Fourth Quarter & Fiscal Year 2024 Earnings Review United Bankshares, Inc. (UBSI) January 24, 2025 EXHIBIT 99.2

This presentation and statements made by United Bankshares, Inc. (“UBSI”) and its management contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Piedmont Bancorp, Inc. (“Piedmont”) and UBSI (the “Merger”), including future financial and operating results, cost savings enhancements to revenue and accretion to reported earnings that may be realized from the Merger; (ii) UBSI’s and Piedmont’s plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts; and (iii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” “will,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the respective managements of UBSI and Piedmont and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of UBSI and Piedmont. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of UBSI and Piedmont may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the Merger may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the Merger, including adverse effects on relationships with employees, may be greater than expected; (4) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which UBSI and Piedmont are engaged; (5) the possibility of increased scrutiny by, and/or additional regulatory requirements of, governmental authorities as a result of the transaction or the size, scope and complexity of UBSI’s business operations following the Merger; (6) competitive pressures on product pricing and services; (7) success, impact, and timing of UBSI’s business strategies, including market acceptance of any new products or services; (8) disruption from the Merger making it more difficult to maintain relationships with employees, customers or other parties with whom UBSI and Piedmont have business relationships; (9) diversion of management time on Merger-related issues; (10) risks relating to the potential dilutive effect of the shares of UBSI common stock to be issued in the Merger; (11) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the transaction; (12) general competitive, economic, political and market conditions and other factors that may affect future results of UBSI and Piedmont, including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms; (13) uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; (14) volatility and disruptions in global capital and credit markets; and (15) the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in UBSI’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available on the SEC’s Internet site (http://www.sec.gov). UBSI cautions that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking statements concerning the acquisition of Piedmont or other matters attributable to UBSI or Piedmont or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. UBSI does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made. FORWARD LOOKING STATEMENTS

Achieved Net Income of $373.0 million and Diluted Earnings Per Share of $2.75 Generated Return on Average Assets of 1.26%, Return on Average Equity of 7.61%, and Return on Average Tangible Equity* of 12.43% Increased dividends to shareholders for the 51st consecutive year (current dividend yield of ~3.9% based upon recent prices) Piedmont Bancorp, Inc. merger – announced the signing of a definitive merger agreement and received shareholder approval and regulatory approvals during 2024. Closing occurred on January 10, 2025 Net Interest Margin (FTE) remained solid at 3.49% Achieved full-year period-end deposit growth of $1.1 billion. Excluding the decline in brokered deposits, full-year period-end deposits grew $1.4 billion Consistently ranked as one of the most trustworthy banks in America by Newsweek (#1 in 2023, #2 in 2022, #4 in 2024) Achieved the #1 deposit market share position in the state of West Virginia based on the FDIC’s annual Summary of Deposits for 2024 Asset quality remains sound and Non-Performing Assets remained low at 0.25% of Total Assets Strong expense control with an efficiency ratio of 52.67% Capital position remains robust and liquidity remains sound 2024 HIGHLIGHTS *Non-GAAP measure. Refer to appendix.

Continuation of UBSI’s proven M&A strategy | UBSI’s 34th acquisition Entrance into Greater Atlanta Area markets with robust economic growth opportunities Enhances UBSI’s position as one of the premier regional banking companies in the Southeast and Mid-Atlantic Piedmont Overview Advancing Strategy Transaction Details Headquarters: Peachtree Corners, GA Financial Data as of January 10, 2025: Total Assets: ~$2.4 billion Total Loans: ~$2.1 billion Total Deposits: ~$2.1 billion Total Shareholders’ Equity: ~$202 million Consistently well-run and highly profitable franchise with sound asset quality Key senior management and executives retained including Monty Watson, CEO, who became Regional President for United Bank Consideration Mix: 100% stock Fixed Exchange Ratio: 0.300x Shares Issued: 7.86 million UBSI Maintains “Well-Capitalized” regulatory capital ratios Systems Conversion: anticipated to occur in March 2025 PIEDMONT MERGER- COMPLETED JANUARY 10, 2025

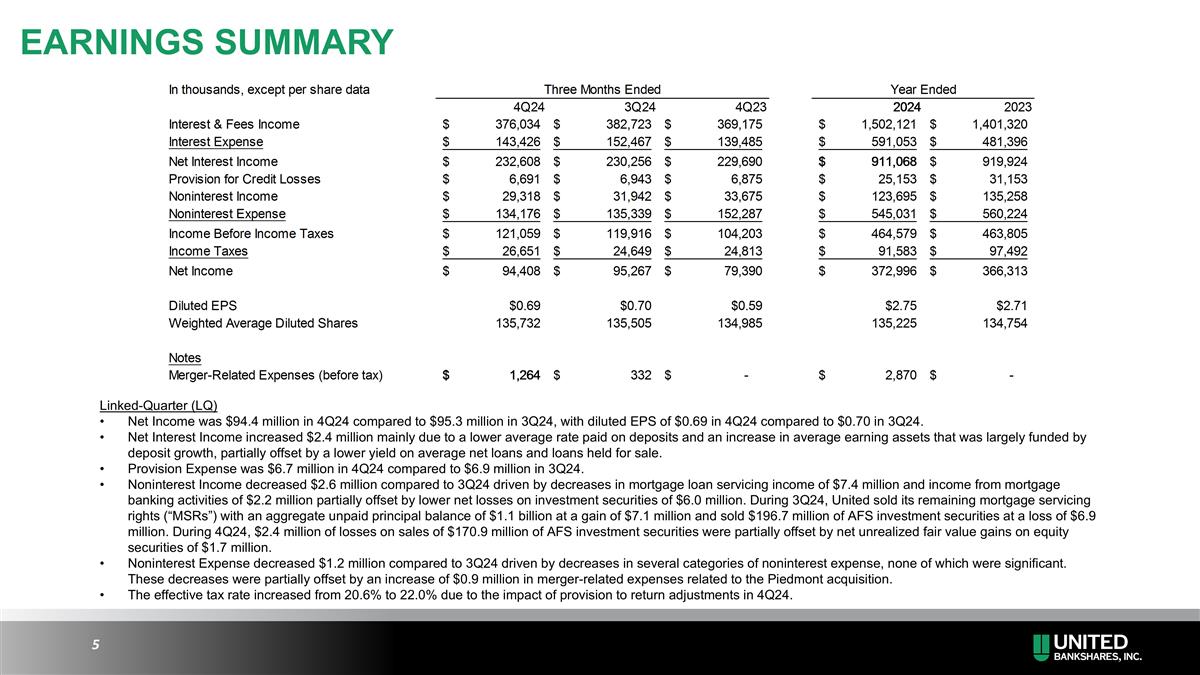

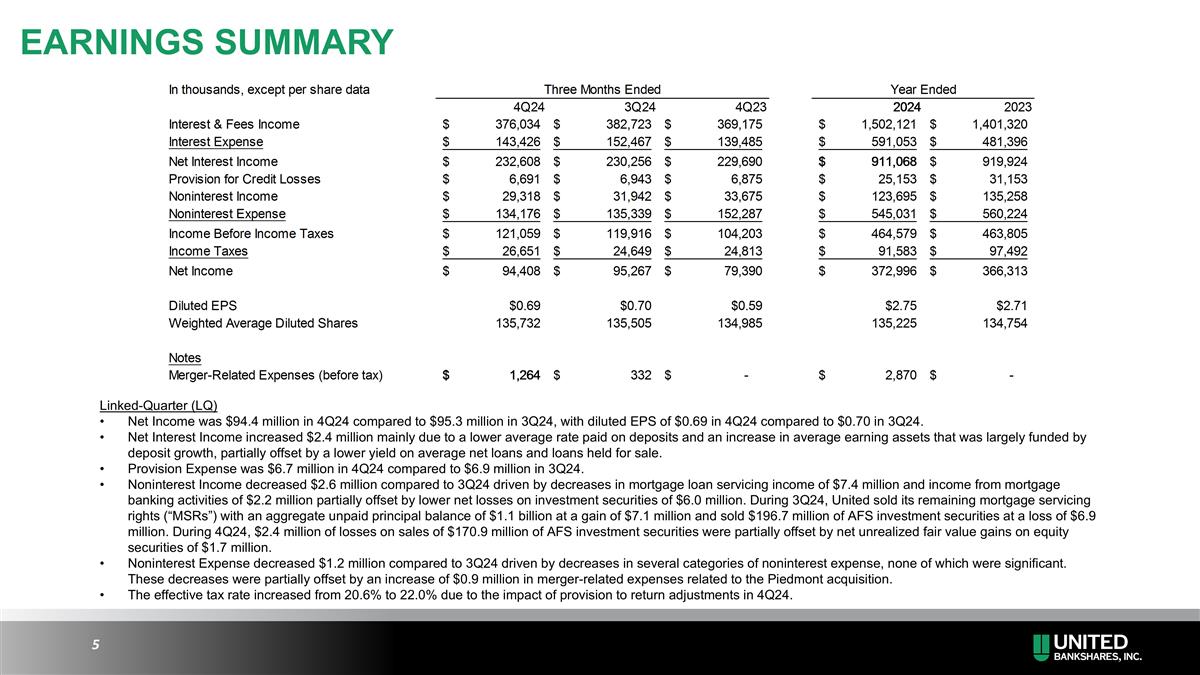

Linked-Quarter (LQ) Net Income was $94.4 million in 4Q24 compared to $95.3 million in 3Q24, with diluted EPS of $0.69 in 4Q24 compared to $0.70 in 3Q24. Net Interest Income increased $2.4 million mainly due to a lower average rate paid on deposits and an increase in average earning assets that was largely funded by deposit growth, partially offset by a lower yield on average net loans and loans held for sale. Provision Expense was $6.7 million in 4Q24 compared to $6.9 million in 3Q24. Noninterest Income decreased $2.6 million compared to 3Q24 driven by decreases in mortgage loan servicing income of $7.4 million and income from mortgage banking activities of $2.2 million partially offset by lower net losses on investment securities of $6.0 million. During 3Q24, United sold its remaining mortgage servicing rights (“MSRs”) with an aggregate unpaid principal balance of $1.1 billion at a gain of $7.1 million and sold $196.7 million of AFS investment securities at a loss of $6.9 million. During 4Q24, $2.4 million of losses on sales of $170.9 million of AFS investment securities were partially offset by net unrealized fair value gains on equity securities of $1.7 million. Noninterest Expense decreased $1.2 million compared to 3Q24 driven by decreases in several categories of noninterest expense, none of which were significant. These decreases were partially offset by an increase of $0.9 million in merger-related expenses related to the Piedmont acquisition. The effective tax rate increased from 20.6% to 22.0% due to the impact of provision to return adjustments in 4Q24. EARNINGS SUMMARY

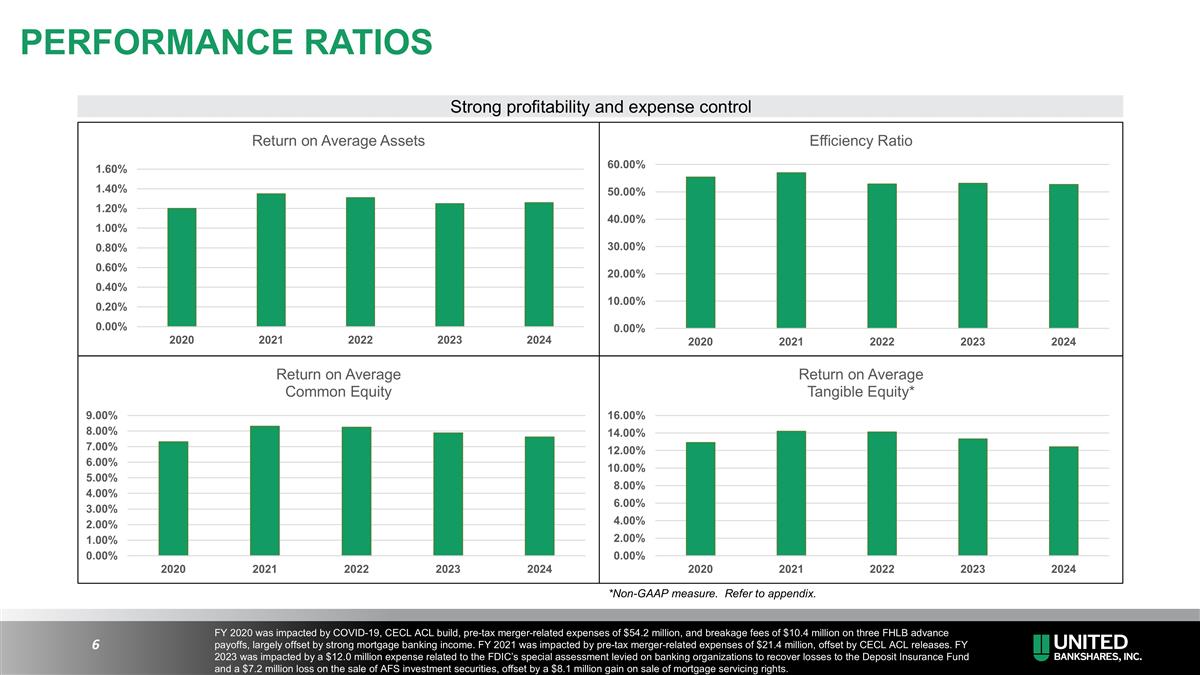

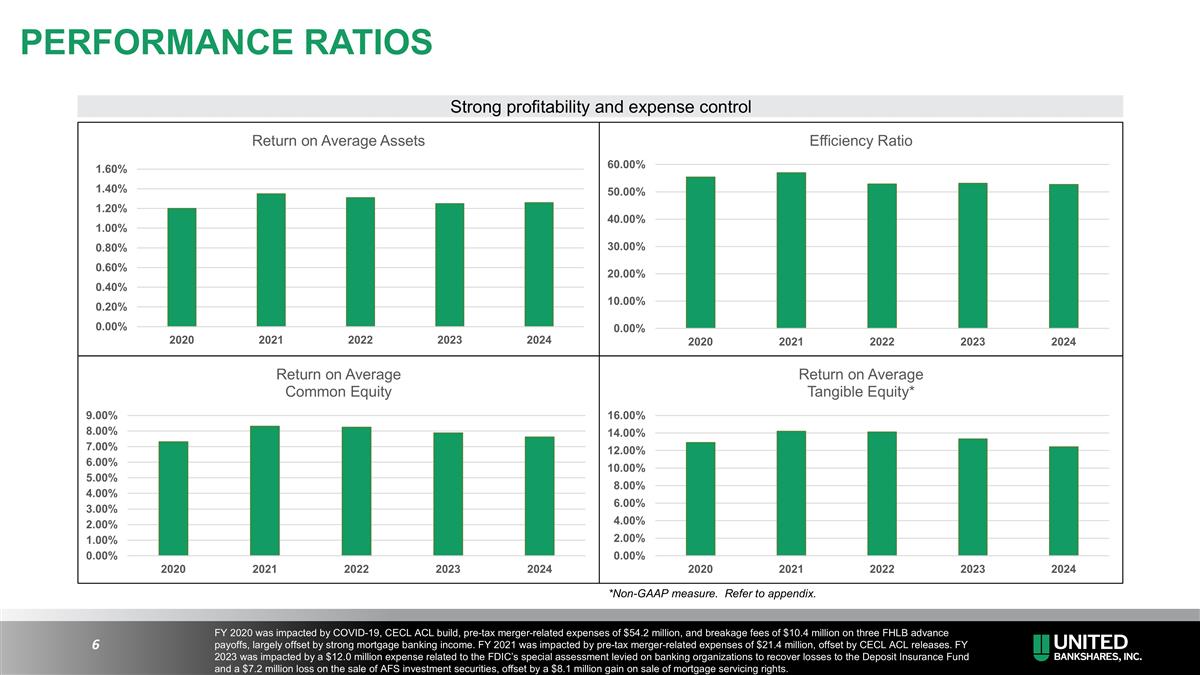

*Non-GAAP measure. Refer to appendix. Strong profitability and expense control FY 2020 was impacted by COVID-19, CECL ACL build, pre-tax merger-related expenses of $54.2 million, and breakage fees of $10.4 million on three FHLB advance payoffs, largely offset by strong mortgage banking income. FY 2021 was impacted by pre-tax merger-related expenses of $21.4 million, offset by CECL ACL releases. FY 2023 was impacted by a $12.0 million expense related to the FDIC’s special assessment levied on banking organizations to recover losses to the Deposit Insurance Fund and a $7.2 million loss on the sale of AFS investment securities, offset by a $8.1 million gain on sale of mortgage servicing rights. PERFORMANCE RATIOS

Reported Net Interest Margin decreased from 3.52% to 3.49% LQ. Linked-quarter Net Interest Income (FTE) increased $2.3 million mainly due to a lower average rate paid on deposits and an increase in average earning assets that was largely funded by deposit growth, partially offset by a lower yield on average net loans and loans held for sale. Approximately ~55% of the loan portfolio is fixed rate and ~45% is adjustable rate, while ~31% of the total portfolio is projected to reprice within the next 3 months. ~20% of the securities portfolio is floating rate. Securities balances of approximately ~$515 million with an average yield of ~4.0% are projected to roll off during FY 2025. During 4Q24, approximately ~$171 million of securities were sold at a loss of $2.4 million. HTM securities are immaterial at $1.0 million, or 0.0% of total securities. The duration of the AFS portfolio is 4.4 years. Time deposits have an average maturity of ~6 months. Approximately ~12% of total deposits have interest rates tied to a floating rate index. Scheduled purchase accounting loan accretion is estimated at $5.7 million for FY 2025 and $4.2 million for FY 2026 (not including the impact from the Piedmont acquisition). NET INTEREST INCOME AND MARGIN

Linked-Quarter loan balances increased $49 million primarily driven by Construction & Land Development and Residential Real Estate loans. YTD loan growth was led by the North Carolina & South Carolina markets, up 12.5% in 2024, and the Central Virginia markets, up 11.2% in 2024. Non Owner Occupied CRE to Total Risk Based Capital was ~269% at 4Q24. CRE portfolio remains diversified among underlying collateral types. Non Owner Occupied Office loans total ~$1.0 billion (~4% of total loans). The Top 40 Office loans make up ~68% of total Non Owner Occupied Office balances. The weighted average LTV based on current loan balances and appraised values at origination for the Top 40 was ~56% at 12/31/24. The weighted average LTV at origination for the Top 40 was ~63%. United has been disciplined in its approach to underwriting Office loans. The stringent underwriting process focuses on the underlying tenants, lease terms, sponsor support, location, property class, amenities, etc. Weighted average FICO of all consumer-related loan sectors is ~758. Total purchase accounting-related fair value discount on loans was $26 million as of 12/31/24. $ in millions LOAN SUMMARY (EXCLUDES LOANS HELD FOR SALE)

End of Period Balances (000s) 9/30/24 12/31/24 Non-Accrual Loans $52,446 $56,460 90-Day Past Due Loans $12,794 $16,940 Total Non-performing Loans $65,240 $73,400 Other Real Estate Owned $169 $327 Total Non-performing Assets $65,409 $73,727 Non-performing Loans / Loans 0.30% 0.34% Non-performing Assets / Total Assets 0.22% 0.25% Annualized Net Charge-offs / Average Loans 0.07% 0.10% Allowance for Loan & Lease Losses (ALLL) $270,767 $271,844 ALLL / Loans, net of unearned income 1.25% 1.25% Allowance for Credit Losses (ACL)* $308,740 $306,755 ACL / Loans, net of unearned income 1.43% 1.42% NPAs were $73.7 million at 12/31/24 compared to $65.4 million at 9/30/24 with the ratio of NPAs to Total Assets increasing from 0.22% to 0.25%. 30-89 Day Past Due loans were 0.39% of total loans at 12/31/24 compared to 0.44% at 9/30/24 and 0.39% at 12/31/23. ALLL increased $1.1 million LQ and remained at 1.25% of Total Loans. *ACL is comprised of ALLL and the reserve for lending-related commitments CREDIT QUALITY

Strong core deposit base with 26% of deposits in Non Interest Bearing accounts. LQ deposits increased $134 million driven by Non Interest Bearing, Time Deposits, and Interest Bearing Transaction accounts. Brokered deposits remained at 0.0% of total deposits as of 12/31/24. Enviable deposit franchise with an attractive mix of both high growth MSAs and stable, rural markets with a dominant market share position. $ in millions Source: S&P Global Market Intelligence *Excludes Piedmont branches DEPOSIT SUMMARY Top 10 Deposit Markets by MSA* (as of 6/30/24) MSA Total Deposits In Market ($000) Number of Branches Rank Washington, DC 10,071,646 58 7 Charleston, WV 1,589,675 5 2 Morgantown, WV 1,141,970 6 2 Richmond, VA 762,351 12 9 Parkersburg, WV 713,929 4 1 Hagerstown, MD 656,854 6 2 Myrtle Beach, SC 631,752 7 9 Charlotte, NC 585,589 7 17 Wheeling, WV 537,803 6 2 Charleston, SC 524,432 8 11

Deposit Account Details ($ in millions) End of Period Ratios / Values 12/31/24 % of Total Deposits Estimated Uninsured Deposits (less affiliate and collateralized deposits) $7,642 32% Estimated Insured/Collateralized Deposits $16,320 68% Total Deposits $23,962 100% *Does not include other sources of liquidity such as Fed Funds Lines, additional Reciprocal Deposit capacity, etc. Available Liquidity ($ in millions) 12/31/24 Cash & Cash Equivalents $2,292 Unpledged AFS Securities $921 Available FHLB Borrowing Capacity $4,244 Available FRB Discount Window Borrowing Capacity $4,826 Subtotal $12,283 Additional FHLB Capacity (with delivery of collateral) $3,901 Additional Brokered Deposit Capacity (based on internal policy) $4,792 Total Liquidity* $20,976 Liquidity remains strong with a granular deposit base and geographic diversification. Average deposit account size is ~$36 thousand with >650 thousand total deposit accounts. Estimated uninsured/uncollateralized deposits were 28% at 12/31/23 and 37% at 12/31/22. LIQUIDITY POSITION & ADDITIONAL DEPOSIT DETAIL

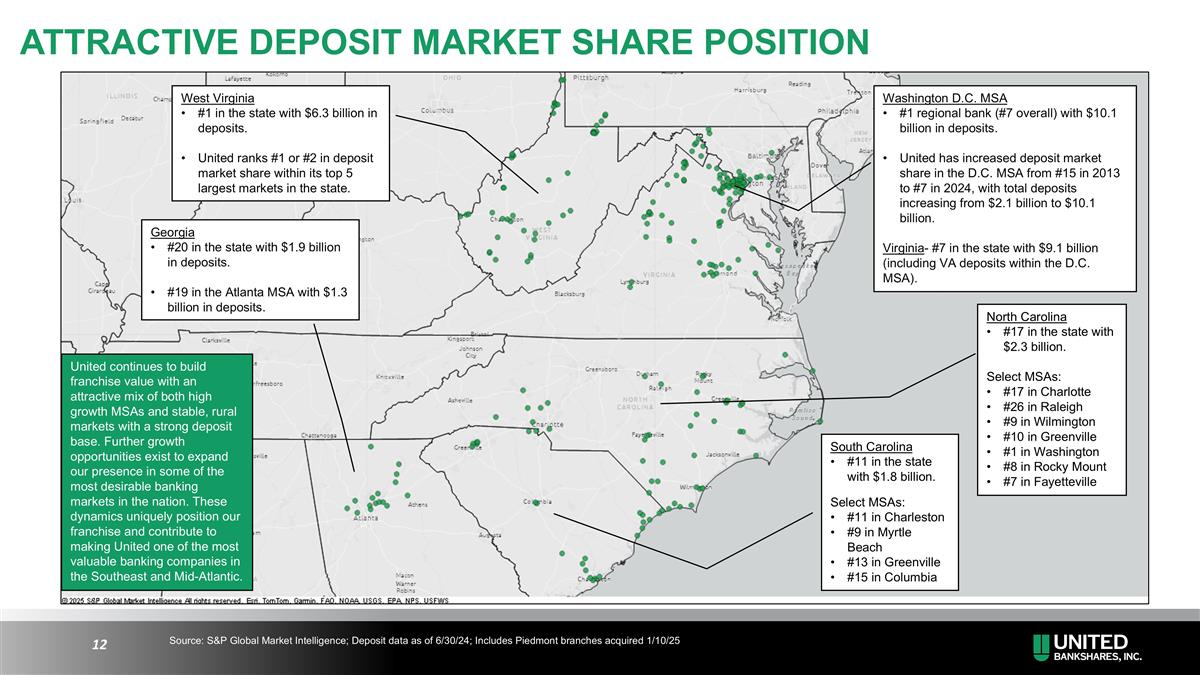

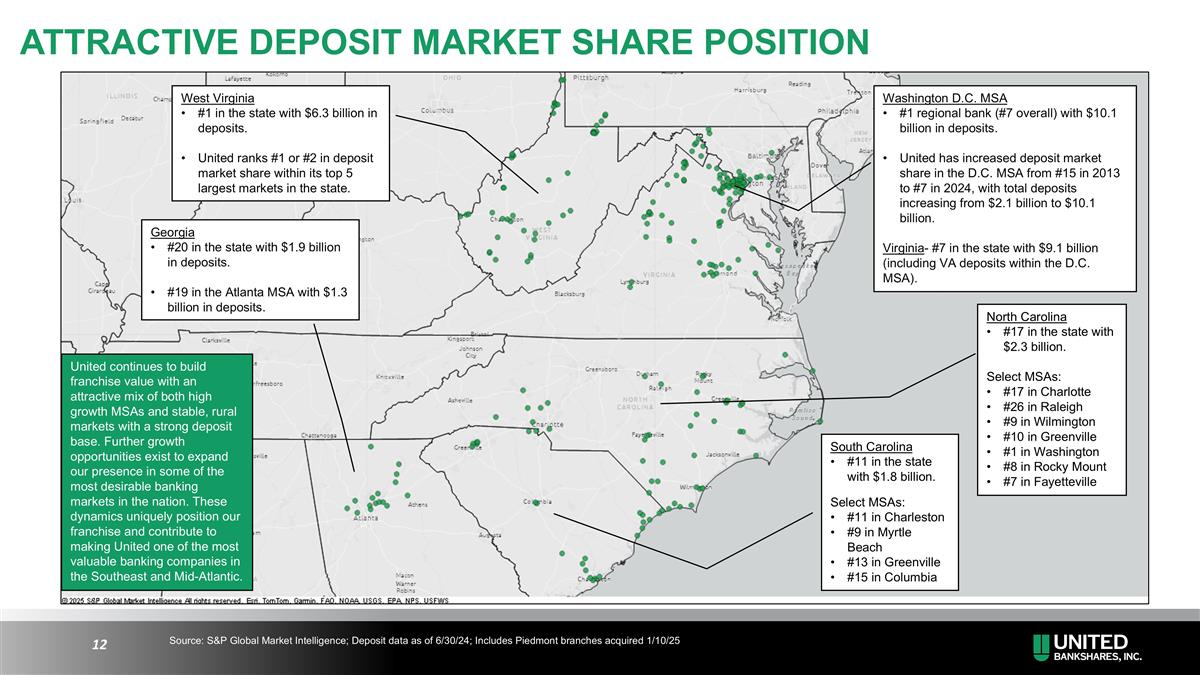

West Virginia #1 in the state with $6.3 billion in deposits. United ranks #1 or #2 in deposit market share within its top 5 largest markets in the state. United continues to build franchise value with an attractive mix of both high growth MSAs and stable, rural markets with a strong deposit base. Further growth opportunities exist to expand our presence in some of the most desirable banking markets in the nation. These dynamics uniquely position our franchise and contribute to making United one of the most valuable banking companies in the Southeast and Mid-Atlantic. Washington D.C. MSA #1 regional bank (#7 overall) with $10.1 billion in deposits. United has increased deposit market share in the D.C. MSA from #15 in 2013 to #7 in 2024, with total deposits increasing from $2.1 billion to $10.1 billion. Virginia- #7 in the state with $9.1 billion (including VA deposits within the D.C. MSA). North Carolina #17 in the state with $2.3 billion. Select MSAs: #17 in Charlotte #26 in Raleigh #9 in Wilmington #10 in Greenville #1 in Washington #8 in Rocky Mount #7 in Fayetteville South Carolina #11 in the state with $1.8 billion. Select MSAs: #11 in Charleston #9 in Myrtle Beach #13 in Greenville #15 in Columbia Source: S&P Global Market Intelligence; Deposit data as of 6/30/24; Includes Piedmont branches acquired 1/10/25 ATTRACTIVE DEPOSIT MARKET SHARE POSITION Georgia #20 in the state with $1.9 billion in deposits. #19 in the Atlanta MSA with $1.3 billion in deposits.

End of Period Ratios / Values 9/30/24 12/31/24** Common Equity Tier 1 Ratio 13.8% 14.2% Tier 1 Capital Ratio 13.8% 14.2% Total Risk Based Capital Ratio 16.2% 16.5% Leverage Ratio 11.7% 11.7% Total Equity to Total Assets 16.6% 16.6% *Tangible Equity to Tangible Assets (non-GAAP) 11.0% 11.0% Book Value Per Share $36.74 $36.89 *Tangible Book Value Per Share (non-GAAP) $22.70 $22.87 Capital ratios remain significantly above regulatory “Well Capitalized” levels and exceed all internal capital targets. United did not repurchase any common shares during 3Q24 or 4Q24. As of 12/31/24, there were 4,371,239 shares available to be repurchased under the approved plan. *Non-GAAP measure. Refer to appendix. **Regulatory ratios are estimates as of the earnings release date. CAPITAL RATIOS AND PER SHARE DATA

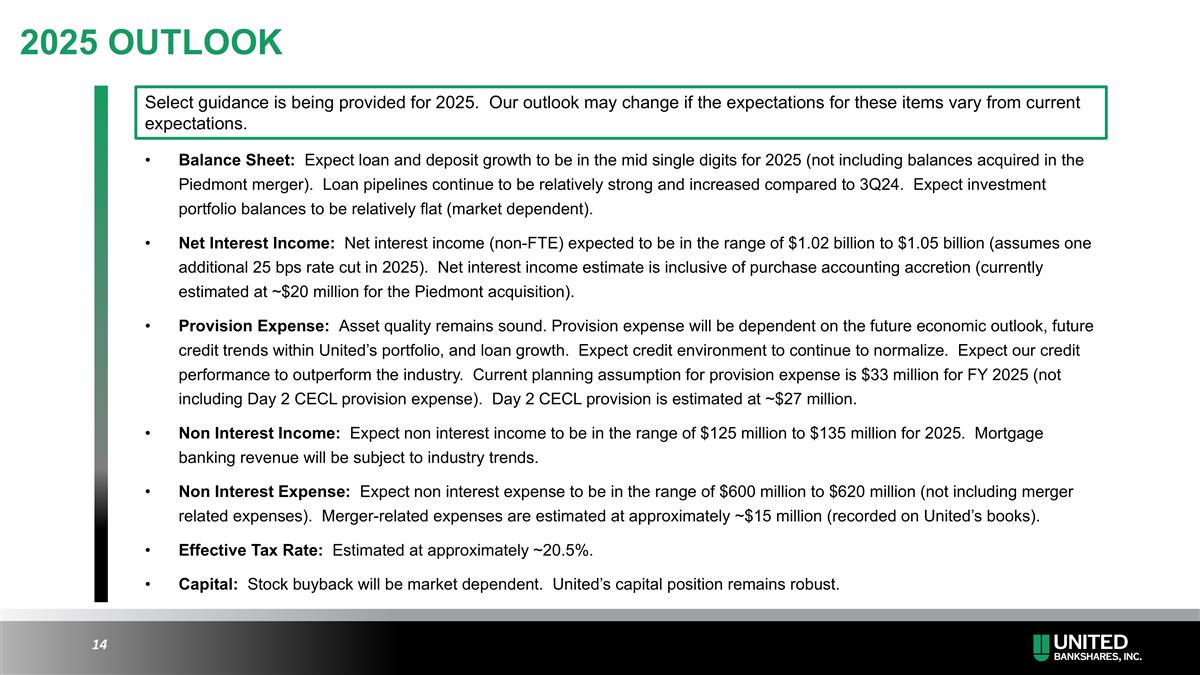

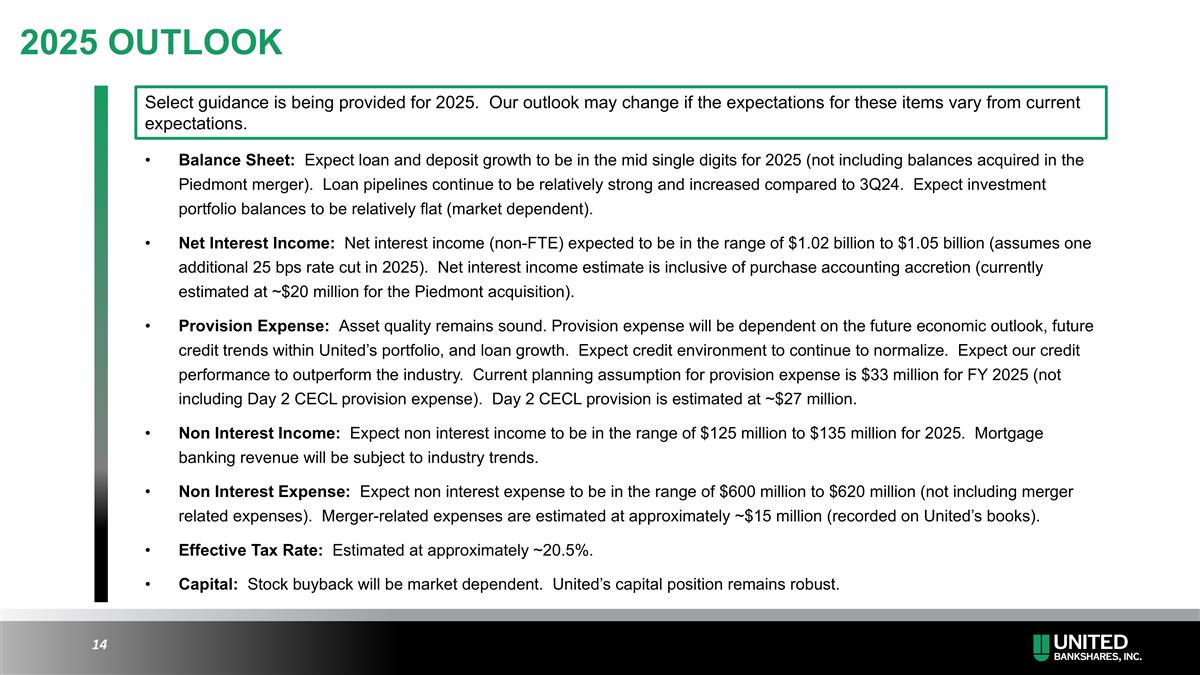

Select guidance is being provided for 2025. Our outlook may change if the expectations for these items vary from current expectations. Balance Sheet: Expect loan and deposit growth to be in the mid single digits for 2025 (not including balances acquired in the Piedmont merger). Loan pipelines continue to be relatively strong and increased compared to 3Q24. Expect investment portfolio balances to be relatively flat (market dependent). Net Interest Income: Net interest income (non-FTE) expected to be in the range of $1.02 billion to $1.05 billion (assumes one additional 25 bps rate cut in 2025). Net interest income estimate is inclusive of purchase accounting accretion (currently estimated at ~$20 million for the Piedmont acquisition). Provision Expense: Asset quality remains sound. Provision expense will be dependent on the future economic outlook, future credit trends within United’s portfolio, and loan growth. Expect credit environment to continue to normalize. Expect our credit performance to outperform the industry. Current planning assumption for provision expense is $33 million for FY 2025 (not including Day 2 CECL provision expense). Day 2 CECL provision is estimated at ~$27 million. Non Interest Income: Expect non interest income to be in the range of $125 million to $135 million for 2025. Mortgage banking revenue will be subject to industry trends. Non Interest Expense: Expect non interest expense to be in the range of $600 million to $620 million (not including merger related expenses). Merger-related expenses are estimated at approximately ~$15 million (recorded on United’s books). Effective Tax Rate: Estimated at approximately ~20.5%. Capital: Stock buyback will be market dependent. United’s capital position remains robust. 2025 OUTLOOK

Premier Mid-Atlantic and Southeast franchise with an attractive mix of high growth MSAs and smaller stable markets with a strong deposit base Consistently high-performing company with a culture of disciplined risk management and expense control 51 consecutive years of dividend increases evidences United’s strong profitability, solid asset quality, and sound capital management over a very long period of time Experienced management team with a proven track record of execution Committed to our mission of excellence in service to our employees, our customers, our shareholders and our communities Attractive valuation with a current Price-to-Earnings Ratio of ~13.7x (based upon median 2025 street consensus estimate of $2.80 per Bloomberg) INVESTMENT THESIS

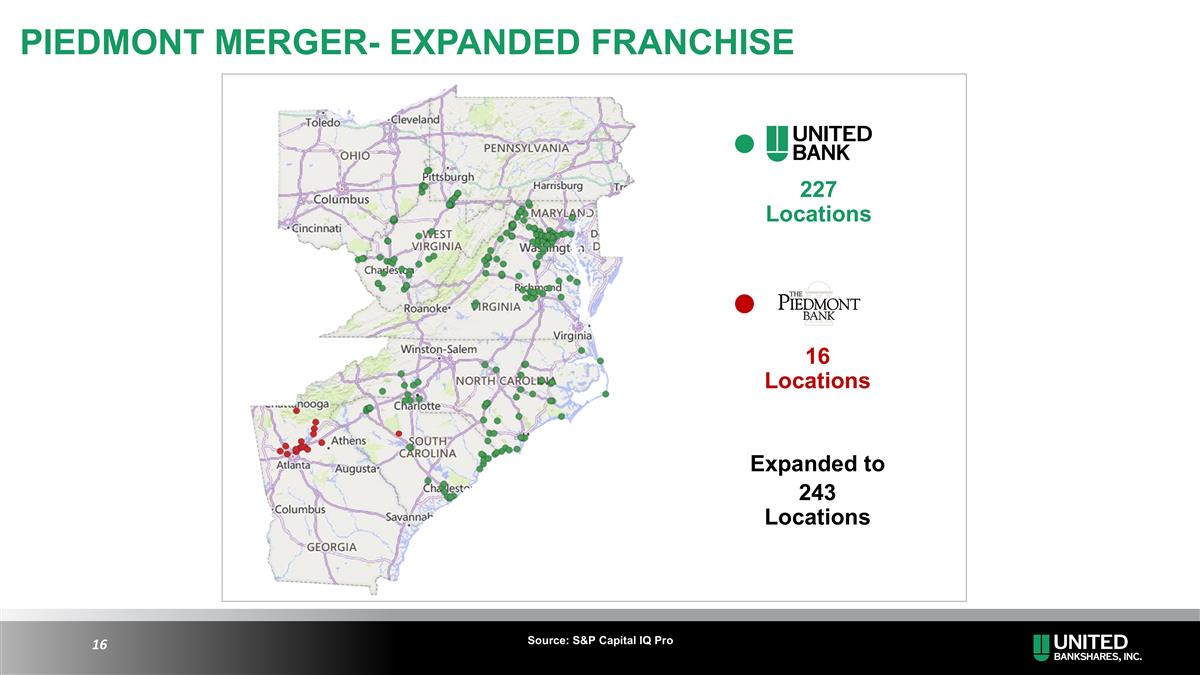

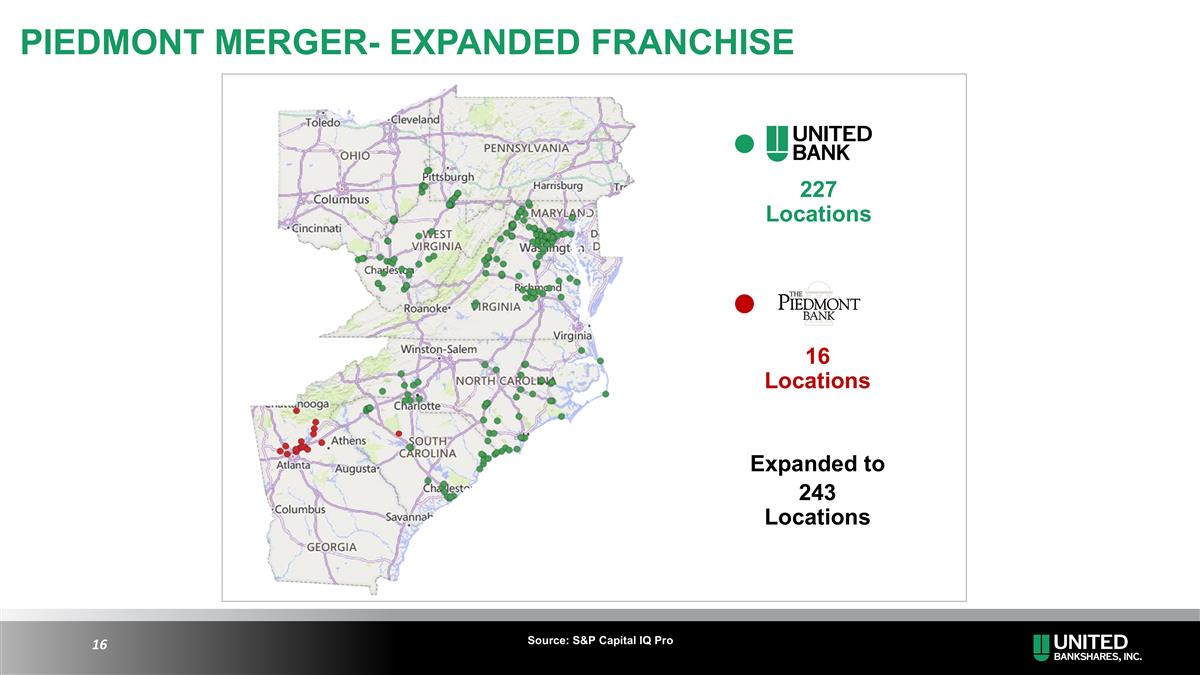

Source: S&P Capital IQ Pro 227 Locations Expanded to 16 Locations 243 Locations PIEDMONT MERGER- EXPANDED FRANCHISE

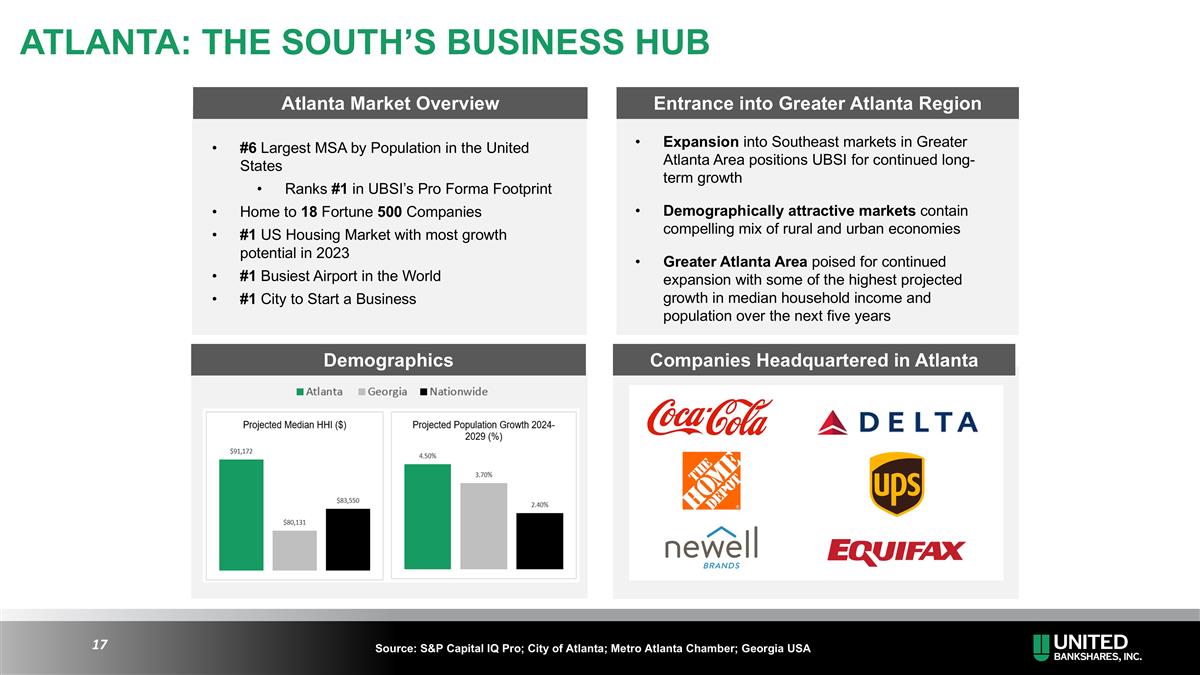

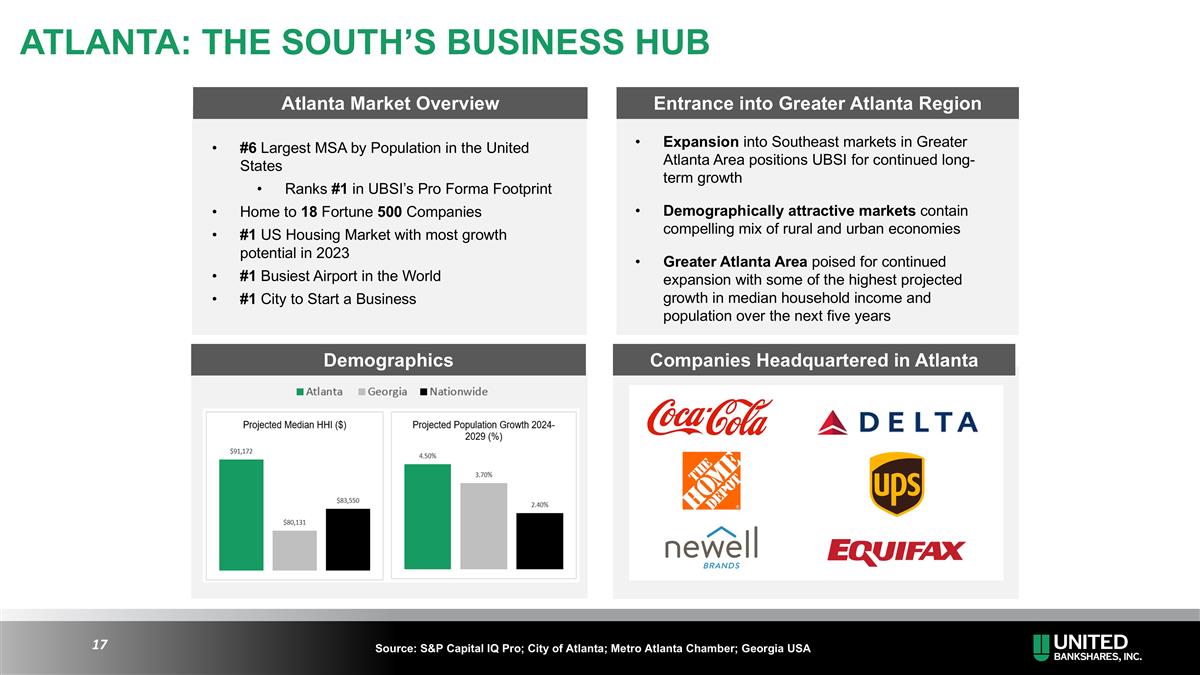

Source: S&P Capital IQ Pro; City of Atlanta; Metro Atlanta Chamber; Georgia USA Companies Headquartered in Atlanta Demographics #6 Largest MSA by Population in the United States Ranks #1 in UBSI’s Pro Forma Footprint Home to 18 Fortune 500 Companies #1 US Housing Market with most growth potential in 2023 #1 Busiest Airport in the World #1 City to Start a Business Atlanta Market Overview Expansion into Southeast markets in Greater Atlanta Area positions UBSI for continued long-term growth Demographically attractive markets contain compelling mix of rural and urban economies Greater Atlanta Area poised for continued expansion with some of the highest projected growth in median household income and population over the next five years Entrance into Greater Atlanta Region ATLANTA: THE SOUTH’S BUSINESS HUB

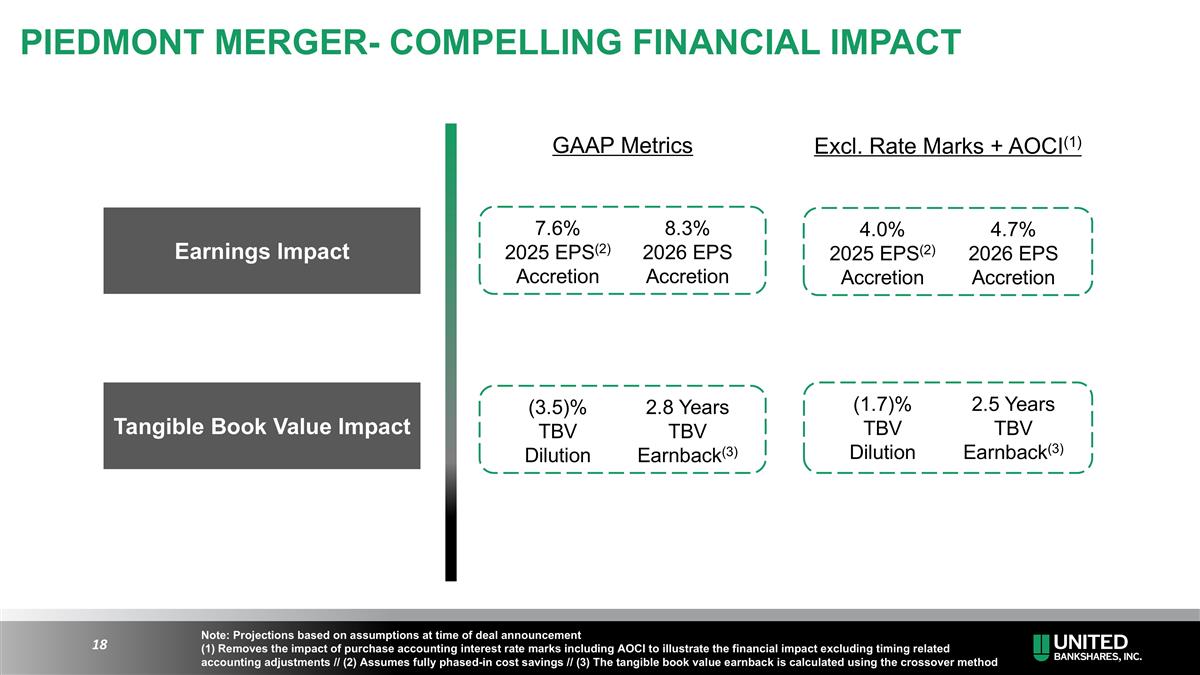

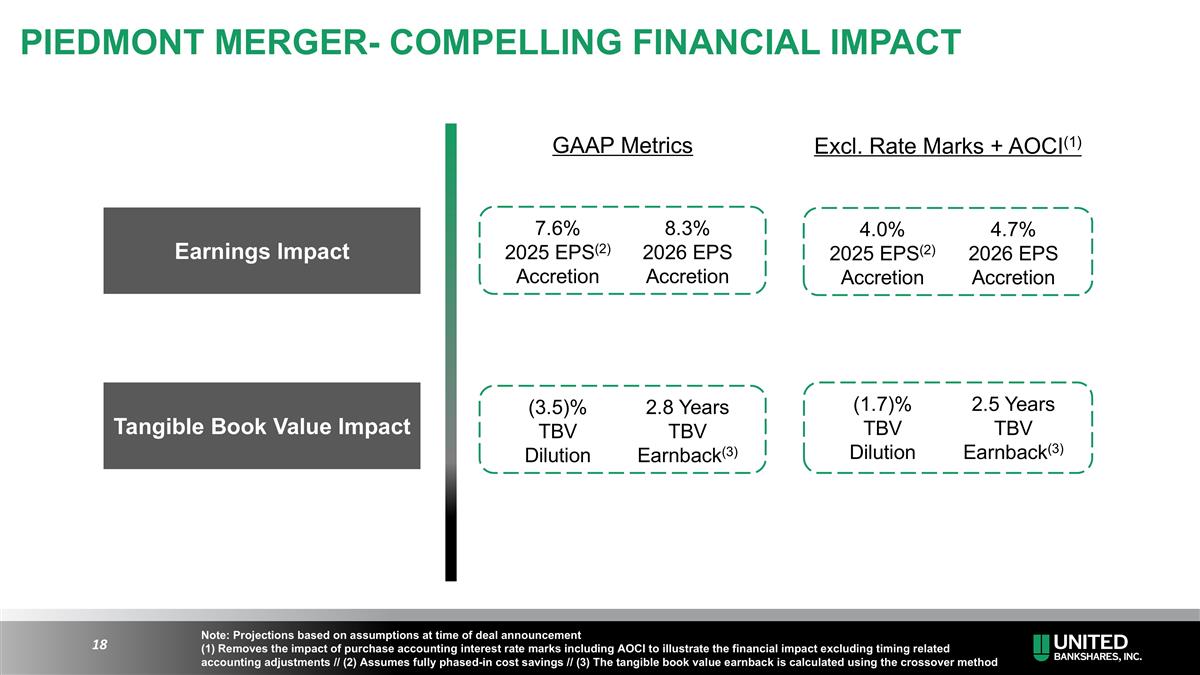

GAAP Metrics Excl. Rate Marks + AOCI(1) Earnings Impact 7.6% 2025 EPS(2) Accretion 8.3% 2026 EPS Accretion 4.0% 2025 EPS(2) Accretion 4.7% 2026 EPS Accretion Tangible Book Value Impact (3.5)% TBV Dilution 2.8 Years TBV Earnback(3) (1.7)% TBV Dilution 2.5 Years TBV Earnback(3) Note: Projections based on assumptions at time of deal announcement (1) Removes the impact of purchase accounting interest rate marks including AOCI to illustrate the financial impact excluding timing related accounting adjustments // (2) Assumes fully phased-in cost savings // (3) The tangible book value earnback is calculated using the crossover method PIEDMONT MERGER- COMPELLING FINANCIAL IMPACT

(1) Estimated total pro forma assets at transaction close based on assumptions at time of deal announcement Source: S&P Capital IQ Pro; Company filings (1) DEMONSTRATED HISTORY OF SUCCESSFUL ACQUISITIONS

APPENDIX

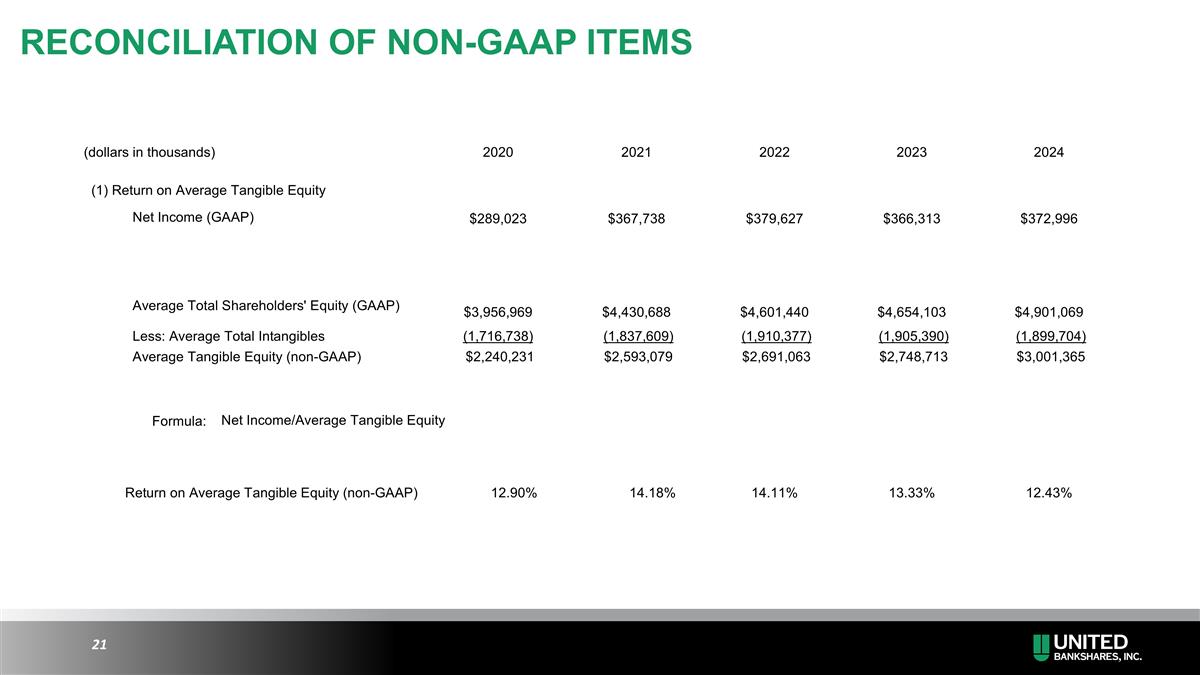

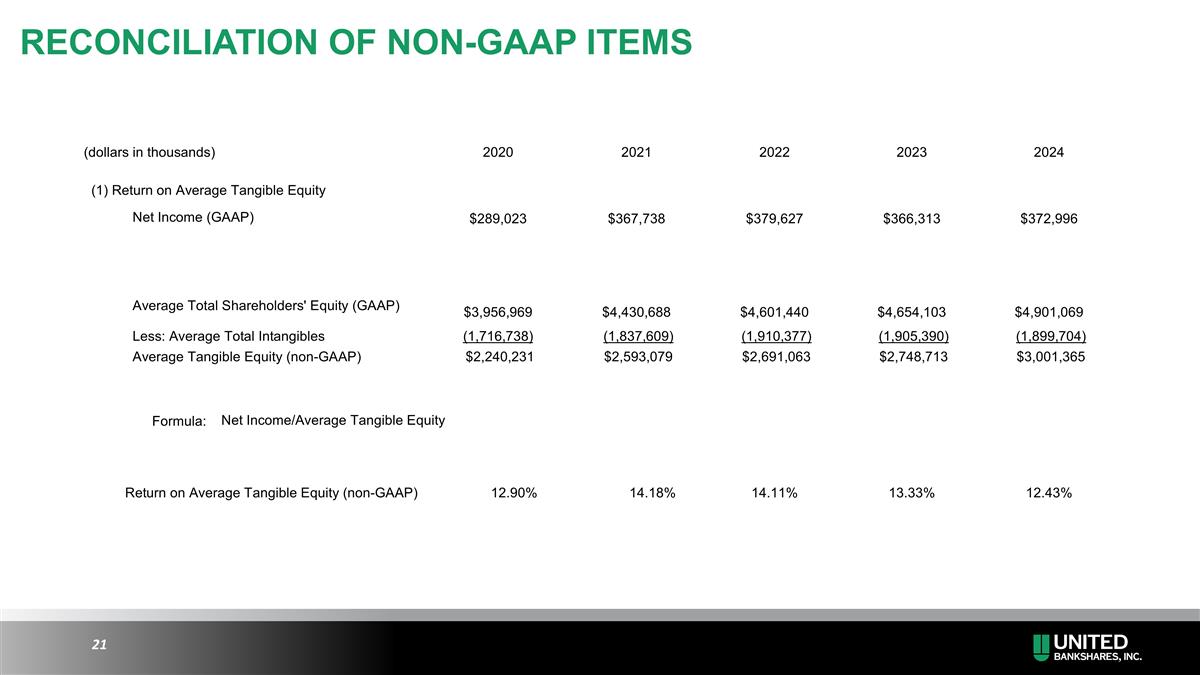

RECONCILIATION OF NON-GAAP ITEMS (dollars in thousands) 2020 2021 2022 2023 2024 (1) Return on Average Tangible Equity Net Income (GAAP) $289,023 $367,738 $379,627 $366,313 $372,996 Average Total Shareholders' Equity (GAAP) $3,956,969 $4,430,688 $4,601,440 $4,654,103 $4,901,069 Less: Average Total Intangibles (1,716,738) (1,837,609) (1,910,377) (1,905,390) (1,899,704) Average Tangible Equity (non-GAAP) $2,240,231 $2,593,079 $2,691,063 $2,748,713 $3,001,365 Formula: Net Income/Average Tangible Equity Return on Average Tangible Equity (non-GAAP) 12.90% 9.58% 14.18% 14.11% 13.33% 12.43%

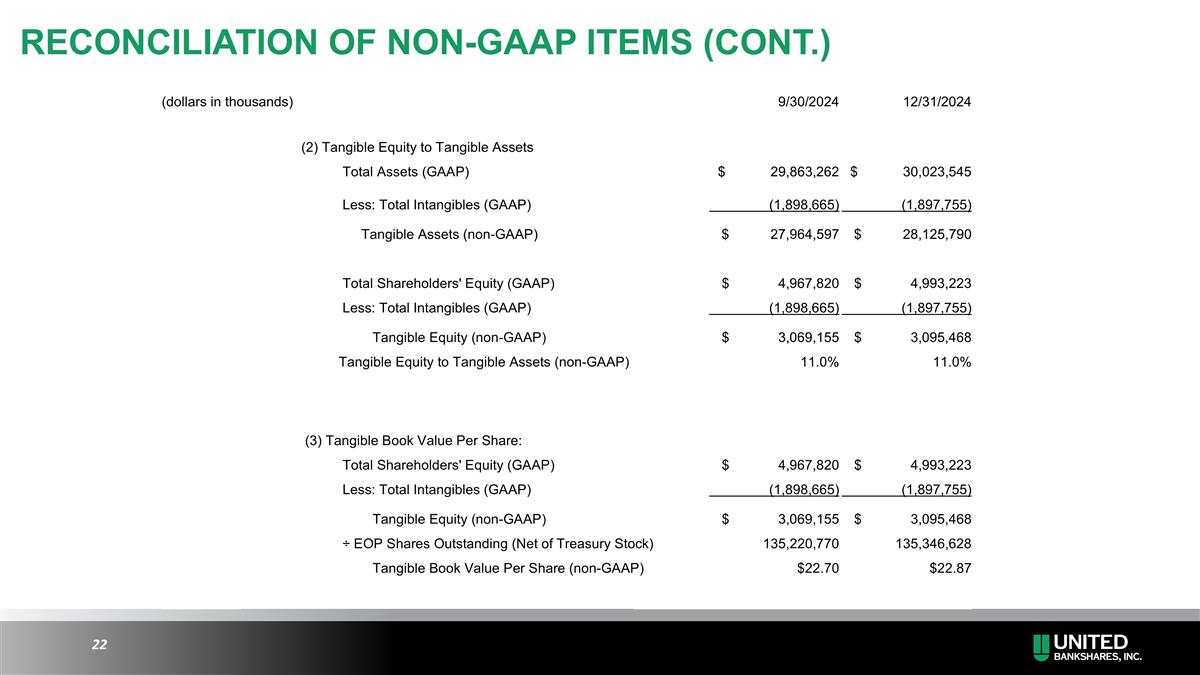

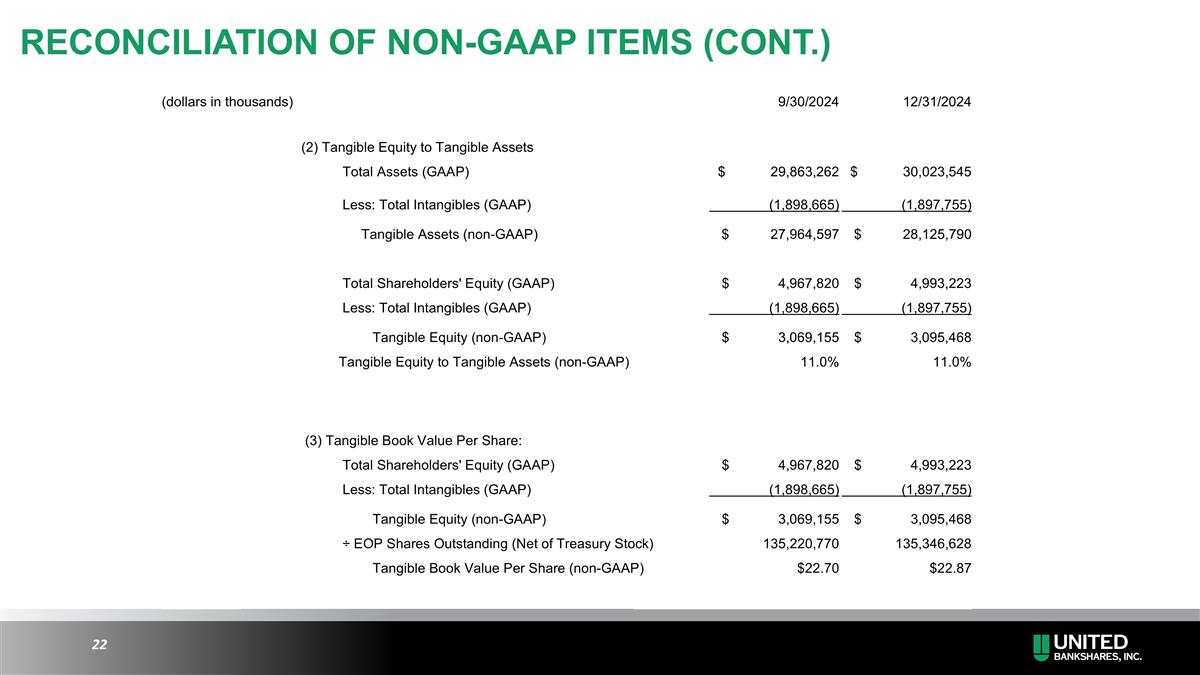

(dollars in thousands) 9/30/2024 12/31/2024 (2) Tangible Equity to Tangible Assets Total Assets (GAAP) $ 29,863,262 $ 30,023,545 Less: Total Intangibles (GAAP) (1,898,665) (1,897,755) Tangible Assets (non-GAAP) $ 27,964,597 $ 28,125,790 Total Shareholders' Equity (GAAP) $ 4,967,820 $ 4,993,223 Less: Total Intangibles (GAAP) (1,898,665) (1,897,755) Tangible Equity (non-GAAP) $ 3,069,155 $ 3,095,468 Tangible Equity to Tangible Assets (non-GAAP) 11.0% 11.0% (3) Tangible Book Value Per Share: Total Shareholders' Equity (GAAP) $ 4,967,820 $ 4,993,223 Less: Total Intangibles (GAAP) (1,898,665) (1,897,755) Tangible Equity (non-GAAP) $ 3,069,155 $ 3,095,468 ÷ EOP Shares Outstanding (Net of Treasury Stock) 135,220,770 135,346,628 Tangible Book Value Per Share (non-GAAP) $22.70 $22.87 RECONCILIATION OF NON-GAAP ITEMS (CONT.)