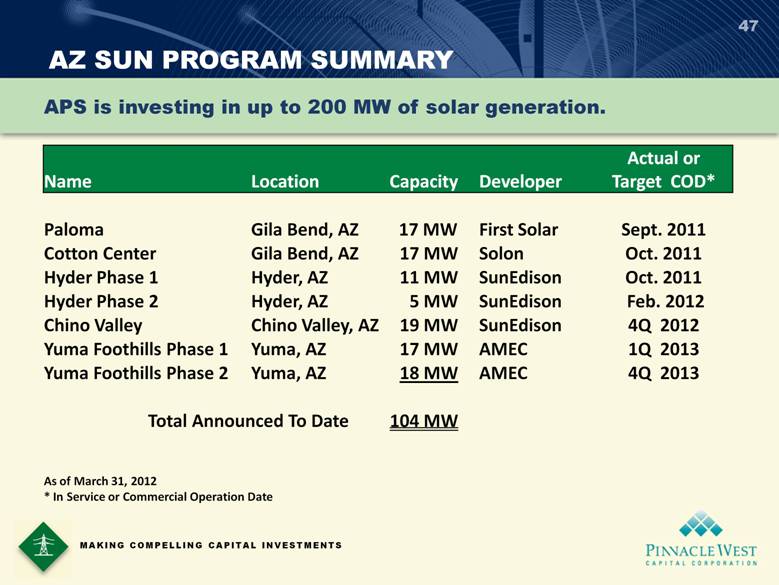

| A WELL-BALANCED GENERATION PORTFOLIO 43 Fuel / Plant Location Units Dispatch Commercial Ops. Date Ownership Interest1 Net Capacity (MW) Nuclear Palo Verde Wintersburg, AZ 1-3 Base 1986 - 1989 29.1% 1,146 Total Nuclear 1,146 Coal Cholla Joseph City, AZ 1-3 Base 1962 - 1980 100 647 Four Corners Farmington, NM 1-3 Base 1963 - 1964 100 560 Four Corners Farmington, NM 4,5 Base 1969 - 1970 15 231 Navajo Page, AZ 1-3 Base 1974 - 1976 14 315 Total Coal 1,753 Gas/Oil - Combined Cycle Redhawk Arlington, AZ 1,2 Intermediate 2002 100 984 West Phoenix Phoenix, AZ 1-5 Intermediate 1976 - 2003 100 887 Total Gas/Oil - Combined Cycle 1,871 Gas/Oil - Steam Turbines Ocotillo Tempe, AZ 1,2 Peaking 1960 100 220 Saguaro Red Rock, AZ 1,2 Peaking 1954 - 1955 100 210 Total Gas/Oil - Steam Turbines 430 Gas/Oil – Combustion Turbines Sundance Casa Grande, AZ 10 Peaking 2002 100 420 Yucca Yuma, AZ 6 Peaking 1971 - 2008 100 243 Saguaro Red Rock, AZ 1-3 Peaking 1972 - 2002 100 189 West Phoenix Phoenix, AZ 1,2 Peaking 1972 - 1973 100 110 Ocotillo Tempe, AZ 1,2 Peaking 1972 - 1973 100 110 Douglas Douglas, AZ 1 Peaking 1972 100 16 Total Gas/Oil - Combustion Turbines 1,088 Solar Total Solar Total Generation Capacity 6,343 As of February 24, 2012 1Includes leased generating plants. 5 Paloma Cotton Center Hyder Various Gila Bend, AZ Gila Bend, AZ Hyder, AZ Multiple Arizona Facilities - - - - As Available As Available As Available As Available 2011 2011 2011 - 2012 1996 - 2006 100 100 100 100 16 17 17 55 MAKING COMPELLING CAPITAL INVESTMENTS |