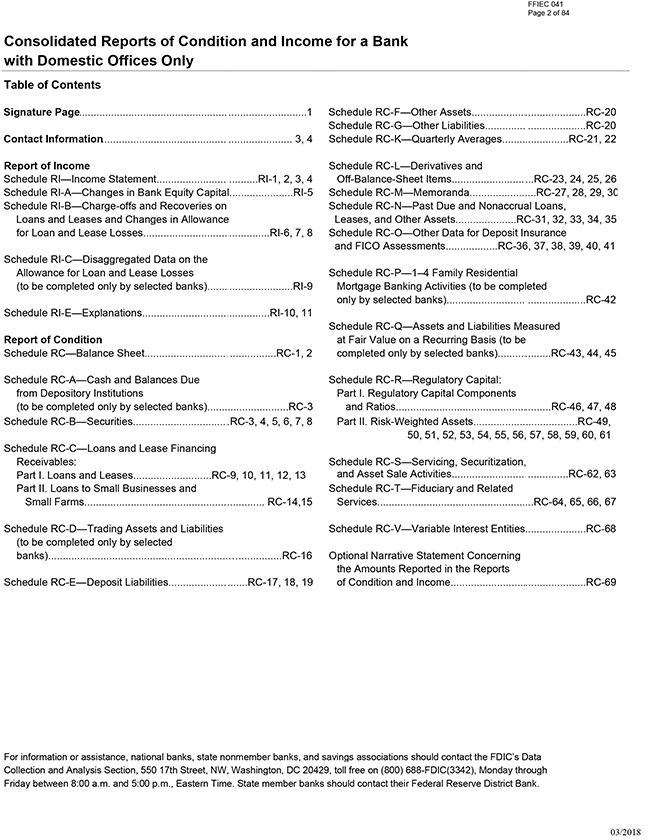

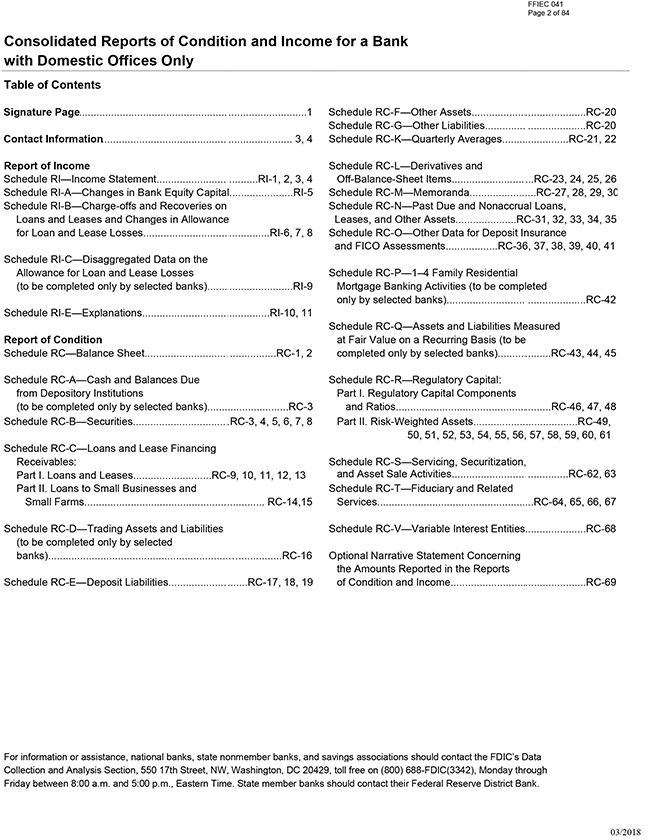

Consolidated Reports of Condition and Income for a Bank with Domestic Offices Only Table of Contents Signature Page.1 Contact Information.................................................................................................... 3, 4 Report of Income Schedule RI—Income Statement...................................RI-1, 2, 3, 4 Schedule RI-A—Changes in Bank Equity Capital......................RI-5 Schedule RI-B—Charge-offs and Recoveries on Loans and Leases and Changes in Allowance for Loan and Lease Losses.......................................................................RI-6, 7, 8 Schedule RI-C—Disaggregated Data on the Allowance for Loan and Lease Losses (to be completed only by selected banks).........................................................................................................................RI-9 Schedule RI-E—Explanations..............................................................................................RI-10, 11 Report of Condition Schedule RC—Balance Sheet....................................................................................................RC-1, 2 Schedule RC-A—Cash and Balances Due from Depository Institutions (to be completed only by selected banks)............................RC-3 Schedule RC-B—Securities.............................................RC-3, 4, 5, 6, 7, 8 Schedule RC-C—Loans and Lease Financing Receivables: Part I. Loans and Leases...........................RC-9, 10, 11, 12, 13 Part II. Loans to Small Businesses and Small Farms................................................................. RC-14,15 Schedule RC-D—Trading Assets and Liabilities (to be completed only by selected banks)...............................................................................……...............RC-16 Schedule RC-E—Deposit Liabilities .............................. .................................................... RC-17, 18, 19 Schedule RC-F—Other Assets.................................................................................RC-20 Schedule RC-G—Other Liabilities........................................................................................................................RC-20 Schedule RC-K—Quarterly Averages.......................................................................................................................RC-21, 22 Schedule RC-L—Derivatives and Off-Balance-Sheet Items...................................................RC-23, 24, 25, 26 Schedule RC-M—Memoranda.......................RC-27, 28, 29, 30 Schedule RC-N—Past Due and Nonaccrual Loans, Leases, and Other Assets.....................RC-31, 32, 33, 34, 35 Schedule RC-O—Other Data for Deposit Insurance and FICO Assessments..................RC-36, 37, 38, 39, 40, 41 Schedule RC-P—1–4 Family Residential Mortgage Banking Activities (to be completed only by selected banks)..................................................................................................................RC-42 Schedule RC-Q—Assets and Liabilities Measured at Fair Value on a Recurring Basis (to be completed only by selected banks)..............................................................................................................RC-43, 44, 45 Schedule RC-R—Regulatory Capital: Part I. Regulatory Capital Components and Ratios...............................................................................................................RC-46, 47, 48 Part II. Risk-Weighted Assets....................................RC-49, 50, 51, 52, 53, 54, 55, 56, 57, 58, 59, 60, 61 Schedule RC-S—Servicing, Securitization, and Asset Sale Activities....................................................................RC-62, 63 Schedule RC-T—Fiduciary and Related Services..........................................................RC-64, 65, 66, 67 Schedule RC-V—Variable Interest Entities ..........................RC-68 Optional Narrative Statement Concerning the Amounts Reported in the Reports of Condition and Income...........................................................................................................................................................RC-69 For information or assistance, national banks, state nonmember banks, and savings associations should contact the FDIC’s Data Collection and Analysis Section, 550 17th Street, NW, Washington, DC 20429, toll free on (800) 688-FDIC(3342), Monday through Friday between 8:00 a.m. and 5:00 p.m., Eastern Time. State member banks should contact their Federal Reserve District Bank. 06/2018 FFIEC 041 Page 16 of 84 RC-1