Exhibit 99.1

Table of Contents

| | | | |

Our Vision & Values guide our actions | | | 4 | |

| |

How to use our Code | | | 4 | |

People as a competitive advantage | | | 5 | |

Who needs to follow our Code? | | | 5 | |

Ethics | | | 6 | |

What’s right for customers | | | 6 | |

Making the right choice | | | 6 | |

Diversity and inclusion | | | 7 | |

Leadership | | | 7 | |

Accountability | | | 7 | |

We do not tolerate retaliation | | | 7 | |

Where to go for help | | | 8 | |

Our EthicsLine and how it works | | | 8 | |

| |

We are trusted | | | 9 | |

| |

Keep confidential information safe and secure | | | 9 | |

Use our assets wisely | | | 10 | |

| |

We are transparent and candid | | | 11 | |

| |

Maintain accurate and complete records | | | 11 | |

Be clear and candid in our public communications | | | 11 | |

| |

We act with honesty and integrity | | | 12 | |

| |

Avoid conflicts of interest | | | 12 | |

Exchange only appropriate gifts and entertainment | | | 13 | |

Exercise sound judgment in incurring business expenses | | | 14 | |

Deal fairly with our customers and others | | | 14 | |

| |

We honor our legal obligations | | | 15 | |

| |

Anti-bribery and anti-corruption | | | 15 | |

Competition and antitrust laws | | | 15 | |

Insider trading and other trading restrictions | | | 16 | |

Global trade, sanctions, embargos, and anti-boycott laws | | | 17 | |

Anti-money laundering | | | 17 | |

Political activities | | | 18 | |

| |

We serve the greater good | | | 19 | |

| |

Support our communities | | | 19 | |

Respect human rights | | | 19 | |

Protect the environment | | | 20 | |

| |

A final thought | | | 21 | |

| |

Additional resources | | | 21 | |

Waivers and exceptions | | | 21 | |

Glossary | | | 22 | |

1

OUR CODE OF ETHICS AND BUSINESS CONDUCT 2

| | |

A message from John Stumpf | |  |

At Wells Fargo, holding ourselves to the highest standards of ethical behavior is nothing new: it’s one of the five shared values that define who we are (as described inThe Vision & Values of Wells Fargo), and it’s been the cornerstone of our culture since 1852! In a nutshell, according to our Vision & Values, “Our ethics are the sum of all the decisions each of us makes every day.” To help guide you in these decisions, I am pleased to introduce our revised Code of Ethics and Business Conduct. The Code works in conjunction with our Vision & Values, our Team Member Handbook, and our company policies to help you navigate situations and answer questions about what to do in specific circumstances. Keep in mind that the Code is not intended to be a comprehensive rulebook. Should you find yourself in doubt, it is important for you to ask questions of your manager or through one of the resources listed in the Code, including the confidential EthicsLine. We are all responsible for maintaining the highest possible ethical standards in how we conduct our business and serve customers. After all, our culture is centered on relationships, and those relationships are built on trust. Our customers have high expectations of us, and we have even higher expectations of ourselves. Thanks for all you do to create and maintain that culture and to serve our customers, communities, team members, and shareholders. Sincerely, /s/ John G. Stumpf John G. Stumpf Chairman and Chief Executive Officer | | |

3 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Our Vision & Values guide our actions

Regardless of our growing size, scope, and reach, our common Vision & Values form the fabric that holds us together wherever we are, whatever we do.

Our Vision & Values have helped create a unique culture at Wells Fargo that sets us apart and defines who we are as an organization. We are proud of our culture and its focus on:

Serving our customers

Connecting with our communities and stakeholders

Caring about one another and those we serve

In order to maintain our reputation as a trusted, ethical company, we must do our part to ensure that our values come alive through our actions. Every day when we come to work, we have the opportunity to bring our Vision & Values to life.

Our culture is continually renewed by the choices and actions each of us makes every day. This Code of Ethics and Business Conduct (“Code”) contains basic principles and additional guidance to help us make the best decisions and to comply with the laws, rules and regulations that govern our business. This Code, together with our Vision & Values, Team Member Handbook, other detailed regional and business work rules, and our more comprehensive company policies, are intended to serve as resources when we are faced with ethics or compliance issues or when we have questions about what to do in specific situations.

How to use our Code

No code of conduct can cover every possible situation, which is why we rely on you to use good judgment and to speak up promptly when you have questions or concerns.

In addition to the Code, we also have a number of other resources and corporate and line of business policies for team members. Throughout the Code, we have listed policies that provide more detail on specific topics. Also included is advice on where to go for additional guidance and support.

Wells Fargo operates globally, and if, at any time, this Code or our policies differ with local laws, rules, and regulations, you should comply with the more restrictive policies, laws, rules, or regulations. Whenever the applicability or interpretation is unclear, team members should contact their manager, HR Advisor (for U.S.-based team members), appropriate Human Resources professional (for non U.S.-based team members), or the Office of Global Ethics and Integrity. Directors of Wells Fargo & Company should contact the General Counsel, Corporate Secretary or Chair of the Governance and Nominating Committee of the Board of Directors (the “Board”) of Wells Fargo & Company.

OUR CODE OF ETHICS AND BUSINESS CONDUCT 4

People as a competitive advantage

We’re a relationship company, but our relationships with our customers are only as strong as our relationships with each other.

As team members and representatives of Wells Fargo, we always value and support one another. We believe everyone on our team is important and deserves respect.

| | • | | We treat one another with fairness and dignity; we do not tolerate discrimination, harassment, or intimidation. |

| | • | | When working with others, we let them know that they are expected to act in a manner consistent with our sense of fair treatment and equal opportunity. |

| | • | | We respect, honor and appreciate one another. |

Who needs to follow our Code?

Our Code applies to all team members, including officers, as well as directors of Wells Fargo & Company and its subsidiaries, regardless of location or whether the team member is classified as regular, part-time, or flexible.

In addition, we look for third-party service providers that share our commitment to integrity, customer service, ethics, compliance, and behavior that is consistent with our Code. We will take the appropriate actions where we believe they have not met our high standards, their contractual obligations, or have violated any applicable law, rule, or regulation. See the Supplier Code of Conduct for additional guidance.

5 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Ethics

Our ethics are the sum of all the decisions each of us makes every day.

We have a responsibility to always act with honesty and integrity. When we do so, we earn the trust of our customers. We have to earn that trust every day by behaving ethically, rewarding open, honest communication, and holding ourselves accountable for our decisions and actions.

What’s right for customers

We want to be approachable and caring, exceed our customers’ expectations, and invest in relationships that last a lifetime.

Our customers are always our priority. Our customer focus is one of the characteristics that distinguishes us from our competitors. We do what’s right for our customers by:

| | • | | Helping them make informed financial choices and being honest and fair in our dealings and communications with them. |

| | • | | Protecting customer confidential information and data. |

| | • | | Providing timely and fair resolution to customer concerns and complaints. |

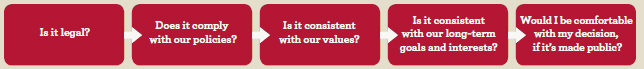

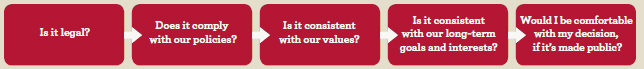

Making the right choice

If you’re faced with an ethical dilemma and you’re not sure what to do, ask these questions:

| | |

| If your answer to any of these questions is “No,” don’t do it. | | You may use the resources on pages 8 and 21 for further guidance and help answering these questions. |

Closing the loop

Our approach to ethics and business conduct must continually evolve to stay current with new and emerging risk areas. Once you’ve made a decision, ask yourself the following additional question:

Do you believe there are sufficient standards, policies and team member resources in place to address the issue you faced – or should more be done?

If you believe more should be done, contact the Office of Global Ethics and Integrity. Your suggestions will help us improve our ethics and compliance programs.

OUR CODE OF ETHICS AND BUSINESS CONDUCT 6

Diversity and inclusion

We value and promote diversity in every aspect of our business and at every level of our organization.

Collaboration and inclusiveness are central to how we work because the best solutions are often those that draw on our diverse ideas and perspectives.

As team members we have a responsibility to:

| | • | | Do our part to help Wells Fargo to serve and earn business from a wide variety of communities and stakeholders. |

| | • | | Integrate diversity into our sourcing processes. |

| | • | | Help create an environment where all team members can contribute, develop, and fully use their talents. |

| | • | | Keep an open mind to new ideas, and listen to different points of view. |

Leadership

We want all team members to be able to lead themselves, lead the team, and lead the business.

Every team member is expected to be a leader. This means that each of us must take responsibility for maintaining Wells Fargo’s reputation and for ensuring that we always act with honesty and integrity. Each of us must:

| | • | | Act consistently with our Vision & Values. |

| | • | | Be familiar and comply with this Code; applicable laws, rules, and regulations; and company and line of business policies. Pay particular attention to the policies that pertain to your job responsibilities. |

| | • | | Be a role model for ethical leadership, and support your fellow team members when they ask questions and raise ethical concerns. |

| | • | | Help maintain a culture where everyone feels comfortable speaking up. |

| | • | | Never pressure a team member or third-party service provider to do something for you that is outside the scope of standard business practice. |

| | • | | Complete required training in a timely manner. |

| | • | | Cooperate and be honest and accurate when responding to any formal investigation, regulatory examination, audit or similar type of inquiry. |

Accountability

We are all accountable for complying with the Code, as well as all company policies and applicable laws, rules, and regulations that apply to us. Likewise, we are all accountable for our decisions and actions, especially managing the risks inherent in our roles and appropriately escalating issues and violations of which we become aware. If mistakes are made, we acknowledge them and act to correct them.

Violation of the provisions of this Code or the referenced policies and guidelines is grounds for corrective action, which may include termination of your employment. Certain actions may also result in legal proceedings, including prosecution for criminal liability.

We do not tolerate retaliation

We do not engage in or tolerate retaliation of any kind against anyone for providing information in good faith about suspected unethical or illegal activities, including possible violations of this Code, violations of laws, rules, or regulations by others, or concerns regarding accounting, internal accounting controls, or auditing matters. If you think that you or someone you know has been retaliated against, contact any of the resources listed in this Code.

To learn more

| | • | | Non-retaliation Policy Statement |

7 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Where to go for help

We have a responsibility to protect the reputation and integrity of Wells Fargo. If you see or suspect illegal or unethical behavior involving Wells Fargo, including possible violations of this Code, or violations of laws, rules or regulations—whether it relates to you, your manager, a co-worker, a customer or a third-party service provider—or if you have a question or need help making an ethics or compliance decision, you have several options. You can contact any of the following at any time:

| | • | | Contact theEthicsLine, particularly to report concerns regarding possible violations of the Code or applicable laws, rules, or regulations; or to report concerns relating to accounting, internal accounting controls, or auditing matters. TheEthicsLine should not be used to report human resources-related matters or criminal activity that is unrelated to Wells Fargo. |

| | • | | Discuss the matter with anymanager in your organization’s reporting line to whom you feel comfortable talking. |

| | • | | ContactHR Advisor, (for U.S.-based team members) or the appropriate Human Resources professional (for non U.S.-based team members). |

| | • | | Contact theOffice of Global Ethics and Integrity. |

| | • | | You may also report a concern regarding accounting, internal accounting controls, or auditing matters directly to theAudit & Examination Committeeof the Board. Information about communicating with our directors or other committees of the Board and the process for reviewing communications sent to the Board or its members is available on theCorporate Governance page of wellsfargo.com. |

We are committed to investigating potential violations and dealing with each report fairly and reasonably.

Our EthicsLine and how it works

OurEthicsLine is a confidential way to report possible violations of the Code or any laws, rules, or regulations. You may contact theEthicsLine 24 hours a day, 7 days a week.

| | • | | Wells Fargo EthicsLine Web Reporting |

| | • | | Team members outside of the United States can call using international phone numbers and access codes. |

TheEthicsLinecall center is staffed by third-party interview specialists. Translation services are available. Where allowed by local law, you may choose to remain anonymous.

When you contact theEthicsLine, the interview specialist will listen, ask clarifying questions if necessary, and then write a summary report of the call. The summary will then be provided to Wells Fargo for assessment and further action. The Audit & Examination Committee of the Board oversees the investigation of concerns raised about accounting, internal accounting controls, or auditing matters.

When you contact theEthicsLine, it is important to provide as many details as possible (e.g., who, what, when, where). Because Wells Fargo may need some additional information, you will be assigned a report number and asked to call back at a later date to answer any follow-up questions.

Any information provided to theEthicsLine will be treated as confidential to the extent allowed by local law. In some instances, during the course of investigations, information may be shared on a need to know basis. Under some circumstances, Wells Fargo may be required to report certain types of suspicious activity and other activity that may potentially violate criminal laws.

OUR CODE OF ETHICS AND BUSINESS CONDUCT 8

We are trusted

Keep confidential information safe and secure

Our standard

Each of us has access to confidential information about Wells Fargo, our customers, team members, and our third-party service providers. We are responsible for keeping confidential information safe and secure.

Always remember

| | • | | Use confidential information only for legitimate Wells Fargo business purposes and not for your personal gain or to compete with Wells Fargo. |

| | • | | Protect confidential information you acquire through your employment or service with Wells Fargo accordance with Information Security Policy standards. |

| | • | | Never discuss confidential information when others might be able to overhear you. |

| | • | | Customer information requires special care—do not disclose it to anyone outside Wells Fargo except when required by law, or in accordance with our privacy policies and customer agreements. |

| | • | | Keep team members’ and customers’ personal information safe and secure and only share it with those who have a legitimate Wells Fargo business need to know. |

| | • | | Report the loss or unauthorized disclosure of confidential information to the Security Response Center at 1-877-494-WELLS (1-877-494-9355), option 3, 001-480-437-7599 for international callers who do not have 877 service, or send an email to CompromisedData@wellsfargo.com. |

9 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Team member responsibilities

| | • | | Do not use proprietary information that you acquired while working at another company, and do not pressure other team members to do so. |

| | • | | Do not attempt to access confidential information unless you have a legitimate Wells Fargo business reason to do so. |

| | • | | Be careful when accepting information from third parties. You should know and trust their sources and ensure that Wells Fargo has appropriate rights to use the information. |

| | • | | Do not use or disclose proprietary information about Wells Fargo or its team members, customers or third-party service providers to anyone except properly designated team members, unless required by law. |

In some business units, there may be additional policies that restrict the flow of confidential information with other business units, including those that are engaged in investment advisory or securities trading activities.

Nothing in this Code prevents you from either discussing or disclosing the terms and conditions of your employment (including your pay) or from reporting any possible violation of law or regulation to the appropriate authority or investigative agency.

To learn more

| | • | | Information Security Policy |

| | • | | Privacy and Solicitation Policy |

| | • | | Global Data Protection and Privacy Policy |

| | • | | Information Risk Management (IRM) |

| | • | | Telemarketing Laws website on Teamworks |

Use our assets wisely

Our standard

We are trusted with and responsible for protecting Wells Fargo’s assets and using them efficiently. Wells Fargo assets include physical and intellectual property.

Always remember

| | • | | Use Wells Fargo assets only for legitimate Wells Fargo business purposes. |

| | • | | Protect the assets under your control from theft, waste, misuse, loss, and damage. |

| | • | | Guard against viruses, malware, and damage to our company systems. |

Team member responsibilities

| | • | | Limited personal use of company-owned phones, computers, electronics, and company networks is allowed, but use good judgment and always ensure that personal use does not interfere with your work environment or in any way violate our policies or security requirements. |

| | • | | All intellectual property that is developed while working for Wells Fargo must be disclosed to Wells Fargo and it cannot be used externally or published without written permission. |

| | • | | Do not sell, lend, or donate our assets without approval. |

| | • | | Protect your user IDs, passwords, and PINs. Whether in the office or traveling, always keep your company-owned laptop, mobile devices, and digital storage media safe and secure. |

To learn more

| | • | | A list of references and contact information to support compliance with our Information Security Policy is included in the Team Member Handbook and in non-U.S. Handbooks and HR Guides. |

| | • | | Bring Your Own Device program |

OUR CODE OF ETHICS AND BUSINESS CONDUCT 10

We are transparent and candid

Maintain accurate and complete records

Our standard

Each of us has an important role to play in recording financial and non-financial information. We must always be accurate and timely when reporting personnel and business transactions.

We are committed to full, fair, accurate, timely, and understandable disclosure in the public reports and documents that Wells Fargo files with, submits, or provides to the U.S. Securities and Exchange Commission, other regulatory authorities, our stockholders, and the public.

Team member responsibilities

| | • | | Follow all applicable accounting standards, legal requirements, and our system of internal controls. |

| | • | | Properly classify and label information. |

| | • | | If, in your role for Wells Fargo, you receive a non-routine request for information from a government or regulatory agency, involve the proper internal resources to review and prepare an appropriate response. |

| | • | | Never dispose of information that may be related to litigation or a regulatory proceeding unless authorized to do so by the Law Department or the Information Risk Management Program (IRM). |

| | • | | Never alter or change legal documents or agreements without the proper authorization or consent. |

| | • | | Never sign a blank or incomplete document or agreement, or ask a customer or vendor to do so. |

| | • | | If you find an error in any of our books or records, including in your pay and benefits statements or time keeping systems, report it to your manager immediately. |

To learn more

| | • | | Information Risk Management (IRM) |

| | • | | Information Security Policy |

| | • | | Records Management Policy |

Be clear and candid in our public communications

Our standard

When we share information with the public, we must do so carefully, consistently, and with one voice. In all of our communications we should be as candid and transparent as possible while keeping in mind our responsibilities to protect confidentiality and privacy. This includes the use of social media as well as more traditional forms of oral and written communication. Only approved Wells Fargo spokespersons may speak on the company’s behalf.

Team member responsibilities

| | • | | Be alert to situations where others might think you are speaking on behalf of Wells Fargo. |

| | • | | Direct external inquiries to the appropriate Communications resource. |

| | • | | If you come across malicious, threatening, libelous, detrimental, or defamatory posts involving Wells Fargo, forward them to corpcsf@wellsfargo.com. |

Some business lines may have additional restrictions on electronic communications including prohibitions and preapproval requirements.

To learn more

| | • | | Electronic Communications & Social Media guidance in the Team Member Handbook and in non-U.S. Handbooks and HR Guides. |

| | • | | Disclosure guidelines in our Regulation FD Policy |

11 OUR CODE OF ETHICS AND BUSINESS CONDUCT

We act with honesty and integrity

Avoid conflicts of interest

Our standard

We must avoid conflicts of interest in our personal and business activities, in any number of circumstances, including through outside employment or business activities and personal transactions, finances or relationships. Remember that the appearance of a conflict of interest may be just as damaging to Wells Fargo’s reputation as an actual conflict of interest. The following are examples of actual or potential conflicts of interest:

| | • | | A situation that interferes with your duties or responsibilities to Wells Fargo, or that affects your ability to act in the best interests of Wells Fargo |

| | • | | A situation when you receive an improper benefit as a result of your position with Wells Fargo |

| | • | | An instance where you learn about a business opportunity through the use of company property, information, or position and use it for personal benefit or otherwise compete with or divert business from Wells Fargo |

| | • | | Wells Fargo’s interests conflict with a customer’s interest |

| | • | | The interests of one customer conflict with those of another customer |

Where conflicts cannot be avoided, we should be transparent about their existence and take proactive steps to manage them.

Always remember

If you are presented with a situation that might involve a conflict of interest or the appearance of a conflict of interest, ask these questions:

| | • | | Would public disclosure of the matter embarrass Wells Fargo? |

| | • | | To an impartial observer, would it look like a conflict? |

| | • | | Is there a specific policy or procedure that covers this type of situation? |

| | • | | Do I need to get preclearance or disclose the situation in writing? |

When in doubt, discuss the matter with your manager or the Office of Global Ethics and Integrity. Additional rules and procedures are applicable to our directors and executive officers.

Team member responsibilities

Some team members are subject to additional requirements and restrictions, including preclearance, under their line-of-business policies and procedures relating to outside activities and personal investments. This may include team members employed in the brokerage, investment banking, investment research, advisory, trust, and investment management units, as well as senior officers who make or supervise fiduciary investment decisions, as applicable.

To learn more

| | • | | Conflicts of Interest and Outside Activities Policy Additional rules apply to senior executives and directors: |

| | • | | FIRA/Regulation O sections of Corporate Regulatory Compliance Standards |

| | • | | Related Person Transaction Policy and Procedures |

| | • | | Corporate Governance Guidelines |

OUR CODE OF ETHICS AND BUSINESS CONDUCT 12

Exchange only appropriate gifts and entertainment

Our standard

We generally permit the giving and receiving of business gifts and entertainment that are reasonable, are neither lavish nor excessive in frequency, are consistent with accepted, lawful business practices, and where no inference can be drawn that the gift or entertainment could influence you in the performance of your duties for Wells Fargo. But if not handled carefully, the giving or receiving of gifts or entertainment can be illegal or may damage Wells Fargo’s reputation, especially if it appears to influence a business decision.

Always remember

Giving and receiving gifts and entertainment are always unacceptable if they are:

| | • | | Illegal, including those that attempt or intend to influence or reward in connection with Wells Fargo business, |

| | • | | Given in exchange for a business referral, to improperly influence, or to gain another form of business advantage, |

| | • | | In the form of cash or cash equivalents, |

| | • | | Indecent or otherwise do not comply with our values, |

| | • | | In excess of the gift limitations in the Gifts and Entertainment Policy and /or other applicable policies based on your position, or |

| | • | | Intended to circumvent our Travel Policies. |

Before providing gifts or entertainment to individuals or entities involved in contract negotiations or competitive bidding with Wells Fargo, team members should discuss with their manager and directors should discuss with the General Counsel, with sensitivity to the potential for the appearance of improper influence.

Team member responsibilities

| | • | | When giving a gift or providing entertainment, keep in mind that your actions should never violate applicable laws, and they should be consistent with the customs and policies of Wells Fargo and the recipient. |

| | • | | Be aware that providing gifts or entertainment to public officials and government entities is controlled by very strict laws and regulations, violations of which can have severe consequences for you and for the company. Preclear all proposed gifts and entertainment provided to public officials or government entities. |

To learn more

| | • | | Gifts and Entertainment Policy |

| | • | | Travel and Expense Policy |

| | • | | Business and Personal Activities with Public Officials and Government Entities |

| | • | | Anti-Bribery and Corruption Policy |

13 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Exercise sound judgment in incurring business expenses

Our standard

At every level, all of us are responsible for expense management.

Team member responsibilities

| • | | Review expenses to ensure that they adhere to our policies and accurately reflect the expense incurred. |

| • | | Be sure that expenses make appropriate business sense. |

| • | | Enter and process all expenses accurately, through required channels and ensure that someone with the proper authority approves them, if required. |

To learn more

| • | | International Travel Policy |

Deal fairly with our customers and others

Our standard

We must be honest and fair in our dealings and communications with our customers, as well as with third-party service providers, competitors and each other. We provide our customers and prospective customers with advice, service, and many products, and we are committed to making financial products and services available to them on a fair, transparent, and consistent basis, and to conducting business in a responsible manner.

Always remember

| | • | | Products provided to our customers should be in the customer’s best interest, must be explained in a way that the customer can understand, and the terms and conditions must be thoroughly and accurately outlined. |

| | • | | Steering a customer to an inappropriate or unnecessary product to receive sales credit may harm the customer and is a violation of the Code. |

| | • | | Manipulating or misrepresenting sales, reporting, or customer information is a violation of the Code. |

| | • | | Know the sales referral and compensation guidelines that are applicable to your role. |

| | • | | Never engage in unfair, deceptive, or abusive acts or practices. |

Team member responsibilities

| | • | | Offer customers enough information to allow them to consent to a product from an informed position. |

| | • | | Record sales results accurately and completely. |

| | • | | Compete fairly in the marketplace. |

| | • | | Report sales activities that may not be in accordance with company policies. |

To learn more

| | • | | Responsible Business Policy |

| | • | | Fair and Responsible Lending Policy |

OUR CODE OF ETHICS AND BUSINESS CONDUCT 14

We honor our legal obligations

We are committed to following all applicable laws, rules and regulations that apply to our businesses. More information about our responsibilities under certain laws, rules and regulations applicable to our industry is outlined below.

Anti-bribery and anti-corruption

Our standard

We do not tolerate bribery and corruption, which, in all forms, go against our Vision & Values and our company policies, and violates the law. We do not offer or accept bribes or any other kind of improper payment, including facilitation payments or anything of value, and we do not do anything through a third party that we are not allowed to do ourselves.

Team member responsibilities

| • | | Keep accurate records so that all payments and business transactions are honestly and completely described. |

| • | | Be aware of our Anti-Bribery and Corruption Policy when selecting third-party service providers. Be vigilant and monitor their behavior. Never “look the other way.” |

To learn more

| | • | | Anti-Bribery and Corruption Policy |

| | • | | Gifts and Entertainment Policy |

Competition and antitrust laws

Our standard

We believe in free and open competition. We gain our competitive advantage through superior performance rather than through unethical or illegal business practices.

Competition laws are complex, and compliance requirements can vary based on the jurisdiction and circumstance. If you have any questions, seek appropriate guidance from your line of business compliance team or the Law Department before taking action.

Always remember

All jurisdictions in which we operate have laws against practices that interfere with competition. The following activities should always be avoided and, if they occur, reported to the Law Department or the EthicsLine:

| | • | | Entering into anti-competitive agreements with competitors, including price fixing, bid rigging, market allocation, and agreements to restrict supply or fix resale prices. |

| | • | | Exchanging competitively sensitive information with competitors. |

| | • | | Boycotting certain customers or third-party service providers. |

| | • | | Abusing a position of market dominance. |

To learn more

| | • | | Anti-Competitive Behavior guidance |

15 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Insider trading and other trading restrictions

Our standard

You must never buy or sell securities when you have material, nonpublic information, nor should you ever “tip” others by providing them with material, nonpublic information. Insider trading restrictions cover Wells Fargo securities and the securities of other companies, including customers and third-party service providers, and apply to you and your immediate family. These restrictions also apply to transactions or trades conducted in your personal accounts or any other account over which you have direct or indirect control.

If you commit an insider trading violation, the consequences can be severe, including immediate termination of your employment, civil and criminal penalties for you, anyone you tip, and Wells Fargo as a company, and damage to Wells Fargo’s reputation.

Always remember

| | • | | Derivative and hedging transactions involving Wells Fargo securities are not permitted. |

| | • | | Insider trading laws prohibit you from trading on material, nonpublic information even after you are no longer employed by or providing services to Wells Fargo. |

| | • | | If you inadvertently disclose material, nonpublic information to a person inside or outside Wells Fargo who is not obligated to keep the information confidential, you must immediately report it to the Law Department. |

| | • | | Certain transactions that comply with applicable securities laws may be subject to specific exceptions from these requirements, including transactions under a trading plan that complies with U.S. securities law requirements. In addition to complying with U.S. securities laws, a trading plan must be preapproved by Wells Fargo’s General Counsel or Corporate Secretary before it is used. |

Team member responsibilities

| | • | | Understand and follow any additional trading policies, firewall and other restrictions that apply to you and your business unit. |

Wells Fargo directors, executive officers, and certain other team members expressly identified and notified by our General Counsel or Corporate Secretary may be subject to quarterly blackout trading restrictions and preclearance requirements under the Wells Fargo Personal Trading Policy.

To learn more

| | • | | Conflicts of Interest and Outside Activities Policy |

| | • | | Wells Fargo Personal Trading Policy |

| | • | | Corporate Governance Guidelines |

OUR CODE OF ETHICS AND BUSINESS CONDUCT 16

Global trade, sanctions, embargos, and anti-boycott laws

Our standard

We are committed to following applicable trade laws, regulations, and sanctions.

Always remember

United States law and our policies prohibit team members from cooperating with unsanctioned boycotts of countries that are friendly to the U.S.

We also have policies, procedures, and controls to comply with U.S., European Union, U.K., and United Nations rules pertaining to transactions and investments that involve certain countries, groups, or individuals, including those associated with terrorism, narcotics trafficking, or nuclear weapons proliferation.

Team member responsibilities

| | • | | Seek guidance from the Law Department to ensure that transfers of information, technology, products, or software across international borders comply with laws governing imports and exports. |

| | • | | Trade restrictions and sanctions often change. If you are involved in cross-border transactions, make sure you are up-to-date on the relevant rules. |

To learn more

| | • | | Global Sanctions Policy |

Anti-money laundering

Our standard

As a global financial institution, we have special responsibilities to help combat money-laundering. Our Global AML Governance Policy and related procedures are designed to comply with all applicable laws and regulations related to money laundering and terrorist financing. Team members are required to comply with these policies, procedures and controls.

Team member responsibilities

| | • | | Complete all customer due diligence requirements. |

| | • | | Be alert to— and report— any unusual or suspicious activity to your manager and internal groups responsible for anti-money laundering compliance. |

| | • | | Complete all required anti-money laundering and related compliance training on a timely basis. |

To learn more

| | • | | Global AML Governance Policy |

17 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Political activities

Our standard

You have the right to voluntarily participate in the political process, however, you need to always be sure that your personal political opinions and activities are not viewed as those of Wells Fargo.

Always remember

| | • | | Wells Fargo does not use company funds for any candidate campaign contributions, including those made to candidate campaign committees, political parties, caucuses, or independent expenditure committees. |

| | • | | Before you become a candidate or appointee to a public office, you must notify your manager to discuss potential conflict of interest issues. |

Team member responsibilities

| | • | | Do not commit any Wells Fargo corporate resources for political purposes; consult with Government Relations if you have questions. |

| | • | | Do not solicit contributions or distribute political literature during work hours or from work premises, or use corporate resources (including your Wells Fargo email address) for such purposes. |

| | • | | Seek approval before communicating with government officials or entities for the purpose of obtaining business. |

Some team members are subject to additional requirements and restrictions, including preclearance of outside political activities and contributions, under corporate and business line policies and procedures. This may include team members employed in the brokerage, investment banking, investment research, advisory, trust, and investment management units, as well as senior officers who make or supervise fiduciary investment decisions.

To learn more

| | • | | Government Relations Compliance Policy |

| | • | | Business and Personal Activities with Public Officials and Government Entities |

| | • | | Conflicts of Interest and Outside Activities Policy |

| | • | | Solicitation and Distribution Policy |

OUR CODE OF ETHICS AND BUSINESS CONDUCT 18

We serve the greater good

Support our communities

Our standard

We want to be known as a trusted neighbor in the communities where we live and operate.

Team member responsibilities

| | • | | If you volunteer to help local civic organizations, be sure that your participation does not interfere with your work or create a potential conflict of interest. |

| | • | | Soliciting or pressuring customers, third-party service providers, or other team members to support your favorite charities or causes is not allowed. |

To learn more

| | • | | Guidelines for corporate contributions to civic and charitable organizations are set locally and are coordinated by the community affairs managers for each market or region. |

| | • | | Community Support Programs website |

| | • | | Conflicts of Interest and Outside Activities Policy |

| | • | | Solicitation and Distribution Policy |

Respect human rights

Our standard

Consistent with our Vision & Values, Wells Fargo recognizes that governments have the duty to protect human rights, and our company has a responsibility to respect human rights. To that end, we strive to respect human rights throughout our operations and our products and services, including consistent treatment among people, employee well-being and security, economic and social freedom, and environmental stewardship.

We seek tangible ways to apply these principles through our actions and relationships with our team members, customers, suppliers and communities in which we do business.

Team member responsibilities

Each of us can help support efforts to eliminate modern slavery, exploitation and human trafficking abuses.

| | • | | Remember that respect for human dignity begins with our daily interactions with one another and with our customers and includes promoting diversity, accommodating disabilities, and doing our part to protect the rights and dignity of everyone with whom we do business. |

| | • | | Report any suspicion or evidence of human rights abuses in our operations or in the operations of our business partners. |

To learn more

| | • | | Supplier Code of Conduct |

19 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Protect the environment

Our standard

We are committed to integrating environmental mindfulness into all we do and accelerating environmental sustainability.

We recognize that our environmental impact goes beyond how we operate. We see the business value of taking a leadership position in addressing our own environmental footprint and in finding innovative solutions to help our communities and customers become more resilient. We also know that our impacts extend beyond the walls of our operations to include our supply chain and customers; and are focused on managing environmental risks in our approach to lending and making investments, and across our supply chain. We all do better when we make decisions that care for and improve the environment.

Team member responsibilities

Each of us can help support efforts to advance environmental sustainability in our operations and our communities.

| | • | | Be proactive about minimizing resource use in your workplace. |

| | • | | Consider joining a Green Team to get more actively involved in supporting sustainability efforts. |

| | • | | Speak up if you have suggestions about ways to improve our sustainability initiatives. |

To learn more

| | • | | Environmental Stewardship Section of wellsfargo.com or the internal environmental affairs site |

| | • | | Environmental and Social Risk Management Policy |

| | • | | Climate Change Statement |

| | • | | Learn how to join a Green Team |

OUR CODE OF ETHICS AND BUSINESS CONDUCT 20

A final thought

Our Code covers many of the ethics and business conduct topics that we are likely to face in our work, but no code can cover every possible situation. That is why it is important to remember that you have other resources in addition to our Code that you can use to help you make good decisions:

| | • | | The most important resource is you. Rely on your experience and good judgment. But remember, in order to make informed decisions you must know and understand the policies, laws and regulations — especially those that apply to your job. |

| | • | | Always keep our Vision & Values in mind. They can help you stay on track, make the right decisions, and be clear about our priorities. |

| | • | | In any situation if you’re not sure what to do, don’t be afraid to ask questions and get help. |

| | • | | Report concerns regarding possible violations of the Code, laws, rules, regulations or company policies and practices to the EthicsLine. |

Additional Resources

| | • | | Anti-Bribery and Corruption Policy |

| | • | | Bring Your Own Device program |

| | • | | Business and Personal Activities with Public Officials and Government Entities |

| | • | | Community Support Programs website |

| | • | | Conflicts of Interest and Outside Activities Policy |

| | • | | Corporate Governance Guidelines |

| | • | | Electronic Communications & Social Media Guidance |

| | • | | Environmental and Social Risk Management (ESRM) Policy |

| | • | | Fair and Responsible Lending Policy |

| | • | | FIRA/Regulation O sections of Corporate Regulatory Compliance Standards |

| | • | | Gifts & Entertainment Policy |

| | • | | Global AML Governance Policy |

| | • | | Global Data Protection and Privacy Policy |

| | • | | Global Sanctions Policy |

| | • | | Government Relations Compliance Policy |

| | • | | HR Guides and Handbooks (non-U.S.) |

| | • | | Information Risk Management (IRM) |

| | • | | Information Security Policy |

| | • | | International Travel Policy |

| | • | | Non-retaliation Policy Statement |

| | • | | Privacy and Solicitation Policy |

| | • | | Records Management Policy |

| | • | | Related Person Transaction Policy and Procedures |

| | • | | Responsible Business Policy |

| | • | | Solicitation and Distribution Policy |

| | • | | Supplier Code of Conduct |

| | • | | Team Member Handbook (U.S.) |

| | • | | Telemarketing Laws website on Teamworks |

| | • | | The Vision & Values of Wells Fargo |

| | • | | Wells Fargo Personal Trading Policy |

Waivers and exceptions

In limited circumstances, waivers or exceptions to the Code may be appropriate. Any waivers or exceptions to this Code for executive officers or directors of Wells Fargo & Company may only be made by the Board or the appropriate Board committee, and will be promptly disclosed to our stockholders in accordance with legal and regulatory requirements.

Any waivers or exceptions to the Code for other team members may only be approved by the Office of Global Ethics and Integrity in accordance with the Corporate Policy Program.

21 OUR CODE OF ETHICS AND BUSINESS CONDUCT

Glossary

Anything of Value

Any benefit or financial or other advantage, and includes (but is not limited to) money, per diems, property, gifts, meals, entertainment, lodging, travel, contributions, donations, offers of employment, below-market discounts, refunds, rebates, benefit-in-kind, or preferential treatment or access.

Bribe or Bribery

The intentional offer, promise, or giving of anything of value, directly or indirectly, to or from any person to improperly influence that person, as an inducement for that person to act improperly or refrain from acting properly, including in accordance with official or fiduciary duties or contractual or other obligations, or to gain any other improper advantage.

Corruption

Dishonest or fraudulent conduct by those in power, typically involving bribery.

Derivative Transaction

A derivative is a security with a price that is dependent upon or derived from one or more underlying assets. Its value is determined by fluctuations in the underlying asset. For purposes of this Code, a derivative transaction would not include the acquisition or exercise of an employee stock option or other stock right granted as part of a Wells Fargo compensation and benefits program or an investment in or the conversion of Wells Fargo convertible preferred stock.

Facilitation Payments

Payments, typically small in amount, to individuals to secure or expedite the performance of a routine action that the individual has a duty to perform (also known as “grease payments”).

Firewall

Information-sharing restrictions, commonly known as firewalls, help protect the flow of nonpublic information.

Hedging Transaction

A type of transaction in securities that limits investment risk with the use of derivatives, such as options and

futures contracts. Hedging transactions purchase opposite positions in the market in order to ensure a certain amount of gain or loss on a trade.

Material Information

Information is “material” if it could reasonably be expected to affect the market price of a company’s securities, or if it likely would be considered important by an investor when deciding to buy or sell a company’s securities. Both positive and negative information may be material. Some types of information are usually considered to be material and include but are not limited to the following:

| • | | Earnings or financial results |

| • | | Dividend increases or decreases |

| • | | Changes in previously released earnings estimates |

| • | | Significant gains or losses |

| • | | Significant expansion or curtailment of operations, merger, acquisition or divestiture proposals or agreements |

| • | | Significant purchases or sales of assets |

| • | | New debt or equity offerings |

Nonpublic Information

Information about a business organization that is not generally available to or known by the public (also called “inside information”).

Proprietary Information

Information that is unique to Wells Fargo and is shared only based on distinct business need to know. Compromise of proprietary information would impact Wells Fargo’s ability to compete. Examples of proprietary information include customer lists, technical data, product costs, and trade secrets.

Securities

Securities include but are not limited to stocks, bonds, notes, debentures, limited partnership units, other equity or debt securities, and derivative instruments (e.g., options, warrants, puts, calls, futures contracts, or other similar instruments).

Additional definitions can be found in the Team Member Handbook.

OUR CODE OF ETHICS AND BUSINESS CONDUCT 22