United Bankshares, Inc. Third Quarter 2020 Earnings Review October 23, 2020 Exhibit 99.2

Forward-Looking Statements This presentation and statements made by United Bankshares, Inc. (“United”) and its management contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the merger (the “Merger”) between Carolina Financial Corporation (“Carolina Financial”) and United that was completed on May 1, 2020; (ii) United’s plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts; (iii) the effect of the COVID-19 pandemic; and (iv) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations managements of United and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of United. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of United and Carolina Financial may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the Merger may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the Merger, including adverse effects on relationships with employees, may be greater than expected; (4) the effects of changing regional and national economic conditions, including the impact of the COVID-19 pandemic and the negative impacts and disruptions on United’s customers, the communities it serves and the domestic and global economy; (5) current and future economic and market conditions, including the effects of high unemployment rates, United States fiscal debt, budget and tax matters and any slowdown in global economic growth; (6) legislative or regulatory changes, including changes in accounting standards, that may adversely affect the businesses in which United is engaged; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competition from other financial services companies in United's markets could adversely affect operations; and (10) the economic slowdown could continue to adversely affect credit quality and loan originations. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed United’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available on the SEC's Internet site (http://www.sec.gov). United cautions that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking statements concerning United or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. United does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

3Q20 HIGHLIGHTS Achieved record quarterly Net Income of $103.8 million and record quarterly Diluted Earnings Per Share of $0.80 Reported record mortgage banking revenue, net income, and volume Generated Return on Average Assets of 1.56%, Return on Average Equity of 9.68%, and Return on Average Tangible Equity* of 16.94% Continue to support our customers’ needs through new loan originations, loan deferrals, PPP loans, and other accommodations Quarterly dividend of $0.35 per share equates to a yield of 5.6% (based upon recent prices) Strong expense control with an efficiency ratio of 53.4% Capital position remains robust and liquidity remains sound Continued to successfully integrate the Carolina Financial merger *Non GAAP measure. Refer to appendix.

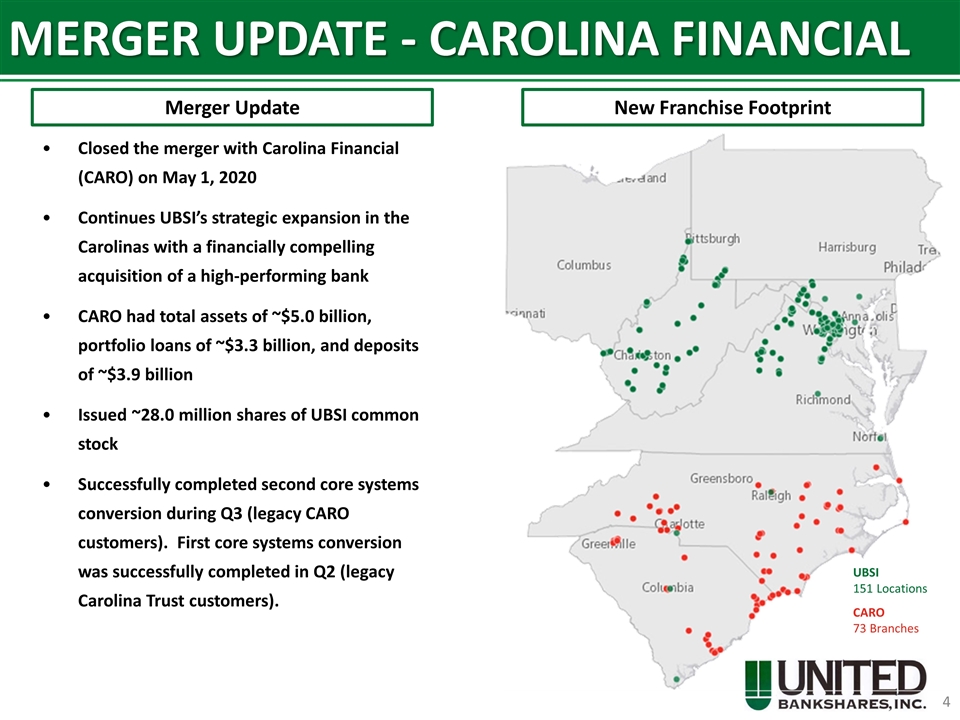

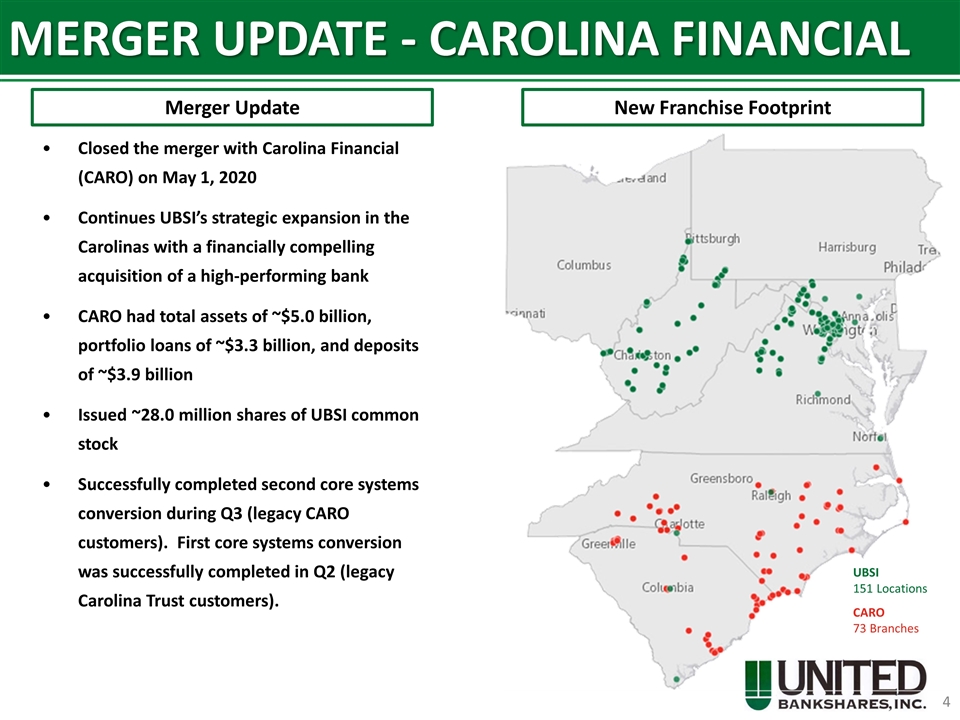

MERGER UPDATE - CAROLINA FINANCIAL Closed the merger with Carolina Financial (CARO) on May 1, 2020 Continues UBSI’s strategic expansion in the Carolinas with a financially compelling acquisition of a high-performing bank CARO had total assets of ~$5.0 billion, portfolio loans of ~$3.3 billion, and deposits of ~$3.9 billion Issued ~28.0 million shares of UBSI common stock Successfully completed second core systems conversion during Q3 (legacy CARO customers). First core systems conversion was successfully completed in Q2 (legacy Carolina Trust customers). New Franchise Footprint Merger Update UBSI 151 Locations CARO 73 Branches

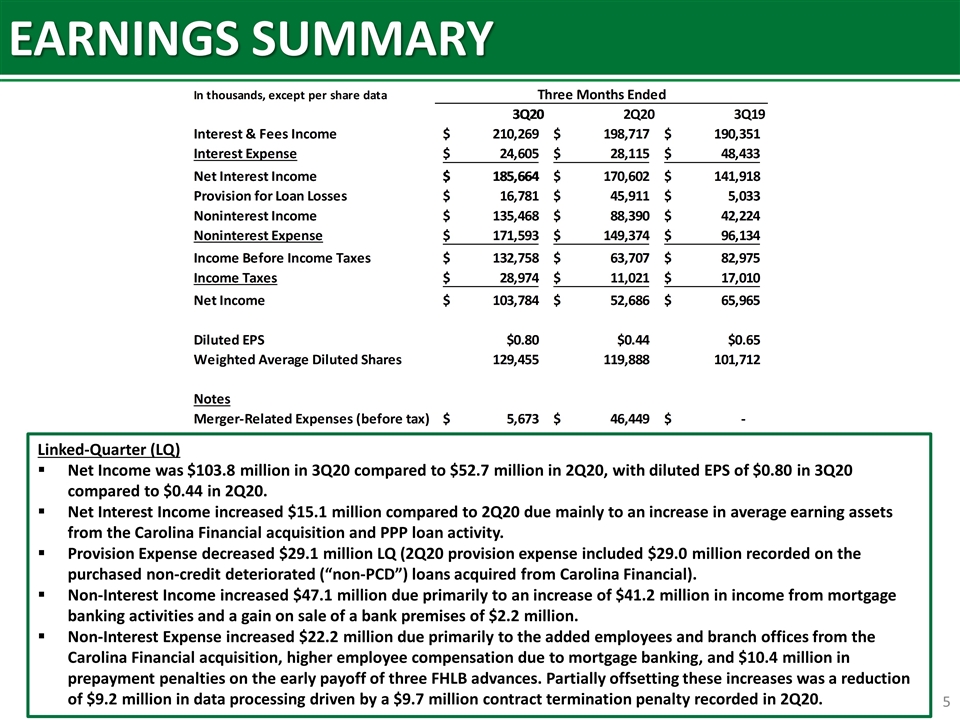

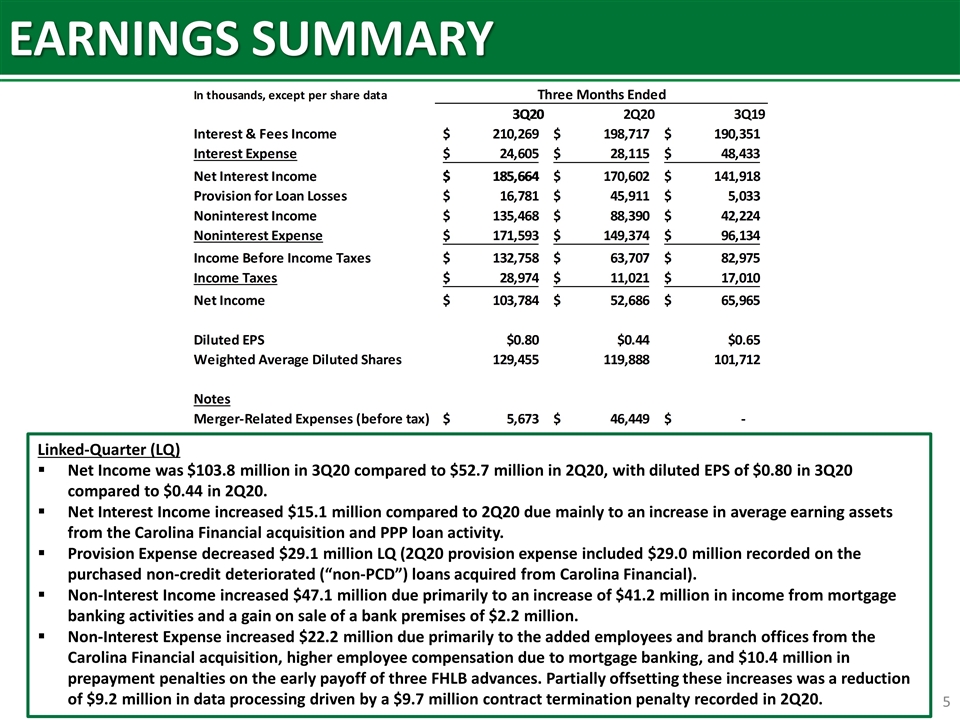

EARNINGS SUMMARY Linked-Quarter (LQ) Net Income was $103.8 million in 3Q20 compared to $52.7 million in 2Q20, with diluted EPS of $0.80 in 3Q20 compared to $0.44 in 2Q20. Net Interest Income increased $15.1 million compared to 2Q20 due mainly to an increase in average earning assets from the Carolina Financial acquisition and PPP loan activity. Provision Expense decreased $29.1 million LQ (2Q20 provision expense included $29.0 million recorded on the purchased non-credit deteriorated (“non-PCD”) loans acquired from Carolina Financial). Non-Interest Income increased $47.1 million due primarily to an increase of $41.2 million in income from mortgage banking activities and a gain on sale of a bank premises of $2.2 million. Non-Interest Expense increased $22.2 million due primarily to the added employees and branch offices from the Carolina Financial acquisition, higher employee compensation due to mortgage banking, and $10.4 million in prepayment penalties on the early payoff of three FHLB advances. Partially offsetting these increases was a reduction of $9.2 million in data processing driven by a $9.7 million contract termination penalty recorded in 2Q20.

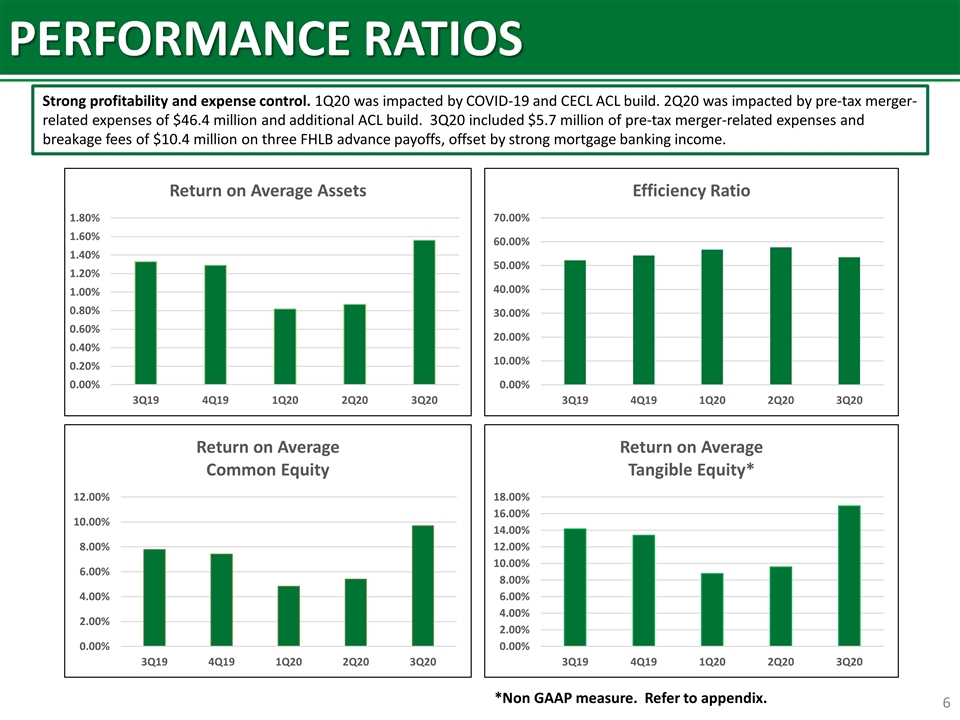

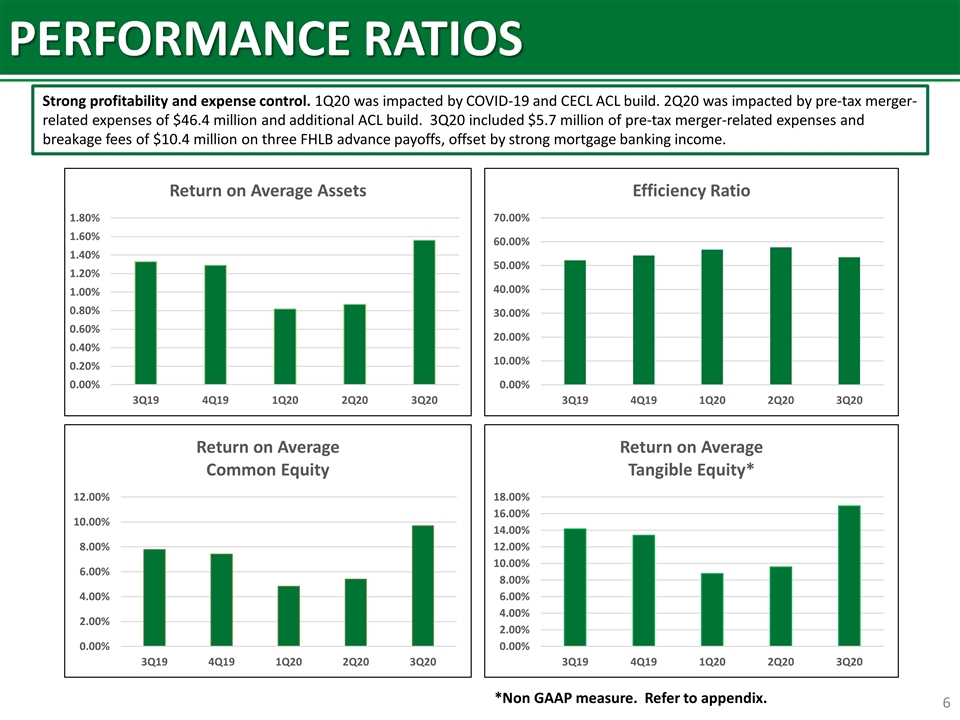

PERFORMANCE RATIOS Strong profitability and expense control. 1Q20 was impacted by COVID-19 and CECL ACL build. 2Q20 was impacted by pre-tax merger-related expenses of $46.4 million and additional ACL build. 3Q20 included $5.7 million of pre-tax merger-related expenses and breakage fees of $10.4 million on three FHLB advance payoffs, offset by strong mortgage banking income. *Non GAAP measure. Refer to appendix.

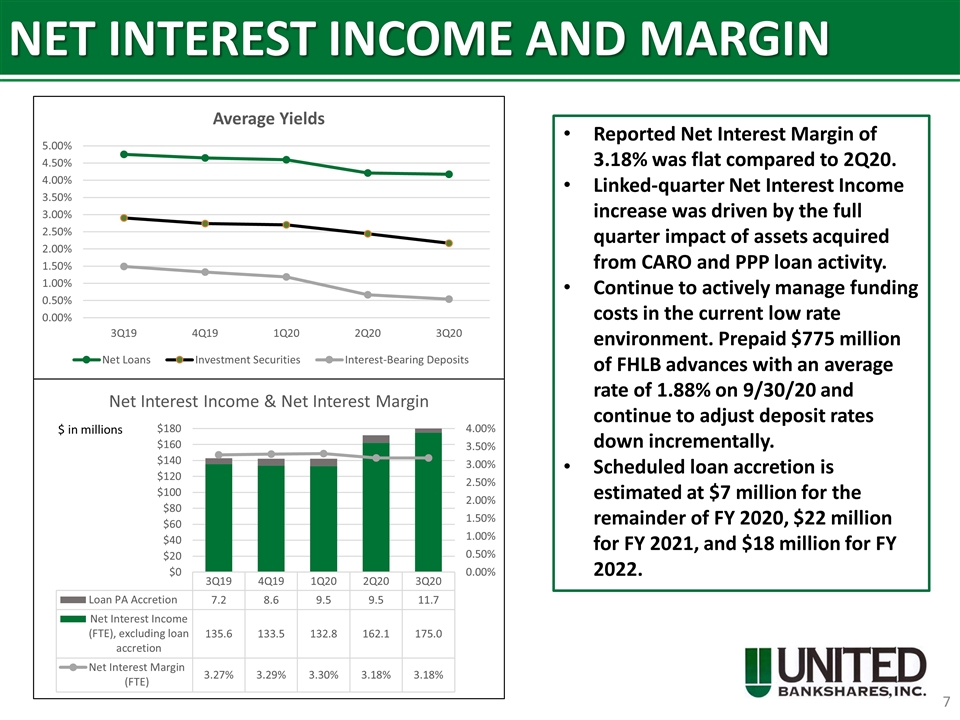

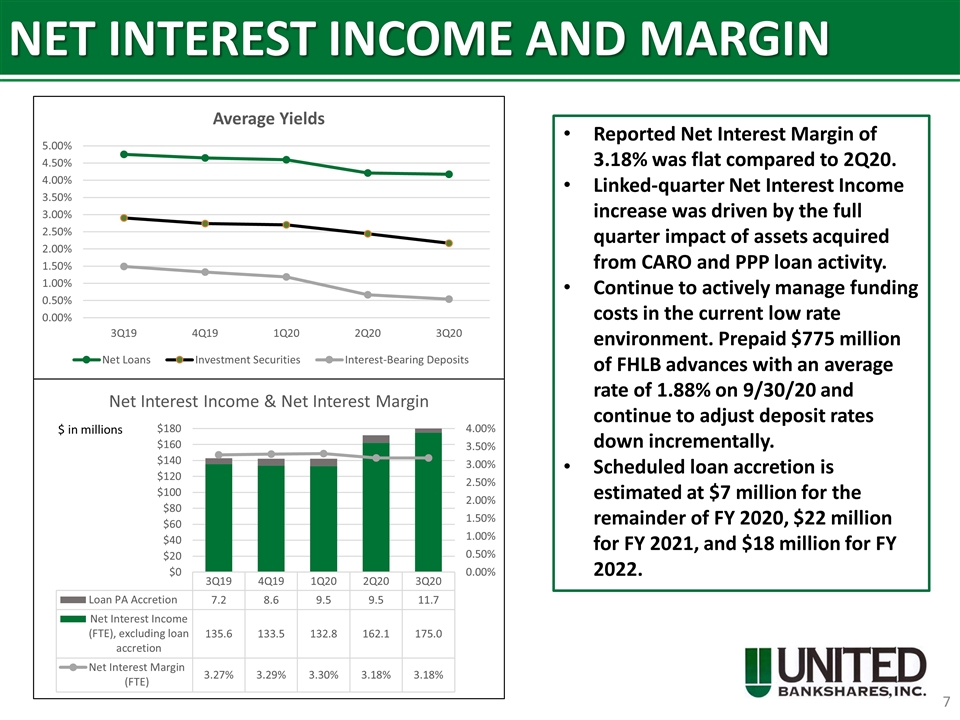

NET INTEREST INCOME AND MARGIN Reported Net Interest Margin of 3.18% was flat compared to 2Q20. Linked-quarter Net Interest Income increase was driven by the full quarter impact of assets acquired from CARO and PPP loan activity. Continue to actively manage funding costs in the current low rate environment. Prepaid $775 million of FHLB advances with an average rate of 1.88% on 9/30/20 and continue to adjust deposit rates down incrementally. Scheduled loan accretion is estimated at $7 million for the remainder of FY 2020, $22 million for FY 2021, and $18 million for FY 2022. $ in millions

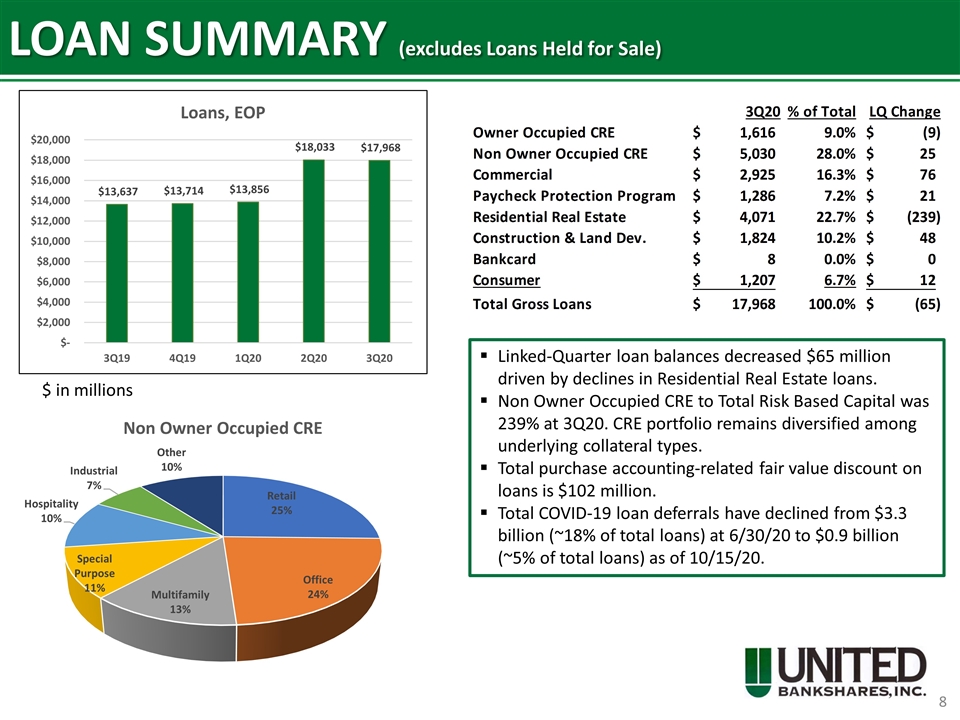

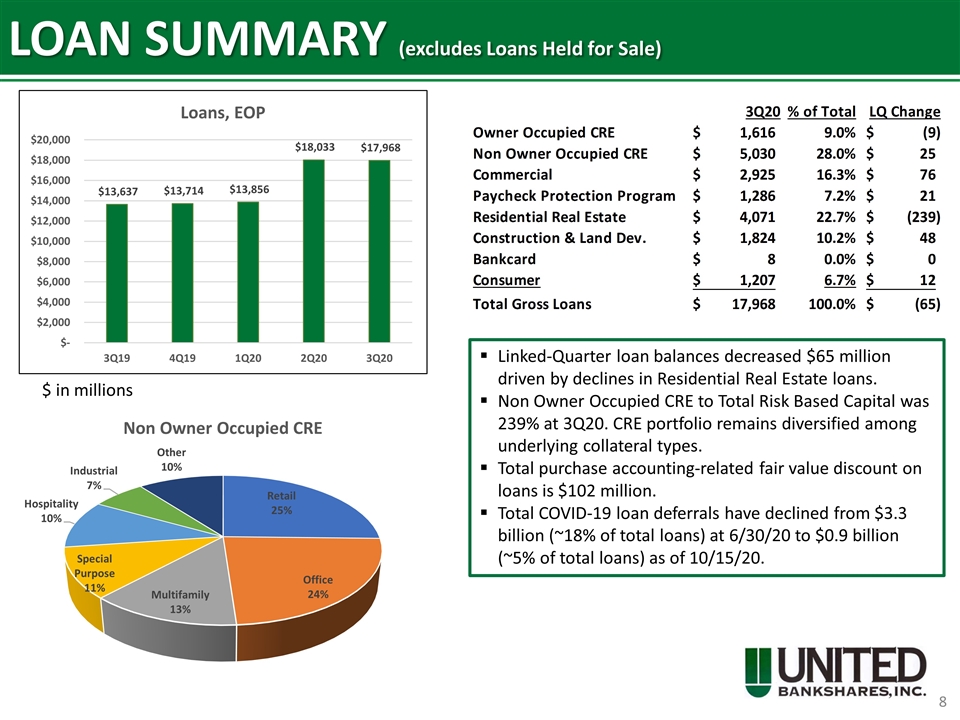

LOAN SUMMARY (excludes Loans Held for Sale) Linked-Quarter loan balances decreased $65 million driven by declines in Residential Real Estate loans. Non Owner Occupied CRE to Total Risk Based Capital was 239% at 3Q20. CRE portfolio remains diversified among underlying collateral types. Total purchase accounting-related fair value discount on loans is $102 million. Total COVID-19 loan deferrals have declined from $3.3 billion (~18% of total loans) at 6/30/20 to $0.9 billion (~5% of total loans) as of 10/15/20. $ in millions

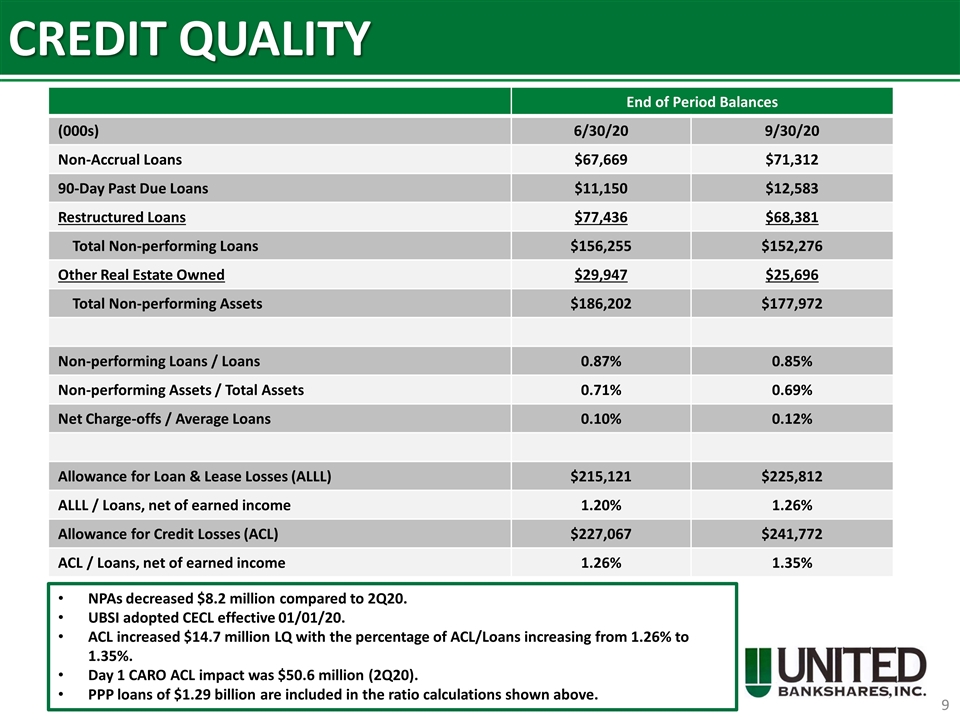

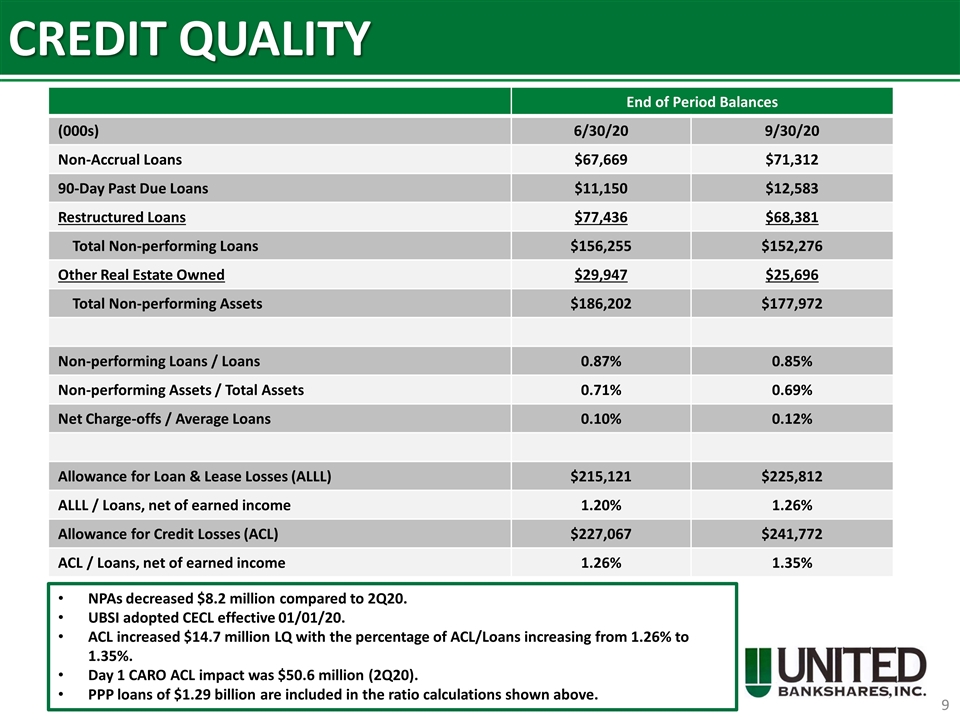

CREDIT QUALITY End of Period Balances (000s) 6/30/20 9/30/20 Non-Accrual Loans $67,669 $71,312 90-Day Past Due Loans $11,150 $12,583 Restructured Loans $77,436 $68,381 Total Non-performing Loans $156,255 $152,276 Other Real Estate Owned $29,947 $25,696 Total Non-performing Assets $186,202 $177,972 Non-performing Loans / Loans 0.87% 0.85% Non-performing Assets / Total Assets 0.71% 0.69% Net Charge-offs / Average Loans 0.10% 0.12% Allowance for Loan & Lease Losses (ALLL) $215,121 $225,812 ALLL / Loans, net of earned income 1.20% 1.26% Allowance for Credit Losses (ACL) $227,067 $241,772 ACL / Loans, net of earned income 1.26% 1.35% NPAs decreased $8.2 million compared to 2Q20. UBSI adopted CECL effective 01/01/20. ACL increased $14.7 million LQ with the percentage of ACL/Loans increasing from 1.26% to 1.35%. Day 1 CARO ACL impact was $50.6 million (2Q20). PPP loans of $1.29 billion are included in the ratio calculations shown above.

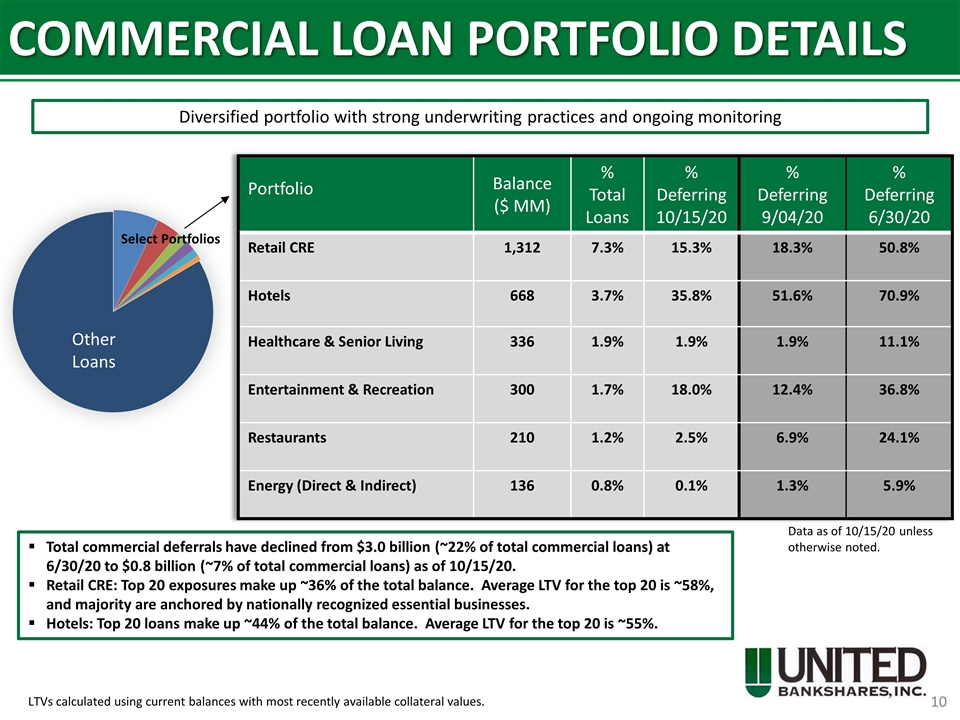

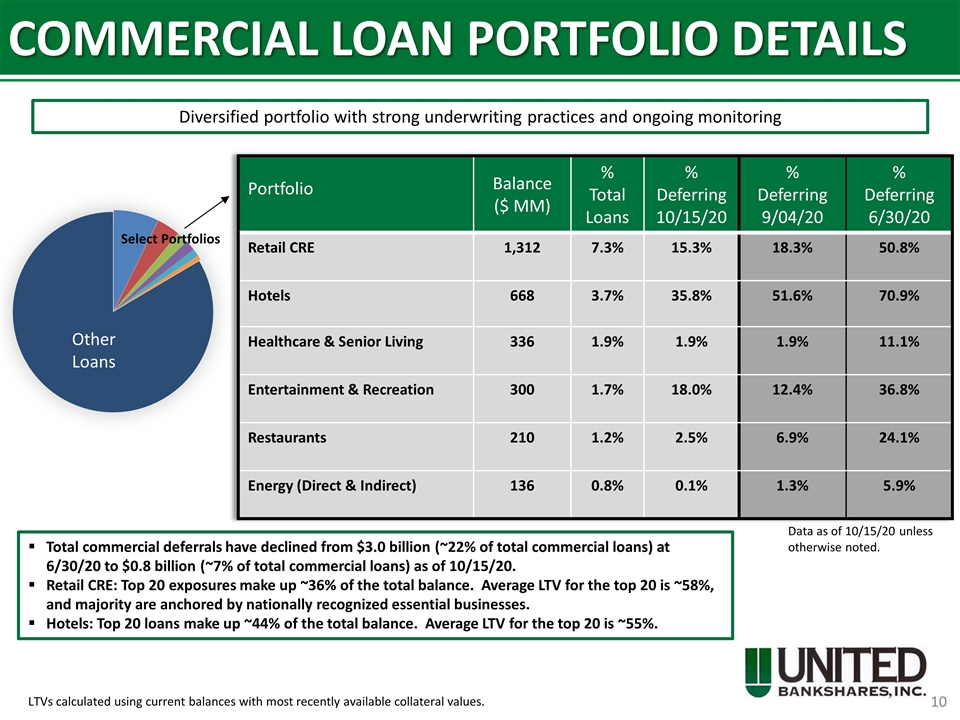

COMMERCIAL LOAN PORTFOLIO DETAILS Diversified portfolio with strong underwriting practices and ongoing monitoring Portfolio Balance ($ MM) % Total Loans % Deferring 10/15/20 % Deferring 9/04/20 % Deferring 6/30/20 Retail CRE 1,312 7.3% 15.3% 18.3% 50.8% Hotels 668 3.7% 35.8% 51.6% 70.9% Healthcare & Senior Living 336 1.9% 1.9% 1.9% 11.1% Entertainment & Recreation 300 1.7% 18.0% 12.4% 36.8% Restaurants 210 1.2% 2.5% 6.9% 24.1% Energy (Direct & Indirect) 136 0.8% 0.1% 1.3% 5.9% Total commercial deferrals have declined from $3.0 billion (~22% of total commercial loans) at 6/30/20 to $0.8 billion (~7% of total commercial loans) as of 10/15/20. Retail CRE: Top 20 exposures make up ~36% of the total balance. Average LTV for the top 20 is ~58%, and majority are anchored by nationally recognized essential businesses. Hotels: Top 20 loans make up ~44% of the total balance. Average LTV for the top 20 is ~55%. Select Portfolios Data as of 10/15/20 unless otherwise noted. LTVs calculated using current balances with most recently available collateral values.

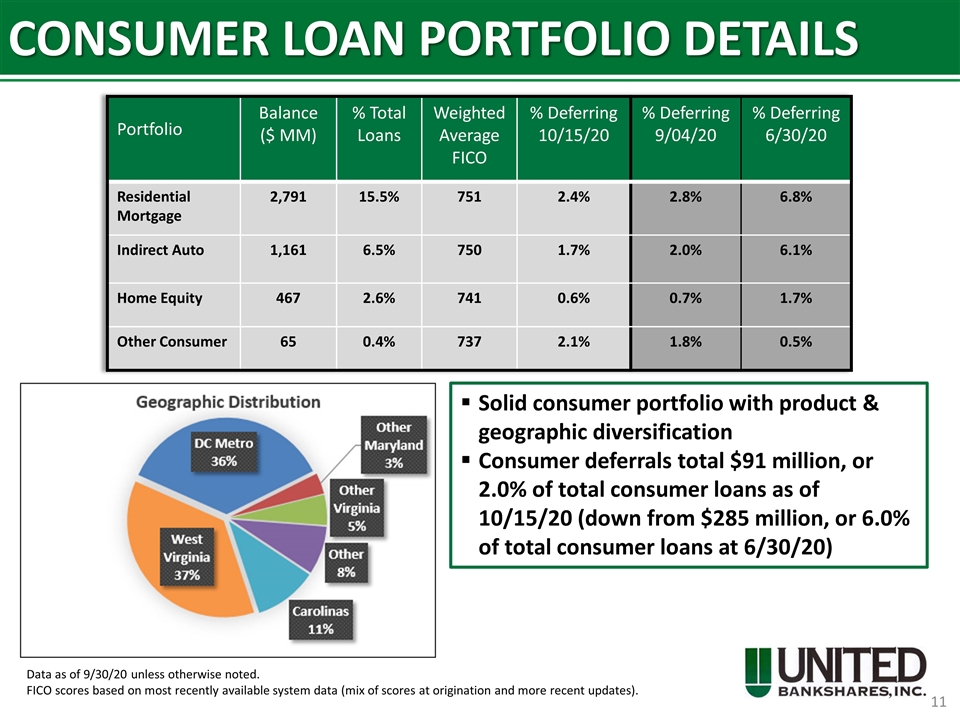

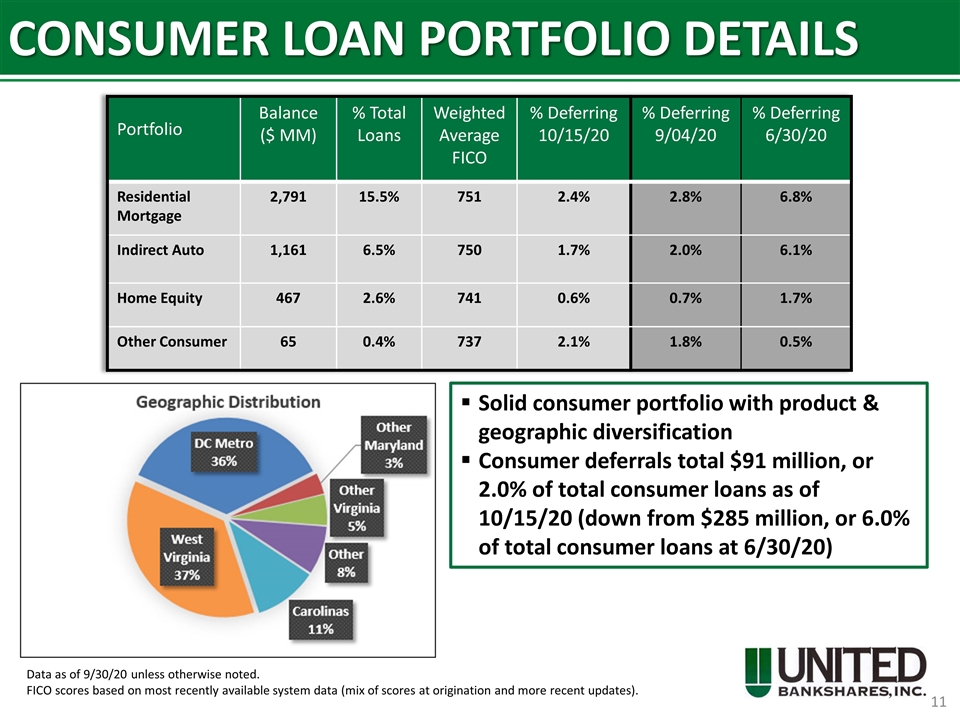

CONSUMER LOAN PORTFOLIO DETAILS Solid consumer portfolio with product & geographic diversification Consumer deferrals total $91 million, or 2.0% of total consumer loans as of 10/15/20 (down from $285 million, or 6.0% of total consumer loans at 6/30/20) Portfolio Balance ($ MM) % Total Loans Weighted Average FICO % Deferring 10/15/20 % Deferring 9/04/20 % Deferring 6/30/20 Residential Mortgage 2,791 15.5% 751 2.4% 2.8% 6.8% Indirect Auto 1,161 6.5% 750 1.7% 2.0% 6.1% Home Equity 467 2.6% 741 0.6% 0.7% 1.7% Other Consumer 65 0.4% 737 2.1% 1.8% 0.5% Data as of 9/30/20 unless otherwise noted. FICO scores based on most recently available system data (mix of scores at origination and more recent updates).

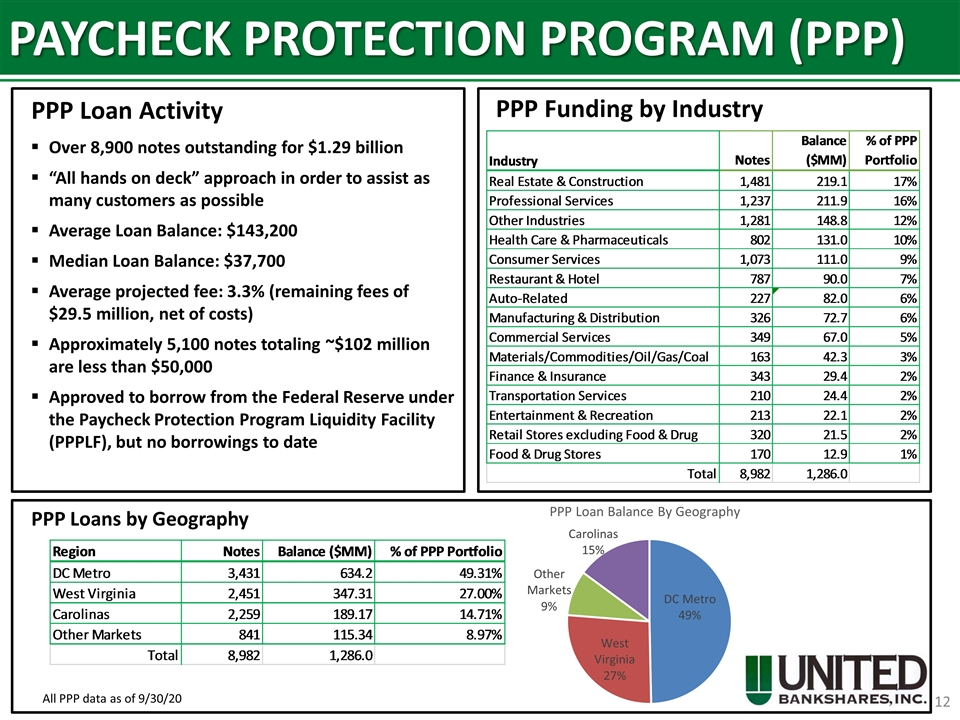

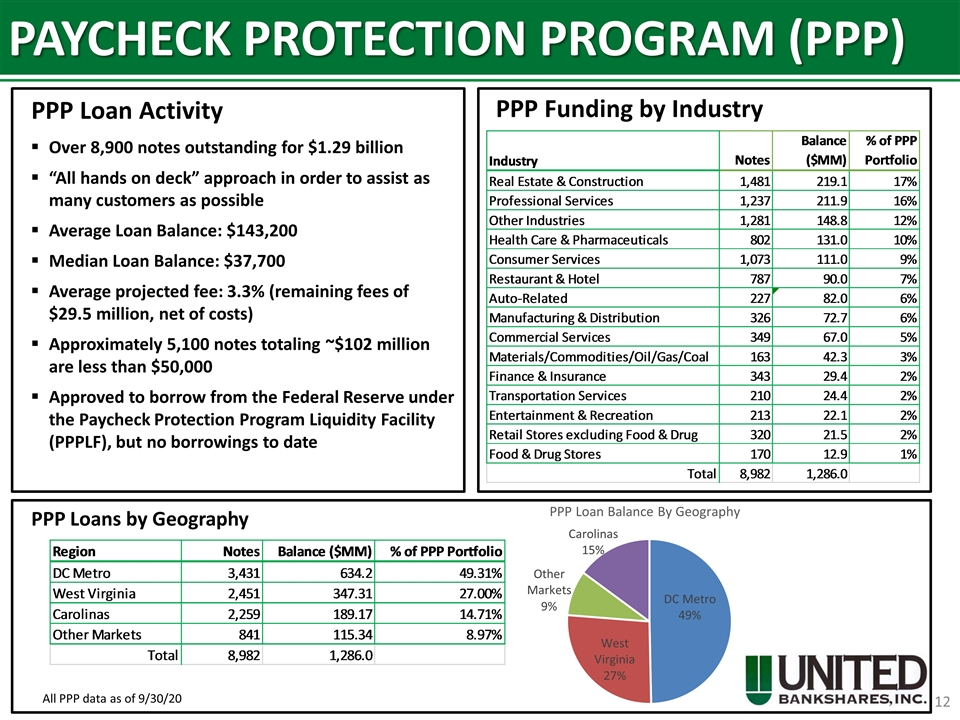

PAYCHECK PROTECTION PROGRAM (PPP) Over 8,900 notes outstanding for $1.29 billion “All hands on deck” approach in order to assist as many customers as possible Average Loan Balance: $143,200 Median Loan Balance: $37,700 Average projected fee: 3.3% (remaining fees of $29.5 million, net of costs) Approximately 5,100 notes totaling ~$102 million are less than $50,000 Approved to borrow from the Federal Reserve under the Paycheck Protection Program Liquidity Facility (PPPLF), but no borrowings to date PPP Loan Activity PPP Loans by Geography PPP Funding by Industry All PPP data as of 9/30/20

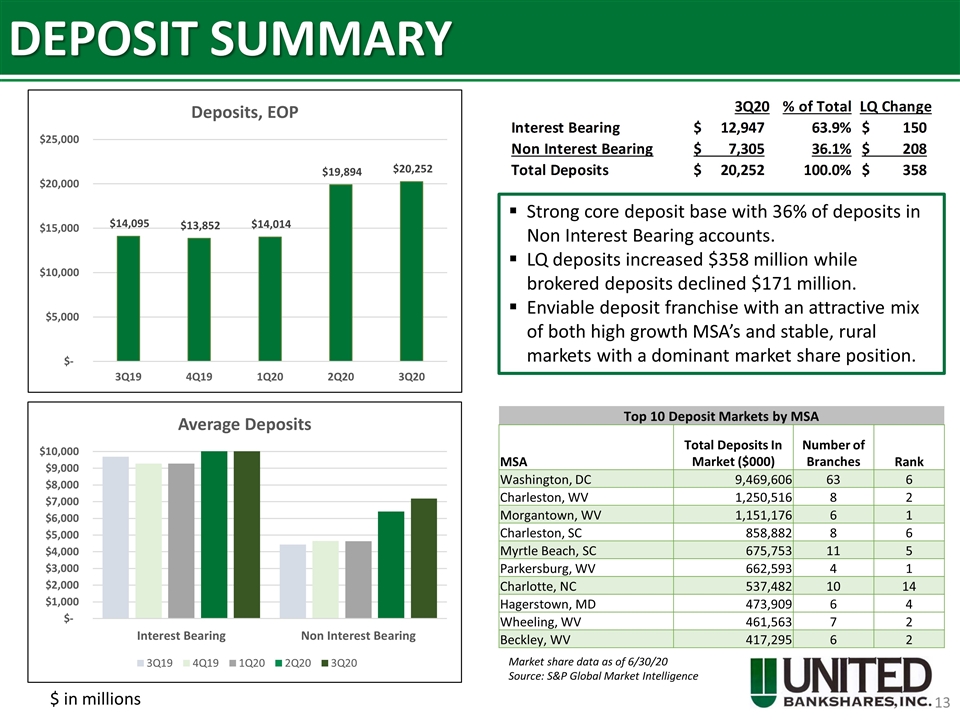

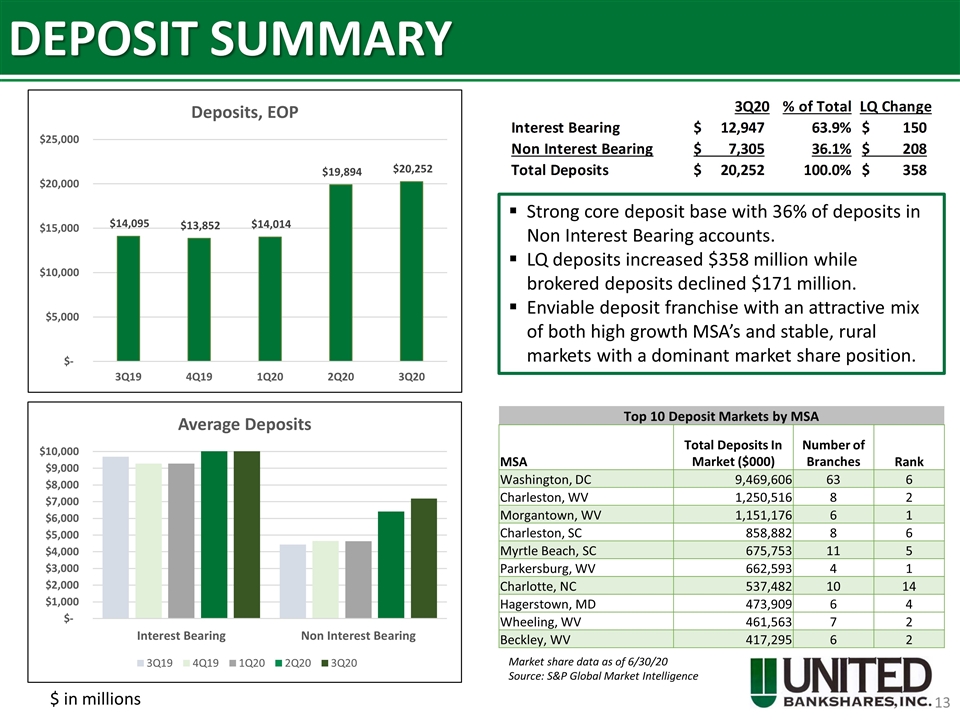

DEPOSIT SUMMARY Strong core deposit base with 36% of deposits in Non Interest Bearing accounts. LQ deposits increased $358 million while brokered deposits declined $171 million. Enviable deposit franchise with an attractive mix of both high growth MSA’s and stable, rural markets with a dominant market share position. $ in millions Market share data as of 6/30/20 Source: S&P Global Market Intelligence Top 10 Deposit Markets by MSA MSA Total Deposits In Market ($000) Number of Branches Rank Washington, DC 9,469,606 63 6 Charleston, WV 1,250,516 8 2 Morgantown, WV 1,151,176 6 1 Charleston, SC 858,882 8 6 Myrtle Beach, SC 675,753 11 5 Parkersburg, WV 662,593 4 1 Charlotte, NC 537,482 10 14 Hagerstown, MD 473,909 6 4 Wheeling, WV 461,563 7 2 Beckley, WV 417,295 6 2

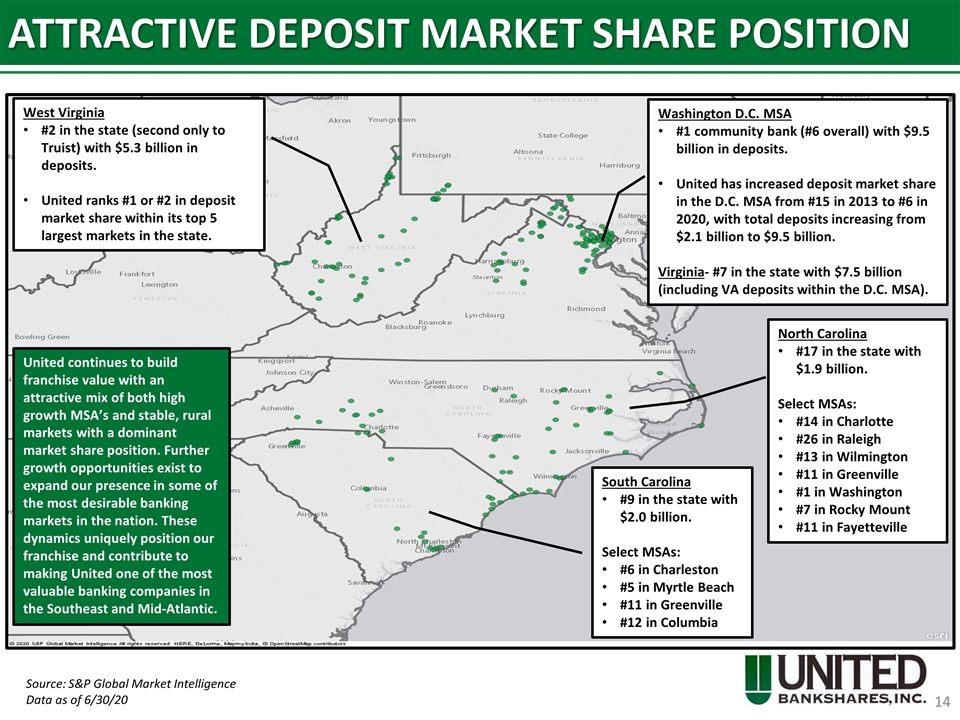

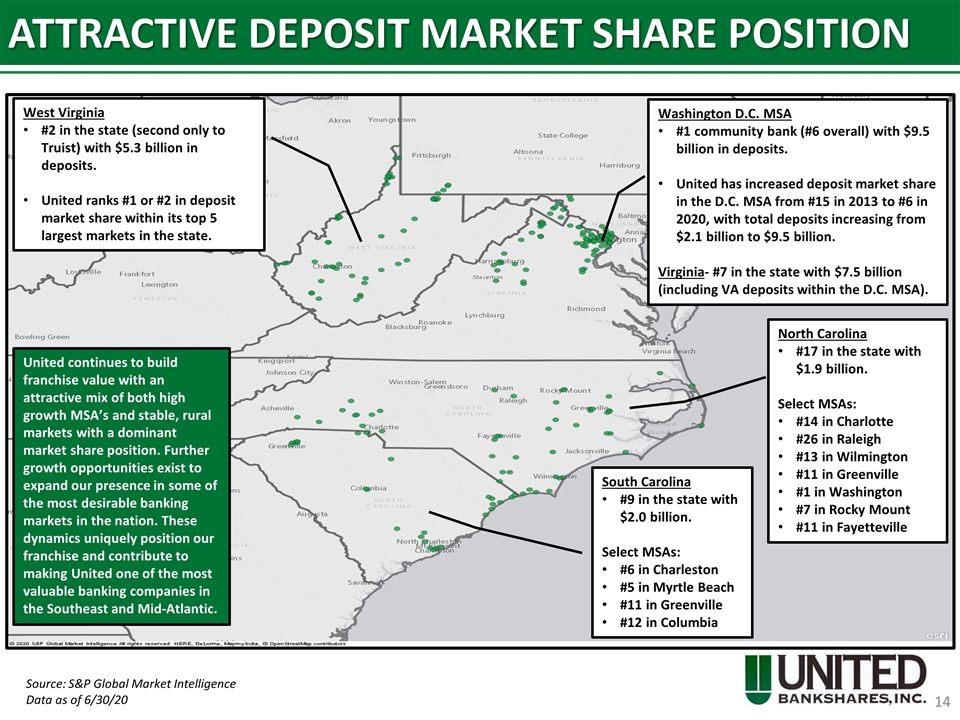

ATTRACTIVE DEPOSIT MARKET SHARE POSITION West Virginia #2 in the state (second only to Truist) with $5.3 billion in deposits. United ranks #1 or #2 in deposit market share within its top 5 largest markets in the state. North Carolina #17 in the state with $1.9 billion. Select MSAs: #14 in Charlotte #26 in Raleigh #13 in Wilmington #11 in Greenville #1 in Washington #7 in Rocky Mount #11 in Fayetteville Washington D.C. MSA #1 community bank (#6 overall) with $9.5 billion in deposits. United has increased deposit market share in the D.C. MSA from #15 in 2013 to #6 in 2020, with total deposits increasing from $2.1 billion to $9.5 billion. Virginia- #7 in the state with $7.5 billion (including VA deposits within the D.C. MSA). South Carolina #9 in the state with $2.0 billion. Select MSAs: #6 in Charleston #5 in Myrtle Beach #11 in Greenville #12 in Columbia United continues to build franchise value with an attractive mix of both high growth MSA’s and stable, rural markets with a dominant market share position. Further growth opportunities exist to expand our presence in some of the most desirable banking markets in the nation. These dynamics uniquely position our franchise and contribute to making United one of the most valuable banking companies in the Southeast and Mid-Atlantic. Source: S&P Global Market Intelligence Data as of 6/30/20

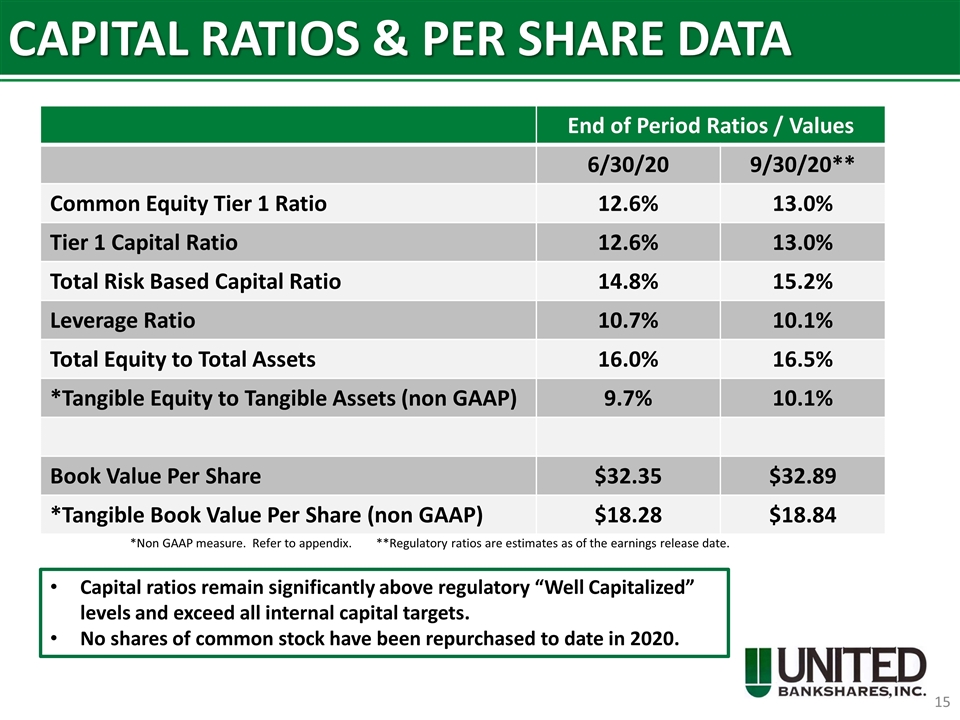

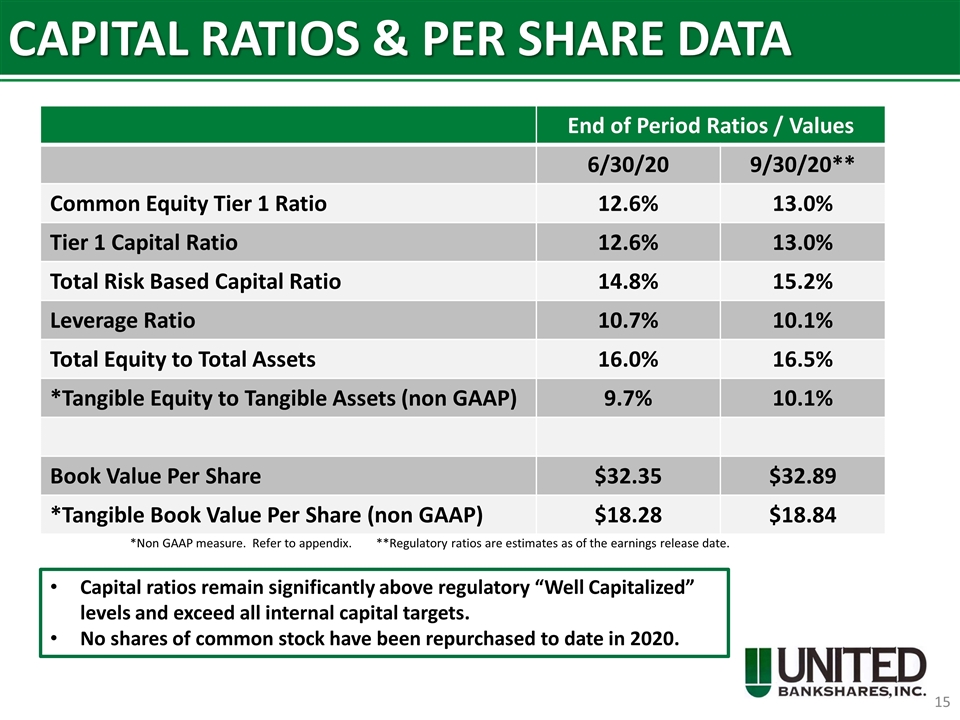

CAPITAL RATIOS & PER SHARE DATA End of Period Ratios / Values 6/30/20 9/30/20** Common Equity Tier 1 Ratio 12.6% 13.0% Tier 1 Capital Ratio 12.6% 13.0% Total Risk Based Capital Ratio 14.8% 15.2% Leverage Ratio 10.7% 10.1% Total Equity to Total Assets 16.0% 16.5% *Tangible Equity to Tangible Assets (non GAAP) 9.7% 10.1% Book Value Per Share $32.35 $32.89 *Tangible Book Value Per Share (non GAAP) $18.28 $18.84 Capital ratios remain significantly above regulatory “Well Capitalized” levels and exceed all internal capital targets. No shares of common stock have been repurchased to date in 2020. *Non GAAP measure. Refer to appendix. **Regulatory ratios are estimates as of the earnings release date.

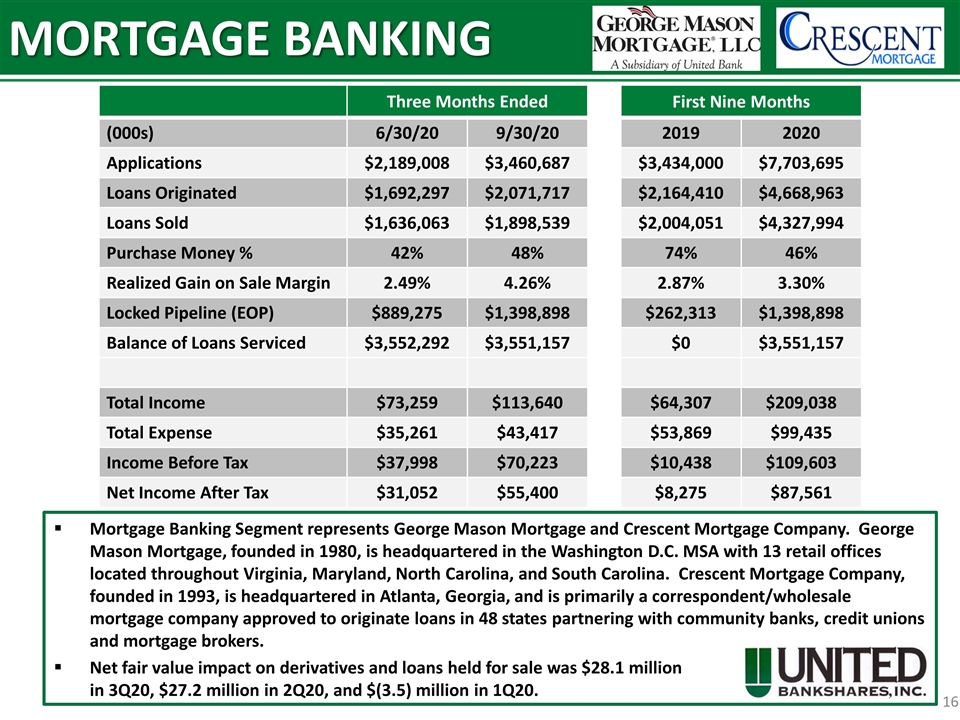

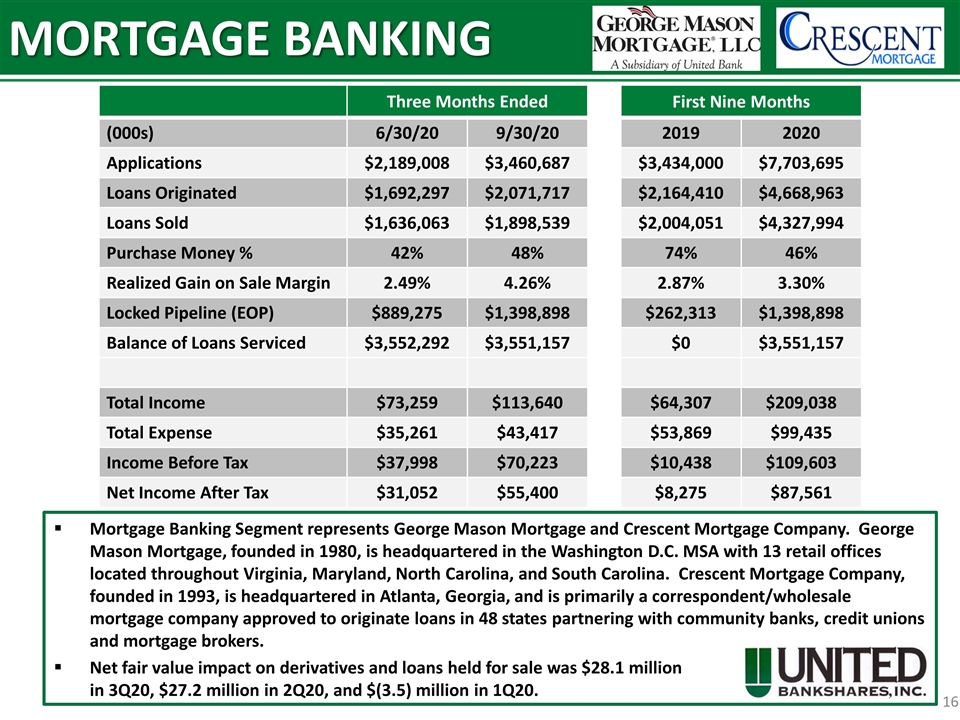

MORTGAGE BANKING Mortgage Banking Segment represents George Mason Mortgage and Crescent Mortgage Company. George Mason Mortgage, founded in 1980, is headquartered in the Washington D.C. MSA with 13 retail offices located throughout Virginia, Maryland, North Carolina, and South Carolina. Crescent Mortgage Company, founded in 1993, is headquartered in Atlanta, Georgia, and is primarily a correspondent/wholesale mortgage company approved to originate loans in 48 states partnering with community banks, credit unions and mortgage brokers. Net fair value impact on derivatives and loans held for sale was $28.1 million in 3Q20, $27.2 million in 2Q20, and $(3.5) million in 1Q20. Three Months Ended First Nine Months (000s) 6/30/20 9/30/20 2019 2020 Applications $2,189,008 $3,460,687 $3,434,000 $7,703,695 Loans Originated $1,692,297 $2,071,717 $2,164,410 $4,668,963 Loans Sold $1,636,063 $1,898,539 $2,004,051 $4,327,994 Purchase Money % 42% 48% 74% 46% Realized Gain on Sale Margin 2.49% 4.26% 2.87% 3.30% Locked Pipeline (EOP) $889,275 $1,398,898 $262,313 $1,398,898 Balance of Loans Serviced $3,552,292 $3,551,157 $0 $3,551,157 Total Income $73,259 $113,640 $64,307 $209,038 Total Expense $35,261 $43,417 $53,869 $99,435 Income Before Tax $37,998 $70,223 $10,438 $109,603 Net Income After Tax $31,052 $55,400 $8,275 $87,561

2020 OUTLOOK Loans & Deposits: Expect majority of PPP loan forgiveness to occur in 1Q21. Net Interest Margin / Net Interest Income: Expect the core net interest margin to be up slightly in 4Q20 compared to 3Q20 (excluding the impact of loan accretion and any accelerated PPP fee income). Prepaid $775 million of FHLB advances with a weighted average rate of 1.88% on 9/30/20 (breakage fee of $10.4 million). Expect further decreases in the cost of interest bearing deposits in 4Q20 (recent rate cuts). Mortgage Banking Revenue: Expect Mortgage Banking Revenue to decrease in 4Q20, down from a record high in 3Q20. Anticipate locked pipelines and loans held for sale to decrease in 4Q20 which will likely result in negative net fair value related adjustments in 4Q20. Non-Interest Expense: Expect minimal merger-related expenses in 4Q20. Tax Rate: Estimated at approximately 20.5%. Other Items: Continued focus on merger-related cost savings and other cost savings initiatives from legacy operations. Select guidance is being provided for the fourth quarter of 2020. Our outlook may change if the expectations for these items vary from current expectations.

UBSI INVESTMENT THESIS Excellent franchise with long-term growth prospects Current income opportunity with a dividend yield of 5.6% (based upon recent prices) High-performance bank with a low-risk profile Experienced management team with a proven track record of execution High level of insider ownership 46 consecutive years of dividend increases evidences United’s strong profitability, solid asset quality, and sound capital management over a very long period of time Attractive valuation with a current Price-to-Earnings Ratio of 11.7x (based upon median 2020 street consensus estimate of $2.11 per Bloomberg)

Appendix

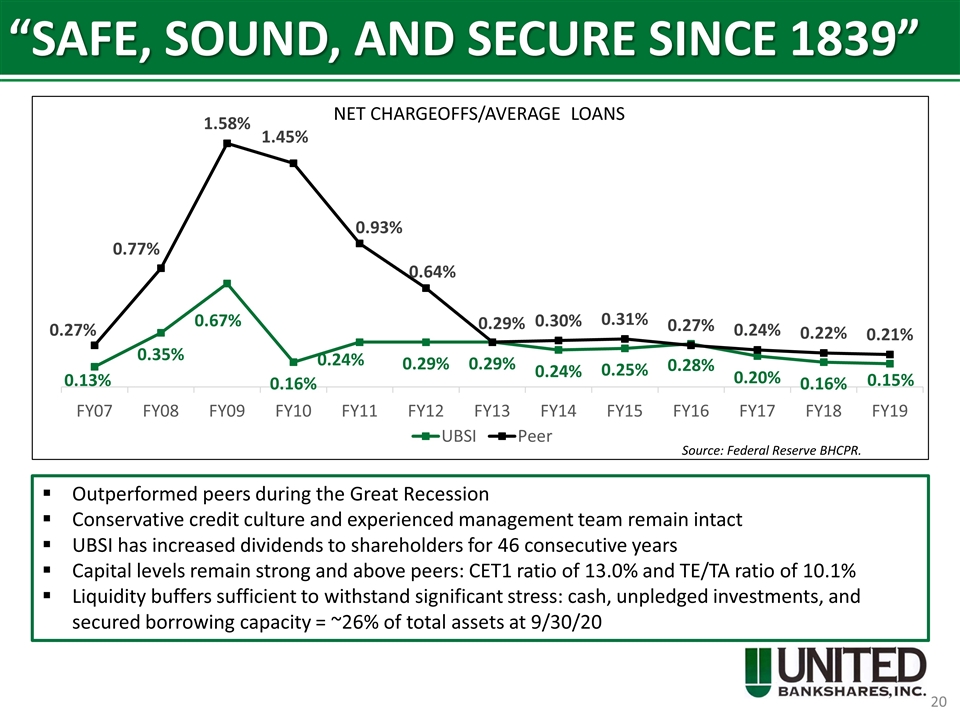

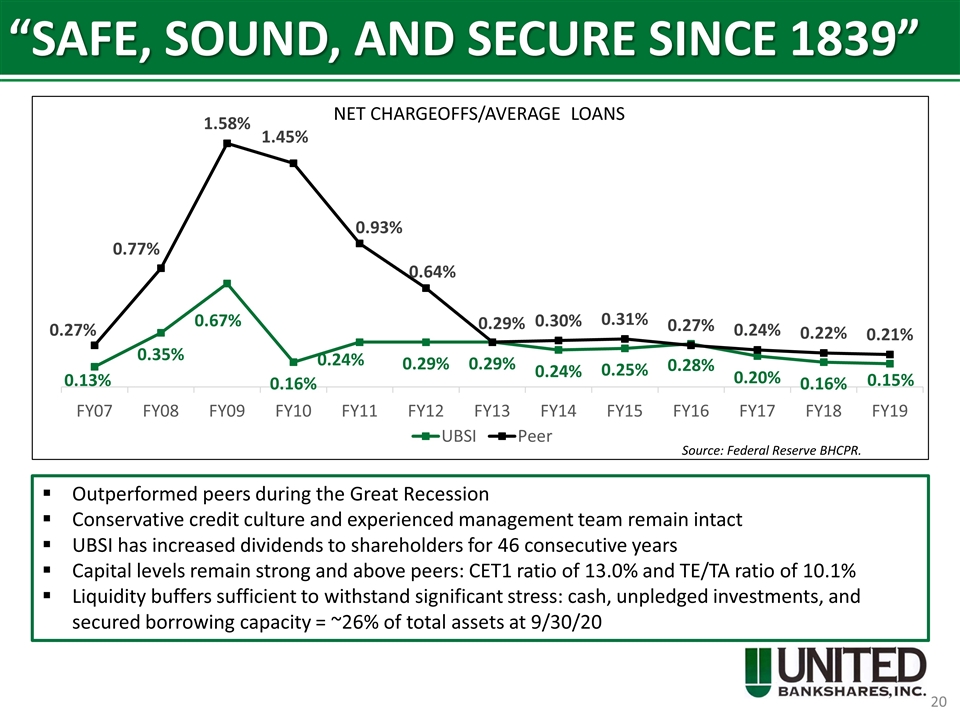

“SAFE, SOUND, AND SECURE SINCE 1839” Source: Federal Reserve BHCPR. NET CHARGEOFFS/AVERAGE LOANS Outperformed peers during the Great Recession Conservative credit culture and experienced management team remain intact UBSI has increased dividends to shareholders for 46 consecutive years Capital levels remain strong and above peers: CET1 ratio of 13.0% and TE/TA ratio of 10.1% Liquidity buffers sufficient to withstand significant stress: cash, unpledged investments, and secured borrowing capacity = ~26% of total assets at 9/30/20

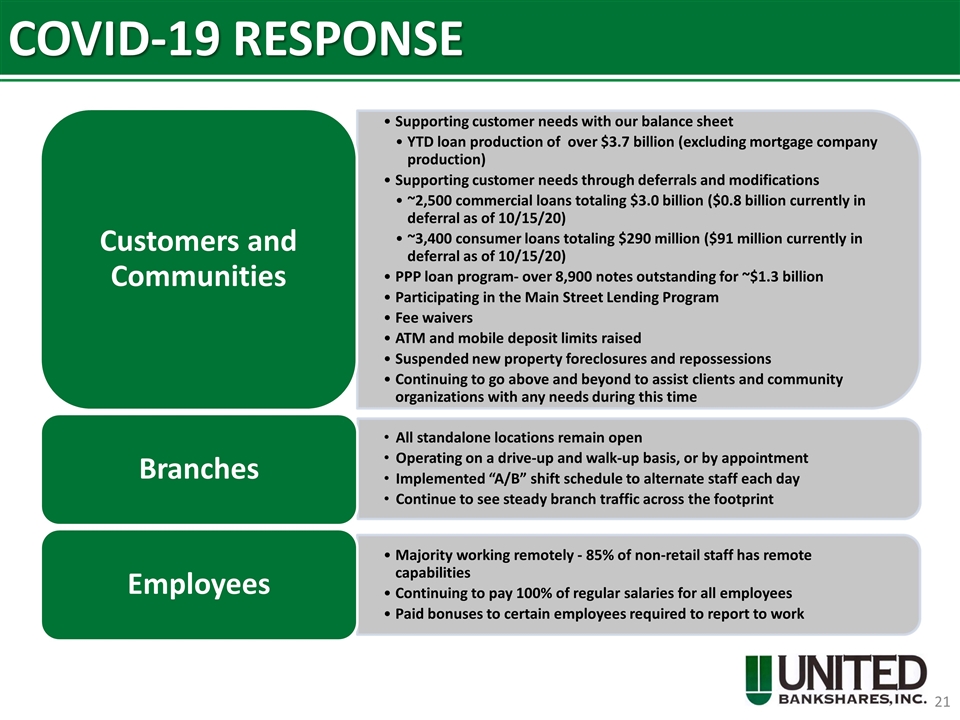

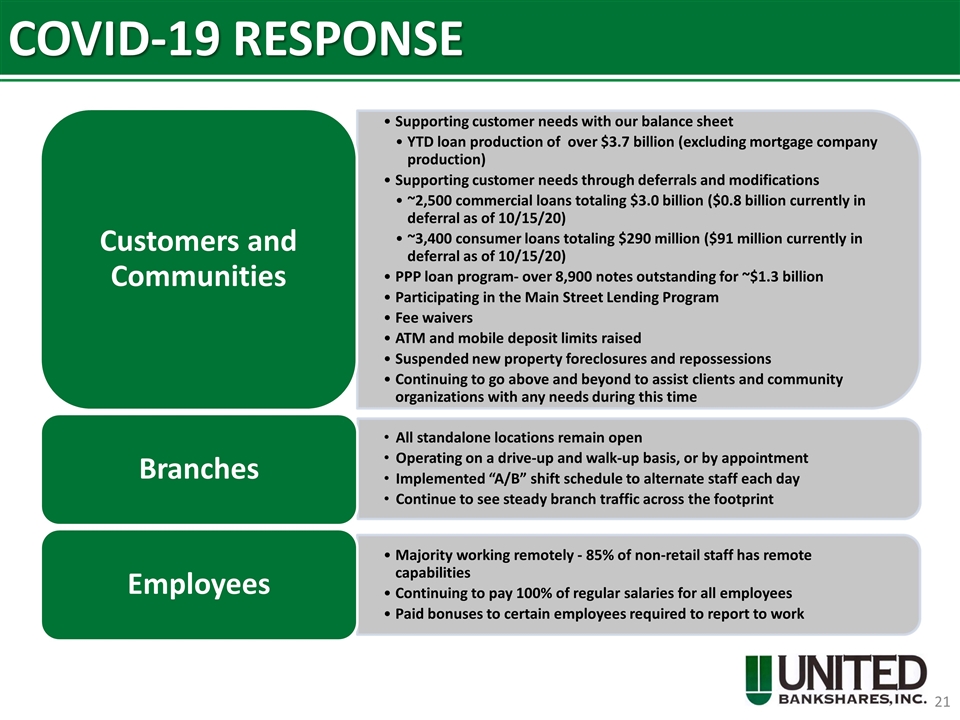

COVID-19 RESPONSE Branches Operating on a drive-up and walk-up basis, or by appointment Employees Majority working remotely - 85% of non-retail staff has remote capabilities Continuing to pay 100% of regular salaries for all employees All standalone locations remain open Paid bonuses to certain employees required to report to work Implemented “A/B” shift schedule to alternate staff each day Continue to see steady branch traffic across the footprint Customers and Communities Supporting customer needs with our balance sheet ~2,500 commercial loans totaling $3.0 billion ($0.8 billion currently in deferral as of 10/15/20) ~3,400 consumer loans totaling $290 million ($91 million currently in deferral as of 10/15/20) Fee waivers ATM and mobile deposit limits raised Continuing to go above and beyond to assist clients and community organizations with any needs during this time PPP loan program- over 8,900 notes outstanding for ~$1.3 billion YTD loan production of over $3.7 billion (excluding mortgage company production) Supporting customer needs through deferrals and modifications Suspended new property foreclosures and repossessions Participating in the Main Street Lending Program

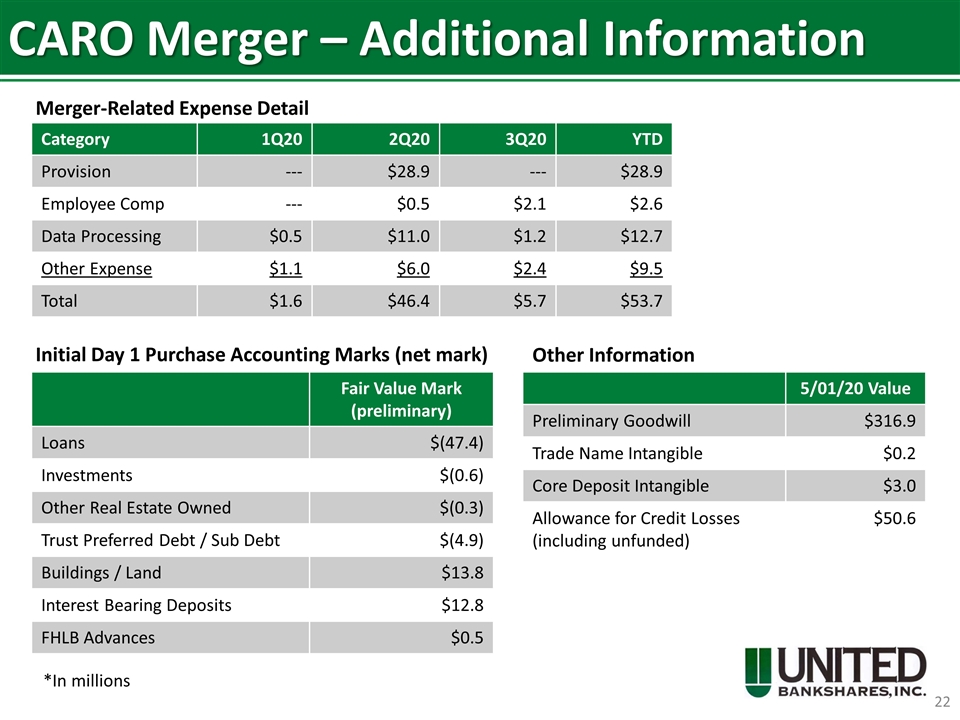

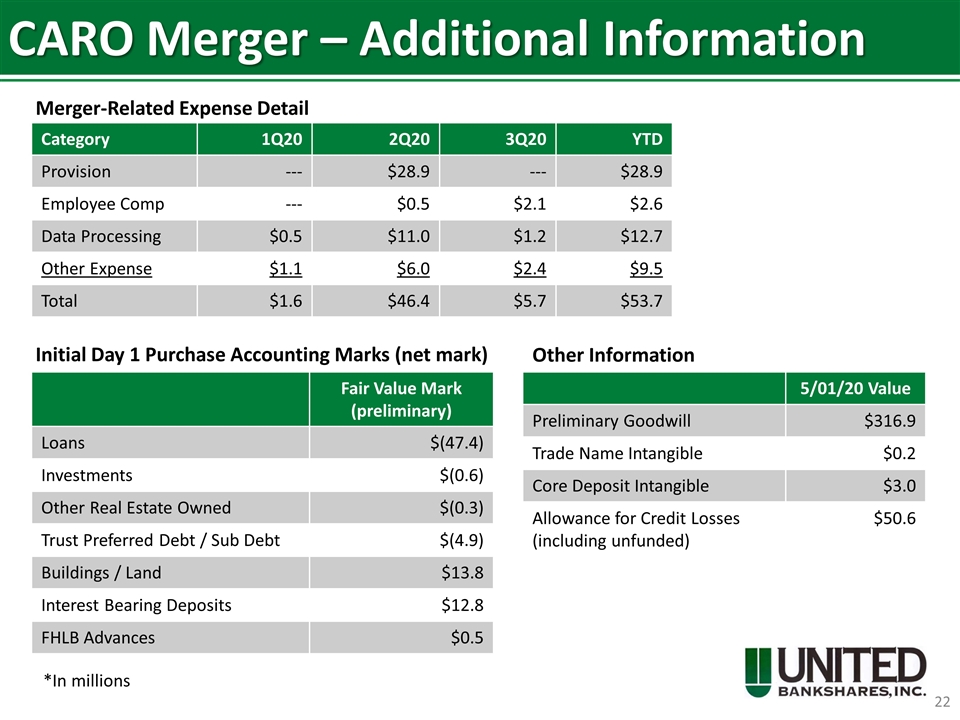

CARO Merger – Additional Information Category 1Q20 2Q20 3Q20 YTD Provision --- $28.9 --- $28.9 Employee Comp --- $0.5 $2.1 $2.6 Data Processing $0.5 $11.0 $1.2 $12.7 Other Expense $1.1 $6.0 $2.4 $9.5 Total $1.6 $46.4 $5.7 $53.7 Merger-Related Expense Detail Other Information Fair Value Mark (preliminary) Loans $(47.4) Investments $(0.6) Other Real Estate Owned $(0.3) Trust Preferred Debt / Sub Debt $(4.9) Buildings / Land $13.8 Interest Bearing Deposits $12.8 FHLB Advances $0.5 *In millions 5/01/20 Value Preliminary Goodwill $316.9 Trade Name Intangible $0.2 Core Deposit Intangible $3.0 Allowance for Credit Losses (including unfunded) $50.6 Initial Day 1 Purchase Accounting Marks (net mark)

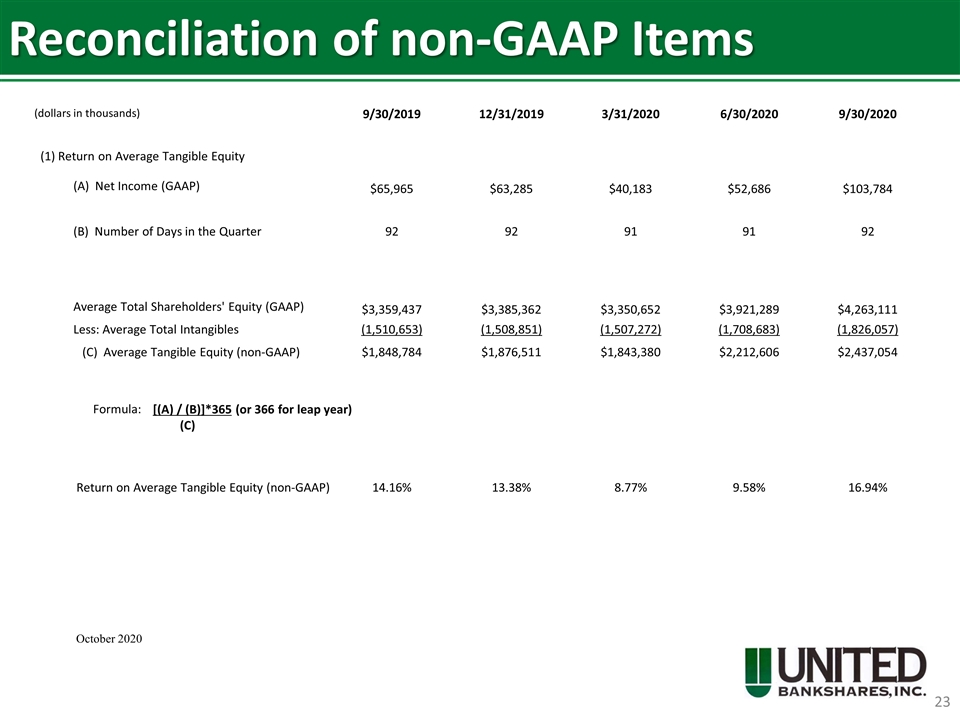

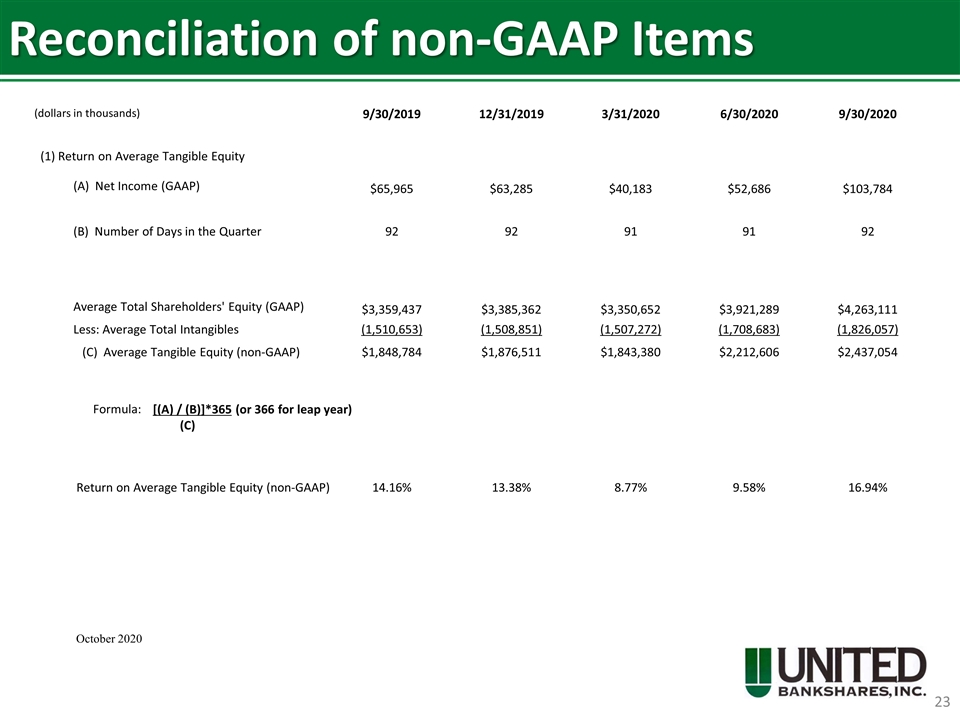

Reconciliation of non-GAAP Items October 2020 (dollars in thousands) 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 (1) Return on Average Tangible Equity (A) Net Income (GAAP) $65,965 $63,285 $40,183 $52,686 $103,784 (B) Number of Days in the Quarter 92 92 91 91 92 Average Total Shareholders' Equity (GAAP) $3,359,437 $3,385,362 $3,350,652 $3,921,289 $4,263,111 Less: Average Total Intangibles (1,510,653) (1,508,851) (1,507,272) (1,708,683) (1,826,057) (C) Average Tangible Equity (non-GAAP) $1,848,784 $1,876,511 $1,843,380 $2,212,606 $2,437,054 Formula: [(A) / (B)]*365 (or 366 for leap year) (C) Return on Average Tangible Equity (non-GAAP) 14.16% 13.38% 8.77% 9.58% 16.94%

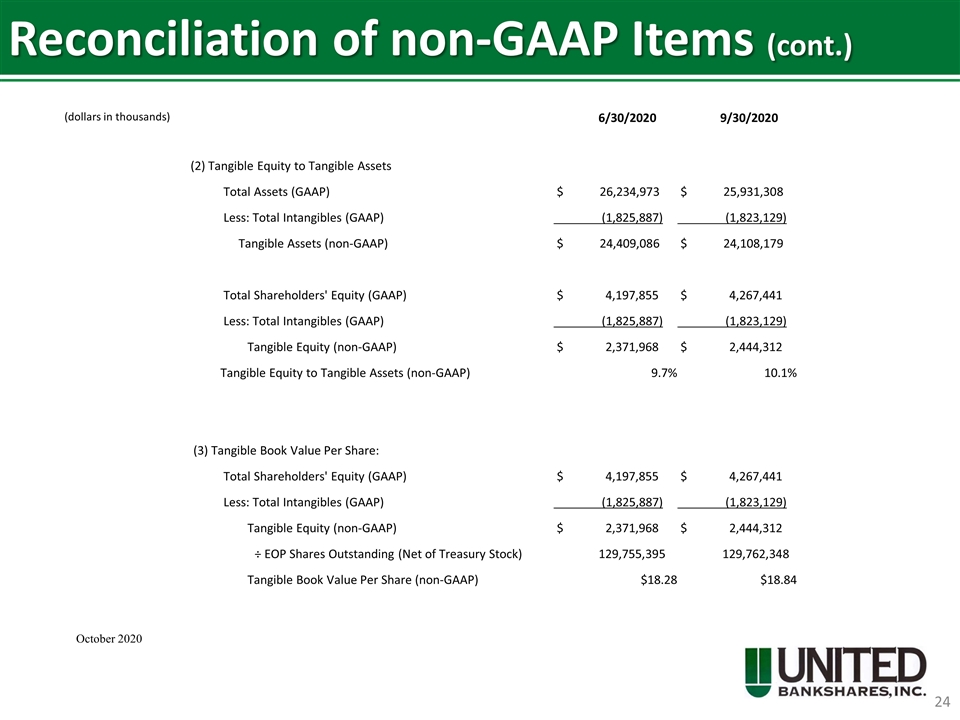

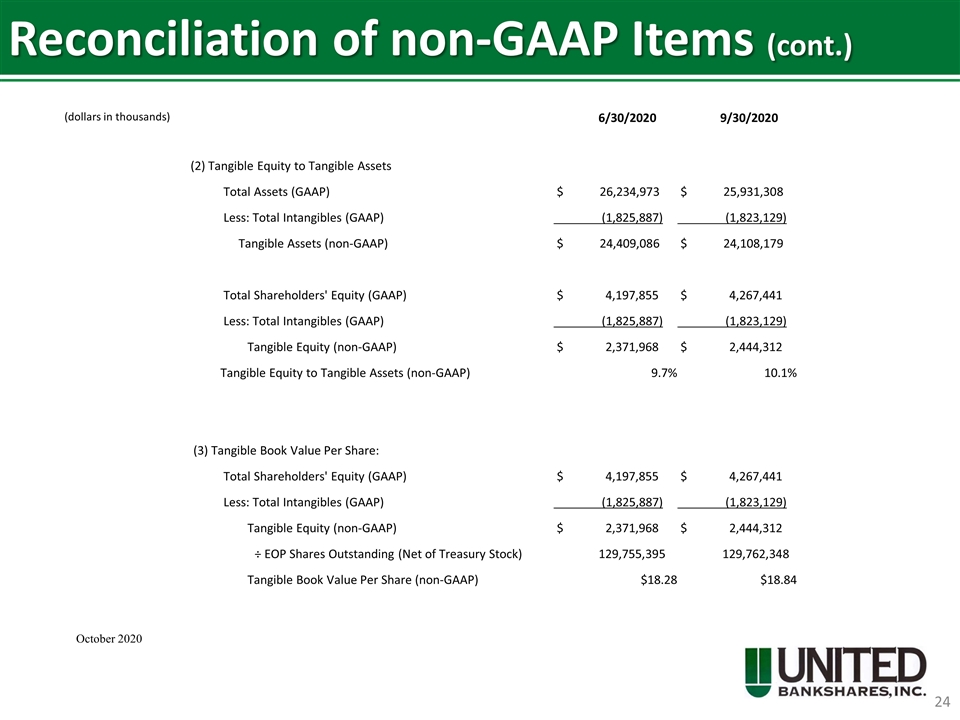

Reconciliation of non-GAAP Items (cont.) October 2020 (dollars in thousands) 6/30/2020 9/30/2020 (2) Tangible Equity to Tangible Assets Total Assets (GAAP) $ 26,234,973 $ 25,931,308 Less: Total Intangibles (GAAP) (1,825,887) (1,823,129) Tangible Assets (non-GAAP) $ 24,409,086 $ 24,108,179 Total Shareholders' Equity (GAAP) $ 4,197,855 $ 4,267,441 Less: Total Intangibles (GAAP) (1,825,887) (1,823,129) Tangible Equity (non-GAAP) $ 2,371,968 $ 2,444,312 Tangible Equity to Tangible Assets (non-GAAP) 9.7% 10.1% (3) Tangible Book Value Per Share: Total Shareholders' Equity (GAAP) $ 4,197,855 $ 4,267,441 Less: Total Intangibles (GAAP) (1,825,887) (1,823,129) Tangible Equity (non-GAAP) $ 2,371,968 $ 2,444,312 ÷ EOP Shares Outstanding (Net of Treasury Stock) 129,755,395 129,762,348 Tangible Book Value Per Share (non-GAAP) $18.28 $18.84