UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

or

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| | |

| 001-03140 | | 39-0508315 |

| (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

|

| (Registrant, State of Incorporation or Organization, Address of Principal Executive Officers and Telephone Number) |

| Northern States Power Company |

| (a Wisconsin corporation) |

| 1414 West Hamilton Avenue |

| Eau Claire, Wisconsin 54701 |

| 715-839-2625 |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 and Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. ¨ Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller Reporting Company ¨ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

As of Feb. 22, 2019, 933,000 shares of common stock, par value $100 per share, were outstanding, all of which were held by Xcel Energy Inc., a Minnesota corporation.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Item 14 of Form 10-K is set forth under the heading “Independent Registered Public Accounting Firm – Audit and Non-Audit Fees” in Xcel Energy Inc.’s definitive Proxy Statement for the 2019 Annual Meeting of Stockholders which definitive Proxy Statement is expected to be filed with the SEC on or about April 1, 2019. Such information set forth under such heading is incorporated herein by this reference hereto.

Northern States Power Company meets the conditions set forth in General Instructions I(1)(a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format permitted by General Instruction I(2).

TABLE OF CONTENTS

Index

|

| |

| PART I | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PART II | |

| |

| |

| |

| |

| |

| |

| |

| |

| PART III | |

| |

| |

| |

| |

| |

| PART IV | |

| |

| |

| SIGNATURES | |

This Form 10-K is filed by NSP-Wisconsin. NSP-Wisconsin is a wholly owned subsidiary of Xcel Energy Inc. Additional information on Xcel Energy is available in various filings with the SEC. This report should be read in its entirety.

PART I

Item l — Business

ABBREVIATIONS AND INDUSTRY TERMS

|

| |

| Xcel Energy Inc.’s Subsidiaries and Affiliates (current and former) |

| e prime | e prime inc. |

| NSP-Minnesota | Northern States Power Company, a Minnesota corporation |

| NSP System | The electric production and transmission system of NSP-Minnesota and NSP-Wisconsin operated on an integrated basis and managed by NSP-Minnesota |

| NSP-Wisconsin | Northern States Power Company, a Wisconsin corporation |

| PSCo | Public Service Company of Colorado |

| SPS | Southwestern Public Service Company |

| Utility subsidiaries | NSP-Minnesota, NSP-Wisconsin, PSCo and SPS |

| Xcel Energy | Xcel Energy Inc. and its subsidiaries |

| | |

| Federal and State Regulatory Agencies |

| Circuit Court | La Crosse County Circuit Court |

| D.C. Circuit | United States Court of Appeals for the District of Columbia Circuit |

| DOT | Department of Transportation |

| EPA | United States Environmental Protection Agency |

| FERC | Federal Energy Regulatory Commission |

| IRS | Internal Revenue Service |

| MPSC | Michigan Public Service Commission |

| NERC | North American Electric Reliability Corporation |

| Ninth Circuit | U.S. Court of Appeals for the Ninth Circuit |

| NRC | Nuclear Regulatory Commission |

| PHMSA | Pipeline and Hazardous Materials Safety Administration |

| PSCW | Public Service Commission of Wisconsin |

| SEC | Securities and Exchange Commission |

| | |

| Other |

| AFUDC | Allowance for funds used during construction |

| ALJ | Administrative law judge |

| ATC | American Transmission Company, LLC |

| ARAM | Average rate assumption method |

| ARO | Asset retirement obligation |

| ASC | FASB Accounting Standards Codification |

| ASU | FASB Accounting Standards Update |

| C&I | Commercial and Industrial |

| CapX2020 | Alliance of electric cooperatives, municipals and investor-owned utilities in the upper Midwest involved in a joint transmission line planning and construction effort |

CO2 | Carbon dioxide |

| Corps | U.S. Army Corps of Engineers |

| CPCN | Certificate of public convenience and necessity |

| CPP | Clean Power Plan |

| CWA | Clean Water Act |

| CWIP | Construction work in progress |

| EMANI | European Mutual Association for Nuclear Insurance |

| ETR | Effective tax rate |

| FASB | Financial Accounting Standards Board |

| GAAP | Generally accepted accounting principles |

| GHG | Greenhouse gas |

| ITC | Investment tax credit |

| LNG | Liquefied natural gas |

|

| |

| MDL | Multi-district litigation |

| MGP | Manufactured gas plant |

| MISO | Midcontinent Independent System Operator, Inc. |

| Moody’s | Moody’s Investor Services |

| Native load | Customer demand of retail and wholesale customers whereby a utility has an obligation to serve under statute or long-term contract |

| NAV | Net asset value |

| NEIL | Nuclear Electric Insurance Ltd. |

| NOL | Net operating loss |

| NOx | Nitrogen oxide |

| O&M | Operating and maintenance |

| Opinion 531 | Methodology for calculating base ROE adopted by the FERC in June 2014 |

| PI | Prairie Island nuclear generating plant |

| Pipeline Safety Act | Pipeline Safety, Regulatory Certainty, and Job Creation Act |

| PPA | Purchased power agreement |

| PTC | Production tax credit |

| REC | Renewable energy credit |

| ROE | Return on equity |

| RPS | Renewable portfolio standards |

| RTO | Regional Transmission Organization |

| SERP | Supplemental executive retirement plan |

SO2 | Sulfur dioxide |

| Standard & Poor’s | Standard & Poor’s Ratings Services |

| TCJA | 2017 federal tax reform enacted as Public Law No: 115-97, commonly referred to as the Tax Cuts and Jobs Act |

| TO | Transmission owner |

| VIE | Variable interest entity |

| | |

| Measurements |

| Bcf | Billion cubic feet |

| KV | Kilovolts |

| KWh | Kilowatt hours |

| MMBtu | Million British thermal units |

| MW | Megawatts |

| MWh | Megawatt hours |

Forward-Looking Statements

Except for the historical statements contained in this report, the matters discussed herein are forward-looking statements that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements, assumptions and other statements identified in this document by the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should,” “will,” “would” and similar expressions. Actual results may vary materially. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any obligation to update any forward-looking information. The following factors, in addition to those discussed elsewhere in this Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2018 (including risk factors listed from time to time by NSP-Wisconsin in reports filed with the SEC, including “Risk Factors” in Item 1A of this Annual Report on Form 10-K hereto), could cause actual results to differ materially from management expectations as suggested by such forward-looking information: changes in environmental laws and regulations; climate change and other weather, natural disaster and resource depletion, including compliance with any accompanying legislative and regulatory changes; ability to recover costs from customers; reductions in our credit ratings and the cost of maintaining certain contractual relationships; general economic conditions, including inflation rates, monetary fluctuations and their impact on capital expenditures and the ability of NSP-Wisconsin and its subsidiaries to obtain financing on favorable terms; availability or cost of capital; our customers’ and counterparties’ ability to pay their debts to us; assumptions and costs relating to funding our employee benefit plans and health care benefits; tax laws; operational safety, including nuclear generation; successful long-term operational planning; commodity risks associated with energy markets and production; rising energy prices; costs of potential regulatory penalties; effects of geopolitical events, including war and acts of terrorism; cyber security threats and data security breaches; fuel costs; and employee work force and third party contractor factors.

Where To Find More Information

NSP-Wisconsin is a wholly owned subsidiary of Xcel Energy Inc. and Xcel Energy’s website address is www.xcelenergy.com. Xcel Energy makes available, free of charge through its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after the reports are electronically filed with or furnished to the SEC. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically at http://www.sec.gov.

COMPANY OVERVIEW

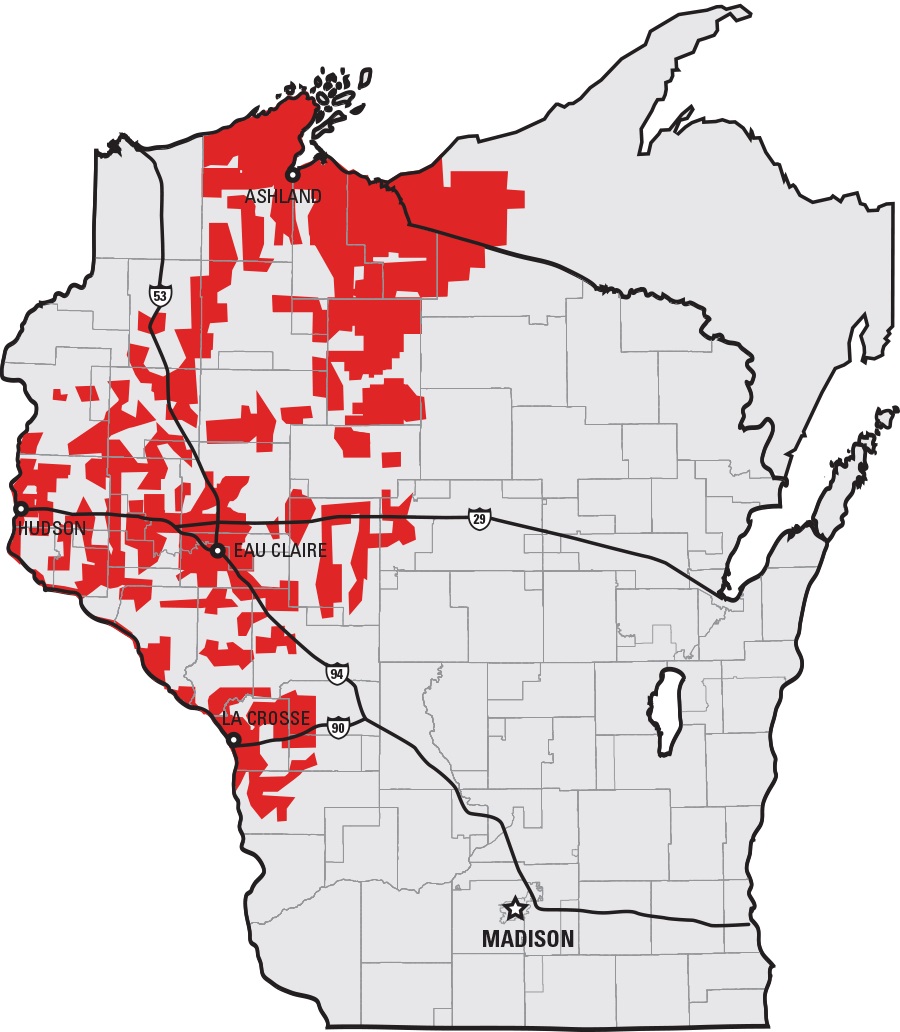

NSP-Wisconsin was incorporated in 1901 under the laws of Wisconsin. NSP-Wisconsin conducts business in Wisconsin and Michigan and generates, transmits, distributes and sells electricity as managed on the NSP System. NSP-Wisconsin also purchases, transports, distributes and sells natural gas to retail customers and transports customer-owned natural gas.

|

| | | |

| | | |

| | | |

| | NSP-Wisconsin |

| | Electric customers | 0.3 million |

| | Natural gas customers | 0.1 million |

| | Consolidated earnings contribution | 5% to 10% |

| | Total assets | $2.7 billion |

| | Electric generating capacity | 563 MW |

| | Gas storage capacity | 3.6 Bcf |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

ELECTRIC UTILITY OPERATIONS

Electric Operating Statistics

|

| | | | | | | | | | | |

| | Year Ended Dec. 31 |

| | 2018 | | 2017 | | 2016 |

| Electric sales (Millions of KWh) | | | | | |

| Residential | 1,959 |

| | 1,853 |

| | 1,868 |

|

| Large C&I | 2,029 |

| | 1,952 |

| | 1,885 |

|

| Small C&I | 2,970 |

| | 2,892 |

| | 2,856 |

|

| Public authorities and other | 27 |

| | 28 |

| | 32 |

|

| Total energy sold | 6,985 |

| | 6,725 |

| | 6,641 |

|

| | | | | | |

| Number of customers at end of period | | | | | |

| Residential | 218,860 |

| | 217,525 |

| | 216,426 |

|

| Large C&I | 126 |

| | 123 |

| | 117 |

|

| Small C&I | 40,218 |

| | 39,740 |

| | 39,529 |

|

| Public authorities and other | 1,188 |

| | 1,176 |

| | 1,142 |

|

| Total customers | 260,392 |

| | 258,564 |

| | 257,214 |

|

| | | | | | |

| Electric revenues (Millions of Dollars) | | | | | |

| Residential | $ | 254.0 |

| | $ | 254.2 |

| | $ | 248.5 |

|

| Large C&I | 151.0 |

| | 151.3 |

| | 142.9 |

|

| Small C&I | 286.3 |

| | 299.1 |

| | 287.1 |

|

| Public authorities and other | 6.1 |

| | 6.1 |

| | 6.1 |

|

| Total retail | 697.4 |

| | 710.7 |

| | 684.6 |

|

| Wholesale | 0.8 |

| | — |

| | — |

|

| Interchange revenues from NSP-Minnesota | 157.9 |

| | 177.2 |

| | 170.5 |

|

| Other electric revenues | 22.5 |

| | (6.0 | ) | | (5.2 | ) |

| Total electric revenues | $ | 878.6 |

| | $ | 881.9 |

| | $ | 849.9 |

|

| | | | | | |

| KWh sales per retail customer | 26,825 |

| | 26,009 |

| | 25,819 |

|

| Revenue per retail customer | $ | 2,678 |

| | $ | 2,749 |

| | $ | 2,662 |

|

| Residential revenue per KWh |

| 12.97 | ¢ | |

| 13.72 | ¢ | |

| 13.30 | ¢ |

| Large C&I revenue per KWh | 7.44 |

| | 7.75 |

| | 7.58 |

|

| Small C&I revenue per KWh | 9.64 |

| | 10.34 |

| | 10.05 |

|

| Total retail revenue per KWh | 9.98 |

| | 10.57 |

| | 10.31 |

|

*Distributed generation from the Solar*Rewards® program is not included (approximately 32 million KWh for 2018). Energy Source Statistics

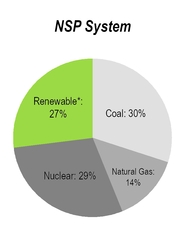

In 2018, of the NSP System’s total energy generation, 77% was owned and 23% was purchased. In 2017, 75% was owned and 25% was purchased.

Renewable Sources

NSP-Wisconsin’s renewable energy portfolio includes wind, hydroelectric, biomass and solar power from both owned generating facilities and PPAs. As of Dec. 31, 2018, NSP-Wisconsin was in compliance with its applicable RPS. Renewable percentages will vary year over year based on local weather, system demand and transmission constraints.

NSP System

Renewable energy as a percentage of the NSP System’s total:

|

| | | | | | |

| | | 2018 | | 2017 |

| Wind | | 16.4 | % | | 18.3 | % |

| Hydroelectric | | 5.8 |

| | 6.3 |

|

| Biomass and solar | | 4.8 |

| | 4.2 |

|

| Renewable | | 27.0 | % | | 28.8 | % |

Wind — The NSP System has more than 130 PPAs ranging from under one MW to more than 200 MW. The NSP System owns and operates five wind farms with 840 MW, net, of capacity.

| |

| • | The NSP System had approximately 2,550 MW and 2,600 MW of wind energy on its system at the end of 2018 and 2017, respectively. |

| |

| • | Average cost per MWh of wind energy under existing PPAs was approximately $44 for 2018 and 2017. |

| |

| • | Average cost per MWh of wind energy from owned generation was approximately $37 and $42 for 2018 and 2017, respectively. |

Non-Renewable Sources

Delivered cost per MMBtu of each significant category of fuel consumed for owned electric generation and the percentage of total fuel requirements represented by each category of fuel:

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Coal (a) | | Nuclear | | Natural Gas |

| | | Cost | | Percent | | Cost | | Percent | | Cost | | Percent |

| 2018 | | $ | 2.13 |

| | 42 | % | | $ | 0.80 |

| | 45 | % | | $ | 3.87 |

| | 13 | % |

| 2017 | | 2.08 |

| | 45 |

| | 0.78 |

| | 45 |

| | 4.10 |

| | 10 |

|

| |

(a) | Includes refuse-derived fuel and wood for the NSP System. |

Weighted average cost per MMBtu of all fuels for owned electric generation was $1.78 in 2018 and $1.72 in 2017.

See Items 1A and 7 for further information.

Coal — Inventory maintained (in days):

|

| | | | |

| Normal | | Dec. 31, 2018 Actual | | Dec. 31, 2017 Actual (a) |

| 35 - 50 | | 47 | | 53 |

| |

(a) | Milder weather, purchase commitments and low power and natural gas prices impacted coal inventory levels. |

Coal requirements (in million tons) was 7.8 in 2018 and 8.0 in 2017. Coal supply as a percentage of requirements for 2019 is 8.4 million tons or 76% of contracted coal supply.The general coal purchasing objective is to contract for approximately 75% of year one requirements, 40% of year two requirements and 20% of year three requirements. Increase in estimated million tons was due to lower delivered coal prices at Sherco in January 2019, combined with higher future forecasted gas prices for 2019 (higher burn forecast).

Contracted coal transportation as a percentage of requirements in 2019 and 2020 is 100%.

Natural Gas — Natural gas supplies, transportation and storage services for power plants are procured to provide an adequate supply of fuel. Remaining requirements are procured through a liquid spot market. Generally, natural gas supply contracts have variable pricing that is tied to natural gas indices. Natural gas supply and transportation agreements include obligations for the purchase and/or delivery of specified volumes or payments in lieu of delivery.

Contracts and commitments at Dec. 31:

|

| | | | | | | | |

| (Millions of Dollars) | | Gas Supply | | Gas Transportation and Storage (a) |

| 2018 | | $ | — |

| | $ | 406 |

|

| 2017 | | — |

| | 398 |

|

| Year of Expiration | | N/A |

| | 2020 - 2037 |

|

| |

(a) | For incremental supplies, there are limited on-site fuel storage facilities, with a primary reliance on the spot market. |

Capacity and Demand

Uninterrupted system peak demand for the NSP System’s electric utility for the last two years, is as follows:

|

| | | | | | | | |

| System Peak Demand (in MW) |

| 2018 | | 2017 |

| 8,927 |

| | June 29 | | 8,546 |

| | July 17 |

The peak demand typically occurs in the summer. The increase in peak load from 2017 to 2018 is partly due to warmer weather in 2018.

Public Utility Regulation

Summary of Regulatory Agencies and Areas of Jurisdiction — Retail rates, services and other aspects of NSP-Wisconsin’s operations are regulated by the PSCW and the MPSC. In addition, each of the state commissions certifies the need for new generating plants and electric transmission lines before the facilities may be sited and built. NSP-Wisconsin is subject to the jurisdiction of the FERC for its wholesale electric operations, hydroelectric generation licensing, accounting practices, wholesale sales for resale, transmission of electricity in interstate commerce, compliance with NERC electric reliability standards, asset transactions and mergers and natural gas transactions in interstate commerce. NSP-Wisconsin is a transmission owning member of the MISO RTO that operates within the MISO RTO and wholesale energy market. NSP-Wisconsin and NSP-Minnesota are jointly authorized by the FERC to make wholesale electric sales at market-based prices.

The PSCW has a biennial base rate filing requirement. By June of each odd numbered year, NSP-Wisconsin must submit a rate filing for the test year beginning the following January.

Fuel and Purchased Energy Cost Recovery Mechanisms — NSP-Wisconsin does not have an automatic electric fuel adjustment clause. Instead, under Wisconsin rules, utilities submit a forward-looking annual fuel cost plan to the PSCW. Once the PSCW approves the fuel cost plan, utilities defer the amount of any fuel cost under-recovery or over-recovery in excess of a 2% annual tolerance band, for future rate recovery or refund. Approval of a fuel cost plan and any rate adjustment for refund or recovery of deferred costs is determined by the PSCW. Rate recovery of deferred fuel cost is subject to an earnings test based on the utility’s most recently authorized ROE. Fuel cost under-collections that exceed the 2% annual tolerance band may not be recovered if the utility earnings for that year exceed the authorized ROE.

NSP-Wisconsin’s electric fuel costs for 2018 were lower than authorized in rates and outside the 2% annual tolerance band, primarily due to greater than forecasted generation sales into the MISO market, and lower purchased power costs coupled with moderate weather. Under the fuel cost recovery rules, NSP-Wisconsin retained approximately $3.6 million of fuel costs and deferred approximately $2.8 million. NSP-Wisconsin will file a reconciliation of 2018 fuel costs with the PSCW, by March 31, 2019.

NSP-Wisconsin’s retail electric rate schedules for Michigan customers include power supply cost recovery factors, which are based on 12-month projections. After each 12-month period, a reconciliation is submitted whereby over-recoveries are refunded and any under-recoveries are collected from the customers.

Wisconsin Energy Efficiency Program — The primary energy efficiency program is funded by the state’s utilities, but operated by independent contractors subject to oversight by the PSCW and the utilities. NSP-Wisconsin recovers these costs from retail customers.

Transmission Initiatives

NSP-Wisconsin operates an integrated system with NSP-Minnesota.

NSP-Wisconsin / ATC - La Crosse to Madison, Wis. Transmission Line — In December 2018, construction was completed on the Badger Coulee 345 KV transmission line. The line extends from La Crosse, WI. to Madison, WI. NSP-Wisconsin’s half of the line is shared with Dairyland Power Cooperative, WPPI Energy and Southern Minnesota Municipal Power Agency-Wisconsin.

Energy Sources and Transmission Initiatives

The NSP System expects to meet its system capacity requirements through existing power plants, power purchases, conservation improvement program/demand side management options, new generation facilities and expansion of existing power plants.

Purchased Power — Through the Interchange Agreement, NSP-Wisconsin receives power purchased by NSP-Minnesota from other utilities and independent power producers. Generally, long-term dispatchable purchased power contracts require a periodic payment and a charge for the delivered associated energy. Some long-term purchased power contracts only contain a charge for the purchased energy. NSP-Minnesota also makes short-term purchases to meet system load and energy requirements, to replace generation from company-owned units under maintenance or during outages, to meet operating reserve obligations, or to obtain energy at a lower cost. In NSP-Wisconsin’s most recent rate proceeding, the PSCW ordered NSP-Wisconsin to apply deferred accounting for the purchased power cost savings and the non-fuel costs associated with NSP-Minnesota’s termination or modification to certain biomass PPAs and NSP-Minnesota’s planned purchase and closure of the Benson Power LLC biomass facility.

Purchased Transmission Services — NSP-Minnesota and NSP-Wisconsin have contracts with MISO and other regional transmission service providers to deliver power and energy to their customers.

NSP System Resource Plans — In January 2017, the Minnesota Public Utilities Commission approved NSP-Minnesota’s Integrated Resource Plan that includes:

| |

| • | Retirement of Sherco Unit 2 in 2023 and Sherco Unit 1 in 2026. The resulting need for 750 MW of capacity in 2026 will be addressed in a future certificate of need proceeding; |

| |

| • | Acquisition of at least 1,000 MW of wind by 2019. The mix of purchased power and owned facilities was not specified; |

| |

| • | Acquisition of 650 MW of solar by 2021 either through the community solar gardens program or other cost-effective resources. The mix of purchased power and owned facilities was not specified; |

| |

| • | Acquisition of at least 400 MW of additional demand response by 2023, and a study of the technical and economic achievability of 1,000 MW of additional demand response in total by 2025; and |

| |

| • | Achievement of at least 444 gigawatt hours of energy efficiency in all planning years. |

Wholesale and Commodity Marketing Operations

NSP-Wisconsin does not serve any wholesale requirements customers at cost-based regulated rates.

NATURAL GAS UTILITY OPERATIONS

Natural Gas Operating Statistics

|

| | | | | | | | | | | |

| | Year Ended Dec. 31 |

| | 2018 | | 2017 | | 2016 |

| Natural gas deliveries (Thousands of MMBtu) | | | | | |

| Residential | 7,751 |

| | 6,981 |

| | 6,320 |

|

| C&I | 10,071 |

| | 8,919 |

| | 8,165 |

|

| Total retail | 17,822 |

| | 15,900 |

| | 14,485 |

|

| Transportation and other | 4,710 |

| | 5,177 |

| | 4,847 |

|

| Total deliveries | 22,532 |

| | 21,077 |

| | 19,332 |

|

| | | | | | |

| Number of customers at end of period | | | | | |

| Residential | 102,309 |

| | 101,322 |

| | 100,424 |

|

| C&I | 13,171 |

| | 13,129 |

| | 13,015 |

|

| Total retail | 115,480 |

| | 114,451 |

| | 113,439 |

|

| Transportation and other | 34 |

| | 30 |

| | 30 |

|

| Total customers | 115,514 |

| | 114,481 |

| | 113,469 |

|

| | | | | | |

| Natural gas revenues (Millions of Dollars) | | | | | |

| Residential | $ | 74.7 |

| | $ | 65.5 |

| | $ | 56.5 |

|

| C&I | 62.9 |

| | 54.2 |

| | 46.9 |

|

| Total retail | 137.6 |

| | 119.7 |

| | 103.4 |

|

| Transportation and other | 4.0 |

| | 2.7 |

| | 2.8 |

|

| Total natural gas revenues | $ | 141.6 |

| | $ | 122.4 |

| | $ | 106.2 |

|

| | | | | | |

| MMBtu sales per retail customer | 154.33 |

| | 138.92 |

| | 127.69 |

|

| Revenue per retail customer | $ | 1,192 |

| | $ | 1,046 |

| | $ | 912 |

|

| Residential revenue per MMBtu |

| 9.64 | ¢ | |

| 9.38 | ¢ | |

| 8.94 | ¢ |

| C&I revenue per MMBtu | 6.25 |

| | 6.08 |

| | 5.74 |

|

| Transportation and other revenue per MMBtu | 0.85 |

| | 0.52 |

| | 0.58 |

|

Capability and Demand

Natural gas supply requirements are categorized as firm or interruptible (customers with an alternate energy supply).

Maximum daily send-out (firm and interruptible) and occurrence date for NSP-Wisconsin:

|

| | | | | | | | |

| 2018 | | 2017 |

| MMBtu | | Date | | MMBtu | | Date |

| 159,700 |

| | Jan. 5 | | 160,170 |

| | Dec. 26 |

Natural gas is purchased from independent suppliers, generally based on market indices that reflect current prices. The natural gas is delivered under transportation agreements with interstate pipelines. These agreements provide for firm deliverable pipeline capacity of 140,195 MMBtu per day.

NSP-Wisconsin contracts with providers of underground natural gas storage services. Agreements provided storage of winter natural gas requirements and peak day firm requirements of 30% and 33% in 2018, respectively.

Natural Gas Supply and Costs

NSP-Wisconsin actively seeks natural gas supply, transportation and storage alternatives to yield a diversified portfolio which provides increased flexibility, decreased interruption and financial risk and economical rates. In addition, NSP-Wisconsin conducts natural gas price hedging activities approved by their respective state commissions.

Average delivered cost per MMBtu of natural gas for regulated retail distribution was $3.84 and $3.88 in 2018 and 2017, respectively.

NSP-Wisconsin has natural gas supply, transportation, and storage agreements that include obligations for purchase and/or delivery of specified volumes or to make payments in lieu of delivery. As of Dec. 31, 2018, NSP-Wisconsin was committed to approximately $89 million of obligations under contracts, which expire in various years from 2019 - 2029.

Public Utility Regulation

Summary of Regulatory Agencies and Areas of Jurisdiction — NSP-Wisconsin is regulated by the PSCW and MPSC. The PSCW has a biennial base-rate filing requirement. By June of each odd-numbered year, NSP-Wisconsin must submit a rate filing for the test year period beginning the following January.

NSP-Wisconsin is subject to the jurisdiction of the FERC with respect to natural gas transactions in interstate commerce. NSP-Wisconsin is subject to the DOT, PSCW and MPSC for pipeline safety compliance.

Natural Gas Cost-Recovery Mechanisms — NSP-Wisconsin has a retail purchased gas adjustment cost-recovery mechanism for Wisconsin to recover the actual cost of natural gas and transportation and storage services.

NSP-Wisconsin’s natural gas rates for Michigan customers include a natural gas cost-recovery factor, which is based on 12-month projections and trued-up to the actual amounts on an annual basis.

GENERAL

Seasonality

Demand for electric power and natural gas is affected by seasonal differences in the weather. In general, peak sales of electricity occur in the summer months, and peak sales of natural gas occur in the winter months. As a result, the overall operating results may fluctuate substantially on a seasonal basis. Additionally, NSP-Wisconsin’s operations have historically generated less revenues and income when weather conditions are milder in the winter and cooler in the summer.

See Item 7 for further information.

Competition

NSP-Wisconsin is a vertically integrated utility, subject to traditional cost-of-service regulation by state public utilities commissions. NSP-Wisconsin is subject to public policies that promote competition and development of energy markets. NSP-Wisconsin’s industrial and large commercial customers have the ability to generate their own electricity. In addition, customers may have the option of substituting other fuels or relocating their facilities to a lower cost region.

Customers have the opportunity to supply their own power with distributed generation including, but not limited to, solar generation and in most jurisdictions can currently avoid paying for most of the fixed production, transmission and distribution costs incurred to serve them. Several states, including Wisconsin, have policies designed to promote the development of solar and other distributed energy resources through incentive policies. With these incentives and federal tax subsidies, distributed generating resources are potential competitors to NSP-Wisconsin’s electric service business.

The FERC has continued to promote competitive wholesale markets through open access transmission and other means. As a result, NSP-Wisconsin and its wholesale customers can purchase generation resources from competing wholesale suppliers and use the transmission systems of Xcel Energy Inc.’s utility subsidiaries on a comparable basis to serve their native load.

FERC Order No. 1000 seeks to establish competition for construction and operation of certain new electric transmission facilities. State utilities commissions, including the MPUC, have created resource planning programs that promote competition for electricity generation resources used to provide service to retail customers.

NSP-Wisconsin has franchise agreements with cities subject to periodic renewal, however, a city could seek alternative means to access electric power or gas, such as municipalization.

While facing these challenges, NSP-Wisconsin believes its rates and services are competitive with the alternatives currently available.

ENVIRONMENTAL MATTERS

NSP-Wisconsin’s facilities are regulated by federal and state environmental agencies that have jurisdiction over air emissions, water quality, wastewater discharges, solid wastes and hazardous substances. Various company activities require registrations, permits, licenses, inspections and approvals from these agencies. NSP-Wisconsin has received all necessary authorizations for the construction and continued operation of its generation, transmission and distribution systems. NSP-Wisconsin’s facilities have been designed and constructed to operate in compliance with applicable environmental standards and related monitoring and reporting requirements. However, it is not possible to determine when or to what extent additional facilities or modifications of existing or planned facilities will be required as a result of changes to environmental regulations, interpretations or enforcement policies or what effect future laws or regulations may have upon NSP-Wisconsin’s operations. NSP-Wisconsin may be required to incur capital expenditures in the future to comply with requirements for remediation of MGP and other legacy sites. The scope and timing of these expenditures cannot be determined until more information is obtained regarding the need for remediation at legacy sites.

NSP-Wisconsin must comply with emissions budgets that require the purchase of emission allowances from other utilities.

There are significant present and future environmental regulations to encourage use of clean energy technologies and regulate emissions of GHGs. NSP-Wisconsin has undertaken numerous initiatives to meet current requirements and prepare for potential future regulations, reduce GHG emissions and respond to state renewable and energy efficiency goals. If future environmental regulations do not provide credit for the investments NSP-Wisconsin has already made or if they require additional initiatives or emission reductions, substantial costs may be incurred. The EPA , as an alternative to the CPP, has proposed a new regulation that, if adopted, would require implementation of heat rate improvement projects at our coal-fired power plants. It is not known what those costs might be until a final rule is adopted and state plans are developed to implement a final regulation. NSP-Wisconsin believes, based on prior state commission practice, it would recover the cost of these initiatives or replacement generation would be recoverable through rates.

NSP-Wisconsin is committed to addressing climate change and potential climate change regulation through efforts to reduce its GHG emissions in a balanced, cost-effective manner. Starting in 2011, NSP-Wisconsin began reporting GHG emissions under the EPA’s mandatory GHG Reporting Program.

EMPLOYEES

As of Dec. 31, 2018, NSP-Wisconsin had 538 full-time employees and two part-time employees, of which 386 were covered under collective-bargaining agreements.

Item 1A — Risk Factors

Xcel Energy, which includes NSP-Wisconsin, is subject to a variety of risks, many of which are beyond our control. Risks that may adversely affect the business, financial condition, results of operations or cash flows are described below. These risks should be carefully considered together with the other information set forth in this report and future reports that Xcel Energy files with the SEC.

Oversight of Risk and Related Processes

A key accountability of the Board of Directors is the oversight of material risk, and our Board of Directors employs an effective process for doing so. Management and the Board of Directors have responsibility for overseeing the identification and mitigation of key risks.

Management identifies and analyzes risks to determine materiality and other attributes such as timing, probability and controllability. Identification and analysis occurs formally through a key risk assessment process by senior management, the financial disclosure process, hazard risk management procedures and internal auditing and compliance with financial and operational controls. Management also identifies and analyzes risk through its business planning process and development of goals and key performance indicators, which include risk identification to determine barriers to implementing NSP-Wisconsin’s strategy. The business planning process also identifies areas in which there is a potential for a business area to assume inappropriate risk to meet goals, and determines how to prevent inappropriate risk-taking.

At a threshold level, NSP-Wisconsin has a robust compliance program and promotes a culture of compliance, including tone at the top. The process for risk mitigation includes adherence to our code of conduct and compliance policies, operation of formal risk management structures and overall business management to mitigate the risks inherent in the implementation of strategy. Building on this culture of compliance, management further mitigates risks through formal risk management structures, including management councils, risk committees and services of corporate areas such as internal audit, corporate controller and legal.

Management communicates regularly with the Board of Directors and key stakeholders regarding risk. Senior management presents and communicates a periodic risk assessment to the Board of Directors. The presentation and the discussion of the key risks provides information on the risks management believes are material, including the earnings impact, timing, likelihood and controllability. Oversight of cybersecurity risks by the Operations, Nuclear, Environmental and Safety Committee includes receiving independent outside assessments of cybersecurity maturity and assessment of plans.

Overall, the Board of Directors approaches oversight, management and mitigation of risk as an integral and continuous part of its governance of NSP-Wisconsin. Processes are in place to ensure appropriate risk oversight, as well as identification and consideration of new risks. The Board of Directors regularly reviews management’s key risk assessment informed by these processes, and analyzes areas of existing and future risks and opportunities.

Risks Associated with Our Business

Operational Risks

Our natural gas and electric transmission and distribution operations involve numerous risks that may result in accidents and other operating risks and costs.

Our natural gas transmission and distribution activities include inherent hazards and operating risks, such as leaks, explosions, outages and mechanical problems. Our electric transmission and distribution activities also include inherent hazards and operating risks such as contact, fire and outages which could cause substantial financial losses. These natural gas and electric risks could result in loss of life, significant property damage, environmental pollution, impairment of our operations and substantial losses. We maintain insurance against some, but not all, of these risks and losses. The occurrence of these events, if not fully covered by insurance, could have a material effect on our financial condition, results of operations and cash flows.

Additionally, for natural gas costs that may be required in order to comply with potential new regulations, including the Pipeline Safety Act, could be significant.

The Pipeline Safety Act requires verification of pipeline infrastructure records by pipeline owners and operators to confirm the maximum allowable operating pressure of lines located in high consequence areas or more-densely populated areas. We have programs in place to comply with the Pipeline Safety Act and for systematic infrastructure monitoring and renewal over time. A significant incident could increase regulatory scrutiny and result in penalties and higher costs of operations.

The PHMSA is responsible for administering the DOT’s national regulatory program to assure the safe transportation of natural gas, petroleum and other hazardous materials by pipelines. The PHMSA continues to develop regulations and other approaches to risk management to assure safety in design, construction, testing, operation, maintenance, and emergency response of natural gas pipeline infrastructure.

Our utility operations are subject to long-term planning risks.

Most electric utility investments are planned to be used for decades. Transmission and generation investments typically have long lead times and are planned well in advance of when they are brought in-service subject to long-term resource plans. These plans are based on numerous assumptions such as: sales growth, customer usage, commodity prices, economic activity, costs, regulatory mechanisms, customer behavior, available technology and public policy.

The electric utility sector is undergoing a period of significant change. For example, increases in appliance, lighting and energy efficiency, wider adoption and lower cost of renewable generation and distributed generation, shifts away from coal generation to decrease CO2 emissions and increasing use of natural gas in electric generation driven by lower natural gas prices. Customer adoption of these technologies and increased energy efficiency could result in excess transmission and generation resources as well as stranded costs if NSP-Wisconsin is not able to fully recover the costs and investments. These changes also introduce additional uncertainty into long-term planning which gives rise to a risk that the magnitude and timing of resource additions and growth in customer demand may not coincide, and that the preference for the types of additions may change from planning to execution. In addition, we are subject to longer-term availability of the natural resource inputs such as coal, natural gas, uranium and water to cool our facilities. Lack of availability of these resources could jeopardize long-term operations of our facilities or make them uneconomic to operate.

Changing customer expectations and technologies are requiring significant investments in advanced grid infrastructure. This increases the exposure to potential outdating of technologies and resultant risks. The inability of coal mining companies to attract capital could disrupt longer-term supplies. Decreasing use per customer driven by appliance and lighting efficiency and the availability of cost-effective distributed generation places downward pressure on sales growth. This may lead to under recovery of costs, excess resources to meet customer demand and increases in electric rates. Finally, multiple states may not agree as to the appropriate resource mix and the differing views may lead to costs incurred to comply with one jurisdiction that are not recoverable across all of the jurisdictions served by the same assets.

Although we do not own any nuclear generating facilities, because our production and transmission system is operated on an integrated basis with NSP-Minnesota’s (an affiliate of NSP-Wisconsin) production and transmission system, we may be subject to risks associated with NSP-Minnesota’s nuclear generation.

NSP-Minnesota’s two nuclear stations, PI and Monticello, subject it to the risks of nuclear generation, which include:

| |

| • | Risks associated with use of radioactive material in the production of energy, the management, handling, storage and disposal of radioactive materials; |

| |

| • | Limitations on insurance available to cover losses that might arise in connection with nuclear operations, as well as obligations to contribute to an insurance pool in the event of damages at a covered U.S. reactor; and, |

| |

| • | Uncertainties with the technological and financial aspects of decommissioning nuclear plants. For example, assumptions regarding decommissioning costs may change based on economic conditions and changes in the expected life of the asset may cause our funding obligations to change. |

The NRC has authority to impose licensing and safety-related requirements for the operation of nuclear generation facilities. The NRC has the authority to impose fines and/or shut down a unit until compliance is achieved. Revised NRC safety requirements could necessitate substantial capital expenditures or an increase in operating expenses. In addition, the Institute for Nuclear Power Operations reviews NSP-Minnesota’s nuclear operations and nuclear generation facilities. Compliance with the Institute for Nuclear Power Operations’ recommendations could result in substantial capital expenditures or a substantial increase in operating expenses.

If an incident did occur, it could have a material effect on our results of operations, financial condition or cash flows. Furthermore, the non-compliance or the occurrence of a serious incident at other nuclear facilities could result in increased regulation of the industry, which may increase NSP-Minnesota’s compliance costs.

We are subject to commodity risks and other risks associated with energy markets and energy production.

If fuel costs increase, customer demand could decline and bad debt expense may rise, which could have a material impact on our results of operations. While we have fuel clause recovery mechanisms, higher fuel costs could significantly impact our results of operations if costs are not recovered. Delays in the timing of the collection of fuel cost recoveries could impact our cash flows. Low fuel costs have a positive impact on sales, however low oil and natural gas prices could negatively impact oil and gas production activities and subsequently our sales volumes and revenue.

A significant disruption in supply could cause us to seek alternative supply services at potentially higher costs or suffer increased liability for unfulfilled contractual obligations. Significantly higher energy or fuel costs relative to sales commitments have a negative impact on our cash flows and potentially result in economic losses. Potential market supply shortages may not be fully resolved through alternative supply sources and could cause disruptions in our ability to provide electric and/or natural gas services to our customers. Failure to provide service due to disruptions may also result in fines, penalties or cost disallowances through the regulatory process.

We also engage in wholesale sales and purchases of electric capacity, energy and energy-related products as well as natural gas. In many markets, emission allowances and/or RECs are also needed to comply with various statutes and commission rulings. As a result we are subject to market supply and commodity price risk. Commodity price changes can affect the value of our commodity trading derivatives. We mark certain derivatives to estimated fair market value on a daily basis. Actual settlements can vary significantly from estimated fair values recorded and significant changes from the assumptions underlying our fair value estimates could cause earnings variability.

We share in the electric production and transmission costs of the NSP-Minnesota system, which is integrated with our system. Accordingly, our costs may be increased due to increased costs associated with NSP-Minnesota’s system.

Our electric production and transmission system is managed on an integrated basis with the electric production and transmission system of NSP-Minnesota. As discussed above, pursuant to the Interchange Agreement between NSP-Minnesota and us, we share, on a proportional basis, all costs related to the generation and transmission facilities of the entire integrated NSP System, including capital costs. Accordingly, if the costs to operate the NSP System increase, or revenue decreases, whether as a result of state or federally mandated improvements or otherwise, our costs could also increase and our revenues could decrease and we cannot guarantee a full recovery of such costs through our rates at the time the costs are incurred.

As we are a subsidiary of Xcel Energy Inc., we may be negatively affected by events impacting the credit or liquidity of Xcel Energy Inc. and its affiliates.

If Xcel Energy Inc. were to become obligated to make payments under various guarantees and bond indemnities or to fund its other contingent liabilities, or if either Standard & Poor’s or Moody’s were to downgrade Xcel Energy Inc.’s credit rating below investment grade, Xcel Energy Inc. may be required to provide credit enhancements in the form of cash collateral, letters of credit or other security to satisfy part or potentially all of these exposures. If either Standard & Poor’s or Moody’s were to downgrade Xcel Energy Inc.’s debt securities below investment grade, it would increase Xcel Energy Inc.’s cost of capital and restrict its access to the capital markets. This could limit Xcel Energy Inc.’s ability to contribute equity or make loans to us, or may cause Xcel Energy Inc. to seek additional or accelerated funding from us in the form of dividends. If such event were to occur, we may need to seek alternative sources of funds to meet our cash needs.

As of Dec. 31, 2018, Xcel Energy Inc. and its utility subsidiaries had approximately $15.8 billion of long-term debt and $1.4 billion of short-term debt and current maturities. Xcel Energy Inc. provides various guarantees and bond indemnities supporting some of its subsidiaries by guaranteeing the payment or performance by these subsidiaries for specified agreements or transactions.

Xcel Energy also has other contingent liabilities resulting from various tax disputes and other matters. Xcel Energy Inc.’s exposure under the guarantees is based upon the net liability of the relevant subsidiary under the specified agreements or transactions. The majority of Xcel Energy Inc.’s guarantees limit its exposure to a maximum amount that is stated in the guarantees. As of Dec. 31, 2018, Xcel Energy had guarantees outstanding with a maximum stated amount of approximately $17.8 million and immaterial exposure. Xcel Energy also had additional guarantees of $51.1 million at Dec. 31, 2018 for performance and payment of surety bonds for the benefit of itself and its subsidiaries, with total exposure that cannot be estimated at this time. If Xcel Energy Inc. were to become obligated to make payments under these guarantees and bond indemnities or become obligated to fund other contingent liabilities, it could limit Xcel Energy Inc.’s ability to contribute equity or make loans to us, or may cause Xcel Energy Inc. to seek additional or accelerated funding from us in the form of dividends. If such event were to occur, we may need to seek alternative sources of funds to meet our cash needs.

We are a wholly owned subsidiary of Xcel Energy Inc. Xcel Energy Inc. can exercise substantial control over our dividend policy and business and operations and may exercise that control in a manner that may be perceived to be adverse to our interests.

All of the members of our Board of Directors, as well as many of our executive officers, are officers of Xcel Energy Inc. Our Board makes determinations with respect to a number of significant corporate events, including the payment of our dividends.

We have historically paid quarterly dividends to Xcel Energy Inc. In 2018, 2017 and 2016 we paid $91.1 million, $64.0 million and $53.1 million of dividends to Xcel Energy Inc., respectively. If Xcel Energy Inc.’s cash requirements increase, our Board of Directors could decide to increase the dividends we pay to Xcel Energy Inc. to help support Xcel Energy Inc.’s cash needs. This could adversely affect our liquidity. The most restrictive dividend limitation for NSP-Wisconsin is imposed by our state regulatory commission. NSP-Wisconsin cannot pay annual dividends in excess of certain amounts if its calendar year average equity-to-total capitalization ratio is or falls below the state commission authorized level. See Note 5 to the consolidated financial statements for further information.

Financial Risks

Our profitability depends on our ability to recover costs from our customers and changes in regulation may impair our ability to recover costs from our customers.

We are subject to comprehensive regulation by federal and state utility regulatory agencies, including siting and construction of facilities, customer service and the rates that we can charge customers.

The profitability of our operations is dependent on our ability to recover the costs of providing energy and utility services and earn a return on our capital investment. Our rates are generally regulated and based on an analysis of our costs incurred in a test year. We are subject to both future and historical test years depending upon the regulatory jurisdiction. Thus, the rates we are allowed to charge may or may not match our costs at any given time. Rate regulation is premised on providing an opportunity to earn a reasonable rate of return on invested capital. In a continued low interest rate environment there has been pressure pushing down ROE. There can also be no assurance that our regulatory commissions will judge all of our costs to be prudent, which could result in disallowances, or that the regulatory process will always result in rates that will produce full recovery. Changes in the long-term cost-effectiveness or changes to the operating conditions of our assets may result in early retirements of utility facilities and while regulation typically provides relief for these types of changes, there is no assurance that regulators would allow full recovery of all remaining costs leaving all or a portion of these asset costs stranded. Higher than expected inflation or tariffs may increase costs of construction and operations. Rising fuel costs could increase the risk that we will not be able to fully recover our fuel costs from our customers. Furthermore, there could be changes in the regulatory environment that would impair our ability to recover costs historically collected from our customers, or these factors could cause us to exceed commitments made regarding cost caps and result in less than full recovery. Overall, management currently believes prudently incurred costs are recoverable given the existing regulatory mechanisms in place.

Adverse regulatory rulings or the imposition of additional regulations could have an adverse impact on our results of operations and materially affect our ability to meet our financial obligations, including debt payments.

Any reductions in our credit ratings could increase our financing costs and the cost of maintaining certain contractual relationships.

We cannot be assured that our current ratings will remain in effect, or that a rating will not be lowered or withdrawn by a rating agency. Significant events including a disallowance of costs, significantly lower returns on equity or equity ratios or impacts of tax policy changes may impact our cash flows and credit metrics, potentially resulting in a change in our credit ratings. In addition, our credit ratings may change as a result of the differing methodologies or change in the methodologies used by the various rating agencies. Any downgrade could lead to higher borrowing costs and could impact our ability to access capital markets. Also, we may enter into contracts that require the posting of collateral or settlement of applicable contracts if credit ratings fall below investment grade.

We are subject to capital market and interest rate risks.

Utility operations require significant capital investment. As a result, we frequently need to access capital markets. Any disruption in capital markets could have a material impact on our ability to fund our operations. Capital markets are global and impacted by issues and events throughout the world. Capital market disruption events and financial market distress could prevent us from issuing short-term commercial paper, issuing new securities or cause us to issue securities with unfavorable terms and conditions, such as higher interest rates.

Higher interest rates on short-term borrowings with variable interest rates could also have an adverse effect on our operating results. Changes in interest rates may also impact the fair value of the debt securities in the pension funds, as well as our ability to earn a return on short-term investments of excess cash.

We are subject to credit risks.

Credit risk includes the risk that our customers will not pay their bills, which may lead to a reduction in liquidity and an increase in bad debt expense. Credit risk is comprised of numerous factors including the price of products and services provided, the overall economy and local economies in the geographic areas we serve, including local unemployment rates.

Credit risk also includes the risk that various counterparties that owe us money or product will become insolvent and/or breach their obligations. Should the counterparties fail to perform, we may be forced to enter into alternative arrangements. In that event, our financial results could be adversely affected and incur losses.

We may at times have direct credit exposure as part of our local gas distribution company supply activity to financial institutions trading for their own accounts or issuing collateral support on behalf of other counterparties. We may also have some indirect credit exposure due to participation in organized markets, such as Southwest Power Pool, Inc, PJM Interconnection, LLC, MISO and Electric Reliability Council of Texas, in which any credit losses are socialized to all market participants.

Increasing costs of our defined benefit retirement plans and employee benefits may adversely affect our results of operations, financial condition or cash flows.

We have defined benefit pension and postretirement plans that cover most of our employees. Assumptions related to future costs, return on investments, interest rates and other actuarial assumptions have a significant impact on our funding requirements related to these plans. Estimates and assumptions may change. In addition, the Pension Protection Act changed the minimum funding requirements for defined benefit pension plans. Therefore, our funding requirements and related contributions may change in the future. Also, the payout of a significant percentage of pension plan liabilities in a single year due to high retirements or employees leaving NSP-Wisconsin could trigger settlement accounting and could require NSP-Wisconsin to recognize incremental pension expense related to unrecognized plan losses in the year liabilities are paid.

Increasing costs associated with health care plans may adversely affect our results of operations.

Our self-insured costs of health care benefits for eligible employees have increased in recent years. Increasing levels of large individual health care claims and overall health care claims could have an adverse impact on our operating results, financial condition and cash flows. Changes in industry standards utilized in key assumptions (e.g., mortality tables) could have a significant impact on future liabilities and benefit costs. Legislation related to health care could also significantly change our benefit programs and costs.

Federal tax law may significantly impact our business.

NSP-Wisconsin collects through regulated rates estimated federal, state and local tax payments. Changes to federal tax law may benefit or adversely affect our earnings and customer costs. Changes to tax depreciable lives and the value of various tax credits may change the economics of resources and our resource selections. There could be timing delays before regulated rates provide for realization of the tax changes in revenues. In addition, certain IRS tax policies such as the requirement to utilize normalization may impact our ability to economically deliver certain types of resources relative to market prices.

Macroeconomic Risks

Economic conditions impact our business.

Our operations are affected by local, national and worldwide economic conditions. Growth in customers and sales are correlated with economic conditions.

Economic conditions may be impacted by insufficient financial sector liquidity leading to potential increased unemployment, which may impact customers’ ability to pay timely, increase customer bankruptcies, and may lead to additional bad debt expense.

Further, worldwide economic activity impacts the demand for basic commodities necessary for utility infrastructure, which may impact our ability to acquire sufficient supplies. We operate in a capital intensive industry and federal policy on trade could significantly impact the cost of materials we use. We could be at risk for higher costs for materials and our workforce. There may be delays before these additional costs can be recovered in rates.

Our operations could be impacted by war, acts of terrorism, and threats of terrorism or disruptions due to events.

Our generation plants, fuel storage facilities, transmission and distribution facilities and information and control systems may be targets of terrorist activities. Any disruption could impact operations or result in a decrease in revenues and additional costs to repair and insure our assets. These disruptions could have a material impact on our financial condition, results of operations or cash flows. The potential for terrorism has subjected our operations to increased risks and could have a material effect on our business. We have already incurred increased costs for security and capital expenditures in response to these risks.

The insurance industry has also been affected by these events and the availability of insurance may decrease. In addition, insurance may have higher deductibles, higher premiums and more restrictive policy terms.

A disruption of the regional electric transmission grid, interstate natural gas pipeline infrastructure or other fuel sources, could negatively impact our business, our brand and reputation. Because our facilities are part of an interconnected system, we face the risk of possible loss of business due to a disruption caused by the actions of a neighboring utility or an event (e.g., severe storm, severe temperature extremes, wildfires, generator or transmission facility outage, pipeline rupture, railroad disruption, operator error, sudden and significant increase or decrease in wind generation or a disruption of work force) within our operating systems or on a neighboring system. Any such disruption could result in a significant decrease in revenues and significant additional costs to repair assets, which could have a material impact on our results of operations, financial condition or cash flows.

A cyber incident or security breach could have a material effect on our business.

We operate in an industry that requires the continued operation of sophisticated information technology, control systems and network infrastructure. In addition, we use our systems and infrastructure to create, collect, use, disclose, store, dispose of and otherwise process sensitive information, including company data, customer energy usage data, and personal information regarding customers, employees and their dependents, contractors and other individuals.

Our generation, transmission, distribution and fuel storage facilities, information technology systems and other infrastructure or physical assets, as well as information processed in our systems (e.g., information regarding our customers, employees, operations, infrastructure and assets) could be affected by cyber security incidents, including those caused by human error.

Our industry has begun to see an increased volume and sophistication of cyber security incidents from international activist organizations, Nation States and individuals. Cyber security incidents could harm our businesses by limiting our generating, transmitting and distributing capabilities, delaying our development and construction of new facilities or capital improvement projects to existing facilities, disrupting our customer operations or causing the release of customer information, all of which could expose us to liability.

Our generation, transmission systems and natural gas pipelines are part of an interconnected system. Therefore, a disruption caused by the impact of a cyber security incident of the regional electric transmission grid, natural gas pipeline infrastructure or other fuel sources of our third party service providers’ operations, could also negatively impact our business.

Our supply chain for procurement of digital equipment may expose software or hardware to these risks and could result in a breach or significant costs of remediation. In addition, such an event would likely receive federal and state regulatory scrutiny. We are unable to quantify the potential impact of cyber security threats or subsequent related actions. These potential cyber security incidents and regulatory action could result in a material decrease in revenues and may cause significant additional costs (e.g., penalties, third party claims, repairs, insurance or compliance) and potentially disrupt our supply and markets for natural gas, oil and other fuels.

We maintain security measures to protect our information technology and control systems, network infrastructure and other assets. However, these assets and the information they process may be vulnerable to cyber security incidents, including the resulting disability, or failures of assets or unauthorized access to assets or information. If our technology systems or those of our third-party service providers were to fail or be breached, we may be unable to fulfill critical business functions. We are unable to quantify the potential impact of cyber security incidents on our business, our brand, and our reputation. The cyber security threat is dynamic and evolves continually, and our efforts to prioritize network monitoring may not be effective given the constant changes to threat vulnerability.

Our operating results may fluctuate on a seasonal and quarterly basis and can be adversely affected by milder weather.

Our electric and natural gas utility businesses are seasonal, and weather patterns can have a material impact on our operating performance. Demand for electricity is often greater in the summer and winter months associated with cooling and heating. Because natural gas is heavily used for residential and commercial heating, the demand depends heavily upon weather patterns. A significant amount of natural gas revenues are recognized in the first and fourth quarters related to the heating season. Accordingly, our operations have historically generated less revenues and income when weather conditions are milder in the winter and cooler in the summer. Unusually mild winters and summers could have an adverse effect on our financial condition, results of operations, or cash flows.

Our operations use third party contractors in addition to employees to perform periodic and on-going work.

We rely on third party contractors to perform work for operations, maintenance and construction. We have contractual arrangements with these contractors which typically include performance standards, progress payments, insurance requirements and security for performance.

Cyber security breaches have at times exploited third party equipment or software in order to gain access. Poor vendor performance could impact on going operations, restoration operations, our reputation and could introduce financial risk or risks of fines.

Public Policy Risks

We may be subject to legislative and regulatory responses to climate change, with which compliance could be difficult and costly.

Legislative and regulatory responses related to climate change and new interpretations of existing laws create financial risk as our facilities may be subject to additional regulation at either the state or federal level in the future. Such regulations could impose substantial costs on our system.

We may be subject to climate change lawsuits. An adverse outcome could require substantial capital expenditures and could possibly require payment of substantial penalties or damages. Defense costs associated with such litigation can also be significant. Such payments or expenditures could affect results of operations, financial condition or cash flows if such costs are not recovered through regulated rates.

Although the United States has not adopted any international or federal GHG emission reduction targets, many states and localities may continue to pursue climate policies in the absence of federal mandates. All of the steps that NSP-Wisconsin has taken to date to reduce GHG emissions, including energy efficiency measures, adding renewable generation or retiring or converting coal plants to natural gas, occurred under state-endorsed resource plans, renewable energy standards and other state policies. While those actions likely would have put NSP-Wisconsin in a good position to meet federal or international standards being discussed, the lack of federal action does not adversely impact these state-endorsed actions and plans.

If our regulators do not allow us to recover all or a part of the cost of capital investment or the O&M costs incurred to comply with the mandates, it could have a material effect on our results of operations, financial condition or cash flows.

Increased risks of regulatory penalties could negatively impact our business.

The Energy Act increased civil penalty authority for violation of FERC statutes, rules and orders. The FERC can impose penalties of up to $1.3 million per violation per day, particularly as it relates to energy trading activities for both electricity and natural gas. In addition, NERC electric reliability standards and critical infrastructure protection requirements are mandatory and subject to potential financial penalties. Additionally, the PHMSA, Occupational Safety and Health Administration and other federal agencies have penalty authority. In the event of serious incidents, these agencies have become more active in pursuing penalties. Some states have the authority to impose substantial penalties. If a serious reliability or safety incident did occur, it could have a material effect on our results of operations, financial condition or cash flows.

Environmental Risks

We are subject to environmental laws and regulations, with which compliance could be difficult and costly.

We are subject to environmental laws and regulations that affect many aspects of our operations, including air emissions, water quality, wastewater discharges and the generation, transport and disposal of solid wastes and hazardous substances. Laws and regulations require us to obtain permits, licenses, and approvals and to comply with a variety of environmental requirements. Environmental laws and regulations can also require us to restrict or limit the output of facilities or the use of certain fuels, shift generation to lower-emitting, install pollution control equipment, clean up spills and other contamination and correct environmental hazards. Environmental regulations may also lead to shutdown of existing facilities.

Failure to meet requirements of environmental mandates may result in fines or penalties. We may be required to pay all or a portion of the cost to remediate (i.e., clean-up) sites where our past activities, or the activities of other parties, caused environmental contamination.

We are subject to mandates to provide customers with clean energy, renewable energy and energy conservation offerings. It could have a material effect on our results of operations, financial condition or cash flows. If our regulators do not allow us to recover the cost of capital investment or the O&M costs incurred to comply with the requirements.

In addition, existing environmental laws or regulations may be revised, and new laws or regulations may be adopted. We may also incur additional unanticipated obligations or liabilities under existing environmental laws and regulations.

We are subject to physical and financial risks associated with climate change and other weather, natural disaster and resource depletion impacts.

Climate change can create physical and financial risk. Physical risks include changes in weather conditions and extreme weather events.

Our customers’ energy needs vary with weather. To the extent weather conditions are affected by climate change, customers’ energy use could increase or decrease. Increased energy use due to weather changes may require us to invest in generating assets, transmission and infrastructure. Decreased energy use due to weather changes may result in decreased revenues. Extreme weather conditions in general require system backup, costs, and can contribute to increased system stress, including service interruptions. Extreme weather conditions creating high energy demand may raise electricity prices, increasing the cost of energy we provide to our customers.

Severe weather impacts our service territories, primarily when thunderstorms, flooding, tornadoes, wildfires and snow or ice storms occur. To the extent the frequency of extreme weather events increases, this could increase our cost of providing service. Periods of extreme temperatures could impact our ability to meet demand. Changes in precipitation resulting in droughts or water shortages could adversely affect our operations. Drought conditions also contribute to the increase in wildfire risk from our electric generation facilities. While we carry liability insurance, given an extreme event, if NSP-Wisconsin was found to be liable for wildfire damages, amounts that potentially exceed our coverage could negatively impact our results of operations, financial condition or cash flows. Drought or water depletion could adversely impact our ability to provide electricity to customers and increase the price paid for energy. We may not recover all costs related to mitigating these physical and financial risks.

Climate change may impact a region’s economy, which could impact our sales and revenues. The price of energy has an impact on the economic health of our communities. The cost of additional regulatory requirements, such as regulation of GHG, could impact the availability of goods and prices charged by our suppliers which would normally be borne by consumers through higher prices for energy and purchased goods. To the extent financial markets view climate change and emissions of GHGs as a financial risk, this could negatively affect our ability to access capital markets or cause us to receive less than ideal terms and conditions.

Item 1B — Unresolved Staff Comments

None.

Item 2 — Properties

Virtually all of the utility plant property of NSP-Wisconsin is subject to the lien of its first mortgage bond indenture.

|

| | | | | | | | |

| Station, Location and Unit | | Fuel | | Installed | | MW (a) | |

| Steam: | | | | | | | |

| Bay Front-Ashland, WI, 3 Units | | Coal/Wood/Natural Gas | | 1948 - 1956 | | 56 |

| |

| French Island-La Crosse, WI, 2 Units | | Wood/Refuse | | 1940 - 1948 | | 16 |

| (b) |

| Combustion Turbine: | | | | | | | |

| French Island-La Crosse, WI, 2 Units | | Oil | | 1974 | | 122 |

| |

| Wheaton-Eau Claire, WI, 5 Units | | Natural Gas/Oil | | 1973 | | 234 |

| |

| Hydro: | | | | | | | |

| Various locations, 63 Units | | Hydro | | Various | | 135 |

| |

| | | | | Total | | 563 |

| |

| |

(a) | Summer 2018 net dependable capacity. |

| |

(b) | Refuse-derived fuel is made from municipal solid waste. |

Electric utility overhead and underground transmission and distribution lines (measured in conductor miles) at Dec. 31, 2018:

|

| | |

| Conductor Miles | |

| 345 KV | 3,415 |

|

| 161 KV | 1,823 |

|

| 115 KV | 1,817 |

|

| Less than 115 KV | 32,831 |

|

NSP-Wisconsin had 203 electric utility transmission and distribution substations at Dec. 31, 2018.

Natural gas utility mains at Dec. 31, 2018:

|

| | |

| Miles | |

| Transmission | 3 |

|

| Distribution | 2,466 |

|

Item 3 — Legal Proceedings

NSP-Wisconsin is involved in various litigation matters that are being defended and handled in the ordinary course of business. Assessment of whether a loss is probable or is a reasonable possibility, and whether a loss or a range of loss is estimable, often involves a series of complex judgments regarding future events. Management maintains accruals for losses that are probable of being incurred and subject to reasonable estimation. Management may be unable to estimate an amount or range of a reasonably possible loss in certain situations, including but not limited to, when (1) damages sought are indeterminate, (2) proceedings are in the early stages,or (3) matters involve novel or unsettled legal theories. In such cases, there is considerable uncertainty regarding the timing or ultimate resolution of such matters, including a possible eventual loss.

See Note 10 to the consolidated financial statements, Item 1 and Item 7 for further information.

Item 4 — Mine Safety Disclosures

None.