Exhibit 99.01

| Sustainable Growth Midwest Investor Meetings March 20-21, 2007 |

| This material includes forward-looking statements that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements include projected earnings, cash flows, capital expenditures and other statements and are identified in this document by the words “anticipate,” “estimate,” “expect,” “projected,” “objective,” “outlook,” “possible,” “potential” and similar expressions. Actual results may vary materially. Factors that could cause actual results to differ materially include, but are not limited to: general economic conditions, including the availability of credit, actions of rating agencies and their impact on capital expenditures; business conditions in the energy industry; competitive factors; unusual weather; effects of geopolitical events, including war and acts of terrorism; changes in federal or state legislation; regulation; costs and other effects of legal administrative proceedings, settlements, investigations and claims including litigation related to company-owned life insurance (COLI); actions of accounting regulatory bodies; the higher degree of risk associated with Xcel Energy’s nonregulated businesses compared with Xcel Energy’s regulated business; and other risk factors listed from time to time by Xcel Energy in reports filed with the SEC, including Exhibit 99.01 to Xcel Energy’s report on Form 10-K for year 2006. Safe Harbor |

| Investment Thesis Rate base growth company Significant capital investment opportunity Fully regulated Constructive regulatory environment with enhanced recovery of major capital projects Environmental leader, well-positioned for changing rules Low risk, transparent business model Stable and predictable cash flow |

| Investment Merits * Represents expected average annual normalized EPS growth, excluding any impact from COLI program Sustainable EPS growth of 5% – 7%* Dividend growth of 2% – 4% per year Dividend yield 4% |

| Strategy: Building the Core Get the rules right Invest in fully regulated utility operations Earn a reasonable return |

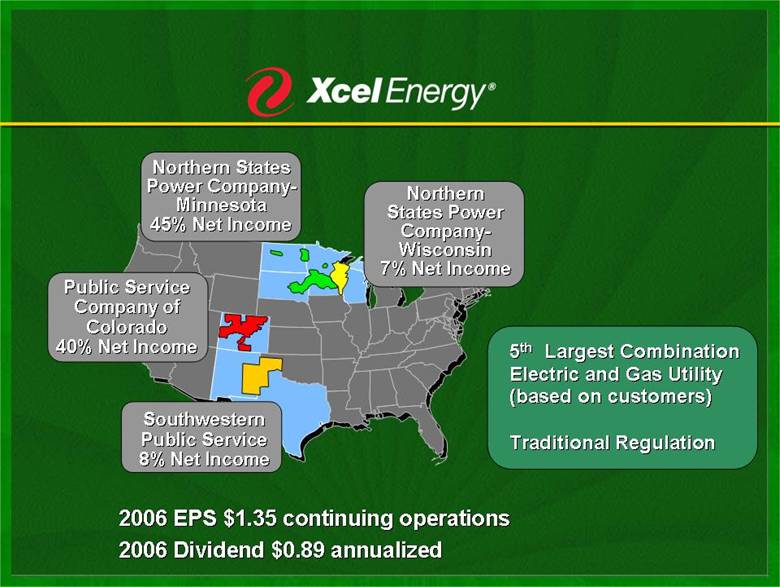

| Northern States Power Company-Minnesota 45% Net Income Public Service Company of Colorado 40% Net Income Southwestern Public Service 8% Net Income Northern States Power Company-Wisconsin 7% Net Income 5th Largest Combination Electric and Gas Utility (based on customers) Traditional Regulation 2006 EPS $1.35 continuing operations 2006 Dividend $0.89 annualized |

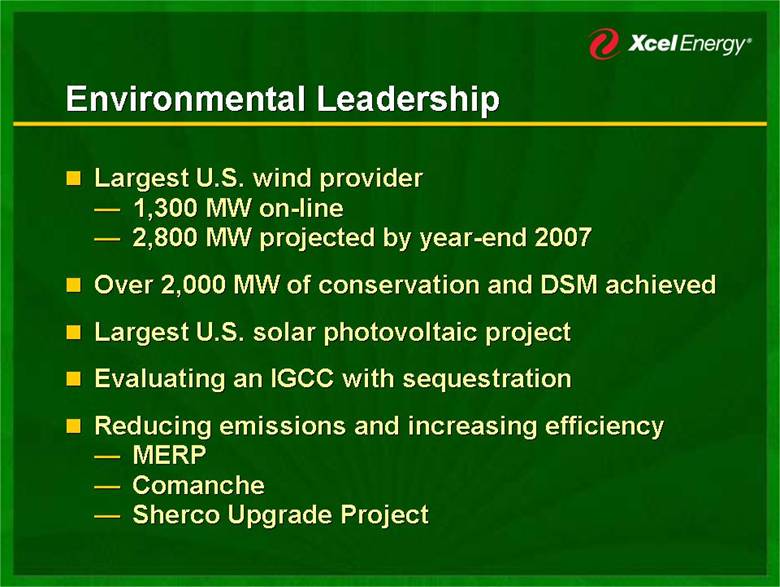

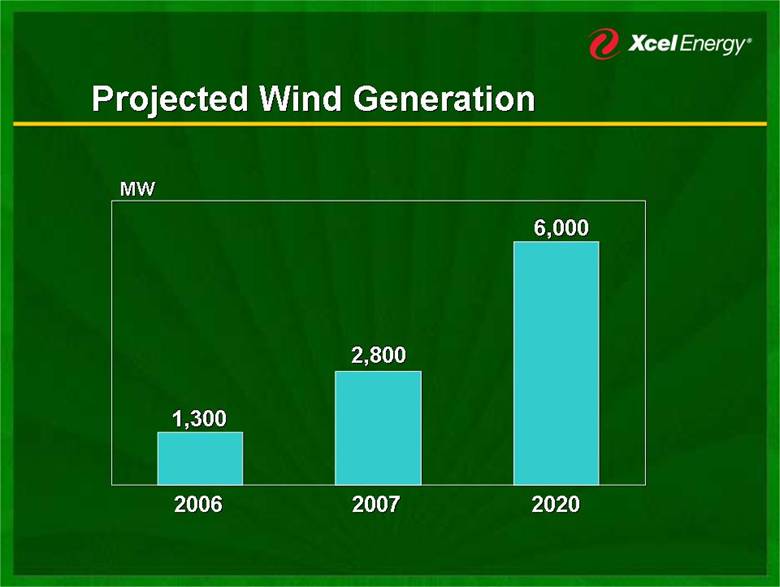

| Environmental Leadership Largest U.S. wind provider — 1,300 MW on-line — 2,800 MW projected by year-end 2007 Over 2,000 MW of conservation and DSM achieved Largest U.S. solar photovoltaic project Evaluating an IGCC with sequestration Reducing emissions and increasing efficiency — MERP — Comanche — Sherco Upgrade Project |

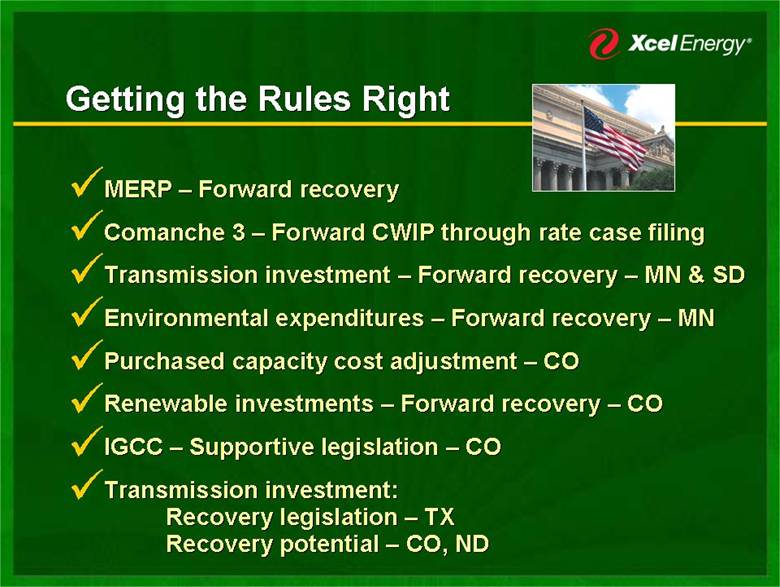

| Getting the Rules Right MERP – Forward recovery Comanche 3 – Forward CWIP through rate case filing Transmission investment – Forward recovery – MN & SD Environmental expenditures – Forward recovery – MN Purchased capacity cost adjustment – CO Renewable investments – Forward recovery – CO IGCC – Supportive legislation – CO Transmission investment: Recovery legislation – TX Recovery potential – CO, ND |

| Constructive Regulation 2006 rate case outcomes Dollars in millions Colorado Gas $34.5 $22.0 11.0% 10.5% Wisconsin Electric 53.1 43.4 11.9% 11.0% Wisconsin Gas 7.8 3.9 11.9% 11.0% Minnesota Electric 156 131/115 * 11.0% 10.54% Colorado Electric 208 151 ** 11.0% 10.50% Dollar Increase Return on Equity Requested Granted Requested Granted * $131 million for 2006 reduced to $115 million in 2007 for large customer coming on-line January 1, 2007 ** $107 million base rates, $39.4 million PCCA and $4.6 million Windsource |

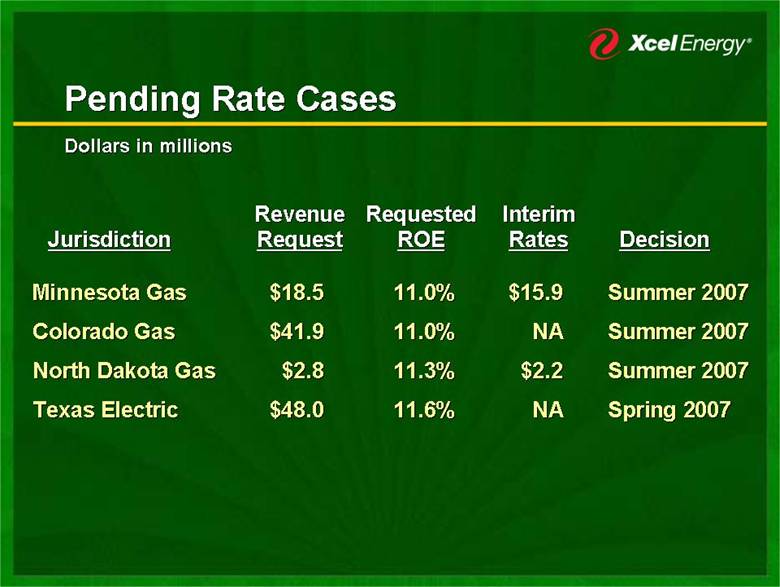

| Pending Rate Cases Dollars in millions Minnesota Gas $18.5 11.0% $15.9 Summer 2007 Colorado Gas $41.9 11.0% NA Summer 2007 North Dakota Gas $2.8 11.3% $2.2 Summer 2007 Texas Electric $48.0 11.6% NA Spring 2007 Revenue Requested Interim Jurisdiction Request ROE Rates Decision |

| Significant Capital Investment Pipeline Growing service territory Environmental initiatives Renewable portfolio standards Capital investment will drive sustainable growth |

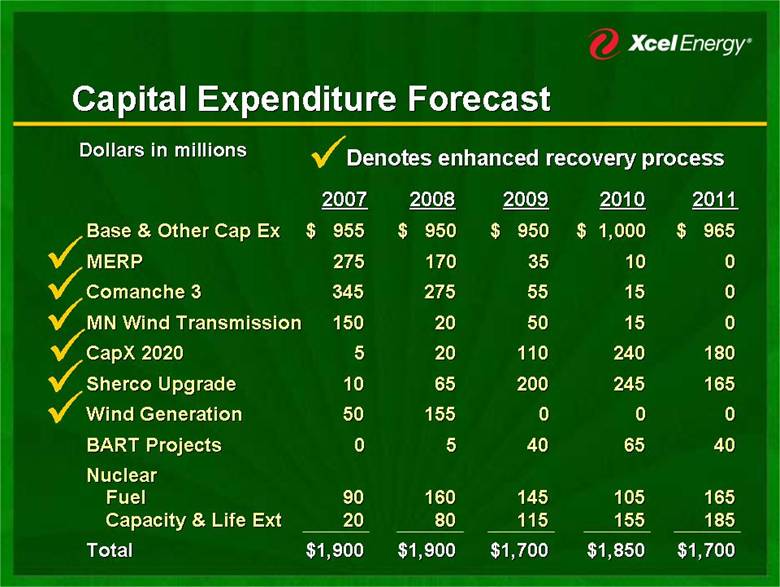

| Capital Expenditure Forecast Dollars in millions Denotes enhanced recovery process 2007 2008 2009 2010 2011 Base & Other Cap Ex $ 955 $ 950 $ 950 $ 1,000 $ 965 MERP 275 170 35 10 0 Comanche 3 345 275 55 15 0 MN Wind Transmission 150 20 50 15 0 CapX 2020 5 20 110 240 180 Sherco Upgrade 10 65 200 245 165 Wind Generation 50 155 0 0 0 BART Projects 0 5 40 65 40 Nuclear Fuel 90 160 145 105 165 Capacity & Life Ext 20 80 115 155 185 Total $1,900 $1,900 $1,700 $1,850 $1,700 |

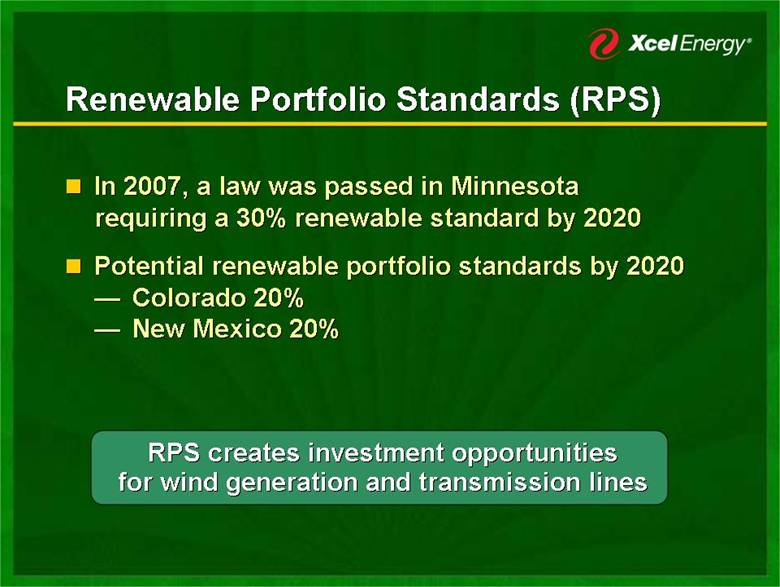

| Renewable Portfolio Standards (RPS) In 2007, a law was passed in Minnesota requiring a 30% renewable standard by 2020 Potential renewable portfolio standards by 2020 — Colorado 20% — New Mexico 20% RPS creates investment opportunities for wind generation and transmission lines |

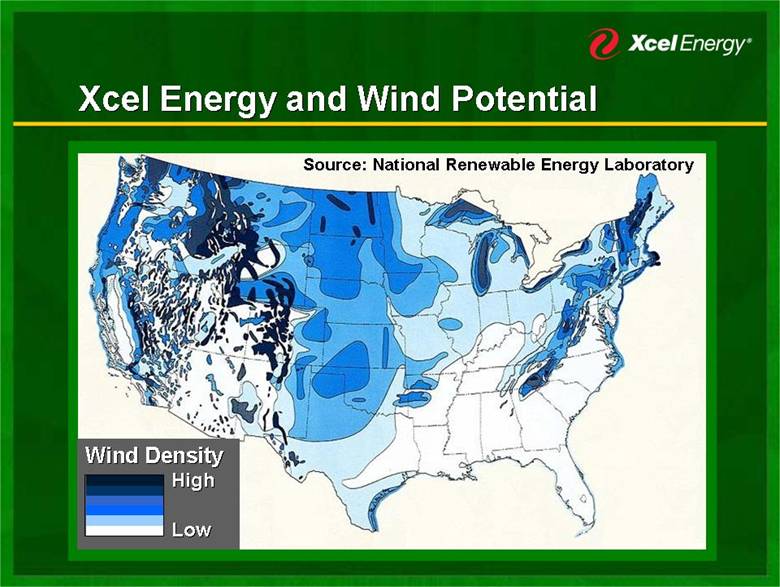

| Wind Density High Low Source: National Renewable Energy Laboratory Xcel Energy and Wind Potential |

| Projected Wind Generation MW 1,300 2,800 6,000 2006 2007 2020 |

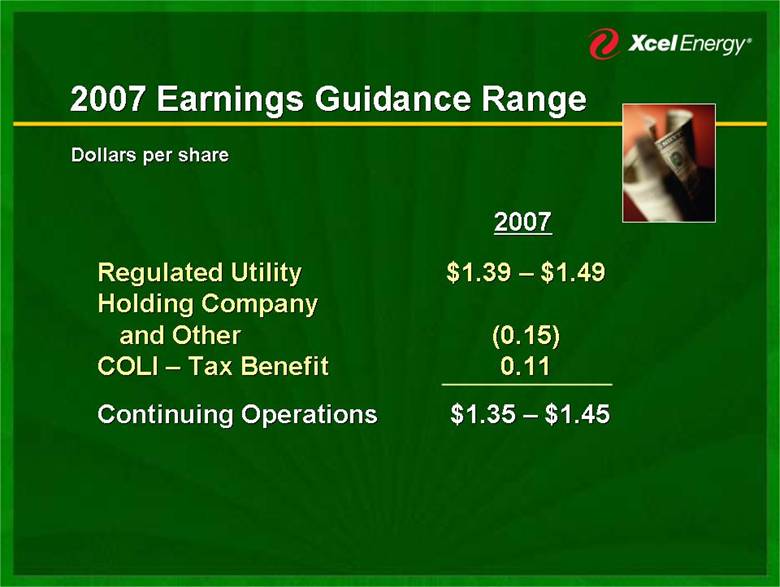

| 2007 Earnings Guidance Range Regulated Utility $1.39 – $1.49 Holding Company and Other (0.15) COLI – Tax Benefit 0.11 Continuing Operations $1.35 – $1.45 Dollars per share 2007 |

| Attractive Total Return Sustainable 5% – 7% earnings per share growth Dividend yield 4% Dividend growth of 2% – 4% per year Sustainable Growth Collaborative process that balances various interests and delivers value to customers and investors Constructive rate case outcomes Forward recovery on significant incremental investments Pipeline of investments beyond 2010 |

| Appendix |

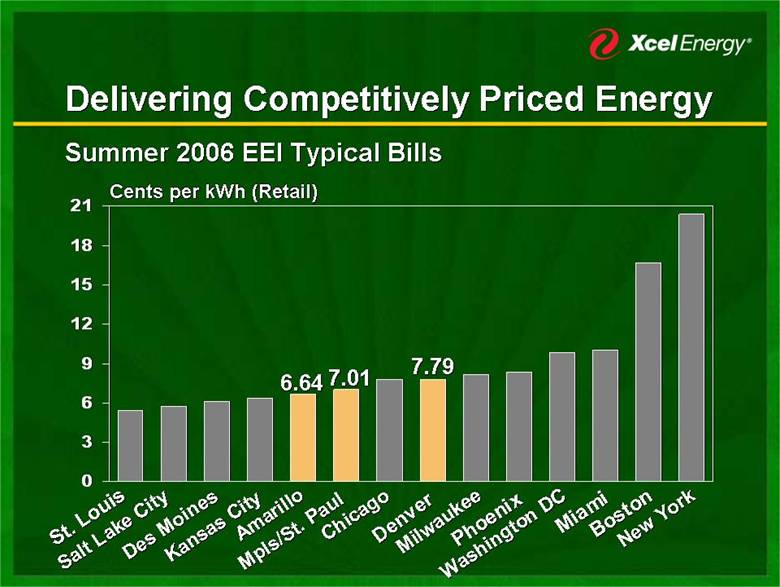

| Delivering Competitively Priced Energy Summer 2006 EEI Typical Bills Milwaukee Cents per kWh (Retail) 7.01 Des Moines Amarillo Kansas City Denver Mpls/St. Paul Boston Chicago Phoenix Salt Lake City St. Louis Miami New York Washington DC 6.64 7.79 0 3 6 9 12 15 18 21 |

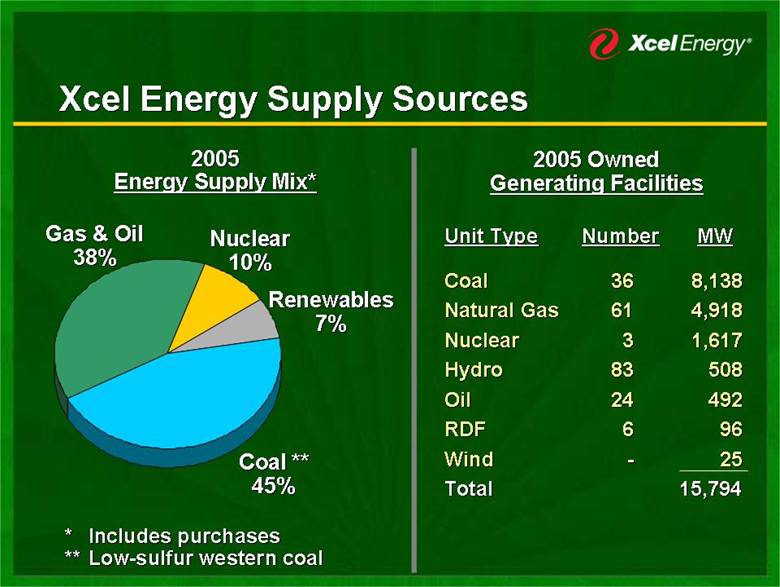

| Coal 36 8,138 Natural Gas 61 4,918 Nuclear 3 1,617 Hydro 83 508 Oil 24 492 RDF 6 96 Wind - 25 Total 15,794 2005 Owned Generating Facilities Unit Type Number MW Xcel Energy Supply Sources Nuclear 10% Coal ** 45% Gas & Oil 38% * Includes purchases ** Low-sulfur western coal Renewables7% 2005 Energy Supply Mix* |

| Senior Debt Ratings Secured Unsecured Holding Co. BBB+ Baa1 BBB- NSPM A+ A2 A- A A3 BBB- NSPW A+ A2 A- A A3 BBB PSCo A- A3 A- BBB+ Baa1 BBB- SPS BBB+ Baa1 BBB Fitch Moody’s S&P Fitch Moody’s S&P |

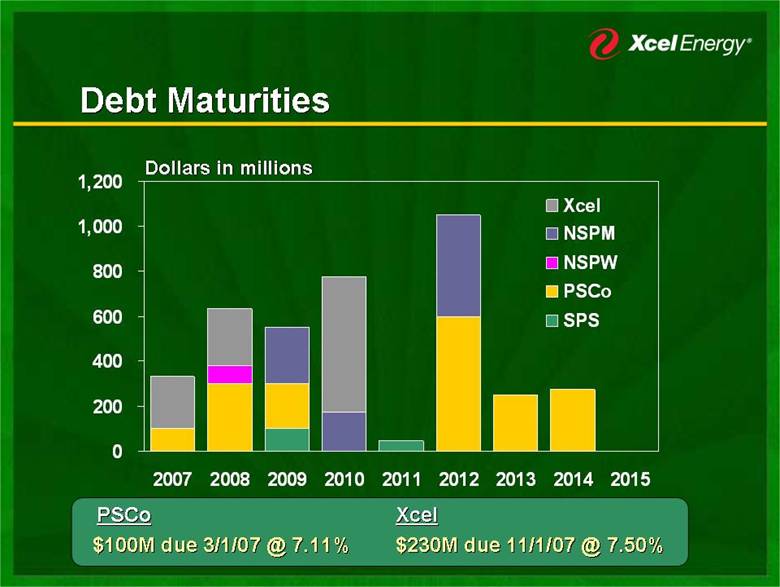

| Debt Maturities Dollars in millions PSCo $100M due 3/1/07 @ 7.11% Xcel $230M due 11/1/07 @ 7.50% 0 200 400 600 800 1,000 1,200 2007 2008 2009 2010 2011 2012 2013 2014 2015 Xcel NSPM NSPW PSCo SPS |

| COLI Litigation Positive pre-deduction cash flows Mortality gains The buildup of cash values The court’s opinion in the Dow case outlined three indicators of potential economic benefits to be examined in a COLI case. In Xcel Energy’s COLI case, the plans: Were projected to have sizeable pre-deduction cash flows, based upon the relevant assumptions when purchased Presented the opportunity for mortality gains that were not eliminated either retroactively or prospectively Had large cash value increases that were not encumbered by loans during the first seven years of the policies Trial likely second half of 2007 |

| Minnesota Cost Recovery Mechanisms Projected electric fuel and purchased energy costs billed for the current month with subsequent true-up; MISO energy and ancillary services being recovered through FCA. Projected purchased gas cost billed for the current month with subsequent true-up Conservation Improvement Program rider which provides recovery of program costs plus incentives Metro Emission Reduction Program, Renewable Development Fund and State Energy Policy rider in place General Transmission rider authorized by law Mercury Reduction and Environmental Improvement rider authorized by law |

| Colorado Cost Recovery Mechanisms Quarterly Energy Cost Adjustment to recover electric fuel and purchased energy costs Monthly Gas Cost Adjustment recovers natural gas commodity, interstate pipeline and storage costs Annual Purchased Capacity Adjustment to recover capacity costs of purchased power contracts through 2010 Fuel Cost Adjustment recovers electric fuel and purchased energy costs from wholesale customers Demand-side Management Cost Adjustment rider Air Quality Improvement rider (recovers cost of emission controls on several Denver metro generation facilities) Recovery of Comanche 3 construction work-in-progress Recovery of expenditures for renewable mandate Rider recovery of IGCC |

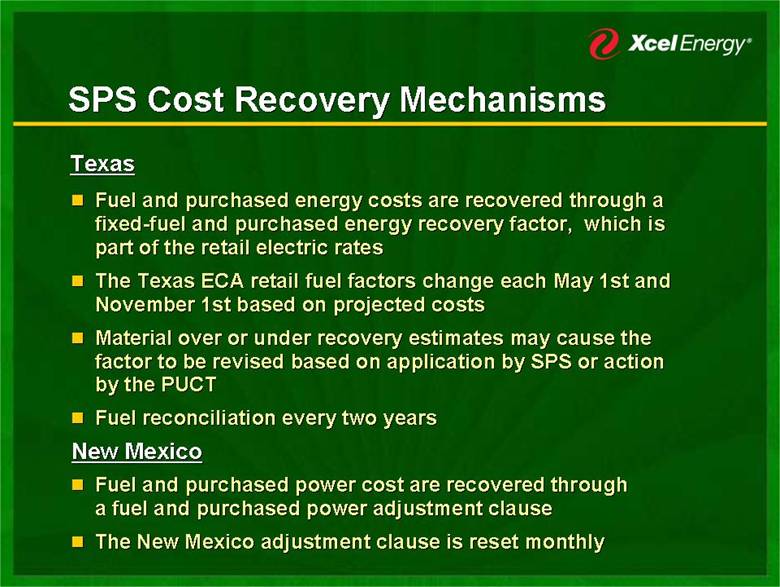

| SPS Cost Recovery Mechanisms Fuel and purchased energy costs are recovered through a fixed-fuel and purchased energy recovery factor, which is part of the retail electric rates The Texas ECA retail fuel factors change each May 1st and November 1st based on projected costs Material over or under recovery estimates may cause the factor to be revised based on application by SPS or action by the PUCT Fuel reconciliation every two years Fuel and purchased power cost are recovered through a fuel and purchased power adjustment clause The New Mexico adjustment clause is reset monthly Texas New Mexico |

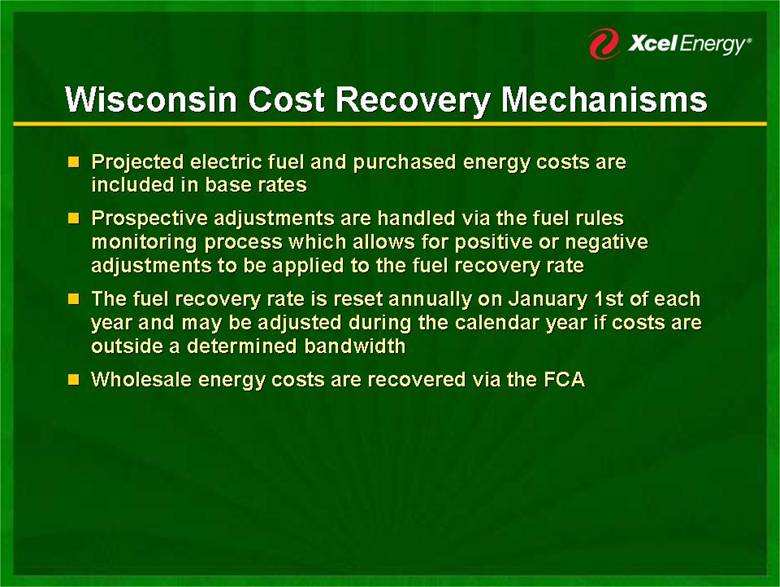

| Wisconsin Cost Recovery Mechanisms Projected electric fuel and purchased energy costs are included in base rates Prospective adjustments are handled via the fuel rules monitoring process which allows for positive or negative adjustments to be applied to the fuel recovery rate The fuel recovery rate is reset annually on January 1st of each year and may be adjusted during the calendar year if costs are outside a determined bandwidth Wholesale energy costs are recovered via the FCA |

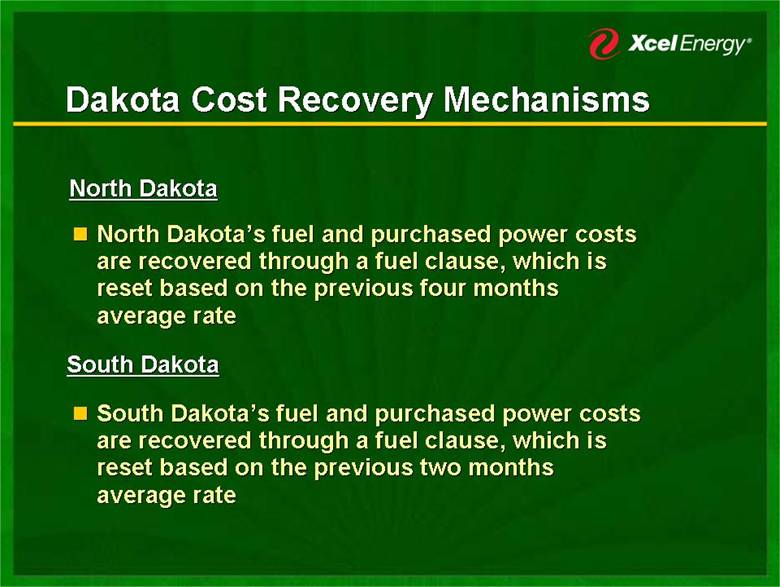

| Dakota Cost Recovery Mechanisms North Dakota’s fuel and purchased power costs are recovered through a fuel clause, which is reset based on the previous four months average rate North Dakota South Dakota South Dakota’s fuel and purchased power costs are recovered through a fuel clause, which is reset based on the previous two months average rate |

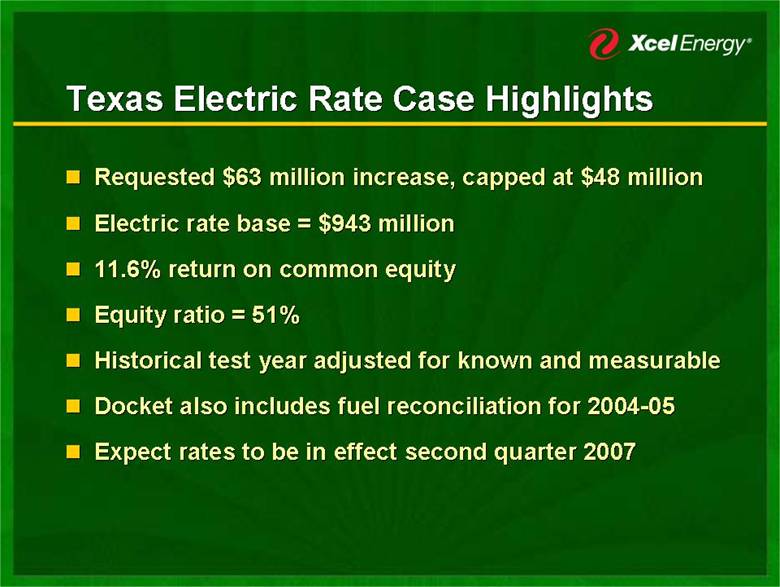

| Texas Electric Rate Case Highlights Requested $63 million increase, capped at $48 million Electric rate base = $943 million 11.6% return on common equity Equity ratio = 51% Historical test year adjusted for known and measurable Docket also includes fuel reconciliation for 2004-05 Expect rates to be in effect second quarter 2007 |

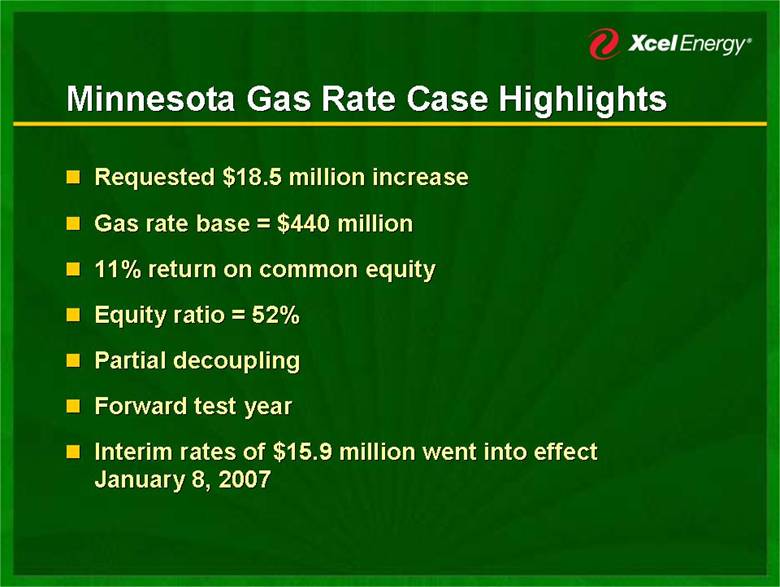

| Minnesota Gas Rate Case Highlights Requested $18.5 million increase Gas rate base = $440 million 11% return on common equity Equity ratio = 52% Partial decoupling Forward test year Interim rates of $15.9 million went into effect January 8, 2007 |

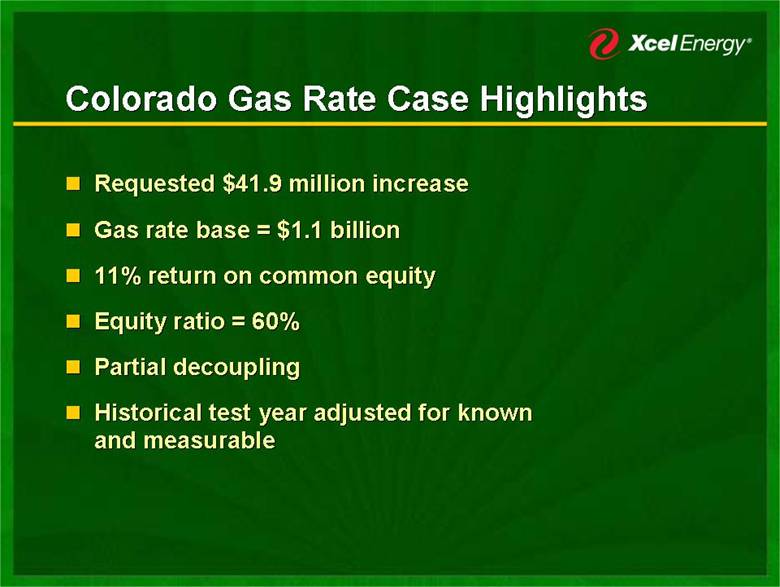

| Colorado Gas Rate Case Highlights Requested $41.9 million increase Gas rate base = $1.1 billion 11% return on common equity Equity ratio = 60% Partial decoupling Historical test year adjusted for known and measurable |

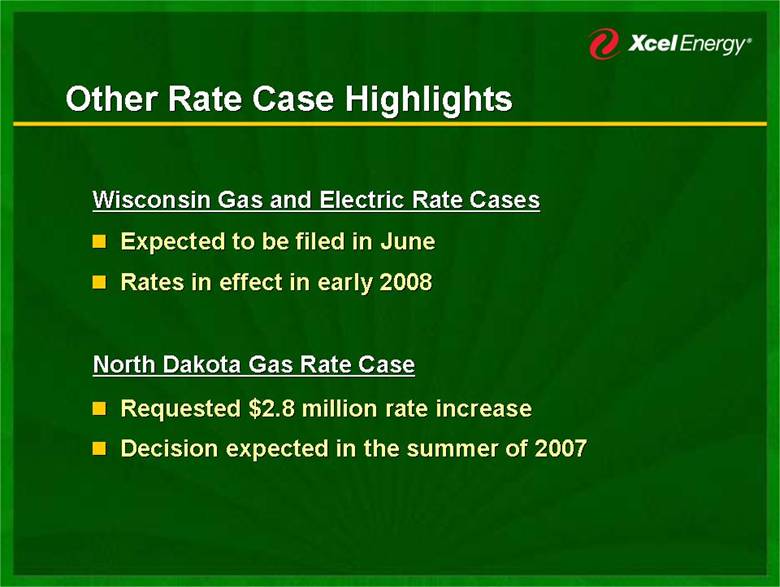

| Wisconsin Gas and Electric Rate Cases North Dakota Gas Rate Case Other Rate Case Highlights Expected to be filed in June Rates in effect in early 2008 Requested $2.8 million rate increase Decision expected in the summer of 2007 |