United Bankshares, Inc. First Quarter 2018 Earnings Review April 26, 2018 EXHIBIT 99.2

Forward-Looking Statements This presentation and statements made by United Bankshares, Inc. (“United”) and its management may contain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts and often use the words “projects”, “targets”, “intends”, “plans”, “believes,” “expects,” “anticipates” or similar expressions or future or conditional verbs such as “will”, “may”, “might”, “should”, “would” and “could”. These forward-looking statements involve certain risks and uncertainties. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: competitive pressures among depository institutions increase significantly; changes in interest rate environment may adversely affect net interest income; gain on sale margins; loan accretion; prepayment speeds, loan sale volumes, charge-offs and loan loss provisions; general economic conditions, either national or in the states in which United does business, are less favorable than expected; changes in the securities markets; continued diversification of assets and adverse changes to credit quality; any economic slowdown that could adversely affect credit quality and loan originations. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the caption “Risk Factors” of United’s Annual Report on Form 10-K for the year ended December 31, 2017, as filed with the SEC. April 2018

1Q18 HIGHLIGHTS Record Net Income of $61.7 million with diluted earnings per share of $0.59 Generated return on average assets of 1.35%, return on equity of 7.65%, and return on tangible equity of 14.30% Quarterly dividend of $0.34 per share equates to a yield of 3.85% based upon recent stock price Strong expense control with an efficiency ratio of 51.6% Asset quality and capital position remain sound Non Performing Assets decreased 6.6%

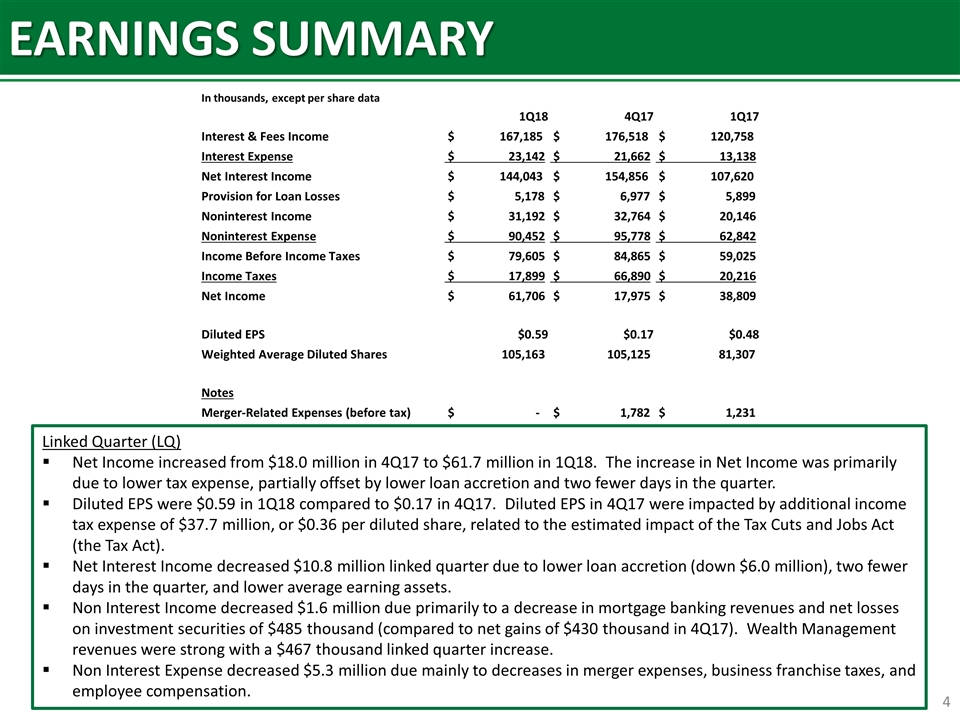

EARNINGS SUMMARY Linked Quarter (LQ) Net Income increased from $18.0 million in 4Q17 to $61.7 million in 1Q18. The increase in Net Income was primarily due to lower tax expense, partially offset by lower loan accretion and two fewer days in the quarter. Diluted EPS were $0.59 in 1Q18 compared to $0.17 in 4Q17. Diluted EPS in 4Q17 were impacted by additional income tax expense of $37.7 million, or $0.36 per diluted share, related to the estimated impact of the Tax Cuts and Jobs Act (the Tax Act). Net Interest Income decreased $10.8 million linked quarter due to lower loan accretion (down $6.0 million), two fewer days in the quarter, and lower average earning assets. Non Interest Income decreased $1.6 million due primarily to a decrease in mortgage banking revenues and net losses on investment securities of $485 thousand (compared to net gains of $430 thousand in 4Q17). Wealth Management revenues were strong with a $467 thousand linked quarter increase. Non Interest Expense decreased $5.3 million due mainly to decreases in merger expenses, business franchise taxes, and employee compensation. In thousands, except per share data 1Q18 4Q17 1Q17 Interest & Fees Income $ 167,185 $ 176,518 $ 120,758 Interest Expense $ 23,142 $ 21,662 $ 13,138 Net Interest Income $ 144,043 $ 154,856 $ 107,620 Provision for Loan Losses $ 5,178 $ 6,977 $ 5,899 Noninterest Income $ 31,192 $ 32,764 $ 20,146 Noninterest Expense $ 90,452 $ 95,778 $ 62,842 Income Before Income Taxes $ 79,605 $ 84,865 $ 59,025 Income Taxes $ 17,899 $ 66,890 $ 20,216 Net Income $ 61,706 $ 17,975 $ 38,809 Diluted EPS $0.59 $0.17 $0.48 Weighted Average Diluted Shares 105,163 105,125 81,307 Notes Merger-Related Expenses (before tax) $ - $ 1,782 $ 1,231

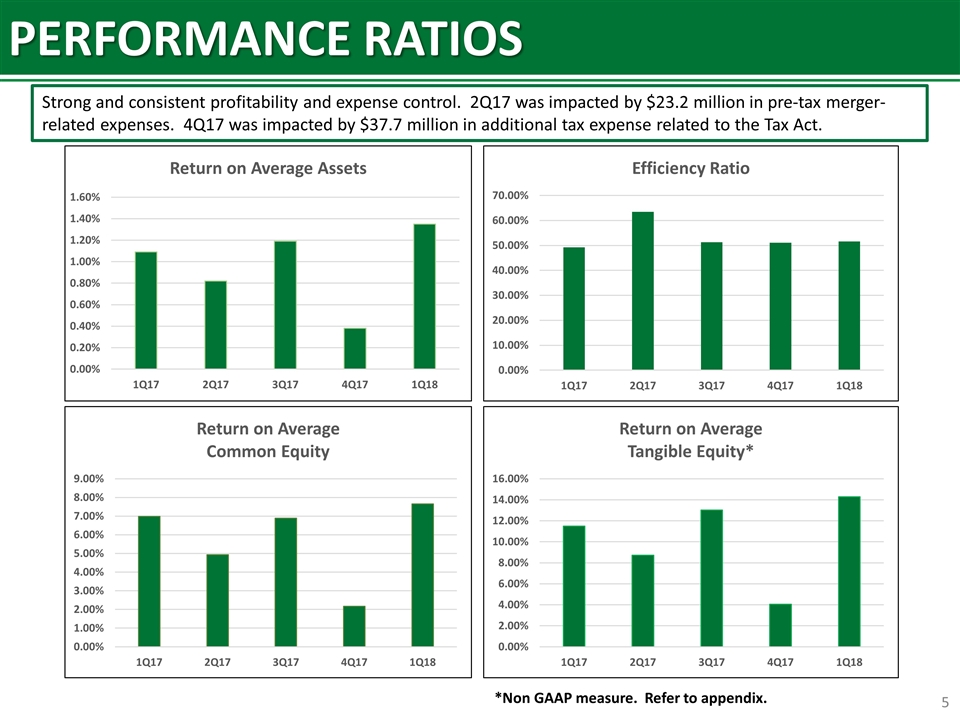

PERFORMANCE RATIOS Strong and consistent profitability and expense control. 2Q17 was impacted by $23.2 million in pre-tax merger-related expenses. 4Q17 was impacted by $37.7 million in additional tax expense related to the Tax Act. *Non GAAP measure. Refer to appendix.

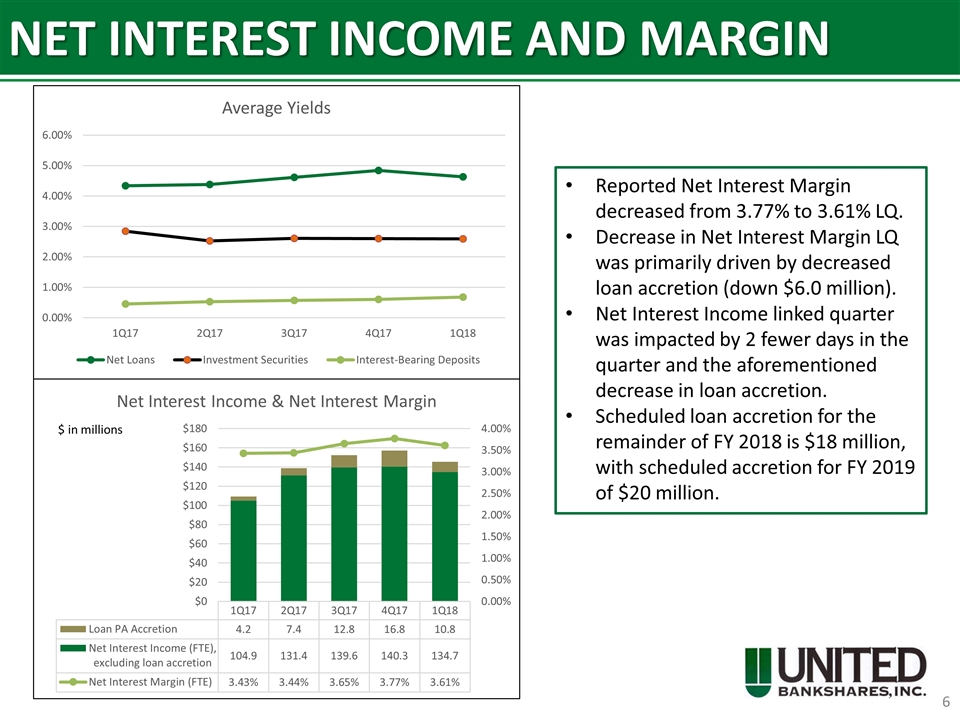

NET INTEREST INCOME AND MARGIN Reported Net Interest Margin decreased from 3.77% to 3.61% LQ. Decrease in Net Interest Margin LQ was primarily driven by decreased loan accretion (down $6.0 million). Net Interest Income linked quarter was impacted by 2 fewer days in the quarter and the aforementioned decrease in loan accretion. Scheduled loan accretion for the remainder of FY 2018 is $18 million, with scheduled accretion for FY 2019 of $20 million. $ in millions

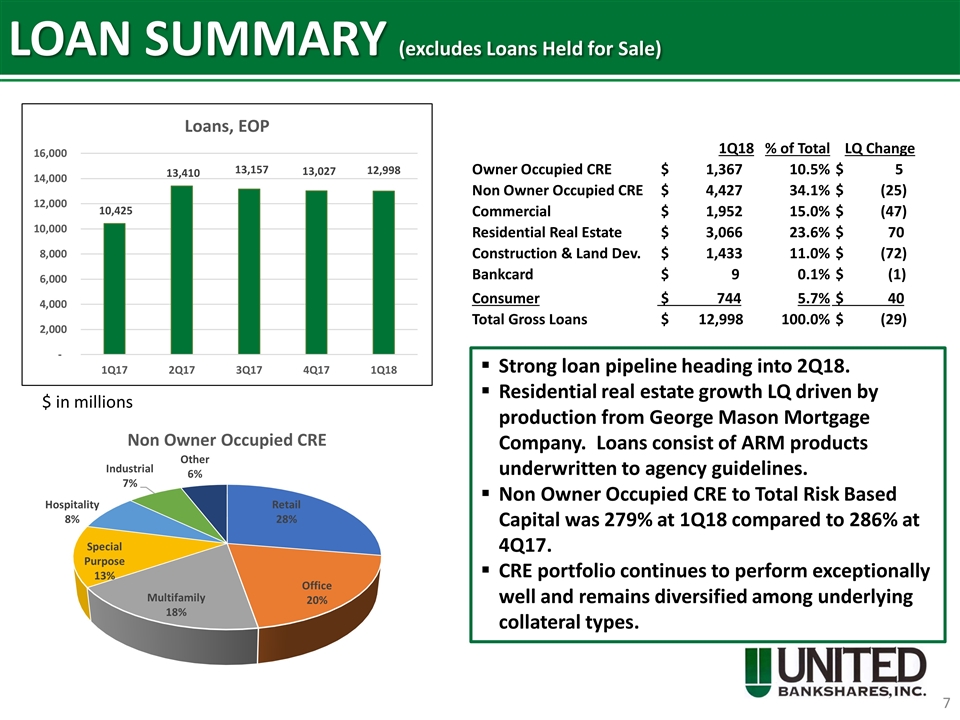

LOAN SUMMARY (excludes Loans Held for Sale) Strong loan pipeline heading into 2Q18. Residential real estate growth LQ driven by production from George Mason Mortgage Company. Loans consist of ARM products underwritten to agency guidelines. Non Owner Occupied CRE to Total Risk Based Capital was 279% at 1Q18 compared to 286% at 4Q17. CRE portfolio continues to perform exceptionally well and remains diversified among underlying collateral types. $ in millions 1Q18 % of Total LQ Change Owner Occupied CRE $ 1,367 10.5% $ 5 Non Owner Occupied CRE $ 4,427 34.1% $ (25) Commercial $ 1,952 15.0% $ (47) Residential Real Estate $ 3,066 23.6% $ 70 Construction & Land Dev. $ 1,433 11.0% $ (72) Bankcard $ 9 0.1% $ (1) Consumer $ 744 5.7% $ 40 Total Gross Loans $ 12,998 100.0% $ (29)

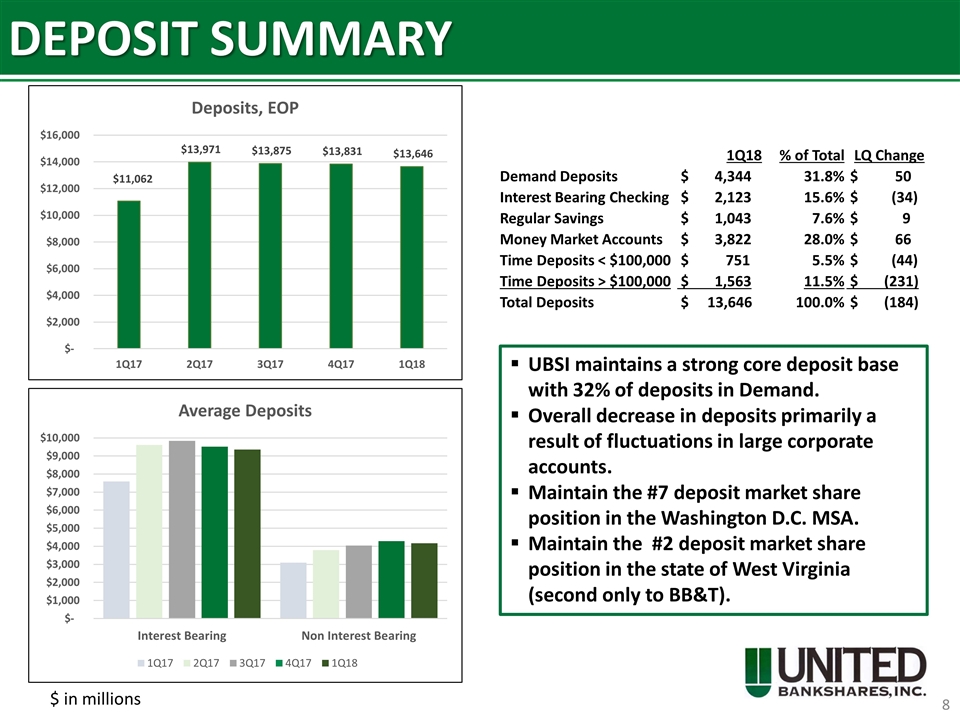

DEPOSIT SUMMARY UBSI maintains a strong core deposit base with 32% of deposits in Demand. Overall decrease in deposits primarily a result of fluctuations in large corporate accounts. Maintain the #7 deposit market share position in the Washington D.C. MSA. Maintain the #2 deposit market share position in the state of West Virginia (second only to BB&T). $ in millions 1Q18 % of Total LQ Change Demand Deposits $ 4,344 31.8% $ 50 Interest Bearing Checking $ 2,123 15.6% $ (34) Regular Savings $ 1,043 7.6% $ 9 Money Market Accounts $ 3,822 28.0% $ 66 Time Deposits < $100,000 $ 751 5.5% $ (44) Time Deposits > $100,000 $ 1,563 11.5% $ (231) Total Deposits $ 13,646 100.0% $ (184)

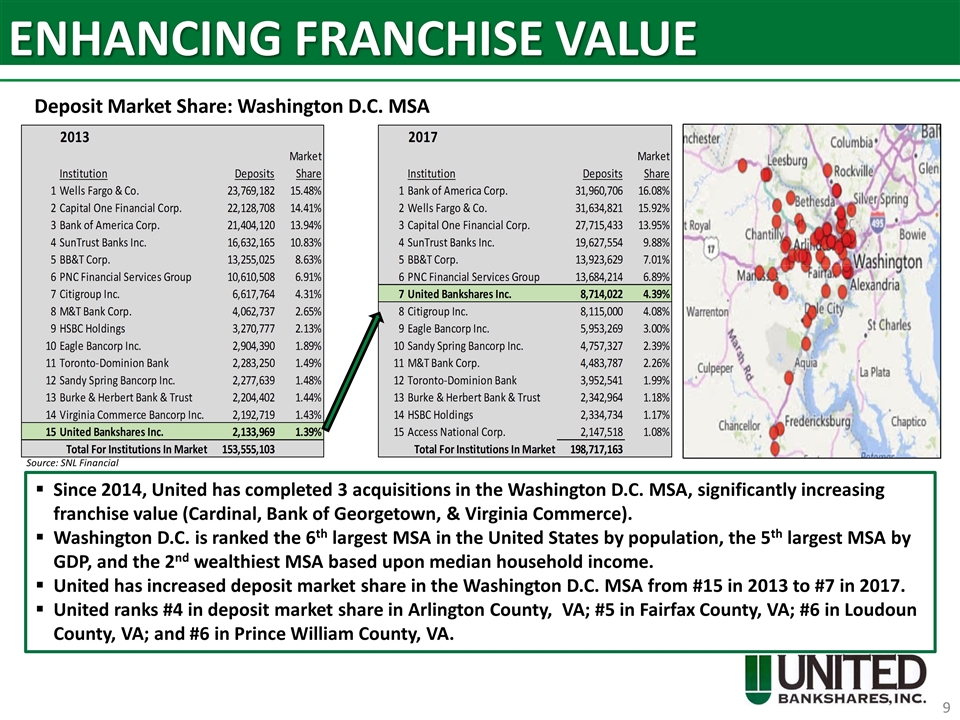

ENHANCING FRANCHISE VALUE Source: SNL Financial Deposit Market Share: Washington D.C. MSA Since 2014, United has completed 3 acquisitions in the Washington D.C. MSA, significantly increasing franchise value (Cardinal, Bank of Georgetown, & Virginia Commerce). Washington D.C. is ranked the 6th largest MSA in the United States by population, the 5th largest MSA by GDP, and the 2nd wealthiest MSA based upon median household income. United has increased deposit market share in the Washington D.C. MSA from #15 in 2013 to #7 in 2017. United ranks #4 in deposit market share in Arlington County, VA; #5 in Fairfax County, VA; #6 in Loudoun County, VA; and #6 in Prince William County, VA. Source: SNL Financial

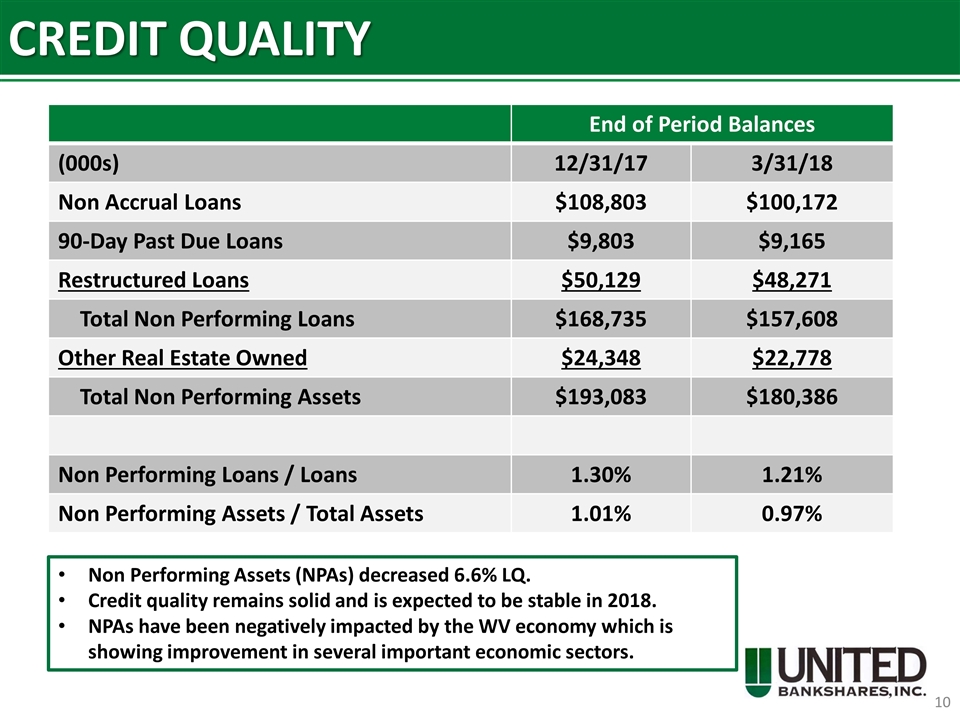

CREDIT QUALITY End of Period Balances (000s) 12/31/17 3/31/18 Non Accrual Loans $108,803 $100,172 90-Day Past Due Loans $9,803 $9,165 Restructured Loans $50,129 $48,271 Total Non Performing Loans $168,735 $157,608 Other Real Estate Owned $24,348 $22,778 Total Non Performing Assets $193,083 $180,386 Non Performing Loans / Loans 1.30% 1.21% Non Performing Assets / Total Assets 1.01% 0.97% Non Performing Assets (NPAs) decreased 6.6% LQ. Credit quality remains solid and is expected to be stable in 2018. NPAs have been negatively impacted by the WV economy which is showing improvement in several important economic sectors.

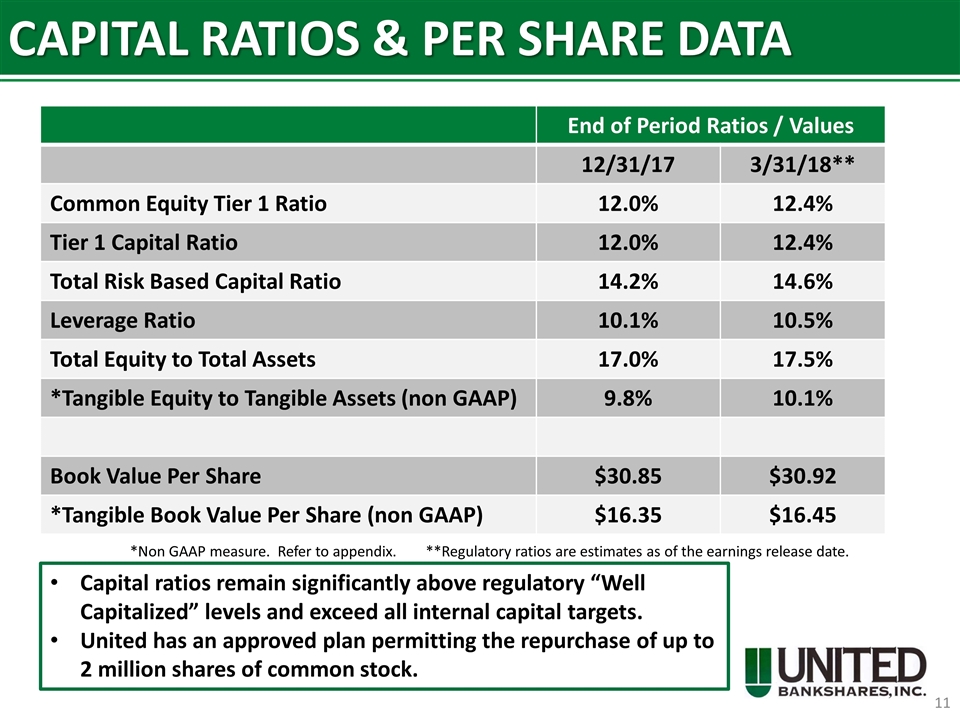

CAPITAL RATIOS & PER SHARE DATA End of Period Ratios / Values 12/31/17 3/31/18** Common Equity Tier 1 Ratio 12.0% 12.4% Tier 1 Capital Ratio 12.0% 12.4% Total Risk Based Capital Ratio 14.2% 14.6% Leverage Ratio 10.1% 10.5% Total Equity to Total Assets 17.0% 17.5% *Tangible Equity to Tangible Assets (non GAAP) 9.8% 10.1% Book Value Per Share $30.85 $30.92 *Tangible Book Value Per Share (non GAAP) $16.35 $16.45 Capital ratios remain significantly above regulatory “Well Capitalized” levels and exceed all internal capital targets. United has an approved plan permitting the repurchase of up to 2 million shares of common stock. *Non GAAP measure. Refer to appendix. **Regulatory ratios are estimates as of the earnings release date.

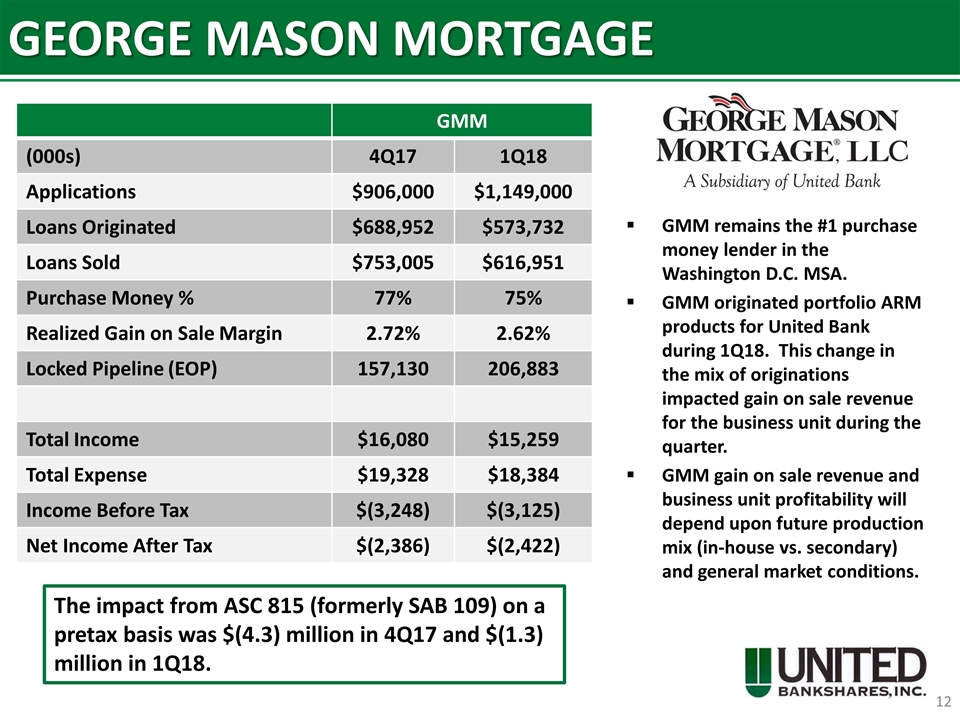

GEORGE MASON MORTGAGE GMM remains the #1 purchase money lender in the Washington D.C. MSA. GMM originated portfolio ARM products for United Bank during 1Q18. This change in the mix of originations impacted gain on sale revenue for the business unit during the quarter. GMM gain on sale revenue and business unit profitability will depend upon future production mix (in-house vs. secondary) and general market conditions. GMM (000s) 4Q17 1Q18 Applications $906,000 $1,149,000 Loans Originated $688,952 $573,732 Loans Sold $753,005 $616,951 Purchase Money % 77% 75% Realized Gain on Sale Margin 2.72% 2.62% Locked Pipeline (EOP) 157,130 206,883 Total Income $16,080 $15,259 Total Expense $19,328 $18,384 Income Before Tax $(3,248) $(3,125) Net Income After Tax $(2,386) $(2,422) The impact from ASC 815 (formerly SAB 109) on a pretax basis was $(4.3) million in 4Q17 and $(1.3) million in 1Q18.

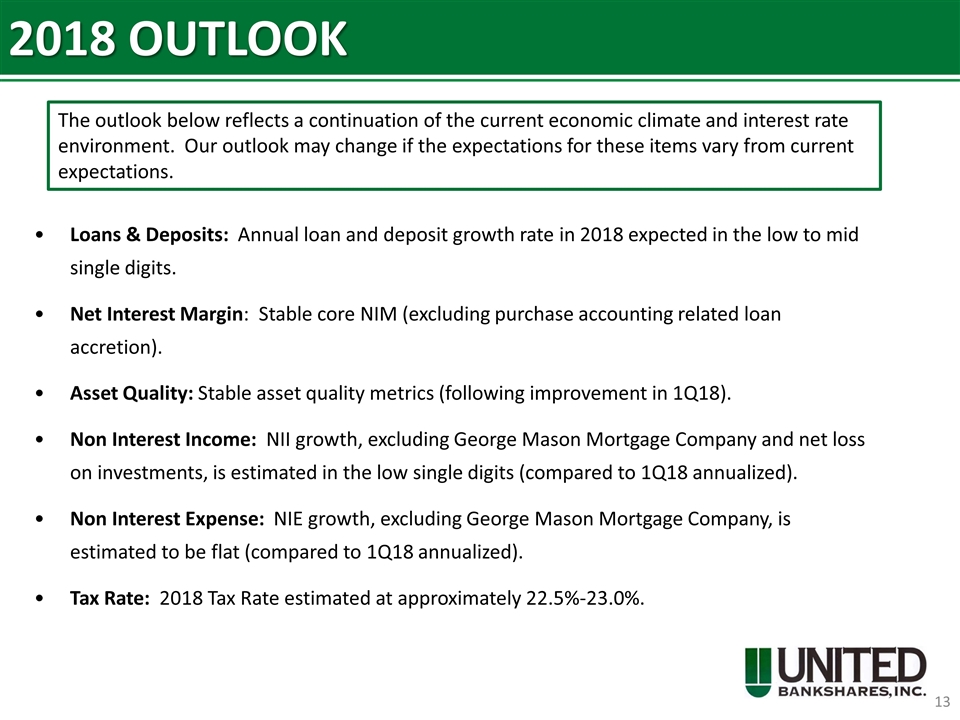

2018 OUTLOOK Loans & Deposits: Annual loan and deposit growth rate in 2018 expected in the low to mid single digits. Net Interest Margin: Stable core NIM (excluding purchase accounting related loan accretion). Asset Quality: Stable asset quality metrics (following improvement in 1Q18). Non Interest Income: NII growth, excluding George Mason Mortgage Company and net loss on investments, is estimated in the low single digits (compared to 1Q18 annualized). Non Interest Expense: NIE growth, excluding George Mason Mortgage Company, is estimated to be flat (compared to 1Q18 annualized). Tax Rate: 2018 Tax Rate estimated at approximately 22.5%-23.0%. The outlook below reflects a continuation of the current economic climate and interest rate environment. Our outlook may change if the expectations for these items vary from current expectations.

UBSI INVESTMENT THESIS Excellent franchise with strong growth prospects Experienced management team with a proven track record of execution High level of insider ownership High-performance bank with a low-risk profile 44 consecutive years of dividend increases evidences United’s strong profitability, solid asset quality, and sound capital management over a very long period of time Attractive valuation with a current Price-to-Earnings Ratio of 14.2x (based upon median street consensus estimate of $2.48, per Bloomberg) and a dividend yield of 3.85% (based upon recent prices)

THE CHALLENGE TO BE THE BEST NEVER ENDS www.ubsi-inc.com

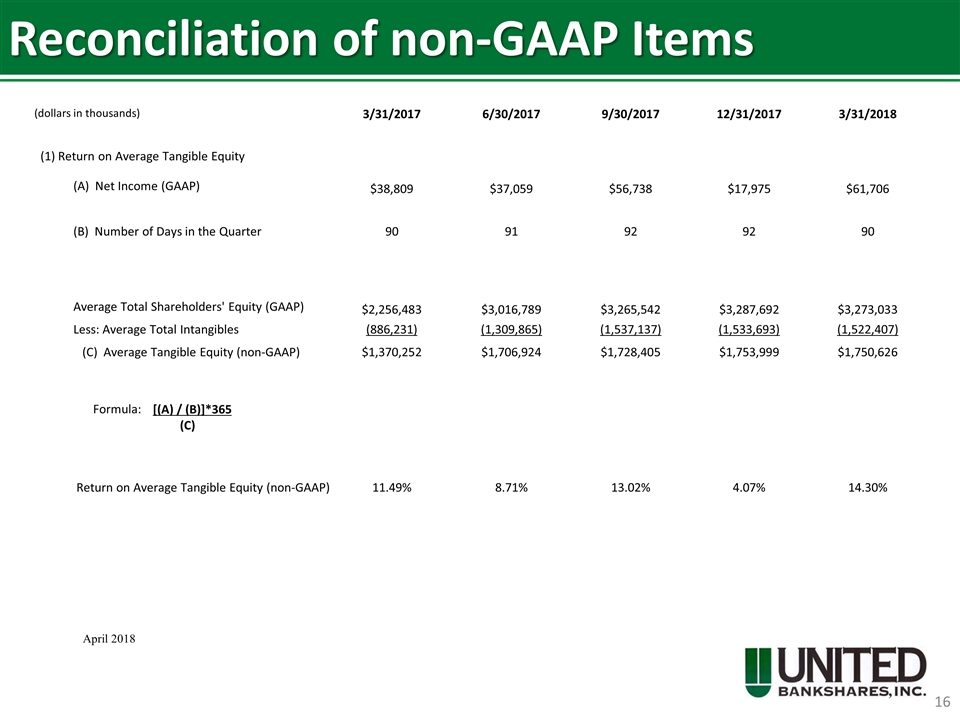

Reconciliation of non-GAAP Items April 2018 (dollars in thousands) 3/31/2017 6/30/2017 9/30/2017 12/31/2017 3/31/2018 (1) Return on Average Tangible Equity (A) Net Income (GAAP) $38,809 $37,059 $56,738 $17,975 $61,706 (B) Number of Days in the Quarter 90 91 92 92 90 Average Total Shareholders' Equity (GAAP) $2,256,483 $3,016,789 $3,265,542 $3,287,692 $3,273,033 Less: Average Total Intangibles (886,231) (1,309,865) (1,537,137) (1,533,693) (1,522,407) (C) Average Tangible Equity (non-GAAP) $1,370,252 $1,706,924 $1,728,405 $1,753,999 $1,750,626 Formula: [(A) / (B)]*365 (C) Return on Average Tangible Equity (non-GAAP) 11.49% 8.71% 13.02% 4.07% 14.30%

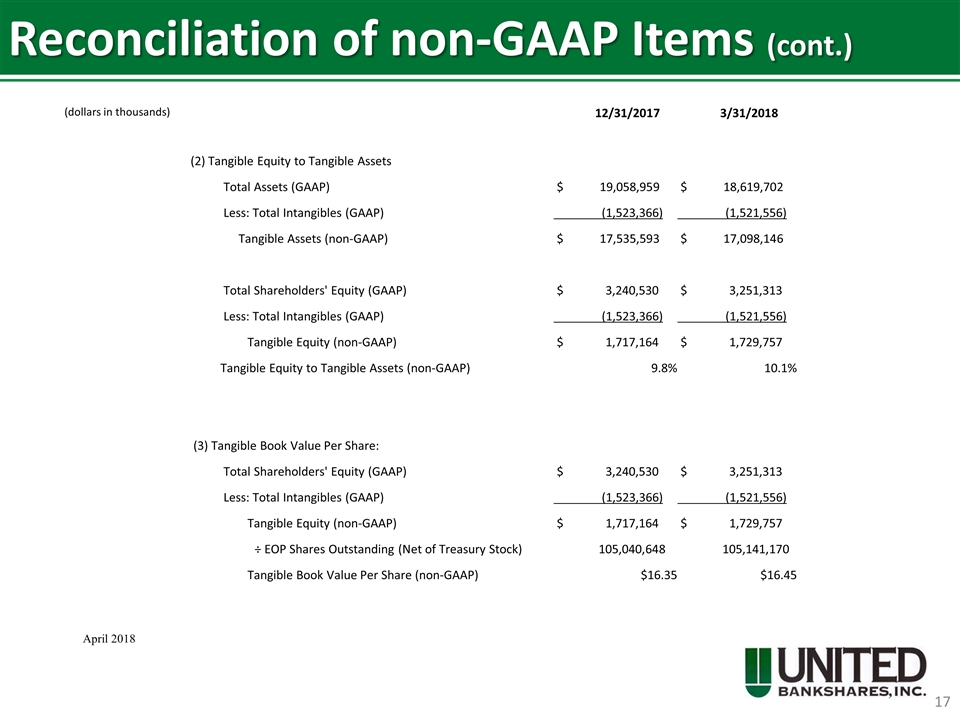

Reconciliation of non-GAAP Items (cont.) April 2018 (dollars in thousands) 12/31/2017 3/31/2018 (2) Tangible Equity to Tangible Assets Total Assets (GAAP) $ 19,058,959 $ 18,619,702 Less: Total Intangibles (GAAP) (1,523,366) (1,521,556) Tangible Assets (non-GAAP) $ 17,535,593 $ 17,098,146 Total Shareholders' Equity (GAAP) $ 3,240,530 $ 3,251,313 Less: Total Intangibles (GAAP) (1,523,366) (1,521,556) Tangible Equity (non-GAAP) $ 1,717,164 $ 1,729,757 Tangible Equity to Tangible Assets (non-GAAP) 9.8% 10.1% (3) Tangible Book Value Per Share: Total Shareholders' Equity (GAAP) $ 3,240,530 $ 3,251,313 Less: Total Intangibles (GAAP) (1,523,366) (1,521,556) Tangible Equity (non-GAAP) $ 1,717,164 $ 1,729,757 ÷ EOP Shares Outstanding (Net of Treasury Stock) 105,040,648 105,141,170 Tangible Book Value Per Share (non-GAAP) $16.35 $16.45