© 2022 Wells Fargo Bank, N.A. All rights reserved. 2Q22 Financial Results July 15, 2022 Exhibit 99.3

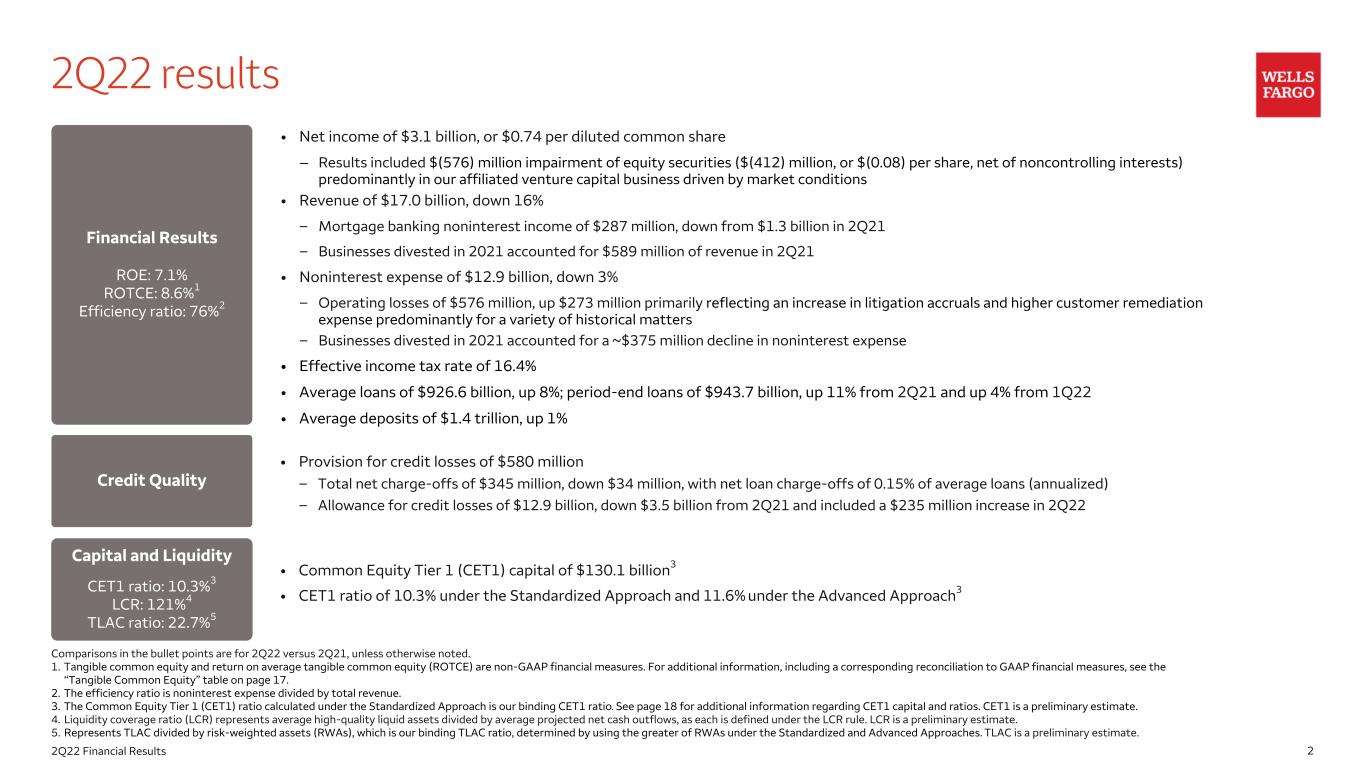

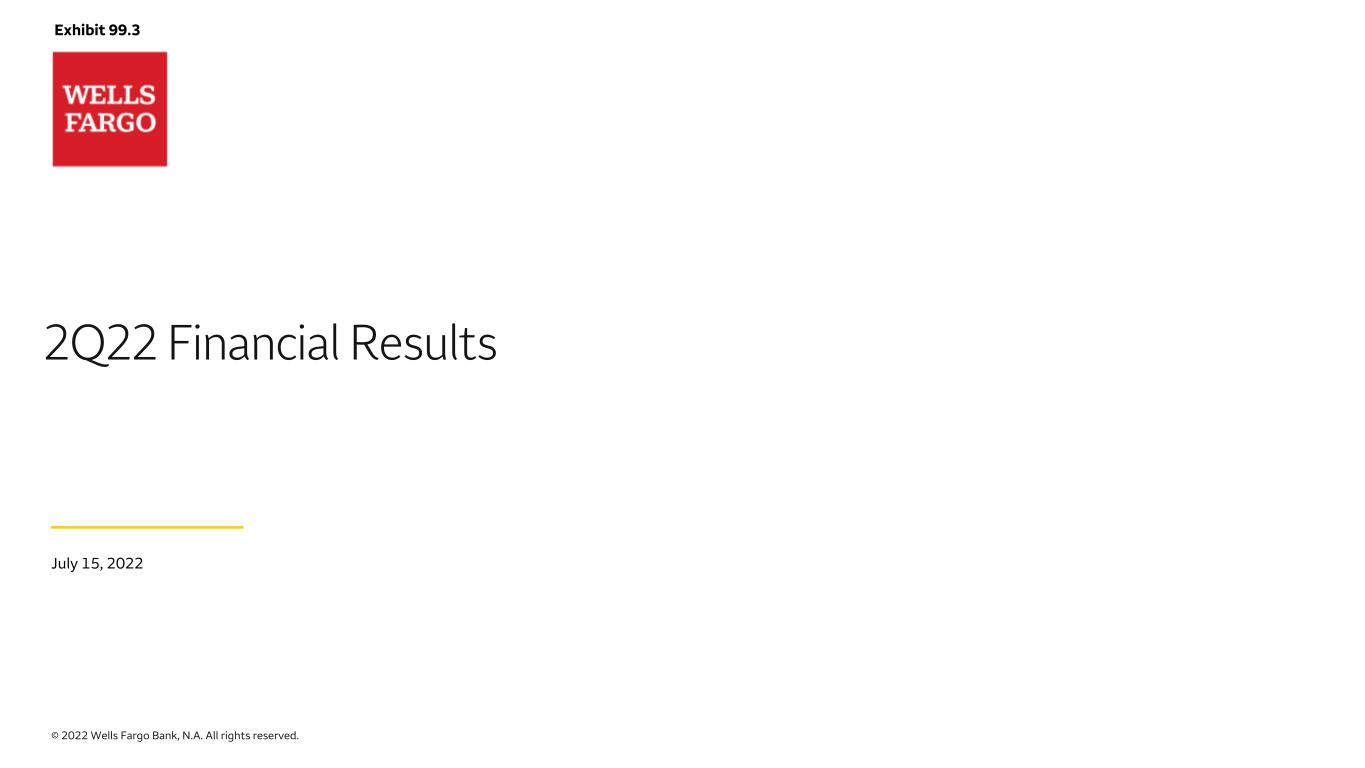

22Q22 Financial Results 2Q22 results Financial Results ROE: 7.1% ROTCE: 8.6%1 Efficiency ratio: 76%2 Credit Quality Capital and Liquidity CET1 ratio: 10.3%3 LCR: 121%4 TLAC ratio: 22.7%5 • Provision for credit losses of $580 million – Total net charge-offs of $345 million, down $34 million, with net loan charge-offs of 0.15% of average loans (annualized) – Allowance for credit losses of $12.9 billion, down $3.5 billion from 2Q21 and included a $235 million increase in 2Q22 • Common Equity Tier 1 (CET1) capital of $130.1 billion3 • CET1 ratio of 10.3% under the Standardized Approach and 11.6% under the Advanced Approach3 Comparisons in the bullet points are for 2Q22 versus 2Q21, unless otherwise noted. 1. Tangible common equity and return on average tangible common equity (ROTCE) are non-GAAP financial measures. For additional information, including a corresponding reconciliation to GAAP financial measures, see the “Tangible Common Equity” table on page 17. 2. The efficiency ratio is noninterest expense divided by total revenue. 3. The Common Equity Tier 1 (CET1) ratio calculated under the Standardized Approach is our binding CET1 ratio. See page 18 for additional information regarding CET1 capital and ratios. CET1 is a preliminary estimate. 4. Liquidity coverage ratio (LCR) represents average high-quality liquid assets divided by average projected net cash outflows, as each is defined under the LCR rule. LCR is a preliminary estimate. 5. Represents TLAC divided by risk-weighted assets (RWAs), which is our binding TLAC ratio, determined by using the greater of RWAs under the Standardized and Advanced Approaches. TLAC is a preliminary estimate. • Net income of $3.1 billion, or $0.74 per diluted common share – Results included $(576) million impairment of equity securities ($(412) million, or $(0.08) per share, net of noncontrolling interests) predominantly in our affiliated venture capital business driven by market conditions • Revenue of $17.0 billion, down 16% – Mortgage banking noninterest income of $287 million, down from $1.3 billion in 2Q21 – Businesses divested in 2021 accounted for $589 million of revenue in 2Q21 • Noninterest expense of $12.9 billion, down 3% – Operating losses of $576 million, up $273 million primarily reflecting an increase in litigation accruals and higher customer remediation expense predominantly for a variety of historical matters – Businesses divested in 2021 accounted for a ~$375 million decline in noninterest expense • Effective income tax rate of 16.4% • Average loans of $926.6 billion, up 8%; period-end loans of $943.7 billion, up 11% from 2Q21 and up 4% from 1Q22 • Average deposits of $1.4 trillion, up 1%

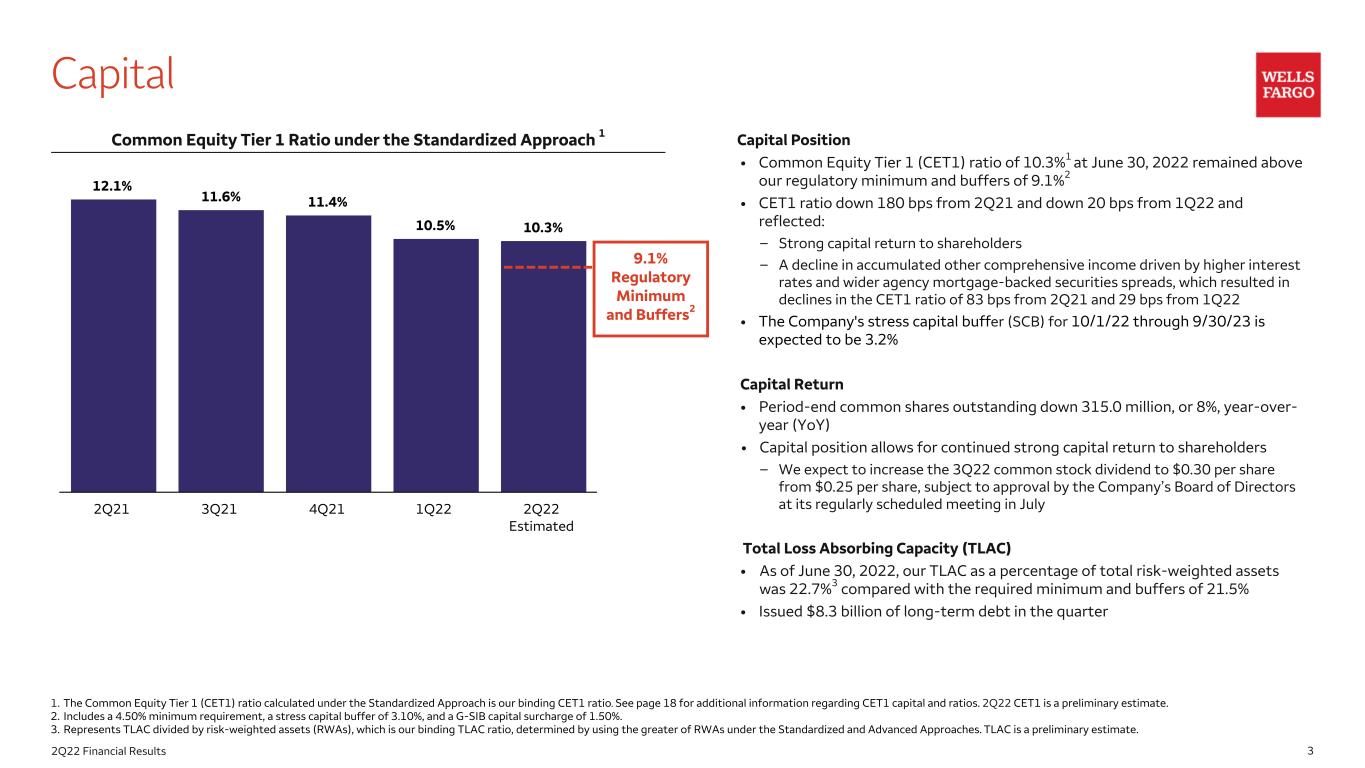

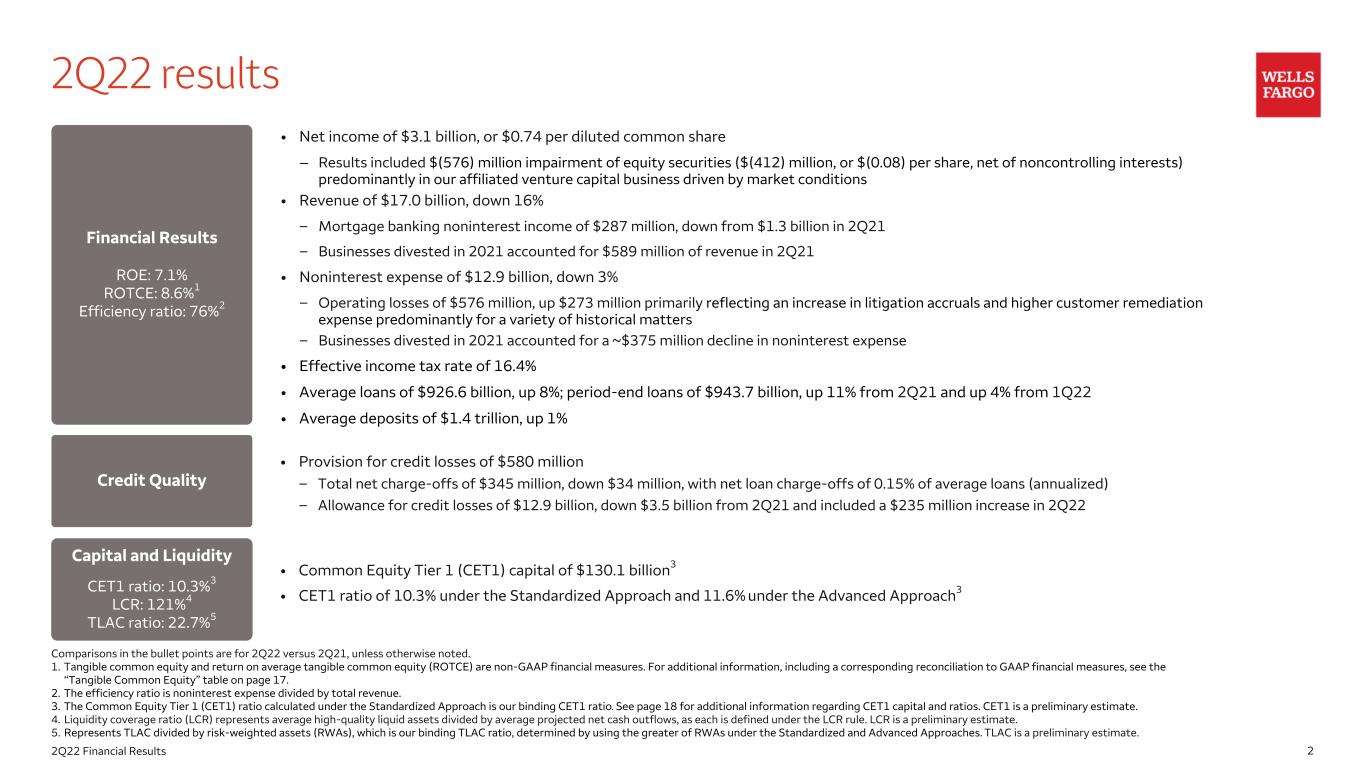

32Q22 Financial Results Capital Capital Position • Common Equity Tier 1 (CET1) ratio of 10.3%1 at June 30, 2022 remained above our regulatory minimum and buffers of 9.1%2 • CET1 ratio down 180 bps from 2Q21 and down 20 bps from 1Q22 and reflected: – Strong capital return to shareholders – A decline in accumulated other comprehensive income driven by higher interest rates and wider agency mortgage-backed securities spreads, which resulted in declines in the CET1 ratio of 83 bps from 2Q21 and 29 bps from 1Q22 • The Company's stress capital buffer (SCB) for 10/1/22 through 9/30/23 is expected to be 3.2% Capital Return • Period-end common shares outstanding down 315.0 million, or 8%, year-over- year (YoY) • Capital position allows for continued strong capital return to shareholders – We expect to increase the 3Q22 common stock dividend to $0.30 per share from $0.25 per share, subject to approval by the Company’s Board of Directors at its regularly scheduled meeting in July Total Loss Absorbing Capacity (TLAC) • As of June 30, 2022, our TLAC as a percentage of total risk-weighted assets was 22.7%3 compared with the required minimum and buffers of 21.5% • Issued $8.3 billion of long-term debt in the quarter Common Equity Tier 1 Ratio under the Standardized Approach 1 12.1% 11.6% 11.4% 10.5% 10.3% 2Q21 3Q21 4Q21 1Q22 2Q22 Estimated 1. The Common Equity Tier 1 (CET1) ratio calculated under the Standardized Approach is our binding CET1 ratio. See page 18 for additional information regarding CET1 capital and ratios. 2Q22 CET1 is a preliminary estimate. 2. Includes a 4.50% minimum requirement, a stress capital buffer of 3.10%, and a G-SIB capital surcharge of 1.50%. 3. Represents TLAC divided by risk-weighted assets (RWAs), which is our binding TLAC ratio, determined by using the greater of RWAs under the Standardized and Advanced Approaches. TLAC is a preliminary estimate. 9.1% Regulatory Minimum and Buffers2

42Q22 Financial Results 2Q22 earnings 1. Tangible common equity and return on average tangible common equity are non-GAAP financial measures. For additional information, including a corresponding reconciliation to GAAP financial measures, see the “Tangible Common Equity” table on page 17. $ in millions (mm), except per share data 2Q22 1Q22 2Q21 vs. 1Q22 vs. 2Q21 Net interest income $10,198 9,221 8,800 $977 1,398 Noninterest income 6,830 8,371 11,470 (1,541) (4,640) Total revenue 17,028 17,592 20,270 (564) (3,242) Net charge-offs 345 305 379 40 (34) Change in the allowance for credit losses 235 (1,092) (1,639) 1,327 1,874 Provision for credit losses 580 (787) (1,260) 1,367 1,840 Noninterest expense 12,883 13,870 13,341 (987) (458) Pre-tax income 3,565 4,509 8,189 (944) (4,624) Income tax expense 613 707 1,445 (94) (832) Effective income tax rate (%) 16.4 % 16.1 19.3 28 bps (288) Net income $3,119 3,671 6,040 ($552) (2,921) Diluted earnings per common share $0.74 0.88 1.38 ($0.14) (0.64) Diluted average common shares (# mm) 3,819.6 3,868.9 4,156.1 (49) (337) Return on equity (ROE) 7.1 % 8.4 13.6 (121) bps (643) Return on average tangible common equity (ROTCE)1 8.6 10.0 16.3 (141) (767) Efficiency ratio 76 79 66 (318) 984

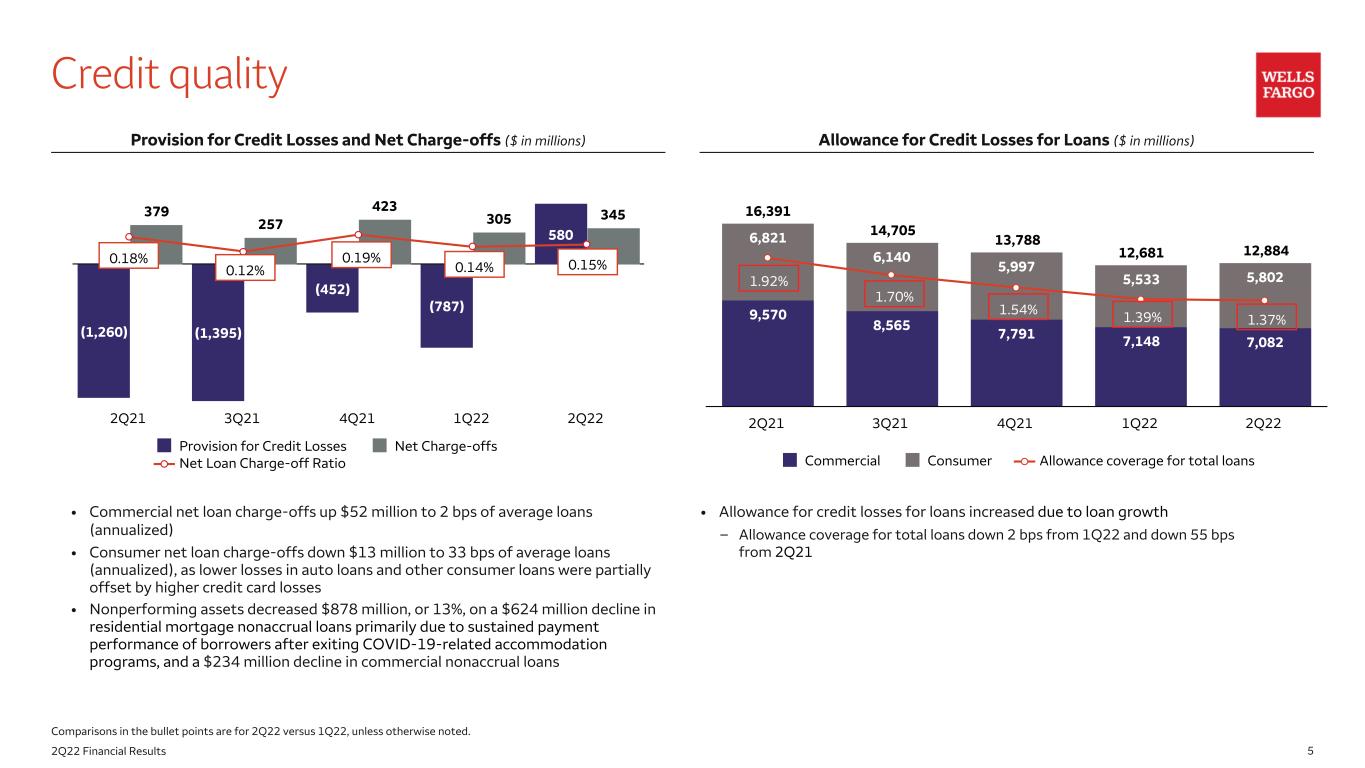

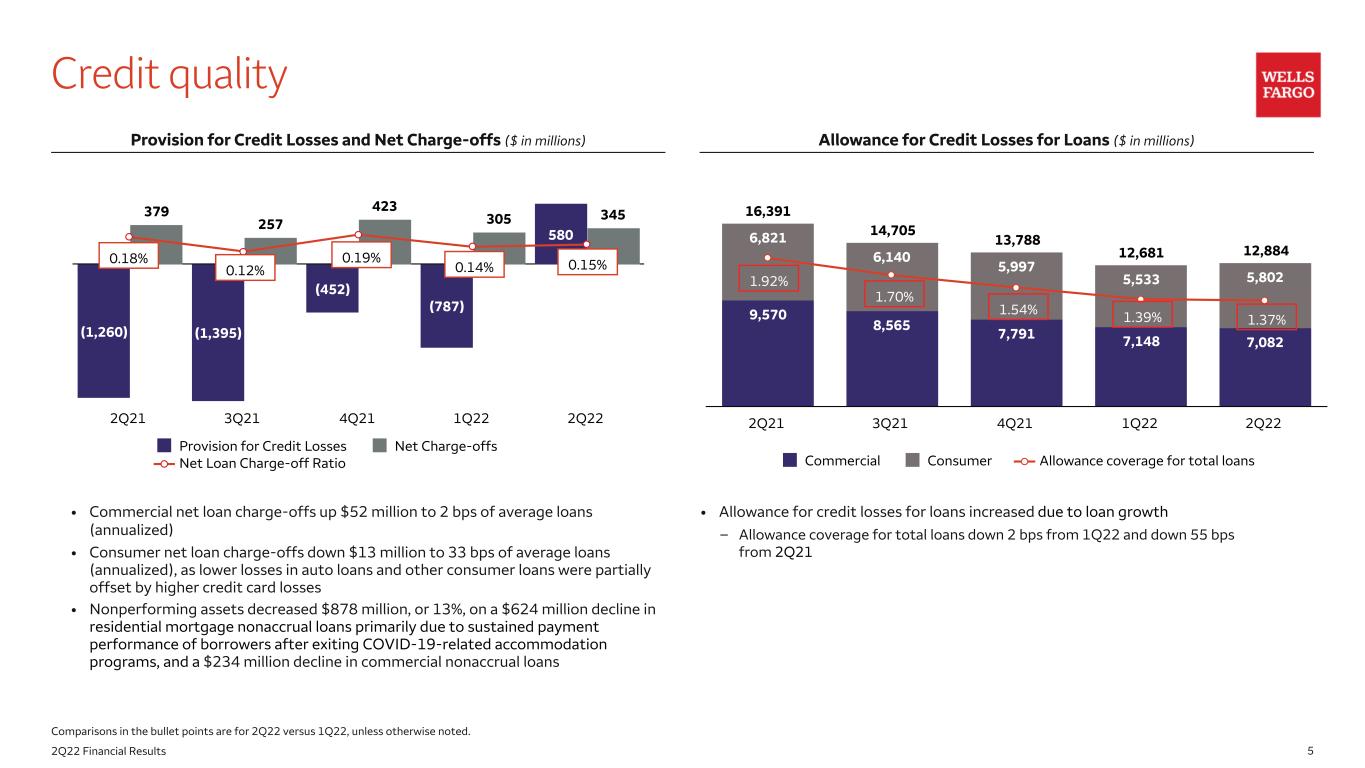

52Q22 Financial Results Credit quality • Commercial net loan charge-offs up $52 million to 2 bps of average loans (annualized) • Consumer net loan charge-offs down $13 million to 33 bps of average loans (annualized), as lower losses in auto loans and other consumer loans were partially offset by higher credit card losses • Nonperforming assets decreased $878 million, or 13%, on a $624 million decline in residential mortgage nonaccrual loans primarily due to sustained payment performance of borrowers after exiting COVID-19-related accommodation programs, and a $234 million decline in commercial nonaccrual loans Provision for Credit Losses and Net Charge-offs ($ in millions) Allowance for Credit Losses for Loans ($ in millions) • Allowance for credit losses for loans increased due to loan growth – Allowance coverage for total loans down 2 bps from 1Q22 and down 55 bps from 2Q21 Comparisons in the bullet points are for 2Q22 versus 1Q22, unless otherwise noted. (1,260) (1,395) (452) (787) 580 379 257 423 305 345 Provision for Credit Losses Net Charge-offs Net Loan Charge-off Ratio 2Q21 3Q21 4Q21 1Q22 2Q22 16,391 14,705 13,788 12,681 12,884 9,570 8,565 7,791 7,148 7,082 6,821 6,140 5,997 5,533 5,802 Commercial Consumer Allowance coverage for total loans 2Q21 3Q21 4Q21 1Q22 2Q22 0.18% 0.12% 0.14% 0.19% 0.15% 1.70% 1.92% 1.54% 1.39% 1.37%

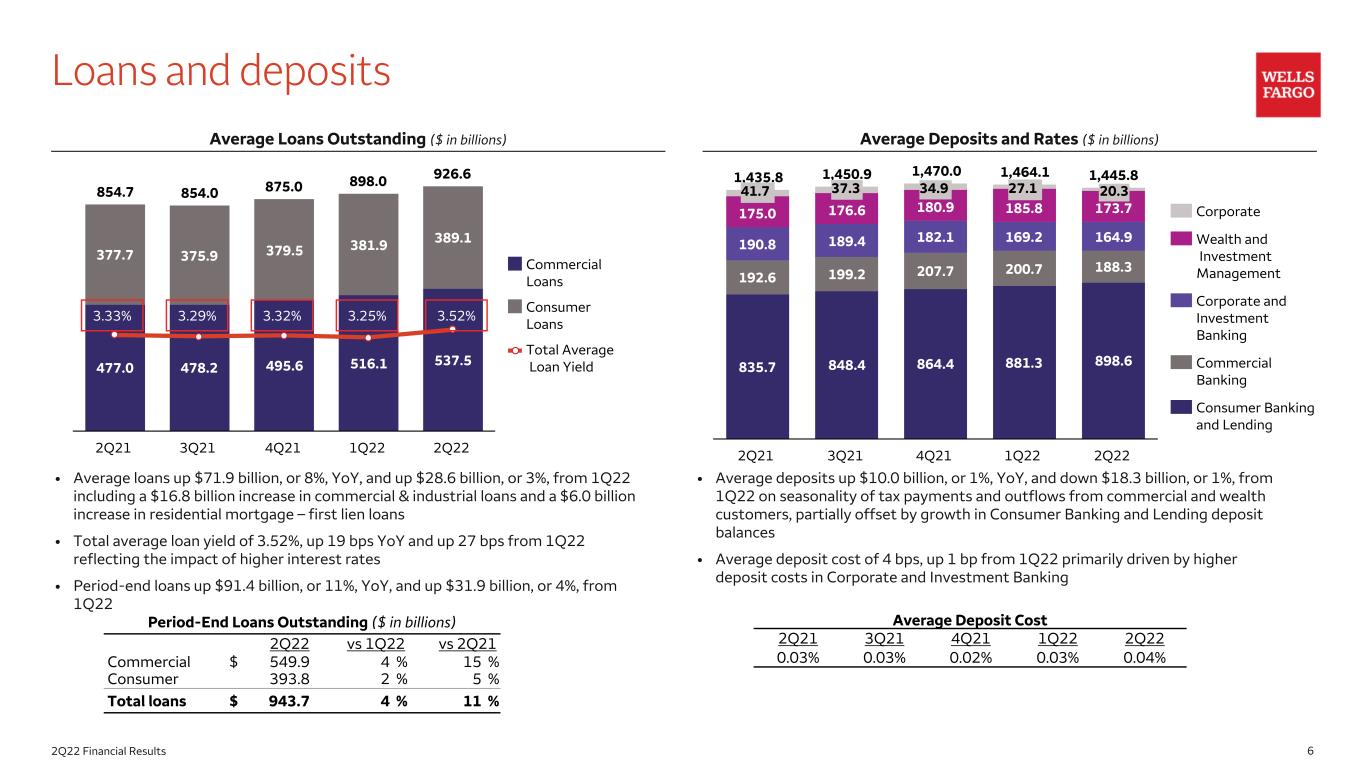

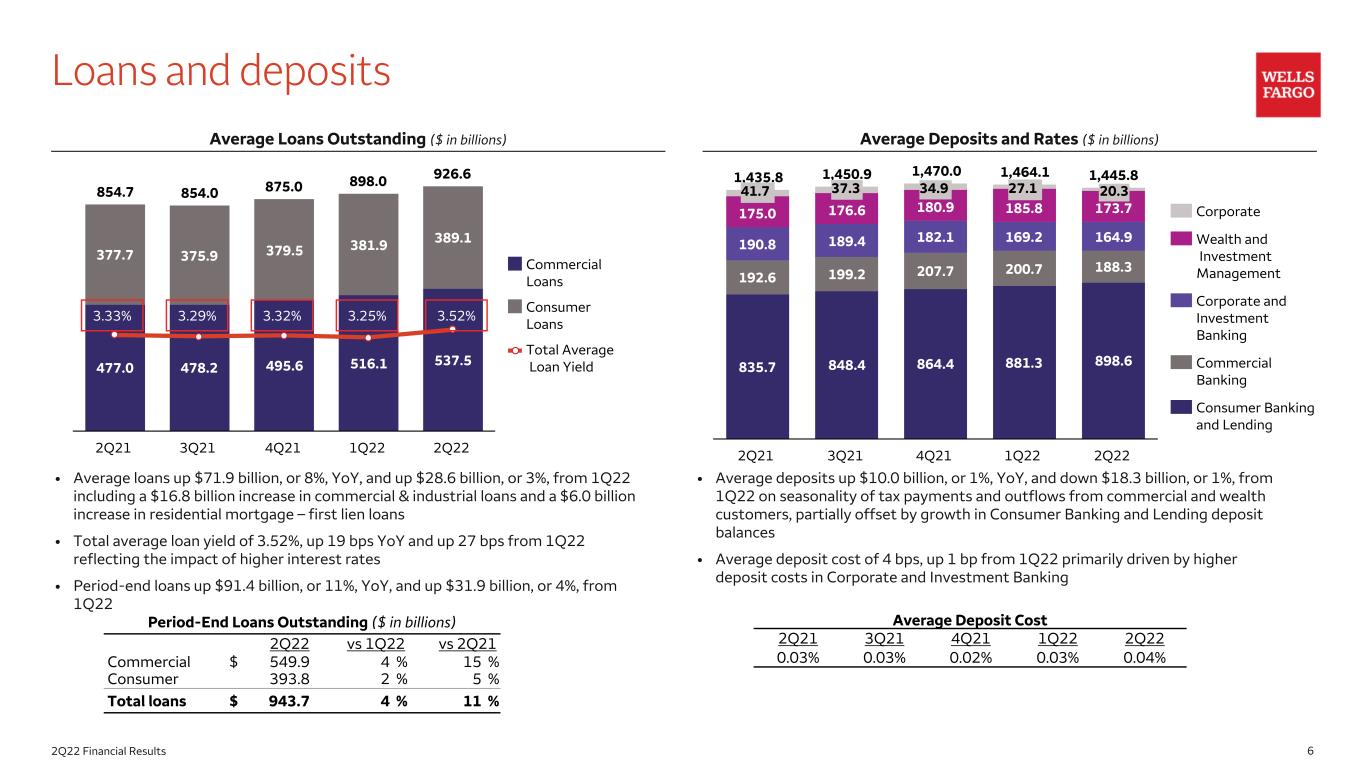

62Q22 Financial Results Loans and deposits • Average loans up $71.9 billion, or 8%, YoY, and up $28.6 billion, or 3%, from 1Q22 including a $16.8 billion increase in commercial & industrial loans and a $6.0 billion increase in residential mortgage – first lien loans • Total average loan yield of 3.52%, up 19 bps YoY and up 27 bps from 1Q22 reflecting the impact of higher interest rates • Period-end loans up $91.4 billion, or 11%, YoY, and up $31.9 billion, or 4%, from 1Q22 • Average deposits up $10.0 billion, or 1%, YoY, and down $18.3 billion, or 1%, from 1Q22 on seasonality of tax payments and outflows from commercial and wealth customers, partially offset by growth in Consumer Banking and Lending deposit balances • Average deposit cost of 4 bps, up 1 bp from 1Q22 primarily driven by higher deposit costs in Corporate and Investment Banking Average Loans Outstanding ($ in billions) Average Deposits and Rates ($ in billions) 854.7 854.0 875.0 898.0 926.6 477.0 478.2 495.6 516.1 537.5 377.7 375.9 379.5 381.9 389.1 Commercial Loans Consumer Loans Total Average Loan Yield 2Q21 3Q21 4Q21 1Q22 2Q22 1,435.8 1,450.9 1,470.0 1,464.1 1,445.8 835.7 848.4 864.4 881.3 898.6 192.6 199.2 207.7 200.7 188.3 190.8 189.4 182.1 169.2 164.9 175.0 176.6 180.9 185.8 173.7 Corporate Wealth and Investment Management Corporate and Investment Banking Commercial Banking Consumer Banking and Lending 2Q21 3Q21 4Q21 1Q22 2Q22 3.33% 3.29% 3.32% 3.25% 3.52% Average Deposit Cost 2Q21 3Q21 4Q21 1Q22 2Q22 0.03% 0.03% 0.02% 0.03% 0.04% 20.327.134.937.341.7 Period-End Loans Outstanding ($ in billions) 2Q22 vs 1Q22 vs 2Q21 Commercial $ 549.9 4 % 15 % Consumer 393.8 2 % 5 % Total loans $ 943.7 4 % 11 %

72Q22 Financial Results 8,800 8,909 9,262 9,221 10,198 Net Interest Income Net Interest Margin (NIM) on a taxable-equivalent basis 2Q21 3Q21 4Q21 1Q22 2Q22 2.39% Net interest income • Net interest income up $1.4 billion, or 16%, from 2Q21 primarily due to the impact of higher interest rates, higher loan balances, lower mortgage- backed securities (MBS) premium amortization, and a decrease in long-term debt, partially offset by lower interest income from Paycheck Protection Program (PPP) loans and loans purchased from securitization pools – 2Q22 MBS premium amortization was $291 million vs. $587 million in 2Q21 and $361 million in 1Q22 • Net interest income up $977 million, or 11%, from 1Q22 as higher earning asset yields, higher loan balances, lower MBS premium amortization, and one additional day in the quarter were partially offset by higher funding costs and lower interest income from loans purchased from securitization pools and PPP loans • 2022 net interest income is expected to be ~20% higher than the full year 2021 level of $35.8 billion Net Interest Income ($ in millions) 2.02% 2.03% 2.11% 2.16% 1. Includes taxable-equivalent adjustments predominantly related to tax-exempt income on certain loans and securities. 1

82Q22 Financial Results 6,830 11,470 8,371 7,438 7,102 7,158 1,336 693 287 2,696 576 (615) Net gains (losses) from equity securities Mortgage banking All other 2Q21 1Q22 2Q22 Noninterest income • Noninterest income down $4.6 billion, or 40%, from 2Q21 – Net gains (losses) from equity securities down $3.3 billion on lower results in our affiliated venture capital and private equity businesses driven by market conditions and included $576 million of impairments on securities in 2Q22 – Mortgage banking down $1.0 billion driven by lower originations and gain on sale margins, and lower gains from the re-securitization of loans purchased from securitization pools – All other noninterest income down $280 million as a $549 million decline from divestitures in 2021 was partially offset by growth • Noninterest income down $1.5 billion, or 18%, from 1Q22 – Net gains (losses) from equity securities down $1.2 billion on lower results in our affiliated venture capital and private equity businesses and included impairments on securities – Mortgage banking down $406 million on lower gain on sale margins and originations, and lower gains from the re-securitization of loans purchased from securitization pools – All other noninterest income up $56 million on higher net gains from trading activities, higher net gains from debt securities, and higher card fees, partially offset by: ◦ Lower investment banking fees on a $107 million write-down on unfunded leveraged finance commitments due to the widening of market spreads, as well as lower market activity ◦ Lower investment advisory and other asset-based fees reflecting lower market valuations ◦ Lower deposit-related fees reflecting the initial implementation of overdraft policy changes Noninterest Income ($ in millions)

92Q22 Financial Results Noninterest expense • Noninterest expense down 3% from 2Q21 – Personnel expense down 4% predominantly reflecting divestitures, lower revenue-related compensation, as well as the impact of efficiency initiatives – Non-personnel expense down $82 million, or 2%, and included lower expenses from divestitures, and lower professional and outside services expense, partially offset by a $273 million increase in operating losses primarily reflecting an increase in litigation accruals and higher customer remediation expense predominantly for a variety of historical matters • Noninterest expense down 7% from 1Q22 – Personnel expense down 9% from seasonally higher expenses in 1Q22 and lower revenue-related expenses, partially offset by one additional day in the quarter – Non-personnel expense down $158 million, or 3% ◦ Operating losses down $97 million ◦ Technology, telecommunications and equipment expense down $77 million from an elevated 1Q22 • 2022 noninterest expense expectation of ~$51.5 billion – As previously disclosed, we have outstanding litigation, regulatory matters and customer remediations, and related expenses could be significant and could cause us to exceed our $51.5 billion outlook Noninterest Expense ($ in millions) 13,341 13,303 13,198 13,870 12,883 8,818 8,690 8,475 9,271 8,442 4,141 4,073 4,211 3,926 3,865 Goodwill Write-down All Other Expenses Operating Losses Personnel Expense 2Q21 3Q21 4Q21 1Q22 2Q22 Headcount (Period-end, '000s) 2Q21 3Q21 4Q21 1Q22 2Q22 259 254 249 247 244 673 512 79 540303 1. 4Q21 noninterest expense included approximately $100 million of operating expenses associated with our Corporate Trust Services business and Wells Fargo Asset Management, which were sold on November 1, 2021. The approximately $100 million excludes expenses attributable to transition services agreements and corporate overhead. 1 576

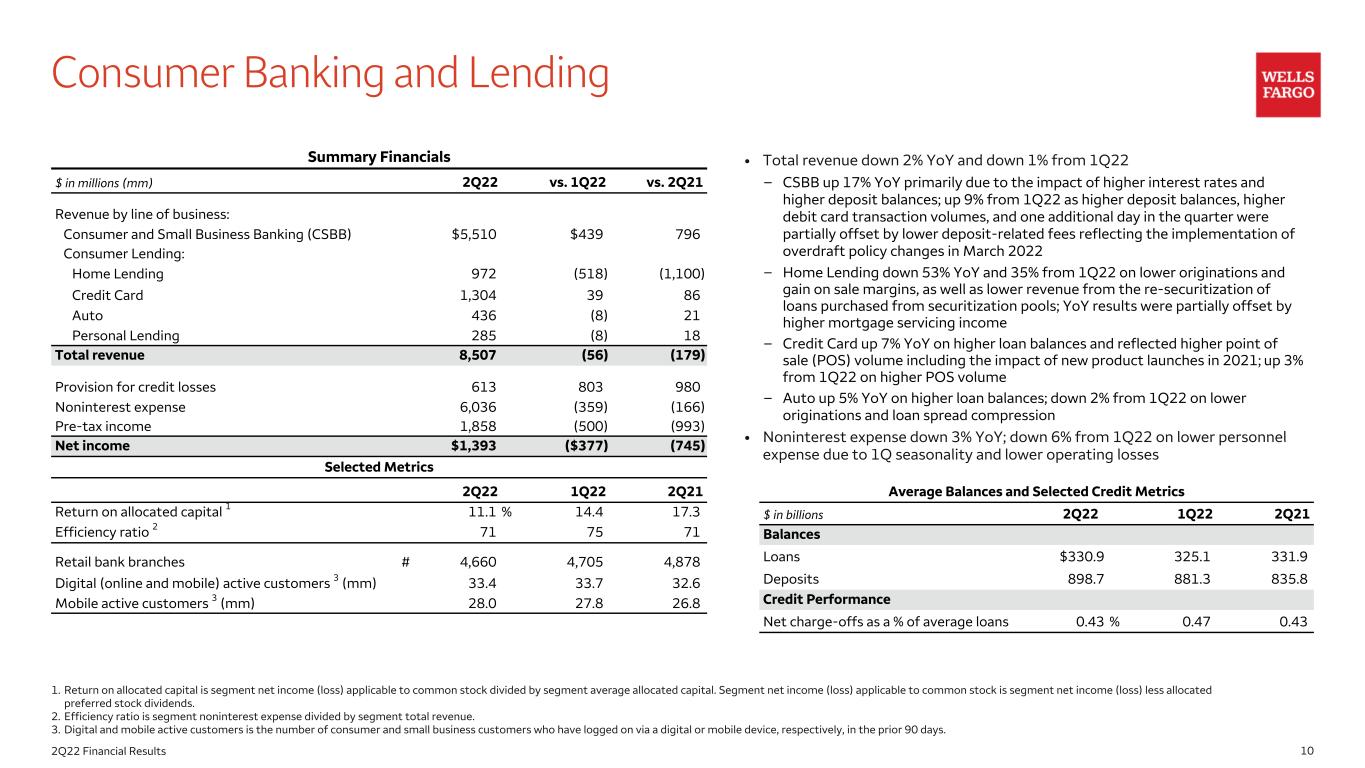

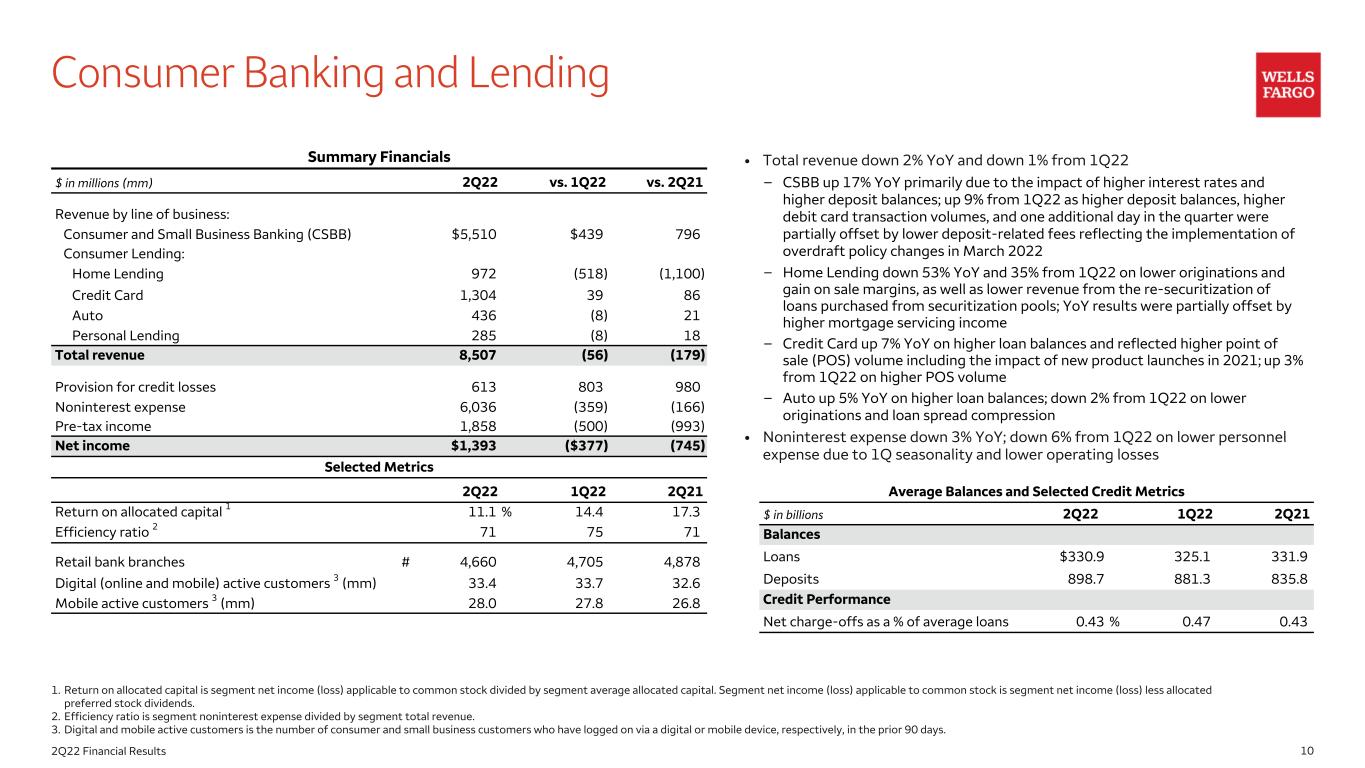

102Q22 Financial Results Consumer Banking and Lending • Total revenue down 2% YoY and down 1% from 1Q22 – CSBB up 17% YoY primarily due to the impact of higher interest rates and higher deposit balances; up 9% from 1Q22 as higher deposit balances, higher debit card transaction volumes, and one additional day in the quarter were partially offset by lower deposit-related fees reflecting the implementation of overdraft policy changes in March 2022 – Home Lending down 53% YoY and 35% from 1Q22 on lower originations and gain on sale margins, as well as lower revenue from the re-securitization of loans purchased from securitization pools; YoY results were partially offset by higher mortgage servicing income – Credit Card up 7% YoY on higher loan balances and reflected higher point of sale (POS) volume including the impact of new product launches in 2021; up 3% from 1Q22 on higher POS volume – Auto up 5% YoY on higher loan balances; down 2% from 1Q22 on lower originations and loan spread compression • Noninterest expense down 3% YoY; down 6% from 1Q22 on lower personnel expense due to 1Q seasonality and lower operating losses 1. Return on allocated capital is segment net income (loss) applicable to common stock divided by segment average allocated capital. Segment net income (loss) applicable to common stock is segment net income (loss) less allocated preferred stock dividends. 2. Efficiency ratio is segment noninterest expense divided by segment total revenue. 3. Digital and mobile active customers is the number of consumer and small business customers who have logged on via a digital or mobile device, respectively, in the prior 90 days. Summary Financials $ in millions (mm) 2Q22 vs. 1Q22 vs. 2Q21 Revenue by line of business: Consumer and Small Business Banking (CSBB) $5,510 $439 796 Consumer Lending: Home Lending 972 (518) (1,100) Credit Card 1,304 39 86 Auto 436 (8) 21 Personal Lending 285 (8) 18 Total revenue 8,507 (56) (179) Provision for credit losses 613 803 980 Noninterest expense 6,036 (359) (166) Pre-tax income 1,858 (500) (993) Net income $1,393 ($377) (745) Selected Metrics 2Q22 1Q22 2Q21 Return on allocated capital 1 11.1 % 14.4 17.3 Efficiency ratio 2 71 75 71 Retail bank branches # 4,660 4,705 4,878 Digital (online and mobile) active customers 3 (mm) 33.4 33.7 32.6 Mobile active customers 3 (mm) 28.0 27.8 26.8 Average Balances and Selected Credit Metrics $ in billions 2Q22 1Q22 2Q21 Balances Loans $330.9 325.1 331.9 Deposits 898.7 881.3 835.8 Credit Performance Net charge-offs as a % of average loans 0.43 % 0.47 0.43

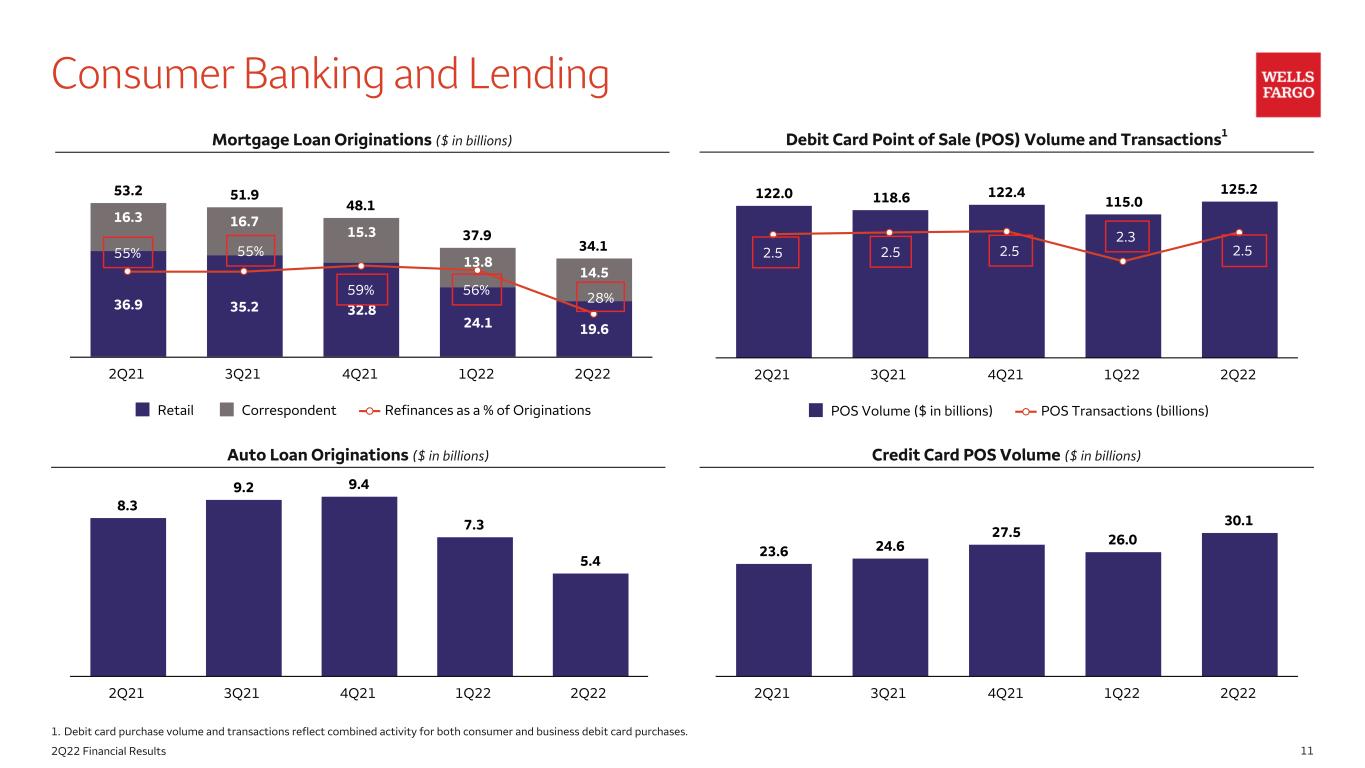

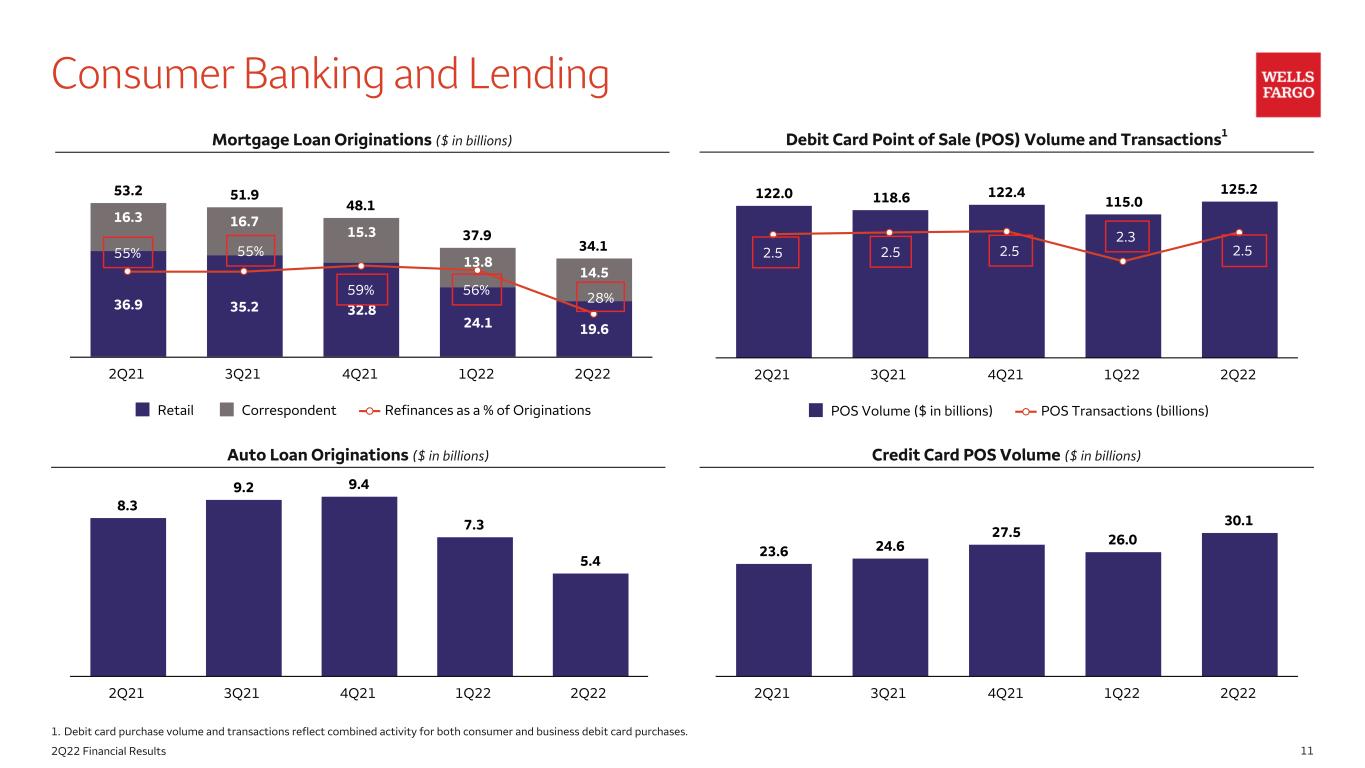

112Q22 Financial Results Consumer Banking and Lending Mortgage Loan Originations ($ in billions) Auto Loan Originations ($ in billions) Credit Card POS Volume ($ in billions) Debit Card Point of Sale (POS) Volume and Transactions1 1. Debit card purchase volume and transactions reflect combined activity for both consumer and business debit card purchases. 53.2 51.9 48.1 37.9 34.1 36.9 35.2 32.8 24.1 19.6 16.3 16.7 15.3 13.8 14.5 Retail Correspondent Refinances as a % of Originations 2Q21 3Q21 4Q21 1Q22 2Q22 122.0 118.6 122.4 115.0 125.2 POS Volume ($ in billions) POS Transactions (billions) 2Q21 3Q21 4Q21 1Q22 2Q22 8.3 9.2 9.4 7.3 5.4 2Q21 3Q21 4Q21 1Q22 2Q22 23.6 24.6 27.5 26.0 30.1 2Q21 3Q21 4Q21 1Q22 2Q22 2.5 2.5 2.5 2.3 2.555% 55% 59% 56% 28%

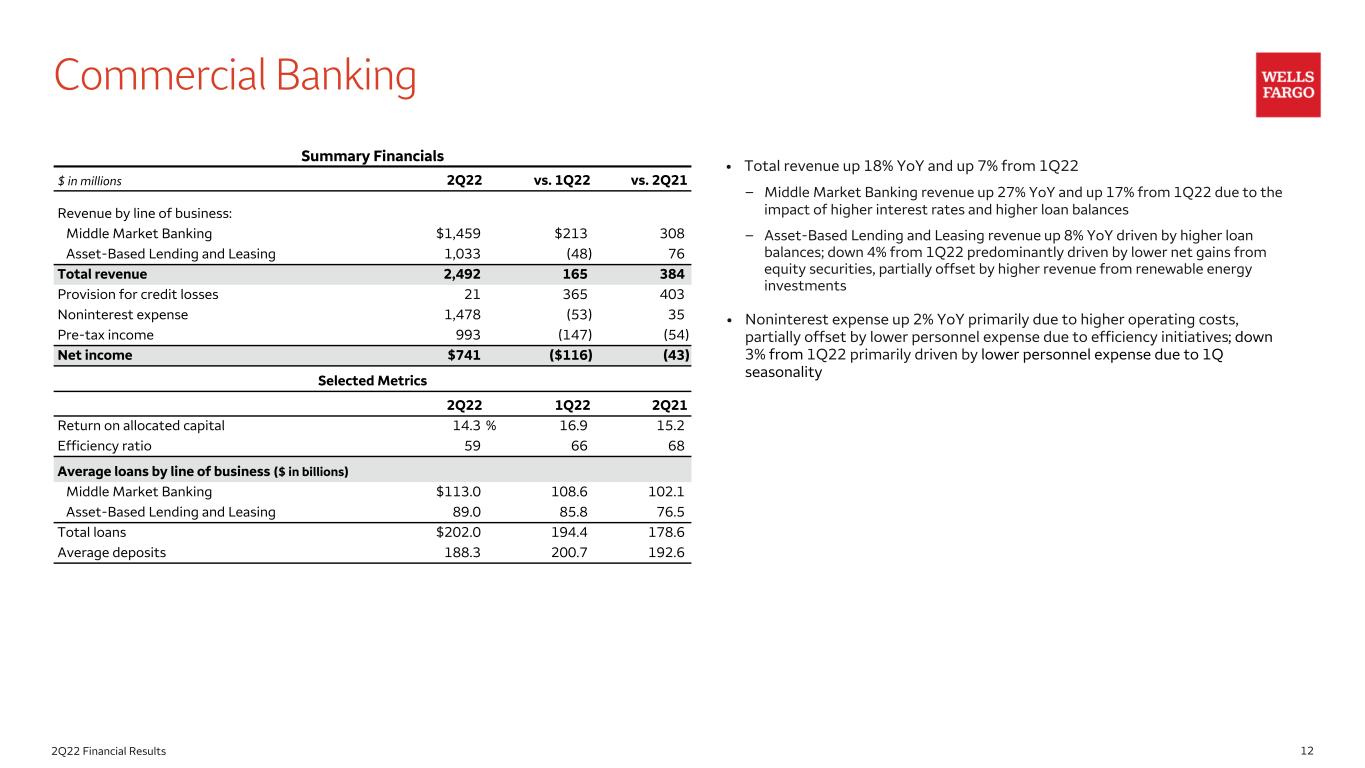

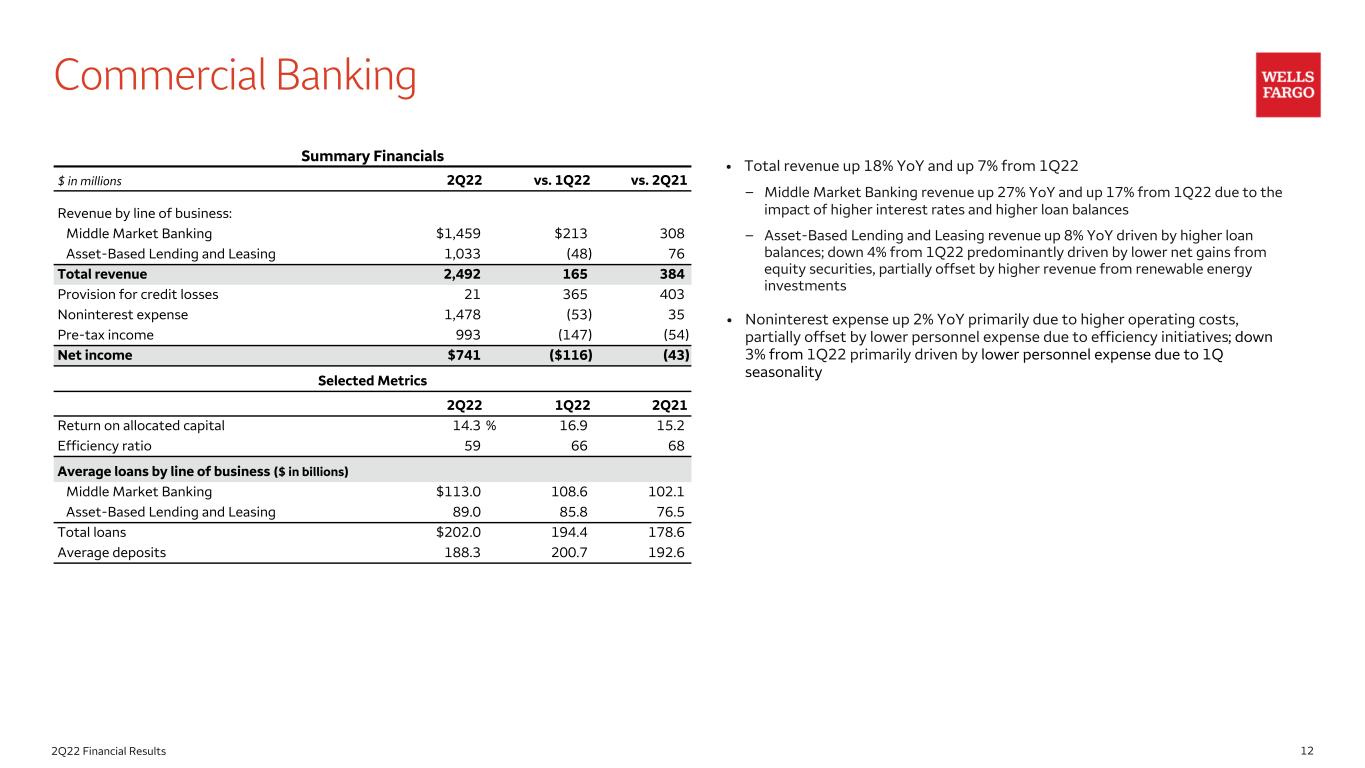

122Q22 Financial Results Commercial Banking • Total revenue up 18% YoY and up 7% from 1Q22 – Middle Market Banking revenue up 27% YoY and up 17% from 1Q22 due to the impact of higher interest rates and higher loan balances – Asset-Based Lending and Leasing revenue up 8% YoY driven by higher loan balances; down 4% from 1Q22 predominantly driven by lower net gains from equity securities, partially offset by higher revenue from renewable energy investments • Noninterest expense up 2% YoY primarily due to higher operating costs, partially offset by lower personnel expense due to efficiency initiatives; down 3% from 1Q22 primarily driven by lower personnel expense due to 1Q seasonality Summary Financials $ in millions 2Q22 vs. 1Q22 vs. 2Q21 Revenue by line of business: Middle Market Banking $1,459 $213 308 Asset-Based Lending and Leasing 1,033 (48) 76 Total revenue 2,492 165 384 Provision for credit losses 21 365 403 Noninterest expense 1,478 (53) 35 Pre-tax income 993 (147) (54) Net income $741 ($116) (43) Selected Metrics 2Q22 1Q22 2Q21 Return on allocated capital 14.3 % 16.9 15.2 Efficiency ratio 59 66 68 Average loans by line of business ($ in billions) Middle Market Banking $113.0 108.6 102.1 Asset-Based Lending and Leasing 89.0 85.8 76.5 Total loans $202.0 194.4 178.6 Average deposits 188.3 200.7 192.6

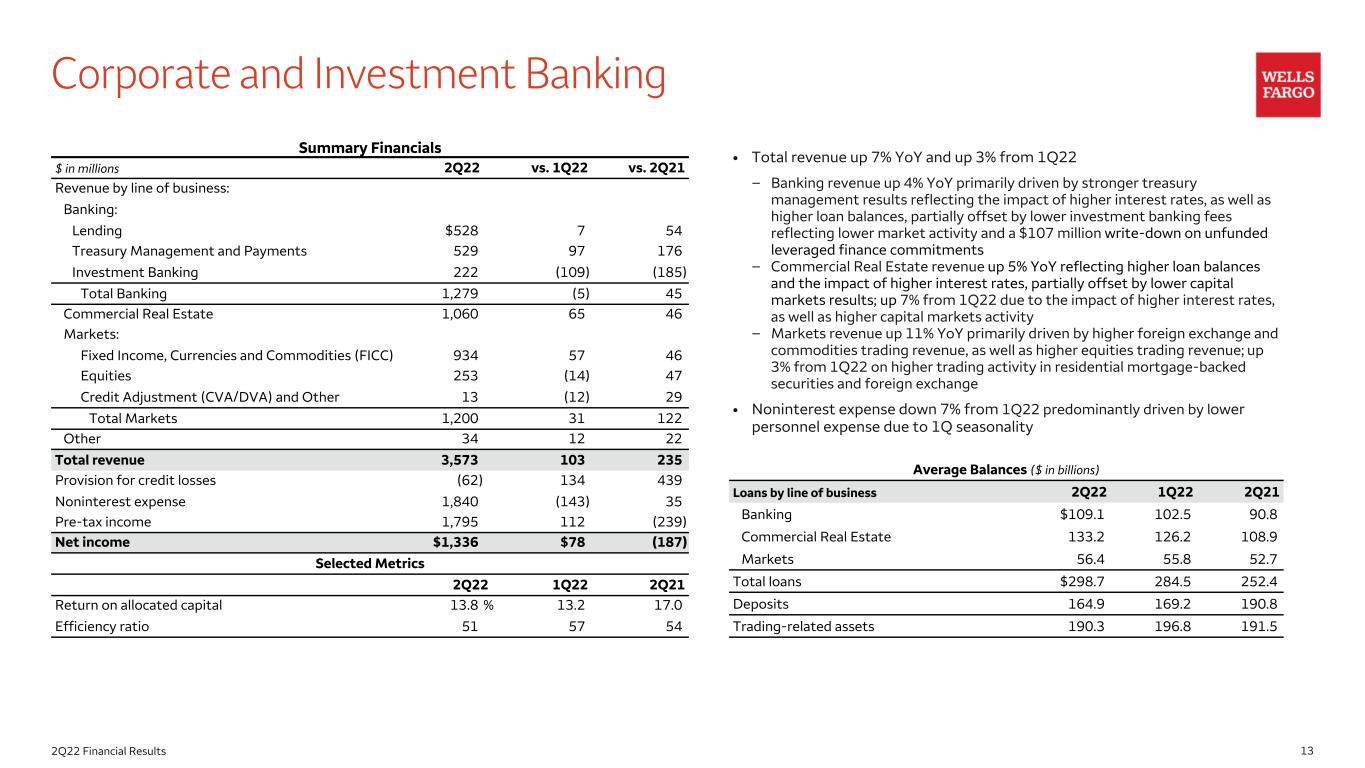

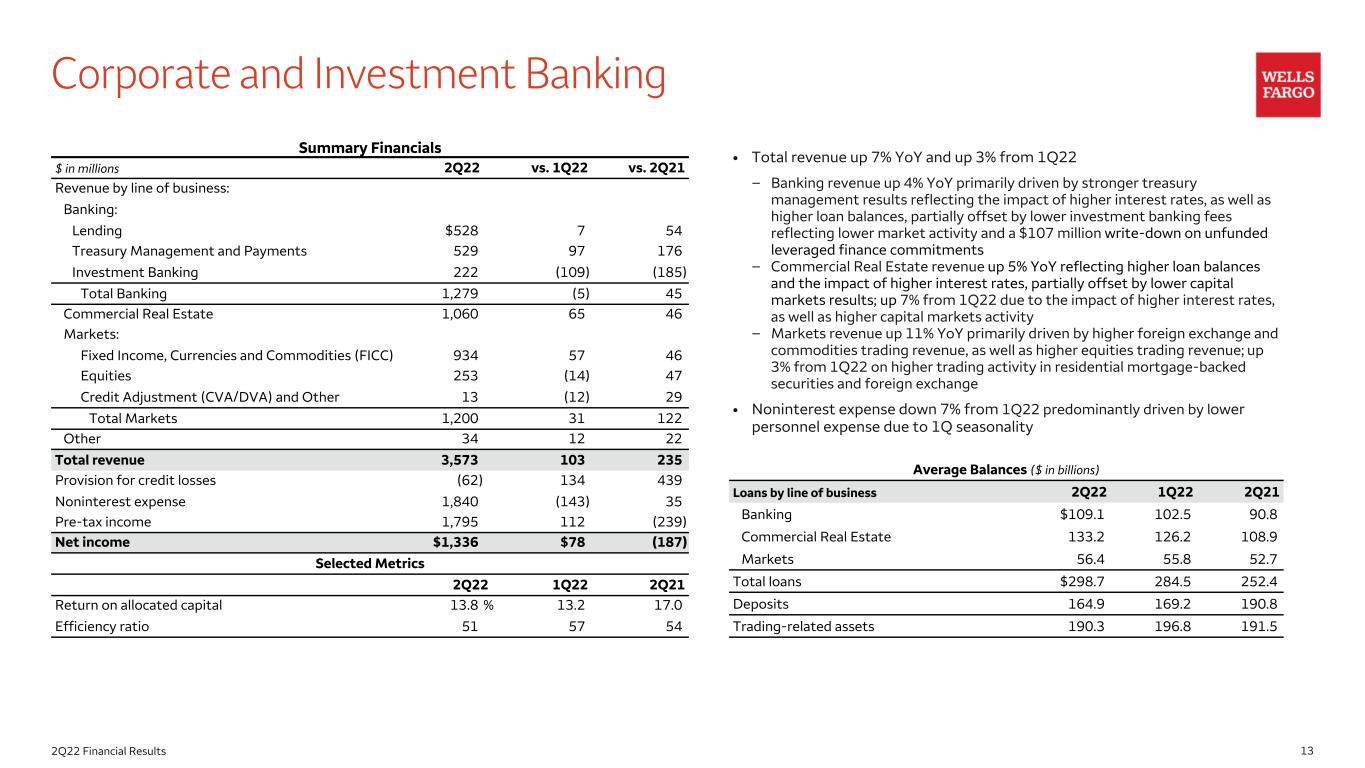

132Q22 Financial Results Corporate and Investment Banking • Total revenue up 7% YoY and up 3% from 1Q22 – Banking revenue up 4% YoY primarily driven by stronger treasury management results reflecting the impact of higher interest rates, as well as higher loan balances, partially offset by lower investment banking fees reflecting lower market activity and a $107 million write-down on unfunded leveraged finance commitments – Commercial Real Estate revenue up 5% YoY reflecting higher loan balances and the impact of higher interest rates, partially offset by lower capital markets results; up 7% from 1Q22 due to the impact of higher interest rates, as well as higher capital markets activity – Markets revenue up 11% YoY primarily driven by higher foreign exchange and commodities trading revenue, as well as higher equities trading revenue; up 3% from 1Q22 on higher trading activity in residential mortgage-backed securities and foreign exchange • Noninterest expense down 7% from 1Q22 predominantly driven by lower personnel expense due to 1Q seasonality Summary Financials $ in millions 2Q22 vs. 1Q22 vs. 2Q21 Revenue by line of business: Banking: Lending $528 7 54 Treasury Management and Payments 529 97 176 Investment Banking 222 (109) (185) Total Banking 1,279 (5) 45 Commercial Real Estate 1,060 65 46 Markets: Fixed Income, Currencies and Commodities (FICC) 934 57 46 Equities 253 (14) 47 Credit Adjustment (CVA/DVA) and Other 13 (12) 29 Total Markets 1,200 31 122 Other 34 12 22 Total revenue 3,573 103 235 Provision for credit losses (62) 134 439 Noninterest expense 1,840 (143) 35 Pre-tax income 1,795 112 (239) Net income $1,336 $78 (187) Selected Metrics 2Q22 1Q22 2Q21 Return on allocated capital 13.8 % 13.2 17.0 Efficiency ratio 51 57 54 Average Balances ($ in billions) Loans by line of business 2Q22 1Q22 2Q21 Banking $109.1 102.5 90.8 Commercial Real Estate 133.2 126.2 108.9 Markets 56.4 55.8 52.7 Total loans $298.7 284.5 252.4 Deposits 164.9 169.2 190.8 Trading-related assets 190.3 196.8 191.5

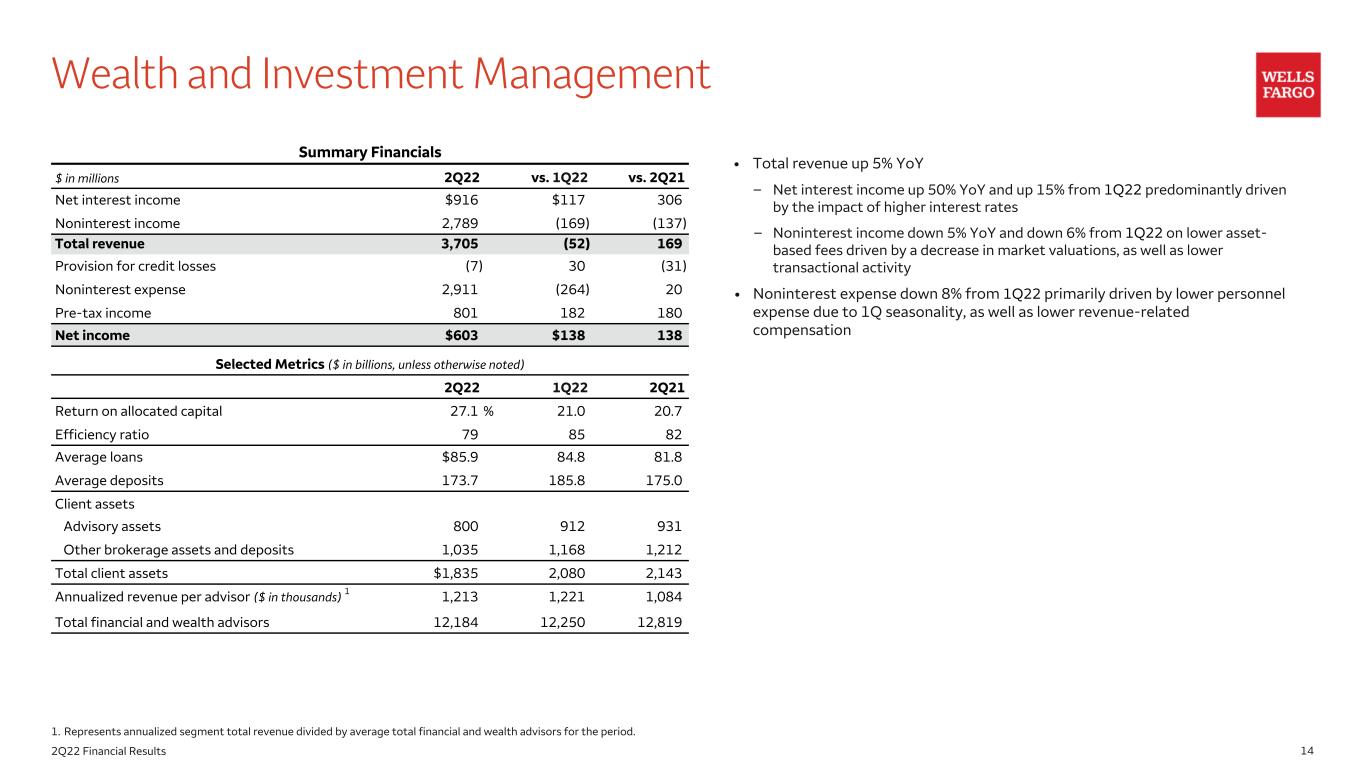

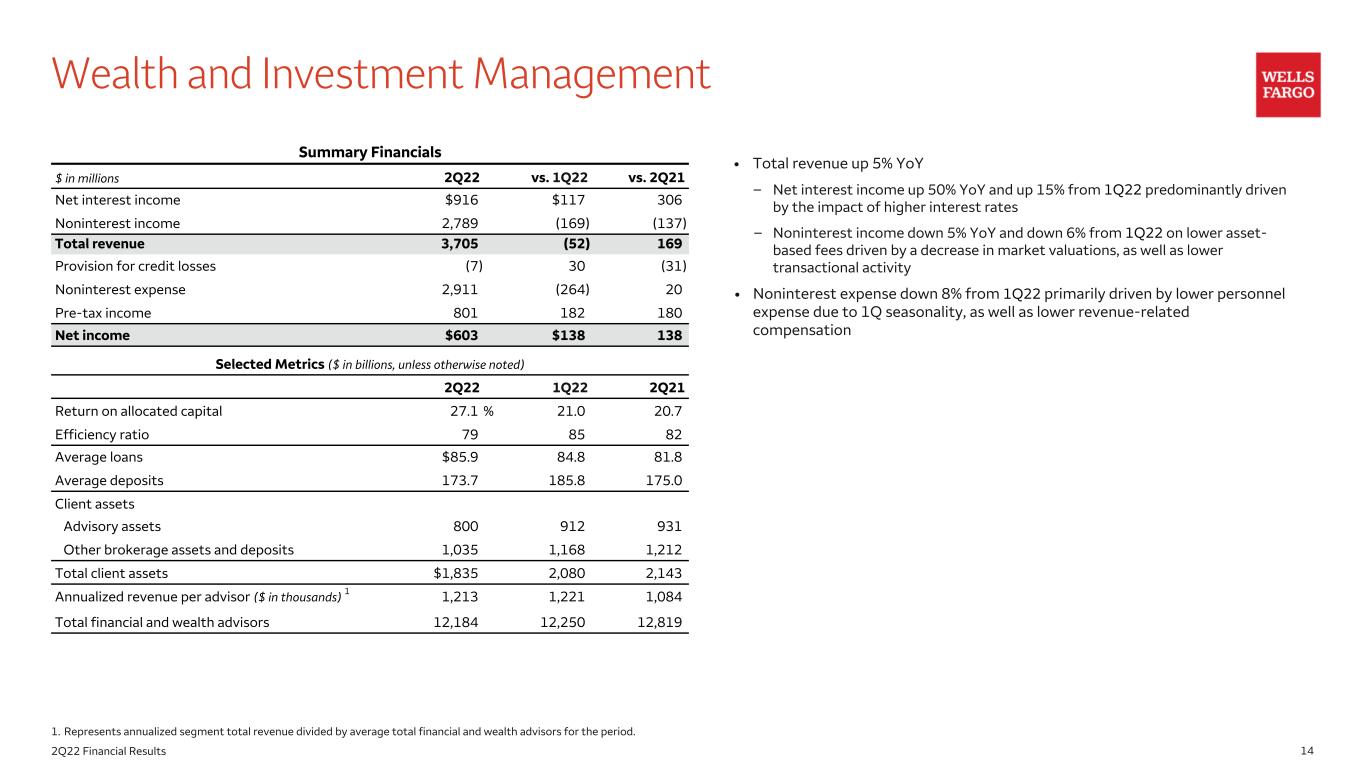

142Q22 Financial Results Wealth and Investment Management Summary Financials $ in millions 2Q22 vs. 1Q22 vs. 2Q21 Net interest income $916 $117 306 Noninterest income 2,789 (169) (137) Total revenue 3,705 (52) 169 Provision for credit losses (7) 30 (31) Noninterest expense 2,911 (264) 20 Pre-tax income 801 182 180 Net income $603 $138 138 Selected Metrics ($ in billions, unless otherwise noted) 2Q22 1Q22 2Q21 Return on allocated capital 27.1 % 21.0 20.7 Efficiency ratio 79 85 82 Average loans $85.9 84.8 81.8 Average deposits 173.7 185.8 175.0 Client assets Advisory assets 800 912 931 Other brokerage assets and deposits 1,035 1,168 1,212 Total client assets $1,835 2,080 2,143 Annualized revenue per advisor ($ in thousands) 1 1,213 1,221 1,084 Total financial and wealth advisors 12,184 12,250 12,819 1. Represents annualized segment total revenue divided by average total financial and wealth advisors for the period. • Total revenue up 5% YoY – Net interest income up 50% YoY and up 15% from 1Q22 predominantly driven by the impact of higher interest rates – Noninterest income down 5% YoY and down 6% from 1Q22 on lower asset- based fees driven by a decrease in market valuations, as well as lower transactional activity • Noninterest expense down 8% from 1Q22 primarily driven by lower personnel expense due to 1Q seasonality, as well as lower revenue-related compensation

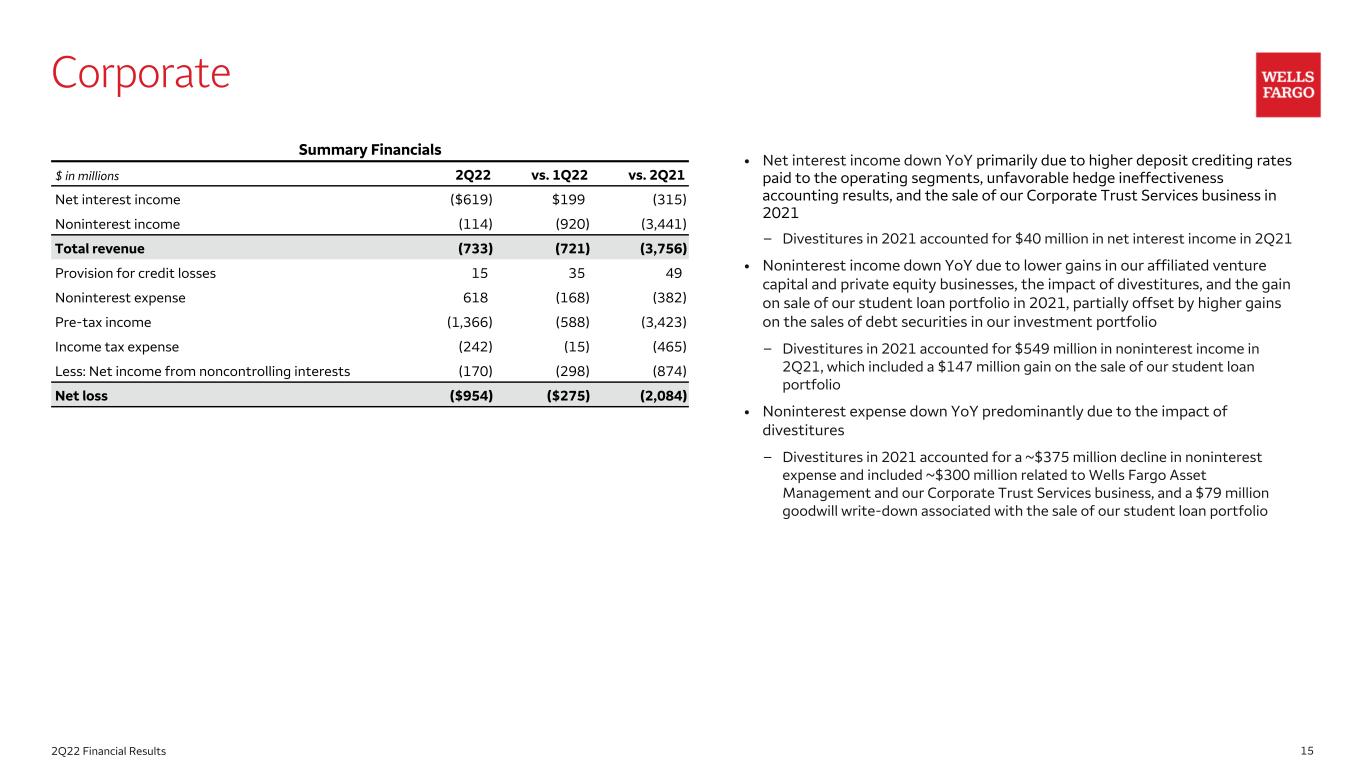

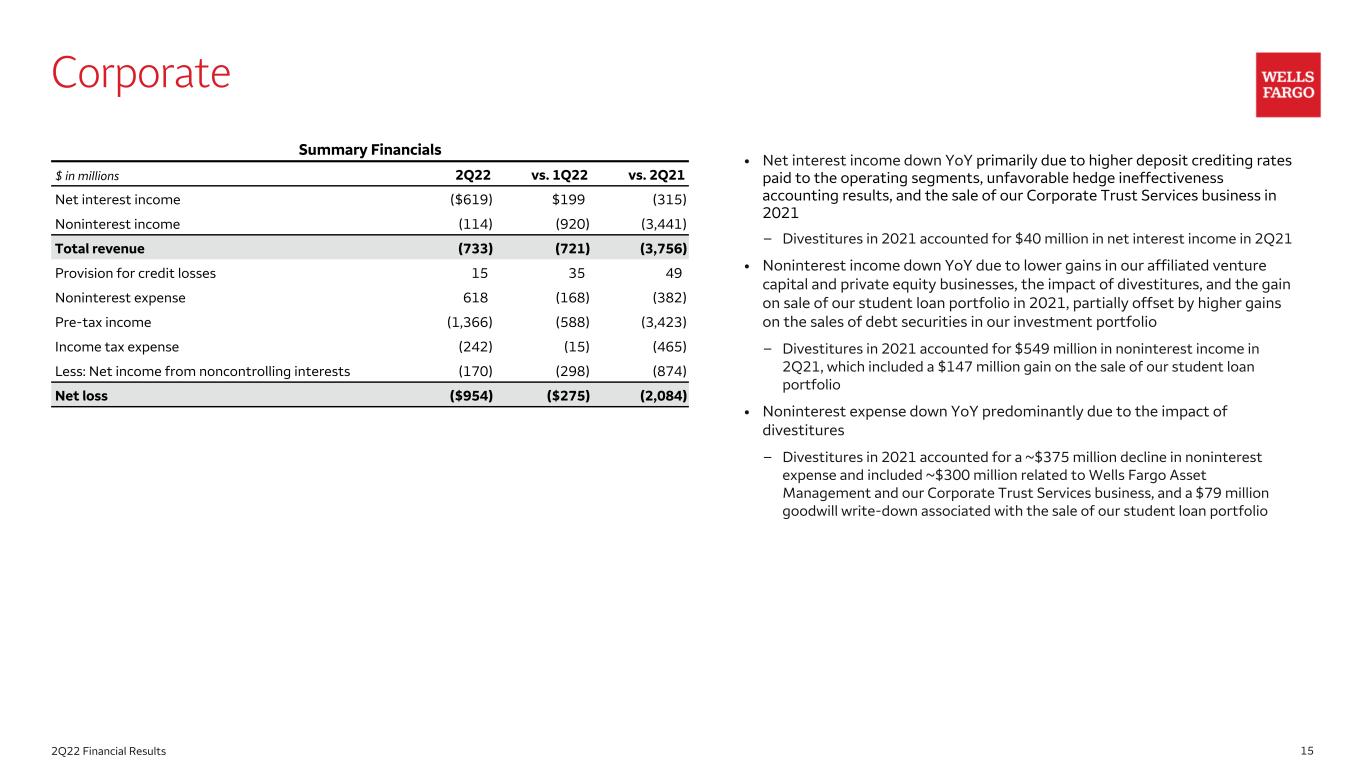

152Q22 Financial Results Corporate • Net interest income down YoY primarily due to higher deposit crediting rates paid to the operating segments, unfavorable hedge ineffectiveness accounting results, and the sale of our Corporate Trust Services business in 2021 – Divestitures in 2021 accounted for $40 million in net interest income in 2Q21 • Noninterest income down YoY due to lower gains in our affiliated venture capital and private equity businesses, the impact of divestitures, and the gain on sale of our student loan portfolio in 2021, partially offset by higher gains on the sales of debt securities in our investment portfolio – Divestitures in 2021 accounted for $549 million in noninterest income in 2Q21, which included a $147 million gain on the sale of our student loan portfolio • Noninterest expense down YoY predominantly due to the impact of divestitures – Divestitures in 2021 accounted for a ~$375 million decline in noninterest expense and included ~$300 million related to Wells Fargo Asset Management and our Corporate Trust Services business, and a $79 million goodwill write-down associated with the sale of our student loan portfolio Summary Financials $ in millions 2Q22 vs. 1Q22 vs. 2Q21 Net interest income ($619) $199 (315) Noninterest income (114) (920) (3,441) Total revenue (733) (721) (3,756) Provision for credit losses 15 35 49 Noninterest expense 618 (168) (382) Pre-tax income (1,366) (588) (3,423) Income tax expense (242) (15) (465) Less: Net income from noncontrolling interests (170) (298) (874) Net loss ($954) ($275) (2,084)

Appendix

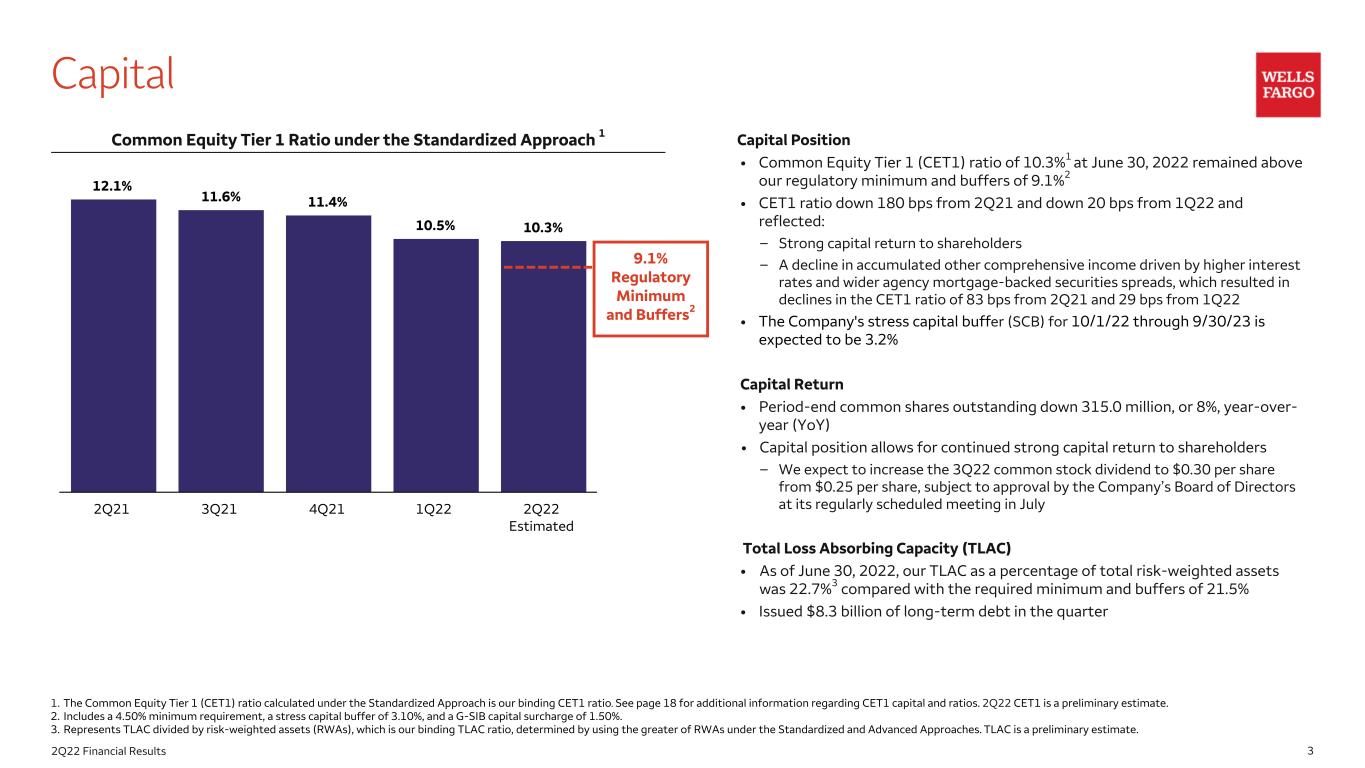

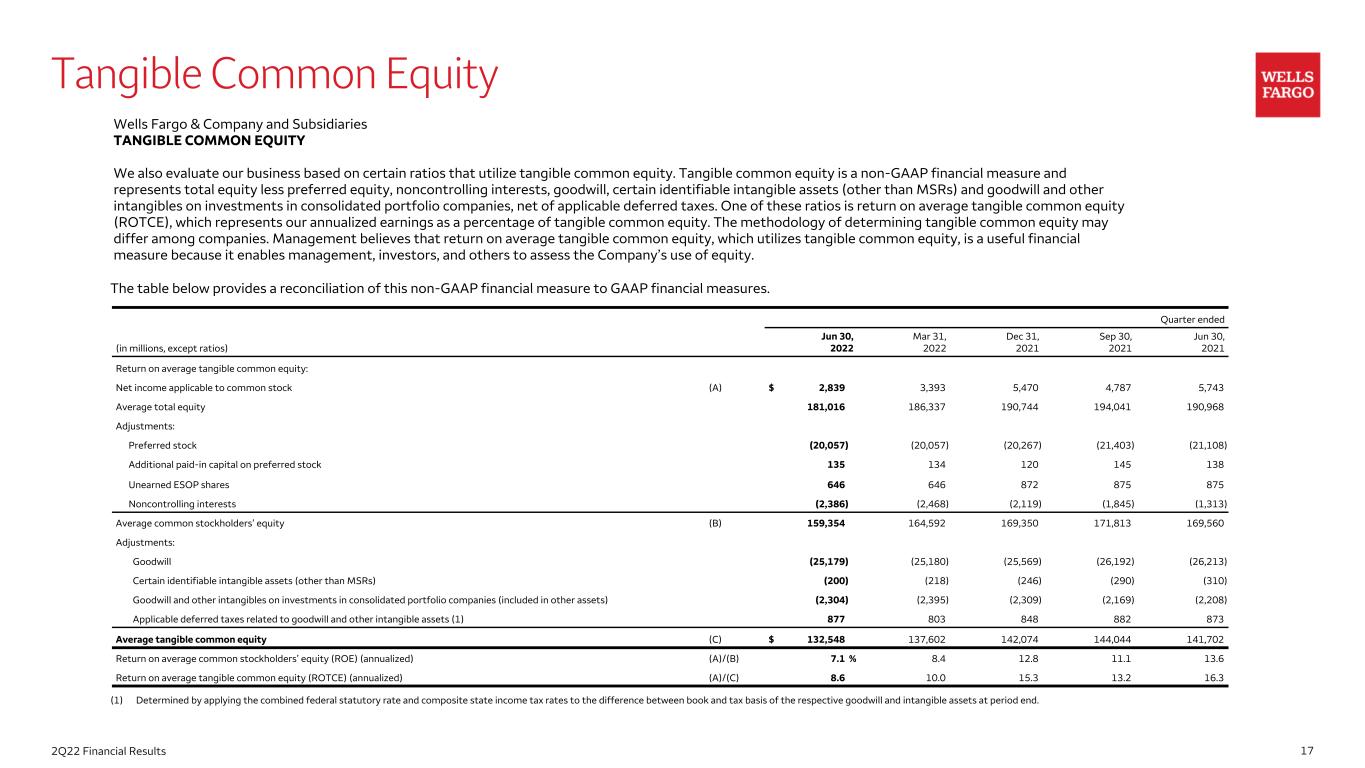

172Q22 Financial Results Tangible Common Equity Wells Fargo & Company and Subsidiaries TANGIBLE COMMON EQUITY We also evaluate our business based on certain ratios that utilize tangible common equity. Tangible common equity is a non-GAAP financial measure and represents total equity less preferred equity, noncontrolling interests, goodwill, certain identifiable intangible assets (other than MSRs) and goodwill and other intangibles on investments in consolidated portfolio companies, net of applicable deferred taxes. One of these ratios is return on average tangible common equity (ROTCE), which represents our annualized earnings as a percentage of tangible common equity. The methodology of determining tangible common equity may differ among companies. Management believes that return on average tangible common equity, which utilizes tangible common equity, is a useful financial measure because it enables management, investors, and others to assess the Company’s use of equity. The table below provides a reconciliation of this non-GAAP financial measure to GAAP financial measures. Quarter ended (in millions, except ratios) Jun 30, 2022 Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 Return on average tangible common equity: Net income applicable to common stock (A) $ 2,839 3,393 5,470 4,787 5,743 Average total equity 181,016 186,337 190,744 194,041 190,968 Adjustments: Preferred stock (20,057) (20,057) (20,267) (21,403) (21,108) Additional paid-in capital on preferred stock 135 134 120 145 138 Unearned ESOP shares 646 646 872 875 875 Noncontrolling interests (2,386) (2,468) (2,119) (1,845) (1,313) Average common stockholders’ equity (B) 159,354 164,592 169,350 171,813 169,560 Adjustments: Goodwill (25,179) (25,180) (25,569) (26,192) (26,213) Certain identifiable intangible assets (other than MSRs) (200) (218) (246) (290) (310) Goodwill and other intangibles on investments in consolidated portfolio companies (included in other assets) (2,304) (2,395) (2,309) (2,169) (2,208) Applicable deferred taxes related to goodwill and other intangible assets (1) 877 803 848 882 873 Average tangible common equity (C) $ 132,548 137,602 142,074 144,044 141,702 Return on average common stockholders’ equity (ROE) (annualized) (A)/(B) 7.1 % 8.4 12.8 11.1 13.6 Return on average tangible common equity (ROTCE) (annualized) (A)/(C) 8.6 10.0 15.3 13.2 16.3 (1) Determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period end.

182Q22 Financial Results (1) The Basel III capital rules provide for two capital frameworks (the Standardized Approach and the Advanced Approach applicable to certain institutions), and we must calculate our CET1, tier 1 and total capital ratios under both approaches. (2) Determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period end. (3) In second quarter 2020, the Company elected to apply a modified transition provision issued by federal banking regulators related to the impact of CECL on regulatory capital. The rule permits certain banking organizations to exclude from regulatory capital the initial adoption impact of CECL, plus 25% of the cumulative changes in the allowance for credit losses (ACL) under CECL for each period until December 31, 2021, followed by a three-year phase-out period in which the benefit is reduced by 25% in year one, 50% in year two and 75% in year three. Common Equity Tier 1 under Basel III Wells Fargo & Company and Subsidiaries RISK-BASED CAPITAL RATIOS UNDER BASEL III (1) Estimated (in billions, except ratio) Jun 30, 2022 Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 Total equity $ 179.8 181.7 190.1 191.1 193.1 Adjustments: Preferred stock (20.1) (20.1) (20.1) (20.3) (20.8) Additional paid-in capital on preferred stock 0.2 0.1 0.1 0.1 0.2 Unearned ESOP shares 0.7 0.7 0.7 0.9 0.9 Noncontrolling interests (2.3) (2.4) (2.5) (2.0) (1.9) Total common stockholders' equity 158.3 160.0 168.3 169.8 171.5 Adjustments: Goodwill (25.2) (25.2) (25.2) (26.2) (26.2) Certain identifiable intangible assets (other than MSRs) (0.2) (0.2) (0.2) (0.3) (0.3) Goodwill and other intangibles on investments in consolidated portfolio companies (included in other assets) (2.3) (2.3) (2.4) (2.1) (2.3) Applicable deferred taxes related to goodwill and other intangible assets (2) 0.9 0.9 0.8 0.9 0.9 Current expected credit loss (CECL) transition provision (3) 0.2 0.2 0.2 0.5 0.9 Other (1.6) (1.1) (0.9) (1.0) (1.1) Common Equity Tier 1 (A) $ 130.1 132.3 140.6 141.6 143.4 Total risk-weighted assets (RWAs) under Standardized Approach (B) 1,257.1 1,265.5 1,239.0 1,218.9 1,188.7 Total RWAs under Advanced Approach (C) 1,123.2 1,119.5 1,116.1 1,138.6 1,126.5 Common Equity Tier 1 to total RWAs under Standardized Approach (A)/(B) 10.3 % 10.5 11.4 11.6 12.1 Common Equity Tier 1 to total RWAs under Advanced Approach (A)/(C) 11.6 11.8 12.6 12.4 12.7

192Q22 Financial Results Disclaimer and forward-looking statements Financial results reported in this document are preliminary. Final financial results and other disclosures will be reported in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, and may differ materially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information. This document contains forward-looking statements. In addition, we may make forward-looking statements in our other documents filed or furnished with the Securities and Exchange Commission, and our management may make forward-looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements include, but are not limited to, statements we make about: (i) the future operating or financial performance of the Company, including our outlook for future growth; (ii) our noninterest expense and efficiency ratio; (iii) future credit quality and performance, including our expectations regarding future loan losses, our allowance for credit losses, and the economic scenarios considered to develop the allowance; (iv) our expectations regarding net interest income and net interest margin; (v) loan growth or the reduction or mitigation of risk in our loan portfolios; (vi) future capital or liquidity levels, ratios or targets; (vii) the performance of our mortgage business and any related exposures; (viii) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; (ix) future common stock dividends, common share repurchases and other uses of capital; (x) our targeted range for return on assets, return on equity, and return on tangible common equity; (xi) expectations regarding our effective income tax rate; (xii) the outcome of contingencies, such as legal proceedings; (xiii) environmental, social and governance related goals or commitments; and (xiv) the Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward- looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For more information about factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements” discussion in Wells Fargo’s press release announcing our second quarter 2022 results and in our most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021.