UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

William C. Coffey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | April 30, 2019 |

Item 1.

Reports to Stockholders

Fidelity Advisor® Overseas Fund

Semi-Annual Report April 30, 2019 |

|

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Five Stocks as of April 30, 2019

| | % of fund's net assets |

| Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 2.4 |

| Diageo PLC (United Kingdom, Beverages) | 1.8 |

| AIA Group Ltd. (Hong Kong, Insurance) | 1.7 |

| SAP SE (Germany, Software) | 1.7 |

| Total SA (France, Oil, Gas & Consumable Fuels) | 1.6 |

| | 9.2 |

Top Five Market Sectors as of April 30, 2019

| | % of fund's net assets |

| Financials | 21.6 |

| Industrials | 17.2 |

| Health Care | 14.6 |

| Information Technology | 13.5 |

| Consumer Staples | 11.6 |

Top Five Countries as of April 30, 2019

| (excluding cash equivalents) | % of fund's net assets |

| United Kingdom | 17.9 |

| Japan | 17.2 |

| France | 10.5 |

| Netherlands | 7.8 |

| Switzerland | 6.9 |

Asset Allocation (% of fund's net assets)

| As of April 30, 2019 |

| | Stocks | 97.6% |

| | Investment Companies | 1.1% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 1.3% |

Percentages are adjusted for the effect of futures contracts and swaps, if applicable.

Schedule of Investments April 30, 2019 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 97.2% | | | |

| | | Shares | Value (000s) |

| Australia - 0.3% | | | |

| Insurance Australia Group Ltd. | | 147,769 | $821 |

| Lovisa Holdings Ltd. (a) | | 48,720 | 346 |

| Pact Group Holdings Ltd. | | 75,176 | 139 |

| realestate.com.au Ltd. | | 10,685 | 602 |

|

| TOTAL AUSTRALIA | | | 1,908 |

|

| Austria - 0.6% | | | |

| Andritz AG | | 3,902 | 186 |

| Erste Group Bank AG | | 82,200 | 3,291 |

| Mayr-Melnhof Karton AG | | 3,700 | 479 |

|

| TOTAL AUSTRIA | | | 3,956 |

|

| Bailiwick of Jersey - 1.6% | | | |

| Experian PLC | | 190,100 | 5,534 |

| Glencore Xstrata PLC | | 159,500 | 633 |

| Sanne Group PLC | | 437,019 | 3,567 |

|

| TOTAL BAILIWICK OF JERSEY | | | 9,734 |

|

| Belgium - 1.2% | | | |

| KBC Groep NV | | 102,713 | 7,606 |

| Bermuda - 1.9% | | | |

| Credicorp Ltd. (United States) | | 11,200 | 2,653 |

| Hiscox Ltd. | | 175,900 | 3,840 |

| Hongkong Land Holdings Ltd. | | 53,900 | 376 |

| IHS Markit Ltd. (b) | | 80,901 | 4,632 |

| SmarTone Telecommunications Holdings Ltd. | | 431,000 | 449 |

|

| TOTAL BERMUDA | | | 11,950 |

|

| Canada - 0.9% | | | |

| Constellation Software, Inc. | | 6,400 | 5,647 |

| Cayman Islands - 0.4% | | | |

| SITC International Holdings Co. Ltd. | | 802,000 | 852 |

| Value Partners Group Ltd. | | 900,000 | 677 |

| ZTO Express (Cayman), Inc. sponsored ADR | | 39,400 | 785 |

|

| TOTAL CAYMAN ISLANDS | | | 2,314 |

|

| China - 0.3% | | | |

| Gree Electric Appliances, Inc. of Zhuhai (A Shares) | | 78,000 | 644 |

| Suofeiya Home Collection Co. Ltd. (A Shares) | | 104,054 | 344 |

| Yunnan Baiyao Group Co. Ltd. (A Shares) | | 46,563 | 612 |

|

| TOTAL CHINA | | | 1,600 |

|

| Denmark - 1.1% | | | |

| A.P. Moller - Maersk A/S Series A | | 377 | 459 |

| DSV de Sammensluttede Vognmaend A/S | | 41,600 | 3,844 |

| Netcompany Group A/S (c) | | 57,844 | 2,063 |

| Scandinavian Tobacco Group A/S (c) | | 47,936 | 571 |

|

| TOTAL DENMARK | | | 6,937 |

|

| Finland - 0.1% | | | |

| Nokian Tyres PLC | | 19,600 | 656 |

| France - 10.5% | | | |

| Altarea SCA | | 2,800 | 592 |

| ALTEN | | 30,510 | 3,330 |

| Amundi SA (c) | | 54,541 | 3,918 |

| Capgemini SA | | 55,300 | 6,705 |

| Compagnie de St. Gobain | | 17,300 | 709 |

| Danone SA | | 87,600 | 7,085 |

| Edenred SA | | 74,243 | 3,498 |

| Elior SA (c) | | 90,100 | 1,247 |

| Essilor International SA | | 24,500 | 2,985 |

| LVMH Moet Hennessy - Louis Vuitton SA | | 24,779 | 9,729 |

| Natixis SA | | 87,000 | 512 |

| Sanofi SA | | 96,541 | 8,423 |

| SR Teleperformance SA | | 28,100 | 5,399 |

| Total SA | | 182,311 | 10,135 |

|

| TOTAL FRANCE | | | 64,267 |

|

| Germany - 6.3% | | | |

| adidas AG | | 21,984 | 5,649 |

| Axel Springer Verlag AG | | 34,100 | 1,931 |

| Bayer AG | | 49,672 | 3,306 |

| Bertrandt AG | | 9,693 | 756 |

| Deutsche Borse AG | | 34,400 | 4,597 |

| Deutsche Post AG | | 122,826 | 4,269 |

| Fresenius SE & Co. KGaA | | 43,640 | 2,476 |

| Hannover Reuck SE | | 31,300 | 4,718 |

| Instone Real Estate Group BV (b)(c) | | 22,900 | 559 |

| JOST Werke AG (c) | | 7,300 | 269 |

| SAP SE | | 80,283 | 10,349 |

|

| TOTAL GERMANY | | | 38,879 |

|

| Hong Kong - 1.9% | | | |

| AIA Group Ltd. | | 1,038,700 | 10,636 |

| Dah Sing Banking Group Ltd. | | 244,800 | 468 |

| Dah Sing Financial Holdings Ltd. | | 100,000 | 525 |

|

| TOTAL HONG KONG | | | 11,629 |

|

| India - 1.5% | | | |

| Axis Bank Ltd. (b) | | 330,414 | 3,638 |

| HDFC Bank Ltd. sponsored ADR | | 31,700 | 3,634 |

| LIC Housing Finance Ltd. | | 250,600 | 1,787 |

|

| TOTAL INDIA | | | 9,059 |

|

| Indonesia - 0.6% | | | |

| PT Astra International Tbk | | 1,633,700 | 874 |

| PT Bank Rakyat Indonesia Tbk | | 8,205,700 | 2,516 |

|

| TOTAL INDONESIA | | | 3,390 |

|

| Ireland - 2.7% | | | |

| DCC PLC (United Kingdom) | | 56,809 | 5,073 |

| Kerry Group PLC Class A | | 47,490 | 5,316 |

| Kingspan Group PLC (Ireland) | | 59,144 | 3,110 |

| United Drug PLC (United Kingdom) | | 349,026 | 2,990 |

|

| TOTAL IRELAND | | | 16,489 |

|

| Italy - 1.3% | | | |

| Banca Generali SpA | | 13,150 | 371 |

| FinecoBank SpA | | 217,100 | 2,857 |

| Recordati SpA | | 125,475 | 5,065 |

|

| TOTAL ITALY | | | 8,293 |

|

| Japan - 17.2% | | | |

| AEON Financial Service Co. Ltd. | | 170,100 | 3,511 |

| Arata Corp. | | 13,800 | 492 |

| Credit Saison Co. Ltd. | | 38,000 | 483 |

| Daiichikosho Co. Ltd. | | 62,400 | 3,047 |

| Elecom Co. Ltd. | | 44,700 | 1,493 |

| GMO Internet, Inc. | | 46,600 | 719 |

| Hoya Corp. | | 106,400 | 7,465 |

| Iriso Electronics Co. Ltd. | | 53,100 | 2,746 |

| Kao Corp. | | 65,300 | 5,016 |

| Keyence Corp. | | 11,400 | 7,074 |

| KH Neochem Co. Ltd. | | 136,900 | 3,963 |

| Miroku Jyoho Service Co., Ltd. | | 81,740 | 2,193 |

| Nabtesco Corp. | | 27,330 | 832 |

| Nakanishi, Inc. (d) | | 78,100 | 1,495 |

| Nitori Holdings Co. Ltd. (d) | | 29,330 | 3,489 |

| NOF Corp. | | 95,000 | 3,373 |

| OBIC Co. Ltd. | | 36,120 | 4,170 |

| Olympus Corp. | | 354,320 | 3,957 |

| Oracle Corp. Japan | | 32,200 | 2,200 |

| ORIX Corp. | | 359,180 | 5,067 |

| Otsuka Corp. | | 93,100 | 3,652 |

| PALTAC Corp. | | 41,100 | 2,254 |

| Paramount Bed Holdings Co. Ltd. | | 12,200 | 572 |

| Persol Holdings Co., Ltd. | | 163,900 | 3,066 |

| Recruit Holdings Co. Ltd. | | 160,740 | 4,804 |

| Renesas Electronics Corp. (b) | | 80,900 | 431 |

| S Foods, Inc. | | 70,500 | 2,424 |

| Shiseido Co. Ltd. | | 64,800 | 5,071 |

| SMC Corp. | | 14,000 | 5,789 |

| Subaru Corp. | | 34,900 | 852 |

| Sundrug Co. Ltd. | | 6,980 | 186 |

| Suzuki Motor Corp. | | 64,600 | 2,937 |

| The Suruga Bank Ltd. (a) | | 54,700 | 241 |

| Tsuruha Holdings, Inc. | | 43,200 | 3,673 |

| USS Co. Ltd. | | 182,000 | 3,474 |

| Welcia Holdings Co. Ltd. | | 72,120 | 2,832 |

| Zozo, Inc. (e) | | 32,800 | 579 |

|

| TOTAL JAPAN | | | 105,622 |

|

| Kenya - 0.4% | | | |

| Safaricom Ltd. | | 7,828,400 | 2,179 |

| Korea (South) - 0.3% | | | |

| LG Chemical Ltd. | | 5,734 | 1,778 |

| Mexico - 0.3% | | | |

| Grupo Financiero Banorte S.A.B. de CV Series O | | 270,500 | 1,710 |

| Netherlands - 7.8% | | | |

| ASML Holding NV (Netherlands) | | 33,700 | 7,013 |

| ASR Nederland NV | | 7,700 | 342 |

| Grandvision NV (c) | | 113,500 | 2,554 |

| Heineken NV (Bearer) | | 68,830 | 7,430 |

| IMCD Group BV | | 84,590 | 6,831 |

| Intertrust NV (c) | | 36,624 | 695 |

| Koninklijke Philips Electronics NV | | 148,930 | 6,396 |

| QIAGEN NV (Germany) (b) | | 70,200 | 2,711 |

| Unilever NV (Certificaten Van Aandelen) (Bearer) | | 162,700 | 9,844 |

| Wolters Kluwer NV | | 55,200 | 3,850 |

|

| TOTAL NETHERLANDS | | | 47,666 |

|

| New Zealand - 0.4% | | | |

| EBOS Group Ltd. | | 193,728 | 2,772 |

| Norway - 2.0% | | | |

| Adevinta ASA: | | | |

| Class A (b) | | 125,100 | 1,262 |

| Class B | | 119,650 | 1,177 |

| Equinor ASA | | 276,240 | 6,162 |

| Schibsted ASA: | | | |

| (A Shares) | | 105,700 | 2,774 |

| (B Shares) | | 17,399 | 416 |

| Skandiabanken ASA (c) | | 52,456 | 516 |

|

| TOTAL NORWAY | | | 12,307 |

|

| Spain - 1.9% | | | |

| Amadeus IT Holding SA Class A | | 51,056 | 4,061 |

| CaixaBank SA | | 1,277,600 | 4,072 |

| Grifols SA ADR | | 23,020 | 441 |

| Prosegur Cash SA (c) | | 1,584,600 | 3,398 |

|

| TOTAL SPAIN | | | 11,972 |

|

| Sweden - 3.6% | | | |

| Addlife AB | | 96,684 | 2,594 |

| AddTech AB (B Shares) | | 67,074 | 1,631 |

| Essity AB Class B | | 18,680 | 554 |

| Hexagon AB (B Shares) | | 76,400 | 4,174 |

| HEXPOL AB (B Shares) | | 47,440 | 371 |

| Indutrade AB | | 156,220 | 4,776 |

| Securitas AB (B Shares) | | 31,000 | 542 |

| Svenska Handelsbanken AB (A Shares) | | 354,700 | 3,874 |

| Swedbank AB (A Shares) (a) | | 142,295 | 2,325 |

| Telefonaktiebolaget LM Ericsson (B Shares) | | 101,400 | 1,003 |

|

| TOTAL SWEDEN | | | 21,844 |

|

| Switzerland - 6.9% | | | |

| Alcon, Inc. (b) | | 80,600 | 4,691 |

| Julius Baer Group Ltd. | | 85,820 | 4,146 |

| Lonza Group AG | | 17,731 | 5,476 |

| Roche Holding AG (participation certificate) | | 55,556 | 14,654 |

| Sika AG | | 33,038 | 5,058 |

| Sonova Holding AG Class B | | 17,570 | 3,543 |

| UBS Group AG | | 378,334 | 5,074 |

|

| TOTAL SWITZERLAND | | | 42,642 |

|

| Taiwan - 0.6% | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | 433,300 | 3,638 |

| United Kingdom - 17.9% | | | |

| Admiral Group PLC | | 107,700 | 3,095 |

| Aggreko PLC | | 52,616 | 585 |

| Ascential PLC | | 525,074 | 2,442 |

| AstraZeneca PLC (United Kingdom) | | 12,600 | 939 |

| BCA Marketplace PLC | | 284,000 | 764 |

| Beazley PLC | | 446,500 | 3,354 |

| BP PLC | | 227,400 | 1,654 |

| British American Tobacco PLC (United Kingdom) | | 35,785 | 1,401 |

| Cineworld Group PLC | | 1,107,895 | 4,594 |

| Close Brothers Group PLC | | 17,118 | 346 |

| Compass Group PLC | | 284,378 | 6,471 |

| Cranswick PLC | | 80,498 | 3,042 |

| Dechra Pharmaceuticals PLC | | 64,320 | 2,231 |

| Diageo PLC | | 264,400 | 11,146 |

| Diploma PLC | | 188,980 | 3,943 |

| Hilton Food Group PLC | | 148,645 | 1,969 |

| InterContinental Hotel Group PLC | | 89,955 | 5,828 |

| Intertek Group PLC | | 66,990 | 4,673 |

| James Fisher and Sons PLC | | 78,577 | 2,019 |

| John Wood Group PLC | | 37,670 | 231 |

| JTC PLC (c) | | 242,000 | 1,253 |

| Keywords Studios PLC | | 25,900 | 526 |

| Lloyds Banking Group PLC | | 1,096,980 | 897 |

| London Stock Exchange Group PLC | | 71,730 | 4,703 |

| Micro Focus International PLC | | 26,287 | 664 |

| Mondi PLC | | 151,700 | 3,324 |

| Prudential PLC | | 368,611 | 8,375 |

| RELX PLC (London Stock Exchange) | | 184,400 | 4,230 |

| Rentokil Initial PLC | | 808,000 | 4,109 |

| Rightmove PLC | | 62,866 | 443 |

| Rolls-Royce Holdings PLC | | 326,377 | 3,909 |

| Rotork PLC | | 811,363 | 3,300 |

| Sabre Insurance Group PLC (c) | | 225,781 | 783 |

| Spectris PLC | | 79,910 | 2,863 |

| St. James's Place Capital PLC | | 48,560 | 710 |

| Standard Life PLC | | 193,661 | 704 |

| The Weir Group PLC | | 20,091 | 435 |

| Ultra Electronics Holdings PLC | | 114,709 | 2,381 |

| Unilever PLC | | 20,400 | 1,237 |

| Victrex PLC | | 77,570 | 2,460 |

| Volution Group PLC | | 818,300 | 1,846 |

|

| TOTAL UNITED KINGDOM | | | 109,879 |

|

| United States of America - 4.7% | | | |

| Alphabet, Inc. Class C (b) | | 2,383 | 2,832 |

| Becton, Dickinson & Co. | | 16,400 | 3,948 |

| Boston Scientific Corp. (b) | | 102,900 | 3,820 |

| Marsh & McLennan Companies, Inc. | | 50,600 | 4,771 |

| Moody's Corp. | | 15,230 | 2,995 |

| Roper Technologies, Inc. | | 9,900 | 3,561 |

| S&P Global, Inc. | | 17,603 | 3,884 |

| Total System Services, Inc. | | 31,500 | 3,221 |

|

| TOTAL UNITED STATES OF AMERICA | | | 29,032 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $502,652) | | | 597,355 |

|

| Nonconvertible Preferred Stocks - 0.4% | | | |

| Germany - 0.4% | | | |

| Henkel AG & Co. KGaA | | 26,970 | 2,730 |

| United Kingdom - 0.0% | | | |

| Rolls-Royce Holdings PLC (C Shares) (b) | | 23,172,767 | 30 |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $3,495) | | | 2,760 |

|

| Investment Companies - 1.1% | | | |

| United States of America - 1.1% | | | |

| iShares MSCI Japan ETF | | | |

| (Cost $6,282) | | 119,400 | 6,617 |

|

| Money Market Funds - 1.9% | | | |

| Fidelity Cash Central Fund, 2.49% (f) | | 11,505,246 | 11,508 |

| Fidelity Securities Lending Cash Central Fund 2.49% (f)(g) | | 390,233 | 390 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $11,897) | | | 11,898 |

| TOTAL INVESTMENT IN SECURITIES - 100.6% | | | |

| (Cost $524,326) | | | 618,630 |

| NET OTHER ASSETS (LIABILITIES) - (0.6)% | | | (3,715) |

| NET ASSETS - 100% | | | $614,915 |

Security Type Abbreviations

ETF – Exchange-Traded Fund

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Security or a portion of the security is on loan at period end.

(b) Non-income producing

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $17,826,000 or 2.9% of net assets.

(d) A portion of the security sold on a delayed delivery basis.

(e) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(f) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(g) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| | (Amounts in thousands) |

| Fidelity Cash Central Fund | $178 |

| Fidelity Securities Lending Cash Central Fund | 47 |

| Total | $225 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of April 30, 2019, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $21,709 | $21,709 | $-- | $-- |

| Consumer Discretionary | 53,222 | 34,037 | 19,185 | -- |

| Consumer Staples | 71,527 | 40,260 | 31,267 | -- |

| Energy | 18,182 | 6,393 | 11,789 | -- |

| Financials | 133,261 | 89,636 | 43,625 | -- |

| Health Care | 90,577 | 49,323 | 41,254 | -- |

| Industrials | 106,158 | 84,788 | 21,370 | -- |

| Information Technology | 82,374 | 63,210 | 19,164 | -- |

| Materials | 21,578 | 20,574 | 1,004 | -- |

| Real Estate | 1,527 | 1,527 | -- | -- |

| Investment Companies | 6,617 | 6,617 | -- | -- |

| Money Market Funds | 11,898 | 11,898 | -- | -- |

| Total Investments in Securities: | $618,630 | $429,972 | $188,658 | $-- |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | April 30, 2019 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $370) — See accompanying schedule:

Unaffiliated issuers (cost $512,429) | $606,732 | |

| Fidelity Central Funds (cost $11,897) | 11,898 | |

| Total Investment in Securities (cost $524,326) | | $618,630 |

| Cash | | 35 |

| Receivable for investments sold | | |

| Regular delivery | | 1,082 |

| Delayed delivery | | 434 |

| Receivable for fund shares sold | | 114 |

| Dividends receivable | | 3,040 |

| Distributions receivable from Fidelity Central Funds | | 27 |

| Other receivables | | 244 |

| Total assets | | 623,606 |

| Liabilities | | |

| Payable for investments purchased | | |

| Regular delivery | $1,479 | |

| Delayed delivery | 657 | |

| Payable for fund shares redeemed | 5,436 | |

| Accrued management fee | 333 | |

| Distribution and service plan fees payable | 109 | |

| Other affiliated payables | 116 | |

| Other payables and accrued expenses | 171 | |

| Collateral on securities loaned | 390 | |

| Total liabilities | | 8,691 |

| Net Assets | | $614,915 |

| Net Assets consist of: | | |

| Paid in capital | | $536,962 |

| Total distributable earnings (loss) | | 77,953 |

| Net Assets | | $614,915 |

| Net Asset Value and Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($50,314 ÷ 2,153 shares) | | $23.37 |

| Maximum offering price per share (100/94.25 of $23.37) | | $24.80 |

| Class M: | | |

| Net Asset Value and redemption price per share ($225,551 ÷ 9,381 shares) | | $24.04 |

| Maximum offering price per share (100/96.50 of $24.04) | | $24.91 |

| Class C: | | |

| Net Asset Value and offering price per share ($6,601 ÷ 291 shares)(a) | | $22.68 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($313,322 ÷ 13,145 shares) | | $23.84 |

| Class Z: | | |

| Net Asset Value, offering price and redemption price per share ($19,127 ÷ 803 shares) | | $23.82 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Six months ended April 30, 2019 (Unaudited) |

| Investment Income | | |

| Dividends | | $6,696 |

| Non-Cash dividends | | 1,553 |

| Interest | | 3 |

| Income from Fidelity Central Funds | | 225 |

| Income before foreign taxes withheld | | 8,477 |

| Less foreign taxes withheld | | (605) |

| Total income | | 7,872 |

| Expenses | | |

| Management fee | | |

| Basic fee | $1,981 | |

| Performance adjustment | (275) | |

| Transfer agent fees | 540 | |

| Distribution and service plan fees | 645 | |

| Accounting and security lending fees | 150 | |

| Custodian fees and expenses | 61 | |

| Independent trustees' fees and expenses | 2 | |

| Registration fees | 58 | |

| Audit | 52 | |

| Legal | 2 | |

| Miscellaneous | 2 | |

| Total expenses before reductions | 3,218 | |

| Expense reductions | (98) | |

| Total expenses after reductions | | 3,120 |

| Net investment income (loss) | | 4,752 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (18,509) | |

| Fidelity Central Funds | (1) | |

| Foreign currency transactions | (84) | |

| Futures contracts | (1,003) | |

| Total net realized gain (loss) | | (19,597) |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers (net of increase in deferred foreign taxes of $110) | 63,024 | |

| Fidelity Central Funds | 1 | |

| Assets and liabilities in foreign currencies | (2) | |

| Total change in net unrealized appreciation (depreciation) | | 63,023 |

| Net gain (loss) | | 43,426 |

| Net increase (decrease) in net assets resulting from operations | | $48,178 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended April 30, 2019 (Unaudited) | Year ended October 31, 2018 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $4,752 | $7,747 |

| Net realized gain (loss) | (19,597) | 21,240 |

| Change in net unrealized appreciation (depreciation) | 63,023 | (78,971) |

| Net increase (decrease) in net assets resulting from operations | 48,178 | (49,984) |

| Distributions to shareholders | (26,504) | (23,429) |

| Share transactions - net increase (decrease) | (33,754) | 35,007 |

| Total increase (decrease) in net assets | (12,080) | (38,406) |

| Net Assets | | |

| Beginning of period | 626,995 | 665,401 |

| End of period | $614,915 | $626,995 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Advisor Overseas Fund Class A

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $22.48 | $25.20 | $20.40 | $21.59 | $21.09 | $21.61 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .17 | .28 | .23 | .20 | .19 | .24 |

| Net realized and unrealized gain (loss) | 1.66 | (2.10) | 4.78 | (1.31) | .33 | (.50) |

| Total from investment operations | 1.83 | (1.82) | 5.01 | (1.11) | .52 | (.26) |

| Distributions from net investment income | (.21) | (.22) | (.20) | (.08) | (.02) | (.18) |

| Distributions from net realized gain | (.73) | (.69) | (.02) | – | – | (.08) |

| Total distributions | (.94) | (.90)B | (.21)C | (.08) | (.02) | (.26) |

| Redemption fees added to paid in capitalA | – | – | –D | –D | –D | –D |

| Net asset value, end of period | $23.37 | $22.48 | $25.20 | $20.40 | $21.59 | $21.09 |

| Total ReturnE,F,G | 8.68% | (7.48)% | 24.86% | (5.16)% | 2.46% | (1.24)% |

| Ratios to Average Net AssetsH,I | | | | | | |

| Expenses before reductions | 1.16%J | 1.21% | 1.25% | 1.36% | 1.35% | 1.30% |

| Expenses net of fee waivers, if any | 1.16%J | 1.21% | 1.25% | 1.35% | 1.35% | 1.30% |

| Expenses net of all reductions | 1.12%J | 1.20% | 1.23% | 1.35% | 1.34% | 1.30% |

| Net investment income (loss) | 1.51%J | 1.13% | 1.05% | .96% | .89% | 1.10% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $50 | $44 | $69 | $58 | $78 | $65 |

| Portfolio turnover rateK | 56%J | 39% | 42% | 94% | 29% | 39% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.90 per share is comprised of distributions from net investment income of $.219 and distributions from net realized gain of $.685 per share.

C Total distributions of $.21 per share is comprised of distributions from net investment income of $.198 and distributions from net realized gain of $.015 per share.

D Amount represents less than $.005 per share.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the sales charges.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Annualized

K Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Overseas Fund Class M

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $23.06 | $25.84 | $20.91 | $22.11 | $21.62 | $22.16 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .15 | .23 | .19 | .16 | .15 | .21 |

| Net realized and unrealized gain (loss) | 1.71 | (2.15) | 4.90 | (1.34) | .34 | (.52) |

| Total from investment operations | 1.86 | (1.92) | 5.09 | (1.18) | .49 | (.31) |

| Distributions from net investment income | (.15) | (.17) | (.15) | (.02) | – | (.15) |

| Distributions from net realized gain | (.73) | (.69) | (.02) | – | – | (.08) |

| Total distributions | (.88) | (.86) | (.16)B | (.02) | – | (.23) |

| Redemption fees added to paid in capitalA | – | – | –C | –C | –C | –C |

| Net asset value, end of period | $24.04 | $23.06 | $25.84 | $20.91 | $22.11 | $21.62 |

| Total ReturnD,E,F | 8.59% | (7.71)% | 24.57% | (5.34)% | 2.27% | (1.42)% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | 1.37%I | 1.44% | 1.46% | 1.56% | 1.55% | 1.48% |

| Expenses net of fee waivers, if any | 1.37%I | 1.43% | 1.46% | 1.56% | 1.55% | 1.48% |

| Expenses net of all reductions | 1.34%I | 1.43% | 1.44% | 1.56% | 1.55% | 1.48% |

| Net investment income (loss) | 1.30%I | .90% | .84% | .76% | .69% | .92% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $226 | $218 | $272 | $237 | $285 | $293 |

| Portfolio turnover rateJ | 56%I | 39% | 42% | 94% | 29% | 39% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.16 per share is comprised of distributions from net investment income of $.148 and distributions from net realized gain of $.015 per share.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Overseas Fund Class C

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $21.72 | $24.41 | $19.74 | $20.98 | $20.63 | $21.21 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .07 | .07 | .05 | .03 | .02 | .07 |

| Net realized and unrealized gain (loss) | 1.62 | (2.02) | 4.64 | (1.27) | .33 | (.50) |

| Total from investment operations | 1.69 | (1.95) | 4.69 | (1.24) | .35 | (.43) |

| Distributions from net investment income | – | (.06) | (.01) | – | – | (.07) |

| Distributions from net realized gain | (.73) | (.69) | (.02) | – | – | (.08) |

| Total distributions | (.73) | (.74)B | (.02)C | – | – | (.15) |

| Redemption fees added to paid in capitalA | – | – | –D | –D | –D | –D |

| Net asset value, end of period | $22.68 | $21.72 | $24.41 | $19.74 | $20.98 | $20.63 |

| Total ReturnE,F,G | 8.22% | (8.23)% | 23.81% | (5.91)% | 1.70% | (2.06)% |

| Ratios to Average Net AssetsH,I | | | | | | |

| Expenses before reductions | 1.99%J | 2.03% | 2.06% | 2.16% | 2.15% | 2.08% |

| Expenses net of fee waivers, if any | 1.99%J | 2.03% | 2.05% | 2.16% | 2.15% | 2.08% |

| Expenses net of all reductions | 1.96%J | 2.02% | 2.04% | 2.16% | 2.14% | 2.08% |

| Net investment income (loss) | .68%J | .31% | .24% | .16% | .09% | .32% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $7 | $13 | $17 | $16 | $19 | $19 |

| Portfolio turnover rateK | 56%J | 39% | 42% | 94% | 29% | 39% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.74 per share is comprised of distributions from net investment income of $.058 and distributions from net realized gain of $.685 per share.

C Total distributions of $.02 per share is comprised of distributions from net investment income of $.009 and distributions from net realized gain of $.015 per share.

D Amount represents less than $.005 per share.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Total returns do not include the effect of the contingent deferred sales charge.

H Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Annualized

K Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Overseas Fund Class I

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $22.99 | $25.74 | $20.86 | $22.06 | $21.55 | $22.07 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .20 | .36 | .31 | .27 | .27 | .32 |

| Net realized and unrealized gain (loss) | 1.70 | (2.15) | 4.87 | (1.33) | .34 | (.52) |

| Total from investment operations | 1.90 | (1.79) | 5.18 | (1.06) | .61 | (.20) |

| Distributions from net investment income | (.32) | (.28) | (.29) | (.14) | (.10) | (.24) |

| Distributions from net realized gain | (.73) | (.69) | (.02) | – | – | (.08) |

| Total distributions | (1.05) | (.96)B | (.30)C | (.14) | (.10) | (.32) |

| Redemption fees added to paid in capitalA | – | – | –D | –D | –D | –D |

| Net asset value, end of period | $23.84 | $22.99 | $25.74 | $20.86 | $22.06 | $21.55 |

| Total ReturnE,F | 8.87% | (7.23)% | 25.24% | (4.85)% | 2.82% | (.95)% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | .86%I | .92% | .95% | 1.04% | 1.03% | .96% |

| Expenses net of fee waivers, if any | .86%I | .92% | .94% | 1.04% | 1.03% | .96% |

| Expenses net of all reductions | .82%I | .91% | .92% | 1.03% | 1.02% | .96% |

| Net investment income (loss) | 1.81%I | 1.42% | 1.35% | 1.28% | 1.21% | 1.44% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $313 | $305 | $306 | $311 | $298 | $330 |

| Portfolio turnover rateJ | 56%I | 39% | 42% | 94% | 29% | 39% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.96 per share is comprised of distributions from net investment income of $.276 and distributions from net realized gain of $.685 per share.

C Total distributions of $.30 per share is comprised of distributions from net investment income of $.287 and distributions from net realized gain of $.015 per share.

D Amount represents less than $.005 per share.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Overseas Fund Class Z

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | |

| | 2019 | 2018 | 2017 A |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $23.00 | $25.76 | $20.88 |

| Income from Investment Operations | | | |

| Net investment income (loss)B | .22 | .38 | .19 |

| Net realized and unrealized gain (loss) | 1.69 | (2.14) | 4.69 |

| Total from investment operations | 1.91 | (1.76) | 4.88 |

| Distributions from net investment income | (.36) | (.31) | – |

| Distributions from net realized gain | (.73) | (.69) | – |

| Total distributions | (1.09) | (1.00) | – |

| Net asset value, end of period | $23.82 | $23.00 | $25.76 |

| Total ReturnC,D | 8.95% | (7.13)% | 23.37% |

| Ratios to Average Net AssetsE,F | | | |

| Expenses before reductions | .73%G | .79% | .82%G |

| Expenses net of fee waivers, if any | .73%G | .79% | .82%G |

| Expenses net of all reductions | .69%G | .78% | .80%G |

| Net investment income (loss) | 1.94%G | 1.55% | 1.02%G |

| Supplemental Data | | | |

| Net assets, end of period (in millions) | $19 | $47 | $2 |

| Portfolio turnover rateH | 56%G | 39% | 42% |

A For the period February 1, 2017 (commencement of sale of shares) to October 31, 2017.

B Calculated based on average shares outstanding during the period.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended April 30, 2019

(Amounts in thousands except percentages)

1. Organization.

Fidelity Advisor Overseas Fund (the Fund) is a fund of Fidelity Advisor Series VIII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Effective March 1, 2019, Class C shares will automatically convert to Class A shares after a holding period of ten years from the initial date of purchase, with certain exceptions.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

ETFs are valued at their last sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of April 30, 2019 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), deferred trustees compensation and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $110,726 |

| Gross unrealized depreciation | (19,982) |

| Net unrealized appreciation (depreciation) | $90,744 |

| Tax cost | $527,886 |

Delayed Delivery Transactions and When-Issued Securities. During the period, the Fund transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The securities purchased on a delayed delivery or when-issued basis are identified as such in the Fund's Schedule of Investments. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment.

|

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $164,399 and $205,368, respectively.

6. Fees and Other Transactions with Affiliates.

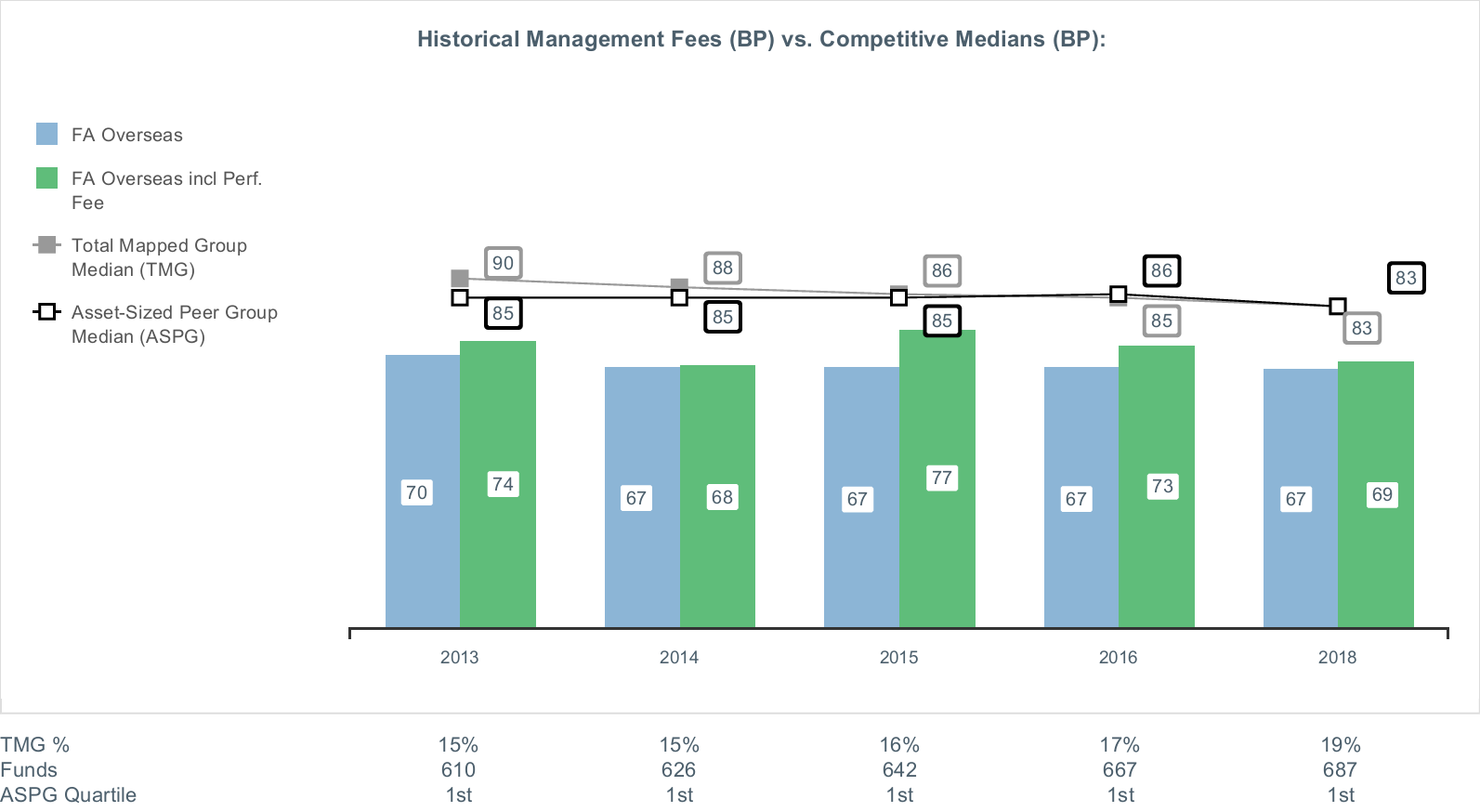

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .424% of the Fund's average net assets and an annualized group fee rate that averaged .24% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the investment performance of the asset-weighted return of all classes as compared to its benchmark index, the MSCI EAFE Index, over the same 36 month performance period. For the reporting period, the total annualized management fee rate, including the performance adjustment, was .57% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution Fee | Service Fee | Total Fees | Retained by FDC |

| Class A | -% | .25% | $55 | $2 |

| Class M | .25% | .25% | 537 | 25 |

| Class C | .75% | .25% | 53 | 4 |

| | | | $645 | $31 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges are 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained by FDC |

| Class A | $2 |

| Class M | 12 |

| Class C(a) | –(b) |

| | $14 |

(a) When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

(b) In the amount of less than five hundred dollars.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund, except for Class Z. FIIOC receives an asset-based fee of Class Z's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets(a) |

| Class A | $50 | .23 |

| Class M | 203 | .19 |

| Class C | 16 | .31 |

| Class I | 265 | .18 |

| Class Z | 6 | .05 |

| | $540 | |

(a) Annualized

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Prior to April 1, 2019, FSC had a separate agreement with the Fund for administration of the security lending program, based on the number and duration of lending transactions. For the period, the total fees paid for accounting and administration of securities lending were equivalent to an annualized rate of .05%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were in the amount of less than five hundred dollars for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $1 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $47. During the period, there were no securities loaned to FCM.

9. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $96 for the period.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $2.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended

April 30, 2019 | Year ended

October 31, 2018 |

| Distributions to shareholders | | |

| Class A | $1,792 | $2,452 |

| Class M | 8,320 | 8,968 |

| Class C | 405 | 506 |

| Class I | 13,825 | 11,363 |

| Class Z | 2,162 | 140 |

| Total | $26,504 | $23,429 |

11. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended April 30, 2019 | Year ended October 31, 2018 | Six months ended April 30, 2019 | Year ended October 31, 2018 |

| Class A | | | | |

| Shares sold | 303 | 268 | $6,729 | $6,680 |

| Reinvestment of distributions | 82 | 97 | 1,682 | 2,369 |

| Shares redeemed | (173) | (1,166) | (3,811) | (28,586) |

| Net increase (decrease) | 212 | (801) | $4,600 | $(19,537) |

| Class M | | | | |

| Shares sold | 680 | 1,484 | $15,293 | $37,742 |

| Reinvestment of distributions | 387 | 354 | 8,221 | 8,851 |

| Shares redeemed | (1,143) | (2,899) | (25,641) | (73,413) |

| Net increase (decrease) | (76) | (1,061) | $(2,127) | $(26,820) |

| Class C | | | | |

| Shares sold | 14 | 85 | $291 | $2,077 |

| Reinvestment of distributions | 20 | 20 | 400 | 477 |

| Shares redeemed | (339) | (189) | (7,316) | (4,547) |

| Net increase (decrease) | (305) | (84) | $(6,625) | $(1,993) |

| Class I | | | | |

| Shares sold | 988 | 3,512 | $21,295 | $87,065 |

| Reinvestment of distributions | 498 | 332 | 10,458 | 8,235 |

| Shares redeemed | (1,625) | (2,465) | (36,309) | (61,772) |

| Net increase (decrease) | (139) | 1,379 | $(4,556) | $33,528 |

| Class Z | | | | |

| Shares sold | 323 | 3,080 | $7,167 | $77,109 |

| Reinvestment of distributions | 51 | 5 | 1,076 | 118 |

| Shares redeemed | (1,611) | (1,104) | (33,289) | (27,398) |

| Net increase (decrease) | (1,237) | 1,981 | $(25,046) | $49,829 |

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, Strategic Advisers Fidelity International Fund was the owner of record of approximately 12% of the total outstanding shares of the Fund.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2018 to April 30, 2019).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Annualized Expense Ratio-A | Beginning

Account Value

November 1, 2018 | Ending

Account Value

April 30, 2019 | Expenses Paid

During Period-B

November 1, 2018

to April 30, 2019 |

| Class A | 1.16% | | | |

| Actual | | $1,000.00 | $1,086.80 | $6.00 |

| Hypothetical-C | | $1,000.00 | $1,019.04 | $5.81 |

| Class M | 1.37% | | | |

| Actual | | $1,000.00 | $1,085.90 | $7.09 |

| Hypothetical-C | | $1,000.00 | $1,018.00 | $6.85 |

| Class C | 1.99% | | | |

| Actual | | $1,000.00 | $1,082.20 | $10.27 |

| Hypothetical-C | | $1,000.00 | $1,014.93 | $9.94 |

| Class I | .86% | | | |

| Actual | | $1,000.00 | $1,088.70 | $4.45 |

| Hypothetical-C | | $1,000.00 | $1,020.53 | $4.31 |

| Class Z | .73% | | | |

| Actual | | $1,000.00 | $1,089.50 | $3.78 |

| Hypothetical-C | | $1,000.00 | $1,021.17 | $3.66 |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

C 5% return per year before expenses

Board Approval of Investment Advisory Contracts [and Management Fees]

Fidelity Advisor Overseas Fund

Each year, the Board of Trustees, including the Independent Trustees (together, the Board), votes on the renewal of the management contract with Fidelity Management & Research Company (FMR) and the sub-advisory agreements (together, the Advisory Contracts) for the fund. FMR and the sub-advisers are referred to herein as the Investment Advisers. The Board, assisted by the advice of fund counsel and Independent Trustees' counsel, requests and considers a broad range of information relevant to the renewal of the Advisory Contracts throughout the year.