UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03870

Morgan Stanley Long Duration Government Opportunities Fund

(Exact Name of Registrant as Specified in Charter)

1585 Broadway, New York, New York 10036

(Address of Principal Executive Offices)

John H. Gernon

1585 Broadway, New York, New York 10036

(Name and Address of Agent for Services)

(212) 762-1886

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

June 30, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

(a)

TABLE OF CONTENTS

Morgan Stanley Long Duration Government Opportunities Fund

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Long Duration Government Opportunities Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $41 | 0.85% |

| Total Net Assets | $196,271,008 |

| # of Portfolio Holdings | 176 |

| Portfolio Turnover Rate | 285% |

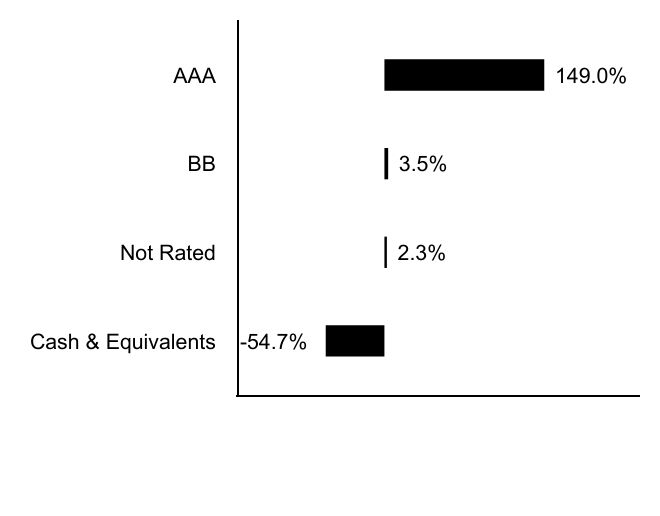

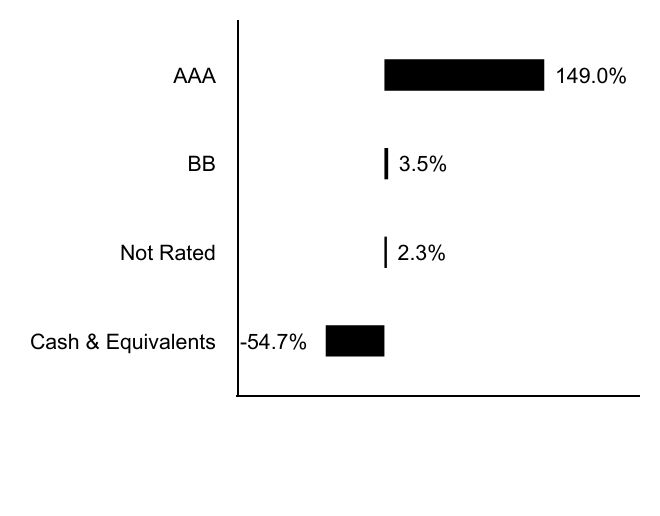

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Credit Quality (% of net assets)Footnote Reference*

| Value | Value |

|---|

| Cash & Equivalents | |

| Not Rated | 2.3% |

| BB | 3.5% |

| AAA | 149.0% |

| Footnote | Description |

Footnote* | Security ratings disclosed with the exception for those labeled “not rated” is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody’s Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization (“NRSRO”). |

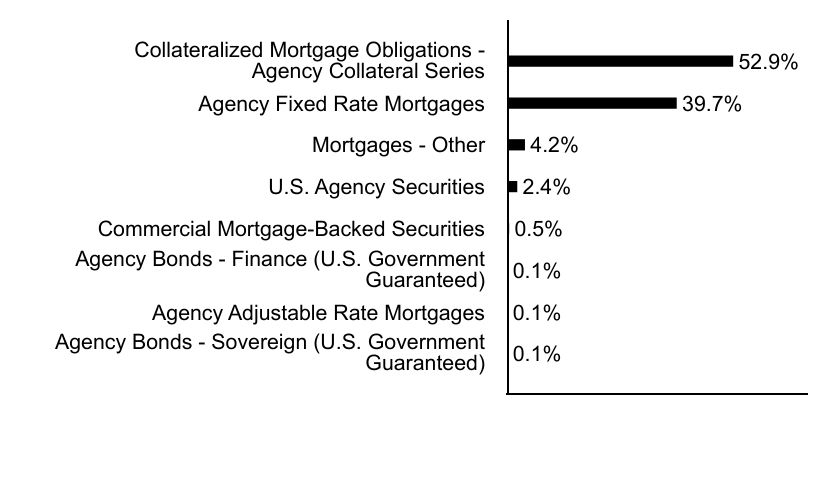

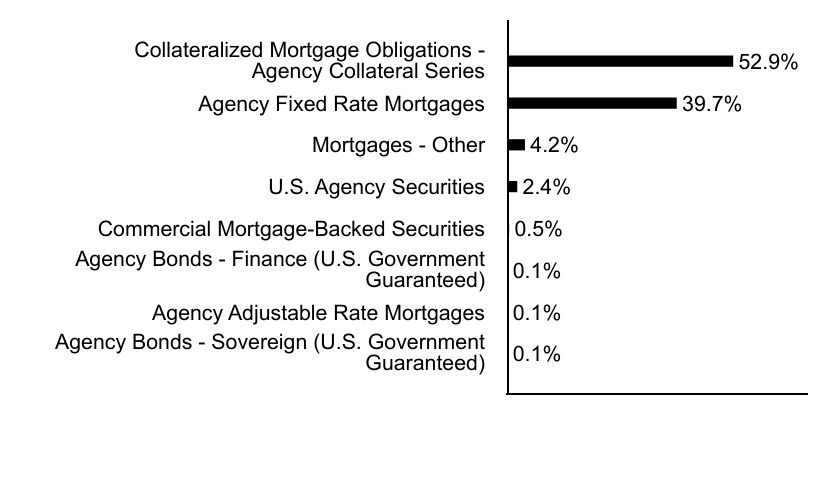

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Agency Bonds - Sovereign (U.S. Government Guaranteed) | 0.1% |

| Agency Adjustable Rate Mortgages | 0.1% |

| Agency Bonds - Finance (U.S. Government Guaranteed) | 0.1% |

| Commercial Mortgage-Backed Securities | 0.5% |

| U.S. Agency Securities | 2.4% |

| Mortgages - Other | 4.2% |

| Agency Fixed Rate Mortgages | 39.7% |

| Collateralized Mortgage Obligations - Agency Collateral Series | 52.9% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Long Duration Government Opportunities Fund

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Long Duration Government Opportunities Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $79 | 1.62% |

| Total Net Assets | $196,271,008 |

| # of Portfolio Holdings | 176 |

| Portfolio Turnover Rate | 285% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

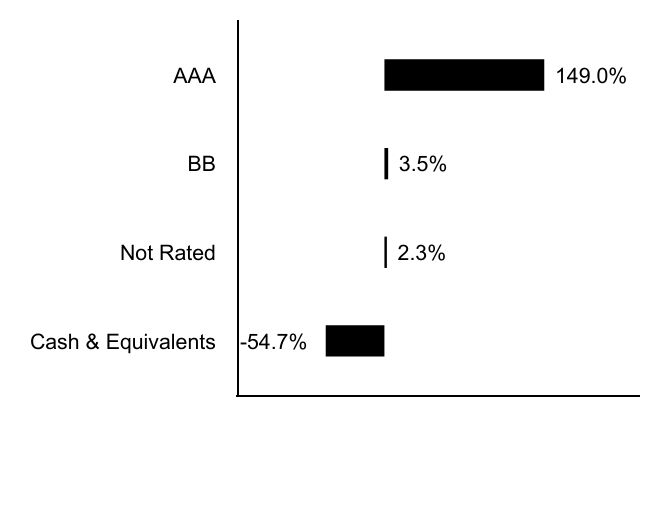

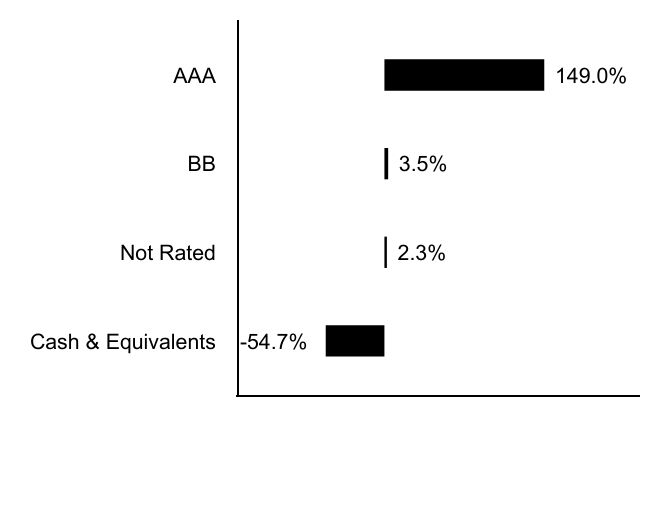

Credit Quality (% of net assets)Footnote Reference*

| Value | Value |

|---|

| Cash & Equivalents | |

| Not Rated | 2.3% |

| BB | 3.5% |

| AAA | 149.0% |

| Footnote | Description |

Footnote* | Security ratings disclosed with the exception for those labeled “not rated” is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody’s Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization (“NRSRO”). |

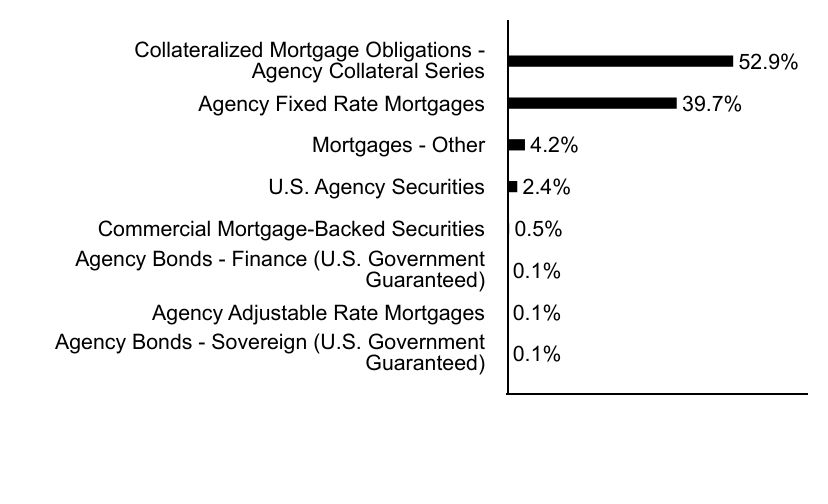

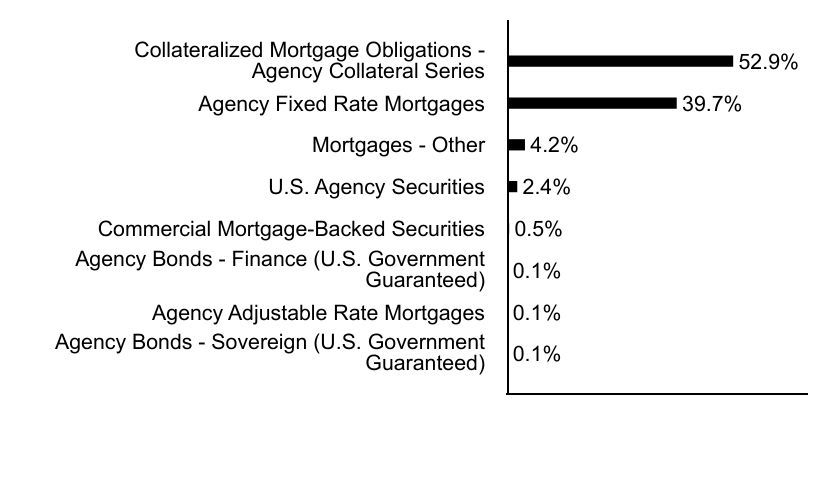

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Agency Bonds - Sovereign (U.S. Government Guaranteed) | 0.1% |

| Agency Adjustable Rate Mortgages | 0.1% |

| Agency Bonds - Finance (U.S. Government Guaranteed) | 0.1% |

| Commercial Mortgage-Backed Securities | 0.5% |

| U.S. Agency Securities | 2.4% |

| Mortgages - Other | 4.2% |

| Agency Fixed Rate Mortgages | 39.7% |

| Collateralized Mortgage Obligations - Agency Collateral Series | 52.9% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Long Duration Government Opportunities Fund

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Long Duration Government Opportunities Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $24 | 0.49% |

| Total Net Assets | $196,271,008 |

| # of Portfolio Holdings | 176 |

| Portfolio Turnover Rate | 285% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Credit Quality (% of net assets)Footnote Reference*

| Value | Value |

|---|

| Cash & Equivalents | |

| Not Rated | 2.3% |

| BB | 3.5% |

| AAA | 149.0% |

| Footnote | Description |

Footnote* | Security ratings disclosed with the exception for those labeled “not rated” is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody’s Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization (“NRSRO”). |

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Agency Bonds - Sovereign (U.S. Government Guaranteed) | 0.1% |

| Agency Adjustable Rate Mortgages | 0.1% |

| Agency Bonds - Finance (U.S. Government Guaranteed) | 0.1% |

| Commercial Mortgage-Backed Securities | 0.5% |

| U.S. Agency Securities | 2.4% |

| Mortgages - Other | 4.2% |

| Agency Fixed Rate Mortgages | 39.7% |

| Collateralized Mortgage Obligations - Agency Collateral Series | 52.9% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Long Duration Government Opportunities Fund

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Long Duration Government Opportunities Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class L | $55 | 1.12% |

| Total Net Assets | $196,271,008 |

| # of Portfolio Holdings | 176 |

| Portfolio Turnover Rate | 285% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Credit Quality (% of net assets)Footnote Reference*

| Value | Value |

|---|

| Cash & Equivalents | |

| Not Rated | 2.3% |

| BB | 3.5% |

| AAA | 149.0% |

| Footnote | Description |

Footnote* | Security ratings disclosed with the exception for those labeled “not rated” is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody’s Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization (“NRSRO”). |

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Agency Bonds - Sovereign (U.S. Government Guaranteed) | 0.1% |

| Agency Adjustable Rate Mortgages | 0.1% |

| Agency Bonds - Finance (U.S. Government Guaranteed) | 0.1% |

| Commercial Mortgage-Backed Securities | 0.5% |

| U.S. Agency Securities | 2.4% |

| Mortgages - Other | 4.2% |

| Agency Fixed Rate Mortgages | 39.7% |

| Collateralized Mortgage Obligations - Agency Collateral Series | 52.9% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

(b) Not applicable.

Item 2. Code of Ethics

Not required in this filing.

Item 3. Audit Committee Financial Expert

Not required in this filing.

Item 4. Principal Accountant Fees and Services

Not required in this filing.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

Morgan Stanley Long Duration Government Opportunities Fund

Semi-Annual Financial Statements and Additional Information

June 30, 2024

Morgan Stanley Long Duration Government Opportunities Fund

Table of Contents (unaudited)

2

Morgan Stanley Long Duration Government Opportunities Fund

Portfolio of Investments ◼ June 30, 2024 (unaudited)

PRINCIPAL

AMOUNT

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Agency Adjustable Rate Mortgages (0.1%) | | | |

| | | Federal Home Loan Mortgage Corporation,

Conventional Pools: | | | |

$ | 81 | | | 1 yr. RFUCC Treasury + 1.74% | | | 5.983 | % | | 11/01/36 | | $ | 82,781 | | |

| | 123 | | | 1 yr. RFUCC Treasury + 1.91% | | | 6.155 | | | 10/01/36 | | | 126,006 | | |

| | | | | Total Agency Adjustable Rate Mortgages (Cost $ 216,863) | | | | | | | 208,787 | | |

| | | Agency Bond - Finance (U.S. Government Guaranteed) (0.2%) | | | |

| | 461 | | | Washington Aircraft 1 Co. DAC (Ireland)

(Cost $461,351) | | | 2.637 | | | 09/15/26 | | | 446,295 | | |

| | | Agency Bond - Sovereign (U.S. Government Guaranteed) (0.2%) | | | |

| | 386 | | | Petroleos Mexicanos (Mexico)

(Cost $386,250) | | | 2.46 | | | 12/15/25 | | | 366,159 | | |

| | | Agency Fixed Rate Mortgages (61.4%) | | | |

| | | Federal Home Loan Mortgage Corporation,

Conventional Pools: | | | |

| | 80 | | | | | | | | 3.00 | | | 12/01/49 | | | 68,342 | | |

| | | Gold Pools: | | | |

| | 26 | | | | | | | | 3.50 | | | 04/01/49 | | | 23,056 | | |

| | 105 | | | | | | | | 6.50 | | | 03/01/29 - 09/01/32 | | | 107,475 | | |

| | 76 | | | | | | | | 7.50 | | | 05/01/35 | | | 79,291 | | |

| | 42 | | | | | | | | 8.00 | | | 08/01/32 | | | 43,775 | | |

| | 54 | | | | | | | | 8.50 | | | 08/01/31 | | | 56,976 | | |

| | | Federal National Mortgage Association,

Conventional Pools: | | | |

| | 305 | | | | | | | | 2.50 | | | 02/01/50 | | | 253,882 | | |

| | 329 | | | | | | | | 3.00 | | | 05/01/49 - 11/01/49 | | | 282,609 | | |

| | 247 | | | | | | | | 3.50 | | | 01/01/48 - 07/01/49 | | | 219,360 | | |

| | 152 | | | | | | | | 4.50 | | | 01/01/25 - 09/01/48 | | | 143,856 | | |

| | 33 | | | | | | | | 5.00 | | | 01/01/41 | | | 32,741 | | |

| | 86 | | | | | | | | 5.50 | | | 09/01/35 | | | 87,157 | | |

| | 14 | | | | | | | | 6.50 | | | 06/01/29 - 02/01/33 | | | 14,756 | | |

| | 1 | | | | | | | | 7.00 | | | 05/01/31 | | | 564 | | |

| | 120 | | | | | | | | 7.50 | | | 08/01/37 | | | 126,155 | | |

| | 89 | | | | | | | | 8.00 | | | 04/01/33 | | | 92,052 | | |

| | 104 | | | | | | | | 8.50 | | | 10/01/32 | | | 109,522 | | |

| | | July TBA: | | | |

| | 9,700 | | | (a) | | | 2.50 | | | 07/01/54 | | | 7,925,204 | | |

| | 17,850 | | | (a) | | | 3.00 | | | 07/01/54 | | | 15,194,821 | | |

See Notes to Financial Statements

3

Morgan Stanley Long Duration Government Opportunities Fund

Portfolio of Investments ◼ June 30, 2024 (unaudited) continued

PRINCIPAL

AMOUNT

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

$ | 11,500 | | | (a) | | | 3.50 | % | | 07/01/54 | | $ | 10,181,986 | | |

| | 9,800 | | | (a) | | | 4.00 | | | 07/01/54 | | | 8,968,532 | | |

| | 11,600 | | | (a) | | | 4.50 | | | 07/01/54 | | | 10,937,982 | | |

| | 22,550 | | | (a) | | | 5.00 | | | 07/01/54 | | | 21,796,858 | | |

| | 23,050 | | | (a) | | | 5.50 | | | 07/01/54 | | | 22,737,563 | | |

| | | Government National Mortgage Association,

July TBA: | | | |

| | 1,600 | | | (a) | | | 3.00 | | | 07/20/54 | | | 1,395,678 | | |

| | 1,100 | | | (a) | | | 3.50 | | | 07/20/54 | | | 989,005 | | |

| | 4,500 | | | (a) | | | 5.50 | | | 07/20/54 | | | 4,465,377 | | |

| | 6,000 | | | (a) | | | 6.00 | | | 07/20/54 | | | 6,026,720 | | |

| | | Various Pools: | | | |

| | 844 | | | | | | 3.50 | | | 08/20/45 - 07/20/46 | | | 769,465 | | |

| | 373 | | | | | | 4.00 | | | 07/15/44 | | | 352,943 | | |

| | 23 | | | | | | 4.50 | | | 04/20/49 | | | 22,121 | | |

| | 271 | | | | | | 5.00 | | | 01/20/40 - 12/20/48 | | | 270,048 | | |

| | 30 | | | | | | 5.125 | | | 11/20/37 | | | 30,143 | | |

| | 209 | | | | | | 5.25 | | | 04/20/36 - 09/20/39 | | | 209,310 | | |

| | 458 | | | | | | 5.375 | | | 02/20/36 - 08/20/40 | | | 461,166 | | |

| | 2,963 | | | | | | 5.50 | | | 06/20/53 | | | 2,950,575 | | |

| | 2,395 | | | | | | 6.00 | | | 06/15/28 - 06/20/53 | | | 2,423,623 | | |

| | 492 | | | | | | 6.50 | | | 06/20/53 | | | 507,139 | | |

| | 27 | | | | | | 7.00 | | | 03/20/26 - 07/20/29 | | | 27,493 | | |

| | 53 | | | | | | 8.00 | | | 05/15/26 - 08/15/31 | | | 55,542 | | |

| | 5 | | | | | | 8.50 | | | 07/15/30 | | | 5,160 | | |

| | — | @ | | | | | 9.00 | | | 02/15/25 | | | 188 | | |

| | | | | Total Agency Fixed Rate Mortgages (Cost $ 120,585,223) | | | | | | | 120,446,211 | | |

| | | Collateralized Mortgage Obligations - Agency Collateral Series (81.7%) | | | |

| | | Federal Home Loan Mortgage Corporation,

IO REMIC | | | |

| | 1,415 | | | 5.89% - SOFR30A | | | 0.553 | (b) | | 11/15/43 | | | 95,140 | | |

| | | REMIC | | | |

| | 20,953 | | | | | | 6.00 | | | 07/25/53 - 07/25/54 | | | 21,015,297 | | |

| | 4,164 | | | | | | 6.25 | | | 01/25/54 | | | 4,321,211 | | |

| | 2,610 | | | | | | 6.50 | | | 11/25/53 | | | 2,724,901 | | |

| | | Federal National Mortgage Association,

IO REMIC | | | |

| | 514 | | | 6.44% - SOFR30A | | | 1.10 | (b) | | 08/25/41 | | | 7,857 | | |

See Notes to Financial Statements

4

Morgan Stanley Long Duration Government Opportunities Fund

Portfolio of Investments ◼ June 30, 2024 (unaudited) continued

PRINCIPAL

AMOUNT

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | REMIC | | | |

$ | 2,268 | | | | | | | | 0.00 | (c) % | | 11/25/53 | | $ | 1,805,765 | | |

| | 7,098 | | | | | | | | 6.00 | | | 10/25/53 - 03/25/54 | | | 7,264,524 | | |

| | 4,526 | | | | | | | | 6.25 | | | 08/25/53 | | | 4,853,994 | | |

| | | Government National Mortgage Association,

IO REMIC | | | |

| | 202 | | | | | | | | 5.00 | | | 02/16/41 | | | 38,847 | | |

| | | | | REMIC | | | | | | | | | | | |

| | 2,258 | | | 22.55% - SOFR30A | | | 2.672 | (b) | | 07/20/53 | | | 2,232,365 | | |

| | 2,145 | | | 21.45% - SOFR30A | | | 5.451 | (b) | | 10/20/53 | | | 2,211,081 | | |

| | 100,190 | | | | | | | | 6.00 | | | 05/20/53 - 01/20/54 | | | 103,040,834 | | |

| | 10,103 | | | | | | | | 6.50 | | | 11/20/53 | | | 10,687,095 | | |

| | | | | Total Collateralized Mortgage Obligations - Agency Collateral Series

(Cost $ 159,016,478) | | | | | | | 160,298,911 | | |

| | | Commercial Mortgage-Backed Securities (0.7%) | | | |

| | 6,507 | | | BANK 2019-BNK21, IO | | | 0.956 | (d) | | 10/17/52 | | | 222,717 | | |

| | | Citigroup Commercial Mortgage Trust,

IO | | | |

| | 4,682 | | | | | | | | 0.856 | (d) | | 11/10/48 | | | 30,978 | | |

| | 12,406 | | | | | | | | 1.019 | (d) | | 09/10/58 | | | 107,264 | | |

| | | Federal Home Loan Mortgage Corp.

Multifamily Structured Pass-Through

Certificates,

IO | | | |

| | 24,088 | | | | | | | | 0.436 | (d) | | 04/25/32 | | | 545,444 | | |

| | 31,368 | | | | | | | | 0.451 | (d) | | 11/25/27 | | | 298,720 | | |

| | 12,853 | | | GS Mortgage Securities Trust, IO | | | 1.346 | (d) | | 10/10/48 | | | 167,594 | | |

| | 7,255 | | | JP Morgan Chase Commercial Mortgage

Securities Trust, IO | | | 0.706 | (d) | | 12/15/49 | | | 74,605 | | |

| | 659 | | | WFRBS Commercial Mortgage Trust, IO | | | 0.00 | (d) | | 08/15/46 | | | 1 | | |

| | | | | Total Commercial Mortgage-Backed Securities (Cost $1,467,807) | | | | | | | 1,447,323 | | |

| | | Mortgages - Other (6.5%) | | | |

| | | Cascade Funding Mortgage Trust | | | |

| | 945 | | | (e) | | | 2.973 | (d) | | 07/25/57 | | | 425,970 | | |

| | 345 | | | (e) | | | 4.00 | (d) | | 10/25/68 | | | 341,913 | | |

| | | FARM Mortgage Trust | | | |

| | 954 | | | (e) | | | 3.035 | (d) | | 03/25/52 | | | 680,653 | | |

| | 747 | | | (e) | | | 3.24 | (d) | | 07/25/51 | | | 538,013 | | |

See Notes to Financial Statements

5

Morgan Stanley Long Duration Government Opportunities Fund

Portfolio of Investments ◼ June 30, 2024 (unaudited) continued

PRINCIPAL

AMOUNT

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

$ | 1,974 | | | (e) | | | 5.122 | (d)% | | 10/01/53 | | $ | 1,607,509 | | |

| | 2,819 | | | | | | 3.00 | | | 08/25/57 - 05/25/60 | | | 2,429,674 | | |

| | | Flagstar Mortgage Trust | | | |

| | 4,133 | | | (e) | | | 3.486 | (d) | | 08/25/51 | | | 3,213,033 | | |

| | 1,893 | | | (e) | | | 3.507 | (d) | | 10/25/51 | | | 1,472,579 | | |

| | | GS Mortgage-Backed Securities Trust | | | |

| | 1,389 | | | (e) | | | 3.182 | (d) | | 01/25/53 | | | 814,053 | | |

| | 838 | | | (e) | | | 3.423 | (d) | | 10/25/50 | | | 492,282 | | |

| | 1,625 | | | Sequoia Mortgage Trust, Class B4 (e) | | | 2.864 | (d) | | 11/25/51 | | | 801,270 | | |

| | | | | Total Mortgages - Other (Cost $ 12,180,872) | | | | | | | 12,816,949 | | |

| | | U.S. Agency Security (3.7%) | | | |

| | 6,935 | | | Tennessee Valley Authority

(Cost $7,095,321) | | | 5.25 | | | 09/15/39 | | | 7,200,180 | | |

| | | | | Total Investments (Cost $ 301,410,165) (f)(g) | | | | | 154.5 | % | | | 303,230,815 | | |

| | | | | Liabilities in Excess of Other Assets | | | | | (54.5 | ) | | | (106,959,807 | ) | |

| | | | | Net Assets | | | | | 100.0 | % | | $ | 196,271,008 | | |

@ Principal amount is less than $500.

(a) Security is subject to delayed delivery.

(b) Inverse Floating Rate Security - Interest rate fluctuates with an inverse relationship to an associated interest rate. Indicated rate is the effective rate at June 30, 2024.

(c) Capital appreciation bond.

(d) Floating or variable rate securities: The rates disclosed are as of June 30, 2024. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. Certain variable rate securities may not be based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description in the Portfolio of Investments.

(e) 144A security - Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(f) Securities are available for collateral in connection with securities purchased on a forward commitment basis and open futures contracts.

(g) At June 30, 2024, the aggregate cost for federal income tax purposes approximates the aggregate cost for book purposes. The aggregate gross unrealized appreciation is $6,729,869 and the aggregate gross unrealized depreciation is $1,658,914, resulting in net unrealized appreciation of $5,070,955.

DAC Designated Activity Company.

IO Interest Only Security.

REMIC Real Estate Mortgage Investment Conduit.

RFUCC Refinitiv USD IBOR Consumer Cash Fallbacks.

SOFR30A 30-Day Average Secured Overnight Financing Rate.

TBA To Be Announced.

See Notes to Financial Statements

6

Morgan Stanley Long Duration Government Opportunities Fund

Portfolio of Investments ◼ June 30, 2024 (unaudited) continued

Futures Contracts:

The Fund had the following futures contracts open at June 30, 2024:

| | | NUMBER OF

CONTRACTS | | EXPIRATION

DATE | | NOTIONAL

AMOUNT

(000) | | VALUE | | UNREALIZED

APPRECIATION | |

Long: | |

U.S. Treasury 10 yr. Note (United States) | | | 954 | | | Sep-24 | | $ | 95,400 | | | $ | 104,925,094 | | | $ | 1,481,672 | | |

U.S. Treasury 10 yr. Ultra Note (United States) | | | 773 | | | Sep-24 | | | 77,300 | | | | 87,759,656 | | | | 1,334,632 | | |

U.S. Treasury 5 yr. Note (United States) | | | 434 | | | Sep-24 | | | 43,400 | | | | 46,254,906 | | | | 434,001 | | |

| | | | | | | | | | | $ | 3,250,305 | | |

Portfolio Composition

| CLASSIFICATION | | PERCENTAGE OF

TOTAL

INVESTMENTS | |

Collateralized Mortgage Obligations — Agency Collateral Series | | | 52.9 | % | |

Agency Fixed Rate Mortgages | | | 39.7 | | |

Mortgages — Other | | | 4.2 | | |

U.S. Agency Security | | | 2.4 | | |

Commercial Mortgage-Backed Securities | | | 0.5 | | |

Agency Bond — Finance (U.S. Government Guaranteed) | | | 0.1 | | |

Agency Bond — Sovereign (U.S. Government Guaranteed) | | | 0.1 | | |

Agency Adjustable Rate Mortgages | | | 0.1 | | |

Total | | | 100.0 | %* | |

* Does not include open futures contracts with a value of $238,939,656 and total unrealized appreciation of $3,250,305.

See Notes to Financial Statements

7

Morgan Stanley Long Duration Government Opportunities Fund

Financial Statements

Statement of Assets and Liabilities June 30, 2024 (unaudited)

Assets: | |

Investments in securities, at value (cost $301,410,165) | | $ | 303,230,815 | | |

Receivable for: | |

Investments sold | | | 22,230,557 | | |

Variation margin on open futures contracts | | | 4,254,939 | | |

Interest | | | 1,013,457 | | |

Shares of beneficial interest sold | | | 134,584 | | |

Dividends from affiliate | | | 30,058 | | |

Prepaid expenses and other assets | | | 116,702 | | |

Total Assets | | | 331,011,112 | | |

Liabilities: | |

Due to broker | | | 913,000 | | |

Payable to Bank | | | 635,491 | | |

Payable for: | |

Investments purchased | | | 132,464,434 | | |

Shares of beneficial interest redeemed | | | 262,186 | | |

Dividends to shareholders | | | 107,710 | | |

Transfer and sub transfer agency fees | | | 64,006 | | |

Distribution fee | | | 60,753 | | |

Trustees' fees | | | 46,599 | | |

Advisory fee | | | 22,749 | | |

Administration fee | | | 12,139 | | |

Accrued expenses and other payables | | | 151,037 | | |

Total Liabilities | | | 134,740,104 | | |

Net Assets | | $ | 196,271,008 | | |

Composition of Net Assets: | |

Paid-in-Capital | | $ | 244,356,030 | | |

Total Accumulated Loss | | | (48,085,022 | ) | |

Net Assets | | $ | 196,271,008 | | |

Class A Shares: | |

Net Assets | | $ | 150,145,501 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 22,080,786 | | |

Net Asset Value Per Share | | $ | 6.80 | | |

Maximum Offering Price Per Share,

(net asset value plus 3.36% of net asset value) | | $ | 7.03 | | |

Class L Shares: | |

Net Assets | | $ | 2,992,771 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 436,664 | | |

Net Asset Value Per Share | | $ | 6.85 | | |

Class I Shares: | |

Net Assets | | $ | 41,250,031 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 6,063,034 | | |

Net Asset Value Per Share | | $ | 6.80 | | |

Class C Shares: | |

Net Assets | | $ | 1,882,705 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 274,704 | | |

Net Asset Value Per Share | | $ | 6.85 | | |

See Notes to Financial Statements

8

Morgan Stanley Long Duration Government Opportunities Fund

Financial Statements continued

Statement of Operations For the six months ended June 30, 2024 (unaudited)

Net Investment Income:

Income | |

Interest | | $ | 6,210,015 | | |

Dividends from affiliate (Note 9) | | | 79,287 | | |

Total Income | | | 6,289,302 | | |

Expenses | |

Advisory fee (Note 4) | | | 412,618 | | |

Distribution fee (Class A) (Note 5) | | | 189,195 | | |

Distribution fee (Class L) (Note 5) | | | 7,565 | | |

Distribution fee (Class C) (Note 5) | | | 10,027 | | |

Professional fees | | | 92,275 | | |

Administration fee (Note 4) | | | 78,594 | | |

Transfer agency fees and expenses (Class A) (Note 7) | | | 61,314 | | |

Transfer agency fees and expenses (Class L) (Note 7) | | | 1,659 | | |

Transfer agency fees and expenses (Class I) (Note 7) | | | 7,332 | | |

Transfer agency fees and expenses (Class C) (Note 7) | | | 1,332 | | |

Sub transfer agency fees and expenses (Class A) | | | 52,909 | | |

Sub transfer agency fees and expenses (Class L) | | | 1,157 | | |

Sub transfer agency fees and expenses (Class I) | | | 16,203 | | |

Sub transfer agency fees and expenses (Class C) | | | 1,059 | | |

Registration fees | | | 25,119 | | |

Shareholder reports and notices | | | 21,781 | | |

Custodian fees (Note 6) | | | 15,201 | | |

Trustees' fees and expenses | | | 4,060 | | |

Other | | | 28,257 | | |

Total Expenses | | | 1,027,657 | | |

Less: waiver of Advisory fees (Note 4) | | | (196,517 | ) | |

Less: reimbursement of class specific expenses (Class A) (Note 4) | | | (31,153 | ) | |

Less: reimbursement of class specific expenses (Class L) (Note 4) | | | (794 | ) | |

Less: reimbursement of class specific expenses (Class I) (Note 4) | | | (23,451 | ) | |

Less: reimbursement of class specific expenses (Class C) (Note 4) | | | (1,051 | ) | |

Less: rebate from Morgan Stanley affiliated cash sweep (Note 9) | | | (2,421 | ) | |

Net Expenses | | | 772,270 | | |

Net Investment Income | | | 5,517,032 | | |

Realized and Unrealized Gain (Loss):

Realized Loss on: | |

Investments | | | (2,050,207 | ) | |

Futures contracts | | | (4,078,645 | ) | |

Net Realized Loss | | | (6,128,852 | ) | |

Change in Unrealized Appreciation (Depreciation) on: | |

Investments | | | (6,096,945 | ) | |

Futures contracts | | | (4,523,179 | ) | |

Net Change in Unrealized Appreciation (Depreciation) | | | (10,620,124 | ) | |

Net Loss | | | (16,748,976 | ) | |

Net Decrease in Net Assets Resulting from Operations | | $ | (11,231,944 | ) | |

See Notes to Financial Statements

9

Morgan Stanley Long Duration Government Opportunities Fund

Financial Statements continued

Statements of Changes in Net Assets

| | | FOR THE SIX

MONTHS ENDED

JUNE 30, 2024 | | FOR THE YEAR

ENDED

DECEMBER 31, 2023 | |

| | | (unaudited) | | | |

Increase (Decrease) in Net Assets:

Operations: | |

Net investment income | | $ | 5,517,032 | | | $ | 9,566,975 | | |

Net realized loss | | | (6,128,852 | ) | | | (25,835,622 | ) | |

Net change in unrealized appreciation (depreciation) | | | (10,620,124 | ) | | | 26,980,593 | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | (11,231,944 | ) | | | 10,711,946 | | |

Dividends and Distributions to Shareholders from: | |

Class A | | | (3,760,463 | ) | | | (7,016,356 | ) | |

Class L | | | (70,494 | ) | | | (132,121 | ) | |

Class I | | | (1,064,614 | ) | | | (1,613,255 | ) | |

Class C | | | (41,749 | ) | | | (109,203 | ) | |

Total Dividends and Distributions to Shareholders | | | (4,937,320 | ) | | | (8,870,935 | ) | |

Net increase (decrease) from transactions in shares of beneficial interest | | | 1,488,866 | | | | (30,656,413 | ) | |

Net Decrease | | | (14,680,398 | ) | | | (28,815,402 | ) | |

Net Assets: | |

Beginning of period | | | 210,951,406 | | | | 239,766,808 | | |

End of Period | | $ | 196,271,008 | | | $ | 210,951,406 | | |

See Notes to Financial Statements

10

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited)

1. Organization and Accounting Policies

Morgan Stanley Long Duration Government Opportunities Fund (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "Act"), as a diversified, open-end management investment company. The Fund's investment objective is to seek a high level of current income consistent with safety of principal. The Fund was organized as a Massachusetts business trust on September 29, 1983 and commenced operations on June 29, 1984. On July 28, 1997, the Fund converted to a multiple class share structure.

The Fund applies investment company accounting and reporting guidance Accounting Standards Codification ("ASC") Topic 946. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the Fund's Statement of Assets and Liabilities through the date that the financial statements were issued.

The Fund has issued Class A shares, Class L shares, Class I shares and Class C shares. Class C shares will automatically convert to Class A shares eight years after the end of the calendar month in which the shares were purchased. The four classes are substantially the same except that most Class A shares are subject to a sales charge imposed at the time of purchase and some Class A shares and most Class C shares are subject to a contingent deferred sales charge imposed on shares redeemed within one year. Class L shares and Class I shares are not subject to a sales charge. Additionally, Class A shares, Class L shares and Class C shares incur distribution expenses.

The Fund suspended offering Class L shares to all investors (April 30, 2015). Class L shareholders of the Fund do not have the option of purchasing additional Class L shares. However, the existing Class L shareholders may invest through reinvestment of dividends and distributions. In addition, Class L shares of the Fund may be exchanged for Class L shares of any Morgan Stanley Multi-Class Fund, even though Class L shares are closed to investors.

The following is a summary of significant accounting policies:

A. Valuation of Investments — (1) Fixed income securities may be valued by an outside pricing service/vendor approved by the Fund's Board of Trustees (the "Trustees"). The pricing service/vendor may employ a pricing model that takes into account, among other things, bids, yield spreads and/or other market data and specific security characteristics. If Morgan Stanley Investment Management Inc. (the "Adviser"), a wholly-owned subsidiary of Morgan Stanley, determines that the price provided by the outside pricing service/vendor does not reflect the security's fair value or is unable to provide a price, prices from reputable brokers/dealers may also be utilized. In these circumstances, the value of the security will be the mean of bid and asked prices obtained from reputable brokers/dealers; (2) portfolio securities for which over-the-counter ("OTC") market quotations are readily available are valued at its latest reported sales price (or at the market official closing price if such market reports an official

11

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

closing price), and if there was no trading in the security on a given day and if there is no official closing price from relevant markets for that day, the security is valued at the mean between the last reported bid and asked prices if such bid and asked prices are available on the relevant markets; (3) when market quotations are not readily available, as defined by Rule 2a-5 under the Act, including circumstances under which the Adviser determines that the market quotations are not reflective of a security's market value, portfolio securities are valued at their fair value as determined in good faith under procedures approved by and under the general supervision of the Trustees. Each business day, the Fund uses a third-party pricing service approved by the Trustees to assist with the valuation of foreign equity securities. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities to more accurately reflect their fair value as of the close of regular trading on the NYSE; (4) futures are valued at the settlement price on the exchange on which they trade or, if a settlement price is unavailable, at the last sale price on the exchange; and (5) investments in mutual funds, including the Morgan Stanley Institutional Liquidity Funds, are valued at the net asset value ("NAV") as of the close of each business day.

In connection with Rule 2a-5 of the Act, the Trustees have designated the Fund's Adviser as its valuation designee. The valuation designee has responsibility for determining fair value and to make the actual calculations pursuant to the fair valuation methodologies previously approved by the Trustees. Under procedures approved by the Trustees, the Fund's Adviser, as valuation designee, has formed a Valuation Committee whose members are approved by the Trustees. The Valuation Committee provides administration and oversight of the Fund's valuation policies and procedures, which are reviewed at least annually by the Trustees. These procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

B. Accounting for Investments — Security transactions are accounted for on the trade date (date the order to buy or sell is executed). Realized gains and losses on security transactions are determined by the identified cost method. Dividend income and other distributions are recorded on the ex-dividend date. Discounts are accreted and premiums are amortized over the life of the respective securities and are included in interest income. Interest income is accrued daily as earned.

C. Multiple Class Allocations — Investment income, realized and unrealized gain (loss) and non-class specific expenses are allocated daily based upon the proportion of net assets of each class. Class specific expenses are borne by the respective share classes and include distribution, transfer agency, co-transfer agency and sub transfer agency fees.

12

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

D. Dividends and Distributions to Shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends from net investment income, if any, are declared daily and paid monthly. Net realized capital gains, if any, are distributed at least annually.

E. When-Issued/Delayed Delivery Securities — The Fund may purchase or sell when-issued and delayed delivery securities. Securities purchased on a when-issued or delayed delivery basis are purchased for delivery beyond the normal settlement date at a stated price, and no income accrues to the Fund on such securities prior to delivery date. Payment and delivery for when-issued and delayed delivery securities can take place a month or more after the date of the transaction. When the Fund enters into a purchase transaction on a when-issued or delayed delivery basis, securities are available for collateral in an amount at least equal in value to the Fund's commitments to purchase such securities. Purchasing securities on a when-issued or delayed delivery basis may involve a risk that the market price at the time of delivery may be lower than the agreed upon purchase price, in which case there could be an unrealized loss at the time of delivery. Purchasing investments on a when-issued or delayed delivery basis may be considered a form of leverage which may increase the impact that gains (losses) may have on the Fund.

F. Use of Estimates — The preparation of financial statements in accordance with generally accepted accounting principles in the United States ("GAAP") requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates.

G. Indemnifications — The Fund enters into contracts that contain a variety of indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

2. Fair Valuation Measurements

Financial Accounting Standards Board ("FASB") ASC 820, "Fair Value Measurement" ("ASC 820"), defines fair value as the price that would be received to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 establishes a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions market participants would use in valuing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs); and (2) inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in valuing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in

13

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

determining the value of the Fund's investments. The inputs are summarized in the three broad levels listed below:

• Level 1 — unadjusted quoted prices in active markets for identical investments

• Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 — significant unobservable inputs including the Fund's own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer's financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities and the determination of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to each security.

The following is a summary of the inputs used to value the Fund's investments as of June 30, 2024:

INVESTMENT TYPE | | LEVEL 1

UNADJUSTED

QUOTED

PRICES | | LEVEL 2

OTHER

SIGNIFICANT

OBSERVABLE

INPUTS | | LEVEL 3

SIGNIFICANT

UNOBSERVABLE

INPUTS | | TOTAL | |

Assets: | |

Fixed Income Securities | |

Agency Adjustable Rate Mortgages | | $ | — | | | $ | 208,787 | | | $ | — | | | $ | 208,787 | | |

Agency Bond — Finance

(U.S. Government Guaranteed) | | | — | | | | 446,295 | | | | — | | | | 446,295 | | |

Agency Bond — Sovereign

(U.S. Government Guaranteed) | | | — | | | | 366,159 | | | | — | | | | 366,159 | | |

Agency Fixed Rate Mortgages | | | — | | | | 120,446,211 | | | | — | | | | 120,446,211 | | |

Collateralized Mortgage Obligations —

Agency Collateral Series | | | — | | | | 160,298,911 | | | | — | | | | 160,298,911 | | |

Commercial Mortgage-Backed Securities | | | — | | | | 1,447,323 | | | | — | | | | 1,447,323 | | |

Mortgages — Other | | | — | | | | 12,816,949 | | | | — | | | | 12,816,949 | | |

U.S. Agency Security | | | — | | | | 7,200,180 | | | | — | | | | 7,200,180 | | |

Total Fixed Income Securities | | | — | | | | 303,230,815 | | | | — | | | | 303,230,815 | | |

Futures Contracts | | | 3,250,305 | | | | — | | | | — | | | | 3,250,305 | | |

Total Assets | | $ | 3,250,305 | | | $ | 303,230,815 | | | $ | — | | | $ | 306,481,120 | | |

14

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment's valuation changes.

3. Derivatives

The Fund may, but it is not required to, use derivative instruments for a variety of purposes, including hedging, risk management, portfolio management or to earn income. Derivatives are financial instruments whose value is based, in part, on the value of an underlying asset, interest rate, index or financial instrument. Prevailing interest rates and volatility levels, among other things, also affect the value of derivative instruments. A derivative instrument often has risks similar to its underlying asset and may have additional risks, including imperfect correlation between the value of the derivative and the underlying asset, risks of default by the counterparty to certain transactions, magnification of losses incurred due to changes in the market value of the securities, instruments, indices or interest rates to which the derivative instrument relates, risks that the transactions may not be liquid, risks arising from margin and payment requirements, risks arising from mispricing or valuation complexity and operational and legal risks. The use of derivatives involves risks that are different from, and possibly greater than, the risks associated with other portfolio investments. Derivatives may involve the use of highly specialized instruments that require investment techniques and risk analyses different from those associated with other portfolio investments. All of the Fund's holdings, including derivative instruments, are marked-to-market each day with the change in value reflected in unrealized appreciation (depreciation). Upon disposition, a realized gain or loss is recognized.

Certain derivative transactions may give rise to a form of leverage. Leverage magnifies the potential for gain and risk of loss. Leverage associated with derivative transactions may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or may cause the Fund to be more volatile than if the Fund had not been leveraged. Although the Adviser seeks to use derivatives to further the Fund's investment objectives, there is no assurance that the use of derivatives will achieve this result.

Following is a description of the derivative instruments and techniques that the Fund used during the period and their associated risks:

Futures — A futures contract is a standardized, exchange-traded agreement to buy or sell a specific quantity of an underlying asset, reference rate or index at a specific price at a specific future time. The value of a futures contract tends to increase and decrease in tandem with the value of the underlying instrument. Depending on the terms of the particular contract, futures contracts are settled through either physical delivery of the underlying instrument on the settlement date or by payment of a cash settlement amount on the settlement date. During the period the futures contract is open, payments are received from or made to the broker based upon changes in the value of the contract (the variation

15

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

margin). A decision as to whether, when and how to use futures contracts involves the exercise of skill and judgment and even a well-conceived futures transaction may be unsuccessful because of market behavior or unexpected events. In addition to the derivatives risks discussed above, the prices of futures contracts can be highly volatile, using futures contracts can lower total return and the potential loss from futures contracts can exceed the Fund's initial investment in such contracts. No assurance can be given that a liquid market will exist for any particular futures contract at any particular time.

FASB ASC 815, "Derivatives and Hedging" ("ASC 815"), is intended to improve financial reporting about derivative instruments by requiring enhanced disclosures to enable investors to better understand how and why the Fund uses derivative instruments, how these derivative instruments are accounted for and their effects on the Fund's financial position and results of operations.

The following table sets forth the fair value of the Fund's derivative contracts by primary risk exposure as of June 30, 2024:

PRIMARY RISK EXPOSURE | | ASSET DERIVATIVES

STATEMENT OF ASSETS

AND LIABILITIES LOCATION | | FAIR VALUE | | LIABILITY DERIVATIVES

STATEMENT OF ASSETS

AND LIABILITIES LOCATION | | FAIR VALUE | |

Interest Rate Risk | | Variation margin on open

futures contracts | | $ | 3,250,305 | (a) | | Variation margin on open

futures contracts | | $ | — | | |

(a) Includes cumulative appreciation (depreciation) as reported in the Portfolio of Investments. Only current day's net variation margin is reported within the Statement of Assets and Liabilities.

The following tables set forth by primary risk exposure the Fund's realized gains (losses) and change in unrealized appreciation (depreciation) by type of derivative contract for the six months ended June 30, 2024 in accordance with ASC 815:

AMOUNT OF REALIZED GAIN (LOSS) ON DERIVATIVES

PRIMARY RISK EXPOSURE | | FUTURES

CONTRACTS | |

Interest Rate Risk | | $ | (4,078,645 | ) | |

CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) ON DERIVATIVES

PRIMARY RISK EXPOSURE | | FUTURES

CONTRACTS | |

Interest Rate Risk | | $ | (4,523,179 | ) | |

16

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

For the six months ended June 30, 2024, the average monthly amount outstanding for each derivative type is as follows:

Futures Contracts: | |

Average monthly notional value | | $ | 163,111,823 | | |

4. Advisory/Administration Agreements

Pursuant to an Investment Advisory Agreement with the Adviser, the Fund pays an advisory fee, accrued daily and paid monthly, by applying the following annual rates to the net assets of the Fund determined as of the close of each business day: 0.42% of the portion of the daily net assets not exceeding $1 billion; 0.395% of the portion of the daily net assets exceeding $1 billion but not exceeding $1.5 billion; 0.37% of the portion of the daily net assets exceeding $1.5 billion but not exceeding $2 billion; 0.345% of the portion of the daily net assets exceeding $2 billion but not exceeding $2.5 billion; 0.32% of the portion of the daily net assets exceeding $2.5 billion but not exceeding $5 billion; 0.295% of the portion of the daily net assets exceeding $5 billion but not exceeding $7.5 billion; 0.27% of the portion of the daily net assets exceeding $7.5 billion but not exceeding $10 billion; 0.245% of the portion of the daily net assets exceeding $10 billion but not exceeding $12.5 billion; and 0.22% of the portion of the daily net assets exceeding $12.5 billion. For the six months ended June 30, 2024, the advisory fee rate (net of waiver/rebate) was equivalent to an annual effective rate of 0.22% of the Fund's average daily net assets.

The Adviser also serves as the Administrator to the Fund and provides administrative services pursuant to an Administration Agreement for an annual fee, accrued daily and paid monthly, of 0.08% of the Fund's average daily net assets.

Under a Sub-Administration Agreement between the Administrator and State Street Bank and Trust Company ("State Street"), State Street provides certain administrative services to the Fund. For such services, the Administrator pays State Street a portion of the fee the Administrator receives from the Fund.

The Adviser/Administrator has agreed to reduce its advisory fee, its administration fee and/or reimburse the Fund so that total annual operating expenses, excluding certain investment related expenses, taxes, interest and other extraordinary expenses (including litigation), will not exceed 0.85% for Class A, 1.12% for Class L, 0.49% for Class I and 1.62% for Class C shares. The fee waivers and/or expense reimbursements will continue for at least one year from the date of the Fund's prospectus or until such time that the Trustees act to discontinue all or a portion of such waivers and/or expense reimbursements when they deem such action is appropriate. For the six months ended June 30, 2024, $196,517 of advisory fees were waived and $56,449 of other expenses were reimbursed by the Adviser pursuant to this arrangement.

17

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

5. Plan of Distribution

Shares of the Fund are distributed by Morgan Stanley Distribution, Inc. (the "Distributor"), an affiliate of the Adviser/Administrator. The Fund has adopted a Plan of Distribution (the "Plan") pursuant to Rule 12b-1 under the Act. The Plan provides that the Fund will pay the Distributor a fee which is accrued daily and paid monthly at the following annual rates: (i) Class A — up to 0.25% of the average daily net assets of Class A shares; (ii) Class L — up to 0.50% of the average daily net assets of Class L shares; and (iii) Class C — up to 1.00% of the average daily net assets of Class C shares.

In the case of Class A shares, Class L shares and Class C shares, expenses incurred pursuant to the Plan in any calendar year in excess of 0.25%, 0.50% and 1.00% of the average daily net assets of Class A shares, Class L shares and Class C shares, respectively, will not be reimbursed by the Fund through payments in any subsequent year, except that expenses representing a gross sales commission credited to Financial Intermediaries at the time of sale may be reimbursed in the subsequent calendar year. The Distributor has advised the Fund that there were no unreimbursed expenses representing a gross sales commission credited to Financial Intermediaries in the case of Class A, Class L, or Class C at June 30, 2024. For the six months ended June 30, 2024, the distribution fee was accrued for Class A shares, Class L shares and Class C shares at the annual rate of 0.25%, 0.50% and 1.00%, respectively.

The Distributor has informed the Fund that for the six months ended June 30, 2024, it received contingent deferred sales charges from certain redemptions of the Fund's Class A shares of $6,646 and received $17,397 in front-end sales charges from sales of the Fund's Class A shares. The respective shareholders pay such charges, which are not an expense of the Fund.

6. Custodian Fees

State Street (the "Custodian") also serves as Custodian for the Fund in accordance with a Custodian Agreement. The Custodian holds cash, securities and other assets of the Fund as required by the Act. Custody fees are payable monthly based on assets held in custody, investment purchases and sales activity and account maintenance fees, plus reimbursement for certain out-of-pocket expenses.

7. Dividend Disbursing and Transfer/Co-Transfer Agent

The Fund's dividend disbursing and transfer agent is SS&C Global Investor & Distribution Solutions, Inc. ("SS&C GIDS"). Pursuant to a Transfer Agency Agreement, the Fund pays SS&C GIDS a fee based on the number of classes, accounts and transactions relating to the Fund.

18

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

Eaton Vance Management ("EVM"), an affiliate of Morgan Stanley, provides co-transfer agency and related services to the Fund pursuant to a Co-Transfer Agency Services Agreement. For the six months ended June 30, 2024, co-transfer agency fees and expenses incurred to EVM, included in "Transfer agency fees and expenses" in the Statement of Operations, amounted to $10,372.

8. Shares of Beneficial Interest

Transactions in shares of beneficial interest, including direct exchanges pursuant to share class conversions for all periods presented, were as follows:

| | | FOR THE SIX

MONTHS ENDED

JUNE 30, 2024 | | FOR THE YEAR

ENDED

DECEMBER 31, 2023 | |

| | | (unaudited) | | | |

| | | SHARES | | AMOUNT | | SHARES | | AMOUNT | |

CLASS A SHARES | |

Sold | | | 733,419 | | | $ | 5,029,902 | | | | 667,729 | | | $ | 4,764,805 | | |

Reinvestment of dividends and distributions | | | 532,123 | | | | 3,551,897 | | | | 976,198 | | | | 6,782,808 | | |

Redeemed | | | (2,114,476 | ) | | | (14,292,920 | ) | | | (5,005,589 | ) | | | (34,894,505 | ) | |

Net decrease — Class A | | | (848,934 | ) | | | (5,711,121 | ) | | | (3,361,662 | ) | | | (23,346,892 | ) | |

CLASS L SHARES | |

Sold | | | — | | | | — | | | | 4 | | | | 19 | | |

Reinvestment of dividends and distributions | | | 10,127 | | | | 68,131 | | | | 18,633 | | | | 130,641 | | |

Redeemed | | | (26,372 | ) | | | (177,085 | ) | | | (114,173 | ) | | | (816,163 | ) | |

Net decrease — Class L | | | (16,245 | ) | | | (108,954 | ) | | | (95,536 | ) | | | (685,503 | ) | |

CLASS I SHARES | |

Sold | | | 2,719,359 | | | | 18,965,578 | | | | 901,371 | | | | 6,223,658 | | |

Reinvestment of dividends and distributions | | | 153,229 | | | | 1,024,498 | | | | 227,111 | | | | 1,581,075 | | |

Redeemed | | | (1,809,148 | ) | | | (12,264,940 | ) | | | (1,710,025 | ) | | | (12,036,762 | ) | |

Net increase (decrease) — Class I | | | 1,063,440 | | | | 7,725,136 | | | | (581,543 | ) | | | (4,232,029 | ) | |

CLASS C SHARES | |

Sold | | | 16,993 | | | | 116,753 | | | | 14,552 | | | | 108,034 | | |

Reinvestment of dividends and distributions | | | 6,068 | | | | 40,885 | | | | 15,528 | | | | 109,148 | | |

Redeemed | | | (83,080 | ) | | | (573,833 | ) | | | (365,599 | ) | | | (2,609,171 | ) | |

Net decrease — Class C | | | (60,019 | ) | | | (416,195 | ) | | | (335,519 | ) | | | (2,391,989 | ) | |

Net increase (decrease) in Fund | | | 138,242 | | | $ | 1,488,866 | | | | (4,374,260 | ) | | $ | (30,656,413 | ) | |

9. Security Transactions and Transactions with Affiliates

The cost of purchases and proceeds from sales of investment securities, excluding short-term investments, for the six months ended June 30, 2024, aggregated $851,817,600 and $835,805,692,

19

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

respectively. Included in the aforementioned are purchases and sales of U.S. Government securities of $850,213,442 and $832,052,611, respectively.

The Fund invests in the Institutional Class of the Morgan Stanley Institutional Liquidity Funds — Government Portfolio (the "Liquidity Fund"), an open-end management investment company managed by the Adviser. Advisory fees paid by the Fund are reduced by an amount equal to its pro-rata share of the advisory and administration fees paid by the Fund due to its investment in the Liquidity Fund. For the six months ended June 30, 2024, advisory fees paid were reduced by $2,421 relating to the Fund's investment in the Liquidity Fund.

A summary of the Fund's transactions in shares of affiliated investments during the six months ended June 30, 2024 is as follows:

AFFILIATED

INVESTMENT

COMPANY | | VALUE

DECEMBER 31,

2023 | | PURCHASES

AT COST | | PROCEEDS

FROM SALES | | DIVIDEND

INCOME | | REALIZED

GAIN (LOSS) | | CHANGE IN

UNREALIZED

APPRECIATION

(DEPRECIATION) | | VALUE

JUNE 30,

2024 | |

Liquidity Fund | | $ | 9,605,050 | | | $ | 77,836,085 | | | $ | 87,441,135 | | | $ | 79,287 | | | $ | — | | | $ | — | | | $ | — | | |

Each Trustee receives an annual retainer fee for serving as a Trustee of the Morgan Stanley Funds. The aggregate compensation paid to each Trustee is paid by the Morgan Stanley Funds, and is allocated on a pro rata basis among each of the operational funds of the Morgan Stanley Funds based on the relative net assets of each of the funds. The Fund also reimburses such Trustees for travel and other out-of-pocket expenses incurred by them in connection with attending such meetings.

The Fund has an unfunded noncontributory defined benefit pension plan covering certain independent Trustees of the Fund who will have served as independent Trustees for at least five years at the time of retirement. Benefits under this plan are based on factors which include years of service and compensation. The Trustees voted to close the plan to new participants and eliminate the future benefits growth due to increases to compensation after July 31, 2003. Aggregate pension costs for the six months ended June 30, 2024, included in "Trustees' fees and expenses" in the Statement of Operations amounted to $1,412. At June 30, 2024 the Fund had an accrued pension liability of $46,599, which is reflected as "Trustees' fees" in the Statement of Assets and Liabilities.

The Fund has an unfunded Deferred Compensation Plan (the "Compensation Plan"), which allows each independent Trustee to defer payment of all, or a portion, of the fees he or she receives for serving on the Board of Trustees. Each eligible Trustee generally may elect to have the deferred amounts credited with a return equal to the total return on one or more of the Morgan Stanley funds that are offered as investment options under the Compensation Plan. Appreciation/depreciation and distributions received

20

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

from these investments are recorded with an offsetting increase/decrease in the deferred compensation obligation and do not affect the NAV of the Fund.

10. Federal Income Tax Status

It is the Fund's intention to continue to qualify as a regulated investment company and distribute all of its taxable and tax-exempt income. Accordingly, no provision for federal income taxes is required in the financial statements.

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued based on net investment income, net realized gains and net unrealized appreciation as such income and/or gains are earned. Taxes may also be based on transactions in foreign currency and are accrued based on the value of investments denominated in such currency.

FASB ASC 740-10, "Income Taxes — Overall", sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. Management has concluded there are no significant uncertain tax positions that would require recognition in the financial statements. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in "Interest Expense" and penalties in "Other Expenses" in the Statement of Operations. The Fund files tax returns with the U.S. Internal Revenue Service, New York and various states. Generally, each of the tax years in the four-year period ended December 31, 2023 remains subject to examination by taxing authorities.

The tax character of distributions paid may differ from the character of distributions shown for GAAP purposes due to short-term capital gains being treated as ordinary income for tax purposes. The tax character of distributions paid during fiscal years 2023 and 2022 was as follows:

| 2023 DISTRIBUTIONS PAID FROM: | | 2022 DISTRIBUTIONS PAID FROM: | |

ORDINARY

INCOME | | ORDINARY

INCOME | |

| $ | 8,870,935 | | | $ | 7,424,647 | | |

The amount and character of income and gains to be distributed are determined in accordance with income tax regulations which may differ from GAAP. These book/tax differences are either considered temporary or permanent in nature.

Temporary differences are attributable to differing book and tax treatments for the timing of the recognition of gains (losses) on certain investment transactions and the timing of the deductibility of certain expenses.

21

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

Permanent differences, due to a nondeductible expense, resulted in the following reclassifications among the components of net assets at December 31, 2023:

TOTAL

ACCUMULATED

LOSS | | PAID-IN

CAPITAL | |

| $ | 493 | | | $ | (493 | ) | |

At December 31, 2023, the components of distributable earnings for the Fund on a tax basis were as follows:

UNDISTRIBUTED

ORDINARY

INCOME | | UNDISTRIBUTED

LONG-TERM

CAPITAL GAIN | |

| $ | 3,016,471 | | | $ | — | | |

At December 31, 2023, the Fund had available for federal income tax purposes unused short-term and long-term capital losses of $14,483,523 and $28,030,322, respectively, that do not have an expiration date.

To the extent that capital loss carryforwards are used to offset any future capital gains realized, no capital gains tax liability will be incurred by the Fund for gains realized and not distributed. To the extent that capital gains are offset, such gains will not be distributed to the shareholders.

11. Market Risk and Risks Relating to Certain Financial Instruments

The Fund may invest in mortgage securities, including securities issued by the Federal National Mortgage Association ("FNMA") and Federal Home Loan Mortgage Corporation ("FHLMC"). These are fixed income securities that derive their value from or represent interests in a pool of mortgages or mortgage securities. An unexpectedly high rate of defaults on the mortgages held by a mortgage pool may adversely affect the value of a mortgage-backed security and could result in losses to the Fund. The risk of such defaults is generally higher in the case of mortgage pools that include sub-prime mortgages. Sub-prime mortgages refer to loans made to borrowers with weakened credit histories or with a lower capacity to make timely payments on their mortgages. The securities held by the Fund are not backed by sub-prime mortgages.

Additionally, securities issued by FNMA and FHLMC are not backed by or entitled to the full faith and credit of the United States; rather, they are supported by the right of the issuer to borrow from the U.S. Department of the Treasury.

22

Morgan Stanley Long Duration Government Opportunities Fund

Notes to Financial Statements ◼ June 30, 2024 (unaudited) continued

The Federal Housing Finance Agency ("FHFA") serves as conservator of FNMA and FHLMC and the U.S. Department of the Treasury has agreed to provide capital as needed to ensure FNMA and FHLMC continue to provide liquidity to the housing and mortgage markets.

The value of an investment in the Fund is based on the values of the Fund's investments, which change due to economic and other events that affect markets generally, as well as those that affect particular regions, countries, industries, companies or governments. The risks associated with these developments may be magnified if certain social, political, economic and other conditions and events adversely interrupt the global economy and financial markets. Securities in the Fund's portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters and extreme weather events, health emergencies (such as epidemics and pandemics), terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, health emergencies, social and political (including geopolitical) discord and tensions or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. The occurrence of such events may be sudden and unexpected, and it is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects (which may last for extended periods). Any such event(s) could have a significant adverse impact on the value, liquidity and risk profile of the Fund's portfolio, as well as its ability to sell securities and/or meet redemptions. Any such event(s) or similar types of factors and developments may also adversely affect the financial performance of the Fund's investments (and, in turn, the Fund's investment results) and/or negatively impact broad segments of businesses and populations and have a significant and rapid negative impact on the performance of the Fund's investments, and exacerbate preexisting risks to the Fund.

12. Credit Facility

The Fund and other Morgan Stanley funds participated in a $500,000,000 committed, unsecured revolving line of credit facility (the "Facility") with State Street. This Facility is to be used for temporary emergency purposes or funding of shareholder redemption requests. The interest rate for any funds drawn will be based on the federal funds rate or overnight bank funding rate plus a spread. The Facility also has a commitment fee of 0.25% per annum based on the unused portion of the Facility, which is allocated among participating funds based on relative net assets. During the six months ended June 30, 2024, the Fund did not have any borrowings under the Facility.

13. Other

At June 30, 2024, the Fund had record owners of 10% or greater. Investment activities of these shareholders could have a material impact on the Fund. The aggregate percentage of such owners was 55.6%.

23

Morgan Stanley Long Duration Government Opportunities Fund

Financial Highlights

Selected ratios and per share data for a share of beneficial interest outstanding throughout each period:

| | | FOR THE SIX | | FOR THE YEAR ENDED DECEMBER 31, | |

| | | MONTHS ENDED | | | |

| | | JUNE 30, 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 | |

| | | (unaudited) | | | | | | | | | | | |

Class A Shares | |

Selected Per Share Data: | |

Net asset value, beginning of period | | $ | 7.34 | | | $ | 7.24 | | | $ | 8.56 | | | $ | 8.94 | | | $ | 8.68 | | | $ | 8.41 | | |

Income (loss) from investment operations: | |

Net investment income | | | 0.19 | | | | 0.31 | | | | 0.20 | | | | 0.18 | | | | 0.20 | | | | 0.27 | | |

Net realized and unrealized gain (loss) | | | (0.56 | ) | | | 0.08 | | | | (1.31 | ) | | | (0.36 | ) | | | 0.28 | | | | 0.27 | | |

Total income (loss) from investment

operations | | | (0.37 | ) | | | 0.39 | | | | (1.11 | ) | | | (0.18 | ) | | | 0.48 | | | | 0.54 | | |

Less distributions from: | |

Net investment income | | | (0.17 | ) | | | (0.29 | ) | | | (0.21 | ) | | | (0.20 | ) | | | (0.22 | ) | | | (0.27 | ) | |

Net asset value, end of period | | $ | 6.80 | | | $ | 7.34 | | | $ | 7.24 | | | $ | 8.56 | | | $ | 8.94 | | | $ | 8.68 | | |

| Total Return(1) | | | (5.00 | )%(2) | | | 5.65 | %(3) | | | (13.03 | )% | | | (2.06 | )% | | | 5.55 | % | | | 6.43 | % | |

Ratios to Average Net Assets: | |

Net expenses | | | 0.85 | %(4)(5)(6) | | | 0.50 | %(5)(6)(7) | | | 0.85 | %(5)(6) | | | 0.85 | %(5)(6) | | | 0.85 | %(5)(6) | | | 0.85 | %(5)(6)(8) | |

Net investment income | | | 5.51 | %(4)(5)(6) | | | 0.40 | %(5)(6)(7) | | | 2.61 | %(5)(6) | | | 1.98 | %(5)(6) | | | 2.32 | %(5)(6) | | | 2.97 | %(5)(6) | |

Rebate from Morgan Stanley affiliate | | | 0.00 | %(4)(9) | | | 0.01 | % | | | 0.00 | %(9) | | | 0.00 | %(9) | | | 0.00 | %(9) | | | 0.00 | %(9) | |

Supplemental Data: | |

Net assets, end of period, in thousands | | $ | 150,146 | | | $ | 168,388 | | | $ | 190,426 | | | $ | 249,990 | | | $ | 289,964 | | | $ | 295,522 | | |

Portfolio turnover rate | | | 285 | %(2) | | | 512 | % | | | 321 | % | | | 376 | % | | | 189 | % | | | 167 | % | |

(1) Does not reflect the deduction of sales charge. Calculated based on the net asset value as of the last business day of the period.

(2) Not annualized.

(3) Performance was positively impacted by approximately 0.43% for Class A shares due to the reimbursement of transfer agency and sub transfer agency fees from prior years. Had this reimbursement not occurred, the total return for Class A shares would have been 5.22%.

(4) Annualized.

(5) If the Fund had borne all of its expenses that were reimbursed and/or waived by the Adviser/Administrator, the annualized expense and net investment income ratios would have been as follows for Class A shares:

| PERIOD ENDED | | EXPENSE

RATIO | | NET INVESTMENT

INCOME RATIO | |

| June 30, 2024 | | | 1.09 | % | | | 5.27 | % | |

December 31, 2023 | | | 1.17 | | | | 3.73 | | |

December 31, 2022 | | | 1.05 | | | | 2.41 | | |

December 31, 2021 | | | 0.98 | | | | 1.85 | | |

December 31, 2020 | | | 0.97 | | | | 2.20 | | |

December 31, 2019 | | | 0.99 | | | | 2.83 | | |

(6) The ratios reflect the rebate of certain Fund expenses in connection with investments in a Morgan Stanley affiliate during the period. The effect of the rebate on the ratios is disclosed in the above table as "Rebate from Morgan Stanley affiliate."

(7) If the Fund had not received the reimbursement of transfer agency and sub transfer agency fees from the Adviser, the net expenses and net investment Income ratios, would have been as follows for Class A shares:

| PERIOD ENDED | | EXPENSE

RATIO | | NET INVESTMENT

INCOME RATIO | |

December 31, 2023 | | | 0.84 | % | | | 4.06 | % | |

(8) Effective February 28, 2019, the Adviser has agreed to limit the ratio of expenses to average net assets to the maximum ratio of 0.85% for Class A shares. Prior to February 28, 2019, the maximum ratio was 0.87% for Class A shares.

(9) Amount is less than 0.005%.

See Notes to Financial Statements

24

Morgan Stanley Long Duration Government Opportunities Fund

Financial Highlights continued

| | | FOR THE SIX | | FOR THE YEAR ENDED DECEMBER 31, | |

| | | MONTHS ENDED | | | |

| | | JUNE 30, 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 | |

| | | (unaudited) | | | | | | | | | | | |

Class L Shares | |

Selected Per Share Data: | |

Net asset value, beginning of period | | $ | 7.40 | | | $ | 7.30 | | | $ | 8.63 | | | $ | 9.01 | | | $ | 8.75 | | | $ | 8.48 | | |

Income (loss) from investment operations: | |

Net investment income | | | 0.18 | | | | 0.29 | | | | 0.18 | | | | 0.16 | | | | 0.18 | | | | 0.24 | | |

Net realized and unrealized gain (loss) | | | (0.57 | ) | | | 0.08 | | | | (1.32 | ) | | | (0.37 | ) | | | 0.27 | | | | 0.27 | | |

Total income (loss) from investment

operations | | | (0.39 | ) | | | 0.37 | | | | (1.14 | ) | | | (0.21 | ) | | | 0.45 | | | | 0.51 | | |

Less distributions from: | |

Net investment income | | | (0.16 | ) | | | (0.27 | ) | | | (0.19 | ) | | | (0.17 | ) | | | (0.19 | ) | | | (0.24 | ) | |

Net asset value, end of period | | $ | 6.85 | | | $ | 7.40 | | | $ | 7.30 | | | $ | 8.63 | | | $ | 9.01 | | | $ | 8.75 | | |

| Total Return(1) | | | (5.23 | )%(2) | | | 5.32 | %(3) | | | (13.28 | )% | | | (2.32 | )% | | | 5.21 | % | | | 6.09 | % | |

Ratios to Average Net Assets: | |

Net expenses | | | 1.12 | %(4)(5)(6) | | | 0.78 | %(5)(6)(7) | | | 1.12 | %(5)(6) | | | 1.12 | %(5)(6) | | | 1.12 | %(5)(6) | | | 1.12 | %(5)(6) | |

Net investment income | | | 5.24 | %(4)(5)(6) | | | 4.11 | %(5)(6)(7) | | | 2.31 | %(5)(6) | | | 1.69 | %(5)(6) | | | 2.02 | %(5)(6) | | | 2.73 | %(5)(6) | |

Rebate from Morgan Stanley affiliate | | | 0.00 | %(4)(8) | | | 0.01 | % | | | 0.00 | %(8) | | | 0.00 | %(8) | | | 0.00 | %(8) | | | 0.00 | %(8) | |

Supplemental Data: | |

Net assets, end of period, in thousands | | $ | 2,993 | | | $ | 3,353 | | | $ | 4,004 | | | $ | 5,454 | | | $ | 6,259 | | | $ | 6,668 | | |

Portfolio turnover rate | | | 285 | %(2) | | | 512 | % | | | 321 | % | | | 376 | % | | | 189 | % | | | 167 | % | |

(1) Calculated based on the net asset value as of the last business day of the period.

(2) Not annualized.

(3) Performance was positively impacted by approximately 0.42% for Class L shares due to the reimbursement of transfer agency and sub transfer agency fees from prior years. Had this reimbursement not occurred, the total return for Class L shares would have been 4.90%.

(4) Annualized.

(5) If the Fund had borne all of its expenses that were reimbursed and/or waived by the Adviser/Administrator, the annualized expense and net investment income ratios would have been as follows for Class L shares: