© 2025 Wells Fargo Bank, N.A. All rights reserved. 4Q24 Financial Results January 15, 2025 Exhibit 99.3

24Q24 Financial Results 4Q24 results Financial Results ROE: 11.7% ROTCE: 13.9%1 Efficiency ratio: 68%2 Credit Quality Capital and Liquidity CET1 ratio: 11.1%6 LCR: 125%7 TLAC ratio: 24.8%8 • Provision for credit losses5 of $1.1 billion – Total net loan charge-offs of $1.2 billion, down $41 million, with net loan charge-offs of 0.53% of average loans (annualized) – Allowance for credit losses for loans of $14.6 billion, down 3% • Common Equity Tier 1 (CET1) capital6 of $134.6 billion • CET1 ratio6 of 11.1% under the Standardized Approach • Liquidity coverage ratio (LCR)7 of 125% • Net income of $5.1 billion, or $1.43 per diluted common share, included: • Revenue of $20.4 billion, down slightly – Net interest income of $11.8 billion, down 7% – Noninterest income of $8.5 billion, up 11% • Noninterest expense of $13.9 billion, down 12% • Pre-tax pre-provision profit3 of $6.5 billion, up 38% • Effective income tax rate of 2.3%4 and included $863 million of discrete tax benefits • Average loans of $906.4 billion, down 3% • Average deposits of $1.4 trillion, up 1% Comparisons in the bullet points are for 4Q24 versus 4Q23, unless otherwise noted. Endnotes are presented starting on page 21. ($ in millions, except EPS) Pre-tax Income EPS Discrete tax benefits related to the resolution of prior period matters $863 $0.26 Severance expense (647) (0.15) Net losses on debt securities related to a repositioning of the investment portfolio (448) (0.10)

34Q24 Financial Results 4Q24 earnings Quarter ended $ Change from Year ended $ Change from $ in millions, except per share data 4Q24 3Q24 4Q23 3Q24 4Q23 2024 2023 2023 Net interest income $11,836 11,690 12,771 $146 (935) $47,676 52,375 ($4,699) Noninterest income 8,542 8,676 7,707 (134) 835 34,620 30,222 4,398 Total revenue 20,378 20,366 20,478 12 (100) 82,296 82,597 (301) Net charge-offs 1,188 1,111 1,258 77 (70) 4,759 3,450 1,309 Change in the allowance for credit losses (93) (46) 24 (47) (117) (425) 1,949 (2,374) Provision for credit losses1 1,095 1,065 1,282 30 (187) 4,334 5,399 (1,065) Noninterest expense 13,900 13,067 15,786 833 (1,886) 54,598 55,562 (964) Pre-tax income 5,383 6,234 3,410 (851) 1,973 23,364 21,636 1,728 Income tax expense (benefit)2 120 1,064 (100) (944) 220 3,399 2,607 792 Effective income tax rate (%) 2.3 % 17.2 (3.0) (1,491) bps 530 14.7 % 12.0 270 bps Net income $5,079 5,114 3,446 ($35) 1,633 $19,722 19,142 $580 Diluted earnings per common share $1.43 1.42 0.86 $0.01 0.57 $5.37 4.83 $0.54 Diluted average common shares (# mm) 3,360.7 3,425.1 3,657.0 (64) (296) 3,467.6 3,720.4 (253) Return on equity (ROE) 11.7 % 11.7 7.6 2 bps 414 11.4 % 11.0 37 bps Return on average tangible common equity (ROTCE)3 13.9 13.9 9.0 3 490 13.4 13.1 31 Efficiency ratio 68 64 77 405 (888) 66 67 (93) Endnotes are presented starting on page 21.

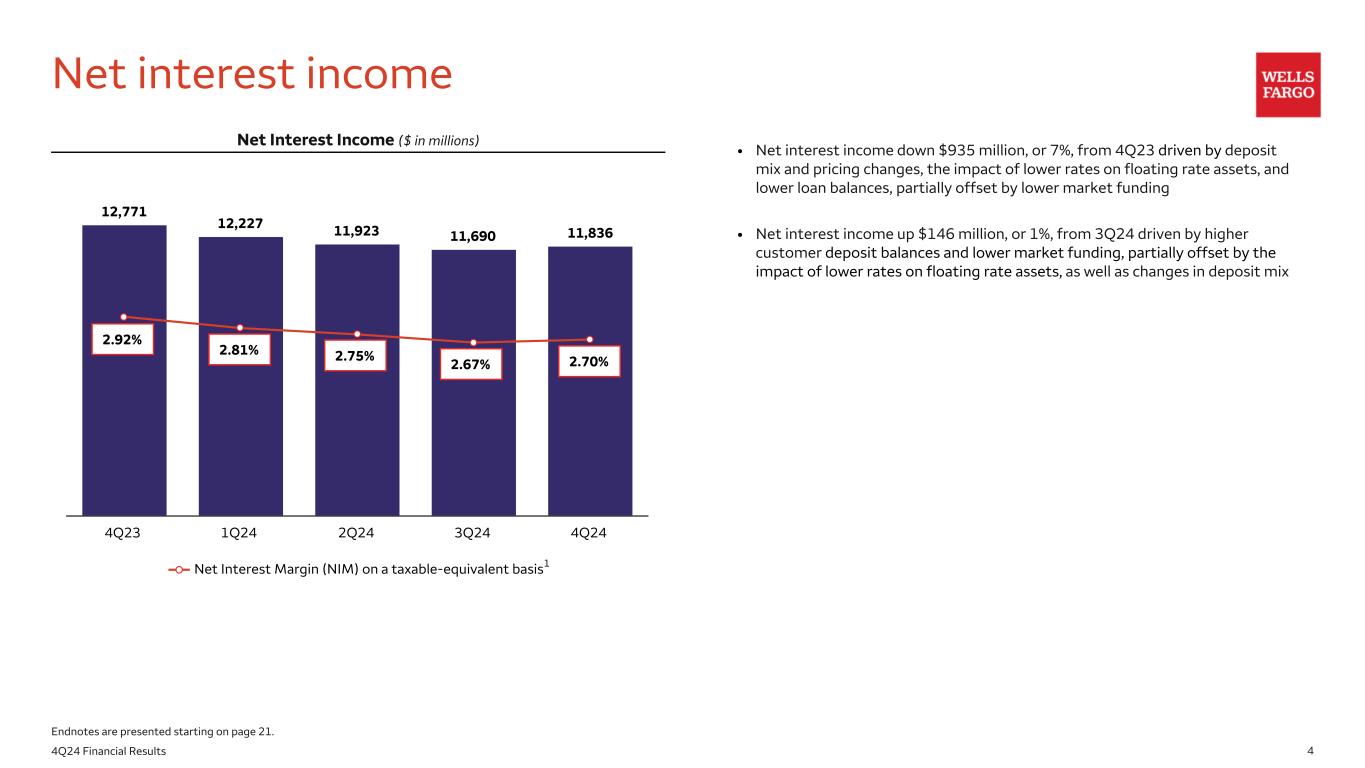

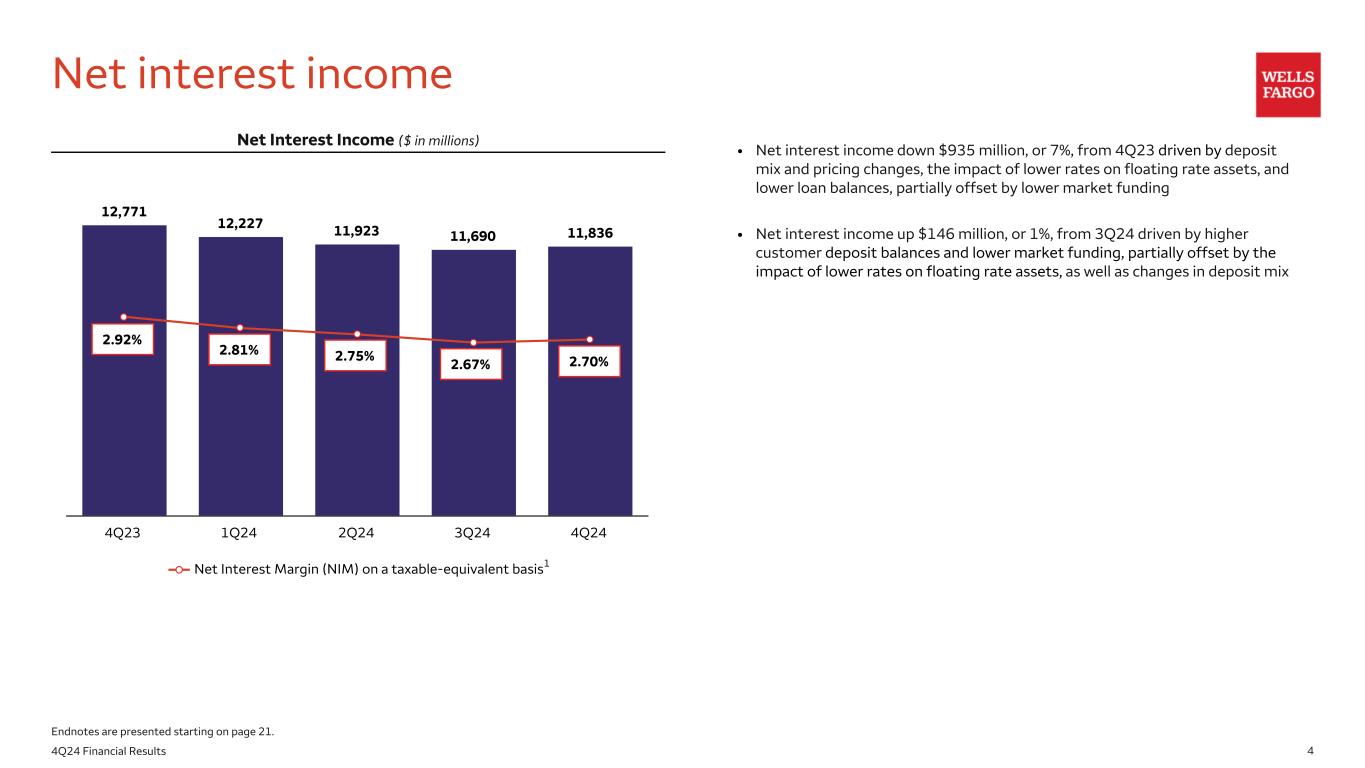

44Q24 Financial Results Net Interest Income ($ in millions) 12,771 12,227 11,923 11,690 11,836 Net Interest Margin (NIM) on a taxable-equivalent basis 4Q23 1Q24 2Q24 3Q24 4Q24 2.70% Net interest income • Net interest income down $935 million, or 7%, from 4Q23 driven by deposit mix and pricing changes, the impact of lower rates on floating rate assets, and lower loan balances, partially offset by lower market funding • Net interest income up $146 million, or 1%, from 3Q24 driven by higher customer deposit balances and lower market funding, partially offset by the impact of lower rates on floating rate assets, as well as changes in deposit mix 2.92% 2.81% 2.75% 2.67% 1 Endnotes are presented starting on page 21.

54Q24 Financial Results Loans and deposits • Average loans down $31.6 billion, or 3%, year-over-year (YoY); down $3.9 billion from 3Q24 as declines in commercial real estate and residential mortgage loans were partially offset by higher commercial and industrial loans and credit card loans • Total average loan yield of 6.16%, down 19 bps YoY and down 25 bps from 3Q24 reflecting the impact of lower interest rates • Period-end loans of $912.7 billion, down $24.0 billion, or 3%, YoY and up $3.0 billion from 3Q24 • Average deposits up $12.9 billion, or 1%, YoY and up $12.1 billion, or 1%, from 3Q24 as growth in customer deposits was partially offset by a reduction in higher cost CDs issued by Corporate Treasury • Period-end deposits up $13.6 billion, or 1%, YoY and up $22.2 billion, or 2%, from 3Q24 Average Loans Outstanding ($ in billions) 938.0 928.1 917.0 910.3 906.4 548.3 542.1 534.8 530.6 528.3 389.7 386.0 382.2 379.7 378.1 Total Average Loan Yield Consumer Loans Commercial Loans 4Q23 1Q24 2Q24 3Q24 4Q24 6.35% 6.38% 6.40% 6.41% 6.16% Period-End Deposits ($ in billions) 4Q24 vs 3Q24 vs 4Q23 Consumer Banking and Lending $ 783.5 1 % — % Commercial Banking 188.7 6 16 Corporate and Investment Banking 212.9 7 15 Wealth and Investment Management 127.0 13 22 Corporate 59.7 (28) (52) Total deposits $ 1,371.8 2 % 1 % Average deposit cost 1.73 % (0.18) 0.15 1,340.9 1,341.6 1,346.5 1,341.7 1,353.8 779.5 773.2 778.2 773.6 773.6 163.3 164.0 166.9 173.2 184.3 173.1 183.3 187.5 194.3 205.1 102.1 101.5 102.8 108.0 118.3 122.9 119.6 111.1 92.6 72.5 Corporate Wealth and Investment Management Corporate and Investment Banking Commercial Banking Consumer Banking and Lending 4Q23 1Q24 2Q24 3Q24 4Q24 Period-End Loans Outstanding ($ in billions) 4Q24 vs 3Q24 vs 4Q23 Commercial $ 534.1 1 % (2) % Consumer 378.6 — (3) Total loans $ 912.7 — % (3) % Average Deposits ($ in billions)

64Q24 Financial Results Noninterest Income ($ in millions) 7,707 8,636 8,766 8,676 8,542 799 940 935 686 957 1,027 1,061 1,101 1,096 1,084 455 627 641 672 725 1,070 1,454 1,442 1,438 950 1,568 1,597 1,618 1,675 1,625 2,788 2,957 3,029 3,109 3,201 Investment advisory fees and brokerage commissions Deposit and lending-related fees Net gains from trading activities Investment banking fees Card fees All other 4Q23 1Q24 2Q24 3Q24 4Q24 • Noninterest income increased $835 million, or 11%, from 4Q23 – Investment advisory fees and brokerage commissions1 up $413 million, or 15%, driven by higher asset-based fees reflecting higher market valuations – Deposit and lending-related fees up $57 million, or 4%, on higher deposit- related fees including higher treasury management fees, as well as higher commercial lending-related fees – Net gains from trading activities down $120 million, or 11%, and included an $(85) million impact from the 4Q24 change to incorporate funding valuation adjustments (FVA) on derivatives – Investment banking fees up $270 million, or 59%, on increased activity in equity and debt capital markets and higher advisory fees – Card fees up $57 million, or 6%, and included higher debit and credit card interchange income on higher point of sale transactions and volume – All other2 up $158 million and included improved results from our venture capital investments, partially offset by higher net losses on debt securities related to a repositioning of the investment portfolio • Noninterest income down $134 million, or 2%, from 3Q24 – Investment advisory fees and brokerage commissions1 up $92 million, or 3%, driven by higher asset-based fees reflecting higher market valuations – Net gains from trading activities down $488 million, or 34%, reflecting seasonality, a decline in customer activity in rates from a strong 3Q24, and an $(85) million impact from the 4Q24 change to incorporate FVA on derivatives – Investment banking fees up $53 million, or 8%, on higher advisory fee income and increased activity in equity capital markets – All other2 up $271 million and included improved results from our venture capital investments Noninterest income 2 1 Endnotes are presented starting on page 21.

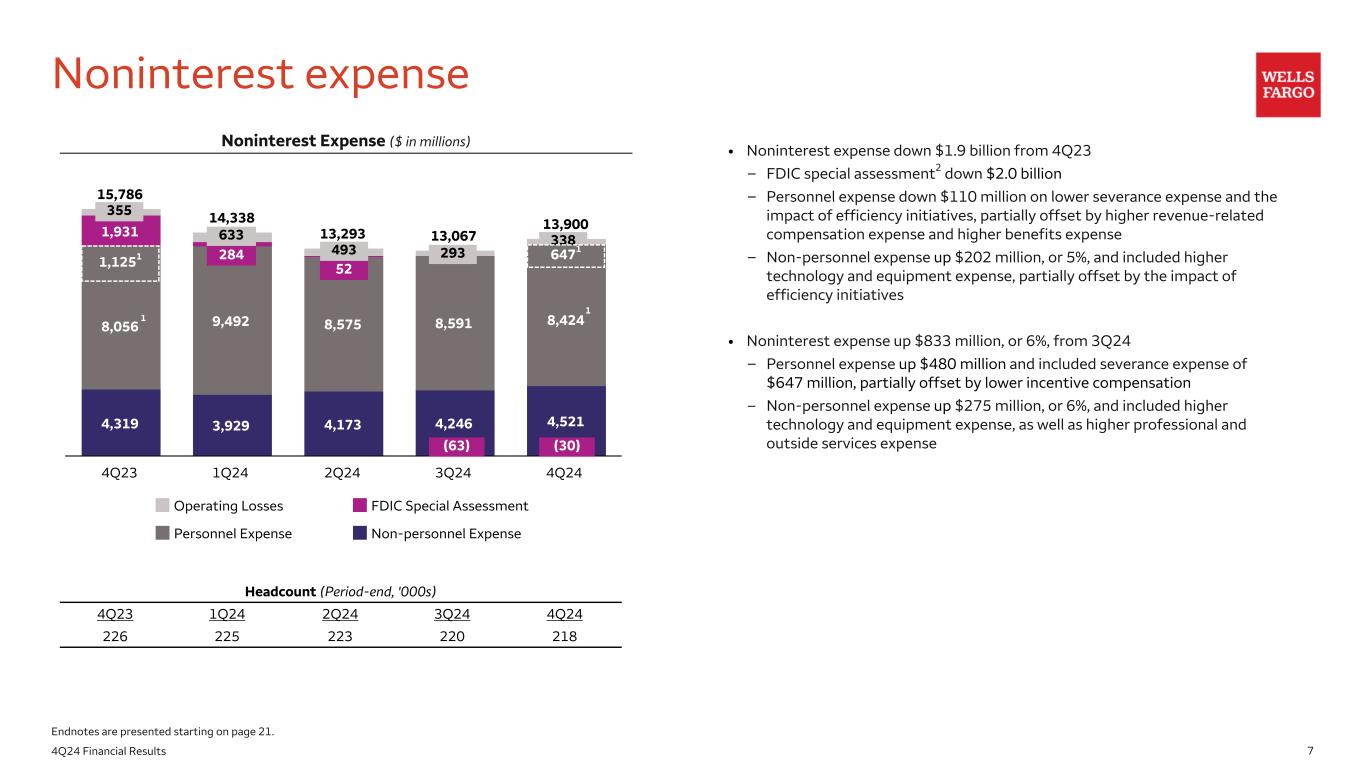

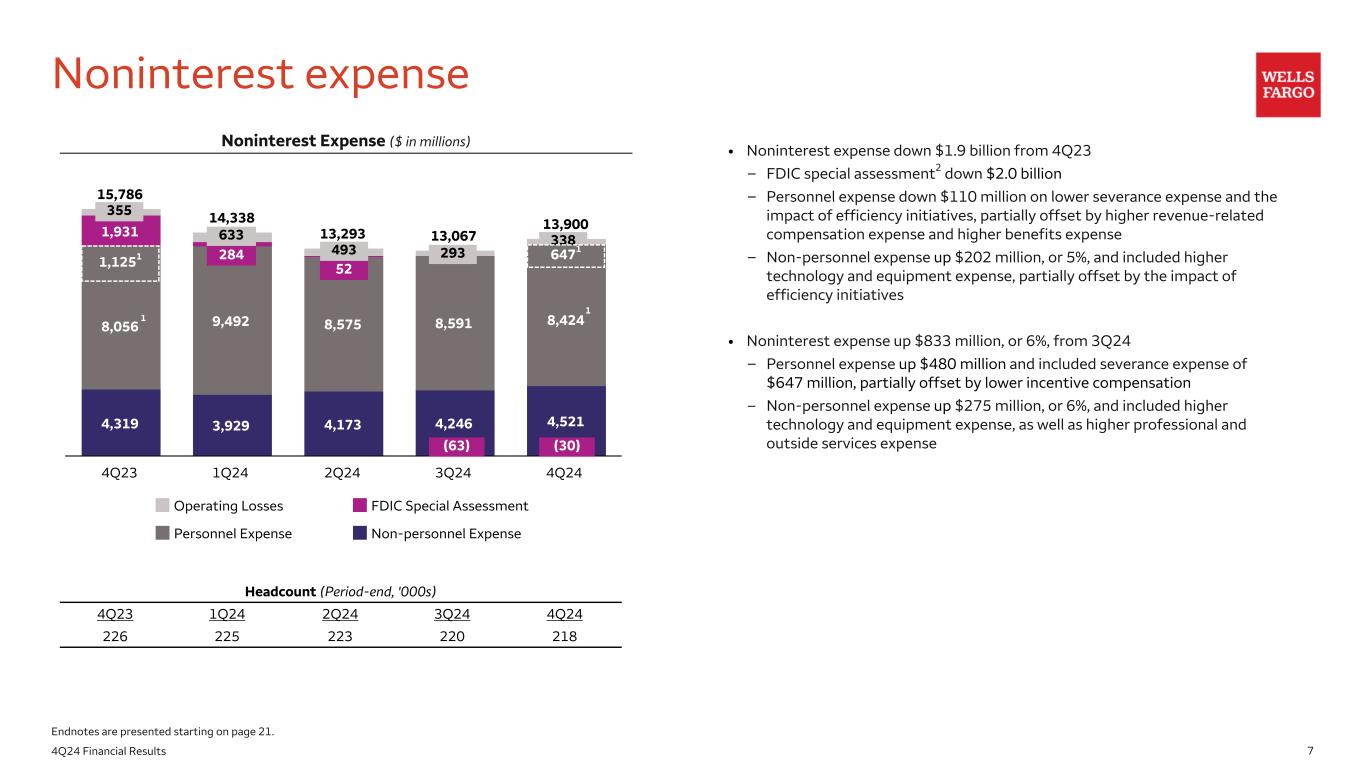

74Q24 Financial Results 15,786 14,338 13,293 13,067 13,900 4,319 3,929 4,173 4,246 4,521 8,056 9,492 8,575 8,591 8,424 1,931 Operating Losses FDIC Special Assessment Personnel Expense Non-personnel Expense 4Q23 1Q24 2Q24 3Q24 4Q24 Noninterest expense • Noninterest expense down $1.9 billion from 4Q23 – FDIC special assessment2 down $2.0 billion – Personnel expense down $110 million on lower severance expense and the impact of efficiency initiatives, partially offset by higher revenue-related compensation expense and higher benefits expense – Non-personnel expense up $202 million, or 5%, and included higher technology and equipment expense, partially offset by the impact of efficiency initiatives • Noninterest expense up $833 million, or 6%, from 3Q24 – Personnel expense up $480 million and included severance expense of $647 million, partially offset by lower incentive compensation – Non-personnel expense up $275 million, or 6%, and included higher technology and equipment expense, as well as higher professional and outside services expense Noninterest Expense ($ in millions) Headcount (Period-end, '000s) 4Q23 1Q24 2Q24 3Q24 4Q24 226 225 223 220 218 293493 633 355 1,1251 Endnotes are presented starting on page 21. (63) 1 52 1 338 (30) 284 6471

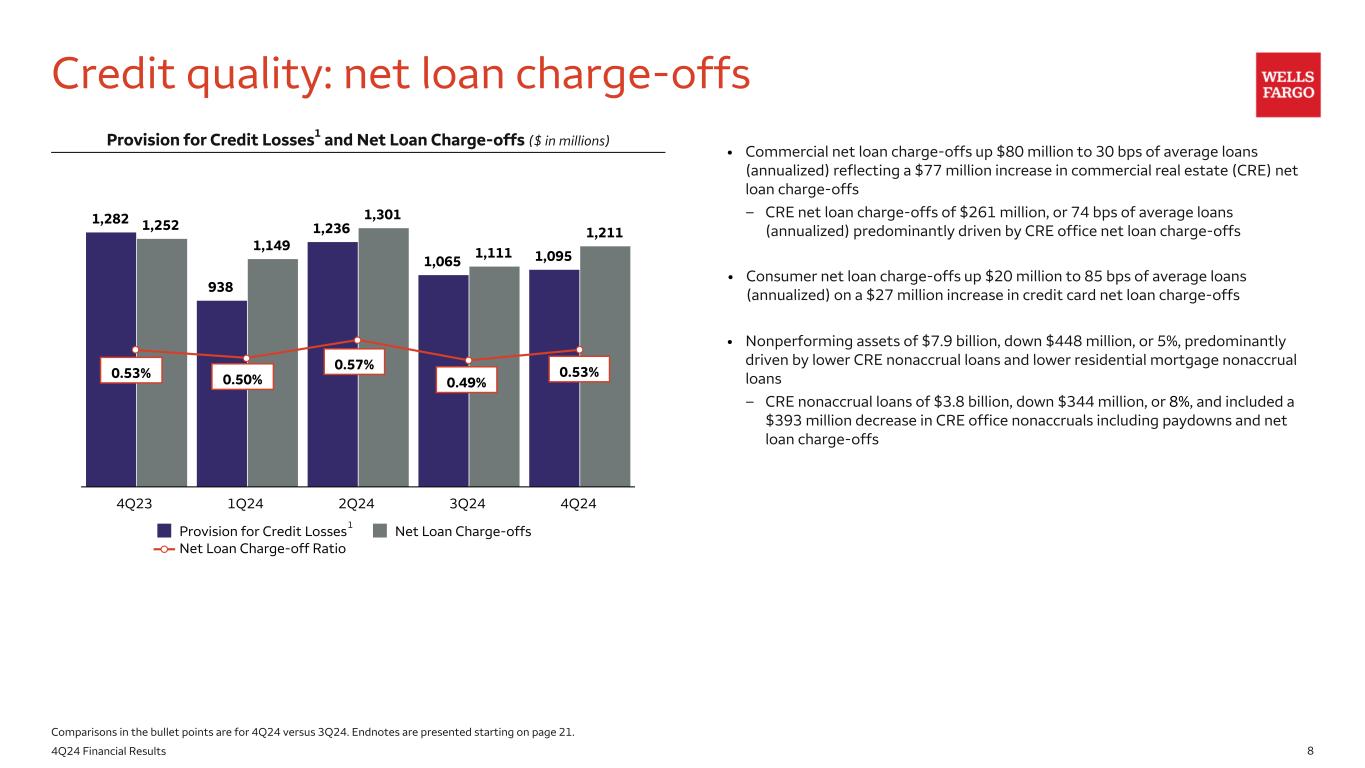

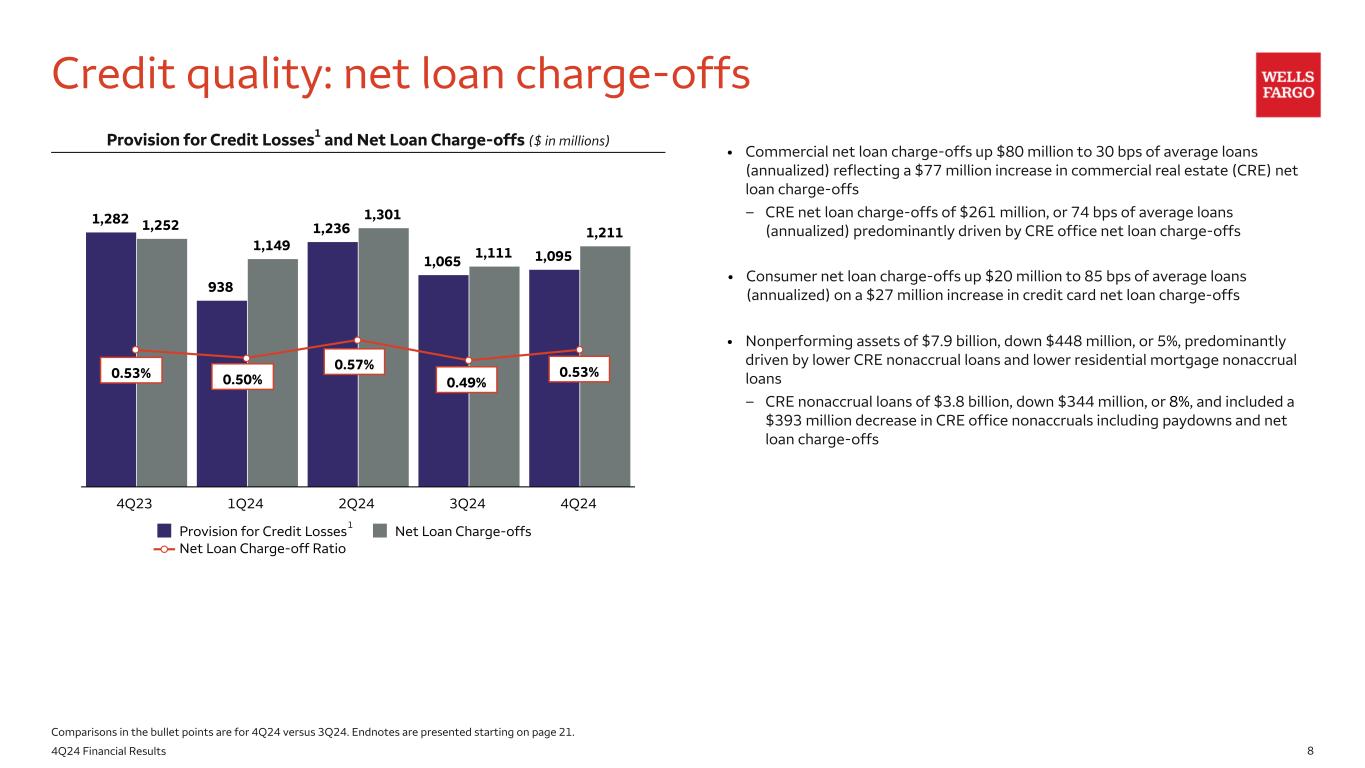

84Q24 Financial Results 1,282 938 1,236 1,065 1,095 1,252 1,149 1,301 1,111 1,211 Provision for Credit Losses Net Loan Charge-offs Net Loan Charge-off Ratio 4Q23 1Q24 2Q24 3Q24 4Q24 Credit quality: net loan charge-offs • Commercial net loan charge-offs up $80 million to 30 bps of average loans (annualized) reflecting a $77 million increase in commercial real estate (CRE) net loan charge-offs – CRE net loan charge-offs of $261 million, or 74 bps of average loans (annualized) predominantly driven by CRE office net loan charge-offs • Consumer net loan charge-offs up $20 million to 85 bps of average loans (annualized) on a $27 million increase in credit card net loan charge-offs • Nonperforming assets of $7.9 billion, down $448 million, or 5%, predominantly driven by lower CRE nonaccrual loans and lower residential mortgage nonaccrual loans – CRE nonaccrual loans of $3.8 billion, down $344 million, or 8%, and included a $393 million decrease in CRE office nonaccruals including paydowns and net loan charge-offs Provision for Credit Losses1 and Net Loan Charge-offs ($ in millions) Comparisons in the bullet points are for 4Q24 versus 3Q24. Endnotes are presented starting on page 21. 0.53% 0.50% 0.49% 0.57% 1 0.53%

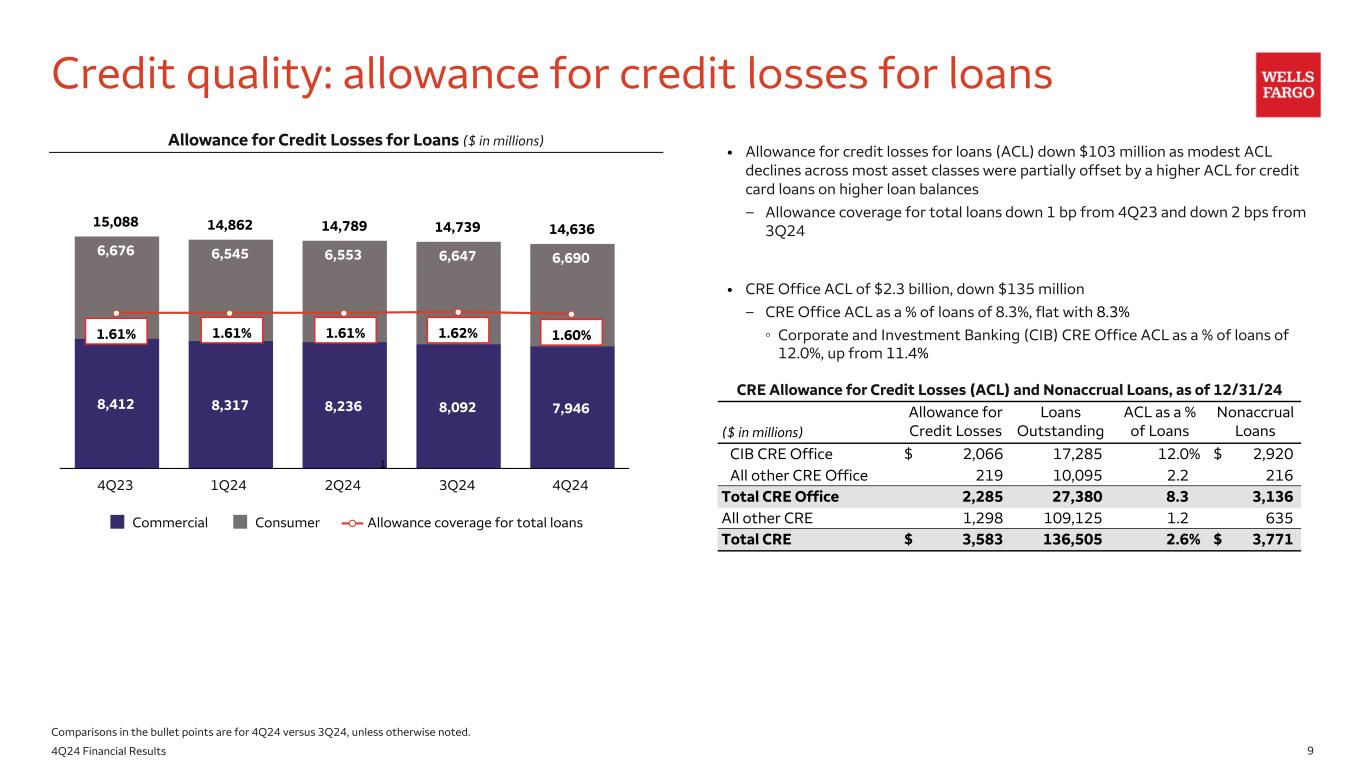

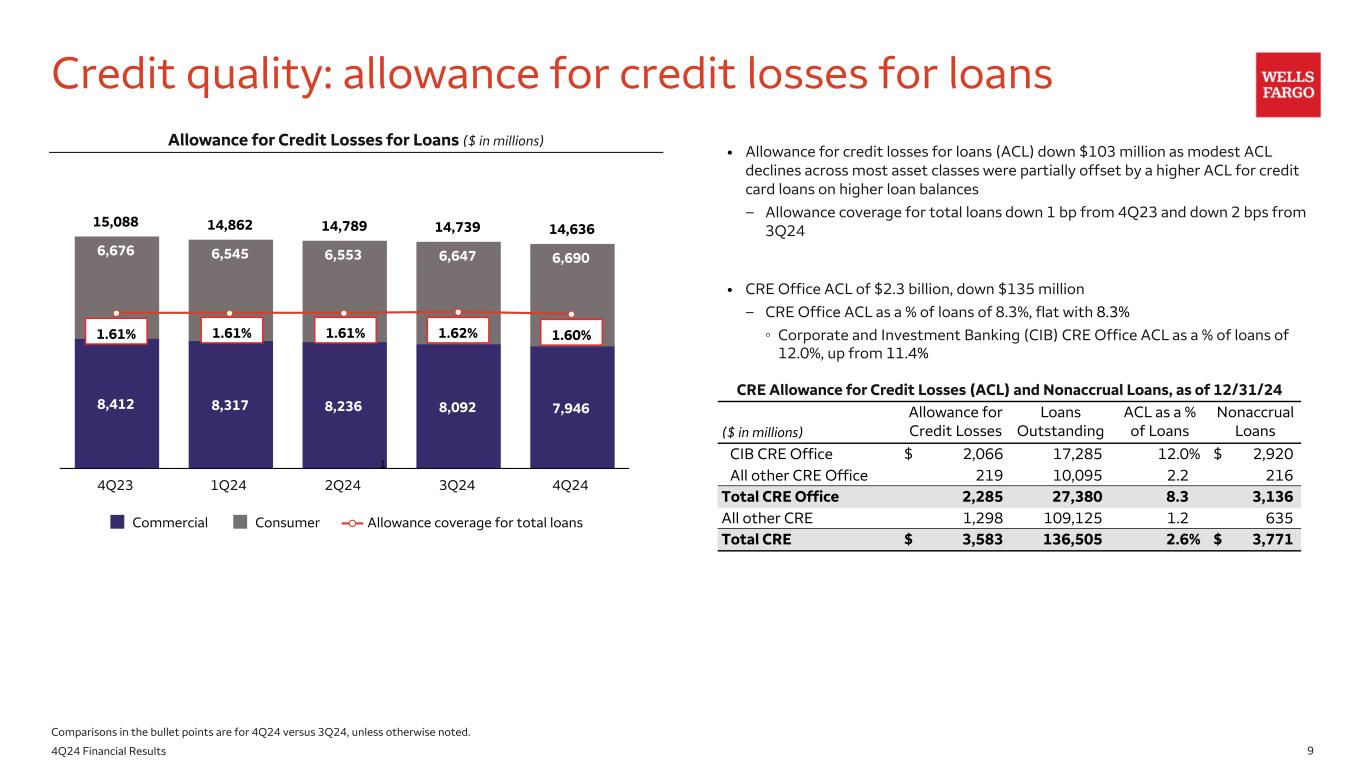

94Q24 Financial Results Credit quality: allowance for credit losses for loans Allowance for Credit Losses for Loans ($ in millions) • Allowance for credit losses for loans (ACL) down $103 million as modest ACL declines across most asset classes were partially offset by a higher ACL for credit card loans on higher loan balances – Allowance coverage for total loans down 1 bp from 4Q23 and down 2 bps from 3Q24 • CRE Office ACL of $2.3 billion, down $135 million – CRE Office ACL as a % of loans of 8.3%, flat with 8.3% ◦ Corporate and Investment Banking (CIB) CRE Office ACL as a % of loans of 12.0%, up from 11.4% 15,088 14,862 14,789 14,739 14,636 8,412 8,317 8,236 8,092 7,946 6,676 6,545 6,553 6,647 6,690 Commercial Consumer Allowance coverage for total loans 4Q23 1Q24 2Q24 3Q24 4Q24 1.61%1.61% 1.61% 1.62% 1.60% 1 CRE Allowance for Credit Losses (ACL) and Nonaccrual Loans, as of 12/31/24 ($ in millions) Allowance for Credit Losses Loans Outstanding ACL as a % of Loans Nonaccrual Loans CIB CRE Office $ 2,066 17,285 12.0% $ 2,920 All other CRE Office 219 10,095 2.2 216 Total CRE Office 2,285 27,380 8.3 3,136 All other CRE 1,298 109,125 1.2 635 Total CRE $ 3,583 136,505 2.6% $ 3,771 Comparisons in the bullet points are for 4Q24 versus 3Q24, unless otherwise noted.

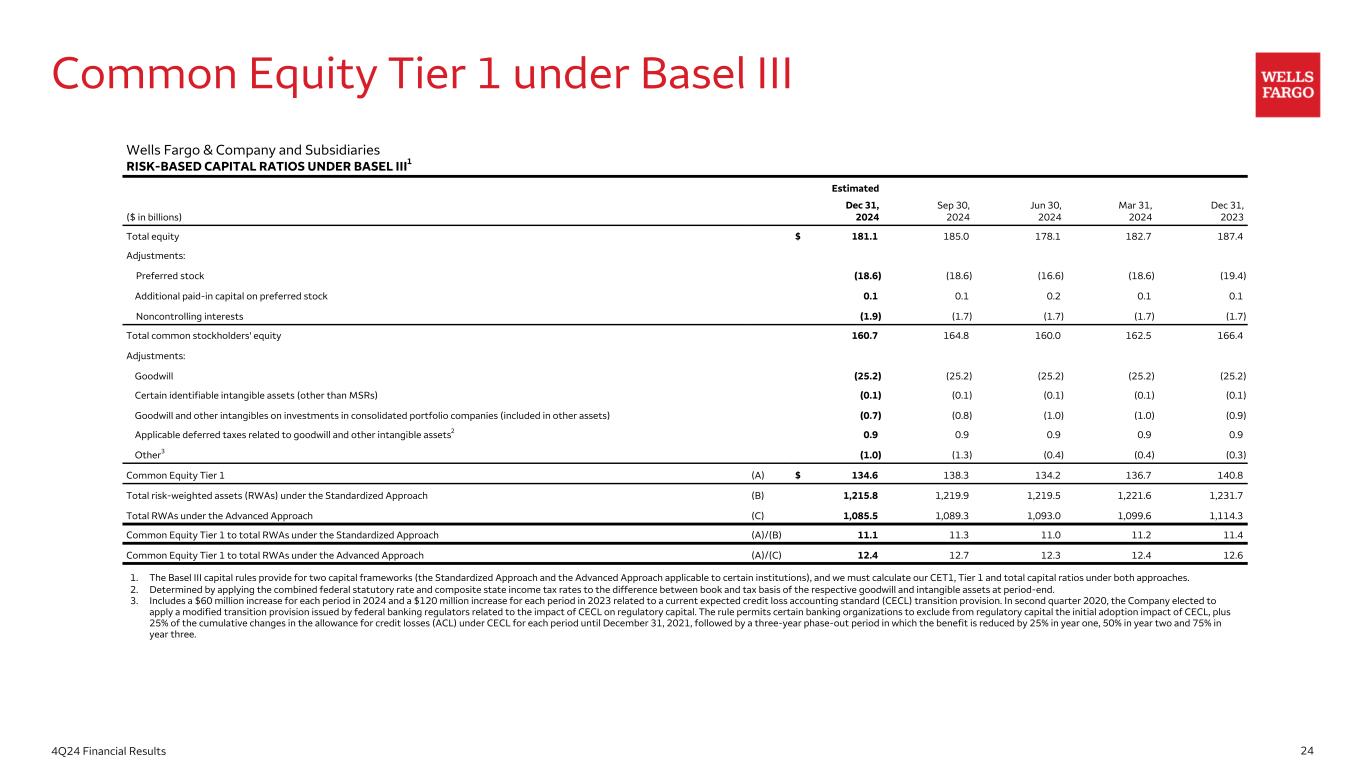

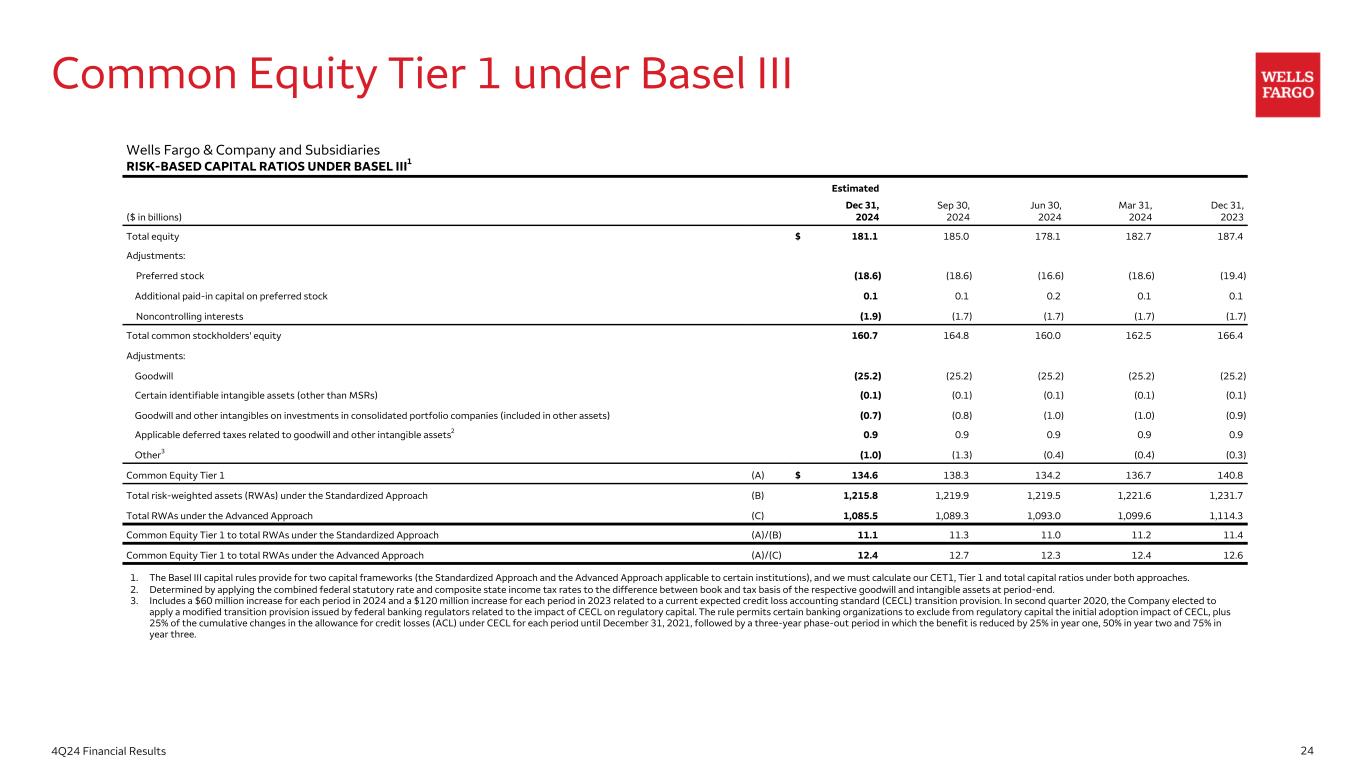

104Q24 Financial Results Capital and liquidity Capital Position • Common Equity Tier 1 (CET1) ratio1 of 11.1% at December 31, 2024 • CET1 ratio down 30 bps from 4Q23 and down 20 bps from 3Q24 – A decrease in accumulated other comprehensive income reflecting higher interest rates and wider spreads on mortgage-backed securities had a (26) bps impact on the CET1 ratio versus 3Q24 Capital Return • $4.0 billion in gross common stock repurchases, or 57.8 million shares, in 4Q24; period-end common shares outstanding down 310.0 million, or 9%, from 4Q23 • 4Q24 common stock dividend of $0.40 per share with $1.3 billion in common stock dividends paid Total Loss Absorbing Capacity (TLAC) • As of December 31, 2024, our TLAC as a percentage of total risk-weighted assets3 was 24.8% compared with the required minimum of 21.5% Liquidity Position • Strong liquidity position with a 4Q24 LCR4 of 125% which remained above our regulatory minimum of 100% 11.4% 11.2% 11.0% 11.3% 11.1% 4Q23 1Q24 2Q24 3Q24 4Q24 Estimated 9.8% Regulatory Minimum and Buffers2 Common Equity Tier 1 Ratio under the Standardized Approach1 Endnotes are presented starting on page 21.

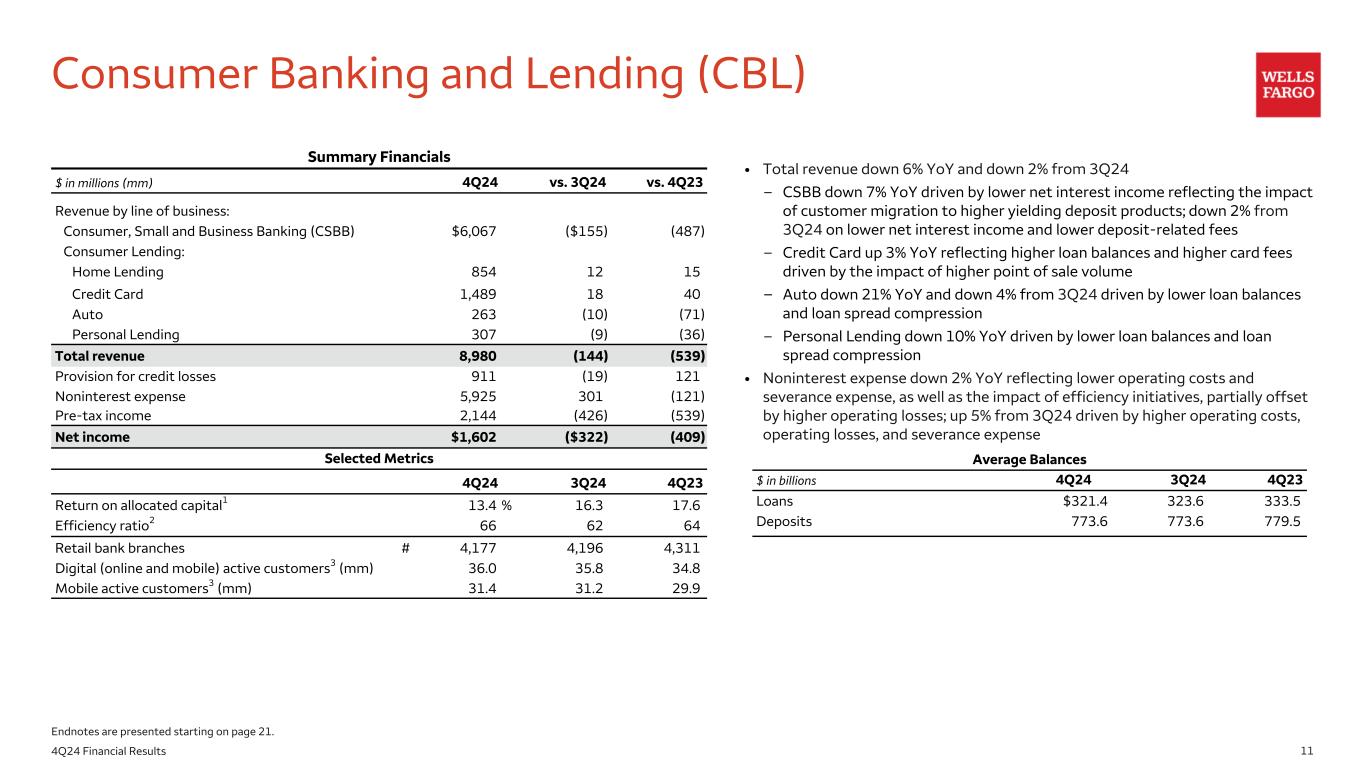

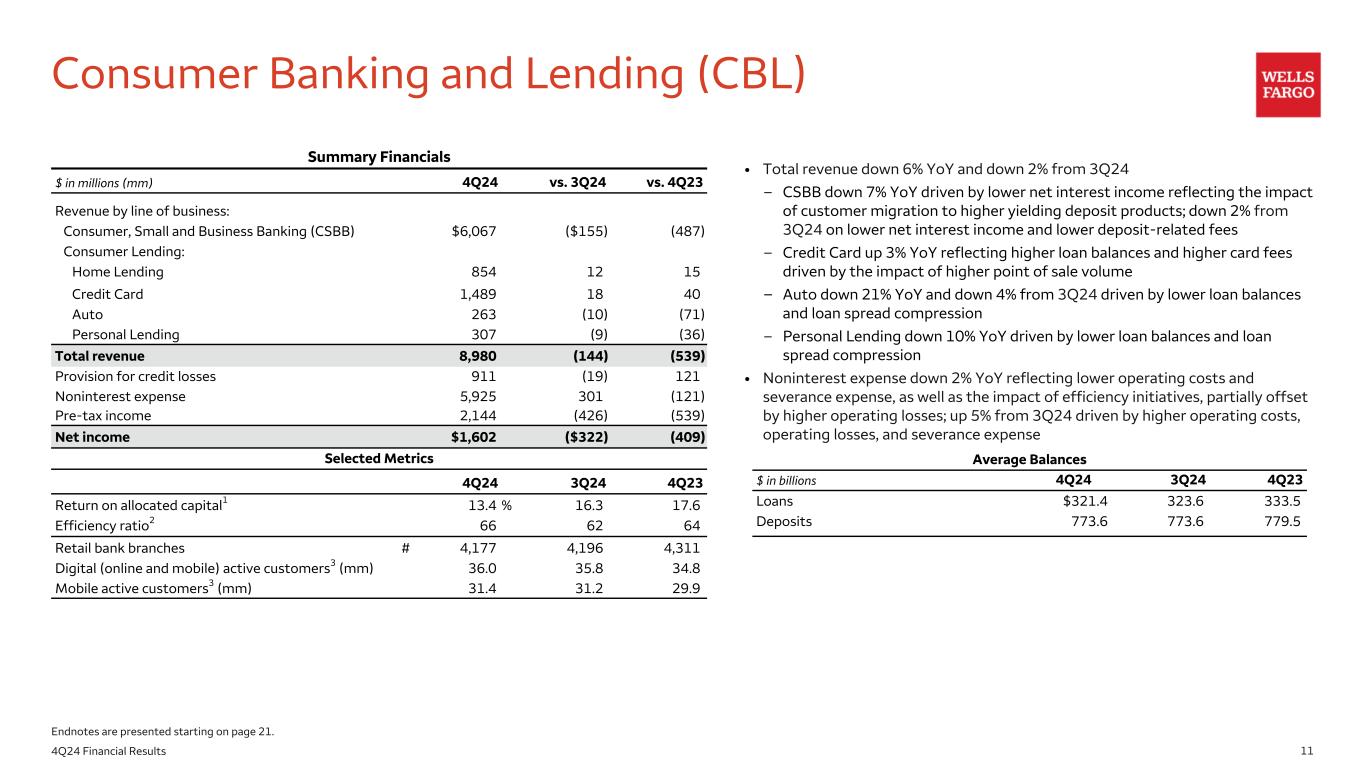

114Q24 Financial Results • Total revenue down 6% YoY and down 2% from 3Q24 – CSBB down 7% YoY driven by lower net interest income reflecting the impact of customer migration to higher yielding deposit products; down 2% from 3Q24 on lower net interest income and lower deposit-related fees – Credit Card up 3% YoY reflecting higher loan balances and higher card fees driven by the impact of higher point of sale volume – Auto down 21% YoY and down 4% from 3Q24 driven by lower loan balances and loan spread compression – Personal Lending down 10% YoY driven by lower loan balances and loan spread compression • Noninterest expense down 2% YoY reflecting lower operating costs and severance expense, as well as the impact of efficiency initiatives, partially offset by higher operating losses; up 5% from 3Q24 driven by higher operating costs, operating losses, and severance expense Consumer Banking and Lending (CBL) Summary Financials $ in millions (mm) 4Q24 vs. 3Q24 vs. 4Q23 Revenue by line of business: Consumer, Small and Business Banking (CSBB) $6,067 ($155) (487) Consumer Lending: Home Lending 854 12 15 Credit Card 1,489 18 40 Auto 263 (10) (71) Personal Lending 307 (9) (36) Total revenue 8,980 (144) (539) Provision for credit losses 911 (19) 121 Noninterest expense 5,925 301 (121) Pre-tax income 2,144 (426) (539) Net income $1,602 ($322) (409) Selected Metrics 4Q24 3Q24 4Q23 Return on allocated capital1 13.4 % 16.3 17.6 Efficiency ratio2 66 62 64 Retail bank branches # 4,177 4,196 4,311 Digital (online and mobile) active customers3 (mm) 36.0 35.8 34.8 Mobile active customers3 (mm) 31.4 31.2 29.9 Average Balances $ in billions 4Q24 3Q24 4Q23 Loans $321.4 323.6 333.5 Deposits 773.6 773.6 779.5 Endnotes are presented starting on page 21.

124Q24 Financial Results Consumer Banking and Lending Retail Mortgage Loan Originations ($ in billions) Auto Loan Originations ($ in billions) Credit Card Point of Sale (POS) Volume ($ in billions) Debit Card Purchase Volume and Transactions1 4.5 3.5 5.3 5.5 5.9 Refinances as a % of Retail Originations 4Q23 1Q24 2Q24 3Q24 4Q24 126.1 121.5 128.2 126.8 131.0 Purchase Volume ($ in billions) Purchase Transactions (billions) 4Q23 1Q24 2Q24 3Q24 4Q24 3.3 4.1 3.7 4.1 5.0 4Q23 1Q24 2Q24 3Q24 4Q24 41.2 39.1 42.9 43.4 45.1 4Q23 1Q24 2Q24 3Q24 4Q24 2.5 2.4 2.6 2.6 2.6 24% 18% 13% 20% 27% Endnotes are presented starting on page 21.

134Q24 Financial Results Commercial Banking (CB) • Total revenue down 6% YoY and down 5% from 3Q24 – Middle Market Banking revenue down 2% YoY driven by lower net interest income reflecting the impact of higher deposit costs, partially offset by higher treasury management fees; down 2% from 3Q24 on lower net interest income – Asset-Based Lending and Leasing revenue down 12% YoY on lower net interest income and lease income, partially offset by improved results from equity investments; down 10% from 3Q24 and included lower revenue from equity investments • Noninterest expense down 6% YoY on lower severance expense and operating losses, as well as the impact of efficiency initiatives, partially offset by higher operating costs; up 3% from 3Q24 and included higher severance expense and higher professional and outside services expense Summary Financials $ in millions 4Q24 vs. 3Q24 vs. 4Q23 Revenue by line of business: Middle Market Banking $2,144 ($43) (52) Asset-Based Lending and Leasing 1,027 (119) (145) Total revenue 3,171 (162) (197) Provision for credit losses 33 (52) (7) Noninterest expense 1,525 45 (105) Pre-tax income 1,613 (155) (85) Net income $1,203 ($115) (70) Selected Metrics 4Q24 3Q24 4Q23 Return on allocated capital 17.4 % 19.2 19.0 Efficiency ratio 48 44 48 Average loans by line of business ($ in billions) Middle Market Banking $126.8 127.3 119.0 Asset-Based Lending and Leasing 95.0 94.8 104.4 Total loans $221.8 222.1 223.4 Average deposits 184.3 173.2 163.3

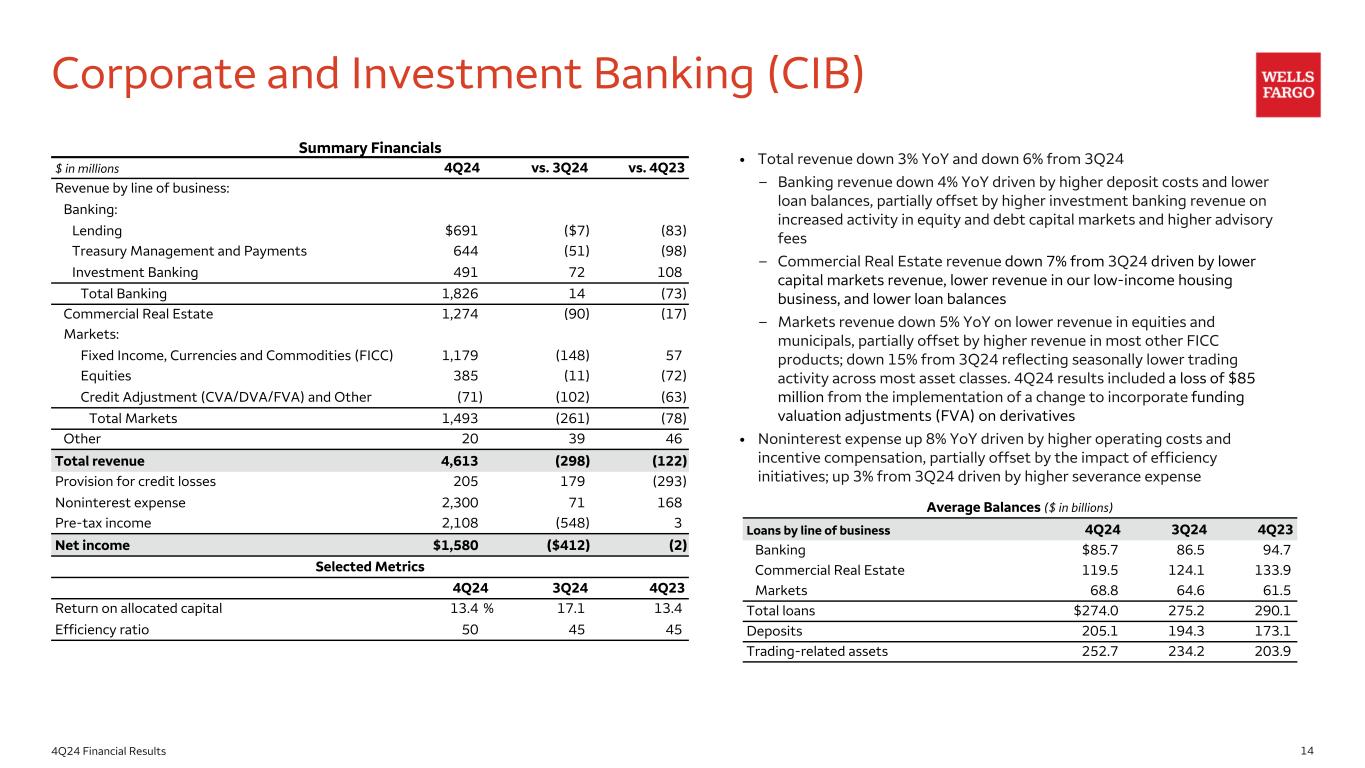

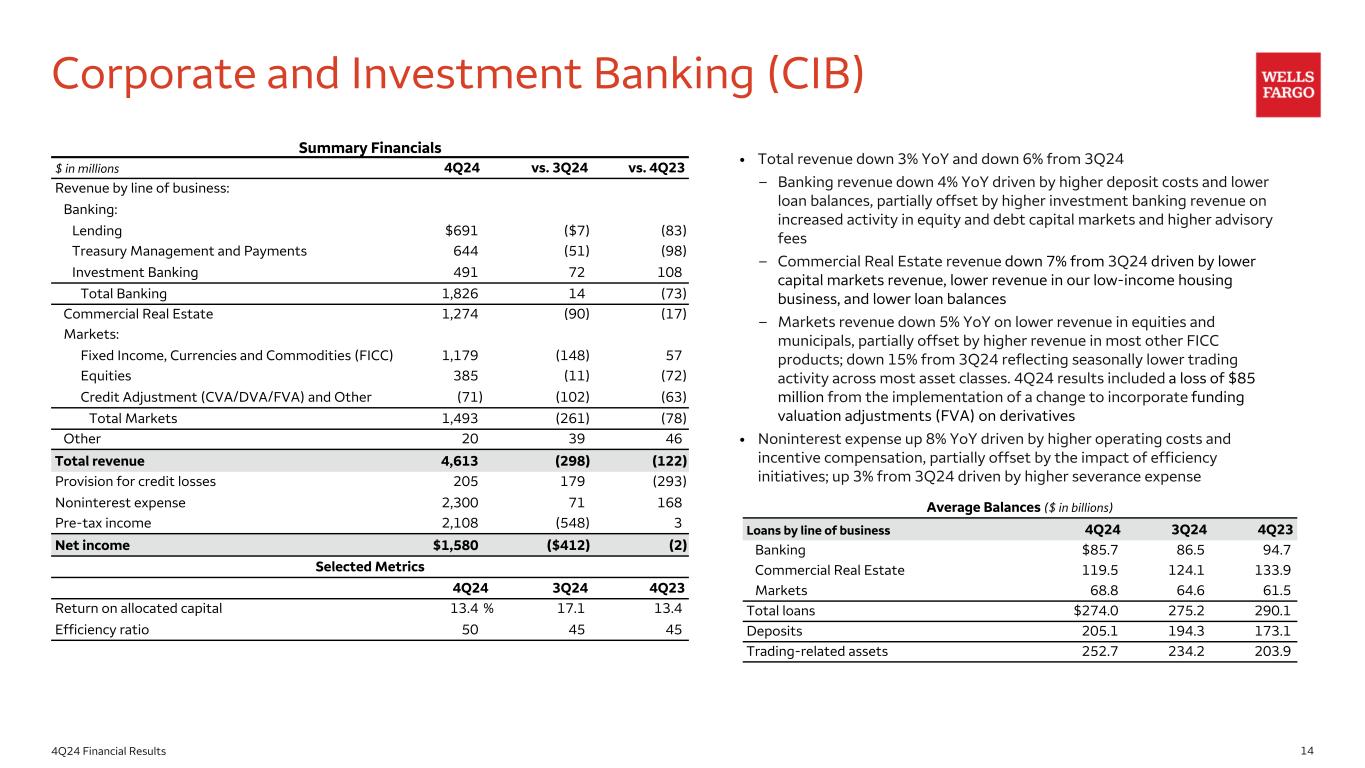

144Q24 Financial Results Corporate and Investment Banking (CIB) • Total revenue down 3% YoY and down 6% from 3Q24 – Banking revenue down 4% YoY driven by higher deposit costs and lower loan balances, partially offset by higher investment banking revenue on increased activity in equity and debt capital markets and higher advisory fees – Commercial Real Estate revenue down 7% from 3Q24 driven by lower capital markets revenue, lower revenue in our low-income housing business, and lower loan balances – Markets revenue down 5% YoY on lower revenue in equities and municipals, partially offset by higher revenue in most other FICC products; down 15% from 3Q24 reflecting seasonally lower trading activity across most asset classes. 4Q24 results included a loss of $85 million from the implementation of a change to incorporate funding valuation adjustments (FVA) on derivatives • Noninterest expense up 8% YoY driven by higher operating costs and incentive compensation, partially offset by the impact of efficiency initiatives; up 3% from 3Q24 driven by higher severance expense Summary Financials $ in millions 4Q24 vs. 3Q24 vs. 4Q23 Revenue by line of business: Banking: Lending $691 ($7) (83) Treasury Management and Payments 644 (51) (98) Investment Banking 491 72 108 Total Banking 1,826 14 (73) Commercial Real Estate 1,274 (90) (17) Markets: Fixed Income, Currencies and Commodities (FICC) 1,179 (148) 57 Equities 385 (11) (72) Credit Adjustment (CVA/DVA/FVA) and Other (71) (102) (63) Total Markets 1,493 (261) (78) Other 20 39 46 Total revenue 4,613 (298) (122) Provision for credit losses 205 179 (293) Noninterest expense 2,300 71 168 Pre-tax income 2,108 (548) 3 Net income $1,580 ($412) (2) Selected Metrics 4Q24 3Q24 4Q23 Return on allocated capital 13.4 % 17.1 13.4 Efficiency ratio 50 45 45 Average Balances ($ in billions) Loans by line of business 4Q24 3Q24 4Q23 Banking $85.7 86.5 94.7 Commercial Real Estate 119.5 124.1 133.9 Markets 68.8 64.6 61.5 Total loans $274.0 275.2 290.1 Deposits 205.1 194.3 173.1 Trading-related assets 252.7 234.2 203.9

154Q24 Financial Results Wealth and Investment Management (WIM) Summary Financials $ in millions 4Q24 vs. 3Q24 vs. 4Q23 Net interest income $856 $14 (50) Noninterest income 3,102 66 348 Total revenue 3,958 80 298 Provision for credit losses (27) (43) (8) Noninterest expense 3,307 153 284 Pre-tax income 678 (30) 22 Net income $508 ($21) 17 Selected Metrics ($ in billions) 4Q24 3Q24 4Q23 Return on allocated capital 30.2 % 31.5 30.4 Efficiency ratio 84 81 83 Average loans $83.6 82.8 82.2 Average deposits 118.3 108.0 102.1 Client assets Advisory assets 998 993 891 Other brokerage assets and deposits 1,295 1,301 1,193 Total client assets $2,293 2,294 2,084 • Total revenue up 8% YoY and up 2% from 3Q24 – Net interest income down 6% YoY driven by higher deposit costs including the impact of increased pricing on sweep deposits in advisory brokerage accounts, partially offset by higher deposit balances; up 2% from 3Q24 driven by higher deposit and loan balances – Noninterest income up 13% YoY and up 2% from 3Q24 on higher asset- based fees driven by an increase in market valuations • Noninterest expense up 9% YoY as higher revenue-related compensation was partially offset by the impact of efficiency initiatives; up 5% from 3Q24 driven by higher revenue-related compensation and severance expense

164Q24 Financial Results Corporate • Revenue increased YoY reflecting improved results from our venture capital investments and net interest income improvement due to lower crediting rates paid to our operating segments, partially offset by net losses on debt securities related to a repositioning of the investment portfolio • Noninterest expense down YoY reflecting lower FDIC assessments, as 4Q23 included a $1.9 billion FDIC special assessment; up from 3Q24 driven by higher severance expense Summary Financials $ in millions 4Q24 vs. 3Q24 vs. 4Q23 Net interest income ($264) $151 280 Noninterest income 368 290 84 Total revenue 104 441 364 Provision for credit losses (27) (35) — Noninterest expense 843 263 (2,112) Pre-tax loss (712) 213 2,476 Income tax benefit (1,080) (750) 259 Less: Net income from noncontrolling interests 182 128 120 Net income $186 $835 2,097

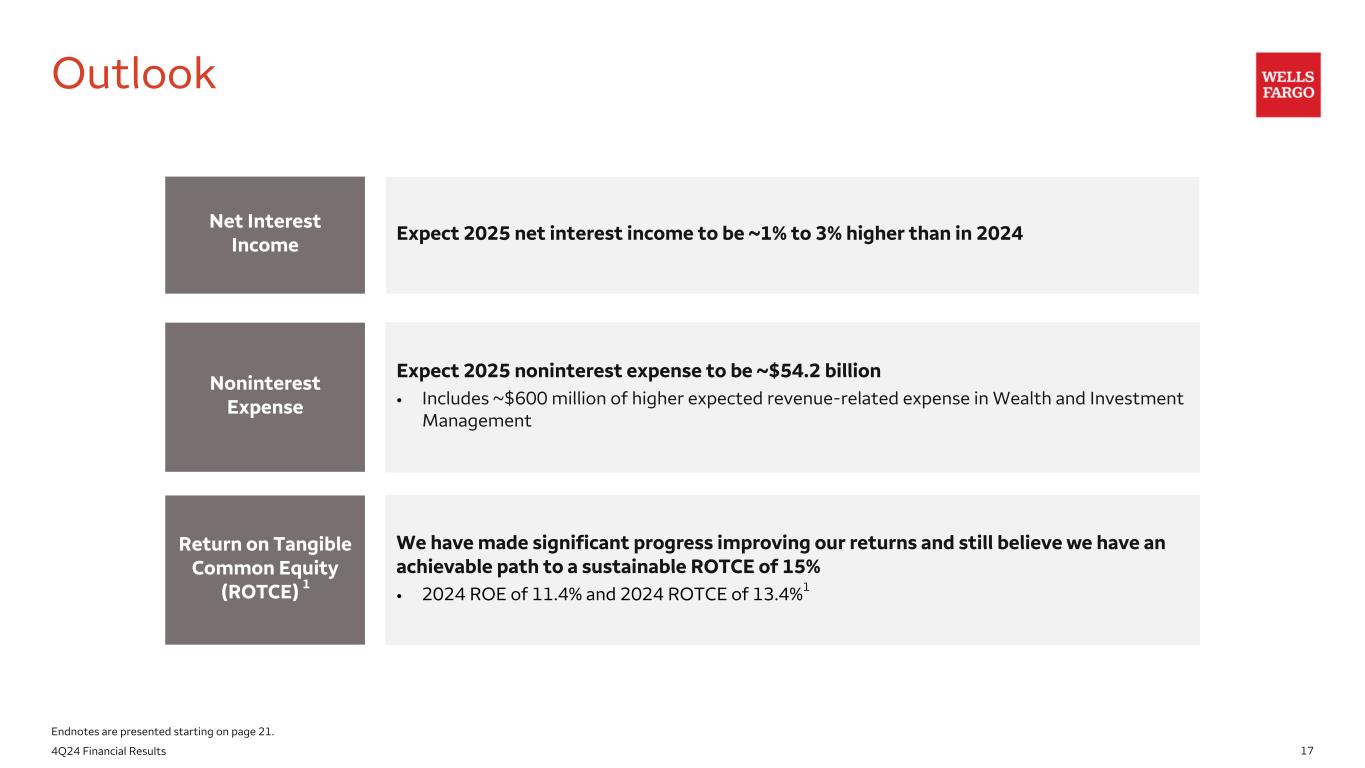

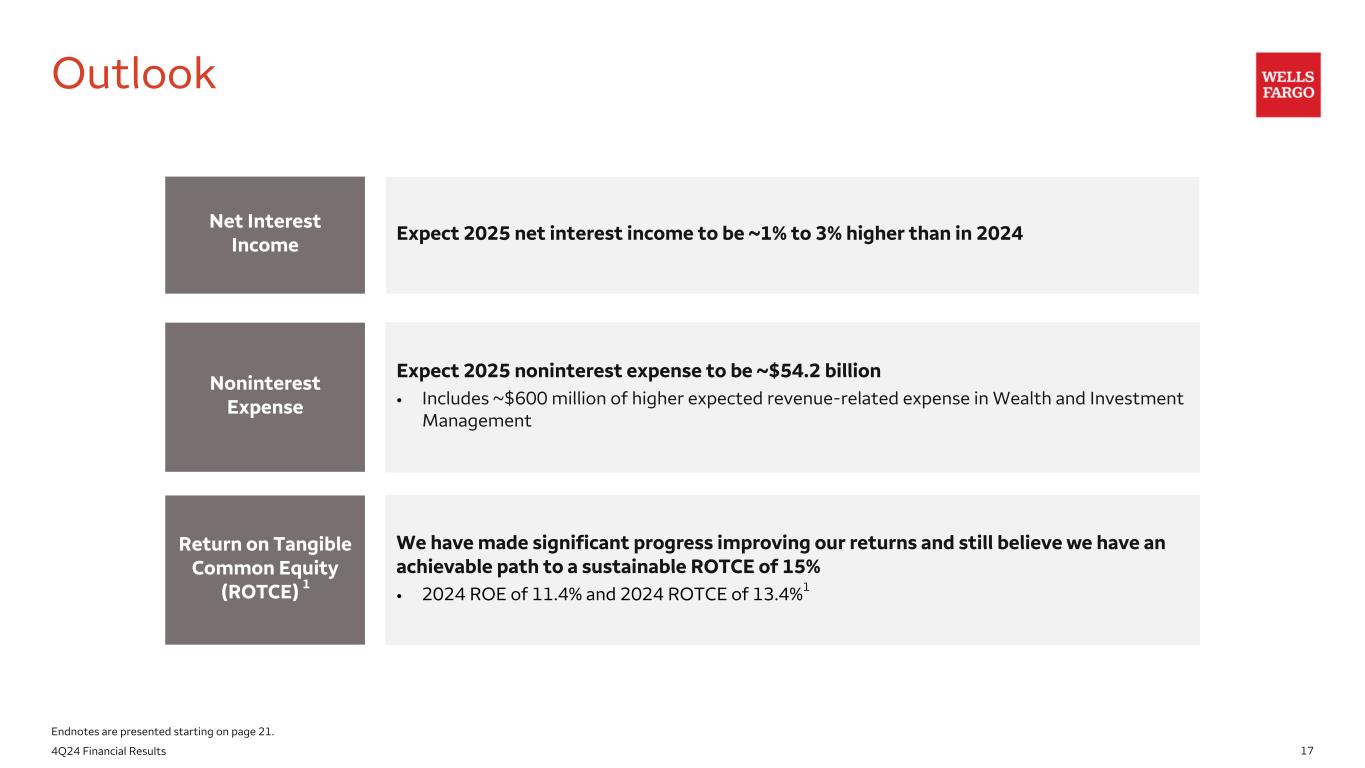

174Q24 Financial Results Outlook Expect 2025 net interest income to be ~1% to 3% higher than in 2024 Net Interest Income Noninterest Expense Expect 2025 noninterest expense to be ~$54.2 billion • Includes ~$600 million of higher expected revenue-related expense in Wealth and Investment Management Return on Tangible Common Equity (ROTCE) 1 We have made significant progress improving our returns and still believe we have an achievable path to a sustainable ROTCE of 15% • 2024 ROE of 11.4% and 2024 ROTCE of 13.4%1 Endnotes are presented starting on page 21.

184Q24 Financial Results • 2025 net interest income is expected to be ~1 to 3% higher than 2024 net interest income of $47.7 billion. Key assumptions include: – Average loans (4Q25 vs. 4Q24) expected to grow modestly on anticipated growth in CIB Markets and Banking, as well as anticipated growth in auto and credit card – Average deposits in all operating segments (CBL, CB, CIB and WIM) expected to grow modestly, which should allow for a reduction in higher-cost market funding – Reinvestment of securities run-off into higher-yielding assets – Benefit of the investment portfolio repositioning that occurred in the second half of 2024 – Higher trading-related NII (largely offset by lower trading-related noninterest income) – Expectations assume the asset cap will remain in place for 2025 • Net interest income performance will ultimately be determined by a variety of factors, many of which are uncertain, including the absolute level of rates and the shape of the yield curve; deposit balances, mix and pricing; and loan demand $47.7 $47.0 GAAP Full Year 2024 4Q24 Annualized Full Year 2025 ~3-5% higher than 4Q24 annualized1 2025 net interest income expectation 2025 Net Interest Income (NII) Expectation ($ in billions) 1 Forward Rate Curve as of 1/8/25 Average rates 1Q25 2Q25 3Q25 4Q25 Fed Funds 4.31 % 4.18 4.03 3.94 10-year Treasury 4.72 4.74 4.77 4.80 Expect 2025 NII to be ~1 to 3% higher than 2024 Endnotes are presented starting on page 21.

194Q24 Financial Results $54.6 (0.7) (0.5) 0.6 0.2 $54.2 2024 Expense 2025 Outlook 0.9 0.9 0.8 Efficiency initiatives Incremental technology expense Incremental other investments Other including expected merit increases 2025 Expense Expectation 2025 expense expectation Building the right risk and control infrastructure to strengthen our Company remains our top priority ($ in billions) Expected net other expense change details ~ • 2025 expense expectations – ~$1.1 billion of operating losses – Lower severance expense – Higher revenue-related expense in Wealth and Investment Management (assumes modestly higher equity markets) • Efficiency initiatives include: – Technology driven efficiencies, including streamlining operations through modern data platforms and tools and increasing automation – Delivering integrated digital solutions and enhancing our digital infrastructure – Operational efficiencies from business optimization, process improvement, and process automation – Continue to see more opportunities past 2025 • Incremental technology expense includes investments in infrastructure and business capabilities • Incremental other investments include targeted hiring in Corporate and Investment Banking and Commercial Banking, as well as higher advertising and promotion expense – For additional detail on investments, see page 20 • Other includes expected merit increases and performance-based discretionary compensation • As previously disclosed, we have outstanding litigation, regulatory, and customer remediation matters that could impact operating losses Expected higher revenue- related expense Expected lower operating losses Expected lower severance expense Expected net other expense change $(2.4)

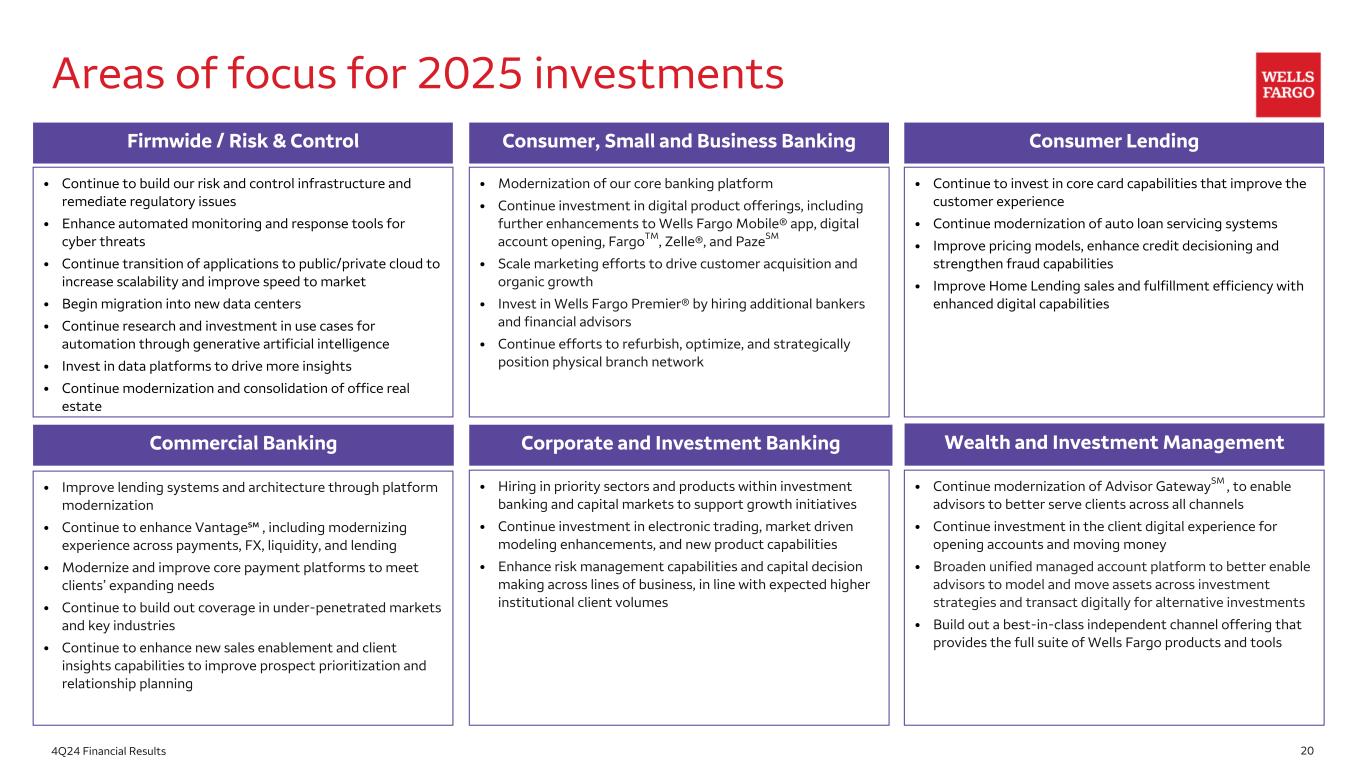

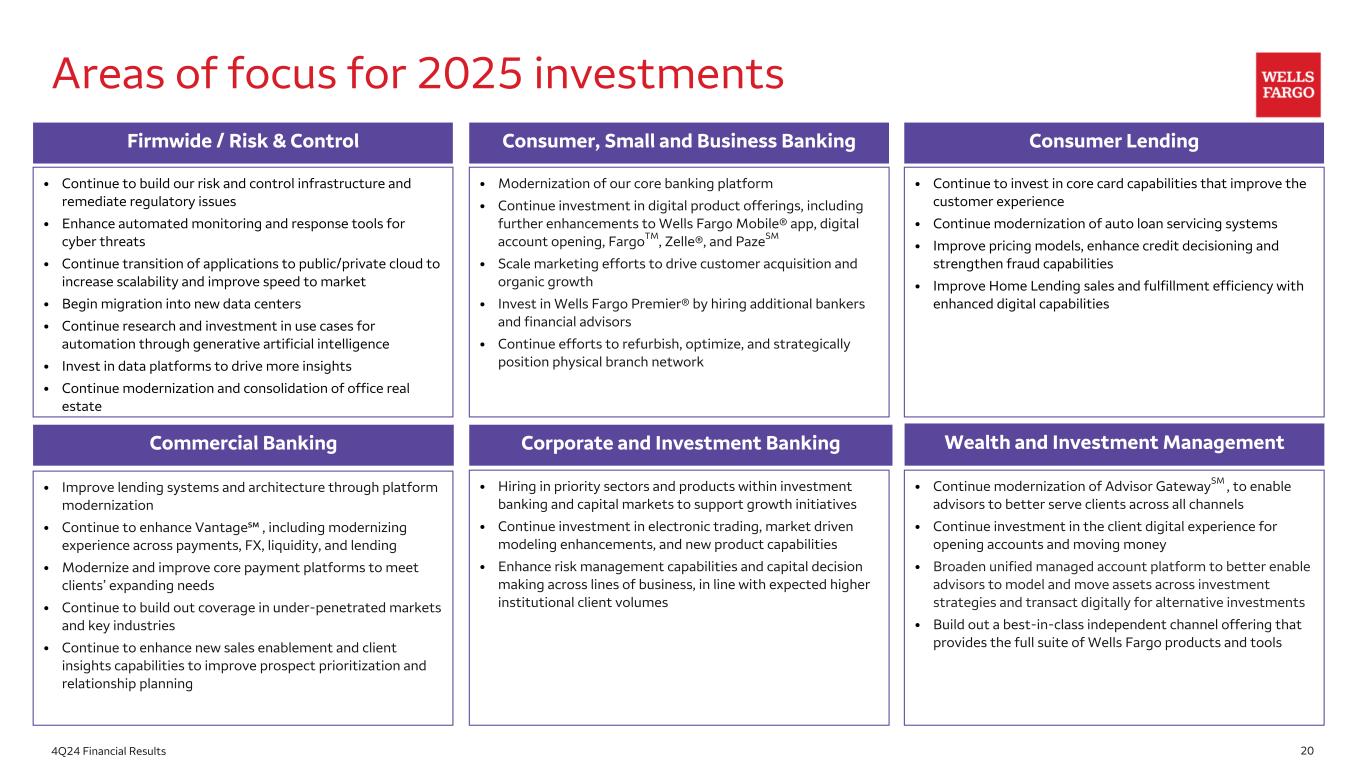

204Q24 Financial Results Areas of focus for 2025 investments Consumer Lending • Continue to invest in core card capabilities that improve the customer experience • Continue modernization of auto loan servicing systems • Improve pricing models, enhance credit decisioning and strengthen fraud capabilities • Improve Home Lending sales and fulfillment efficiency with enhanced digital capabilities Corporate and Investment Banking • Hiring in priority sectors and products within investment banking and capital markets to support growth initiatives • Continue investment in electronic trading, market driven modeling enhancements, and new product capabilities • Enhance risk management capabilities and capital decision making across lines of business, in line with expected higher institutional client volumes Commercial Banking • Improve lending systems and architecture through platform modernization • Continue to enhance Vantage℠ , including modernizing experience across payments, FX, liquidity, and lending • Modernize and improve core payment platforms to meet clients’ expanding needs • Continue to build out coverage in under-penetrated markets and key industries • Continue to enhance new sales enablement and client insights capabilities to improve prospect prioritization and relationship planning Wealth and Investment Management • Continue modernization of Advisor GatewaySM , to enable advisors to better serve clients across all channels • Continue investment in the client digital experience for opening accounts and moving money • Broaden unified managed account platform to better enable advisors to model and move assets across investment strategies and transact digitally for alternative investments • Build out a best-in-class independent channel offering that provides the full suite of Wells Fargo products and tools • Continue to build our risk and control infrastructure and remediate regulatory issues • Enhance automated monitoring and response tools for cyber threats • Continue transition of applications to public/private cloud to increase scalability and improve speed to market • Begin migration into new data centers • Continue research and investment in use cases for automation through generative artificial intelligence • Invest in data platforms to drive more insights • Continue modernization and consolidation of office real estate Firmwide / Risk & Control Consumer, Small and Business Banking • Modernization of our core banking platform • Continue investment in digital product offerings, including further enhancements to Wells Fargo Mobile® app, digital account opening, FargoTM, Zelle®, and PazeSM • Scale marketing efforts to drive customer acquisition and organic growth • Invest in Wells Fargo Premier® by hiring additional bankers and financial advisors • Continue efforts to refurbish, optimize, and strategically position physical branch network

214Q24 Financial Results Endnotes Page 2 – 4Q24 results 1. Tangible common equity and return on average tangible common equity (ROTCE) are non-GAAP financial measures. For additional information, including a corresponding reconciliation to GAAP financial measures, see the “Tangible Common Equity” table on page 23. 2. The efficiency ratio is noninterest expense divided by total revenue. 3. Pre-tax pre-provision profit (PTPP) is total revenue less noninterest expense. Management believes that PTPP is a useful financial measure because it enables investors and others to assess the Company's ability to generate capital to cover credit losses through a credit cycle. 4. In first quarter 2024, we adopted a new accounting standard to use the proportional amortization method for renewable energy tax credit investments. Under the proportional amortization method, the amortization of the investments and the related tax impacts are both recognized in income tax expense. Previously, we recognized the amortization of the investments in other noninterest income and the related tax impacts were recognized in income tax expense. 5. Includes provision for credit losses for loans, debt securities, and other financial assets. 6. The Common Equity Tier 1 (CET1) ratio calculated under the Standardized Approach is our binding CET1 ratio. See page 24 for additional information regarding CET1 capital and ratios. CET1 is a preliminary estimate. 7. Liquidity coverage ratio (LCR) represents average high-quality liquid assets divided by average projected net cash outflows, as each is defined under the LCR rule. LCR is a preliminary estimate. 8. Represents total loss absorbing capacity (TLAC) divided by risk-weighted assets (RWAs), which is our binding TLAC ratio, determined by using the greater of RWAs under the Standardized and Advanced Approaches. TLAC is a preliminary estimate. Page 3 – 4Q24 earnings 1. Includes provision for credit losses for loans, debt securities, and other financial assets. 2. In first quarter 2024, we adopted a new accounting standard to use the proportional amortization method for renewable energy tax credit investments. Under the proportional amortization method, the amortization of the investments and the related tax impacts are both recognized in income tax expense. Previously, we recognized the amortization of the investments in other noninterest income and the related tax impacts were recognized in income tax expense. 3. Tangible common equity and return on average tangible common equity (ROTCE) are non-GAAP financial measures. For additional information, including a corresponding reconciliation to GAAP financial measures, see the “Tangible Common Equity” table on page 23. Page 4 – Net interest income 1. Includes taxable-equivalent adjustments predominantly related to tax-exempt income on certain loans and securities. Page 6 – Noninterest income 1. Investment advisory fees and brokerage commissions includes investment advisory and other asset-based fees and commissions and brokerage services fees. 2. All other includes mortgage banking, net gains (losses) from debt securities, net gains (losses) from equity securities, lease income, and other. Page 7 – Noninterest expense 1. 4Q23 total personnel expense of $9.2 billion included $1.1 billion of severance expense. 4Q24 total personnel expense of $9.1 billion included $647 million of severance expense. 2. Federal Deposit Insurance Corporation (FDIC) special assessment expense reflects updates provided by the FDIC on losses to the deposit insurance fund.

224Q24 Financial Results Page 8 – Credit quality: net loan charge-offs 1. Includes provision for credit losses for loans, debt securities, and other financial assets. Page 10 – Capital and liquidity 1. The Common Equity Tier 1 (CET1) ratio calculated under the Standardized Approach is our binding CET1 ratio. See page 24 for additional information regarding CET1 capital and ratios. 4Q24 CET1 is a preliminary estimate. 2. Includes a 4.50% minimum requirement, a stress capital buffer of 3.80%, and a G-SIB capital surcharge of 1.50%. 3. Represents total loss absorbing capacity (TLAC) divided by risk-weighted assets (RWAs), which is our binding TLAC ratio, determined by using the greater of RWAs under the Standardized and Advanced Approaches. TLAC is a preliminary estimate. 4. Liquidity coverage ratio (LCR) represents average high-quality liquid assets divided by average projected net cash outflows, as each is defined under the LCR rule. 4Q24 LCR is a preliminary estimate. Page 11 – Consumer Banking and Lending 1. Return on allocated capital is segment net income (loss) applicable to common stock divided by segment average allocated capital. Segment net income (loss) applicable to common stock is segment net income (loss) less allocated preferred stock dividends. 2. Efficiency ratio is segment noninterest expense divided by segment total revenue. 3. Digital and mobile active customers is the number of consumer and small business customers who have logged on via a digital or mobile device, respectively, in the prior 90 days. Page 12 – Consumer Banking and Lending 1. Debit card purchase volume and transactions reflect combined activity for both consumer and business debit card purchases. Page 17 – Outlook 1. Tangible common equity and return on average tangible common equity (ROTCE) are non-GAAP financial measures. For additional information, including a corresponding reconciliation to GAAP financial measures, see the “Tangible Common Equity” table on page 23. Page 18 – 2025 net interest income expectation 1. 4Q24 annualized net interest income of $47.0 billion reflects 2025 day count. Endnotes (continued)

234Q24 Financial Results Tangible Common Equity Wells Fargo & Company and Subsidiaries TANGIBLE COMMON EQUITY We also evaluate our business based on certain ratios that utilize tangible common equity. Tangible common equity is a non-GAAP financial measure and represents total equity less preferred equity, noncontrolling interests, goodwill, certain identifiable intangible assets (other than MSRs) and goodwill and other intangibles on investments in consolidated portfolio companies, net of applicable deferred taxes. One of these ratios is return on average tangible common equity (ROTCE), which represents our annualized earnings as a percentage of tangible common equity. The methodology of determining tangible common equity may differ among companies. Management believes that return on average tangible common equity, which utilizes tangible common equity, is a useful financial measure because it enables management, investors, and others to assess the Company’s use of equity. The table below provides a reconciliation of this non-GAAP financial measure to GAAP financial measures. Quarter ended Year ended ($ in millions) Dec 31, 2024 Sep 30, 2024 Jun 30, 2024 Mar 31, 2024 Dec 31, 2023 Dec 31, 2024 Dec 31, 2023 Return on average tangible common equity: Net income applicable to common stock (A) $ 4,801 4,852 4,640 4,313 3,160 $ 18,606 17,982 Average total equity 182,933 184,368 181,552 186,669 185,853 183,879 184,860 Adjustments: Preferred stock (18,608) (18,129) (18,300) (19,291) (19,448) (18,581) (19,698) Additional paid-in capital on preferred stock 144 143 145 155 157 147 168 Noncontrolling interests (1,803) (1,748) (1,743) (1,710) (1,664) (1,751) (1,844) Average common stockholders’ equity (B) 162,666 164,634 161,654 165,823 164,898 163,694 163,486 Adjustments: Goodwill (25,170) (25,172) (25,172) (25,174) (25,173) (25,172) (25,173) Certain identifiable intangible assets (other than MSRs) (78) (89) (101) (112) (124) (95) (136) Goodwill and other intangibles on investments in consolidated portfolio companies (included in other assets)1 (772) (965) (965) (879) (878) (895) (2,083) Applicable deferred taxes related to goodwill and other intangible assets2 945 938 931 924 918 935 906 Average tangible common equity (C) $ 137,591 139,346 136,347 140,582 139,641 $ 138,467 137,000 Return on average common stockholders’ equity (ROE) (annualized) (A)/(B) 11.7 % 11.7 11.5 10.5 7.6 11.4 % 11.0 Return on average tangible common equity (ROTCE) (annualized) (A)/(C) 13.9 13.9 13.7 12.3 9.0 13.4 13.1 1. In third quarter 2023, we sold investments in certain private equity funds. As a result, we have removed the related goodwill and other intangible assets on private equity investments in consolidated portfolio companies. 2. Determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period-end.

244Q24 Financial Results 1. The Basel III capital rules provide for two capital frameworks (the Standardized Approach and the Advanced Approach applicable to certain institutions), and we must calculate our CET1, Tier 1 and total capital ratios under both approaches. 2. Determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period-end. 3. Includes a $60 million increase for each period in 2024 and a $120 million increase for each period in 2023 related to a current expected credit loss accounting standard (CECL) transition provision. In second quarter 2020, the Company elected to apply a modified transition provision issued by federal banking regulators related to the impact of CECL on regulatory capital. The rule permits certain banking organizations to exclude from regulatory capital the initial adoption impact of CECL, plus 25% of the cumulative changes in the allowance for credit losses (ACL) under CECL for each period until December 31, 2021, followed by a three-year phase-out period in which the benefit is reduced by 25% in year one, 50% in year two and 75% in year three. Common Equity Tier 1 under Basel III Wells Fargo & Company and Subsidiaries RISK-BASED CAPITAL RATIOS UNDER BASEL III1 Estimated ($ in billions) Dec 31, 2024 Sep 30, 2024 Jun 30, 2024 Mar 31, 2024 Dec 31, 2023 Total equity $ 181.1 185.0 178.1 182.7 187.4 Adjustments: Preferred stock (18.6) (18.6) (16.6) (18.6) (19.4) Additional paid-in capital on preferred stock 0.1 0.1 0.2 0.1 0.1 Noncontrolling interests (1.9) (1.7) (1.7) (1.7) (1.7) Total common stockholders' equity 160.7 164.8 160.0 162.5 166.4 Adjustments: Goodwill (25.2) (25.2) (25.2) (25.2) (25.2) Certain identifiable intangible assets (other than MSRs) (0.1) (0.1) (0.1) (0.1) (0.1) Goodwill and other intangibles on investments in consolidated portfolio companies (included in other assets) (0.7) (0.8) (1.0) (1.0) (0.9) Applicable deferred taxes related to goodwill and other intangible assets2 0.9 0.9 0.9 0.9 0.9 Other3 (1.0) (1.3) (0.4) (0.4) (0.3) Common Equity Tier 1 (A) $ 134.6 138.3 134.2 136.7 140.8 Total risk-weighted assets (RWAs) under the Standardized Approach (B) 1,215.8 1,219.9 1,219.5 1,221.6 1,231.7 Total RWAs under the Advanced Approach (C) 1,085.5 1,089.3 1,093.0 1,099.6 1,114.3 Common Equity Tier 1 to total RWAs under the Standardized Approach (A)/(B) 11.1 11.3 11.0 11.2 11.4 Common Equity Tier 1 to total RWAs under the Advanced Approach (A)/(C) 12.4 12.7 12.3 12.4 12.6

254Q24 Financial Results Disclaimer and forward-looking statements Financial results reported in this document are preliminary. Final financial results and other disclosures will be reported in our Annual Report on Form 10-K for the year ended December 31, 2024, and may differ materially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information. This document contains forward-looking statements. In addition, we may make forward-looking statements in our other documents filed or furnished with the Securities and Exchange Commission, and our management may make forward-looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements include, but are not limited to, statements we make about: (i) the future operating or financial performance of the Company or any of its businesses, including our outlook for future growth; (ii) our expectations regarding noninterest expense and our efficiency ratio; (iii) future credit quality and performance, including our expectations regarding future loan losses, our allowance for credit losses, and the economic scenarios considered to develop the allowance; (iv) our expectations regarding net interest income and net interest margin; (v) loan growth or the reduction or mitigation of risk in our loan portfolios; (vi) future capital or liquidity levels, ratios or targets; (vii) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; (viii) future common stock dividends, common share repurchases and other uses of capital; (ix) our targeted range for return on assets, return on equity, and return on tangible common equity; (x) expectations regarding our effective income tax rate; (xi) the outcome of contingencies, such as legal actions; (xii) environmental, social and governance related goals or commitments; and (xiii) the Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on forward-looking statements as actual results may differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For additional information about factors that could cause actual results to differ materially from our expectations, refer to the “Forward-Looking Statements” discussion in Wells Fargo’s press release announcing our fourth quarter 2024 results and in our most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023.