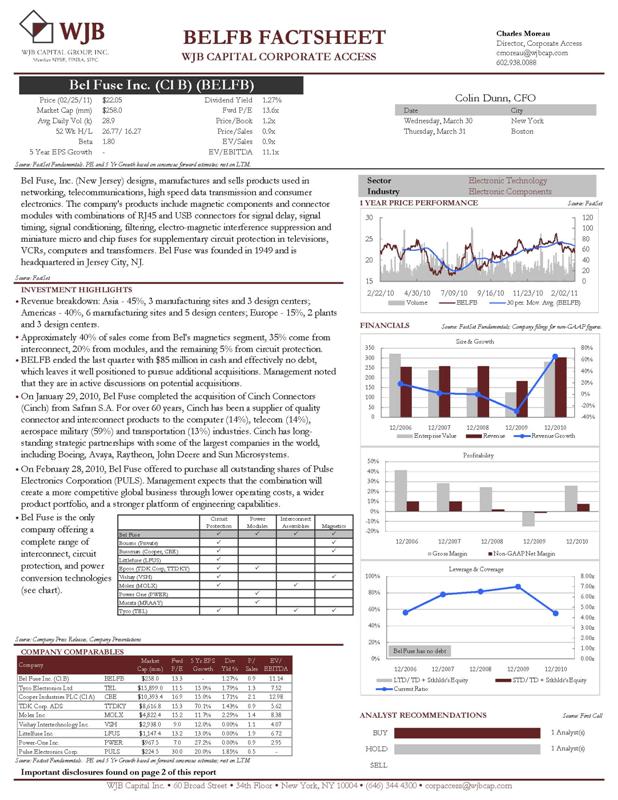

ABOUT BEL FUSE INC.

Bel (www.belfuse.com) and its divisions are primarily engaged in the design, manufacture, and sale of products used in networking, telecommunications, high-speed data transmission, commercial aerospace, military, transportation, and consumer electronics. Products include magnetics (discrete components, power transformers and MagJack® connectors with integrated magnetics), modules (DC-DC converters, integrated analog front-end modules and custom designs), circuit protection (miniature, micro and surface mount fuses) and interconnect devices (micro, circular and filtered D-Sub connectors, passive jacks, plugs and high-speed cable assemblies). Bel operates facilities around the world.

ADDITIONAL INFORMATION

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. No tender offer for the shares of Pulse Electronics Corporation (“Pulse Electronics”) has commenced at this time. In connection with Bel’s proposed business combination with Pulse Electronics, Bel may file tender offer documents with the U.S. Securities and Exchange Commission (“SEC”). Any definitive tender offer documents will be mailed to shareholders of Pulse Electronics. INVESTORS AND SECURITY HOLDERS OF PULSE ELECTRONICS ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Bel through the web site maintained by the SEC at http://www.sec.gov.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Bel, together with the other Participants (as defined below), has made a preliminary filing with the SEC of a proxy statement (the “Preliminary Proxy Statement”) and accompanying GOLD proxy card to be used to solicit proxies for the election of its slate of director nominees at the 2011 annual meeting of shareholders of Pulse Electronics.

BEL STRONGLY ADVISES ALL SHAREHOLDERS OF PULSE ELECTRONICS TO READ THE PROXY STATEMENT WHEN IT IS AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY STATEMENT ANG GOLD PROXY CARD WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THE SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE UPON REQUEST.

The Participants in the proxy solicitation are anticipated to be Bel, Bel Ventures Inc. (“Bel Ventures”), Timothy E. Brog and James Dennedy and the officers, directors and employees of Bel listed on Schedule I of the Preliminary Proxy Statement (collectively, the “Participants”). As of the date hereof, the Participants collectively own an aggregate of 341,725 shares of Pulse Electronics Common Stock, consisting of the following: (1) 368 shares owned directly by Bel and (2) 341,357 shares owned directly by Bel Ventures.

FORWARD-LOOKING STATEMENTS

Except for historical information contained in this presentation, the matters discussed in this presentation are forward-looking statements that involve risks and uncertainties. Among the factors that could cause actual results to differ materially from such statements are: the market concerns facing our customers; the continuing viability of sectors that rely on our products; the effects of business and economic conditions; capacity and supply constraints or difficulties; product development, commercializing or technological difficulties; the regulatory and trade environment; risks associated with foreign currencies; uncertainties associated with legal proceedings; the market's acceptance of our new products and competitive responses to those new products; and the risk factors detailed from time to time in our SEC reports. In light of the risks and uncertainties, there can be no assurance that any forward-looking statement will in fact prove to be correct. We undertake no obligation to update or revise any forward-looking statements.