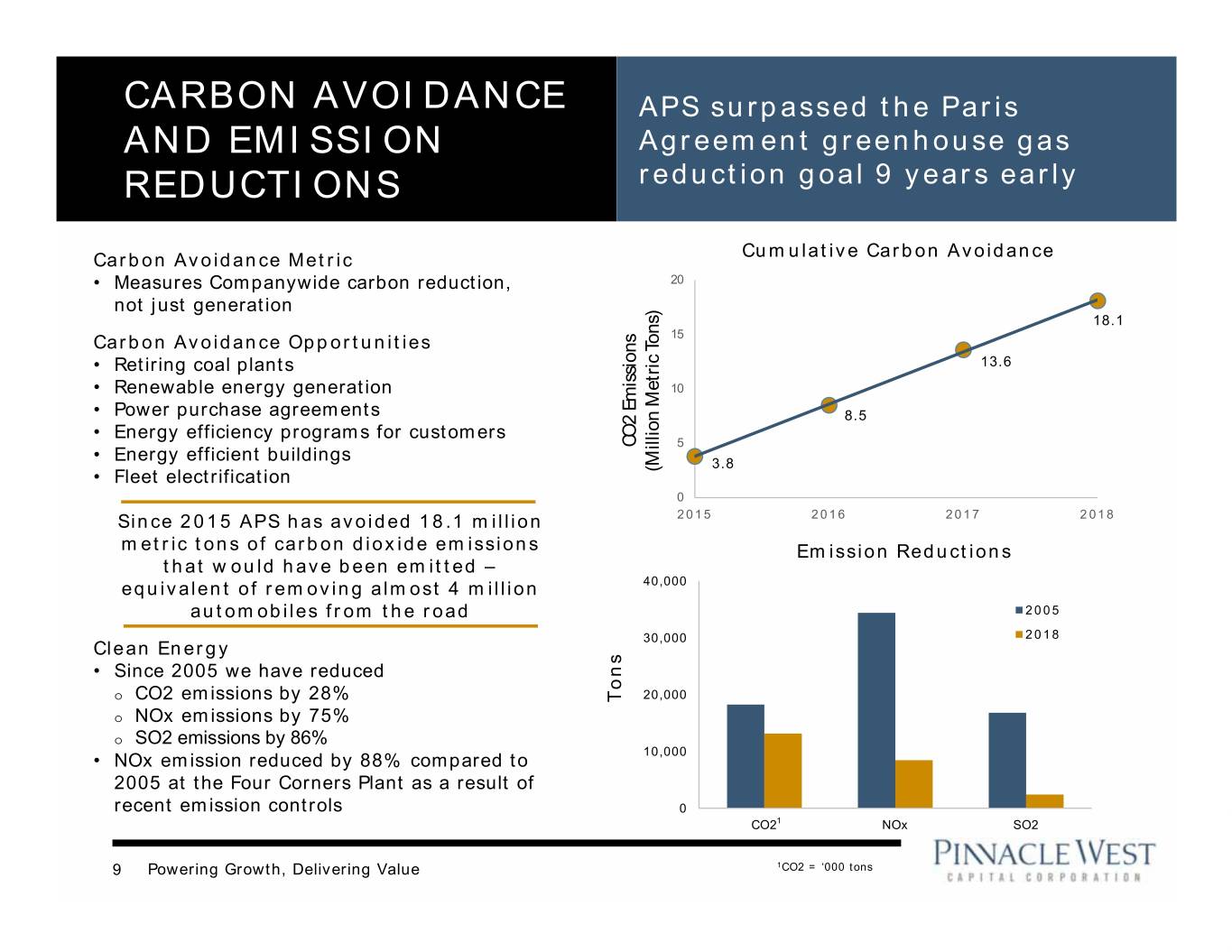

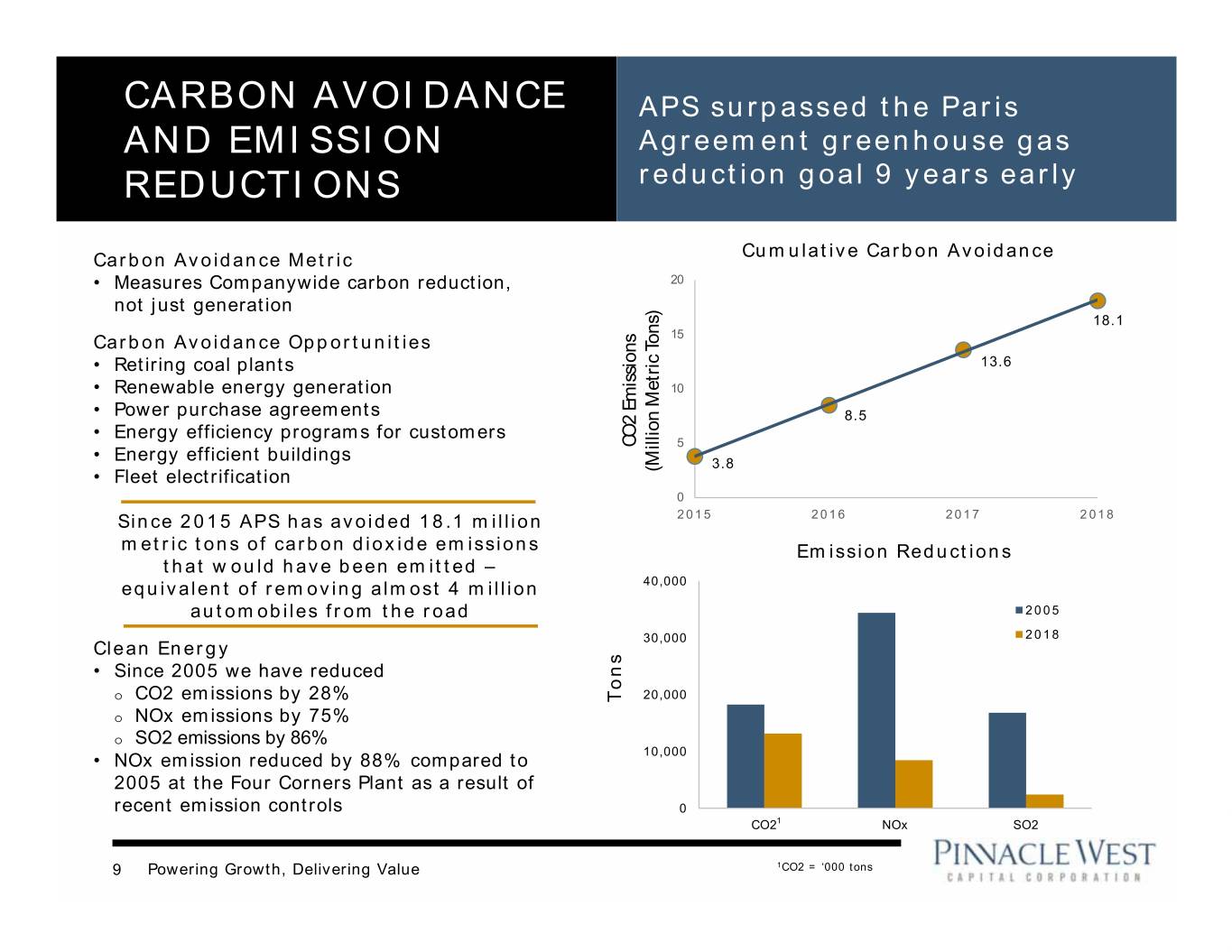

CARBON AVOIDANCE APS surpassed the Paris AND EMISSION Agreement greenhouse gas REDUCTIONS reduction goal 9 years early Cumulative Carbon Avoidance Carbon Avoidance Metric • Measures Companywide carbon reduction, 20 not just generation 18.1 Carbon Avoidance Opportunities 15 • Retiring coal plants 13.6 • Renewable energy generation 10 • Power purchase agreements 8.5 • Energy efficiency programs for customers CO2 Emissions CO2 5 • Energy efficient buildings 3.8 • Fleet electrification Tons) (Million Metric 0 Since 2015 APS has avoided 18.1 million 2015 2016 2017 2018 metric tons of carbon dioxide emissions Emission Reductions that would have been emitted – equivalent of removing almost 4 million 40,000 automobiles from the road 2005 30,000 2018 Clean Energy • Since 2005 we have reduced o 20,000 CO2 emissions by 28% Tons o NOx emissions by 75% o SO2 emissions by 86% • NOx emission reduced by 88% compared to 10,000 2005 at the Four Corners Plant as a result of recent emission controls 0 CO21 NOx SO2 9 Powering Growth, Delivering Value 1CO2 = ‘000 tons

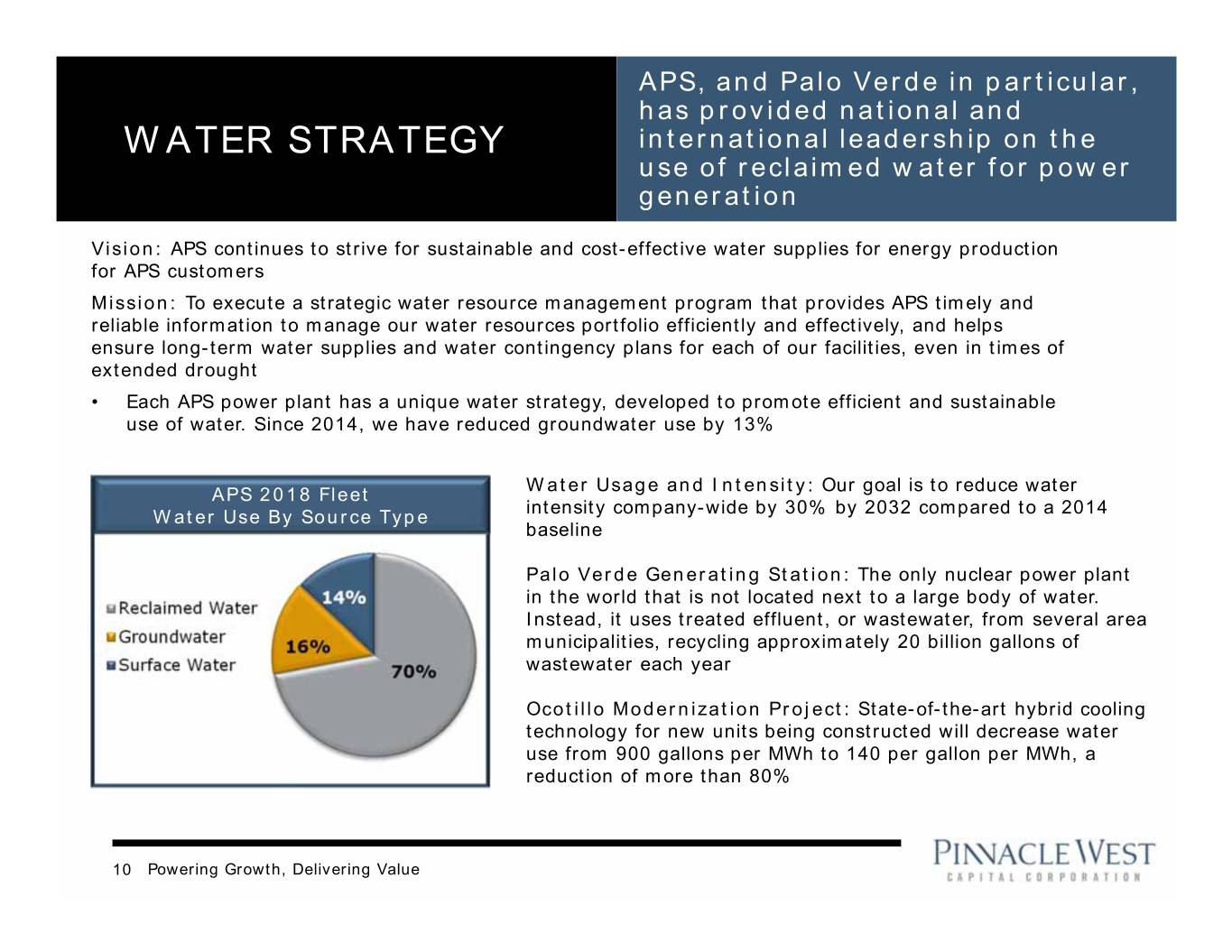

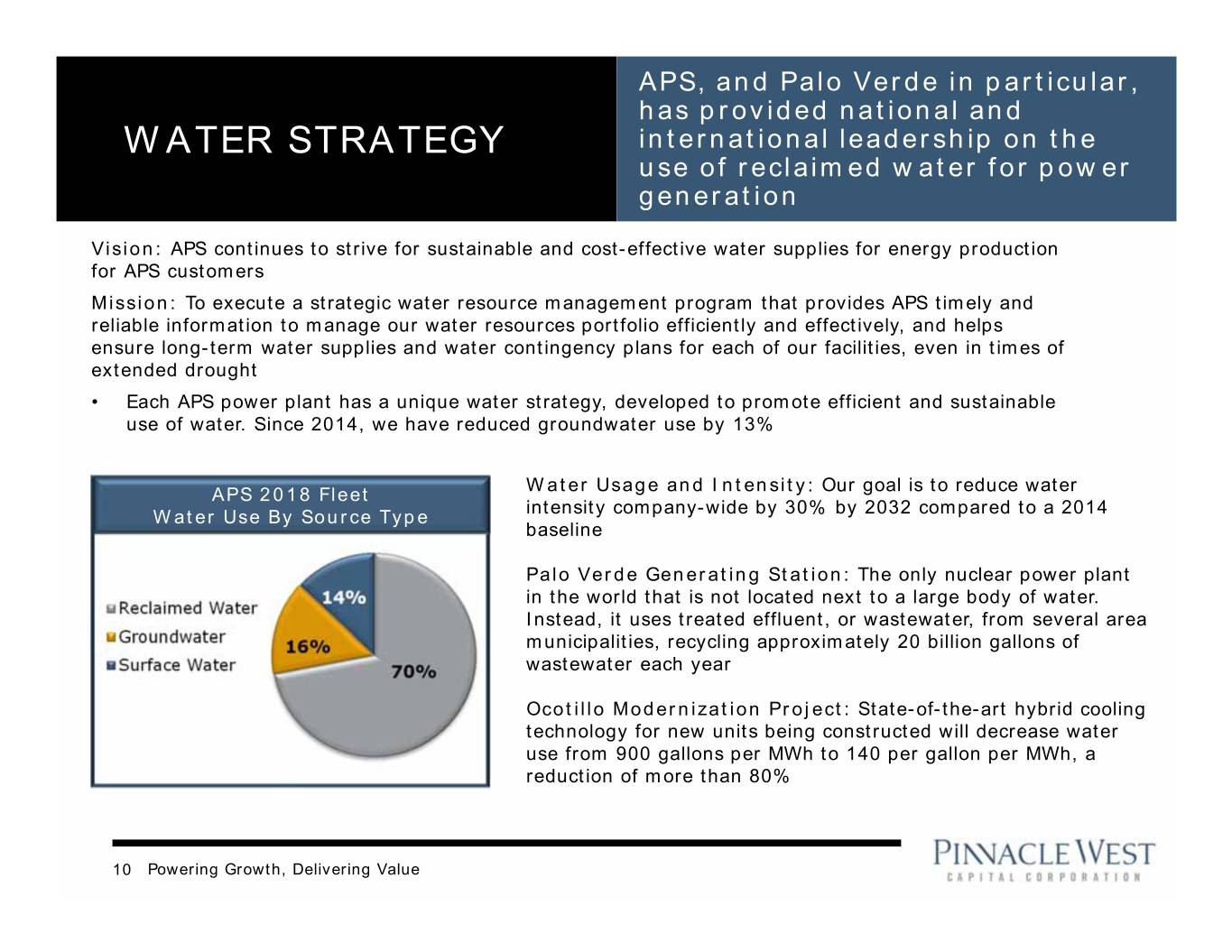

APS, and Palo Verde in particular, has provided national and WATER STRATEGY international leadership on the use of reclaimed water for power generation Vision: APS continues to strive for sustainable and cost-effective water supplies for energy production for APS customers Mission: To execute a strategic water resource management program that provides APS timely and reliable information to manage our water resources portfolio efficiently and effectively, and helps ensure long-term water supplies and water contingency plans for each of our facilities, even in times of extended drought • Each APS power plant has a unique water strategy, developed to promote efficient and sustainable use of water. Since 2014, we have reduced groundwater use by 13% Water Usage and Intensity: Our goal is to reduce water APS 2018 Fleet intensity company-wide by 30% by 2032 compared to a 2014 Water Use By Source Type baseline Palo Verde Generating Station: The only nuclear power plant 14% in the world that is not located next to a large body of water. Reclaimed Water Instead, it uses treated effluent, or wastewater, from several area Groundwater 16% municipalities, recycling approximately 20 billion gallons of Surface Water 70% wastewater each year Ocotillo Modernization Project: State-of-the-art hybrid cooling technology for new units being constructed will decrease water use from 900 gallons per MWh to 140 per gallon per MWh, a reduction of more than 80% 10 Powering Growth, Delivering Value

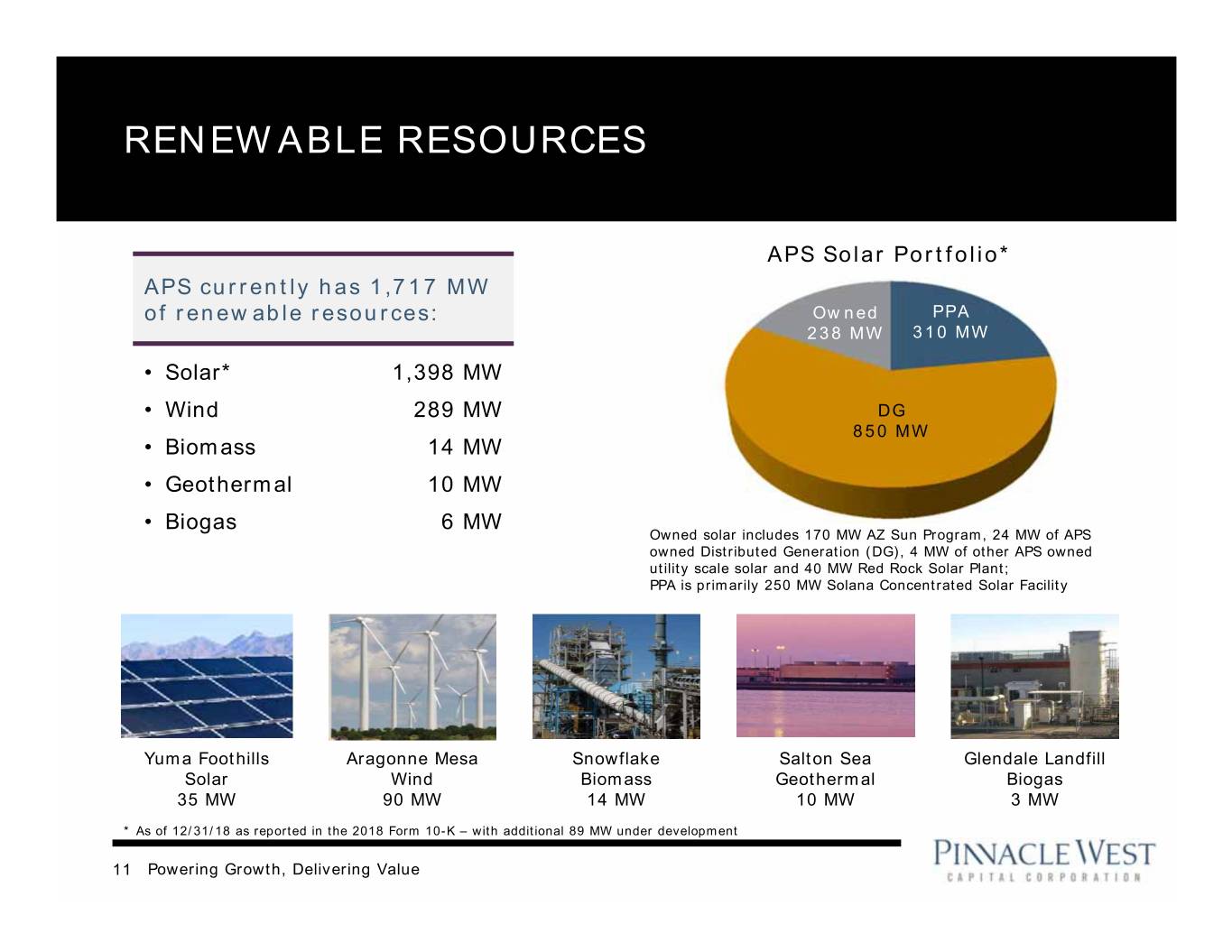

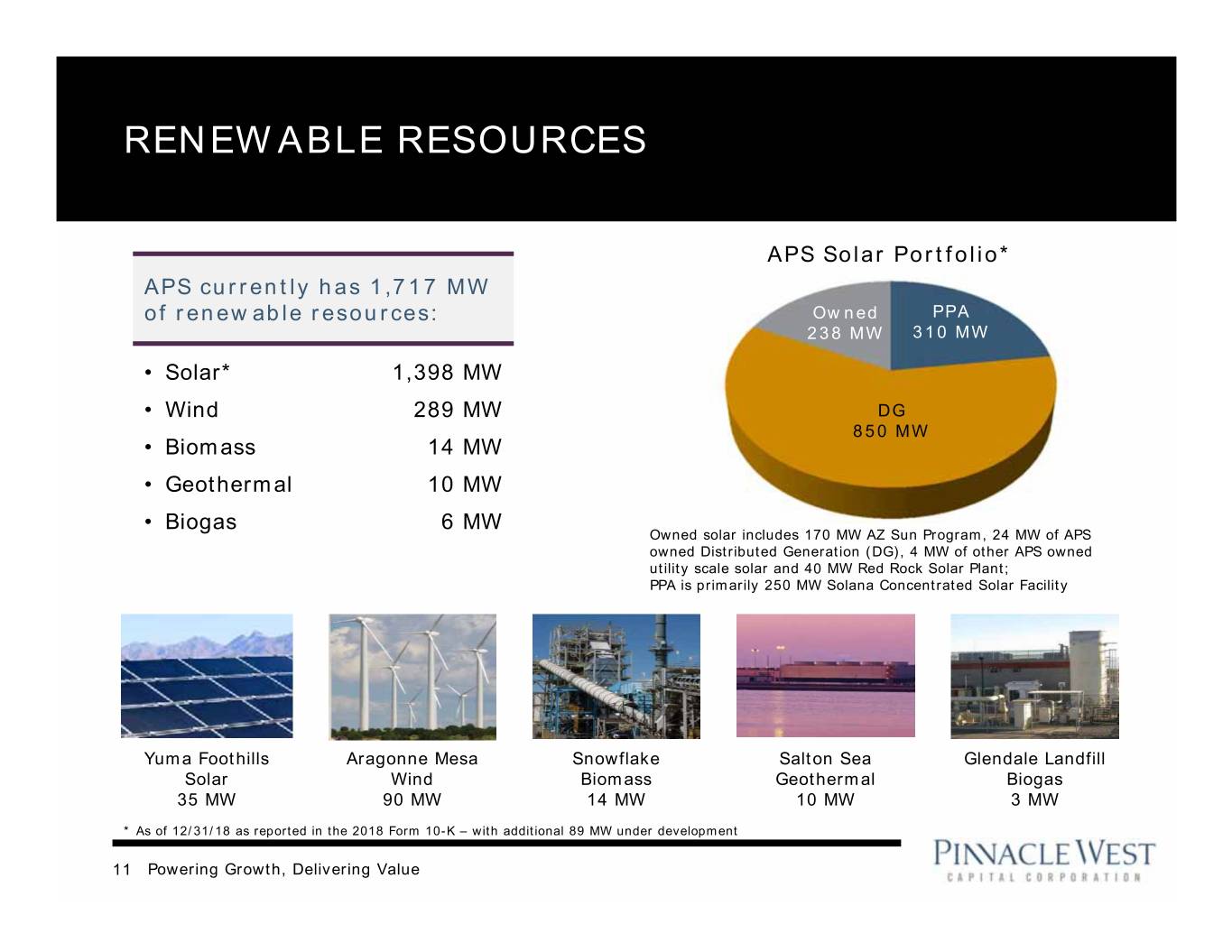

RENEWABLE RESOURCES APS Solar Portfolio* APS currently has 1,717 MW of renewable resources: Owned PPA 238 MW 310 MW • Solar* 1,398 MW • Wind 289 MW DG 850 MW • Biomass 14 MW • Geothermal 10 MW • Biogas 6 MW Owned solar includes 170 MW AZ Sun Program, 24 MW of APS owned Distributed Generation (DG), 4 MW of other APS owned utility scale solar and 40 MW Red Rock Solar Plant; PPA is primarily 250 MW Solana Concentrated Solar Facility Yuma Foothills Aragonne Mesa Snowflake Salton Sea Glendale Landfill Solar Wind Biomass Geothermal Biogas 35 MW 90 MW 14 MW 10 MW 3MW * As of 12/31/18 as reported in the 2018 Form 10-K – with additional 89 MW under development 11 Powering Growth, Delivering Value

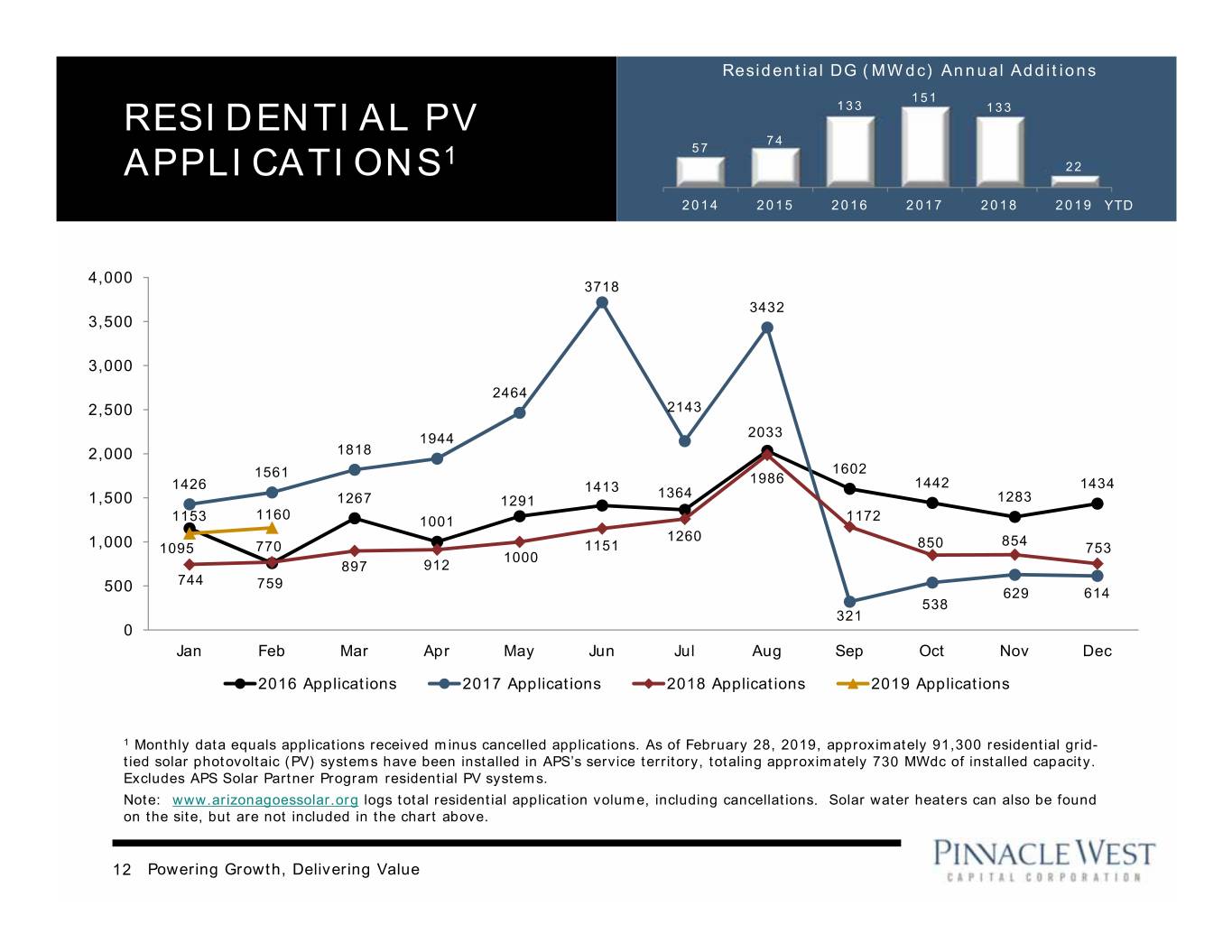

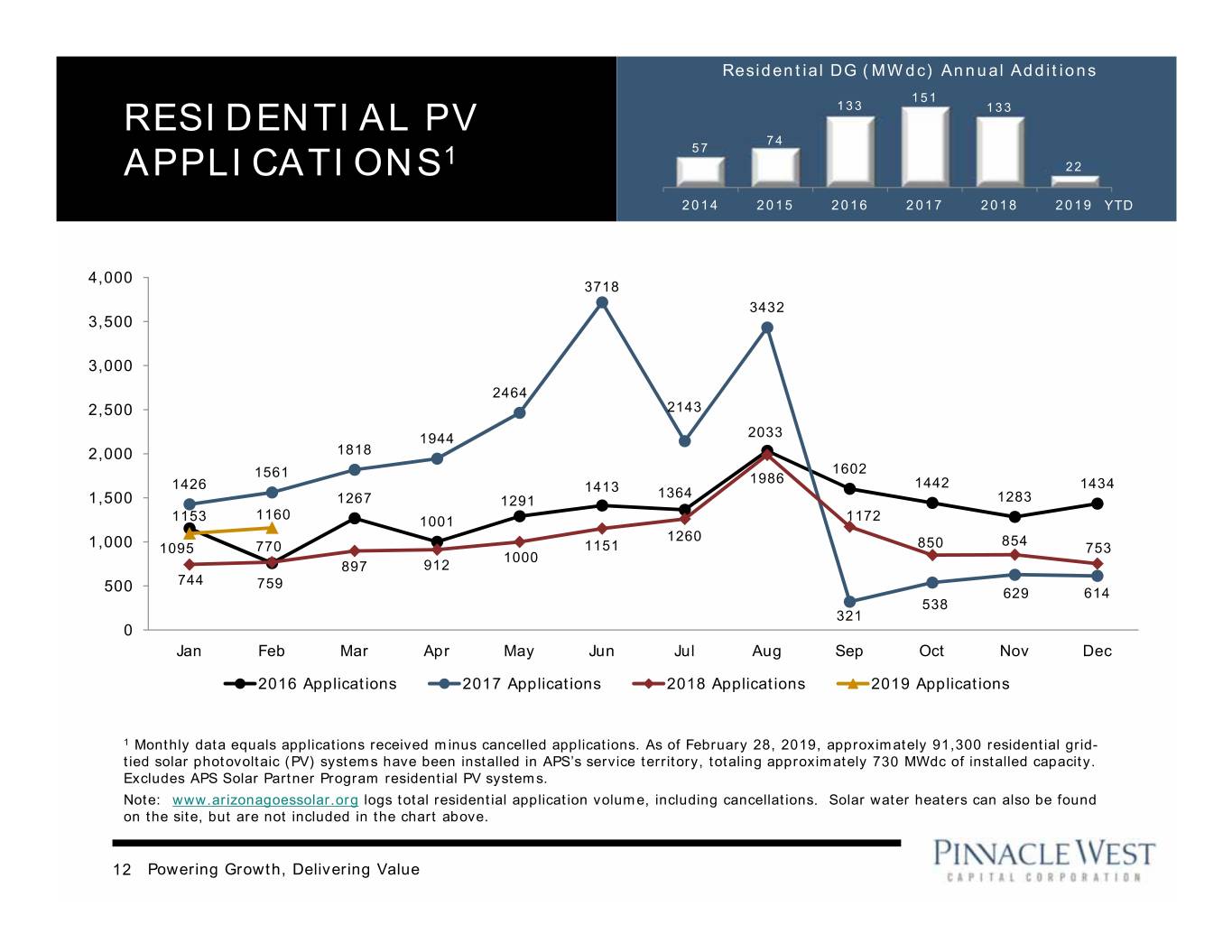

Residential DG (MWdc) Annual Additions 151 RESIDENTIAL PV 133 133 74 1 57 APPLICATIONS 22 2014 2015 2016 2017 2018 2019 YTD 4,000 3718 3432 3,500 3,000 2464 2,500 2143 1944 2033 2,000 1818 1561 1602 1426 1986 1442 1434 1413 1364 1,500 1267 1291 1283 1160 1153 1001 1172 1260 854 1,000 1095 770 1151 850 753 1000 897 912 744 759 500 629 614 538 321 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2016 Applications 2017 Applications 2018 Applications 2019 Applications 1 Monthly data equals applications received minus cancelled applications. As of February 28, 2019, approximately 91,300 residential grid- tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately 730 MWdc of installed capacity. Excludes APS Solar Partner Program residential PV systems. Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site, but are not included in the chart above. 12 Powering Growth, Delivering Value

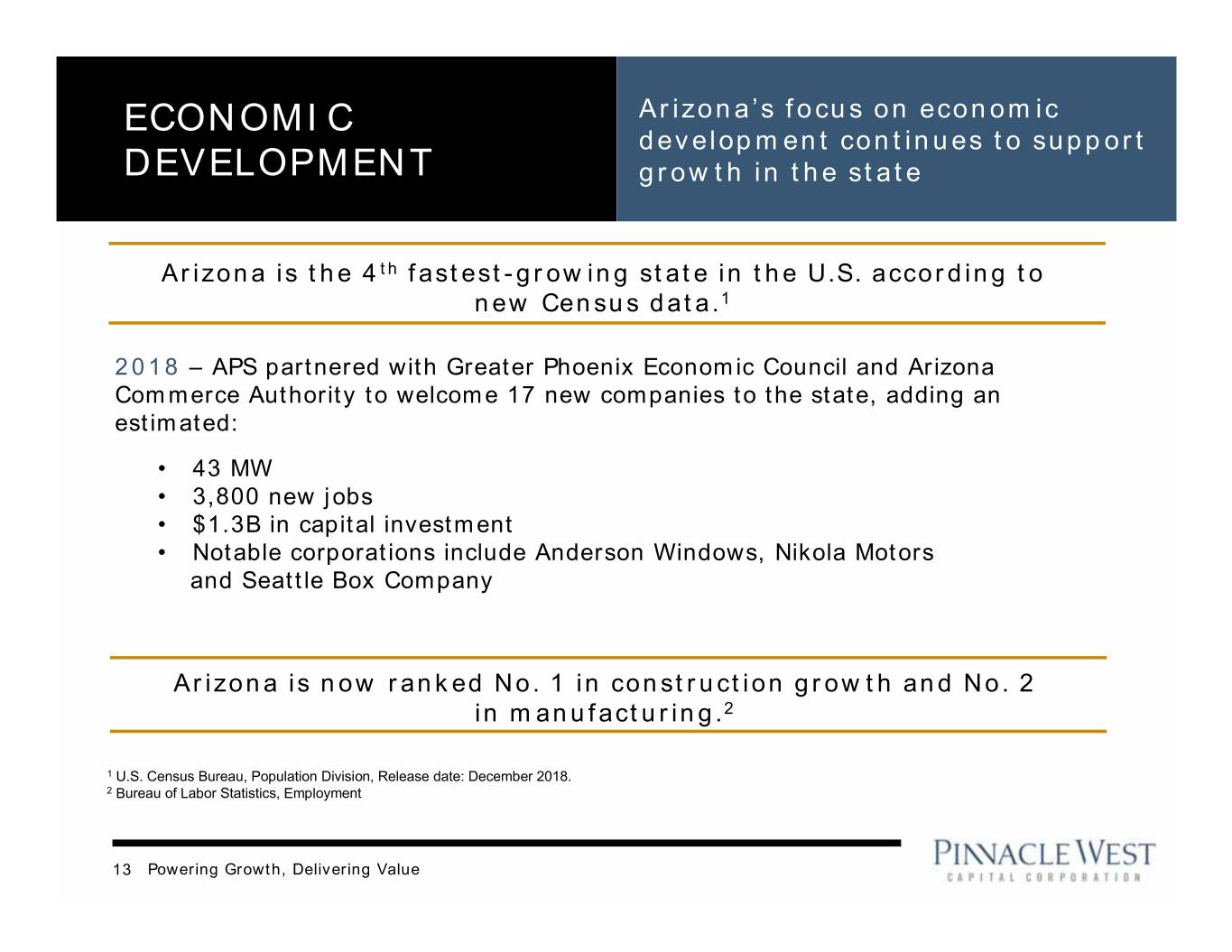

ECONOMIC Arizona’s focus on economic development continues to support DEVELOPMENT growth in the state Arizona is the 4th fastest-growing state in the U.S. according to new Census data.1 2018 – APS partnered with Greater Phoenix Economic Council and Arizona Commerce Authority to welcome 17 new companies to the state, adding an estimated: • 43 MW • 3,800 new jobs • $1.3B in capital investment • Notable corporations include Anderson Windows, Nikola Motors and Seattle Box Company Arizona is now ranked No. 1 in construction growth and No. 2 in manufacturing.2 1 U.S. Census Bureau, Population Division, Release date: December 2018. 2 Bureau of Labor Statistics, Employment 13 Powering Growth, Delivering Value

APPENDIX Powering Growth, Delivering Value

SENIOR Our management team has more than 100 combined years MANAGEMENT of creating shareholder value in TEAM the energy industry Don Brandt Jim Hatfield Chairman of the Board, President and Executive Vice President and Chief Executive Officer, Pinnacle West and Chief Financial Officer, Pinnacle West & APS Chairman and Chief Executive Officer, APS We maintain a robust • Joined Pinnacle West in 2002 • Joined as SVP and CFO in pipeline of talent to serve from Ameren 2008 from OGE Energy our complex operations • Elected to Pinnacle West Corp. and facilitate effective Board and named Chairman, • Responsible for corporate CEO in 2009 functions including finance, succession planning in a • Recognized industry leader investor relations, and risk highly competitive talent with 30+ years in the nuclear management and energy industries • 38+ years of financial environment • Vice Chairman of the experience in the utility and Institute of Nuclear Power energy business Operations and Chairman of the Nuclear Energy Institute Jeff Guldner Daniel Froetscher Bob Bement President, APS and Executive Vice President Executive Vice President of Operations, APS Executive Vice President and Public Policy, Pinnacle West Chief Nuclear Officer, APS • Joined APS in 2004 from • Joined APS in 1980 • Joined APS in 2007 from Snell & Wilmer • Appointed EVP of Operations, Arkansas Nuclear One • Promoted to President in February 2018 • Promoted from SVP of Site 2018 • Responsible for overseeing Operations to EVP and Chief • Responsible for all areas of T&D, fossil generation, Nuclear Officer in 2016 APS excluding nuclear resource management, • Responsible for all nuclear- • Significant experience in sustainability, supply chain, related activities associated public utility and energy law security and customer service with Palo Verde and regulation • Significant leadership and • Seasoned nuclear industry industry experience expert serving on several industry committees 15 Powering Growth, Delivering Value

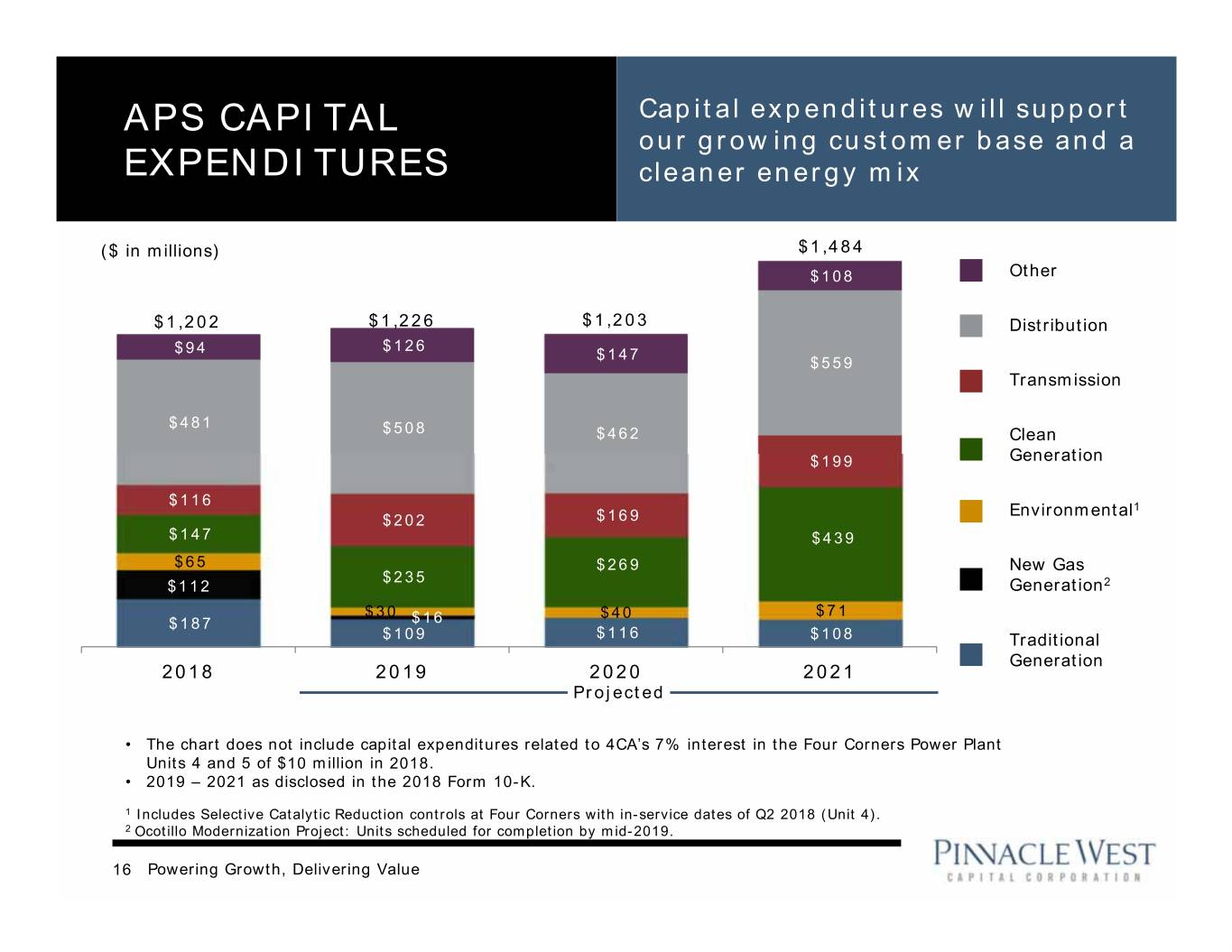

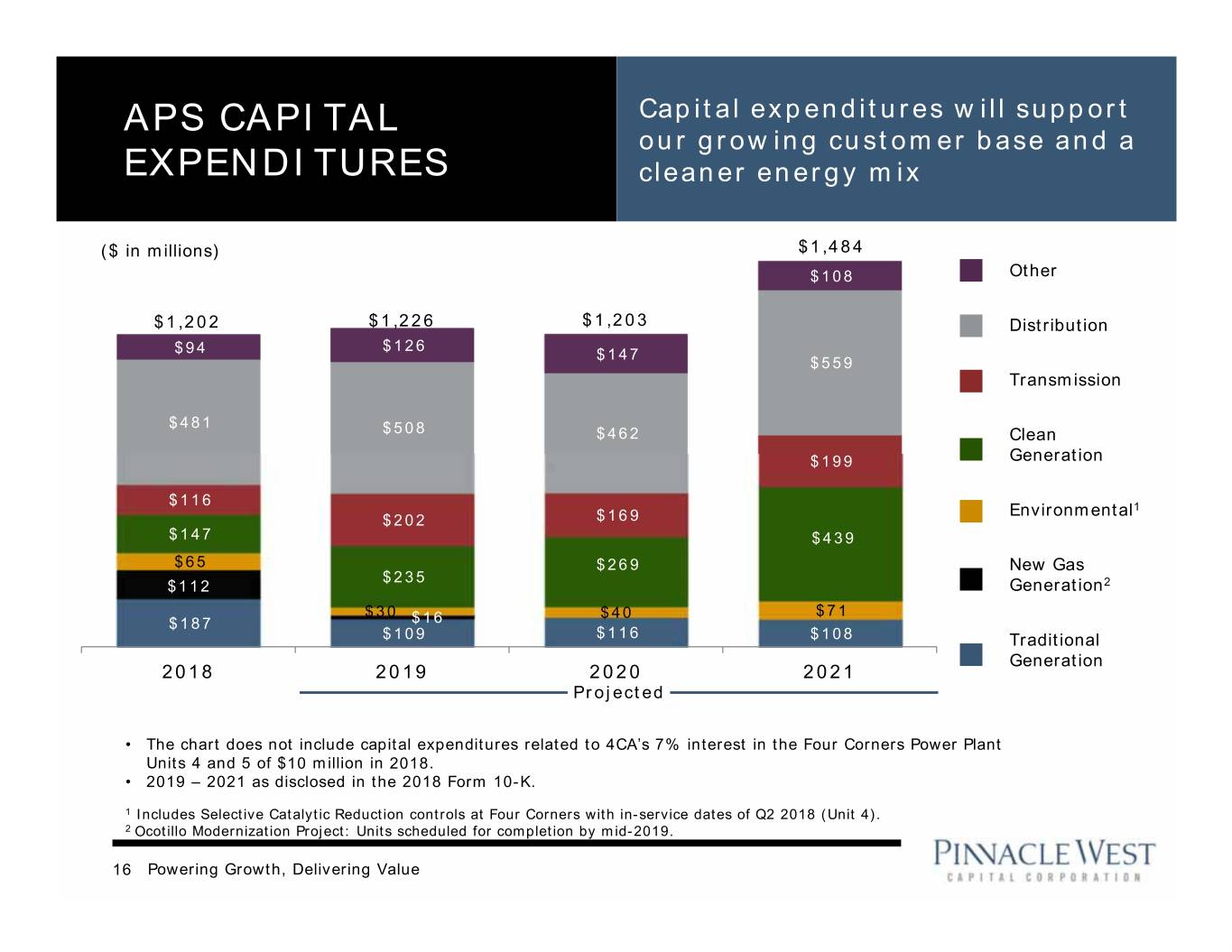

APS CAPITAL Capital expenditures will support our growing customer base and a EXPENDITURES cleaner energy mix ($ in millions) $1,484 $108 Other $1,202 $1,226 $1,203 Distribution $126 $94 $147 $559 Transmission $481 $508 $462 Clean $199 Generation $116 Environmental1 $202 $169 $147 $439 $65 $269 New Gas $235 $112 Generation2 $30 $40 $71 $187 $16 $109 $116 $108 Traditional Generation 2018 2019 2020 2021 Projected • The chart does not include capital expenditures related to 4CA’s 7% interest in the Four Corners Power Plant Units 4 and 5 of $10 million in 2018. • 2019 – 2021 as disclosed in the 2018 Form 10-K. 1 Includes Selective Catalytic Reduction controls at Four Corners with in-service dates of Q2 2018 (Unit 4). 2 Ocotillo Modernization Project: Units scheduled for completion by mid-2019. 16 Powering Growth, Delivering Value

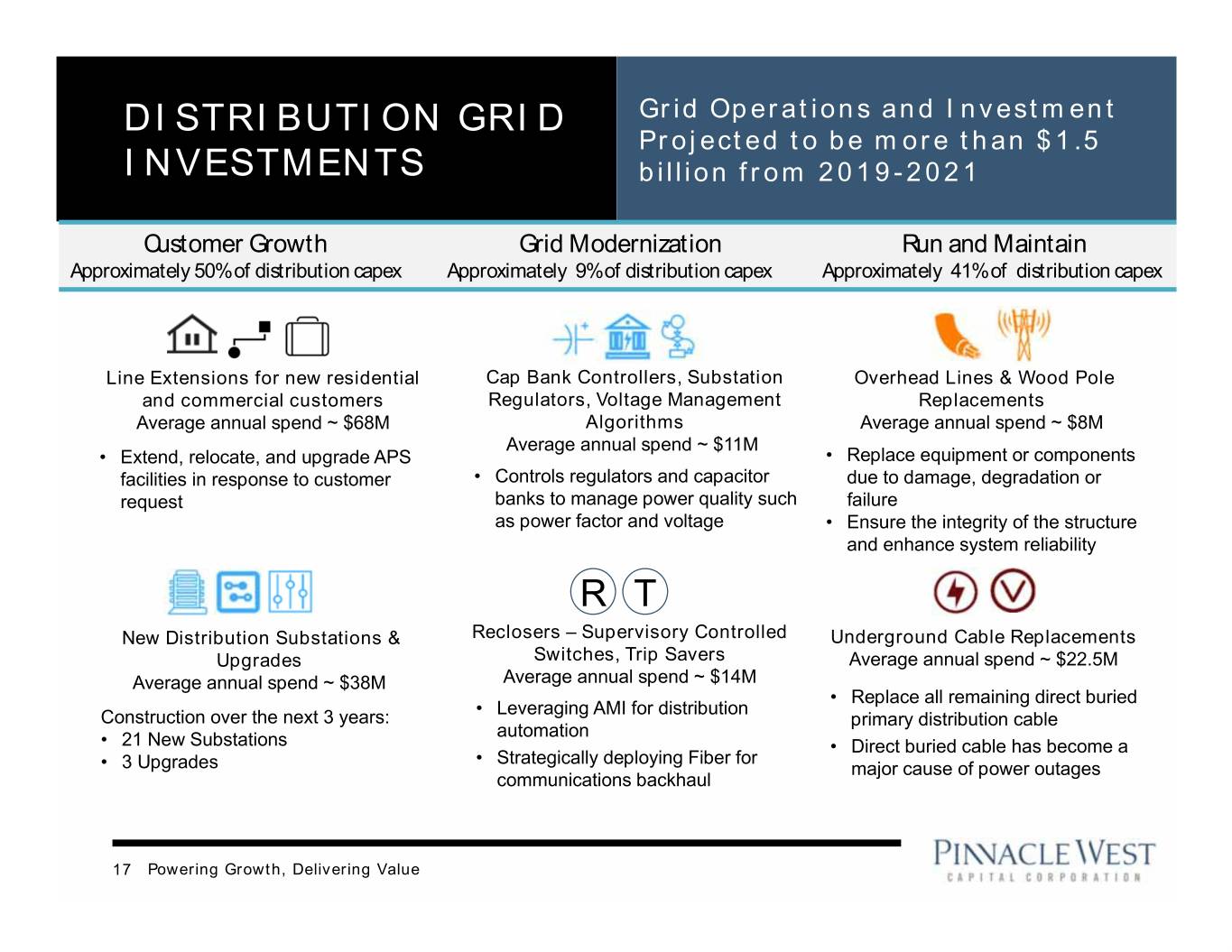

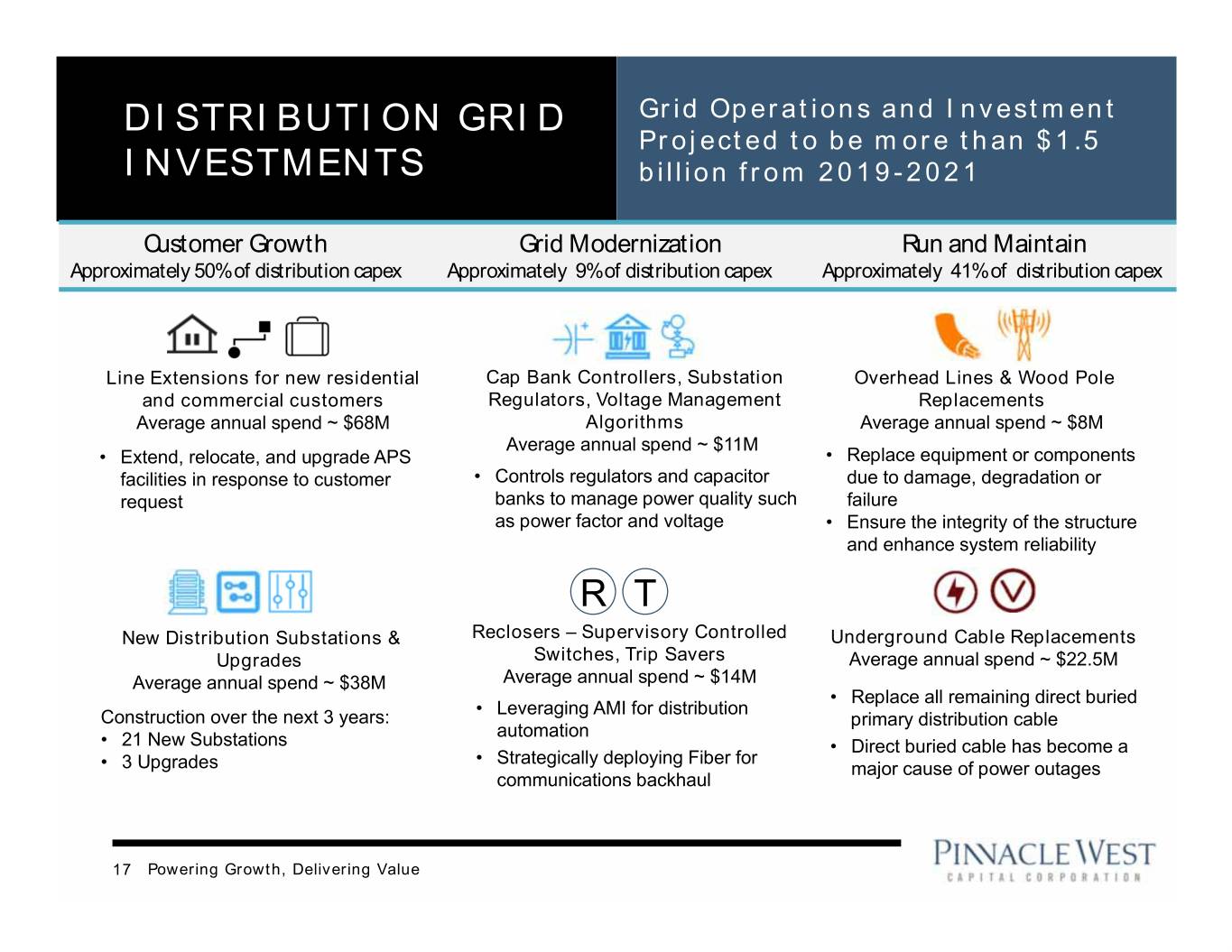

DISTRIBUTION GRID Grid Operations and Investment Projected to be more than $1.5 INVESTMENTS billion from 2019-2021 Customer Growth Grid Modernization Run and Maintain Approximately 50% of distribution capex Approximately 9% of distribution capex Approximately 41% of distribution capex Line Extensions for new residential Cap Bank Controllers, Substation Overhead Lines & Wood Pole and commercial customers Regulators, Voltage Management Replacements Average annual spend ~ $68M Algorithms Average annual spend ~ $8M Average annual spend ~ $11Mpend • Extend, relocate, and upgrade APS • Replace equipment or components ~ $11M facilities in response to customer • Controls regulators and capacitor due to damage, degradation or request banks to manage power quality such failure as power factor and voltage • Ensure the integrity of the structure and enhance system reliability R T New Distribution Substations & Reclosers – Supervisory Controlled Underground Cable Replacements Upgrades Switches, Trip Savers Average annual spend ~ $22.5M Average annual spend ~ $38M Average annual spend ~ $14M • Replace all remaining direct buried • Leveraging AMI for distribution Construction over the next 3 years: primary distribution cable automation • 21 New Substations • Direct buried cable has become a • Strategically deploying Fiber for • 3 Upgrades major cause of power outages communications backhaul 17 Powering Growth, Delivering Value

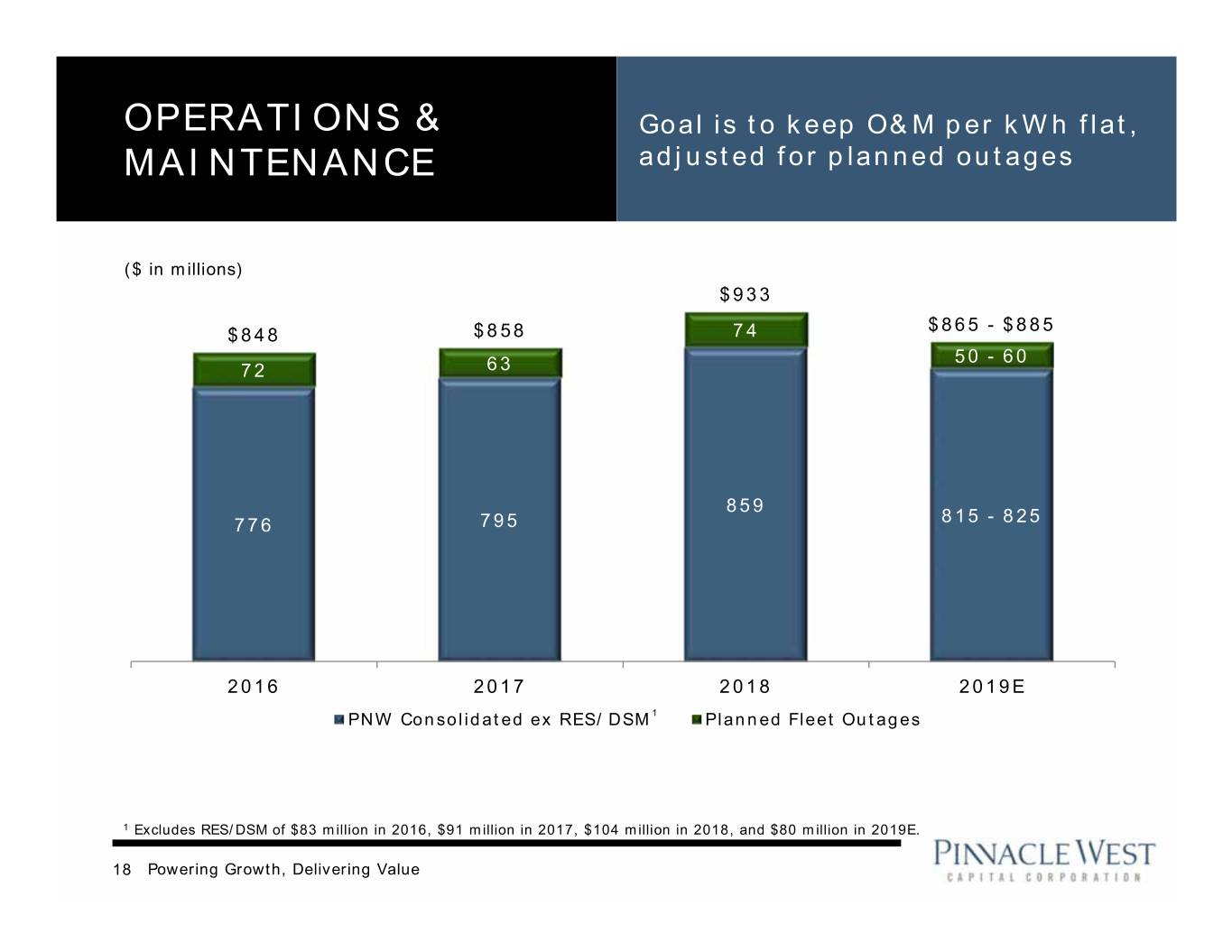

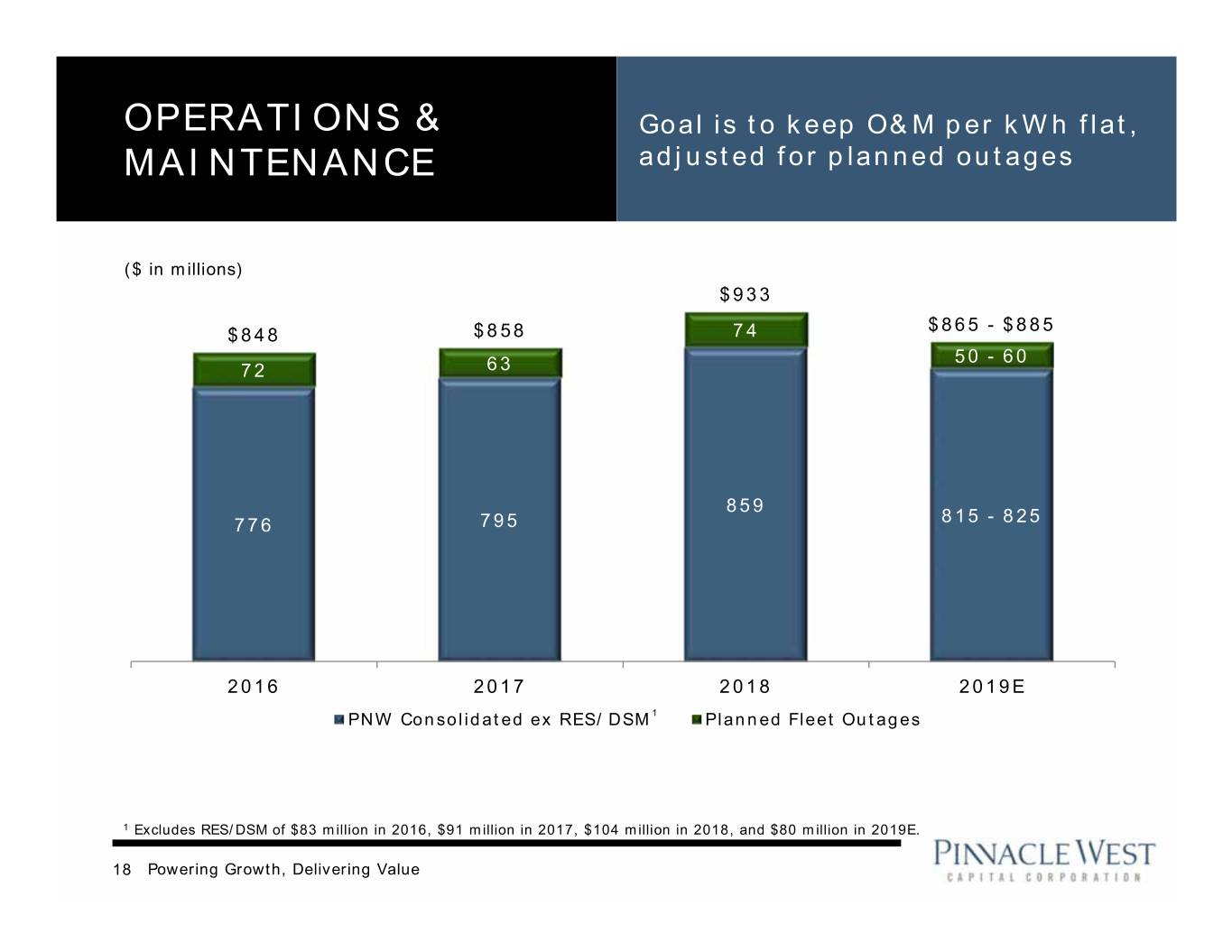

OPERATIONS & Goal is to keep O&M per kWh flat, MAINTENANCE adjusted for planned outages ($ in millions) $933 $865 - $885 $848 $858 74 50 - 60 72 63 859 776 795 815 - 825 2016 2017 2018 2019E PNW Consolidated ex RES/DSM1 Planned Fleet Outages 1 Excludes RES/DSM of $83 million in 2016, $91 million in 2017, $104 million in 2018, and $80 million in 2019E. 18 Powering Growth, Delivering Value

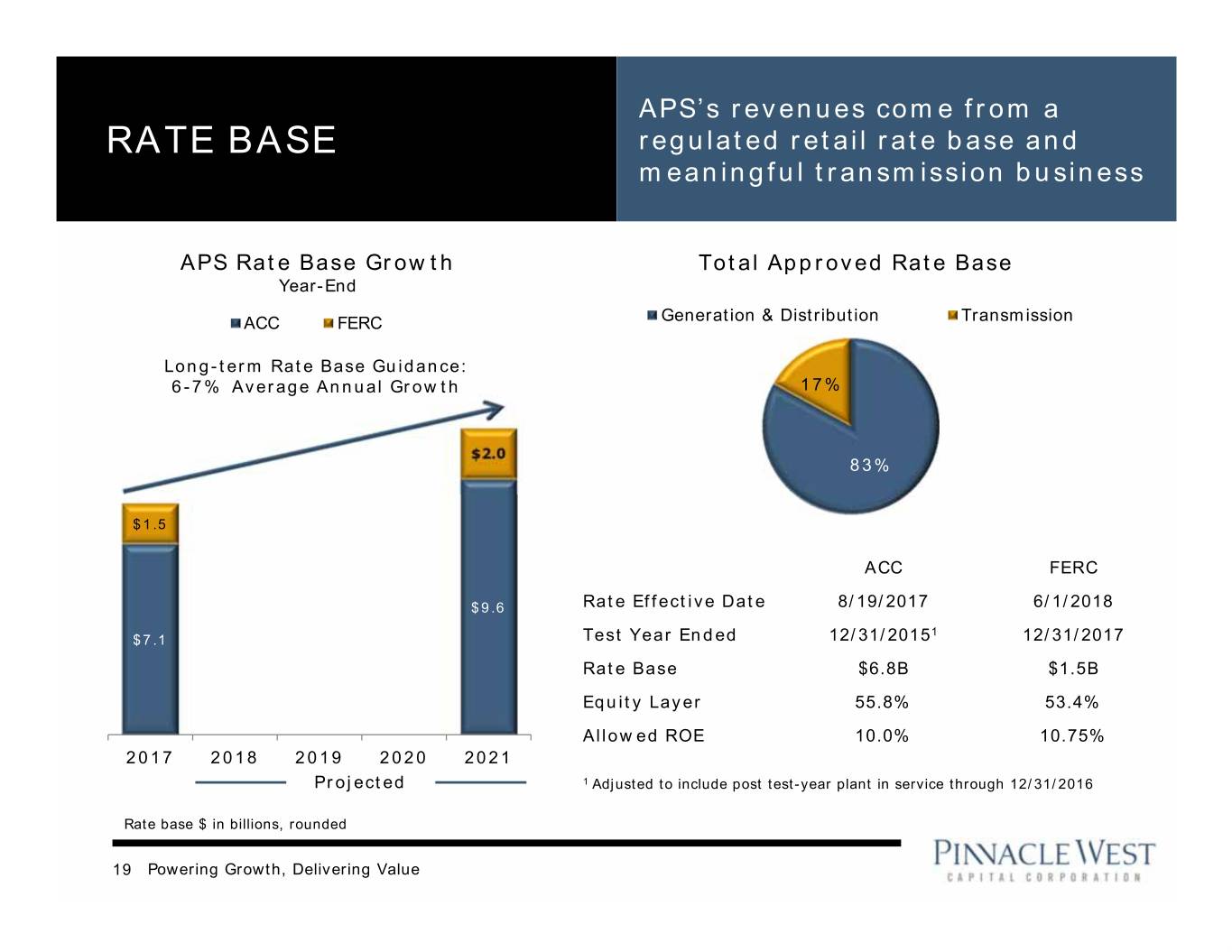

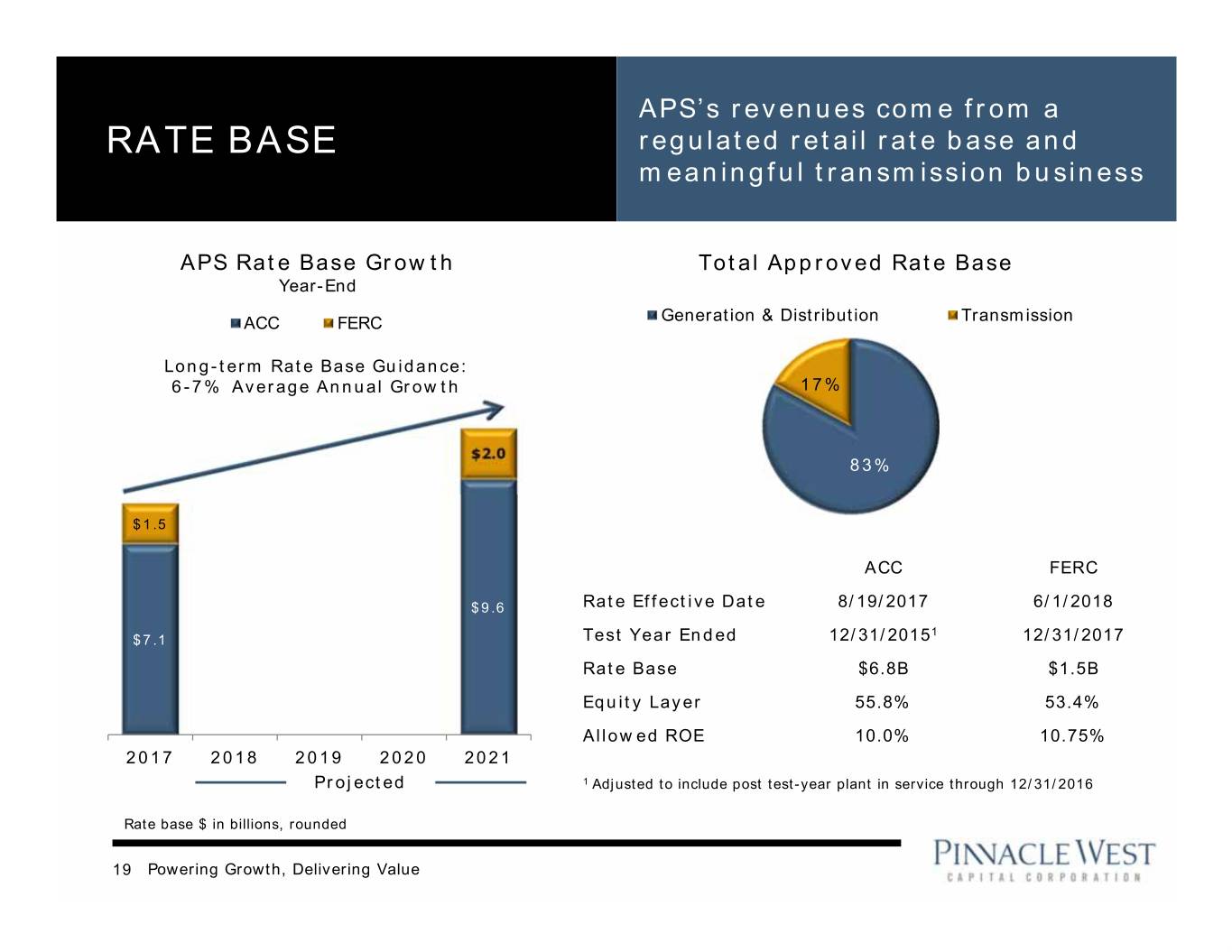

APS’s revenues come from a RATE BASE regulated retail rate base and meaningful transmission business APS Rate Base Growth Total Approved Rate Base Year-End ACC FERC Generation & Distribution Transmission Long-term Rate Base Guidance: 6-7% Average Annual Growth 17% $2.0 83% $1.5 ACC FERC $9.6 Rate Effective Date 8/19/2017 6/1/2018 1 $7.1 Test Year Ended 12/31/2015 12/31/2017 Rate Base $6.8B $1.5B Equity Layer 55.8% 53.4% Allowed ROE 10.0% 10.75% 2017 2018 2019 2020 2021 Projected 1 Adjusted to include post test-year plant in service through 12/31/2016 Rate base $ in billions, rounded 19 Powering Growth, Delivering Value

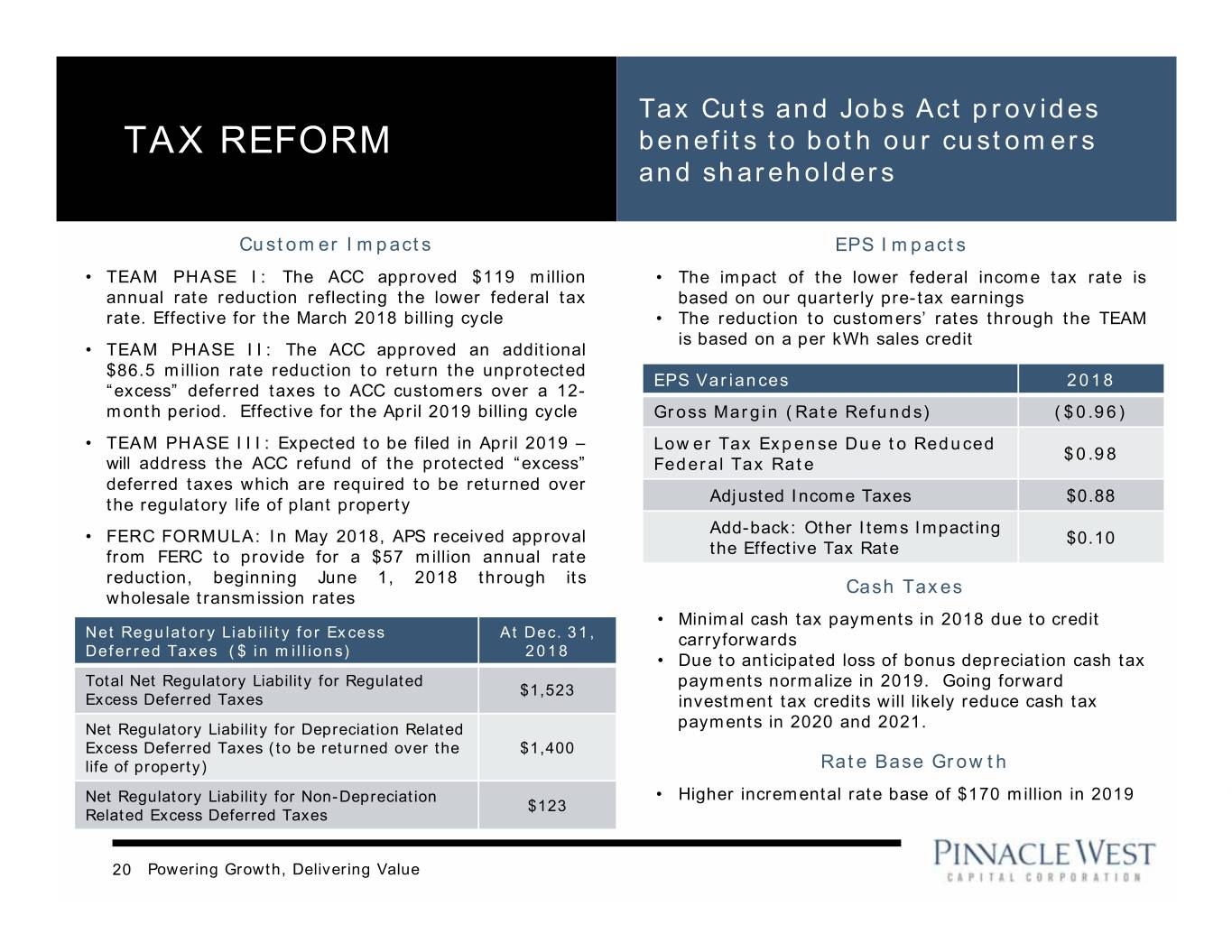

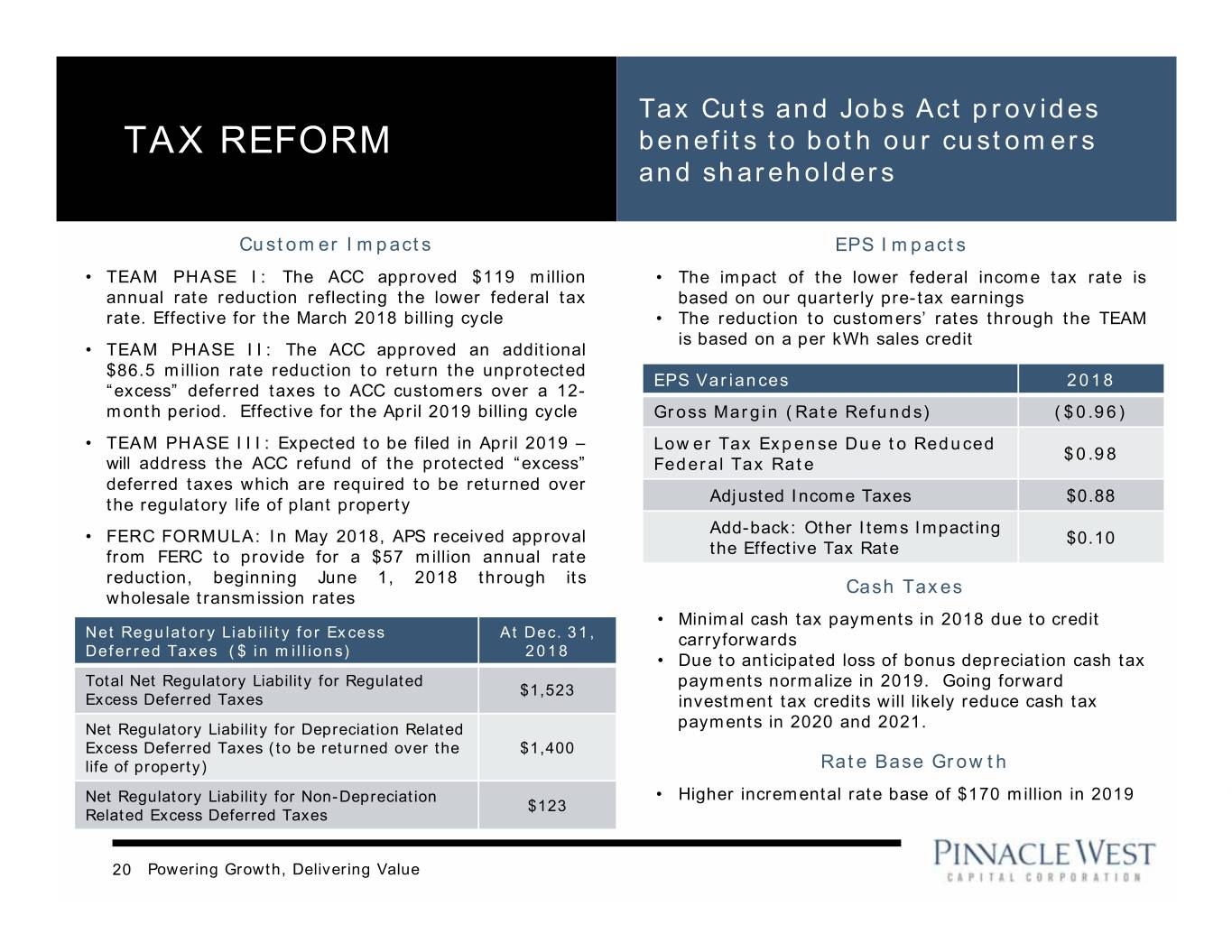

Tax Cuts and Jobs Act provides TAX REFORM benefits to both our customers and shareholders Customer Impacts EPS Impacts • TEAM PHASE I: The ACC approved $119 million • The impact of the lower federal income tax rate is annual rate reduction reflecting the lower federal tax based on our quarterly pre-tax earnings rate. Effective for the March 2018 billing cycle • The reduction to customers’ rates through the TEAM is based on a per kWh sales credit • TEAM PHASE II: The ACC approved an additional $86.5 million rate reduction to return the unprotected EPS Variances 2018 “excess” deferred taxes to ACC customers over a 12- month period. Effective for the April 2019 billing cycle Gross Margin (Rate Refunds) ($0.96) • TEAM PHASE III: Expected to be filed in April 2019 – Lower Tax Expense Due to Reduced $0.98 will address the ACC refund of the protected “excess” Federal Tax Rate deferred taxes which are required to be returned over Adjusted Income Taxes $0.88 the regulatory life of plant property Add-back: Other Items Impacting • FERC FORMULA: In May 2018, APS received approval $0.10 the Effective Tax Rate from FERC to provide for a $57 million annual rate reduction, beginning June 1, 2018 through its Cash Taxes wholesale transmission rates • Minimal cash tax payments in 2018 due to credit Net Regulatory Liability for Excess At Dec. 31, carryforwards Deferred Taxes ($ in millions) 2018 • Due to anticipated loss of bonus depreciation cash tax Total Net Regulatory Liability for Regulated payments normalize in 2019. Going forward $1,523 Excess Deferred Taxes investment tax credits will likely reduce cash tax Net Regulatory Liability for Depreciation Related payments in 2020 and 2021. Excess Deferred Taxes (to be returned over the $1,400 life of property) Rate Base Growth Net Regulatory Liability for Non-Depreciation • Higher incremental rate base of $170 million in 2019 $123 Related Excess Deferred Taxes 20 Powering Growth, Delivering Value

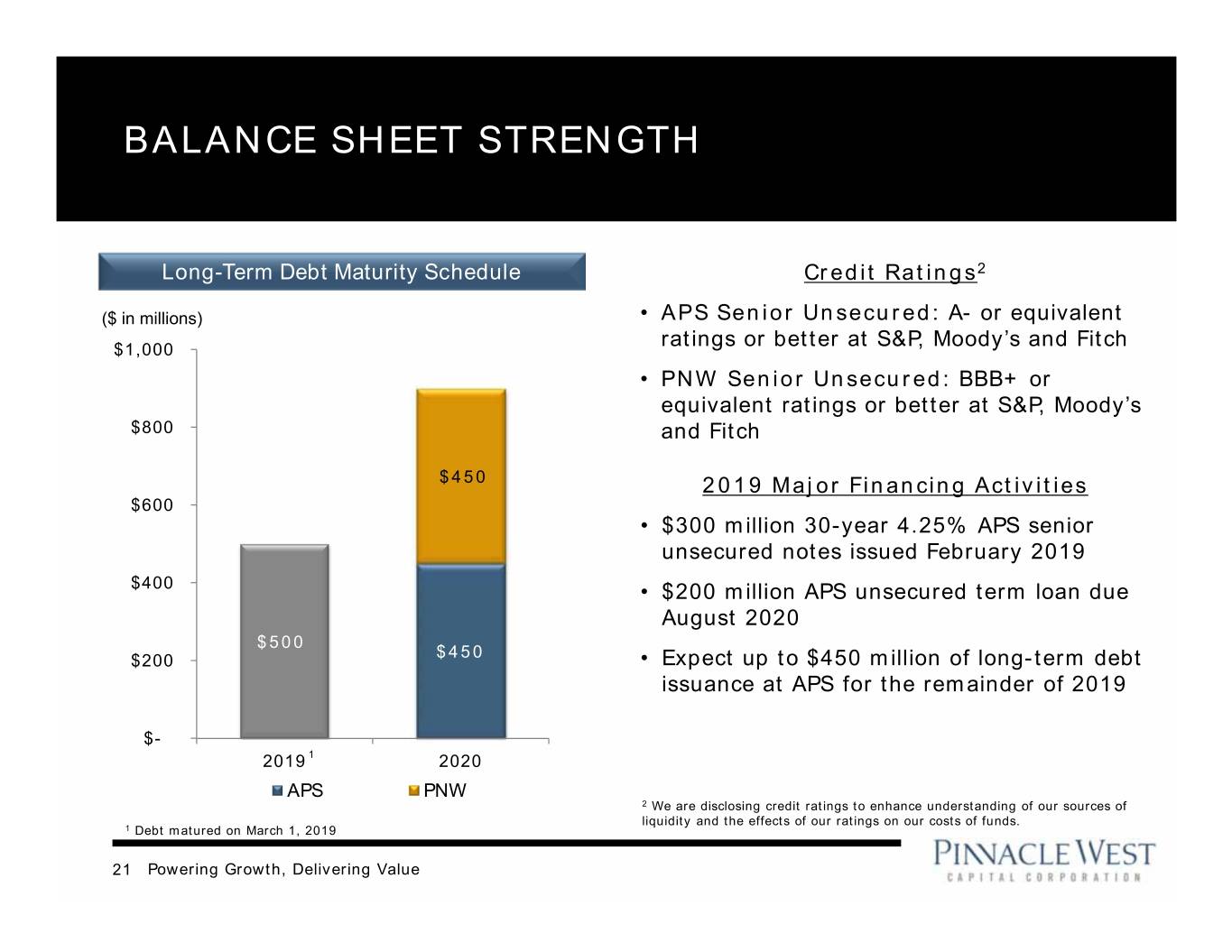

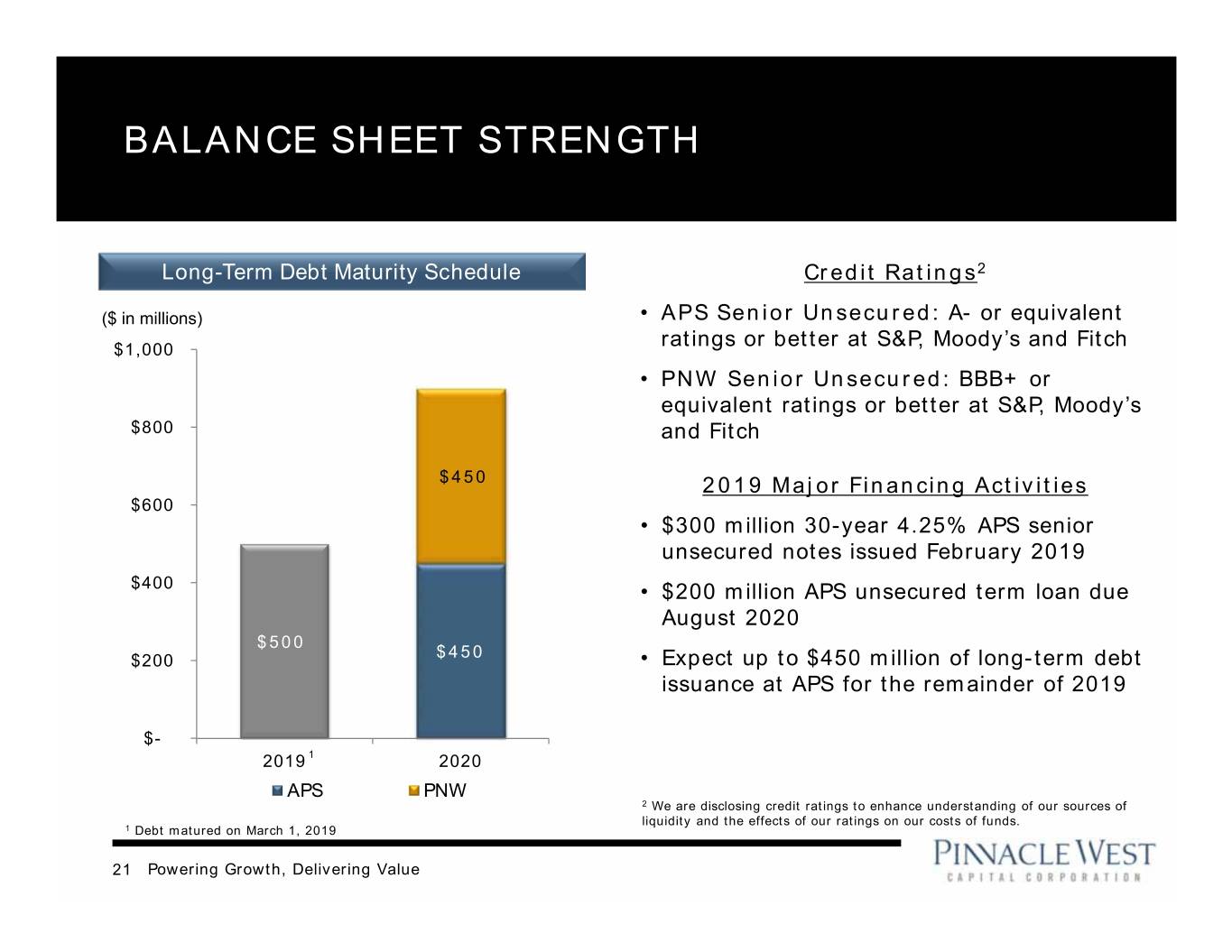

BALANCE SHEET STRENGTH Long-Term Debt Maturity Schedule Credit Ratings2 ($ in millions) • APS Senior Unsecured: A- or equivalent $1,000 ratings or better at S&P, Moody’s and Fitch • PNW Senior Unsecured: BBB+ or equivalent ratings or better at S&P, Moody’s $800 and Fitch $450 2019 Major Financing Activities $600 • $300 million 30-year 4.25% APS senior unsecured notes issued February 2019 $400 • $200 million APS unsecured term loan due August 2020 $500 $450 $200 • Expect up to $450 million of long-term debt issuance at APS for the remainder of 2019 $- 20191 2020 APS PNW 2 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. 1 Debt matured on March 1, 2019 21 Powering Growth, Delivering Value

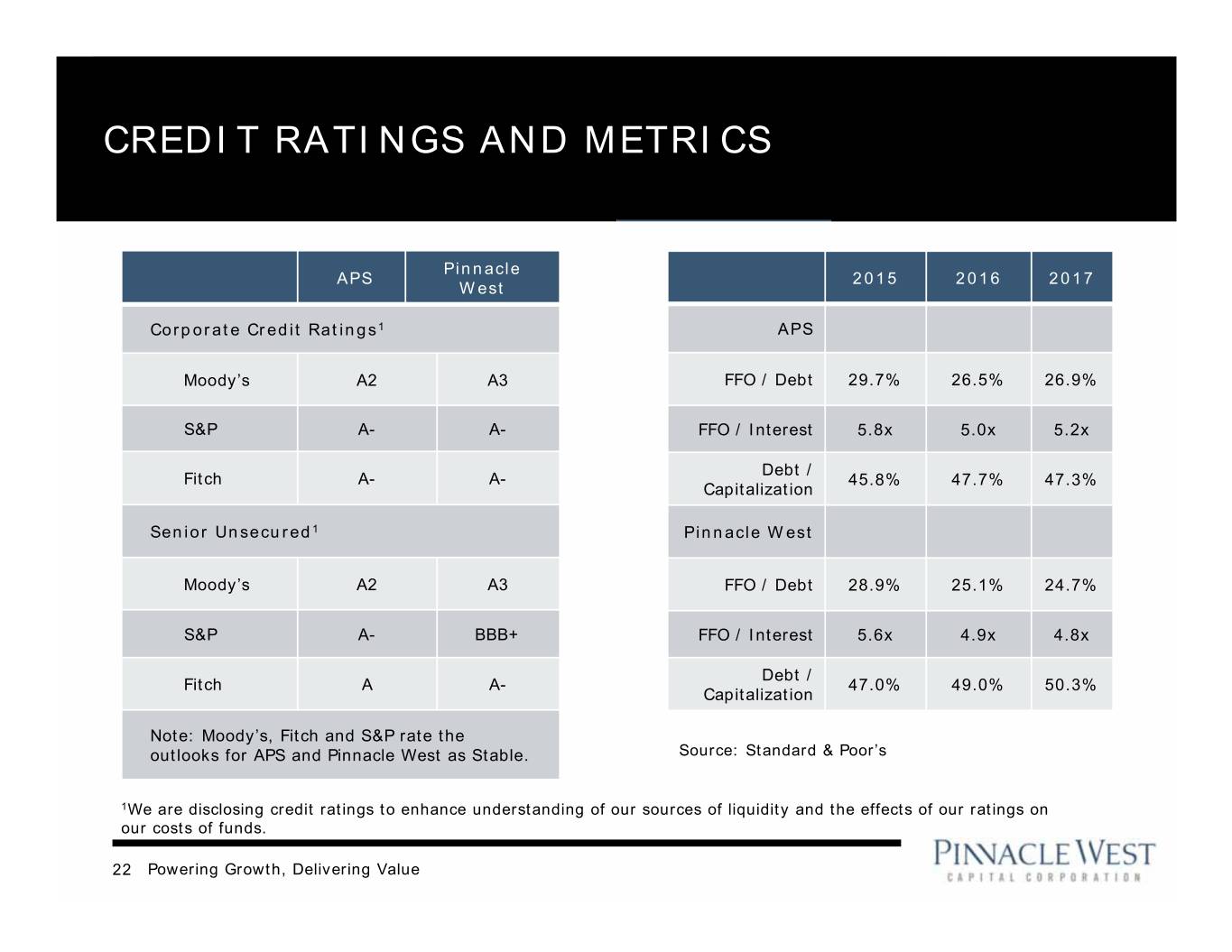

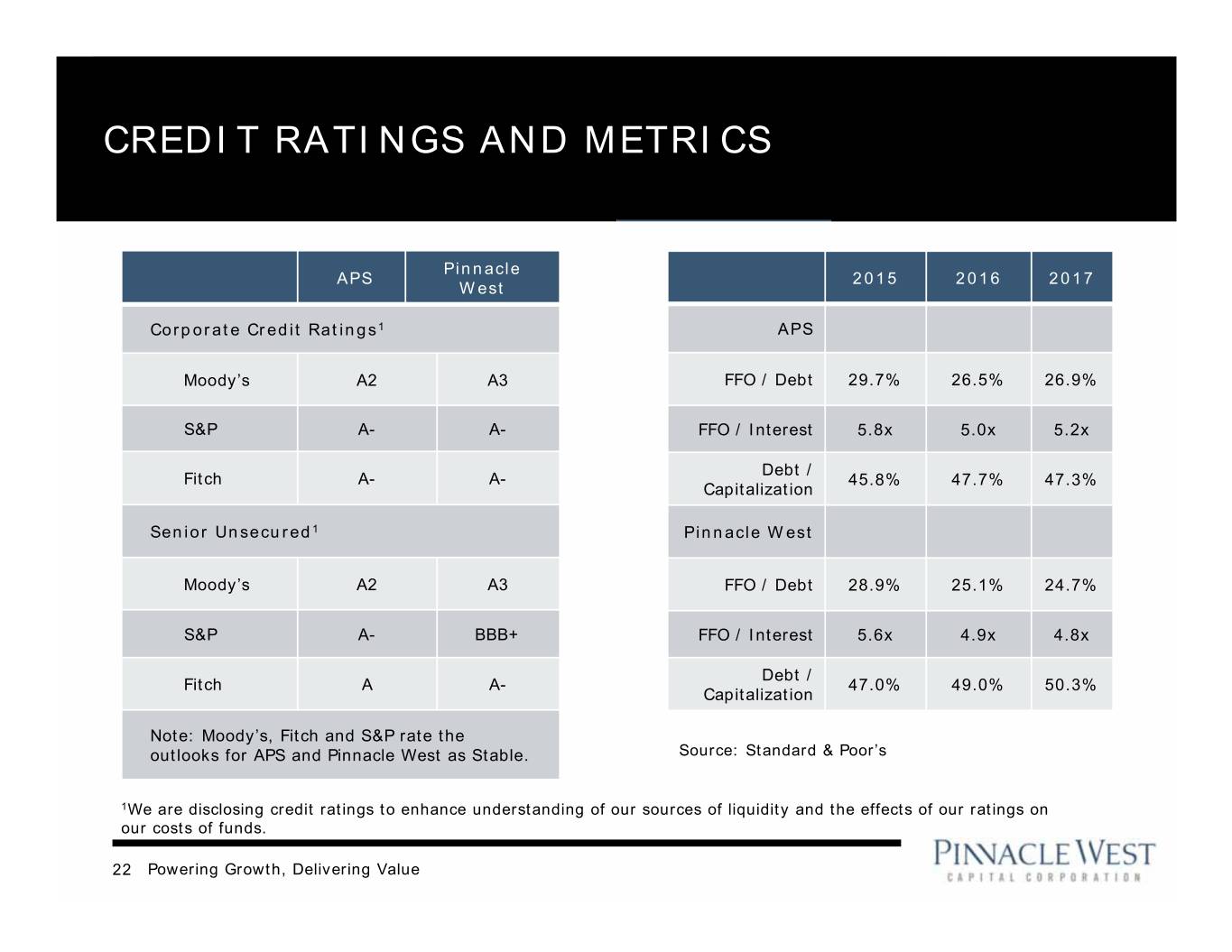

CREDIT RATINGS AND METRICS Pinnacle APS 2015 2016 2017 West Corporate Credit Ratings1 APS Moody’s A2 A3 FFO / Debt 29.7% 26.5% 26.9% S&P A- A- FFO / Interest 5.8x 5.0x 5.2x Debt / Fitch A- A- 45.8% 47.7% 47.3% Capitalization Senior Unsecured1 Pinnacle West Moody’s A2 A3 FFO / Debt 28.9% 25.1% 24.7% S&P A- BBB+ FFO / Interest 5.6x 4.9x 4.8x Debt / Fitch A A- 47.0% 49.0% 50.3% Capitalization Note: Moody’s, Fitch and S&P rate the outlooks for APS and Pinnacle West as Stable. Source: Standard & Poor’s 1We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. 22 Powering Growth, Delivering Value

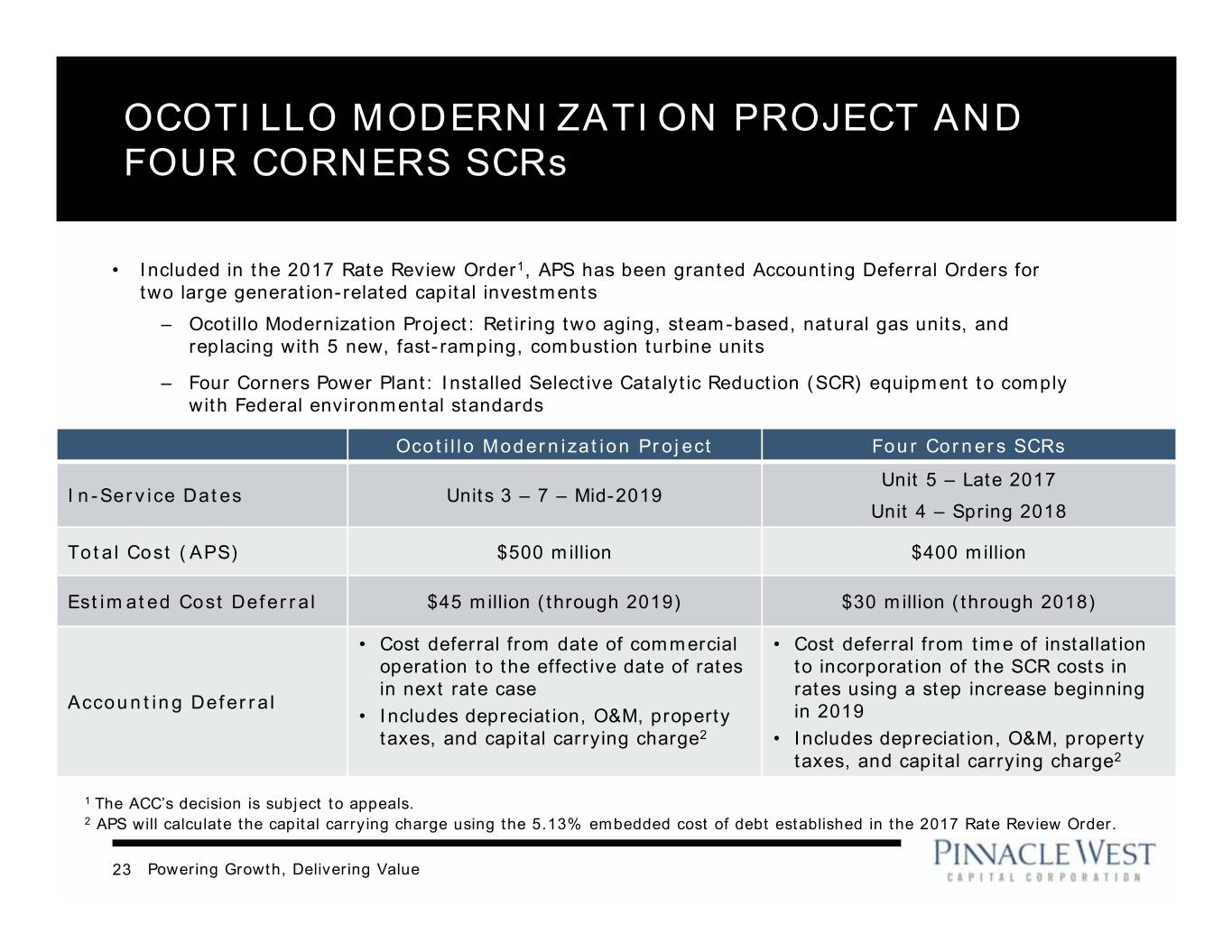

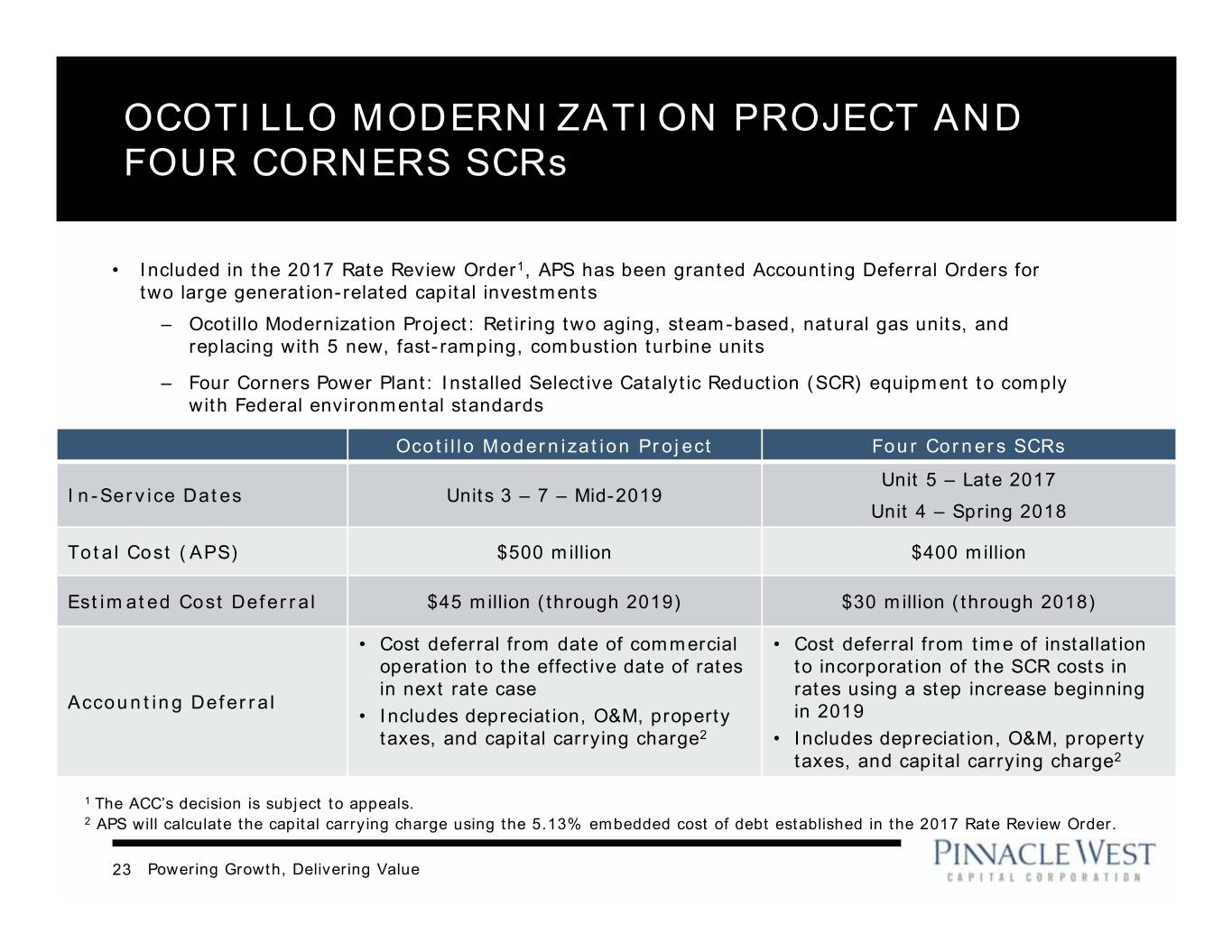

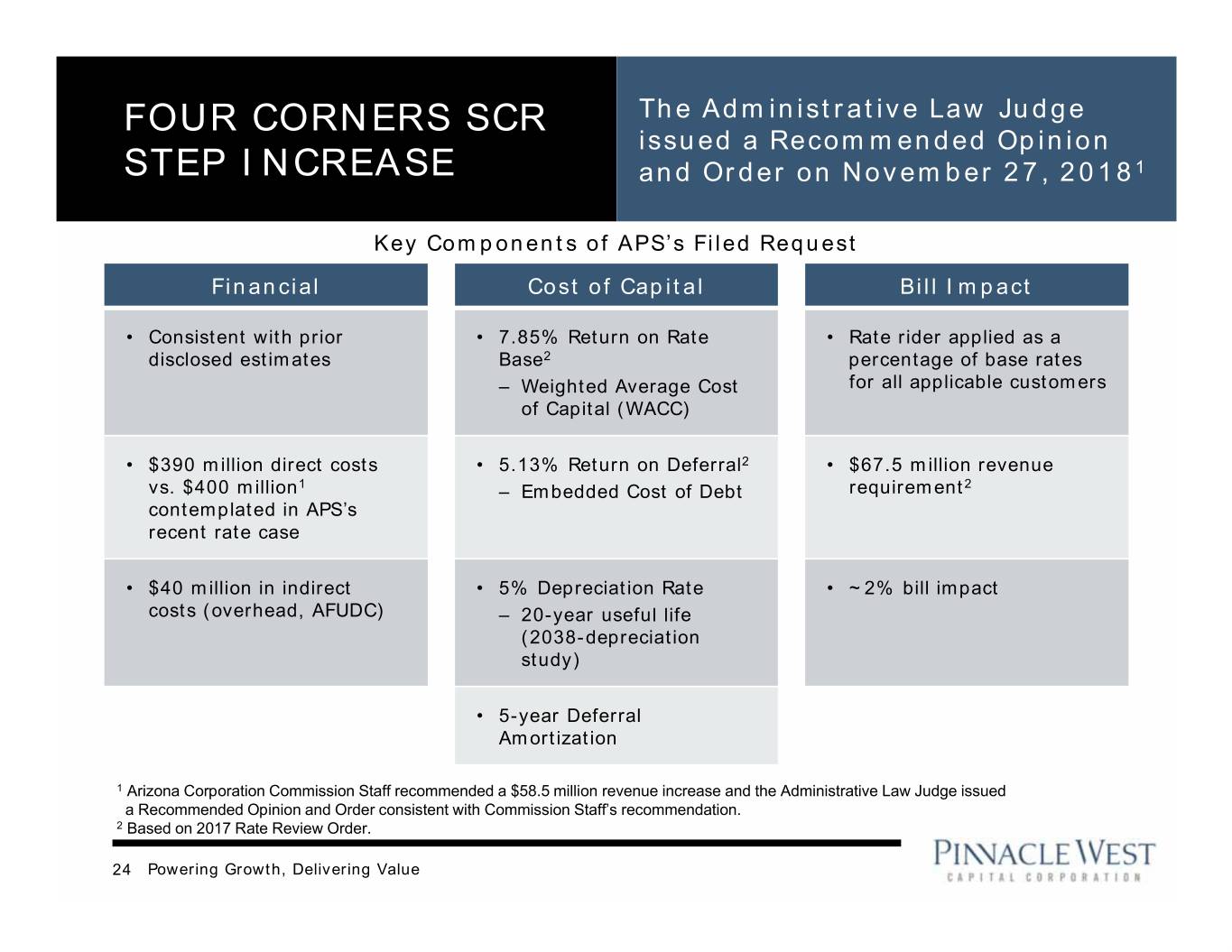

OCOTILLO MODERNIZATION PROJECT AND FOUR CORNERS SCRs • Included in the 2017 Rate Review Order1, APS has been granted Accounting Deferral Orders for two large generation-related capital investments – Ocotillo Modernization Project: Retiring two aging, steam-based, natural gas units, and replacing with 5 new, fast-ramping, combustion turbine units – Four Corners Power Plant: Installed Selective Catalytic Reduction (SCR) equipment to comply with Federal environmental standards Ocotillo Modernization Project Four Corners SCRs Unit 5 – Late 2017 In-Service Dates Units 3 – 7 – Mid-2019 Unit 4 – Spring 2018 Total Cost (APS) $500 million $400 million Estimated Cost Deferral $45 million (through 2019) $30 million (through 2018) • Cost deferral from date of commercial • Cost deferral from time of installation operation to the effective date of rates to incorporation of the SCR costs in in next rate case rates using a step increase beginning Accounting Deferral • Includes depreciation, O&M, property in 2019 taxes, and capital carrying charge2 • Includes depreciation, O&M, property taxes, and capital carrying charge2 1 The ACC’s decision is subject to appeals. 2 APS will calculate the capital carrying charge using the 5.13% embedded cost of debt established in the 2017 Rate Review Order. 23 Powering Growth, Delivering Value

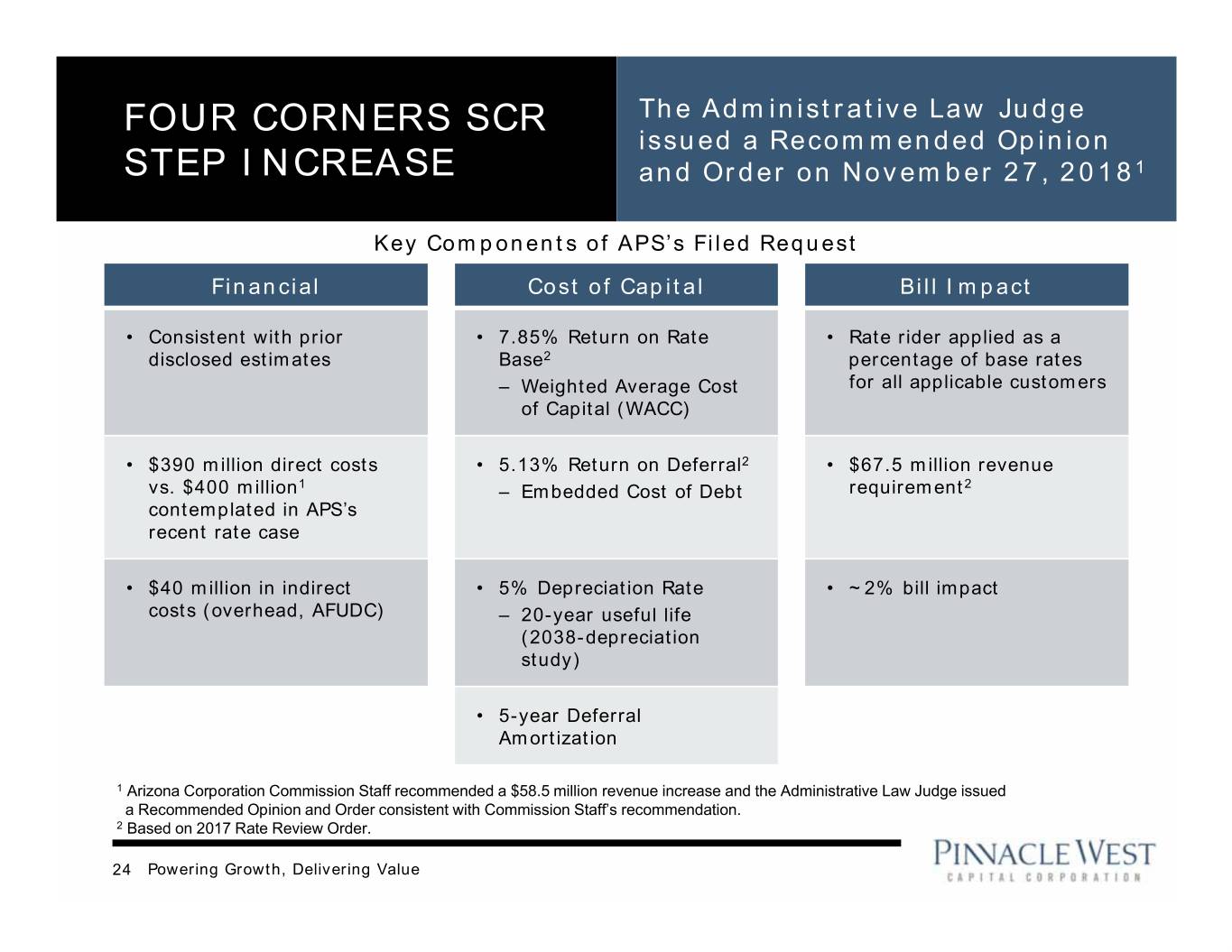

FOUR CORNERS SCR The Administrative Law Judge issued a Recommended Opinion STEP INCREASE and Order on November 27, 20181 Key Components of APS’s Filed Request Financial Cost of Capital Bill Impact • Consistent with prior • 7.85% Return on Rate • Rate rider applied as a disclosed estimates Base2 percentage of base rates – Weighted Average Cost for all applicable customers of Capital (WACC) • $390 million direct costs • 5.13% Return on Deferral2 • $67.5 million revenue vs. $400 million1 – Embedded Cost of Debt requirement2 contemplated in APS’s recent rate case • $40 million in indirect • 5% Depreciation Rate • ~2% bill impact costs (overhead, AFUDC) – 20-year useful life (2038-depreciation study) • 5-year Deferral Amortization 1 Arizona Corporation Commission Staff recommended a $58.5 million revenue increase and the Administrative Law Judge issued a Recommended Opinion and Order consistent with Commission Staff’s recommendation. 2 Based on 2017 Rate Review Order. 24 Powering Growth, Delivering Value

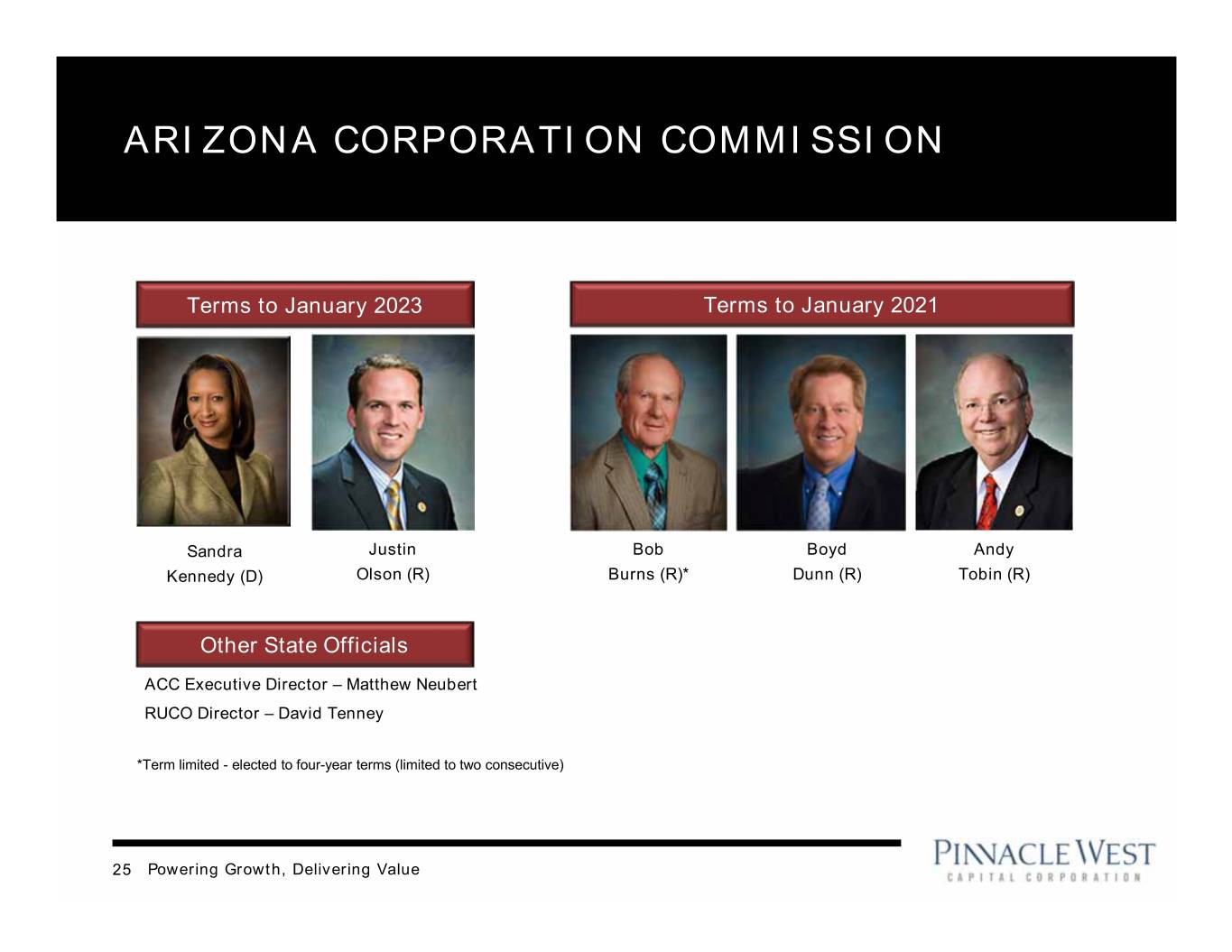

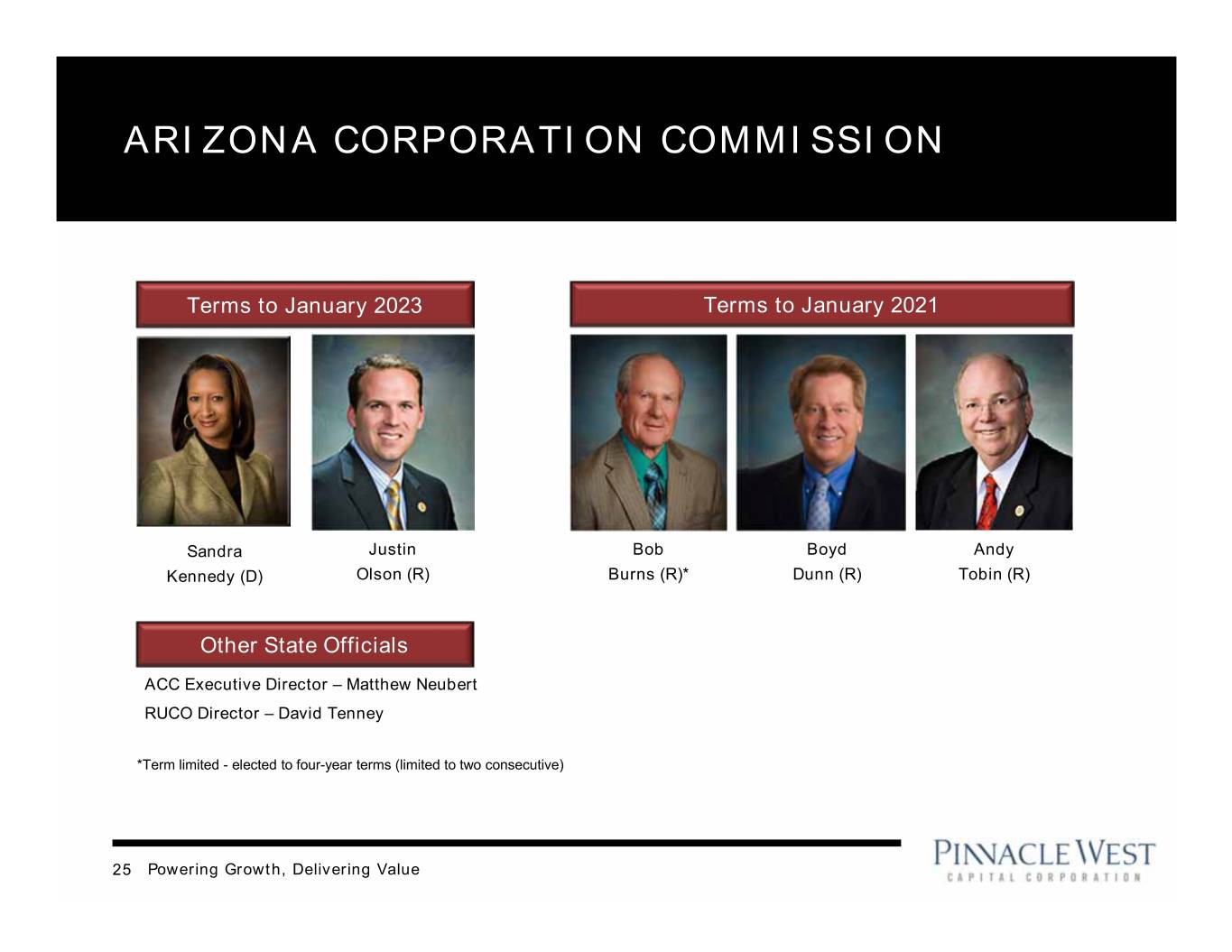

ARIZONA CORPORATION COMMISSION Terms to January 2023 Terms to January 2021 Sandra Justin Bob Boyd Andy Kennedy (D) Olson (R) Burns (R)* Dunn (R) Tobin (R) Other State Officials ACC Executive Director – Matthew Neubert RUCO Director – David Tenney *Term limited - elected to four-year terms (limited to two consecutive) 25 Powering Growth, Delivering Value

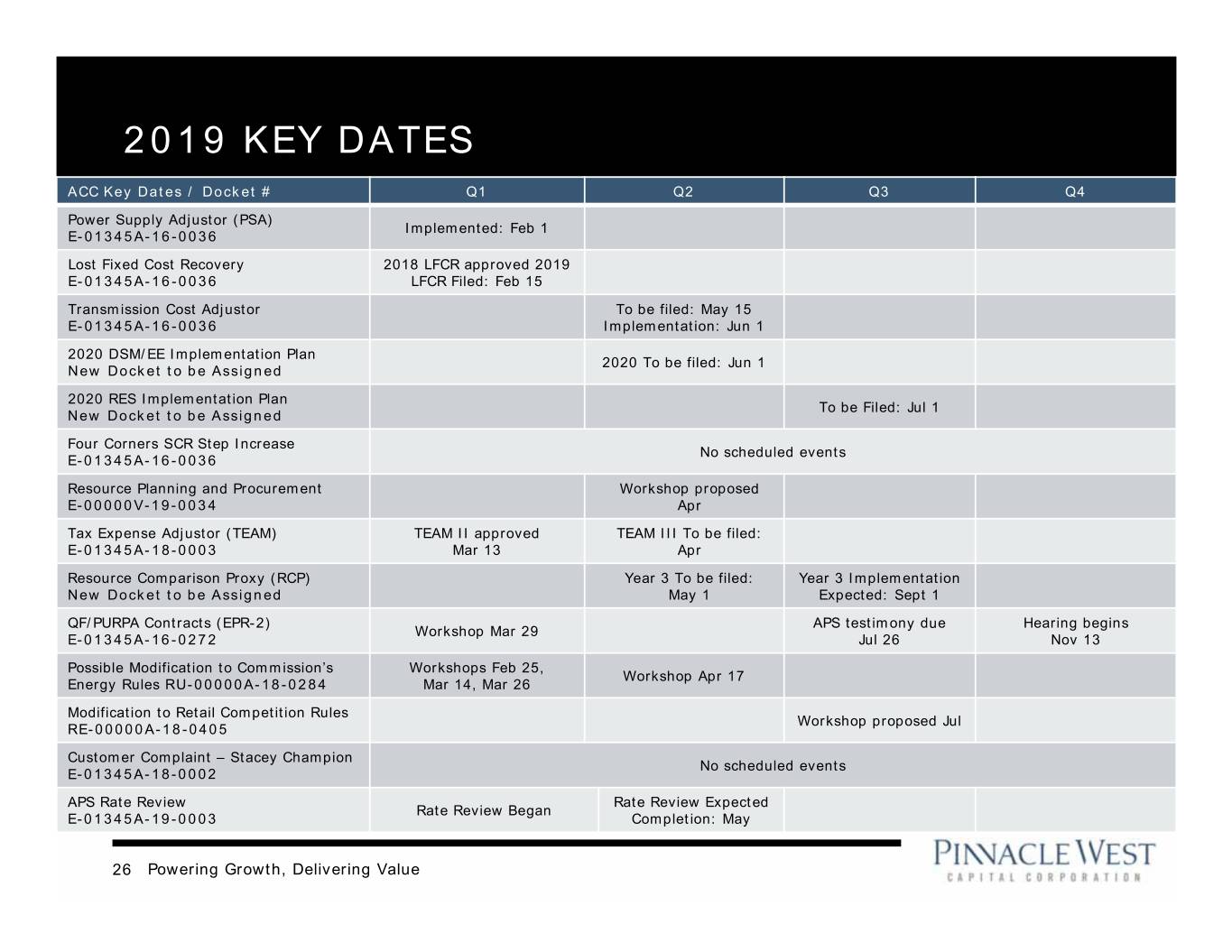

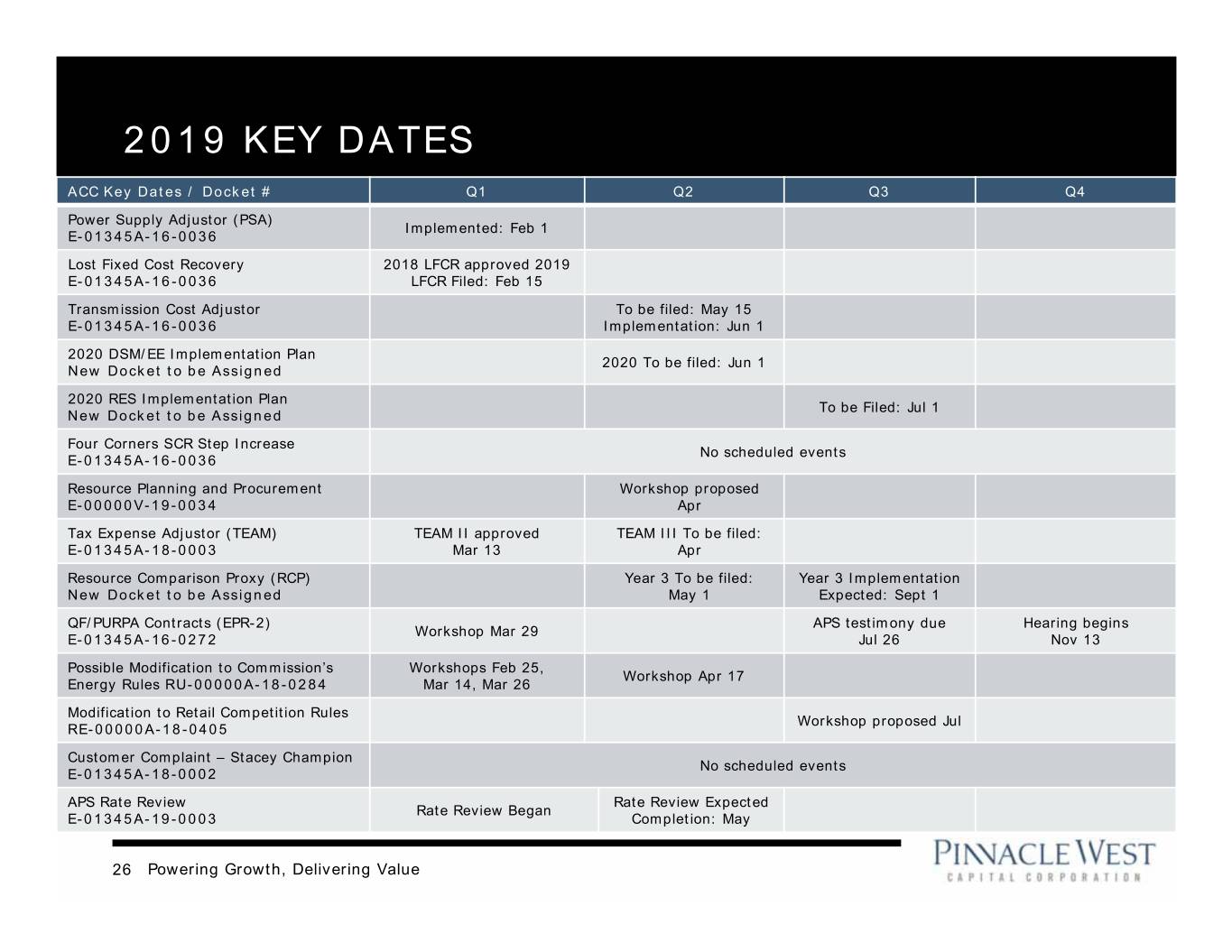

2019 KEY DATES ACC Key Dates / Docket # Q1 Q2 Q3 Q4 Power Supply Adjustor (PSA) Implemented: Feb 1 E-01345A-16-0036 Lost Fixed Cost Recovery 2018 LFCR approved 2019 E-01345A-16-0036 LFCR Filed: Feb 15 Transmission Cost Adjustor To be filed: May 15 E-01345A-16-0036 Implementation: Jun 1 2020 DSM/EE Implementation Plan 2020 To be filed: Jun 1 New Docket to be Assigned 2020 RES Implementation Plan To be Filed: Jul 1 New Docket to be Assigned Four Corners SCR Step Increase No scheduled events E-01345A-16-0036 Resource Planning and Procurement Workshop proposed E-00000V-19-0034 Apr Tax Expense Adjustor (TEAM) TEAM II approved TEAM III To be filed: E-01345A-18-0003 Mar 13 Apr Resource Comparison Proxy (RCP) Year 3 To be filed: Year 3 Implementation New Docket to be Assigned May 1 Expected: Sept 1 QF/PURPA Contracts (EPR-2) APS testimony due Hearing begins Workshop Mar 29 E-01345A-16-0272 Jul 26 Nov 13 Possible Modification to Commission’s Workshops Feb 25, Workshop Apr 17 Energy Rules RU-00000A-18-0284 Mar 14, Mar 26 Modification to Retail Competition Rules Workshop proposed Jul RE-00000A-18-0405 Customer Complaint – Stacey Champion No scheduled events E-01345A-18-0002 APS Rate Review Rate Review Expected Rate Review Began E-01345A-19-0003 Completion: May 26 Powering Growth, Delivering Value

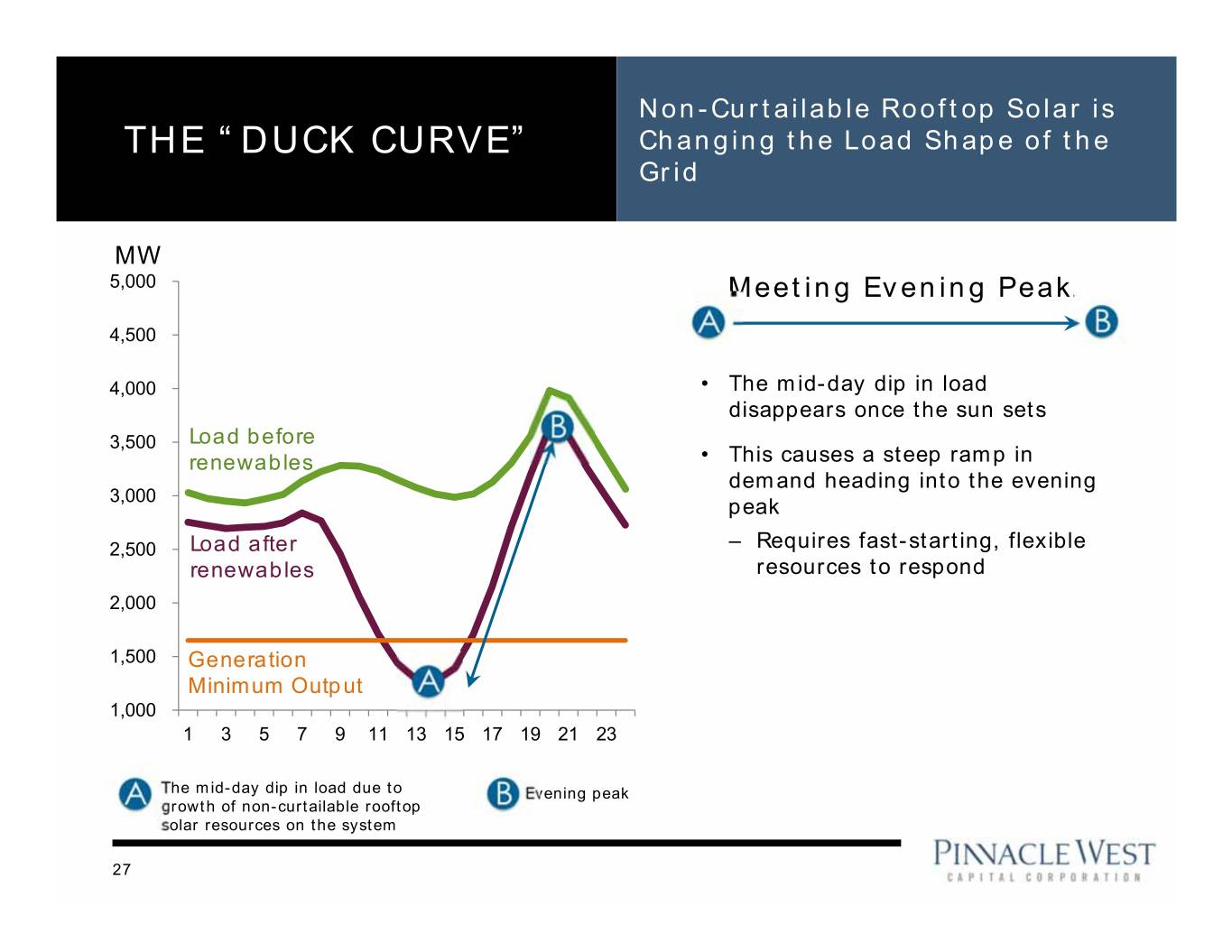

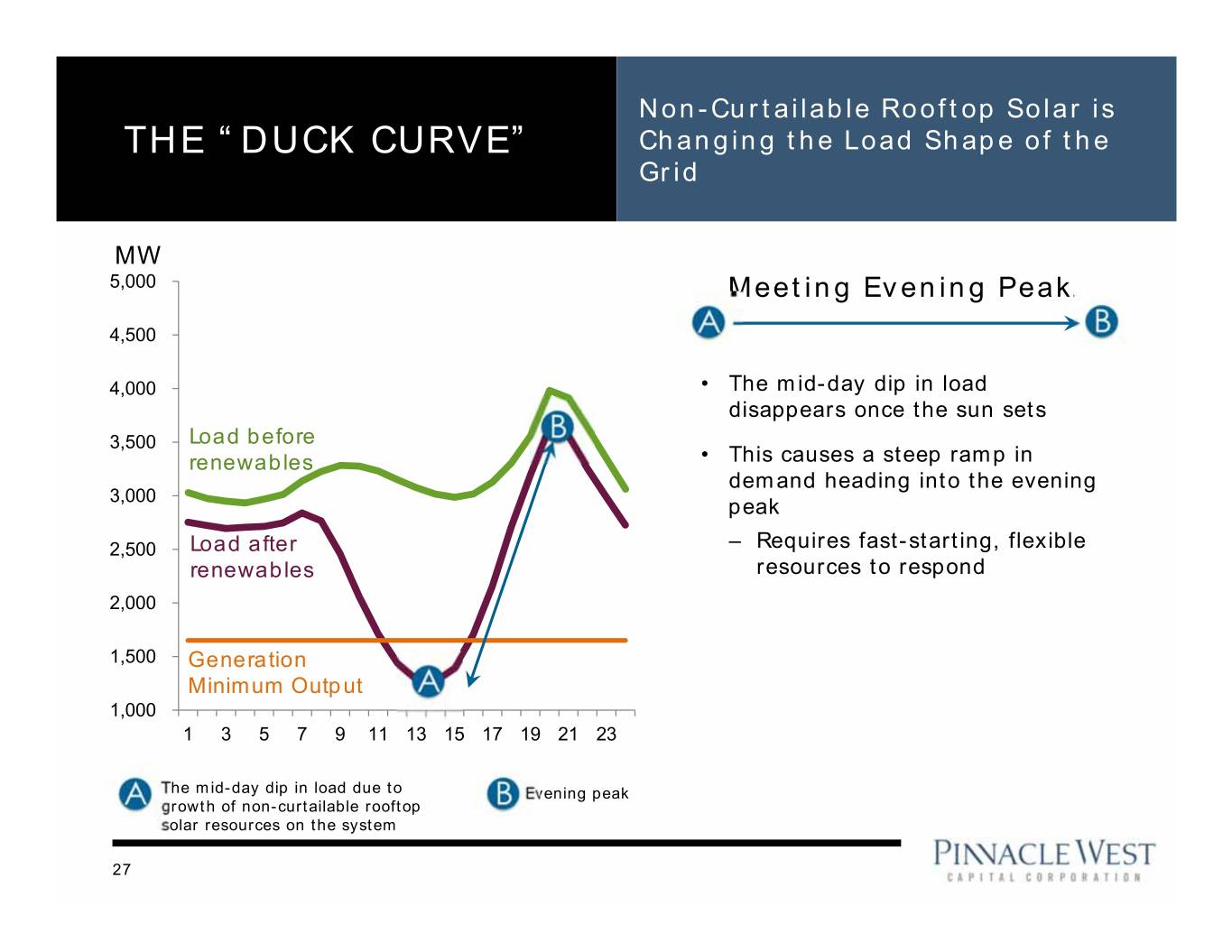

Non-Curtailable Rooftop Solar is THE “DUCK CURVE” Changing the Load Shape of the Grid MW 5,000 Meeting Evening Peak 4,500 4,000 • The mid-day dip in load disappears once the sun sets 3,500 Load before renewables • This causes a steep ramp in demand heading into the evening 3,000 peak 2,500 Load after – Requires fast-starting, flexible renewables resources to respond 2,000 1,500 Generation Minimum Output 1,000 1 3 5 7 9 11131517192123 The mid-day dip in load due to Evening peak growth of non-curtailable rooftop solar resources on the system 27

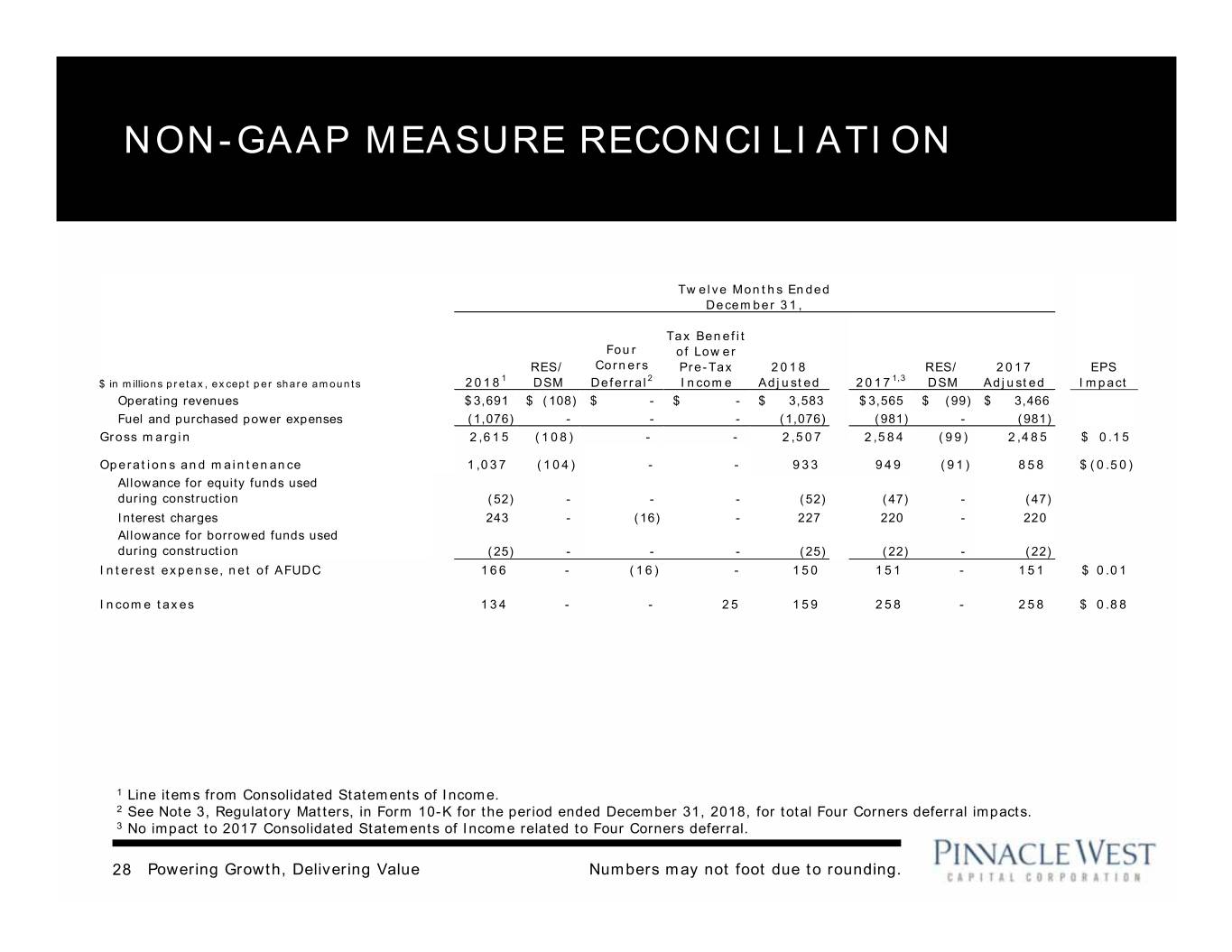

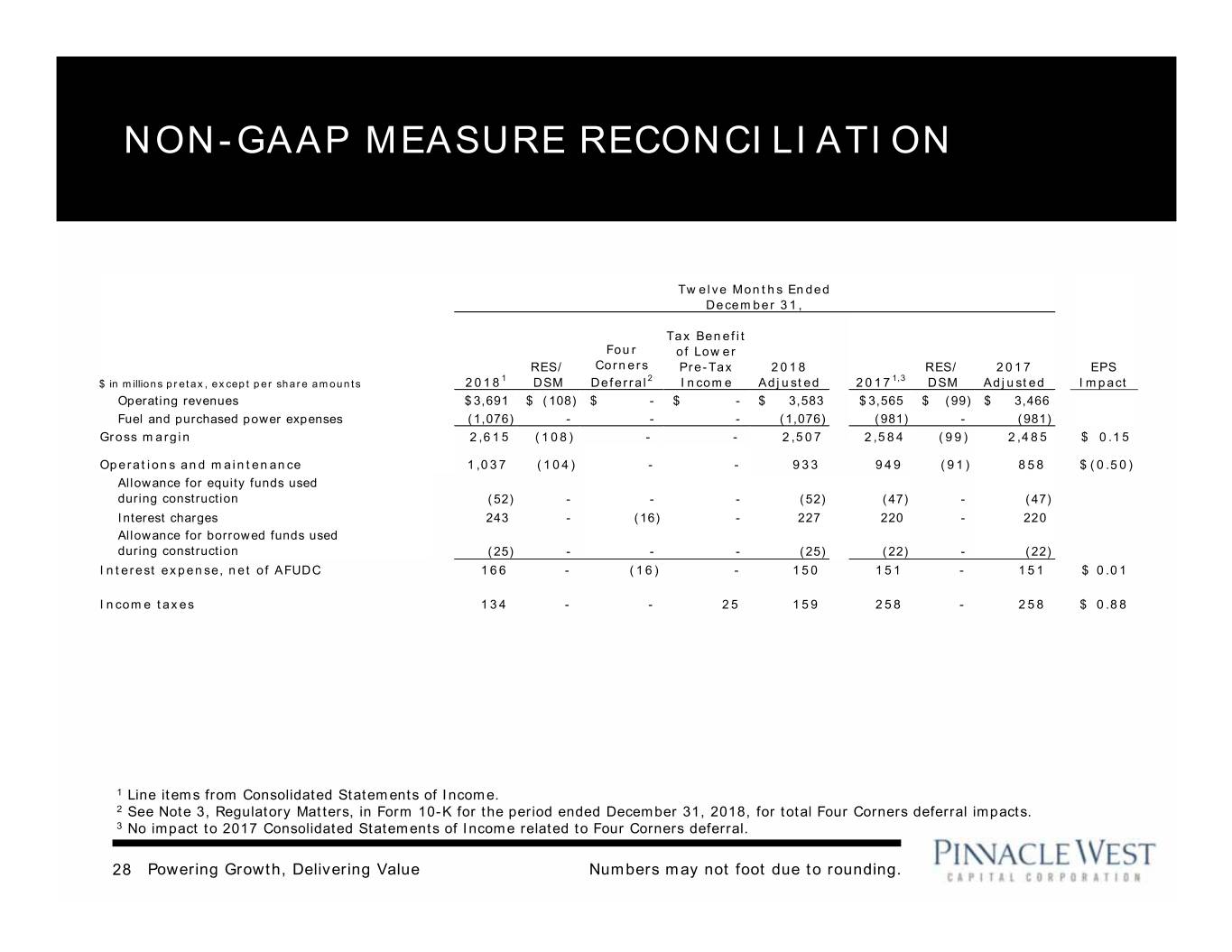

NON-GAAP MEASURE RECONCILIATION Twelve Months Ended December 31, Tax Benefit Four of Lower RES/ Corners Pre-Tax 2018 RES/ 2017 EPS 1 2 1,3 $ in millions pretax, except per share amounts 2018 DSM Deferral Income Adjusted 2017 DSM Adjusted Impact Operating revenues$ 3,691 $ (108) $ - $ - $ 3,583 $ 3,565 $ (99) $ 3,466 Fuel and purchased power expenses (1,076) - - - (1,076) (981) - (981) Gross margin 2,615 (108) - - 2,507 2,584 (99) 2,485 $ 0.15 Operations and maintenance 1,037 (104) - - 933 949 (91) 858 $ (0.50) Allowance for equity funds used during construction (52) - - - (52) (47) - (47) Interest charges 243 - (16) - 227 220 - 220 Allowance for borrowed funds used during construction (25) - - - (25) (22) - (22) Interest expense, net of AFUDC 166 - (16) - 150 151 - 151 $ 0.01 Income taxes 134 - - 25 159 258 - 258 $ 0.88 1 Line items from Consolidated Statements of Income. 2 See Note 3, Regulatory Matters, in Form 10-K for the period ended December 31, 2018, for total Four Corners deferral impacts. 3 No impact to 2017 Consolidated Statements of Income related to Four Corners deferral. 28 Powering Growth, Delivering Value Numbers may not foot due to rounding.

INVESTOR RELATIONS CONTACTS Stefanie Layton Director, Investor Relations (602) 250-4541 stefanie.layton@pinnaclewest.com Michelle Clemente (602) 250-3752 michelle.clemente@pinnaclewest.com Pinnacle West Capital Corporation P.O. Box 53999, Mail Station 9998 Phoenix, Arizona 85072-3999 Visit us online at: www.pinnaclewest.com 29 Powering Growth, Delivering Value