Acquisition of UNITED BANKSHARES, INC. Exhibit 99.2

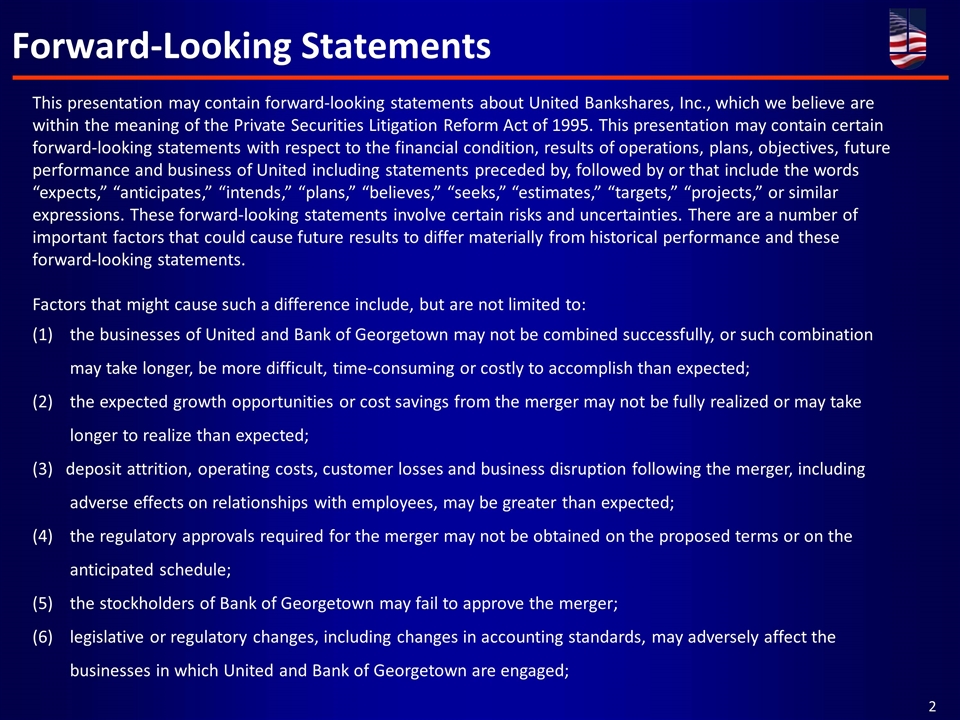

Forward-Looking Statements 2 This presentation may contain forward-looking statements about United Bankshares, Inc., which we believe are within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of United including statements preceded by, followed by or that include the words “believes,” “expects,” “anticipates” or similar expressions. These forward-looking statements involve certain risks and uncertainties. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) competitive pressures among depository institutions increase significantly; (2) changes in interest rate environment reduce interest margins; (3) prepayment speeds, loan sale volumes, charge-offs and loan loss provisions; (4) general economic conditions, either national or in the states in which United does business, are less favorable than expected; (5) legislative or regulatory changes adversely affect the businesses in which United is engaged; (6) changes in the securities markets. Further information on other factors, which could affect the financial results of United, are included in United’s filings with the Securities and Exchange Commission. These documents are available free of charge at the Commission’s website at www.sec.gov and/or from United. This presentation may contain forward-looking statements about United Bankshares, Inc., which we believe are within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of United including statements preceded by, followed by or that include the words “believes,” “expects,” “anticipates” or similar expressions. These forward-looking statements involve certain risks and uncertainties. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) competitive pressures among depository institutions increase significantly; (2) changes in interest rate environment reduce interest margins; (3) prepayment speeds, loan sale volumes, charge-offs and loan loss provisions; (4) general economic conditions, either national or in the states in which United does business, are less favorable than expected; (5) legislative or regulatory changes adversely affect the businesses in which United is engaged; (6) changes in the securities markets. Further information on other factors, which could affect the financial results of United, are included in United’s filings with the Securities and Exchange Commission. These documents are available free of charge at the Commission’s website at www.sec.gov and/or from United. This presentation may contain forward-looking statements about United Bankshares, Inc., which we believe are within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may contain certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of United including statements preceded by, followed by or that include the words “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or similar expressions. These forward-looking statements involve certain risks and uncertainties. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) the businesses of United and Bank of Georgetown may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) the regulatory approvals required for the merger may not be obtained on the proposed terms or on the anticipated schedule; (5) the stockholders of Bank of Georgetown may fail to approve the merger; (6) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which United and Bank of Georgetown are engaged;

Forward-Looking Statements (continued) 3 Factors that might cause such a difference include, but are not limited to (continued): (7) changes in the interest rate environment may adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competition from other financial services companies in United's and Bank of Georgetown's markets could adversely affect operations; (10) any economic slowdown could adversely affect credit quality and loan originations. Further information on other factors, which could affect the financial results of United, are included in United’s filings with the Securities and Exchange Commission. These documents are available free of charge at the Commission’s website at www.sec.gov and/or from United.

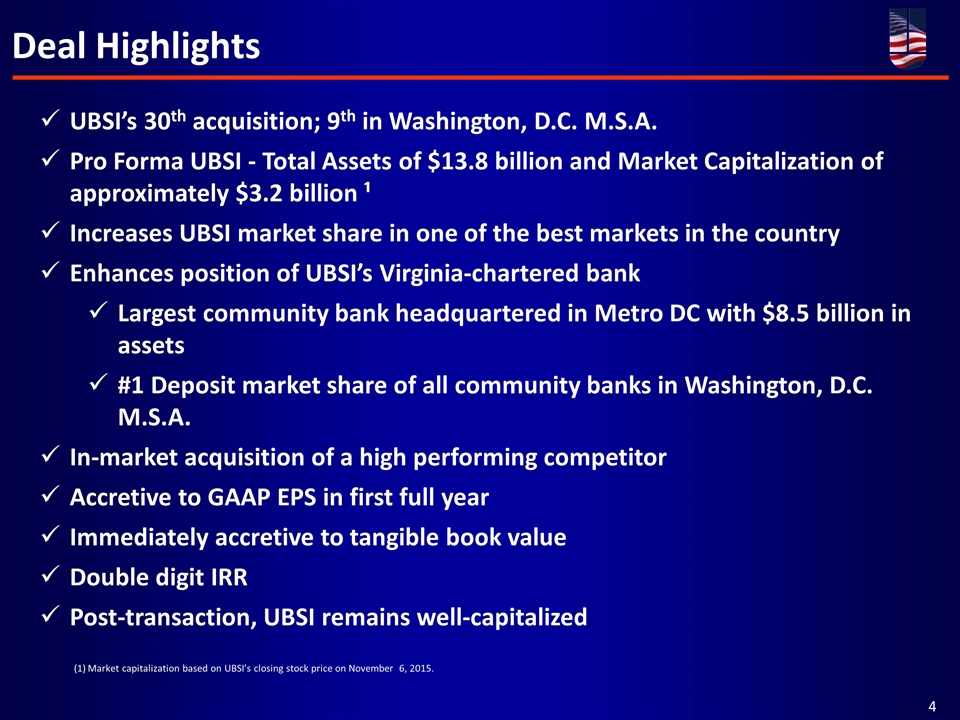

Deal Highlights 4 UBSI’s 30th acquisition; 9th in Washington, D.C. M.S.A. Pro Forma UBSI - Total Assets of $13.8 billion and Market Capitalization of approximately $3.2 billion ¹ Increases UBSI market share in one of the best markets in the country Enhances position of UBSI’s Virginia-chartered bank Largest community bank headquartered in Metro DC with $8.5 billion in assets #1 Deposit market share of all community banks in Washington, D.C. M.S.A. In-market acquisition of a high performing competitor Accretive to GAAP EPS in first full year Immediately accretive to tangible book value Double digit IRR Post-transaction, UBSI remains well-capitalized Market capitalization based on UBSI’s closing stock price on November 6, 2015.

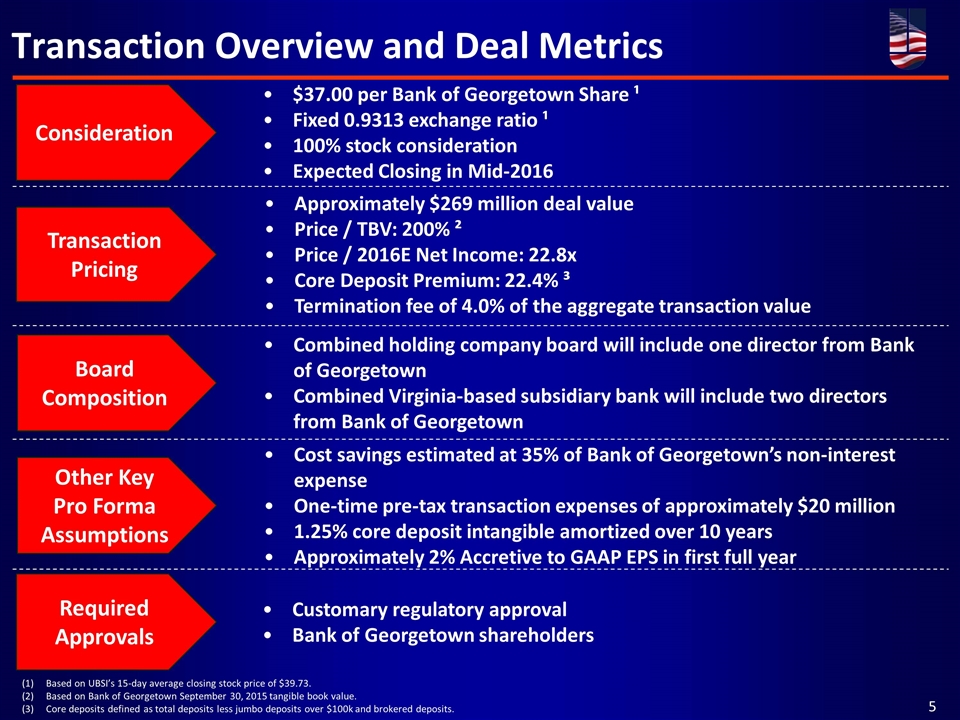

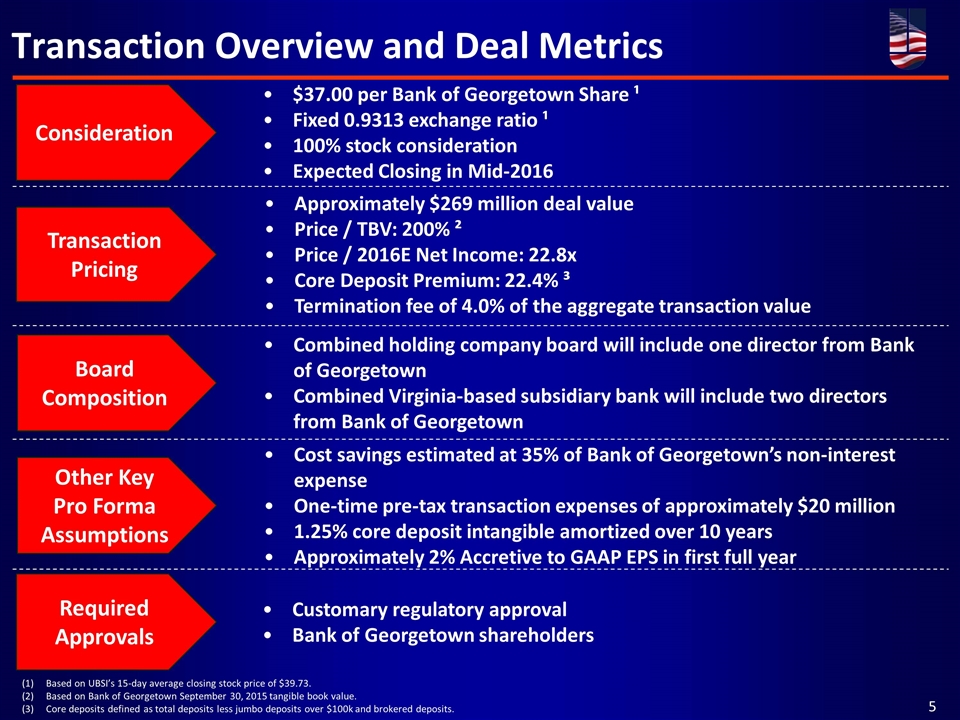

Transaction Overview and Deal Metrics 5 Based on UBSI’s 15-day average closing stock price of $39.73. Based on Bank of Georgetown September 30, 2015 tangible book value. Core deposits defined as total deposits less jumbo deposits over $100k and brokered deposits. $37.00 per Bank of Georgetown Share ¹ Fixed 0.9313 exchange ratio ¹ 100% stock consideration Expected Closing in Mid-2016 Consideration Approximately $269 million deal value Price / TBV: 200% ² Price / 2016E Net Income: 22.8x Core Deposit Premium: 22.4% ³ Termination fee of 4.0% of the aggregate transaction value Transaction Pricing Cost savings estimated at 35% of Bank of Georgetown’s non-interest expense One-time pre-tax transaction expenses of approximately $20 million 1.25% core deposit intangible amortized over 10 years Approximately 2% Accretive to GAAP EPS in first full year Other Key Pro Forma Assumptions Combined holding company board will include one director from Bank of Georgetown Combined Virginia-based subsidiary bank will include two directors from Bank of Georgetown Board Composition Customary regulatory approval Bank of Georgetown shareholders Required Approvals

United Bankshares, Inc. 6 $12.6 billion in assets and 129 full-service offices in Washington, D.C., VA, MD, OH, PA, & WV 30th Acquisition since 1982 Strong, Experienced Management Team 42 Consecutive Years of Dividend Increases 9th Acquisition in Washington, D.C. M.S.A. 45th largest bank in the U.S. by Market Cap Pro Forma Financial Highlights ¹ Source: SNL Financial. (1) Estimated pro forma financial information as of September 30, 2015. (2) Estimated TCE / TA at date of expected transaction closing.

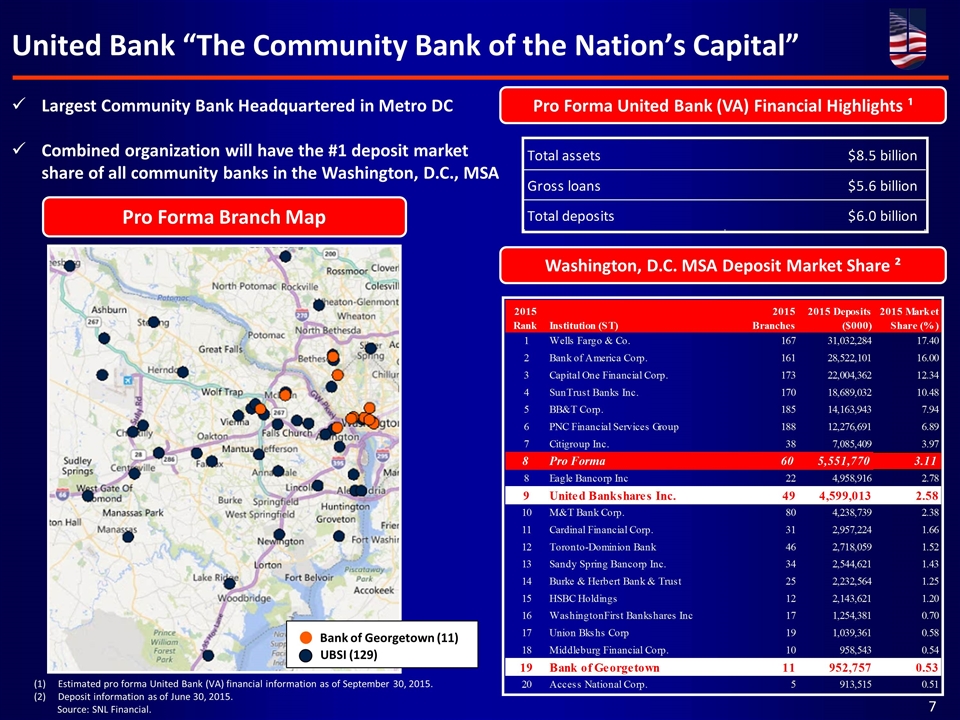

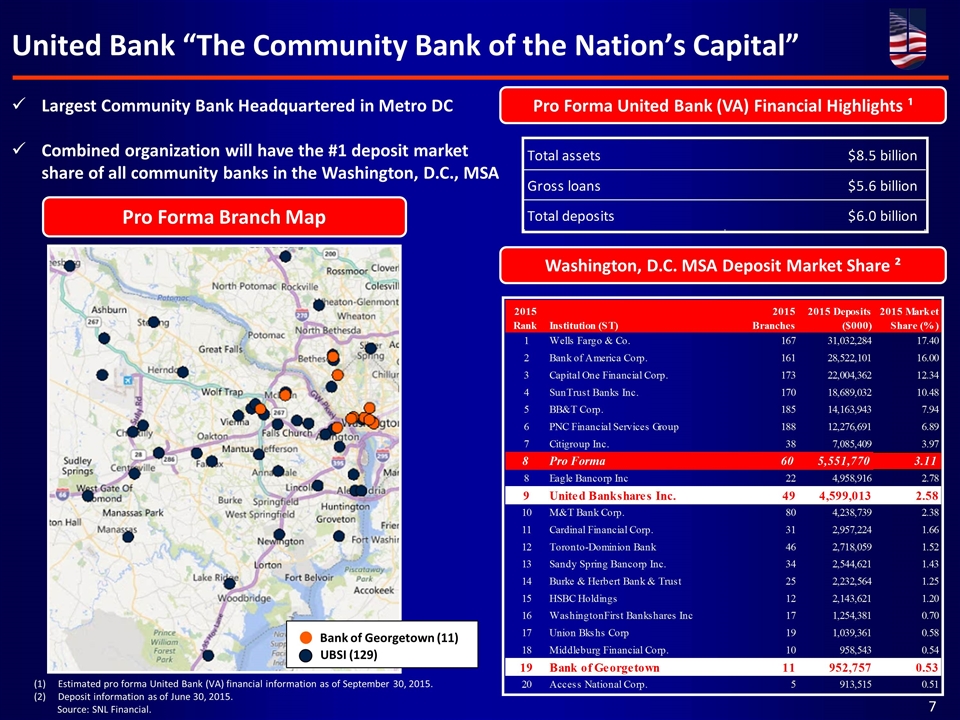

United Bank “The Community Bank of the Nation’s Capital” 7 Pro Forma Branch Map Washington, D.C. MSA Deposit Market Share ² Bank of Georgetown (11) UBSI (129) Estimated pro forma United Bank (VA) financial information as of September 30, 2015. Deposit information as of June 30, 2015. Source: SNL Financial. Pro Forma United Bank (VA) Financial Highlights ¹ Largest Community Bank Headquartered in Metro DC Combined organization will have the #1 deposit market share of all community banks in the Washington, D.C., MSA

Bank of Georgetown Franchise Overview 8 Bank of Georgetown is a well-run, conservatively managed commercial bank Organized and opened as a community-based commercial bank in 2005 Seasoned management team that leverages deep local relationships to fulfill the local market’s need for a community-based bank Strong customer service and sales culture Historically strong loan growth and lending pipeline Conservative culture particularly with regard to credit 11 branches and 3 business development offices in the demographically attractive Washington, D.C. MSA Highlights Total assets $1.2 billion Gross loans $875 million Total deposits $959 million 2015 YTD Net Income $7.5 million Total employees 113 TCE / TA 10.15% Tier 1 Risk Based Ratio 12.10% Total Risk Based Capital Ratio 13.04%

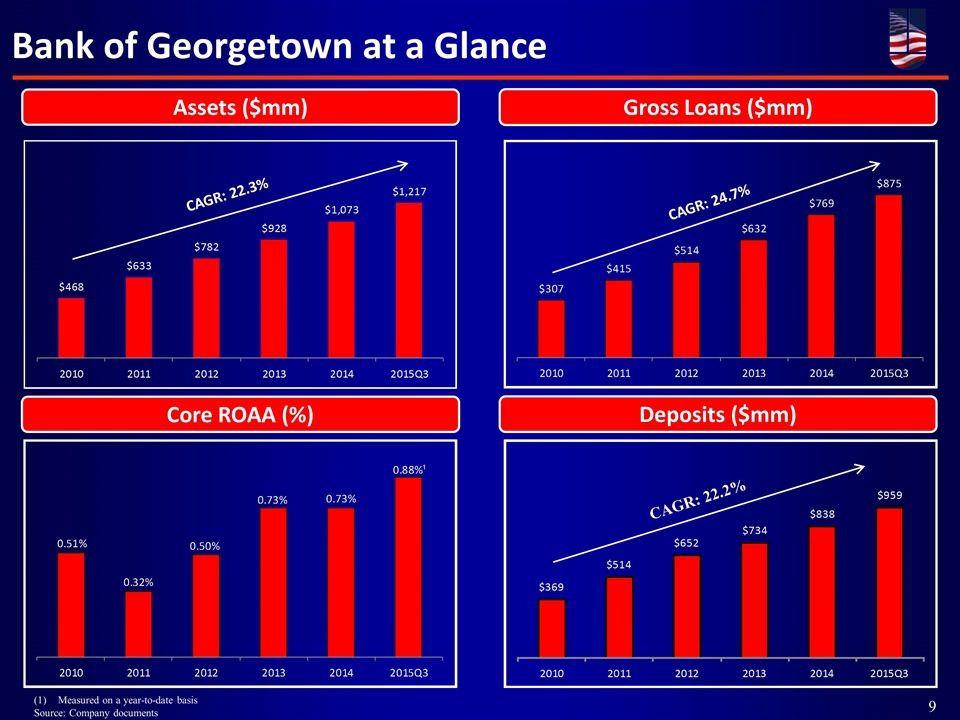

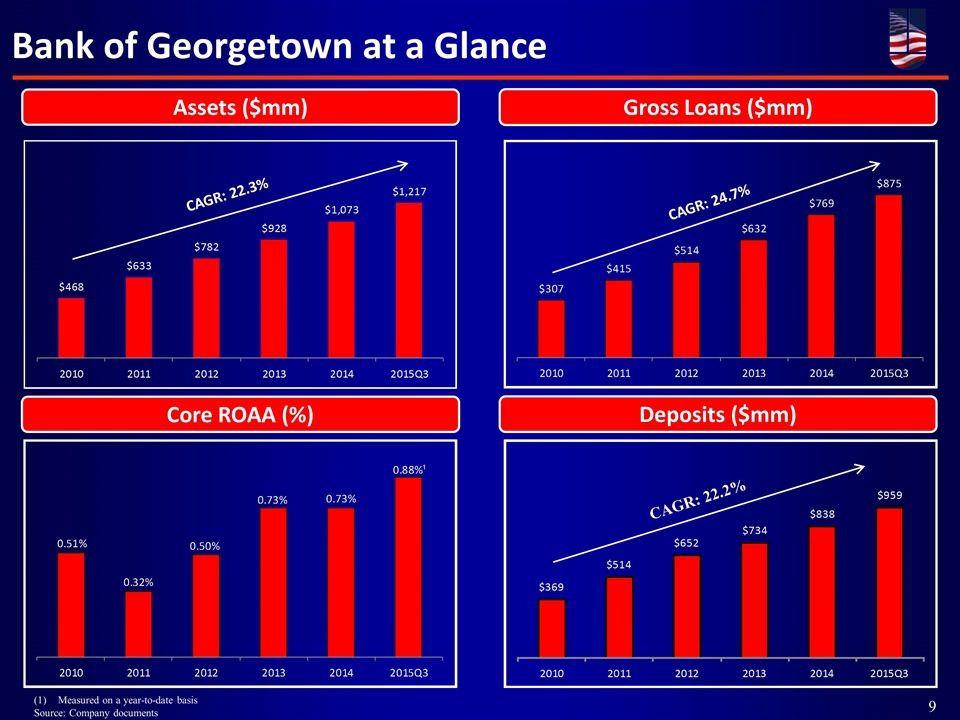

Bank of Georgetown at a Glance 9 Assets ($mm) Gross Loans ($mm) Core ROAA (%) Deposits ($mm) Measured on a year-to-date basis Source: Company documents CAGR: 22.3% CAGR: 24.7% CAGR: 22.2%

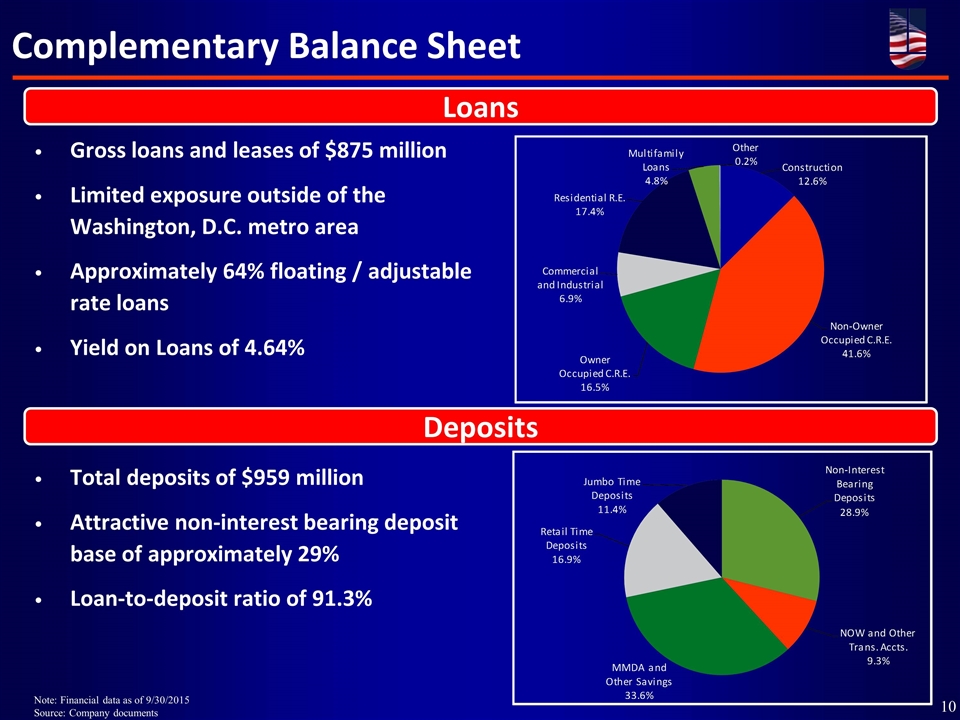

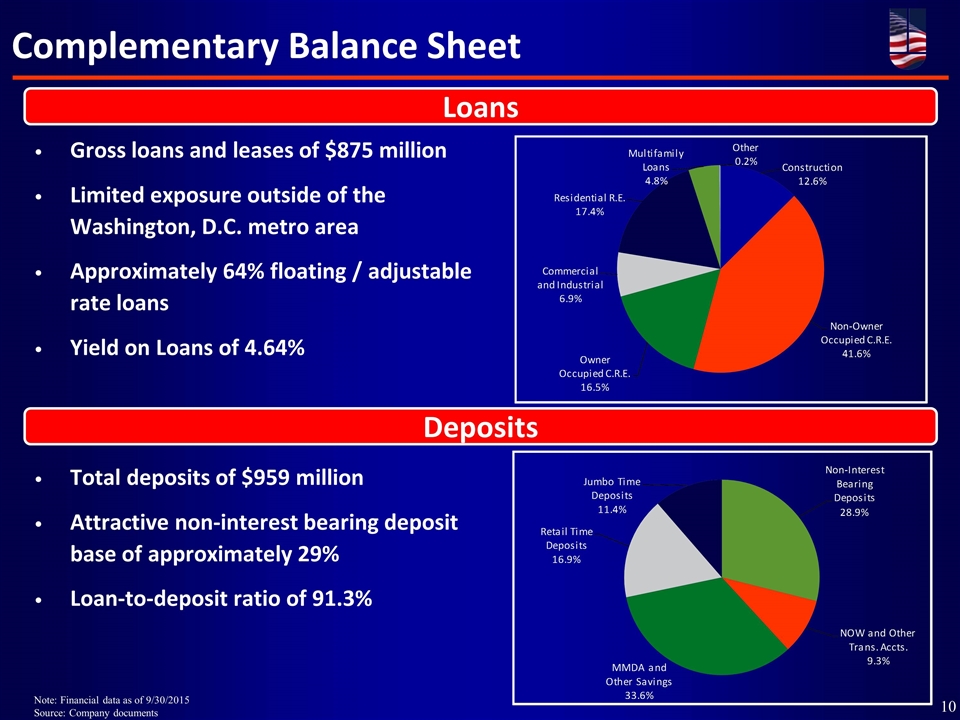

Complementary Balance Sheet Gross loans and leases of $875 million Limited exposure outside of the Washington, D.C. metro area Approximately 64% floating / adjustable rate loans Yield on Loans of 4.64% 10 Loans Total deposits of $959 million Attractive non-interest bearing deposit base of approximately 29% Loan-to-deposit ratio of 91.3% Deposits Note: Financial data as of 9/30/2015 Source: Company documents

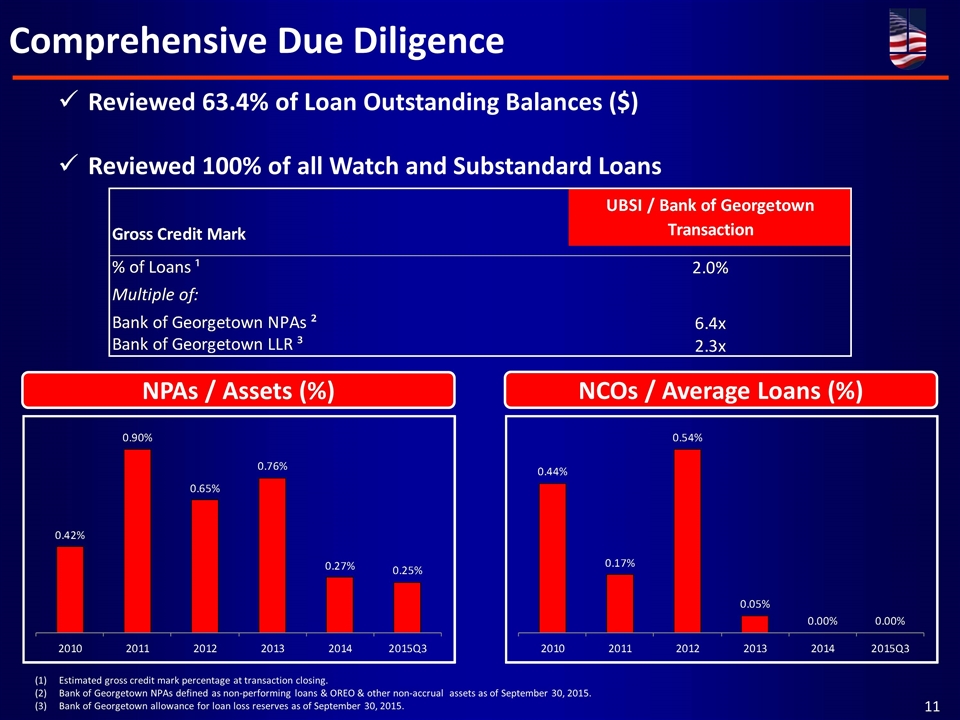

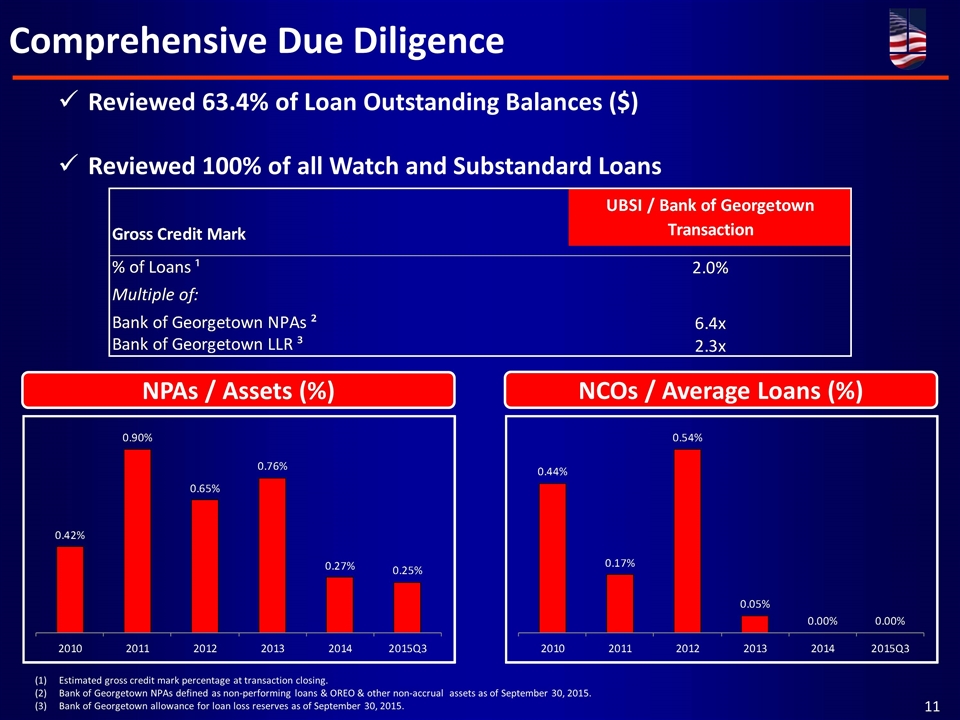

Comprehensive Due Diligence 11 Estimated gross credit mark percentage at transaction closing. Bank of Georgetown NPAs defined as non-performing loans & OREO & other non-accrual assets as of September 30, 2015. Bank of Georgetown allowance for loan loss reserves as of September 30, 2015. NPAs / Assets (%) NCOs / Average Loans (%) Reviewed 63.4% of Loan Outstanding Balances ($) Reviewed 100% of all Watch and Substandard Loans

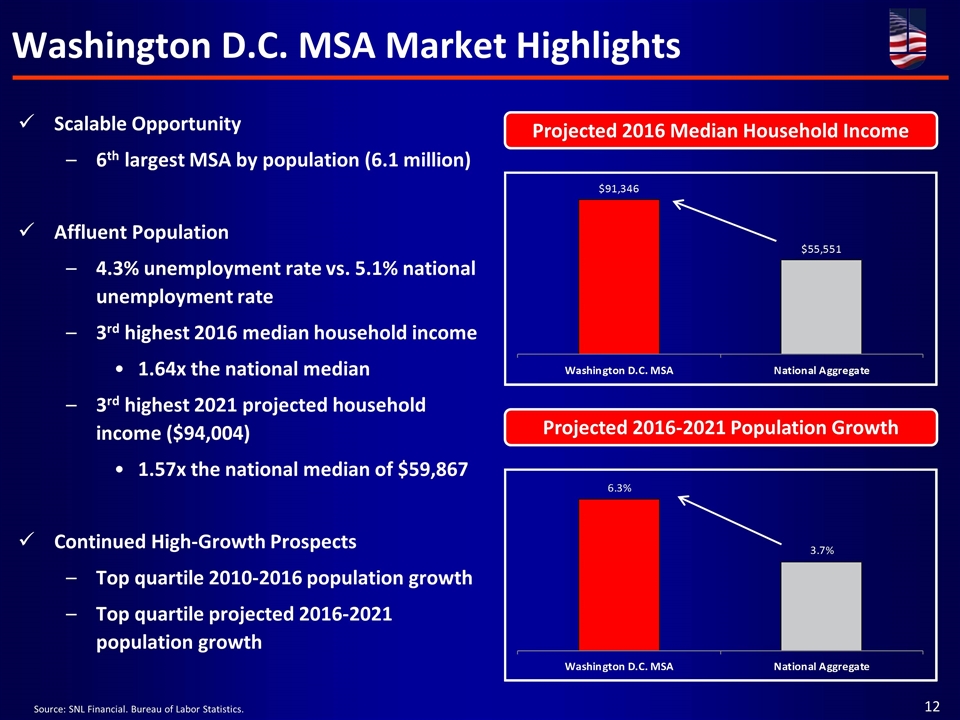

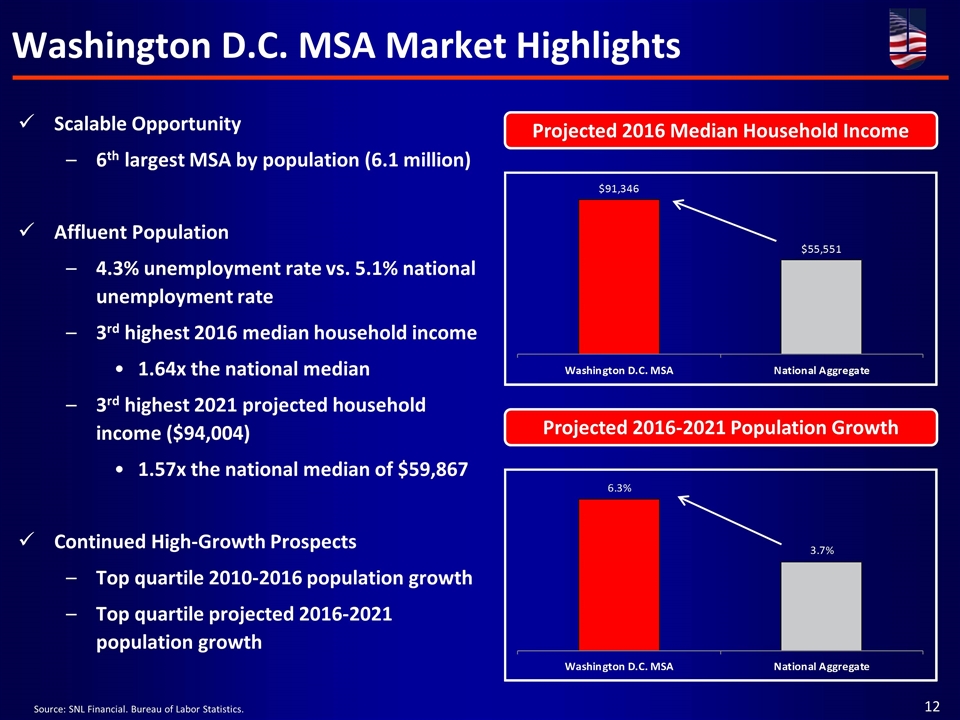

Washington D.C. MSA Market Highlights Scalable Opportunity 6th largest MSA by population (6.1 million) Affluent Population 4.3% unemployment rate vs. 5.1% national unemployment rate 3rd highest 2016 median household income 1.64x the national median 3rd highest 2021 projected household income ($94,004) 1.57x the national median of $59,867 Continued High-Growth Prospects Top quartile 2010-2016 population growth Top quartile projected 2016-2021 population growth 12 Projected 2016 Median Household Income Projected 2016-2021 Population Growth Source: SNL Financial. Bureau of Labor Statistics.