UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | April 30, 2016 |

Item 1.

Reports to Stockholders

Fidelity Advisor® Global Capital Appreciation Fund

Class I

Semi-Annual Report April 30, 2016 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Five Stocks as of April 30, 2016

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Medtronic PLC (Ireland, Health Care Equipment & Supplies) | 1.3 | 0.8 |

| Global Payments, Inc. (United States of America, IT Services) | 1.2 | 1.1 |

| Harman International Industries, Inc. (United States of America, Household Durables) | 1.2 | 0.0 |

| Amgen, Inc. (United States of America, Biotechnology) | 1.1 | 0.7 |

| First Republic Bank (United States of America, Banks) | 1.1 | 0.7 |

| | 5.9 | |

Top Five Market Sectors as of April 30, 2016

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Consumer Discretionary | 17.6 | 21.9 |

| Health Care | 17.0 | 13.0 |

| Financials | 15.8 | 16.4 |

| Information Technology | 15.4 | 21.0 |

| Industrials | 13.4 | 12.0 |

Top Five Countries as of April 30, 2016

| (excluding cash equivalents) | % of fund's net assets | % of fund's net assets 6 months ago |

| United States of America | 50.1 | 54.4 |

| Japan | 5.8 | 7.1 |

| Canada | 3.8 | 3.0 |

| Ireland | 2.7 | 1.8 |

| United Kingdom | 2.4 | 4.5 |

Percentages are adjusted for the effect of futures contracts, if applicable.

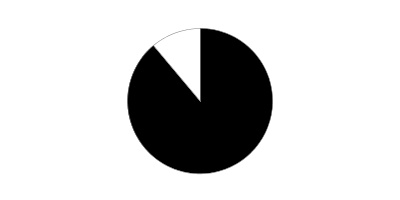

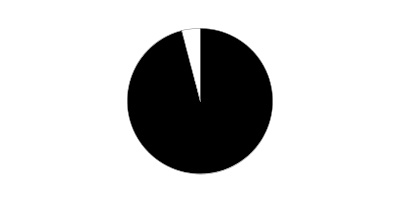

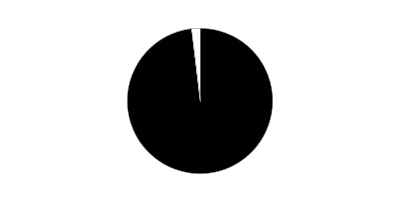

Asset Allocation (% of fund's net assets)

| As of April 30, 2016 |

| | Stocks | 92.5% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 7.5% |

| As of October 31, 2015 |

| | Stocks | 94.7% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 5.3% |

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Investments April 30, 2016 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 92.2% | | | |

| | | Shares | Value |

| Australia - 2.0% | | | |

| Altium Ltd. | | 86,364 | $403,851 |

| Ausdrill Ltd. | | 190,649 | 68,131 |

| Burson Group Ltd. | | 147,119 | 557,072 |

| Corporate Travel Managemnt Ltd. | | 40,551 | 439,678 |

| Imdex Ltd. (a) | | 192,909 | 30,069 |

| Japara Healthcare Ltd. | | 170,999 | 367,954 |

| NEXTDC Ltd. (a) | | 80,265 | 175,765 |

| Orora Ltd. | | 186,523 | 374,412 |

| Sonic Healthcare Ltd. | | 308 | 4,520 |

| The Star Entertainment Group Ltd. | | 103,003 | 442,499 |

|

| TOTAL AUSTRALIA | | | 2,863,951 |

|

| Austria - 0.3% | | | |

| CA Immobilien Anlagen AG | | 18,300 | 349,520 |

| IMMOFINANZ Immobilien Anlagen AG (a) | | 46,100 | 108,688 |

|

| TOTAL AUSTRIA | | | 458,208 |

|

| Bailiwick of Jersey - 0.4% | | | |

| Randgold Resources Ltd. sponsored ADR | | 5,300 | 532,650 |

| Belgium - 0.3% | | | |

| Ion Beam Applications SA | | 10,700 | 440,461 |

| Bermuda - 1.9% | | | |

| BW LPG Ltd. | | 6,900 | 41,476 |

| Essent Group Ltd. (a) | | 36,700 | 749,414 |

| Genpact Ltd. (a) | | 51,100 | 1,425,179 |

| Great Eagle Holdings Ltd. | | 34,590 | 140,114 |

| Man Wah Holdings Ltd. | | 274,800 | 320,469 |

|

| TOTAL BERMUDA | | | 2,676,652 |

|

| Brazil - 1.3% | | | |

| Cetip SA - Mercados Organizado | | 37,800 | 464,030 |

| Direcional Engenharia SA | | 57,600 | 102,999 |

| Fleury SA | | 62,100 | 451,045 |

| Lojas Renner SA | | 60,900 | 367,782 |

| Natura Cosmeticos SA | | 3,700 | 27,433 |

| Smiles SA | | 30,700 | 356,162 |

|

| TOTAL BRAZIL | | | 1,769,451 |

|

| British Virgin Islands - 0.0% | | | |

| Epic Gas Ltd. (a) | | 5,100 | 9,501 |

| Canada - 3.8% | | | |

| B2Gold Corp. (a) | | 99,000 | 220,140 |

| CCL Industries, Inc. Class B | | 400 | 73,245 |

| Cott Corp. | | 25,100 | 332,680 |

| FirstService Corp. | | 6,700 | 301,065 |

| Gluskin Sheff + Associates, Inc. | | 23,300 | 331,663 |

| Lions Gate Entertainment Corp. (b) | | 29,100 | 646,020 |

| New Gold, Inc. (a) | | 5,700 | 26,803 |

| North West Co., Inc. | | 14,300 | 317,866 |

| Pason Systems, Inc. | | 4,300 | 62,511 |

| PrairieSky Royalty Ltd. | | 32,600 | 686,453 |

| Premium Brands Holdings Corp. | | 26,500 | 1,143,046 |

| Suncor Energy, Inc. | | 30,900 | 907,027 |

| Winpak Ltd. | | 9,500 | 327,772 |

|

| TOTAL CANADA | | | 5,376,291 |

|

| Cayman Islands - 2.3% | | | |

| AAC Technology Holdings, Inc. | | 45,500 | 315,814 |

| Cheung Kong Property Holdings Ltd. | | 27,000 | 184,396 |

| Cogobuy Group (a) | | 238,000 | 344,412 |

| Fu Shou Yuan International Group Ltd. | | 554,000 | 388,682 |

| Greatview Aseptic Pack Co. Ltd. | | 206,000 | 104,324 |

| HKBN Ltd. | | 275,000 | 338,162 |

| New Oriental Education & Technology Group, Inc. sponsored ADR | | 10,600 | 415,096 |

| Sunny Optical Technology Group Co. Ltd. | | 135,000 | 416,374 |

| Tencent Holdings Ltd. | | 20,300 | 413,071 |

| Tongda Group Holdings Ltd. | | 1,670,000 | 343,041 |

|

| TOTAL CAYMAN ISLANDS | | | 3,263,372 |

|

| China - 0.4% | | | |

| Beijing Urban Consolidated & Development Group Ltd. (H Shares) | | 276,000 | 159,420 |

| Kweichow Moutai Co. Ltd. | | 10,226 | 396,780 |

|

| TOTAL CHINA | | | 556,200 |

|

| Colombia - 0.3% | | | |

| Cementos Argos SA | | 101,360 | 412,031 |

| Denmark - 1.7% | | | |

| Ambu A/S Series B | | 700 | 24,124 |

| Genmab A/S (a) | | 6,400 | 948,228 |

| Pandora A/S | | 2,600 | 337,616 |

| Vestas Wind Systems A/S | | 9,900 | 708,663 |

| William Demant Holding A/S (a) | | 3,400 | 349,432 |

|

| TOTAL DENMARK | | | 2,368,063 |

|

| France - 1.1% | | | |

| Compagnie Plastic Omnium | | 18,600 | 615,936 |

| Les Nouveaux Construct Investment SA | | 5,700 | 155,990 |

| Orpea | | 2,000 | 164,910 |

| Sartorius Stedim Biotech | | 600 | 229,125 |

| SR Teleperformance SA | | 4,500 | 403,974 |

|

| TOTAL FRANCE | | | 1,569,935 |

|

| Germany - 1.4% | | | |

| adidas AG | | 4,700 | 605,983 |

| BAUER AG | | 17,000 | 277,583 |

| DIC Asset AG | | 38,500 | 354,791 |

| LEG Immobilien AG | | 3,913 | 362,076 |

| MLP AG | | 12,800 | 49,891 |

| Nemetschek Se | | 3,700 | 206,750 |

| Rational AG | | 300 | 152,297 |

|

| TOTAL GERMANY | | | 2,009,371 |

|

| Greece - 0.1% | | | |

| Mytilineos Holdings SA | | 24,600 | 98,777 |

| Hong Kong - 1.1% | | | |

| Hang Lung Properties Ltd. | | 170,000 | 338,500 |

| Sino Land Ltd. | | 515,832 | 809,828 |

| Techtronic Industries Co. Ltd. | | 103,000 | 386,113 |

|

| TOTAL HONG KONG | | | 1,534,441 |

|

| India - 0.4% | | | |

| Kajaria Ceramics Ltd. (a) | | 11,303 | 178,626 |

| Tvs Motor Co. Ltd. | | 71,883 | 346,075 |

|

| TOTAL INDIA | | | 524,701 |

|

| Indonesia - 0.5% | | | |

| PT Astra International Tbk | | 11,100 | 5,660 |

| PT Bank Rakyat Indonesia Tbk | | 283,800 | 222,727 |

| Waskita Karya Persero Tbk PT | | 2,297,800 | 408,579 |

|

| TOTAL INDONESIA | | | 636,966 |

|

| Ireland - 2.7% | | | |

| Accenture PLC Class A | | 700 | 79,044 |

| C&C Group PLC | | 50,629 | 227,427 |

| CRH PLC | | 12,000 | 349,451 |

| Jazz Pharmaceuticals PLC (a) | | 8,700 | 1,311,090 |

| Medtronic PLC | | 23,400 | 1,852,110 |

|

| TOTAL IRELAND | | | 3,819,122 |

|

| Isle of Man - 0.0% | | | |

| Optimal Payments PLC (a) | | 3,900 | 21,723 |

| Israel - 0.9% | | | |

| Elbit Systems Ltd. (Israel) | | 4,300 | 430,178 |

| Frutarom Industries Ltd. | | 8,400 | 430,516 |

| Ituran Location & Control Ltd. | | 17,300 | 359,840 |

|

| TOTAL ISRAEL | | | 1,220,534 |

|

| Italy - 0.4% | | | |

| Mediaset SpA | | 34,100 | 153,452 |

| Reply SpA | | 2,417 | 344,011 |

|

| TOTAL ITALY | | | 497,463 |

|

| Japan - 5.8% | | | |

| Ariake Japan Co. Ltd. | | 7,900 | 437,679 |

| Asahi Co. Ltd. | | 68,800 | 1,020,460 |

| Astellas Pharma, Inc. | | 70,300 | 947,826 |

| Broadleaf Co. Ltd. | | 18,700 | 184,795 |

| Chodai Co. Ltd. | | 27,500 | 97,795 |

| Daiwa Industries Ltd. | | 42,900 | 367,736 |

| FJ Next Co. Ltd. | | 18,600 | 86,847 |

| Gulliver International Co. Ltd. (b) | | 37,200 | 365,665 |

| JK Holdings Co. Ltd. | | 16,200 | 69,362 |

| KDDI Corp. | | 15,000 | 432,086 |

| Kinugawa Rubber Industrial Co. Ltd. | | 82,000 | 570,958 |

| Koshidaka Holdings Co. Ltd. | | 15,200 | 298,889 |

| Makita Corp. | | 6,700 | 422,659 |

| Misumi Group, Inc. | | 22,800 | 314,863 |

| Monex Group, Inc. | | 132,300 | 341,297 |

| NEC Corp. | | 108,000 | 262,848 |

| Olympus Corp. | | 26,600 | 1,036,246 |

| Sakai Heavy Industries Ltd. | | 36,000 | 60,799 |

| Seikitokyu Kogyo Co. Ltd. | | 67,700 | 295,917 |

| Sohgo Security Services Co., Ltd. | | 4,400 | 244,332 |

| Sundrug Co. Ltd. | | 4,500 | 319,751 |

|

| TOTAL JAPAN | | | 8,178,810 |

|

| Korea (South) - 0.7% | | | |

| DuzonBizon Co. Ltd. | | 7,893 | 171,890 |

| Fila Korea Ltd. | | 1,480 | 134,349 |

| Osstem Implant Co. Ltd. (a) | | 6,209 | 388,037 |

| Vieworks Co. Ltd. | | 7,579 | 333,412 |

|

| TOTAL KOREA (SOUTH) | | | 1,027,688 |

|

| Luxembourg - 0.6% | | | |

| Stabilus SA (a) | | 17,500 | 874,675 |

| Malaysia - 0.4% | | | |

| My E.G.Services Bhd | | 1,052,600 | 541,591 |

| Marshall Islands - 0.1% | | | |

| StealthGas, Inc. (a) | | 46,700 | 182,597 |

| Mexico - 1.4% | | | |

| Gruma S.A.B. de CV Series B | | 21,900 | 319,921 |

| Grupo Aeroportuario del Pacifico S.A.B. de CV Series B | | 4,900 | 46,167 |

| Grupo Aeroportuario Norte S.A.B. de CV | | 63,200 | 365,726 |

| Grupo Bimbo S.A.B. de CV Series A | | 118,900 | 362,478 |

| Grupo Lala S.A.B. de CV | | 162,700 | 435,105 |

| Promotora y Operadora de Infraestructura S.A.B. de CV | | 30,500 | 386,802 |

|

| TOTAL MEXICO | | | 1,916,199 |

|

| Netherlands - 0.5% | | | |

| Grandvision NV | | 12,900 | 354,507 |

| Heijmans NV (Certificaten Van Aandelen) (a) | | 12,700 | 119,682 |

| Nsi NV | | 35,061 | 166,408 |

|

| TOTAL NETHERLANDS | | | 640,597 |

|

| New Zealand - 0.9% | | | |

| Fisher & Paykel Healthcare Corp. | | 19,592 | 125,173 |

| Ryman Healthcare Group Ltd. | | 58,266 | 363,310 |

| Sky City Entertainment Group Ltd. | | 112,308 | 383,469 |

| Summerset Group Holdings Ltd. | | 118,816 | 368,357 |

|

| TOTAL NEW ZEALAND | | | 1,240,309 |

|

| Panama - 0.2% | | | |

| Copa Holdings SA Class A | | 3,800 | 242,250 |

| Philippines - 0.2% | | | |

| GT Capital Holdings, Inc. | | 11,060 | 321,442 |

| Poland - 0.2% | | | |

| Kruk SA | | 6,900 | 344,372 |

| Singapore - 0.0% | | | |

| Broadcom Ltd. | | 169 | 24,632 |

| South Africa - 0.3% | | | |

| JSE Ltd. | | 34,600 | 401,071 |

| Sweden - 0.7% | | | |

| Attendo AB | | 38,200 | 380,552 |

| Indutrade AB | | 7,000 | 392,518 |

| ITAB Shop Concept AB | | 6,800 | 210,847 |

|

| TOTAL SWEDEN | | | 983,917 |

|

| Switzerland - 1.1% | | | |

| Chubb Ltd. | | 9,200 | 1,084,312 |

| Lonza Group AG | | 3,006 | 500,112 |

|

| TOTAL SWITZERLAND | | | 1,584,424 |

|

| Taiwan - 0.9% | | | |

| Aerospace Industries Development Corp. | | 4,000 | 5,448 |

| Ennoconn Corp. | | 27,000 | 344,364 |

| Hota Industrial Manufacturing Co. Ltd. | | 60,000 | 287,899 |

| Sunny Friend Environmental Technology Co. Ltd. | | 37,000 | 160,357 |

| Taiwan Paiho Ltd. | | 122,000 | 366,721 |

| Voltronic Power Technology Corp. | | 3,150 | 49,635 |

|

| TOTAL TAIWAN | | | 1,214,424 |

|

| Thailand - 1.9% | | | |

| Airports of Thailand PCL (For. Reg.) | | 39,300 | 441,168 |

| Bangkok Airways PCL | | 760,300 | 555,202 |

| Central Pattana PCL (For. Reg.) | | 236,000 | 356,501 |

| Eastern Polymer Group PCL | | 1,347,400 | 513,185 |

| Kasikornbank PCL (For. Reg.) | | 17,900 | 85,604 |

| KCE Electronics PCL | | 7,500 | 16,860 |

| MC Group PCL | | 11,400 | 4,375 |

| Muangthai Leasing PCL | | 647,100 | 370,619 |

| Srisawad Power 1979 PCL | | 309,857 | 374,899 |

|

| TOTAL THAILAND | | | 2,718,413 |

|

| Turkey - 0.5% | | | |

| Turk Tuborg Bira ve Malt Sanayii A/S (a) | | 165,000 | 374,464 |

| Ulker Biskuvi Sanayi A/S | | 46,000 | 366,290 |

|

| TOTAL TURKEY | | | 740,754 |

|

| United Kingdom - 2.4% | | | |

| Alliance Pharma PLC | | 642,800 | 422,652 |

| Ensco PLC Class A | | 19,700 | 235,612 |

| Lloyds Banking Group PLC | | 671,800 | 659,379 |

| Micro Focus International PLC | | 32,700 | 730,550 |

| Royal Mail PLC | | 55,700 | 396,269 |

| Steris PLC | | 10,900 | 770,303 |

| U & I Group PLC | | 26,800 | 77,828 |

| Virgin Money Holdings Uk PLC | | 16,200 | 86,421 |

|

| TOTAL UNITED KINGDOM | | | 3,379,014 |

|

| United States of America - 50.1% | | | |

| Abraxas Petroleum Corp. (a) | | 408,100 | 620,312 |

| Adobe Systems, Inc. (a) | | 1,800 | 169,596 |

| AFLAC, Inc. | | 5,500 | 379,335 |

| Air Lease Corp. Class A | | 5,300 | 161,544 |

| Albemarle Corp. U.S. | | 16,400 | 1,085,024 |

| Alphabet, Inc.: | | | |

| Class A | | 2,100 | 1,486,548 |

| Class C | | 1,259 | 872,500 |

| AMC Networks, Inc. Class A (a) | | 8,900 | 580,547 |

| American Tower Corp. | | 3,600 | 377,568 |

| Amgen, Inc. | | 10,000 | 1,583,000 |

| Amplify Snack Brands, Inc. (b) | | 31,500 | 485,415 |

| Apache Corp. | | 15,200 | 826,880 |

| AT&T, Inc. | | 9,500 | 368,790 |

| AutoZone, Inc. (a) | | 700 | 535,661 |

| Baker Hughes, Inc. | | 3,900 | 188,604 |

| Bank of America Corp. | | 41,600 | 605,696 |

| Becton, Dickinson & Co. | | 8,000 | 1,290,080 |

| Biogen, Inc. (a) | | 4,600 | 1,264,954 |

| Boise Cascade Co. (a) | | 8,400 | 175,308 |

| Boston Scientific Corp. (a) | | 68,300 | 1,497,136 |

| Cadence Design Systems, Inc. (a) | | 17,000 | 394,230 |

| Cambrex Corp. (a) | | 2,200 | 106,128 |

| Capital One Financial Corp. | | 12,200 | 883,158 |

| Catalent, Inc. (a) | | 43,100 | 1,272,743 |

| CDW Corp. | | 31,400 | 1,208,900 |

| CEB, Inc. | | 5,000 | 308,450 |

| CIT Group, Inc. | | 16,900 | 584,233 |

| Citigroup, Inc. | | 32,700 | 1,513,356 |

| Colfax Corp. (a) | | 12,600 | 408,618 |

| Continental Resources, Inc. (a)(b) | | 4,100 | 152,766 |

| Coty, Inc. Class A | | 500 | 15,200 |

| CPI Card Group (b) | | 38,000 | 301,340 |

| Cree, Inc. (a) | | 20,300 | 497,553 |

| Cummins, Inc. | | 3,100 | 362,793 |

| Dermira, Inc. (a) | | 3,100 | 78,399 |

| Discover Financial Services | | 9,300 | 523,311 |

| Eastman Chemical Co. | | 4,200 | 320,796 |

| Ethan Allen Interiors, Inc. | | 16,900 | 575,276 |

| Facebook, Inc. Class A (a) | | 6,200 | 728,996 |

| Fair Isaac Corp. | | 9,300 | 992,403 |

| First Republic Bank | | 21,900 | 1,540,008 |

| Fortune Brands Home & Security, Inc. | | 8,200 | 454,362 |

| Franklin Resources, Inc. | | 19,800 | 739,332 |

| Global Payments, Inc. | | 23,800 | 1,717,884 |

| Greenhill & Co., Inc. | | 5,400 | 118,908 |

| Halliburton Co. | | 18,300 | 755,973 |

| Harman International Industries, Inc. | | 22,000 | 1,688,720 |

| HealthSouth Corp. warrants 1/17/17 (a) | | 10 | 36 |

| Helmerich & Payne, Inc. | | 2,300 | 152,076 |

| Houghton Mifflin Harcourt Co. (a) | | 19,800 | 406,098 |

| Huron Consulting Group, Inc. (a) | | 1,700 | 94,537 |

| INC Research Holdings, Inc. Class A (a) | | 7,300 | 351,349 |

| Interpublic Group of Companies, Inc. | | 41,000 | 940,540 |

| Interval Leisure Group, Inc. (b) | | 6,400 | 90,368 |

| IPG Photonics Corp. (a) | | 5,800 | 502,686 |

| iRobot Corp. (a)(b) | | 11,000 | 411,180 |

| Johnson & Johnson | | 10,900 | 1,221,672 |

| Johnson Controls, Inc. | | 400 | 16,560 |

| Kate Spade & Co. (a) | | 17,400 | 447,702 |

| Keysight Technologies, Inc. (a) | | 16,800 | 438,144 |

| Ladder Capital Corp. Class A | | 8,419 | 100,270 |

| Lakeland Financial Corp. | | 11,100 | 524,919 |

| Las Vegas Sands Corp. | | 2,300 | 103,845 |

| Lennox International, Inc. | | 9,300 | 1,255,035 |

| M&T Bank Corp. | | 3,100 | 366,792 |

| Malibu Boats, Inc. Class A (a) | | 52,300 | 920,480 |

| Marsh & McLennan Companies, Inc. | | 2,700 | 170,505 |

| Maxim Integrated Products, Inc. | | 19,500 | 696,540 |

| Microchip Technology, Inc. | | 959 | 46,598 |

| NACCO Industries, Inc. Class A | | 15,400 | 916,608 |

| News Corp. Class A | | 900 | 11,178 |

| Northrop Grumman Corp. | | 4,800 | 990,048 |

| NVR, Inc. (a) | | 500 | 830,645 |

| Oaktree Capital Group LLC Class A | | 1,500 | 72,465 |

| Omega Flex, Inc. | | 23,679 | 779,986 |

| Omnicom Group, Inc. | | 5,500 | 456,335 |

| Oxford Industries, Inc. | | 1,600 | 106,272 |

| Pacira Pharmaceuticals, Inc. (a) | | 5,600 | 303,016 |

| PayPal Holdings, Inc. (a) | | 12,300 | 481,914 |

| PDC Energy, Inc. (a) | | 1,700 | 106,743 |

| Praxair, Inc. | | 3,100 | 364,126 |

| Procter & Gamble Co. | | 5,400 | 432,648 |

| Progressive Corp. | | 21,900 | 713,940 |

| PulteGroup, Inc. | | 60,300 | 1,108,917 |

| PVH Corp. | | 4,400 | 420,640 |

| Qualcomm, Inc. | | 12,400 | 626,448 |

| Regeneron Pharmaceuticals, Inc. (a) | | 300 | 113,013 |

| Regions Financial Corp. | | 41,800 | 392,084 |

| ResMed, Inc. | | 7,619 | 425,140 |

| Rexnord Corp. (a) | | 64,200 | 1,399,560 |

| Rockwell Collins, Inc. | | 4,400 | 388,036 |

| Ruth's Hospitality Group, Inc. | | 26,500 | 420,820 |

| Semtech Corp. (a) | | 6,900 | 149,316 |

| SLM Corp. (a) | | 79,000 | 534,830 |

| SM Energy Co. | | 10,200 | 317,832 |

| Southwestern Energy Co. (a)(b) | | 49,000 | 658,070 |

| Stanley Black & Decker, Inc. | | 3,700 | 414,104 |

| Store Capital Corp. | | 40,800 | 1,047,336 |

| Surgical Care Affiliates, Inc. (a) | | 9,900 | 478,665 |

| Synchrony Financial (a) | | 15,300 | 467,721 |

| Syntel, Inc. (a) | | 3,200 | 136,096 |

| Tenneco, Inc. (a) | | 4,900 | 261,170 |

| Thermo Fisher Scientific, Inc. | | 9,800 | 1,413,650 |

| TJX Companies, Inc. | | 5,600 | 424,592 |

| Toll Brothers, Inc. (a) | | 31,800 | 868,140 |

| Total System Services, Inc. | | 13,600 | 695,504 |

| TransUnion Holding Co., Inc. | | 11,900 | 356,405 |

| Twenty-First Century Fox, Inc. Class B | | 18,200 | 548,184 |

| U.S. Bancorp | | 10,900 | 465,321 |

| UMB Financial Corp. | | 13,000 | 724,750 |

| Vantiv, Inc. (a) | | 27,900 | 1,521,666 |

| Visa, Inc. Class A | | 8,800 | 679,712 |

| VSE Corp. | | 15,394 | 955,044 |

| WESCO International, Inc. (a) | | 7,800 | 458,562 |

| Western Digital Corp. | | 12,900 | 527,159 |

| WestRock Co. | | 11,300 | 472,905 |

| Wyndham Worldwide Corp. | | 4,700 | 333,465 |

| Xylem, Inc. | | 24,200 | 1,011,076 |

| Yum! Brands, Inc. | | 2,200 | 175,032 |

| Zimmer Biomet Holdings, Inc. | | 3,500 | 405,195 |

|

| TOTAL UNITED STATES OF AMERICA | | | 70,418,350 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $119,508,941) | | | 129,635,393 |

|

| Nonconvertible Preferred Stocks - 0.3% | | | |

| Brazil - 0.0% | | | |

| Banco do Estado Rio Grande do Sul SA | | 36,300 | 89,820 |

| Germany - 0.3% | | | |

| Sartorius AG (non-vtg.) | | 1,600 | 394,722 |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $317,351) | | | 484,542 |

| | | Principal Amount(c) | Value |

|

| Nonconvertible Bonds - 0.0% | | | |

| Canada - 0.0% | | | |

| Constellation Software, Inc. 7.6% 3/31/40 (d) | | | |

| (Cost $4,949) | | 5,600 | 4,859 |

| | | Shares | Value |

|

| Money Market Funds - 9.6% | | | |

| Fidelity Cash Central Fund, 0.38% (e) | | 10,341,455 | 10,341,455 |

| Fidelity Securities Lending Cash Central Fund, 0.42% (e)(f) | | 3,092,919 | 3,092,919 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $13,434,374) | | | 13,434,374 |

| TOTAL INVESTMENT PORTFOLIO - 102.1% | | | |

| (Cost $133,265,615) | | | 143,559,168 |

| NET OTHER ASSETS (LIABILITIES) - (2.1)% | | | (2,908,682) |

| NET ASSETS - 100% | | | $140,650,486 |

Currency Abbreviations

CAD – Canadian dollar

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Amount is stated in United States dollars unless otherwise noted.

(d) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(e) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(f) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $14,202 |

| Fidelity Securities Lending Cash Central Fund | 15,272 |

| Total | $29,474 |

Investment Valuation

The following is a summary of the inputs used, as of April 30, 2016, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $24,304,820 | $20,522,325 | $3,782,495 | $-- |

| Consumer Staples | 5,994,183 | 5,236,753 | 757,430 | -- |

| Energy | 5,904,433 | 5,894,932 | -- | 9,501 |

| Financials | 22,553,136 | 20,079,622 | 2,473,514 | -- |

| Health Care | 23,977,877 | 21,989,285 | 1,988,592 | -- |

| Industrials | 18,705,820 | 15,964,274 | 2,741,546 | -- |

| Information Technology | 21,629,094 | 19,693,151 | 1,935,943 | -- |

| Materials | 5,911,534 | 5,358,982 | 552,552 | -- |

| Telecommunication Services | 1,139,038 | 368,790 | 770,248 | -- |

| Corporate Bonds | 4,859 | -- | 4,859 | -- |

| Money Market Funds | 13,434,374 | 13,434,374 | -- | -- |

| Total Investments in Securities: | $143,559,168 | $128,542,488 | $15,007,179 | $9,501 |

The following is a summary of transfers between Level 1 and Level 2 for the period ended April 30, 2016. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements:

| Transfers | Total |

| Level 1 to Level 2 | $113,066 |

| Level 2 to Level 1 | $2,934,482 |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | April 30, 2016 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $3,014,507) — See accompanying schedule:

Unaffiliated issuers (cost $119,831,241) | $130,124,794 | |

| Fidelity Central Funds (cost $13,434,374) | 13,434,374 | |

| Total Investments (cost $133,265,615) | | $143,559,168 |

| Cash | | 46,827 |

| Foreign currency held at value (cost $2,179) | | 2,171 |

| Receivable for investments sold | | 838,884 |

| Receivable for fund shares sold | | 272,310 |

| Dividends receivable | | 172,432 |

| Interest receivable | | 29 |

| Distributions receivable from Fidelity Central Funds | | 8,599 |

| Prepaid expenses | | 80 |

| Receivable from investment adviser for expense reductions | | 5,601 |

| Other receivables | | 50,434 |

| Total assets | | 144,956,535 |

| Liabilities | | |

| Payable for investments purchased | $600,487 | |

| Payable for fund shares redeemed | 407,290 | |

| Accrued management fee | 101,582 | |

| Distribution and service plan fees payable | 35,187 | |

| Other affiliated payables | 28,238 | |

| Other payables and accrued expenses | 40,346 | |

| Collateral on securities loaned, at value | 3,092,919 | |

| Total liabilities | | 4,306,049 |

| Net Assets | | $140,650,486 |

| Net Assets consist of: | | |

| Paid in capital | | $133,122,043 |

| Accumulated net investment loss | | (151,316) |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (2,593,177) |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 10,272,936 |

| Net Assets | | $140,650,486 |

| Calculation of Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($40,529,046 ÷ 2,596,455 shares) | | $15.61 |

| Maximum offering price per share (100/94.25 of $15.61) | | $16.56 |

| Class T: | | |

| Net Asset Value and redemption price per share ($22,097,718 ÷ 1,470,368 shares) | | $15.03 |

| Maximum offering price per share (100/96.50 of $15.03) | | $15.58 |

| Class B: | | |

| Net Asset Value and offering price per share ($639,736 ÷ 46,187 shares)(a) | | $13.85 |

| Class C: | | |

| Net Asset Value and offering price per share ($20,375,646 ÷ 1,475,364 shares)(a) | | $13.81 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($57,008,340 ÷ 3,501,116 shares) | | $16.28 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended April 30, 2016 (Unaudited) |

| Investment Income | | |

| Dividends | | $951,020 |

| Income from Fidelity Central Funds | | 29,474 |

| Income before foreign taxes withheld | | 980,494 |

| Less foreign taxes withheld | | (37,018) |

| Total income | | 943,476 |

| Expenses | | |

| Management fee | | |

| Basic fee | $485,485 | |

| Performance adjustment | 114,993 | |

| Transfer agent fees | 146,216 | |

| Distribution and service plan fees | 210,369 | |

| Accounting and security lending fees | 27,177 | |

| Custodian fees and expenses | 13,476 | |

| Independent trustees' compensation | 303 | |

| Registration fees | 62,303 | |

| Audit | 54,244 | |

| Legal | 2,964 | |

| Miscellaneous | 494 | |

| Total expenses before reductions | 1,118,024 | |

| Expense reductions | (75,279) | 1,042,745 |

| Net investment income (loss) | | (99,269) |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (2,212,395) | |

| Foreign currency transactions | 1,967 | |

| Total net realized gain (loss) | | (2,210,428) |

Change in net unrealized appreciation (depreciation) on:

Investment securities | 266,974 | |

| Assets and liabilities in foreign currencies | 7,732 | |

| Total change in net unrealized appreciation (depreciation) | | 274,706 |

| Net gain (loss) | | (1,935,722) |

| Net increase (decrease) in net assets resulting from operations | | $(2,034,991) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended April 30, 2016 (Unaudited) | Year ended October 31, 2015 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $(99,269) | $(180,159) |

| Net realized gain (loss) | (2,210,428) | 1,861,188 |

| Change in net unrealized appreciation (depreciation) | 274,706 | 504,624 |

| Net increase (decrease) in net assets resulting from operations | (2,034,991) | 2,185,653 |

| Distributions to shareholders from net realized gain | (833,839) | – |

| Share transactions - net increase (decrease) | (2,907,901) | 31,147,206 |

| Redemption fees | 268 | 3,469 |

| Total increase (decrease) in net assets | (5,776,463) | 33,336,328 |

| Net Assets | | |

| Beginning of period | 146,426,949 | 113,090,621 |

| End of period (including accumulated net investment loss of $151,316 and accumulated net investment loss of $52,047, respectively) | $140,650,486 | $146,426,949 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Global Capital Appreciation Fund Class A

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $15.89 | $15.32 | $13.64 | $10.40 | $9.57 | $11.41 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | (.01) | (.01) | .01 | .04 | .02 | (.03) |

| Net realized and unrealized gain (loss) | (.18) | .58 | 1.76 | 3.20 | .81 | (1.76) |

| Total from investment operations | (.19) | .57 | 1.77 | 3.24 | .83 | (1.79) |

| Distributions from net investment income | – | – | (.02) | – | – | – |

| Distributions from net realized gain | (.09) | – | (.06) | – | – | (.05) |

| Total distributions | (.09) | – | (.09)B | – | – | (.05) |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – | – |

| Net asset value, end of period | $15.61 | $15.89 | $15.32 | $13.64 | $10.40 | $9.57 |

| Total ReturnD,E,F | (1.22)% | 3.72% | 13.03% | 31.15% | 8.67% | (15.81)% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | 1.58%I | 1.57% | 1.62% | 1.38% | 1.43% | 1.51% |

| Expenses net of fee waivers, if any | 1.45%I | 1.45% | 1.45% | 1.38% | 1.43% | 1.45% |

| Expenses net of all reductions | 1.45%I | 1.44% | 1.45% | 1.35% | 1.40% | 1.43% |

| Net investment income (loss) | (.09)%I | (.07)% | .07% | .33% | .22% | (.24)% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $40,529 | $41,225 | $35,987 | $33,694 | $26,961 | $36,367 |

| Portfolio turnover rateJ | 114%I | 176% | 249% | 211% | 155% | 140% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.09 per share is comprised of distributions from net investment income of $.024 and distributions from net realized gain of $.064 per share.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Global Capital Appreciation Fund Class T

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $15.32 | $14.81 | $13.19 | $10.09 | $9.31 | $11.11 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | (.02) | (.05) | (.03) | –B | –B | (.05) |

| Net realized and unrealized gain (loss) | (.18) | .56 | 1.71 | 3.10 | .78 | (1.72) |

| Total from investment operations | (.20) | .51 | 1.68 | 3.10 | .78 | (1.77) |

| Distributions from net realized gain | (.09) | – | (.06) | – | – | (.03) |

| Total distributions | (.09) | – | (.06) | – | – | (.03) |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – | – |

| Net asset value, end of period | $15.03 | $15.32 | $14.81 | $13.19 | $10.09 | $9.31 |

| Total ReturnC,D,E | (1.33)% | 3.44% | 12.77% | 30.72% | 8.38% | (15.97)% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 1.88%H | 1.89% | 1.93% | 1.68% | 1.71% | 1.80% |

| Expenses net of fee waivers, if any | 1.70%H | 1.70% | 1.70% | 1.68% | 1.70% | 1.70% |

| Expenses net of all reductions | 1.70%H | 1.69% | 1.70% | 1.64% | 1.68% | 1.68% |

| Net investment income (loss) | (.34)%H | (.32)% | (.17)% | .04% | (.05)% | (.49)% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $22,098 | $24,017 | $20,975 | $19,193 | $15,731 | $24,180 |

| Portfolio turnover rateI | 114%H | 176% | 249% | 211% | 155% | 140% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Global Capital Appreciation Fund Class B

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $14.16 | $13.75 | $12.27 | $9.43 | $8.74 | $10.46 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | (.06) | (.12) | (.09) | (.05) | (.05) | (.10) |

| Net realized and unrealized gain (loss) | (.16) | .53 | 1.58 | 2.89 | .74 | (1.62) |

| Total from investment operations | (.22) | .41 | 1.49 | 2.84 | .69 | (1.72) |

| Distributions from net realized gain | (.09) | – | (.01) | – | – | –B |

| Total distributions | (.09) | – | (.01) | – | – | – |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – | – |

| Net asset value, end of period | $13.85 | $14.16 | $13.75 | $12.27 | $9.43 | $8.74 |

| Total ReturnC,D,E | (1.58)% | 2.98% | 12.11% | 30.12% | 7.89% | (16.42)% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 2.40%H | 2.44% | 2.44% | 2.17% | 2.19% | 2.32% |

| Expenses net of fee waivers, if any | 2.20%H | 2.20% | 2.20% | 2.17% | 2.19% | 2.20% |

| Expenses net of all reductions | 2.20%H | 2.19% | 2.20% | 2.13% | 2.17% | 2.18% |

| Net investment income (loss) | (.84)%H | (.82)% | (.68)% | (.45)% | (.54)% | (.99)% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $640 | $882 | $1,223 | $1,331 | $1,401 | $1,926 |

| Portfolio turnover rateI | 114%H | 176% | 249% | 211% | 155% | 140% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Global Capital Appreciation Fund Class C

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $14.12 | $13.72 | $12.26 | $9.41 | $8.73 | $10.46 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | (.06) | (.12) | (.09) | (.05) | (.05) | (.10) |

| Net realized and unrealized gain (loss) | (.16) | .52 | 1.58 | 2.90 | .73 | (1.61) |

| Total from investment operations | (.22) | .40 | 1.49 | 2.85 | .68 | (1.71) |

| Distributions from net realized gain | (.09) | – | (.03) | – | – | (.02) |

| Total distributions | (.09) | – | (.03) | – | – | (.02) |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – | – |

| Net asset value, end of period | $13.81 | $14.12 | $13.72 | $12.26 | $9.41 | $8.73 |

| Total ReturnC,D,E | (1.58)% | 2.92% | 12.13% | 30.29% | 7.79% | (16.38)% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 2.34%H | 2.34% | 2.40% | 2.16% | 2.18% | 2.28% |

| Expenses net of fee waivers, if any | 2.20%H | 2.20% | 2.20% | 2.16% | 2.18% | 2.20% |

| Expenses net of all reductions | 2.20%H | 2.19% | 2.20% | 2.13% | 2.16% | 2.18% |

| Net investment income (loss) | (.84)%H | (.82)% | (.67)% | (.45)% | (.53)% | (.99)% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $20,376 | $21,186 | $15,747 | $13,055 | $9,421 | $11,632 |

| Portfolio turnover rateI | 114%H | 176% | 249% | 211% | 155% | 140% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Global Capital Appreciation Fund Class I

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $16.55 | $15.92 | $14.18 | $10.78 | $9.88 | $11.76 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .01 | .03 | .05 | .09 | .06 | –B |

| Net realized and unrealized gain (loss) | (.19) | .60 | 1.82 | 3.33 | .84 | (1.82) |

| Total from investment operations | (.18) | .63 | 1.87 | 3.42 | .90 | (1.82) |

| Distributions from net investment income | – | – | (.06) | (.02) | – | – |

| Distributions from net realized gain | (.09) | – | (.06) | – | – | (.06) |

| Total distributions | (.09) | – | (.13)C | (.02) | – | (.06) |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – | – |

| Net asset value, end of period | $16.28 | $16.55 | $15.92 | $14.18 | $10.78 | $9.88 |

| Total ReturnD,E | (1.11)% | 3.96% | 13.27% | 31.74% | 9.11% | (15.60)% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 1.25%H | 1.26% | 1.29% | 1.02% | 1.06% | 1.18% |

| Expenses net of fee waivers, if any | 1.20%H | 1.20% | 1.20% | 1.02% | 1.06% | 1.17% |

| Expenses net of all reductions | 1.20%H | 1.19% | 1.20% | .99% | 1.03% | 1.15% |

| Net investment income (loss) | .16%H | .18% | .33% | .69% | .59% | .04% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $57,008 | $59,117 | $39,159 | $30,153 | $22,548 | $28,725 |

| Portfolio turnover rateI | 114%H | 176% | 249% | 211% | 155% | 140% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total distributions of $.13 per share is comprised of distributions from net investment income of $.064 and distributions from net realized gain of $.064 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended April 30, 2016

1. Organization.

Fidelity Advisor Global Capital Appreciation Fund (the Fund) is a fund of Fidelity Advisor Series VIII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C, and Class I shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a maximum holding period of seven years from the initial date of purchase. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

During the period, the Board of Trustees approved the conversion of all existing Class B shares into Class A shares, effective on or about July 1, 2016, regardless of the length of times shares have been held.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fidelity Management & Research Company (FMR) Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of April 30, 2016, including information on transfers between Levels 1 and 2, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC), partnerships, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $16,414,631 |

| Gross unrealized depreciation | (6,529,874) |

| Net unrealized appreciation (depreciation) on securities | $9,884,757 |

| Tax cost | $133,674,411 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days may have been subject to a redemption fee equal to 1.00% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $75,516,537 and $82,090,398, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of the Institutional Class of the Fund as compared to its benchmark index, the MSCI All Country World Index, over the same 36 month performance period. For the reporting period, the total annualized management fee rate, including the performance adjustment, was .86% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution

Fee | Service

Fee | Total Fees | Retained

by FDC |

| Class A | -% | .25% | $49,403 | $– |

| Class T | .25% | .25% | 56,128 | – |

| Class B | .75% | .25% | 3,745 | 2,809 |

| Class C | .75% | .25% | 101,093 | 20,614 |

| | | | $210,369 | $23,423 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. The deferred sales charges range from 5.00% to 1.00% for Class B shares, 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained

by FDC |

| Class A | $8,015 |

| Class T | 1,944 |

| Class B(a) | 71 |

| Class C(a) | 893 |

| | $10,923 |

(a) When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of

Class-Level Average

Net Assets(a) |

| Class A | $45,513 | .23 |

| Class T | 32,421 | .29 |

| Class B | 1,134 | .30 |

| Class C | 24,445 | .24 |

| Class I | 42,703 | .15 |

| | $146,216 | |

(a) Annualized

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $1,145 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $123 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. The value of securities loaned to FCM at period end was $103,090. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $15,272, including $1,875 from securities loaned to FCM.

8. Expense Reductions.

The investment adviser contractually agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. This reimbursement will remain in place through December 31, 2016. Some expenses, for example interest expense, including commitment fees, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| | Expense

Limitations | Reimbursement |

| Class A | 1.45% | $24,783 |

| Class T | 1.70% | 20,810 |

| Class B | 2.20% | 756 |

| Class C | 2.20% | 13,825 |

| Class I | 1.20% | 13,586 |

| | | $73,760 |

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $990 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $5.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund level operating expenses in the amount of $524.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended

April 30, 2016 | Year ended October 31, 2015 |

| From net realized gain | | |

| Class A | $232,217 | $– |

| Class T | 141,812 | – |

| Class B | 5,345 | – |

| Class C | 134,701 | – |

| Class I | 319,764 | – |

| Total | $833,839 | $– |

10. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended

April 30, 2016 | Year ended October 31, 2015 | Six months ended

April 30, 2016 | Year ended October 31, 2015 |

| Class A | | | | |

| Shares sold | 246,810 | 1,624,998 | $3,728,112 | $27,021,428 |

| Reinvestment of distributions | 14,077 | – | 225,941 | – |

| Shares redeemed | (259,211) | (1,379,091) | (3,890,585) | (22,009,282) |

| Net increase (decrease) | 1,676 | 245,907 | $63,468 | $5,012,146 |

| Class T | | | | |

| Shares sold | 99,564 | 370,447 | $1,479,015 | $5,817,431 |

| Reinvestment of distributions | 9,033 | – | 139,646 | – |

| Shares redeemed | (206,046) | (219,006) | (2,936,172) | (3,388,077) |

| Net increase (decrease) | (97,449) | 151,441 | $(1,317,511) | $2,429,354 |

| Class B | | | | |

| Shares sold | 179 | 8,363 | $2,344 | $124,801 |

| Reinvestment of distributions | 351 | – | 5,016 | – |

| Shares redeemed | (16,620) | (35,011) | (220,477) | (502,734) |

| Net increase (decrease) | (16,090) | (26,648) | $(213,117) | $(377,933) |

| Class C | | | | |

| Shares sold | 109,969 | 572,578 | $1,489,253 | $8,431,576 |

| Reinvestment of distributions | 8,899 | – | 126,727 | – |

| Shares redeemed | (143,970) | (219,967) | (1,921,940) | (3,119,457) |

| Net increase (decrease) | (25,102) | 352,611 | $(305,960) | $5,312,119 |

| Class I | | | | |

| Shares sold | 262,748 | 1,401,232 | $4,181,938 | $23,612,800 |

| Reinvestment of distributions | 18,757 | – | 313,609 | – |

| Shares redeemed | (352,690) | (288,809) | (5,630,328) | (4,841,280) |

| Net increase (decrease) | (71,185) | 1,112,423 | $(1,134,781) | $18,771,520 |

11. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, Strategic Advisers International II Fund was the owner of record of approximately 17% of the total outstanding shares of the Fund.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2015 to April 30, 2016).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Annualized Expense Ratio-A | Beginning

Account Value

November 1, 2015 | Ending

Account Value

April 30, 2016 | Expenses Paid

During Period-B

November 1, 2015

to April 30, 2016 |

| Class A | 1.45% | | | |

| Actual | | $1,000.00 | $987.80 | $7.17 |

| Hypothetical-C | | $1,000.00 | $1,017.65 | $7.27 |

| Class T | 1.70% | | | |

| Actual | | $1,000.00 | $986.70 | $8.40 |

| Hypothetical-C | | $1,000.00 | $1,016.41 | $8.52 |

| Class B | 2.20% | | | |

| Actual | | $1,000.00 | $984.20 | $10.85 |

| Hypothetical-C | | $1,000.00 | $1,013.92 | $11.02 |

| Class C | 2.20% | | | |

| Actual | | $1,000.00 | $984.20 | $10.85 |

| Hypothetical-C | | $1,000.00 | $1,013.92 | $11.02 |

| Class I | 1.20% | | | |

| Actual | | $1,000.00 | $988.90 | $5.93 |

| Hypothetical-C | | $1,000.00 | $1,018.90 | $6.02 |