Exhibit 99.2 3Q18 Quarterly Supplement October 12, 2018 © 2018 Wells Fargo & Company. All rights reserved.

Table of contents 3Q18 Results Appendix 3Q18 Highlights Pages 2 Real estate 1-4 family mortgage portfolio 25 3Q18 Earnings 3 Consumer credit card portfolio 26 Year-over-year results 4 Auto portfolios 27 Balance Sheet and credit overview (linked quarter) 5 Student lending portfolio 28 Income Statement overview (linked quarter) 6 Trading-related revenue 29 Loans 7 Noninterest expense analysis (reference for slides 15-16) 30 Commercial loan trends 8 Common Equity Tier 1 (Fully Phased-In) 31 Consumer loan trends 9 Average deposit trends and costs 10 Return on average tangible common equity Period-end deposit trends 11 (ROTCE) 32 Net interest income 12 Forward-looking statements and Noninterest income 13 additional information 33 Noninterest expense and efficiency ratio 14 Noninterest expense – linked quarter 15 Noninterest expense – year over year 16 Community Banking 17 Community Banking metrics 18-19 Wholesale Banking 20 Wealth and Investment Management 21 Credit quality 22 Capital 23 Financial results reported in this document are preliminary. Final financial results and other disclosures will be reported in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2018, and may differ materially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information. Wells Fargo 3Q18 Supplement 1

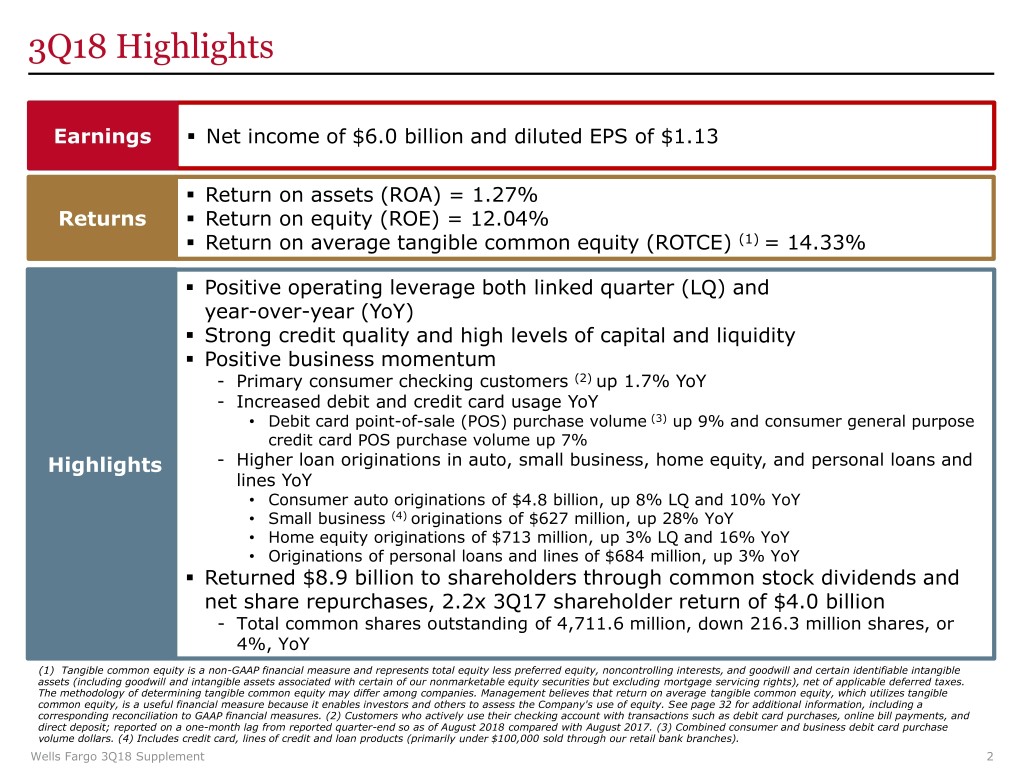

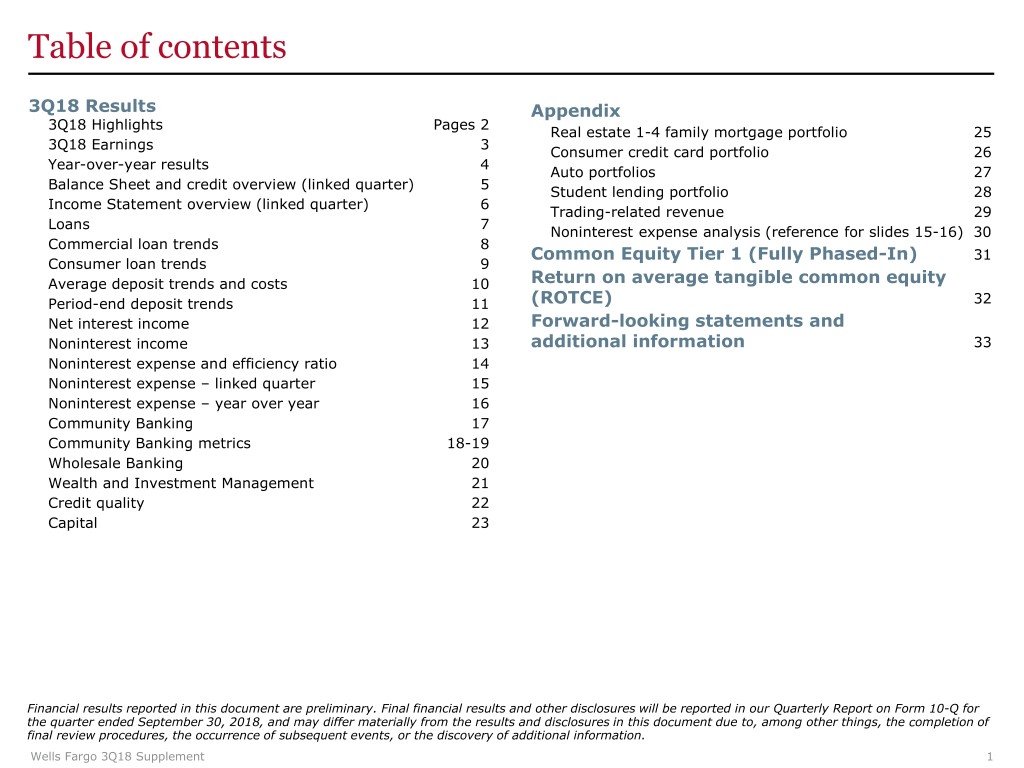

3Q18 Highlights Earnings . Net income of $6.0 billion and diluted EPS of $1.13 . Return on assets (ROA) = 1.27% Returns . Return on equity (ROE) = 12.04% . Return on average tangible common equity (ROTCE) (1) = 14.33% . Positive operating leverage both linked quarter (LQ) and year-over-year (YoY) . Strong credit quality and high levels of capital and liquidity . Positive business momentum - Primary consumer checking customers (2) up 1.7% YoY - Increased debit and credit card usage YoY • Debit card point-of-sale (POS) purchase volume (3) up 9% and consumer general purpose credit card POS purchase volume up 7% Highlights - Higher loan originations in auto, small business, home equity, and personal loans and lines YoY • Consumer auto originations of $4.8 billion, up 8% LQ and 10% YoY • Small business (4) originations of $627 million, up 28% YoY • Home equity originations of $713 million, up 3% LQ and 16% YoY • Originations of personal loans and lines of $684 million, up 3% YoY . Returned $8.9 billion to shareholders through common stock dividends and net share repurchases, 2.2x 3Q17 shareholder return of $4.0 billion - Total common shares outstanding of 4,711.6 million, down 216.3 million shares, or 4%, YoY (1) Tangible common equity is a non-GAAP financial measure and represents total equity less preferred equity, noncontrolling interests, and goodwill and certain identifiable intangible assets (including goodwill and intangible assets associated with certain of our nonmarketable equity securities but excluding mortgage servicing rights), net of applicable deferred taxes. The methodology of determining tangible common equity may differ among companies. Management believes that return on average tangible common equity, which utilizes tangible common equity, is a useful financial measure because it enables investors and others to assess the Company's use of equity. See page 32 for additional information, including a corresponding reconciliation to GAAP financial measures. (2) Customers who actively use their checking account with transactions such as debit card purchases, online bill payments, and direct deposit; reported on a one-month lag from reported quarter-end so as of August 2018 compared with August 2017. (3) Combined consumer and business debit card purchase volume dollars. (4) Includes credit card, lines of credit and loan products (primarily under $100,000 sold through our retail bank branches). Wells Fargo 3Q18 Supplement 2

3Q18 Earnings . Wells Fargo Net Income Earnings of $6.0 billion included: ($ in millions, except EPS) - $638 million gain on the sales of $1.7 billion 6,151 6,007 of Pick-a-Pay PCI mortgage loans (recognized in all other noninterest income) 5,136 5,186 - $605 million of operating losses primarily related to remediation expense for a variety of 4,542 matters, including an additional $241 million $1.16 accrual for previously disclosed issues related $1.13 to automobile collateral protection insurance (CPI) (operating losses) $0.96 $0.98 - $100 million reserve release (1) (provision for credit losses) $0.83 - An effective income tax rate of 20.1%, which included net discrete income tax expense related to the re-measurement of our initial estimates for the impacts of the Tax Cuts & Jobs Act recognized in 4Q17 (income tax expense) . Diluted earnings per common share (EPS) 3Q17 4Q17 1Q18 2Q18 3Q18 Diluted earnings per common share of $1.13 included: - The 9/17/18 redemption of our Series J Preferred Stock, which reduced EPS by $0.03 per share as a result of the elimination of the purchase accounting discount recorded on these shares at the time of the Wachovia acquisition (preferred stock dividends) (1) Reserve build represents the amount by which the provision for credit losses exceeds net charge-offs, while reserve release represents the amount by which net charge-offs exceed the provision for credit losses. Wells Fargo 3Q18 Supplement 3

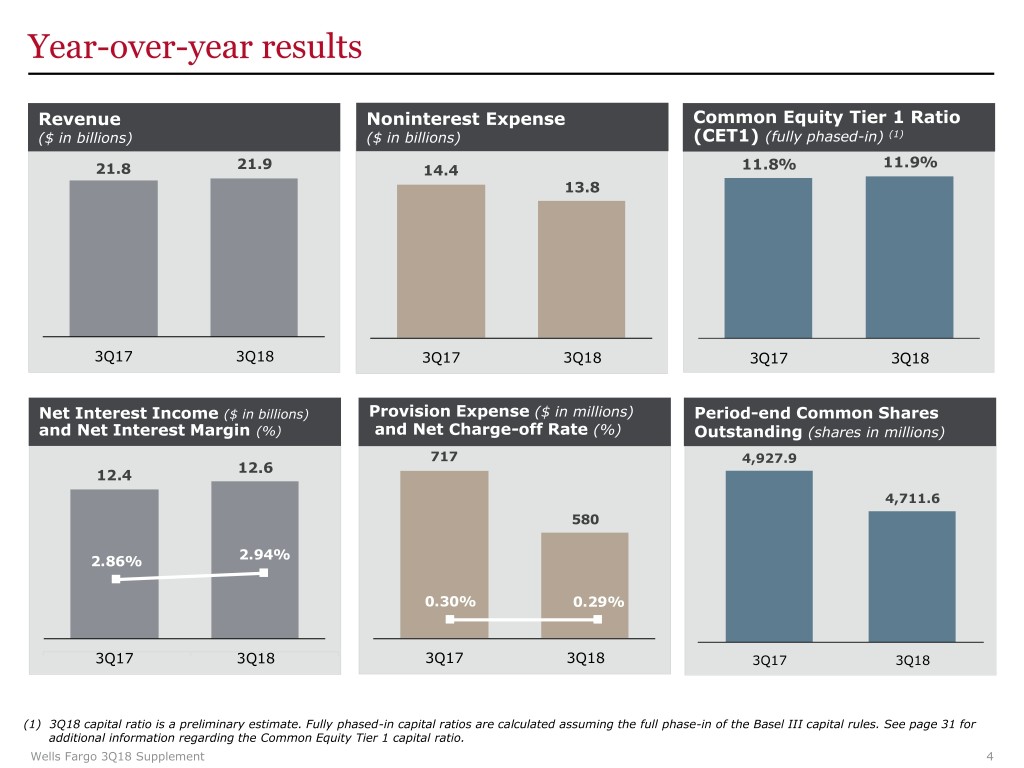

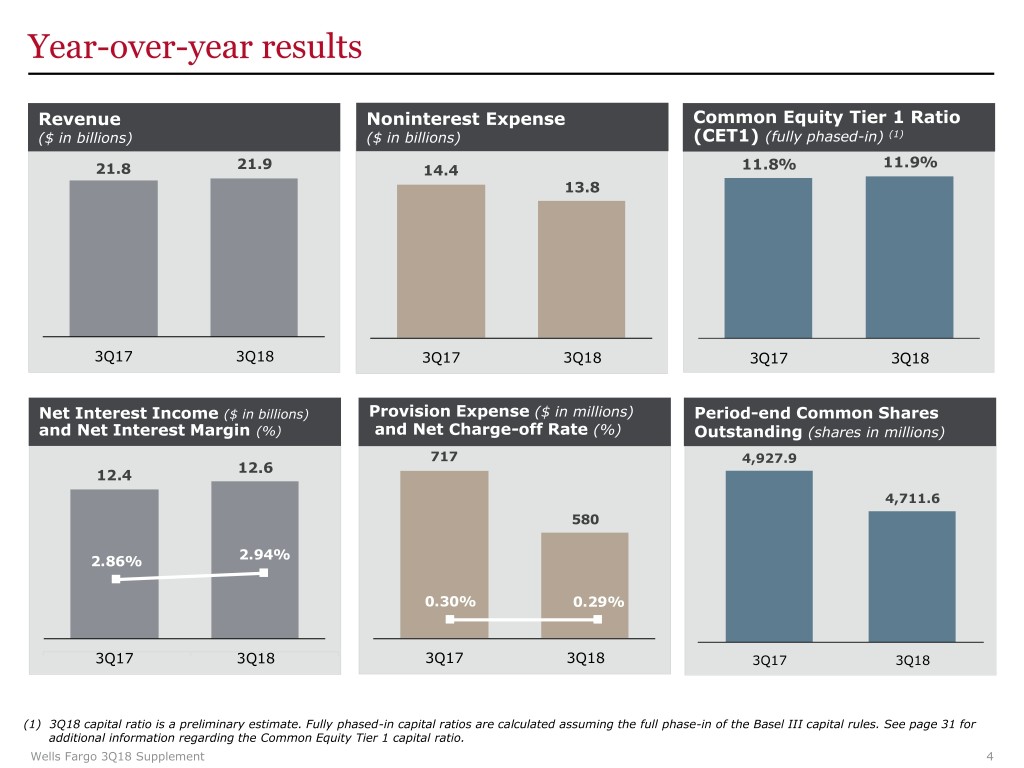

Year-over-year results Revenue Noninterest Expense Common Equity Tier 1 Ratio ($ in billions) ($ in billions) (CET1) (fully phased-in) (1) 11.9% 21.8 21.9 14.4 11.8% 13.8 3Q17 3Q18 3Q17 3Q18 3Q17 3Q18 Net Interest Income ($ in billions) Provision Expense ($ in millions) Period-end Common Shares and Net Interest Margin (%) and Net Charge-off Rate (%) Outstanding (shares in millions) 717 4,927.9 12.6 12.4 4,711.6 580 2.86% 2.94% 0.30% 0.29% 3Q17 3Q18 3Q17 3Q18 3Q17 3Q18 3Q17 3Q18 (1) 3Q18 capital ratio is a preliminary estimate. Fully phased-in capital ratios are calculated assuming the full phase-in of the Basel III capital rules. See page 31 for additional information regarding the Common Equity Tier 1 capital ratio. Wells Fargo 3Q18 Supplement 4

Balance Sheet and credit overview (linked quarter) Loans . Down $2.0 billion on lower commercial real estate loans, legacy consumer real estate loans and auto loans - Commercial loans down $1.2 billion as growth in commercial & industrial loans was more than offset by declines in commercial real estate loans - Consumer loans down $746 million as growth in nonconforming mortgage loans and credit card loans was more than offset by declines in legacy consumer real estate loans due to run-off and sales, and declines in auto loans Cash and short-term . Down $639 million investments Debt and equity . Trading assets up $3.7 billion on an increase in equity securities held for trading due securities to stronger customer activity . Debt securities (AFS and HTM) down $2.8 billion as ~$14.3 billion of gross purchases, primarily agency mortgage-backed securities (MBS) in the available for sale portfolio, were more than offset by run-off and sales Deposits . Down $2.3 billion as consumers continued to move excess liquidity to higher-rate alternatives Short-term borrowings . Up $1.0 billion reflecting higher trading-related funding Long-term debt . Up $2.0 billion as $9.8 billion in issuances were largely offset by maturities - Includes first bank-issued SOFR (1) debt issuance of $1.0 billion Total stockholders’ . Down $6.4 billion to $198.7 billion reflecting increased common stock repurchases in equity the quarter, as well as a $1.4 billion decline in other comprehensive income (OCI) primarily due to higher interest rates . Common shares outstanding down 137.5 million shares on net share repurchases of $6.8 billion Credit . Net charge-offs of $680 million, or 29 bps of average loans (annualized) . Nonperforming assets of $7.6 billion, down $410 million on both lower consumer and commercial nonaccruals . $100 million reserve release reflected strong credit performance, as well as lower loan balances Period-end balances. All comparisons are 3Q18 compared with 2Q18. (1) SOFR = Secured Overnight Financing Rate. Wells Fargo 3Q18 Supplement 5

Income Statement overview (linked quarter) Total revenue . Revenue of $21.9 billion, up $388 million, or 2% Net interest income . NII up $31 million; NIM increased 1 bp to 2.94% Noninterest income . Noninterest income up $357 million - Mortgage banking up $76 million on $92 million higher gains on mortgage origination activity driven by a higher production margin due to an improvement in secondary market conditions, as well as higher commercial mortgage banking gains, which were partially offset by a $16 million decline in servicing income - Market sensitive revenue (1) up $104 million on higher net gains from equity securities largely reflecting lower other-than-temporary impairment (OTTI) - Other income up $148 million on higher gains from the sales of Pick-a-Pay PCI loans Noncontrolling interest . Minority interest down $44 million reflecting lower equity gains from venture capital (reduces net income) businesses Noninterest expense . Noninterest expense down $219 million - Personnel expense down $87 million on lower incentive compensation - Equipment expense up $84 million on higher computer and software spend - Outside professional services expense down $120 million on lower project spend and legal expense - Other expense (2) down $116 million on lower charitable donations expense Income tax expense . 20.1% effective income tax rate included a net discrete income tax expense related to the re-measurement of our initial estimates for the impact of the Tax Cuts & Jobs Act recognized in 4Q17 . Currently expect the effective income tax rate for 4Q18 to be ~19%, excluding the impact of any future discrete items All comparisons are 3Q18 compared with 2Q18. (1) Consists of net gains from trading activities, debt securities and equity securities. (2) The sum of Outside professional services expense, operating losses and Other expense equals Other noninterest expense in the Consolidated Statement of Income, pages 19 and 20 of the press release. Wells Fargo 3Q18 Supplement 6

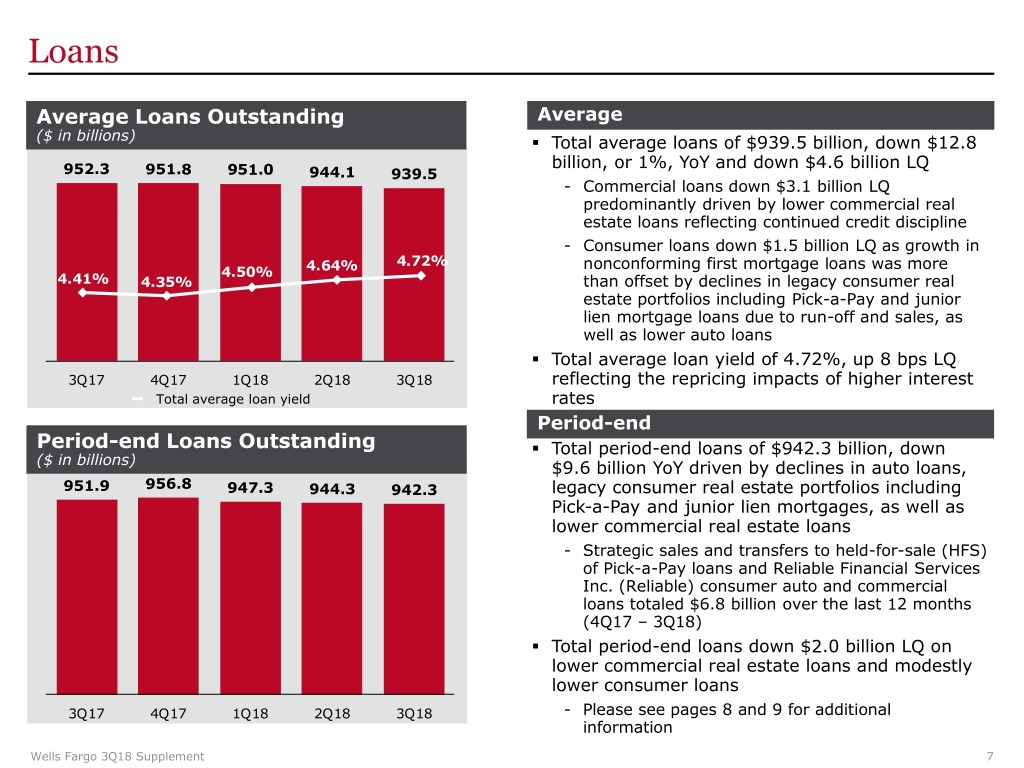

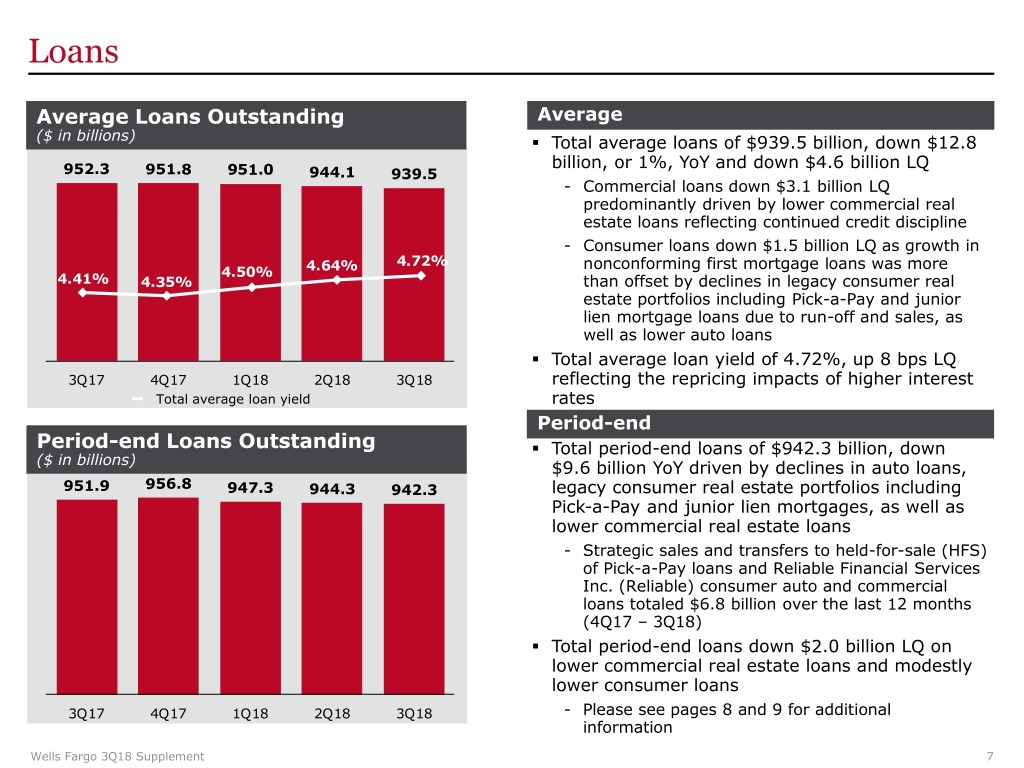

Loans Average Loans Outstanding Average ($ in billions) . Total average loans of $939.5 billion, down $12.8 billion, or 1%, YoY and down $4.6 billion LQ 952.3 951.8 951.0 944.1 939.5 - Commercial loans down $3.1 billion LQ predominantly driven by lower commercial real estate loans reflecting continued credit discipline - Consumer loans down $1.5 billion LQ as growth in 4.72% nonconforming first mortgage loans was more 4.50% 4.64% 4.41% 4.35% than offset by declines in legacy consumer real estate portfolios including Pick-a-Pay and junior lien mortgage loans due to run-off and sales, as well as lower auto loans . Total average loan yield of 4.72%, up 8 bps LQ 3Q17 4Q17 1Q18 2Q18 3Q18 reflecting the repricing impacts of higher interest Total average loan yield rates Period-end Period-end Loans Outstanding . Total period-end loans of $942.3 billion, down ($ in billions) $9.6 billion YoY driven by declines in auto loans, 951.9 956.8 947.3 944.3 942.3 legacy consumer real estate portfolios including Pick-a-Pay and junior lien mortgages, as well as lower commercial real estate loans - Strategic sales and transfers to held-for-sale (HFS) of Pick-a-Pay loans and Reliable Financial Services Inc. (Reliable) consumer auto and commercial loans totaled $6.8 billion over the last 12 months (4Q17 – 3Q18) . Total period-end loans down $2.0 billion LQ on lower commercial real estate loans and modestly lower consumer loans 3Q17 4Q17 1Q18 2Q18 3Q18 - Please see pages 8 and 9 for additional information Wells Fargo 3Q18 Supplement 7

Commercial loan trends Commercial loans up $1.7 billion YoY and down $1.2 billion LQ: ($ in billions, Period-end balances) B= billion, MM = million Commercial and industrial (C&I) loans up $1.5 billion LQ On growth of… …partially offset by declines of: Commercial and Industrial 350 . $2.6B in Corporate & Investment . $1.1B in Middle Market Banking 340 Banking on a seasonal decline in revolver 330 - $1.7B in Wells Fargo Securities on utilization growth in Prime Brokerage and Asset . 320 $807MM in Government & Backed Finance reflecting strength in Institutional Banking on tax 310 corporate businesses reform as customers chose 300 - $612MM in Corporate Banking driven alternative financing options 290 by healthcare and energy . $250MM in Commercial Auto on 280 - $313MM in Financial Institutions . seasonally lower dealer floor plan 270 $672MM in Commercial Capital as utilization 260 strength in corporate businesses was partially offset by a seasonal decline in 250 3Q17 2Q18 3Q18 Commercial Distribution Finance . $635MM in Commercial Real Estate credit facilities to REITs and non- depository financial institutions Commercial Real Estate 160 Commercial real estate loans down $2.8 billion LQ reflecting 150 continued credit discipline . 140 CRE construction up $753MM due to growth in community lending, hospitality and senior housing 130 . CRE mortgage down $3.6B due to ongoing paydowns/payoffs on existing and acquired loans, and lower originations reflecting continued credit discipline in a 120 competitive, highly liquid financing market 110 100 3Q17 2Q18 3Q18 Wells Fargo 3Q18 Supplement 8

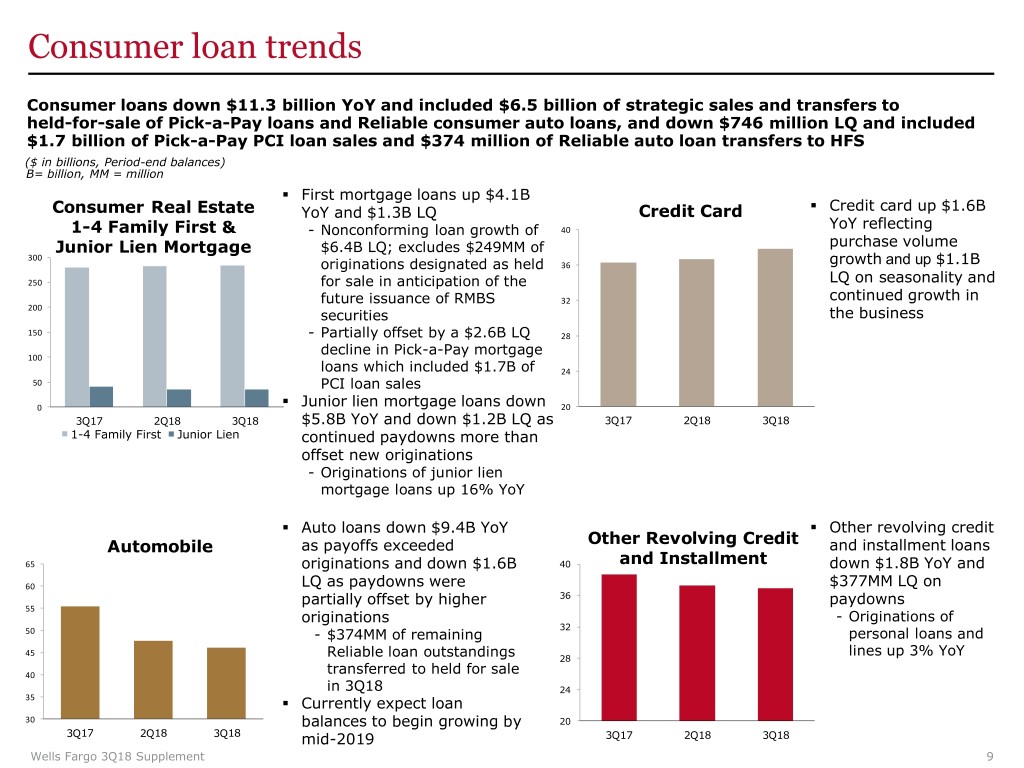

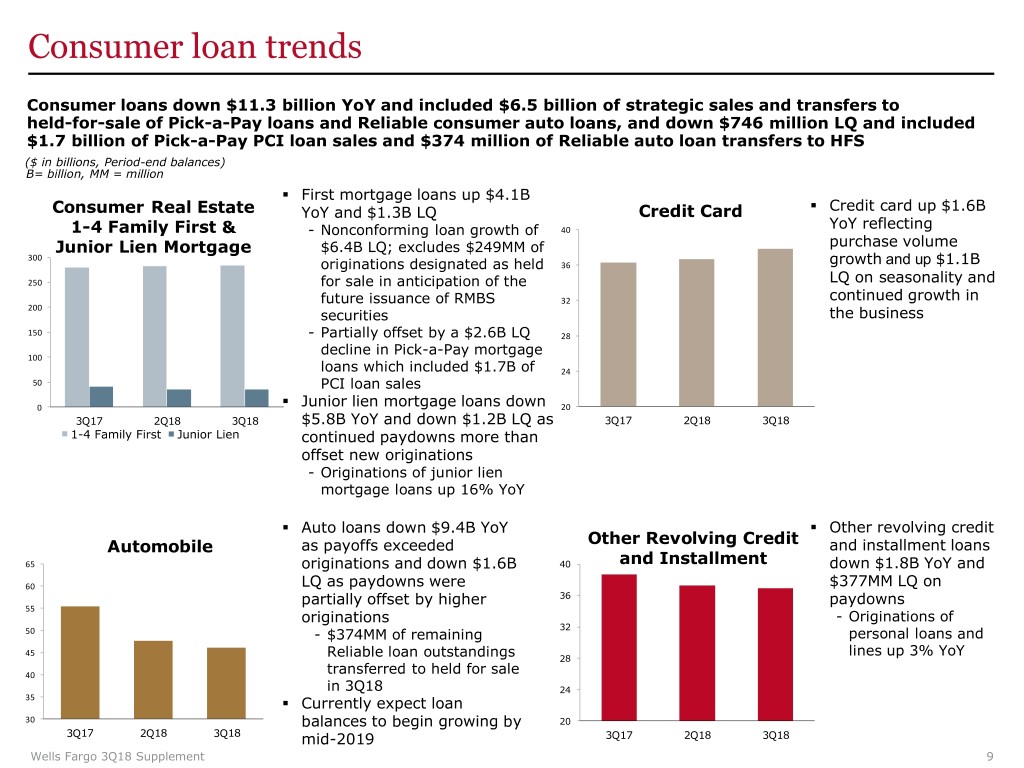

Consumer loan trends Consumer loans down $11.3 billion YoY and included $6.5 billion of strategic sales and transfers to held-for-sale of Pick-a-Pay loans and Reliable consumer auto loans, and down $746 million LQ and included $1.7 billion of Pick-a-Pay PCI loan sales and $374 million of Reliable auto loan transfers to HFS ($ in billions, Period-end balances) B= billion, MM = million . First mortgage loans up $4.1B . Consumer Real Estate YoY and $1.3B LQ Credit Card Credit card up $1.6B YoY reflecting 1-4 Family First & - Nonconforming loan growth of 40 Junior Lien Mortgage $6.4B LQ; excludes $249MM of purchase volume 300 originations designated as held 36 growth and up $1.1B 250 for sale in anticipation of the LQ on seasonality and future issuance of RMBS 32 continued growth in 200 securities the business 150 - Partially offset by a $2.6B LQ 28 decline in Pick-a-Pay mortgage 100 loans which included $1.7B of 24 50 PCI loan sales . 0 Junior lien mortgage loans down 20 3Q17 2Q18 3Q18 $5.8B YoY and down $1.2B LQ as 3Q17 2Q18 3Q18 1-4 Family First Junior Lien continued paydowns more than offset new originations - Originations of junior lien mortgage loans up 16% YoY . Auto loans down $9.4B YoY . Other revolving credit Other Revolving Credit Automobile as payoffs exceeded and installment loans 65 originations and down $1.6B 40 and Installment down $1.8B YoY and 60 LQ as paydowns were $377MM LQ on partially offset by higher 36 paydowns 55 originations - Originations of 32 50 - $374MM of remaining personal loans and 45 lines up 3% YoY Reliable loan outstandings 28 40 transferred to held for sale in 3Q18 24 35 . Currently expect loan 30 balances to begin growing by 20 3Q17 2Q18 3Q18 mid-2019 3Q17 2Q18 3Q18 Wells Fargo 3Q18 Supplement 9

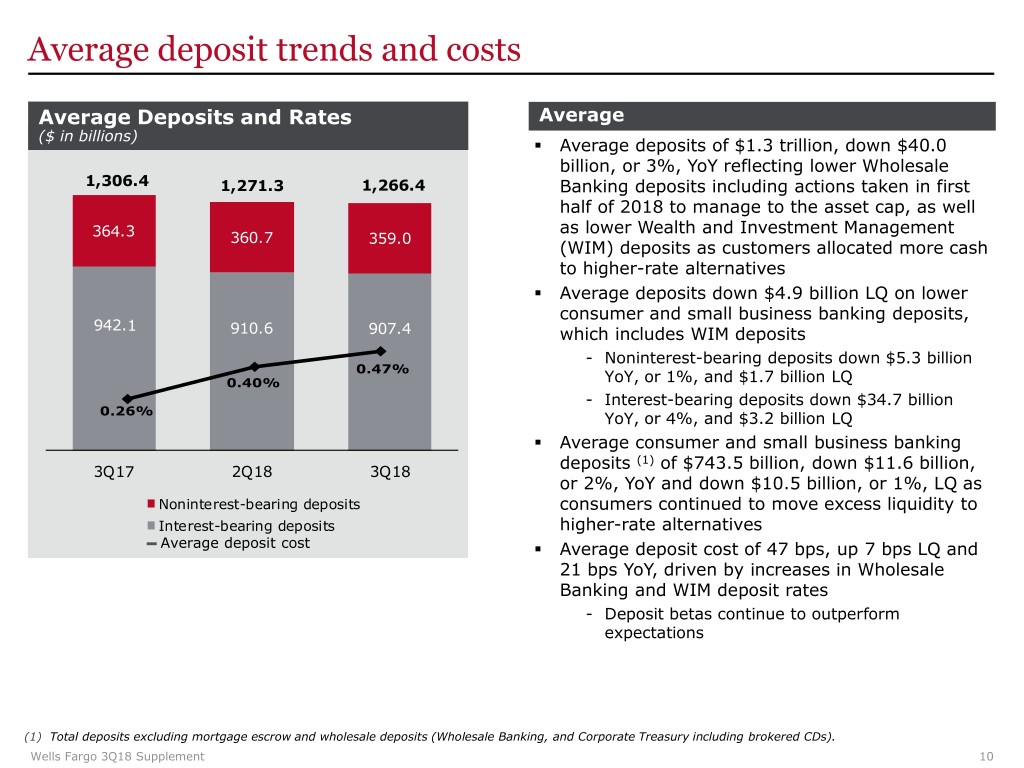

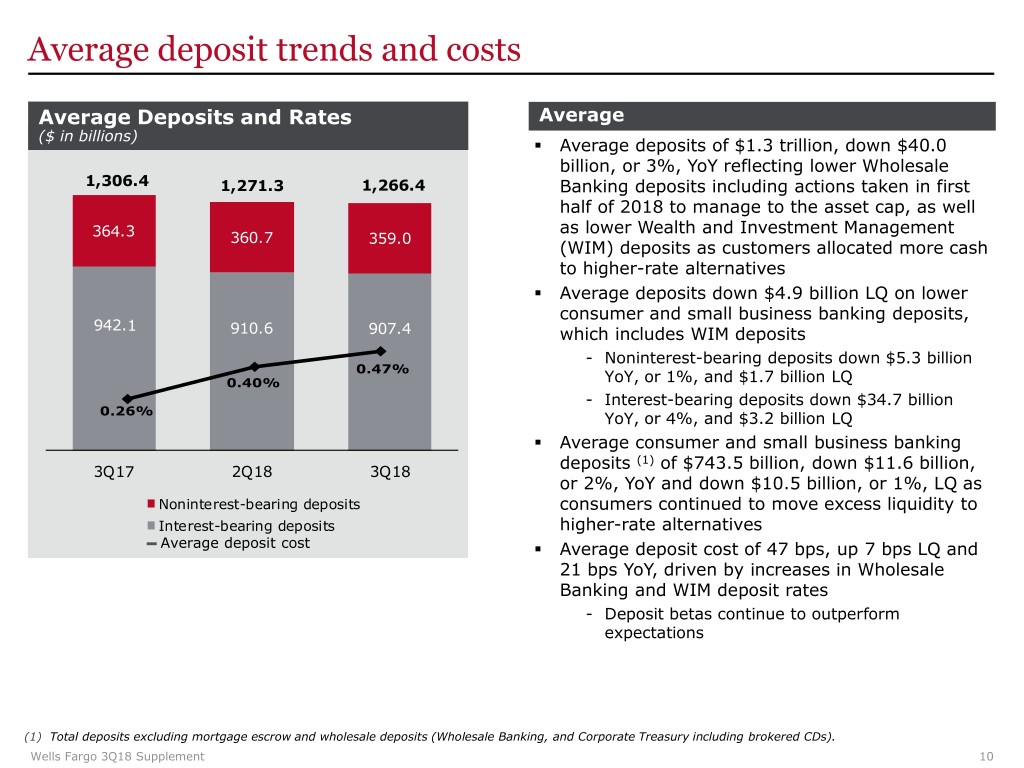

Average deposit trends and costs Average Deposits and Rates Average ($ in billions) . Average deposits of $1.3 trillion, down $40.0 billion, or 3%, YoY reflecting lower Wholesale 1,306.4 1,271.3 1,266.4 Banking deposits including actions taken in first half of 2018 to manage to the asset cap, as well as lower Wealth and Investment Management 364.3 360.7 359.0 (WIM) deposits as customers allocated more cash to higher-rate alternatives . Average deposits down $4.9 billion LQ on lower consumer and small business banking deposits, 942.1 910.6 907.4 which includes WIM deposits - Noninterest-bearing deposits down $5.3 billion 0.47% 0.40% YoY, or 1%, and $1.7 billion LQ - Interest-bearing deposits down $34.7 billion 0.26% YoY, or 4%, and $3.2 billion LQ . Average consumer and small business banking deposits (1) of $743.5 billion, down $11.6 billion, 3Q17 2Q18 3Q18 or 2%, YoY and down $10.5 billion, or 1%, LQ as Noninterest-bearing deposits consumers continued to move excess liquidity to Interest-bearing deposits higher-rate alternatives Average deposit cost . Average deposit cost of 47 bps, up 7 bps LQ and 21 bps YoY, driven by increases in Wholesale Banking and WIM deposit rates - Deposit betas continue to outperform expectations (1) Total deposits excluding mortgage escrow and wholesale deposits (Wholesale Banking, and Corporate Treasury including brokered CDs). Wells Fargo 3Q18 Supplement 10

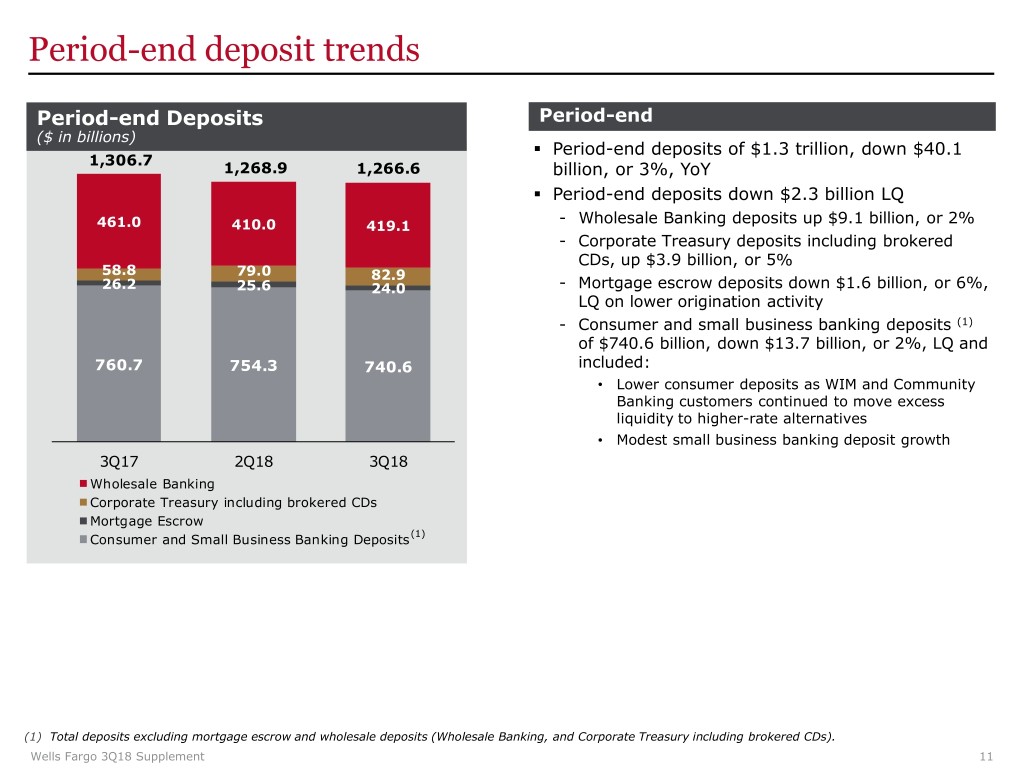

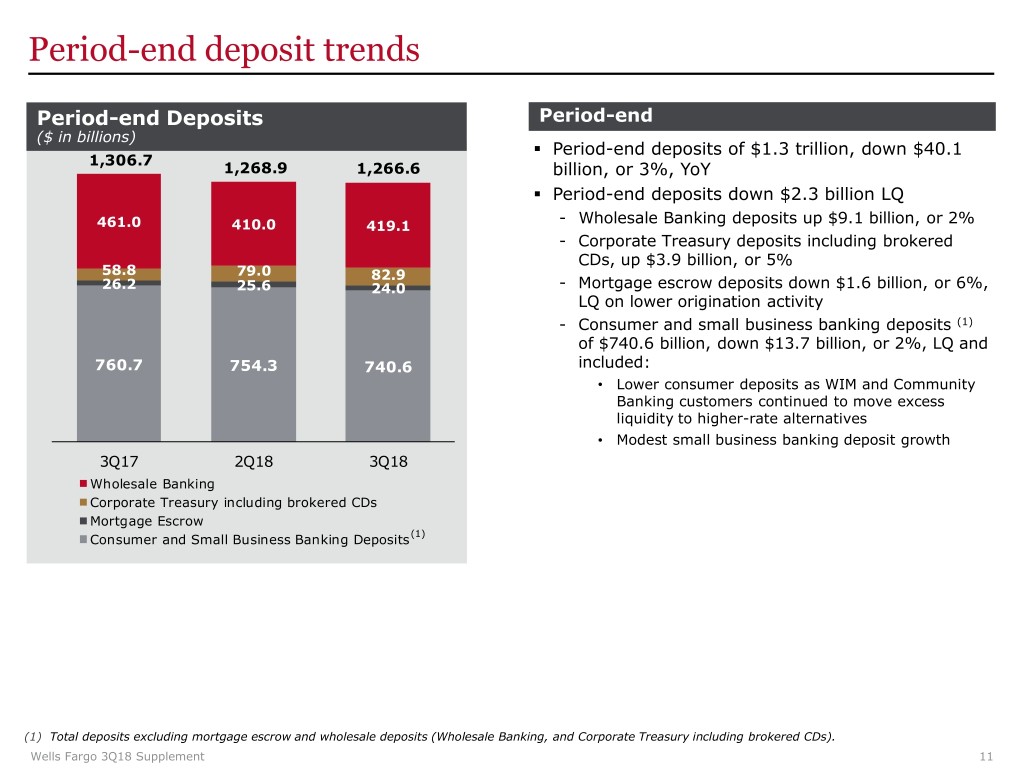

Period-end deposit trends Period-end Deposits Period-end ($ in billions) . Period-end deposits of $1.3 trillion, down $40.1 1,306.7 1,268.9 1,266.6 billion, or 3%, YoY . Period-end deposits down $2.3 billion LQ - Wholesale Banking deposits up $9.1 billion, or 2% 461.0 410.0 419.1 - Corporate Treasury deposits including brokered CDs, up $3.9 billion, or 5% 58.8 79.0 82.9 26.2 25.6 24.0 - Mortgage escrow deposits down $1.6 billion, or 6%, LQ on lower origination activity - Consumer and small business banking deposits (1) of $740.6 billion, down $13.7 billion, or 2%, LQ and 760.7 754.3 740.6 included: • Lower consumer deposits as WIM and Community Banking customers continued to move excess liquidity to higher-rate alternatives • Modest small business banking deposit growth 3Q17 2Q18 3Q18 Wholesale Banking Corporate Treasury including brokered CDs Mortgage Escrow Consumer and Small Business Banking Deposits(1) (1) Total deposits excluding mortgage escrow and wholesale deposits (Wholesale Banking, and Corporate Treasury including brokered CDs). Wells Fargo 3Q18 Supplement 11

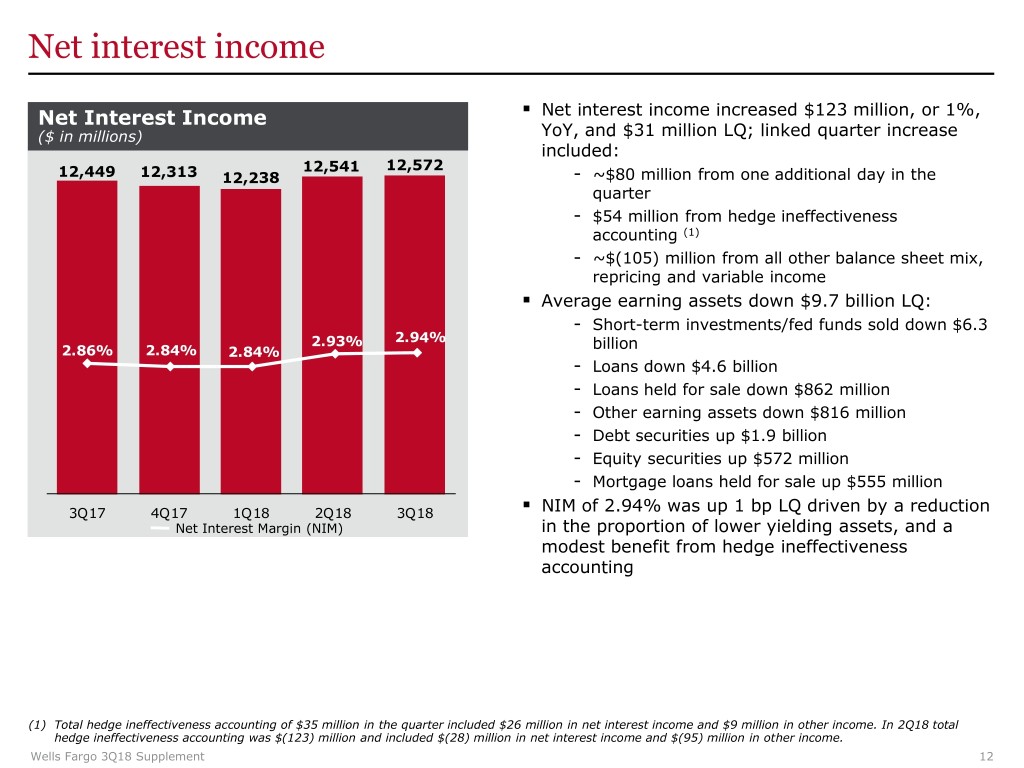

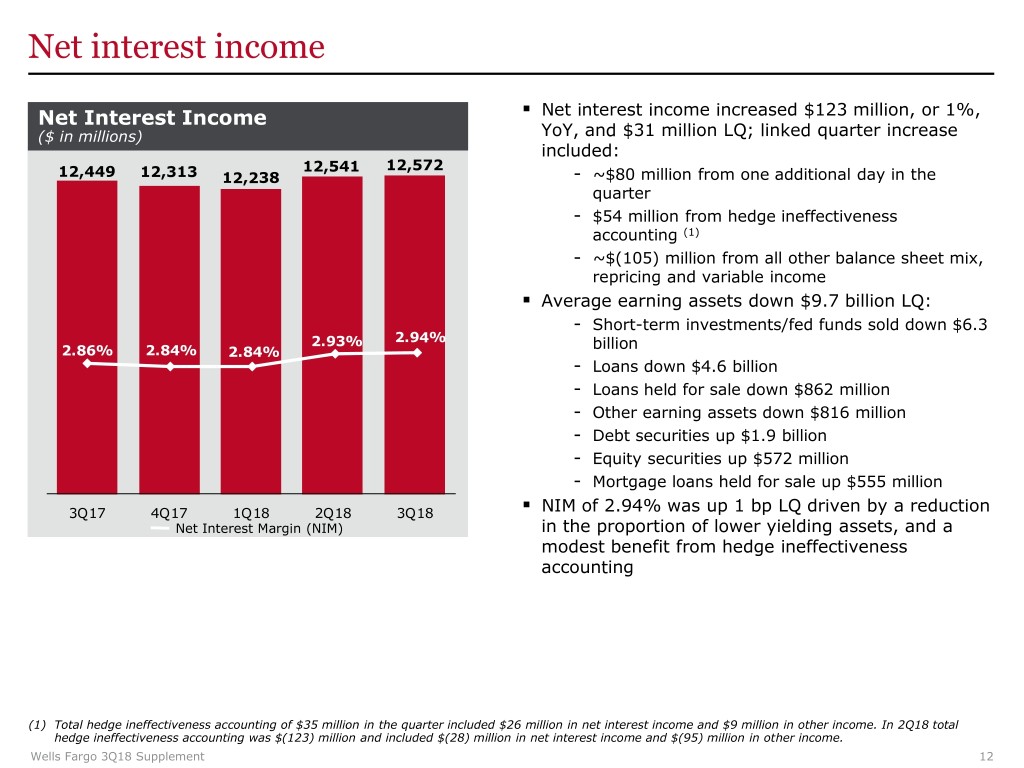

Net interest income . Net Interest Income Net interest income increased $123 million, or 1%, ($ in millions) YoY, and $31 million LQ; linked quarter increase included: 12,541 12,572 12,449 12,313 12,238 - ~$80 million from one additional day in the quarter - $54 million from hedge ineffectiveness accounting (1) - ~$(105) million from all other balance sheet mix, repricing and variable income . Average earning assets down $9.7 billion LQ: - Short-term investments/fed funds sold down $6.3 2.93% 2.94% billion 2.86% 2.84% 2.84% - Loans down $4.6 billion - Loans held for sale down $862 million - Other earning assets down $816 million - Debt securities up $1.9 billion - Equity securities up $572 million - Mortgage loans held for sale up $555 million . 3Q17 4Q17 1Q18 2Q18 3Q18 NIM of 2.94% was up 1 bp LQ driven by a reduction Net Interest Margin (NIM) in the proportion of lower yielding assets, and a modest benefit from hedge ineffectiveness accounting (1) Total hedge ineffectiveness accounting of $35 million in the quarter included $26 million in net interest income and $9 million in other income. In 2Q18 total hedge ineffectiveness accounting was $(123) million and included $(28) million in net interest income and $(95) million in other income. Wells Fargo 3Q18 Supplement 12

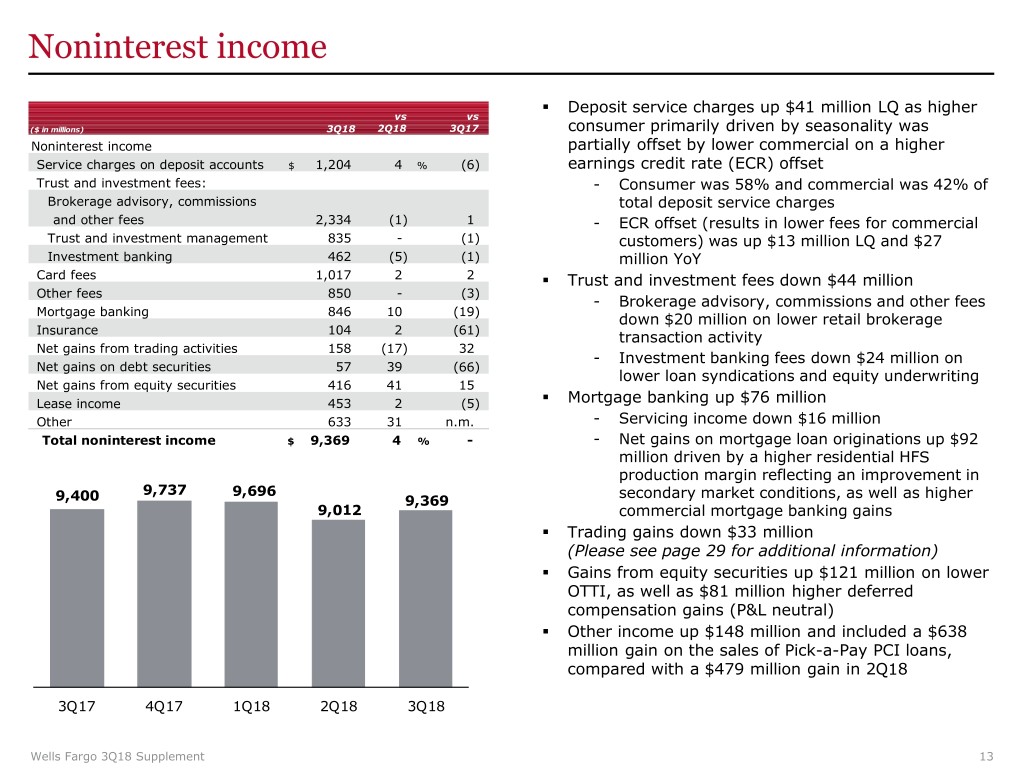

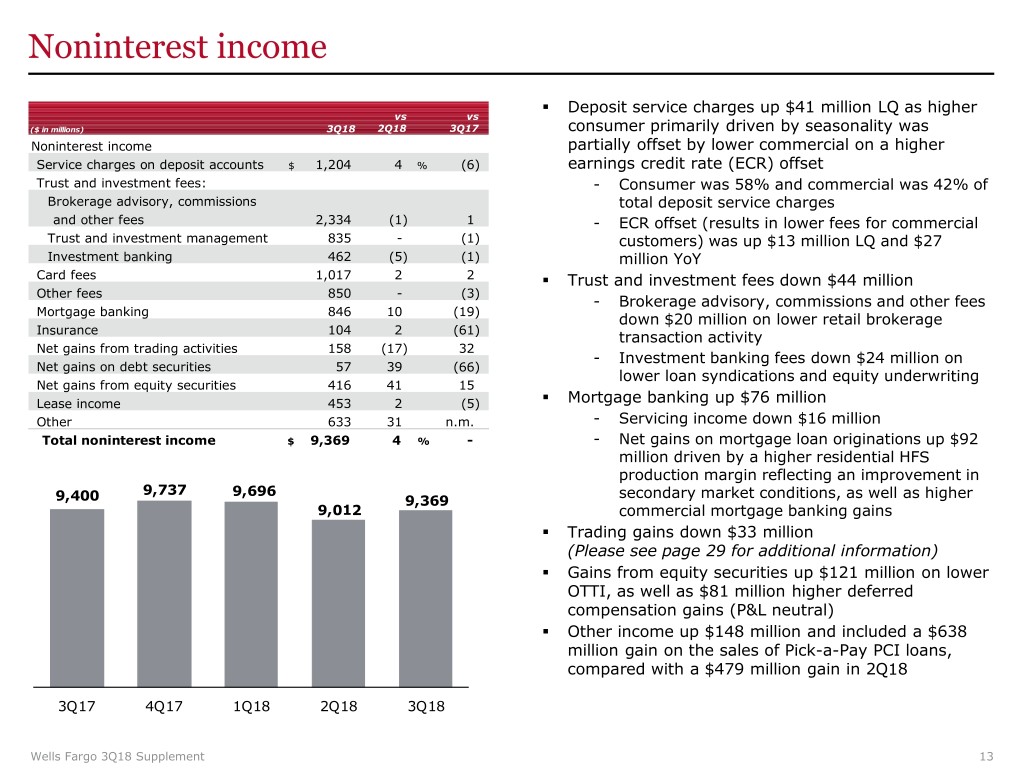

Noninterest income . Deposit service charges up $41 million LQ as higher vs vs ($ in millions) 3Q18 2Q18 3Q17 consumer primarily driven by seasonality was Noninterest income partially offset by lower commercial on a higher Service charges on deposit accounts $ 1,204 4 % (6) earnings credit rate (ECR) offset Trust and investment fees: - Consumer was 58% and commercial was 42% of Brokerage advisory, commissions total deposit service charges and other fees 2,334 (1) 1 - ECR offset (results in lower fees for commercial Trust and investment management 835 - (1) customers) was up $13 million LQ and $27 Investment banking 462 (5) (1) million YoY Card fees 1,017 2 2 . Trust and investment fees down $44 million Other fees 850 - (3) - Brokerage advisory, commissions and other fees Mortgage banking 846 10 (19) down $20 million on lower retail brokerage Insurance 104 2 (61) transaction activity Net gains from trading activities 158 (17) 32 - Investment banking fees down $24 million on Net gains on debt securities 57 39 (66) lower loan syndications and equity underwriting Net gains from equity securities 416 41 15 . Lease income 453 2 (5) Mortgage banking up $76 million Other 633 31 n.m. - Servicing income down $16 million Total noninterest income $ 9,369 4 % - - Net gains on mortgage loan originations up $92 million driven by a higher residential HFS production margin reflecting an improvement in 9,737 9,696 secondary market conditions, as well as higher 9,400 9,369 9,012 commercial mortgage banking gains . Trading gains down $33 million (Please see page 29 for additional information) . Gains from equity securities up $121 million on lower OTTI, as well as $81 million higher deferred compensation gains (P&L neutral) . Other income up $148 million and included a $638 million gain on the sales of Pick-a-Pay PCI loans, compared with a $479 million gain in 2Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Wells Fargo 3Q18 Supplement 13

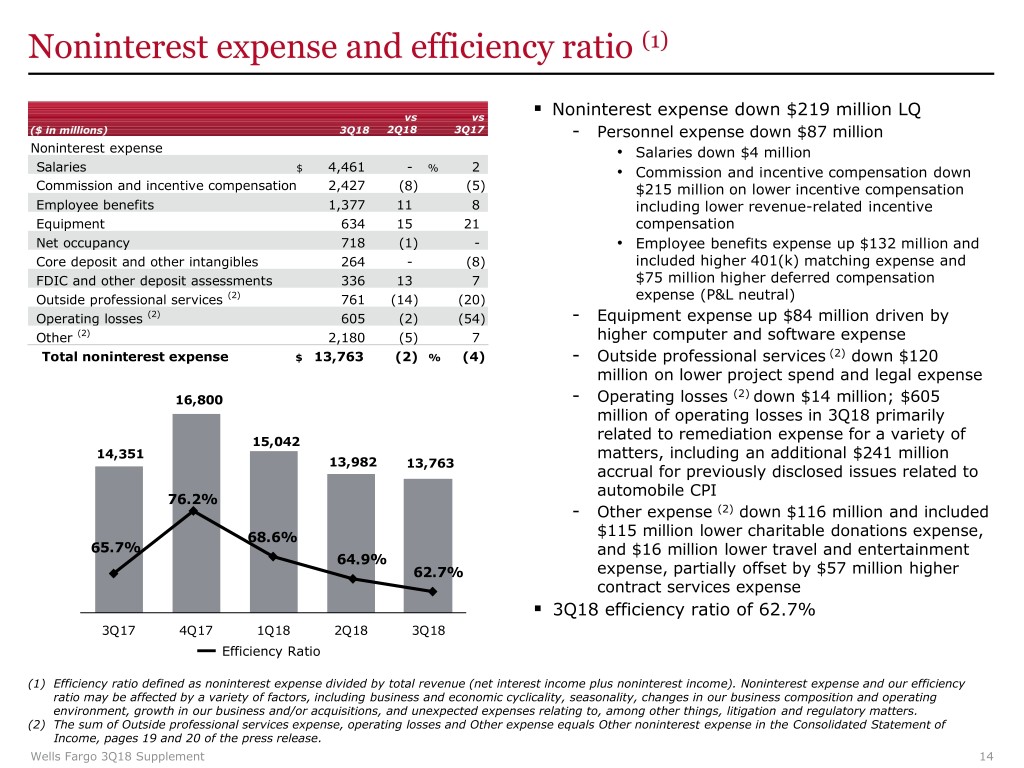

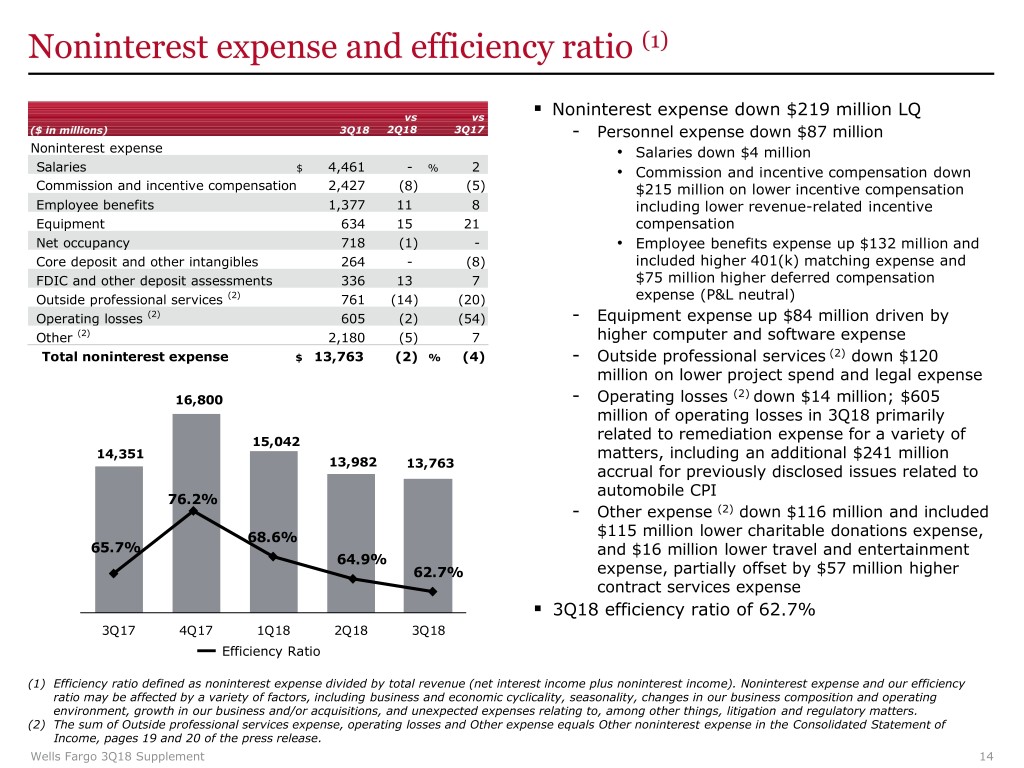

Noninterest expense and efficiency ratio (1) . vs vs Noninterest expense down $219 million LQ ($ in millions) 3Q18 2Q18 3Q17 - Personnel expense down $87 million Noninterest expense • Salaries down $4 million Salaries $ 4,461 - % 2 • Commission and incentive compensation down Commission and incentive compensation 2,427 (8) (5) $215 million on lower incentive compensation Employee benefits 1,377 11 8 including lower revenue-related incentive Equipment 634 15 21 compensation Net occupancy 718 (1) - • Employee benefits expense up $132 million and Core deposit and other intangibles 264 - (8) included higher 401(k) matching expense and FDIC and other deposit assessments 336 13 7 $75 million higher deferred compensation Outside professional services (2) 761 (14) (20) expense (P&L neutral) Operating losses (2) 605 (2) (54) - Equipment expense up $84 million driven by Other (2) 2,180 (5) 7 higher computer and software expense Total noninterest expense $ 13,763 (2) % (4) - Outside professional services (2) down $120 million on lower project spend and legal expense (2) 16,800 - Operating losses down $14 million; $605 million of operating losses in 3Q18 primarily 15,042 related to remediation expense for a variety of 14,351 matters, including an additional $241 million 13,982 13,763 accrual for previously disclosed issues related to automobile CPI 76.2% - Other expense (2) down $116 million and included 68.6% $115 million lower charitable donations expense, 65.7% and $16 million lower travel and entertainment 64.9% 62.7% expense, partially offset by $57 million higher contract services expense x . 3Q18 efficiency ratio of 62.7% 3Q17 4Q17 1Q18 2Q18 3Q18 Efficiency Ratio (1) Efficiency ratio defined as noninterest expense divided by total revenue (net interest income plus noninterest income). Noninterest expense and our efficiency ratio may be affected by a variety of factors, including business and economic cyclicality, seasonality, changes in our business composition and operating environment, growth in our business and/or acquisitions, and unexpected expenses relating to, among other things, litigation and regulatory matters. (2) The sum of Outside professional services expense, operating losses and Other expense equals Other noninterest expense in the Consolidated Statement of Income, pages 19 and 20 of the press release. Wells Fargo 3Q18 Supplement 14

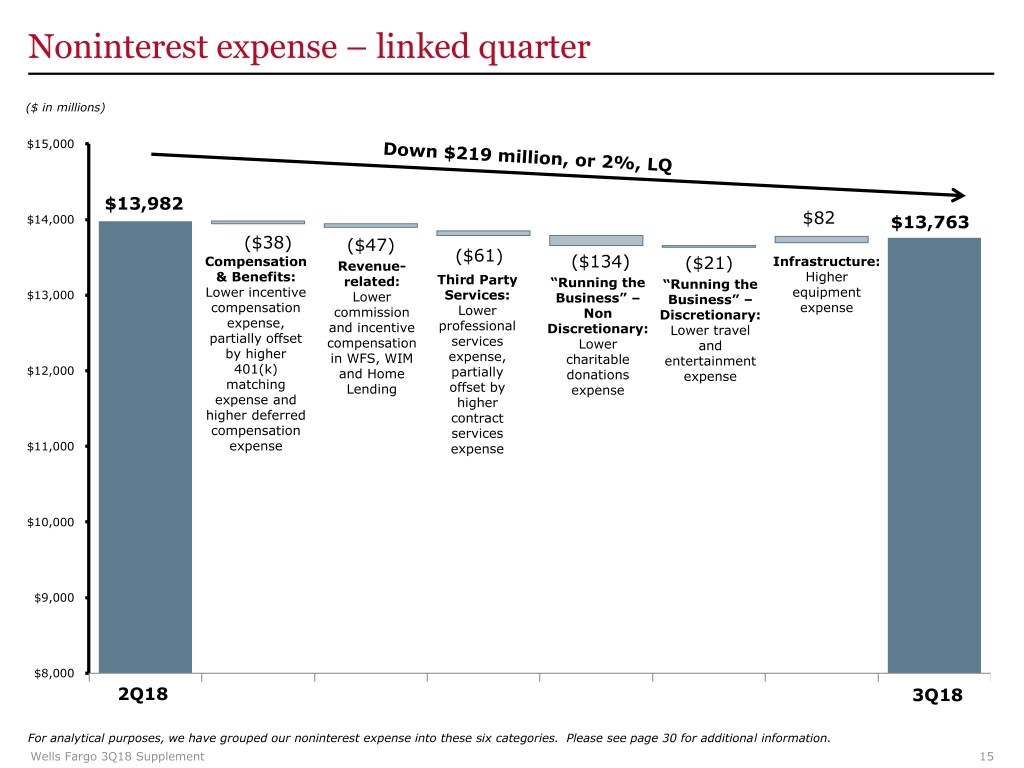

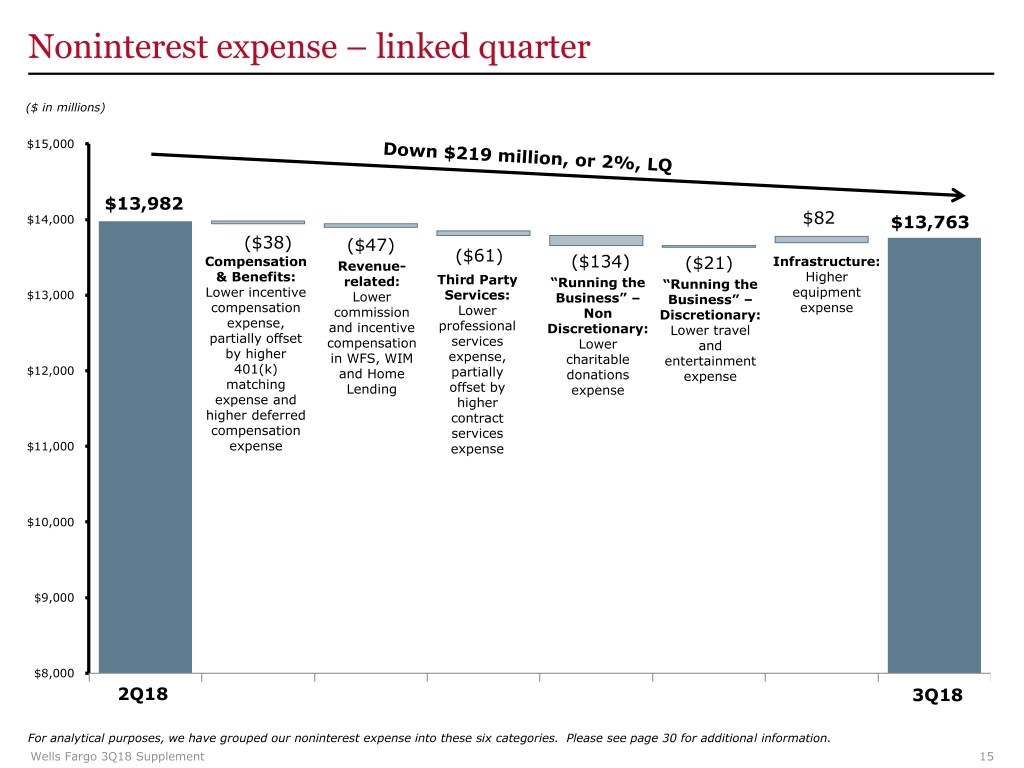

Noninterest expense – linked quarter ($ in millions) $15,000 $13,982 $14,000 $82 $13,763 ($38) ($47) ($61) Compensation Revenue- ($134) ($21) Infrastructure: & Benefits: Higher related: Third Party “Running the “Running the Lower incentive equipment $13,000 Lower Services: Business” – Business” – compensation expense commission Lower Non Discretionary: expense, and incentive professional Discretionary: Lower travel partially offset compensation services Lower and by higher in WFS, WIM expense, charitable entertainment 401(k) $12,000 and Home partially donations expense matching Lending offset by expense expense and higher higher deferred contract compensation services $11,000 expense expense $10,000 $9,000 $8,000 2Q18 3Q18 For analytical purposes, we have grouped our noninterest expense into these six categories. Please see page 30 for additional information. Wells Fargo 3Q18 Supplement 15

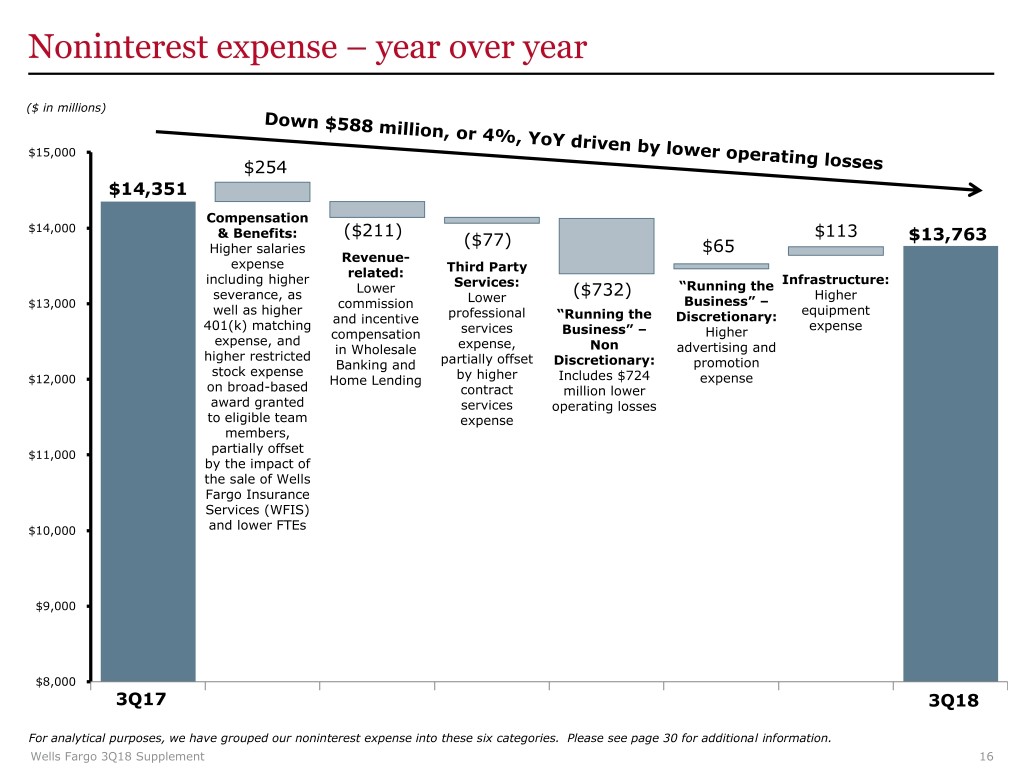

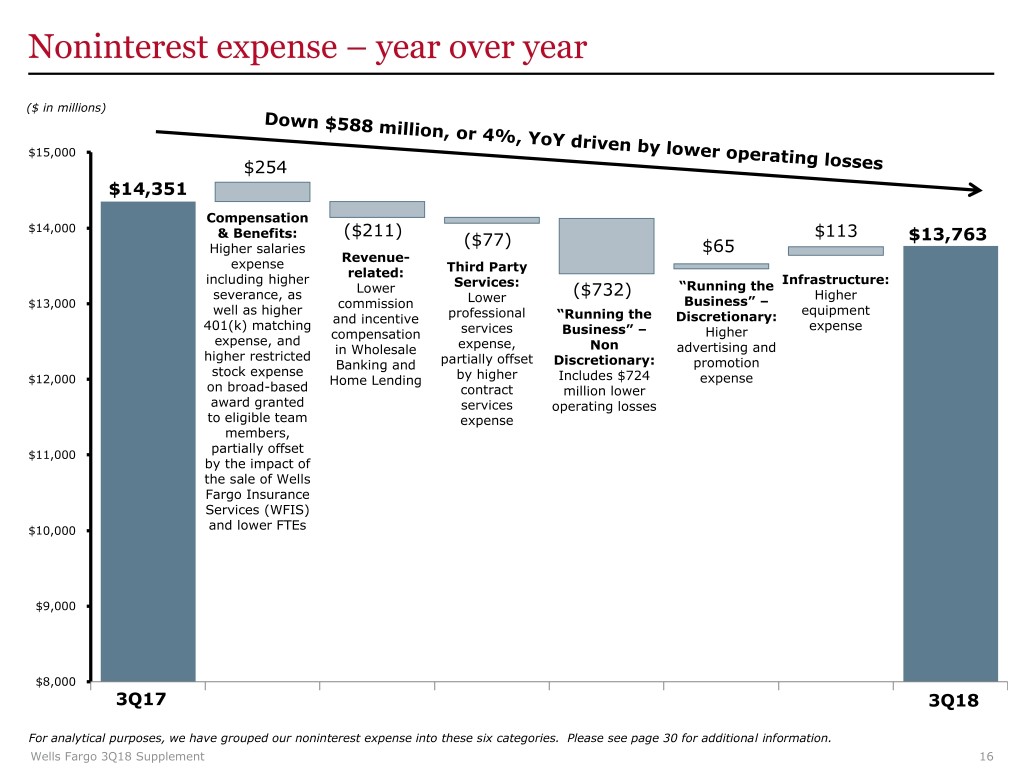

Noninterest expense – year over year ($ in millions) $15,000 $254 $14,351 Compensation $14,000 ($211) $113 & Benefits: ($77) $13,763 Higher salaries $65 Revenue- expense related: Third Party including higher Infrastructure: Lower Services: “Running the severance, as ($732) Higher $13,000 commission Lower Business” – well as higher equipment and incentive professional “Running the Discretionary: 401(k) matching expense compensation services Business” – Higher expense, and in Wholesale expense, Non advertising and higher restricted Banking and partially offset Discretionary: promotion stock expense $12,000 Home Lending by higher Includes $724 expense on broad-based contract million lower award granted services operating losses to eligible team expense members, partially offset $11,000 by the impact of the sale of Wells Fargo Insurance Services (WFIS) $10,000 and lower FTEs $9,000 $8,000 3Q17 3Q18 For analytical purposes, we have grouped our noninterest expense into these six categories. Please see page 30 for additional information. Wells Fargo 3Q18 Supplement 16

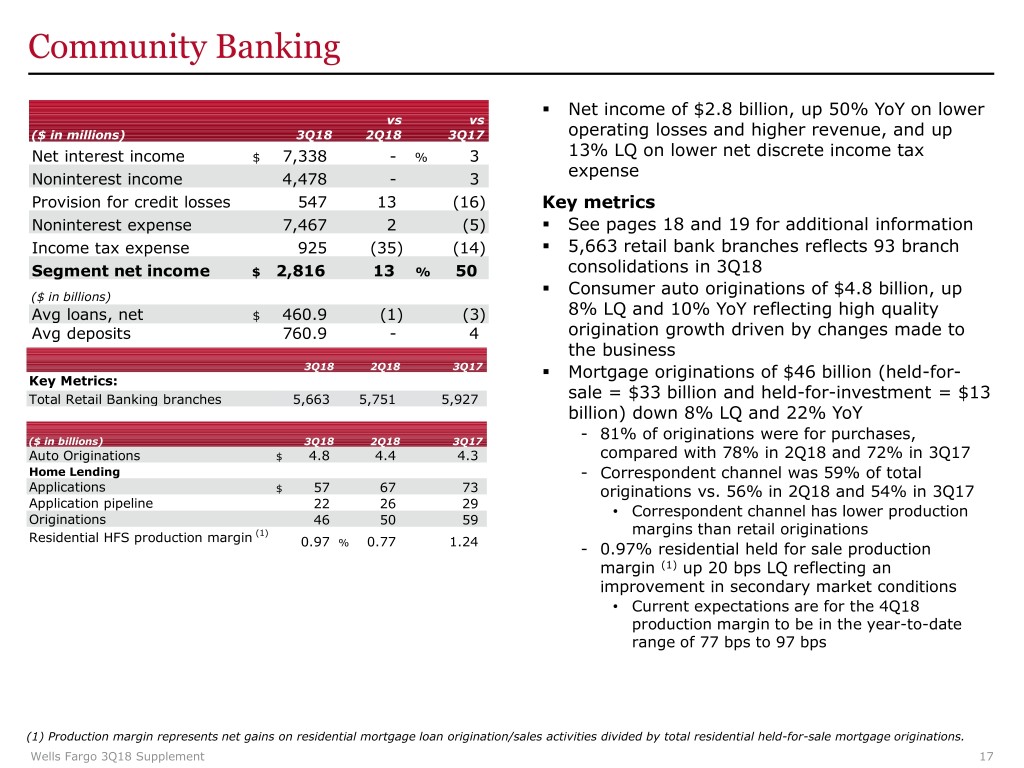

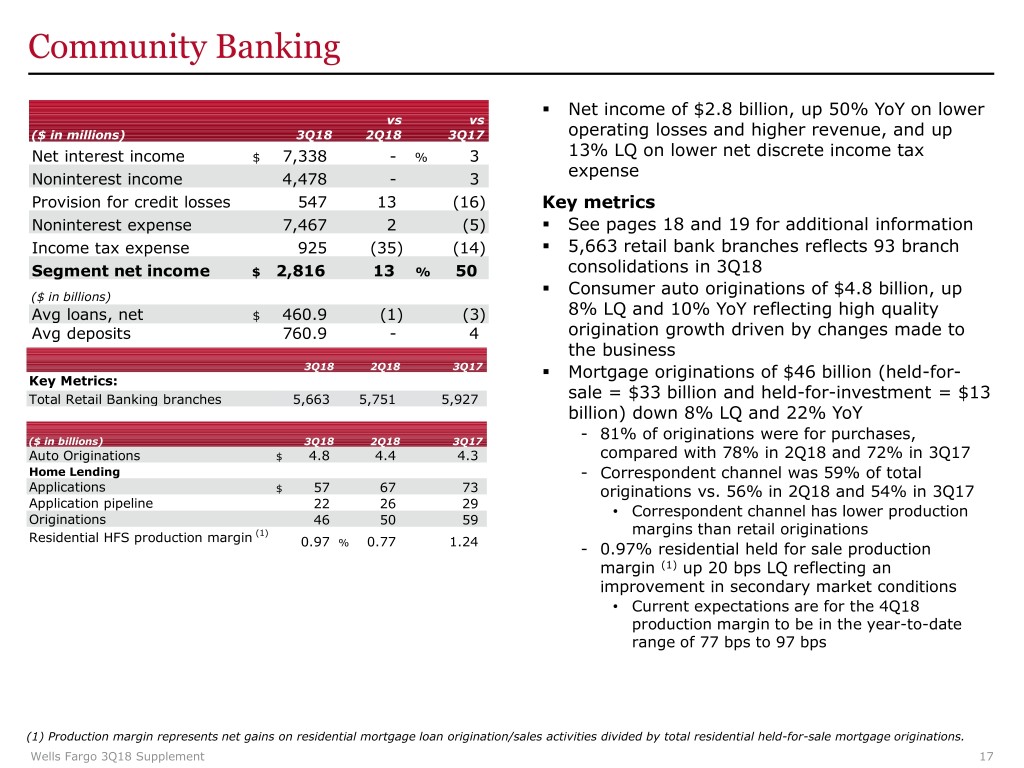

Community Banking . Net income of $2.8 billion, up 50% YoY on lower vs vs ($ in millions) 3Q18 2Q18 3Q17 operating losses and higher revenue, and up Net interest income $ 7,338 - % 3 13% LQ on lower net discrete income tax Noninterest income 4,478 - 3 expense Provision for credit losses 547 13 (16) Key metrics Noninterest expense 7,467 2 (5) . See pages 18 and 19 for additional information . Income tax expense 925 (35) (14) 5,663 retail bank branches reflects 93 branch Segment net income $ 2,816 13 % 50 consolidations in 3Q18 . ($ in billions) Consumer auto originations of $4.8 billion, up Avg loans, net $ 460.9 (1) (3) 8% LQ and 10% YoY reflecting high quality Avg deposits 760.9 - 4 origination growth driven by changes made to the business 3Q18 2Q18 3Q17 . Mortgage originations of $46 billion (held-for- Key Metrics: Total Retail Banking branches 5,663 5,751 5,927 sale = $33 billion and held-for-investment = $13 billion) down 8% LQ and 22% YoY ($ in billions) 3Q18 2Q18 3Q17 - 81% of originations were for purchases, Auto Originations $ 4.8 4.4 4.3 compared with 78% in 2Q18 and 72% in 3Q17 Home Lending - Correspondent channel was 59% of total Applications $ 57 67 73 originations vs. 56% in 2Q18 and 54% in 3Q17 Application pipeline 22 26 29 • Correspondent channel has lower production Originations 46 50 59 margins than retail originations Residential HFS production margin (1) 0.97 % 0.77 1.24 - 0.97% residential held for sale production margin (1) up 20 bps LQ reflecting an improvement in secondary market conditions • Current expectations are for the 4Q18 production margin to be in the year-to-date range of 77 bps to 97 bps (1) Production margin represents net gains on residential mortgage loan origination/sales activities divided by total residential held-for-sale mortgage originations. Wells Fargo 3Q18 Supplement 17

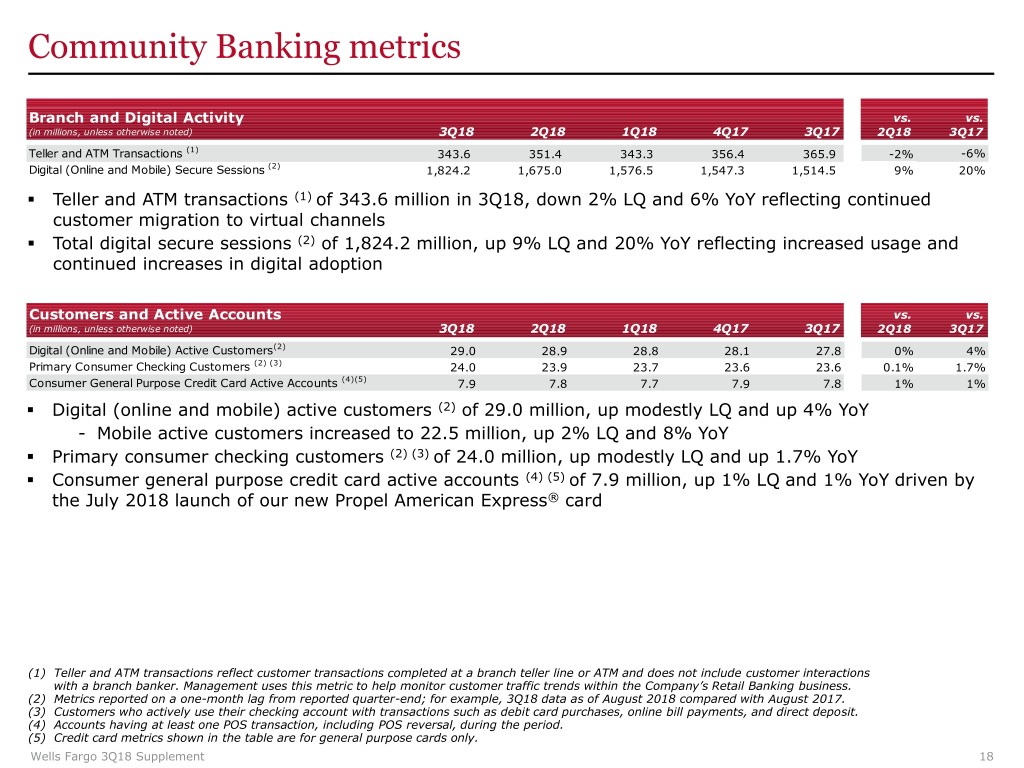

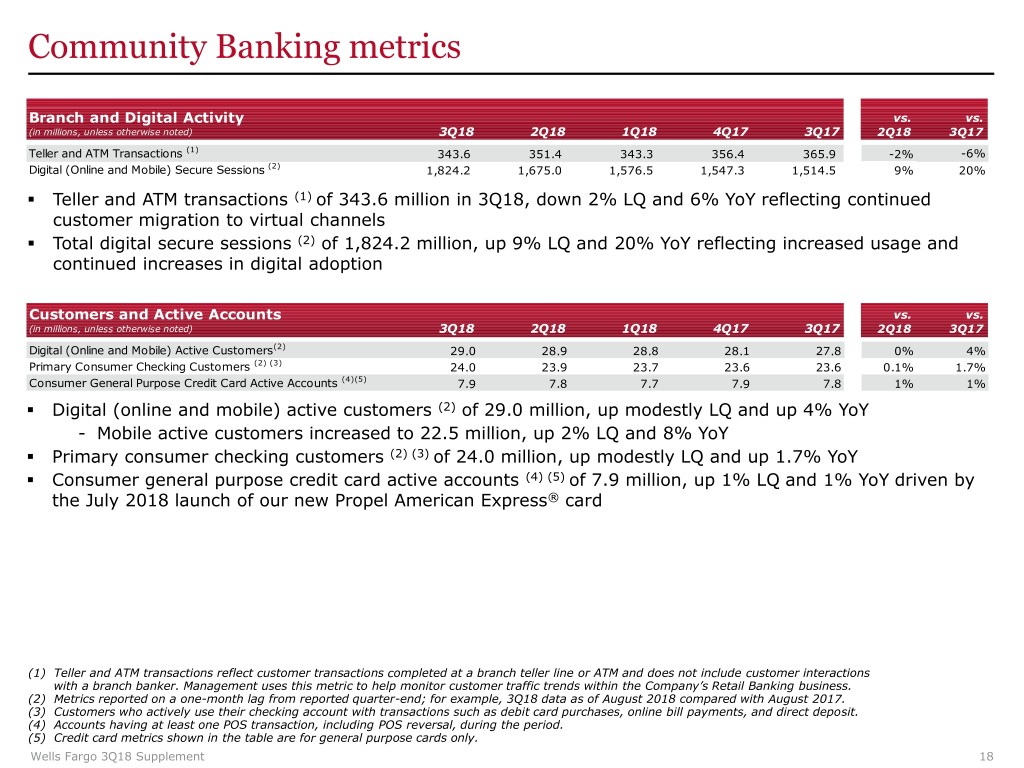

Community Banking metrics Branch and Digital Activity vs. vs. (in millions, unless otherwise noted) 3Q18 2Q18 1Q18 4Q17 3Q17 2Q18 3Q17 Teller and ATM Transactions (1) 343.6 351.4 343.3 356.4 365.9 -2% -6% Digital (Online and Mobile) Secure Sessions (2) 1,824.2 1,675.0 1,576.5 1,547.3 1,514.5 9% 20% . Teller and ATM transactions (1) of 343.6 million in 3Q18, down 2% LQ and 6% YoY reflecting continued customer migration to virtual channels . Total digital secure sessions (2) of 1,824.2 million, up 9% LQ and 20% YoY reflecting increased usage and continued increases in digital adoption Customers and Active Accounts vs. vs. (in millions, unless otherwise noted) 3Q18 2Q18 1Q18 4Q17 3Q17 2Q18 3Q17 Digital (Online and Mobile) Active Customers(2) 29.0 28.9 28.8 28.1 27.8 0% 4% Primary Consumer Checking Customers (2) (3) 24.0 23.9 23.7 23.6 23.6 0.1% 1.7% Consumer General Purpose Credit Card Active Accounts (4)(5) 7.9 7.8 7.7 7.9 7.8 1% 1% . Digital (online and mobile) active customers (2) of 29.0 million, up modestly LQ and up 4% YoY - Mobile active customers increased to 22.5 million, up 2% LQ and 8% YoY . Primary consumer checking customers (2) (3) of 24.0 million, up modestly LQ and up 1.7% YoY . Consumer general purpose credit card active accounts (4) (5) of 7.9 million, up 1% LQ and 1% YoY driven by the July 2018 launch of our new Propel American Express® card (1) Teller and ATM transactions reflect customer transactions completed at a branch teller line or ATM and does not include customer interactions with a branch banker. Management uses this metric to help monitor customer traffic trends within the Company’s Retail Banking business. (2) Metrics reported on a one-month lag from reported quarter-end; for example, 3Q18 data as of August 2018 compared with August 2017. (3) Customers who actively use their checking account with transactions such as debit card purchases, online bill payments, and direct deposit. (4) Accounts having at least one POS transaction, including POS reversal, during the period. (5) Credit card metrics shown in the table are for general purpose cards only. Wells Fargo 3Q18 Supplement 18

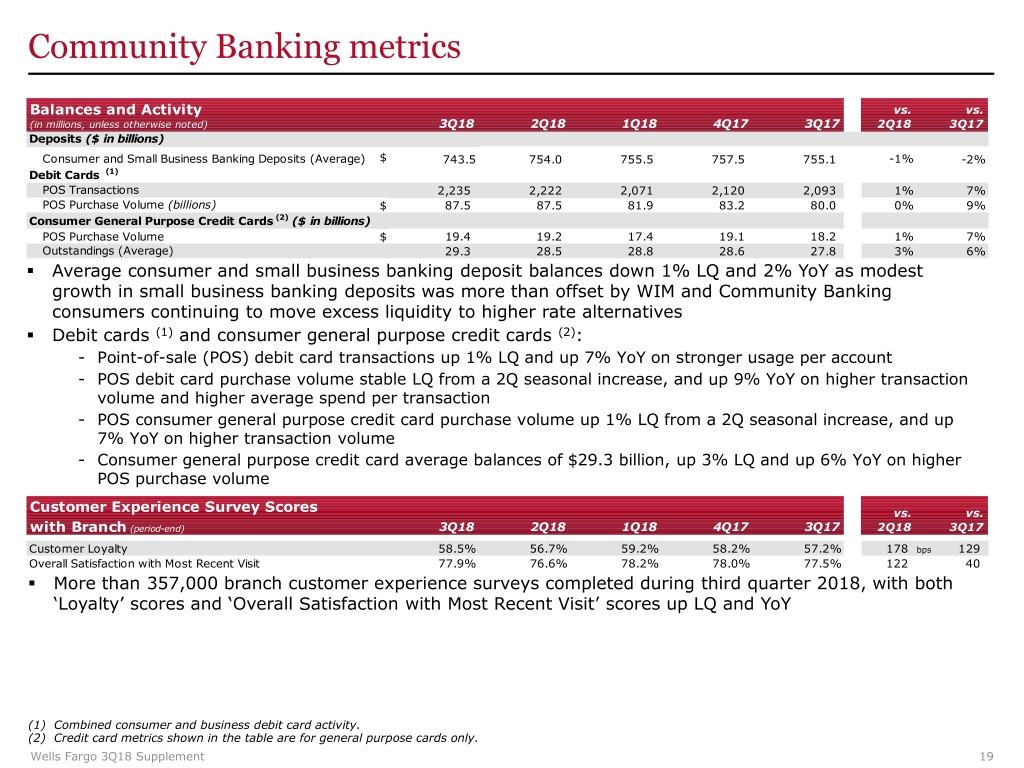

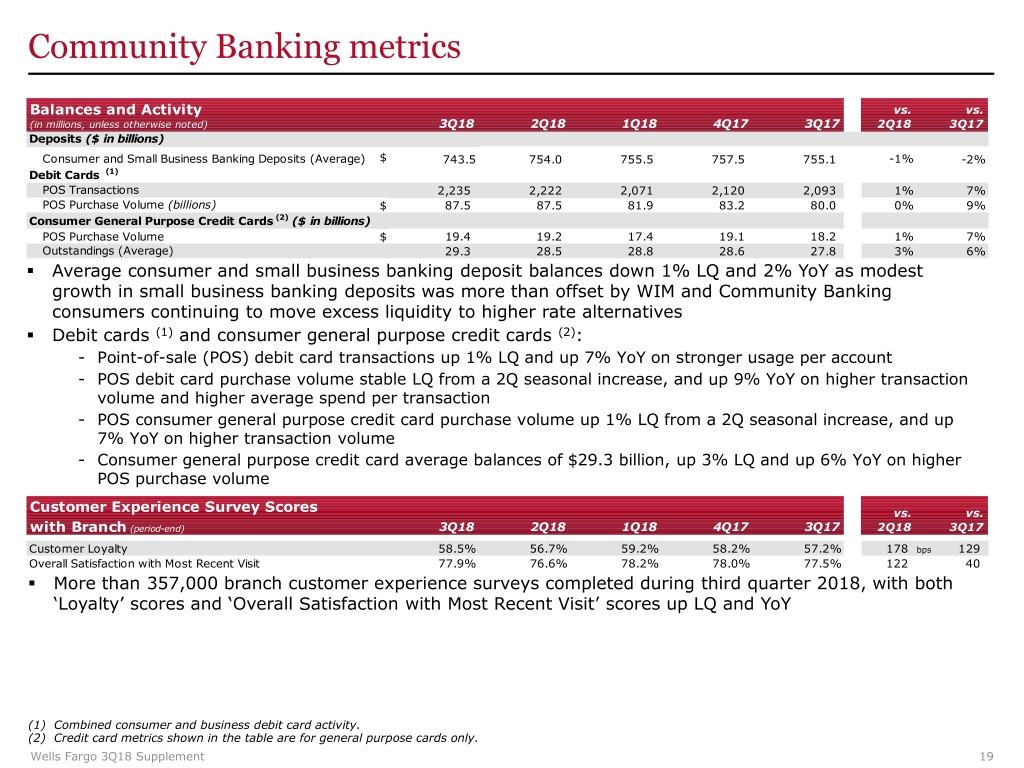

Community Banking metrics Balances and Activity vs. vs. (in millions, unless otherwise noted) 3Q18 2Q18 1Q18 4Q17 3Q17 2Q18 3Q17 Deposits ($ in billions) Consumer and Small Business Banking Deposits (Average) $ 743.5 754.0 755.5 757.5 755.1 -1% -2% Debit Cards (1) POS Transactions 2,235 2,222 2,071 2,120 2,093 1% 7% POS Purchase Volume (billions) $ 87.5 87.5 81.9 83.2 80.0 0% 9% Consumer General Purpose Credit Cards (2) ($ in billions) POS Purchase Volume $ 19.4 19.2 17.4 19.1 18.2 1% 7% Outstandings (Average) 29.3 28.5 28.8 28.6 27.8 3% 6% . Average consumer and small business banking deposit balances down 1% LQ and 2% YoY as modest growth in small business banking deposits was more than offset by WIM and Community Banking consumers continuing to move excess liquidity to higher rate alternatives . Debit cards (1) and consumer general purpose credit cards (2): - Point-of-sale (POS) debit card transactions up 1% LQ and up 7% YoY on stronger usage per account - POS debit card purchase volume stable LQ from a 2Q seasonal increase, and up 9% YoY on higher transaction volume and higher average spend per transaction - POS consumer general purpose credit card purchase volume up 1% LQ from a 2Q seasonal increase, and up 7% YoY on higher transaction volume - Consumer general purpose credit card average balances of $29.3 billion, up 3% LQ and up 6% YoY on higher POS purchase volume Customer Experience Survey Scores vs. vs. with Branch (period-end) 3Q18 2Q18 1Q18 4Q17 3Q17 2Q18 3Q17 Customer Loyalty 58.5% 56.7% 59.2% 58.2% 57.2% 178 bps 129 Overall Satisfaction with Most Recent Visit 77.9% 76.6% 78.2% 78.0% 77.5% 122 40 . More than 357,000 branch customer experience surveys completed during third quarter 2018, with both ‘Loyalty’ scores and ‘Overall Satisfaction with Most Recent Visit’ scores up LQ and YoY (1) Combined consumer and business debit card activity. (2) Credit card metrics shown in the table are for general purpose cards only. Wells Fargo 3Q18 Supplement 19

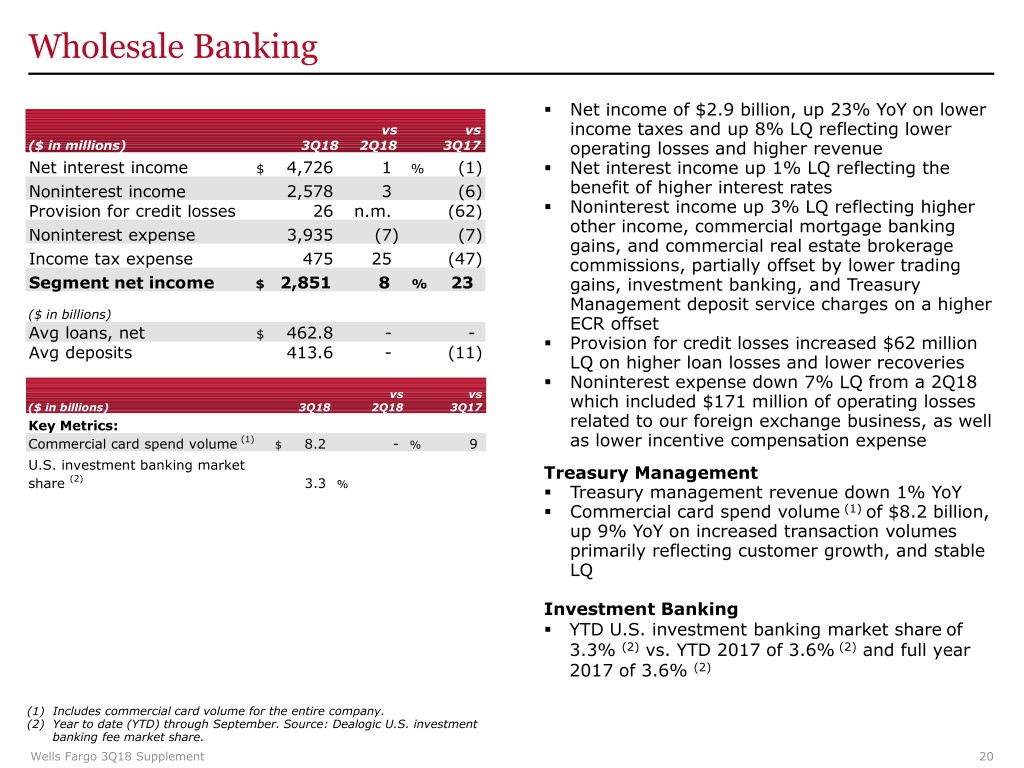

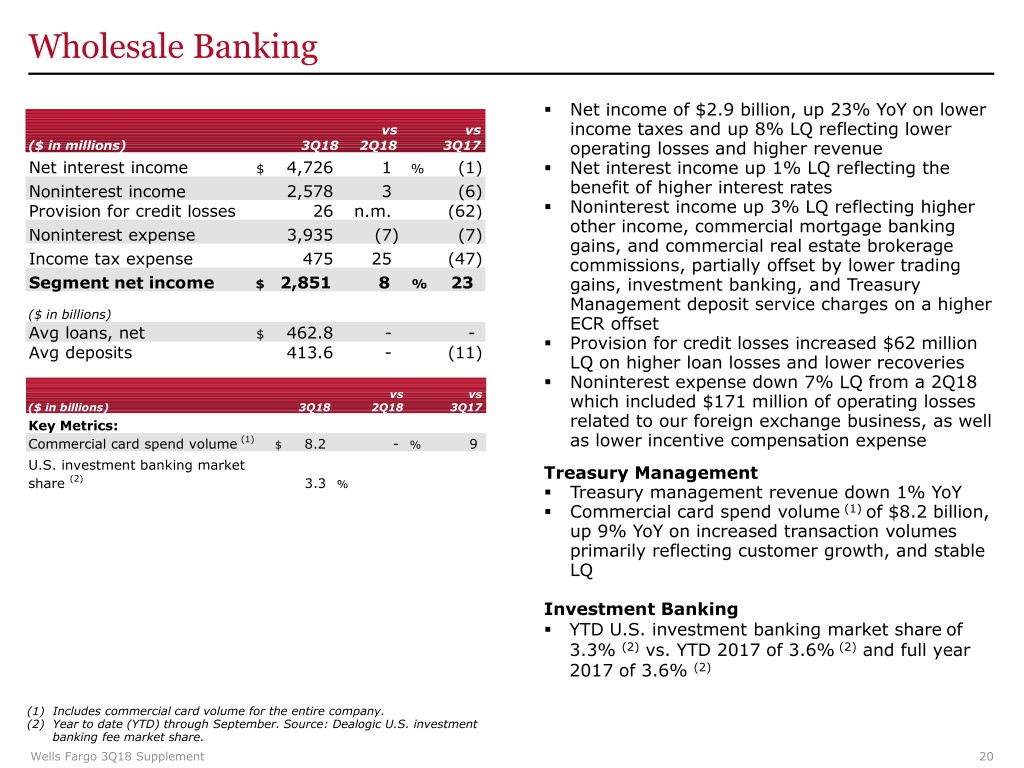

Wholesale Banking . Net income of $2.9 billion, up 23% YoY on lower vs vs income taxes and up 8% LQ reflecting lower ($ in millions) 3Q18 2Q18 3Q17 operating losses and higher revenue Net interest income $ 4,726 1 % (1) . Net interest income up 1% LQ reflecting the benefit of higher interest rates Noninterest income 2,578 3 (6) . Provision for credit losses 26 n.m. (62) Noninterest income up 3% LQ reflecting higher other income, commercial mortgage banking Noninterest expense 3,935 (7) (7) gains, and commercial real estate brokerage Income tax expense 475 25 (47) commissions, partially offset by lower trading Segment net income $ 2,851 8 % 23 gains, investment banking, and Treasury Management deposit service charges on a higher ($ in billions) ECR offset Avg loans, net $ 462.8 - - . Provision for credit losses increased $62 million Avg deposits 413.6 - (11) LQ on higher loan losses and lower recoveries . Noninterest expense down 7% LQ from a 2Q18 vs vs ($ in billions) 3Q18 2Q18 3Q17 which included $171 million of operating losses Key Metrics: related to our foreign exchange business, as well (1) Commercial card spend volume $ 8.2 - % 9 as lower incentive compensation expense U.S. investment banking market (2) Treasury Management share 3.3 % . Treasury management revenue down 1% YoY . Commercial card spend volume (1) of $8.2 billion, up 9% YoY on increased transaction volumes primarily reflecting customer growth, and stable LQ Investment Banking . YTD U.S. investment banking market share of 3.3% (2) vs. YTD 2017 of 3.6% (2) and full year 2017 of 3.6% (2) (1) Includes commercial card volume for the entire company. (2) Year to date (YTD) through September. Source: Dealogic U.S. investment banking fee market share. Wells Fargo 3Q18 Supplement 20

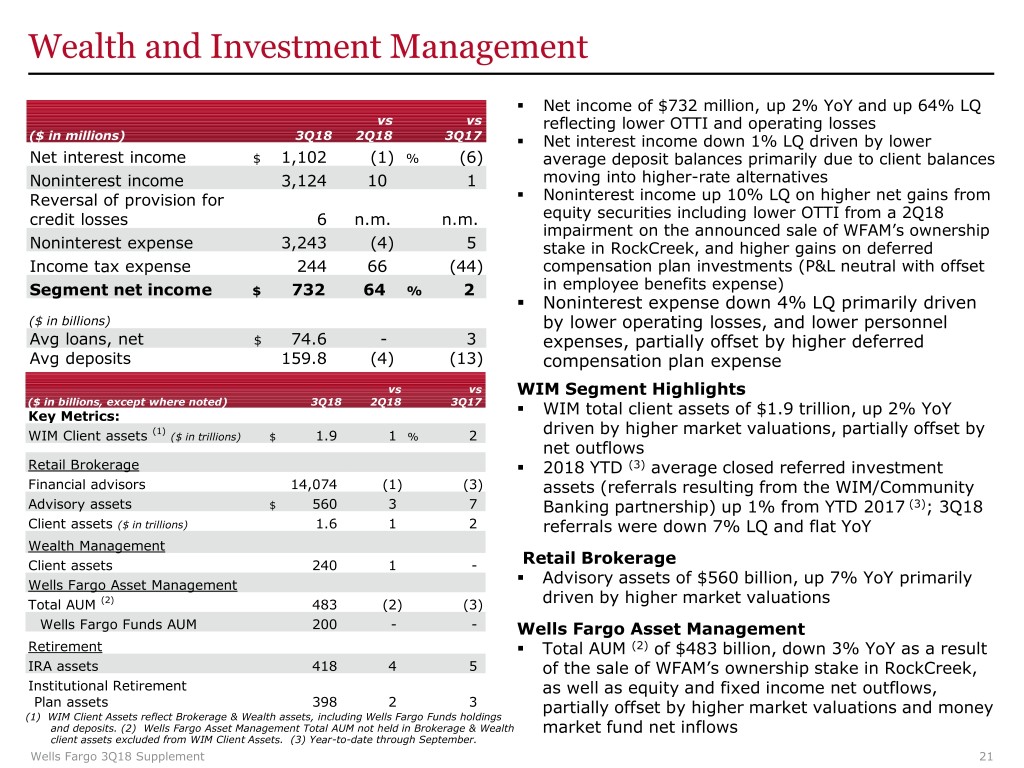

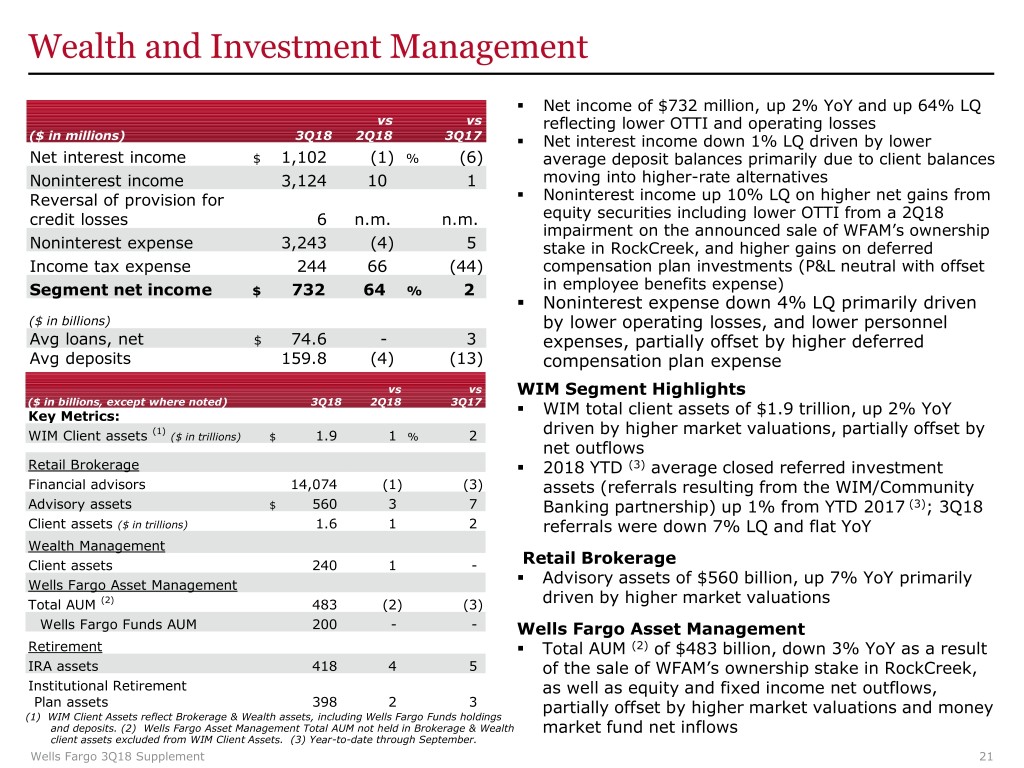

Wealth and Investment Management . Net income of $732 million, up 2% YoY and up 64% LQ vs vs reflecting lower OTTI and operating losses ($ in millions) 3Q18 2Q18 3Q17 . Net interest income down 1% LQ driven by lower Net interest income $ 1,102 (1) % (6) average deposit balances primarily due to client balances moving into higher-rate alternatives Noninterest income 3,124 10 1 . Reversal of provision for Noninterest income up 10% LQ on higher net gains from equity securities including lower OTTI from a 2Q18 credit losses 6 n.m. n.m. impairment on the announced sale of WFAM’s ownership Noninterest expense 3,243 (4) 5 stake in RockCreek, and higher gains on deferred Income tax expense 244 66 (44) compensation plan investments (P&L neutral with offset Segment net income $ 732 64 % 2 in employee benefits expense) . Noninterest expense down 4% LQ primarily driven ($ in billions) by lower operating losses, and lower personnel Avg loans, net $ 74.6 - 3 expenses, partially offset by higher deferred Avg deposits 159.8 (4) (13) compensation plan expense vs vs WIM Segment Highlights ($ in billions, except where noted) 3Q18 2Q18 3Q17 . Key Metrics: WIM total client assets of $1.9 trillion, up 2% YoY (1) driven by higher market valuations, partially offset by WIM Client assets ($ in trillions) $ 1.9 1 % 2 net outflows Retail Brokerage . 2018 YTD (3) average closed referred investment Financial advisors 14,074 (1) (3) assets (referrals resulting from the WIM/Community Advisory assets $ 560 3 7 Banking partnership) up 1% from YTD 2017 (3); 3Q18 Client assets ($ in trillions) 1.6 1 2 referrals were down 7% LQ and flat YoY Wealth Management Retail Brokerage Client assets 240 1 - . Wells Fargo Asset Management Advisory assets of $560 billion, up 7% YoY primarily Total AUM (2) 483 (2) (3) driven by higher market valuations Wells Fargo Funds AUM 200 - - Wells Fargo Asset Management Retirement . Total AUM (2) of $483 billion, down 3% YoY as a result IRA assets 418 4 5 of the sale of WFAM’s ownership stake in RockCreek, Institutional Retirement as well as equity and fixed income net outflows, Plan assets 398 2 3 partially offset by higher market valuations and money (1) WIM Client Assets reflect Brokerage & Wealth assets, including Wells Fargo Funds holdings and deposits. (2) Wells Fargo Asset Management Total AUM not held in Brokerage & Wealth market fund net inflows client assets excluded from WIM Client Assets. (3) Year-to-date through September. Wells Fargo 3Q18 Supplement 21

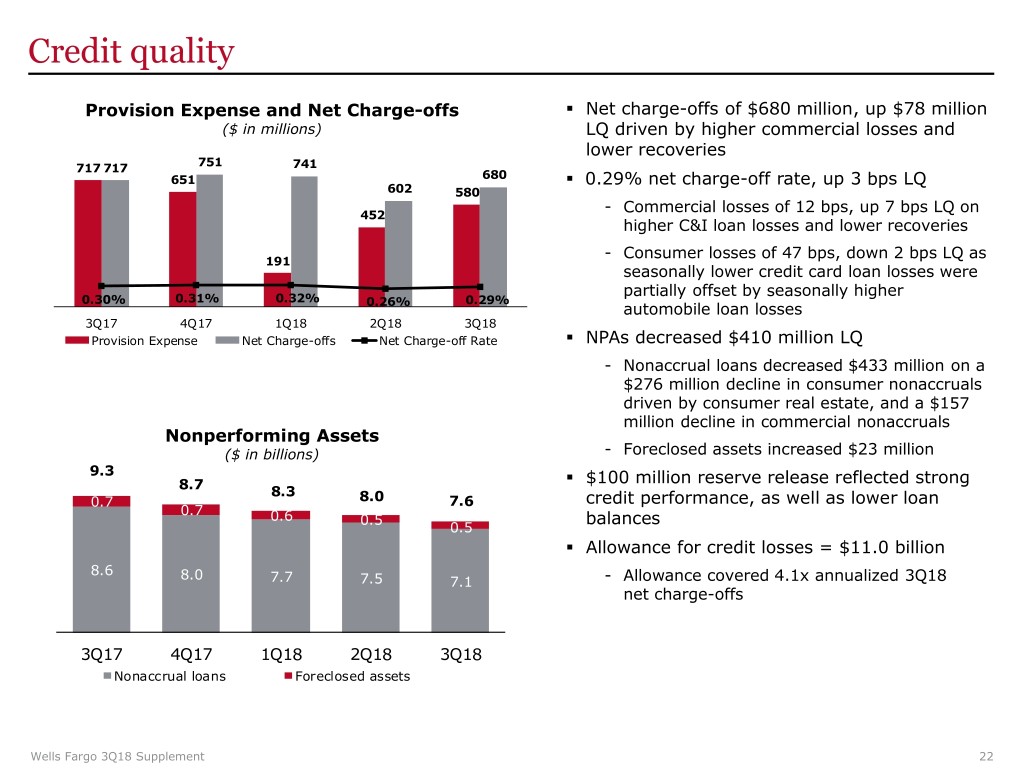

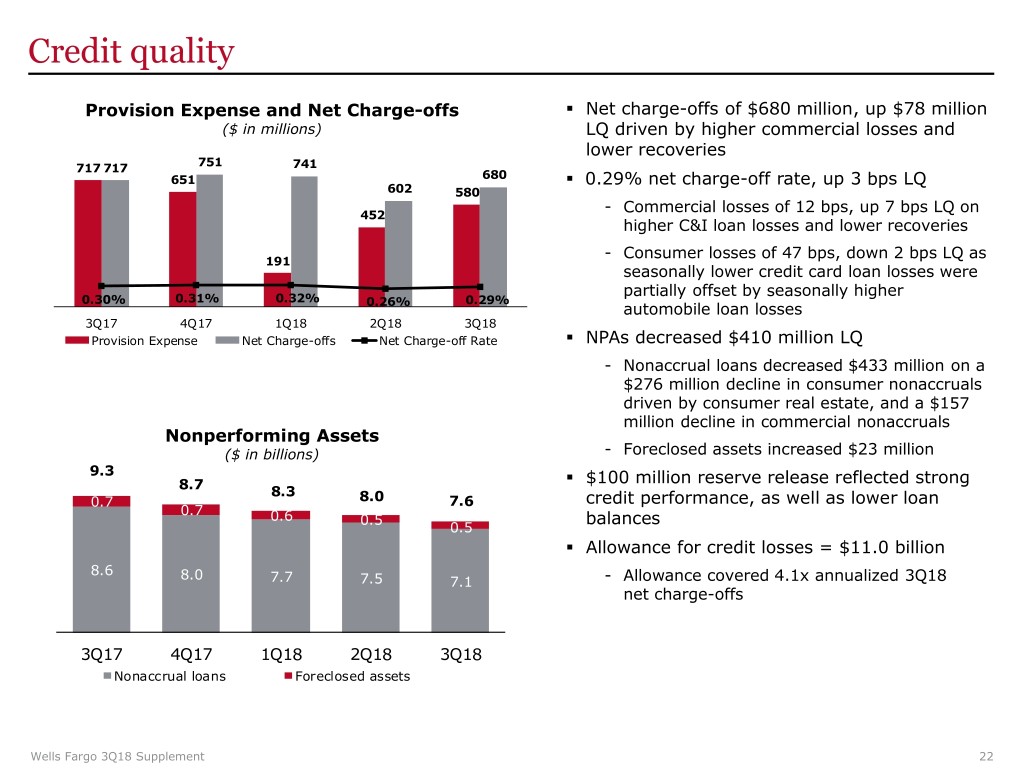

Credit quality . Provision Expense and Net Charge-offs Net charge-offs of $680 million, up $78 million ($ in millions) LQ driven by higher commercial losses and lower recoveries 751 717 717 741 . 651 680 0.29% net charge-off rate, up 3 bps LQ 602 580 - Commercial losses of 12 bps, up 7 bps LQ on 452 higher C&I loan losses and lower recoveries - Consumer losses of 47 bps, down 2 bps LQ as 191 seasonally lower credit card loan losses were partially offset by seasonally higher 0.30% 0.31% 0.32% 0.29% 0.26% automobile loan losses 3Q17 4Q17 1Q18 2Q18 3Q18 . Provision Expense Net Charge-offs Net Charge-off Rate NPAs decreased $410 million LQ - Nonaccrual loans decreased $433 million on a $276 million decline in consumer nonaccruals driven by consumer real estate, and a $157 million decline in commercial nonaccruals Nonperforming Assets ($ in billions) - Foreclosed assets increased $23 million 9.3 . 8.7 $100 million reserve release reflected strong 8.3 0.7 8.0 7.6 credit performance, as well as lower loan 0.7 0.6 0.5 balances 0.5 . Allowance for credit losses = $11.0 billion 8.6 8.0 7.7 7.5 7.1 - Allowance covered 4.1x annualized 3Q18 net charge-offs 3Q17 4Q17 1Q18 2Q18 3Q18 Nonaccrual loans Foreclosed assets Wells Fargo 3Q18 Supplement 22

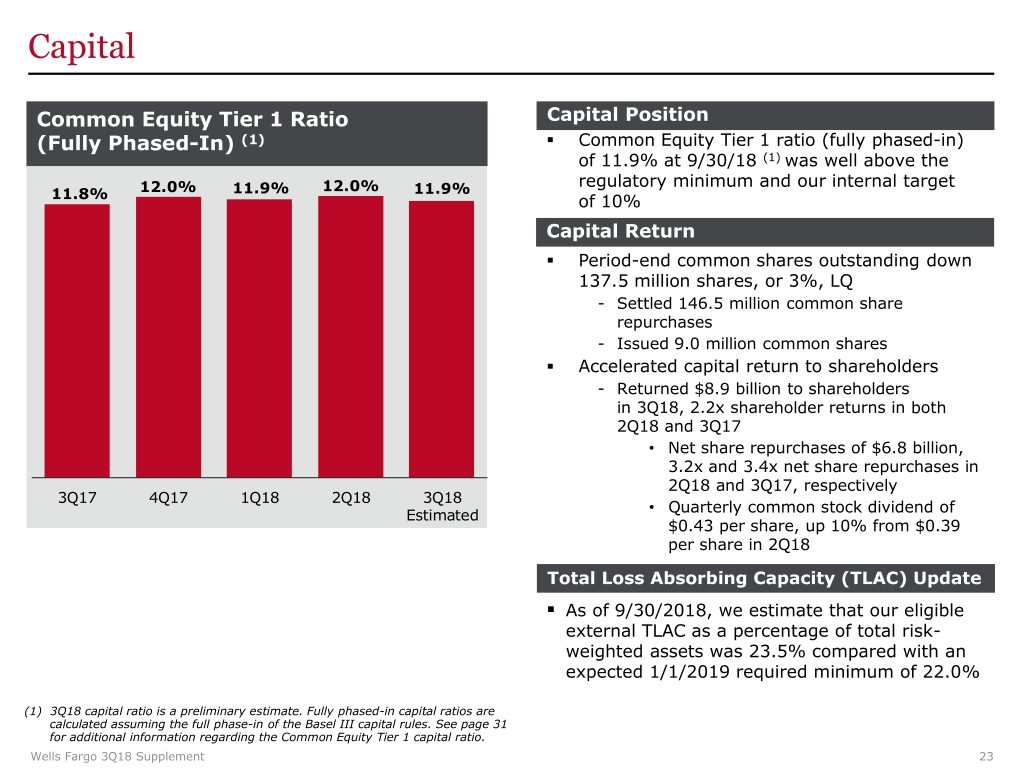

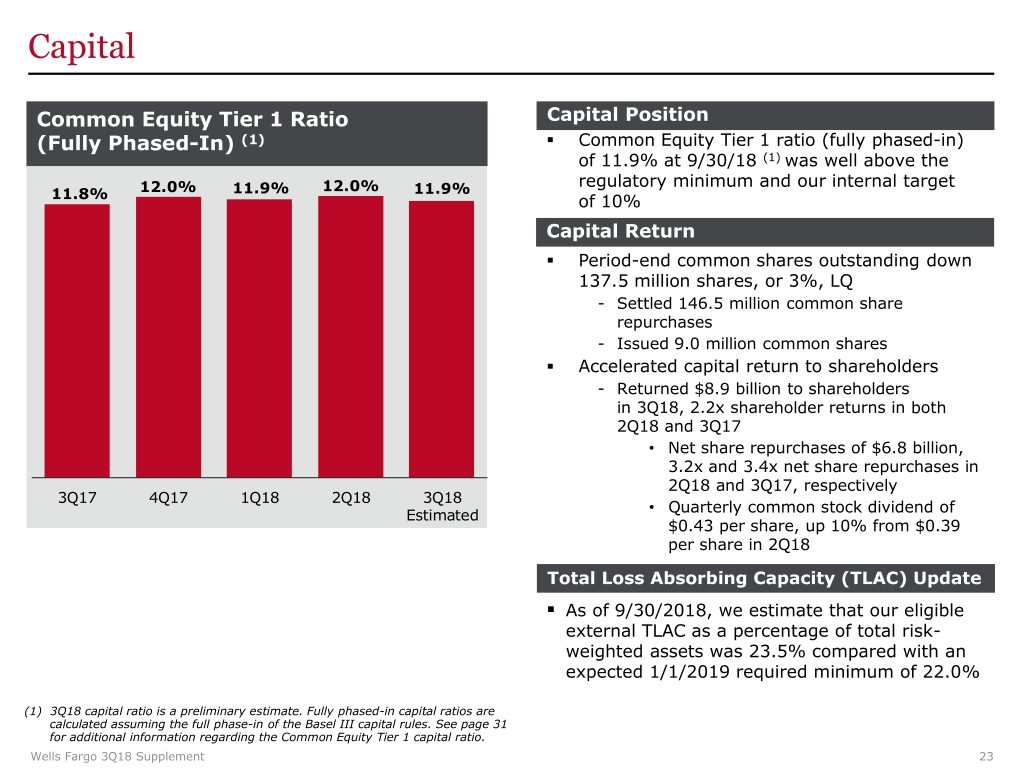

Capital Common Equity Tier 1 Ratio Capital Position . (Fully Phased-In) (1) Common Equity Tier 1 ratio (fully phased-in) of 11.9% at 9/30/18 (1) was well above the 12.0% 11.9% 12.0% 11.9% regulatory minimum and our internal target 11.8% of 10% Capital Return . Period-end common shares outstanding down 137.5 million shares, or 3%, LQ - Settled 146.5 million common share repurchases - Issued 9.0 million common shares . Accelerated capital return to shareholders - Returned $8.9 billion to shareholders in 3Q18, 2.2x shareholder returns in both 2Q18 and 3Q17 • Net share repurchases of $6.8 billion, 3.2x and 3.4x net share repurchases in 2Q18 and 3Q17, respectively 3Q17 4Q17 1Q18 2Q18 3Q18 • Quarterly common stock dividend of Estimated $0.43 per share, up 10% from $0.39 per share in 2Q18 Total Loss Absorbing Capacity (TLAC) Update . As of 9/30/2018, we estimate that our eligible external TLAC as a percentage of total risk- weighted assets was 23.5% compared with an expected 1/1/2019 required minimum of 22.0% (1) 3Q18 capital ratio is a preliminary estimate. Fully phased-in capital ratios are calculated assuming the full phase-in of the Basel III capital rules. See page 31 for additional information regarding the Common Equity Tier 1 capital ratio. Wells Fargo 3Q18 Supplement 23

Appendix

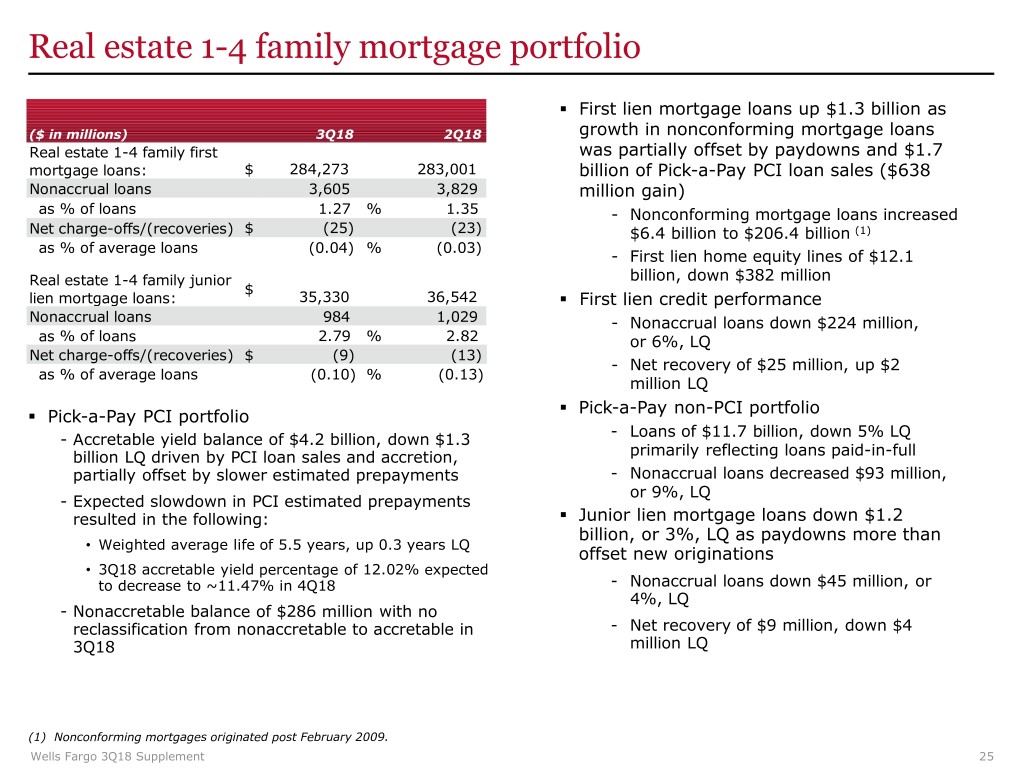

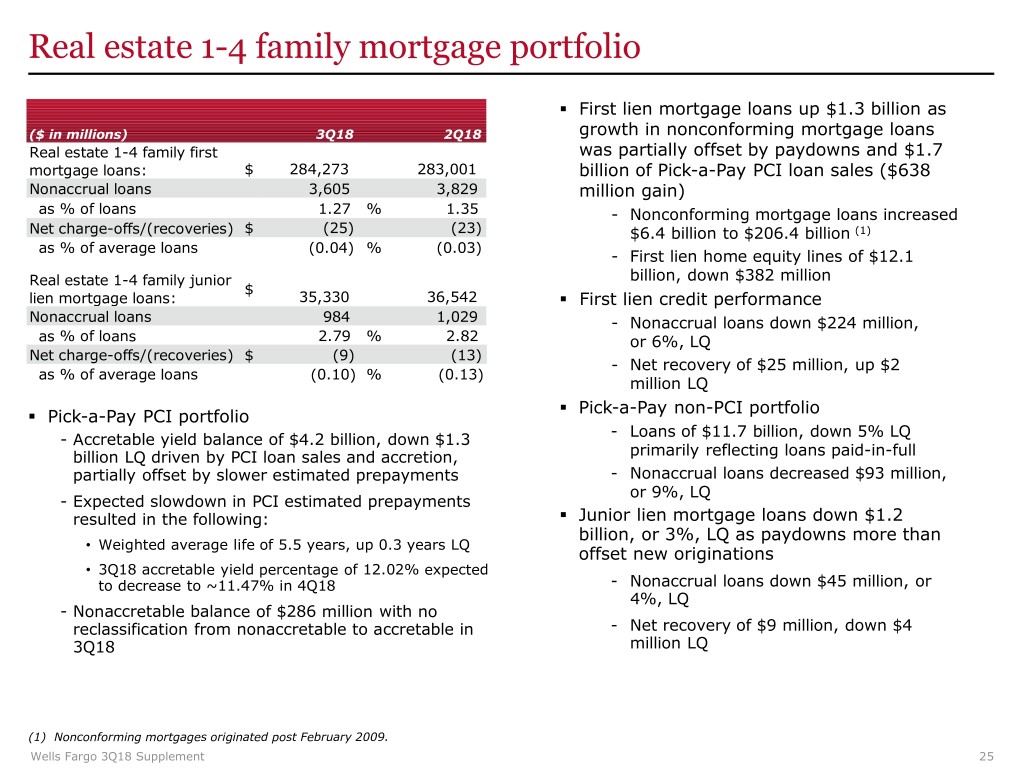

Real estate 1-4 family mortgage portfolio . First lien mortgage loans up $1.3 billion as ($ in millions) 3Q18 2Q18 growth in nonconforming mortgage loans Real estate 1-4 family first was partially offset by paydowns and $1.7 mortgage loans: $ 284,273 283,001 billion of Pick-a-Pay PCI loan sales ($638 Nonaccrual loans 3,605 3,829 million gain) as % of loans 1.27 % 1.35 - Nonconforming mortgage loans increased Net charge-offs/(recoveries) $ (25) (23) $6.4 billion to $206.4 billion (1) as % of average loans (0.04) % (0.03) - First lien home equity lines of $12.1 Real estate 1-4 family junior billion, down $382 million $ lien mortgage loans: 35,330 36,542 . First lien credit performance Nonaccrual loans 984 1,029 - Nonaccrual loans down $224 million, as % of loans 2.79 % 2.82 or 6%, LQ Net charge-offs/(recoveries) $ (9) (13) - Net recovery of $25 million, up $2 as % of average loans (0.10) % (0.13) million LQ . Pick-a-Pay non-PCI portfolio . Pick-a-Pay PCI portfolio - Loans of $11.7 billion, down 5% LQ - Accretable yield balance of $4.2 billion, down $1.3 billion LQ driven by PCI loan sales and accretion, primarily reflecting loans paid-in-full partially offset by slower estimated prepayments - Nonaccrual loans decreased $93 million, or 9%, LQ - Expected slowdown in PCI estimated prepayments . resulted in the following: Junior lien mortgage loans down $1.2 billion, or 3%, LQ as paydowns more than • Weighted average life of 5.5 years, up 0.3 years LQ offset new originations • 3Q18 accretable yield percentage of 12.02% expected to decrease to ~11.47% in 4Q18 - Nonaccrual loans down $45 million, or 4%, LQ - Nonaccretable balance of $286 million with no reclassification from nonaccretable to accretable in - Net recovery of $9 million, down $4 3Q18 million LQ (1) Nonconforming mortgages originated post February 2009. Wells Fargo 3Q18 Supplement 25

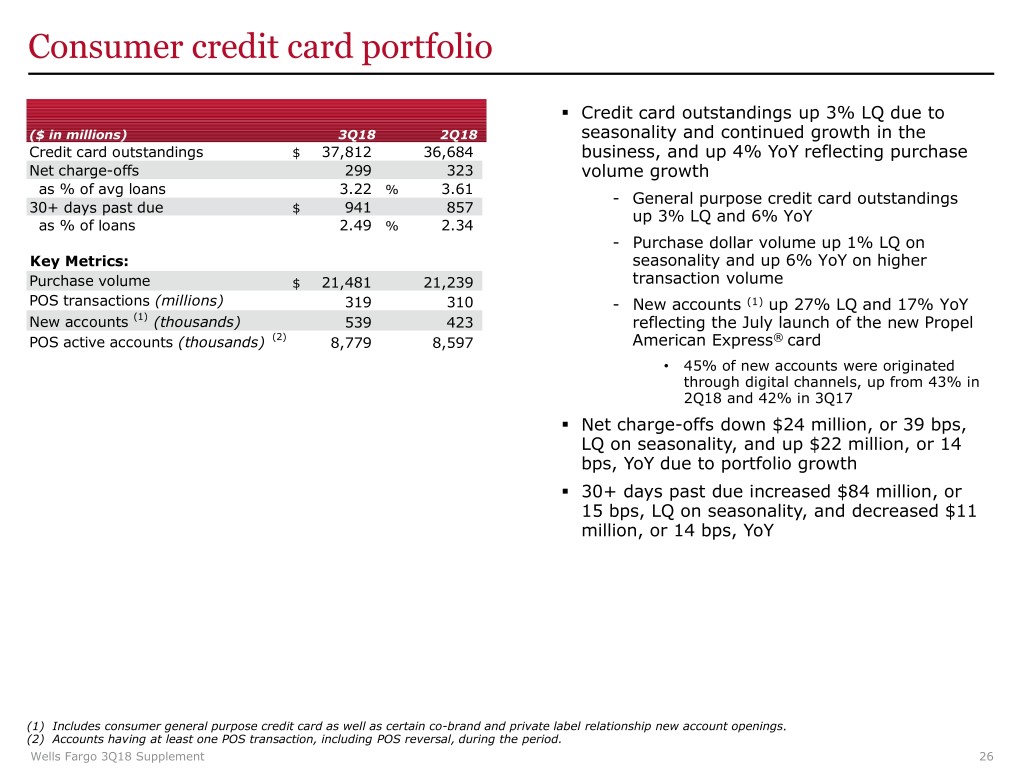

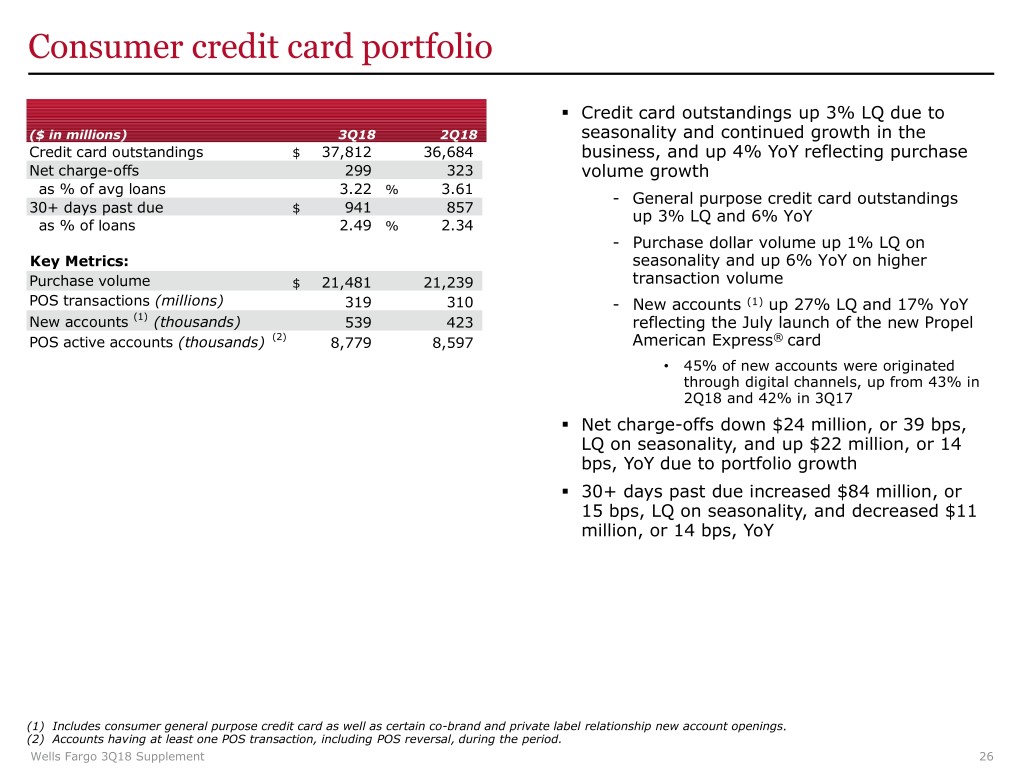

Consumer credit card portfolio . Credit card outstandings up 3% LQ due to ($ in millions) 3Q18 2Q18 seasonality and continued growth in the Credit card outstandings $ 37,812 36,684 business, and up 4% YoY reflecting purchase Net charge-offs 299 323 volume growth as % of avg loans 3.22 % 3.61 - General purpose credit card outstandings 30+ days past due $ 941 857 up 3% LQ and 6% YoY as % of loans 2.49 % 2.34 - Purchase dollar volume up 1% LQ on Key Metrics: seasonality and up 6% YoY on higher Purchase volume $ 21,481 21,239 transaction volume POS transactions (millions) 319 310 - New accounts (1) up 27% LQ and 17% YoY New accounts (1) (thousands) 539 423 reflecting the July launch of the new Propel POS active accounts (thousands) (2) 8,779 8,597 American Express® card • 45% of new accounts were originated through digital channels, up from 43% in 2Q18 and 42% in 3Q17 . Net charge-offs down $24 million, or 39 bps, LQ on seasonality, and up $22 million, or 14 bps, YoY due to portfolio growth . 30+ days past due increased $84 million, or 15 bps, LQ on seasonality, and decreased $11 million, or 14 bps, YoY (1) Includes consumer general purpose credit card as well as certain co-brand and private label relationship new account openings. (2) Accounts having at least one POS transaction, including POS reversal, during the period. Wells Fargo 3Q18 Supplement 26

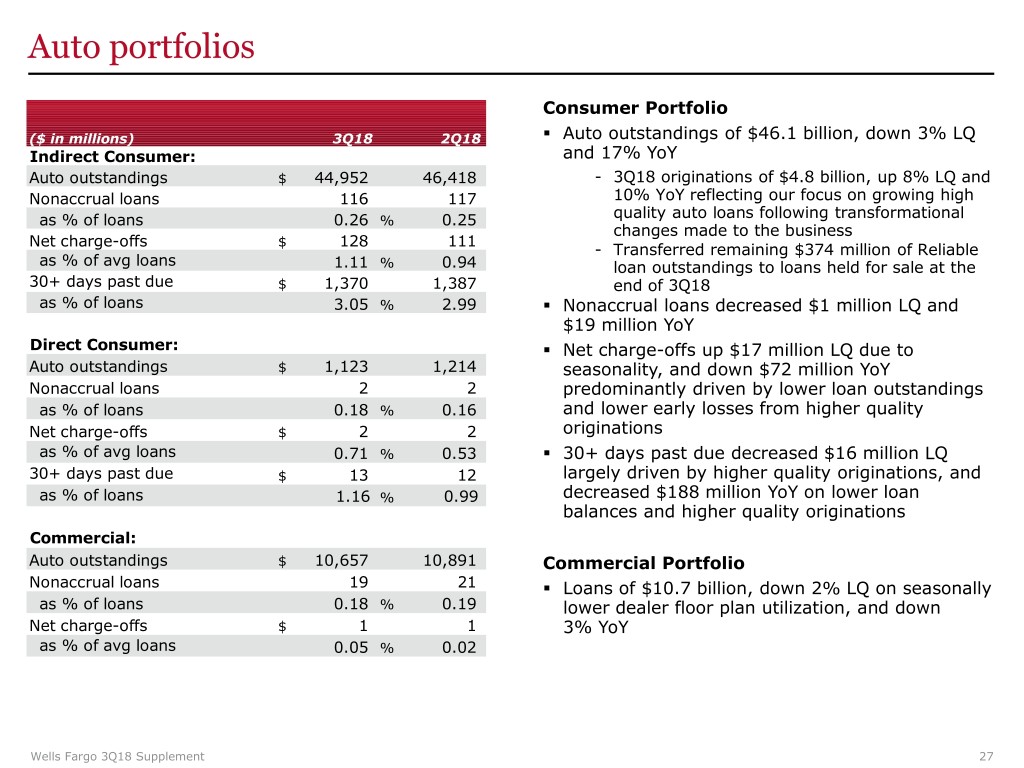

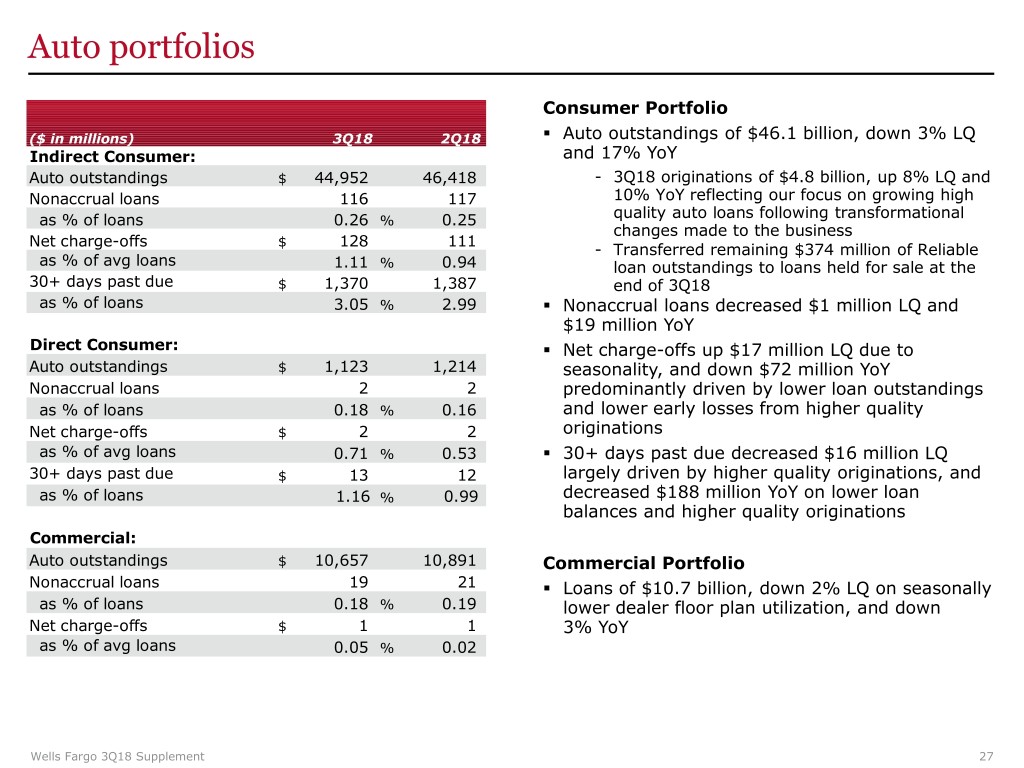

Auto portfolios Consumer Portfolio . ($ in millions) 3Q18 2Q18 Auto outstandings of $46.1 billion, down 3% LQ Indirect Consumer: and 17% YoY Auto outstandings $ 44,952 46,418 - 3Q18 originations of $4.8 billion, up 8% LQ and Nonaccrual loans 116 117 10% YoY reflecting our focus on growing high quality auto loans following transformational as % of loans 0.26 % 0.25 changes made to the business Net charge-offs $ 128 111 - Transferred remaining $374 million of Reliable as % of avg loans 1.11 % 0.94 loan outstandings to loans held for sale at the 30+ days past due $ 1,370 1,387 end of 3Q18 as % of loans 3.05 % 2.99 . Nonaccrual loans decreased $1 million LQ and $19 million YoY Direct Consumer: . Net charge-offs up $17 million LQ due to Auto outstandings $ 1,123 1,214 seasonality, and down $72 million YoY Nonaccrual loans 2 2 predominantly driven by lower loan outstandings as % of loans 0.18 % 0.16 and lower early losses from higher quality Net charge-offs $ 2 2 originations as % of avg loans 0.71 % 0.53 . 30+ days past due decreased $16 million LQ 30+ days past due $ 13 12 largely driven by higher quality originations, and as % of loans 1.16 % 0.99 decreased $188 million YoY on lower loan balances and higher quality originations Commercial: Auto outstandings $ 10,657 10,891 Commercial Portfolio Nonaccrual loans 19 21 . Loans of $10.7 billion, down 2% LQ on seasonally as % of loans 0.18 % 0.19 lower dealer floor plan utilization, and down Net charge-offs $ 1 1 3% YoY as % of avg loans 0.05 % 0.02 Wells Fargo 3Q18 Supplement 27

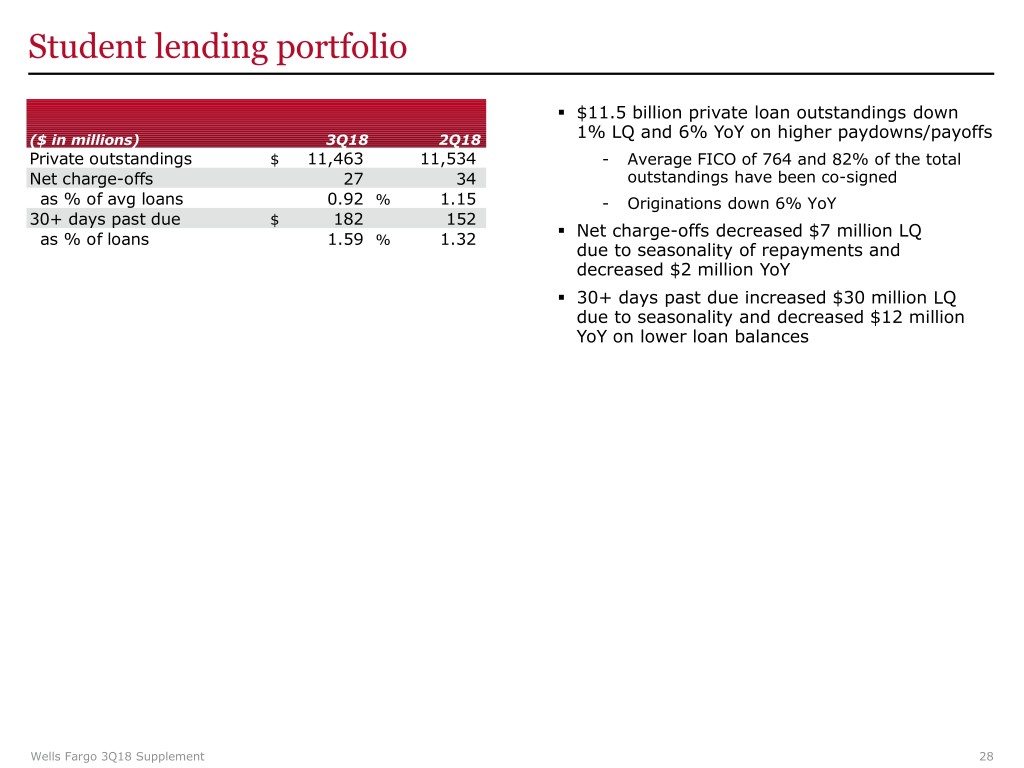

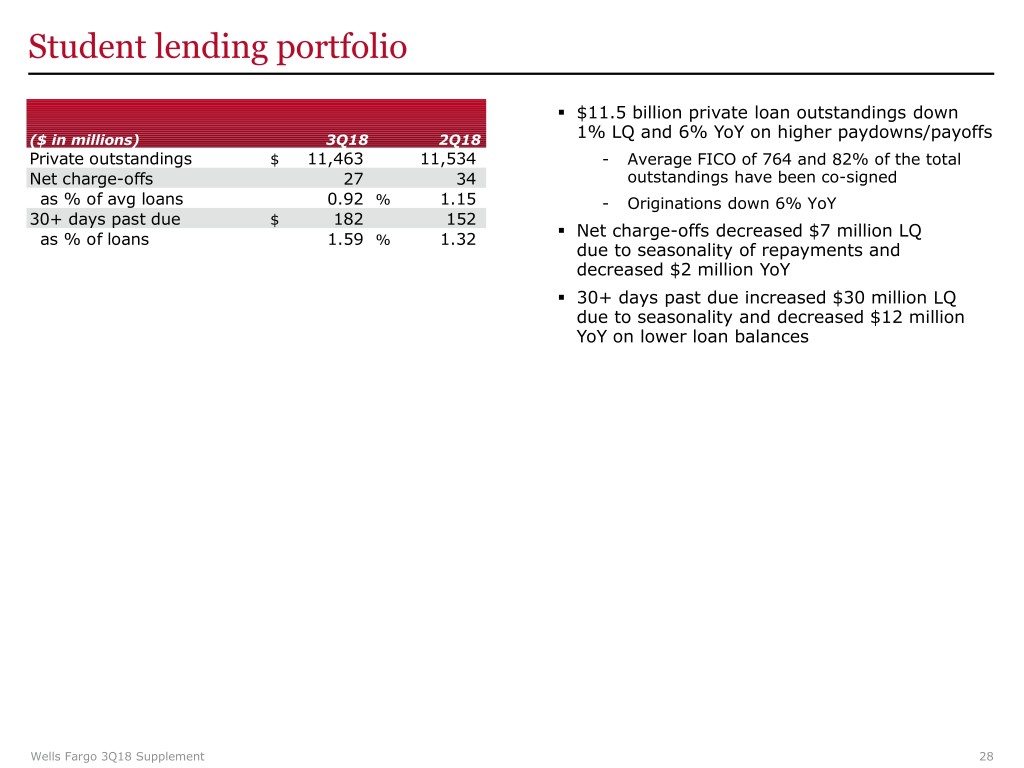

Student lending portfolio . $11.5 billion private loan outstandings down ($ in millions) 3Q18 2Q18 1% LQ and 6% YoY on higher paydowns/payoffs Private outstandings $ 11,463 11,534 - Average FICO of 764 and 82% of the total Net charge-offs 27 34 outstandings have been co-signed as % of avg loans 0.92 % 1.15 - Originations down 6% YoY 30+ days past due $ 182 152 . Net charge-offs decreased $7 million LQ as % of loans 1.59 % 1.32 due to seasonality of repayments and decreased $2 million YoY . 30+ days past due increased $30 million LQ due to seasonality and decreased $12 million YoY on lower loan balances Wells Fargo 3Q18 Supplement 28

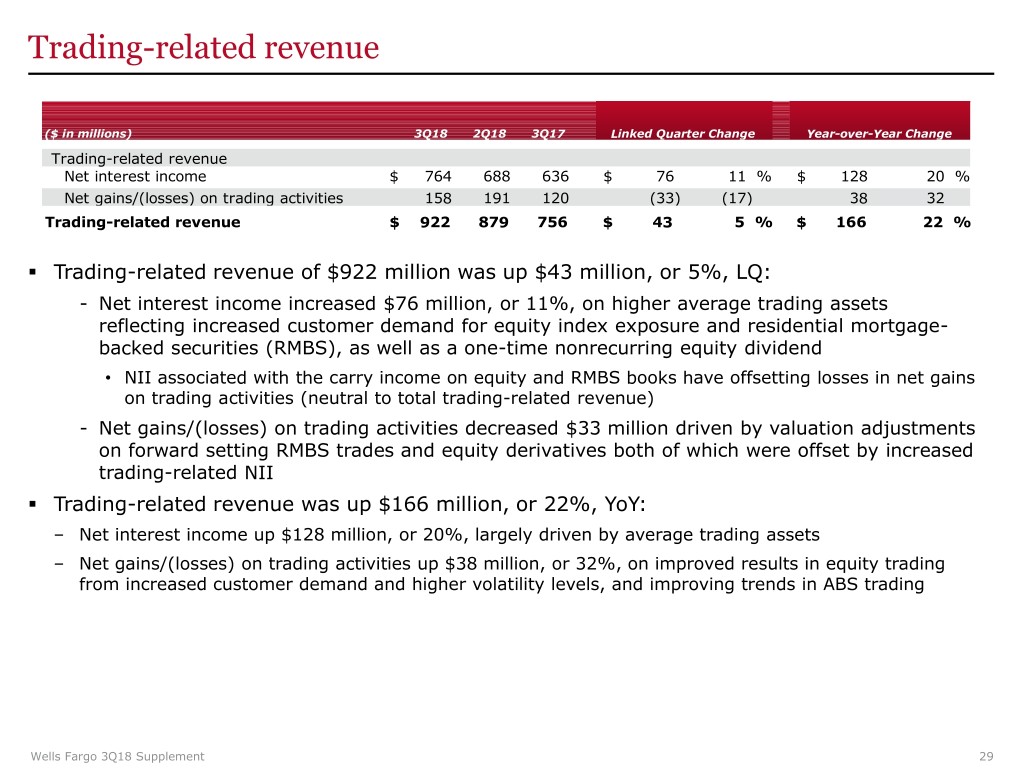

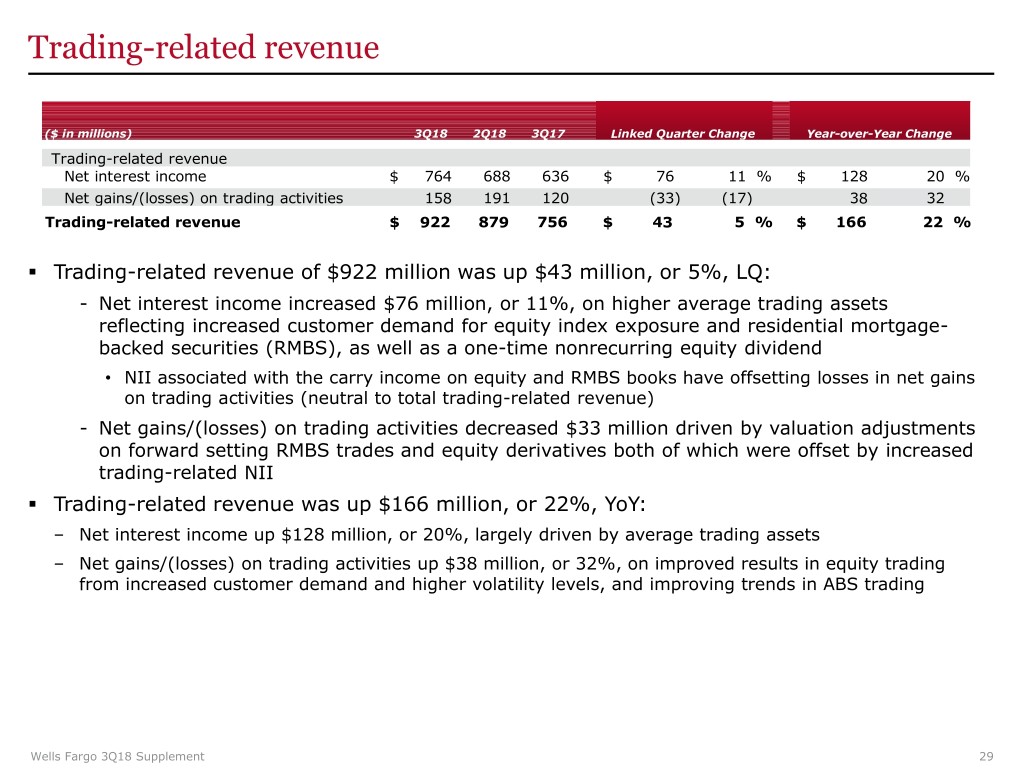

Trading-related revenue ($ in millions) 3Q18 2Q18 3Q17 Linked Quarter Change Year-over-Year Change Trading-related revenue Net interest income $ 764 688 636 $ 76 11 % $ 128 20 % Net gains/(losses) on trading activities 158 191 120 (33) (17) 38 32 Trading-related revenue $ 922 879 756 $ 43 5 % $ 166 22 % . Trading-related revenue of $922 million was up $43 million, or 5%, LQ: - Net interest income increased $76 million, or 11%, on higher average trading assets reflecting increased customer demand for equity index exposure and residential mortgage- backed securities (RMBS), as well as a one-time nonrecurring equity dividend • NII associated with the carry income on equity and RMBS books have offsetting losses in net gains on trading activities (neutral to total trading-related revenue) - Net gains/(losses) on trading activities decreased $33 million driven by valuation adjustments on forward setting RMBS trades and equity derivatives both of which were offset by increased trading-related NII . Trading-related revenue was up $166 million, or 22%, YoY: – Net interest income up $128 million, or 20%, largely driven by average trading assets – Net gains/(losses) on trading activities up $38 million, or 32%, on improved results in equity trading from increased customer demand and higher volatility levels, and improving trends in ABS trading Wells Fargo 3Q18 Supplement 29

Noninterest expense analysis (reference for slides 15-16) For analytical purposes, we have grouped our noninterest expense into six categories: Compensation & Benefits: Salaries, benefits and non-revenue-related incentive compensation Revenue-related: Incentive compensation directly tied to generating revenue; businesses with expenses directly tied to revenue (operating leases, insurance) Third Party Services: Expenses related to the use of outside parties, such as legal and consultant costs “Running the Business” – Non Discretionary: Expenses that are costs of doing business, including foreclosed asset expense and FDIC assessments “Running the Business” – Discretionary: Travel, advertising, postage, etc. Infrastructure: Equipment, occupancy, etc. Wells Fargo 3Q18 Supplement 30

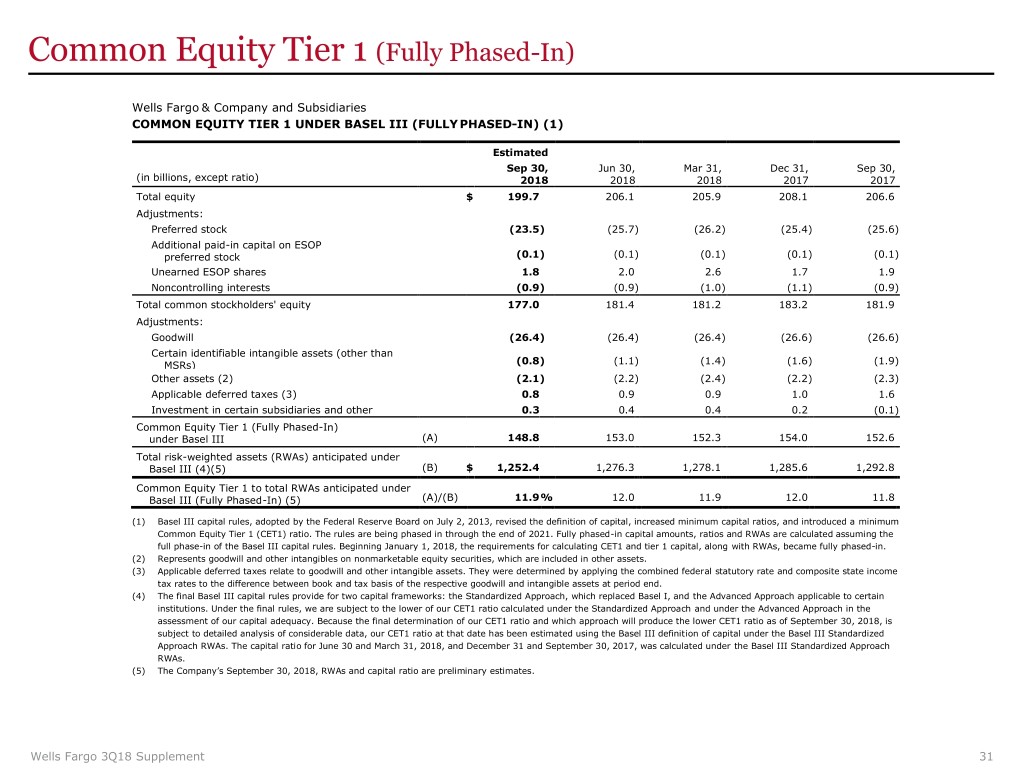

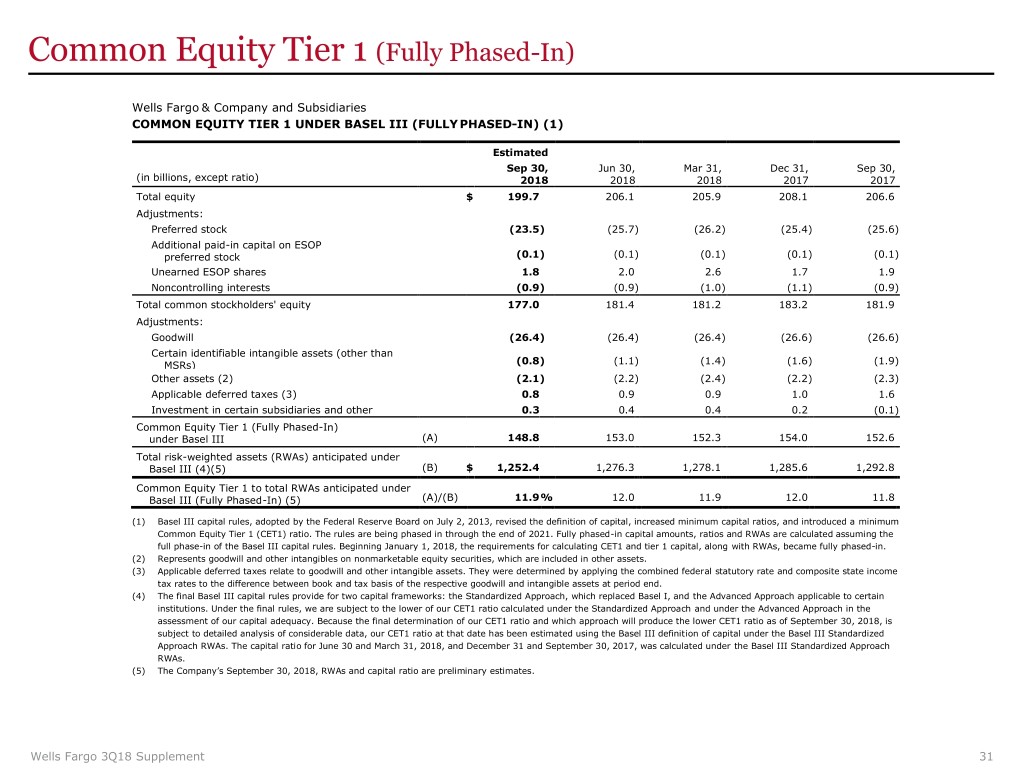

Common Equity Tier 1 (Fully Phased -In) Wells Fargo & Company and Subsidiaries COMMON EQUITY TIER 1 UNDER BASEL III (FULLY PHASED-IN) (1) Estimated Sep 30, Jun 30, Mar 31, Dec 31, Sep 30, (in billions, except ratio) 2018 2018 2018 2017 2017 Total equity $ 199.7 206.1 205.9 208.1 206.6 Adjustments: Preferred stock (23.5 ) (25.7) (26.2 ) (25.4 ) (25.6) Additional paid-in capital on ESOP preferred stock (0.1 ) (0.1) (0.1 ) (0.1 ) (0.1) Unearned ESOP shares 1.8 2.0 2.6 1.7 1.9 Noncontrolling interests (0.9 ) (0.9) (1.0 ) (1.1 ) (0.9) Total common stockholders' equity 177.0 181.4 181.2 183.2 181.9 Adjustments: Goodwill (26.4 ) (26.4) (26.4 ) (26.6 ) (26.6) Certain identifiable intangible assets (other than MSRs) (0.8 ) (1.1) (1.4 ) (1.6 ) (1.9) Other assets (2) (2.1 ) (2.2) (2.4 ) (2.2 ) (2.3) Applicable deferred taxes (3) 0.8 0.9 0.9 1.0 1.6 Investment in certain subsidiaries and other 0.3 0.4 0.4 0.2 (0.1) Common Equity Tier 1 (Fully Phased-In) under Basel III (A) 148.8 153.0 152.3 154.0 152.6 Total risk-weighted assets (RWAs) anticipated under Basel III (4)(5) (B) $ 1,252.4 1,276.3 1,278.1 1,285.6 1,292.8 Common Equity Tier 1 to total RWAs anticipated under Basel III (Fully Phased-In) (5) (A)/(B) 11.9 % 12.0 11.9 12.0 11.8 (1) Basel III capital rules, adopted by the Federal Reserve Board on July 2, 2013, revised the definition of capital, increased minimum capital ratios, and introduced a minimum Common Equity Tier 1 (CET1) ratio. The rules are being phased in through the end of 2021. Fully phased-in capital amounts, ratios and RWAs are calculated assuming the full phase-in of the Basel III capital rules. Beginning January 1, 2018, the requirements for calculating CET1 and tier 1 capital, along with RWAs, became fully phased-in. (2) Represents goodwill and other intangibles on nonmarketable equity securities, which are included in other assets. (3) Applicable deferred taxes relate to goodwill and other intangible assets. They were determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period end. (4) The final Basel III capital rules provide for two capital frameworks: the Standardized Approach, which replaced Basel I, and the Advanced Approach applicable to certain institutions. Under the final rules, we are subject to the lower of our CET1 ratio calculated under the Standardized Approach and under the Advanced Approach in the assessment of our capital adequacy. Because the final determination of our CET1 ratio and which approach will produce the lower CET1 ratio as of September 30, 2018, is subject to detailed analysis of considerable data, our CET1 ratio at that date has been estimated using the Basel III definition of capital under the Basel III Standardized Approach RWAs. The capital ratio for June 30 and March 31, 2018, and December 31 and September 30, 2017, was calculated under the Basel III Standardized Approach RWAs. (5) The Company’s September 30, 2018, RWAs and capital ratio are preliminary estimates. Wells Fargo 3Q18 Supplement 31

Return on average tangible common equity (ROTCE) Wells Fargo & Company and Subsidiaries TANGIBLE COMMON EQUITY (1) Quarter ended (in millions, except ratios) Sep 30, 2018 Return on average tangible common equity (1): Net income applicable to common stock (A) $ 5,453 Average total equity 202,826 Adjustments: Preferred stock (24,219 ) Additional paid-in capital on ESOP preferred stock (115 ) Unearned ESOP shares 2,026 Noncontrolling interests (892 ) Average common stockholders’ equity (B) 179,626 Adjustments: Goodwill (26,429 ) Certain identifiable intangible assets (other than MSRs) (958 ) Other assets (2) (2,083 ) Applicable deferred taxes (3) 845 Average tangible common equity (C) $ 151,001 Return on average common stockholders' equity (ROE) (annualized) (A)/(B) 12.04 % Return on average tangible common equity (ROTCE) (annualized) (A)/(C) 14.33 (1) Tangible common equity is a non-GAAP financial measure and represents total equity less preferred equity, noncontrolling interests, and goodwill and certain identifiable intangible assets (including goodwill and intangible assets associated with certain of our nonmarketable equity securities but excluding mortgage servicing rights), net of applicable deferred taxes. The methodology of determining tangible common equity may differ among companies. Management believes that return on average tangible common equity, which utilizes tangible common equity, is a useful financial measure because it enables investors and others to assess the Company's use of equity. (2) Represents goodwill and other intangibles on nonmarketable equity securities, which are included in other assets. (3) Applicable deferred taxes relate to goodwill and other intangible assets. They were determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period end. Wells Fargo 3Q18 Supplement 32

Forward-looking statements and additional information Forward-looking statements: This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, we may make forward-looking statements in our other documents filed or furnished with the SEC, and our management may make forward- looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements include, but are not limited to, statements we make about: (i) the future operating or financial performance of the Company, including our outlook for future growth; (ii) our noninterest expense and efficiency ratio; (iii) future credit quality and performance, including our expectations regarding future loan losses and allowance levels; (iv) the appropriateness of the allowance for credit losses; (v) our expectations regarding net interest income and net interest margin; (vi) loan growth or the reduction or mitigation of risk in our loan portfolios; (vii) future capital or liquidity levels or targets and our estimated Common Equity Tier 1 ratio under Basel III capital standards; (viii) the performance of our mortgage business and any related exposures; (ix) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; (x) future common stock dividends, common share repurchases and other uses of capital; (xi) our targeted range for return on assets, return on equity, and return on tangible common equity; (xii) the outcome of contingencies, such as legal proceedings; and (xiii) the Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For more information about factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements” discussion in Wells Fargo’s press release announcing our third quarter 2018 results and in our most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017. Purchased credit-impaired loan portfolios: Loans acquired that were considered credit impaired at acquisition were written down at that date in purchase accounting to an amount estimated to be collectible and the related allowance for loan losses was not carried over to Wells Fargo’s allowance. In addition, such purchased credit-impaired loans are not classified as nonaccrual or nonperforming, and are not included in loans that were contractually 90+ days past due and still accruing. Any losses on such loans are charged against the nonaccretable difference established in purchase accounting and are not reported as charge-offs (until such difference is fully utilized). As a result of accounting for purchased loans with evidence of credit deterioration, certain ratios of Wells Fargo are not comparable to a portfolio that does not include purchased credit- impaired loans. In certain cases, the purchased credit-impaired loans may affect portfolio credit ratios and trends. Management believes that the presentation of information adjusted to exclude the purchased credit-impaired loans provides useful disclosure regarding the credit quality of the non-impaired loan portfolio. Accordingly, certain of the loan balances and credit ratios in this document have been adjusted to exclude the purchased credit-impaired loans. References in this document to impaired loans mean the purchased credit-impaired loans. Please see page 33 of the press release announcing our 3Q18 results for additional information regarding the purchased credit-impaired loans. Wells Fargo 3Q18 Supplement 33