Exhibit 99.2 1Q20 Quarterly Supplement April 14, 2020 © 2020 Wells Fargo Bank, N.A. All rights reserved.

Table of contents 1Q20 Results Providing support for our customers Pages 2 Wholesale Banking 28 Providing support for our employees 3 Wealth and Investment Management 29 Providing support for our communities 4 Credit quality of the loan portfolio 30 Supporting The CARES Act 5 Oil and gas loan portfolio performance 31 1Q20 Earnings 6 Current expected credit losses (CECL) 32 Strong capital and liquidity positions 7 Capital 33 Income Statement overview (linked quarter) 8 Balance Sheet and credit overview (linked quarter) 9 Appendix Managing under the asset cap 10 Real estate 1-4 family mortgage portfolio 35 Average loans 11 Consumer credit card portfolio 36 Period-end loans 12 Auto portfolios 37 Consumer loan trends 13 Student lending portfolio 38 Commercial loan trends 14 Trading-related revenue 39 Commercial & Industrial loans and lease financing by industry 15 Wholesale Banking adjusted efficiency ratio for income tax credits 40 Industries with escalated monitoring: Oil and gas, and Retail 16 Common Equity Tier 1 41 Industries with escalated monitoring: Entertainment and recreation, and Transportation services 17 Forward-looking statements 42 Industries with escalated monitoring: Commercial Real Estate loans by property type 18 Average deposit trends and costs 19 Period-end deposit trends 20 Net interest income 21 Noninterest income 22 Net losses from equity securities including deferred compensation 23 Noninterest expense and efficiency ratio 24 Community Banking 25 Community Banking metrics 26-27 Financial results reported in this document are preliminary. Final financial results and other disclosures will be reported in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, and may differ materially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information. Wells Fargo 1Q20 Supplement 1

Providing support for our customers COVID-19 actions: . Offering fee waivers, payment deferrals and other expanded assistance for credit card, auto, mortgage, small business and personal lending customers who contact us . Granting immediate 90-day payment suspension for any Wells Fargo Home Lending customer who requests assistance . Suspended residential property foreclosures and evictions . Suspended involuntary auto repossessions . In the month of March alone, commercial customers utilized over $80 billion of their loan commitments . From March 9 through April 10: - Helped more than 1.3 million consumer and small business customers by deferring payments and waiving fees - Deferred over 1 million payments, representing $2.8 billion of principal and interest payments for loans that we service or hold on our balance sheet - Provided over 900,000 fee waivers, exceeding $30 million Additional actions taken in first quarter: . Announced plans to introduce a new checkless account which will limit spending to the amount available in the account and customers will not incur overdrafts or insufficient fund fees; expected to be available early next year . Announced plans to introduce an account that includes checks and will cap overdraft or insufficient funds fees at once per month; expected to be available early next year Wells Fargo 1Q20 Supplement 2

Providing support for our employees COVID-19 actions: . For certain qualifying employees, we are making up to $1,600 in combined payments: - A one-time cash award to approximately 165,000 employees, which will be reflected in their paychecks this week - For employees whose roles require they come into the office to serve customers or other employees, we are making additional cash payments . Eliminated the seven-day waiting period under our short-term disability plan for U.S.-based employees so that, if they get a positive COVID-19 diagnosis, they will not need to use PTO . Updated our U.S. medical plan to eliminate coinsurance and fully cover the cost of any medically necessary screening and testing for COVID-19 . Providing financial support for eligible employees of $100 per day for those seeking child care through their own personal networks for up to 20 days . Supporting front-line employees by paying employees for hours of work lost due to facility closures . Enabled approximately 180,000 employees to work remotely . Made $10 million grant to the WE Care Employee relief fund Additional actions taken in first quarter: . Announced plans to raise minimum hourly pay levels in the majority of our U.S. markets ranging from $15 to $20. This change will increase pay for more than 20,000 employees and will take effect by the end of 2020 Wells Fargo 1Q20 Supplement 3

Providing support for our communities COVID-19 actions: . Directing $175 million in charitable donations from the Wells Fargo Foundation to help address food, shelter, small business and housing stability, as well as to provide help to public health organizations fighting to contain the spread of COVID-19 . Providing $1 million to Feeding America to support their 200 member foodbanks as they work to feed people during this time of crisis . Providing $1 million to the CDC Foundation to meet emerging needs . Providing $250,000 to the International Medical Corps . Giving substantial fees received under the Payroll Protection Program to nonprofits focused on small businesses Additional actions taken in first quarter: . Announced that we are seeking to invest up to $50 million in African American Minority Depository Institutions as part of our commitment to supporting economic growth in African American communities . Announced plans to expand our credit offering to provide DACA recipients access to education loans; personal lines and loans; credit cards; auto loans and small business credit. Additionally, we will make mortgage and home equity loans to eligible DACA customers except where prohibited by specific investors Wells Fargo 1Q20 Supplement 4

Supporting The CARES Act Consumers: . We are working with industry trade groups and the U.S. Treasury in preparation to distribute millions of Economic Impact Payments to Americans as quickly as possible . We expect the distribution of payments to be made to our customers beginning early this week . For those that receive checks, we have implemented changes to our ATMs and mobile app to make it more convenient to use those depository options instead of going into a branch Small Businesses: . Payroll Protection Program (PPP) includes fully forgivable loans to help small businesses maintain payrolls during the COVID-19 pandemic . We have expanded our participation in the PPP to provide additional relief for our customers and our communities . Customers must meet the overall Small Business Administration program requirements, have a Wells Fargo Business checking account as of Feb. 15, 2020, and be enrolled in business online banking . Through April 10, we have received more than 370,000 indications of interest from our customers Wells Fargo 1Q20 Supplement 5

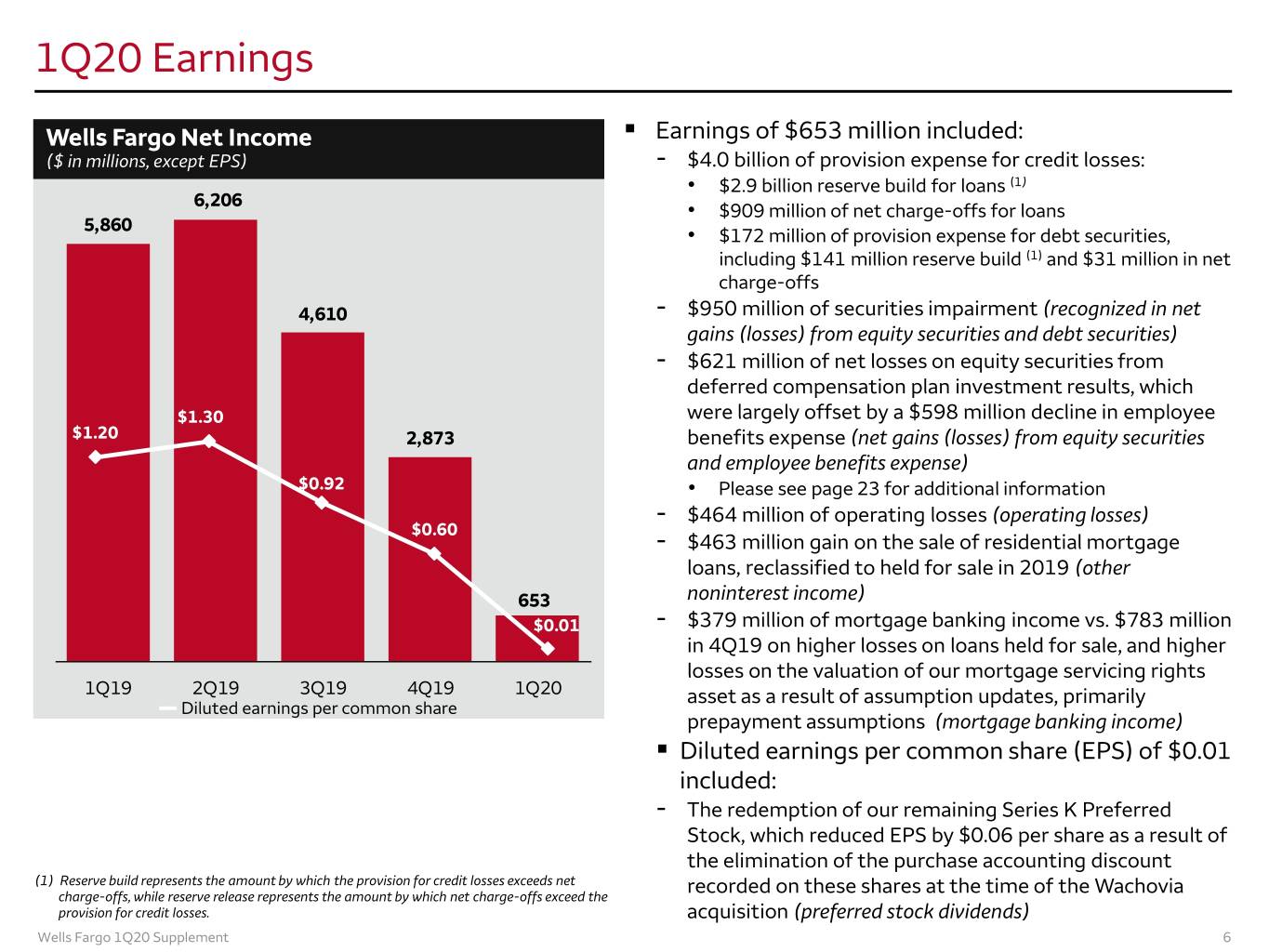

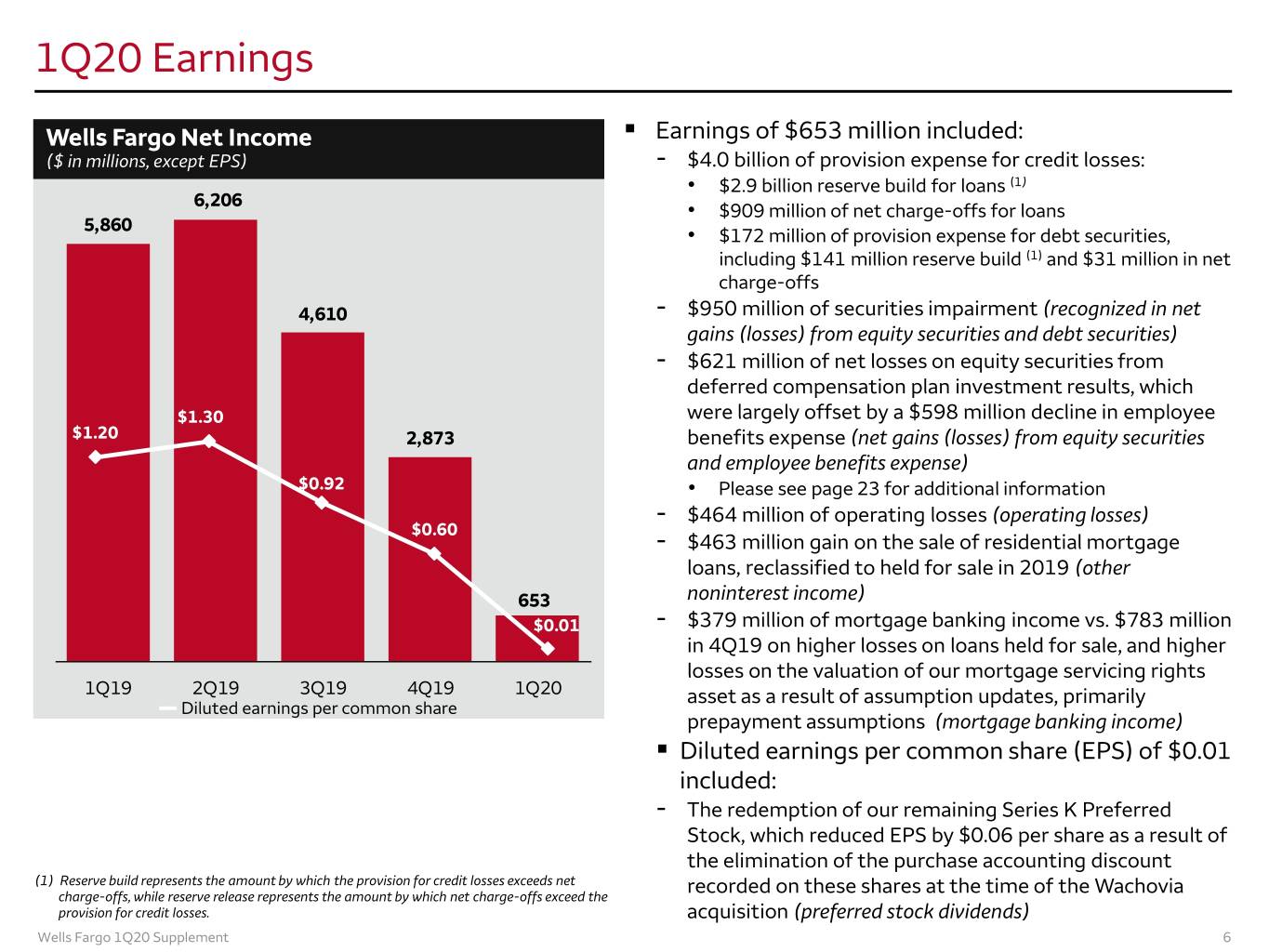

1Q20 Earnings Wells Fargo Net Income . Earnings of $653 million included: ($ in millions, except EPS) - $4.0 billion of provision expense for credit losses: • $2.9 billion reserve build for loans (1) 6,206 • $909 million of net charge-offs for loans 5,860 • $172 million of provision expense for debt securities, including $141 million reserve build (1) and $31 million in net charge-offs 4,610 - $950 million of securities impairment (recognized in net gains (losses) from equity securities and debt securities) - $621 million of net losses on equity securities from deferred compensation plan investment results, which $1.30 were largely offset by a $598 million decline in employee $1.20 2,873 benefits expense (net gains (losses) from equity securities and employee benefits expense) $0.92 • Please see page 23 for additional information - $464 million of operating losses (operating losses) $0.60 - $463 million gain on the sale of residential mortgage loans, reclassified to held for sale in 2019 (other 653 noninterest income) $0.01 - $379 million of mortgage banking income vs. $783 million in 4Q19 on higher losses on loans held for sale, and higher losses on the valuation of our mortgage servicing rights 1Q19 2Q19 3Q19 4Q19 1Q20 asset as a result of assumption updates, primarily Diluted earnings per common share prepayment assumptions (mortgage banking income) . Diluted earnings per common share (EPS) of $0.01 included: - The redemption of our remaining Series K Preferred Stock, which reduced EPS by $0.06 per share as a result of the elimination of the purchase accounting discount (1) Reserve build represents the amount by which the provision for credit losses exceeds net charge-offs, while reserve release represents the amount by which net charge-offs exceed the recorded on these shares at the time of the Wachovia provision for credit losses. acquisition (preferred stock dividends) Wells Fargo 1Q20 Supplement 6

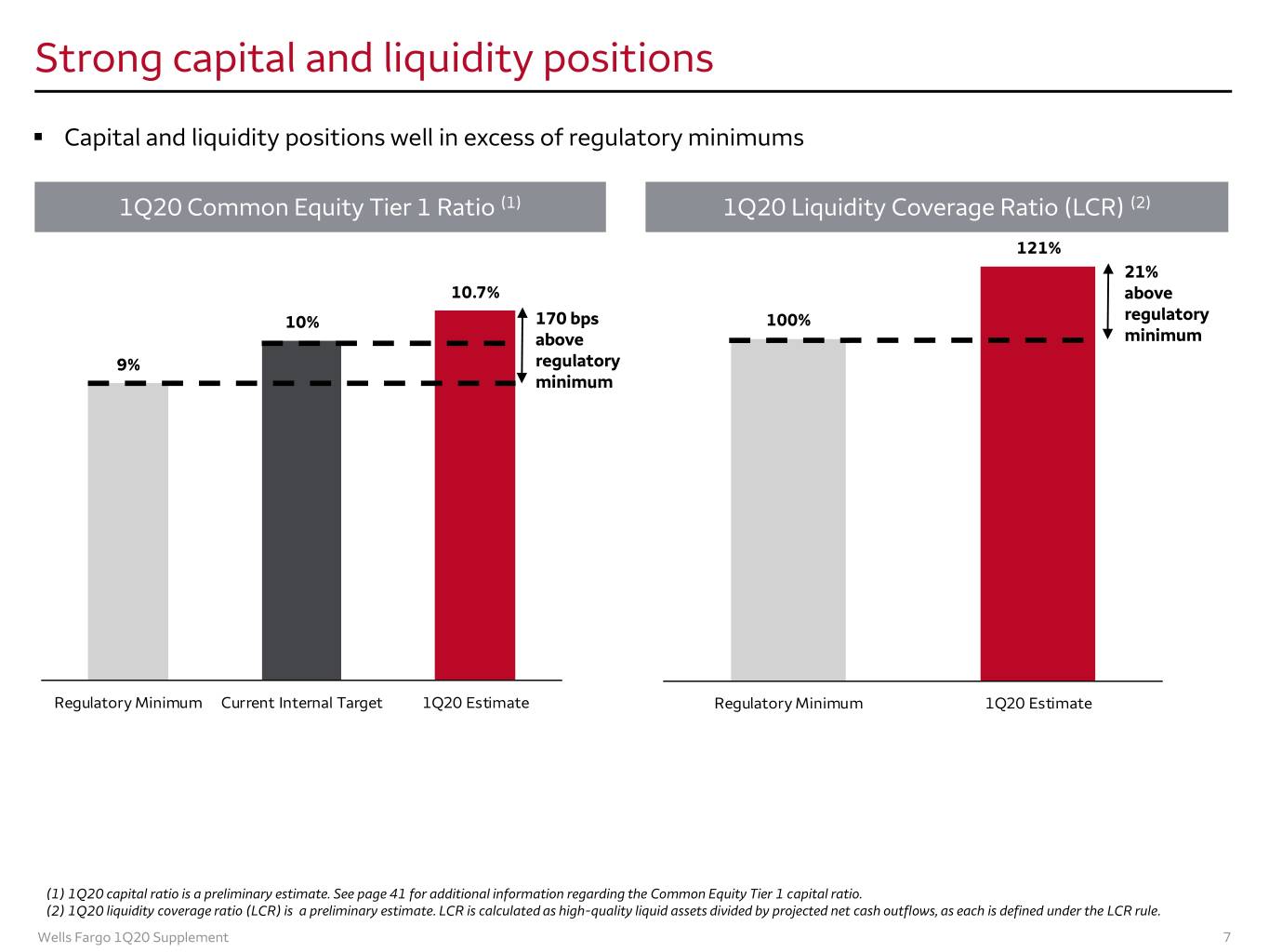

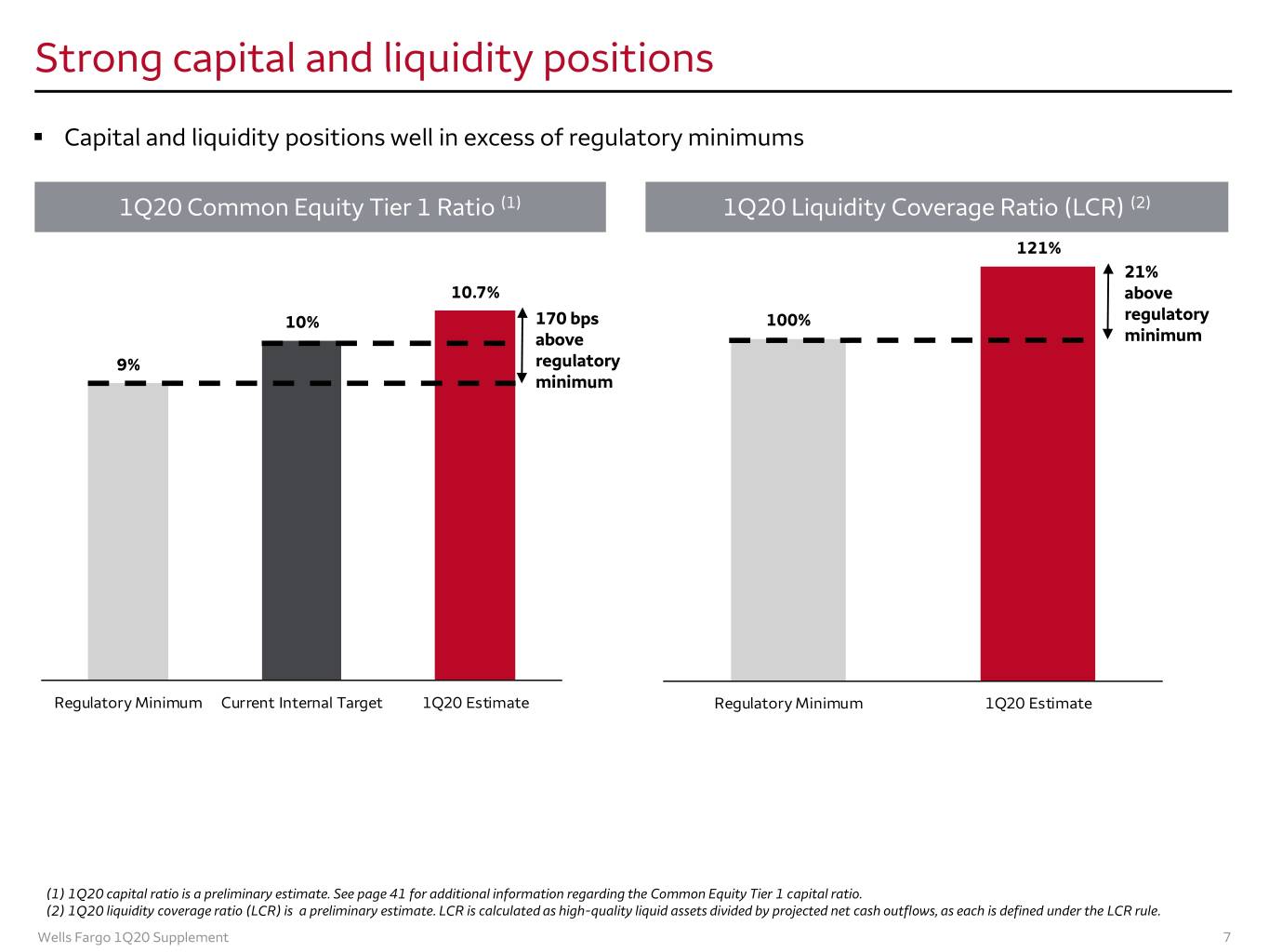

Strong capital and liquidity positions . Capital and liquidity positions well in excess of regulatory minimums 1Q20 Common Equity Tier 1 Ratio (1) 1Q20 Liquidity Coverage Ratio (LCR) (2) 121% 21% 10.7% above 10% 170 bps 100% regulatory above minimum 9% regulatory minimum Regulatory Minimum Current Internal Target 1Q20 Estimate Regulatory Minimum 1Q20 Estimate (1) 1Q20 capital ratio is a preliminary estimate. See page 41 for additional information regarding the Common Equity Tier 1 capital ratio. (2) 1Q20 liquidity coverage ratio (LCR) is a preliminary estimate. LCR is calculated as high-quality liquid assets divided by projected net cash outflows, as each is defined under the LCR rule. Wells Fargo 1Q20 Supplement 7

Income Statement overview (linked quarter (LQ)) Total revenue . Revenue of $17.7 billion Net interest income . NII up $112 million, and NIM up 5 bps to 2.58% predominantly reflecting the benefit of hedge ineffectiveness accounting results and lower MBS premium amortization, which was largely offset by balance sheet repricing driven by the impact of the lower interest rate environment and one fewer day in the quarter Noninterest income . Noninterest income down $2.3 billion - Market sensitive revenue (1) down $1.7 billion, including $1.9 billion of lower net gains from equity securities on an $811 million increase in impairment and an $857 million decline in deferred compensation plan investment results (P&L neutral) . Please see page 23 for additional information on net losses from equity securities, including deferred compensation - Mortgage banking down $404 million on unrealized losses on residential and commercial mortgage loans held for sale (HFS) of ~ $143 million and ~ $62 million, respectively, due to illiquid market conditions and a widening of credit spreads, as well as $192 million of higher losses on the valuation of our mortgage servicing rights (MSR) asset as a result of assumption updates, primarily prepayment assumptions - Card fees down $128 million on lower interchange income due to seasonality and the impact of COVID-19 on consumer spending - Other income relatively flat as $349 million higher gains from loan sales were offset by lower gains on the sale of businesses from a 4Q19 which included a $362 million gain from the sale of Eastdil Noninterest expense . Noninterest expense down $2.6 billion - Operating losses down $1.5 billion on lower litigation accruals - Employee benefits expense down $306 million, as $861 million of lower deferred compensation expense (largely offset by higher net losses from equity securities) was partially offset by seasonally higher payroll tax and 401(k) expense - Other expense categories down in the quarter included outside professional services, and technology and equipment Income tax expense . 19.5% effective income tax rate included net discrete income tax expense of $141 million driven by the accounting for stock compensation activity, the net impact of accounting for uncertain tax positions, and the outcome of U.S. federal income tax examinations All comparisons are 1Q20 compared with 4Q19. (1) Consists of net gains (losses) from trading activities, debt securities and equity securities. Wells Fargo 1Q20 Supplement 8

Balance Sheet and credit overview (linked quarter) Loans . Up $47.6 billion - Commercial loans up $52.0 billion on growth in commercial & industrial loans, and commercial real estate loans - Consumer loans down $4.4 billion despite growth in auto loans Cash and short-term . Down $6.1 billion investments Debt and equity . Trading assets down $3.1 billion driven by lower equity securities valuations securities . Debt securities (AFS and HTM) up $3.7 billion as purchases were partially offset by run-off and sales; ~$38.9 billion of gross purchases in 1Q20, largely federal agency mortgage- backed securities (MBS), vs. ~$15.6 billion in 4Q19 Deposits . Up $53.9 billion reflecting growth in both commercial and consumer deposits Short-term borrowings . Down $12.2 billion on actions taken to manage to the asset cap Long-term debt . Up $9.2 billion as $18.5 billion of issuances were partially offset by $15.7 billion of redemptions and maturities Total stockholders’ . Down $4.4 billion to $182.7 billion driven by dividends and net share repurchases equity . Common shares outstanding down 38.0 million shares, or 1%, on net share repurchases of $2.9 billion Credit . Net loan charge-offs of $909 million, or 38 bps of average loans (annualized), up $140 million, or 6 bps . Nonperforming assets of $6.4 billion, up $759 million predominantly on higher commercial nonaccruals . $3.1 billion reserve build reflects forecasted credit deterioration due to the COVID-19 pandemic, credit weakness in oil and gas, and stronger than expected loan growth including draws on loan commitments, and includes a $2.9 billion reserve build for loans and a $141 million reserve build for debt securities Period-end balances. All comparisons are 1Q20 compared with 4Q19. Wells Fargo 1Q20 Supplement 9

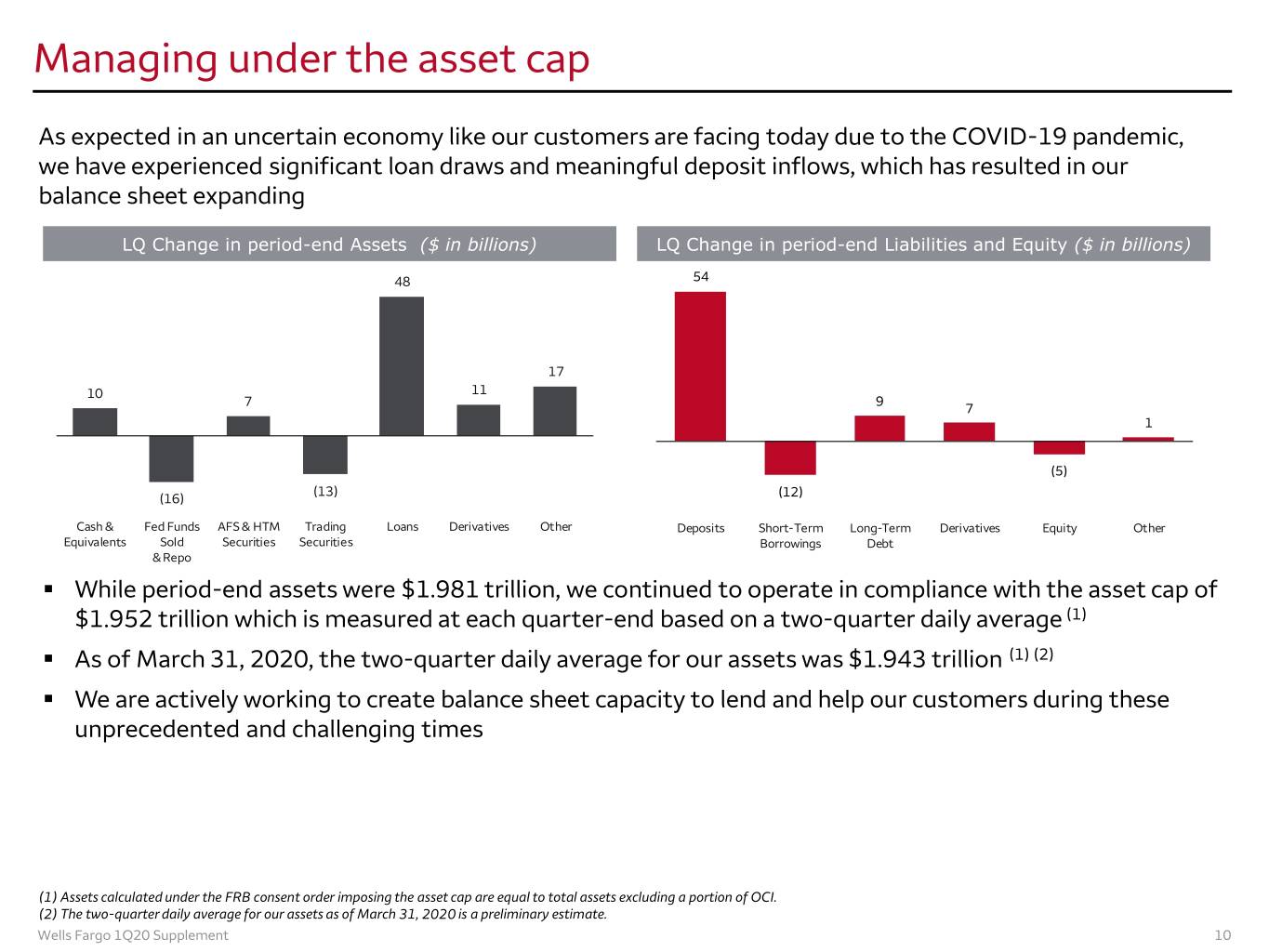

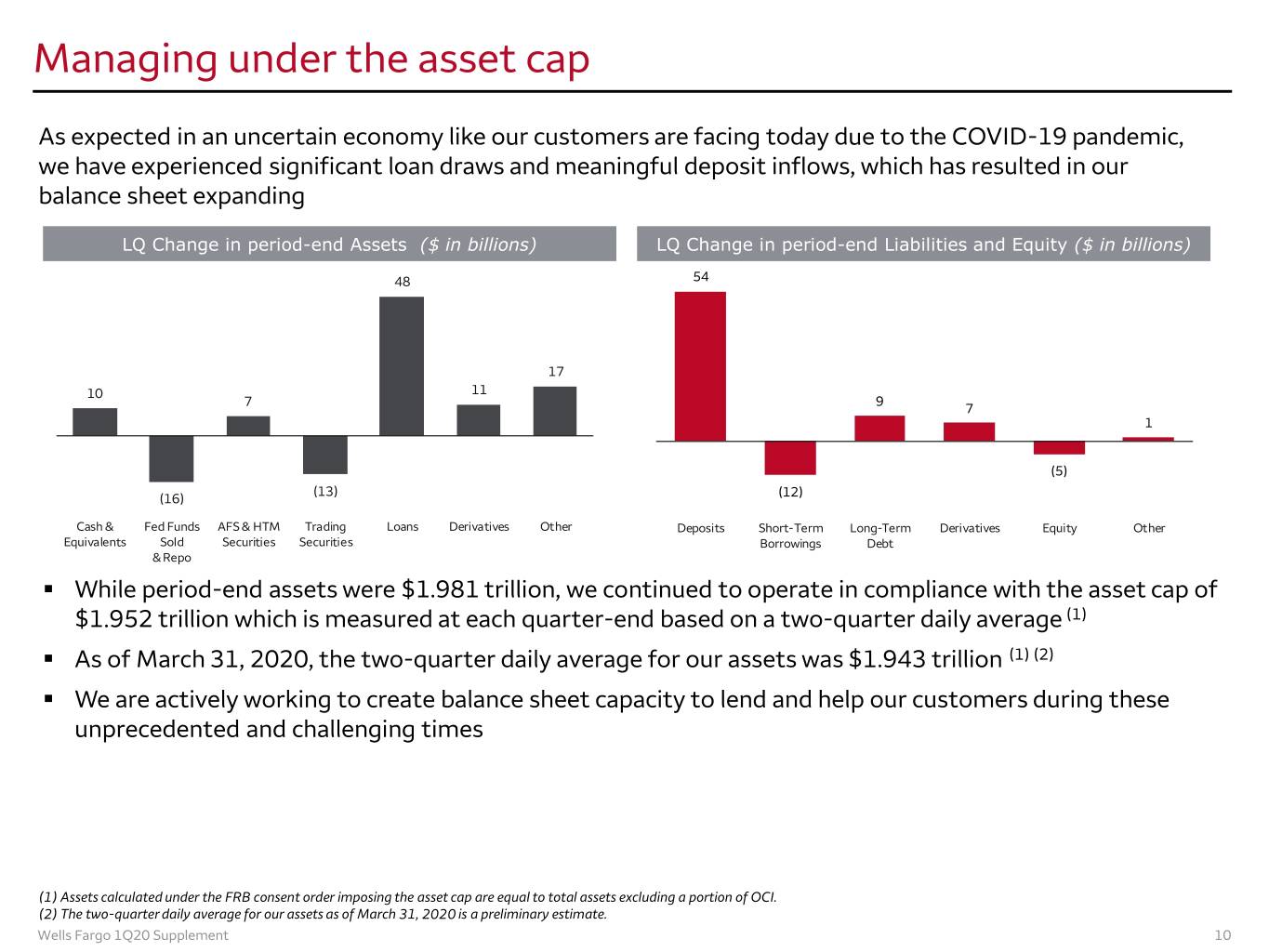

Managing under the asset cap As expected in an uncertain economy like our customers are facing today due to the COVID-19 pandemic, we have experienced significant loan draws and meaningful deposit inflows, which has resulted in our balance sheet expanding LQ Change in period-end Assets ($ in billions) LQ Change in period-end Liabilities and Equity ($ in billions) 65 55 54 48 55 45 45 35 35 25 17 25 15 11 10 15 7 9 7 5 5 1 (5) (5) (5) (15) (15) (13) (16) (12) (25) (25) Cash & Fed Funds AFS & HTM Trading Loans Derivatives Other Deposits Short-Term Long-Term Derivatives Equity Other Equivalents Sold Securities Securities Borrowings Debt & Repo . While period-end assets were $1.981 trillion, we continued to operate in compliance with the asset cap of $1.952 trillion which is measured at each quarter-end based on a two-quarter daily average (1) . As of March 31, 2020, the two-quarter daily average for our assets was $1.943 trillion (1) (2) . We are actively working to create balance sheet capacity to lend and help our customers during these unprecedented and challenging times (1) Assets calculated under the FRB consent order imposing the asset cap are equal to total assets excluding a portion of OCI. (2) The two-quarter daily average for our assets as of March 31, 2020 is a preliminary estimate. Wells Fargo 1Q20 Supplement 10

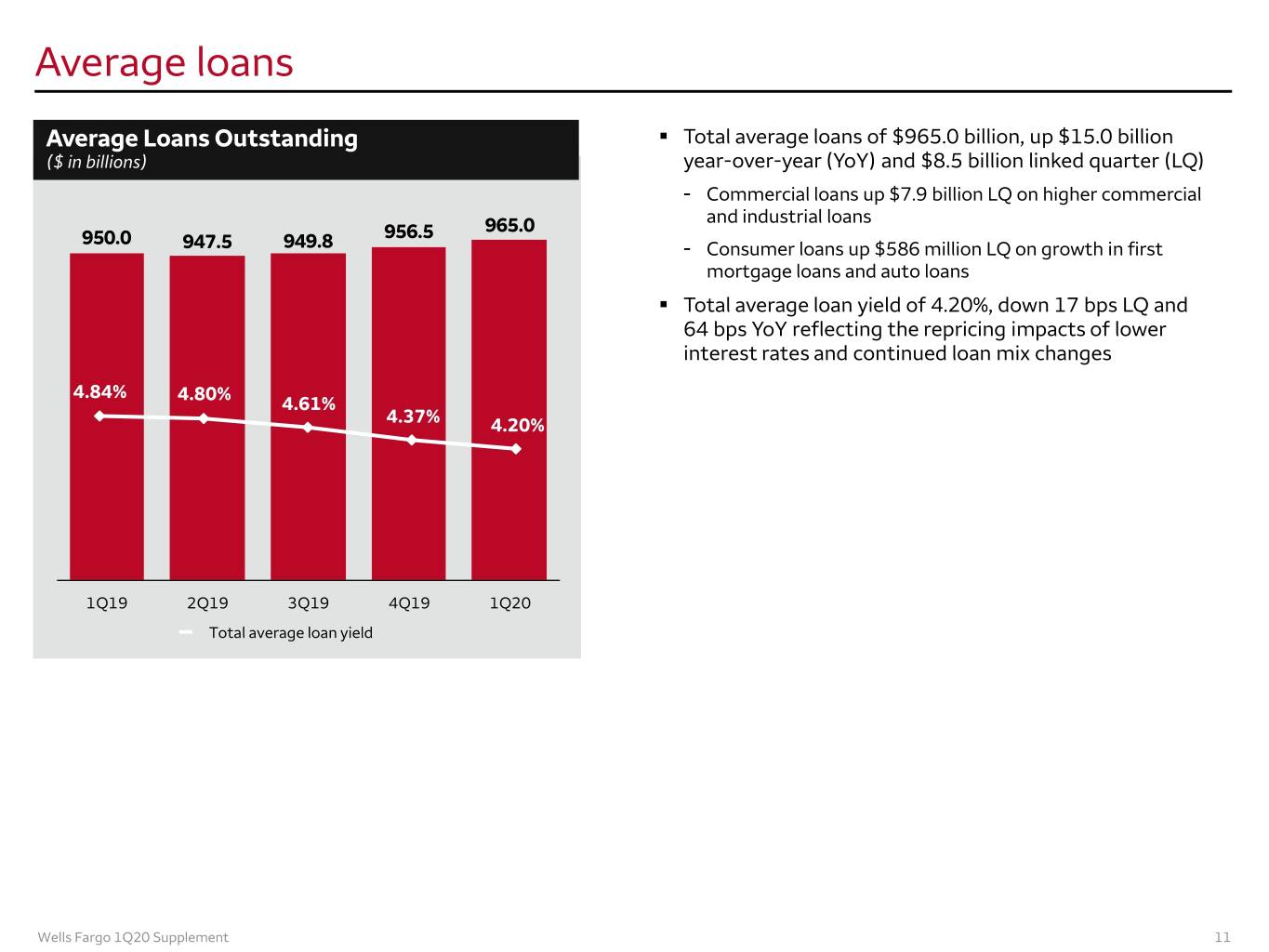

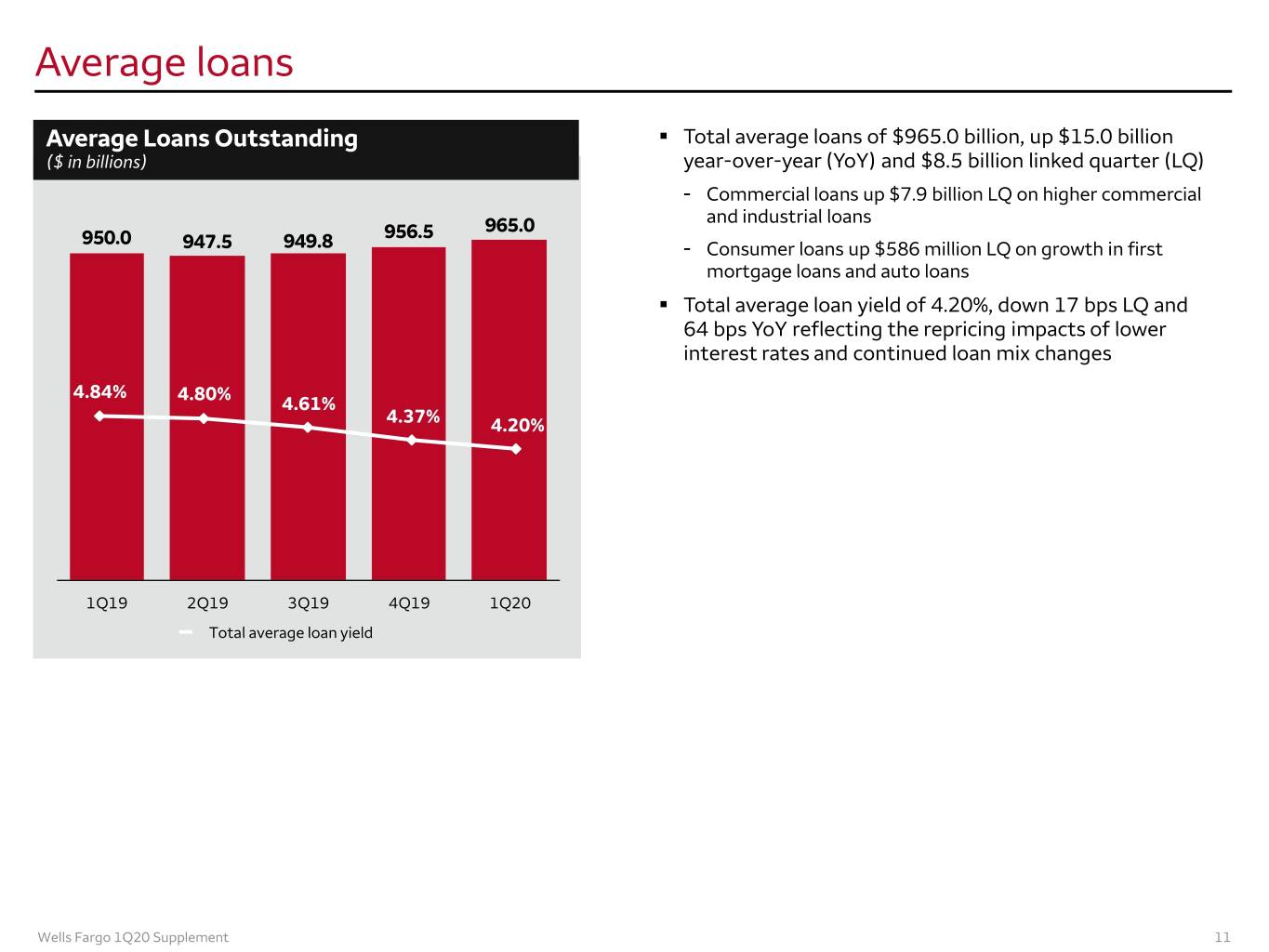

Average loans Average Loans Outstanding . Total average loans of $965.0 billion, up $15.0 billion ($ in billions) year-over-year (YoY) and $8.5 billion linked quarter (LQ) - Commercial loans up $7.9 billion LQ on higher commercial 965.0 and industrial loans 950.0 956.5 947.5 949.8 - Consumer loans up $586 million LQ on growth in first mortgage loans and auto loans . Total average loan yield of 4.20%, down 17 bps LQ and 64 bps YoY reflecting the repricing impacts of lower interest rates and continued loan mix changes 4.84% 4.80% 4.61% 4.37% 4.20% 1Q19 2Q19 3Q19 4Q19 1Q20 Total average loan yield Wells Fargo 1Q20 Supplement 11

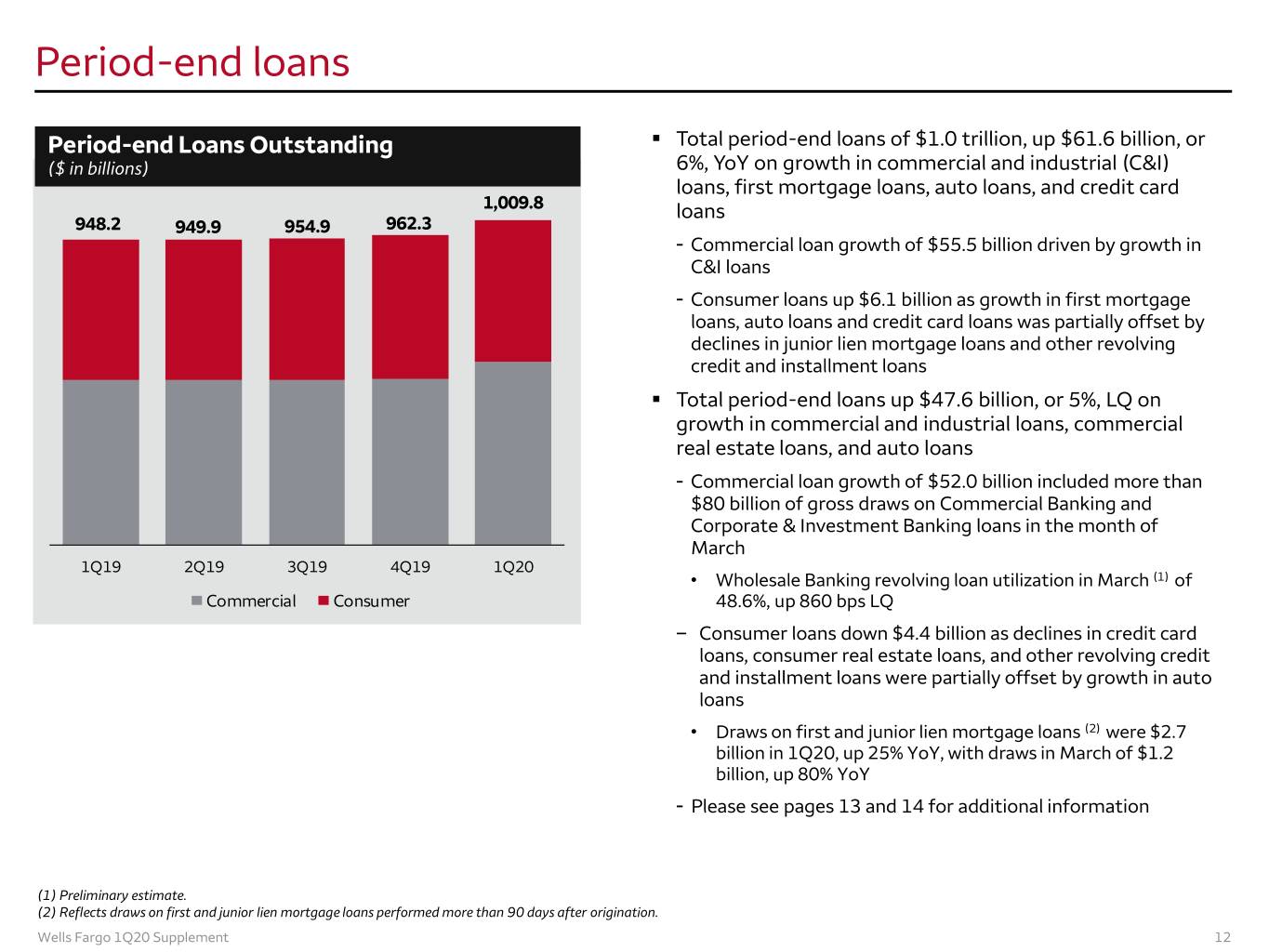

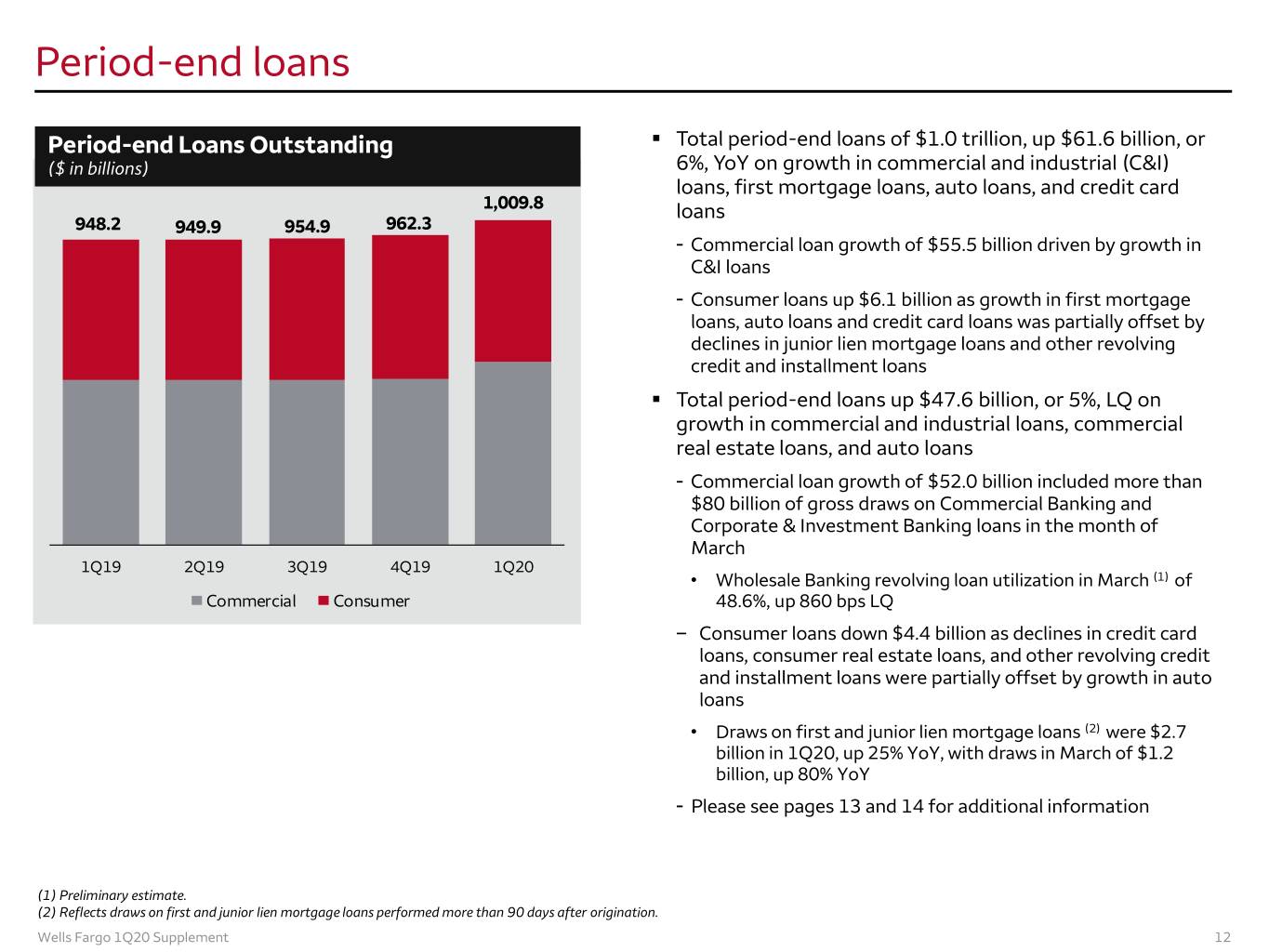

Period-end loans Period-end Loans Outstanding . Total period-end loans of $1.0 trillion, up $61.6 billion, or ($ in billions) 6%, YoY on growth in commercial and industrial (C&I) loans, first mortgage loans, auto loans, and credit card 1,009.8 loans 948.2 949.9 954.9 962.3 - Commercial loan growth of $55.5 billion driven by growth in C&I loans - Consumer loans up $6.1 billion as growth in first mortgage loans, auto loans and credit card loans was partially offset by declines in junior lien mortgage loans and other revolving credit and installment loans . Total period-end loans up $47.6 billion, or 5%, LQ on growth in commercial and industrial loans, commercial real estate loans, and auto loans - Commercial loan growth of $52.0 billion included more than $80 billion of gross draws on Commercial Banking and Corporate & Investment Banking loans in the month of March 1Q19 2Q19 3Q19 4Q19 1Q20 • Wholesale Banking revolving loan utilization in March (1) of Commercial Consumer 48.6%, up 860 bps LQ – Consumer loans down $4.4 billion as declines in credit card loans, consumer real estate loans, and other revolving credit and installment loans were partially offset by growth in auto loans • Draws on first and junior lien mortgage loans (2) were $2.7 billion in 1Q20, up 25% YoY, with draws in March of $1.2 billion, up 80% YoY - Please see pages 13 and 14 for additional information (1) Preliminary estimate. (2) Reflects draws on first and junior lien mortgage loans performed more than 90 days after origination. Wells Fargo 1Q20 Supplement 12

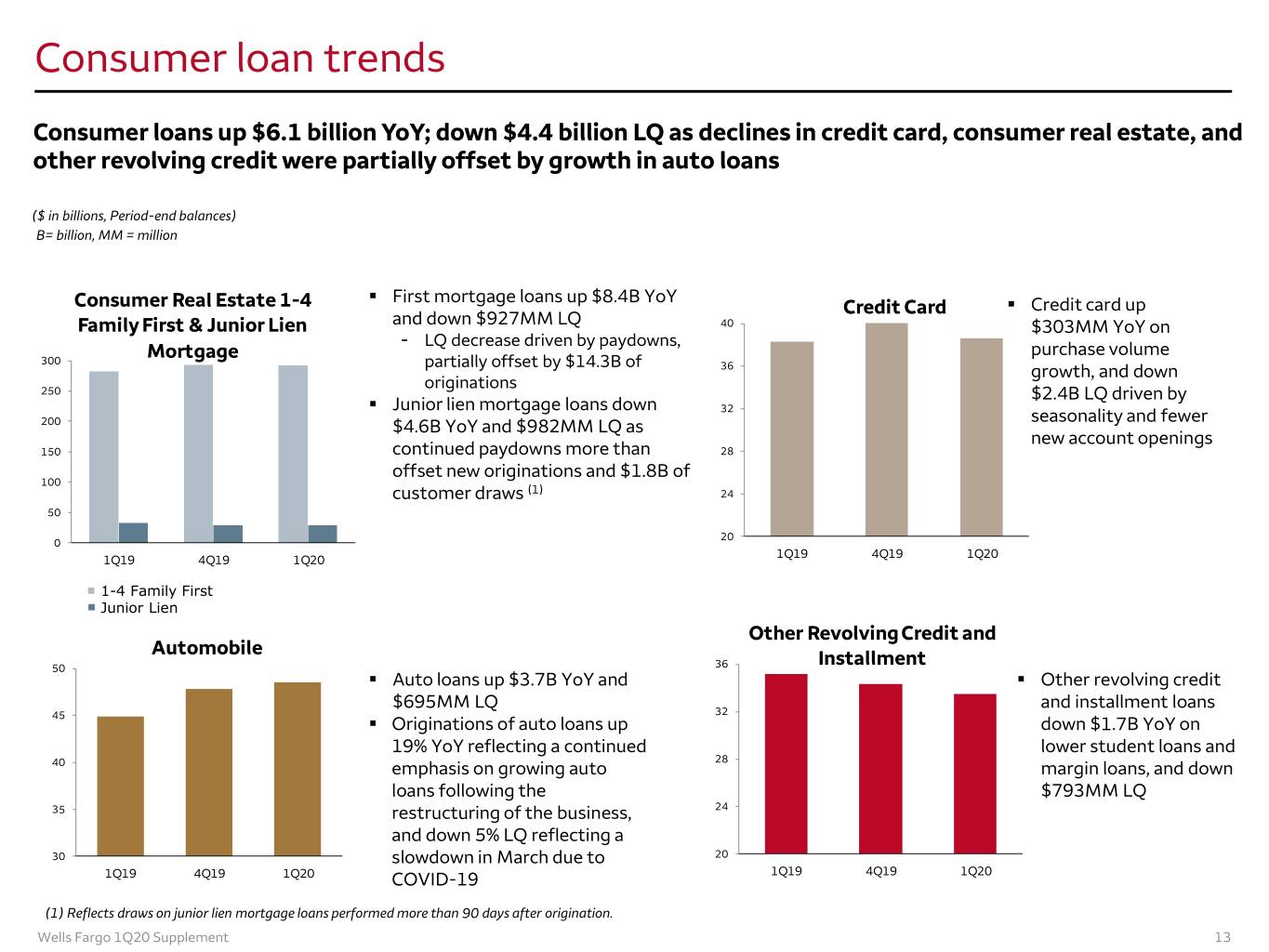

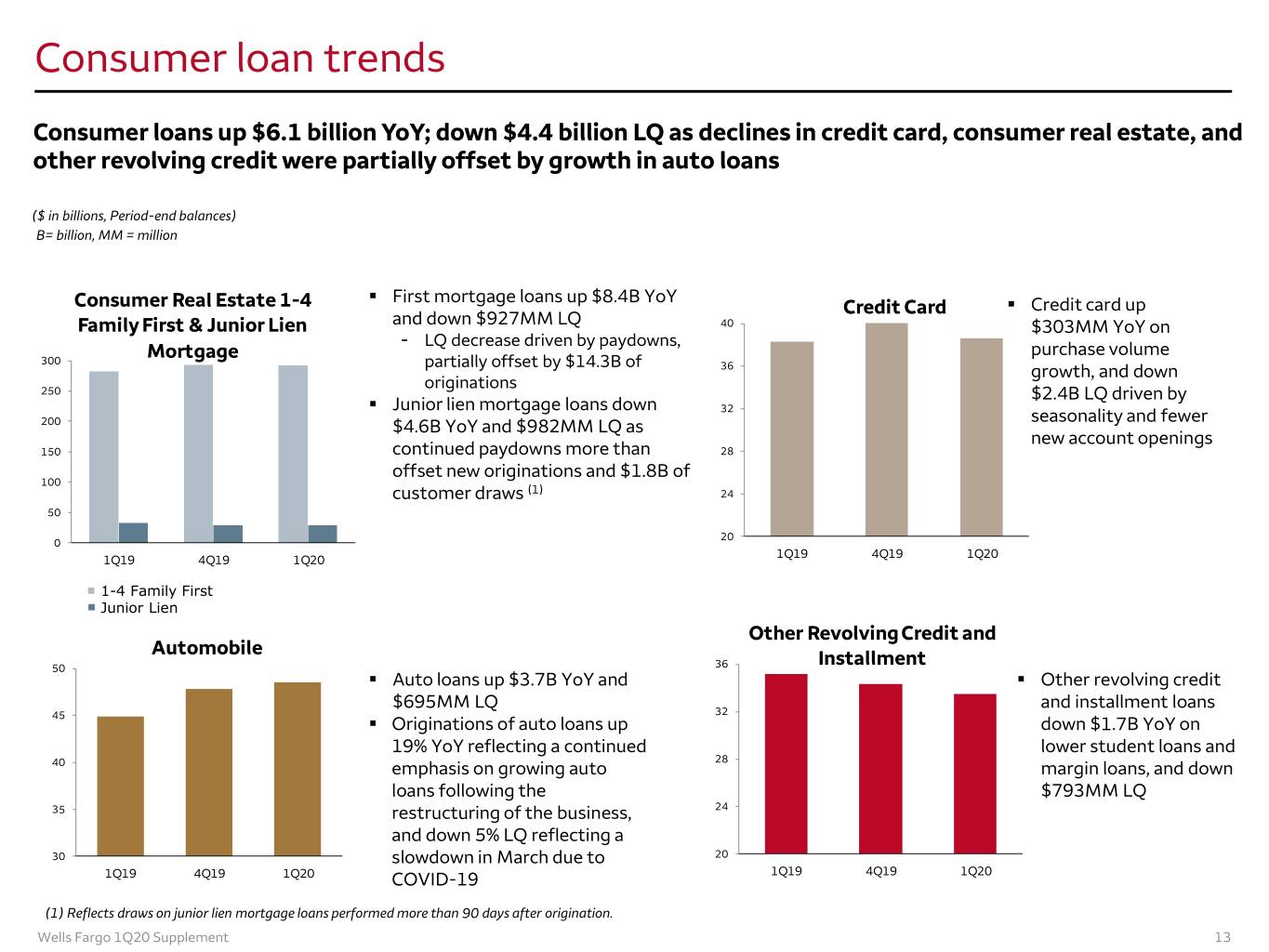

Consumer loan trends Consumer loans up $6.1 billion YoY; down $4.4 billion LQ as declines in credit card, consumer real estate, and other revolving credit were partially offset by growth in auto loans ($ in billions, Period-end balances) B= billion, MM = million . First mortgage loans up $8.4B YoY Consumer Real Estate 1-4 Credit Card . Credit card up Family First & Junior Lien and down $927MM LQ 40 $303MM YoY on - LQ decrease driven by paydowns, Mortgage purchase volume 300 partially offset by $14.3B of 36 growth, and down originations 250 $2.4B LQ driven by . Junior lien mortgage loans down 32 seasonality and fewer 200 $4.6B YoY and $982MM LQ as new account openings 150 continued paydowns more than 28 offset new originations and $1.8B of 100 customer draws (1) 24 50 20 0 1Q19 4Q19 1Q20 1Q19 4Q19 1Q20 1-4 Family First Junior Lien Other Revolving Credit and Automobile 50 36 Installment . Auto loans up $3.7B YoY and . Other revolving credit $695MM LQ 32 and installment loans 45 . Originations of auto loans up down $1.7B YoY on 19% YoY reflecting a continued lower student loans and 28 40 emphasis on growing auto margin loans, and down loans following the $793MM LQ 35 restructuring of the business, 24 and down 5% LQ reflecting a 30 slowdown in March due to 20 1Q19 4Q19 1Q20 COVID-19 1Q19 4Q19 1Q20 (1) Reflects draws on junior lien mortgage loans performed more than 90 days after origination. Wells Fargo 1Q20 Supplement 13

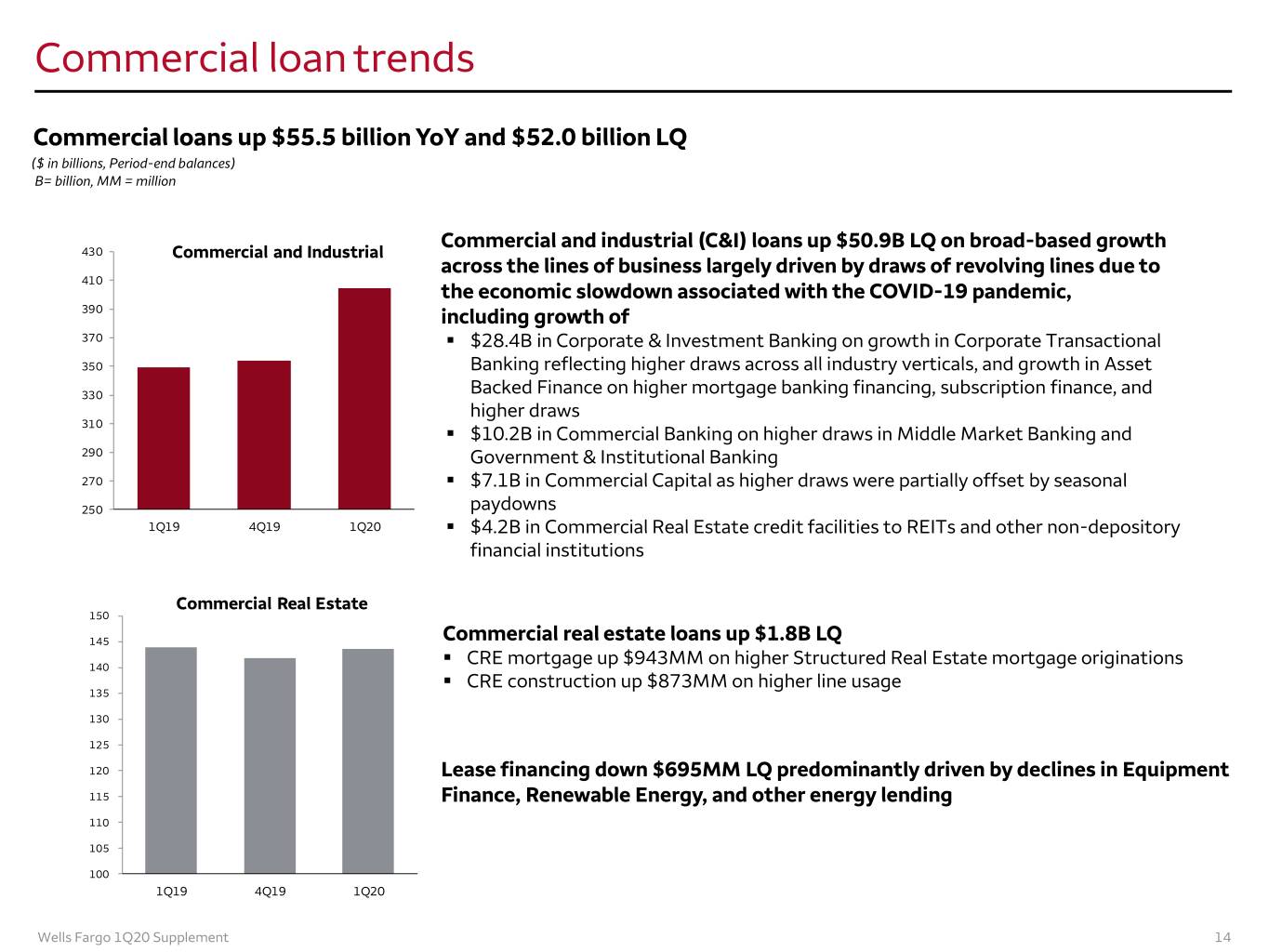

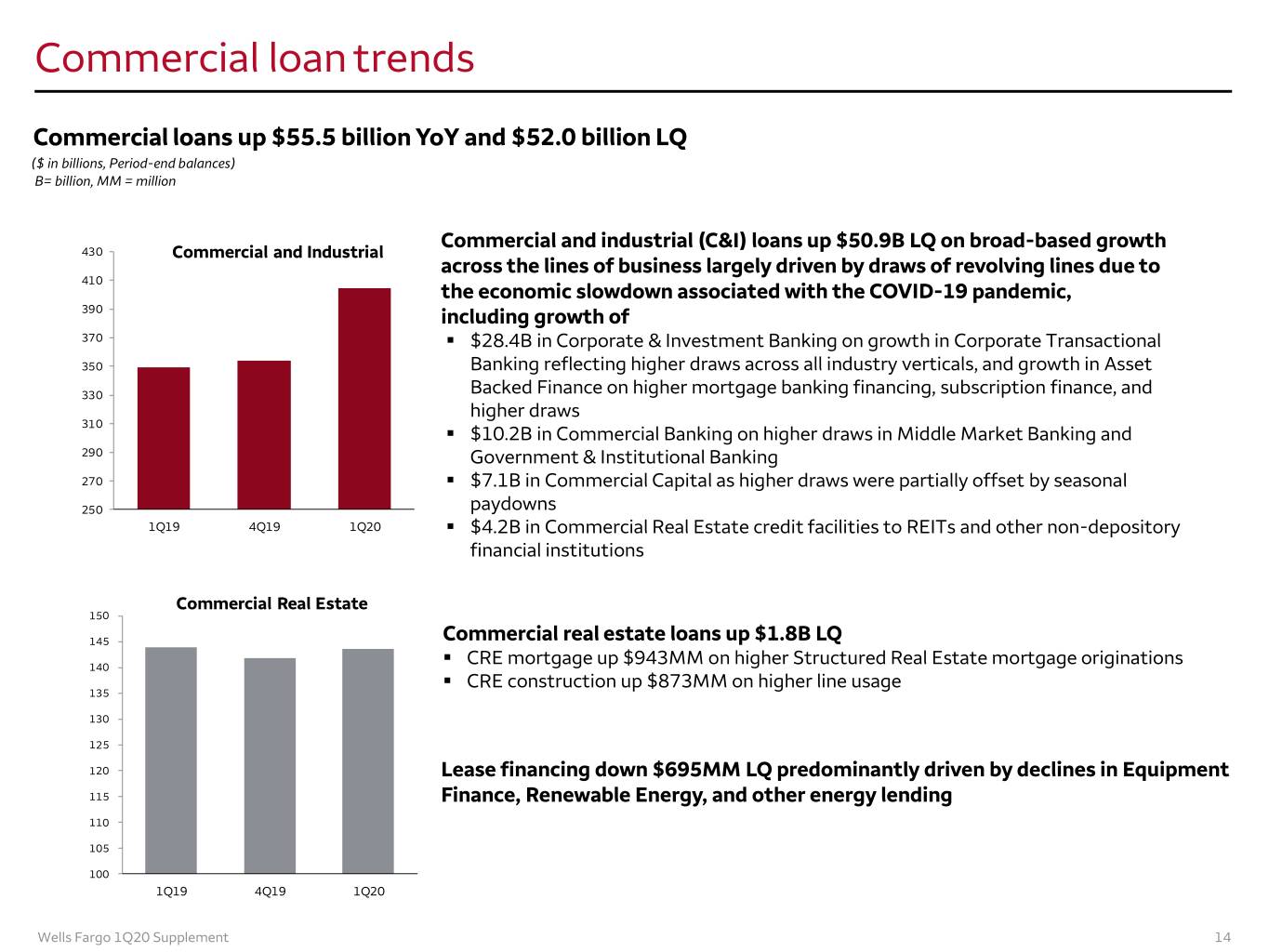

Commercial loan trends Commercial loans up $55.5 billion YoY and $52.0 billion LQ ($ in billions, Period-end balances) B= billion, MM = million Commercial and industrial (C&I) loans up $50.9B LQ on broad-based growth 430 Commercial and Industrial across the lines of business largely driven by draws of revolving lines due to 410 the economic slowdown associated with the COVID-19 pandemic, 390 including growth of 370 . $28.4B in Corporate & Investment Banking on growth in Corporate Transactional 350 Banking reflecting higher draws across all industry verticals, and growth in Asset 330 Backed Finance on higher mortgage banking financing, subscription finance, and higher draws 310 . $10.2B in Commercial Banking on higher draws in Middle Market Banking and 290 Government & Institutional Banking 270 . $7.1B in Commercial Capital as higher draws were partially offset by seasonal 250 paydowns 1Q19 4Q19 1Q20 . $4.2B in Commercial Real Estate credit facilities to REITs and other non-depository financial institutions Commercial Real Estate 150 145 Commercial real estate loans up $1.8B LQ . 140 CRE mortgage up $943MM on higher Structured Real Estate mortgage originations . CRE construction up $873MM on higher line usage 135 130 125 120 Lease financing down $695MM LQ predominantly driven by declines in Equipment 115 Finance, Renewable Energy, and other energy lending 110 105 100 1Q19 4Q19 1Q20 Wells Fargo 1Q20 Supplement 14

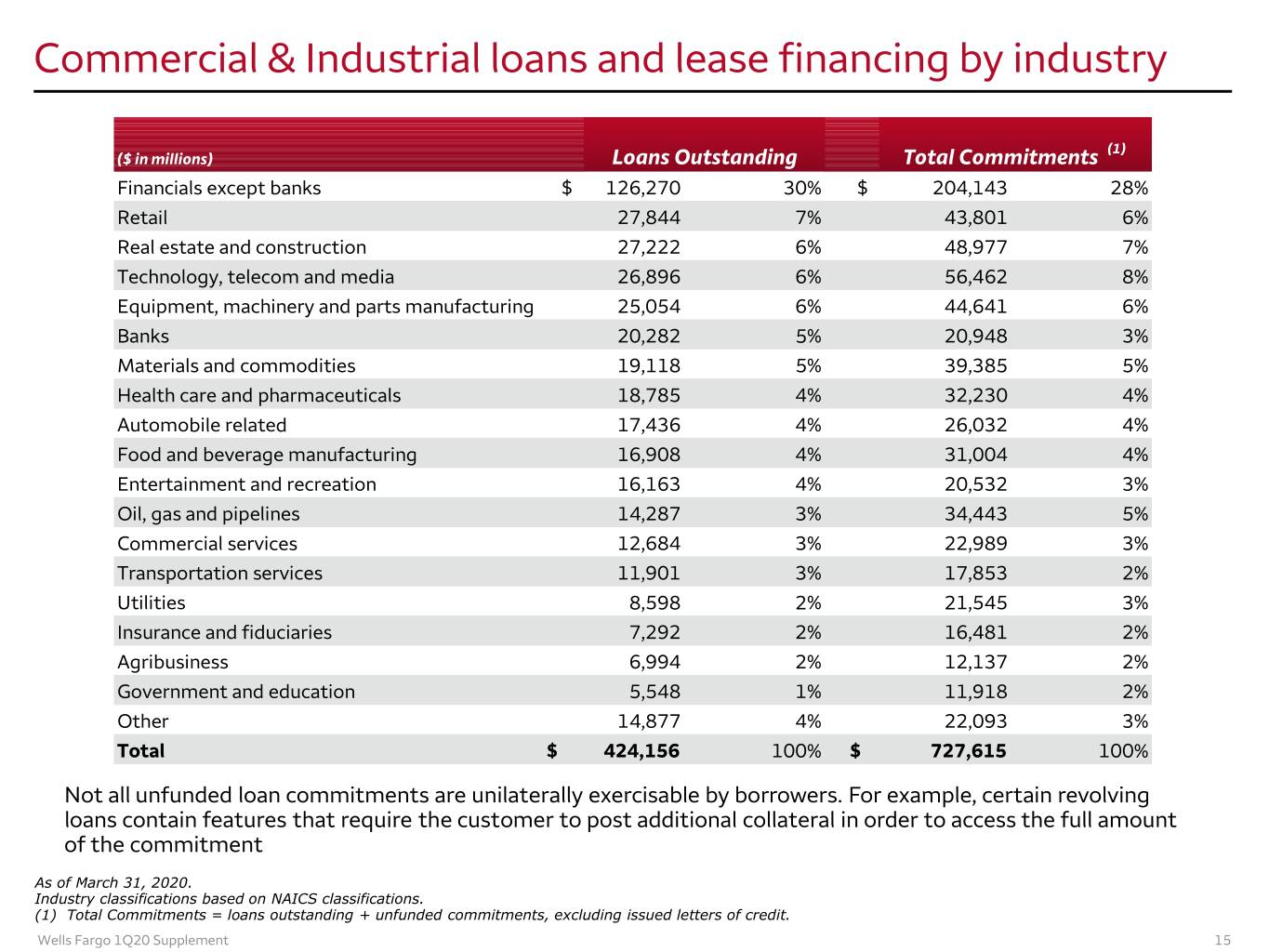

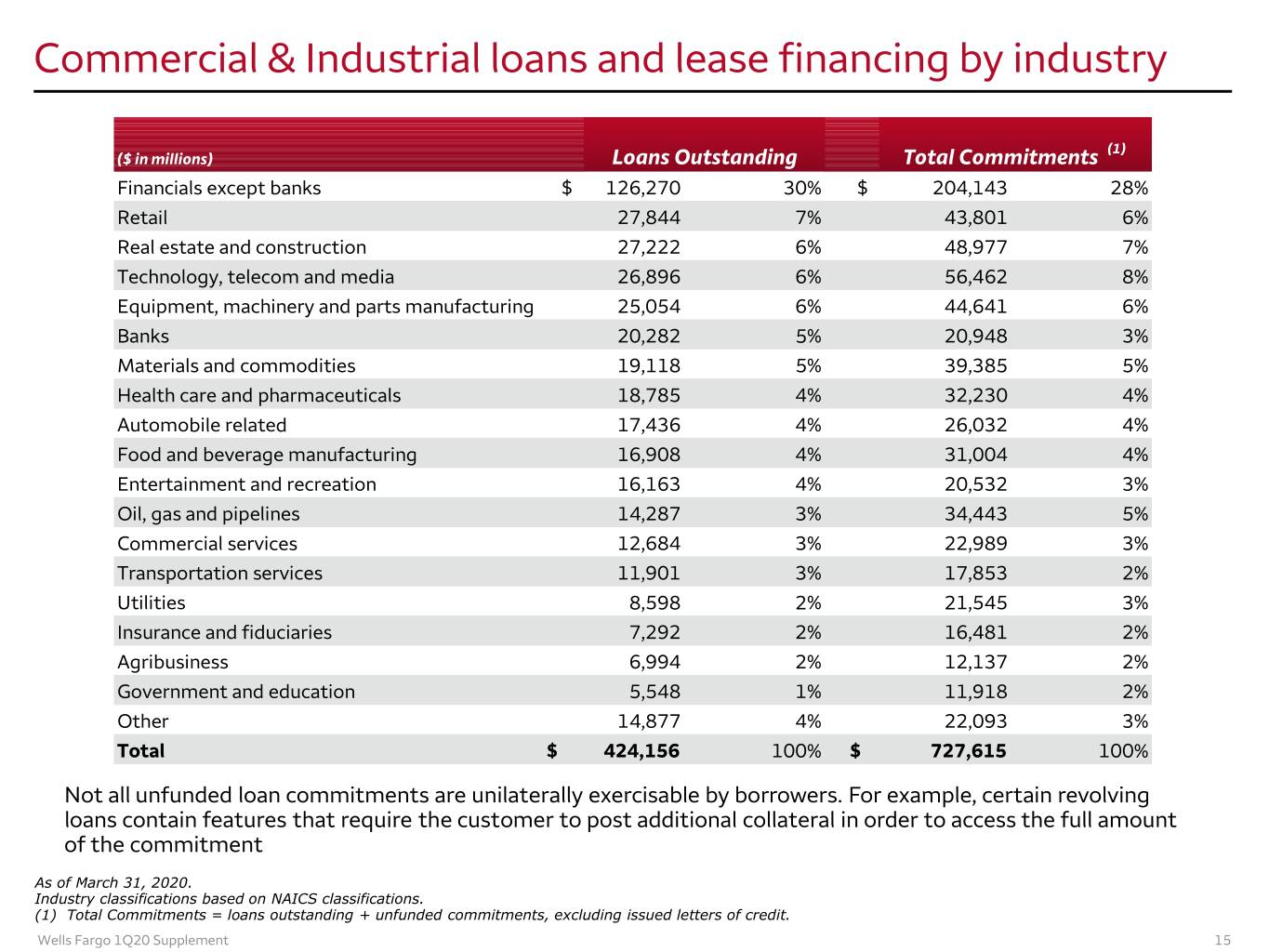

Commercial & Industrial loans and lease financing by industry (1) ($ in millions) Loans Outstanding Total Commitments Financials except banks $ 126,270 30% $ 204,143 28% Retail 27,844 7% 43,801 6% Real estate and construction 27,222 6% 48,977 7% Technology, telecom and media 26,896 6% 56,462 8% Equipment, machinery and parts manufacturing 25,054 6% 44,641 6% Banks 20,282 5% 20,948 3% Materials and commodities 19,118 5% 39,385 5% Health care and pharmaceuticals 18,785 4% 32,230 4% Automobile related 17,436 4% 26,032 4% Food and beverage manufacturing 16,908 4% 31,004 4% Entertainment and recreation 16,163 4% 20,532 3% Oil, gas and pipelines 14,287 3% 34,443 5% Commercial services 12,684 3% 22,989 3% Transportation services 11,901 3% 17,853 2% Utilities 8,598 2% 21,545 3% Insurance and fiduciaries 7,292 2% 16,481 2% Agribusiness 6,994 2% 12,137 2% Government and education 5,548 1% 11,918 2% Other 14,877 4% 22,093 3% Total $ 424,156 100% $ 727,615 100% Not all unfunded loan commitments are unilaterally exercisable by borrowers. For example, certain revolving loans contain features that require the customer to post additional collateral in order to access the full amount of the commitment As of March 31, 2020. Industry classifications based on NAICS classifications. (1) Total Commitments = loans outstanding + unfunded commitments, excluding issued letters of credit. Wells Fargo 1Q20 Supplement 15

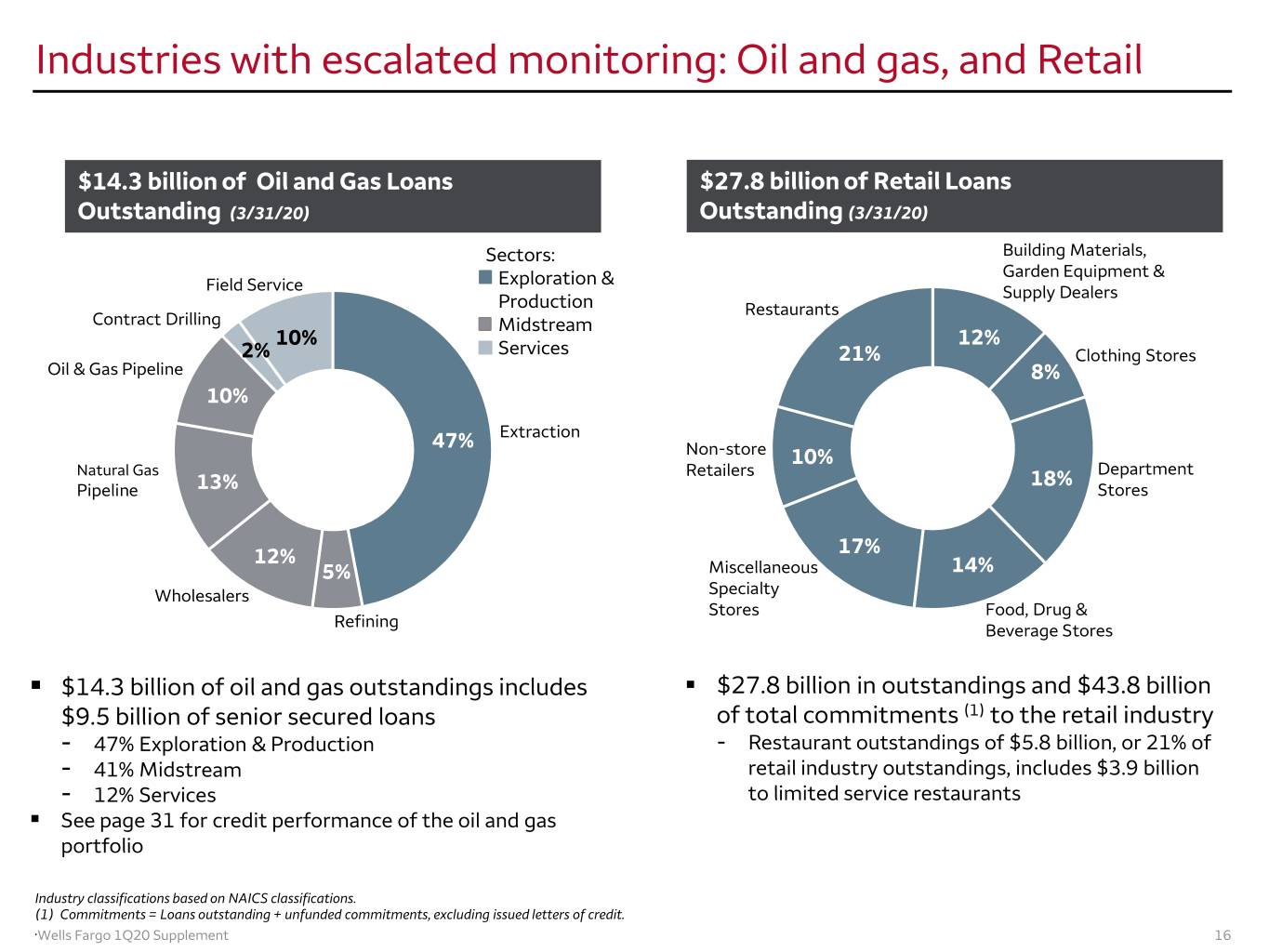

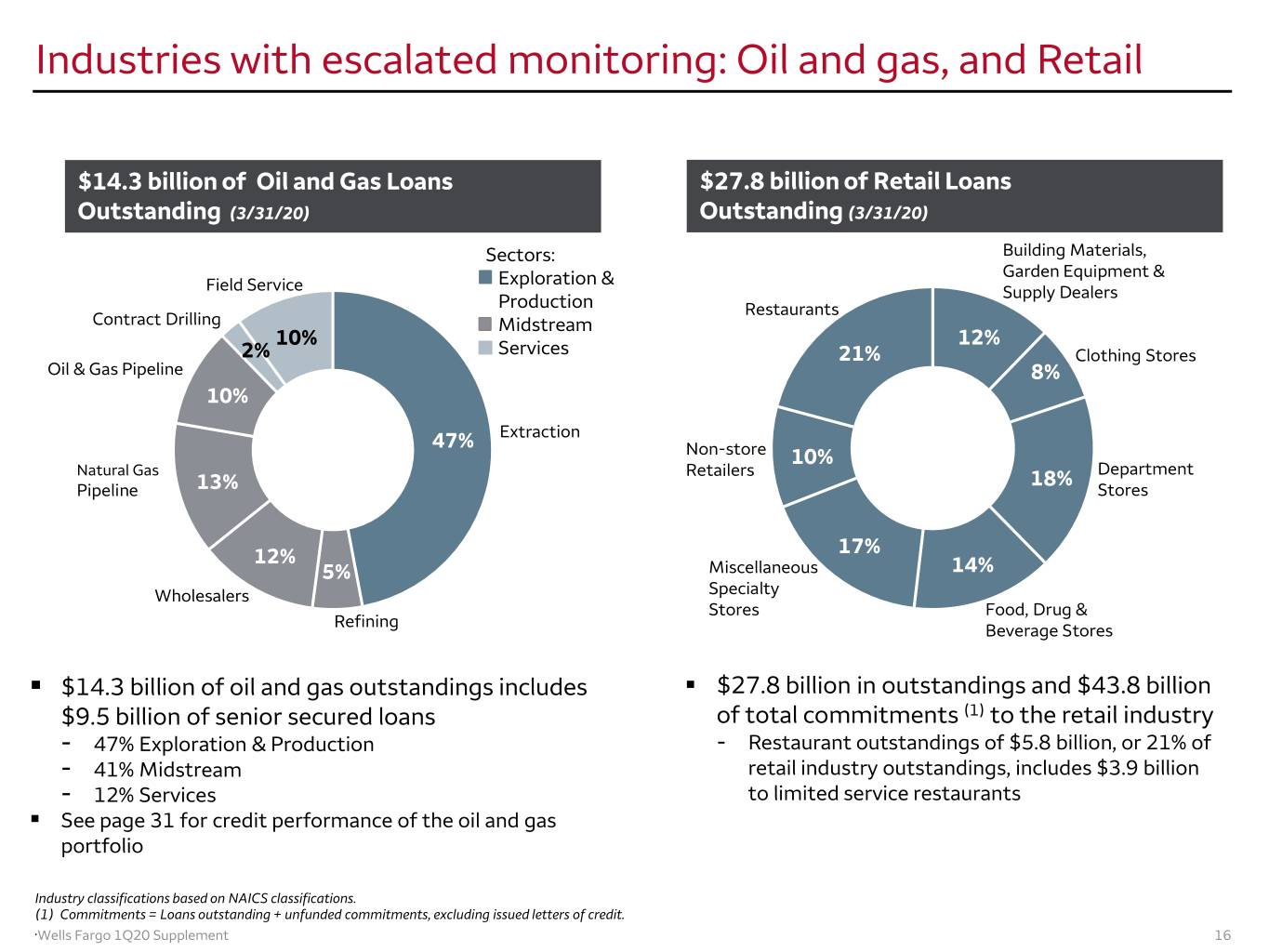

Industries with escalated monitoring: Oil and gas, and Retail $14.3 billion of Oil and Gas Loans $27.8 billion of Retail Loans Outstanding (3/31/20) Outstanding (3/31/20) Sectors: Building Materials, Exploration & Garden Equipment & Field Service Supply Dealers Production Restaurants Contract Drilling Midstream 10% 12% 2% Services 21% Clothing Stores Oil & Gas Pipeline 8% 10% 47% Extraction Non-store 10% Natural Gas Retailers 18% Department Pipeline 13% Stores 12% 17% 5% Miscellaneous 14% Wholesalers Specialty Stores Food, Drug & Refining Beverage Stores . $14.3 billion of oil and gas outstandings includes . $27.8 billion in outstandings and $43.8 billion $9.5 billion of senior secured loans of total commitments (1) to the retail industry - 47% Exploration & Production - Restaurant outstandings of $5.8 billion, or 21% of - 41% Midstream retail industry outstandings, includes $3.9 billion - 12% Services to limited service restaurants . See page 31 for credit performance of the oil and gas portfolio Industry classifications based on NAICS classifications. (1) Commitments = Loans outstanding + unfunded commitments, excluding issued letters of credit. .Wells Fargo 1Q20 Supplement 16

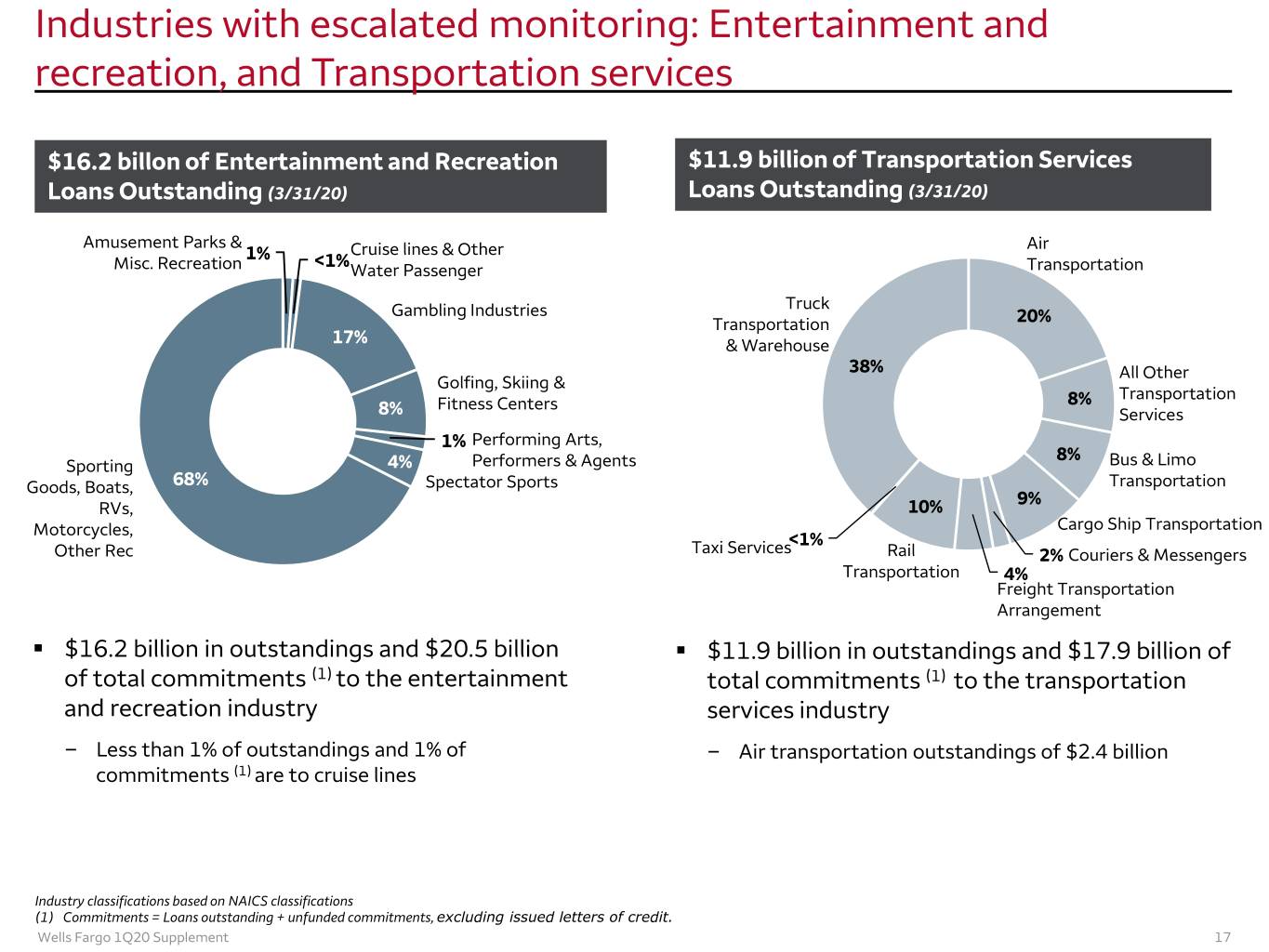

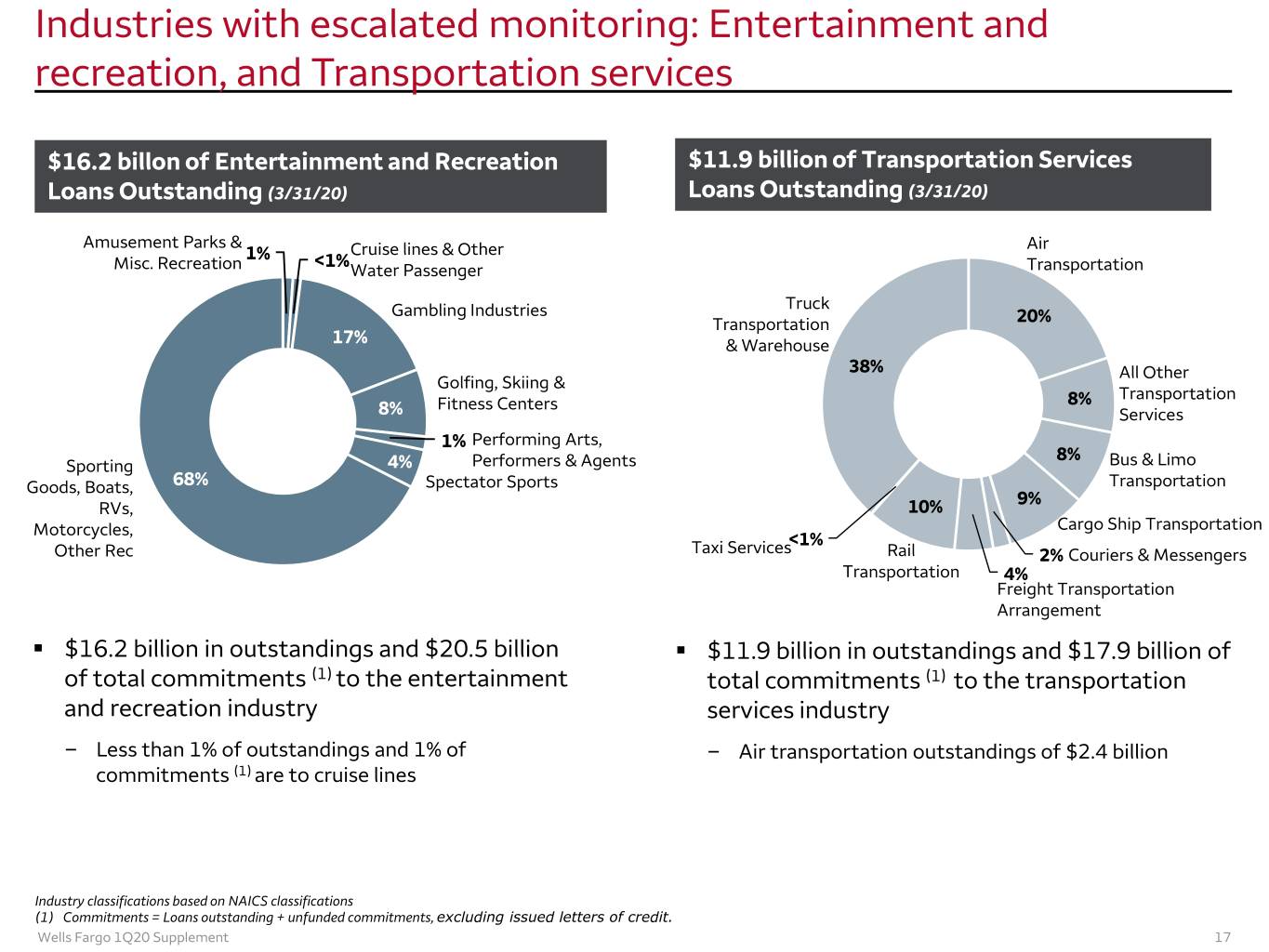

Industries with escalated monitoring: Entertainment and recreation, and Transportation services $16.2 billon of Entertainment and Recreation $11.9 billion of Transportation Services Loans Outstanding (3/31/20) Loans Outstanding (3/31/20) Amusement Parks & Cruise lines & Other Air 1% <1% Misc. Recreation Water Passenger Transportation Gambling Industries Truck Transportation 20% 17% & Warehouse 38% All Other Golfing, Skiing & Transportation Fitness Centers 8% 8% Services 1% Performing Arts, 8% Sporting 4% Performers & Agents Bus & Limo Goods, Boats, 68% Spectator Sports Transportation 9% RVs, 10% Motorcycles, Cargo Ship Transportation <1% Other Rec Taxi Services Rail 2% Couriers & Messengers Transportation 4% Freight Transportation Arrangement . $16.2 billion in outstandings and $20.5 billion . $11.9 billion in outstandings and $17.9 billion of of total commitments (1) to the entertainment total commitments (1) to the transportation and recreation industry services industry – Less than 1% of outstandings and 1% of – Air transportation outstandings of $2.4 billion commitments (1) are to cruise lines Industry classifications based on NAICS classifications (1) Commitments = Loans outstanding + unfunded commitments, excluding issued letters of credit. Wells Fargo 1Q20 Supplement 17

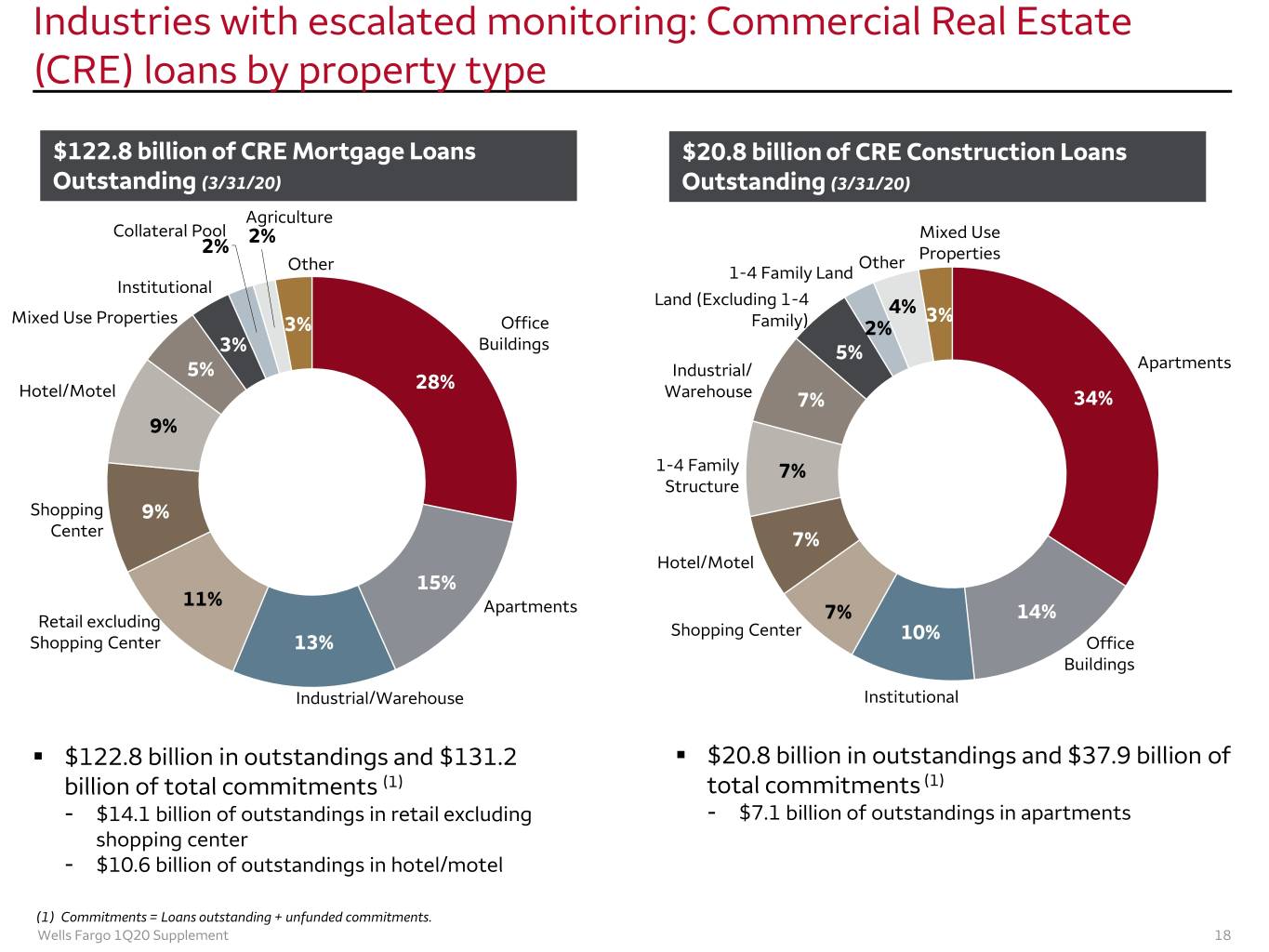

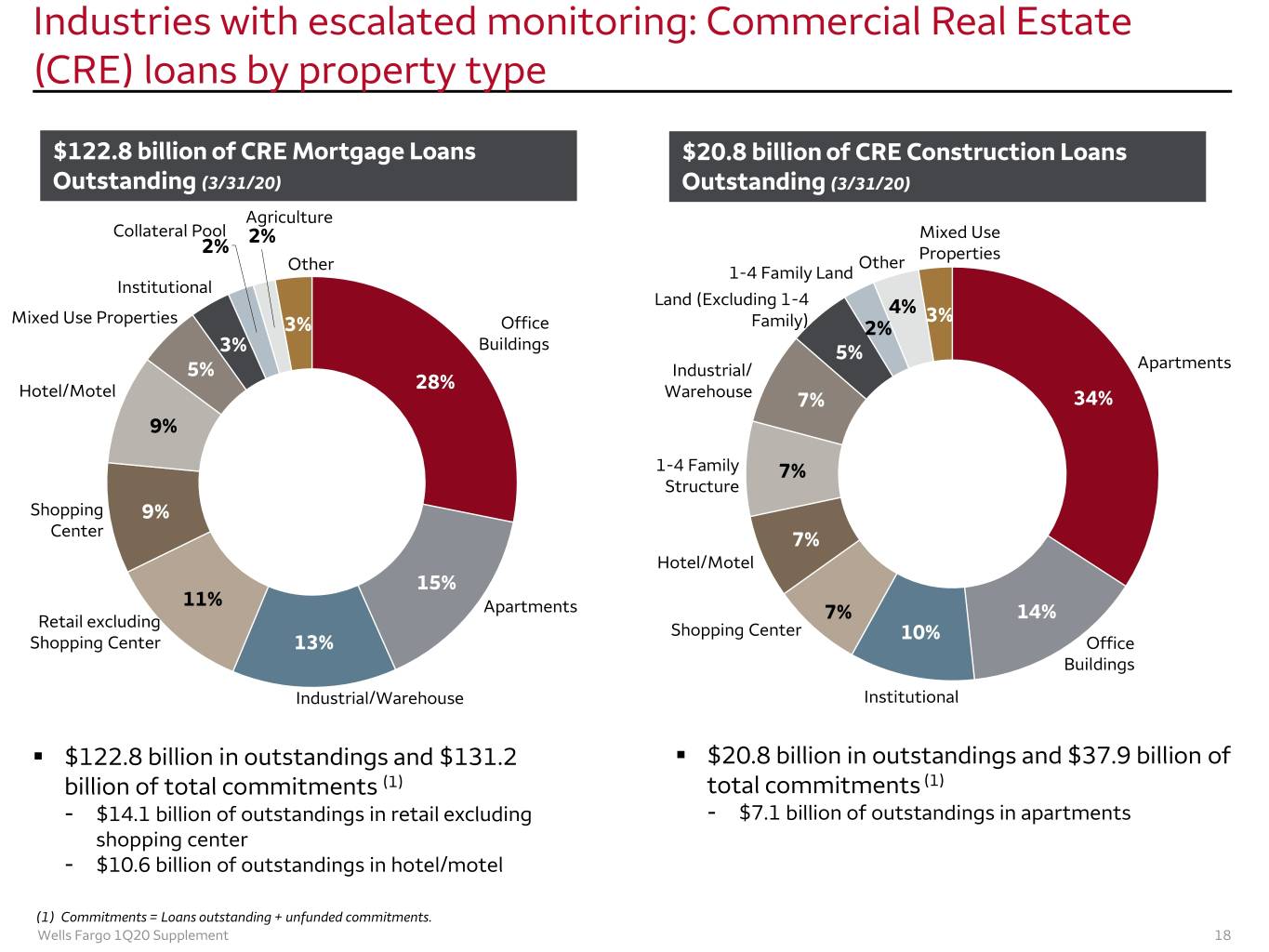

Industries with escalated monitoring: Commercial Real Estate (CRE) loans by property type $122.8 billion of CRE Mortgage Loans $20.8 billion of CRE Construction Loans Outstanding (3/31/20) Outstanding (3/31/20) Agriculture Collateral Pool 2% Mixed Use 2% Properties Other Other 1-4 Family Land Institutional Land (Excluding 1-4 4% Mixed Use Properties 3% 3% Office Family) 2% 3% Buildings 5% 5% Industrial/ Apartments 28% Hotel/Motel Warehouse 7% 34% 9% 1-4 Family 7% Structure Shopping 9% Center 7% Hotel/Motel 15% 11% Apartments Retail excluding 7% 14% Shopping Center 10% Shopping Center 13% Office Buildings Industrial/Warehouse Institutional . $122.8 billion in outstandings and $131.2 . $20.8 billion in outstandings and $37.9 billion of billion of total commitments (1) total commitments (1) - $14.1 billion of outstandings in retail excluding - $7.1 billion of outstandings in apartments shopping center - $10.6 billion of outstandings in hotel/motel (1) Commitments = Loans outstanding + unfunded commitments. Wells Fargo 1Q20 Supplement 18

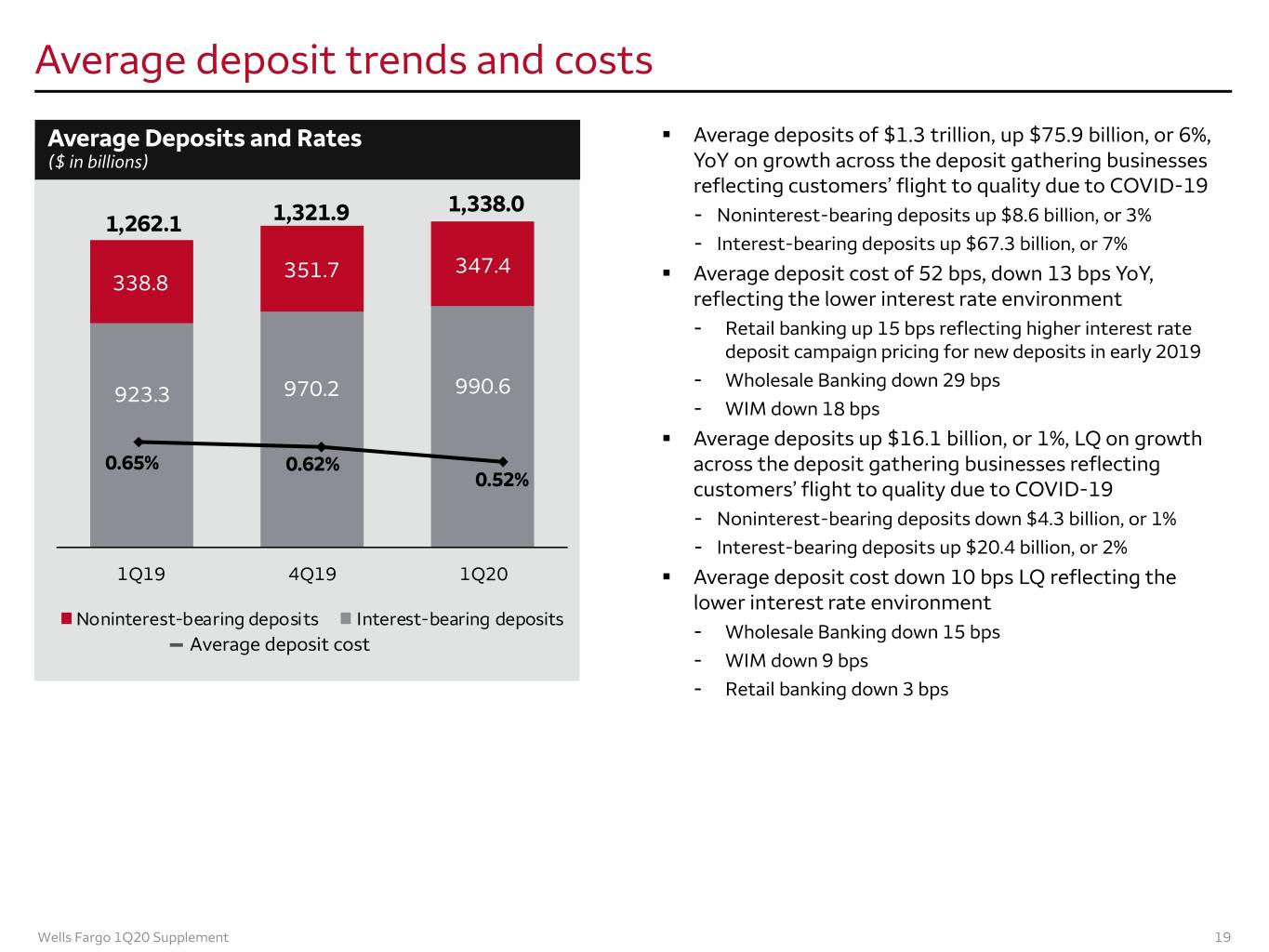

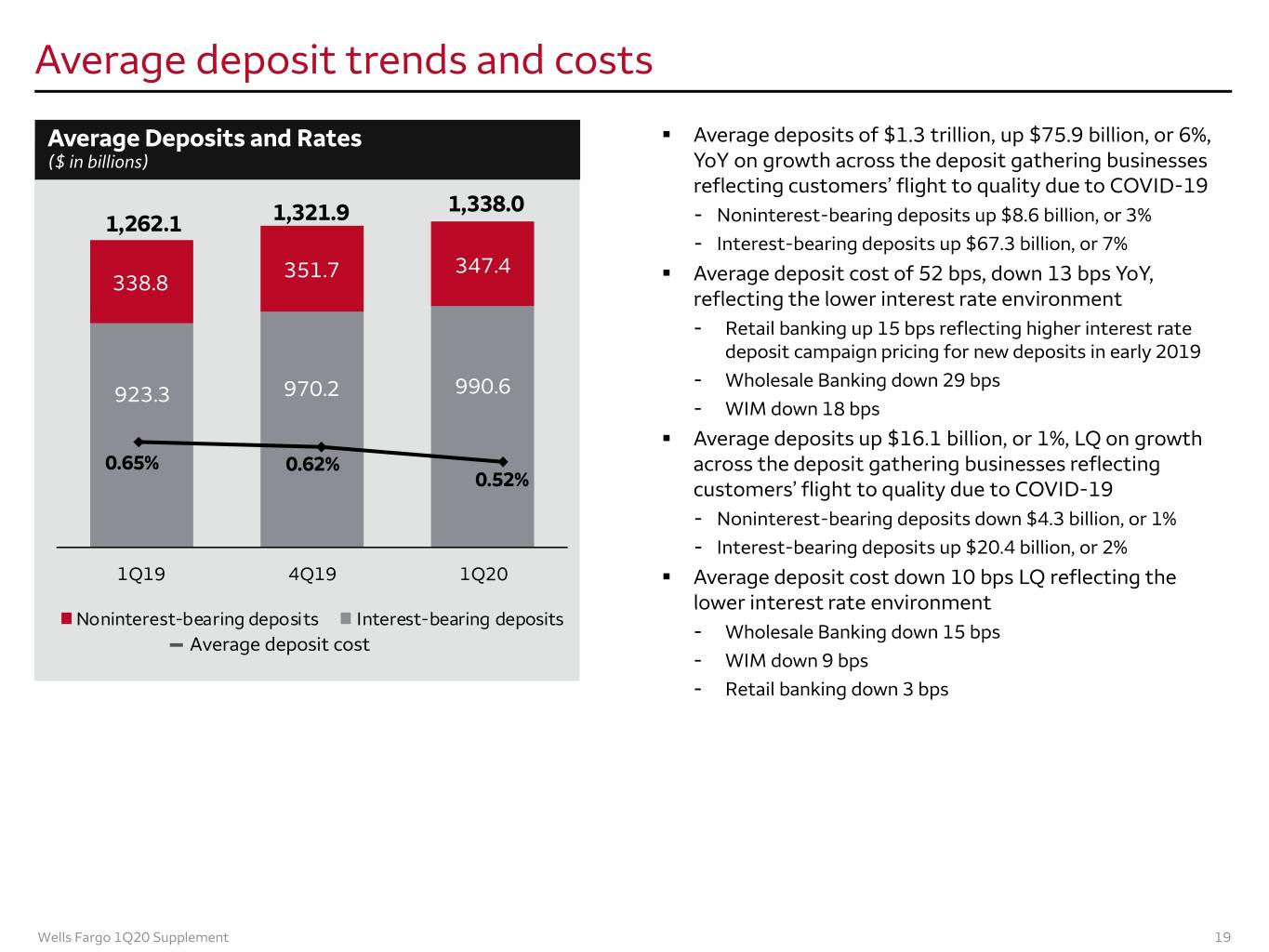

Average deposit trends and costs Average Deposits and Rates . Average deposits of $1.3 trillion, up $75.9 billion, or 6%, ($ in billions) YoY on growth across the deposit gathering businesses reflecting customers’ flight to quality due to COVID-19 1,338.0 1,262.1 1,321.9 - Noninterest-bearing deposits up $8.6 billion, or 3% - Interest-bearing deposits up $67.3 billion, or 7% 351.7 347.4 . 338.8 Average deposit cost of 52 bps, down 13 bps YoY, reflecting the lower interest rate environment - Retail banking up 15 bps reflecting higher interest rate deposit campaign pricing for new deposits in early 2019 - Wholesale Banking down 29 bps 923.3 970.2 990.6 - WIM down 18 bps . Average deposits up $16.1 billion, or 1%, LQ on growth 0.65% 0.62% across the deposit gathering businesses reflecting 0.52% customers’ flight to quality due to COVID-19 - Noninterest-bearing deposits down $4.3 billion, or 1% - Interest-bearing deposits up $20.4 billion, or 2% 1Q19 4Q19 1Q20 . Average deposit cost down 10 bps LQ reflecting the lower interest rate environment Noninterest-bearing deposits Interest-bearing deposits - Wholesale Banking down 15 bps Average deposit cost - WIM down 9 bps - Retail banking down 3 bps Wells Fargo 1Q20 Supplement 19

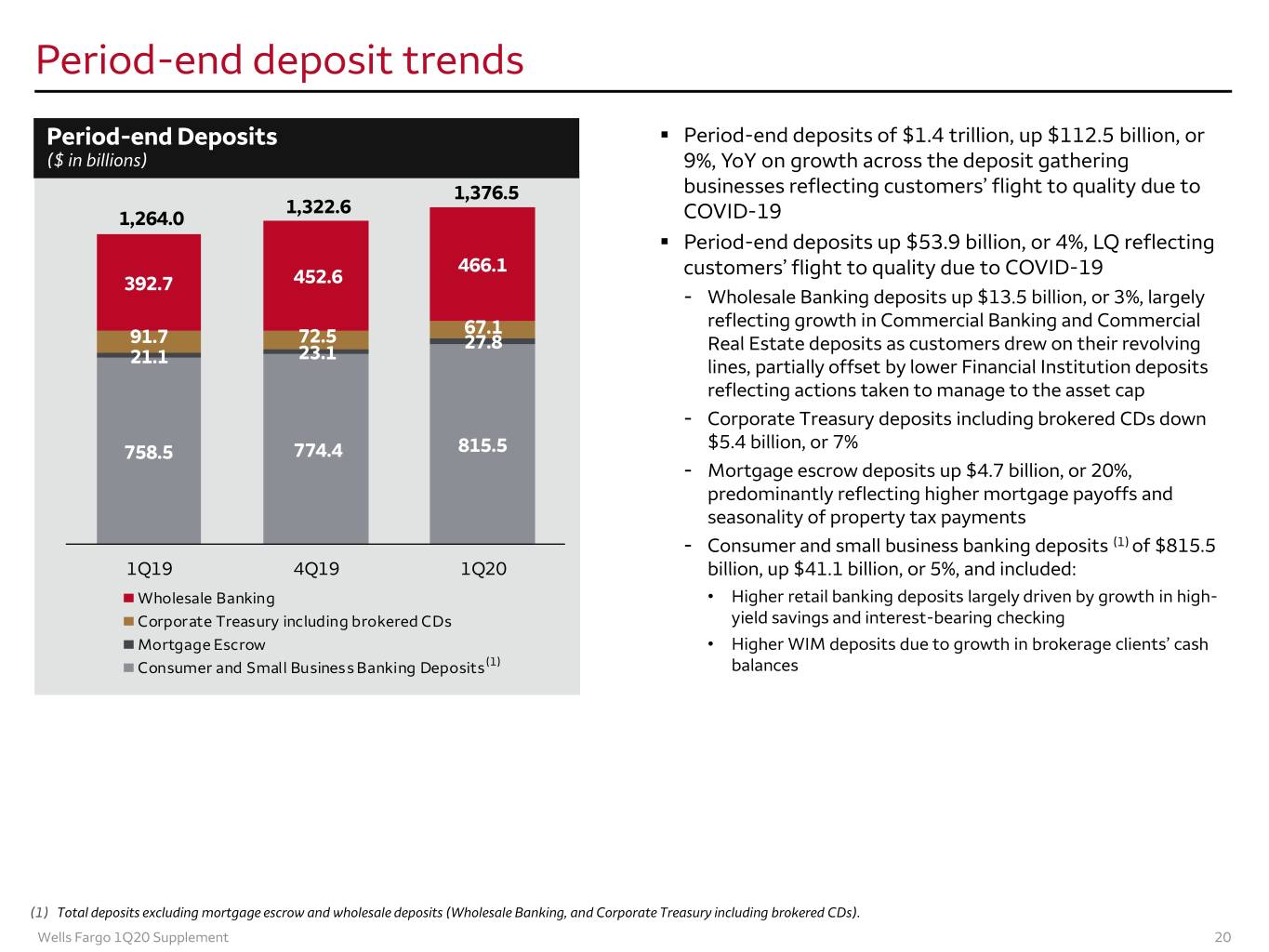

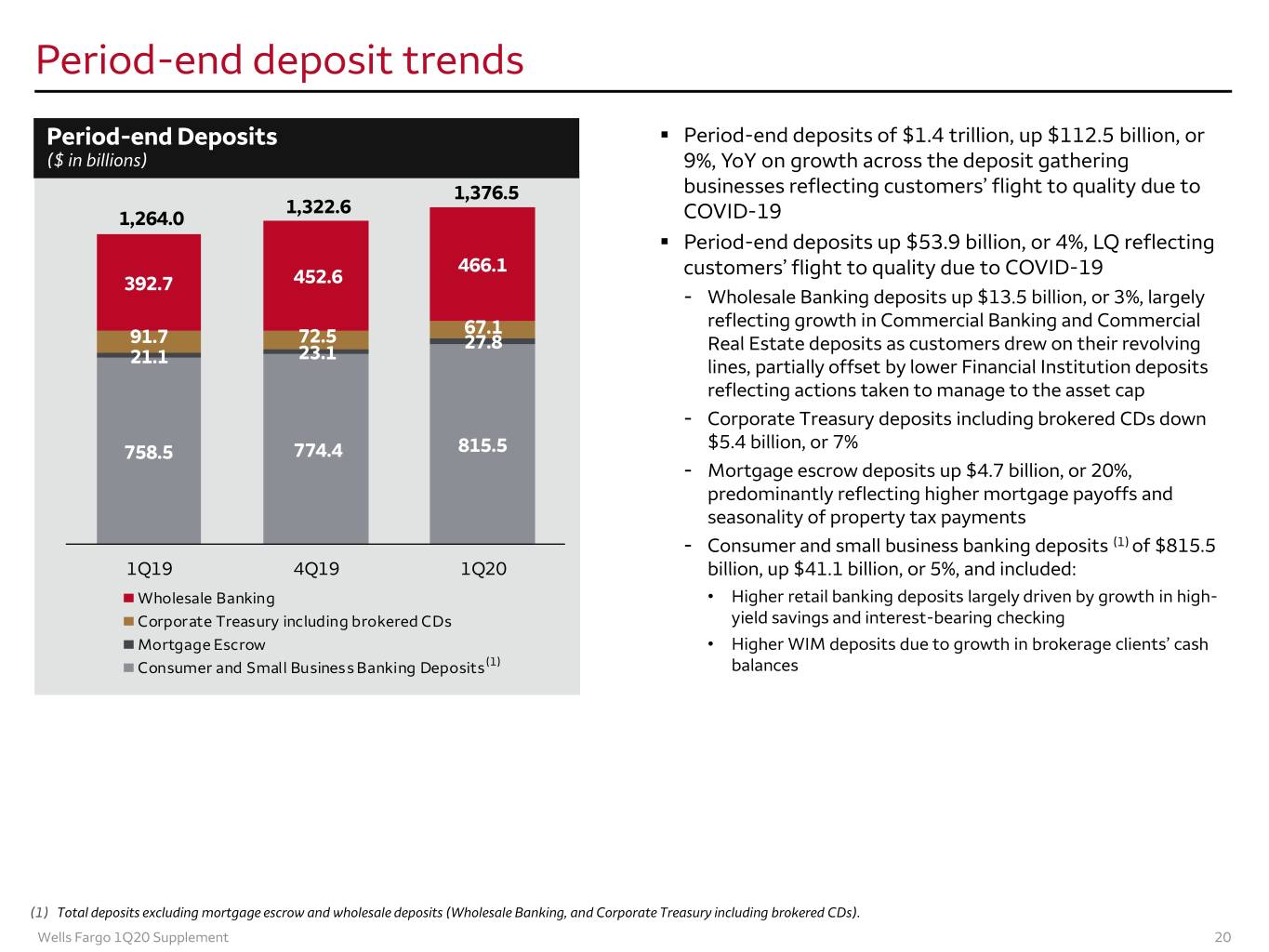

Period-end deposit trends Period-end Deposits . Period-end deposits of $1.4 trillion, up $112.5 billion, or ($ in billions) 9%, YoY on growth across the deposit gathering 1,376.5 businesses reflecting customers’ flight to quality due to 1,322.6 1,264.0 COVID-19 . Period-end deposits up $53.9 billion, or 4%, LQ reflecting 466.1 customers’ flight to quality due to COVID-19 392.7 452.6 - Wholesale Banking deposits up $13.5 billion, or 3%, largely 67.1 reflecting growth in Commercial Banking and Commercial 91.7 72.5 27.8 Real Estate deposits as customers drew on their revolving 21.1 23.1 lines, partially offset by lower Financial Institution deposits reflecting actions taken to manage to the asset cap - Corporate Treasury deposits including brokered CDs down $5.4 billion, or 7% 758.5 774.4 815.5 - Mortgage escrow deposits up $4.7 billion, or 20%, predominantly reflecting higher mortgage payoffs and seasonality of property tax payments - Consumer and small business banking deposits (1) of $815.5 1Q19 4Q19 1Q20 billion, up $41.1 billion, or 5%, and included: Wholesale Banking • Higher retail banking deposits largely driven by growth in high- Corporate Treasury including brokered CDs yield savings and interest-bearing checking Mortgage Escrow • Higher WIM deposits due to growth in brokerage clients’ cash Consumer and Small Business Banking Deposits(1) balances (1) Total deposits excluding mortgage escrow and wholesale deposits (Wholesale Banking, and Corporate Treasury including brokered CDs). Wells Fargo 1Q20 Supplement 20

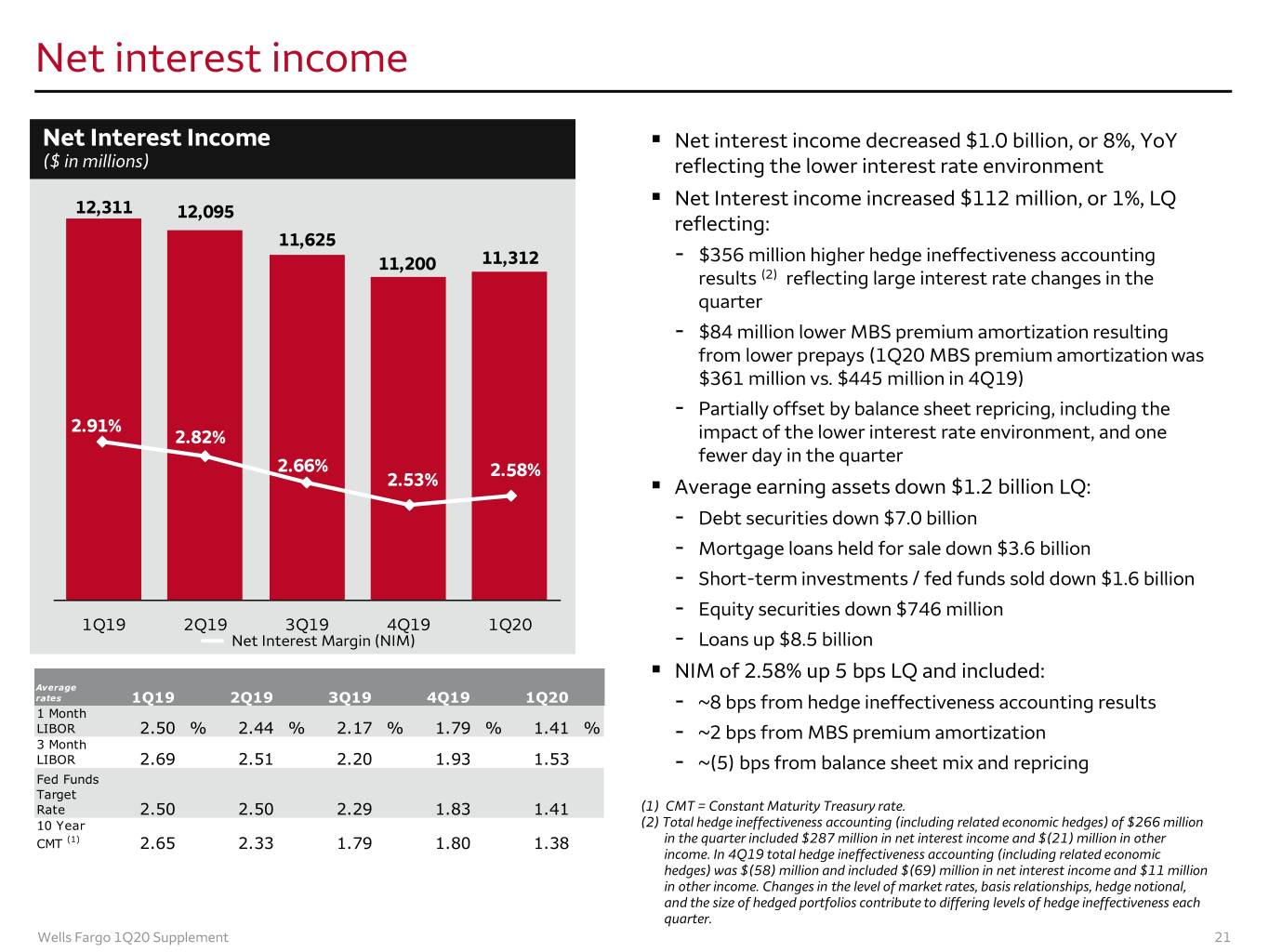

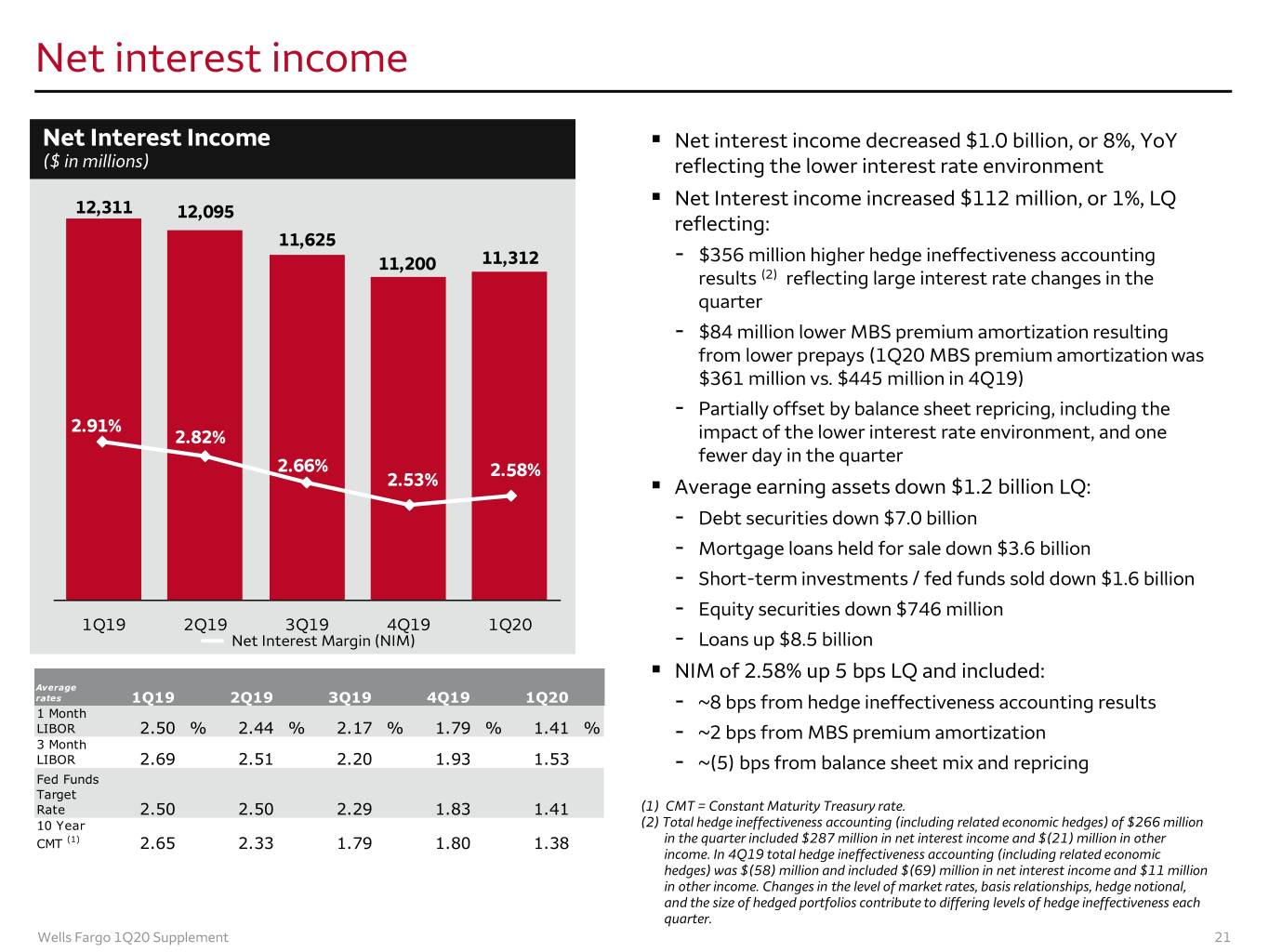

Net interest income Net Interest Income . Net interest income decreased $1.0 billion, or 8%, YoY ($ in millions) reflecting the lower interest rate environment . Net Interest income increased $112 million, or 1%, LQ 12,311 12,095 reflecting: 11,625 11,200 11,312 - $356 million higher hedge ineffectiveness accounting results (2) reflecting large interest rate changes in the quarter - $84 million lower MBS premium amortization resulting from lower prepays (1Q20 MBS premium amortization was $361 million vs. $445 million in 4Q19) - Partially offset by balance sheet repricing, including the 2.91% 2.82% impact of the lower interest rate environment, and one fewer day in the quarter 2.66% 2.58% 2.53% . Average earning assets down $1.2 billion LQ: - Debt securities down $7.0 billion - Mortgage loans held for sale down $3.6 billion - Short-term investments / fed funds sold down $1.6 billion - Equity securities down $746 million 1Q19 2Q19 3Q19 4Q19 1Q20 Net Interest Margin (NIM) - Loans up $8.5 billion . NIM of 2.58% up 5 bps LQ and included: Average rates 1Q19 2Q19 3Q19 4Q19 1Q20 - ~8 bps from hedge ineffectiveness accounting results 1 Month LIBOR 2.50 % 2.44 % 2.17 % 1.79 % 1.41 % - ~2 bps from MBS premium amortization 3 Month LIBOR 2.69 2.51 2.20 1.93 1.53 - ~(5) bps from balance sheet mix and repricing Fed Funds Target Rate 2.50 2.50 2.29 1.83 1.41 (1) CMT = Constant Maturity Treasury rate. 10 Year (2) Total hedge ineffectiveness accounting (including related economic hedges) of $266 million CMT (1) 2.65 2.33 1.79 1.80 1.38 in the quarter included $287 million in net interest income and $(21) million in other income. In 4Q19 total hedge ineffectiveness accounting (including related economic hedges) was $(58) million and included $(69) million in net interest income and $11 million in other income. Changes in the level of market rates, basis relationships, hedge notional, and the size of hedged portfolios contribute to differing levels of hedge ineffectiveness each quarter. Wells Fargo 1Q20 Supplement 21

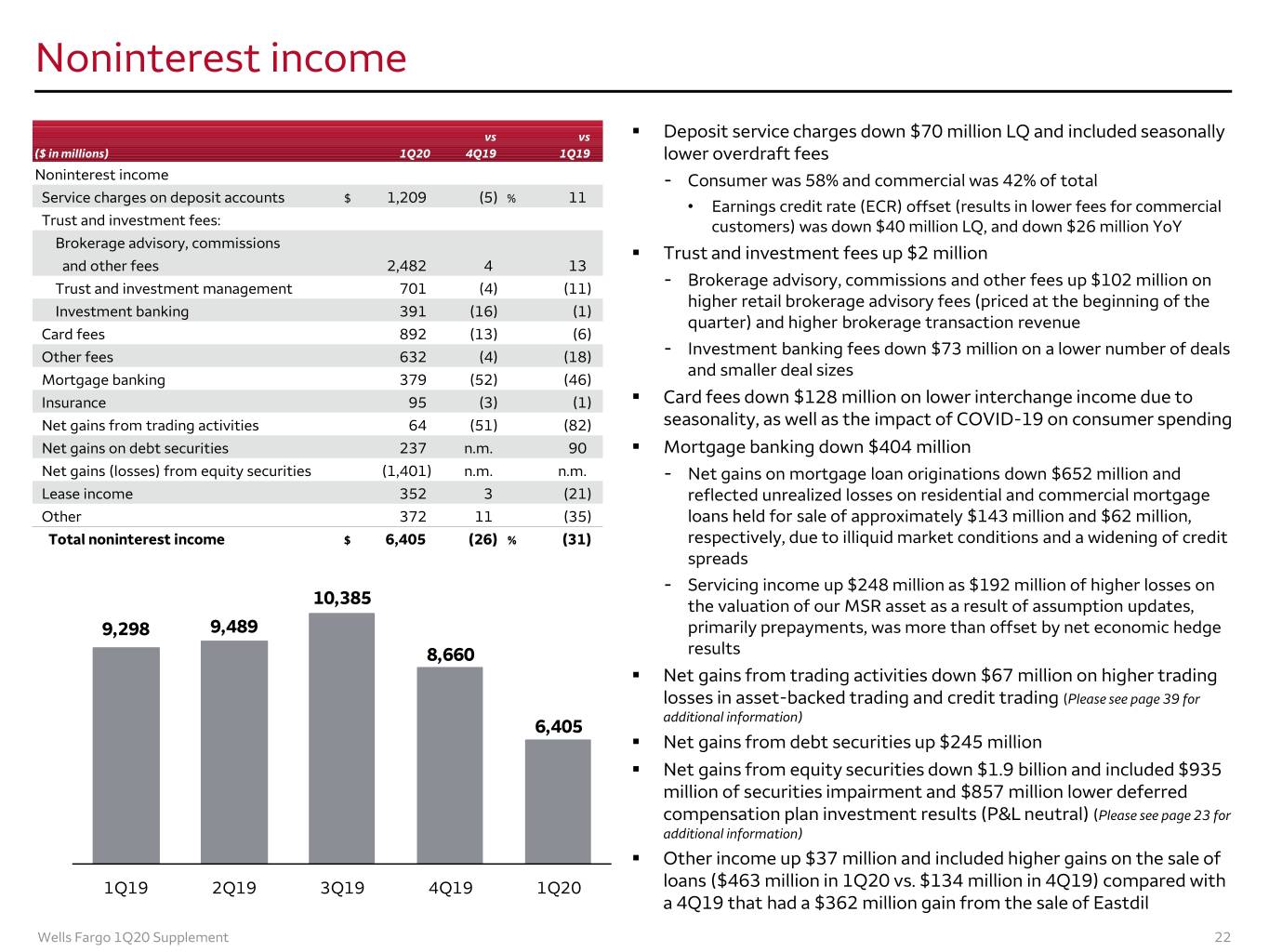

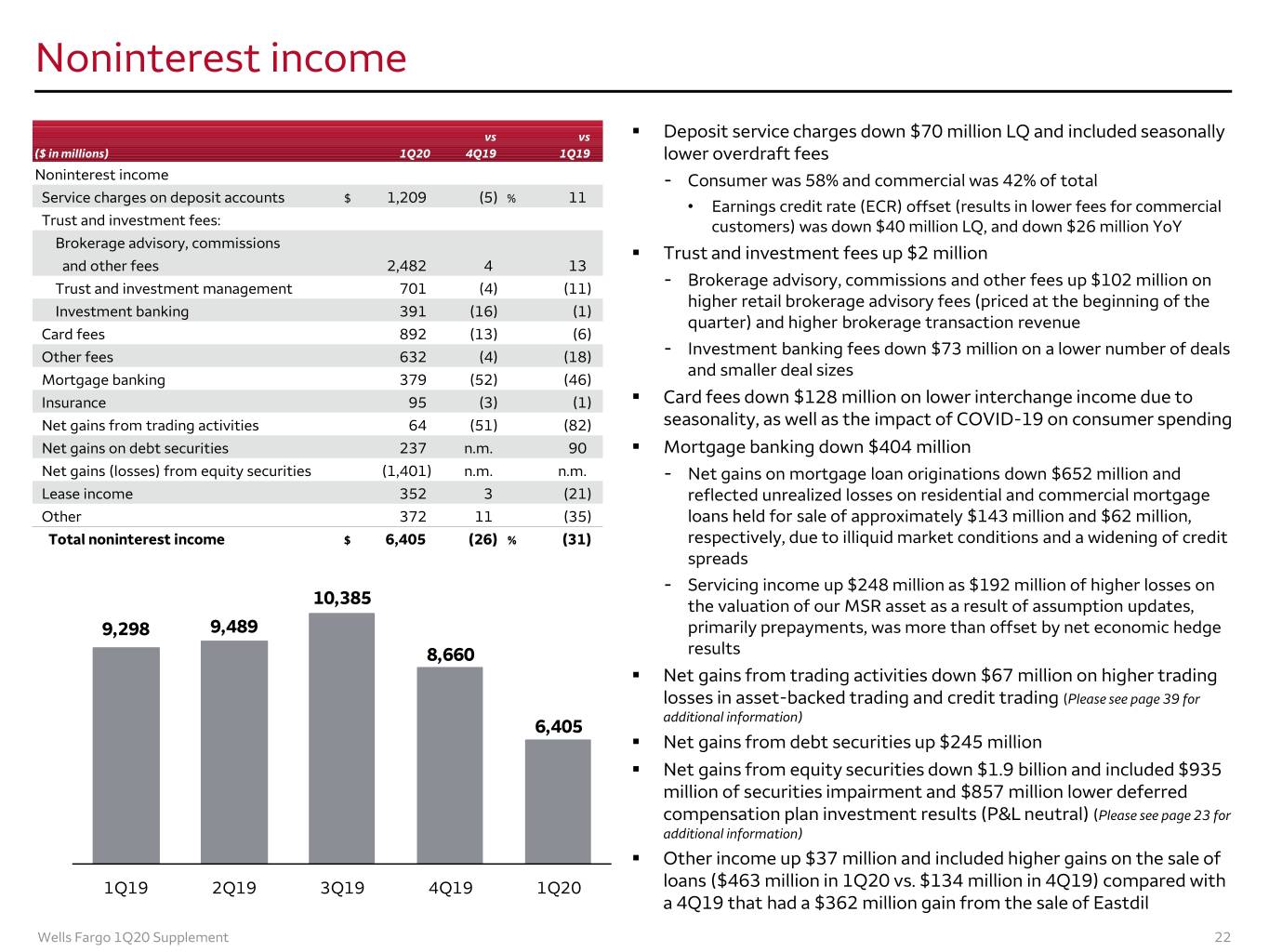

Noninterest income vs vs . Deposit service charges down $70 million LQ and included seasonally ($ in millions) 1Q20 4Q19 1Q19 lower overdraft fees Noninterest income - Consumer was 58% and commercial was 42% of total Service charges on deposit accounts $ 1,209 (5) % 11 • Earnings credit rate (ECR) offset (results in lower fees for commercial Trust and investment fees: customers) was down $40 million LQ, and down $26 million YoY Brokerage advisory, commissions . Trust and investment fees up $2 million and other fees 2,482 4 13 - Trust and investment management 701 (4) (11) Brokerage advisory, commissions and other fees up $102 million on higher retail brokerage advisory fees (priced at the beginning of the Investment banking 391 (16) (1) quarter) and higher brokerage transaction revenue Card fees 892 (13) (6) - Other fees 632 (4) (18) Investment banking fees down $73 million on a lower number of deals and smaller deal sizes Mortgage banking 379 (52) (46) Insurance 95 (3) (1) . Card fees down $128 million on lower interchange income due to Net gains from trading activities 64 (51) (82) seasonality, as well as the impact of COVID-19 on consumer spending Net gains on debt securities 237 n.m. 90 . Mortgage banking down $404 million Net gains (losses) from equity securities (1,401) n.m. n.m. - Net gains on mortgage loan originations down $652 million and Lease income 352 3 (21) reflected unrealized losses on residential and commercial mortgage Other 372 11 (35) loans held for sale of approximately $143 million and $62 million, Total noninterest income $ 6,405 (26) % (31) respectively, due to illiquid market conditions and a widening of credit spreads - Servicing income up $248 million as $192 million of higher losses on 10,385 the valuation of our MSR asset as a result of assumption updates, 9,298 9,489 primarily prepayments, was more than offset by net economic hedge 8,660 results . Net gains from trading activities down $67 million on higher trading losses in asset-backed trading and credit trading (Please see page 39 for additional information) 6,405 . Net gains from debt securities up $245 million . Net gains from equity securities down $1.9 billion and included $935 million of securities impairment and $857 million lower deferred compensation plan investment results (P&L neutral) (Please see page 23 for additional information) . Other income up $37 million and included higher gains on the sale of 1Q19 2Q19 3Q19 4Q19 1Q20 loans ($463 million in 1Q20 vs. $134 million in 4Q19) compared with a 4Q19 that had a $362 million gain from the sale of Eastdil Wells Fargo 1Q20 Supplement 22

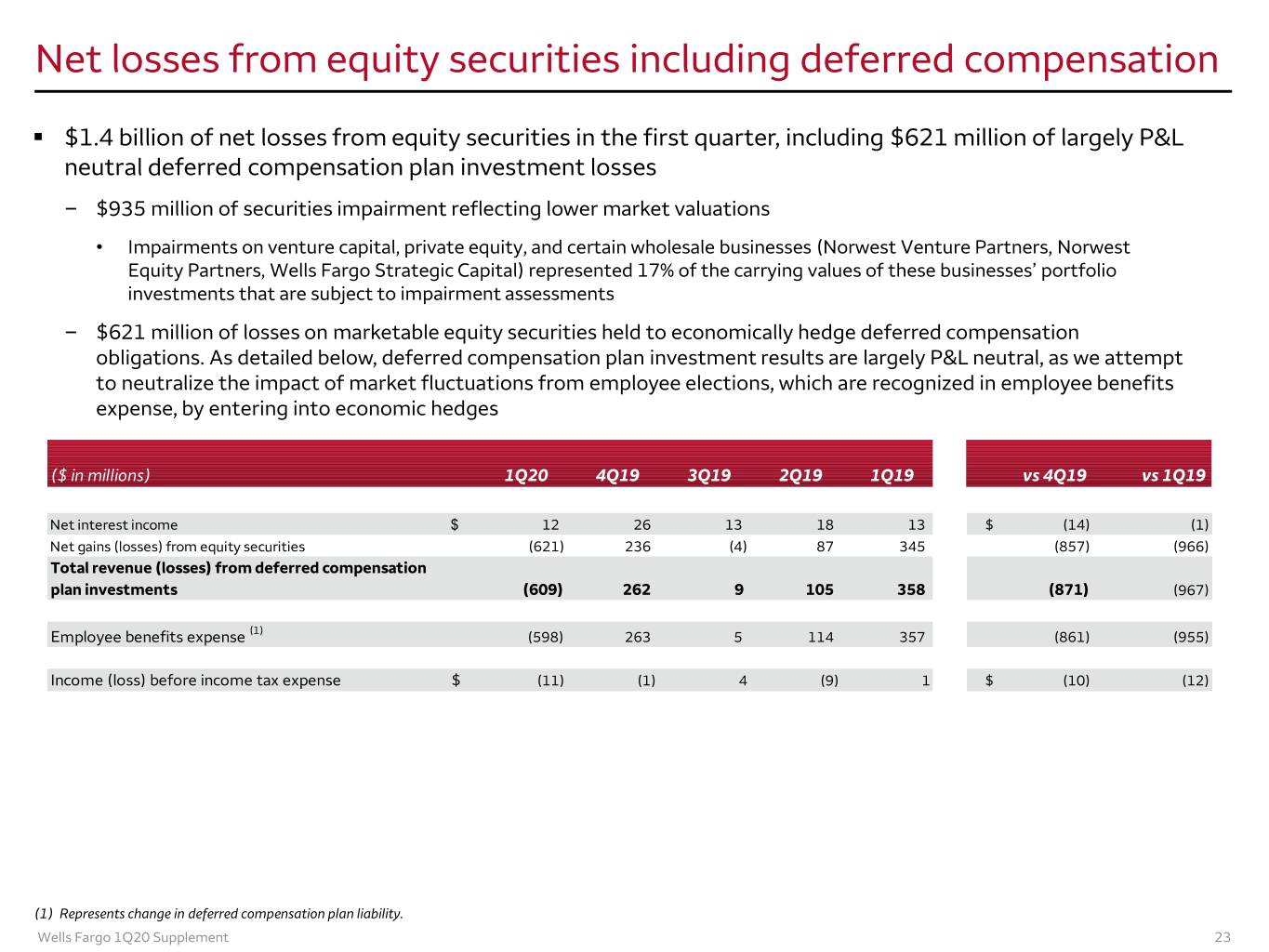

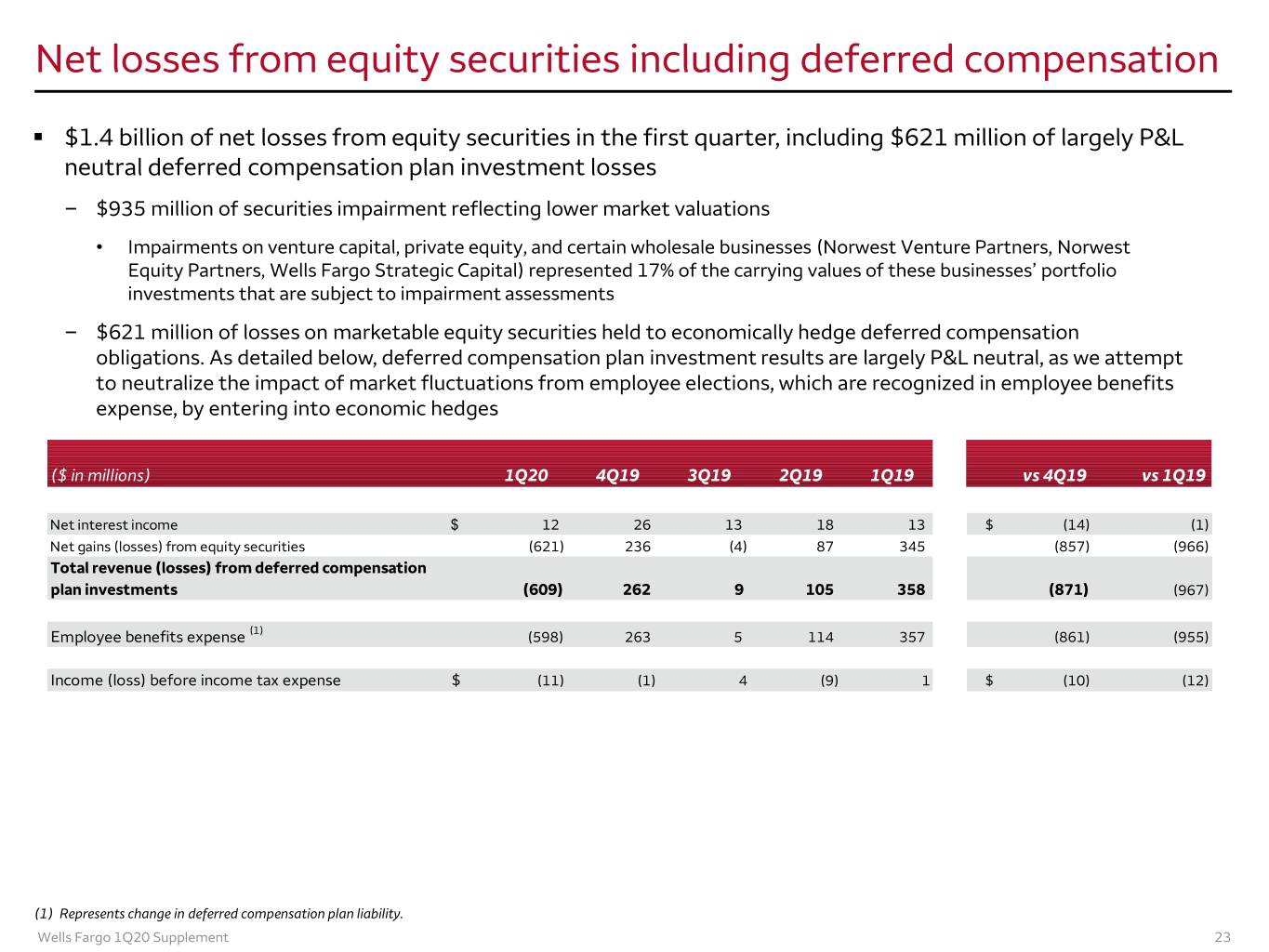

Net losses from equity securities including deferred compensation . $1.4 billion of net losses from equity securities in the first quarter, including $621 million of largely P&L neutral deferred compensation plan investment losses – $935 million of securities impairment reflecting lower market valuations • Impairments on venture capital, private equity, and certain wholesale businesses (Norwest Venture Partners, Norwest Equity Partners, Wells Fargo Strategic Capital) represented 17% of the carrying values of these businesses’ portfolio investments that are subject to impairment assessments – $621 million of losses on marketable equity securities held to economically hedge deferred compensation obligations. As detailed below, deferred compensation plan investment results are largely P&L neutral, as we attempt to neutralize the impact of market fluctuations from employee elections, which are recognized in employee benefits expense, by entering into economic hedges ($ in millions) 1Q20 4Q19 3Q19 2Q19 1Q19 vs 4Q19 vs 1Q19 Net interest income $ 12 26 13 18 13 $ (14) (1) Net gains (losses) from equity securities (621) 236 (4) 87 345 (857) (966) Total revenue (losses) from deferred compensation plan investments (609) 262 9 105 358 (871) (967) Employee benefits expense (1) (598) 263 5 114 357 (861) (955) Income (loss) before income tax expense $ (11) (1) 4 (9) 1 $ (10) (12) (1) Represents change in deferred compensation plan liability. Wells Fargo 1Q20 Supplement 23

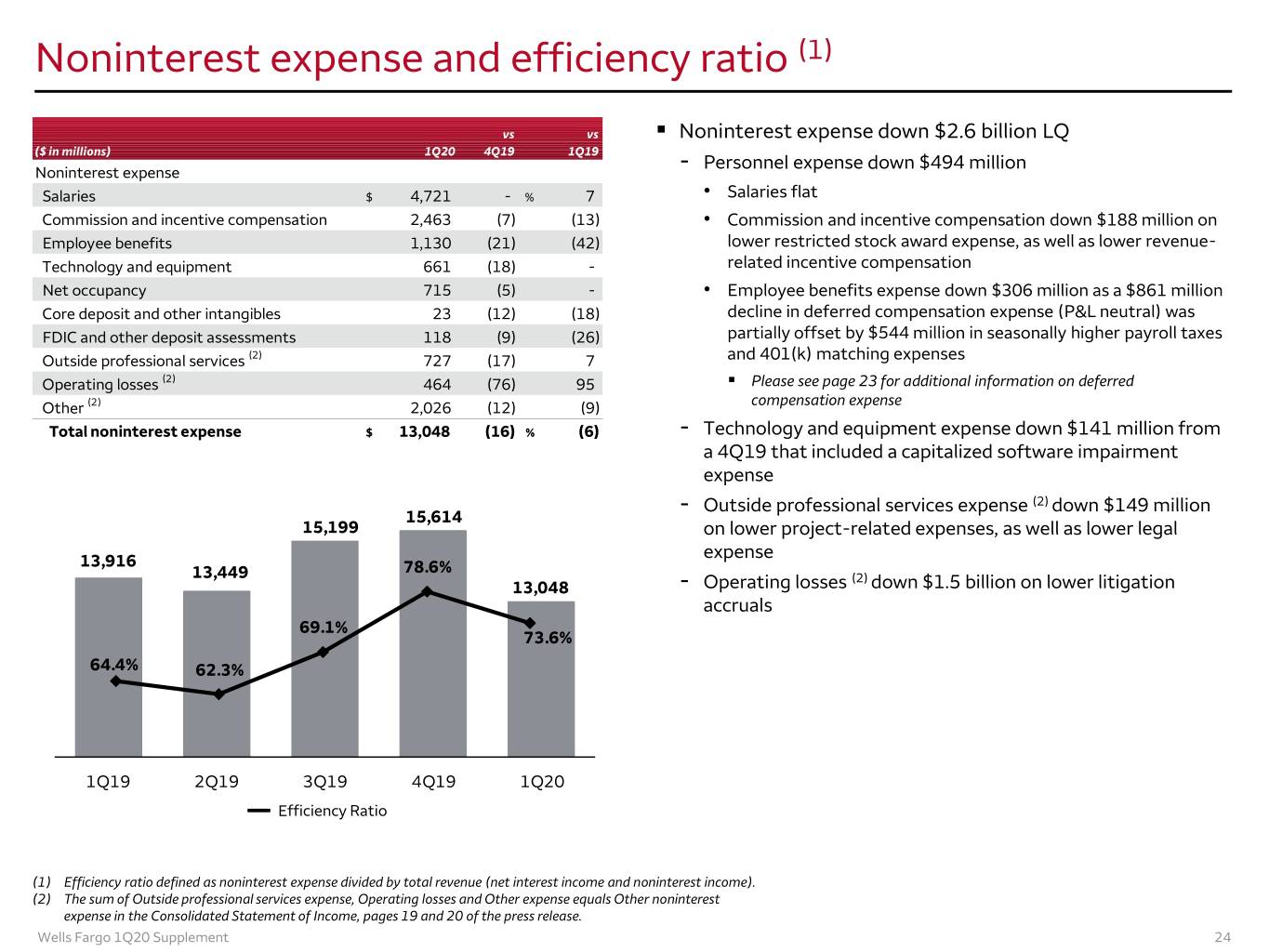

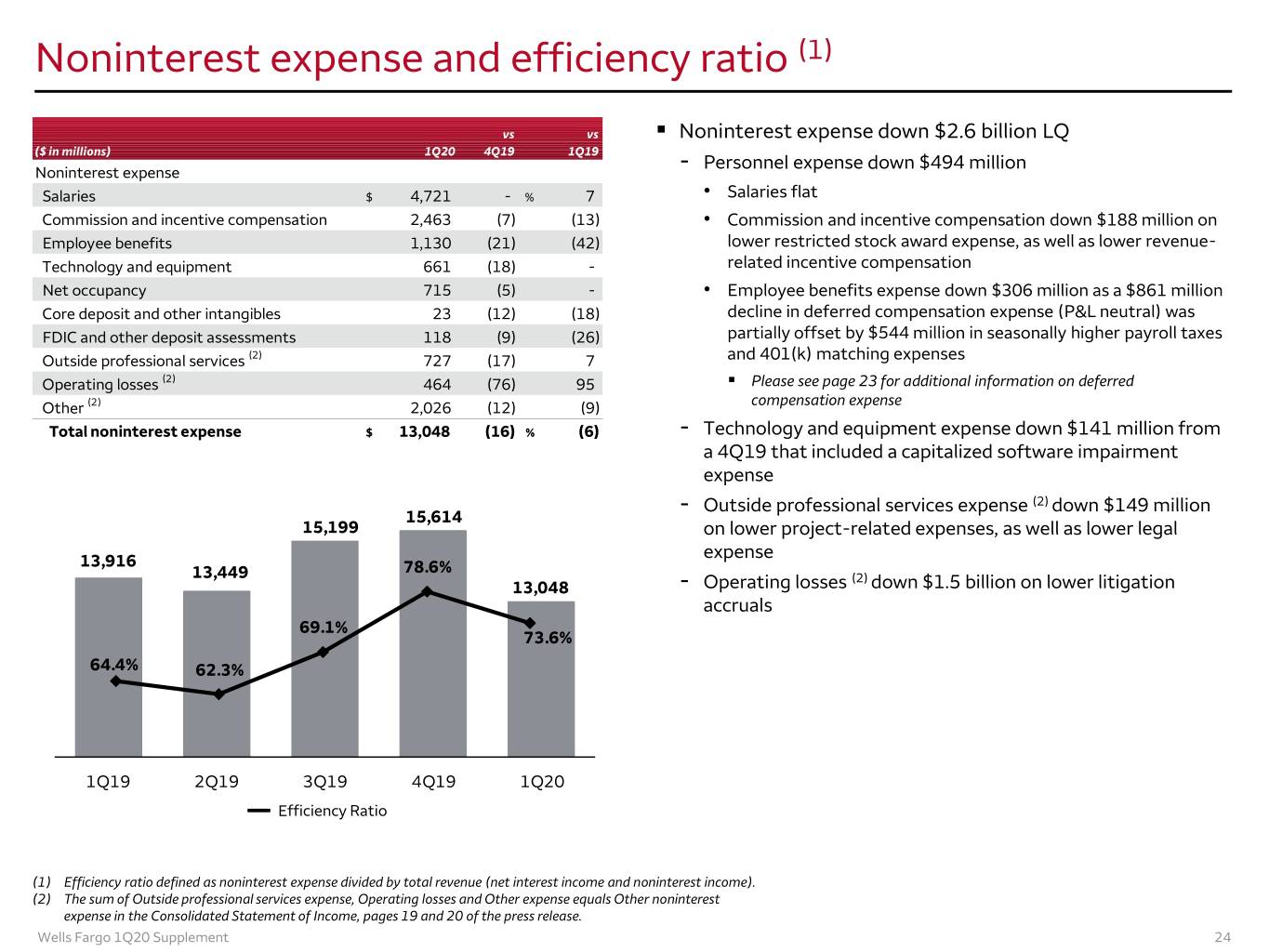

Noninterest expense and efficiency ratio (1) vs vs . Noninterest expense down $2.6 billion LQ ($ in millions) 1Q20 4Q19 1Q19 - Personnel expense down $494 million Noninterest expense Salaries $ 4,721 - % 7 • Salaries flat Commission and incentive compensation 2,463 (7) (13) • Commission and incentive compensation down $188 million on Employee benefits 1,130 (21) (42) lower restricted stock award expense, as well as lower revenue- Technology and equipment 661 (18) - related incentive compensation Net occupancy 715 (5) - • Employee benefits expense down $306 million as a $861 million Core deposit and other intangibles 23 (12) (18) decline in deferred compensation expense (P&L neutral) was FDIC and other deposit assessments 118 (9) (26) partially offset by $544 million in seasonally higher payroll taxes Outside professional services (2) 727 (17) 7 and 401(k) matching expenses Operating losses (2) 464 (76) 95 . Please see page 23 for additional information on deferred (2) compensation expense Other 2,026 (12) (9) Total noninterest expense $ 13,048 (16) % (6) - Technology and equipment expense down $141 million from a 4Q19 that included a capitalized software impairment expense - Outside professional services expense (2) down $149 million 15,614 15,199 on lower project-related expenses, as well as lower legal expense 13,916 78.6% 13,449 (2) 13,048 - Operating losses down $1.5 billion on lower litigation accruals 69.1% 73.6% 64.4% 62.3% 1Q19 2Q19 3Q19 4Q19 1Q20 Efficiency Ratio (1) Efficiency ratio defined as noninterest expense divided by total revenue (net interest income and noninterest income). (2) The sum of Outside professional services expense, Operating losses and Other expense equals Other noninterest expense in the Consolidated Statement of Income, pages 19 and 20 of the press release. Wells Fargo 1Q20 Supplement 24

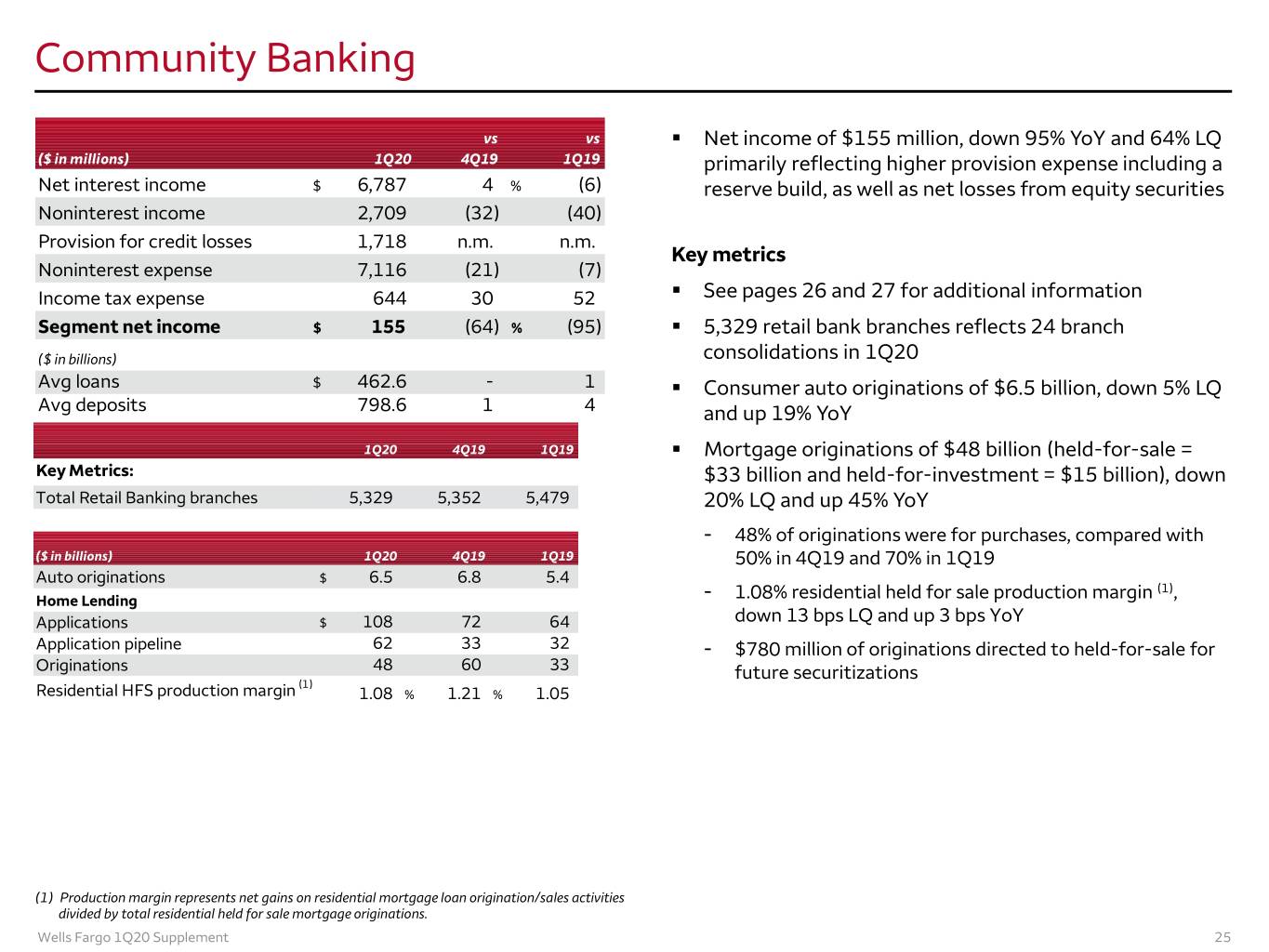

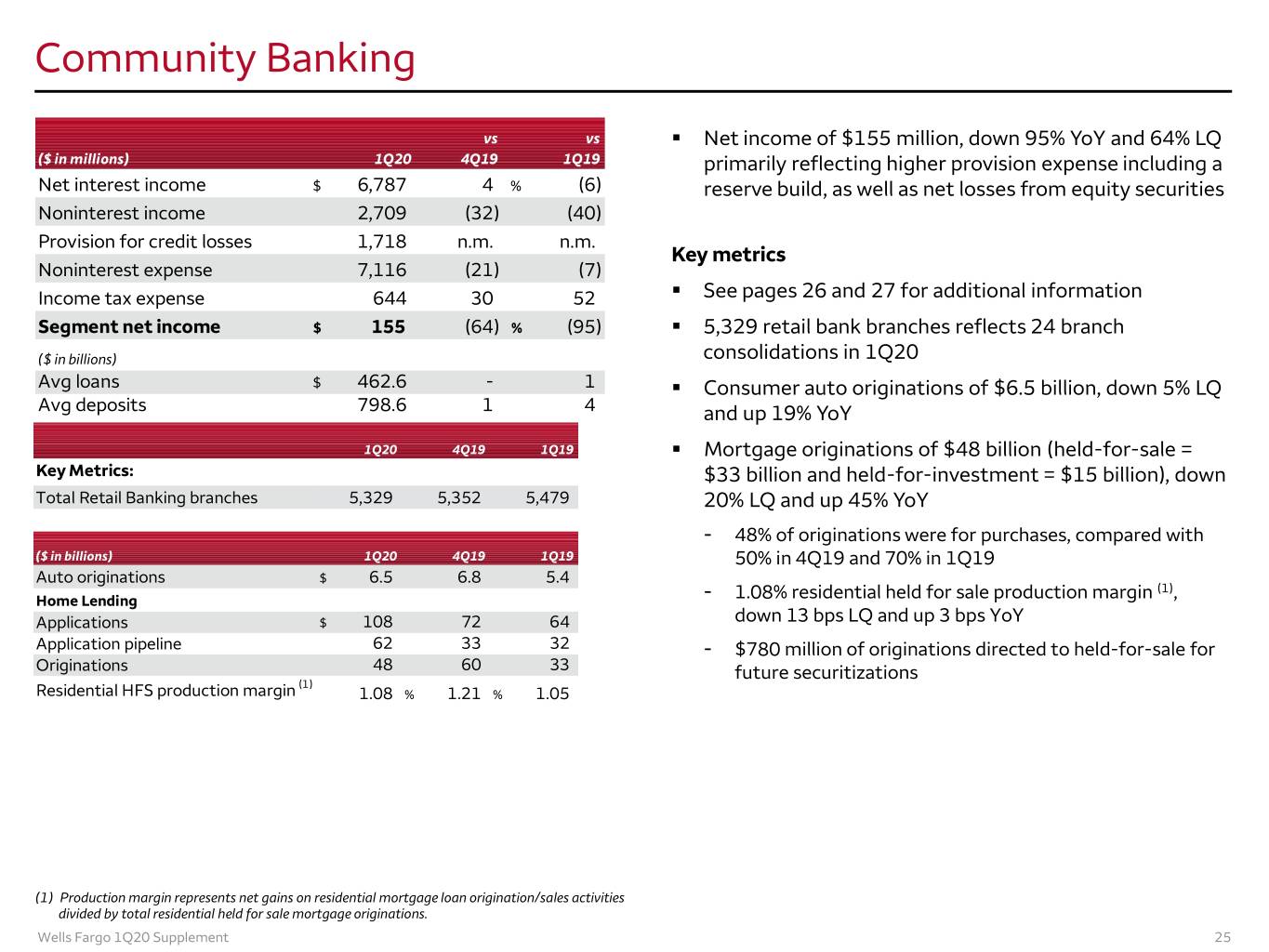

Community Banking vs vs . Net income of $155 million, down 95% YoY and 64% LQ ($ in millions) 1Q20 4Q19 1Q19 primarily reflecting higher provision expense including a Net interest income $ 6,787 4 % (6) reserve build, as well as net losses from equity securities Noninterest income 2,709 (32) (40) Provision for credit losses 1,718 n.m. n.m. Key metrics Noninterest expense 7,116 (21) (7) Income tax expense 644 30 52 . See pages 26 and 27 for additional information Segment net income $ 155 (64) % (95) . 5,329 retail bank branches reflects 24 branch ($ in billions) consolidations in 1Q20 Avg loans $ 462.6 - 1 . Consumer auto originations of $6.5 billion, down 5% LQ Avg deposits 798.6 1 4 and up 19% YoY 1Q20 4Q19 1Q19 . Mortgage originations of $48 billion (held-for-sale = Key Metrics: $33 billion and held-for-investment = $15 billion), down Total Retail Banking branches 5,329 5,352 5,479 20% LQ and up 45% YoY - 48% of originations were for purchases, compared with ($ in billions) 1Q20 4Q19 1Q19 50% in 4Q19 and 70% in 1Q19 Auto originations $ 6.5 6.8 5.4 - (1) Home Lending 1.08% residential held for sale production margin , Applications $ 108 72 64 down 13 bps LQ and up 3 bps YoY Application pipeline 62 33 32 - $780 million of originations directed to held-for-sale for Originations 48 60 33 future securitizations (1) Residential HFS production margin 1.08 % 1.21 % 1.05 (1) Production margin represents net gains on residential mortgage loan origination/sales activities divided by total residential held for sale mortgage originations. Wells Fargo 1Q20 Supplement 25

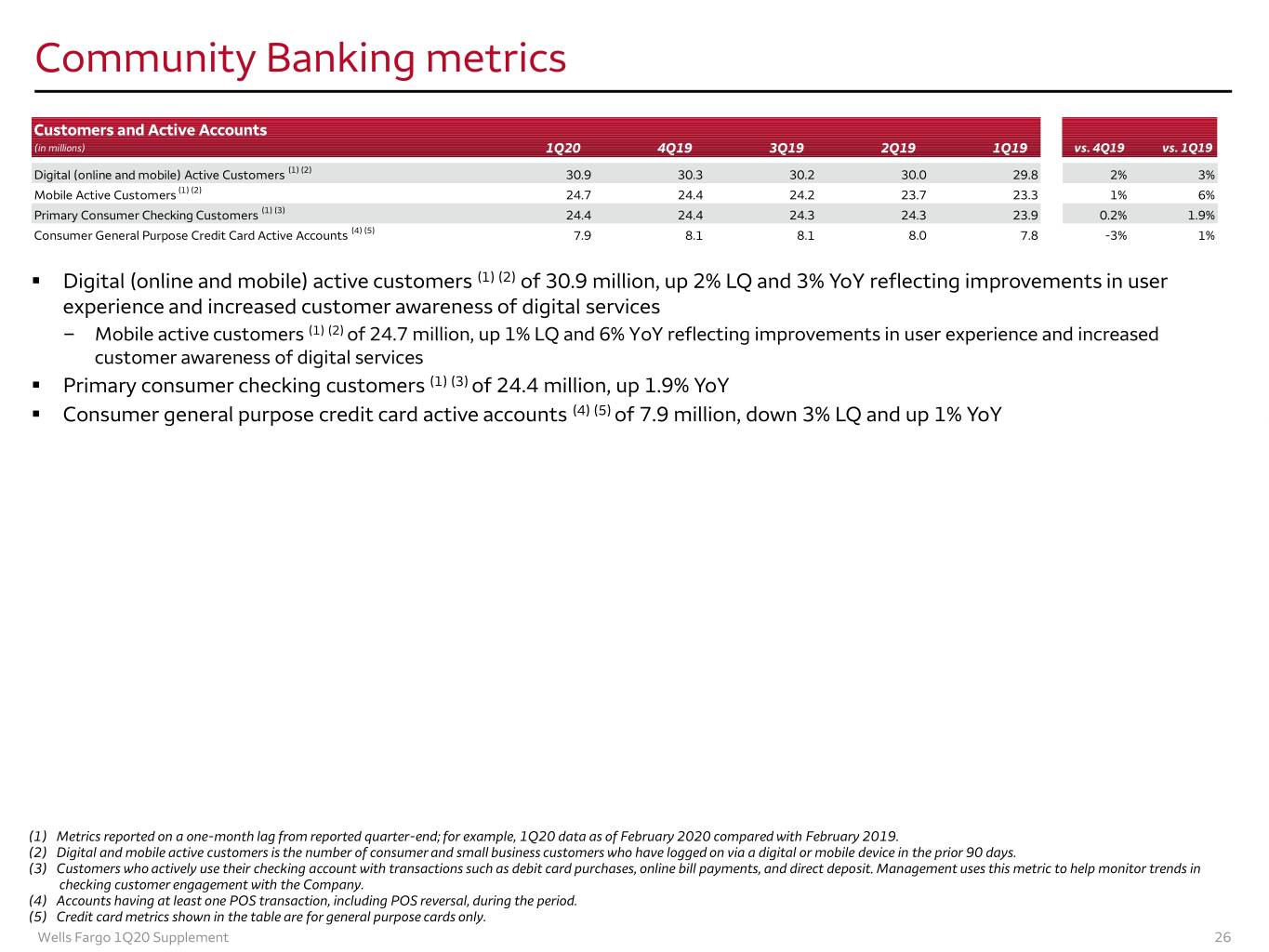

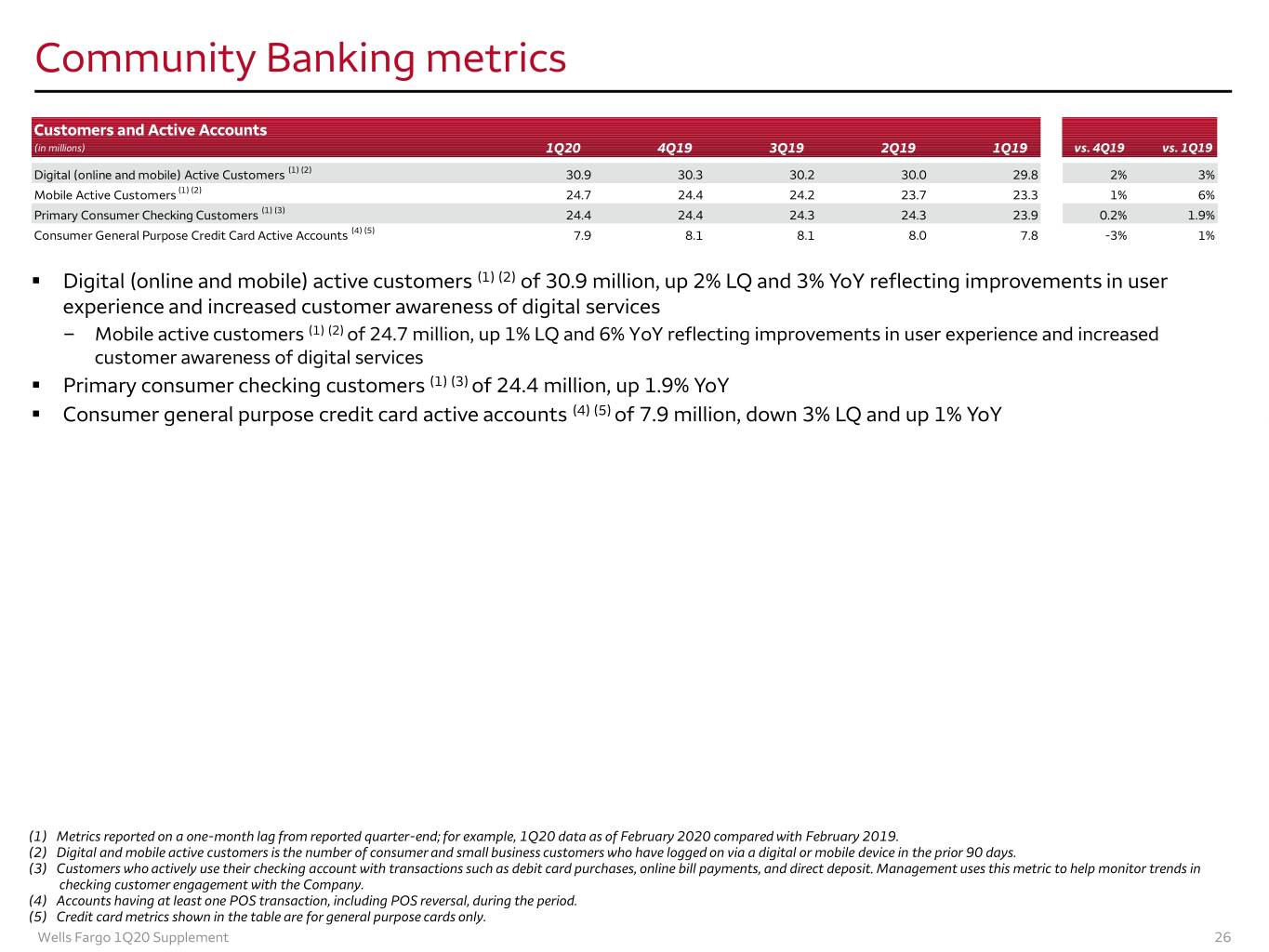

Community Banking metrics Customers and Active Accounts (in millions) 1Q20 4Q19 3Q19 2Q19 1Q19 vs. 4Q19 vs. 1Q19 Digital (online and mobile) Active Customers (1) (2) 30.9 30.3 30.2 30.0 29.8 2% 3% Mobile Active Customers (1) (2) 24.7 24.4 24.2 23.7 23.3 1% 6% Primary Consumer Checking Customers (1) (3) 24.4 24.4 24.3 24.3 23.9 0.2% 1.9% Consumer General Purpose Credit Card Active Accounts (4) (5) 7.9 8.1 8.1 8.0 7.8 -3% 1% . Digital (online and mobile) active customers (1) (2) of 30.9 million, up 2% LQ and 3% YoY reflecting improvements in user experience and increased customer awareness of digital services – Mobile active customers (1) (2) of 24.7 million, up 1% LQ and 6% YoY reflecting improvements in user experience and increased customer awareness of digital services . Primary consumer checking customers (1) (3) of 24.4 million, up 1.9% YoY . Consumer general purpose credit card active accounts (4) (5) of 7.9 million, down 3% LQ and up 1% YoY (1) Metrics reported on a one-month lag from reported quarter-end; for example, 1Q20 data as of February 2020 compared with February 2019. (2) Digital and mobile active customers is the number of consumer and small business customers who have logged on via a digital or mobile device in the prior 90 days. (3) Customers who actively use their checking account with transactions such as debit card purchases, online bill payments, and direct deposit. Management uses this metric to help monitor trends in checking customer engagement with the Company. (4) Accounts having at least one POS transaction, including POS reversal, during the period. (5) Credit card metrics shown in the table are for general purpose cards only. Wells Fargo 1Q20 Supplement 26

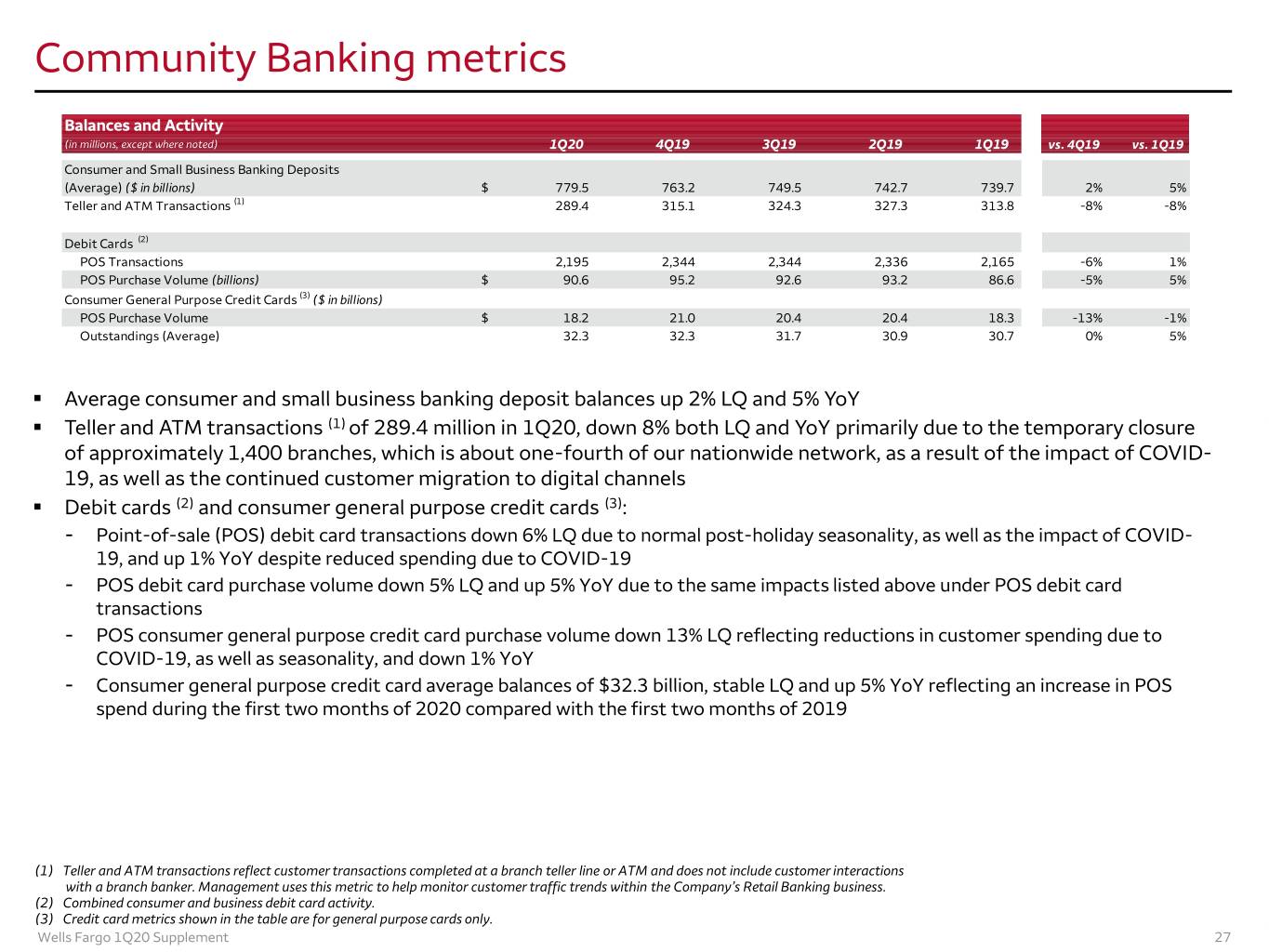

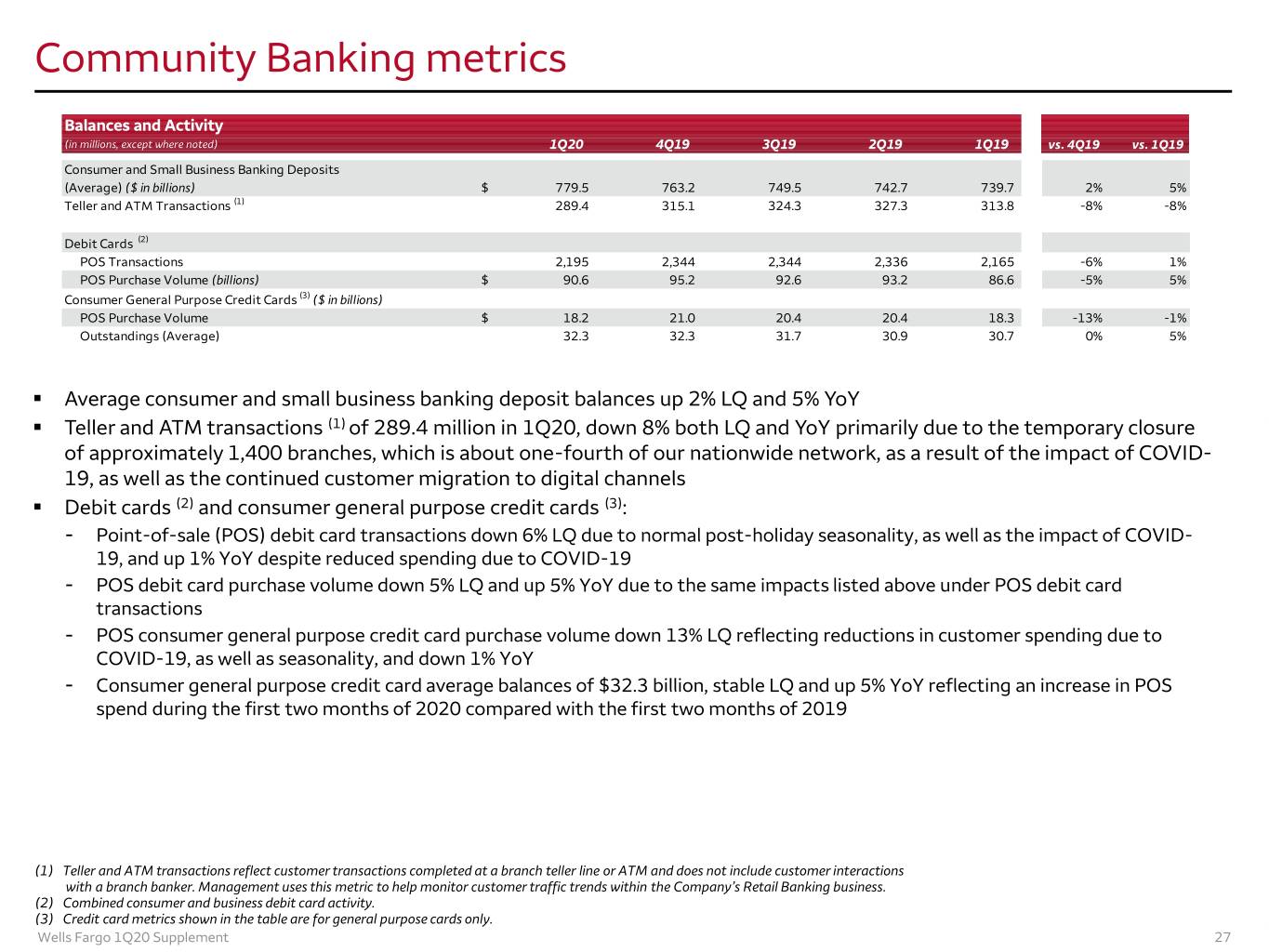

Community Banking metrics Balances and Activity (in millions, except where noted) 1Q20 4Q19 3Q19 2Q19 1Q19 vs. 4Q19 vs. 1Q19 Consumer and Small Business Banking Deposits (Average) ($ in billions) $ 779.5 763.2 749.5 742.7 739.7 2% 5% Teller and ATM Transactions (1) 289.4 315.1 324.3 327.3 313.8 -8% -8% [Purchase] Volume ?? #DIV/0! Debit Cards (2) POS Transactions 2,195 2,344 2,344 2,336 2,165 -6% 1% POS Purchase Volume (billions) $ 90.6 95.2 92.6 93.2 86.6 -5% 5% Consumer General Purpose Credit Cards (3) ($ in billions) POS Purchase Volume $ 18.2 21.0 20.4 20.4 18.3 -13% -1% Outstandings (Average) 32.3 32.3 31.7 30.9 30.7 0% 5% . Average consumer and small business banking deposit balances up 2% LQ and 5% YoY . Teller and ATM transactions (1) of 289.4 million in 1Q20, down 8% both LQ and YoY primarily due to the temporary closure of approximately 1,400 branches, which is about one-fourth of our nationwide network, as a result of the impact of COVID- 19, as well as the continued customer migration to digital channels . Debit cards (2) and consumer general purpose credit cards (3): - Point-of-sale (POS) debit card transactions down 6% LQ due to normal post-holiday seasonality, as well as the impact of COVID- 19, and up 1% YoY despite reduced spending due to COVID-19 - POS debit card purchase volume down 5% LQ and up 5% YoY due to the same impacts listed above under POS debit card transactions - POS consumer general purpose credit card purchase volume down 13% LQ reflecting reductions in customer spending due to COVID-19, as well as seasonality, and down 1% YoY - Consumer general purpose credit card average balances of $32.3 billion, stable LQ and up 5% YoY reflecting an increase in POS spend during the first two months of 2020 compared with the first two months of 2019 (1) Teller and ATM transactions reflect customer transactions completed at a branch teller line or ATM and does not include customer interactions with a branch banker. Management uses this metric to help monitor customer traffic trends within the Company’s Retail Banking business. (2) Combined consumer and business debit card activity. (3) Credit card metrics shown in the table are for general purpose cards only. Wells Fargo 1Q20 Supplement 27

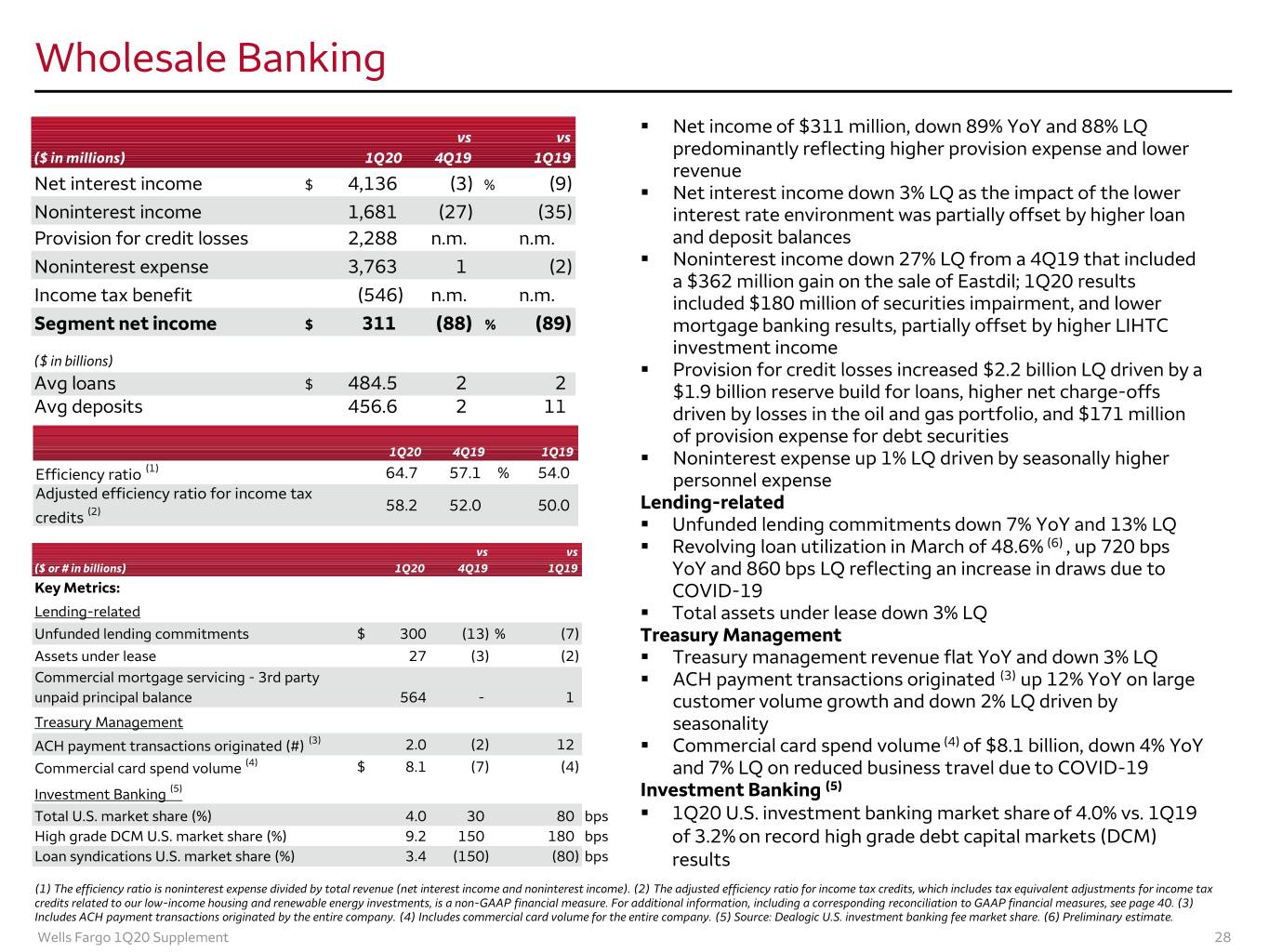

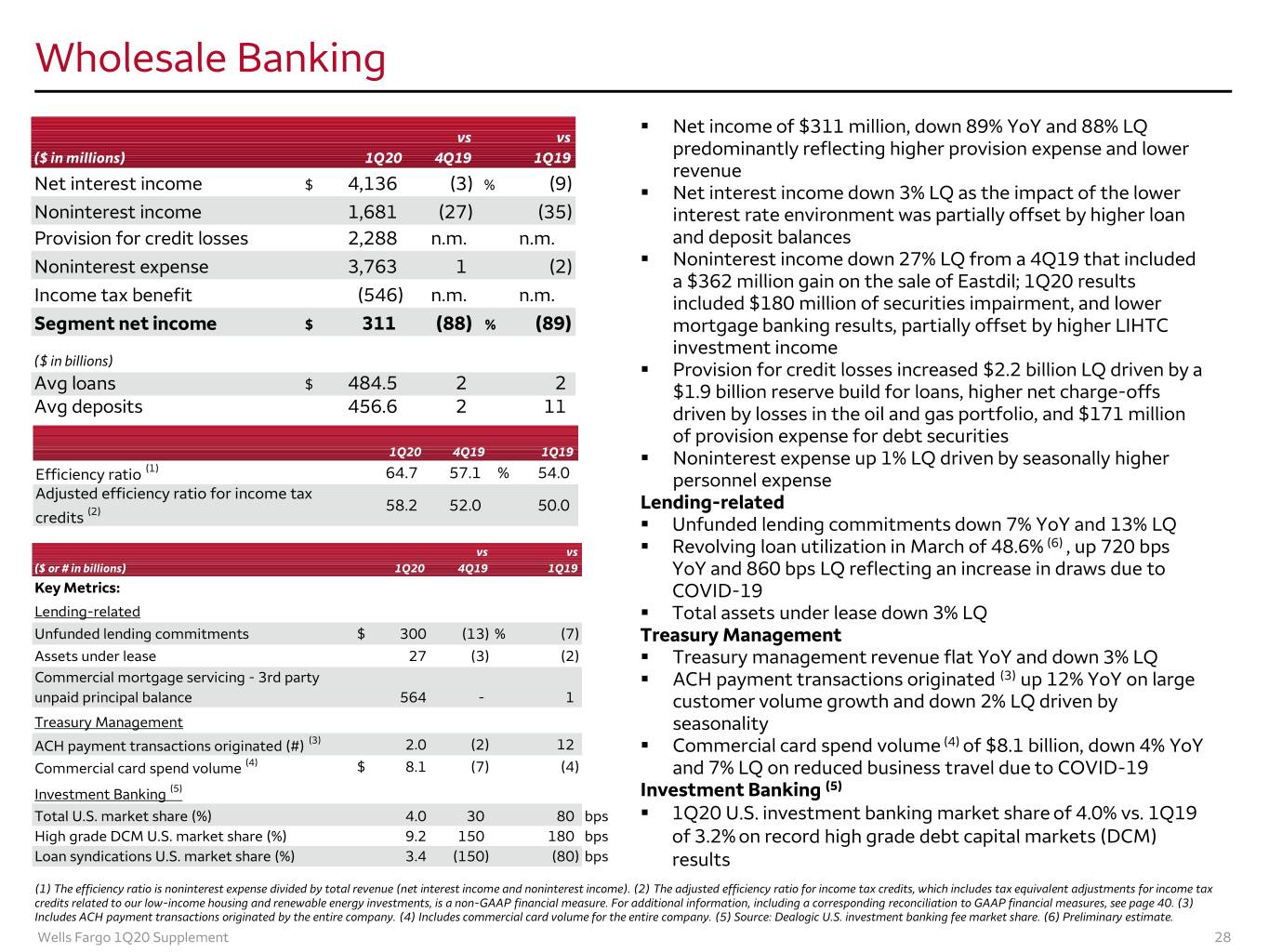

Wholesale Banking . Net income of $311 million, down 89% YoY and 88% LQ vs vs ($ in millions) 1Q20 4Q19 1Q19 predominantly reflecting higher provision expense and lower revenue Net interest income $ 4,136 (3) % (9) . Net interest income down 3% LQ as the impact of the lower Noninterest income 1,681 (27) (35) interest rate environment was partially offset by higher loan Provision for credit losses 2,288 n.m. n.m. and deposit balances Noninterest expense 3,763 1 (2) . Noninterest income down 27% LQ from a 4Q19 that included a $362 million gain on the sale of Eastdil; 1Q20 results Income tax benefit (546) n.m. n.m. included $180 million of securities impairment, and lower Segment net income $ 311 (88) % (89) mortgage banking results, partially offset by higher LIHTC investment income ($ in billions) . Provision for credit losses increased $2.2 billion LQ driven by a Avg loans $ 484.5 2 2 $1.9 billion reserve build for loans, higher net charge-offs Avg deposits 456.6 2 11 driven by losses in the oil and gas portfolio, and $171 million of provision expense for debt securities 1Q20 4Q19 1Q19 . (1) Noninterest expense up 1% LQ driven by seasonally higher Efficiency ratio 64.7 57.1 % 54.0 personnel expense Adjusted efficiency ratio for income tax (2) 58.2 52.0 50.0 Lending-related credits . Unfunded lending commitments down 7% YoY and 13% LQ (6) vs vs . Revolving loan utilization in March of 48.6% , up 720 bps ($ or # in billions) 1Q20 4Q19 1Q19 YoY and 860 bps LQ reflecting an increase in draws due to Key Metrics: COVID-19 Lending-related . Total assets under lease down 3% LQ Unfunded lending commitments $ 300 (13) % (7) Treasury Management Assets under lease 27 (3) (2) . Treasury management revenue flat YoY and down 3% LQ Commercial mortgage servicing - 3rd party . ACH payment transactions originated (3) up 12% YoY on large unpaid principal balance 564 - 1 customer volume growth and down 2% LQ driven by Treasury Management seasonality ACH payment transactions originated (#) (3) 2.0 (2) 12 . Commercial card spend volume (4) of $8.1 billion, down 4% YoY Commercial card spend volume (4) $ 8.1 (7) (4) and 7% LQ on reduced business travel due to COVID-19 (5) Investment Banking (5) Investment Banking Total U.S. market share (%) 4.0 30 80 bps . 1Q20 U.S. investment banking market share of 4.0% vs. 1Q19 High grade DCM U.S. market share (%) 9.2 150 180 bps of 3.2% on record high grade debt capital markets (DCM) Loan syndications U.S. market share (%) 3.4 (150) (80) bps results (1) The efficiency ratio is noninterest expense divided by total revenue (net interest income and noninterest income). (2) The adjusted efficiency ratio for income tax credits, which includes tax equivalent adjustments for income tax credits related to our low-income housing and renewable energy investments, is a non-GAAP financial measure. For additional information, including a corresponding reconciliation to GAAP financial measures, see page 40. (3) Includes ACH payment transactions originated by the entire company. (4) Includes commercial card volume for the entire company. (5) Source: Dealogic U.S. investment banking fee market share. (6) Preliminary estimate. Wells Fargo 1Q20 Supplement 28

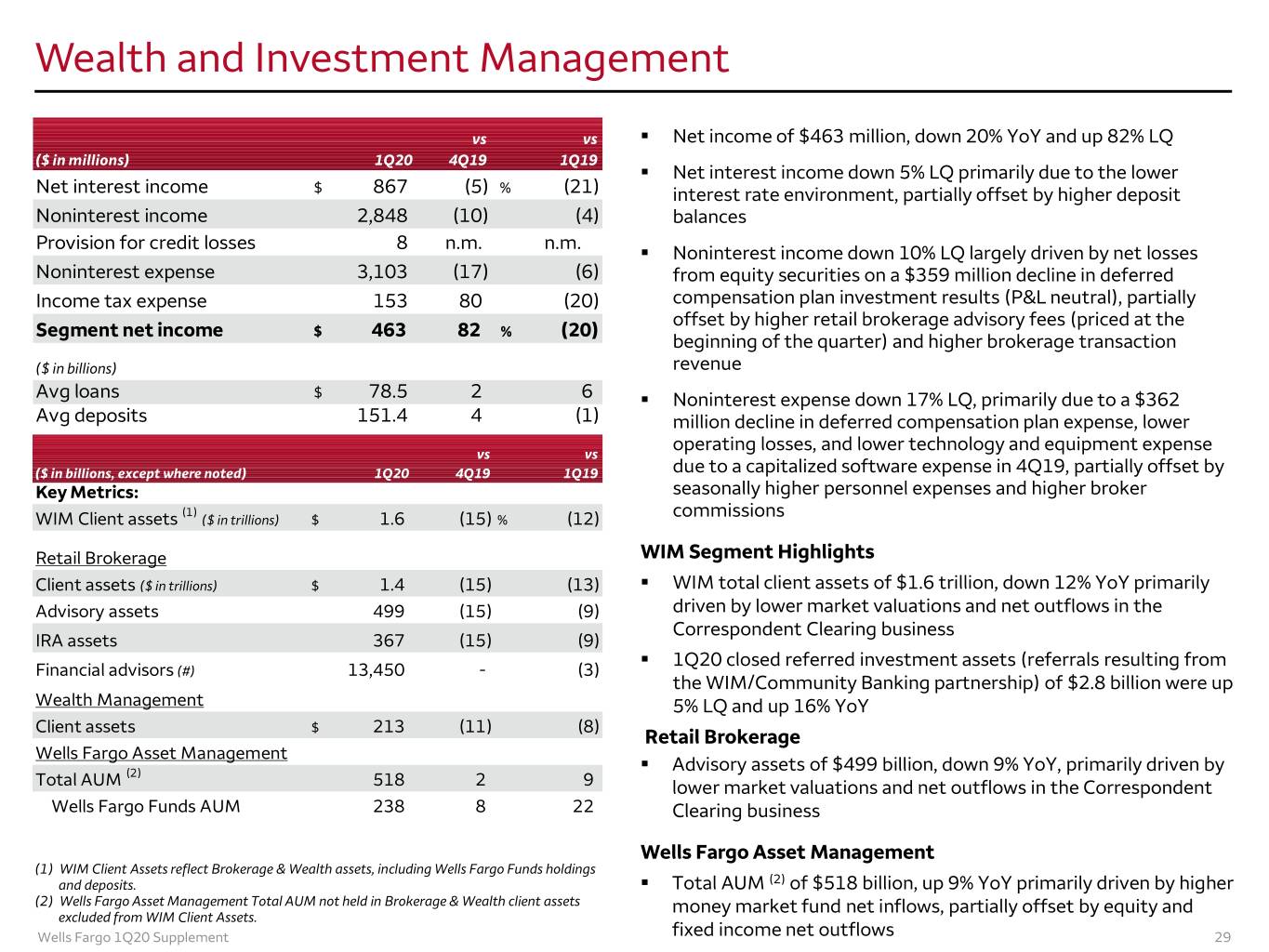

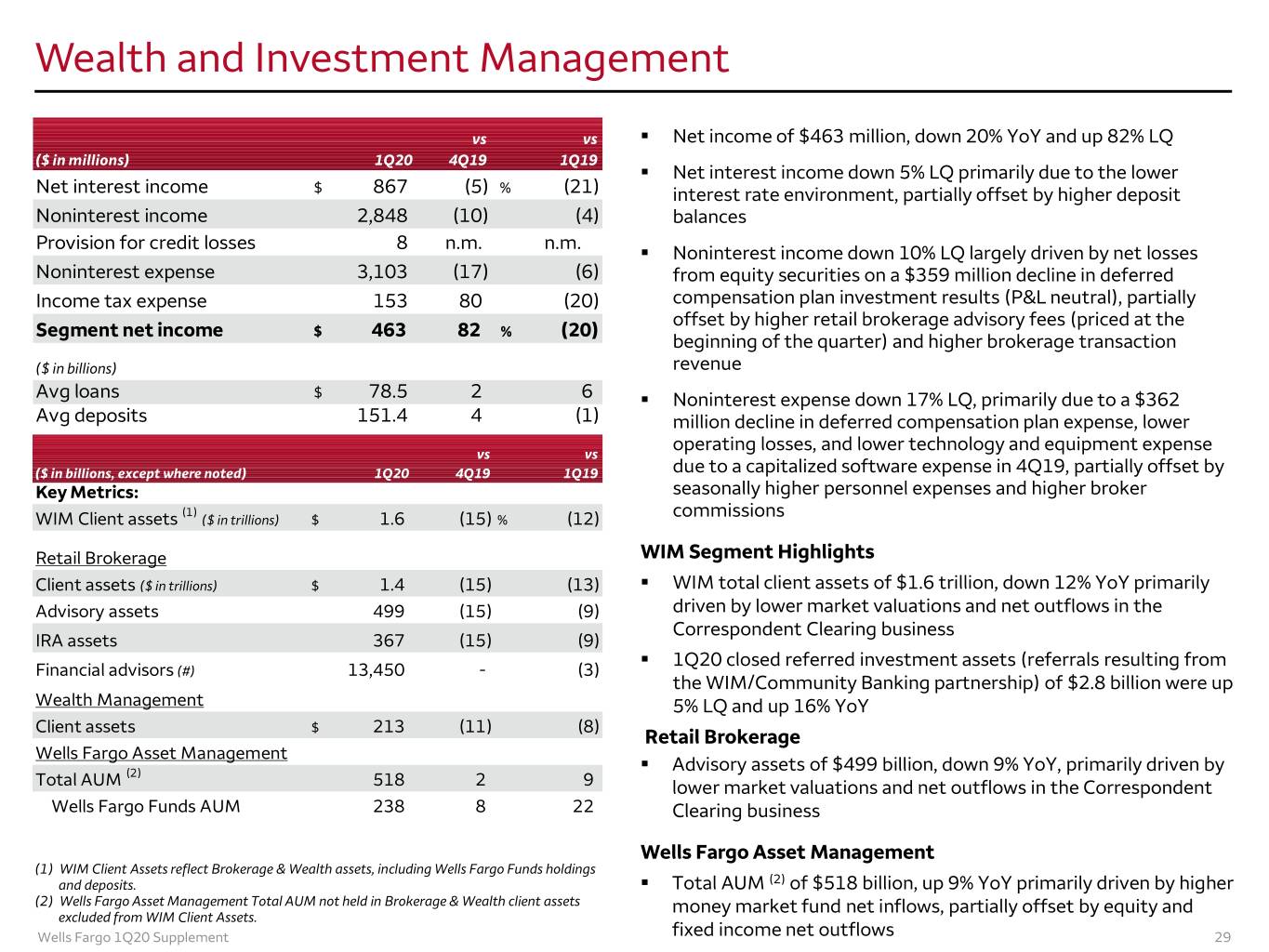

Wealth and Investment Management vs vs . Net income of $463 million, down 20% YoY and up 82% LQ ($ in millions) 1Q20 4Q19 1Q19 . Net interest income down 5% LQ primarily due to the lower Net interest income $ 867 (5) % (21) interest rate environment, partially offset by higher deposit Noninterest income 2,848 (10) (4) balances Provision for credit losses 8 n.m. n.m. . Noninterest income down 10% LQ largely driven by net losses Noninterest expense 3,103 (17) (6) from equity securities on a $359 million decline in deferred Income tax expense 153 80 (20) compensation plan investment results (P&L neutral), partially offset by higher retail brokerage advisory fees (priced at the Segment net income $ 463 82 % (20) beginning of the quarter) and higher brokerage transaction ($ in billions) revenue Avg loans $ 78.5 2 6 . Noninterest expense down 17% LQ, primarily due to a $362 Avg deposits 151.4 4 (1) million decline in deferred compensation plan expense, lower operating losses, and lower technology and equipment expense vs vs ($ in billions, except where noted) 1Q20 4Q19 1Q19 due to a capitalized software expense in 4Q19, partially offset by Key Metrics: seasonally higher personnel expenses and higher broker (1) commissions WIM Client assets ($ in trillions) $ 1.6 (15) % (12) Retail Brokerage WIM Segment Highlights Client assets ($ in trillions) $ 1.4 (15) (13) . WIM total client assets of $1.6 trillion, down 12% YoY primarily Advisory assets 499 (15) (9) driven by lower market valuations and net outflows in the Correspondent Clearing business IRA assets 367 (15) (9) . 1Q20 closed referred investment assets (referrals resulting from Financial advisors (#) 13,450 - (3) the WIM/Community Banking partnership) of $2.8 billion were up Wealth Management 5% LQ and up 16% YoY Client assets $ 213 (11) (8) Retail Brokerage Wells Fargo Asset Management (2) . Advisory assets of $499 billion, down 9% YoY, primarily driven by Total AUM 518 2 9 lower market valuations and net outflows in the Correspondent Wells Fargo Funds AUM 238 8 22 Clearing business Wells Fargo Asset Management (1) WIM Client Assets reflect Brokerage & Wealth assets, including Wells Fargo Funds holdings and deposits. . Total AUM (2) of $518 billion, up 9% YoY primarily driven by higher (2) Wells Fargo Asset Management Total AUM not held in Brokerage & Wealth client assets money market fund net inflows, partially offset by equity and excluded from WIM Client Assets. Wells Fargo 1Q20 Supplement fixed income net outflows 29

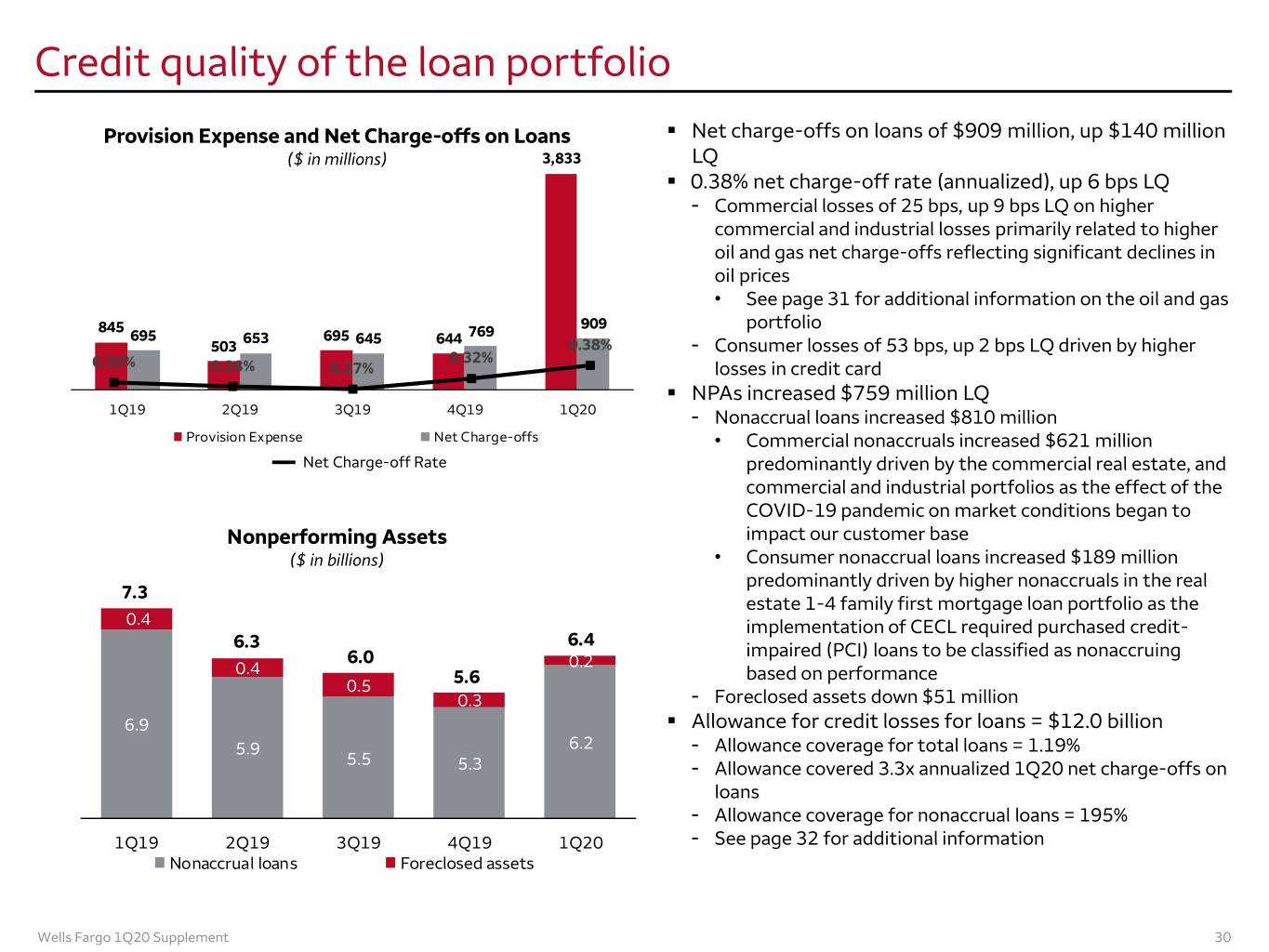

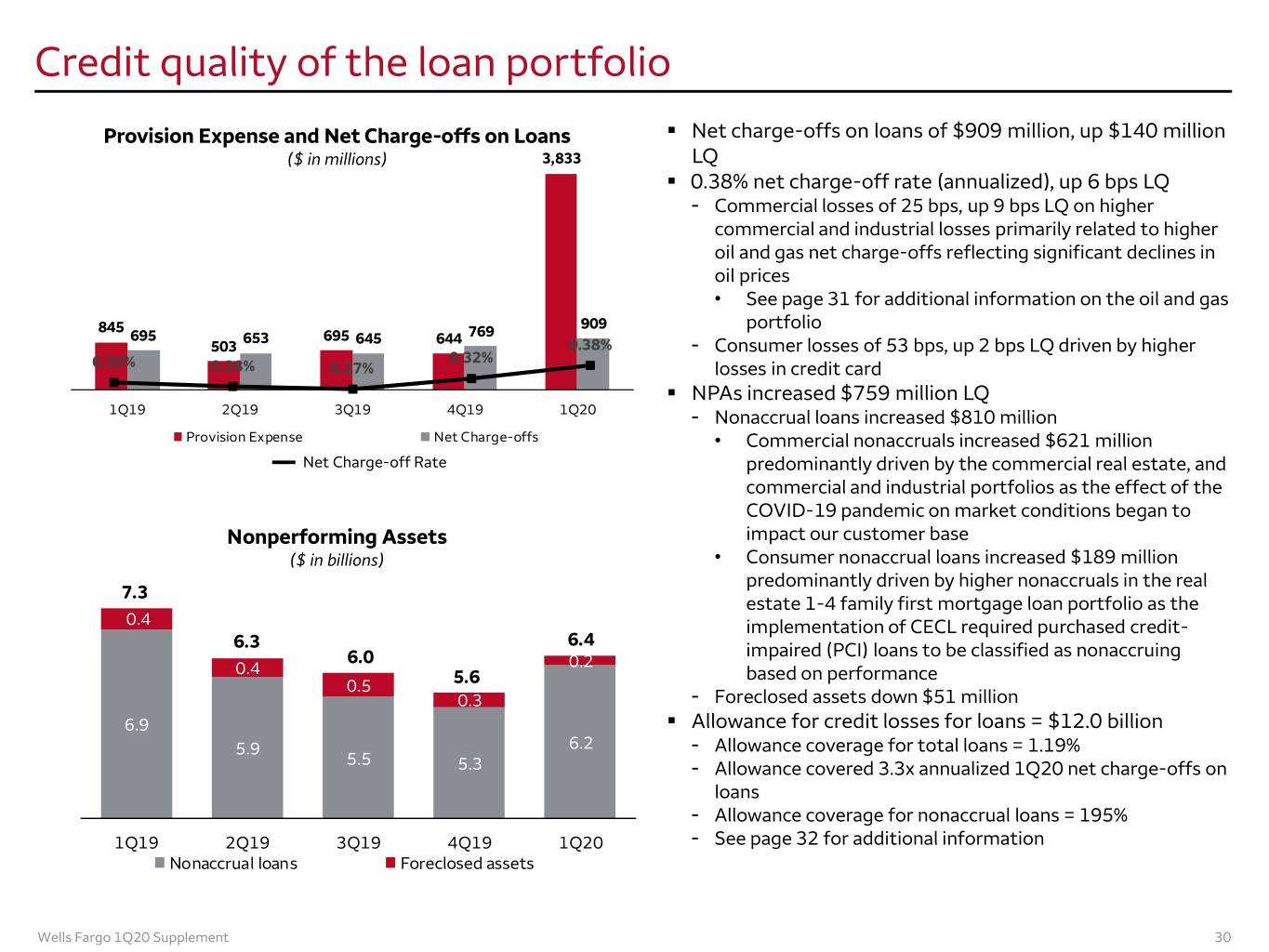

Credit quality of the loan portfolio Provision Expense and Net Charge-offs on Loans . Net charge-offs on loans of $909 million, up $140 million ($ in millions) 3,833 LQ . 0.38% net charge-off rate (annualized), up 6 bps LQ - Commercial losses of 25 bps, up 9 bps LQ on higher commercial and industrial losses primarily related to higher oil and gas net charge-offs reflecting significant declines in oil prices • See page 31 for additional information on the oil and gas 845 909 portfolio 695 653 695 645 644 769 503 0.38% - Consumer losses of 53 bps, up 2 bps LQ driven by higher 0.32% 0.30% 0.28% 0.27% losses in credit card . NPAs increased $759 million LQ 1Q19 2Q19 3Q19 4Q19 1Q20 - Nonaccrual loans increased $810 million Provision Expense Net Charge-offs • Commercial nonaccruals increased $621 million Net Charge-off Rate predominantly driven by the commercial real estate, and commercial and industrial portfolios as the effect of the COVID-19 pandemic on market conditions began to Nonperforming Assets impact our customer base ($ in billions) • Consumer nonaccrual loans increased $189 million predominantly driven by higher nonaccruals in the real 7.3 estate 1-4 family first mortgage loan portfolio as the 0.4 implementation of CECL required purchased credit- 6.4 6.3 impaired (PCI) loans to be classified as nonaccruing 6.0 0.2 0.4 based on performance 0.5 5.6 0.3 - Foreclosed assets down $51 million 6.9 . Allowance for credit losses for loans = $12.0 billion 5.9 6.2 - Allowance coverage for total loans = 1.19% 5.5 5.3 - Allowance covered 3.3x annualized 1Q20 net charge-offs on loans - Allowance coverage for nonaccrual loans = 195% 1Q19 2Q19 3Q19 4Q19 1Q20 - See page 32 for additional information Nonaccrual loans Foreclosed assets Wells Fargo 1Q20 Supplement 30

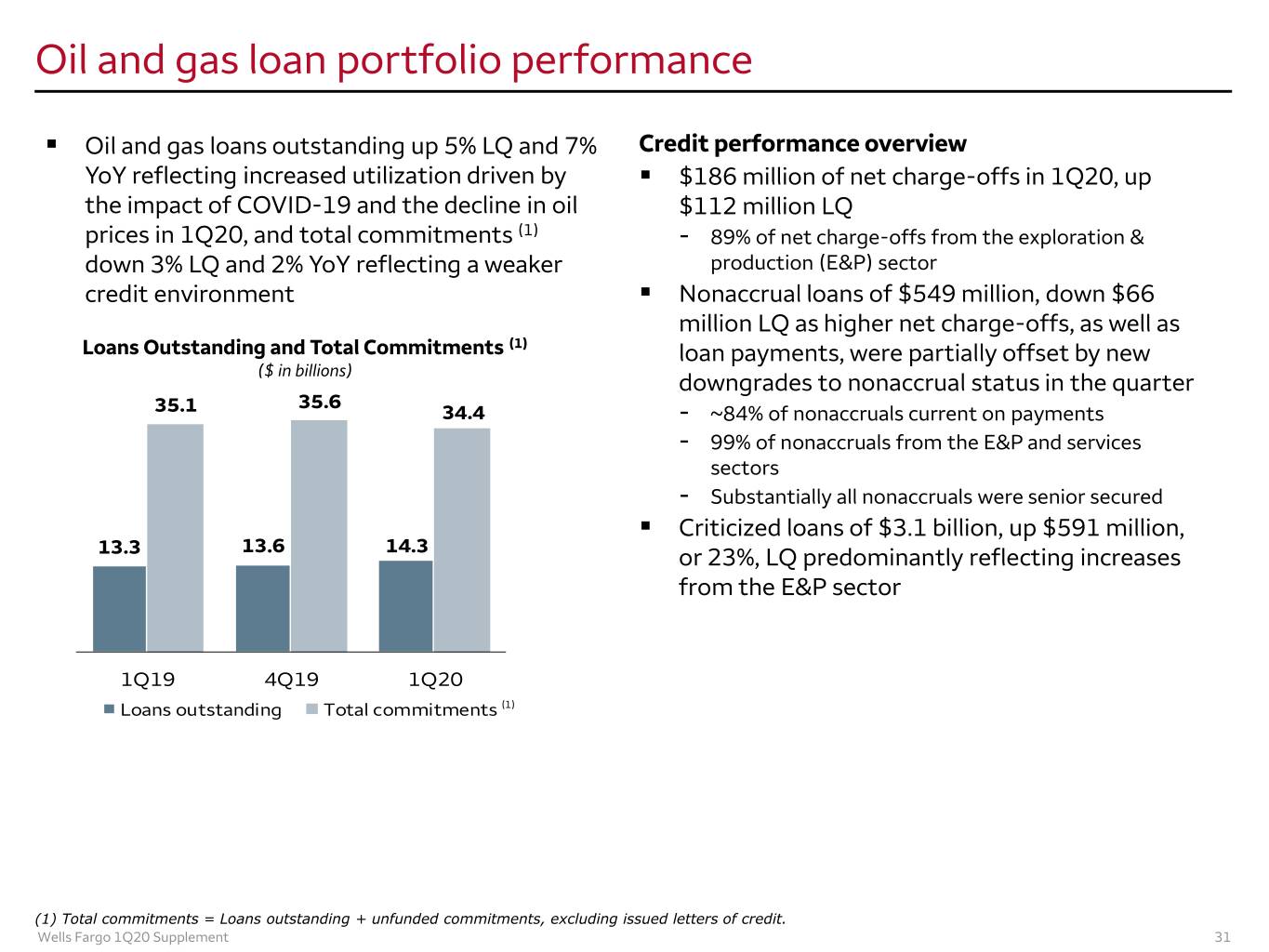

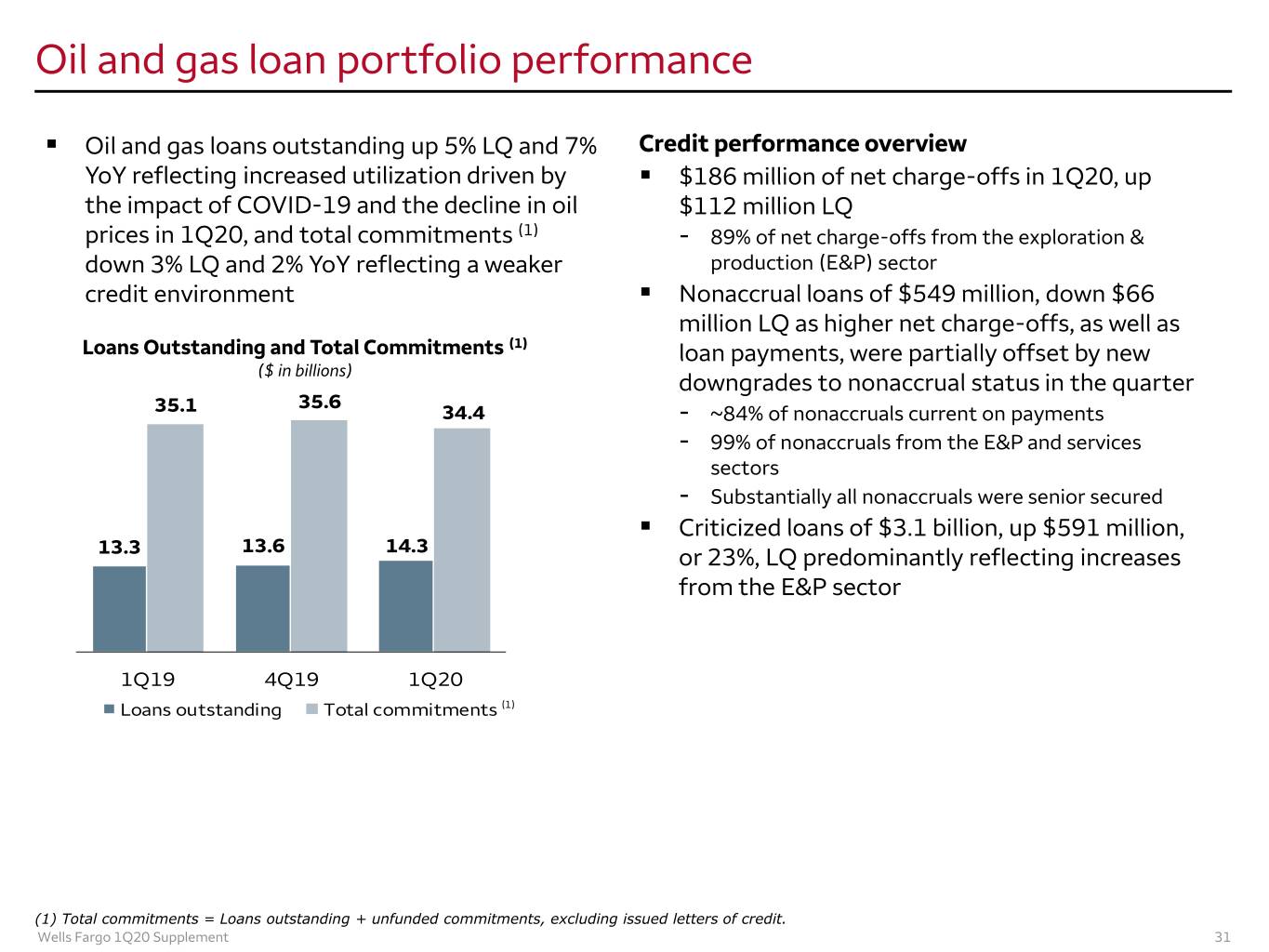

Oil and gas loan portfolio performance . Oil and gas loans outstanding up 5% LQ and 7% Credit performance overview YoY reflecting increased utilization driven by . $186 million of net charge-offs in 1Q20, up the impact of COVID-19 and the decline in oil $112 million LQ prices in 1Q20, and total commitments (1) - 89% of net charge-offs from the exploration & down 3% LQ and 2% YoY reflecting a weaker production (E&P) sector credit environment . Nonaccrual loans of $549 million, down $66 million LQ as higher net charge-offs, as well as Loans Outstanding and Total Commitments (1) loan payments, were partially offset by new ($ in billions) downgrades to nonaccrual status in the quarter 35.6 35.1 34.4 - ~84% of nonaccruals current on payments - 99% of nonaccruals from the E&P and services sectors - Substantially all nonaccruals were senior secured . Criticized loans of $3.1 billion, up $591 million, 13.3 13.6 14.3 or 23%, LQ predominantly reflecting increases from the E&P sector 1Q19 4Q19 1Q20 Loans outstanding Total commitments (1) (1) Total commitments = Loans outstanding + unfunded commitments, excluding issued letters of credit. Wells Fargo 1Q20 Supplement 31

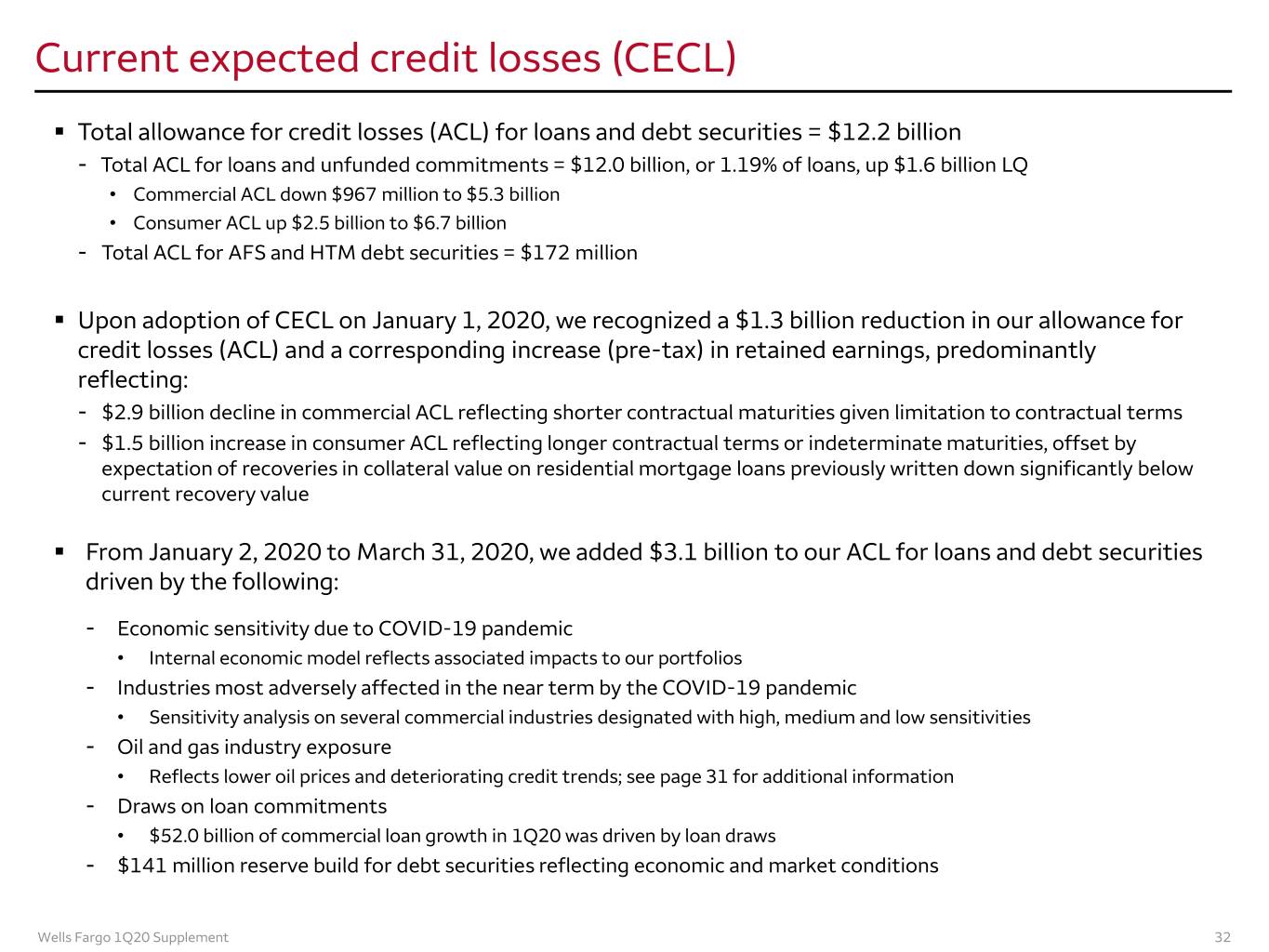

Current expected credit losses (CECL) . Total allowance for credit losses (ACL) for loans and debt securities = $12.2 billion - Total ACL for loans and unfunded commitments = $12.0 billion, or 1.19% of loans, up $1.6 billion LQ • Commercial ACL down $967 million to $5.3 billion • Consumer ACL up $2.5 billion to $6.7 billion - Total ACL for AFS and HTM debt securities = $172 million . Upon adoption of CECL on January 1, 2020, we recognized a $1.3 billion reduction in our allowance for credit losses (ACL) and a corresponding increase (pre-tax) in retained earnings, predominantly reflecting: - $2.9 billion decline in commercial ACL reflecting shorter contractual maturities given limitation to contractual terms - $1.5 billion increase in consumer ACL reflecting longer contractual terms or indeterminate maturities, offset by expectation of recoveries in collateral value on residential mortgage loans previously written down significantly below current recovery value . From January 2, 2020 to March 31, 2020, we added $3.1 billion to our ACL for loans and debt securities driven by the following: - Economic sensitivity due to COVID-19 pandemic • Internal economic model reflects associated impacts to our portfolios - Industries most adversely affected in the near term by the COVID-19 pandemic • Sensitivity analysis on several commercial industries designated with high, medium and low sensitivities - Oil and gas industry exposure • Reflects lower oil prices and deteriorating credit trends; see page 31 for additional information - Draws on loan commitments • $52.0 billion of commercial loan growth in 1Q20 was driven by loan draws - $141 million reserve build for debt securities reflecting economic and market conditions Wells Fargo 1Q20 Supplement 32

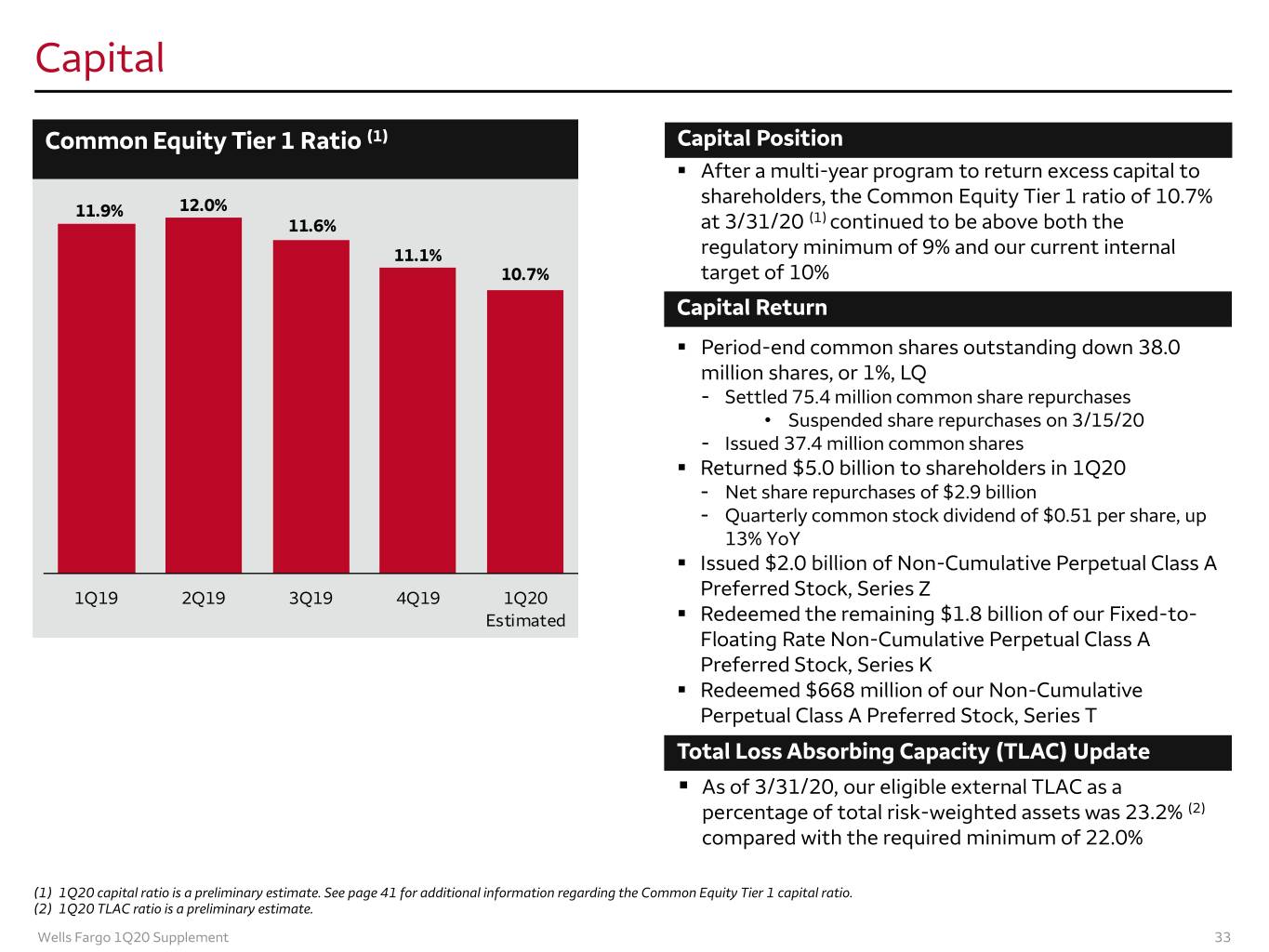

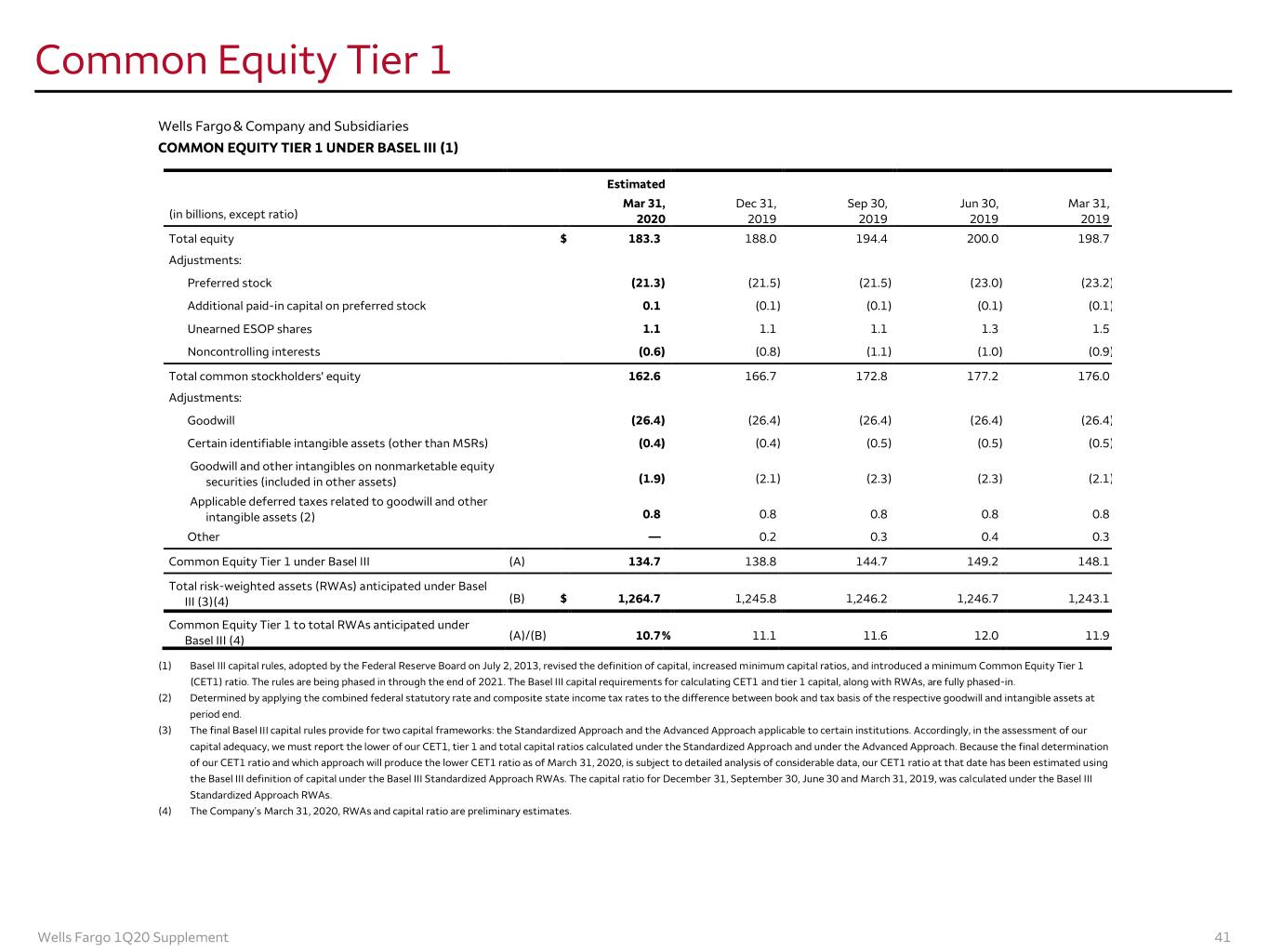

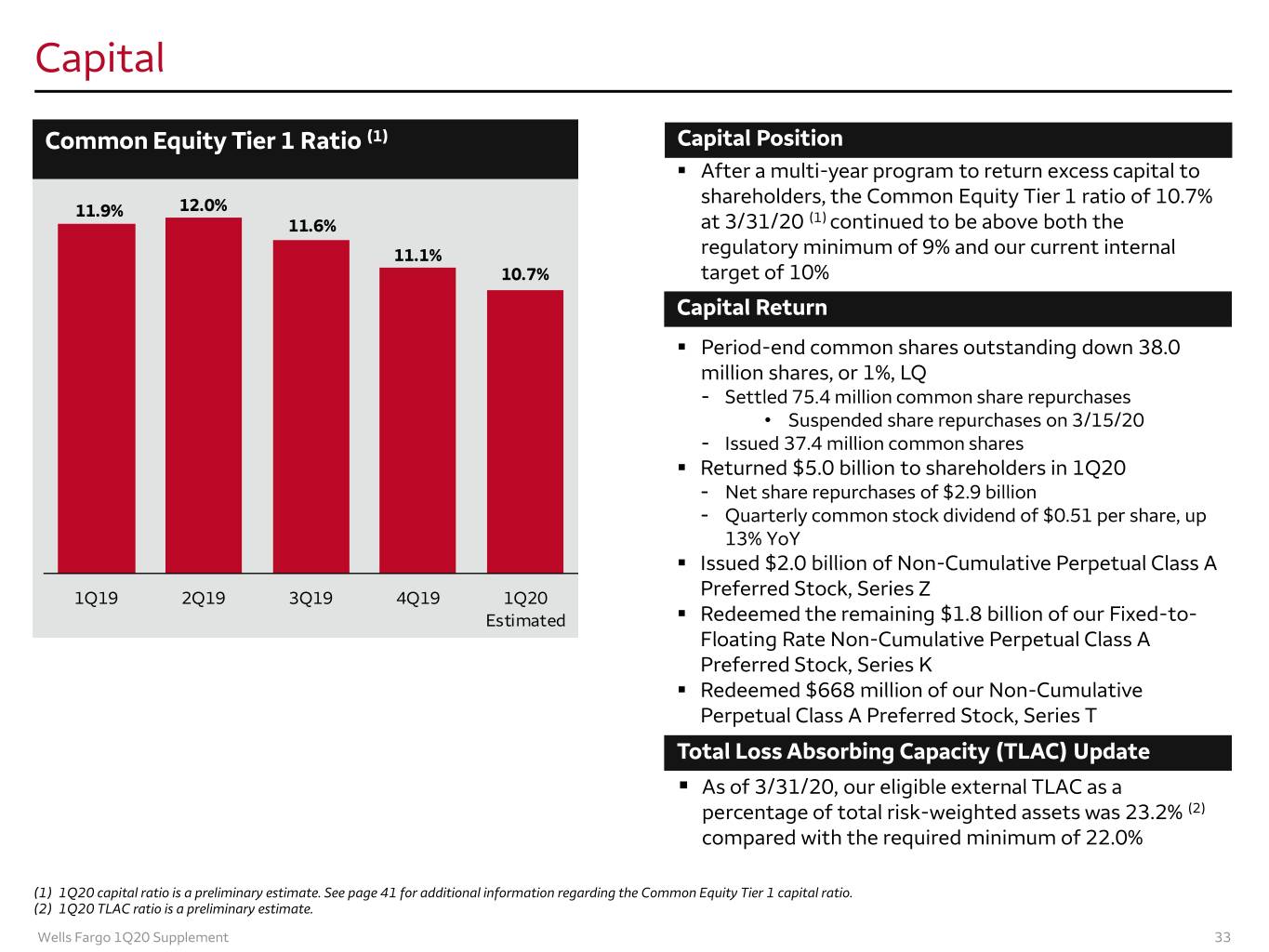

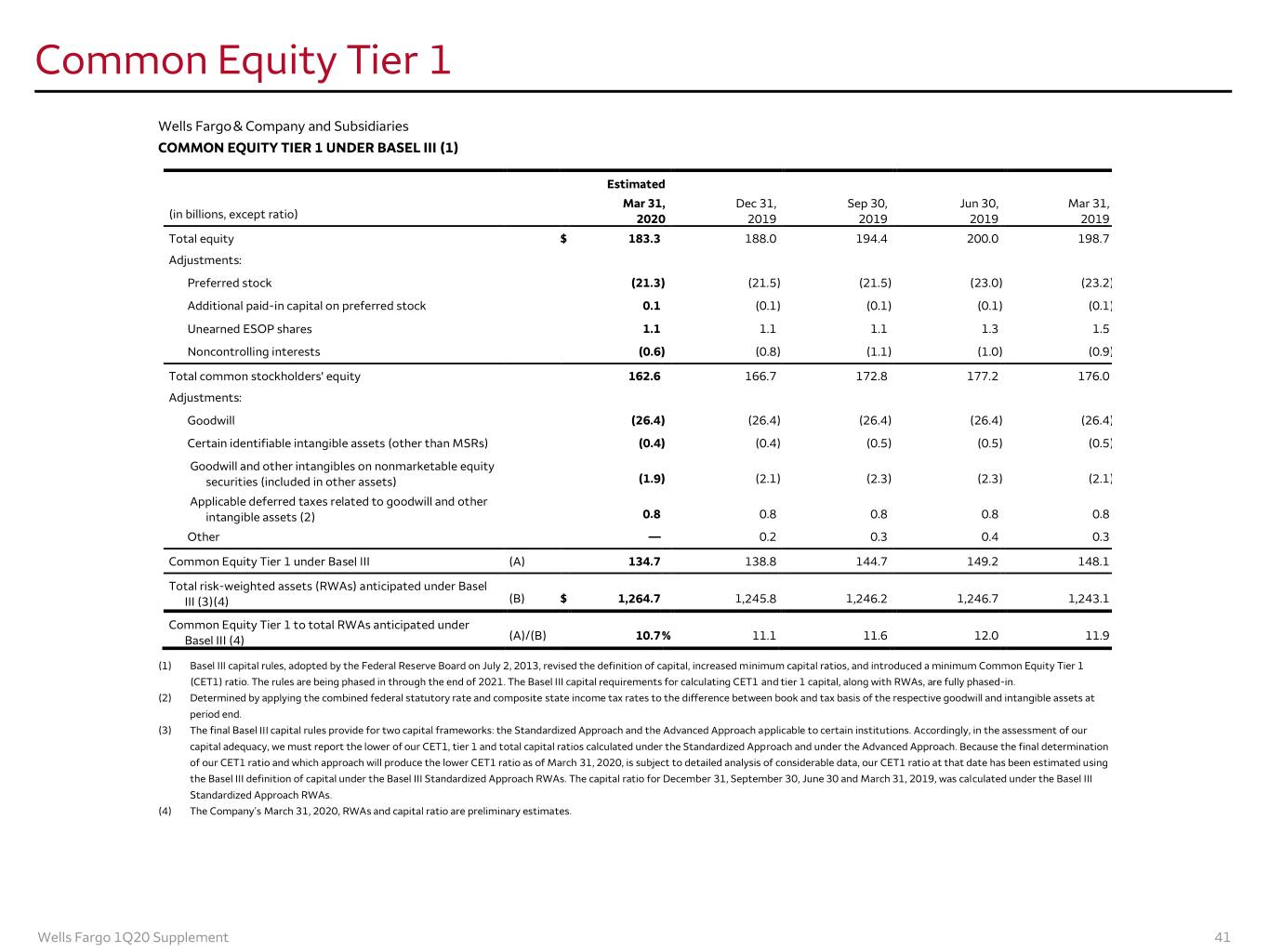

Capital Common Equity Tier 1 Ratio (1) Capital Position . After a multi-year program to return excess capital to shareholders, the Common Equity Tier 1 ratio of 10.7% 11.9% 12.0% 11.6% at 3/31/20 (1) continued to be above both the 11.1% regulatory minimum of 9% and our current internal 10.7% target of 10% Capital Return . Period-end common shares outstanding down 38.0 million shares, or 1%, LQ - Settled 75.4 million common share repurchases • Suspended share repurchases on 3/15/20 - Issued 37.4 million common shares . Returned $5.0 billion to shareholders in 1Q20 - Net share repurchases of $2.9 billion - Quarterly common stock dividend of $0.51 per share, up 13% YoY . Issued $2.0 billion of Non-Cumulative Perpetual Class A 1Q19 2Q19 3Q19 4Q19 1Q20 Preferred Stock, Series Z Estimated . Redeemed the remaining $1.8 billion of our Fixed-to- Floating Rate Non-Cumulative Perpetual Class A Preferred Stock, Series K . Redeemed $668 million of our Non-Cumulative Perpetual Class A Preferred Stock, Series T Total Loss Absorbing Capacity (TLAC) Update . As of 3/31/20, our eligible external TLAC as a percentage of total risk-weighted assets was 23.2% (2) compared with the required minimum of 22.0% (1) 1Q20 capital ratio is a preliminary estimate. See page 41 for additional information regarding the Common Equity Tier 1 capital ratio. (2) 1Q20 TLAC ratio is a preliminary estimate. Wells Fargo 1Q20 Supplement 33

Appendix

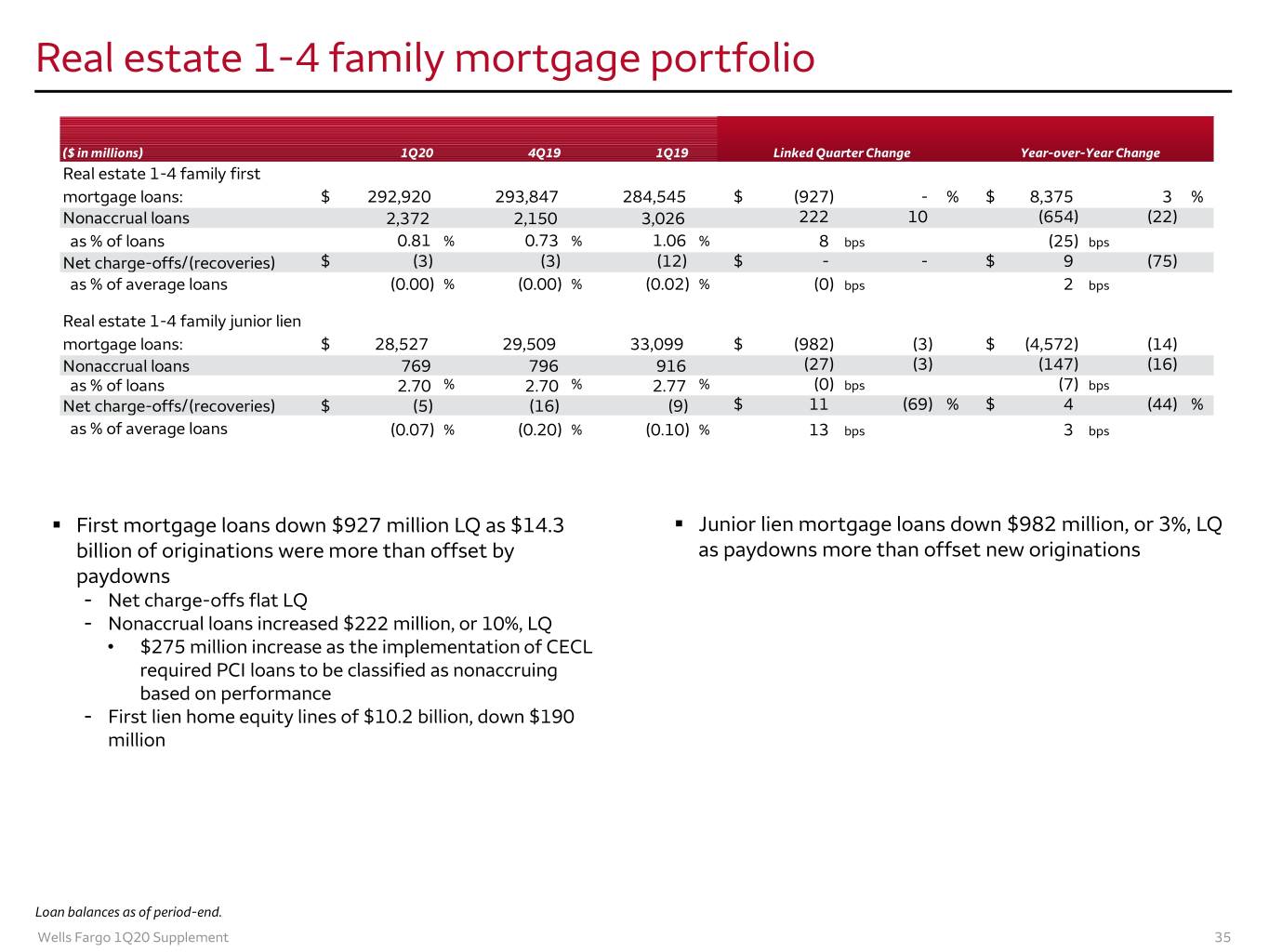

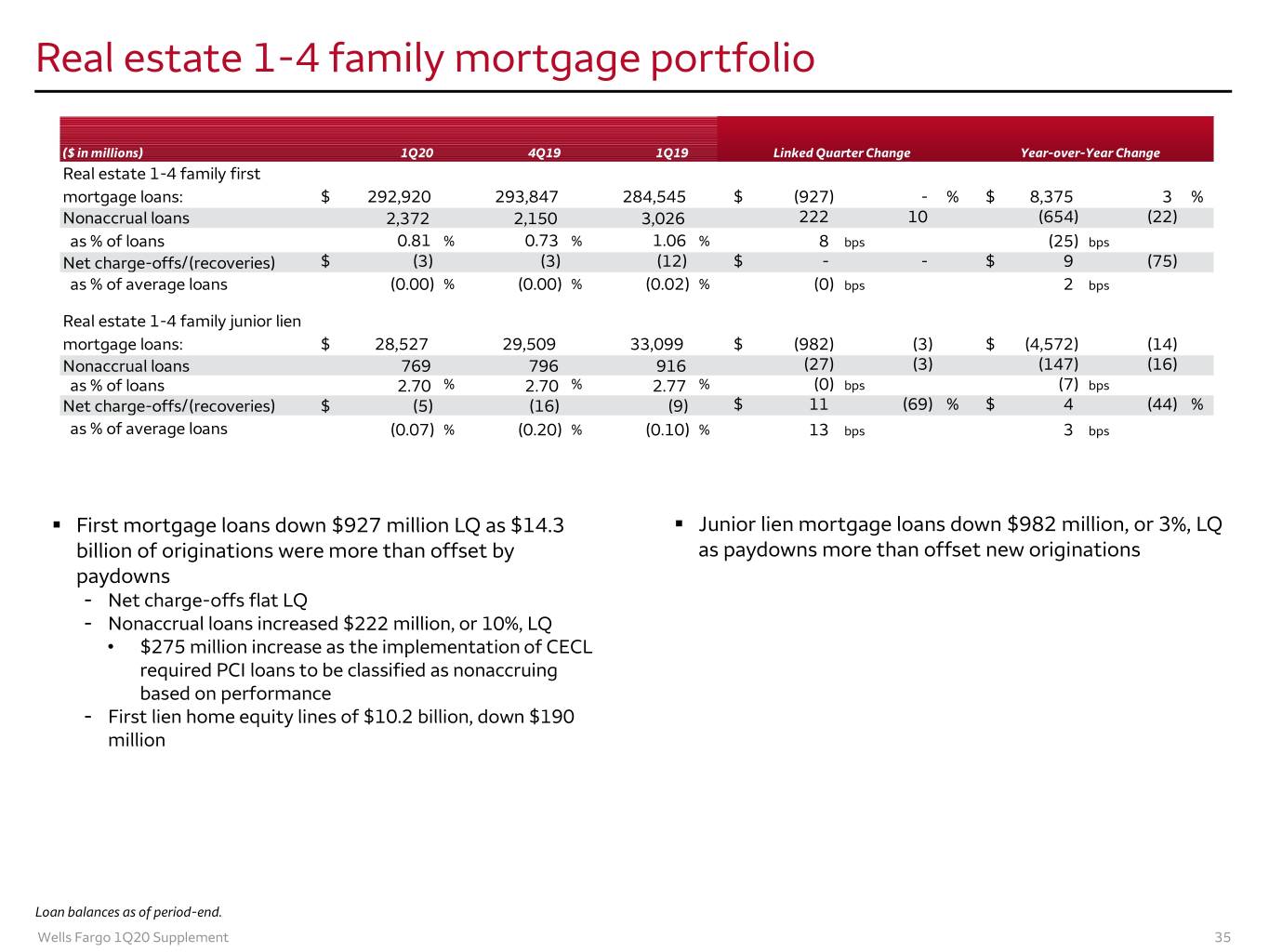

Real estate 1-4 family mortgage portfolio ($ in millions) 1Q20 4Q19 1Q19 Linked Quarter Change Year-over-Year Change Real estate 1-4 family first mortgage loans: $ 292,920 293,847 284,545 $ (927) - % $ 8,375 3 % Nonaccrual loans 2,372 2,150 3,026 222 10 (654) (22) as % of loans 0.81 % 0.73 % 1.06 % 8 bps (25) bps Net charge-offs/(recoveries) $ (3) (3) (12) $ - - $ 9 (75) as % of average loans (0.00) % (0.00) % (0.02) % (0) bps 2 bps Real estate 1-4 family junior lien mortgage loans: $ 28,527 29,509 33,099 $ (982) (3) $ (4,572) (14) Nonaccrual loans 769 796 916 (27) (3) (147) (16) as % of loans 2.70 % 2.70 % 2.77 % (0) bps (7) bps Net charge-offs/(recoveries) $ (5) (16) (9) $ 11 (69) % $ 4 (44) % as % of average loans (0.07) % (0.20) % (0.10) % 13 bps 3 bps . First mortgage loans down $927 million LQ as $14.3 . Junior lien mortgage loans down $982 million, or 3%, LQ billion of originations were more than offset by as paydowns more than offset new originations paydowns - Net charge-offs flat LQ - Nonaccrual loans increased $222 million, or 10%, LQ • $275 million increase as the implementation of CECL required PCI loans to be classified as nonaccruing based on performance - First lien home equity lines of $10.2 billion, down $190 million Loan balances as of period-end. Wells Fargo 1Q20 Supplement 35

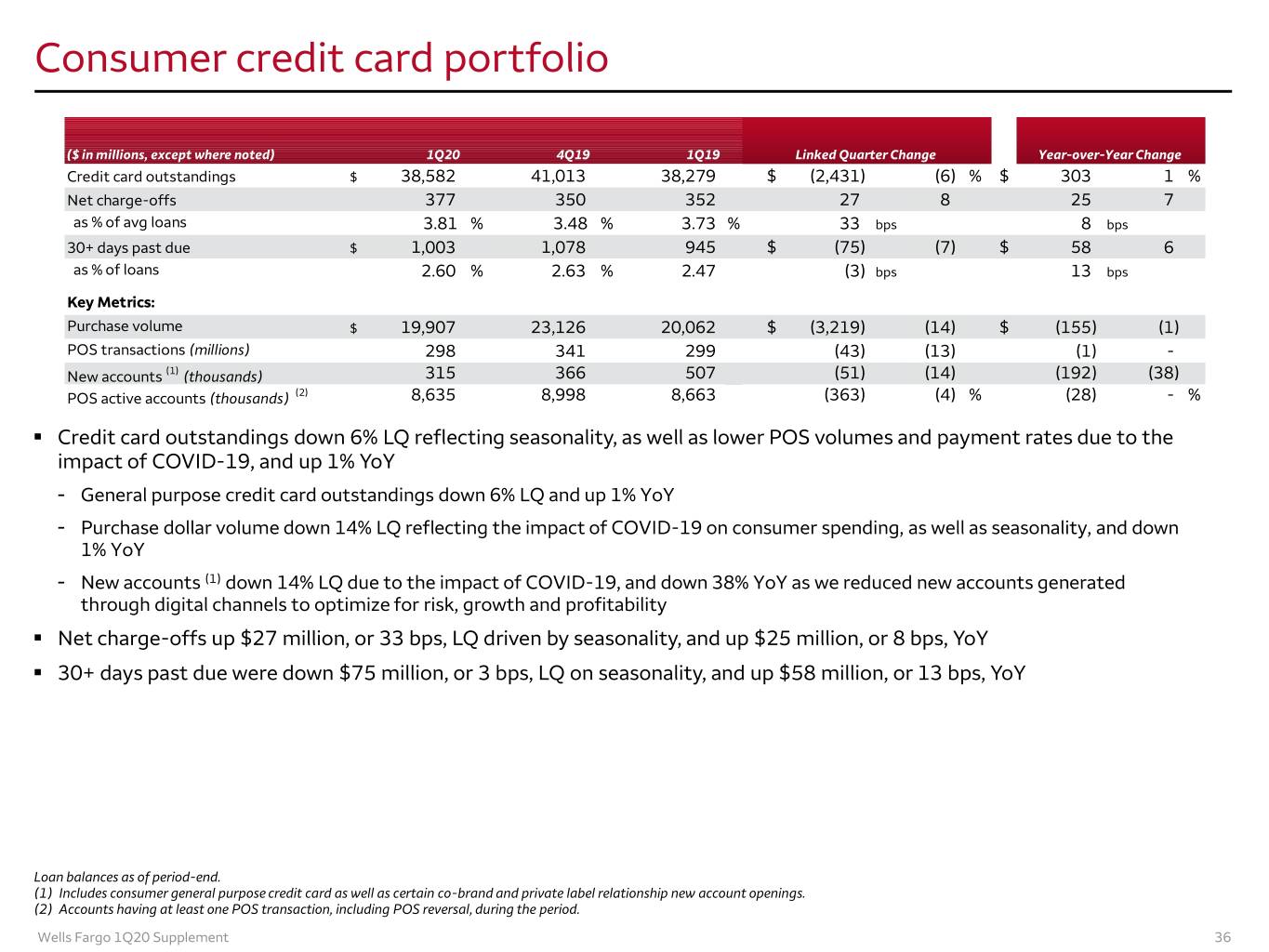

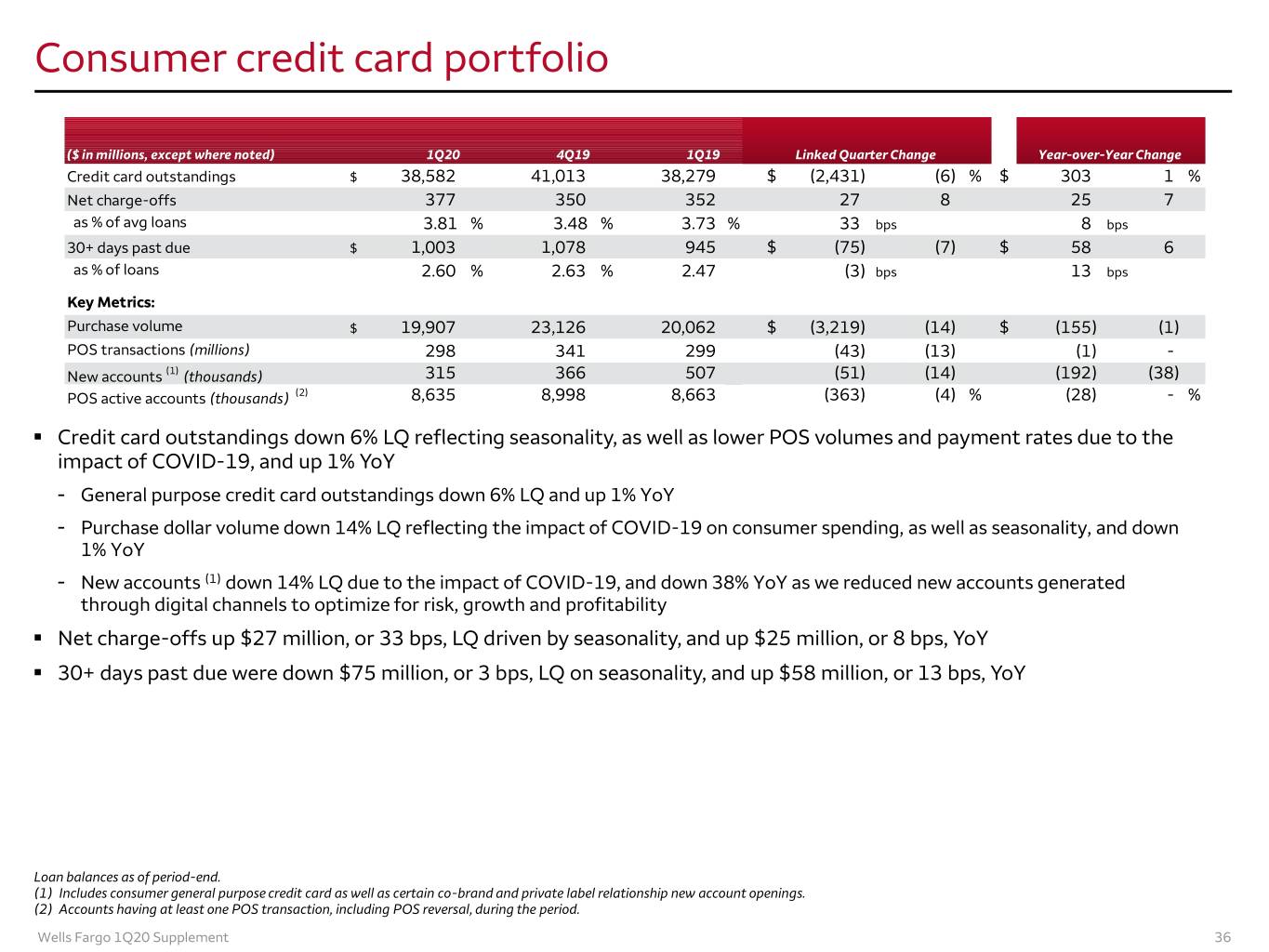

Consumer credit card portfolio ($ in millions, except where noted) 1Q20 4Q19 1Q19 Linked Quarter Change Year-over-Year Change Credit card outstandings $ 38,582 41,013 38,279 $ (2,431) (6) % $ 303 1 % Net charge-offs 377 350 352 27 8 25 7 as % of avg loans 3.81 % 3.48 % 3.73 % 33 bps 8 bps 30+ days past due $ 1,003 1,078 945 $ (75) (7) $ 58 6 as % of loans 2.60 % 2.63 % 2.47 (3) bps 13 bps - Key Metrics: Purchase volume $ 19,907 23,126 20,062 $ (3,219) (14) $ (155) (1) POS transactions (millions) 298 341 299 (43) (13) (1) - New accounts (1) (thousands) 315 366 507 (51) (14) (192) (38) POS active accounts (thousands) (2) 8,635 8,998 8,663 (363) (4) % (28) - % . Credit card outstandings down 6% LQ reflecting seasonality, as well as lower POS volumes and payment rates due to the impact of COVID-19, and up 1% YoY - General purpose credit card outstandings down 6% LQ and up 1% YoY - Purchase dollar volume down 14% LQ reflecting the impact of COVID-19 on consumer spending, as well as seasonality, and down 1% YoY - New accounts (1) down 14% LQ due to the impact of COVID-19, and down 38% YoY as we reduced new accounts generated through digital channels to optimize for risk, growth and profitability . Net charge-offs up $27 million, or 33 bps, LQ driven by seasonality, and up $25 million, or 8 bps, YoY . 30+ days past due were down $75 million, or 3 bps, LQ on seasonality, and up $58 million, or 13 bps, YoY Loan balances as of period-end. (1) Includes consumer general purpose credit card as well as certain co-brand and private label relationship new account openings. (2) Accounts having at least one POS transaction, including POS reversal, during the period. Wells Fargo 1Q20 Supplement 36

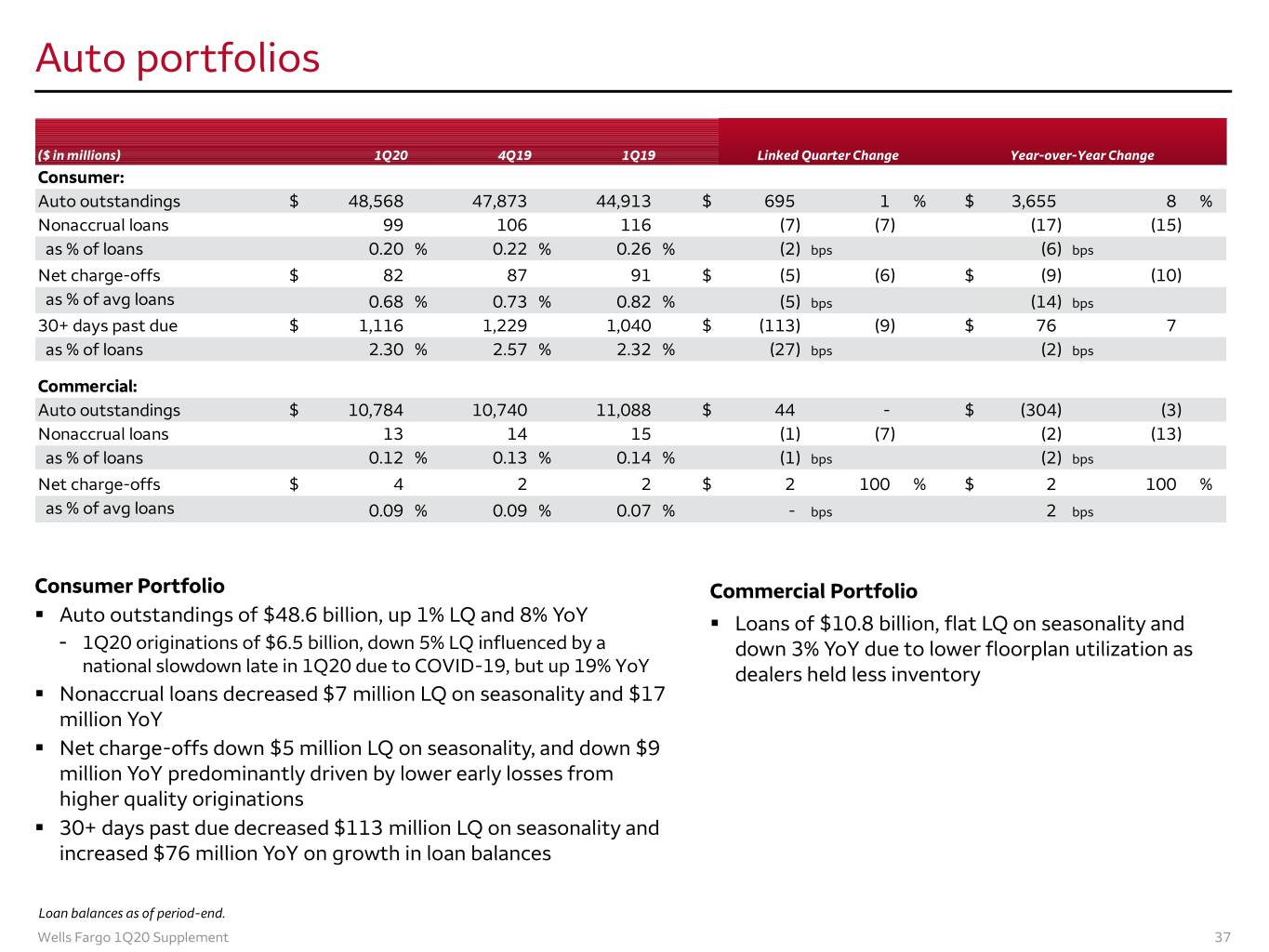

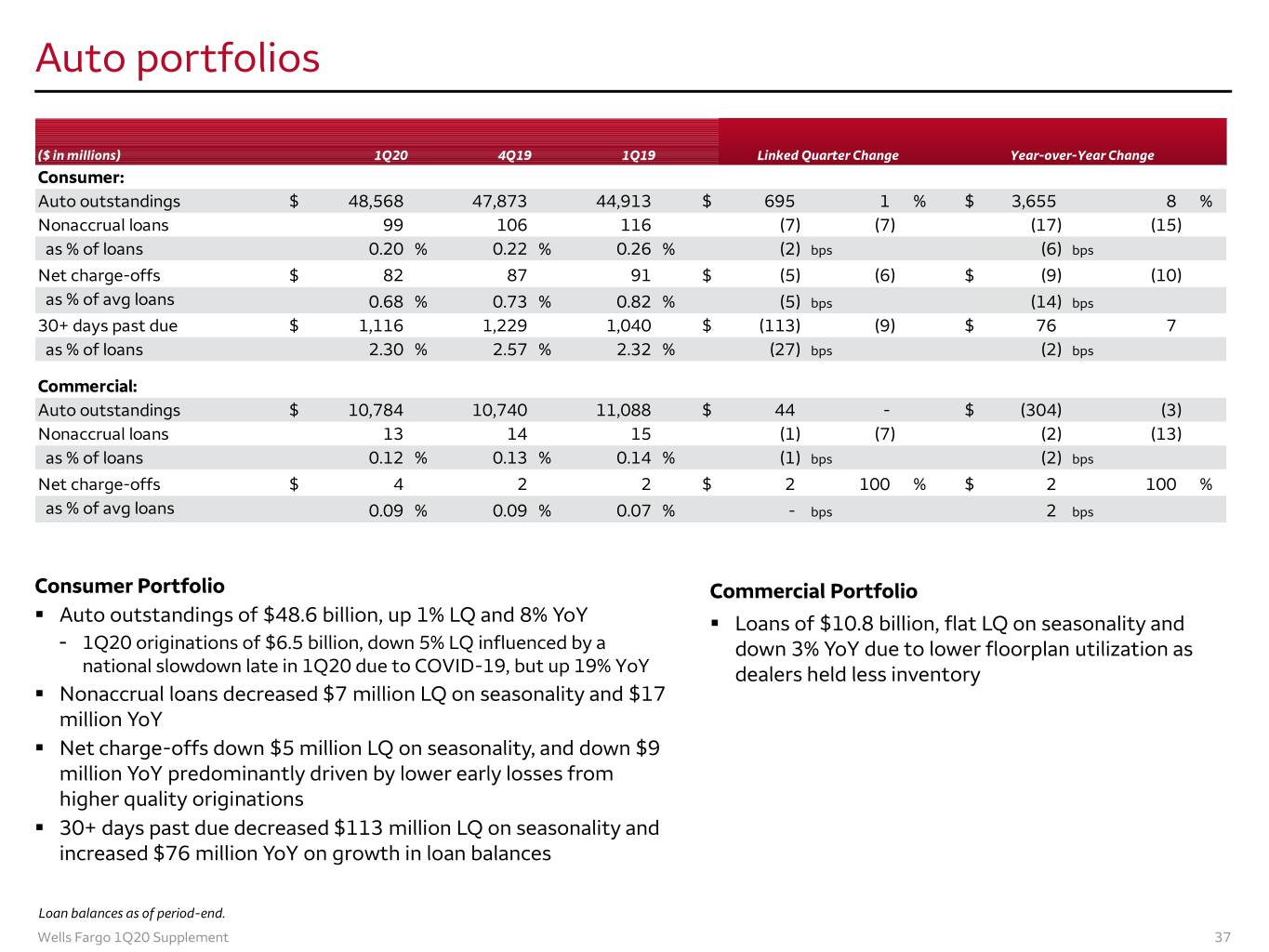

Auto portfolios ($ in millions) 1Q20 4Q19 1Q19 Linked Quarter Change Year-over-Year Change Consumer: Auto outstandings $ 48,568 47,873 44,913 $ 695 1 % $ 3,655 8 % Nonaccrual loans 99 106 116 (7) (7) (17) (15) as % of loans 0.20 % 0.22 % 0.26 % (2) bps (6) bps Net charge-offs $ 82 87 91 $ (5) (6) $ (9) (10) as % of avg loans 0.68 % 0.73 % 0.82 % (5) bps (14) bps 30+ days past due $ 1,116 1,229 1,040 $ (113) (9) $ 76 7 as % of loans 2.30 % 2.57 % 2.32 % (27) bps (2) bps Commercial: Auto outstandings $ 10,784 10,740 11,088 $ 44 - $ (304) (3) Nonaccrual loans 13 14 15 (1) (7) (2) (13) as % of loans 0.12 % 0.13 % 0.14 % (1) bps (2) bps Net charge-offs $ 4 2 2 $ 2 100 % $ 2 100 % as % of avg loans 0.09 % 0.09 % 0.07 % - bps 2 bps Consumer Portfolio Commercial Portfolio . Auto outstandings of $48.6 billion, up 1% LQ and 8% YoY . Loans of $10.8 billion, flat LQ on seasonality and - 1Q20 originations of $6.5 billion, down 5% LQ influenced by a down 3% YoY due to lower floorplan utilization as national slowdown late in 1Q20 due to COVID-19, but up 19% YoY dealers held less inventory . Nonaccrual loans decreased $7 million LQ on seasonality and $17 million YoY . Net charge-offs down $5 million LQ on seasonality, and down $9 million YoY predominantly driven by lower early losses from higher quality originations . 30+ days past due decreased $113 million LQ on seasonality and increased $76 million YoY on growth in loan balances Loan balances as of period-end. Wells Fargo 1Q20 Supplement 37

Student lending portfolio ($ in millions) 1Q20 4Q19 1Q19 Linked Quarter Change Year-over-Year Change Private outstandings $ 10,555 10,608 11,139 $ (53) - % $ (584) (5) % Net charge-offs 32 37 27 (5) (14) 5 19 as % of avg loans 1.21 % 1.38 % 0.94 % (17) bps 27 bps 30+ days past due $ 172 187 176 $ (15) (8) % $ (4) (2) % as % of loans 1.63 % 1.75 % 1.58 % (12) bps 5 bps . $10.6 billion private loan outstandings, flat LQ and down 5% YoY on higher paydowns - Average FICO of 761, and 84% of the total outstandings have been co-signed - Originations were flat YoY . Net charge-offs decreased $5 million LQ due to seasonality of repayments, and increased $5 million YoY . 30+ days past due decreased $15 million LQ and decreased $4 million YoY Loan balances as of period-end. Wells Fargo 1Q20 Supplement 38

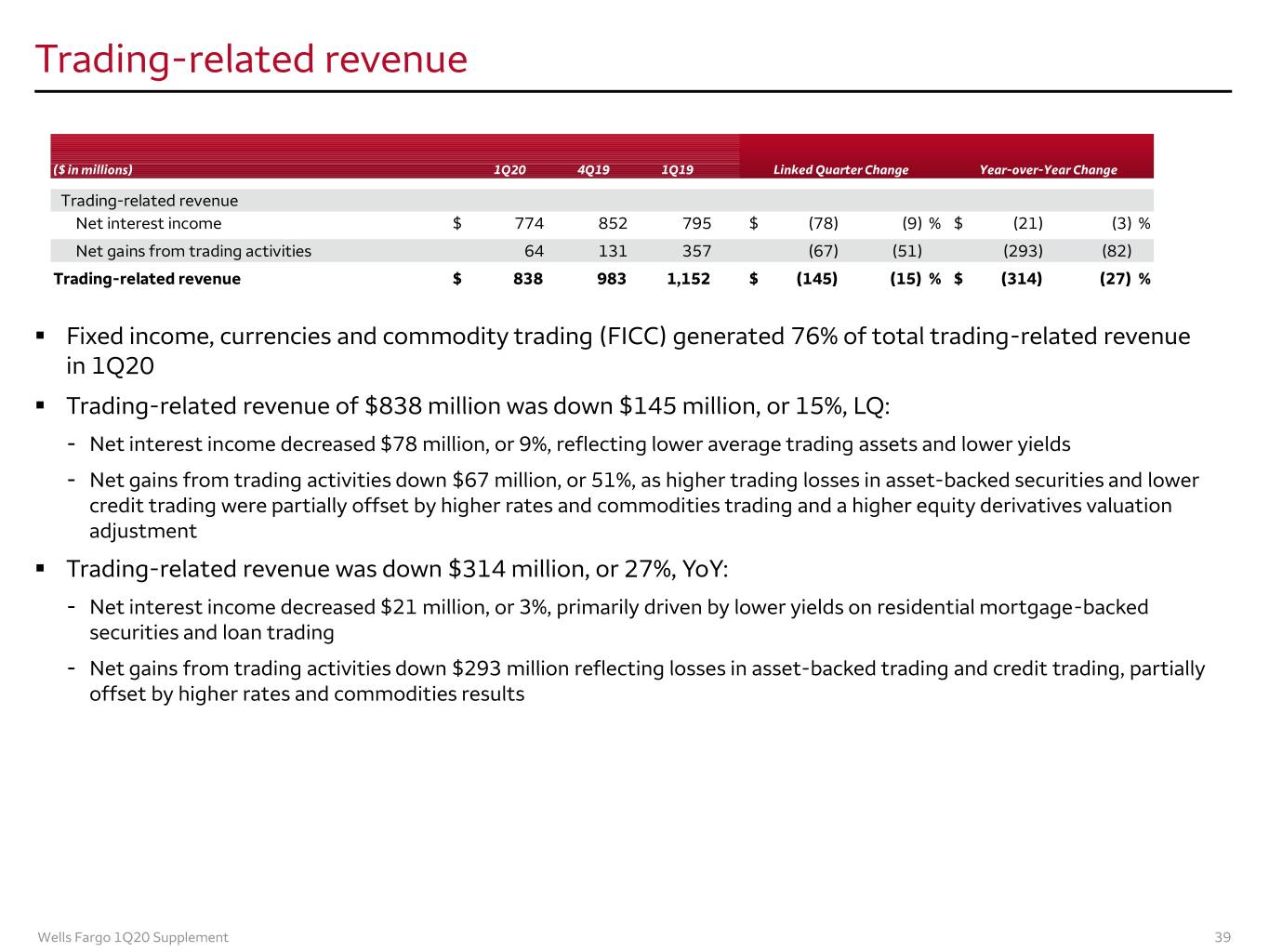

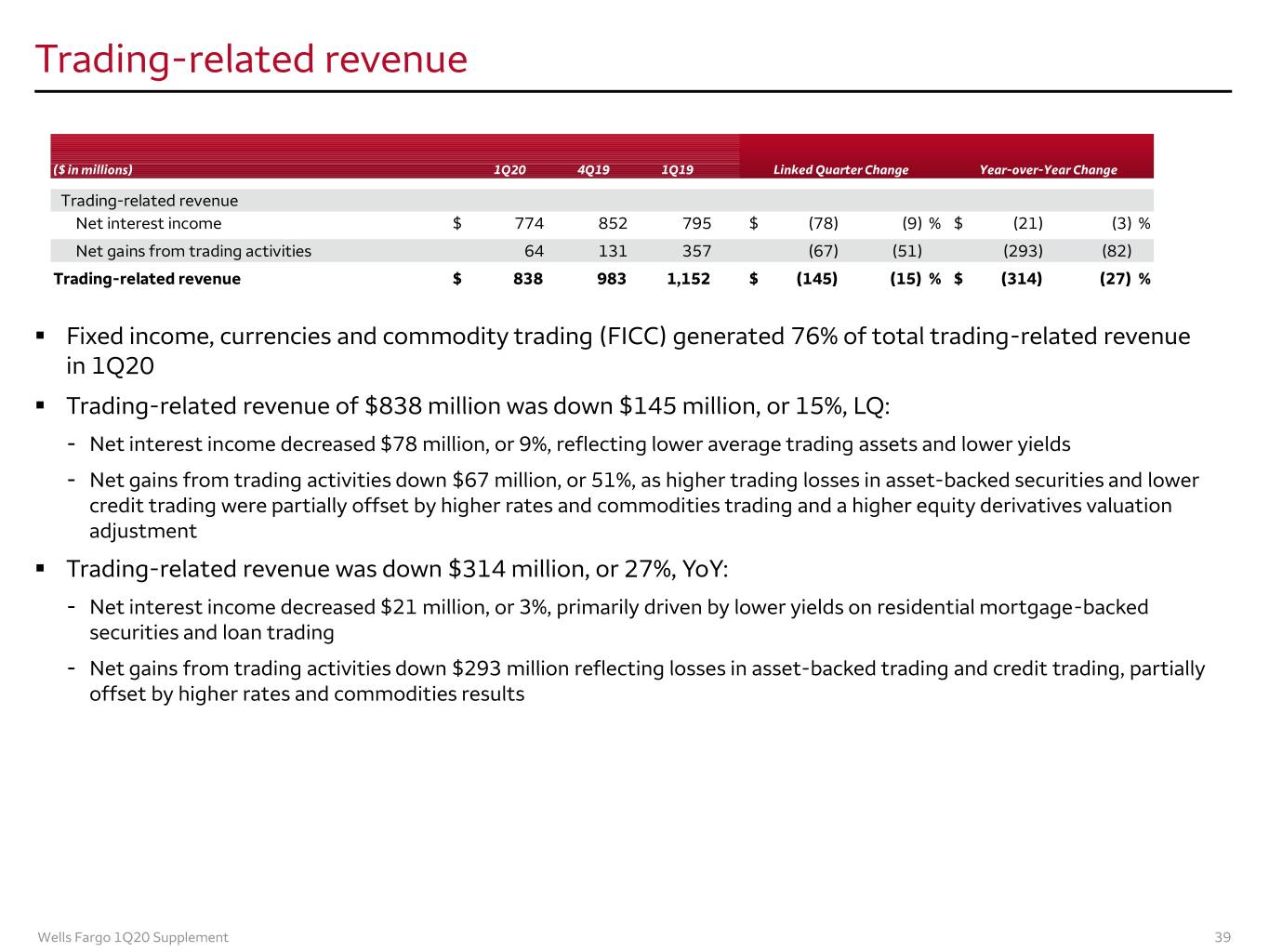

Trading-related revenue ($ in millions) 1Q20 4Q19 1Q19 Linked Quarter Change Year-over-Year Change Trading-related revenue Net interest income $ 774 852 795 $ (78) (9) % $ (21) (3) % Net gains from trading activities 64 131 357 (67) (51) (293) (82) Trading-related revenue $ 838 983 1,152 $ (145) (15) % $ (314) (27) % . Fixed income, currencies and commodity trading (FICC) generated 76% of total trading-related revenue in 1Q20 . Trading-related revenue of $838 million was down $145 million, or 15%, LQ: - Net interest income decreased $78 million, or 9%, reflecting lower average trading assets and lower yields - Net gains from trading activities down $67 million, or 51%, as higher trading losses in asset-backed securities and lower credit trading were partially offset by higher rates and commodities trading and a higher equity derivatives valuation adjustment . Trading-related revenue was down $314 million, or 27%, YoY: - Net interest income decreased $21 million, or 3%, primarily driven by lower yields on residential mortgage-backed securities and loan trading - Net gains from trading activities down $293 million reflecting losses in asset-backed trading and credit trading, partially offset by higher rates and commodities results Wells Fargo 1Q20 Supplement 39

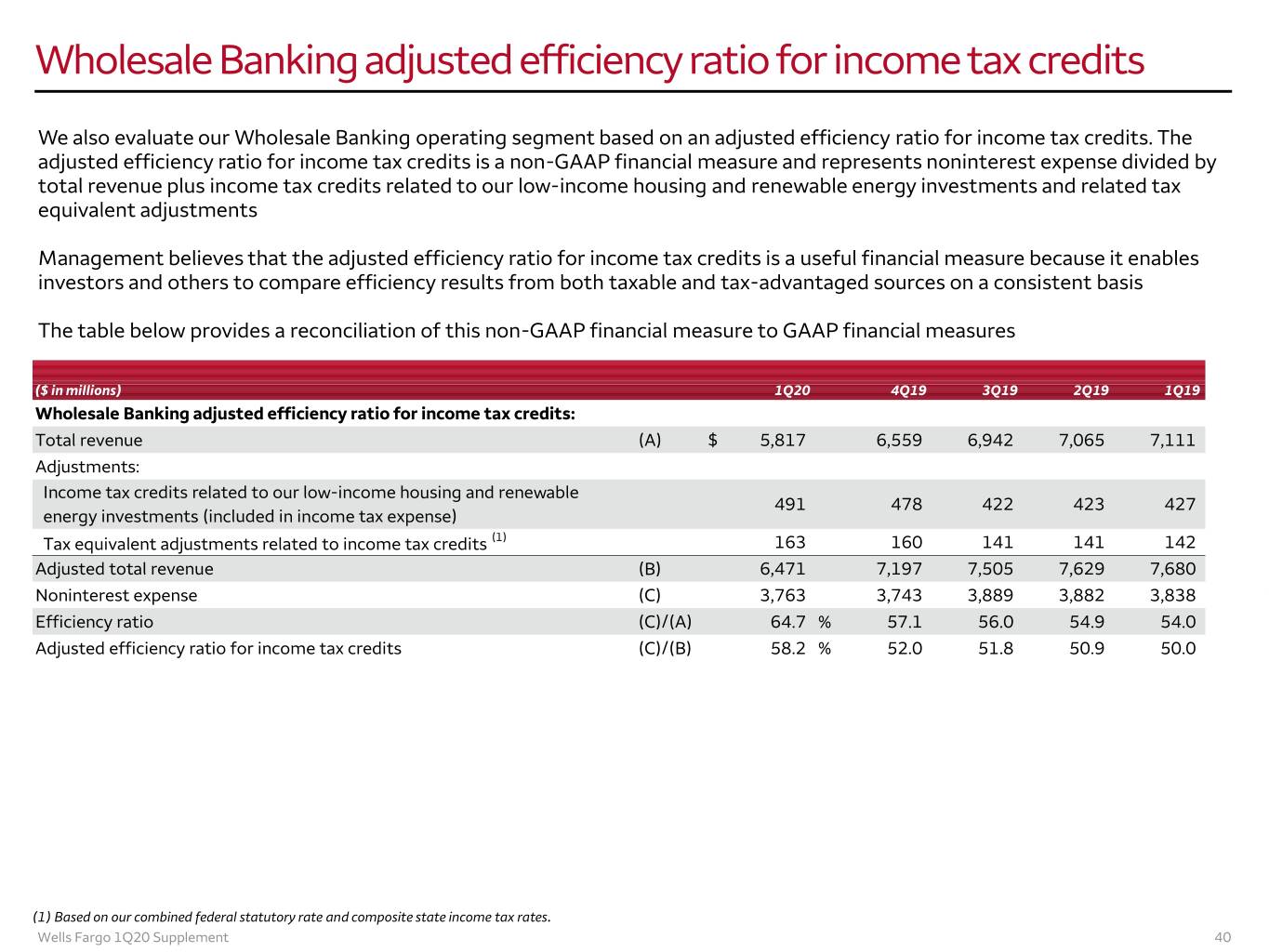

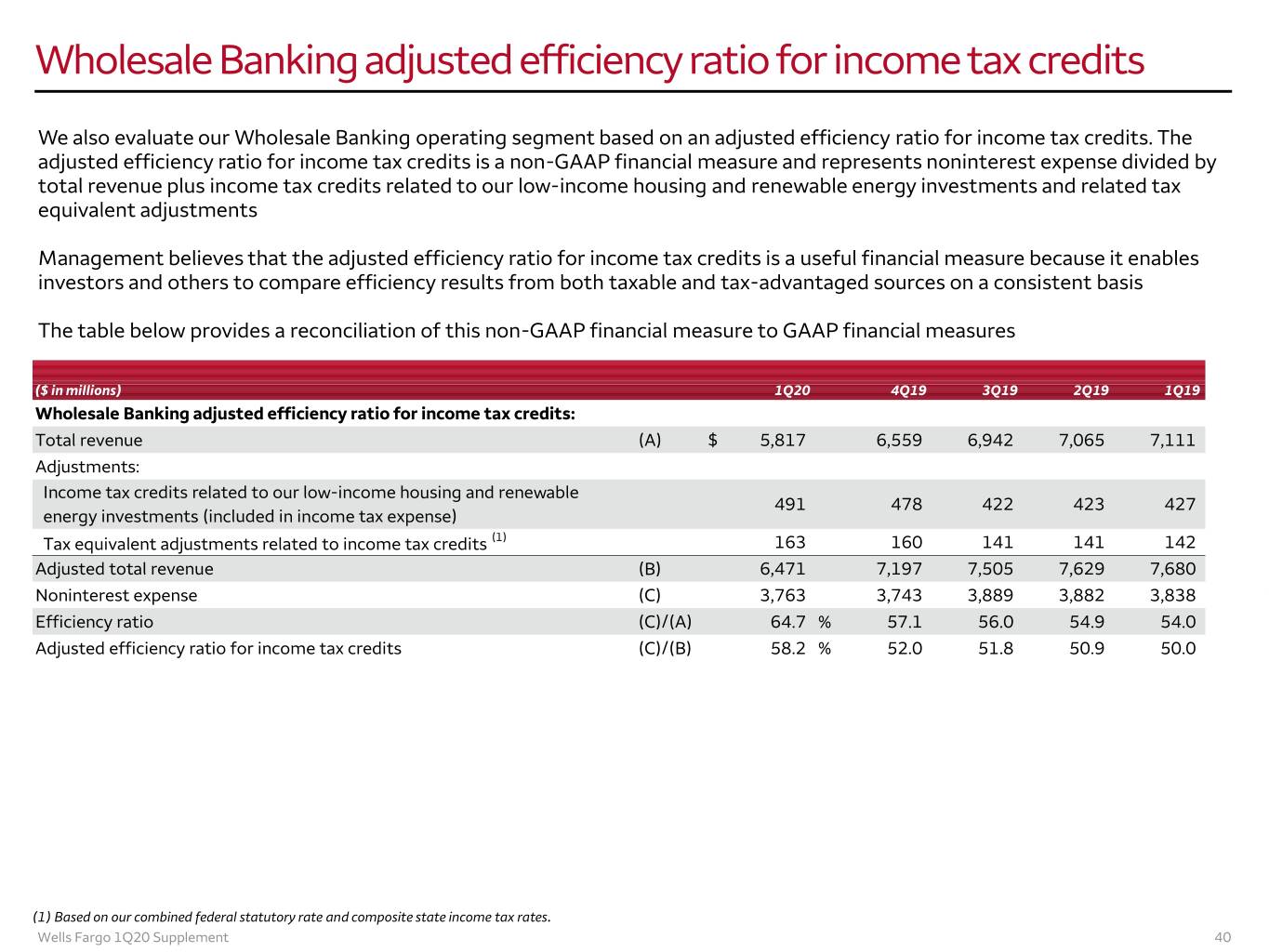

Wholesale Banking adjusted efficiency ratio for income tax credits We also evaluate our Wholesale Banking operating segment based on an adjusted efficiency ratio for income tax credits. The adjusted efficiency ratio for income tax credits is a non-GAAP financial measure and represents noninterest expense divided by total revenue plus income tax credits related to our low-income housing and renewable energy investments and related tax equivalent adjustments Management believes that the adjusted efficiency ratio for income tax credits is a useful financial measure because it enables investors and others to compare efficiency results from both taxable and tax-advantaged sources on a consistent basis The table below provides a reconciliation of this non-GAAP financial measure to GAAP financial measures ($ in millions) 1Q20 4Q19 3Q19 2Q19 1Q19 Wholesale Banking adjusted efficiency ratio for income tax credits: Total revenue (A) $ 5,817 6,559 6,942 7,065 7,111 Adjustments: Income tax credits related to our low-income housing and renewable 491 478 422 423 427 energy investments (included in income tax expense) Tax equivalent adjustments related to income tax credits (1) 163 160 141 141 142 Adjusted total revenue (B) 6,471 7,197 7,505 7,629 7,680 Noninterest expense (C) 3,763 3,743 3,889 3,882 3,838 Efficiency ratio (C)/(A) 64.7 % 57.1 56.0 54.9 54.0 Adjusted efficiency ratio for income tax credits (C)/(B) 58.2 % 52.0 51.8 50.9 50.0 (1) Based on our combined federal statutory rate and composite state income tax rates. Wells Fargo 1Q20 Supplement 40

Common Equity Tier 1 - 1 - Wells Fargo & Company and Subsidiaries COMMON EQUITY TIER 1 UNDER BASEL III (1) Estimated Mar 31, Dec 31, Sep 30, Jun 30, Mar 31, (in billions, except ratio) 2020 2019 2019 2019 2019 Total equity $ 183.3 188.0 194.4 200.0 198.7 Adjustments: Preferred stock (21.3 ) (21.5 ) (21.5 ) (23.0 ) (23.2 ) Additional paid-in capital on preferred stock 0.1 (0.1 ) (0.1 ) (0.1 ) (0.1 ) Unearned ESOP shares 1.1 1.1 1.1 1.3 1.5 Noncontrolling interests (0.6 ) (0.8 ) (1.1 ) (1.0 ) (0.9 ) Total common stockholders' equity 162.6 166.7 172.8 177.2 176.0 Adjustments: Goodwill (26.4 ) (26.4 ) (26.4 ) (26.4 ) (26.4 ) Certain identifiable intangible assets (other than MSRs) (0.4 ) (0.4 ) (0.5 ) (0.5 ) (0.5 ) Goodwill and other intangibles on nonmarketable equity securities (included in other assets) (1.9 ) (2.1 ) (2.3 ) (2.3 ) (2.1 ) Applicable deferred taxes related to goodwill and other intangible assets (2) 0.8 0.8 0.8 0.8 0.8 Other — 0.2 0.3 0.4 0.3 Common Equity Tier 1 under Basel III (A) 134.7 138.8 144.7 149.2 148.1 Total risk-weighted assets (RWAs) anticipated under Basel III (3)(4) (B) $ 1,264.7 1,245.8 1,246.2 1,246.7 1,243.1 Common Equity Tier 1 to total RWAs anticipated under Basel III (4) (A)/(B) 10.7 % 11.1 11.6 12.0 11.9 (1) Basel III capital rules, adopted by the Federal Reserve Board on July 2, 2013, revised the definition of capital, increased minimum capital ratios, and introduced a minimum Common Equity Tier 1 (CET1) ratio. The rules are being phased in through the end of 2021. The Basel III capital requirements for calculating CET1 and tier 1 capital, along with RWAs, are fully phased-in. (2) Determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period end. (3) The final Basel III capital rules provide for two capital frameworks: the Standardized Approach and the Advanced Approach applicable to certain institutions. Accordingly, in the assessment of our capital adequacy, we must report the lower of our CET1, tier 1 and total capital ratios calculated under the Standardized Approach and under the Advanced Approach. Because the final determination of our CET1 ratio and which approach will produce the lower CET1 ratio as of March 31, 2020, is subject to detailed analysis of considerable data, our CET1 ratio at that date has been estimated using the Basel III definition of capital under the Basel III Standardized Approach RWAs. The capital ratio for December 31, September 30, June 30 and March 31, 2019, was calculated under the Basel III Standardized Approach RWAs. (4) The Company’s March 31, 2020, RWAs and capital ratio are preliminary estimates. Wells Fargo 1Q20 Supplement 41

Forward-looking statements This document contains forward-looking statements. In addition, we may make forward-looking statements in our other documents filed or furnished with the SEC, and our management may make forward-looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements include, but are not limited to, statements we make about: (i) the future operating or financial performance of the Company, including our outlook for future growth; (ii) our noninterest expense and efficiency ratio; (iii) future credit quality and performance, including our expectations regarding future loan losses and our allowance for credit losses; (iv) the appropriateness of the allowance for credit losses; (v) our expectations regarding net interest income and net interest margin; (vi) loan growth or the reduction or mitigation of risk in our loan portfolios; (vii) future capital or liquidity levels, ratios or targets; (viii) the performance of our mortgage business and any related exposures; (ix) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; (x) future common stock dividends, common share repurchases and other uses of capital; (xi) our targeted range for return on assets, return on equity, and return on tangible common equity; (xii) expectations regarding our effective income tax rate; (xiii) the outcome of contingencies, such as legal proceedings; and (xiv) the Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For more information about factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements” discussion in Wells Fargo’s press release announcing our first quarter 2020 results and in our most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, as supplemented by our Current Report on Form 8-K filed on April 14, 2020. Wells Fargo 1Q20 Supplement 42