WELLS FARGO & COMPANY 8-K

Exhibit 4.6

[Face of Note]

Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (“DTC”), to the Company or its agent for registration of transfer, exchange or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as requested by an authorized representative of DTC (and any payment is made to Cede & Co. or such other entity as is requested by an authorized representative of DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.

CUSIP NO. 95002W834 | PRINCIPAL AMOUNT: $________ |

ISIN NO. US95002W8340 | |

REGISTERED NO. ___ | |

WELLS FARGO FINANCE LLC

MEDIUM-TERM NOTE, SERIES A

Fully and Unconditionally Guaranteed by Wells Fargo & Company

Accelerated Return Notes® Linked to a

Basket of Three Financial Sector Stocks

WELLS FARGO FINANCE LLC, a limited liability company duly organized and existing under the laws of the State of Delaware (hereinafter called the “Company,” which term includes any successor corporation under and as defined in the Indenture hereinafter referred to), for value received, hereby promises to pay to CEDE & Co., or registered assigns, an amount equal to the Redemption Amount (as defined below), in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts, on November 20, 2020 (the “Stated Maturity Date”). This Security shall not bear any interest.

Any payments on this Security at Maturity will be made against presentation of this Security at the office or agency of the Company maintained for that purpose in the City of Minneapolis, Minnesota and at any other office or agency maintained by the Company for such purpose.

“Principal Amount” shall mean, when used with respect to this Security, the amount set forth on the face of this Security as its “Principal Amount.”

Determination of Redemption Amount

The “Redemption Amount” of this Security will equal:

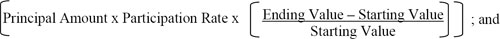

| ● | if the Ending Value is greater than the Starting Value: the lesser of: (i) Principal Amount plus: |

(ii) the Capped Value;

| ● | if the Ending Value is less than or equal to the Starting Value: |

All calculations with respect to the Redemption Amount will be rounded to the nearest one hundred-thousandth, with five one-millionths rounded upward (e.g., 0.000005 would be rounded to 0.00001); and the Redemption Amount will be rounded to the nearest cent, with one-half cent rounded upward.

“Market Measure” or “Basket” shall mean a basket comprised of the following Basket Stocks, with each Basket Stock having the “Initial Component Weight” noted parenthetically: Citigroup Inc. (33.33), JPMorgan Chase & Co. (33.33) and Morgan Stanley (33.34).

“Basket Stock” or “Underlying Stock” shall mean the common stock of each of Citigroup Inc., JPMorgan Chase & Co. and Morgan Stanley.

“Underlying Company” shall mean each of Citigroup Inc., JPMorgan Chase & Co. and Morgan Stanley.

The “Pricing Date” shall mean September 26, 2019.

The “Starting Value” is 100.00.

The “Participation Rate” is 300%.

The “Capped Value” is 125.20% of the Principal Amount.

The “Value” of the Market Measure on the Calculation Day (as defined below) will be equal to the sum of the products of the Closing Market Price of each Basket Stock on the Calculation Day multiplied by its Price Multiplier on that day, and the Component Ratio for each Basket Stock.

The “Ending Value” will be the Value of the Market Measure on the Calculation Day, subject to the provisions set forth below under “Market Disruption Events” and “Anti-Dilution Adjustments.”

The “Calculation Day” is November 13, 2020, subject to the provisions set forth below under “Market Disruption Events.”

The “Component Ratio” for each Basket Stock is equal to:

[the Initial Component Weight for such Basket Stock (expressed as a percentage) x 100]

the Closing Market Price of such Basket Stock on the Pricing Date,

in each case rounded to eight decimal places and subject to the provisions set forth below under “Adjustments to the Component Ratio for a Basket Component.” The Component Ratios of the Basket Stocks are as follows: Citigroup Inc. (0.48227463), JPMorgan Chase & Co. (0.28479877) and Morgan Stanley (0.78226185). The Closing Market Prices of the Basket Stocks on the Pricing Date are as follows: Citigroup Inc. (69.11), JPMorgan Chase & Co. (117.03) and Morgan Stanley (42.62).

The “Price Multiplier” for an Underlying Stock is 1, and is subject to adjustment for certain corporate events relating to such Underlying Stock described below under “Anti-Dilution Adjustments.”

“Business Day” shall mean a day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in New York, New York.

“Joint Calculation Agency Agreement” shall mean the Joint Calculation Agency Agreement dated as of October 5, 2018 among the Company, Wells Fargo & Company, as guarantor (the “Guarantor”), and the Calculation Agents, as amended from time to time.

“Calculation Agents” shall mean the Persons that have entered into the Joint Calculation Agency Agreement with the Company and the Guarantor providing for, among other things, the determination of the Ending Value, the Price Multiplier, the Closing Market Price, the Redemption Amount any Market Disruption Events, any anti-dilution adjustments, any successor Underlying Stock, Business Days, Trading Days and Non-Calculation Days, which term shall, unless the context otherwise requires, include their successors under such Joint Calculation Agency Agreement. The initial Calculation Agents shall be Wells Fargo Securities, LLC and BofA Securities, Inc. Pursuant to the Joint Calculation Agency Agreement, the Company may appoint a different Calculation Agent from time to time after the initial issuance of this Security without the consent of the Holder of this Security and without notifying the Holder of this Security.

A “Trading Day” means a day on which trading is generally conducted (or was scheduled to have been generally conducted, but for the occurrence of a Market Disruption Event) on the New York Stock Exchange (the “NYSE”), the Nasdaq Stock Market, the Chicago Board Options Exchange, and in the over-the-counter market for equity securities in the United States, or any

successor exchange or market, or in the case of a security traded on one or more non-U.S. securities exchanges or markets, on the principal non-U.S. securities exchange or market for such security.

The “Closing Market Price” for one share of any Underlying Stock (or one unit of any other security for which a Closing Market Price must be determined) on any Trading Day means any of the following:

● if the Underlying Stock (or such other security) is listed or admitted to trading on a national securities exchange, the last reported sale price, regular way (or, in the case of The Nasdaq Stock Market, the official closing price), of the principal trading session on that day on the principal U.S. securities exchange registered under the Exchange Act on which the Underlying Stock (or such other security) is listed or admitted to trading;

● if the Underlying Stock (or such other security) is not listed or admitted to trading on any national securities exchange but is included in the OTC Bulletin Board, the last reported sale price of the principal trading session on the OTC Bulletin Board on that day;

● if the Underlying Stock (or such other security) is issued by a foreign issuer and its closing price cannot be determined as set forth in the two bullet points above, and the Underlying Stock (or such other security) is listed or admitted to trading on a non-U.S. securities exchange or market, the last reported sale price, regular way, of the principal trading session on that day on the primary non-U.S. securities exchange or market on which the Underlying Stock (or such other security) is listed or admitted to trading (converted to U.S. dollars using such exchange rate as the Calculation Agents, in their sole discretion, determine to be commercially reasonable); or

● if the Closing Market Price cannot be determined as set forth in the prior bullets, the mean, as determined by the Calculation Agents, of the bid prices for the Underlying Stock (or such other security) obtained from as many dealers in that security, but not exceeding three, as will make the bid prices available to the Calculation Agents. If no such bid price can be obtained, the Closing Market Price will be determined (or, if not determinable, estimated) by the Calculation Agents in their sole discretion in a commercially reasonable manner.

Adjustments to the Component Ratio for a Basket Stock

The Component Ratios for the Basket Stocks will not be revised subsequent to their determination on the Pricing Date, except that the Calculation Agents may in their good faith judgment adjust the Component Ratio of any Basket Stock in the event that Basket Stock is materially changed or modified in a manner that does not, in the opinion of the Calculation Agents, fairly represent the value of that Basket Stock had those material changes or modifications not been made.

Market Disruption Events

As to any Underlying Stock (or any “successor Underlying Stock,” which is the common equity securities or the ADRs (as defined below) of a Successor Entity (as defined below)), a “Market Disruption Event” means any of the following events, as determined by the Calculation Agents in their sole discretion:

| (A) | the suspension of or material limitation on trading, in each case, for more than two consecutive hours of trading, or during the one-half hour period preceding the close of trading, of the shares of the Underlying Stock (or the successor to the Underlying Stock) on the primary exchange where such shares trade, as determined by the Calculation Agents (without taking into account any extended or after-hours trading session); |

| (B) | the suspension of or material limitation on trading, in each case, for more than two consecutive hours of trading, or during the one-half hour period preceding the close of trading, on the primary exchange that trades options contracts or futures contracts related to the shares of the Underlying Stock (or successor to the Underlying Stock) as determined by the Calculation Agents (without taking into account any extended or after-hours trading session), in options contracts or futures contracts related to the shares of the Underlying Stock (or successor to the Underlying Stock); or |

| (C) | the determination that the scheduled Calculation Day is not a Trading Day by reason of an extraordinary event, occurrence, declaration, or otherwise. |

For the purpose of determining whether a Market Disruption Event has occurred:

| (1) | a limitation on the hours in a Trading Day and/or number of days of trading will not constitute a Market Disruption Event if it results from an announced change in the regular business hours of the relevant exchange; |

| (2) | a decision to permanently discontinue trading in the shares of the Underlying Stock (or successor Underlying Stock) or the relevant futures or options contracts relating to such shares will not constitute a Market Disruption Event; |

| (3) | a suspension in trading in a futures or options contract on the shares of the Underlying Stock (or successor Underlying Stock), by a major securities market by reason of (a) a price change violating limits set by that securities market, (b) an imbalance of orders relating to those contracts, or (c) a disparity in bid and ask quotes relating to those contracts, will each constitute a suspension of or material limitation on trading in futures or options contracts relating to the Underlying Stock; |

| (4) | subject to paragraph (3) above, a suspension of or material limitation on trading on the relevant exchange will not include any time when that exchange is closed for trading under ordinary circumstances; and |

| (5) | for the purpose of clause (A) above, any limitations on trading during significant market fluctuations under NYSE Rule 80B, or any applicable rule or regulation enacted or promulgated by the NYSE or any other self-regulatory organization or the Securities and Exchange Commission of similar scope as determined by the Calculation Agents, will be considered “material.” |

If for any Basket Stock (an “Affected Basket Stock”), a Market Disruption Event occurs on the scheduled Calculation Day (such day being a “Non-Calculation Day”), the Calculation Agents will determine the prices of the Basket Stocks for such Non-Calculation Day, and as a result, the Ending Value, as follows:

| ● | the Closing Market Price of each Basket Stock that is not an Affected Basket Stock will be its Closing Market Price on that Non-Calculation Day; and |

| ● | the Closing Market Price of each Basket Stock that is an Affected Basket Stock for the Non-Calculation Day will be determined on the immediately succeeding Trading Day on which no Market Disruption Event occurs or is continuing; provided that the Closing Market Price of that Basket Stock will be determined (or, if not determinable, estimated) by the Calculation Agents in a commercially reasonable manner on a date no later than the second scheduled Trading Day prior to the Stated Maturity Date, regardless of the occurrence of a Market Disruption Event on that day. |

Anti-Dilution Adjustments

As to any Underlying Stock (or successor Underlying Stock), the Calculation Agents, in their sole discretion, may adjust the Price Multiplier (and as a result, the Ending Value), and any other terms of this Security, if an event described below occurs after the Pricing Date and on or before the Calculation Day and if the Calculation Agents determine that such an event has a diluting or concentrative effect on the theoretical value of the shares of the Underlying Stock (or successor Underlying Stock).

The Price Multiplier resulting from any of the adjustments specified below will be rounded to the eighth decimal place with five one-billionths being rounded upward. No adjustments to the Price Multiplier will be required unless the adjustment would require a change of at least 0.1% in the Price Multiplier then in effect. Any adjustment that would require a change of less than 0.1% in the Price Multiplier which is not applied at the time of the event may be reflected at the time of any subsequent adjustment that would require a change of the Price Multiplier.

No adjustments to the Price Multiplier for any Underlying Stock or any other terms of this Security will be required other than those specified below. However, the Calculation Agents may, at their sole discretion, make additional adjustments or adjustments that differ from those described herein to the Price Multiplier or any other terms of this Security to reflect changes to

any Underlying Stock if the Calculation Agents determine that the adjustment is appropriate to ensure an equitable result.

The Calculation Agents will be solely responsible for the determination of any adjustments to the Price Multiplier for any Underlying Stock or any other terms of this Security and of any related determinations with respect to any distributions of stock, other securities or other property or assets, including cash, in connection with any corporate event described below; their determinations and calculations will be conclusive absent a determination of a manifest error.

No adjustments are required to be made for certain other events, such as offerings of common equity securities by any Underlying Company for cash or in connection with the occurrence of a partial tender or exchange offer for any Underlying Stock by the Underlying Company.

Following certain corporate events relating to an Underlying Stock, where the Underlying Company is not the surviving entity, any payment received on this Security may be based on the equity securities of a successor to the Underlying Company or any cash or any other assets distributed to holders of the Underlying Stock in such corporate event.

Following an event that results in an adjustment to the Price Multiplier for any Underlying Stock or any of the other terms of this Security, the Calculation Agents may (but are not required to) provide the Holder of this Security with information about that adjustment as they deem appropriate, depending on the nature of the adjustment. Upon written request by the Holder of this Security, the Calculation Agents will provide the Holder of this Security with information about such adjustment.

Anti-Dilution Adjustments to Underlying Stocks that Are Common Equity

The Calculation Agents, in their sole discretion and as they deem reasonable, may adjust the Price Multiplier for an Underlying Stock and other terms of this Security, and hence the Ending Value, as a result of certain events related to an Underlying Stock, which include, but are not limited to, the following:

Stock Splits and Reverse Stock Splits. If an Underlying Stock is subject to a stock split or reverse stock split, then once such split has become effective, the Price Multiplier will be adjusted such that the new Price Multiplier will equal the product of:

| ● | the prior Price Multiplier; and |

| ● | the number of shares that a holder of one share of the Underlying Stock before the effective date of the stock split or reverse stock split would have owned immediately following the applicable effective date. |

Stock Dividends. If an Underlying Stock is subject to (i) a stock dividend (i.e., an issuance of additional shares of Underlying Stock) that is given ratably to all holders of the Underlying Stock or (ii) a distribution of additional shares of the Underlying Stock as a result of the triggering of any provision of the organizational documents of the Underlying Company, then, once the dividend has become effective and the Underlying Stock is trading ex-dividend,

the Price Multiplier will be adjusted on the ex-dividend date such that the new Price Multiplier will equal the prior Price Multiplier plus the product of:

| ● | the prior Price Multiplier; and |

| ● | the number of additional shares issued in the stock dividend with respect to one share of the Underlying Stock; |

provided that no adjustment will be made for a stock dividend for which the number of shares of the Underlying Stock paid or distributed is based on a fixed cash equivalent value, unless such distribution is an Extraordinary Dividend (as defined below).

Extraordinary Dividends. There will be no adjustments to the Price Multiplier to reflect any cash dividends or cash distributions paid with respect to an Underlying Stock other than Extraordinary Dividends, as described below, and distributions described under the section entitled “—Reorganization Events” below.

An “Extraordinary Dividend” means, with respect to a cash dividend or other distribution with respect to an Underlying Stock, a dividend or other distribution that the Calculation Agents determine, in their sole discretion, is not declared or otherwise made according to the Underlying Company’s then existing policy or practice of paying such dividends on a quarterly or other regular basis. If an Extraordinary Dividend occurs, the Price Multiplier will be adjusted on the ex-dividend date so that the new Price Multiplier will equal the product of:

| ● | the prior Price Multiplier; and |

| ● | a fraction, the numerator of which is the Closing Market Price per share of the Underlying Stock on the Trading Day preceding the ex-dividend date and the denominator of which is the amount by which the Closing Market Price per share of the Underlying Stock on that preceding Trading Day exceeds the Extraordinary Dividend Amount. |

The “Extraordinary Dividend Amount” with respect to an Extraordinary Dividend will equal:

| ● | in the case of cash dividends or other distributions that constitute regular dividends, the amount per share of the Underlying Stock of that Extraordinary Dividend minus the amount per share of the immediately preceding non-Extraordinary Dividend for that share; or |

| ● | in the case of cash dividends or other distributions that do not constitute regular dividends, the amount per share of the Underlying Stock of that Extraordinary Dividend. |

To the extent an Extraordinary Dividend is not paid in cash, the value of the non-cash component will be determined by the Calculation Agents, whose determination will be conclusive. A distribution on the Underlying Stock described in the section “—Issuance of Transferable Rights or Warrants“ or clause (a), (d) or (e) of the section entitled “—

Reorganization Events” below that also constitutes an Extraordinary Dividend will only cause an adjustment under those respective sections.

Issuance of Transferable Rights or Warrants. If an Underlying Company issues transferable rights or warrants to all holders of record of the Underlying Stock to subscribe for or purchase the Underlying Stock, including new or existing rights to purchase the Underlying Stock under a shareholder rights plan or arrangement, then the Price Multiplier will be adjusted on the Trading Day immediately following the issuance of those transferable rights or warrants so that the new Price Multiplier will equal the prior Price Multiplier plus the product of:

| ● | the prior Price Multiplier; and |

| ● | the number of shares of the Underlying Stock that can be purchased with the cash value of those warrants or rights distributed on one share of the Underlying Stock. |

The number of shares that can be purchased will be based on the Closing Market Price of the Underlying Stock on the date the new Price Multiplier is determined. The cash value of those warrants or rights, if the warrants or rights are traded on a registered national securities exchange, will equal the closing price of that warrant or right. If the warrants or rights are not traded on a registered national securities exchange, the cash value will be determined by the Calculation Agents and will equal the average of the bid prices obtained from three dealers at 3:00 p.m., New York time on the date the new Price Multiplier is determined, provided that if only two of those bid prices are available, then the cash value of those warrants or rights will equal the average of those bids and if only one of those bids is available, then the cash value of those warrants or rights will equal that bid.

Reorganization Events

If after the Pricing Date and on or prior to the Calculation Day of this Security, as to any Underlying Stock:

| (a) | there occurs any reclassification or change of the Underlying Stock, including, without limitation, as a result of the issuance of tracking stock by the Underlying Company; |

| (b) | the Underlying Company, or any surviving entity or subsequent surviving entity of the Underlying Company (a “Successor Entity”), has been subject to a merger, combination, or consolidation and is not the surviving entity; |

| (c) | any statutory exchange of securities of the Underlying Company or any Successor Entity with another corporation occurs, other than under clause (b) above; |

| (d) | the Underlying Company is liquidated or is subject to a proceeding under any applicable bankruptcy, insolvency, or other similar law; |

| (e) | the Underlying Company issues to all of its shareholders securities of an issuer other than the Underlying Company, including equity securities of an affiliate of the |

| | Underlying Company, other than in a transaction described in clauses (b), (c), or (d) above; |

| (f) | a tender or exchange offer or going-private transaction is consummated for all the outstanding shares of the Underlying Company; |

| (g) | there occurs any reclassification or change of the Underlying Stock that results in a transfer or an irrevocable commitment to transfer all such outstanding shares of the Underlying Stock to another entity or person; |

| (h) | the Underlying Company or any Successor Entity is the surviving entity of a merger, combination, or consolidation, that results in the outstanding Underlying Stock (other than Underlying Stock owned or controlled by the other party to such transaction) immediately prior to such event collectively representing less than 50% of the outstanding Underlying Stock immediately following such event; or |

| (i) | the Underlying Company ceases to file the financial and other information with the SEC in accordance with Section 13(a) of the Exchange Act (an event in clauses (a) through (i), a “Reorganization Event”), |

then, on or after the date of the occurrence of a Reorganization Event, the Calculation Agents shall, in their sole discretion, make an adjustment to the Price Multiplier or to the method of determining the Redemption Amount or any other terms of this Security as the Calculation Agents, in their sole discretion, determine appropriate to account for the economic effect on this Security of that Reorganization Event (including adjustments to account for changes in volatility, expected dividends, stock loan rate, or liquidity relevant to the Underlying Stock or to this Security), which may, but need not, be determined by reference to the adjustment(s) made in respect of such Reorganization Event by an options exchange to options on the relevant Underlying Stock traded on that options exchange and determine the effective date of that adjustment. If the Calculation Agents determine that no adjustment that they could make will produce a commercially reasonable result, then the Calculation Agents may cause the Stated Maturity Date of this Security to be accelerated to the fifth Business Day following the date of that determination and the Redemption Amount payable to the Holder of this Security will be calculated as though the date of early repayment were the Stated Maturity Date of this Security and as though the Calculation Day were the fifth Trading Day prior to the date of acceleration.

If the Underlying Company ceases to file the financial and other information with the Securities and Exchange Commission in accordance with Section 13(a) of the Exchange Act, as contemplated by clause (i) above, and the Calculation Agents determine in their sole discretion that sufficiently similar information is not otherwise available to the Holder of this Security, then the Calculation Agents may cause the Stated Maturity Date of this Security to be accelerated to the fifth Business Day following the date of that determination and the Redemption Amount payable to the Holder of this Security will be calculated as though the date of early repayment were the Stated Maturity Date of this Security, and as though the Calculation Day were the fifth Trading Day prior to the date of acceleration. If the Calculation Agents determine that sufficiently similar information is available to the Holder of this Security, the Reorganization Event will be deemed to have not occurred.

Alternative Anti-Dilution and Reorganization Adjustments

The Calculation Agents may elect at their discretion to not make any of the adjustments to the Price Multiplier for any Underlying Stock or to the other terms of this Security, including the method of determining the Redemption Amount, but may instead make adjustments, in their discretion, to the Price Multiplier for the Underlying Stock or any other terms of this Security (such as the Starting Value) that will reflect the adjustments to the extent practicable made by the Options Clearing Corporation on options contracts on the Underlying Stock or any successor common stock.

Anti-Dilution Adjustments to Underlying Stocks that Are ADRs

For purposes of the anti-dilution adjustments set forth above, if an Underlying Stock is an ADR (an “Underlying ADR”), the Calculation Agents will consider the effect of any of the relevant events on the Underlying ADR, and adjustments will be made as if the Underlying ADR was the Underlying Stock described above. For example, if the stock represented by the Underlying ADR is subject to a two-for-one stock split, and assuming an initial Price Multiplier of 1, the Price Multiplier for the Underlying ADR would be adjusted so that it equals two. With respect this Security linked to an Underlying ADR (or an Underlying Stock issued by a non-U.S. Underlying Company), the term “dividend” means the dividends paid to holders of the Underlying ADR (or the Underlying Stock issued by the non-U.S. Underlying Company), and such dividends may reflect the netting of any applicable foreign withholding or similar taxes that may be due on dividends paid to a U.S. person.

The Calculation Agents may determine not to make an adjustment if:

(A) holders of the Underlying ADR are not eligible to participate in any of the events that would otherwise require anti-dilution adjustments as set forth above if this Security had been linked directly to the common shares of the Underlying Company represented by the Underlying ADR; or

(B) to the extent that the Calculation Agents determine that the Underlying Company or the depositary for the ADRs has adjusted the number of common shares of the Underlying Company represented by each share of the Underlying ADR, so that the market price of the Underlying ADR would not be affected by the corporate event.

If the Underlying Company or the depositary for the ADRs, in the absence of any of the events described above, elects to adjust the number of common shares of the Underlying Company represented by each share of the Underlying ADR, then the Calculation Agents may make the appropriate anti-dilution adjustments to reflect such change. The depositary for the ADRs may also make adjustments in respect of the ADRs for share distributions, rights distributions, cash distributions and distributions other than shares, rights, and cash. Upon any such adjustment by the depositary, the Calculation Agents may adjust the Price Multiplier or other terms of this Security as the Calculation Agents determine commercially reasonable to account for that event.

Delisting of ADRs or Termination of ADR Facility

If the Underlying Stock is an Underlying ADR and such Underlying ADR is no longer listed or admitted to trading on a U.S. securities exchange registered under the Exchange Act or included in the OTC Bulletin Board Service operated by the Financial Industry Regulatory Authority, Inc., or if the ADR facility between the Underlying Company and the ADR depositary is terminated for any reason, then, on and after the date that the Underlying ADR is no longer so listed or admitted to trading or the date of such termination, as applicable (the “termination date”), the Underlying Stock will be deemed to be the Underlying Company’s common equity securities rather than the Underlying ADR. The Calculation Agents will determine the price of the Underlying Stock by reference to those common shares. Under such circumstances, the Calculation Agents may modify any terms of this Security as they deem necessary, in their sole discretion, to ensure an equitable result. On and after the termination date, for all purposes, the Closing Market Price of the Underlying Company’s common shares on their primary exchange will be converted to U.S. dollars using such exchange rate as the Calculation Agents, in their sole discretion, determine to be commercially reasonable.

Calculation Agents

The Calculation Agents have the sole discretion to make all determinations regarding this Security as described in this Security, including determinations regarding the Starting Value, the Ending Value, the Price Multiplier, the Closing Market Price, the Redemption Amount, any Market Disruption Events, any anti-dilution adjustments, any successor Underlying Stock, Business Days, Trading Days and Non-Calculation Days. Absent manifest error, all determinations of the Calculation Agents will be conclusive for all purposes and final and binding on the Holder hereof and the Company, without any liability on the part of the Calculation Agents.

The Company covenants that, so long as this Security is Outstanding, there shall at all times be a Calculation Agent (which shall be a broker-dealer, bank or other financial institution) with respect to this Security.

Tax Considerations

The Company agrees, and by acceptance of a beneficial ownership interest in this Security each Holder of this Security will be deemed to have agreed (in the absence of a statutory, regulatory, administrative or judicial ruling to the contrary), for United States federal income tax purposes to characterize and treat this Security as a prepaid derivative contract that is an “open transaction.”

Redemption and Repayment

This Security is not subject to redemption at the option of the Company or repayment at the option of the Holder hereof prior to November 20, 2020. This Security is not entitled to any sinking fund.

Acceleration

If an Event of Default, as defined in the Indenture, with respect to this Security shall occur and be continuing, the Redemption Amount (calculated as set forth in the next sentence) of this Security may be declared due and payable in the manner and with the effect provided in the Indenture. The amount payable to the Holder hereof upon any acceleration permitted under the Indenture will be equal to the Redemption Amount described under “Determination of Redemption Amount,” determined as if the date of acceleration were the Calculation Day. The payment of the Redemption Amount of this Security may also be accelerated as set forth above under “Anti-Dilution Adjustments—Reorganization Events.”

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been executed by the Trustee referred to on the reverse hereof by manual signature or its duly authorized agent under the Indenture referred to on the reverse hereof by manual signature, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

[The remainder of this page has been left intentionally blank]

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed.

DATED:

| WELLS FARGO FINANCE LLC |

| | |

| By: | |

| | |

| | Its: |

| | |

| Attest: | |

| | |

| | Its: |

TRUSTEE’S CERTIFICATE OF

AUTHENTICATION

This is one of the Securities of the

series designated therein described

in the within-mentioned Indenture.

CITIBANK, N.A.,

as Trustee

By: | | |

| Authorized Signature | |

| | |

| OR | |

| | |

WELLS FARGO BANK, N.A., | |

as Authenticating Agent for the Trustee | |

| | |

By: | | |

| Authorized Signature | |

[Reverse of Note]

WELLS FARGO FINANCE LLC

MEDIUM-TERM NOTE, SERIES A

Fully and Unconditionally Guaranteed by Wells Fargo & Company

Accelerated Return Notes® Linked to a

Basket of Three Financial Sector Stocks

This Security is one of a duly authorized issue of securities of the Company (herein called the “Securities”), issued and to be issued in one or more series under an indenture dated as of April 25, 2018, as amended or supplemented from time to time (herein called the “Indenture”), among the Company, as issuer, the Guarantor and Citibank, N.A., as trustee (herein called the “Trustee,” which term includes any successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Guarantor, the Trustee and the Holders of the Securities, and of the terms upon which the Securities are, and are to be, authenticated and delivered. This Security is one of the series of the Securities designated as Medium-Term Notes, Series A, of the Company. The amount payable on the Securities of this series may be determined by reference to the performance of one or more equity-, commodity- or currency-based indices, exchange traded funds, securities, commodities, currencies, statistical measures of economic or financial performance, or a basket comprised of two or more of the foregoing, or any other market measure or may bear interest at a fixed rate or a floating rate. The Securities of this series may mature at different times, be redeemable at different times or not at all, be repayable at the option of the Holder at different times or not at all and be denominated in different currencies.

The Securities are issuable only in registered form without coupons and will be either (a) book-entry securities represented by one or more Global Securities recorded in the book-entry system maintained by the Depositary or (b) certificated securities issued to and registered in the names of, the beneficial owners or their nominees.

The Company agrees, to the extent permitted by law, not to voluntarily claim the benefits of any laws concerning usurious rates of interest against a Holder of this Security.

Guarantee

The Securities of this series are fully and unconditionally guaranteed by the Guarantor as and to the extent set forth in the Indenture.

Modification and Waivers

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Company and the Guarantor and the rights

of the Holders of the Securities of each series to be affected under the Indenture at any time by the Company, the Guarantor and the Trustee with the consent of the Holders of a majority in principal amount of the Securities at the time Outstanding of all series to be affected, acting together as a class. The Indenture also contains provisions permitting the Holders of a majority in principal amount of the Securities of all series at the time Outstanding affected by certain provisions of the Indenture, acting together as a class, on behalf of the Holders of all Securities of such series, to waive compliance by the Company or the Guarantor with those provisions of the Indenture. Certain past defaults under the Indenture and their consequences may be waived under the Indenture by the Holders of a majority in principal amount of the Securities of each series at the time Outstanding, on behalf of the Holders of all Securities of such series. Solely for the purpose of determining whether any consent, waiver, notice or other action or Act to be taken or given by the Holders of Securities pursuant to the Indenture has been given or taken by the Holders of Outstanding Securities in the requisite aggregate principal amount, the principal amount of this Security will be deemed to be equal to the amount set forth on the face hereof as the “Principal Amount” hereof. Any such consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Security.

Defeasance

Section 403 and Article Fifteen of the Indenture and the provisions of clause (ii) of Section 401(1)(B) of the Indenture, relating to defeasance at any time of (a) the entire indebtedness on this Security and (b) certain restrictive covenants, upon compliance by the Company or the Guarantor with certain conditions set forth therein, shall not apply to this Security. The remaining provisions of Section 401 of the Indenture shall apply to this Security.

Authorized Denominations

This Security is issuable only in registered form without coupons in denominations of $10 or any amount in excess thereof which is an integral multiple of $10.

Registration of Transfer

Upon due presentment for registration of transfer of this Security at the office or agency of the Company in the City of Minneapolis, Minnesota, a new Security or Securities of this series, with the same terms as this Security, in authorized denominations for an equal aggregate Principal Amount will be issued to the transferee in exchange herefor, as provided in the Indenture and subject to the limitations provided therein and to the limitations described below, without charge except for any tax or other governmental charge imposed in connection therewith.

This Security is exchangeable for definitive Securities in registered form only if (x) the Depositary notifies the Company that it is unwilling or unable to continue as Depositary for this Security or if at any time the Depositary ceases to be a clearing agency registered under the Securities Exchange Act of 1934, as amended, and a successor depositary is not appointed within 90 days after the Company receives such notice or becomes aware of such ineligibility, (y) the Company in its sole discretion determines that this Security shall be exchangeable for definitive

Securities in registered form and notifies the Trustee thereof or (z) an Event of Default with respect to the Securities represented hereby has occurred and is continuing. If this Security is exchangeable pursuant to the preceding sentence, it shall be exchangeable for definitive Securities in registered form, having the same date of issuance, Stated Maturity Date and other terms and of authorized denominations aggregating a like amount.

This Security may not be transferred except as a whole by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any such nominee to a successor of the Depositary or a nominee of such successor. Except as provided above, owners of beneficial interests in this Global Security will not be entitled to receive physical delivery of Securities in definitive form and will not be considered the Holders hereof for any purpose under the Indenture.

Prior to due presentment of this Security for registration of transfer, the Company, the Guarantor, the Trustee and any agent of the Company, the Guarantor or the Trustee may treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be overdue, and neither the Company, the Guarantor, the Trustee nor any such agent shall be affected by notice to the contrary.

Obligation of the Company Absolute

No reference herein to the Indenture and no provision of this Security or the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the Redemption Amount at the times, place and rate, and in the coin or currency, herein prescribed, except as otherwise provided in this Security.

No Personal Recourse

No recourse shall be had for the payment of the Redemption Amount, or for any claim based hereon, or otherwise in respect hereof, or based on or in respect of the Indenture or any indenture supplemental thereto, against any incorporator, stockholder, officer or director, as such, past, present or future, of the Company or any successor corporation or of the Guarantor or any successor corporation, whether by virtue of any constitution, statute or rule of law, or by the enforcement of any assessment or penalty or otherwise, all such liability being, by the acceptance hereof and as part of the consideration for the issuance hereof, expressly waived and released.

Defined Terms

All terms used in this Security which are defined in the Indenture shall have the meanings assigned to them in the Indenture unless otherwise defined in this Security.

Governing Law

This Security shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of laws.

ABBREVIATIONS

The following abbreviations, when used in the inscription on the face of this instrument, shall be construed as though they were written out in full according to applicable laws or regulations:

TEN COM | -- | as tenants in common |

| | |

TEN ENT | -- | as tenants by the entireties |

| | |

JT TEN | -- | as joint tenants with right |

| | of survivorship and not |

| | as tenants in common |

UNIF GIFT MIN ACT | -- | | | Custodian | |

| (Cust) | | (Minor) |

Under Uniform Gifts to Minors Act

Additional abbreviations may also be used though not in the above list.

FOR VALUE RECEIVED, the undersigned hereby sell(s) and transfer(s) unto

Please Insert Social Security or

Other Identifying Number of Assignee

|

|

|

(Please print or type name and address including postal zip code of Assignee) |

the within Security of WELLS FARGO FINANCE LLC and does hereby irrevocably constitute and appoint __________________ attorney to transfer the said Security on the books of the Company, with full power of substitution in the premises.

Dated: _________________________

NOTICE: The signature to this assignment must correspond with the name as written upon the face of the within instrument in every particular, without alteration or enlargement or any change whatever.