Exhibit 99.1

300 W. 6th St. One American Center Frost Bank Tower One Congress San Jacinto Center

Austin Market Update

September 10, 2013

Additional Information

In connection with the proposed transaction, Parkway Properties Inc. expects to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Parkway and Thomas Properties that also constitutes a prospectus of Parkway, which joint proxy statement will be mailed or otherwise disseminated to Parkway and Thomas Properties shareholders when it becomes available. Parkway and Thomas Properties also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE

JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by Parkway and Thomas Properties with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by the companies will be available free of charge on their websites at www.pky.com and www.tpgre.com or by contacting Investor Relations at the companies (for Parkway at (407) 650-0593 and for Thomas Properties at (213) 613-1900).

Parkway and Thomas Properties and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about Parkway’s executive officers and directors in Parkway’s definitive proxy statement filed with the SEC on April 4, 2013 in connection with its 2013 annual meeting of shareholders. You can find information about Thomas Properties’ executive officers and directors in Thomas Properties’ definitive proxy statement filed with the SEC on April 30, 2013 in connection with its 2013 annual meeting of shareholders. Additional information regarding the interests of such potential participants will be included in the joint proxy statement/prospectus and other relevant documents filed with the SEC if and when they become available. You may obtain free copies of these documents from Parkway or Thomas Properties using the sources indicated above.

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. 2

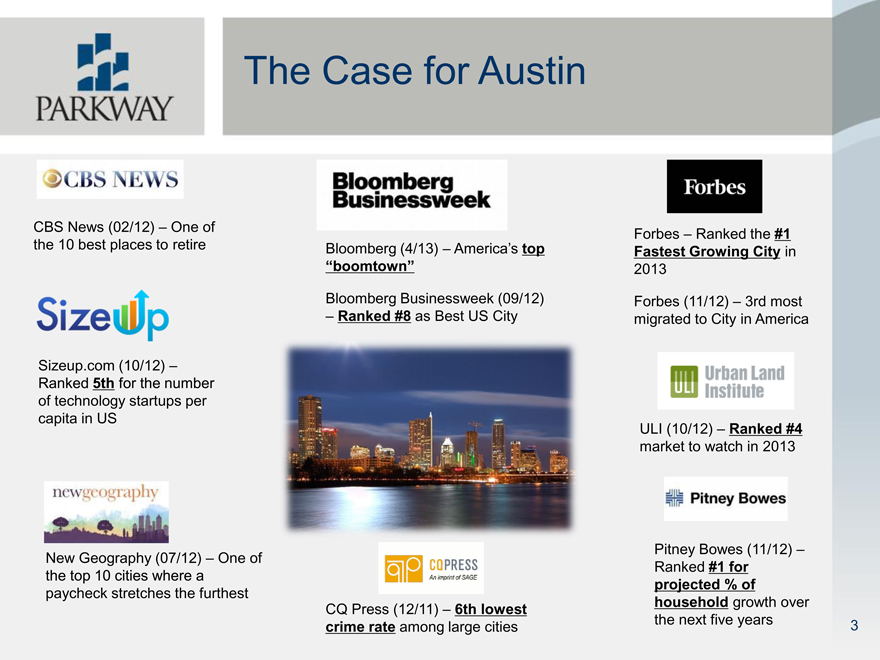

The Case for Austin

CBS News (02/12) – One of the 10 best places to retire

Bloomberg (4/13) – America’s top

“boomtown”

Bloomberg Businessweek (09/12)

– Ranked #8 as Best US City

Forbes – Ranked the #1 Fastest Growing City in 2013

Forbes (11/12) – 3rd most migrated to City in America

Sizeup.com (10/12) –Ranked 5th for the number of technology startups per capita in US

New Geography (07/12) – One of the top 10 cities where a paycheck stretches the furthest

CQ Press (12/11) – 6th lowest crime rate among large cities

ULI (10/12) – Ranked #4 market to watch in 2013

Pitney Bowes (11/12) – Ranked #1 for projected % of household growth over the next five years

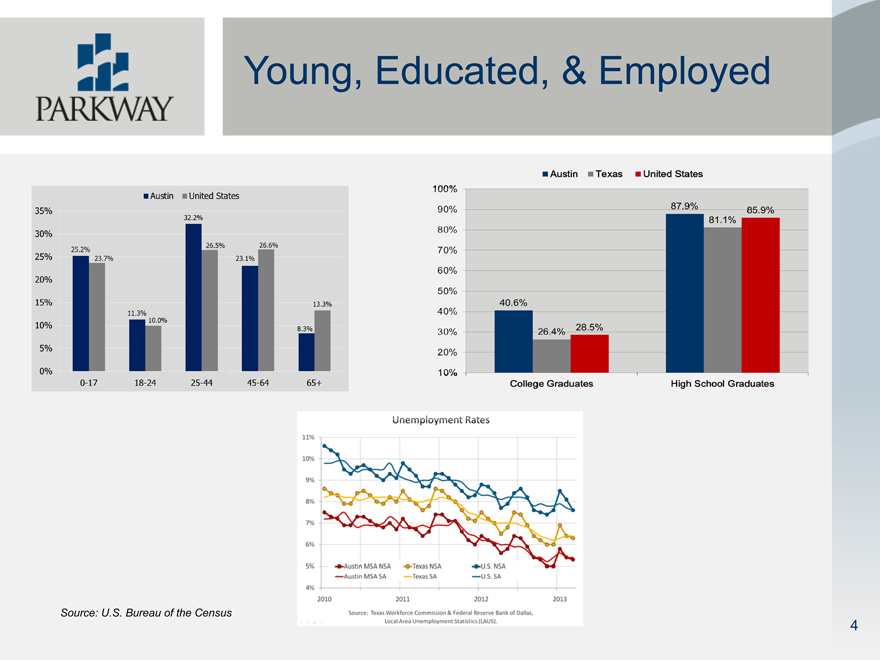

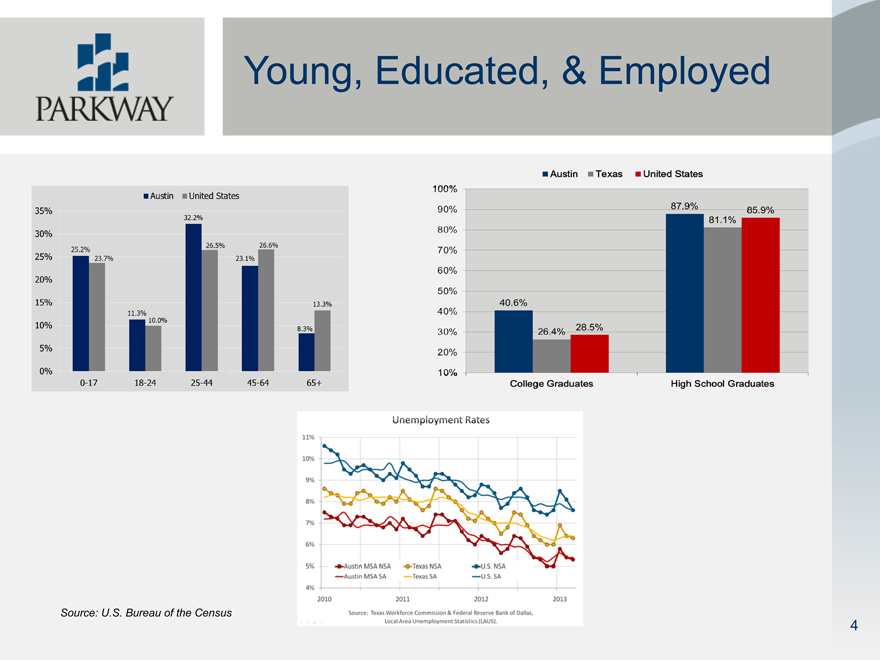

Young, Educated, & Employed

Source: U.S. Bureau of the Census

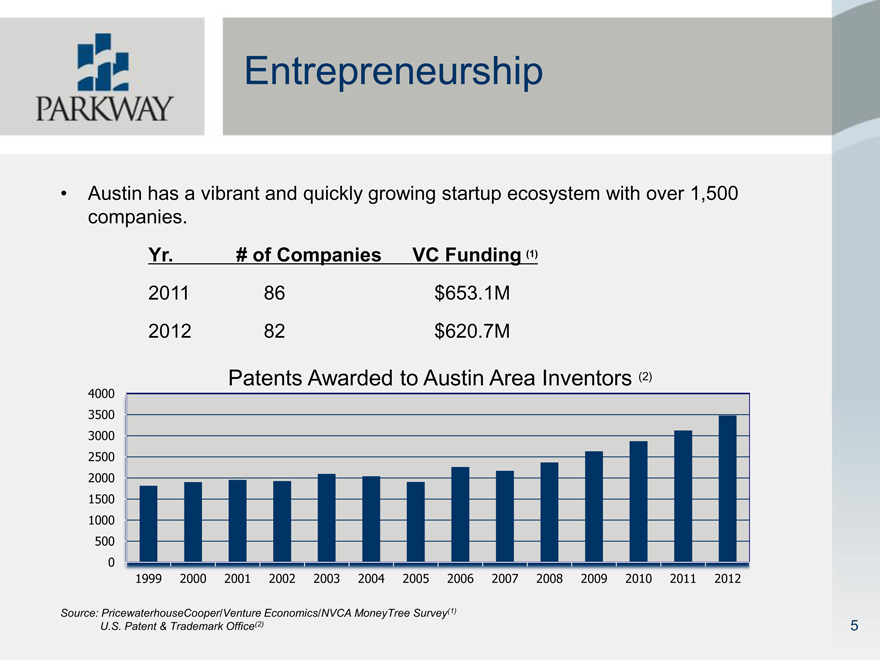

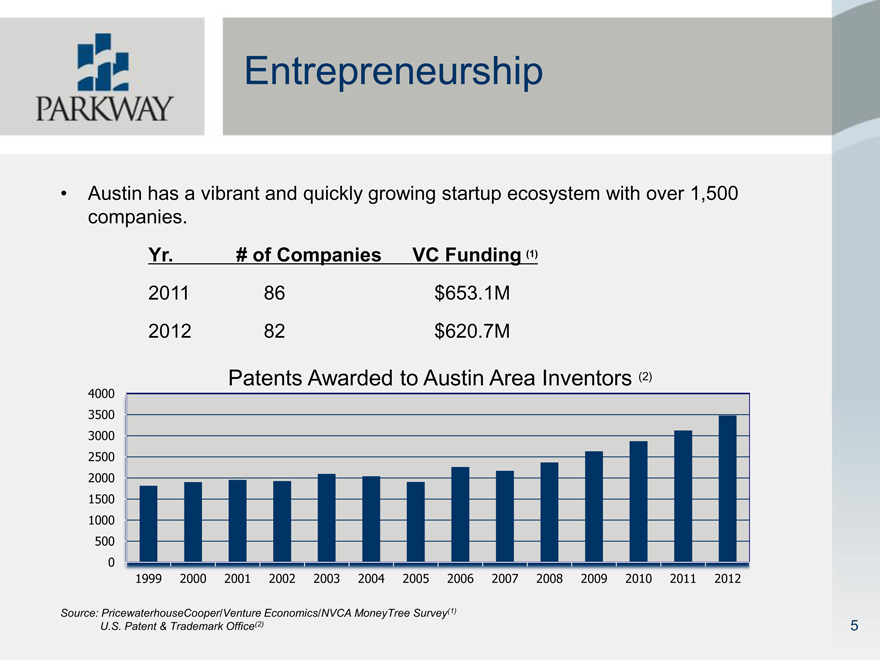

Entrepreneurship

Austin has a vibrant and quickly growing startup ecosystem with over 1,500 companies.

Yr. # of Companies VC Funding (1)

2011 86 $653.1M 2012 82 $620.7M

Patents Awarded to Austin Area Inventors (2)

Patents Awarded to Austin Area Inventors (2)

4000 3500 3000 2500 2000 1500 1000 500 0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Source: PricewaterhouseCooper/Venture Economics/NVCA MoneyTree Survey(1)

U.S. Patent & Trademark Office(2) 5

Technology – more stability

Tech industry started in 1987 with launch of SEMATECH which was an industry/gov’t venture to strengthen U.S. semi-conductor industry

IBM, Freescale, AMD, Samsung, Intel and Apple all have large presence in Austin

Austin is now home to over 4,400 technology companies that employ over 109,000 people (13.5% of the work force base)

Avg. earnings per job in tech sector is $115,361 compared to $52,488 for Austin economy as a whole

For every one new job created in the tech sector, the Austin economy gains an additional 2.5 jobs

Businesses like Capital Factory and Main Street Hub help drive emerging businesses

Tech employment expected to grow 9% between 2012-2017, adding 9,000 jobs

Source: Austin Chamber of Commerce: Technology Ecosystem 6

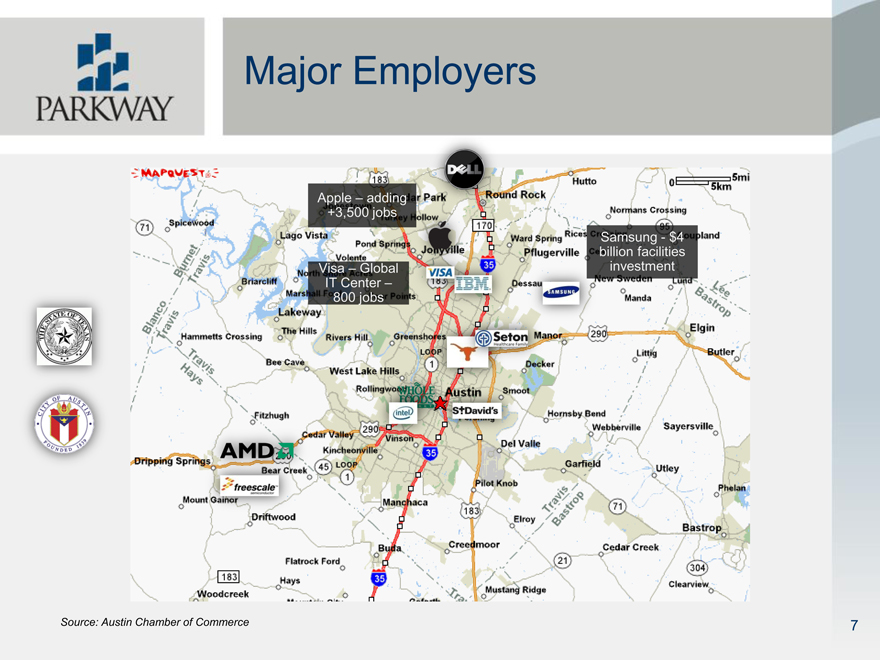

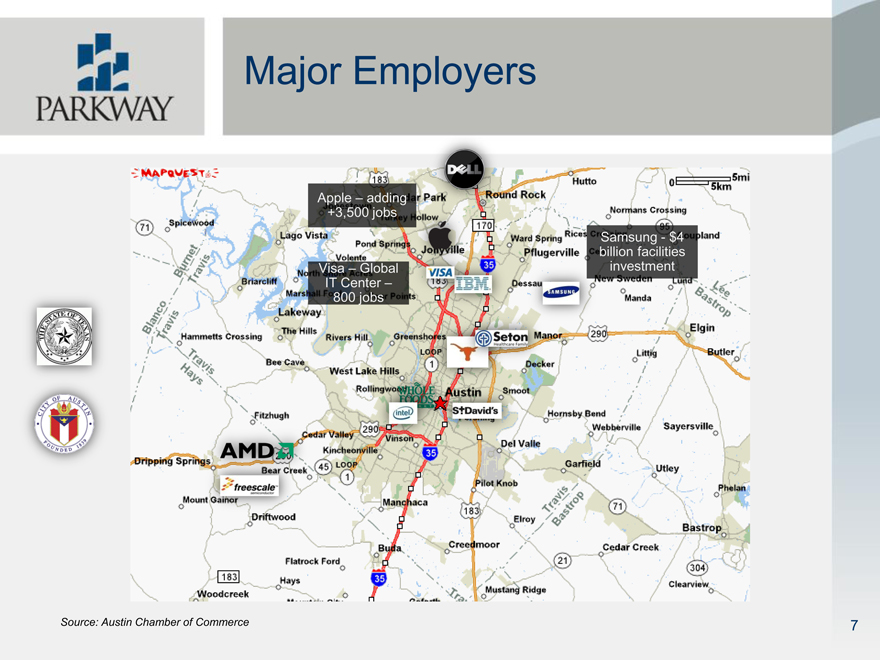

Major Employers

Apple – adding +3,500 jobs

Samsung—$4 billion facilities Visa – Global investment IT Center – 800 jobs

Source: Austin Chamber of Commerce 7

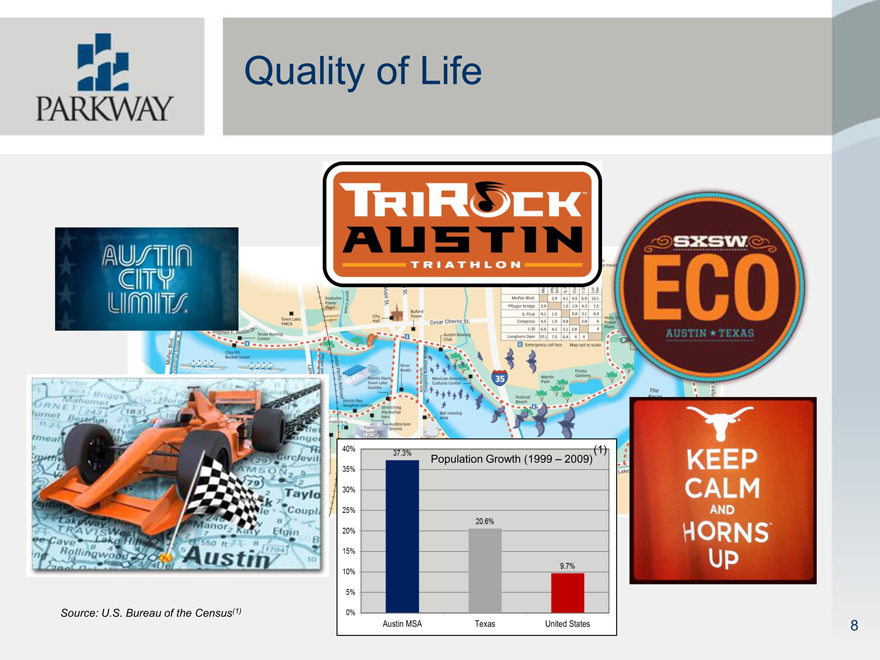

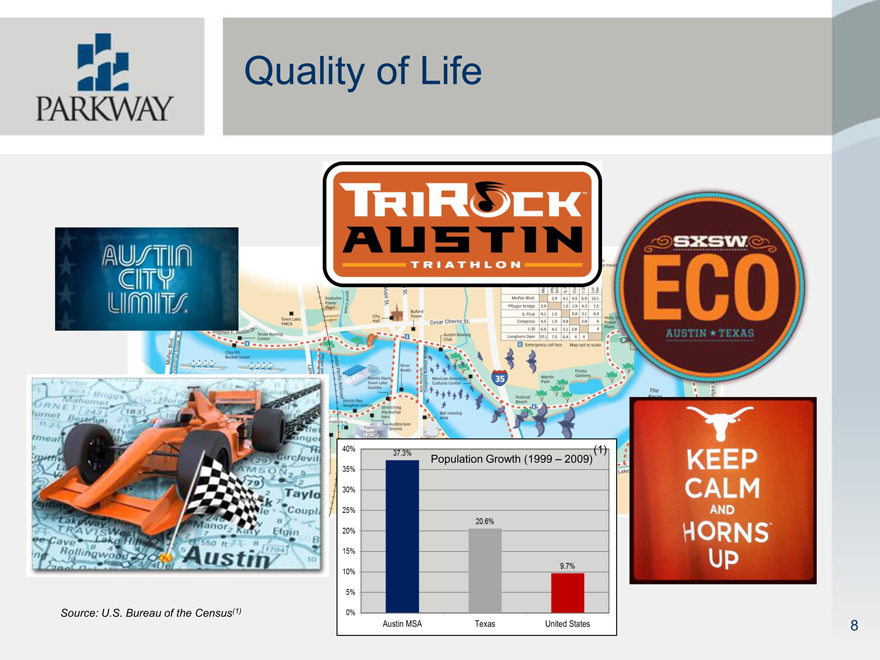

Quality of Life

Population Growth (1999 – 2009) (1)

Source: U.S. Bureau of the Census(1)

Real Estate

3,135 Single family homes sold in July 2013. 29% more than 2012

Median home price $228,250. 8% more than July 2012

2.8 months of inventory in July 2013, 1.7 months less than July 2012

In July homes spent an average of 41 days on the market compared to 60 days a year earlier

Urban Land Institute revealed that Austin’s real estate market is the #4 best market to watch in the US.

While still considered a secondary market by most institutional investors, Austin has many characteristics of primary markets – technology companies, government, and educated workforce

Source: MLS Report from Austin Board of Realtors

9

CBD Office Market Drivers(1)

University of Texas

Retail

Capitol Complex & Courthouses

Convention Center

Teaching Hospital/Medical School

Multi-family – “live, work, play”

Barriers to Entry

Source: Austin Chamber of Commerce(1)

10

University of Texas(1)

Approximately 52,000 students

Approximately 24,000 faculty and staff

Continuing education enrollment 300,000

$17.15 billion endowment (#3 Nationally)

Approximately 450,000 alumni

12,000 degrees awarded yearly

$2.14 billion operating budget

Source: University of Texas at Austin(1)

11

Capitol Complex & Courthouses

Capitol Complex includes 46 square blocks in downtown Austin

Complex includes office buildings, parking garages, museums and courthouses

Downtown includes federal, state and municipal courthouses

The new Federal Courthouse just opened in downtown (8 floors/252,000 SF)

Source: www.austintexas.gov/department/capitol-complex

12

Convention Center

881,400 Gross Square Feet (6 city blocks)

Located in the heart of downtown

2 Garages (1,600 + parking spaces)

In 2012 the convention center hosted 148 total events that generated approximately 226,000 booked overnight hotel stays with a total attendance of slightly over 600,000

Source: www.austinconventioncenter.com/pressroom/facts.htm

13

UT Medical School & Teaching Hospital

A combined effort among Travis County, University of Texas and Seton Healthcare

Medical school alone could create 15,000 jobs and generate $2 billion annually to the local economy

Expanded research facilities for biotech and pharmaceuticals

Likely located near Brackenridge Hospital and Erwin Center (central Austin near CBD)

Source: University of Texas at Austin Dell Medical School News

14

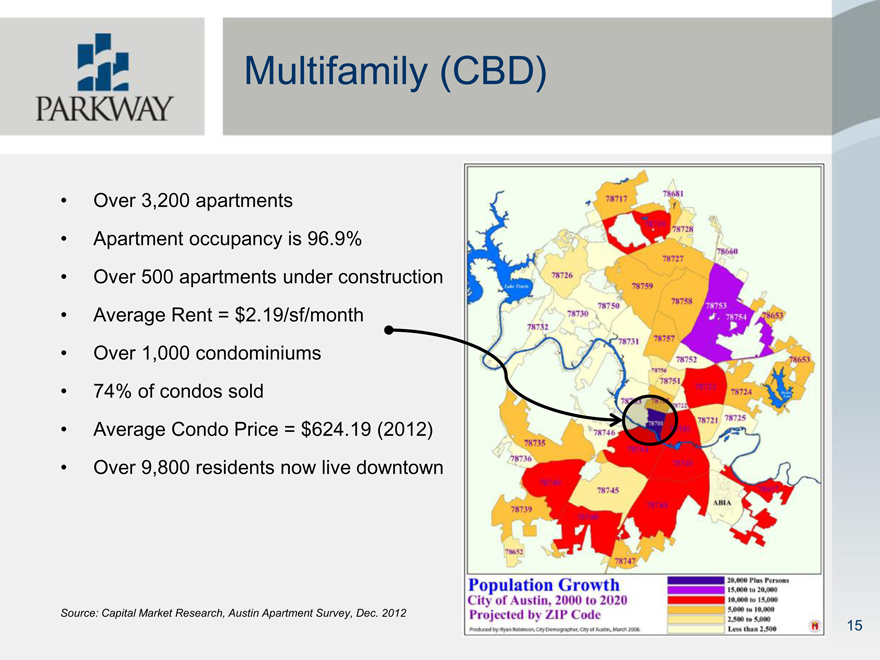

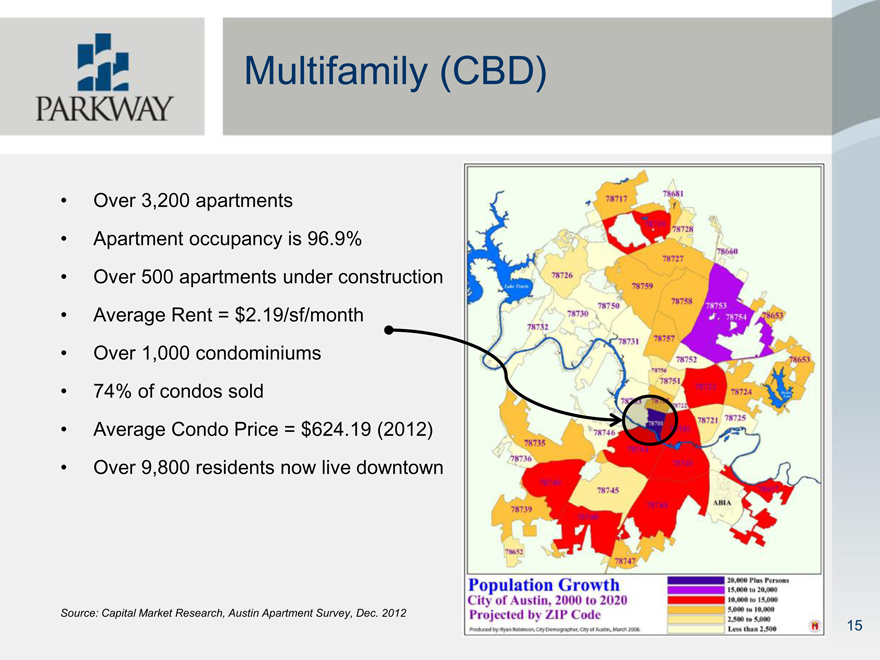

Multifamily (CBD)

Over 3,200 apartments

Apartment occupancy is 96.9%

Over 500 apartments under construction

Average Rent = $2.19/sf/month

Over 1,000 condominiums

74% of condos sold

Average Condo Price = $624.19 (2012)

Over 9,800 residents now live downtown

Source: Capital Market Research, Austin Apartment Survey, Dec. 2012

15

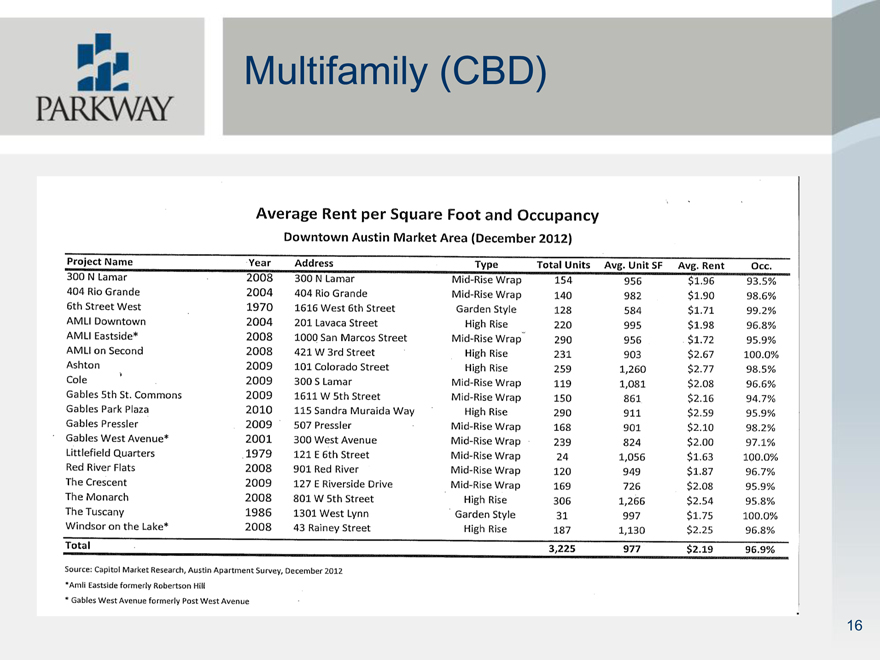

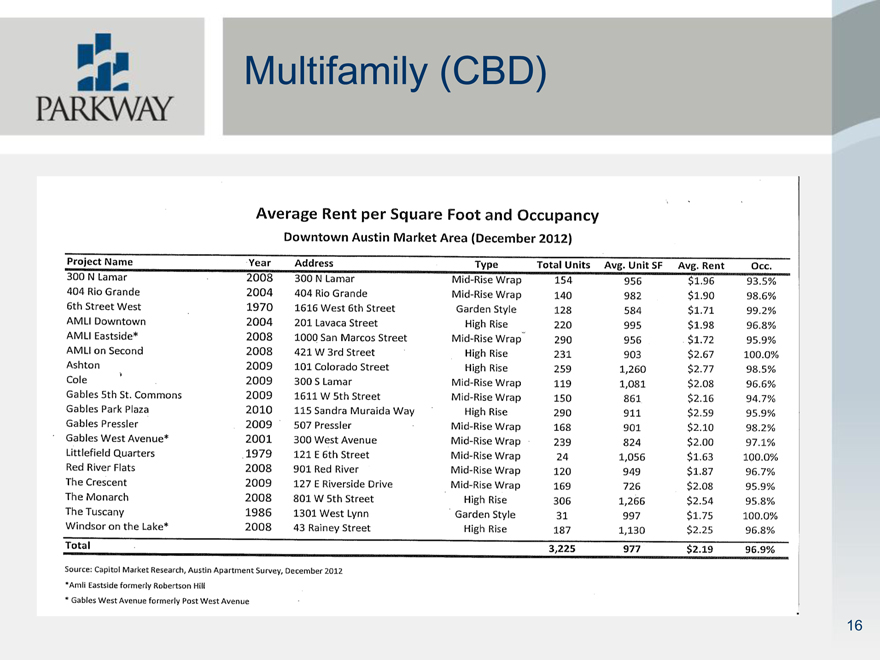

Multifamily (CBD)

16

Living: Trending towards CBD

The Whitley

(2013)

The Monarch AMLI on 2nd The Austonian

(2008) (2008) (2010)

The Gables 360 Condos

Spring Condos (2008) W Austin

(2009) (2010) (2011) The Ashton Four Seasons

(2009) Residences

(2010)

CBD Housing driving tech downtown

18

Barriers to Entry

Environmental constraints

Edwards Aquifer

Protected Species

Save our Springs

Entitlement Process

Capital View Corridor

Limited number of quality CBD sites

Market size constrains large developments

19

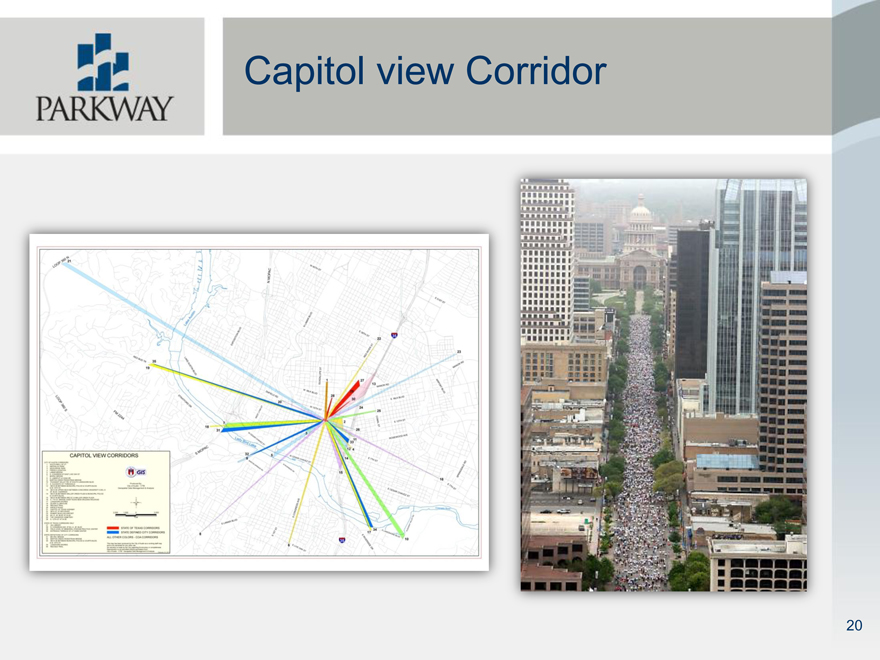

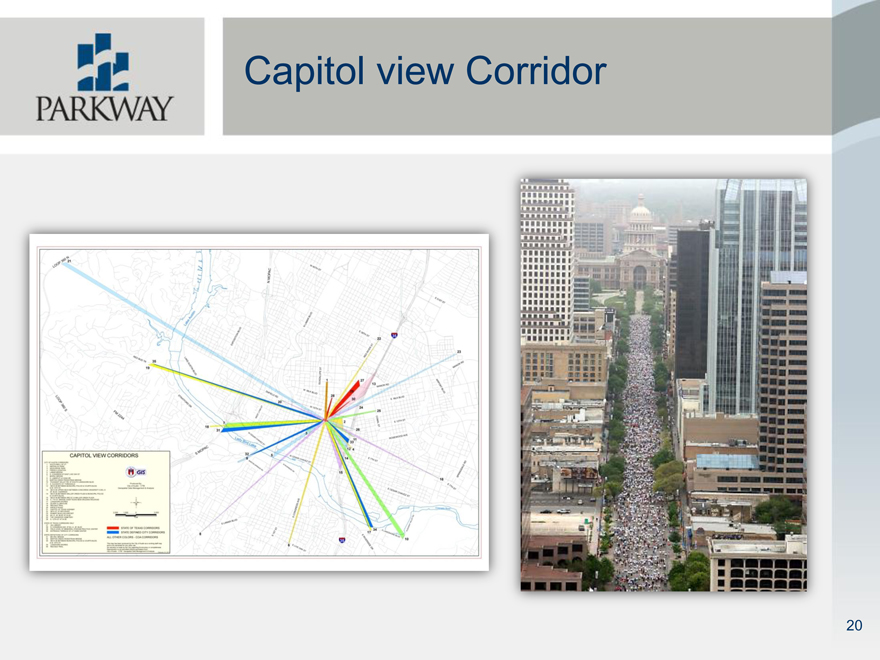

Capitol view Corridor

20

Austin Office Market(1)

Market Size 40.6 million Square Feet

Submarkets CBD – 9 mm SF (Class A – 4.1mm) SW – 8.6 mm SF (Class A – 5.4mm) NW – 15.7 mm SF (Class A – 9.7mm SF)

Features CBD – Live, Work, Play, UT, Capitol SW – Prox. to CBD, High Tech, Scenic NW – Dell, Growth Cos., Campus Setting

Source: CoStar(1)

21

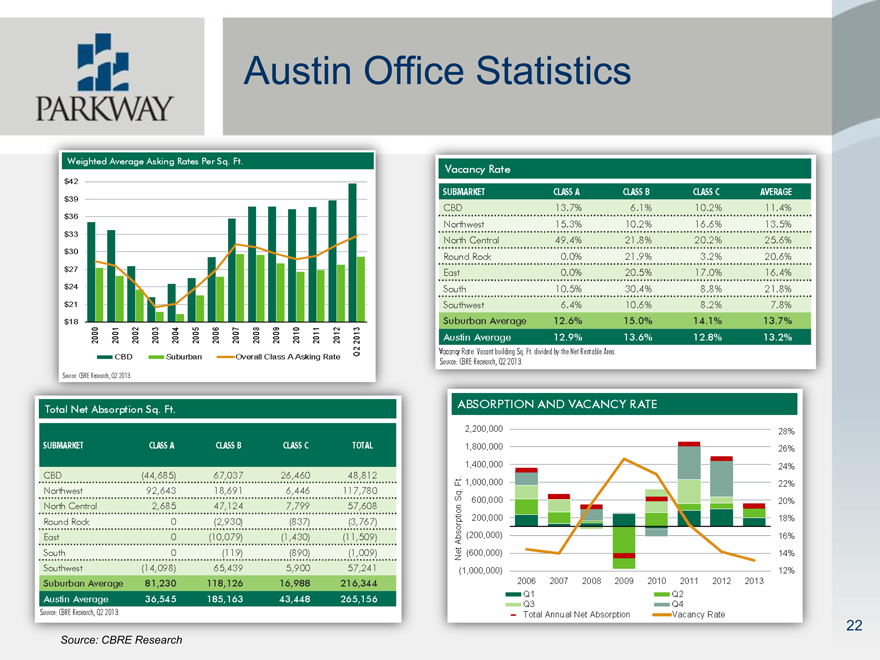

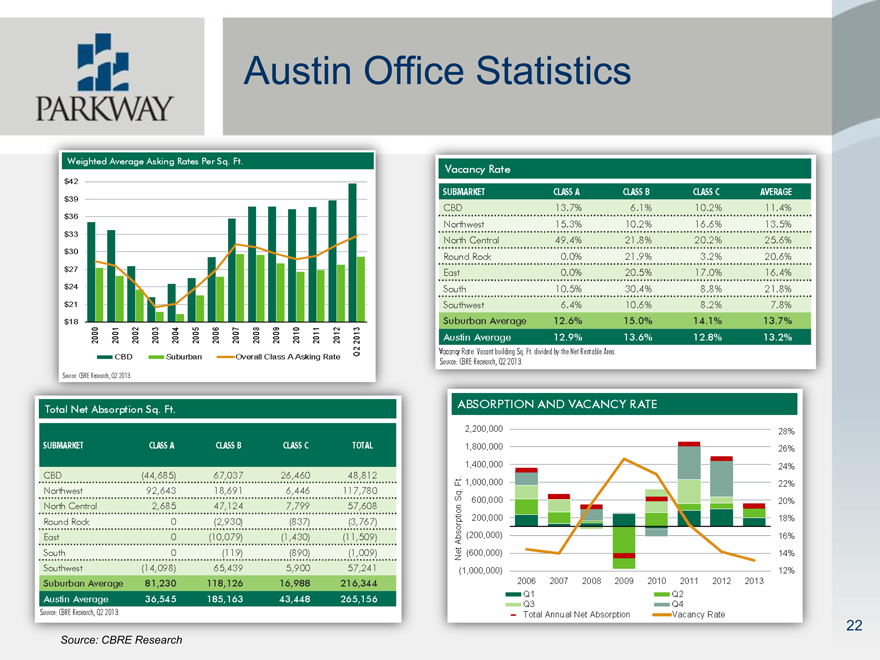

Austin Office Statistics

Source: CBRE Research 22

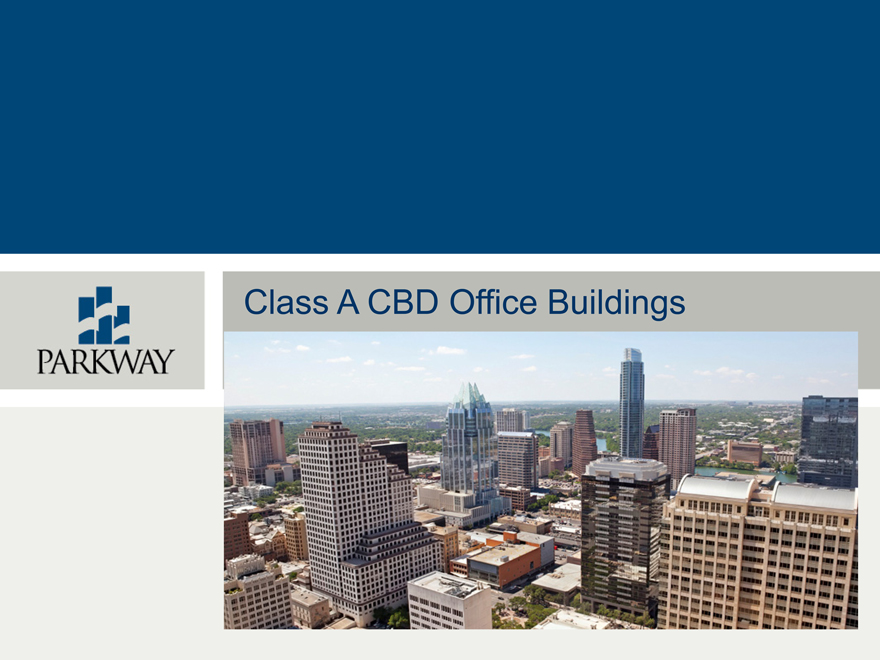

Class A CBD Office Buildings

Class A Primary Market

816 One American 515

Congress Austin Center Congress Center

300 W. 6th Street

Frost Bank Tower

Chase Tower

301 Congress

100 One San Jacinto

Congress Congress Center 24

Austin Thomas Portfolio

Frost Bank San Jacinto One Congress One American

Tower 300 West 6th Street Center Plaza Center

Submarket CBD CBD CBD CBD CBD

RSF 535,078 454,225 410,248 518,385 503,951

Year Built (Renovated) 2003 2001 1987 1987 1984 (1992)

Occupancy (6/30/2013) 94.8% 89.9% 81.2% 83.5% 75.9%

Quoted Rents (NNN) $32-35 $30-32 $25-28 $27-30 $25-28

Portfolio Highlights

Five Class A, Trophy assets comprising 2.4mm RSF All five assets are LEED EB Gold certified

Represents ~58% of Class A office inventory Anchored by a diverse, stable tenant base including

in CBD1 legal, financial services, insurance firms and

Centrally located in thriving downtown Austin CBD technology companies such as Facebook

Source: CoStar(1)

25

Parkway Properties, Inc. 390 North Orange Avenue Suite 2400

Orlando, FL 32801

(407) 650-0593 www.pky.com