UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | October 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity Advisor® Global Equity Income Fund

Annual Report

October 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended October 31, 2023 | Past 1 year | Past 5 years | Past 10 years |

Class A (incl. 5.75% sales charge) | -1.31% | 7.02% | 6.44% |

Class M (incl. 3.50% sales charge) | 0.75% | 7.25% | 6.42% |

Class C (incl. contingent deferred sales charge) | 2.94% | 7.49% | 6.43% |

| Class I | 4.96% | 8.57% | 7.34% |

| Class Z | 5.09% | 8.72% | 7.42% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

The initial offering of Class Z shares took place on October 2, 2018. Returns prior to October 2, 2018, are those of Class I.

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Global Equity Income Fund - Class A, a class of the fund, on October 31, 2013, and the current 5.75% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the MSCI ACWI (All Country World Index) Index performed over the same period. |

|

|

Market Recap:

Global equities gained 10.91% for the 12 months ending October 31, 2023, according to the MSCI ACWI (All Country World Index) Index, as global economic expansion and a slowing in the pace of inflation in some markets provided a favorable backdrop for risk assets. After returning -18.07% in 2022, the index's upturn has been largely driven by a narrow set of companies in the information technology and communication services sectors, in part due to excitement for generative artificial intelligence applications. The index gained 18.36% year to date through July, including gains in June (+5.83%) and July (+3.68%). The rally for international equities sputtered for the next three months (-9.54%) amid a stalling pattern in disinflationary trends, heightened global recession and geopolitical risks, soaring yields on longer-term U.S. government bonds, and particularly weak economic conditions in the eurozone and China. Even still, the three-month decline left global stocks up 7.07% year to date through October. For the full 12 months, nearly all regions advanced, with Europe ex U.K. (+18%) and Japan (+17%) leading, whereas Canada (-0.38%) lagged by the widest margin, while the U.S. middled (+10%). All but three of 11 sectors advanced, with information technology (+29%) and communication services (+27%) leading. Conversely, the real estate sector (-3%) lagged most, followed by health care and utilities (-1% each).

Comments from Portfolio Manager Ramona Persaud:

For the fiscal year, the fund's share classes (excluding sales charges, if applicable) gained about 4% to 5%, versus 10.91% for the benchmark MSCI All Country World Index (Net MA). From a regional standpoint, stock selection in the United States and picks and an overweight in Europe ex the U.K. detracted from the fund's performance versus the benchmark. By sector, security selection was the primary detractor, especially within communication services. Security selection in financials, primarily within the banks industry, also hurt. Stock selection in information technology, primarily within the semiconductors & semiconductor equipment industry, also hampered the fund's result. Also detracting from our result were stock picking and an overweight in consumer staples. Not owning Nvidia, a benchmark component that gained approximately 202%, was the largest individual relative detractor. A second notable relative detractor this period was avoiding Meta Platforms, a benchmark component that gained roughly 223%. In contrast, from a regional standpoint, picks in Canada and an underweight in Asia Pacific ex Japan contributed to the fund's performance versus the benchmark. By sector, the biggest contributor to performance versus the benchmark was security selection in industrials, primarily within the capital goods industry. An underweight in financials, primarily within the financial services industry, also boosted relative performance. Also helping our relative result was stock picking in consumer discretionary. The top individual relative contributor was an overweight in Eli Lilly (+55%). Eli Lilly was one of our biggest holdings. The second-largest relative contributor was an overweight in General Electric (+81%). Notable changes in positioning include higher allocations to the information technology and consumer discretionary sectors.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Top Holdings (% of Fund's net assets) |

| |

| Apple, Inc. (United States of America, Technology Hardware, Storage & Peripherals) | 5.5 | |

| Microsoft Corp. (United States of America, Software) | 5.3 | |

| Eli Lilly & Co. (United States of America, Pharmaceuticals) | 2.7 | |

| UnitedHealth Group, Inc. (United States of America, Health Care Providers & Services) | 2.2 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan, Semiconductors & Semiconductor Equipment) | 2.0 | |

| JPMorgan Chase & Co. (United States of America, Banks) | 2.0 | |

| Exxon Mobil Corp. (United States of America, Oil, Gas & Consumable Fuels) | 1.8 | |

| Linde PLC (United States of America, Chemicals) | 1.8 | |

| Accenture PLC Class A (United States of America, IT Services) | 1.7 | |

| Cisco Systems, Inc. (United States of America, Communications Equipment) | 1.5 | |

| | 26.5 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Information Technology | 21.8 | |

| Health Care | 13.8 | |

| Financials | 12.2 | |

| Consumer Staples | 11.4 | |

| Industrials | 9.6 | |

| Consumer Discretionary | 9.1 | |

| Communication Services | 5.9 | |

| Energy | 5.2 | |

| Materials | 5.2 | |

| Utilities | 3.9 | |

| Real Estate | 1.1 | |

| |

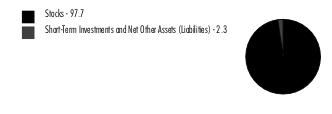

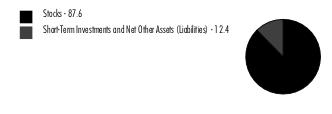

Asset Allocation (% of Fund's net assets) |

|

|

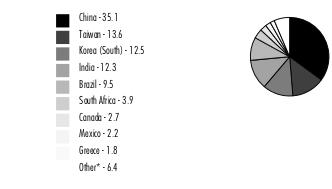

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| |

Showing Percentage of Net Assets

| Common Stocks - 99.2% |

| | | Shares | Value ($) |

| Belgium - 0.7% | | | |

| KBC Group NV | | 8,395 | 461,015 |

| UCB SA | | 2,201 | 160,832 |

TOTAL BELGIUM | | | 621,847 |

| Brazil - 0.9% | | | |

| Equatorial Energia SA | | 137,420 | 861,303 |

| Canada - 5.1% | | | |

| Alimentation Couche-Tard, Inc. Class A (multi-vtg.) | | 23,116 | 1,258,357 |

| Canadian Natural Resources Ltd. | | 12,234 | 776,871 |

| Constellation Software, Inc. | | 219 | 439,028 |

| Constellation Software, Inc. warrants 8/22/28 (a)(b) | | 219 | 0 |

| Imperial Oil Ltd. | | 12,119 | 690,654 |

| Metro, Inc. | | 19,393 | 985,068 |

| PrairieSky Royalty Ltd. | | 36,606 | 642,766 |

TOTAL CANADA | | | 4,792,744 |

| China - 1.9% | | | |

| Kweichow Moutai Co. Ltd. (A Shares) | | 1,016 | 234,040 |

| NXP Semiconductors NV | | 7,901 | 1,362,369 |

| SITC International Holdings Co. Ltd. | | 111,487 | 171,735 |

TOTAL CHINA | | | 1,768,144 |

| Denmark - 0.4% | | | |

| DSV A/S | | 2,776 | 414,014 |

| Finland - 1.1% | | | |

| Elisa Corp. (A Shares) | | 20,520 | 870,225 |

| Neste OYJ | | 4,672 | 156,757 |

TOTAL FINLAND | | | 1,026,982 |

| France - 4.3% | | | |

| Airbus Group NV | | 6,426 | 861,574 |

| Capgemini SA | | 3,724 | 658,138 |

| Edenred SA | | 16,675 | 886,425 |

| LVMH Moet Hennessy Louis Vuitton SE | | 1,905 | 1,363,848 |

| VINCI SA | | 2,536 | 280,417 |

TOTAL FRANCE | | | 4,050,402 |

| Germany - 2.5% | | | |

| Deutsche Telekom AG | | 33,588 | 728,983 |

| Rheinmetall AG | | 3,980 | 1,138,719 |

| Siemens AG | | 3,999 | 530,663 |

TOTAL GERMANY | | | 2,398,365 |

| Hong Kong - 0.8% | | | |

| AIA Group Ltd. | | 74,907 | 650,478 |

| HKBN Ltd. | | 271,997 | 94,225 |

TOTAL HONG KONG | | | 744,703 |

| Hungary - 0.3% | | | |

| Richter Gedeon PLC | | 11,200 | 262,609 |

| India - 0.3% | | | |

| HDFC Bank Ltd. sponsored ADR | | 3,540 | 200,187 |

| Redington (India) Ltd. | | 45,659 | 78,203 |

TOTAL INDIA | | | 278,390 |

| Japan - 6.6% | | | |

| Capcom Co. Ltd. | | 11,594 | 373,203 |

| Daiichikosho Co. Ltd. | | 35,847 | 529,871 |

| FUJIFILM Holdings Corp. | | 5,027 | 274,966 |

| Hitachi Ltd. | | 9,310 | 590,130 |

| Hoya Corp. | | 7,117 | 685,144 |

| Inaba Denki Sangyo Co. Ltd. | | 22,843 | 476,343 |

| Minebea Mitsumi, Inc. | | 19,198 | 301,011 |

| Renesas Electronics Corp. (a) | | 37,669 | 494,806 |

| Roland Corp. | | 10,695 | 309,235 |

| Shin-Etsu Chemical Co. Ltd. | | 22,463 | 671,720 |

| Sony Group Corp. | | 12,206 | 1,014,793 |

| Toyota Motor Corp. | | 30,673 | 536,586 |

TOTAL JAPAN | | | 6,257,808 |

| Kenya - 0.1% | | | |

| Safaricom Ltd. | | 1,435,064 | 118,675 |

| Korea (South) - 1.2% | | | |

| Samsung Electronics Co. Ltd. | | 22,181 | 1,102,420 |

| Luxembourg - 0.1% | | | |

| L'Occitane Ltd. | | 49,000 | 125,941 |

| Sweden - 0.3% | | | |

| HEXPOL AB (B Shares) | | 29,602 | 261,745 |

| Switzerland - 0.5% | | | |

| Sika AG | | 2,040 | 486,424 |

| Taiwan - 2.0% | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | 117,961 | 1,925,116 |

| United Kingdom - 6.8% | | | |

| AstraZeneca PLC sponsored ADR | | 21,094 | 1,333,774 |

| B&M European Value Retail SA | | 103,032 | 662,218 |

| BAE Systems PLC | | 68,895 | 926,388 |

| Compass Group PLC | | 26,425 | 666,211 |

| Diageo PLC | | 11,263 | 425,922 |

| JD Sports Fashion PLC | | 233,953 | 362,557 |

| London Stock Exchange Group PLC | | 4,200 | 423,759 |

| RELX PLC (London Stock Exchange) | | 17,618 | 615,356 |

| RS GROUP PLC | | 43,505 | 358,091 |

| Starling Bank Ltd. Series D (a)(b)(c) | | 20,800 | 74,327 |

| Unilever PLC | | 8,542 | 404,555 |

| WH Smith PLC | | 15,592 | 219,835 |

TOTAL UNITED KINGDOM | | | 6,472,993 |

| United States of America - 63.0% | | | |

| Accenture PLC Class A | | 5,507 | 1,636,075 |

| Albertsons Companies, Inc. | | 9,300 | 201,810 |

| Amdocs Ltd. | | 11,396 | 913,503 |

| Ameren Corp. | | 7,125 | 539,434 |

| American Tower Corp. | | 2,196 | 391,305 |

| Apple, Inc. | | 30,596 | 5,224,880 |

| AT&T, Inc. | | 18,808 | 289,643 |

| Ball Corp. | | 3,698 | 178,059 |

| Bank of America Corp. | | 46,161 | 1,215,881 |

| BJ's Wholesale Club Holdings, Inc. (a) | | 8,334 | 567,712 |

| Bristol-Myers Squibb Co. | | 10,882 | 560,749 |

| Capital One Financial Corp. | | 5,032 | 509,691 |

| Chubb Ltd. | | 3,306 | 709,534 |

| Cisco Systems, Inc. | | 26,803 | 1,397,240 |

| Comcast Corp. Class A | | 19,523 | 806,105 |

| Costco Wholesale Corp. | | 1,198 | 661,823 |

| Crane Co. | | 2,421 | 235,636 |

| Crane Nxt Co. | | 2,421 | 125,892 |

| Crown Holdings, Inc. | | 6,704 | 540,342 |

| Danaher Corp. | | 5,976 | 1,147,512 |

| Dollar Tree, Inc. (a) | | 7,225 | 802,625 |

| Eli Lilly & Co. | | 4,608 | 2,552,509 |

| Estee Lauder Companies, Inc. Class A | | 1,757 | 226,425 |

| Experian PLC | | 21,315 | 645,351 |

| Exxon Mobil Corp. | | 16,470 | 1,743,350 |

| Freeport-McMoRan, Inc. | | 22,784 | 769,644 |

| General Electric Co. | | 8,215 | 892,395 |

| Gilead Sciences, Inc. | | 10,276 | 807,077 |

| H&R Block, Inc. | | 13,225 | 542,886 |

| Hartford Financial Services Group, Inc. | | 12,509 | 918,786 |

| Hess Corp. | | 4,193 | 605,469 |

| Johnson Controls International PLC | | 5,906 | 289,512 |

| JPMorgan Chase & Co. | | 13,732 | 1,909,572 |

| Kenvue, Inc. | | 6,800 | 126,480 |

| Keurig Dr. Pepper, Inc. | | 16,737 | 507,633 |

| Lamar Advertising Co. Class A | | 7,860 | 646,642 |

| Linde PLC | | 4,477 | 1,710,930 |

| Lowe's Companies, Inc. | | 2,696 | 513,777 |

| M&T Bank Corp. | | 4,671 | 526,655 |

| McDonald's Corp. | | 3,167 | 830,292 |

| Merck & Co., Inc. | | 9,625 | 988,488 |

| Microsoft Corp. | | 14,749 | 4,986,784 |

| Mondelez International, Inc. | | 6,578 | 435,529 |

| MSCI, Inc. | | 562 | 265,011 |

| Nestle SA (Reg. S) | | 6,291 | 678,414 |

| NextEra Energy, Inc. | | 10,089 | 588,189 |

| PG&E Corp. (a) | | 10,827 | 176,480 |

| Philip Morris International, Inc. | | 5,313 | 473,707 |

| Phillips 66 Co. | | 1,943 | 221,638 |

| PNC Financial Services Group, Inc. | | 8,354 | 956,282 |

| Procter & Gamble Co. | | 7,284 | 1,092,819 |

| Roche Holding AG (participation certificate) | | 5,412 | 1,394,725 |

| Sanofi SA | | 11,670 | 1,059,709 |

| Southern Co. | | 8,578 | 577,299 |

| T-Mobile U.S., Inc. | | 9,024 | 1,298,193 |

| Tapestry, Inc. | | 6,108 | 168,336 |

| Target Corp. | | 1,969 | 218,146 |

| The Coca-Cola Co. | | 12,885 | 727,874 |

| The Travelers Companies, Inc. | | 5,229 | 875,544 |

| TJX Companies, Inc. | | 14,825 | 1,305,638 |

| United Parcel Service, Inc. Class B | | 3,035 | 428,694 |

| UnitedHealth Group, Inc. | | 3,858 | 2,066,190 |

| Valero Energy Corp. | | 1,558 | 197,866 |

| Veralto Corp. | | 1,992 | 137,448 |

| Verizon Communications, Inc. | | 10,023 | 352,108 |

| Vistra Corp. | | 20,446 | 668,993 |

| Walmart, Inc. | | 4,186 | 684,034 |

| WEC Energy Group, Inc. | | 3,365 | 273,877 |

| Wells Fargo & Co. | | 24,804 | 986,455 |

TOTAL UNITED STATES OF AMERICA | | | 59,705,306 |

| Zambia - 0.3% | | | |

| First Quantum Minerals Ltd. | | 26,950 | 312,303 |

| TOTAL COMMON STOCKS (Cost $87,036,095) | | | 93,988,234 |

| | | | |

| Money Market Funds - 2.0% |

| | | Shares | Value ($) |

Fidelity Cash Central Fund 5.40% (d) (Cost $1,880,612) | | 1,880,236 | 1,880,612 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 101.2% (Cost $88,916,707) | 95,868,846 |

NET OTHER ASSETS (LIABILITIES) - (1.2)% | (1,133,634) |

| NET ASSETS - 100.0% | 94,735,212 |

| | |

Legend

| (c) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $74,327 or 0.1% of net assets. |

| (d) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| Additional information on each restricted holding is as follows: |

| Security | Acquisition Date | Acquisition Cost ($) |

| Starling Bank Ltd. Series D | 6/18/21 - 4/05/22 | 40,298 |

| | | |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.40% | 3,668,251 | 56,098,391 | 57,886,030 | 247,268 | - | - | 1,880,612 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.40% | - | 3,405,254 | 3,405,254 | 3,091 | - | - | - | 0.0% |

| Total | 3,668,251 | 59,503,645 | 61,291,284 | 250,359 | - | - | 1,880,612 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Communication Services | 5,461,231 | 3,734,949 | 1,726,282 | - |

Consumer Discretionary | 8,496,212 | 4,605,539 | 3,890,673 | - |

Consumer Staples | 10,838,914 | 8,970,042 | 1,868,872 | - |

Energy | 5,035,371 | 5,035,371 | - | - |

Financials | 11,569,602 | 10,421,038 | 1,074,237 | 74,327 |

Health Care | 13,019,318 | 9,879,740 | 3,139,578 | - |

Industrials | 9,293,477 | 4,539,860 | 4,753,617 | - |

Information Technology | 20,619,420 | 16,085,771 | 4,533,649 | - |

Materials | 4,931,167 | 4,259,447 | 671,720 | - |

Real Estate | 1,037,947 | 1,037,947 | - | - |

Utilities | 3,685,575 | 3,685,575 | - | - |

|

| Money Market Funds | 1,880,612 | 1,880,612 | - | - |

| Total Investments in Securities: | 95,868,846 | 74,135,891 | 21,658,628 | 74,327 |

| Statement of Assets and Liabilities |

| | | | October 31, 2023 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $87,036,095) | $ | 93,988,234 | | |

Fidelity Central Funds (cost $1,880,612) | | 1,880,612 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $88,916,707) | | | $ | 95,868,846 |

| Foreign currency held at value (cost $55,209) | | | | 55,202 |

| Receivable for investments sold | | | | 34,406 |

| Receivable for fund shares sold | | | | 12,594 |

| Dividends receivable | | | | 114,915 |

| Reclaims receivable | | | | 63,738 |

| Distributions receivable from Fidelity Central Funds | | | | 4,265 |

| Prepaid expenses | | | | 143 |

Total assets | | | | 96,154,109 |

| Liabilities | | | | |

| Payable for fund shares redeemed | $ | 1,271,409 | | |

| Accrued management fee | | 62,849 | | |

| Distribution and service plan fees payable | | 12,868 | | |

| Other affiliated payables | | 14,051 | | |

| Other payables and accrued expenses | | 57,720 | | |

| Total Liabilities | | | | 1,418,897 |

| Net Assets | | | $ | 94,735,212 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 89,243,124 |

| Total accumulated earnings (loss) | | | | 5,492,088 |

| Net Assets | | | $ | 94,735,212 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($18,786,450 ÷ 1,066,850 shares)(a) | | | $ | 17.61 |

| Maximum offering price per share (100/94.25 of $17.61) | | | $ | 18.68 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($12,429,887 ÷ 706,531 shares)(a) | | | $ | 17.59 |

| Maximum offering price per share (100/96.50 of $17.59) | | | $ | 18.23 |

| Class C : | | | | |

Net Asset Value and offering price per share ($4,313,477 ÷ 247,775 shares)(a) | | | $ | 17.41 |

| Class I : | | | | |

Net Asset Value, offering price and redemption price per share ($14,281,797 ÷ 810,248 shares) | | | $ | 17.63 |

| Class Z : | | | | |

Net Asset Value, offering price and redemption price per share ($44,923,601 ÷ 2,530,261 shares) | | | $ | 17.75 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Year ended October 31, 2023 |

| Investment Income | | | | |

| Dividends | | | $ | 2,064,985 |

| Income from Fidelity Central Funds (including $3,091 from security lending) | | | | 250,359 |

| Income before foreign taxes withheld | | | $ | 2,315,344 |

| Less foreign taxes withheld | | | | (114,179) |

| Total Income | | | | 2,201,165 |

| Expenses | | | | |

| Management fee | $ | 618,879 | | |

| Transfer agent fees | | 119,978 | | |

| Distribution and service plan fees | | 147,920 | | |

| Accounting fees | | 45,688 | | |

| Custodian fees and expenses | | 14,905 | | |

| Independent trustees' fees and expenses | | 450 | | |

| Registration fees | | 95,566 | | |

| Audit | | 85,862 | | |

| Legal | | 1,634 | | |

| Miscellaneous | | 301 | | |

| Total expenses before reductions | | 1,131,183 | | |

| Expense reductions | | (76,578) | | |

| Total expenses after reductions | | | | 1,054,605 |

| Net Investment income (loss) | | | | 1,146,560 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers (net of foreign taxes of $10,377) | | (948,088) | | |

| Foreign currency transactions | | (20,727) | | |

| Total net realized gain (loss) | | | | (968,815) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers(net of decrease in deferred foreign taxes of $11,284) | | 2,149,126 | | |

| Assets and liabilities in foreign currencies | | 973 | | |

| Total change in net unrealized appreciation (depreciation) | | | | 2,150,099 |

| Net gain (loss) | | | | 1,181,284 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 2,327,844 |

| Statement of Changes in Net Assets |

| |

| | Year ended October 31, 2023 | | Year ended October 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 1,146,560 | $ | 324,981 |

| Net realized gain (loss) | | (968,815) | | (476,484) |

| Change in net unrealized appreciation (depreciation) | | 2,150,099 | | (4,969,189) |

| Net increase (decrease) in net assets resulting from operations | | 2,327,844 | | (5,120,692) |

| Distributions to shareholders | | (1,156,098) | | (3,032,586) |

| | | | | |

| Share transactions - net increase (decrease) | | 37,571,402 | | 29,771,568 |

| Total increase (decrease) in net assets | | 38,743,148 | | 21,618,290 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 55,992,064 | | 34,373,774 |

| End of period | $ | 94,735,212 | $ | 55,992,064 |

| | | | | |

| | | | | |

Financial Highlights

| Fidelity Advisor® Global Equity Income Fund Class A |

| |

| Years ended October 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 17.01 | $ | 21.07 | $ | 15.95 | $ | 15.33 | $ | 13.86 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .20 | | .15 | | .10 | | .13 | | .19 |

| Net realized and unrealized gain (loss) | | .61 | | (2.41) | | 5.32 | | .61 | | 1.76 |

| Total from investment operations | | .81 | | (2.26) | | 5.42 | | .74 | | 1.95 |

| Distributions from net investment income | | (.21) | | (.11) | | (.10) C | | (.12) | | (.20) |

| Distributions from net realized gain | | - | | (1.69) | | (.20) C | | - | | (.28) |

| Total distributions | | (.21) | | (1.80) | | (.30) | | (.12) | | (.48) |

| Net asset value, end of period | $ | 17.61 | $ | 17.01 | $ | 21.07 | $ | 15.95 | $ | 15.33 |

Total Return D,E | | 4.71% | | (11.78)% | | 34.23% | | 4.87% | | 14.52% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | |

| Expenses before reductions | | 1.40% | | 1.54% | | 1.72% | | 1.97% | | 2.18% |

| Expenses net of fee waivers, if any | | 1.29% | | 1.30% | | 1.34% | | 1.39% | | 1.45% |

| Expenses net of all reductions | | 1.29% | | 1.30% | | 1.34% | | 1.38% | | 1.45% |

| Net investment income (loss) | | 1.10% | | .81% | | .49% | | .81% | | 1.32% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 18,786 | $ | 16,093 | $ | 12,640 | $ | 8,362 | $ | 8,314 |

Portfolio turnover rate H | | 25% | | 17% | | 40% | | 52% | | 18% I |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CThe amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

ETotal returns do not include the effect of the sales charges.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

IPortfolio turnover rate excludes securities received or delivered in-kind.

| Fidelity Advisor® Global Equity Income Fund Class M |

| |

| Years ended October 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 17.00 | $ | 21.05 | $ | 15.94 | $ | 15.32 | $ | 13.85 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .16 | | .10 | | .05 | | .09 | | .15 |

| Net realized and unrealized gain (loss) | | .60 | | (2.40) | | 5.31 | | .61 | | 1.76 |

| Total from investment operations | | .76 | | (2.30) | | 5.36 | | .70 | | 1.91 |

| Distributions from net investment income | | (.17) | | (.05) | | (.06) C | | (.08) | | (.16) |

| Distributions from net realized gain | | - | | (1.69) | | (.20) C | | - | | (.28) |

| Total distributions | | (.17) | | (1.75) D | | (.25) D | | (.08) | | (.44) |

| Net asset value, end of period | $ | 17.59 | $ | 17.00 | $ | 21.05 | $ | 15.94 | $ | 15.32 |

Total Return E,F | | 4.41% | | (11.98)% | | 33.89% | | 4.63% | | 14.23% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | |

| Expenses before reductions | | 1.62% | | 1.76% | | 1.95% | | 2.24% | | 2.49% |

| Expenses net of fee waivers, if any | | 1.54% | | 1.55% | | 1.60% | | 1.64% | | 1.70% |

| Expenses net of all reductions | | 1.54% | | 1.55% | | 1.60% | | 1.63% | | 1.70% |

| Net investment income (loss) | | .85% | | .56% | | .23% | | .56% | | 1.07% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 12,430 | $ | 8,535 | $ | 8,442 | $ | 3,545 | $ | 3,135 |

Portfolio turnover rate I | | 25% | | 17% | | 40% | | 52% | | 18% J |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CThe amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

DTotal distributions per share do not sum due to rounding.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FTotal returns do not include the effect of the sales charges.

GFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

JPortfolio turnover rate excludes securities received or delivered in-kind.

| Fidelity Advisor® Global Equity Income Fund Class C |

| |

| Years ended October 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 16.82 | $ | 20.88 | $ | 15.84 | $ | 15.24 | $ | 13.77 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .06 | | .01 | | (.05) | | .01 | | .08 |

| Net realized and unrealized gain (loss) | | .61 | | (2.39) | | 5.28 | | .62 | | 1.75 |

| Total from investment operations | | .67 | | (2.38) | | 5.23 | | .63 | | 1.83 |

| Distributions from net investment income | | (.08) | | (.02) | | - C,D | | (.03) | | (.09) |

| Distributions from net realized gain | | - | | (1.66) | | (.19) C | | - | | (.28) |

| Total distributions | | (.08) | | (1.68) | | (.19) | | (.03) | | (.36) E |

| Net asset value, end of period | $ | 17.41 | $ | 16.82 | $ | 20.88 | $ | 15.84 | $ | 15.24 |

Total Return F,G | | 3.94% | | (12.46)% | | 33.22% | | 4.12% | | 13.71% |

Ratios to Average Net Assets B,H,I | | | | | | | | | | |

| Expenses before reductions | | 2.17% | | 2.31% | | 2.47% | | 2.75% | | 2.99% |

| Expenses net of fee waivers, if any | | 2.04% | | 2.05% | | 2.09% | | 2.14% | | 2.20% |

| Expenses net of all reductions | | 2.04% | | 2.05% | | 2.09% | | 2.13% | | 2.20% |

| Net investment income (loss) | | .35% | | .06% | | (.26)% | | .06% | | .57% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 4,313 | $ | 4,437 | $ | 5,891 | $ | 4,082 | $ | 4,173 |

Portfolio turnover rate J | | 25% | | 17% | | 40% | | 52% | | 18% K |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CThe amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

DAmount represents less than $.005 per share.

ETotal distributions per share do not sum due to rounding.

FTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

GTotal returns do not include the effect of the contingent deferred sales charge.

HFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

IExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

JAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

KPortfolio turnover rate excludes securities received or delivered in-kind.

| Fidelity Advisor® Global Equity Income Fund Class I |

| |

| Years ended October 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 17.03 | $ | 21.09 | $ | 15.96 | $ | 15.35 | $ | 13.88 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .25 | | .19 | | .15 | | .17 | | .22 |

| Net realized and unrealized gain (loss) | | .60 | | (2.40) | | 5.32 | | .60 | | 1.77 |

| Total from investment operations | | .85 | | (2.21) | | 5.47 | | .77 | | 1.99 |

| Distributions from net investment income | | (.25) | | (.15) | | (.15) C | | (.16) | | (.24) |

| Distributions from net realized gain | | - | | (1.69) | | (.20) C | | - | | (.28) |

| Total distributions | | (.25) | | (1.85) D | | (.34) D | | (.16) | | (.52) |

| Net asset value, end of period | $ | 17.63 | $ | 17.03 | $ | 21.09 | $ | 15.96 | $ | 15.35 |

Total Return E | | 4.96% | | (11.53)% | | 34.59% | | 5.08% | | 14.84% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | |

| Expenses before reductions | | 1.11% | | 1.15% | | 1.37% | | 1.63% | | 1.83% |

| Expenses net of fee waivers, if any | | 1.05% | | 1.04% | | 1.07% | | 1.13% | | 1.20% |

| Expenses net of all reductions | | 1.05% | | 1.04% | | 1.07% | | 1.12% | | 1.20% |

| Net investment income (loss) | | 1.35% | | 1.06% | | .75% | | 1.06% | | 1.57% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 14,282 | $ | 16,953 | $ | 2,823 | $ | 2,378 | $ | 2,188 |

Portfolio turnover rate H | | 25% | | 17% | | 40% | | 52% | | 18% I |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CThe amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

DTotal distributions per share do not sum due to rounding.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

IPortfolio turnover rate excludes securities received or delivered in-kind.

| Fidelity Advisor® Global Equity Income Fund Class Z |

| |

| Years ended October 31, | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 17.13 | $ | 21.18 | $ | 16.01 | $ | 15.37 | $ | 13.88 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .28 | | .22 | | .18 | | .19 | | .25 |

| Net realized and unrealized gain (loss) | | .60 | | (2.42) | | 5.34 | | .61 | | 1.76 |

| Total from investment operations | | .88 | | (2.20) | | 5.52 | | .80 | | 2.01 |

| Distributions from net investment income | | (.26) | | (.16) | | (.15) C | | (.16) | | (.24) |

| Distributions from net realized gain | | - | | (1.69) | | (.20) C | | - | | (.28) |

| Total distributions | | (.26) | | (1.85) | | (.35) | | (.16) | | (.52) |

| Net asset value, end of period | $ | 17.75 | $ | 17.13 | $ | 21.18 | $ | 16.01 | $ | 15.37 |

Total Return D | | 5.09% | | (11.41)% | | 34.75% | | 5.29% | | 15.00% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | |

| Expenses before reductions | | .97% | | 1.09% | | 1.29% | | 1.50% | | 1.37% |

| Expenses net of fee waivers, if any | | .89% | | .89% | | .93% | | .98% | | 1.04% |

| Expenses net of all reductions | | .89% | | .89% | | .93% | | .97% | | 1.04% |

| Net investment income (loss) | | 1.50% | | 1.21% | | .90% | | 1.21% | | 1.73% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 44,924 | $ | 9,974 | $ | 4,579 | $ | 3,354 | $ | 3,599 |

Portfolio turnover rate G | | 25% | | 17% | | 40% | | 52% | | 18% H |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CThe amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

FExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

GAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

HPortfolio turnover rate excludes securities received or delivered in-kind.

For the period ended October 31, 2023

1. Organization.

Fidelity Advisor Global Equity Income Fund (the Fund) is a fund of Fidelity Advisor Series VIII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Class A, Class M, Class C, Class I and Class Z are Fidelity Advisor classes. Each class has exclusive voting rights with respect to matters that affect that class. Class C shares will automatically convert to Class A shares after a holding period of eight years from the initial date of purchase, with certain exceptions.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, ETFs and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of October 31, 2023 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Certain Funds may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Funds may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any withholding tax reclaims income is included in the Statement of Operations in foreign taxes withheld. Any receivables for withholding tax reclaims are included in the Statement of Assets and Liabilities in reclaims receivable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of a fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of a fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred, as applicable. Certain expense reductions may also differ by class, if applicable. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds (ETFs). Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund (ETF). Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of October 31, 2023, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC), capital loss carryforwards and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $13,718,262 |

| Gross unrealized depreciation | (6,927,168) |

| Net unrealized appreciation (depreciation) | $6,791,094 |

| Tax Cost | $89,077,752 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $55,658 |

| Capital loss carryforward | $(1,347,127) |

| Net unrealized appreciation (depreciation) on securities and other investments | $6,785,508 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

Short-term | $(1,012,416) |

Long-term | (334,711) |

| Total capital loss carryforward | $(1,347,127) |

The tax character of distributions paid was as follows:

| | October 31, 2023 | October 31, 2022 |

| Ordinary Income | $1,156,098 | $442,476 |

| Long-term Capital Gains | - | 2,590,110 |

| Total | $1,156,098 | $3,032,586 |

Restricted Securities (including Private Placements). Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities held at period end is included at the end of the Schedule of Investments, if applicable.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| Fidelity Advisor Global Equity Income Fund | 62,257,458 | 21,284,449 |

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and an annualized group fee rate that averaged .23% during the period. The group fee rate is based upon the monthly average net assets of a group of registered investment companies with which the investment adviser has management contracts. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .67% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Company LLC (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution Fee | Service Fee | Total Fees | Retained by FDC |

| Class A | - % | .25% | $46,513 | $4,585 |

| Class M | .25% | .25% | 55,934 | 46 |

| Class C | .75% | .25% | 45,473 | 5,017 |

| | | | $147,920 | $9,648 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges are 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained by FDC |

| Class A | $11,181 |

| Class M | 1,335 |

Class CA | 334 |

| | $12,850 |

A When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund, except for Class Z. FIIOC receives an asset-based fee of Class Z's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets |

| Class A | $38,494 | .21 |

| Class M | 20,065 | .18 |

| Class C | 10,014 | .22 |

| Class I | 37,021 | .16 |

| Class Z | 14,384 | .04 |

| | $119,978 | |

During November 2023, the Board approved a change in the transfer agent fees effective December 1, 2023 to a fixed annual rate of class-level average net assets as follows:

| % of Class-Level Average Net Assets |

| Class A | 0.2000% |

| Class M | 0.1768% |

| Class C | 0.2000% |

| Class I | 0.1644% |

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. For the period, the fees were equivalent to the following annual rates:

| | % of Average Net Assets |

| Fidelity Advisor Global Equity Income Fund | .05 |

During November 2023, the Board approved a change in the accounting fees effective December 1, 2023 to a fixed annual rate of average net assets as follows:

| | % of Average Net Assets |

| Fidelity Advisor Global Equity Income Fund | 0.0497% |

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| | Amount |

| Fidelity Advisor Global Equity Income Fund | $378 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. Interfund trades during the period are noted in the table below.

| | Purchases ($) | Sales ($) | Realized Gain (Loss) ($) |

| Fidelity Advisor Global Equity Income Fund | 5,489,551 | 2,948,029 | (1,315) |

6. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Statement of Operations, and are listed below. During the period, there were no borrowings on this line of credit.

| | Amount |

| Fidelity Advisor Global Equity Income Fund | $157 |

7. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End |

| Fidelity Advisor Global Equity Income Fund | $300 | $- | $- |

8. Expense Reductions.

The investment adviser contractually agreed to reimburse expenses of each class to the extent annual operating expenses exceeded certain levels of class-level average net assets as noted in the table below. This reimbursement will remain in place through February 28, 2025. Some expenses, for example the compensation of the independent Trustees, and certain miscellaneous expenses such as proxy and shareholder meeting expenses, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| | Expense Limitations | Reimbursement |

| Class A | 1.30% | $18,413 |

| Class M | 1.55% | 7,505 |

| Class C | 2.05% | 5,228 |

| Class I | 1.05% | 13,910 |

| Class Z | .90% | 25,451 |

| | | $70,507 |

Through arrangements with the Fund's custodian and each class' transfer agent, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, custodian credits reduced the Fund's expenses by $268. During the period, transfer agent credits reduced each class' expenses as noted in the table below.

| | Expense reduction |

| Class A | $79 |

| Class M | 51 |

| | $130 |

In addition, during the period the investment adviser or an affiliate reimbursed and/or waived a portion of fund-level operating expenses in the amount of $5,673.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended October 31, 2023 | Year ended October 31, 2022 |

| Fidelity Advisor Global Equity Income Fund | | |

| Distributions to shareholders | | |

| Class A | $214,532 | $1,161,549 |

| Class M | 103,575 | 727,027 |

| Class C | 18,505 | 438,290 |

| Class I | 291,932 | 304,398 |

| Class Z | 527,554 | 401,322 |

Total | $1,156,098 | $3,032,586 |

10. Share Transactions.

Share transactions for each class were as follows and may contain in-kind transactions, automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Year ended October 31, 2023 | Year ended October 31, 2022 | Year ended October 31, 2023 | Year ended October 31, 2022 |

| Fidelity Advisor Global Equity Income Fund | | | | |

| Class A | | | | |

| Shares sold | 417,192 | 422,904 | $7,613,221 | $7,682,449 |

| Reinvestment of distributions | 11,701 | 58,695 | 214,004 | 1,140,971 |

| Shares redeemed | (308,132) | (135,332) | (5,632,749) | (2,463,385) |

| Net increase (decrease) | 120,761 | 346,267 | $2,194,476 | $6,360,035 |

| Class M | | | | |

| Shares sold | 277,079 | 187,839 | $5,046,852 | $3,454,901 |

| Reinvestment of distributions | 5,646 | 37,279 | 103,558 | 726,929 |

| Shares redeemed | (78,376) | (123,934) | (1,420,621) | (2,223,736) |

| Net increase (decrease) | 204,349 | 101,184 | $3,729,789 | $1,958,094 |

| Class C | | | | |

| Shares sold | 57,136 | 51,783 | $1,042,747 | $965,694 |

| Reinvestment of distributions | 1,009 | 22,518 | 18,498 | 437,451 |

| Shares redeemed | (74,169) | (92,657) | (1,330,726) | (1,755,261) |

| Net increase (decrease) | (16,024) | (18,356) | $(269,481) | $(352,116) |

| Class I | | | | |

| Shares sold | 1,260,460 | 928,989 | $22,822,669 | $16,746,678 |

| Reinvestment of distributions | 13,415 | 13,473 | 244,927 | 251,798 |

| Shares redeemed | (1,459,343) | (80,579) | (26,791,245) | (1,470,040) |

| Net increase (decrease) | (185,468) | 861,883 | $(3,723,649) | $15,528,436 |

| Class Z | | | | |

| Shares sold | 2,511,253 | 434,610 | $45,972,252 | $7,540,263 |

| Reinvestment of distributions | 27,802 | 19,889 | 513,800 | 385,895 |

| Shares redeemed | (591,088) | (88,338) | (10,845,785) | (1,649,039) |

| Net increase (decrease) | 1,947,967 | 366,161 | $35,640,267 | $6,277,119 |

11. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

12. Risk and Uncertainties.

Many factors affect a fund's performance. Developments that disrupt global economies and financial markets, such as pandemics, epidemics, outbreaks of infectious diseases, war, terrorism, and environmental disasters, may significantly affect a fund's investment performance. The effects of these developments to a fund will be impacted by the types of securities in which a fund invests, the financial condition, industry, economic sector, and geographic location of an issuer, and a fund's level of investment in the securities of that issuer. Significant concentrations in security types, issuers, industries, sectors, and geographic locations may magnify the factors that affect a fund's performance.

To the Board of Trustees of Fidelity Advisor Series VIII and Shareholders of Fidelity Advisor Global Equity Income Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Fidelity Advisor Global Equity Income Fund (one of the funds constituting Fidelity Advisor Series VIII, referred to hereafter as the "Fund") as of October 31, 2023, the related statement of operations for the year ended October 31, 2023, the statement of changes in net assets for each of the two years in the period ended October 31, 2023, including the related notes, and the financial highlights for each of the five years in the period ended October 31, 2023 (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October 31, 2023 and the financial highlights for each of the five years in the period ended October 31, 2023 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2023 by correspondence with the custodian and issuer of privately offered securities. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

December 14, 2023

We have served as the auditor of one or more investment companies in the Fidelity group of funds since 1932.

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for Jonathan Chiel, each of the Trustees oversees 322 funds. Mr. Chiel oversees 191 funds.