| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2014 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03907

The Empire Builder Tax Free Bond Fund

(Exact name of registrant as specified in charter)

| 546 Fifth Avenue, 7th Floor New York, New York | 10036 |

| (Address of principal executive offices) | (Zip code) |

Frank L. Newbauer, Esq.

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 953-7800

Date of fiscal year end: February 28, 2013

Date of reporting period: February 28, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

THE

EMPIRE

BUILDER

TAX FREE

BOND FUND

ANNUAL REPORT

February 28, 2013

At the close of business on March 8, 2013, the Neuberger Berman New York Municipal Income Fund (the “New Fund”) acquired all the assets and assumed all the liabilities of The Empire Builder Tax Free Bond Fund (the “Fund”) (the “Reorganization”), and shareholders of the Fund received New Fund shares in exchange for their Fund shares. Prior to that date, the New Fund had no operations. The financial information through March 8, 2013, for the Institutional Class of the New Fund is that of the Builder Class of the Fund, the predecessor to the New Fund for accounting purposes.

THE EMPIRE BUILDER TAX FREE BOND FUND LETTER TO SHAREHOLDERS |

Dear Shareholder,

We are pleased to present The Empire Builder Tax Free Bond Fund (the “Fund”) Annual Report for the period ended February 28, 2013.

For the past year, the Builder Class was up 2.01% while the Premier Class was up 2.04%. The Federal Reserve Board has left the Federal Funds Rate, the key target rate on loans between member banks, at recent lows (between 0% and 0.25%). In our view, this low rate environment has helped the economy improve. The stock market has had a good recovery, but the housing market and unemployment remain great concerns and we believe will for years to come.

The municipal yield curve has recently been steep from a historical perspective and we believe supply should remain manageable. In addition, the economy has been expanding only at a modest pace so we feel the Federal Reserve will hold rates at their current ultra-low levels for the foreseeable future. As such, we believe demand for municipal securities will be solid, especially given what we see as their compelling valuations versus other higher-quality fixed income securities.

As many of you know, Neuberger Berman Management LLC was engaged as the Fund’s investment adviser and the services of Glickenhaus & Co. were discontinued following the reorganization of The Empire Builder Tax Free Bond Fund into Neuberger Berman New York Municipal Income Fund, a series of Neuberger Berman Income Funds, on March 8, 2013. Accordingly this is my final letter to you. We appreciate your business during our years as Adviser to the Fund.

Sincerely,

Seth M. Glickenhaus

President

The opinions expressed are those of the Fund’s portfolio management prior to March 8, 2013. The opinions are as of the date of this report and are subject to change without notice.

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change.

2

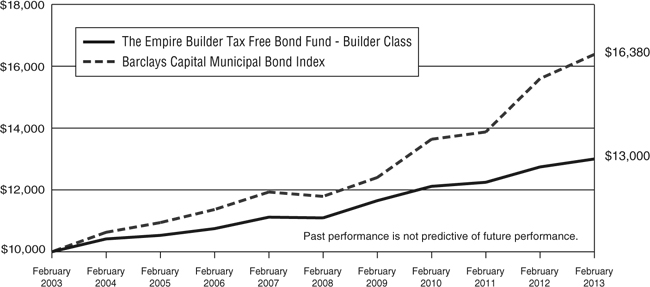

THE EMPIRE BUILDER TAX FREE BOND FUND - BUILDER CLASS PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

in The Empire Builder Tax Free Bond Fund – Builder Class

and the Barclays Capital Municipal Bond Index

| Average Annual Total Returns (Unaudited) | ||||

1 Year | 5 Years | 10 Years | Expense Ratio* | |

| The Empire Builder Tax Free Bond Fund - Builder Class | 2.01% | 3.22% | 2.66% | 1.08% |

| Barclays Capital Municipal Bond Index | 5.01% | 6.79% | 5.06% | NA |

| * | The above expense ratio is from the Fund’s prospectus dated June 27, 2012. Additional information pertaining to the Fund’s expense ratio for the year ended February 28, 2013 can be found in the Financial Highlights. |

3

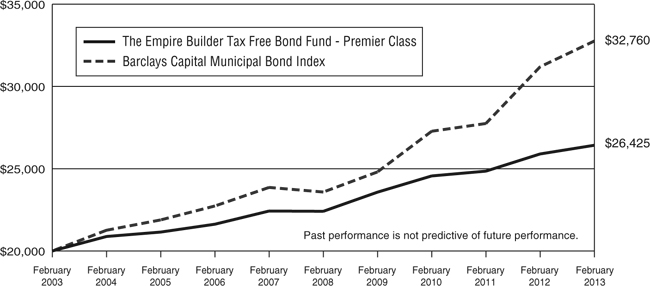

THE EMPIRE BUILDER TAX FREE BOND FUND - PREMIER CLASS PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $20,000 Investment

in The Empire Builder Tax Free Bond Fund – Premier Class

and the Barclays Capital Municipal Bond Index

| Average Annual Total Returns (Unaudited) | ||||

1 Year | 5 Years | 10 Years | Expense Ratio* | |

| The Empire Builder Tax Free Bond Fund - Premier Class | 2.04% | 3.35% | 2.82% | 0.99% |

| Barclays Capital Municipal Bond Index | 5.01% | 6.79% | 5.06% | NA |

| * | The above expense ratio is from the Fund’s prospectus dated June 27, 2012. Additional information pertaining to the Fund’s expense ratio for the year ended February 28, 2013 can be found in the Financial Highlights. |

4

THE EMPIRE BUILDER TAX FREE BOND FUND SCHEDULE OF INVESTMENTS February 28, 2013 |

MUNICIPAL SECURITIES — 90.0% | Credit Ratings* | Par Value | Value | |||||||||

| New York City and New York City Agencies — 12.0% | ||||||||||||

| Hudson Yards Infrastructure Corp., Revenue, Series A, | ||||||||||||

| 5.75%, due 02/15/2047, Par Call 02/15/2021 @ 100 | A2/A | $ | 1,000,000 | $ | 1,180,690 | |||||||

| New York City, General Obligation, Series C, | ||||||||||||

| 5.50%, due 08/01/2014, Par Call 02/01/2014 @100 | Aa2/AA | 420,000 | 421,583 | |||||||||

| New York City, General Obligation, Series E-1, | ||||||||||||

| 6.25%, due 10/15/2028, Par Call 10/15/2018 @ 100 | Aa2/AA | 2,000,000 | 2,458,521 | |||||||||

| New York City, Housing Development Corp., Multi-Family Housing Revenue, Series M, | ||||||||||||

| 4.40%, due 05/01/2014, Non-Callable | Aa2/AA | 165,000 | 170,478 | |||||||||

| 4.45%, due 11/01/2014, Non-Callable | Aa2/AA | 330,000 | 345,632 | |||||||||

| 4.60%, due 05/01/2015, Non-Callable | Aa2/AA | 340,000 | 361,522 | |||||||||

| 4.65%, due 11/01/2015, Non-Callable | Aa2/AA | 350,000 | 377,164 | |||||||||

| 6.75%, due 11/01/2033, Par Call 11/01/2018 @ 100 | Aa2/AA | 1,000,000 | 1,179,940 | |||||||||

| New York City, Municipal Water Finance Authority, Water & Sewer Systems, Revenue, Series GG, | ||||||||||||

| 5.00%, due 06/15/2017, Par Call 12/15/2015 @ 100 | Aa2/AA+ | 1,125,000 | 1,258,166 | |||||||||

| Triborough Bridge & Tunnel Authority, Revenue, | ||||||||||||

| 5.25%, due 11/15/2022, Par Call 11/15/2013 @ 100 (NATL-RE) | A1/A+ | 310,000 | 311,082 | |||||||||

| 5.25%, due 11/15/2023, Par Call 11/15/2013 @ 100 (NATL-RE) | A1/A+ | 1,205,000 | 1,209,181 | |||||||||

| Total New York City and New York City Agencies | $ | 9,273,959 | ||||||||||

| New York State Agencies — 45.4% | ||||||||||||

| Dormitory Authority of the State of New York — 37.3% | ||||||||||||

| Catholic Health System Obligated Group, Non-State Supported Debt, Revenue, Series A, | ||||||||||||

| 2.00%, due 07/01/2014, Non-Callable | Baa1/BBB+ | 130,000 | 130,898 | |||||||||

| 3.00%, due 07/01/2015, Non-Callable | Baa1/BBB+ | 340,000 | 350,095 | |||||||||

| 3.00%, due 07/01/2016, Non-Callable | Baa1/BBB+ | 300,000 | 310,668 | |||||||||

| City University System Consolidated Fifth General Resolution, State Supported Debt, Revenue, Series E, | ||||||||||||

| 6.125%, due 01/01/2031, Par Call 01/01/2019 @ 100 | NR/AA- | 1,500,000 | 1,803,675 | |||||||||

See accompanying notes to financial statements.

5

THE EMPIRE BUILDER TAX FREE BOND FUND SCHEDULE OF INVESTMENTS (Continued) February 28, 2013 |

MUNICIPAL SECURITIES — 90.0% (Continued) | Credit Ratings* | Par Value | Value | ||||||

| New York State Agencies — 45.4% (Continued) | |||||||||

| Dormitory Authority of the State of New York — 37.3% (Continued) | |||||||||

| Department of Education, State Supported Debt, Revenue, Series A, | |||||||||

| 5.00%, due 07/01/2018, Par Call 07/01/2016 @ 100 | NR/AA- | $ | 1,000,000 | $ | 1,131,420 | ||||

| Department of Health, Veterans Home, Revenue, Series A, | |||||||||

| 5.00%, due 07/01/2013, Non-Callable | NR/AA- | 955,000 | 968,714 | ||||||

| Hospital for Special Surgery, Non-State Supported Debt, Revenue, | |||||||||

| 6.00%, due 08/15/2038, Par Call 08/15/2019 @ 100 (FHA) | Aa2/AA+ | 500,000 | 602,565 | ||||||

Memorial Sloan-Kettering Cancer Center, Non-State Supported Debt, Revenue, Series 1, | |||||||||

| 5.00%, due 07/01/2020, Non-Callable | Aa3/AA- | 500,000 | 615,070 | ||||||

| Mental Health Services Facilities Improvement, State Supported Debt, Revenue, Series A, | |||||||||

| 5.00%, due 02/15/2019, Par Call 02/15/2015 @ 100 (AMBAC) | NR/AA- | 2,500,000 | 2,690,575 | ||||||

| Mental Health Services Facilities Improvement, State Supported Debt, Revenue, Series F, | |||||||||

| 6.25%, due 02/15/2031, Par Call 08/15/2018 @ 100 | NR/AA- | 1,500,000 | 1,799,010 | ||||||

| Municipal Health Facilities Improvement Program, Non-State Supported Debt, Revenue, Subseries 2-1, | |||||||||

| 5.00%, due 01/15/2018, Non-Callable | Aa3/AA- | 2,000,000 | 2,360,920 | ||||||

| New York Medical College, Revenue, | |||||||||

| 5.25%, due 07/01/2013, Continuously Callable @ 100 (NATL-RE) | Baa2/BBB | 1,015,000 | 1,017,741 | ||||||

| North Shore-Long Island Jewish Obligated Group, Non-State Supported Debt, Revenue, Series B, | |||||||||

| 4.25%, due 05/01/2039, Par Call 05/01/2022 @ 100 | A3/A- | 150,000 | 159,954 | ||||||

| School Districts Revenue Bond Financing Program, Non-State Supported Debt, Revenue, Series A, | |||||||||

| 3.00%, due 04/01/2014, Non-Callable (State Aid Withholding) | NR/A+ | 735,000 | 753,022 | ||||||

| 4.00%, due 10/01/2014, Non-Callable (State Aid Withholding) | NR/A+ | 500,000 | 525,670 | ||||||

See accompanying notes to financial statements.

6

THE EMPIRE BUILDER TAX FREE BOND FUND SCHEDULE OF INVESTMENTS (Continued) February 28, 2013 |

MUNICIPAL SECURITIES — 90.0% (Continued) | Credit Ratings* | Par Value | Value | ||||||

| New York State Agencies — 45.4% (Continued) | |||||||||

| Dormitory Authority of the State of New York — 37.3% (Continued) | |||||||||

| Special Act School Districts Program, Revenue, | |||||||||

| 6.00%, due 07/01/2019, Continuously Callable @ 100 (NATL-RE) | Baa2/BBB | $ | 3,540,000 | $ | 3,554,443 | ||||

| St. Lawrence-Lewis BOCES Program, Non-State Supported Debt, Revenue, | |||||||||

| 4.00%, due 08/15/2018, Par Call 08/15/2017 @ 100 (AGM) | Aa3/AA- | 100,000 | 109,311 | ||||||

| 4.125%, due 08/15/2020, Par Call 08/15/2017 @ 100 (AGM) | Aa3/AA- | 110,000 | 118,531 | ||||||

| 4.25%, due 08/15/2021, Par Call 08/15/2017 @ 100 (AGM) | Aa3/AA- | 100,000 | 108,281 | ||||||

| State Personal Income Tax, Revenue, Series A, | |||||||||

| 5.00%, due 12/15/2029, Par Call 12/15/2022 @ 100 | NR/AAA | 3,000,000 | 3,609,389 | ||||||

| University of Rochester, Non-State Supported Debt, Revenue, Series A-1, | |||||||||

| 5.00%, due 07/01/2019, Par Call 01/01/2017 @ 100 | Aa3/AA- | 2,305,000 | 2,647,062 | ||||||

| Upstate Community Colleges, Revenue, Series B, | |||||||||

| 5.25%, due 07/01/2015, Par Call 07/01/2014 @ 100 (NATL-RE, FGIC, TCRS) | Aa3/NR | 3,140,000 | 3,347,554 | ||||||

| Total Dormitory Authority of the State of New York | 28,714,568 | ||||||||

| Other New York State Agencies — 8.1% | |||||||||

| New York State Environmental Facilities Corp., United Water New Rochelle, Water Facilities Revenue, Series A, | |||||||||

| 4.875%, due 09/01/2040, Par Call 09/01/2020 @ 100 | Baa1/A- | 1,000,000 | 1,064,790 | ||||||

| New York State Housing Finance Agency, Revenue, Series A, | |||||||||

| 2.00%, due 09/15/2013, Non-Callable | NR/AA- | 1,500,000 | 1,512,165 | ||||||

| 5.00%, due 09/15/2013, Non-Callable | NR/AA- | 2,500,000 | 2,559,750 | ||||||

| New York State Urban Development Corp., Service Contract Revenue, Series D, | |||||||||

| 5.00%, due 01/01/2015, Non-Callable | NR/AA- | 1,000,000 | 1,082,660 | ||||||

| Total Other New York State Agencies | 6,219,365 | ||||||||

| Total New York State Agencies | $ | 34,933,933 | |||||||

See accompanying notes to financial statements.

7

THE EMPIRE BUILDER TAX FREE BOND FUND SCHEDULE OF INVESTMENTS (Continued) February 28, 2013 |

MUNICIPAL SECURITIES — 90.0% (Continued) | Credit Ratings* | Par Value | Value | ||||||

| Other New York State Bonds — 32.6% | |||||||||

| Addison Central School District, General Obligation, | |||||||||

| 5.00%, due 06/01/2019, Non-Callable (State Aid Withholding) | A1/NR | $ | 1,425,000 | $ | 1,690,149 | ||||

| Ausable Valley Central School District, General Obligation, | |||||||||

| 2.50%, due 06/15/2013, Non-Callable (State Aid Withholding) | NR/A | 380,000 | 381,915 | ||||||

| Caledonia-Mumford Central School District, General Obligation, | |||||||||

| 4.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | NR/A+ | 455,000 | 459,232 | ||||||

| Dansville Central School District, General Obligation, | |||||||||

| 2.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | NR/AA- | 275,000 | 276,034 | ||||||

| East Moriches Union Free School District, General Obligation, | |||||||||

| 3.00%, due 07/01/2018, Non-Callable (AGM State Aid Withholding) | NR/AA- | 525,000 | 559,304 | ||||||

| 3.00%, due 07/01/2019, Non-Callable (AGM State Aid Withholding) | NR/AA- | 385,000 | 408,223 | ||||||

| 3.00%, due 07/01/2020, Non-Callable (AGM State Aid Withholding) | NR/AA- | 460,000 | 481,546 | ||||||

| Elmira City School District, General Obligation, | |||||||||

| 5.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | NR/A | 1,000,000 | 1,012,270 | ||||||

| Erie County IDA, City School District of Buffalo Project, School Facility Revenue, Series A, | |||||||||

| 5.75%, due 05/01/2025, Par Call 05/01/2017 @ 100 (AGM) | Aa3/AA- | 2,000,000 | 2,329,739 | ||||||

| Freeport, Public Improvement, General Obligation, Series A, | |||||||||

| 3.00%, due 03/15/2013, Non-Callable (AGM) | A1/NR | 1,005,000 | 1,006,018 | ||||||

| Freeport, Public Improvement, General Obligation, Series B, | |||||||||

| 2.00%, due 06/01/2013, Non-Callable (AGM) | A1/NR | 655,000 | 657,325 | ||||||

| Genesee Valley Central School District at Angelica Belmont, General Obligation, | |||||||||

| 3.00%, due 06/15/2014, Non-Callable (AGM State Aid Withholding) | NR/AA- | 300,000 | 308,526 | ||||||

| 4.00%, due 06/15/2015, Non-Callable (AGM State Aid Withholding) | NR/AA- | 295,000 | 314,603 | ||||||

See accompanying notes to financial statements.

8

THE EMPIRE BUILDER TAX FREE BOND FUND SCHEDULE OF INVESTMENTS (Continued) February 28, 2013 |

MUNICIPAL SECURITIES — 90.0% (Continued) | Credit Ratings* | Par Value | Value | |||||||||

| Other New York State Bonds — 32.6% (Continued) | ||||||||||||

| Geneva City School District, General Obligation, | ||||||||||||

| 2.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | A1/NR | $ | 300,000 | $ | 301,254 | |||||||

| 3.00%, due 06/15/2014, Non-Callable (State Aid Withholding) | A1/NR | 1,090,000 | 1,120,694 | |||||||||

| Greene County, Public Improvement, General Obligation, | ||||||||||||

| 3.00%, due 03/15/2013, Non-Callable | Aa3/NR | 790,000 | 790,796 | |||||||||

| Hannibal Central School District, General Obligation, Series A, | ||||||||||||

| 2.00%, due 07/01/2013, Non-Callable (AGM State Aid Withholding) | NR/AA- | 460,000 | 462,084 | |||||||||

| Hempstead Town, Adelphi University Project, Revenue, | ||||||||||||

| 3.00%, due 06/01/2013, Non-Callable | NR/A | 565,000 | 567,384 | |||||||||

| Hempstead Town, Local Development Corp., Revenue, Series 2011, | ||||||||||||

| 4.625%, due 07/01/2036, Par Call 07/01/2021 @ 100 | A3/A | 250,000 | 266,423 | |||||||||

| Hornell City School District, General Obligation, | ||||||||||||

| 3.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | A1/NR | 750,000 | 754,583 | |||||||||

| Ithaca City, General Obligation, Series A, | ||||||||||||

| 3.00%, due 01/15/2016, Non-Callable | Aa2/NR | 750,000 | 790,890 | |||||||||

| Ithaca City, General Obligation, Series B, | ||||||||||||

| 3.00%, due 08/01/2015, Non-Callable | Aa2/NR | 250,000 | 263,508 | |||||||||

| Jamestown City School District, General Obligation, | ||||||||||||

| 4.00%, due 11/01/2019, Non-Callable (State Aid Withholding) | A1/NR | 1,310,000 | 1,465,549 | |||||||||

| Johnson City Central School District, General Obligation, | ||||||||||||

| 5.00%, due 06/15/2022, Par Call 06/15/2014 @ 100 | NR/AA- | 335,000 | 402,415 | |||||||||

| 5.00%, due 06/15/2026, Par Call 06/15/2022 @ 100 (AGM State Aid Withholding) | NR/AA- | 400,000 | 473,600 | |||||||||

| Long Island Power Authority, Electric System General Revenue, Series A, | ||||||||||||

| 6.00%, due 05/01/2033, Par Call 05/01/2019 @ 100 | A3/A- | 500,000 | 606,560 | |||||||||

See accompanying notes to financial statements.

9

THE EMPIRE BUILDER TAX FREE BOND FUND SCHEDULE OF INVESTMENTS (Continued) February 28, 2013 |

MUNICIPAL SECURITIES — 90.0% (Continued) | Credit Ratings* | Par Value | Value | |||||||||

| Other New York State Bonds — 32.6% (Continued) | ||||||||||||

| Mechanicville City School District, General Obligation, | ||||||||||||

| 3.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | NR/A+ | $ | 250,000 | $ | 251,633 | |||||||

| Metropolitan Transportation Authority, Transportation Revenue, Series 2008C, | ||||||||||||

| 6.50%, due 11/15/2028, Par Call 11/15/2018 @ 100 | A2/A | 1,500,000 | 1,891,949 | |||||||||

| Newburgh City School District, General Obligation, | ||||||||||||

| 2.50%, due 06/15/2013, Non-Callable (AGM State Aid Withholding) | A2/AA- | 625,000 | 628,394 | |||||||||

| North Syracuse Central School District, General Obligation, Series B, | ||||||||||||

| 5.00%, due 06/15/2019, Non-Callable (State Aid Withholding) | Aa3/NR | 350,000 | 421,264 | |||||||||

| 5.00%, due 06/15/2021, Non-Callable (State Aid Withholding) | Aa3/NR | 300,000 | 364,761 | |||||||||

| Otego-Unadilla Central School District, General Obligation, | ||||||||||||

| 3.00%, due 06/15/2019, Non-Callable (AGM State Aid Withholding) | NR/AA- | 250,000 | 266,503 | |||||||||

| 4.00%, due 06/15/2020, Non-Callable (AGM State Aid Withholding) | NR/AA- | 250,000 | 281,178 | |||||||||

| Peru Central School District, General Obligation, | ||||||||||||

| 2.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | Aa3/A+ | 380,000 | 381,569 | |||||||||

| Ravena-Coeymans-Selkirk Central School District, General Obligation, | ||||||||||||

| 2.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | Aa3/NR | 500,000 | 502,160 | |||||||||

| Schuylerville Central School District, General Obligation, | ||||||||||||

| 3.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | NR/A+ | 250,000 | 251,633 | |||||||||

| Sodus Central School District, General Obligation, | ||||||||||||

| 2.00%, due 06/15/2013, Non-Callable (State Aid Withholding) | NR/A+ | 485,000 | 486,959 | |||||||||

See accompanying notes to financial statements.

10

THE EMPIRE BUILDER TAX FREE BOND FUND SCHEDULE OF INVESTMENTS (Continued) February 28, 2013 |

MUNICIPAL SECURITIES — 90.0% (Continued) | Credit Ratings* | Par Value | Value | ||||||

| Other New York State Bonds — 32.6% (Continued) | |||||||||

| South Seneca Central School District, General Obligation, | |||||||||

| 4.25%, due 06/15/2013, Non-Callable (State Aid Withholding) | A1/NR | $ | 500,000 | $ | 504,870 | ||||

| Sullivan West Central School District, General Obligation, | |||||||||

| 3.00%, due 06/15/2013, Non-Callable (AGM State Aid Withholding) | A2/AA- | 350,000 | 352,433 | ||||||

| Warsaw Central School District, General Obligation, | |||||||||

| 2.625%, due 06/15/2013, Non-Callable (State Aid Withholding) | Aa3/A+ | 375,000 | 377,059 | ||||||

| Total Other New York State Bonds | $ | 25,112,989 | |||||||

Total Investments at Value — 90.0% (Cost $65,524,307) | $ | 69,320,881 | |||||||

| Other Assets in Excess of Liabilities — 10.0% | 7,734,283 | ||||||||

| Net Assets — 100.0% | $ | 77,055,164 | |||||||

| * | Credit Ratings assigned by Moody’s Investors Service, Inc. (“Moody’s”) and Standard & Poor’s Corp. (“Standard & Poor’s”), respectively (Unaudited). |

Definitions | |

| AGM | Insured as to principal and interest by the Assured Guaranty Municipal Corp. |

| AMBAC | Insured as to principal and interest by the American Municipal Bond Assurance Corp. |

| BOCES | Board of Cooperative Educational Services |

| FGIC | Insured as to principal and interest by the Financial Guaranty Insurance Co. |

| FHA | Insured as to principal and interest by the Federal Housing Administration |

| IDA | Industrial Development Agency |

| NATL-RE | Reinsured as to principal and interest by the National Public Finance Guarantee Corp. |

| TCRS | Transferable Custodial Receipts |

See accompanying notes to financial statements.

11

THE EMPIRE BUILDER TAX FREE BOND FUND SCHEDULE OF INVESTMENTS (Continued) February 28, 2013 |

Description of Moody’s Ratings (Unaudited) | |

| Aaa | Issuers or issues rated 'Aaa' demonstrate the strongest creditworthiness relative to other U.S. municipal or tax-exempt issuers or issues. |

| Aa | Issuers or issues rated 'Aa' demonstrate very strong creditworthiness relative to other U.S. municipal or tax-exempt issuers or issues. |

| A | Issuers or issues rated 'A' demonstrate above-average creditworthiness relative to other U.S. municipal or tax-exempt issuers or issues. |

| Baa | Issuers or issues rated 'Baa' demonstrate average creditworthiness relative to other U.S. municipal or tax-exempt issuers or issues. |

| NR | Not Rated. In the opinion of the Adviser, instrument judged to be of comparable investment quality to rated securities which may be purchased by the Fund. |

| WR | Rating has been withdrawn. |

| Moody’s applies numerical modifiers 1, 2 and 3 in each generic rating classification below Aaa. The modifier 1 indicates that the obligation ranks in the higher end of its generic rating category; the modifier 2 indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lower end of that generic rating category. | |

Description of Standard & Poor’s Ratings (Unaudited) | |

| AAA | An obligation rated 'AAA' has the highest rating assigned by Standard & Poor's. The obligor's capacity to meet its financial commitment on the obligation is extremely strong. |

| AA | An obligation rated 'AA' differs from the highest-rated obligations only to a small degree. The obligor's capacity to meet its financial commitment on the obligation is very strong. |

| A | An obligation rated 'A' is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher-rated categories. However, the obligor's capacity to meet financial commitment on the obligation is still strong. |

| BBB | An obligation rated 'BBB' exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation. |

| NR | Not Rated. In the opinion of the Adviser, instrument judged to be of comparable investment quality to rated securities which may be purchased by the Fund. |

| Standard & Poor’s ratings may be modified by the addition of a plus or minus sign to show relative standing within the major rating categories. | |

Summary of Portfolio Holdings (Unaudited)

The Empire Builder Tax Free Bond Fund | Percent of Net Assets |

| New York State Agencies | 45.4 |

| Other New York State Bonds | 32.6 |

| New York City and New York City Agencies | 12.0 |

| Other Assets in Excess of Liabilities | 10.0 |

100.0 |

See accompanying notes to financial statements.

12

THE EMPIRE BUILDER TAX FREE BOND FUND STATEMENT OF ASSETS AND LIABILITIES February 28, 2013 |

| ASSETS | ||||

| Investments in securities, at value (cost $65,524,307) (Note 2) | $ | 69,320,881 | ||

| Cash | 7,204,852 | |||

| Interest receivable | 674,772 | |||

| Receivable for capital shares sold | 319 | |||

| Other assets | 12,003 | |||

| TOTAL ASSETS | 77,212,827 | |||

| LIABILITIES | ||||

| Dividends payable | 13,250 | |||

| Payable for capital shares redeemed | 42,948 | |||

| Advisory fees payable (Note 4) | 24,298 | |||

| Accrued Trustees’ fees (Note 4) | 14,001 | |||

| Payable to administrator, fund accountant and transfer agent (Note 4) | 14,320 | |||

| Payable to Chief Compliance Officer (Note 4) | 3,000 | |||

| Other accrued expenses | 45,846 | |||

| TOTAL LIABILITIES | 157,663 | |||

| NET ASSETS | $ | 77,055,164 | ||

| Net assets consist of: | ||||

| Paid-in capital | $ | 73,256,935 | ||

| Undistributed net investment income | 15,620 | |||

| Accumulated net realized losses from investments | (13,965 | ) | ||

| Net unrealized appreciation of investments | 3,796,574 | |||

| NET ASSETS | $ | 77,055,164 | ||

| PRICING OF BUILDER CLASS SHARES: | ||||

| Net assets applicable to Builder Class shares | $ | 36,178,250 | ||

Shares of beneficial interest outstanding (unlimited shares authorized, no par value) | 2,033,016 | |||

| Net asset value, offering and redemption price per share (Note 2) | $ | 17.80 | ||

| PRICING OF PREMIER CLASS SHARES: | ||||

| Net assets applicable to Premier Class shares | $ | 40,876,914 | ||

Shares of beneficial interest outstanding (unlimited shares authorized, no par value) | 2,296,837 | |||

| Net asset value, offering and redemption price per share (Note 2) | $ | 17.80 | ||

See accompanying notes to financial statements.

13

THE EMPIRE BUILDER TAX FREE BOND FUND STATEMENT OF OPERATIONS For the Year Ended February 28, 2013 |

| INVESTMENT INCOME | ||||

| Interest | $ | 2,248,207 | ||

| EXPENSES | ||||

| Advisory fees (Note 4) | 323,728 | |||

| Administration fees (Note 4) | 81,178 | |||

| Trustees' fees (Note 4) | 62,601 | |||

| Legal fees | 59,053 | |||

| Transfer agency fees - Builder Class (Note 4) | 39,133 | |||

| Transfer agency fees - Premier Class (Note 4) | 18,000 | |||

| Fund accounting fees (Note 4) | 44,058 | |||

| Postage and supplies | 41,797 | |||

| Compliance services fees (Note 4) | 36,000 | |||

| Audit and tax fees | 28,911 | |||

| Registration fees - Builder Class | 14,112 | |||

| Registration fees - Premier Class | 6,972 | |||

| Registration and filing fees - Common | 6,640 | |||

| Custody and bank service fees | 18,006 | |||

| Pricing fees | 15,080 | |||

| Insurance expense | 12,753 | |||

| Other expenses | 14,567 | |||

| TOTAL EXPENSES | 822,589 | |||

| NET INVESTMENT INCOME | 1,425,618 | |||

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS (NOTES 2 AND 3) | ||||

| Net realized gains from investment transactions | 2,777 | |||

| Change in unrealized appreciation/depreciation on investments | 187,728 | |||

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | 190,505 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 1,616,123 | ||

See accompanying notes to financial statements.

14

THE EMPIRE BUILDER TAX FREE BOND FUND STATEMENTS OF CHANGES IN NET ASSETS |

Year Ended February 28, 2013 | Year Ended February 29, 2012 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 1,425,618 | $ | 1,664,387 | ||||

| Net realized gains from investment transactions | 2,777 | 1,040 | ||||||

| Change in unrealized appreciation/depreciation on investments | 187,728 | 1,648,624 | ||||||

| Net increase in net assets resulting from operations | 1,616,123 | 3,314,051 | ||||||

| FROM DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From net investment income, Builder Class | (631,954 | ) | (751,035 | ) | ||||

| From net investment income, Premier Class | (791,700 | ) | (911,527 | ) | ||||

| Decrease in net assets from distributions to shareholders | (1,423,654 | ) | (1,662,562 | ) | ||||

| FROM CAPITAL SHARE TRANSACTIONS | ||||||||

| BUILDER CLASS | ||||||||

| Proceeds from shares sold | 1,302,637 | 747,284 | ||||||

| Reinvestment of distributions to shareholders | 589,201 | 698,312 | ||||||

| Payments for shares redeemed | (3,421,706 | ) | (2,737,742 | ) | ||||

| Net decrease in net assets from Builder Class capital share transactions | (1,529,868 | ) | (1,292,146 | ) | ||||

| PREMIER CLASS | ||||||||

| Proceeds from shares sold | 2,175,808 | 1,196,847 | ||||||

| Reinvestment of distributions to shareholders | 628,035 | 755,894 | ||||||

| Payments for shares redeemed | (6,619,130 | ) | (2,546,330 | ) | ||||

| Net decrease in net assets from Premier Class capital share transactions | (3,815,287 | ) | (593,589 | ) | ||||

| TOTAL DECREASE IN NET ASSETS | (5,152,686 | ) | (234,246 | ) | ||||

| NET ASSETS | ||||||||

| Beginning of year | 82,207,850 | 82,442,096 | ||||||

| End of year | $ | 77,055,164 | $ | 82,207,850 | ||||

| UNDISTRIBUTED NET INVESTMENT INCOME | $ | 15,620 | $ | 13,656 | ||||

| SUMMARY OF CAPITAL SHARE ACTIVITY | ||||||||

| BUILDER CLASS | ||||||||

| Shares sold | 73,177 | 42,593 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 33,112 | 39,755 | ||||||

| Shares redeemed | (192,285 | ) | (155,956 | ) | ||||

| Net decrease in shares outstanding | (85,996 | ) | (73,608 | ) | ||||

| Shares outstanding, beginning of year | 2,119,012 | 2,192,620 | ||||||

| Shares outstanding, end of year | 2,033,016 | 2,119,012 | ||||||

| PREMIER CLASS | ||||||||

| Shares sold | 122,530 | 67,723 | ||||||

| Shares issued in reinvestment of distributions to shareholders | 35,291 | 43,034 | ||||||

| Shares redeemed | (372,040 | ) | (145,060 | ) | ||||

| Net decrease in shares outstanding | (214,219 | ) | (34,303 | ) | ||||

| Shares outstanding, beginning of year | 2,511,056 | 2,545,359 | ||||||

| Shares outstanding, end of year | 2,296,837 | 2,511,056 | ||||||

See accompanying notes to financial statements.

15

THE EMPIRE BUILDER TAX FREE BOND FUND - BUILDER CLASS FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

Year Ended February 28, 2013 | Year Ended February 29, 2012 | Year Ended February 28, 2011 | Year Ended February 28, 2010 | Year Ended February 28, 2009 | ||||||||||||||||

| Net asset value at beginning of year | $ | 17.75 | $ | 17.40 | $ | 17.60 | $ | 17.34 | $ | 16.97 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income | 0.31 | 0.35 | 0.37 | 0.40 | 0.47 | |||||||||||||||

Net realized and unrealized gains (losses) on investments | 0.05 | 0.35 | (0.17 | ) | 0.28 | 0.37 | ||||||||||||||

| Total from investment operations | 0.36 | 0.70 | 0.20 | 0.68 | 0.84 | |||||||||||||||

| Less distributions: | ||||||||||||||||||||

| Dividends from net investment income | (0.31 | ) | (0.35 | ) | (0.37 | ) | (0.40 | ) | (0.47 | ) | ||||||||||

| Distributions from net realized capital gains | — | — | (0.03 | ) | (0.02 | ) | — | |||||||||||||

| Total distributions | (0.31 | ) | (0.35 | ) | (0.40 | ) | (0.42 | ) | (0.47 | ) | ||||||||||

| Net asset value at end of year | $ | 17.80 | $ | 17.75 | $ | 17.40 | $ | 17.60 | $ | 17.34 | ||||||||||

Total return (a) | 2.01% | 4.05% | 1.08% | 3.97% | 5.01% | |||||||||||||||

| Ratios/Supplementary Data: | ||||||||||||||||||||

| Net assets at end of year (in 000s) | $ | 36,178 | $ | 37,622 | $ | 38,151 | $ | 39,993 | $ | 40,250 | ||||||||||

Ratio of net investment income to average net assets | 1.71% | 1.99% | 2.07% | 2.28% | 2.74% | |||||||||||||||

Ratio of expenses to average net assets (b) | 1.06% | 1.07% | 1.16% | 1.41% | 1.31% | |||||||||||||||

Portfolio turnover rate (c) | 28% | 19% | 25% | 18% | 75% | |||||||||||||||

| (a) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Ratio as disclosed reflects the impact of custody fee credits earned by the Fund on cash balances. Had the custody fee credits not been included, the impact would have been to increase the ratios by 0.00% and 0.03% for the fiscal years ended February 2010 and 2009, respectively (Note 2). There was no impact to such ratio for the fiscal years ended February 2013, 2012 and 2011. |

| (c) | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

See accompanying notes to financial statements.

16

THE EMPIRE BUILDER TAX FREE BOND FUND - PREMIER CLASS FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

Year Ended February 28, 2013 | Year Ended February 29, 2012 | Year Ended February 28, 2011 | Year Ended February 28, 2010 | Year Ended February 28, 2009 | ||||||||||||||||

| Net asset value at beginning of year | $ | 17.76 | $ | 17.40 | $ | 17.60 | $ | 17.34 | $ | 16.97 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income | 0.32 | 0.36 | 0.39 | 0.43 | 0.50 | |||||||||||||||

Net realized and unrealized gains (losses) on investments | 0.04 | 0.36 | (0.17 | ) | 0.28 | 0.37 | ||||||||||||||

| Total from investment operations | 0.36 | 0.72 | 0.22 | 0.71 | 0.87 | |||||||||||||||

| Less distributions: | ||||||||||||||||||||

| Dividends from net investment income | (0.32 | ) | (0.36 | ) | (0.39 | ) | (0.43 | ) | (0.50 | ) | ||||||||||

| Distributions from net realized capital gains | — | — | (0.03 | ) | (0.02 | ) | — | |||||||||||||

| Total distributions | (0.32 | ) | (0.36 | ) | (0.42 | ) | (0.45 | ) | (0.50 | ) | ||||||||||

| Net asset value at end of year | $ | 17.80 | $ | 17.76 | $ | 17.40 | $ | 17.60 | $ | 17.34 | ||||||||||

Total return (a) | 2.04% | 4.21% | 1.19% | 4.18% | 5.19% | |||||||||||||||

| Ratios/Supplementary Data: | ||||||||||||||||||||

| Net assets at end of year (in 000s) | $ | 40,877 | $ | 44,586 | $ | 44,292 | $ | 45,513 | $ | 46,032 | ||||||||||

Ratio of net investment income to average net assets | 1.79% | 2.08% | 2.17% | 2.48% | 2.90% | |||||||||||||||

Ratio of expenses to average net assets (b) | 0.98% | 0.98% | 1.06% | 1.21% | 1.15% | |||||||||||||||

Portfolio turnover rate (c) | 28% | 19% | 25% | 18% | 75% | |||||||||||||||

| (a) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Ratio as disclosed reflects the impact of custody fee credits earned by the Fund on cash balances. Had the custody fee credits not been included, the impact would have been to increase the ratios by 0.00% and 0.03% for the fiscal years ended February 2010 and 2009, respectively (Note 2). There was no impact to such ratio for the fiscal years ended February 2013, 2012 and 2011. |

| (c) | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

See accompanying notes to financial statements.

17

THE EMPIRE BUILDER TAX FREE BOND FUND NOTES TO FINANCIAL STATEMENTS February 28, 2013 |

1. Organization

The Empire Builder Tax Free Bond Fund (the “Fund”) was established as a Massachusetts business trust by an Agreement and Declaration of Trust dated September 30, 1983. The Fund is registered under the Investment Company Act of 1940 (the “1940 Act”) as an open-end, non-diversified investment company. The Fund seeks as high a level of current income exempt from federal income tax and New York State and City personal income taxes as the Adviser believes to be consistent with the preservation of capital.

The Fund has an unlimited number of shares authorized with no par value. The Fund’s two classes of shares, Builder Class and Premier Class, represent interests in the same portfolio of investments and have the same rights, but differ primarily in expenses to which they are subject and required investment minimums. Premier Class shares bear lower transfer agency costs as a percentage of average net assets (Note 4) and require a $20,000 initial investment, whereas Builder Class shares require a $1,000 initial investment. Each class of shares has exclusive voting rights with respect to matters affecting only that class.

At the close of business on March 8, 2013, the Neuberger Berman New York Municipal Income Fund acquired all the assets and assumed all the liabilities of the Fund (Note 7). The disclosure in the financial statements relates to the period ended February 28, 2013 and does not contemplate the changes that occurred after the fiscal year end.

2. Significant Accounting Policies

The following is a summary of significant accounting policies.

Securities Valuation – Tax-exempt securities are generally valued using prices provided by an independent pricing service approved by the Fund’s Board of Trustees (the “Board”). The independent pricing service uses information with respect to transactions in bonds, quotations from bond dealers, market transactions in comparable securities and various relationships between securities in determining these prices. The methods used by the independent pricing service and the quality of valuations so established are reviewed by Glickenhaus & Co. (the “Adviser”), under the general supervision of the Board.

Securities for which quotations are not readily available are stated at fair value using procedures approved by the Board and will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Short-term debt securities having remaining maturities of sixty days or less are valued at amortized cost, which approximates market value. Investments in registered investment companies are reported at their respective net asset values as reported by those companies.

Accounting principles generally accepted in the United States (“GAAP”) establish a single authoritative definition of fair value, set out a framework for measuring fair value and require additional disclosures about fair value measurements.

18

THE EMPIRE BUILDER TAX FREE BOND FUND NOTES TO FINANCIAL STATEMENTS (Continued) February 28, 2013 |

Various inputs are used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs |

| • | Level 3 – significant unobservable inputs |

Municipal securities are valued using various inputs, including benchmark yields, reported trades, broker dealer quotes, issuer spreads, benchmark securities, bids, offers, reference data and industry and market events and are typically classified as Level 2. The inputs or methodology used are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of February 28, 2013:

Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Municipal Securities | $ | — | $ | 69,320,881 | $ | — | $ | 69,320,881 | ||||||||

As of February 28, 2013, the Fund did not have any transfers in and out of any Level. The Fund did not have derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of February 28, 2013. It is the Fund’s policy to recognize transfers into and out of any Level at the end of the reporting period.

Share Valuation – The net asset value per share of each class of shares of the Fund is calculated as of the close of trading on the New York Stock Exchange (the “Exchange”) (normally 4:00 p.m., Eastern Time) on each day that the Exchange is open for business. The net asset value per share of each class of shares of the Fund is calculated by dividing the total value of the Fund’s assets attributable to that class, minus liabilities attributable to that class, by the number of shares of that class outstanding. The offering price and redemption price per share is equal to the net asset value per share.

Securities Transactions and Investment Income – Security transactions are accounted for on trade date. Cost of securities sold is determined on a specific identification basis. Dividend income is recorded on the ex-dividend date. Interest income, which includes amortization of premium and accretion of discounts, is accrued as earned.

19

THE EMPIRE BUILDER TAX FREE BOND FUND NOTES TO FINANCIAL STATEMENTS (Continued) February 28, 2013 |

Distributions and Dividends – Distributions to shareholders from net investment income are declared daily and paid monthly. The Fund also distributes at least annually substantially all net capital gains, if any, realized from portfolio transactions.

The amounts of distributions from net investment income and net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., reclass of market discounts, gain/loss, paydowns, and distributions), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment. Temporary differences do not require reclassification.

Allocation Between Classes – Investment income earned, realized capital gains and losses, and unrealized appreciation and depreciation are allocated daily to each class of shares based upon its proportionate share of total net assets of the Fund. Class specific expenses are charged directly to the class incurring the expense. Common expenses which are not attributable to a specific class are allocated daily to each class of shares based upon its proportionate share of total net assets of the Fund.

Custody Fee Credits – Prior to August 2, 2010, the Fund received a reduction of its custody fees and expenses for interest earned on any uninvested cash balances maintained with its custodian. Had the custody fee credits not been included, the impact would have been to increase the ratios by 0.00% and 0.03% for the fiscal years ended February 2010 and 2009, respectively. There was no effect on net investment income for the fiscal years ended February 2013, 2012 and 2011. The Fund could have invested such cash balances in an income-producing asset if it had not agreed to a reduction of fees or expenses under the expense offset arrangement with the custodian.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the Fund’s financial statements and the reported amounts of income and expenses during the reporting period. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ from these estimated amounts.

Taxes – It is the Fund’s policy to comply with the special provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. As provided therein, in any fiscal year in which the Fund so qualifies and distributes at least 90% of its taxable net income, the Fund (but not the shareholders) will be relieved of federal income tax on the income distributed. Accordingly, no provision for income taxes has been made.

20

THE EMPIRE BUILDER TAX FREE BOND FUND NOTES TO FINANCIAL STATEMENTS (Continued) February 28, 2013 |

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

Contingencies and Commitments – Under the Fund’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

3. Investment Transactions

During the year ended February 28, 2013, cost of purchases and proceeds from sales and maturities of investment securities, excluding short-term investments, amounted to $21,433,531 and $24,959,250, respectively.

4. Transactions with Affiliates

INVESTMENT ADVISORY AGREEMENT

The Fund retains the Adviser to act as investment adviser pursuant to an Investment Advisory Agreement. As compensation for its advisory services, the Adviser receives a fee, accrued daily and paid monthly, at an annual rate of 0.40% of the first $100 million of average daily net assets and 0.3333% of such assets in excess of $100 million.

The Adviser has agreed to a reduction of its advisory fees to the extent that the Fund’s total expenses, including the advisory fees, exceed 1.50% per annum of the Fund’s average daily net assets. For the year ended February 28, 2013, there was no reduction of advisory fees pursuant to this agreement.

MUTUAL FUND SERVICES AGREEMENTS

Under the terms of an Administration Agreement with the Fund, Ultimus Fund Solutions, LLC (“Ultimus”) supervises the preparation of reports to shareholders, reports to and filings with the Securities and Exchange Commission (the “SEC”) and state securities commissions, tax returns, and materials for meetings of the Board. For the performance of these administrative services, the Fund pays Ultimus a fee at the annual rate of 0.10% of the average value of its daily net assets up to $250 million, 0.075% of such assets from $250 million to $500 million and 0.05% of such assets in excess of $500 million, provided, however, that the minimum fee is $5,000 per month.

21

THE EMPIRE BUILDER TAX FREE BOND FUND NOTES TO FINANCIAL STATEMENTS (Continued) February 28, 2013 |

Under the terms of a Transfer Agent and Shareholder Services Agreement with the Fund, Ultimus serves as transfer agent and shareholder services agent for the Fund. Ultimus maintains the records of each shareholder’s account, answers shareholders’ inquiries concerning their accounts, processes purchases and redemptions of the Fund’s shares, acts as dividend and distribution disbursing agent and performs other shareholder service functions. For these services, Ultimus receives a fee, payable monthly, at an annual rate of $20 per shareholder account, subject to a minimum fee of $1,500 per month for each Class of shares. In addition, the Fund pays out-of-pocket expenses, including, but not limited to, postage and supplies. The transfer agent fees associated with each Class are allocated to that Class. As the transfer agent fee is a specified dollar amount for each shareholder account and the average size of Premier Class accounts is higher than for Builder Class accounts, the Premier Class bears lower transfer agent fees as a percentage of net assets.

Under the terms of a Fund Accounting Agreement with the Fund, Ultimus provides the Fund with accounting and pricing services. For calculating daily net asset value per share and maintaining such books and records as are necessary to enable Ultimus to perform its duties, the Fund pays Ultimus a base fee of $3,000 per month, plus an asset-based fee at the annual rate of 0.01% of the average value of its daily net assets up to $500 million and 0.005% of such assets in excess of $500 million. In addition, the Fund pays all costs of external pricing services.

COMPLIANCE CONSULTING AGREEMENT

Under the terms of a Compliance Consulting Agreement between the Fund and Ultimus (the “Compliance Agreement”), Ultimus makes available an individual to serve as the Fund’s Chief Compliance Officer (“CCO”). Under the Compliance Agreement, Ultimus also provides infrastructure and support in implementing the written policies and procedures comprising the Fund’s compliance program, including supporting services to the CCO. As compensation for the services rendered under the Compliance Agreement, Ultimus receives a monthly fee of $3,000.

OFFICERS AND TRUSTEES

Certain officers and Trustees of the Fund are affiliated with the Adviser or Ultimus. Except as disclosed above in connection with the Compliance Agreement, such officers and Trustees receive no compensation from the Fund for serving in their respective roles. Each of the four non-interested Trustees who serve on the Fund’s Board are paid a retainer of $2,600 per quarter and an additional $900 fee for each Board meeting attended, plus reimbursement for certain expenses. The non-interested Trustees who serve on committees of the Board receive an additional fee of $750 for attendance at each committee meeting held on a day other than a regular quarterly Board meeting. Prior to March 6, 2012, the quarterly retainer paid to each Trustee was $2,100.

22

THE EMPIRE BUILDER TAX FREE BOND FUND NOTES TO FINANCIAL STATEMENTS (Continued) February 28, 2013 |

5. Tax Matters

The tax character of dividends paid to shareholders during the years ended February 28, 2013 and February 29, 2012 were as follows:

Year Ended | Tax Exempt Distributions | Total Distributions Paid | ||||||

| February 28, 2013 | $ | 1,423,654 | $ | 1,423,654 | ||||

| February 29, 2012 | $ | 1,662,562 | $ | 1,662,562 | ||||

The following information is computed on a tax basis for each item as of February 28, 2013:

| Cost of portfolio investments | $ | 65,505,626 | ||

| Gross unrealized appreciation | $ | 3,826,888 | ||

| Gross unrealized depreciation | (11,633 | ) | ||

| Net unrealized appreciation | 3,815,255 | |||

| Undistributed tax-exempt income | 25,158 | |||

| Short-term capital loss carryforwards | (28,934 | ) | ||

| Dividends payable | (13,250 | ) | ||

| Total distributable earnings | $ | 3,798,229 |

The difference between the federal income tax cost of portfolio investments and the financial statement cost is primarily due to differing methods in the amortization of market discount on fixed income securities.

The differences between book basis and tax basis distributable earnings are primarily due to timing differences of distribution payments and differing methods in the amortization of market discount on fixed income securities.

During the year ended February 28, 2013, the Fund utilized capital loss carryforwards of $2,777 to offset current year realized gains.

As of February 28, 2013, the Fund had short-term capital loss carryforwards for federal tax purposes of $28,934 which may be carried forward indefinitely. These capital loss carryforwards are available to offset realized capital gains in future years, thereby reducing future taxable gains distributions.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the positions are “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions taken on Federal income tax returns for all open tax years (February 28, 2010 through February 28, 2013) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

23

THE EMPIRE BUILDER TAX FREE BOND FUND NOTES TO FINANCIAL STATEMENTS (Continued) February 28, 2013 |

6. Concentration of Credit Risk

The Fund invests primarily in debt instruments of municipal issuers in New York State. The issuers’ abilities to meet their obligations may be affected by economic developments in New York State or its region, as well as recent disruptions in the credit markets and the economy, generally. The issuers of municipal securities, including issuers of New York Tax Exempt Bonds, have been under stress relating to recent disruptions in the credit markets and the economy generally. These disruptions could have a significant negative effect on an issuer’s ability to make payments of principal and/or interest.

7. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and, except as disclosed in the following paragraph, has noted no such events.

On February 22, 2013, shareholders of the Fund approved the proposed reorganization of the Fund into the Neuberger Berman New York Municipal Income Fund (“New Fund”), a newly created fund that was organized in connection with the reorganization and advised by Neuberger Berman Management LLC. The reorganization was completed on March 8, 2013. Under the terms of the Agreement and Plan of Reorganization and Termination, the New Fund acquired all the assets and assumed all the liabilities of the Fund, and shareholders of the Fund received Institutional Class shares of the New Fund with a total value equal to the net asset value of the Fund as of the close of business March 8, 2013. The New Fund Institutional Class shares were distributed pro rata to shareholders of the Fund in exchange for their Fund shares. This transaction was a tax-free event for federal income tax purposes. The New Fund has a fiscal year end of October 31.

24

THE EMPIRE BUILDER TAX FREE BOND FUND REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Trustees and Shareholders

Empire Builder Tax Free Bond Fund

We have audited the accompanying statement of assets and liabilities of the Empire Builder Tax Free Bond Fund (the “Fund”), including the schedule of investments, as of February 28, 2013, and the related statement of operations, the statement of changes in net assets, and the financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The statement of changes in net assets for the year ended February 29, 2012 and the financial highlights for each of the four years in the period then ended were audited by other auditors, whose report dated April 16, 2012 expressed an unqualified opinion on such statements and financial highlights.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of February 28, 2013, by correspondence with the custodian. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Empire Builder Tax Free Bond Fund, as of February 28, 2013, and the results of its operations, the changes in its net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

|

Philadelphia, Pennsylvania

April 12, 2013

25

THE EMPIRE BUILDER TAX FREE BOND FUND ABOUT YOUR FUND’S EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including exchange fees; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (September 1, 2012 – February 28, 2013).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual Fund Return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% Return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other mutual funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge a sales load or redemption fee.

The calculations assume no shares were bought, sold or exchanged during the period. Your actual costs may have been higher or lower, depending on the amount of your investment, any exchanges and the timing of any purchases or redemptions.

More information about the Fund’s expenses, including historical expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

26

THE EMPIRE BUILDER TAX FREE BOND FUND ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued) |

Beginning Account Value September 1, 2012 | Ending Account Value February 28, 2013 | Expenses Paid During Period* | |

Builder Class | |||

| Based on Actual Fund Return | $1,000.00 | $1,007.90 | $5.28 |

| Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,019.54 | $5.31 |

Premier Class | |||

| Based on Actual Fund Return | $1,000.00 | $1,007.70 | $4.88 |

| Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,019.93 | $4.91 |

| * | Expenses are equal to the Class’s annualized expense ratios for the period as stated below, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| Builder Class | 1.06% |

| Premier Class | 0.98% |

27

THE EMPIRE BUILDER TAX FREE BOND FUND BOARD OF TRUSTEES AND EXECUTIVE OFFICERS as of February 28, 2013 (Unaudited) |

The Trustees of the Fund are responsible under the terms of its Amended and Restated Agreement and Declaration of Trust, which is governed by Massachusetts law, for overseeing the conduct of the Fund’s business. The following tables show information concerning the Trustees and principal officers of the Fund, including their principal occupations for at least the past five years.

Name, Address, and Age | Position(s) Held with Fund | Term of Office with Trust - Length of Time Served* | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee |

INDEPENDENT TRUSTEES | |||||

Edward Falkenberg 23 Oak Lane Scarsdale, NY 10583 Year of Birth: 1942 | Trustee | Since June 1989 | Principal, ACME Real Estate (1998 to present). | 1 | None |

Edward A. Kuczmarski Crowe Horwath LLP 488 Madison Avenue 3rd Floor New York, NY 10022 Year of Birth: 1949 | Trustee | Since April 1984 | Certified Public Accountant, Partner, Crowe Horwath LLP (formerly, Hays & Company LLP) (accounting firm) (1980 to present). | 1 | Director of New York Daily Tax-Free Income Fund, Inc., the ISI Fund Group, and 9 Funds within the Reich & Tang Complex |

Caroline E. Newell PACCDS 1010 Park Avenue New York, NY 10028 Year of Birth: 1942 | Trustee | Since April 1984 | Director, Park Ave. Christian Church Day School (2001 to present); Director, The American School in Switzerland (summer program) (1991 to present). | 1 | Director of New York Daily Tax-Free Income Fund, Inc. |

John P. Steines, Jr. NYU School of Law Room 430 40 Washington Square South New York, NY 10012 Year of Birth: 1948 | Trustee | Since August 1984 | Professor of Law, New York University School of Law (1978 to present); Counsel, Cooley LLP (law firm) (2004 to present). | 1 | Director of New York Daily Tax-Free Income Fund, Inc. |

INTERESTED TRUSTEE | |||||

Seth M. Glickenhaus** 546 Fifth Avenue 7th Floor New York, NY 10036 Year of Birth: 1914 | Trustee, Chairman of the Board and President | Since April 1984 | General Partner of Glickenhaus & Co. (1961 to present). | 1 | None |

| * | Each Trustee serves until (s)he resigns or is removed in accordance with the Fund’s Amended and Restated Agreement and Declaration of Trust. |

| ** | Designates an “interested person” of the Fund as that term is defined in Section 2(a)(19) of the 1940 Act. Mr. Glickenhaus is deemed to be an interested person because he is a general partner and controlling person of the Adviser. |

28

THE EMPIRE BUILDER TAX FREE BOND FUND BOARD OF TRUSTEES AND EXECUTIVE OFFICERS as of February 28, 2013 (Unaudited) (Continued) |

EXECUTIVE OFFICERS | |||

Name, Address, and Age | Position Held with Fund | Term of Office - Length of Time Served | Principal Occupation(s) During Past Five Years |

Michael J. Lynch Glickenhaus & Co. 546 Fifth Avenue 7th Floor New York, NY 10036 Year of Birth: 1962 | Senior Vice President | Indefinite, Since March 1997 | Director, Unit Trust Department of Glickenhaus & Co. (1997 to present). |

Robert G. Dorsey Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 Year of Birth: 1957 | Vice President | Indefinite, Since April 2010 | Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC (1999 to present). |

Frank L. Newbauer Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 Year of Birth: 1954 | Secretary Chief Compliance Officer | Indefinite, Since May 2011 Indefinite, Since March 2012 | Assistant Vice President of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC (2010 to present); Assistant Vice President of JPMorgan Chase Bank, N.A. (1999 to 2010). |

Mark J. Seger Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 Year of Birth: 1962 | Treasurer | Indefinite, Since April 2010 | Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC (1999 to present). |

Additional Information about the members of the Board of Trustees and executive officers is available in The Statement of Additional Information of the Fund, dated June 27, 2012 available without charge on the SEC’s website at http://www.sec.gov (File Nos. 002-86931 and 811-03907; filed on June 27, 2012; Accession Number 0001111830-12-000387). Effective as of the close of business on March 8, 2013, Neuberger Berman New York Municipal Income Fund (the “New Fund”) acquired all the assets and assumed all of the liabilities of the Fund. Information about the members of New Fund’s Board of Trustees and executive officers is available in the New Fund’s Statement of Additional Information dated, December 29, 2012 which is available upon request, without charge, by calling (800) 877-9700.

29

THE EMPIRE BUILDER TAX FREE BOND FUND RESULTS OF SPECIAL MEETING OF SHAREHOLDERS (Unaudited) |

On February 22, 2013, a Special Meeting of Shareholders of the Empire Builder Tax Free Bond Fund (the “Fund”), was held for the purpose of voting on the following Proposal:

To approve an Agreement and Plan of Reorganization and Termination (“Reorganization Plan”), between The Empire Builder Tax Free Bond Fund (“Empire Builder Fund”), and Neuberger Berman Income Funds, on behalf of its newly created series, Neuberger Berman New York Municipal Income Fund (“New Fund”), and the transactions contemplated thereby, including (a) the transfer of all the assets of Empire Builder Fund to, and the assumption of all the liabilities by, New Fund in exchange solely for Institutional Class shares of New Fund; (b) the distribution of those New Fund shares pro rata to shareholders of Empire Builder Fund; and (c) the termination of Empire Builder Fund. Approval of the Reorganization Plan includes approval of New Fund’s investment advisory contract with Neuberger Berman Management LLC, which will manage New Fund following the Reorganization.

The total number of shares of the Fund present in person or by proxy represented 59.33% of the shares entitled to vote at the Special Meeting.

The shareholders of the Fund voted to approve the Reorganization Plan. The votes cast with respect to the Reorganization Plan were as follows:

Number of Shares | ||

For | Against | Abstain |

| 2,365,559 | 145,867 | 157,328 |

30

THE EMPIRE BUILDER TAX FREE BOND FUND OTHER INFORMATION (Unaudited) |

Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. The filings are available free of charge, upon request, by calling 1-800-847-5886. Furthermore, you may obtain a copy of these filings on the SEC’s website at http://www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Proxy Voting Policies

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-800-847-5886, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free 1-800-847-5886, or on the SEC’s website at http://www.sec.gov.

Change in Independent Auditor

On March 5, 2013, PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) was replaced as independent auditor of the Fund, and Tait, Weller & Baker LLP (“Tait Weller”) was selected as the Fund’s new independent auditor. The Fund’s selection of Tait Weller as its independent auditor was recommended and approved by the Fund’s audit committee and was ratified by the Board of Trustees.

PricewaterhouseCoopers reports on the Fund’s financial statements for the prior two fiscal years did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During such fiscal years, and through the date of PricewaterhouseCoopers replacement, there were no disagreements between the Fund and PricewaterhouseCoopers on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of PricewaterhouseCoopers, would have caused it to make reference to the subject matter of the disagreements in connection with its reports on the financial statements for such years. Prior to March 5, 2013, Tait Weller was not contacted during the prior two fiscal years regarding the application of accounting principles to any particular financial matter.

31

At the close of business on March 8, 2013, the Neuberger Berman New York Municipal Income Fund (the “New Fund”) acquired all the assets and assumed all the liabilities of The Empire Builder Tax Free Bond Fund (the “Fund”) (the “Reorganization”), and shareholders of the Fund received New Fund shares in exchange for their Fund shares. Prior to that date, the New Fund had no operations. The financial information through March 8, 2013, for the Institutional Class of the New Fund is that of the Builder Class of the Fund, the predecessor to the New Fund for accounting purposes. The New Fund’s service providers are as follows:

Investment Adviser

Neuberger Berman Management LLC

605 Third Avenue

2nd Floor

New York, New York 10158

Custodian and Shareholder Servicing Agent

State Street Bank and Trust Company

2 Avenue de Lafayette

Boston, Massachusetts 02111

Legal Counsel

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

Independent Registered Public Accounting Firm

Tait, Weller & Baker LLP

1818 Market Street, Suite 2400

Philadelphia, Pennsylvania 19103

Customer Service

Neuberger Berman Funds

Boston Service Center

P.O. Box 8403

Boston, Massachusetts 02266

800.977.9700

| Item 2. | Code of Ethics. |

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 12(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

| Item 3. | Audit Committee Financial Expert. |

The registrant’s board of trustees has determined that the registrant has at least one audit committee financial expert serving on its audit committee. The name of the audit committee financial expert is Edward A. Kuczmarski. Mr. Kuczmarski is “independent” for purposes of this Item.

| Item 4. | Principal Accountant Fees and Services. |

The principal accountants for the audit of the registrant's annual financial statements were Tait, Weller & Baker LLP and PricewaterhouseCoopers LLP with respect to the registrant's fiscal years ended February 28, 2013 and February 29, 2012, respectively.

| (a) | Audit Fees. The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $23,500 and $37,800 with respect to the registrant’s fiscal years ended February 28, 2013 and February 29, 2012, respectively. |

| (b) | Audit-Related Fees. The aggregate fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item were $3,500 and $3,045 with respect to the registrant’s fiscal years ended February 28, 2013 and February 29, 2012, respectively. The services comprising these fees are the review of updates to the registrant’s registration statements. |

| (c) | Tax Fees. The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $0 and $10,475 with respect to the registrant’s fiscal years ended February 28, 2013 and February 29, 2012, respectively. The services comprising these fees are the preparation of the registrant’s federal income and excise tax returns. |

| (d) | All Other Fees. No fees were billed in either of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. |

| (e)(1) | The audit committee has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

| (e)(2) | None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Not applicable. |

| (g) | With respect to the fiscal years ended February 28, 2013 and February 29, 2012, aggregate non-audit fees of $0 and $10,475, respectively, were billed by the registrant’s principal accountant for services rendered to the registrant. No non-audit fees were billed in either of the last two fiscal years by the registrant’s principal accountant for services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant. |

| (h) | The principal accountant has not provided any non-audit services to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant. |