VOTE YOUR GOLD PROXY CARD TODAY

April 11, 2011

Dear Pulse Electronics Shareholder:

Bel Fuse Inc. is seeking your support for the election of our two highly-qualified, independent nominees to the Board of Directors of Pulse Electronics Corporation at Pulse’s 2011 Annual Meeting of Shareholders scheduled to be held on May 18, 2011. We are not seeking control of the Pulse Board and these nominees have no agenda other than examining ALL options available to maximize value for Pulse shareholders. We are seeking representation on the Pulse Board because we believe that the current directors of Pulse have not acted in the best interests of shareholders.

THE PULSE BOARD HAS REFUSED TO ENGAGE IN SERIOUS DISCUSSIONS WITH US REGARDING OUR PROPOSAL TO ACQUIRE PULSE

Over the past decade, the electronic components industry has become increasingly more cost-competitive and, as a result, it has become incrementally more difficult for businesses within the industry to sustain profitable results. Consequently, economies of scale and scope of resources have emerged as two extremely important aspects for remaining competitive and for producing long-term, sustainable shareholder wealth. Recognizing this dynamic, in 2006, representatives from Bel and Pulse began discussing a framework for a potential business combination that made strong strategic sense and that had the potential to create more value than either company could achieve on a standalone basis. Today, with the electronic components industry facing higher operating costs and a more competitive global environment, we are convinced that the strategic rationale for such a combined business entity is even more compelling.

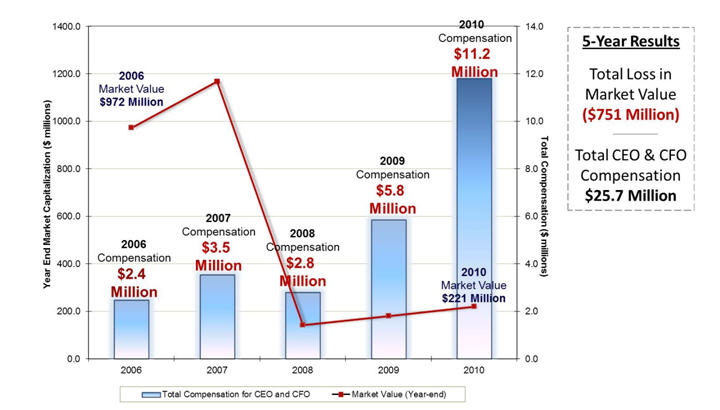

Since 2008, we have attempted to renew merger discussions on four different occasions with members of the Pulse Board. Unfortunately, despite the clear benefits we believe a business combination would yield for both companies and the value such a transaction would create for all shareholders, we were told by members of the Pulse Board that it was either “not the right time for a conversation” or that they preferred to defer substantive negotiations to a future date. Each time, we respectfully honored these requests, patiently waiting while Pulse churned through four CEOs (including an interim CEO), the value of Pulse deteriorated (Pulse’s market value has declined by more than $750 million over the past five years) and the Pulse Board distributed millions in compensation and fringe benefits to a select few senior managers (Pulse’s top two senior managers have been paid $25.7 million in salary, stock awards, tax gross ups, social club memberships, retirement plan benefits and other perks over the past five years).

After years of unsuccessful attempts to engage with the Pulse Board, we felt we had no other option but to make our interest public. On February 28, 2011, we made a compelling proposal for a business combination under which Bel would acquire all of the outstanding shares of Pulse common stock for per share consideration of $6.00 in cash or Bel Class B common stock. In this letter, we expressed our flexibility to negotiate a deal that makes the most sense for Pulse shareholders and invited the Pulse Board to engage with us once again. Following the delivery of this letter, we contacted Pulse’s CEO to indicate our willingness to revise our offer to reflect a higher price if Pulse could demonstrate to us that it was worth more. On March 10, 2011, prior to making any attempt to discuss any alternative transaction or suitable valuation, we received a letter from Pulse summarily rejecting our proposal.

CONSIDER ALL OF THE FACTS REGARDING BEL’S PROPOSAL TO MERGE WITH PULSE

| · | Both companies have agreed in the past that a Bel/Pulse combination is compelling and makes long-term strategic sense for shareholders and other constituents. |

| · | On February 28, 2011, Bel proposed to purchase all of the outstanding shares of Pulse for $6.00 per share. |

| · | The $6.00 per share offer represents a premium of approximately 38% to Pulse’s average closing share price on December 28, 2010 (the last trading day prior to Pulse’s public disclosure of Bel’s interest in discussing a potential business combination). |

| · | The $6.00 per share offer represents a premium of approximately 23% to Pulse’s average closing share price for the 60 trading days ended February 25, 2011. |

| · | The $6.00 per share offer represents a premium of 11% to Pulse’s closing share price on February 25, 2011 (the last trading day before Bel made the proposal). |

| · | Bel’s offer is not opportunistic. Bel has indicated its willingness to negotiate an increased purchase price that reflects any incremental value that Pulse can demonstrate. |

| · | Again, Bel’s offer is not opportunistic. Bel has also indicated its willingness to structure a transaction that makes the most sense for shareholders, including a form of consideration that may include (i) all cash, (ii) Bel stock, or (iii) a combination thereof. |

| · | Bel has a strong balance sheet representing over $85 million in cash and no debt, and is prepared to produce a financing commitment letter from its investment banks once the Pulse Board shows its willingness to negotiate with us. |

| · | Bel is prepared to move quickly to consummate a deal subject to limited due diligence. |

If elected, our two highly-qualified director nominees – who are completely independent of Bel and were introduced to us through a specialized corporate governance consulting firm – will represent a minority of the Pulse Board and are committed to working constructively with the other members of the Pulse Board to ensure that the interests of ALL Pulse shareholders are fully protected.

BEL’S $6.00 PROPOSAL TO ACQUIRE PULSE IS NEGOTIABLE

The Pulse Board has dismissed our $6.00 offer in cash or Bel Class B common stock as opportunistic and unfair, stating that our proposal would give Pulse shareholders no voting rights in the combined company and does not specify the amount of cash and stock being offered. Bel’s offer is not opportunistic nor is it unfair. We have attempted to enter into merger negotiations with Pulse since 2008. Furthermore, as we have previously communicated to Pulse, we are willing to revise our offer to reflect a higher price if Pulse can demonstrate to us that it is worth more.

We have also stated that we are open to discussing alternative structures and forms of consideration. However, the Pulse Board must first agree to discuss such alternatives.

CONSIDER PULSE’S PERFORMANCE OVER THE PAST FIVE YEARS

PULSE HAS LOST $751 MILLION IN MARKET VALUE WHILE THE CEO & CFO HAVE BEEN PAID $25.7 MILLION IN TOTAL COMPENSATION. What should be particularly concerning to shareholders is that, as part of this $25.7 million in total compensation, in June 2009 these two individuals collected one-time change-in-control payments totaling more than $4.0 million following the sale of Pulse’s Medtech subsidiary, a business acquired under the same management team less than 18 months earlier.

PULSE’S ADDITIONAL PERFORMANCE CONCERNS OVER THE PAST FIVE YEARS

Pulse Total Revenues

Decline from $627 million to $432 million (31% decline)

Income from Continuing Operations

Decline from a $46 million profit to a $28 million loss ($74 million decline)

Total CEO & CFO Compensation

$25.7 million (This does NOT include a $0.6 million payment to Daniel Moloney, CEO from March 22 to August 2, 2010)

Total Capital Allocated to Acquisitions

$480 million ($590 million including LK Products in September 2005)

Total Research & Development Expenses

$170 million

Total Goodwill & Intangible Asset Impairment

$411 million (Primarily related to acquisitions)

Total Loss in Market Value

$751 million loss

IN OUR OPINION PULSE SHAREHOLDERS DESERVE BETTER

While we continue to hope that the Pulse Board will work with us to structure a transaction that enables shareholders to receive a full and fair value for their investment, we do not believe this will occur under the stewardship of this current board of directors. Therefore, we are asking you to vote “FOR” the election of our two highly-qualified, independent candidates Timothy E. Brog and James Dennedy to the Pulse Board by signing, dating and returning the enclosed GOLD proxy card in the postage-paid envelope.

Sincerely,

/s/ Daniel Bernstein

Daniel Bernstein

Director, President and CEO

Bel Fuse Inc.

| If you have any questions, require assistance in voting your GOLD proxy card, or need additional copies of Bel Fuse’s proxy materials, please call Alliance Advisors, LLC at the phone numbers or email listed below. Proxy materials are also available at www.ProxyProcess.com/BelFuse

200 Broadacres Drive, 3rd Floor Bloomfield, NJ 07003 (973) 873-7706 (Call Collect) whassan@allianceadvisorsllc.com or CALL TOLL FREE (877)-777-5017 |

ADDITIONAL INFORMATION

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. No tender offer for the shares of Pulse Electronics Corporation (“Pulse”) has commenced at this time. In connection with the proposed transaction, Bel Fuse Inc. (“Bel”) may file tender offer documents with the U.S. Securities and Exchange Commission (“SEC”). Any definitive tender offer documents will be mailed to shareholders of Pulse. INVESTORS AND SECURITY HOLDERS OF PULSE ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Bel through the web site maintained by the SEC at http://www.sec.gov.