4Q14 Quarterly Supplement January 14, 2015 © 2015 Wells Fargo & Company. All rights reserved. Exhibit 99.2

Wells Fargo 4Q14 Supplement 1 Appendix Pages 21-32 - Non-strategic/liquidating loan portfolio 22 - Purchased credit-impaired (PCI) portfolios 23 - Residential mortgage trends 24 - Real estate 1-4 family first mortgage portfolio 25 - Real estate 1-4 family junior lien mortgage portfolio 26 - Consumer credit card portfolio 27 - Auto portfolios 28 - Student lending portfolio 29 Common Equity Tier 1 under Basel III (General Approach) 30 Common Equity Tier 1 under Basel III (Advanced Approach, fully phased-in) 31 Forward-looking statements and additional information 32 Table of contents 4Q14 Results - 4Q14 Highlights Page 2 - Year-over-year results 3 - 4Q14 Revenue diversification 4 - Balance Sheet and credit overview (linked quarter) 5 - Income Statement overview (linked quarter) 6 - Loans 7 - Broad-based, year-over-year loan growth 8 - Commercial and Industrial diversified loan growth 9 - Deposits 10 - Net interest income 11 - Noninterest income 12 - Noninterest expense and efficiency ratio 13 - Community Banking 14 - Wholesale Banking 15 - Wealth, Brokerage and Retirement 16 - Credit quality 17 - Capital position 18 - Capital return 19 - Summary 20 Financial information for certain periods prior to 2014 was revised to reflect our determination that certain factoring arrangements did not qualify as loans. Accordingly, we revised our commercial loan balances for year-end 2012 and each of the quarters in 2013 in order to present the Company’s lending trends on a comparable basis over this period. This revision, which resulted in a reduction to total commercial loans and a corresponding decrease to other liabilities, did not impact the Company’s consolidated net income or total cash flows. We reduced our commercial loans by $3.5 billion, $3.2 billion, $2.1 billion, $1.6 billion, and $1.2 billion at December 31, September 30, June 30, and March 31, 2013, and December 31, 2012, respectively, which represented less than 1% of total commercial loans and less than 0.5% of our total loan portfolio. Other affected financial information, including financial guarantees and financial ratios, has been appropriately revised to reflect this revision.

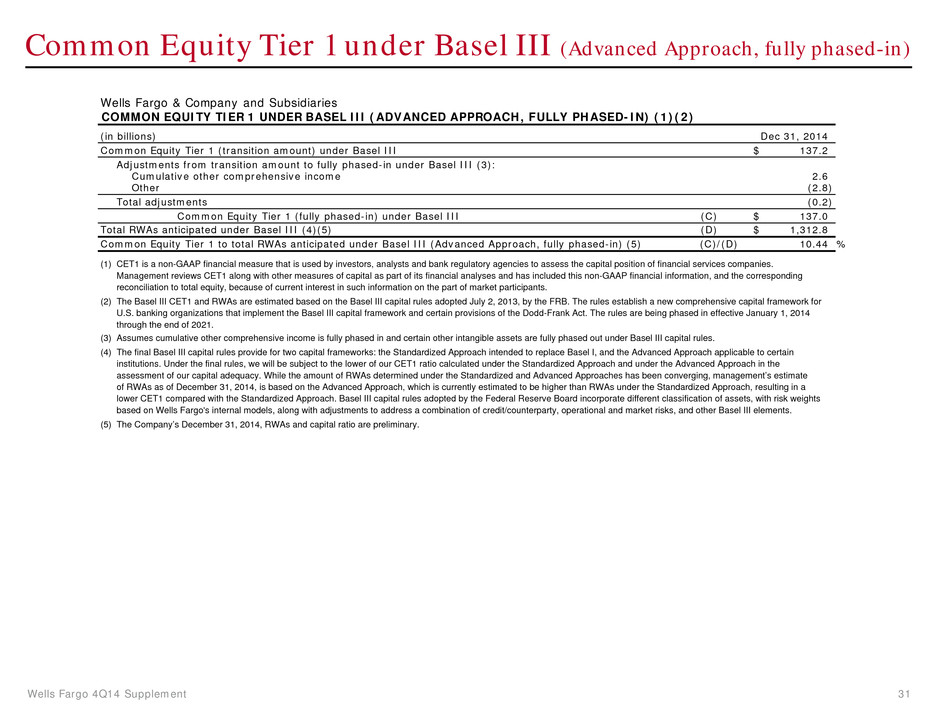

Wells Fargo 4Q14 Supplement 2 5,610 5,893 5,726 5,729 5,709 4Q13 1Q14 2Q14 3Q14 4Q14 4Q14 Highlights Strong earnings of $5.7 billion, up $99 million, or 2% year-over-year (YoY), and stable linked quarter (LQ) Diluted earnings per common share of $1.02, up 2% YoY and stable LQ Revenue growth of 4% YoY and 1% LQ - Net interest income up 3% YoY and 2% LQ - Noninterest income up 4% YoY and stable LQ Solid loan and deposit growth, with core loans (1) and deposits both up 3%, or 13% annualized, LQ Credit quality remained strong with net charge- offs of 34 bps of average loans Strong capital position - Common Equity Tier 1 ratio under Basel III (Advanced Approach, fully phased-in) of 10.44% at 12/31/14 (2) Returned $3.9 billion to shareholders through common stock dividends and net share repurchases Wells Fargo Net Income ($ in millions) (1) See pages 7 and 22 for additional information regarding core loans and the non-strategic/liquidating portfolio, which is comprised of Pick-a-Pay, liquidating home equity, legacy WFF indirect auto, legacy WFF debt consolidation, Education Finance-government guaranteed, and legacy Wachovia commercial & industrial, commercial real estate, and other PCI loan portfolios. (2) 4Q14 capital ratios are preliminary estimates. See pages 30-31 for additional information regarding common equity ratios. Estimated based on final rules adopted July 2, 2013, by the Federal Reserve Board establishing a new comprehensive capital framework for U.S. banking organizations that would implement the Basel III capital framework and certain provisions of the Dodd-Frank Act. Diluted earnings per common share $1.00 $1.05 $1.01 $1.02 $1.02

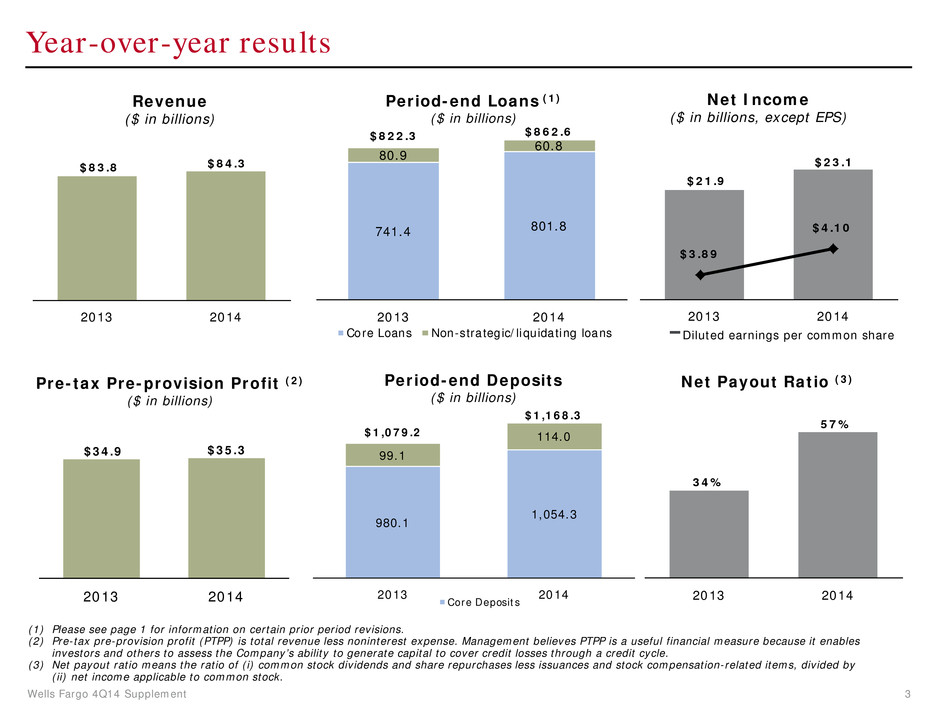

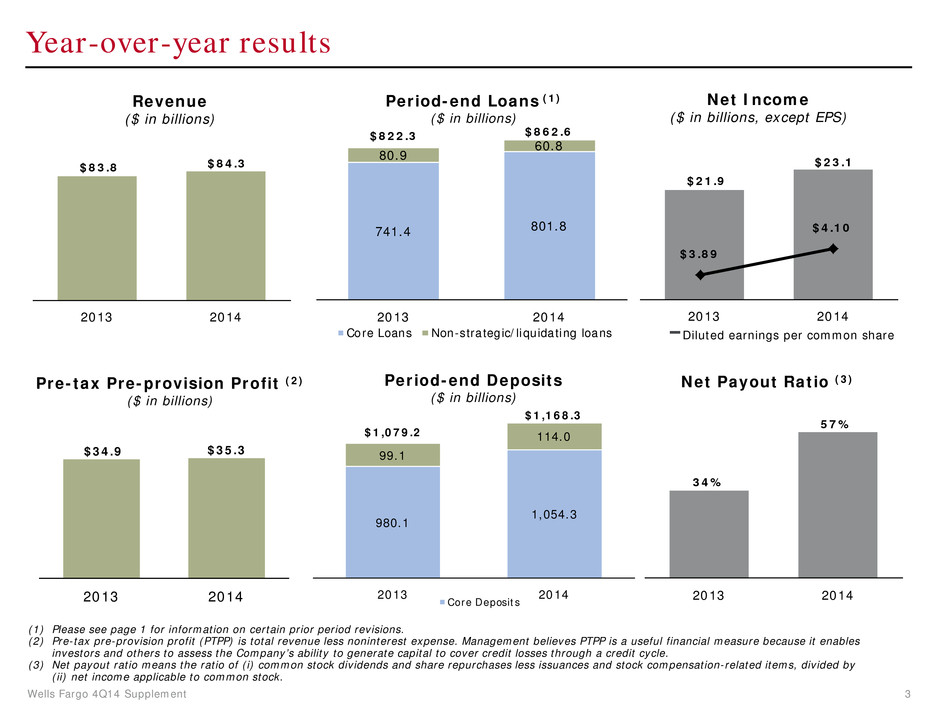

Wells Fargo 4Q14 Supplement 3 980.1 1,054.3 99.1 114.0$1,079.2 $1,168.3 2013 2014 Core Deposits Year-over-year results (1) Please see page 1 for information on certain prior period revisions. (2) Pre-tax pre-provision profit (PTPP) is total revenue less noninterest expense. Management believes PTPP is a useful financial measure because it enables investors and others to assess the Company’s ability to generate capital to cover credit losses through a credit cycle. (3) Net payout ratio means the ratio of (i) common stock dividends and share repurchases less issuances and stock compensation-related items, divided by (ii) net income applicable to common stock. Pre-tax Pre-provision Profit (2) ($ in billions) $34.9 $35.3 2013 2014 Net Income ($ in billions, except EPS) $21.9 $23.1 2013 2014 $3.89 $4.10 Diluted earnings per common share Period-end Loans (1) ($ in billions) Period-end Deposits ($ in billions) Net Payout Ratio (3) 741.4 801.8 80.9 60.8 $822.3 $862.6 2013 2014 Core Loans Non-strategic/liquidating loans Revenue ($ in billions) $83.8 $84.3 2013 2014 34% 57% 2013 2014

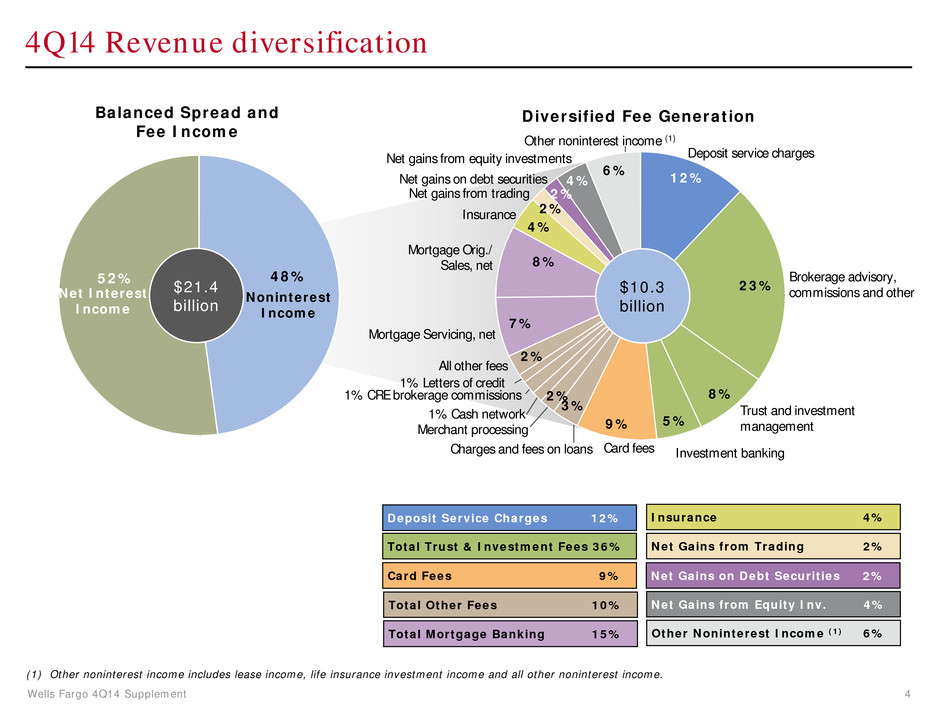

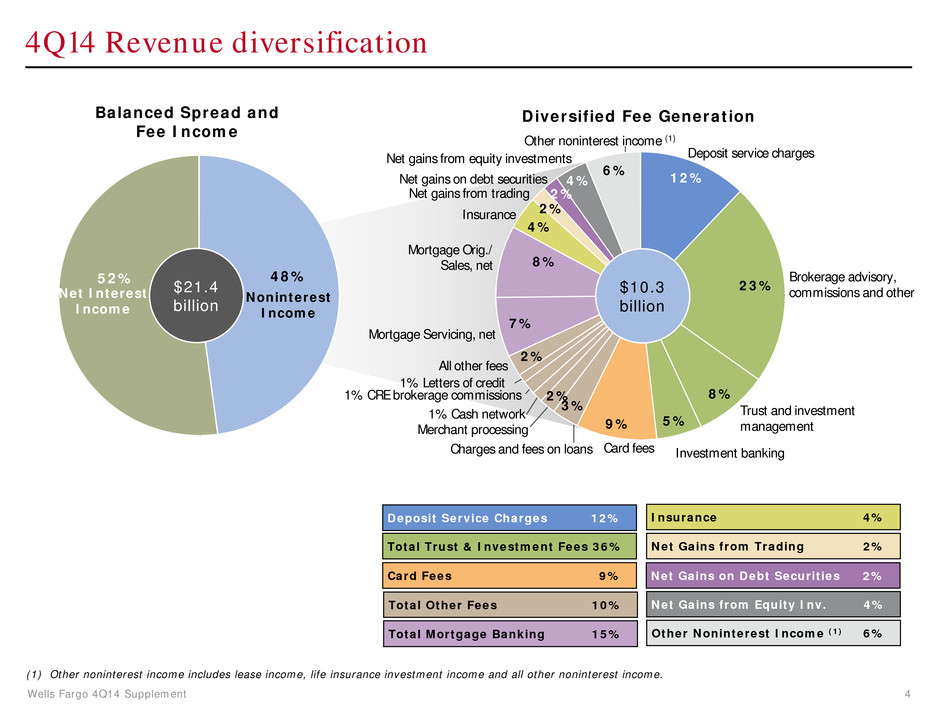

Wells Fargo 4Q14 Supplement 4 Balanced Spread and Fee Income Diversified Fee Generation Deposit Service Charges 12% Card Fees 9% Total Mortgage Banking 15% Insurance 4% Net Gains from Trading 2% (1) Other noninterest income includes lease income, life insurance investment income and all other noninterest income. 4Q14 Revenue diversification Total Trust & Investment Fees 36% Total Other Fees 10% Net Gains from Equity Inv. 4% Brokerage advisory, commissions and other Mortgage Orig./ Sales, net Mortgage Servicing, net Trust and investment management Investment banking Charges and fees on loans Merchant processing 1% Cash network 1% CRE brokerage commissions 1% Letters of credit Card fees Deposit service charges Other noninterest income (1) Net gains from trading Insurance 48%52% Net Interest Income Noninterest Income All other fees Net gains from equity investments Other Noninterest Income (1) 6% 12% 23% 8% 5%9% 3% 2% 2% 7% 8% 4% 2% 2% 4% 6% Net Gains on Debt Securities 2% Net gains on debt securities $21.4 billion $10.3 billion

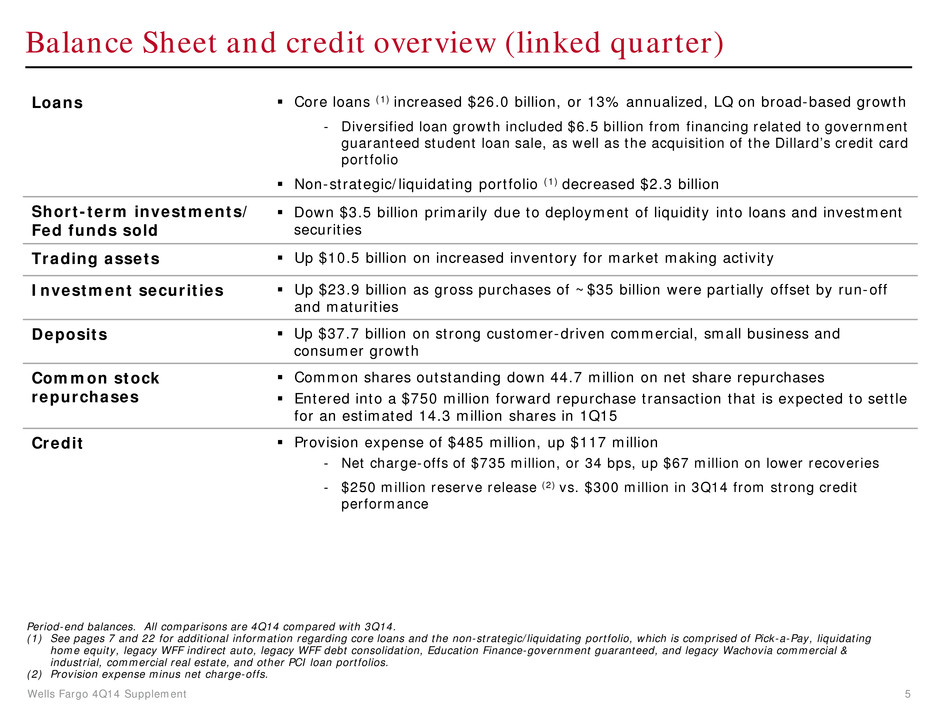

Wells Fargo 4Q14 Supplement 5 Balance Sheet and credit overview (linked quarter) Loans Core loans (1) increased $26.0 billion, or 13% annualized, LQ on broad-based growth - Diversified loan growth included $6.5 billion from financing related to government guaranteed student loan sale, as well as the acquisition of the Dillard’s credit card portfolio Non-strategic/liquidating portfolio (1) decreased $2.3 billion Short-term investments/ Fed funds sold Down $3.5 billion primarily due to deployment of liquidity into loans and investment securities Trading assets Up $10.5 billion on increased inventory for market making activity Investment securities Up $23.9 billion as gross purchases of ~$35 billion were partially offset by run-off and maturities Deposits Up $37.7 billion on strong customer-driven commercial, small business and consumer growth Common stock repurchases Common shares outstanding down 44.7 million on net share repurchases Entered into a $750 million forward repurchase transaction that is expected to settle for an estimated 14.3 million shares in 1Q15 Credit Provision expense of $485 million, up $117 million - Net charge-offs of $735 million, or 34 bps, up $67 million on lower recoveries - $250 million reserve release (2) vs. $300 million in 3Q14 from strong credit performance Period-end balances. All comparisons are 4Q14 compared with 3Q14. (1) See pages 7 and 22 for additional information regarding core loans and the non-strategic/liquidating portfolio, which is comprised of Pick-a-Pay, liquidating home equity, legacy WFF indirect auto, legacy WFF debt consolidation, Education Finance-government guaranteed, and legacy Wachovia commercial & industrial, commercial real estate, and other PCI loan portfolios. (2) Provision expense minus net charge-offs.

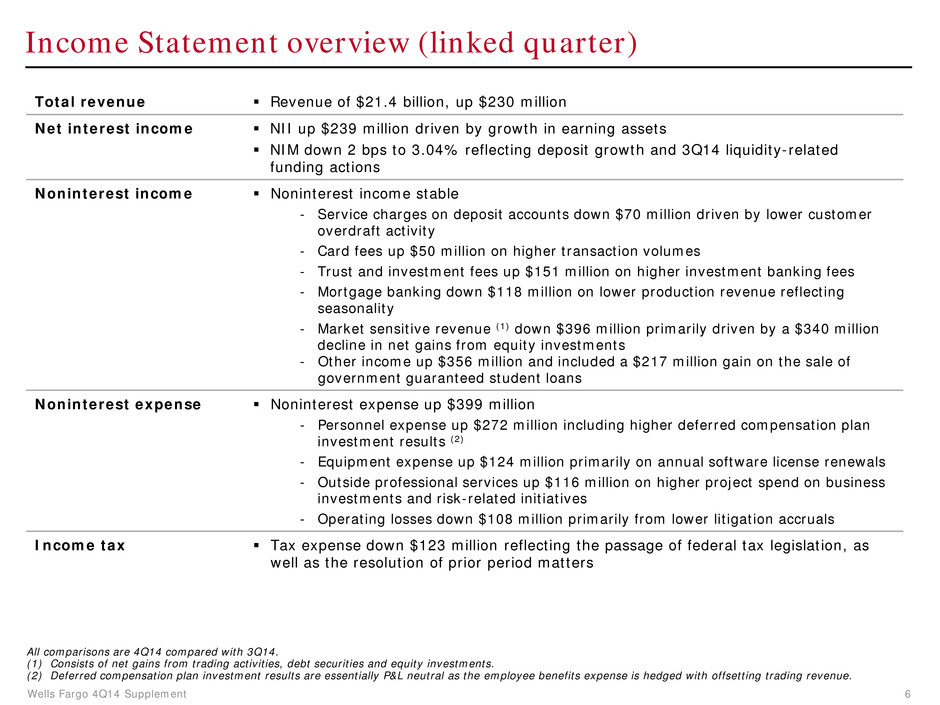

Wells Fargo 4Q14 Supplement 6 Income Statement overview (linked quarter) Total revenue Revenue of $21.4 billion, up $230 million Net interest income NII up $239 million driven by growth in earning assets NIM down 2 bps to 3.04% reflecting deposit growth and 3Q14 liquidity-related funding actions Noninterest income Noninterest income stable - Service charges on deposit accounts down $70 million driven by lower customer overdraft activity - Card fees up $50 million on higher transaction volumes - Trust and investment fees up $151 million on higher investment banking fees - Mortgage banking down $118 million on lower production revenue reflecting seasonality - Market sensitive revenue (1) down $396 million primarily driven by a $340 million decline in net gains from equity investments - Other income up $356 million and included a $217 million gain on the sale of government guaranteed student loans Noninterest expense Noninterest expense up $399 million - Personnel expense up $272 million including higher deferred compensation plan investment results (2) - Equipment expense up $124 million primarily on annual software license renewals - Outside professional services up $116 million on higher project spend on business investments and risk-related initiatives - Operating losses down $108 million primarily from lower litigation accruals Income tax Tax expense down $123 million reflecting the passage of federal tax legislation, as well as the resolution of prior period matters All comparisons are 4Q14 compared with 3Q14. (1) Consists of net gains from trading activities, debt securities and equity investments. (2) Deferred compensation plan investment results are essentially P&L neutral as the employee benefits expense is hedged with offsetting trading revenue.

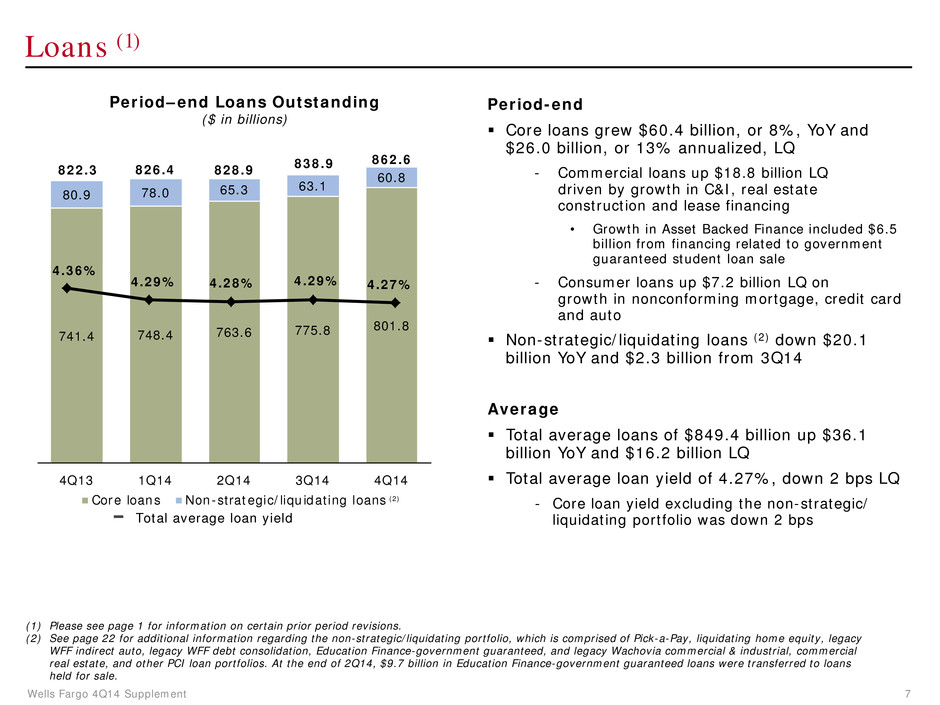

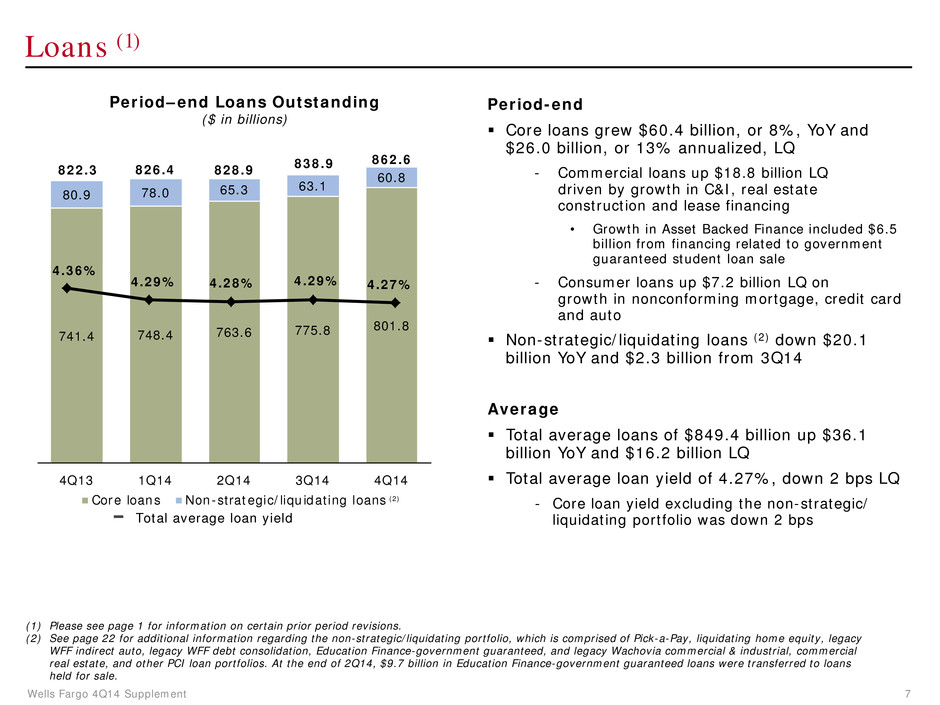

Wells Fargo 4Q14 Supplement 7 Loans (1) Period-end Core loans grew $60.4 billion, or 8%, YoY and $26.0 billion, or 13% annualized, LQ - Commercial loans up $18.8 billion LQ driven by growth in C&I, real estate construction and lease financing • Growth in Asset Backed Finance included $6.5 billion from financing related to government guaranteed student loan sale - Consumer loans up $7.2 billion LQ on growth in nonconforming mortgage, credit card and auto Non-strategic/liquidating loans (2) down $20.1 billion YoY and $2.3 billion from 3Q14 Average Total average loans of $849.4 billion up $36.1 billion YoY and $16.2 billion LQ Total average loan yield of 4.27%, down 2 bps LQ - Core loan yield excluding the non-strategic/ liquidating portfolio was down 2 bps (1) Please see page 1 for information on certain prior period revisions. (2) See page 22 for additional information regarding the non-strategic/liquidating portfolio, which is comprised of Pick-a-Pay, liquidating home equity, legacy WFF indirect auto, legacy WFF debt consolidation, Education Finance-government guaranteed, and legacy Wachovia commercial & industrial, commercial real estate, and other PCI loan portfolios. At the end of 2Q14, $9.7 billion in Education Finance-government guaranteed loans were transferred to loans held for sale. Period–end Loans Outstanding ($ in billions) (2) Total average loan yield 741.4 748.4 763.6 775.8 801.8 80.9 78.0 65.3 63.1 60.8822.3 826.4 828.9 838.9 862.6 4Q13 1Q14 2Q14 3Q14 4Q14 Core loans Non-strategic/liquidating loans 4.36% 4.29% 4.28% 4.29% 4.27%

Wells Fargo 4Q14 Supplement 8 8 12 16 20 24 28 32 4Q13 4Q14 Credit Card 24 29 34 39 44 49 54 59 4Q13 4Q14 Automobile 125 145 165 185 205 225 4Q13 4Q14 Core 1-4 Family First Mortgage (2) 150 170 190 210 230 250 270 290 4Q13 4Q14 Commercial and Industrial (1) Broad-based, year-over-year loan growth Growth in nonconforming mortgage 2014 originations New account growth and Dillard’s card portfolio acquisition ($ in billions) Broad-based growth, see page 9 for additional information (1) Please see page 1 for information on certain prior period revisions. (2) Please see page 25 for additional information.

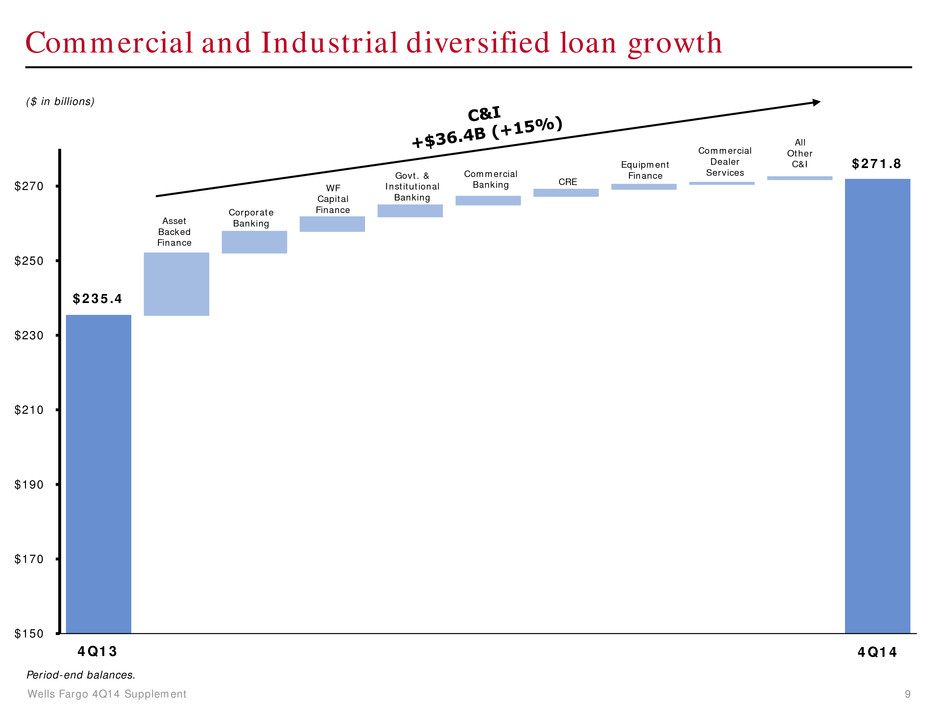

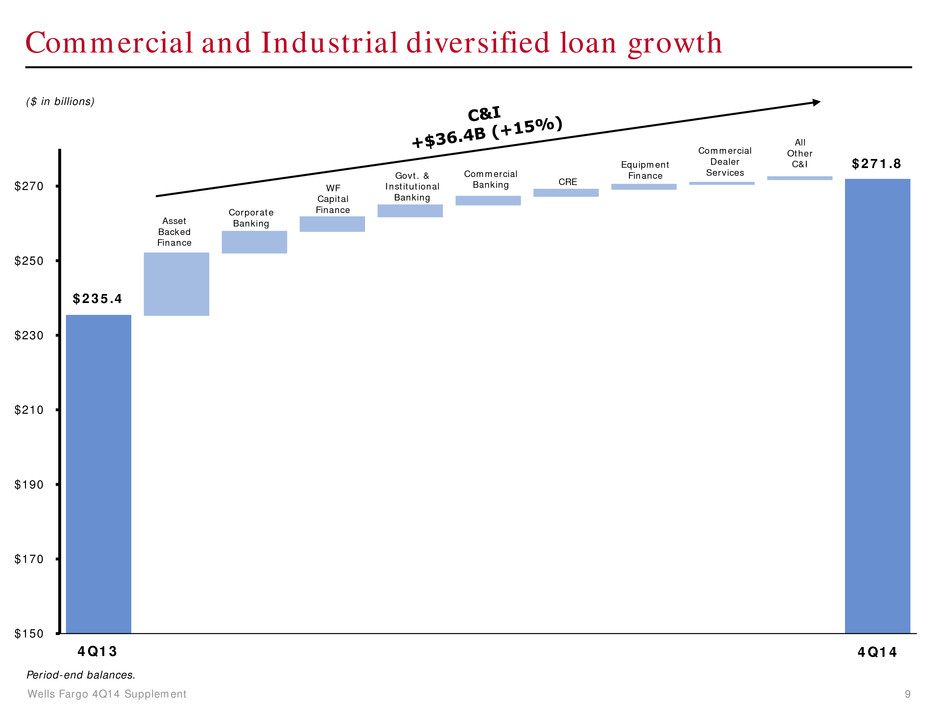

Wells Fargo 4Q14 Supplement 9 $235.4 $271.8 $150 $170 $190 $210 $230 $250 $270 Asset Backed Finance 4Q13 4Q14 Corporate Banking Govt. & Institutional Banking Commercial Banking CRE All Other C&I Commercial and Industrial diversified loan growth WF Capital Finance Equipment Finance Commercial Dealer Services Period-end balances. ($ in billions)

Wells Fargo 4Q14 Supplement 10 773.0 819.1 825.7 1,060.4 1,127.1 1,149.8 287.4 308.0 324.1 4Q13 3Q14 4Q14 Noninterest-bearing deposits Interest-bearing deposits Deposits Average Deposits up $89.4 billion, or 8%, YoY and $22.7 billion, or 8% annualized, LQ Average deposit cost of 9 bps, down 1 bp LQ and down 2 bps YoY Core deposits (1) of $1.0 trillion up $70.2 billion, or 7%, YoY and up $23.8 billion, or 9% annualized, LQ - Average retail core deposits up 5% YoY on both existing and new customer account balance growth, and up 6% annualized, LQ Period-end Total period-end deposits of $1.2 trillion up $89.1 billion, or 8%, YoY and up $37.7 billion, or 13% annualized, LQ Primary consumer checking customers (2) up 5.2% YoY Primary small business and business banking checking customers (2) up 5.4% YoY Average Deposits and Rates ($ in billions) Average deposit cost Period-end Deposits ($ in billions) (1) Core deposits are noninterest-bearing deposits, interest-bearing checking, savings certificates, certain market rate and other savings, and certain foreign deposits (Eurodollar sweep balances). (2) Data as of November 2014, comparisons with November 2013; customers who actively use their checking account with transactions such as debit card purchases, online bill payments, and direct deposits. 0.11% 0.10% 0.09% 1,079.2 1,130.6 1,168.3 4Q13 3Q14 4Q14

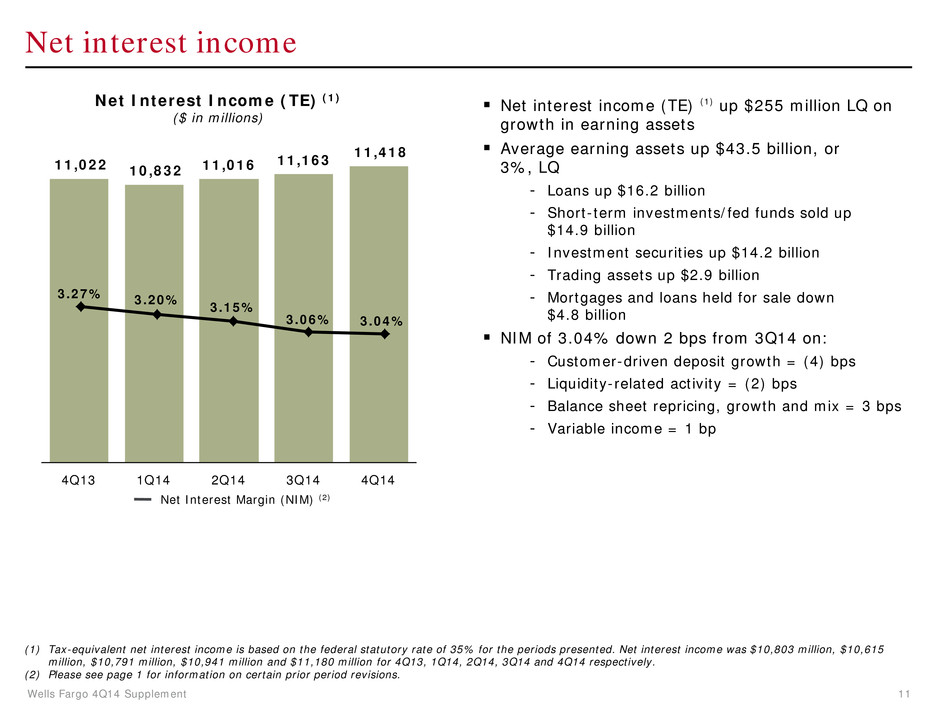

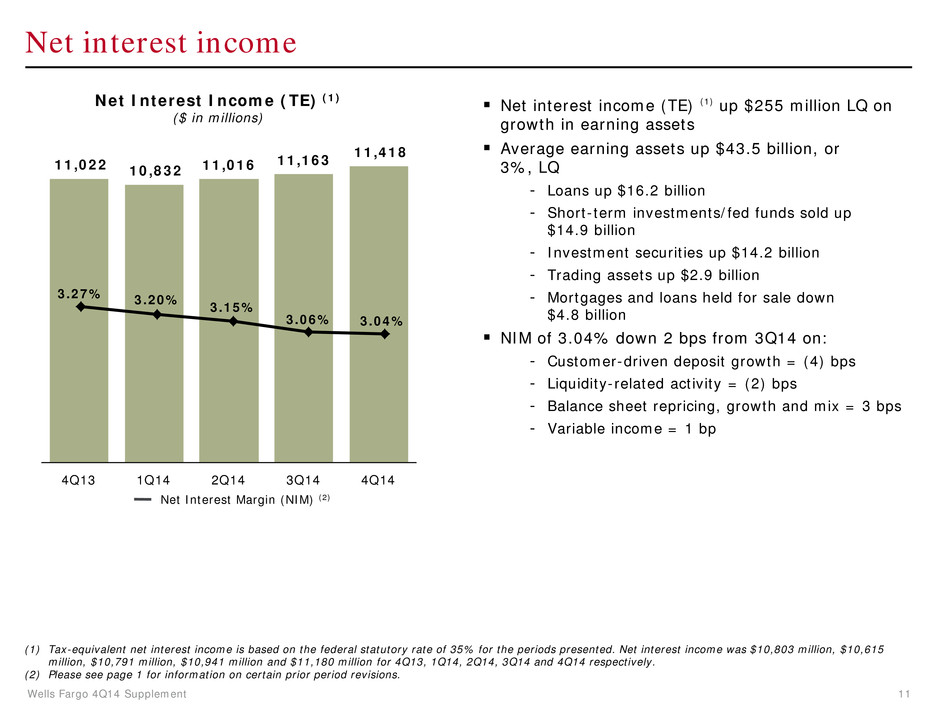

Wells Fargo 4Q14 Supplement 11 Net interest income (TE) (1) up $255 million LQ on growth in earning assets Average earning assets up $43.5 billion, or 3%, LQ - Loans up $16.2 billion - Short-term investments/fed funds sold up $14.9 billion - Investment securities up $14.2 billion - Trading assets up $2.9 billion - Mortgages and loans held for sale down $4.8 billion NIM of 3.04% down 2 bps from 3Q14 on: - Customer-driven deposit growth = (4) bps - Liquidity-related activity = (2) bps - Balance sheet repricing, growth and mix = 3 bps - Variable income = 1 bp Net interest income Net Interest Income (TE) (1) ($ in millions) Net Interest Margin (NIM) (2) (1) Tax-equivalent net interest income is based on the federal statutory rate of 35% for the periods presented. Net interest income was $10,803 million, $10,615 million, $10,791 million, $10,941 million and $11,180 million for 4Q13, 1Q14, 2Q14, 3Q14 and 4Q14 respectively. (2) Please see page 1 for information on certain prior period revisions. 11,022 10,832 11,016 11,163 11,418 4Q13 1Q14 2Q14 3Q14 4Q14 3.27% 3.20% 3.15% 3.06% 3.04%

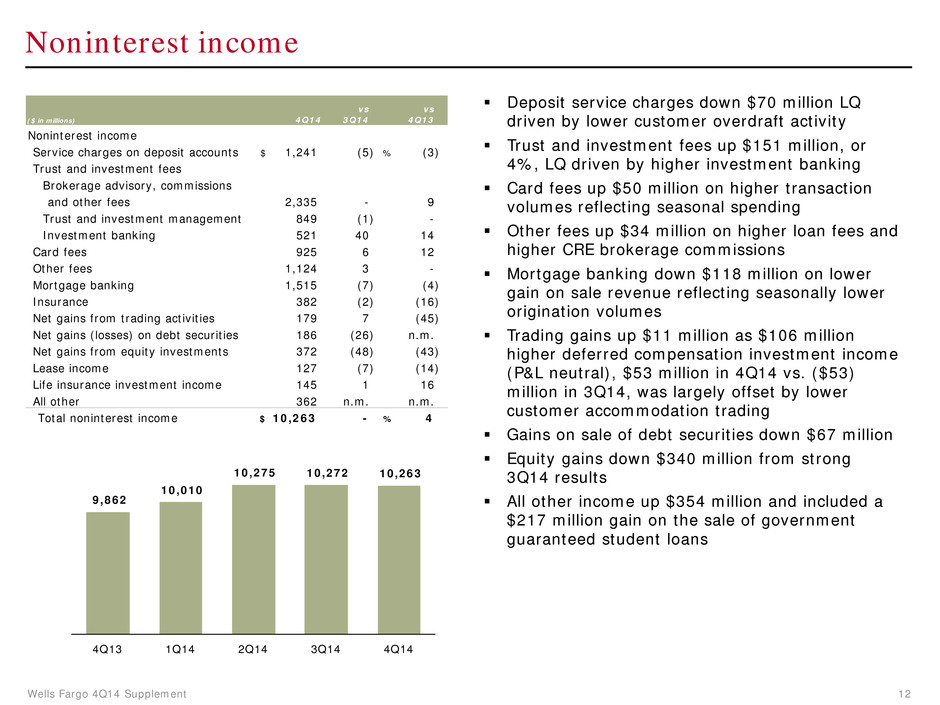

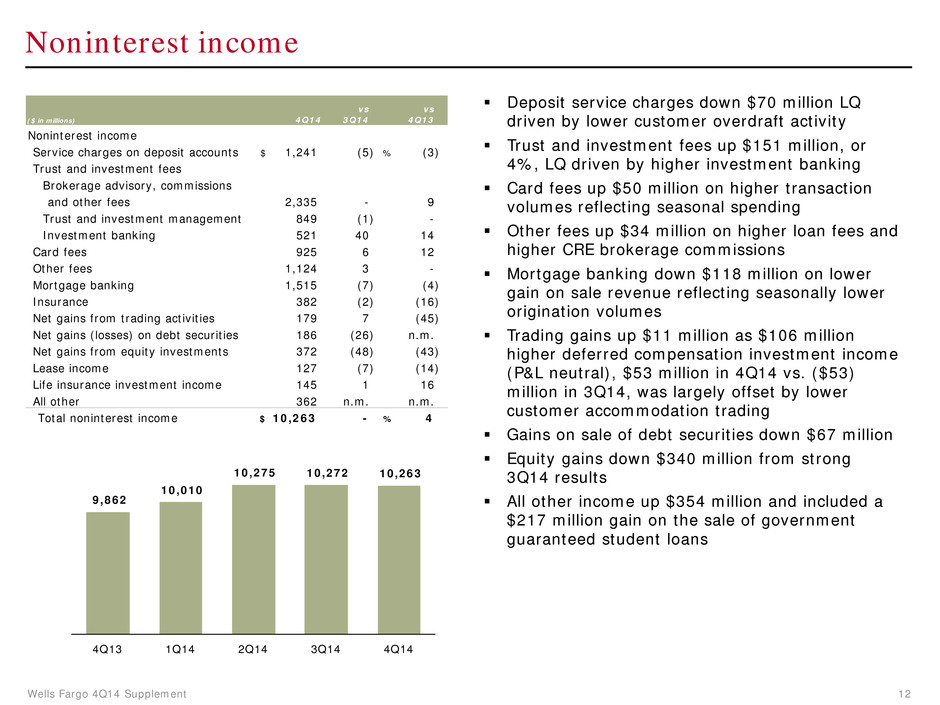

Wells Fargo 4Q14 Supplement 12 Noninterest income Deposit service charges down $70 million LQ driven by lower customer overdraft activity Trust and investment fees up $151 million, or 4%, LQ driven by higher investment banking Card fees up $50 million on higher transaction volumes reflecting seasonal spending Other fees up $34 million on higher loan fees and higher CRE brokerage commissions Mortgage banking down $118 million on lower gain on sale revenue reflecting seasonally lower origination volumes Trading gains up $11 million as $106 million higher deferred compensation investment income (P&L neutral), $53 million in 4Q14 vs. ($53) million in 3Q14, was largely offset by lower customer accommodation trading Gains on sale of debt securities down $67 million Equity gains down $340 million from strong 3Q14 results All other income up $354 million and included a $217 million gain on the sale of government guaranteed student loans vs vs ($ in millions) 4Q14 3Q14 4Q13 Noninterest income Service charges on deposit accounts $ 1,241 (5) % (3) Trust and investment fees Brokerage advisory, commissions and other fees 2,335 - 9 Trust and investment management 849 (1) - Investment banking 521 40 14 Card fees 925 6 12 Other fees 1,124 3 - Mortgage banking 1,515 (7) (4) Insurance 382 (2) (16) Net gains from trading activities 179 7 (45) Net gains (losses) on debt securities 186 (26) n.m. Net gains from equity investments 372 (48) (43) Lease income 127 (7) (14) Life insurance investment income 145 1 16 All other 362 n.m. n.m. Total noninterest income $ 10,263 - % 4 9,862 10,010 10,275 10,272 10,263 4Q13 1Q14 2Q14 3Q14 4Q14

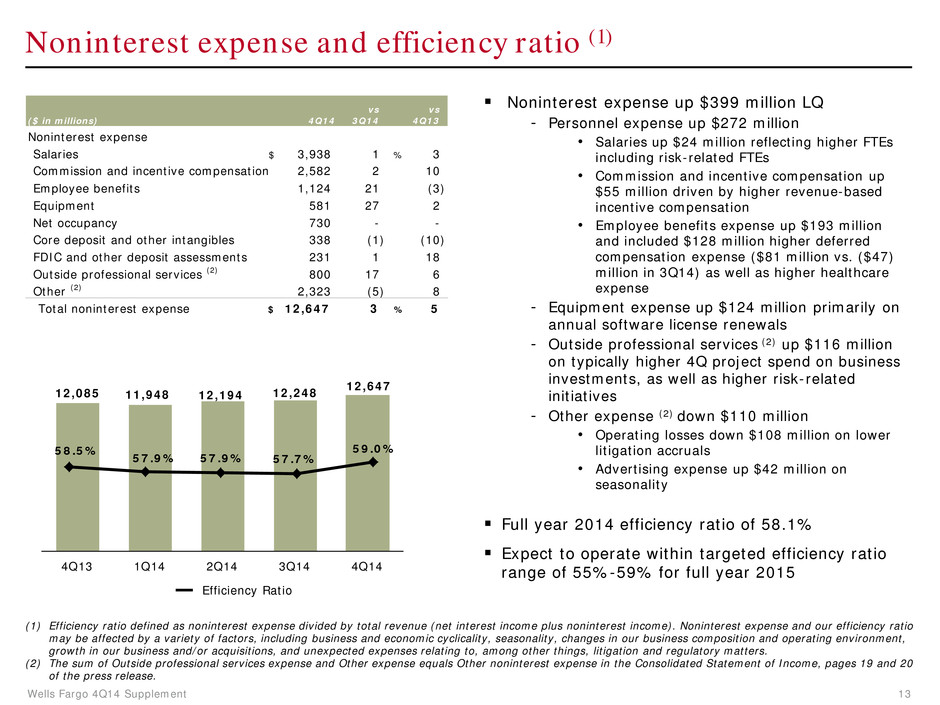

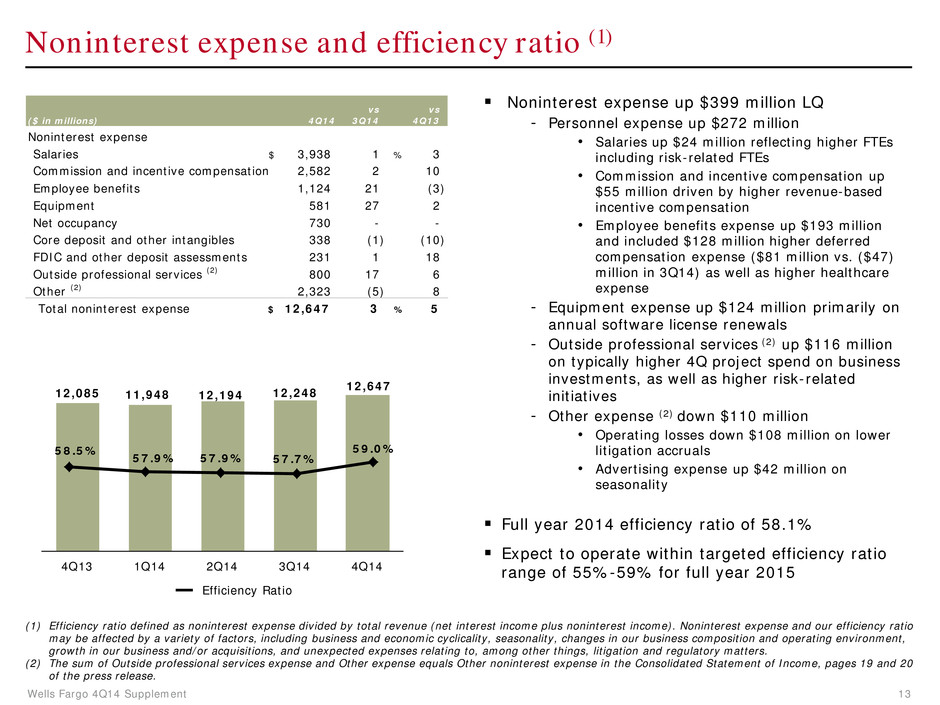

Wells Fargo 4Q14 Supplement 13 Noninterest expense and efficiency ratio (1) Noninterest expense up $399 million LQ - Personnel expense up $272 million • Salaries up $24 million reflecting higher FTEs including risk-related FTEs • Commission and incentive compensation up $55 million driven by higher revenue-based incentive compensation • Employee benefits expense up $193 million and included $128 million higher deferred compensation expense ($81 million vs. ($47) million in 3Q14) as well as higher healthcare expense - Equipment expense up $124 million primarily on annual software license renewals - Outside professional services (2) up $116 million on typically higher 4Q project spend on business investments, as well as higher risk-related initiatives - Other expense (2) down $110 million • Operating losses down $108 million on lower litigation accruals • Advertising expense up $42 million on seasonality Full year 2014 efficiency ratio of 58.1% Expect to operate within targeted efficiency ratio range of 55%-59% for full year 2015 Efficiency Ratio (1) Efficiency ratio defined as noninterest expense divided by total revenue (net interest income plus noninterest income). Noninterest expense and our efficiency ratio may be affected by a variety of factors, including business and economic cyclicality, seasonality, changes in our business composition and operating environment, growth in our business and/or acquisitions, and unexpected expenses relating to, among other things, litigation and regulatory matters. (2) The sum of Outside professional services expense and Other expense equals Other noninterest expense in the Consolidated Statement of Income, pages 19 and 20 of the press release. vs vs ($ in millions) 4Q14 3Q14 4Q13 Noninterest expense Salaries $ 3,938 1 % 3 Commission and incentive compensation 2,582 2 10 Employee benefits 1,124 21 (3) Equipment 581 27 2 Net occupancy 730 - - Core deposit and other intangibles 338 (1) (10) FDIC and other deposit assessments 231 1 18 Outside professional services (2) 800 17 6 Other (2) 2,323 (5) 8 Total noninterest expense $ 12,647 3 % 5 12,085 11,948 12,194 12,248 12,647 4Q13 1Q14 2Q14 3Q14 4Q14 58.5% 57.9% 57.9% 57.7% 59.0%

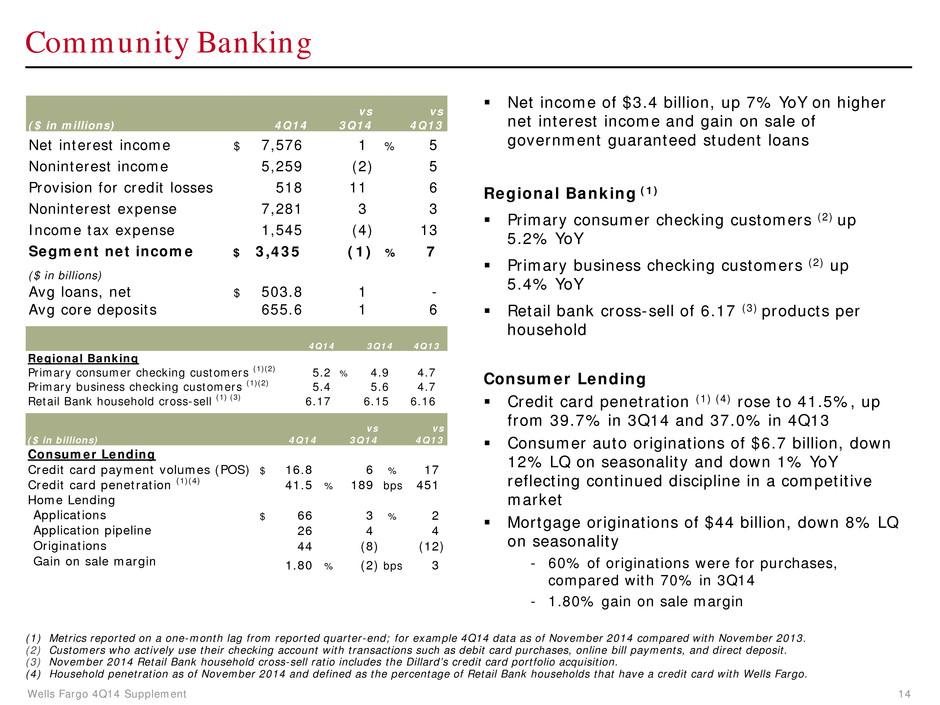

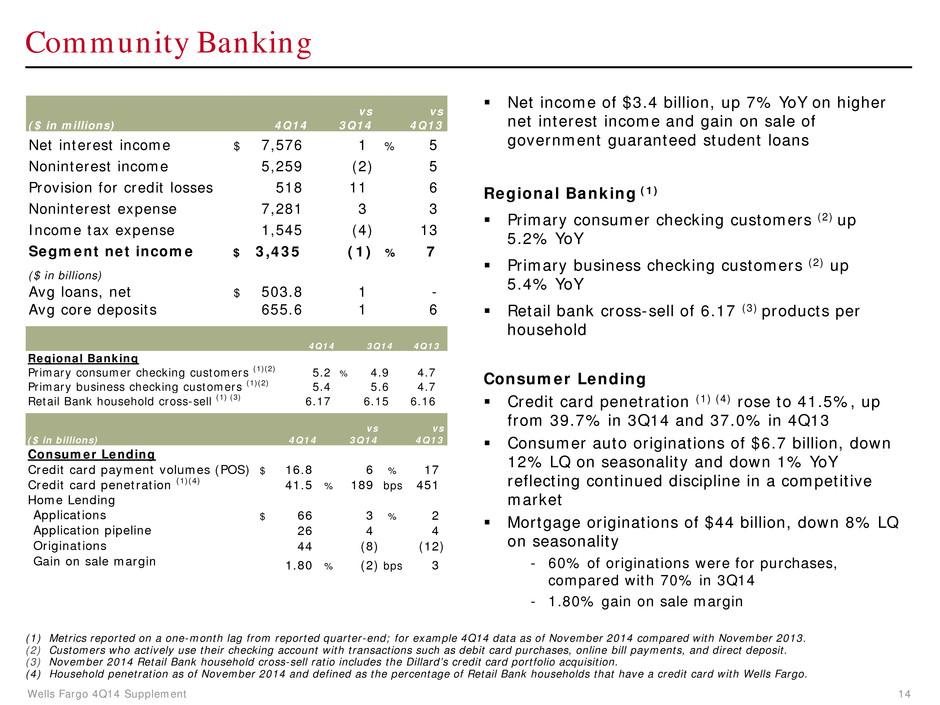

Wells Fargo 4Q14 Supplement 14 Community Banking Net income of $3.4 billion, up 7% YoY on higher net interest income and gain on sale of government guaranteed student loans Regional Banking (1) Primary consumer checking customers (2) up 5.2% YoY Primary business checking customers (2) up 5.4% YoY Retail bank cross-sell of 6.17 (3) products per household Consumer Lending Credit card penetration (1) (4) rose to 41.5%, up from 39.7% in 3Q14 and 37.0% in 4Q13 Consumer auto originations of $6.7 billion, down 12% LQ on seasonality and down 1% YoY reflecting continued discipline in a competitive market Mortgage originations of $44 billion, down 8% LQ on seasonality - 60% of originations were for purchases, compared with 70% in 3Q14 - 1.80% gain on sale margin (1) Metrics reported on a one-month lag from reported quarter-end; for example 4Q14 data as of November 2014 compared with November 2013. (2) Customers who actively use their checking account with transactions such as debit card purchases, online bill payments, and direct deposit. (3) November 2014 Retail Bank household cross-sell ratio includes the Dillard’s credit card portfolio acquisition. (4) Household penetration as of November 2014 and defined as the percentage of Retail Bank households that have a credit card with Wells Fargo. vs vs ($ in millions) 4Q14 3Q14 4Q13 Net interest income $ 7,576 1 % 5 Noninterest income 5,259 (2) 5 Provision for credit losses 518 11 6 Noninterest expense 7,281 3 3 Income tax expense 1,545 (4) 13 Segment net income $ 3,435 (1) % 7 ($ in billions) Avg loans, net $ 503.8 1 - Avg core deposits 655.6 1 6 4Q14 3Q14 4Q13 Regional Banking Primary consumer checking customers (1)(2) 5.2 % 4.9 4.7 Primary business checking customers (1)(2) 5.4 5.6 4.7 Retail Bank household cross-sell (1) (3) 6.17 6.15 6.16 vs vs ($ in billions) 4Q14 3Q14 4Q13 Consumer Lending Credit card payment volumes (POS) $ 16.8 6 % 17 Credit card penetration (1)(4) 41.5 % 189 bps 451 Home Lending Applications $ 66 3 % 2 Application pipeline 26 4 4 Originations 44 (8) (12) Gain on sale margin 1.80 % (2) bps 3

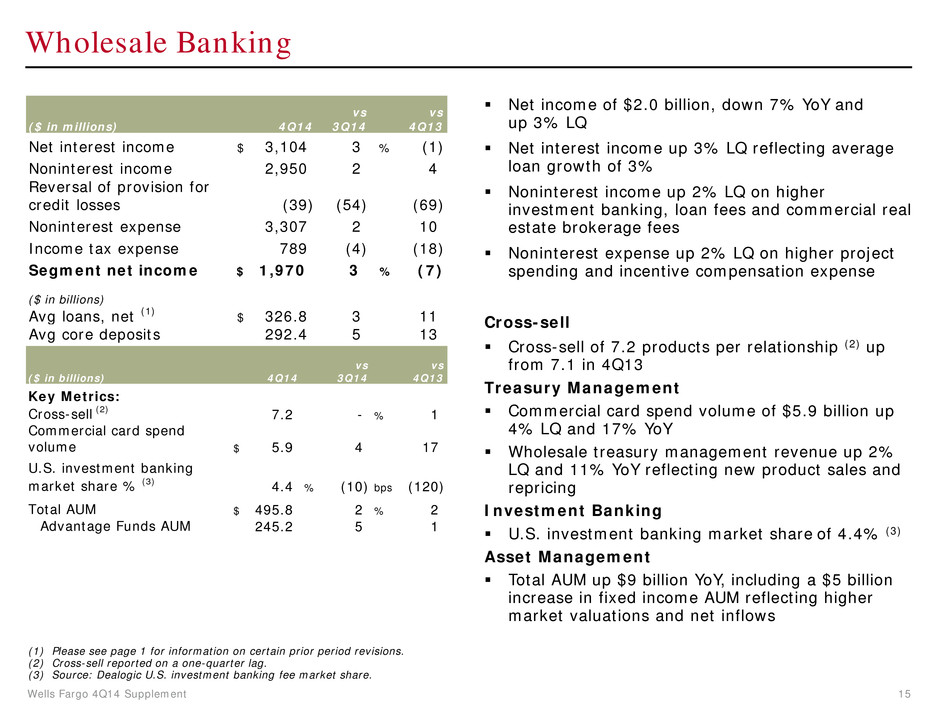

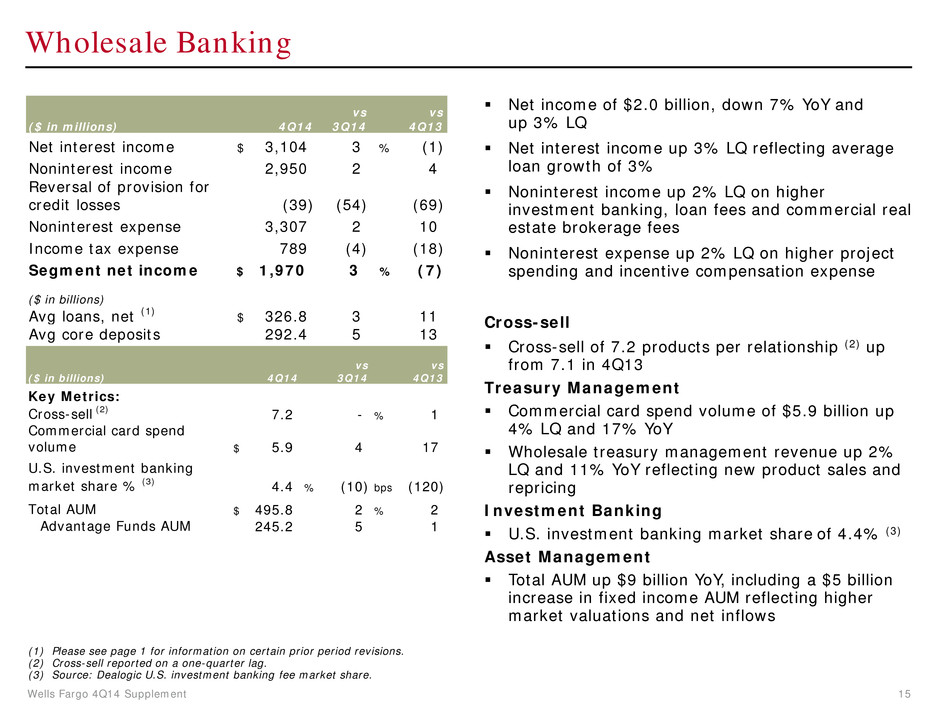

Wells Fargo 4Q14 Supplement 15 Wholesale Banking Net income of $2.0 billion, down 7% YoY and up 3% LQ Net interest income up 3% LQ reflecting average loan growth of 3% Noninterest income up 2% LQ on higher investment banking, loan fees and commercial real estate brokerage fees Noninterest expense up 2% LQ on higher project spending and incentive compensation expense Cross-sell Cross-sell of 7.2 products per relationship (2) up from 7.1 in 4Q13 Treasury Management Commercial card spend volume of $5.9 billion up 4% LQ and 17% YoY Wholesale treasury management revenue up 2% LQ and 11% YoY reflecting new product sales and repricing Investment Banking U.S. investment banking market share of 4.4% (3) Asset Management Total AUM up $9 billion YoY, including a $5 billion increase in fixed income AUM reflecting higher market valuations and net inflows (1) Please see page 1 for information on certain prior period revisions. (2) Cross-sell reported on a one-quarter lag. (3) Source: Dealogic U.S. investment banking fee market share. vs vs ($ in millions) 4Q14 3Q14 4Q13 Net interest income $ 3,104 3 % (1) Noninterest income 2,950 2 4 Reversal of provision for credit losses (39) (54) (69) Noninterest expense 3,307 2 10 Income tax expense 789 (4) (18) Segment net income $ 1,970 3 % (7) ($ in billions) Avg loans, net (1) $ 326.8 3 11 Avg core deposits 292.4 5 13 vs vs ($ in billions) 4Q14 3Q14 4Q13 Key Metrics: Cross-sell (2) 7.2 - % 1 Commercial card spend volume $ 5.9 4 17 U.S. investment banking market share % (3) 4.4 % (10) bps (120) Total AUM $ 495.8 2 % 2 Advantage Funds AUM 245.2 5 1

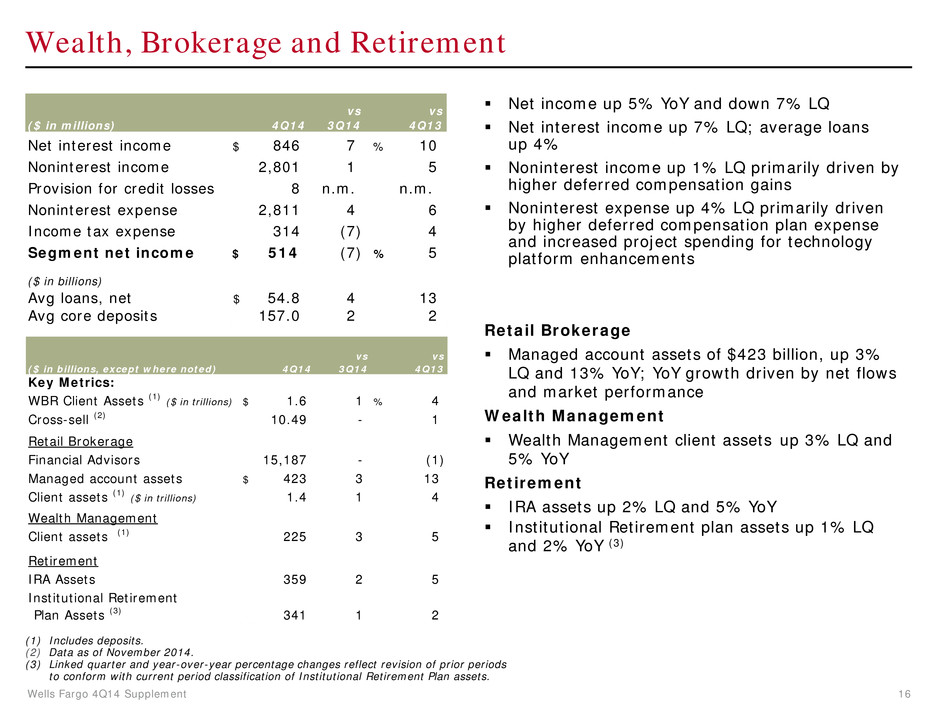

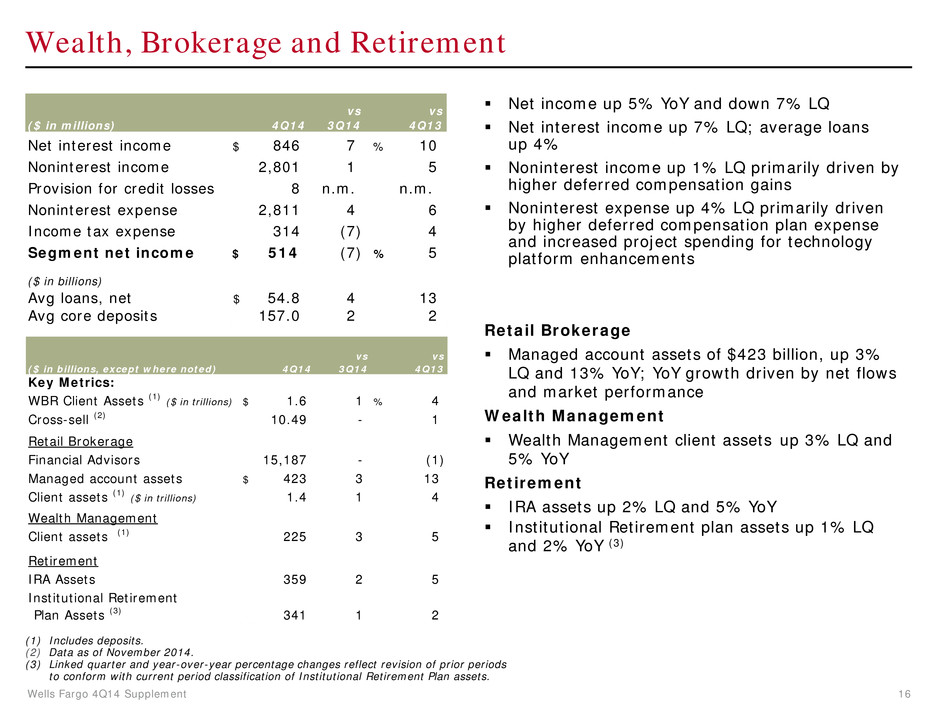

Wells Fargo 4Q14 Supplement 16 Wealth, Brokerage and Retirement Net income up 5% YoY and down 7% LQ Net interest income up 7% LQ; average loans up 4% Noninterest income up 1% LQ primarily driven by higher deferred compensation gains Noninterest expense up 4% LQ primarily driven by higher deferred compensation plan expense and increased project spending for technology platform enhancements Retail Brokerage Managed account assets of $423 billion, up 3% LQ and 13% YoY; YoY growth driven by net flows and market performance Wealth Management Wealth Management client assets up 3% LQ and 5% YoY Retirement IRA assets up 2% LQ and 5% YoY Institutional Retirement plan assets up 1% LQ and 2% YoY (3) (1) Includes deposits. (2) Data as of November 2014. (3) Linked quarter and year-over-year percentage changes reflect revision of prior periods to conform with current period classification of Institutional Retirement Plan assets. vs vs ($ in millions) 4Q14 3Q14 4Q13 Net interest income $ 846 7 % 10 Noninterest income 2,801 1 5 Provision for credit losses 8 n.m. n.m. Noninterest expense 2,811 4 6 Income tax expense 314 (7) 4 Segment net income $ 514 (7) % 5 ($ in billions) Avg loans, net $ 54.8 4 13 Avg core deposits 157.0 2 2 vs vs ($ in billions, except where noted) 4Q14 3Q14 4Q13 Key Metrics: WBR Client Assets (1) ($ in trillions) $ 1.6 1 % 4 Cross-sell (2) 10.49 - 1 Retail Brokerage Financial Advisors 15,187 - (1) Managed account assets $ 423 3 13 Client assets (1) ($ in trillions) 1.4 1 4 Wealth Management Client assets (1) 225 3 5 Retirement IRA Assets 359 2 5 Institutional Retirement Plan Assets (3) 341 1 2

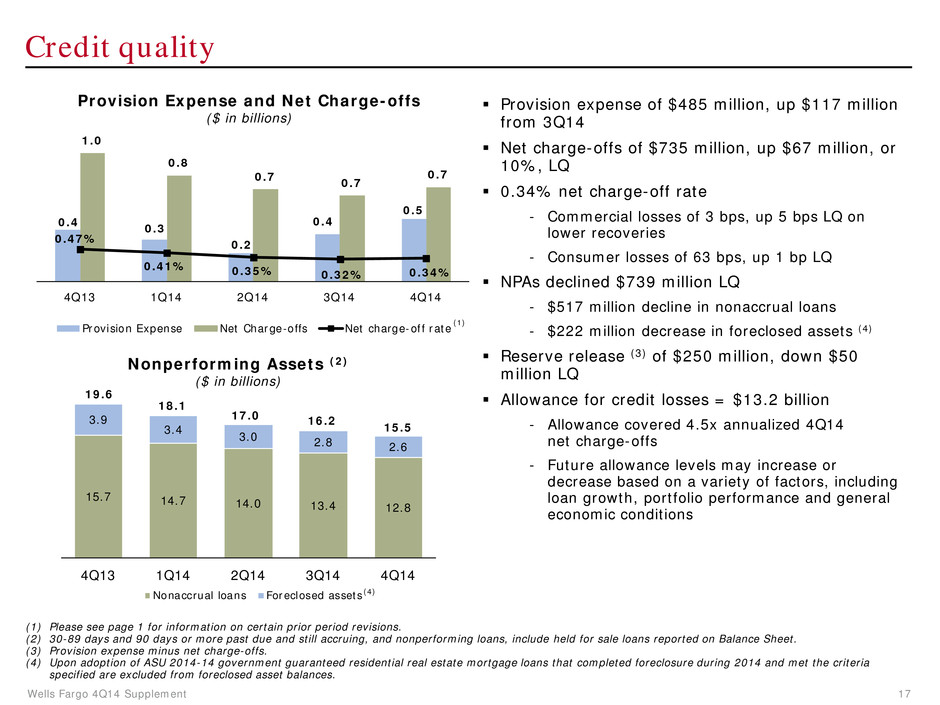

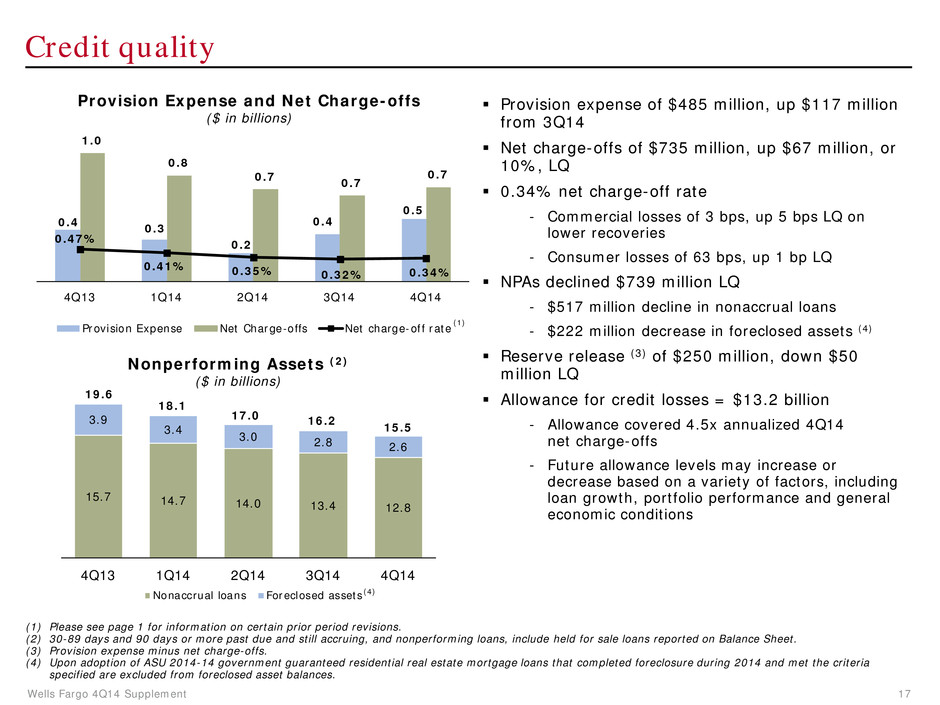

Wells Fargo 4Q14 Supplement 17 0.4 0.3 0.2 0.4 0.5 1.0 0.8 0.7 0.7 0.7 0.47% 0.41% 0.35% 0.32% 0.34% 4Q13 1Q14 2Q14 3Q14 4Q14 Provision Expense Net Charge-offs Net charge-off rate Credit quality Provision expense of $485 million, up $117 million from 3Q14 Net charge-offs of $735 million, up $67 million, or 10%, LQ 0.34% net charge-off rate - Commercial losses of 3 bps, up 5 bps LQ on lower recoveries - Consumer losses of 63 bps, up 1 bp LQ NPAs declined $739 million LQ - $517 million decline in nonaccrual loans - $222 million decrease in foreclosed assets (4) Reserve release (3) of $250 million, down $50 million LQ Allowance for credit losses = $13.2 billion - Allowance covered 4.5x annualized 4Q14 net charge-offs - Future allowance levels may increase or decrease based on a variety of factors, including loan growth, portfolio performance and general economic conditions (1) Please see page 1 for information on certain prior period revisions. (2) 30-89 days and 90 days or more past due and still accruing, and nonperforming loans, include held for sale loans reported on Balance Sheet. (3) Provision expense minus net charge-offs. (4) Upon adoption of ASU 2014-14 government guaranteed residential real estate mortgage loans that completed foreclosure during 2014 and met the criteria specified are excluded from foreclosed asset balances. Provision Expense and Net Charge-offs ($ in billions) Nonperforming Assets (2) ($ in billions) (1) 15.7 14.7 14.0 13.4 12.8 3.9 3.4 3.0 2.8 2.6 19.6 18.1 17.0 16.2 15.5 4Q13 1Q14 2Q14 3Q14 4Q14 Nonaccrual loans Foreclosed assets(4)

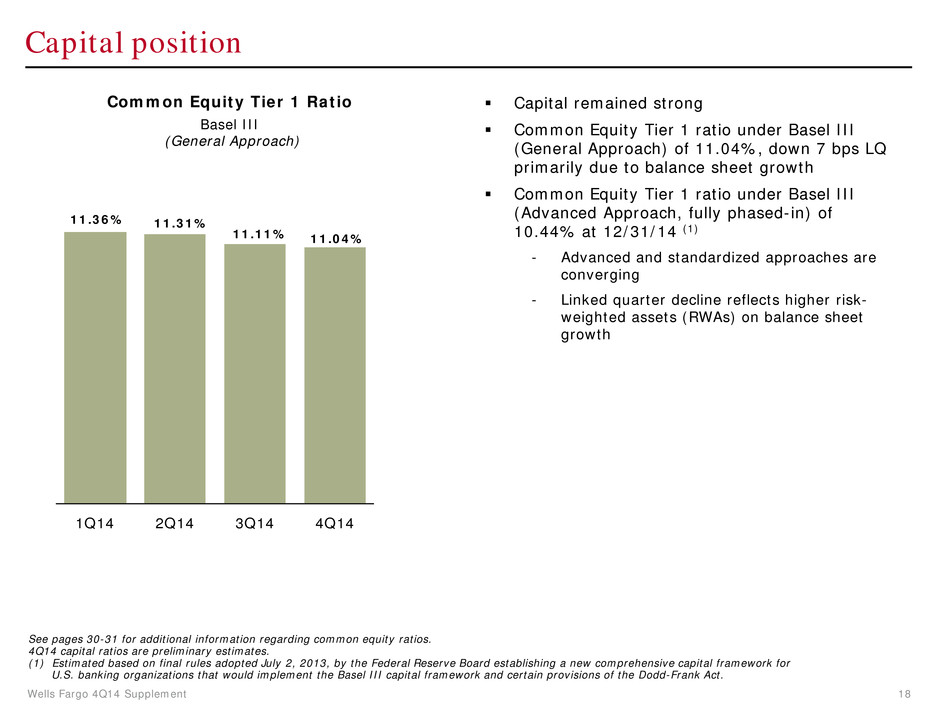

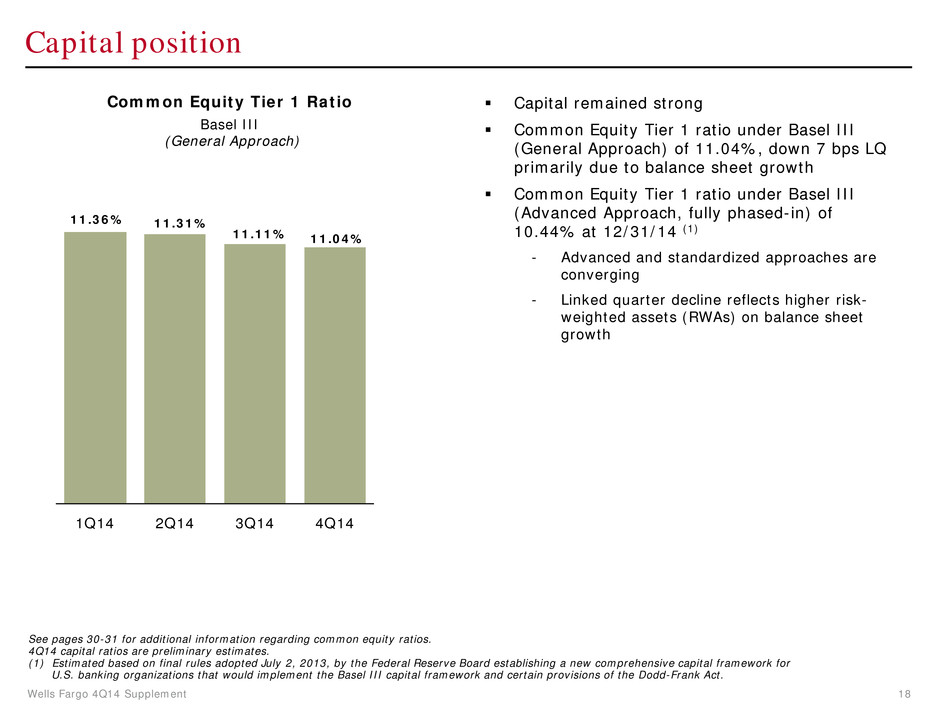

Wells Fargo 4Q14 Supplement 18 11.36% 11.31% 11.11% 11.04% 1Q14 2Q14 3Q14 4Q14 Capital remained strong Common Equity Tier 1 ratio under Basel III (General Approach) of 11.04%, down 7 bps LQ primarily due to balance sheet growth Common Equity Tier 1 ratio under Basel III (Advanced Approach, fully phased-in) of 10.44% at 12/31/14 (1) - Advanced and standardized approaches are converging - Linked quarter decline reflects higher risk- weighted assets (RWAs) on balance sheet growth Capital position See pages 30-31 for additional information regarding common equity ratios. 4Q14 capital ratios are preliminary estimates. (1) Estimated based on final rules adopted July 2, 2013, by the Federal Reserve Board establishing a new comprehensive capital framework for U.S. banking organizations that would implement the Basel III capital framework and certain provisions of the Dodd-Frank Act. Common Equity Tier 1 Ratio Basel III (General Approach)

Wells Fargo 4Q14 Supplement 19 Our strong capital levels have allowed us to return more capital to shareholders - Returned $3.9 billion to shareholders in 4Q14 Capital return (1) Dividend payout ratio means the ratio of (i) common stock dividends, divided by (ii) net income applicable to common stock. (2) Net payout ratio means the ratio of (i) common stock dividends and share repurchases less issuances and stock compensation-related items, divided by (ii) net income applicable to common stock. Payout Ratios Period-end common shares outstanding down 44.7 million LQ - Purchased 61.6 million common shares - Issued 16.9 million common shares Entered into a $750 million forward repurchase transaction which is expected to settle in 1Q15 for an estimated 14.3 million shares (17) 9 (16) (35) (45) (50) (40) (30) (20) (10) - 10 20 4Q13 1Q14 2Q14 3Q14 4Q14 Net Change in Ending Common Shares Outstanding (shares in millions) 29% 28% 34% 34% 34% 43% 26% 66% 66% 72% 4Q13 1Q14 2Q14 3Q14 4Q14 Dividend Payout Ratio Net Payout Ratio(1) (2)

Wells Fargo 4Q14 Supplement 20 Summary 2014 Record earnings of $23.1 billion, up $1.2 billion, or 5% from 2013 Record diluted earnings per share (EPS) of $4.10, up 5% Returned $12.5 billion to shareholders through common stock dividends and net share repurchases - Net payout ratio (1) of 57% 4Q14 Strong earnings of $5.7 billion, up $99 million, or 2% from 4Q13 - Diluted EPS of $1.02, up 2% Solid returns - ROA = 1.36% - ROE = 12.84% Strong loan and deposit growth - Period-end loans (2) up $40.3 billion, or 5%, YoY with core loans up $60.4 billion, or 8%, on broad-based growth - Period-end deposits up $89.1 billion, or 8% YoY Diversified and high quality loan portfolio - Credit quality remained strong with net charge-offs of 0.34% (annualized), down from 0.47% a year ago - Maintained our risk and pricing discipline Strong capital levels while returning more capital to shareholders - Returned $3.9 billion to shareholders through common stock dividends and net share repurchases Strong liquidity (1) Net payout ratio means the ratio of (i) common stock dividends and share repurchases less issuances and stock compensation-related items, divided by (ii) net income applicable to common stock. (2) Please see page 1 for information on certain prior period revisions.

Appendix

Wells Fargo 4Q14 Supplement 22 (1) Net of purchase accounting adjustments. (2) At the end of 2Q14, $9.7 billion in Education Finance-government guaranteed loans were transferred to loans held for sale. -$109.9 Non-strategic/liquidating loan portfolio -$2.9 -$130.0 -$12.7 -$2.2 -$2.3 ($ in billions) 4Q14 3Q14 2Q14 1Q14 4Q13 4Q08 Pick-a-Pay mortgage (1) $ 45.0 46.4 48.0 49.5 51.0 95.3 Liquidating home equity 2.9 3.1 3.3 3.5 3.7 10.3 Legacy WFF indirect auto - 0.1 0.1 0.1 0.2 18.2 Legacy WFF debt consolidation 11.4 11.8 12.2 12.6 12.9 25.3 Education Finance - gov't guaranteed (2) - - - 10.2 10.7 20.5 Legacy WB C&I and CRE PCI loans (1) 1.1 1.5 1.5 1.7 2.0 18.7 Legacy WB other PCI loans (1) 0.4 0.2 0.2 0.4 0.4 2.5 Total $ 60.8 63.1 65.3 78.0 80.9 190.8

Wells Fargo 4Q14 Supplement 23 Purchased credit-impaired (PCI) portfolios (1) Includes write-downs taken on loans where severe delinquency (normally 180 days) or other indications of severe borrower financial stress exist that indicate there will be a loss of contractually due amounts upon final resolution of the loan. (2) Reflects releases of $1.9 billion for loan resolutions and $8.6 billion from the reclassification of nonaccretable difference to the accretable yield, which will result in increasing income over the remaining life of the loan or pool of loans. Nonaccretable difference $2.9 billion remains to absorb losses on PCI loans Accretable yield $416 million accreted into interest income in 4Q14 vs. $446 million in 3Q14 $154 million reclassified from nonaccretable, primarily from the Pick-a-Pay portfolio $17.8 billion expected to accrete to income over the remaining life of the underlying loans - Commercial accretable yield balance of $274 million; weighted average life of portfolio is 2.0 years - Pick-a-Pay accretable yield balance of $17.2 billion; weighted average life of 11.7 years • 4Q14 accretable yield percentage of 6.15% stable LQ; yield expected to increase in 1Q15 to 6.21% on $140 million reclassification ($ in billions) Adjusted unpaid principal balance (1) December 31, 2008 $ 29.2 62.5 6.5 98.2 December 31, 2014 1.7 26.3 0.8 28.8 Nonaccretable difference rollforward 12/31/08 Nonaccretable difference $ 10.4 26.5 4.0 40.9 Addition of nonaccretable difference due to acquisitions 0.2 - - 0.2 Losses from loan resolutions and write-downs (6.9) (17.9) (2.9) (27.7) Release of nonaccretable difference since merger (3.6) (6.0) (0.9) (10.5) (2) 12/31/14 Remaining nonaccretable difference 0.1 2.6 0.2 2.9 Life-to-date net performance Additional provision since 2008 merger $ (1.6) - (0.1) (1.7) Release of nonaccretable difference since 2008 merger 3.6 6.0 0.9 10.5 (2) Net performance 2.0 6.0 0.8 8.8 Commercial Pick-a-Pay Other consumer Total

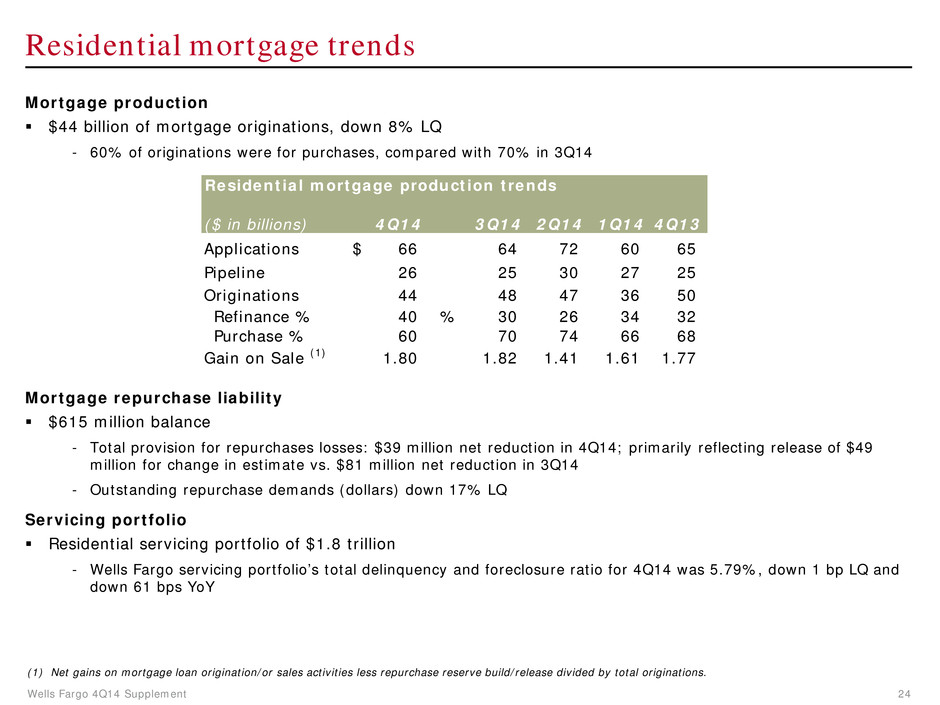

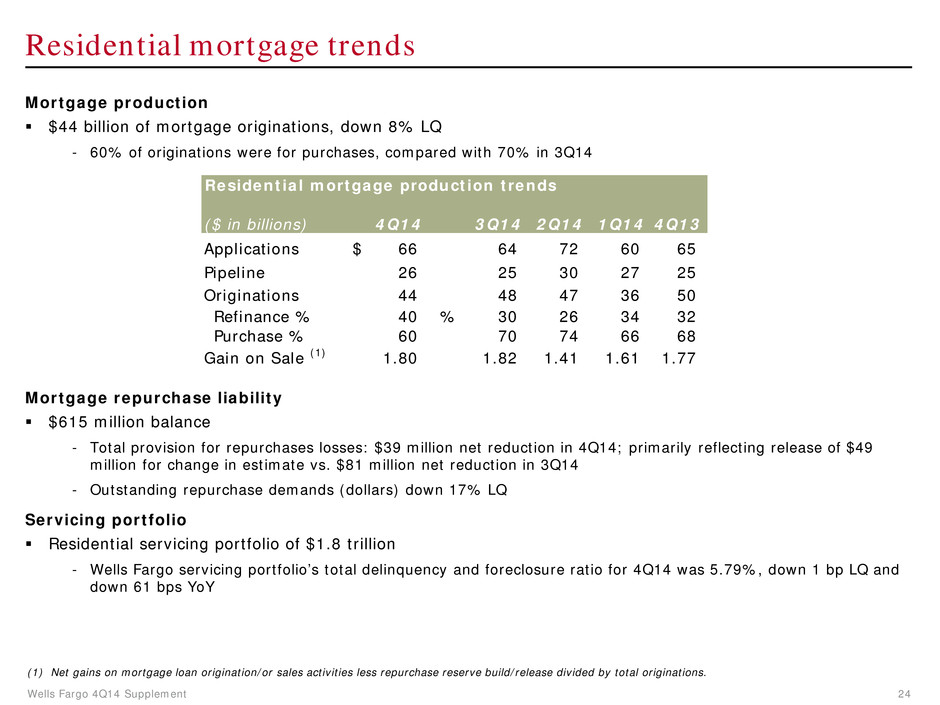

Wells Fargo 4Q14 Supplement 24 Residential mortgage trends Mortgage production $44 billion of mortgage originations, down 8% LQ - 60% of originations were for purchases, compared with 70% in 3Q14 Mortgage repurchase liability $615 million balance - Total provision for repurchases losses: $39 million net reduction in 4Q14; primarily reflecting release of $49 million for change in estimate vs. $81 million net reduction in 3Q14 - Outstanding repurchase demands (dollars) down 17% LQ Servicing portfolio Residential servicing portfolio of $1.8 trillion - Wells Fargo servicing portfolio’s total delinquency and foreclosure ratio for 4Q14 was 5.79%, down 1 bp LQ and down 61 bps YoY (1) Net gains on mortgage loan origination/or sales activities less repurchase reserve build/release divided by total originations. Residential mortgage production trends ($ in billions) 4Q14 3Q14 2Q14 1Q14 4Q13 Applications $ 66 64 72 60 65 Pipeline 26 25 30 27 25 Originations 44 48 47 36 50 Refinance % 40 % 30 26 34 32 Purchase % 60 70 74 66 68 Gain on Sale (1) 1.80 1.82 1.41 1.61 1.77

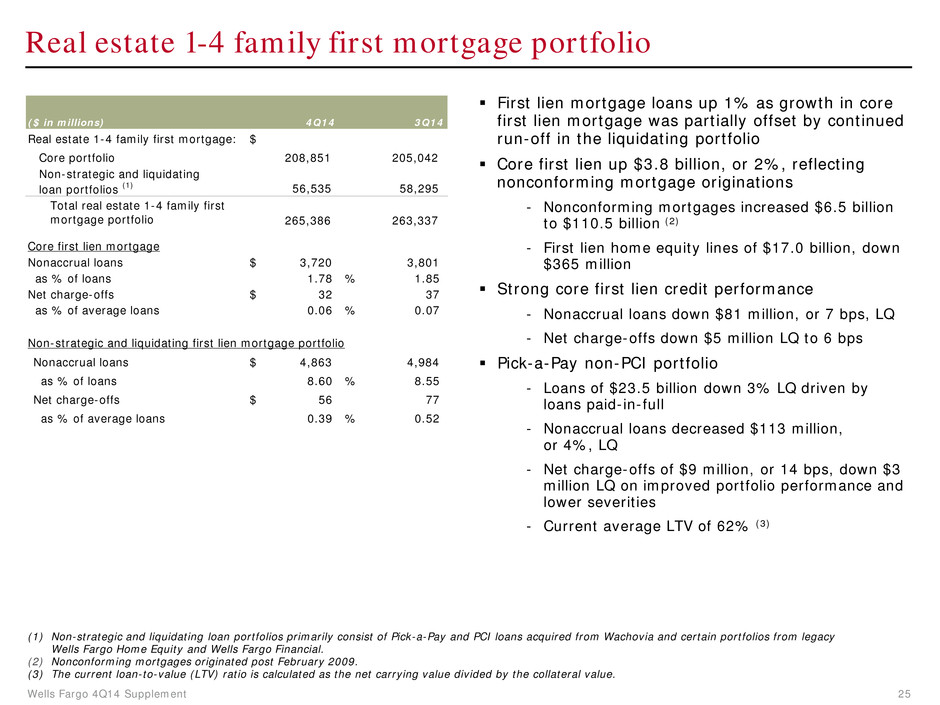

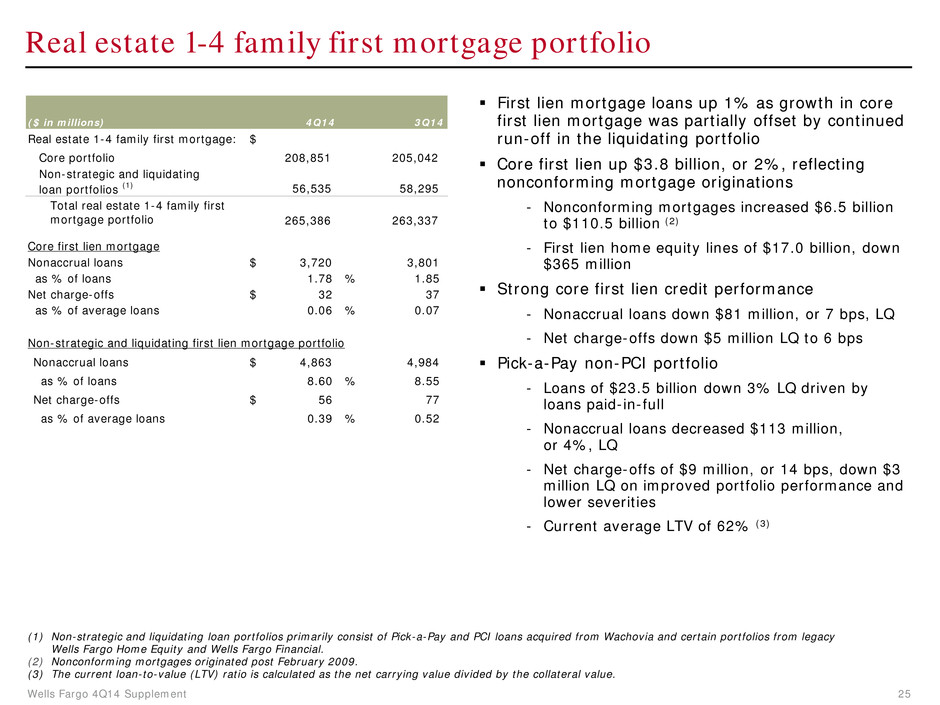

Wells Fargo 4Q14 Supplement 25 Real estate 1-4 family first mortgage portfolio First lien mortgage loans up 1% as growth in core first lien mortgage was partially offset by continued run-off in the liquidating portfolio Core first lien up $3.8 billion, or 2%, reflecting nonconforming mortgage originations - Nonconforming mortgages increased $6.5 billion to $110.5 billion (2) - First lien home equity lines of $17.0 billion, down $365 million Strong core first lien credit performance - Nonaccrual loans down $81 million, or 7 bps, LQ - Net charge-offs down $5 million LQ to 6 bps Pick-a-Pay non-PCI portfolio - Loans of $23.5 billion down 3% LQ driven by loans paid-in-full - Nonaccrual loans decreased $113 million, or 4%, LQ - Net charge-offs of $9 million, or 14 bps, down $3 million LQ on improved portfolio performance and lower severities - Current average LTV of 62% (3) (1) Non-strategic and liquidating loan portfolios primarily consist of Pick-a-Pay and PCI loans acquired from Wachovia and certain portfolios from legacy Wells Fargo Home Equity and Wells Fargo Financial. (2) Nonconforming mortgages originated post February 2009. (3) The current loan-to-value (LTV) ratio is calculated as the net carrying value divided by the collateral value. ($ in millions) 4Q14 3Q14 Real estate 1-4 family first mortgage: $ Core portfolio 208,851 205,042 Non-strategic and liquidating loan portfolios (1) 56,535 58,295 Total real estate 1-4 family first mortgage portfolio 265,386 263,337 Nonaccrual loans $ 3,720 3,801 as % of loans 1.78 % 1.85 Net charge-offs $ 32 37 as % of average loans 0.06 % 0.07 Nonaccrual loans $ 4,863 4,984 as % of loans 8.60 % 8.55 Net charge-offs $ 56 77 as % of average loans 0.39 % 0.52 Core first lien mortgage Non-strategic and liquidating first lien mortgage portfolio

Wells Fargo 4Q14 Supplement 26 Real estate 1-4 family junior lien mortgage portfolio Junior lien mortgage loans down 2% LQ as high quality new originations were more than offset by paydowns Core junior nonaccruals down $51 million, or 3%, LQ Core junior net charge-offs of $111 million, or 77 bps, down $7 million LQ (1) Non-strategic and liquidating loan portfolios primarily consist of PCI loans acquired from Wachovia and certain portfolios from legacy Wells Fargo Home Equity and Wells Fargo Financial. ($ in millions) 4Q14 3Q14 Real estate 1-4 family junior mortgage: $ Core portfolio 56,631 57,608 Non-strategic and liquidating loan portfolios (1) 3,086 3,267 Total real estate 1-4 family junior mortgage portfolio 59,717 60,875 Nonaccrual loans $ 1,722 1,773 as % of loans 3.04 % 3.08 Net charge-offs $ 111 118 as % of average loans 0.77 % 0.80 Nonaccrual loans $ 126 130 as % of loans 4.08 % 3.98 Net charge-offs $ 23 22 as % of average loans 2.87 % 2.58 Core junior lien mortgage Non-strategic and liquidating junior lien mortgage portfolio

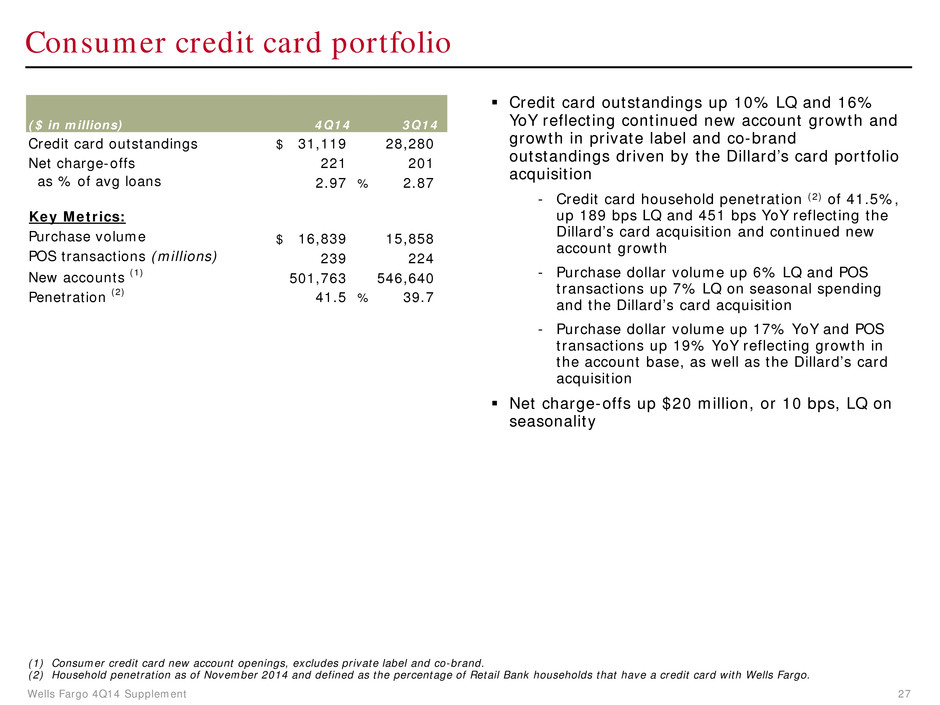

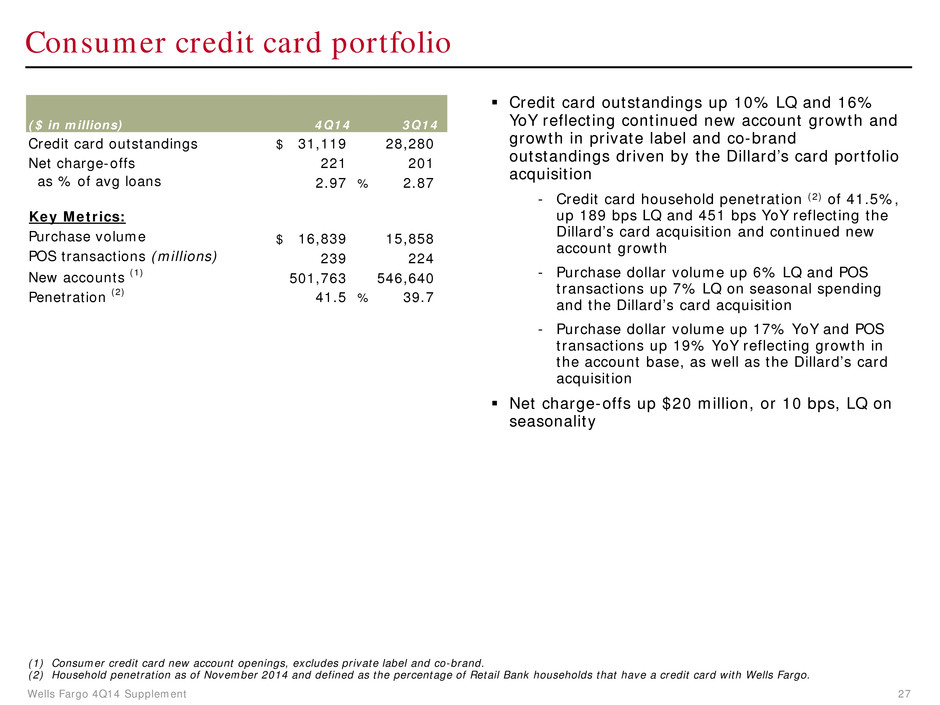

Wells Fargo 4Q14 Supplement 27 Consumer credit card portfolio Credit card outstandings up 10% LQ and 16% YoY reflecting continued new account growth and growth in private label and co-brand outstandings driven by the Dillard’s card portfolio acquisition - Credit card household penetration (2) of 41.5%, up 189 bps LQ and 451 bps YoY reflecting the Dillard’s card acquisition and continued new account growth - Purchase dollar volume up 6% LQ and POS transactions up 7% LQ on seasonal spending and the Dillard’s card acquisition - Purchase dollar volume up 17% YoY and POS transactions up 19% YoY reflecting growth in the account base, as well as the Dillard’s card acquisition Net charge-offs up $20 million, or 10 bps, LQ on seasonality (1) Consumer credit card new account openings, excludes private label and co-brand. (2) Household penetration as of November 2014 and defined as the percentage of Retail Bank households that have a credit card with Wells Fargo. ($ in millions) 4Q14 3Q14 Credit card outstandings $ 31,119 28,280 Net charge-offs 221 201 as % of avg loans 2.97 % 2.87 Key Metrics: Purchase volume $ 16,839 15,858 POS transactions (millions) 239 224 New accounts (1) 501,763 546,640 Penetration (2) 41.5 % 39.7

Wells Fargo 4Q14 Supplement 28 Auto portfolios (1) Consumer Portfolio Auto outstandings of $55.7 billion up 1% LQ and 10% YoY - 4Q14 originations of $6.7 billion down 12% LQ on seasonality and down 1% YoY reflecting continued discipline in a competitive market Nonaccrual loans declined $6 million LQ and $36 million YoY Net charge-offs were up $20 million LQ reflecting seasonality, and up $24 million YoY on portfolio growth - December Manheim index of 123.9 up 2% LQ and YoY 30+ days past due increased $240 million, or 42 bps, LQ reflecting seasonality and increased $295 million, or 35 bps, YoY on portfolio mix and aging Commercial Portfolio Loans of $9.0 billion up 6% LQ and up 7% YoY (1) The consumer auto portfolio includes the liquidating legacy Wells Fargo Financial indirect portfolio of $34 million. ($ in millions) 4Q14 3Q14 Auto outstandings $ 52,672 52,245 Nonaccrual loans 131 136 as % of loans 0.25 % 0.26 Net charge-offs $ 128 110 as % of avg loans 0.96 % 0.84 30+ days past due $ 1,325 1,090 as % of loans 2.52 % 2.09 Auto outstandings $ 3,068 2,997 Nonaccrual loans 6 7 as % of loans 0.18 % 0.23 Net charge-offs $ 4 2 as % of avg loans 0.46 % 0.28 30+ days past due $ 16 11 as % of loans 0.52 % 0.37 Commercial Auto outstandings $ 8,973 8,470 Nonaccrual loans 17 18 as % of loans 0.19 % 0.21 Net charge-offs $ - - as % of avg loans n.m. % n.m. Indirect Consumer Direct Consumer

Wells Fargo 4Q14 Supplement 29 Student lending portfolio Private Portfolio $11.9 billion private loan outstandings stable LQ and up 5% YoY - Average FICO of 753 and 80% of the total outstandings have been co-signed Net charge-offs increased $8 million LQ due to seasonality of repayment 30+ days past due increased $23 million LQ on seasonality Government Portfolio Transferred to held for sale at the end of 2Q14 - $8.3 billion sold in 4Q14 - $0.7 billion remains in held for sale ($ in millions) 4Q14 3Q14 Private Portfolio Private outstandings $ 11,936 11,916 Net charge-offs 38 30 as % of avg loans 1.27 % 1.03 30 days past due $ 253 230 as % of loans 2.12 % 1.93

Wells Fargo 4Q14 Supplement 30 Common Equity Tier 1 under Basel III (General Approach) Wells Fargo & Company and Subsidiaries FIVE QUARTER RISK-BASED CAPITAL COMPONENTS Under Basel I Dec 31, Sep 30, Jun 30, Mar 31, Dec 31, 2014 2014 2014 2014 2013 $ 185.3 183.0 181.5 176.5 171.0 (0.9) (0.5) (0.6) (0.8) (0.9) 184.4 182.5 180.9 175.7 170.1 (18.0) (18.0) (17.2) (15.2) (15.2) (2.6) (2.5) (3.2) (2.2) (1.4) (26.3) (26.1) (25.6) (25.6) (29.6) (0.3) - (0.1) - (0.4) (A) 137.2 135.9 134.8 132.7 123.5 18.0 18.0 17.2 15.2 15.2 - - - - 2.0 (0.5) (0.5) (0.3) (0.3) - 154.7 153.4 151.7 147.6 140.7 25.0 23.7 24.0 21.7 20.5 13.2 13.5 13.8 14.1 14.3 0.2 (0.1) - 0.2 0.7 38.4 37.1 37.8 36.0 35.5 (B) $ 193.1 190.5 189.5 183.6 176.2 $ 1,193.1 1,171.8 1,145.7 1,120.3 49.6 51.1 46.8 48.1 1,105.2 36.3 (C) $ 1,242.7 1,222.9 1,192.5 1,168.4 1,141.5 (A)/(C) 11.04 % 11.11 11.31 11.36 10.82 (B)/(C) 15.54 15.58 15.89 15.71 15.43 (1) (2) (3) (4) (5) (6) Total Basel III / Basel I RWAs Capital Ratios (6): Common Equity Tier 1 to total RWAs Total capital to total RWAs Basel III revises the definition of capital, increases minimum capital ratios, and introduces a minimum Common Equity Tier 1 (CET1) ratio. These changes are being fully phased in effective January 1, 2014 through the end of 2021 and the capital ratios will be determined using Basel III (General Approach) RWAs during 2014. Under transition provisions to Basel III, cumulative other comprehensive income (previously deducted under Basel I) is included in CET1 over a specified phase-in period. In addition, certain intangible assets includable in CET1 are phased out over a specified period. Goodwill and other intangible assets are net of any associated deferred tax liabilities. CET1 (formerly Tier 1 common equity under Basel I) is a non-GAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies. Management reviews CET1 along with other measures of capital as part of its financial analyses and has included this non-GAAP financial information, and the corresponding reconciliation to total equity, because of current interest in such information on the part of market participants. Under the regulatory guidelines for risk-based capital, on-balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items are assigned to one of several broad risk categories according to the obligor, or, if relevant, the guarantor or the nature of any collateral. The aggregate dollar amount in each risk category is then multiplied by the risk weight associated with that category. The resulting weighted values from each of the risk categories are aggregated for determining total RWAs. The Company's December 31, 2014, RWAs and capital ratios are preliminary. Market risk Total Tier 1 capital Long-term debt and other instruments qualifying as Tier 2 Qualifying allowance for credit losses Other Total Tier 2 capital Total qualifying capital Basel III Risk-Weighted Assets (RWAs) (5)(6): Credit risk Market risk Basel I RWAs (5)(6): Credit risk Other Total equity Noncontrolling interests Total Wells Fargo stockholders' equity Adjustments: Preferred stock Cumulative other comprehensive income (2) Goodwill and other intangible assets (2)(3) Investment in certain subsidiaries and other Common Equity Tier 1 (1)(4) Preferred stock Qualifying hybrid securities and noncontrolling interests (in billions) (General Approach) (1) Under Basel III

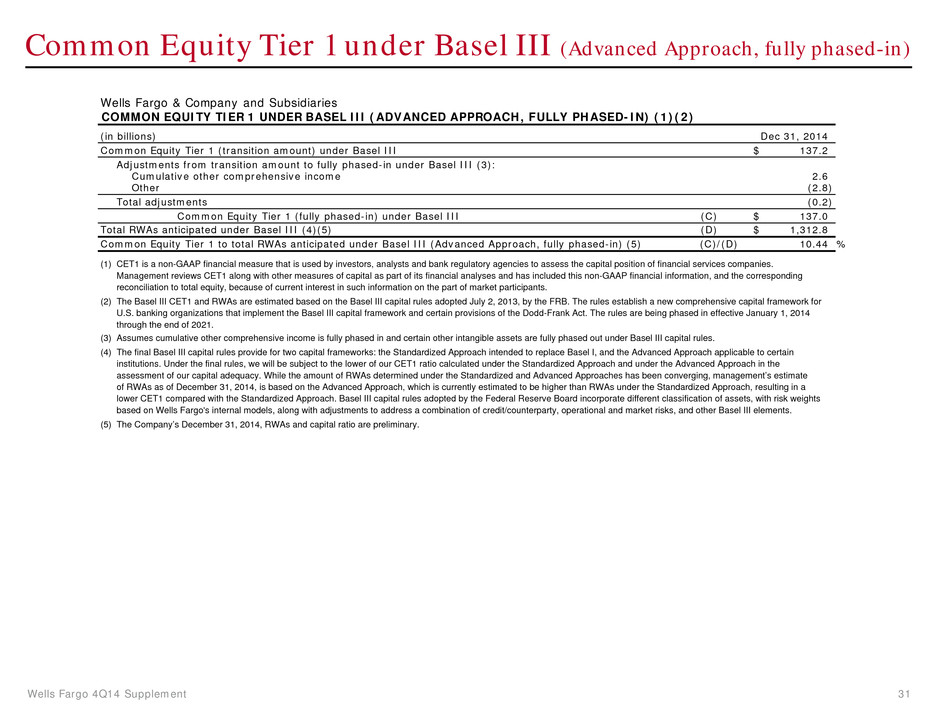

Wells Fargo 4Q14 Supplement 31 Common Equity Tier 1 under Basel III (Advanced Approach, fully phased-in) Wells Fargo & Company and Subsidiaries COMMON EQUITY TIER 1 UNDER BASEL III (ADVANCED APPROACH, FULLY PHASED-IN) (1)(2) Dec 31, 2014 $ 137.2 2.6 (2.8) (0.2) Common Equity Tier 1 (fully phased-in) under Basel III (C) $ 137.0 (D) $ 1,312.8 Common Equity Tier 1 to total RWAs anticipated under Basel III (Advanced Approach, fully phased-in) (5) (C)/(D) 10.44 % (1) (2) (3) (4) (5) Common Equity Tier 1 (transition amount) under Basel III (in billions) Adjustments from transition amount to fully phased-in under Basel III (3): Cumulative other comprehensive income Other Total adjustments Total RWAs anticipated under Basel III (4)(5) The Company’s December 31, 2014, RWAs and capital ratio are preliminary. CET1 is a non-GAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies. Management reviews CET1 along with other measures of capital as part of its financial analyses and has included this non-GAAP financial information, and the corresponding reconciliation to total equity, because of current interest in such information on the part of market participants. The Basel III CET1 and RWAs are estimated based on the Basel III capital rules adopted July 2, 2013, by the FRB. The rules establish a new comprehensive capital framework for U.S. banking organizations that implement the Basel III capital framework and certain provisions of the Dodd-Frank Act. The rules are being phased in effective January 1, 2014 through the end of 2021. Assumes cumulative other comprehensive income is fully phased in and certain other intangible assets are fully phased out under Basel III capital rules. The final Basel III capital rules provide for two capital frameworks: the Standardized Approach intended to replace Basel I, and the Advanced Approach applicable to certain institutions. Under the final rules, we will be subject to the lower of our CET1 ratio calculated under the Standardized Approach and under the Advanced Approach in the assessment of our capital adequacy. While the amount of RWAs determined under the Standardized and Advanced Approaches has been converging, management’s estimate of RWAs as of December 31, 2014, is based on the Advanced Approach, which is currently estimated to be higher than RWAs under the Standardized Approach, resulting in a lower CET1 compared with the Standardized Approach. Basel III capital rules adopted by the Federal Reserve Board incorporate different classification of assets, with risk weights based on Wells Fargo's internal models, along with adjustments to address a combination of credit/counterparty, operational and market risks, and other Basel III elements.

Wells Fargo 4Q14 Supplement 32 Forward-looking statements and additional information Forward-looking statements: This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, we may make forward-looking statements in our other documents filed or furnished with the SEC, and our management may make forward- looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements include, but are not limited to, statements we make about: (i) the future operating or financial performance of the Company, including our outlook for future growth; (ii) our noninterest expense and efficiency ratio; (iii) future credit quality and performance, including our expectations regarding future loan losses and allowance releases; (iv) the appropriateness of the allowance for credit losses; (v) our expectations regarding net interest income and net interest margin; (vi) loan growth or the reduction or mitigation of risk in our loan portfolios; (vii) future capital levels and our estimated Common Equity Tier 1 ratio under Basel III capital standards; (viii) the performance of our mortgage business and any related exposures; (ix) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; (x) future common stock dividends, common share repurchases and other uses of capital; (xi) our targeted range for return on assets and return on equity; (xii) the outcome of contingencies, such as legal proceedings; and (xiii) the Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on forward- looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For more information about factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements” discussion in Wells Fargo’s press release announcing our fourth quarter 2014 results and in our most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013. Purchased credit-impaired loan portfolio: Loans that were acquired from Wachovia that were considered credit impaired were written down at acquisition date in purchase accounting to an amount estimated to be collectible and the related allowance for loan losses was not carried over to Wells Fargo’s allowance. In addition, such purchased credit-impaired loans are not classified as nonaccrual or nonperforming, and are not included in loans that were contractually 90+ days past due and still accruing. Any losses on such loans are charged against the nonaccretable difference established in purchase accounting and are not reported as charge-offs (until such difference is fully utilized). As a result of accounting for purchased loans with evidence of credit deterioration, certain ratios of the combined company are not comparable to a portfolio that does not include purchased credit-impaired loans. In certain cases, the purchased credit-impaired loans may affect portfolio credit ratios and trends. Management believes that the presentation of information adjusted to exclude the purchased credit-impaired loans provides useful disclosure regarding the credit quality of the non-impaired loan portfolio. Accordingly, certain of the loan balances and credit ratios in this document have been adjusted to exclude the purchased credit-impaired loans. References in this document to impaired loans mean the purchased credit-impaired loans. Please see pages 32-34 of the press release announcing our 4Q14 results for additional information regarding the purchased credit-impaired loans.