UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-3872

| T. Rowe Price Tax-Free Short-Intermediate Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: February 29

Date of reporting period: February 29, 2012

Item 1. Report to Shareholders

| Tax-Free Short-Intermediate Fund | February 29, 2012 |

The views and opinions in this report were current as of February 29, 2012. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

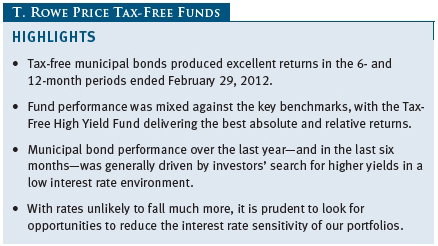

Tax-free municipal bonds produced excellent returns in the 6- and 12-month periods ended February 29, 2012. In the second half of the funds’ fiscal year, munis rallied with U.S. Treasuries—led by long-term issues—as year-over-year issuance declined and last year’s fears of widespread defaults continued to subside despite the largest municipal bankruptcy in U.S. history in Jefferson County, Alabama. The T. Rowe Price Tax-Free Funds performed mostly in line with their benchmarks over the last year, and their longer-term relative performance remained favorable.

MARKET ENVIRONMENT

The U.S. economy strengthened in the fourth quarter of 2011 and grew moderately in the early months of 2012, defying expectations that the ongoing sovereign debt crisis in Europe would weigh heavily on the domestic economic recovery. The labor market recovery has been firming, with nonfarm payrolls increasing 245,000 on average in the three months through February and the national unemployment rate dipping to 8.3%, the lowest level since early 2009. Corporate profit growth remains healthy, and manufacturing activity has been increasing moderately. The housing market is still weak, however, and the Federal Reserve remains cautious about the durability of the economy.

To support the recovery with low long-term interest rates, the Fed initiated a “maturity extension program” in September 2011 through which it would purchase $400 billion in longer-term Treasuries and sell issues maturing in three years or less through June 2012. Also, after the Fed’s monetary policy meeting in January, central bank officials projected that short-term rates will remain low at least until late 2014—versus previous expectations of low rates lasting through mid-2013—and expressed willingness to provide additional stimulus if the economic outlook deteriorates.

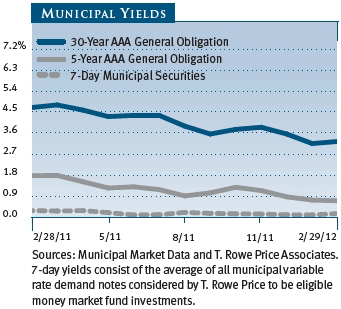

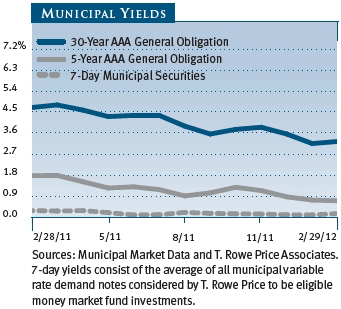

The municipal yield curve flattened over the last year, with long-term yields falling significantly while shorter-term yields continued to grind their way closer to 0%. Nevertheless, with municipal yields comparable to or higher than Treasury yields, tax-free securities are an attractive alternative for fixed income investors. As of February 29, 2012, the 3.23% yield offered by a 30-year tax-free municipal bond rated AAA was about 104% of the 3.09% pretax yield offered by a 30-year Treasury. An investor in the 28% federal tax bracket would need to invest in a taxable bond yielding about 4.49% in order to receive the same after-tax income. (To calculate a municipal bond’s taxable-equivalent yield, divide the municipal bond’s yield by the quantity of 1.00 minus your federal tax bracket expressed as a decimal—in this case, 1.00 – 0.28, or 0.72.)

MUNICIPAL MARKET NEWS

Municipal issuance in 2011 totaled only $295 billion, according to The Bond Buyer—the lowest level in a decade. Contributing factors include the absence of the Build America Bond program and a pervasive sentiment toward fiscal austerity, which could keep issuance somewhat subdued in 2012. While the $43 billion in year-to-date long-term issuance is higher than it was at this point in 2011, much of it reflects municipalities refinancing their debts to take advantage of low long-term interest rates, rather than net new issuance. Issuance may stay on the low side of estimates as state and local governments have been conservative about adding to indebtedness, despite prevailing low yields.

Demand for municipal securities in early 2011 was weak but picked up as the year progressed. Municipal bond fund cash flows, which were negative in the first half of 2011, turned positive in the second half, as risk-averse investors realized that municipals were still a high-quality asset class. In recent months, cash flows have been strong.

Many states continue to face fiscal difficulties and have been forced to raise taxes and fees and cut spending to close budget deficits. We believe many states deserve high credit ratings, and we do not see a near-term threat to their ability to continue servicing their outstanding debts. However, we have longer-term concerns about potentially onerous future pension obligations and other retirement benefits.

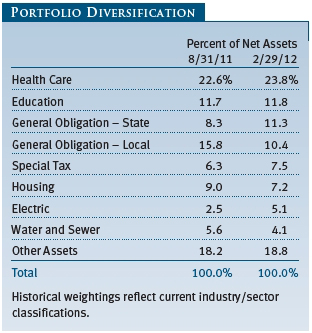

Municipal bond performance over the last year—and in the last six months—was generally driven by investors’ search for higher yields in a low interest rate environment. In both periods, long- and intermediate-term bonds outperformed short-term securities, while lower-quality investment-grade issues, especially A rated bonds, outpaced higher-grade munis. Among revenue bonds, tobacco and health care were two of the top-performing segments. We continue to underweight tobacco bonds because of declining long-term tobacco consumption trends, and while we are overweight health care in most portfolios, we are very selective in this sector, particularly hospitals, as the implementation of health care reform may put pressure on already thin hospital profit margins. Prerefunded bonds, which are backed by U.S. Treasuries, produced mild gains in both periods due to their high-quality and short-term characteristics.

PORTFOLIO STRATEGY

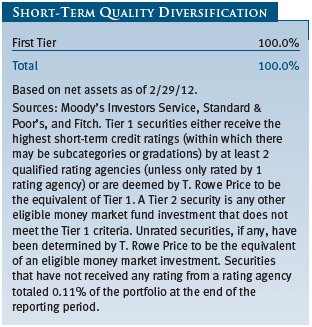

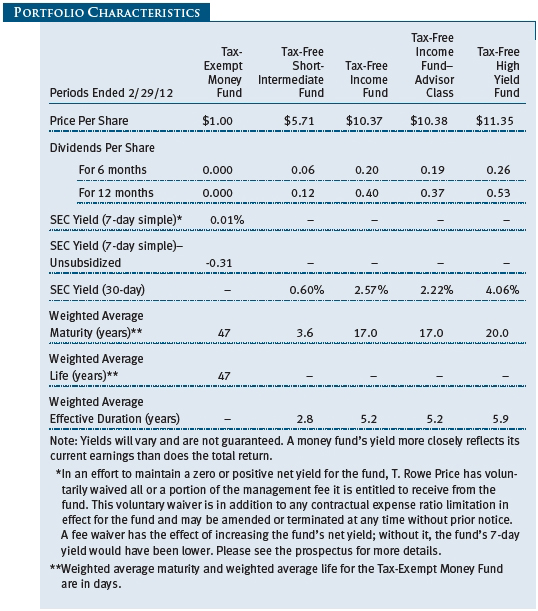

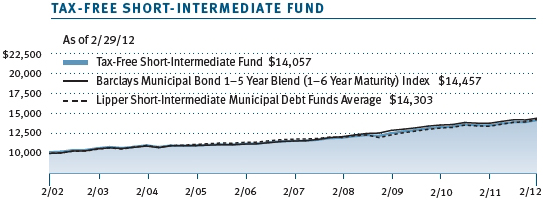

TAX-EXEMPT MONEY FUND

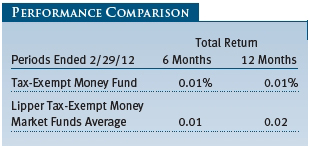

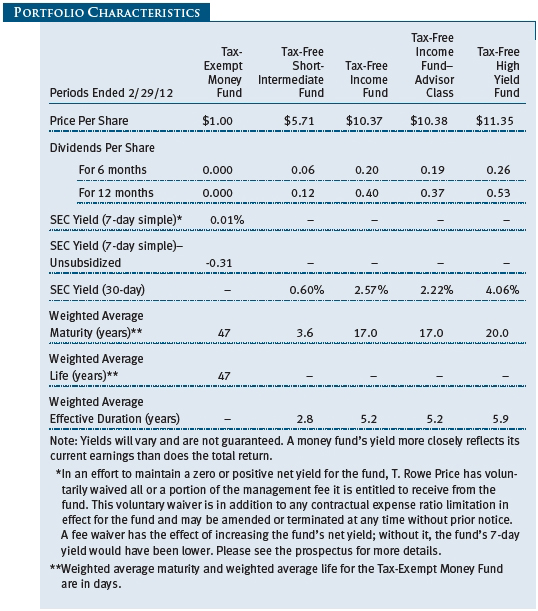

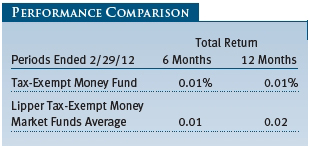

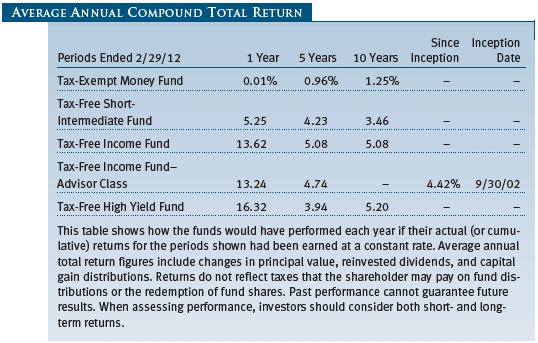

The fund returned 0.01% during both the 6- and 12-month periods ended February 29, 2012, which was in line with the performance of the Lipper Tax-Exempt Money Market Funds Average. All money market rates continue to be closely tied to the Federal Reserve’s fed funds target rate of 0.00%–0.25%.

With the Federal Reserve’s zero interest rate policy now in place for more than three years and showing no signs of abating, rates in the municipal money market offer minimal return for investors. One aspect of Fed policy has been to motivate investors to shift assets away from lower-risk returns of money funds toward higher-risk alternatives. As a result, money fund assets are down significantly from their 2008 peaks.

Municipal money rates continued to compress around 0%. Overall, rates across the money market curve were lower compared with those in place at our last report. Overnight rates averaged 0.08% during the period compared with 0.12% in the prior period, while seven-day rates averaged 0.11% compared with 0.17%. Six-month and one-year note yields pushed lower, both down about five basis points, the six-month note ending at 0.16% while the one-year yields ended at 0.20%.

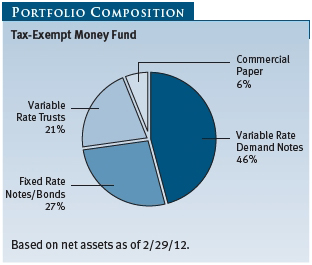

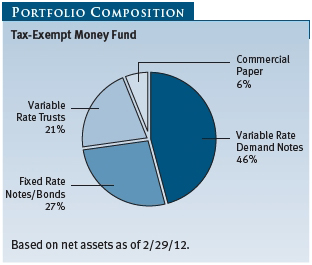

One interesting sidebar within the municipal money markets has been the growing popularity of tax-exempt municipal variable rate demand notes (VRDNs) within taxable money funds. SEC rules now require money funds to maintain a significant overnight and seven-day liquidity, and VRDNs nicely perform that function. Moreover, for quite some time, yields on tax-exempt VRDNs were comparable to taxable yields. These attributes created significant demand for VRDNs and have been a contributor to the push to lower yields.

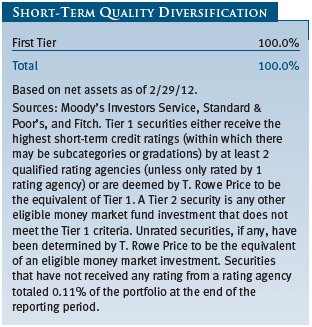

Credit quality remains a key focus in the management of the fund, both with respect to municipal issuers as well as to the banks that figure prominently in providing forms of credit and liquidity support to so many municipal issues. Many of the more challenged state issuers, such as California and Illinois, are not included in our portfolio. Our largest positions are among high-quality hospitals and universities, as well as state and local governments. Ratings downgrade concerns for banks such as Bank of America and Citibank cause us to look for credit and liquidity enhancement elsewhere. Wells Fargo and J.P. Morgan Chase are among our preferred bank liquidity providers.

Recently, headlines have suggested that regulators may be considering further changes to rules governing money funds. We continue to monitor such a possibility but are unclear as to the benefits of some proposals. Despite the challenges—low rates, a challenged credit environment, and the potential for increased regulation—we continue to focus on managing the fund with an emphasis on quality and principal stability.

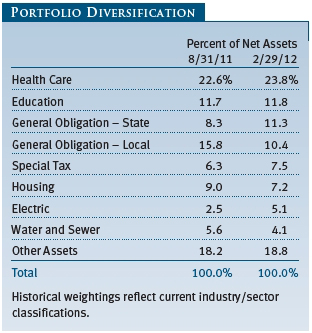

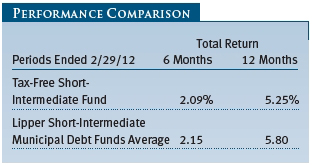

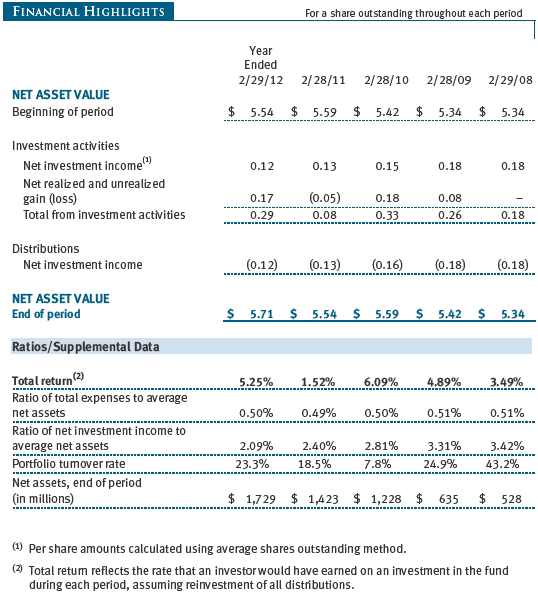

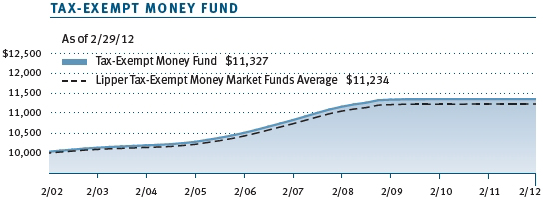

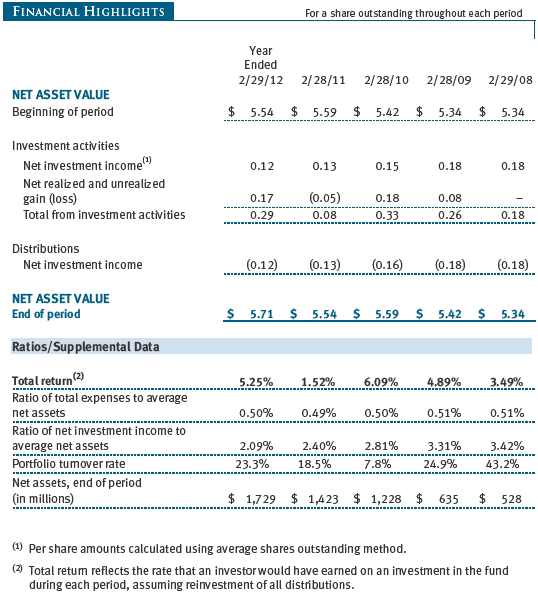

TAX-FREE SHORT-INTERMEDIATE FUND

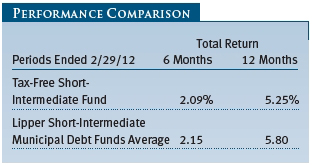

The fund returned 2.09% during the six months ended February 29, 2012, compared with 2.15% for the Lipper Short-Intermediate Municipal Debt Funds Average, which measures the performance of competing funds. For the fund’s fiscal year, the respective returns were 5.25% and 5.80%. The fund’s net asset value per share was $5.71 at the end of February, up from $5.65 at the end of August. Dividends per share contributed $0.06 to the fund’s total return during the six-month period.

As we entered the fourth quarter of 2011, we decided the fund was holding too much cash and too many bonds maturing within two years. In the higher-rated categories—A or better—cash and short-term securities yield less than 50 basis points. Very high-quality bonds maturing in less than one year yield less than 20 basis points. This combination was not conducive to good performance, as it generated a nominal return slightly above 0%, but not much more. Relative fund performance would benefit only if short-term interest rates were to move higher, which is unlikely at present with the Federal Open Market Committee (FOMC) stating that it will leave the fed funds rate unchanged for another year and possibly longer.

With this policy in place, we decided to make some changes in the portfolio to generate extra yield with low risk. During the final months of 2011, we extended about 10% of the portfolio primarily into three- to five-year bonds, causing the fund’s duration (a measure of sensitivity to changing interest rates) to move slightly longer than that of the benchmark, and we are currently maintaining this strategy. Looking ahead, our plan is to stay in front of our reinvestment needs and not allow the combination of cash and short-term bonds to build up as bonds mature and “roll” down the yield curve (a graphic depiction of the relationship among yields of bonds with different maturities).

The relatively steep yield curve makes it possible to implement this type of duration strategy. There are two components to a bond’s total return—the yield to maturity and price appreciation. With the yield difference that currently exists between short- and longer-term bonds, a five-year bond that rolls down the yield curve becomes a four-year bond, leading to price appreciation since the yield on the four-year bond is less than that of a five-year bond. In today’s environment, this appreciation can exceed the yield return of the bond.

This strategy works as long as the yield curve stays steep and the FOMC keeps the federal funds rate anchored near zero. While we take comfort in the Fed’s statement that it will keep the fed fund’s rate low through the foreseeable future, we understand that the nation’s central bank can change direction anytime it seems appropriate. Indeed, the Fed would welcome the opportunity to err on the side of caution, since it would mean the economy is growing faster than anticipated. However, we do not view this as a significant risk over the next six months.

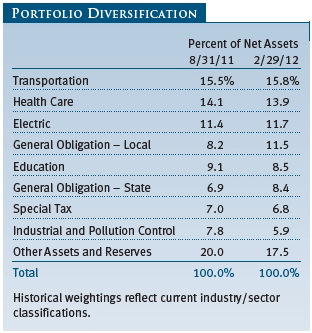

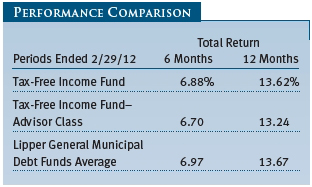

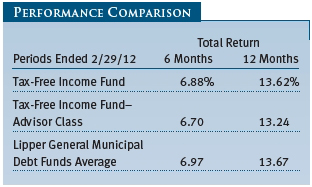

TAX-FREE INCOME FUND

Your fund returned 6.88% during the past six months, slightly behind the 6.97% return for the Lipper General Municipal Debt Funds Average. For the fund’s fiscal year, the respective returns were 13.62% and 13.67%. (Performance for the Advisor Class was somewhat lower, reflecting its different fee structure.) The fund’s net asset value per share was $10.37 at the end of February compared with $9.90 six months earlier. Dividends per share contributed $0.20 to the fund’s total return during the past six months.

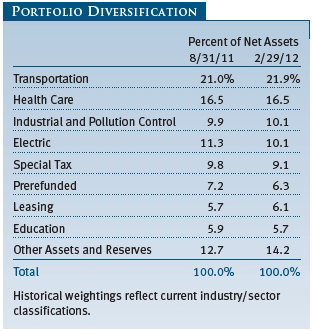

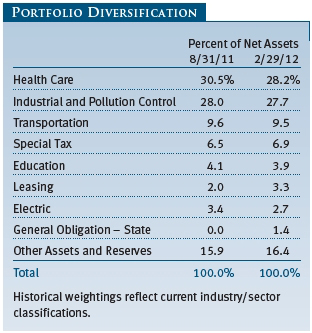

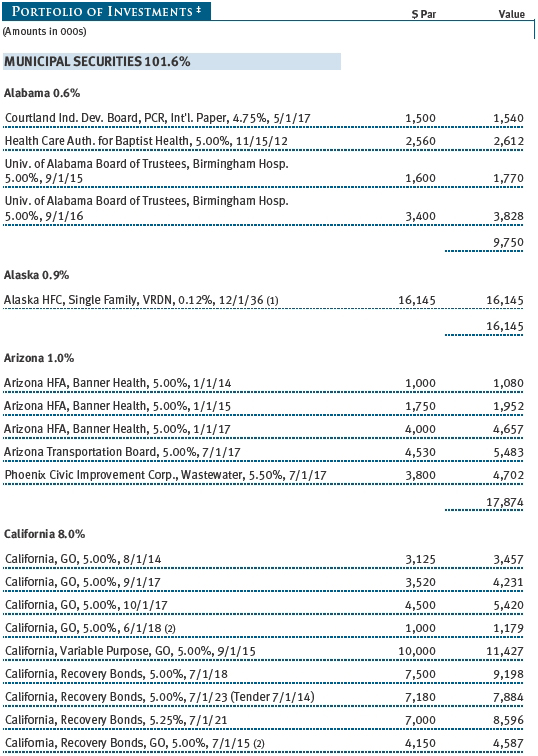

Our positioning along the yield curve was relatively unchanged from six months ago. We significantly decreased exposure to cash and holdings inside of two years and redeployed investments into longer maturities to take advantage of much higher yields. Shorter bonds continued to be a drag on performance. Although we retained a slight overweight on the front end of the municipal yield curve, it reflects our preference to underweight 5- to 15-year bonds, where rates are very low and vulnerable. The fund continues to be overweight in long bonds relative to the benchmark. However, other peer group funds were even more overweight in this area, which benefited their performance as longer maturities fared best. We maintained a longer duration relative to the benchmark yet shorter versus our peer group. The fund’s weighted average maturity increased slightly to 17.0 years since our last report in August.

After a dearth of new issuance for the first half of 2011, a significant pickup ensued in the early fall and was greeted for the most part with an insatiable buyers’ appetite. We bought new issues in both New York and California. In California, we purchased the state’s general obligation (GO) bonds but are still underweight the group. We also viewed New York’s calendar as an opportunity to purchase numerous credits, including issues related to the rebuilding of the World Trade Center site and transportation-related securities. New names in the fund include Hudson Yards Infrastructure and NYC Liberty for 4 WTC. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

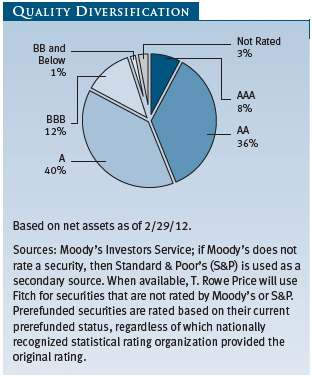

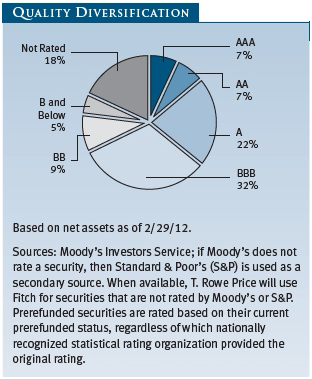

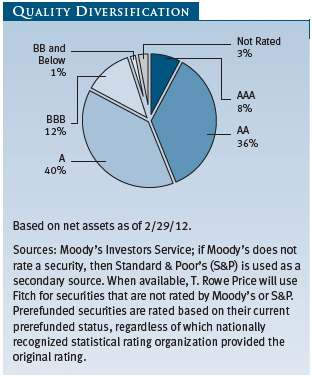

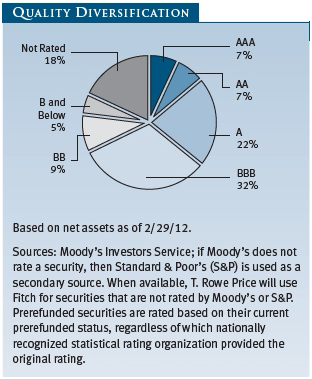

The fund’s overall quality diversification was relatively unchanged. Our largest weightings remain in the A to AA range, an overall high-quality profile. Our exposure to A rated bonds on the long end benefited performance as returns were above average. Peers that were more aggressive in their credit postures and carried a greater portion of BBB rated and lower-quality credits fared best, as lower-quality bonds were top performers for the one-year period.

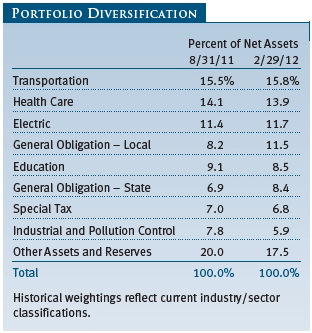

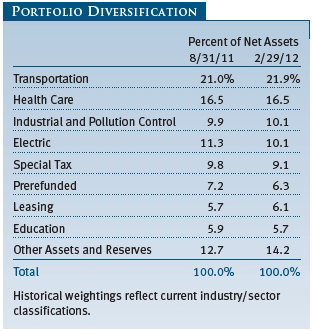

There were no significant changes in sector exposure, reflecting our bias for revenue bonds over GOs. The transportation sector was the largest in the portfolio, followed by health care, which was a top-performing sector for the period. We decreased our holdings in Puerto Rico due to concerns about elevated borrowing and burdensome debt loads. The fund holds very few tobacco bonds backed by the Master Settlement Agreement, reflecting our outlook for weaker tobacco consumption than originally forecast. However, the sector enjoyed tremendous outperformance as buyers reached for yield, and our relative performance suffered accordingly. We expect the tobacco sector to remain volatile, and we are negative on the sector overall.

Fund holdings that performed best during the one-year period were bonds with long durations and longer maturities, including noncallable and zero coupon structures. Our BBB and lower-quality credits outpaced their higher-quality counterparts and included the hospital and life care sectors. A rated holdings also did well, particularly airports and toll roads in the transportation sector. Bonds contributing least to performance were high-quality holdings such as prerefunded bonds with maturities of three years and shorter.

TAX-FREE HIGH YIELD FUND

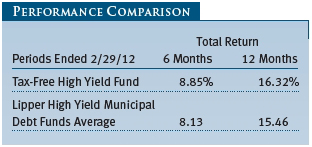

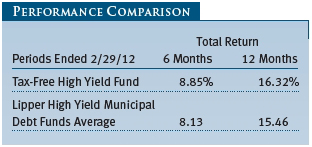

The Tax-Free High Yield Fund returned 8.85% during the past six months compared with 8.13% for the Lipper High Yield Municipal Debt Funds Average, which measures the performance of similar funds. For the fund’s fiscal year, the returns were 16.32% and 15.46%, respectively. The fund’s net asset value per share was $11.35 at the end of February, and dividends per share contributed $0.26 to the fund’s total return during the past six months.

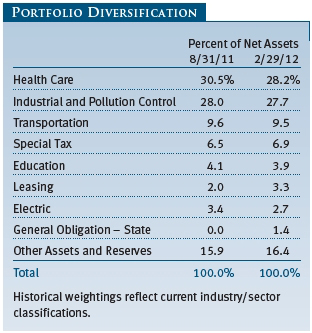

The fund benefited from its significant holdings in health care revenue bonds. In spite of significant macroeconomic concerns (such as reimbursement pressure at the federal and state levels), hospital bonds posted stellar returns. At the credit-specific level, many hospital issuers continued to improve operational efficiencies, strengthen balance sheets, and post solid bottom line results. Many revenue bonds issued by continuing care retirement communities also fared well during the period, as an improved equity market and more stable real estate prices provided support for increased occupancy at these facilities.

We continued to favor essential service transportation bonds, such as airports, toll roads, and port authority bonds. These capital-intensive infrastructure projects provide vital economic value to the public, often with limited competition. As such, the revenue streams that support these bonds are predictable and durable, even during challenging economic periods. Holdings in these sectors, such as the North Texas Tollway Authority, outperformed the general obligation market. Our publicly owned utility bonds (NC Eastern and Florida Municipal Power Agency) also performed well.

The fund maintained significant exposure to industrial development and pollution control bonds backed by corporations. These private activity bonds provided considerable excess yield to the portfolio, in addition to solid price appreciation. We had no exposure to bonds backed by American Airlines when the company filed for bankruptcy in November 2011. The airline is a large borrower in the tax-free high yield market, so our zero weight in its debt bolstered relative results.

We remained conservatively positioned in tobacco securitization bonds. Despite notable rating agency downgrades during the period, tobacco securitization bonds performed quite well. We continue to be skeptical of this sector, as these structured transactions rely on assumed smoking trends that are difficult to predict. To date, declines in tobacco consumption have far outpaced original estimates, negatively affecting payment expectations and longer-term bond performance.

It has been a year of tremendous recovery in medium- and lower-quality tax-exempt bonds. Dire prognostications regarding the municipal market proved overblown, and investors returned to the asset class with vigor. The effects of an extended period of subpar economic growth have weighed heavily on municipal borrowers, but most issuers have and will continue to address new economic realities prudently. As always, we will rely on our proven, research-driven process to select the most attractive investment opportunities within this arena.

OUTLOOK

While we are pleased with the tremendous performance of municipal bonds over the last year, we believe that returns in 2012 will moderate, as the credit and economic environment for municipalities is likely to remain challenging. Modest economic growth and improving income and sales tax revenues are providing some support for state and local governments. However, tax revenues remain below previous peaks, and cutbacks in state support and persistent downward pressure on property tax revenues could keep local municipal issuers vulnerable. If the economy slides back into a recession—which we are not currently predicting—municipalities will face even tougher challenges.

State and local government liabilities such as pension benefits and health care costs are a growing long-term concern. Maintaining balanced budgets and addressing these long-term issues require careful and dedicated work by state and local officials. These efforts will need to continue—with or without additional federal government assistance.

We continue to believe that the municipal bond market is a high-quality market with good opportunities for long-term investors. While we are comforted somewhat by Federal Reserve assurances that interest rate hikes are not imminent and by the demonstrated ability of states to balance their budgets in tough times, we are mindful that municipal yields are at or near historic lows and that there is the potential for losses if rates start to rise in response to stronger economic growth or inflation. With rates at such low levels, we are guarded in our interest rate outlook and careful with any investment shift that might increase our portfolios’ interest rate sensitivity.

We believe T. Rowe Price’s strong credit research capabilities have been and will remain an asset for our investors. We continue to conduct our own thorough research and assign our own independent credit ratings before making investment decisions. As always, we are on the lookout for attractively valued bonds issued by municipalities with good fundamentals—an investment strategy that has served our investors well in the past.

Thank you for investing with T. Rowe Price.

Respectfully submitted,

Joseph K. Lynagh

Chairman of the Investment Advisory Committee

Tax-Exempt Money Fund

Charles B. Hill

Chairman of the Investment Advisory Committee

Tax-Free Short-Intermediate Fund

Konstantine B. Mallas

Chairman of the Investment Advisory Committee

Tax-Free Income Fund

James M. Murphy

Chairman of the Investment Advisory Committee

Tax-Free High Yield Fund

March 16, 2012

The committee chairmen have day-to-day responsibility for managing the portfolios and work with committee members in developing and executing the funds’ investment programs.

RISKS OF FIXED INCOME INVESTING

Since money market funds are managed to maintain a constant $1.00 share price, there should be little risk of principal loss. However, there is no assurance the fund will avoid principal losses if fund holdings default or are downgraded or if interest rates rise sharply in an unusually short period. In addition, the fund’s yield will vary; it is not fixed for a specific period like the yield on a bank certificate of deposit. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in it.

Bonds are subject to interest rate risk (the decline in bond prices that usually accompanies a rise in interest rates) and credit risk (the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default by failing to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. High yield bonds could have greater price declines than funds that invest primarily in high-quality bonds. Municipalities issuing high yield bonds are not as strong financially as those with higher credit ratings, so the bonds are usually considered speculative investments. Some income may be subject to state and local taxes and the federal alternative minimum tax.

GLOSSARY

Barclays Municipal Bond Index: An unmanaged index that tracks municipal debt instruments.

Barclays Municipal Revenue Bond Index: An unmanaged index that tracks municipal revenue bonds.

Barclays Municipal Bond 1–5 Year Blend (1–6 Year Maturity) Index: A subindex of the Barclays Municipal Bond Index. It is a rules-based, market value-weighted index of short-term bonds engineered for the tax-exempt bond market.

Basis point: One one-hundredth of one percentage point, or 0.01%.

Duration: A measure of a bond fund’s sensitivity to changes in interest rates. For example, a fund with a duration of five years would fall about 5% in price in response to a one-percentage-point rise in interest rates, and vice versa.

Escrowed-to-maturity bond: A bond that has the funds necessary for repayment at maturity, or a call date, set aside in a separate or “escrow” account.

Federal funds rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

General obligation debt: A government’s strongest pledge that obligates its full faith and credit, including, if necessary, its ability to raise taxes.

Investment grade: High-quality bonds as measured by one of the major credit rating agencies. For example, Standard & Poor’s designates the bonds in its top four categories (AAA to BBB) as investment grade.

LIBOR: The London Interbank Offered Rate, which is a benchmark for short-term taxable rates.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in categories defined by Lipper.

Prerefunded bond: A bond that originally may have been issued as a general obligation or revenue bond but that is now secured by an escrow fund consisting entirely of direct U.S. government obligations that are sufficient for paying the bondholders.

SEC yield (7-day simple): A method of calculating a money fund’s yield by annualizing the fund’s net investment income for the last seven days of each period divided by the fund’s net asset value at the end of the period. Yield will vary and is not guaranteed.

SEC yield (30-day): A method of calculating a fund’s yield that assumes all portfolio securities are held until maturity. Yield will vary and is not guaranteed.

Weighted average life: A measure of a fund’s credit quality risk. In general, the longer the average life, the greater the fund’s credit quality risk. The average life is the dollar-weighted average maturity of a portfolio’s individual securities without taking into account interest rate readjustment dates. Money funds must maintain a weighted average life of less than 120 days.

Weighted average maturity: A measure of a fund’s interest rate sensitivity. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Yield curve: A graphic depiction of the relationship between yields and maturity dates for a set of similar securities such as Treasuries or municipal securities. Securities with longer maturities usually have a higher yield. If short-term securities offer a higher yield, then the curve is said to be “inverted.” If short-and long-term bonds are offering equivalent yields, then the curve is said to be “flat.”

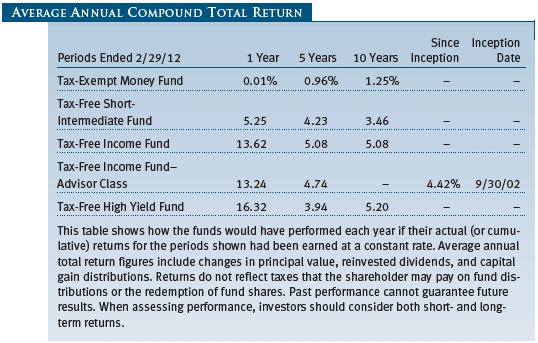

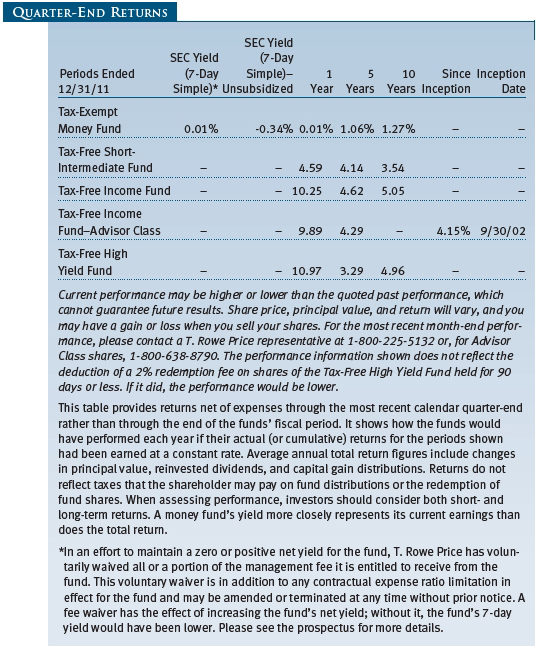

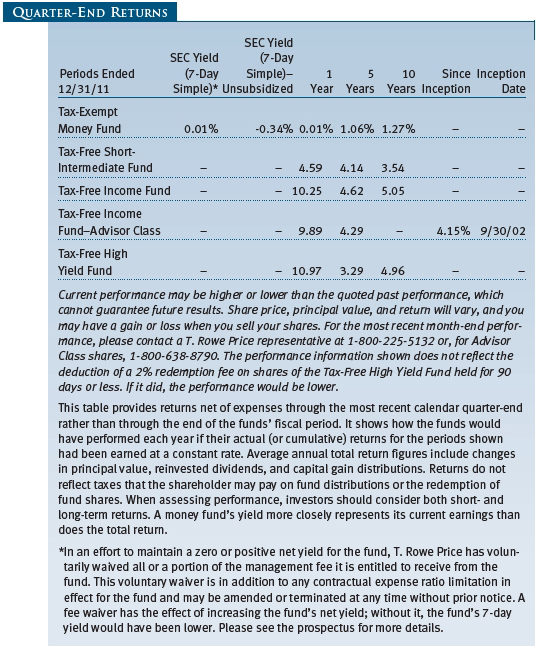

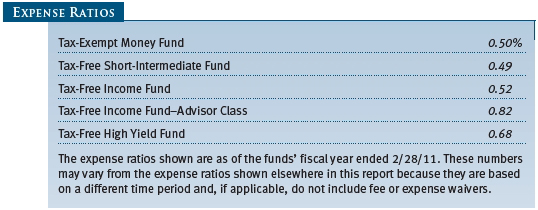

Performance and Expenses

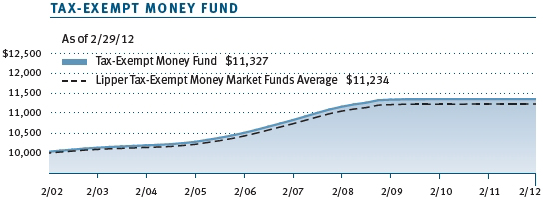

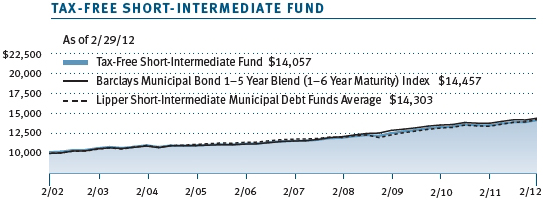

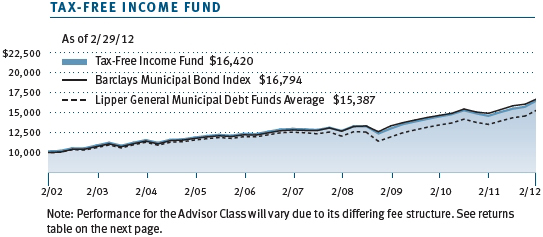

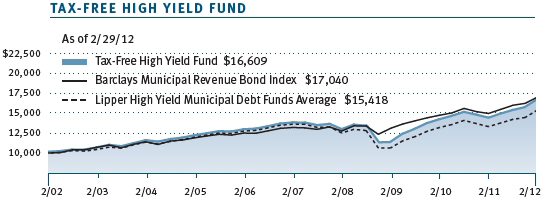

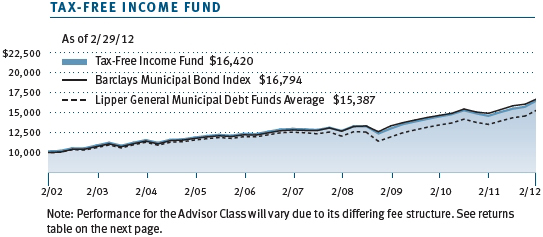

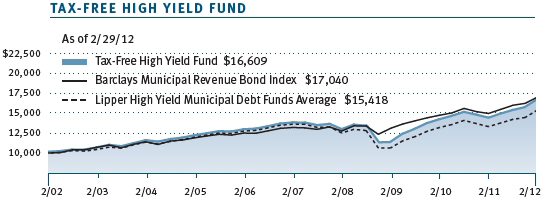

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

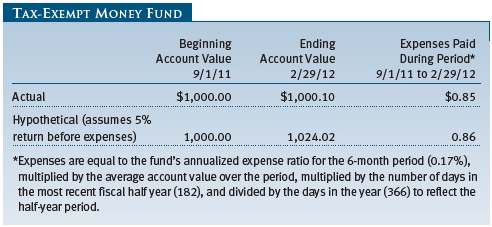

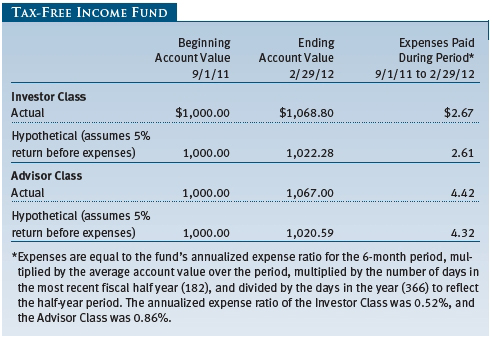

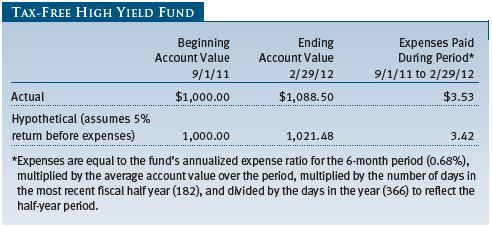

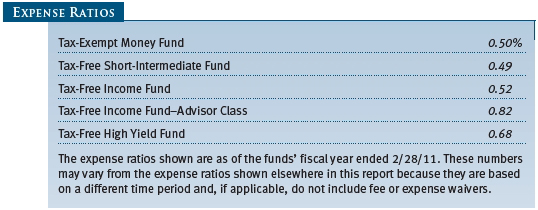

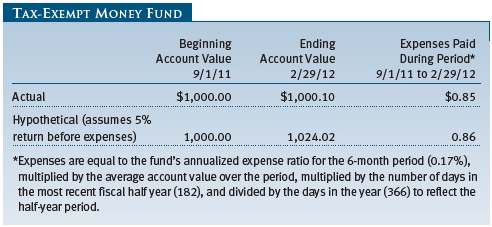

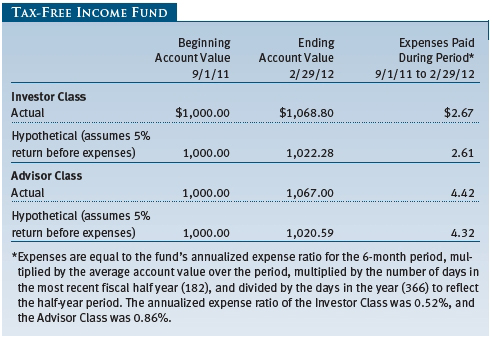

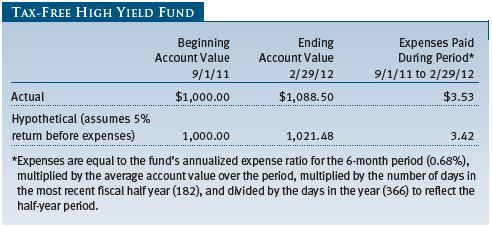

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Please note that the Tax-Free Income Fund has two share classes: The original share class (“Investor Class”) charges no distribution and service (12b-1) fee, and the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

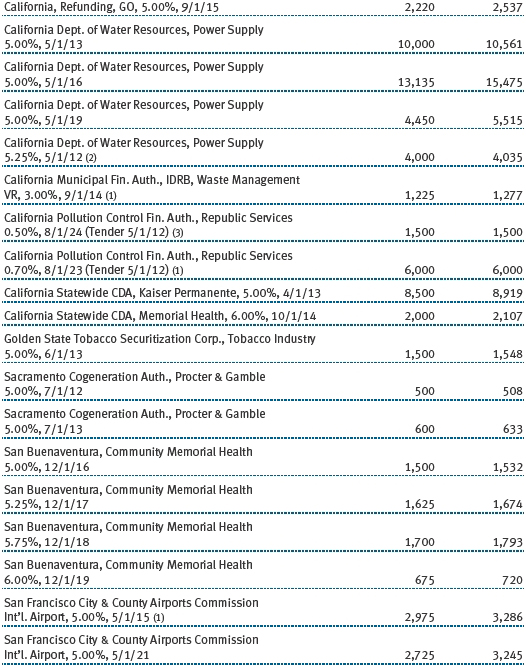

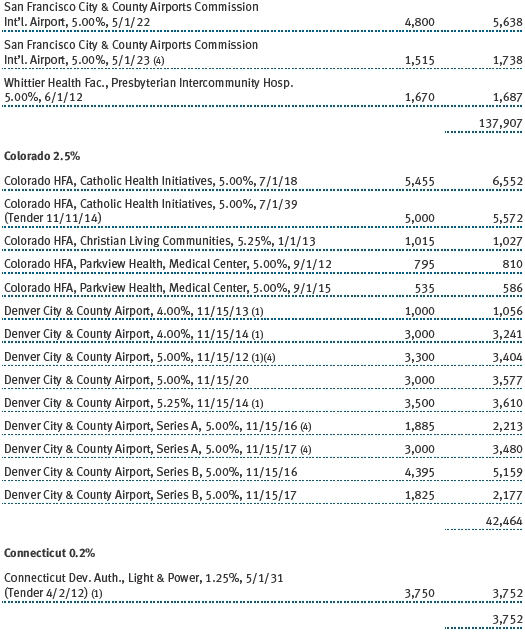

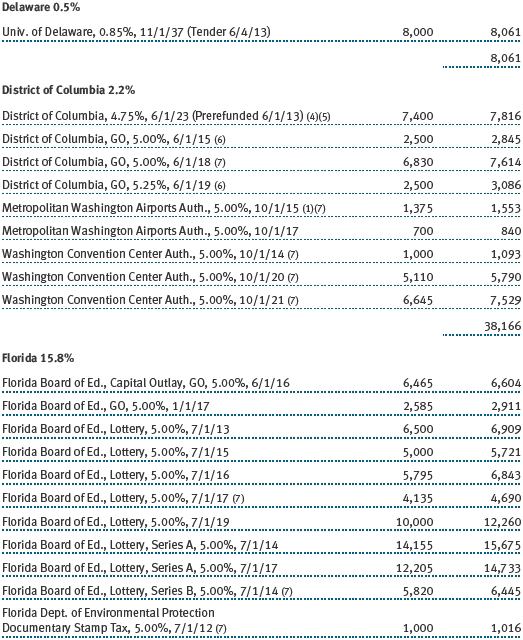

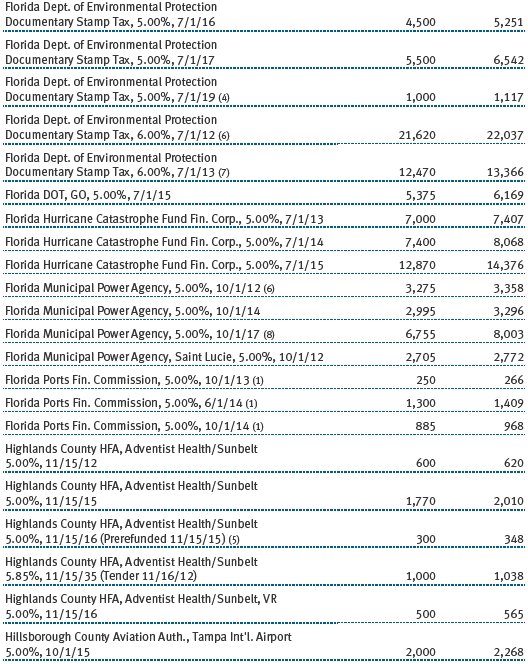

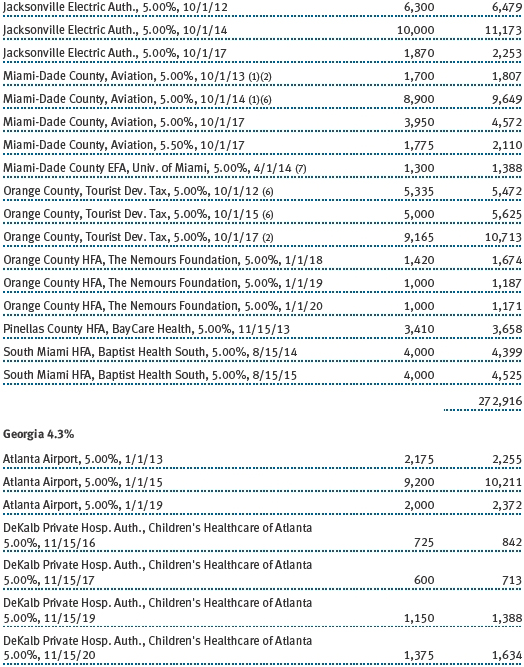

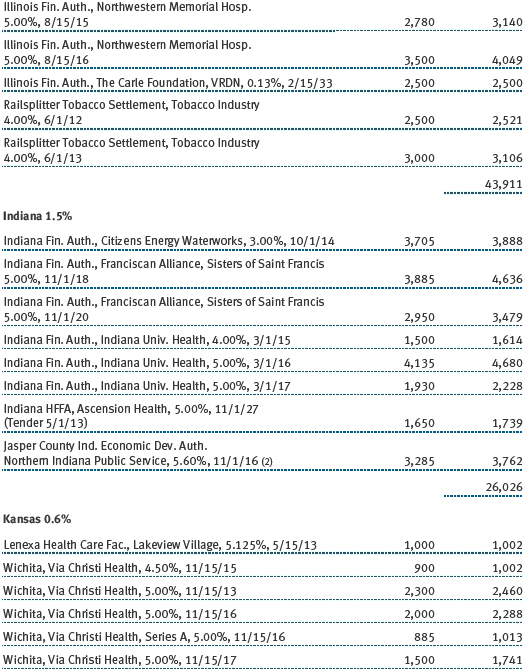

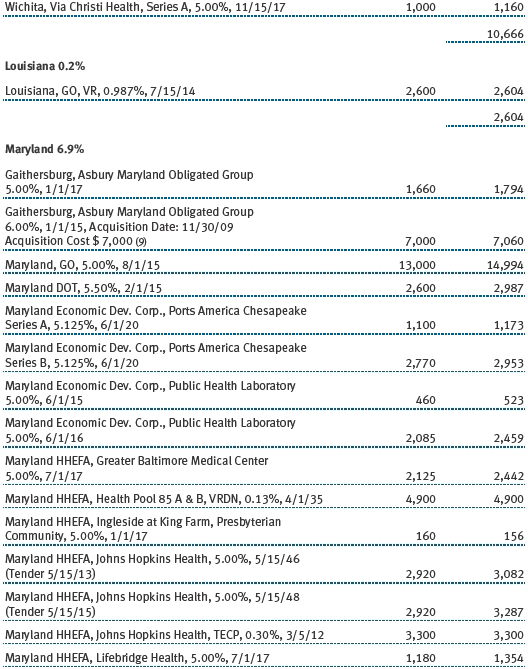

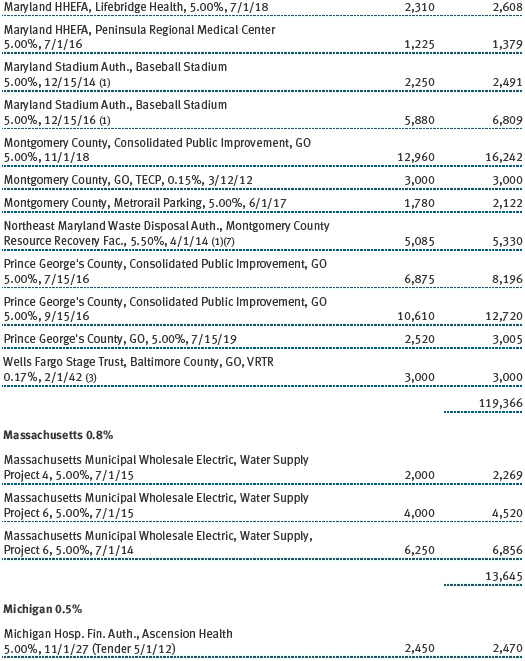

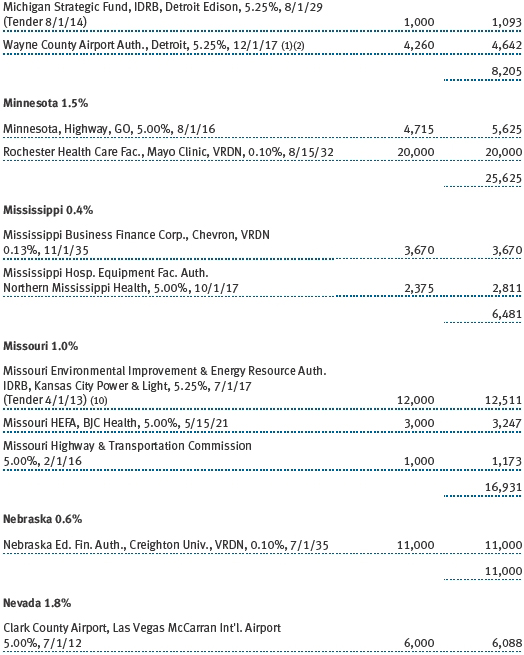

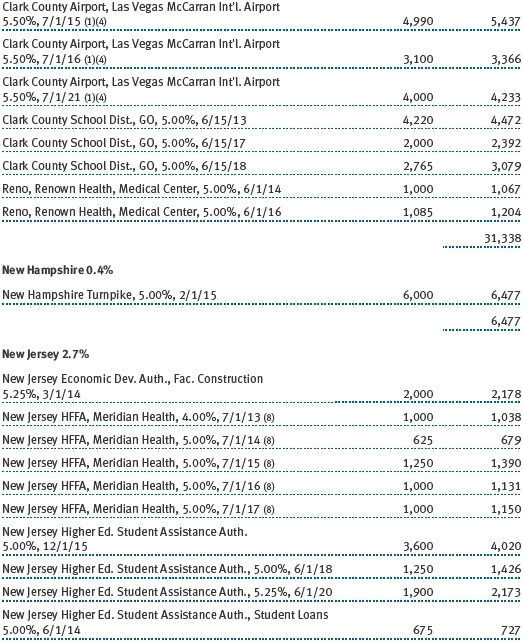

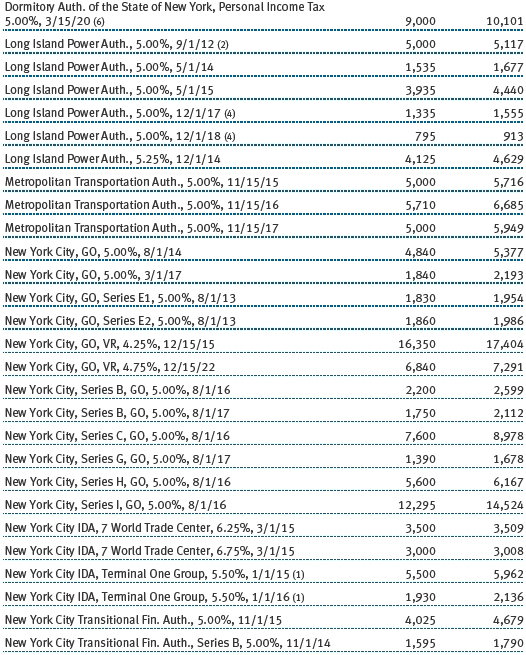

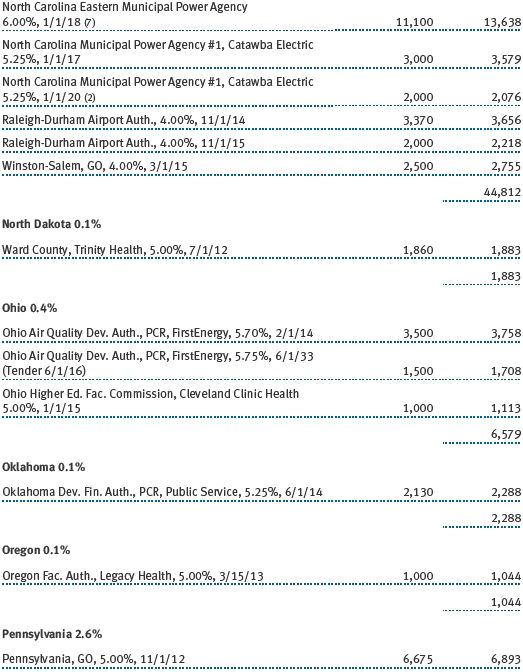

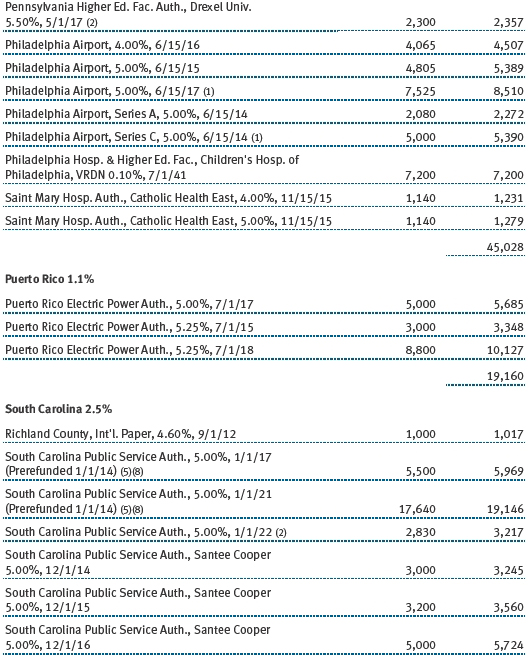

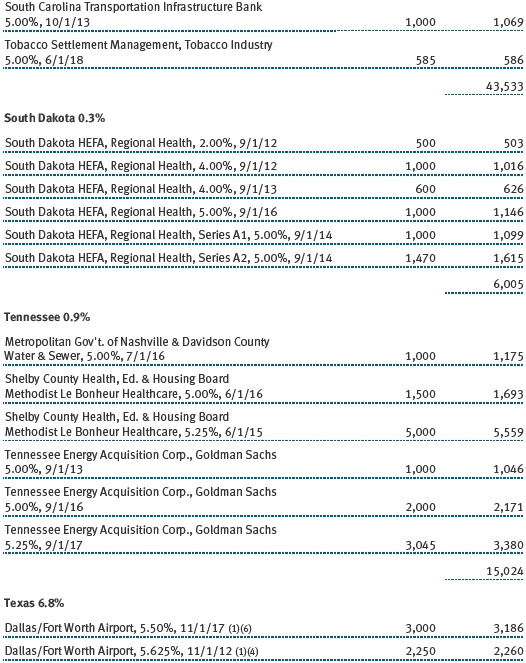

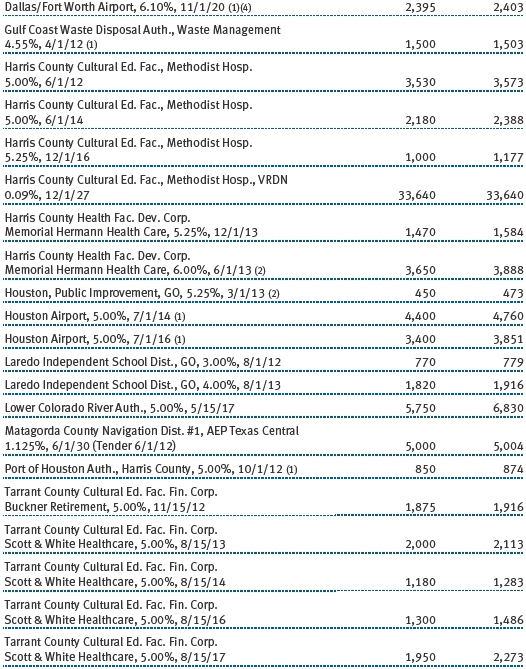

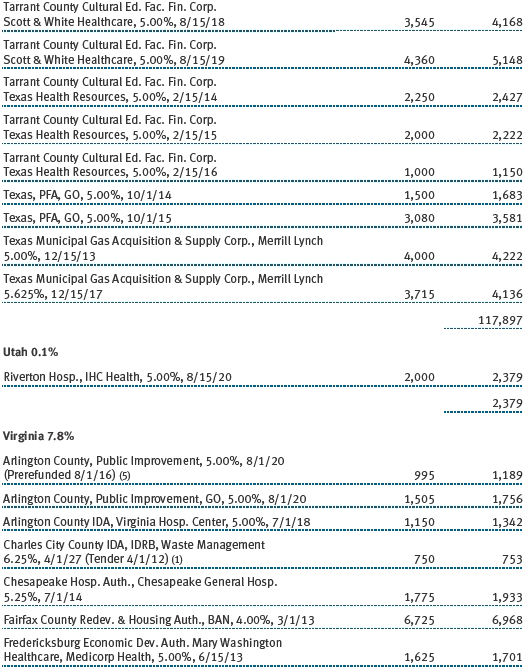

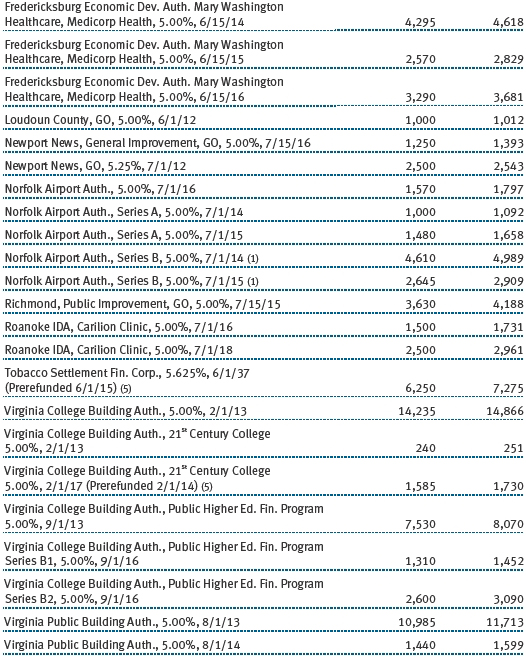

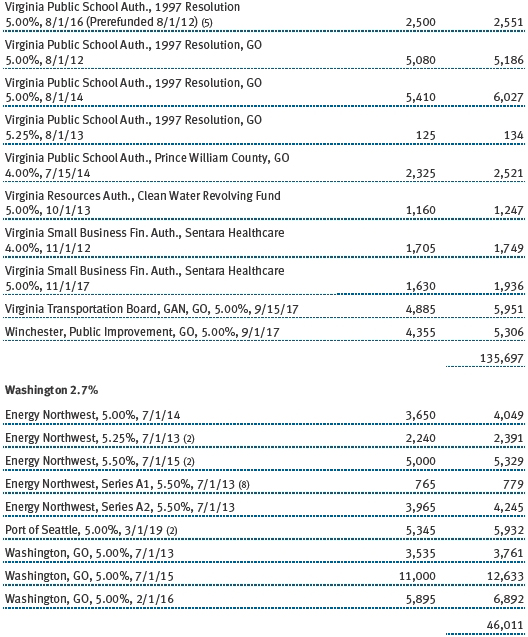

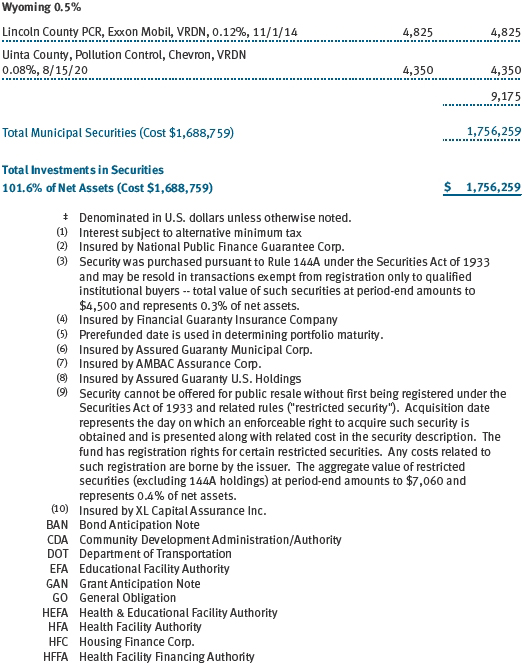

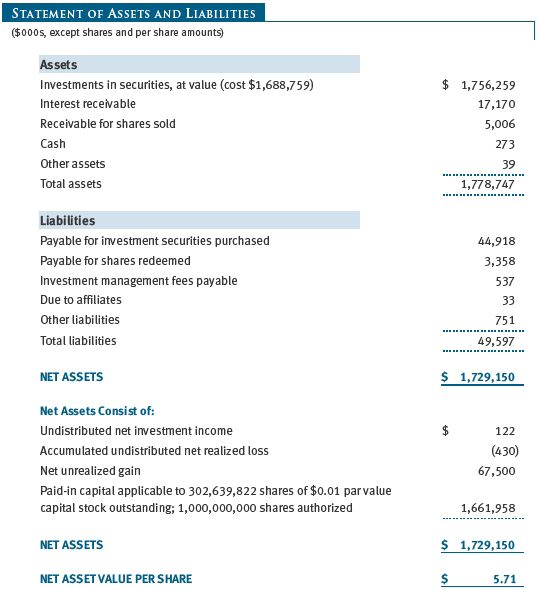

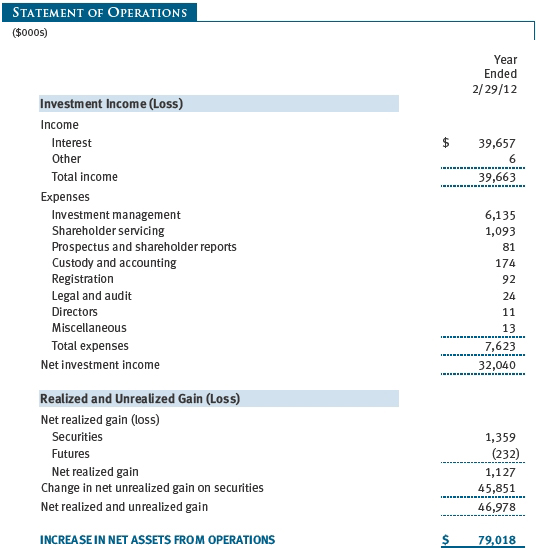

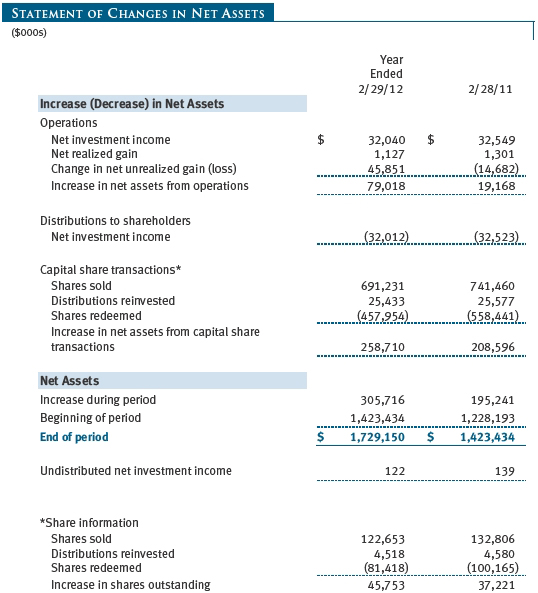

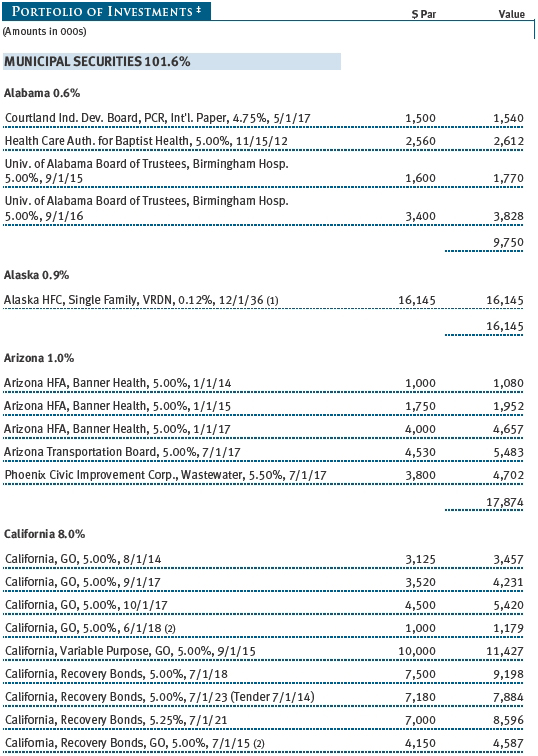

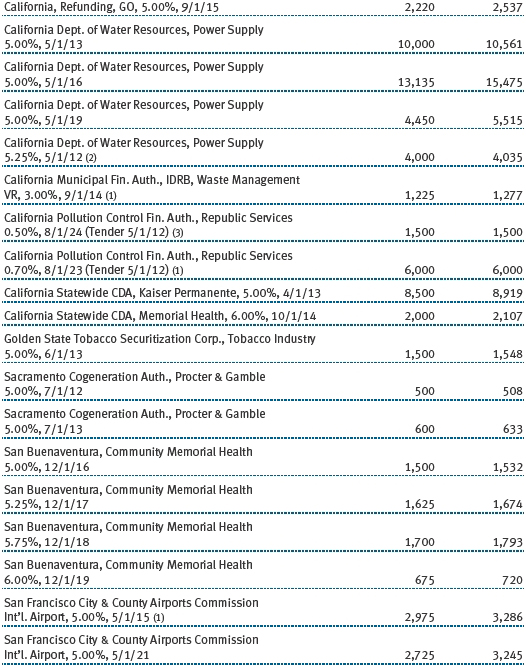

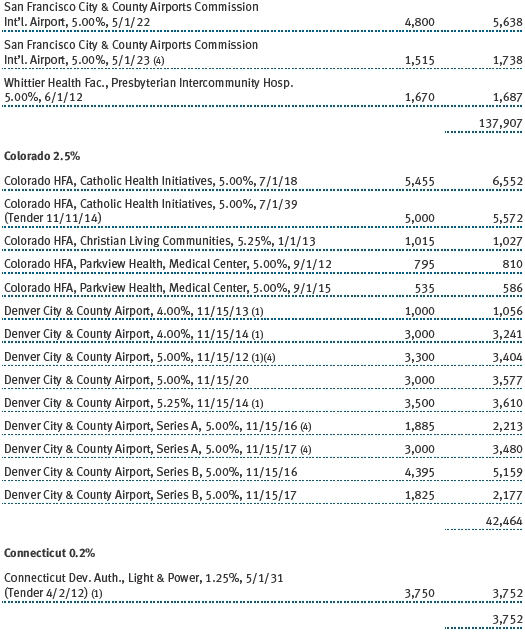

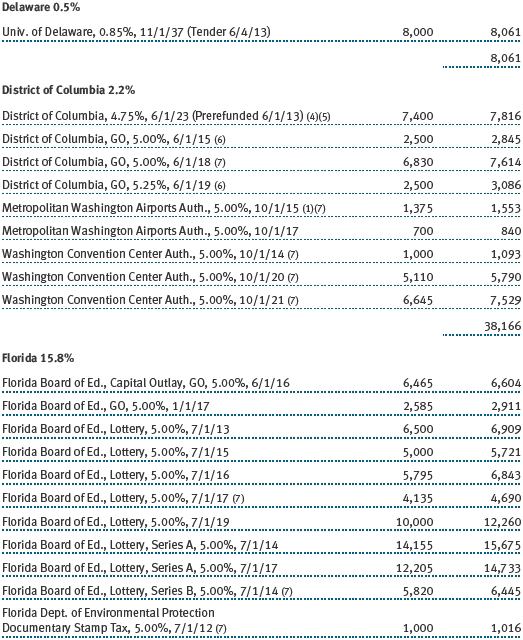

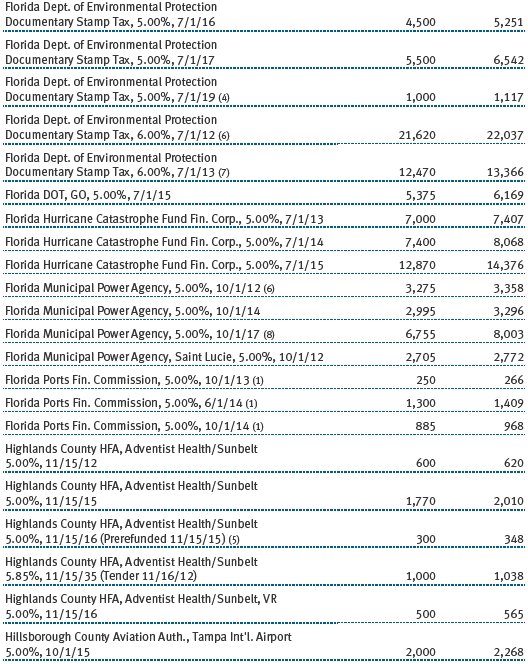

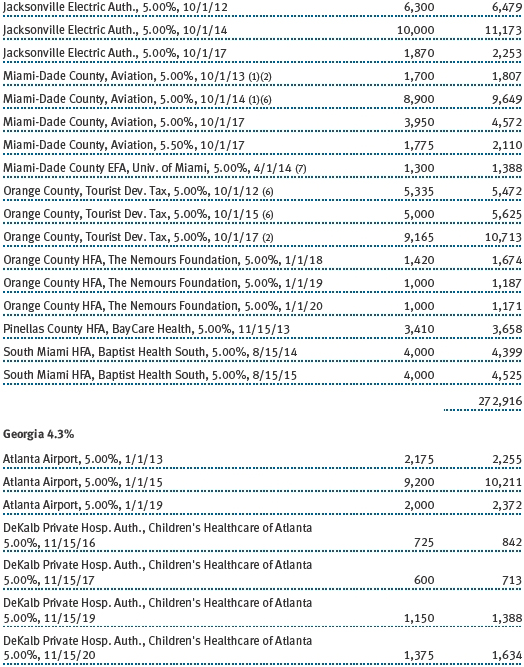

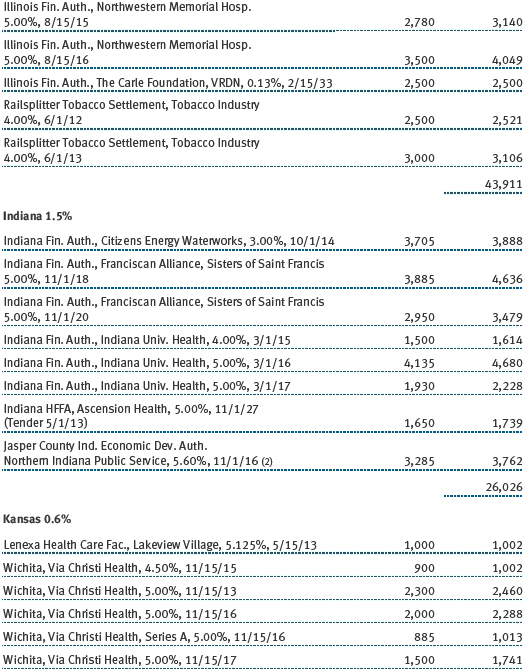

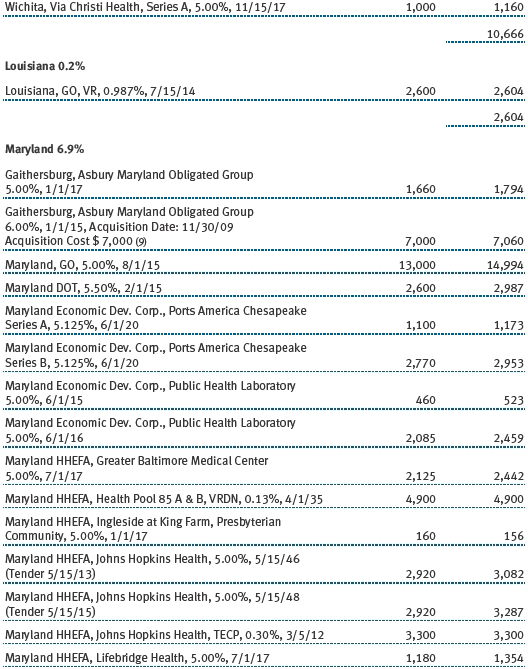

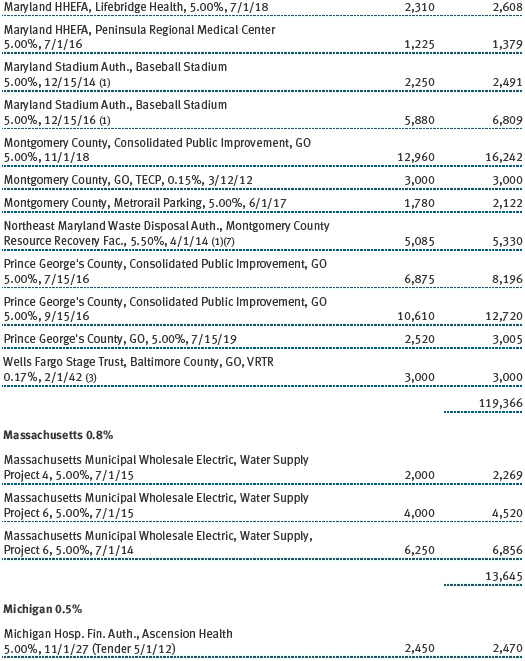

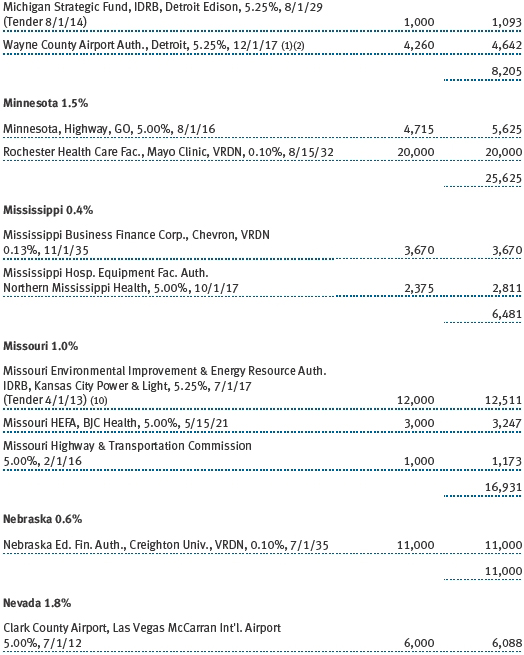

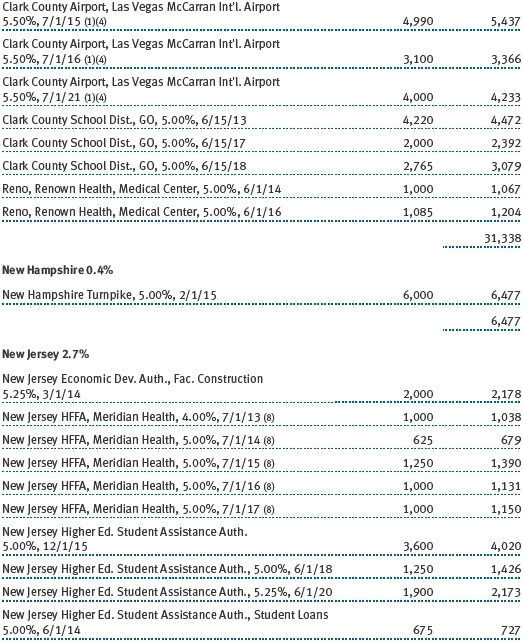

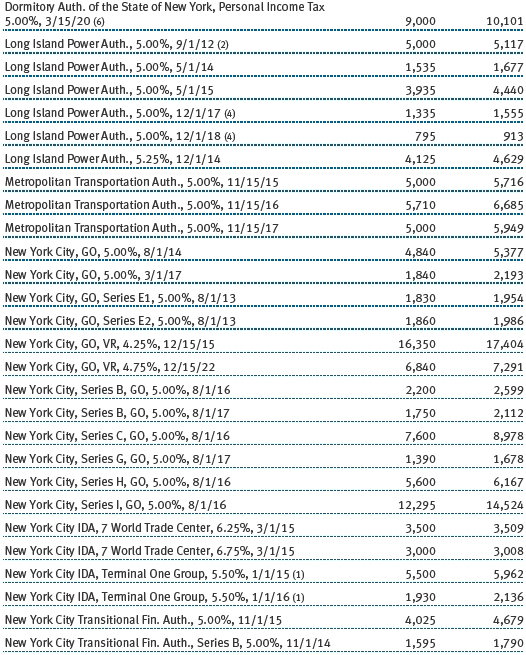

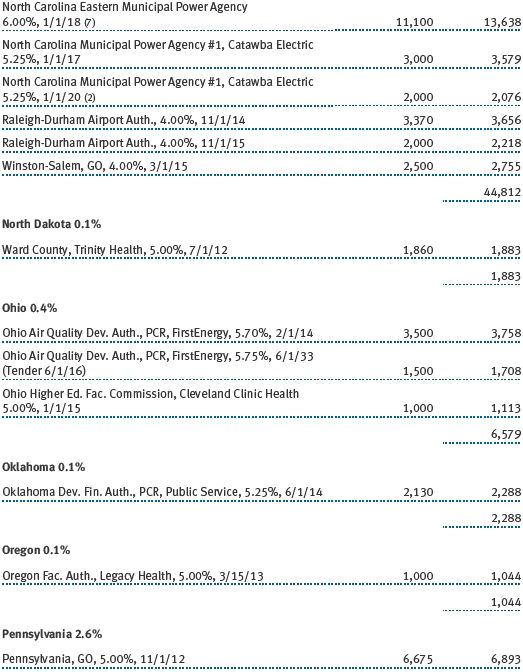

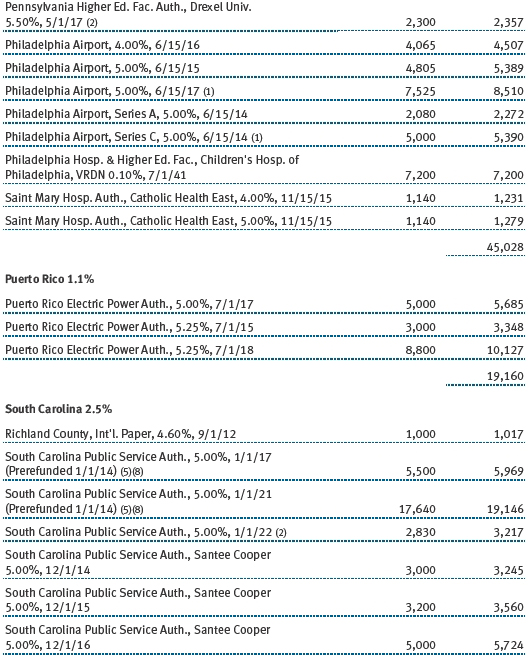

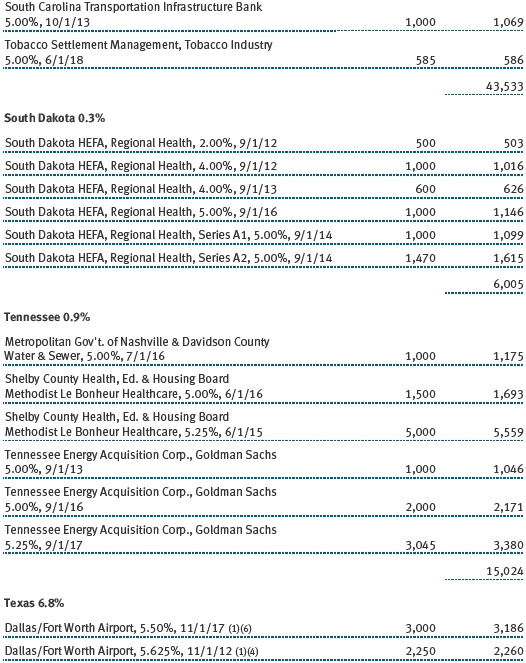

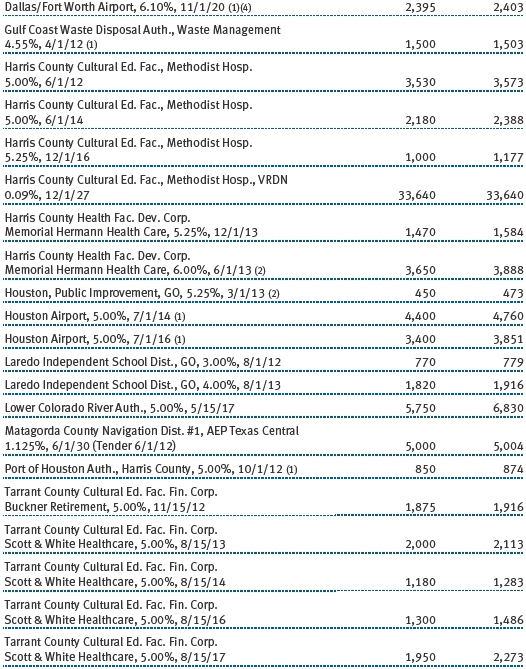

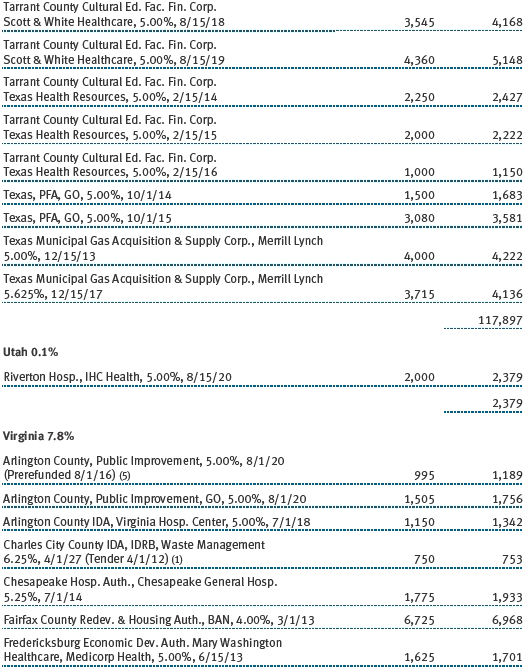

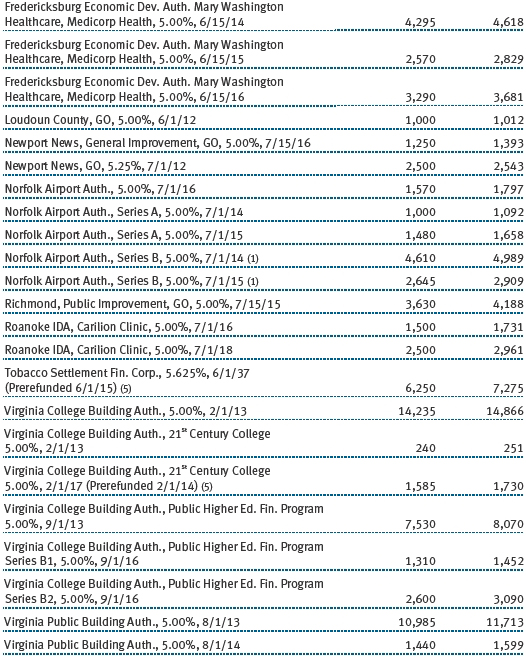

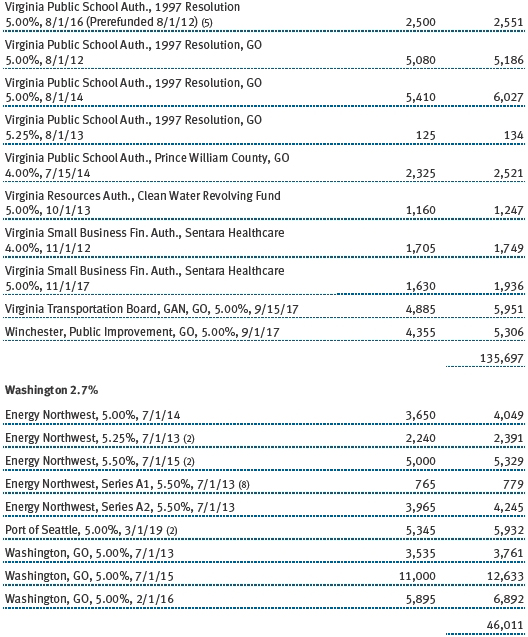

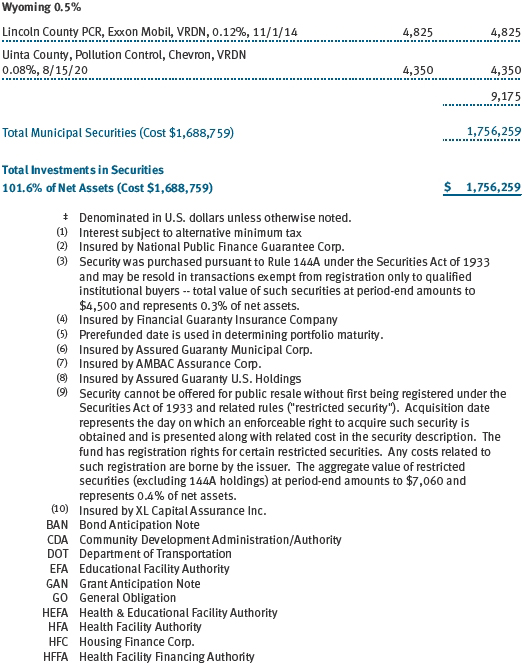

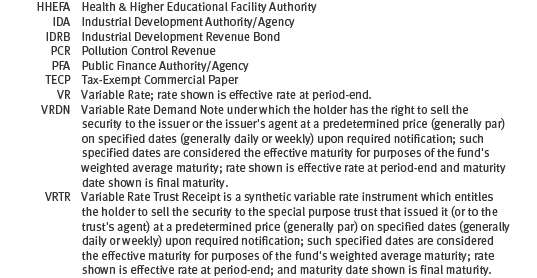

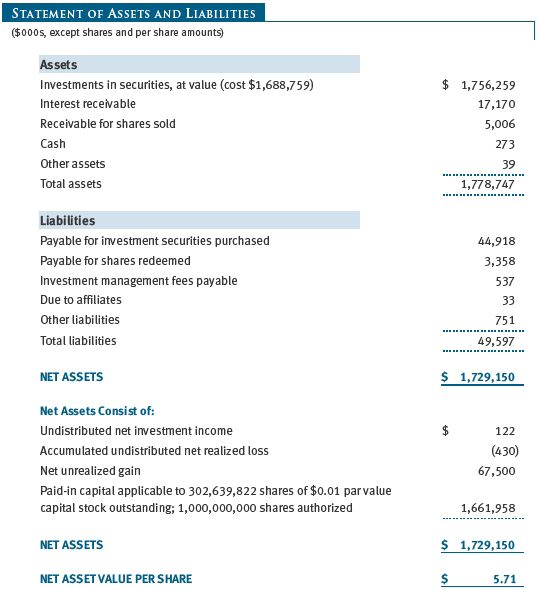

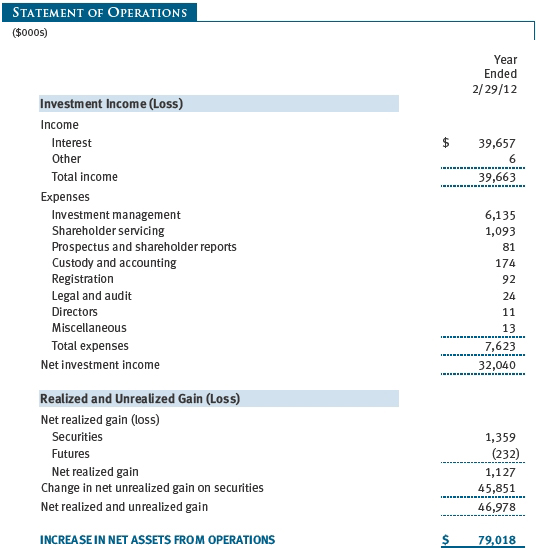

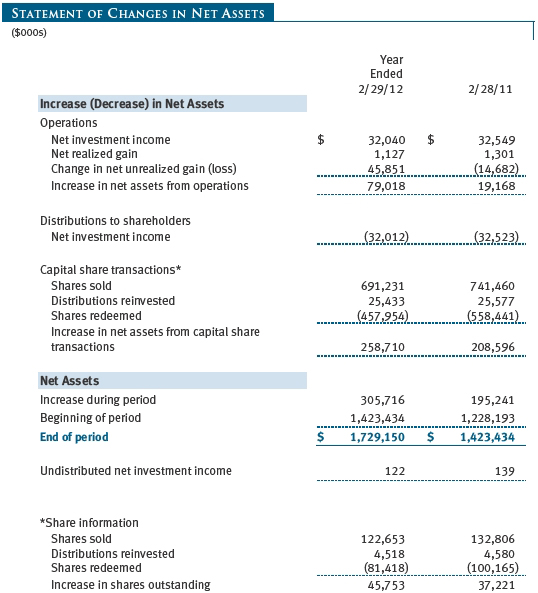

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price Tax-Free Short-Intermediate Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund commenced operations on December 23, 1983. The fund seeks to provide, consistent with modest price fluctuation, a high level of income exempt from federal income taxes by investing primarily in short- and intermediate-term investment-grade municipal securities.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared daily and paid monthly. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Credits The fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

New Accounting Pronouncements In December 2011, the Financial Accounting Standards Board issued amended guidance to enhance disclosure for offsetting assets and liabilities. The guidance is effective for fiscal years and interim periods beginning on or after January 1, 2013; adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Debt securities are generally traded in the over-the-counter (OTC) market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Other investments, including restricted securities and private placements, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value, are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors (the Board). Subject to oversight by the Board, the Valuation Committee develops pricing-related policies and procedures and approves all fair-value determinations. The Valuation Committee regularly makes good faith judgments, using a wide variety of sources and information, to establish and adjust valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of private-equity instruments, the Valuation Committee considers a variety of factors, including the company’s business prospects, its financial performance, strategic events impacting the company, relevant valuations of similar companies, new rounds of financing, and any negotiated transactions of significant size between other investors in the company. Because any fair-value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions.

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. On February 29, 2012, all of the fund’s financial instruments were classified as Level 2, based on the inputs used to determine their values.

NOTE 3 - DERIVATIVE INSTRUMENTS

During the year ended February 29, 2012, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, such as seeking to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, or to adjust portfolio duration and credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. Investments in derivatives can magnify returns positively or negatively; however, the fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover the settlement obligations under its open derivative contracts.

The fund values its derivatives at fair value, as described below and in Note 2, and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. The fund does not offset the fair value of derivative instruments against the right to reclaim or obligation to return collateral. As of February 29, 2012, the fund held no derivative instruments.

Additionally, during the year ended February 29, 2012, the fund recognized $232,000 of loss on interest rate derivatives, included in realized gain (loss) on Futures on the accompanying Statement of Operations.

Counterparty risk related to exchange-traded derivatives, including futures and options contracts, is minimal because the exchange’s clearinghouse provides protection against defaults. Additionally, for exchange-traded derivatives, each broker, in its sole discretion, may change margin requirements applicable to the fund.

Futures Contracts The fund is subject to interest rate risk in the normal course of pursuing its investment objectives and uses futures contracts to help manage such risk. The fund may enter into futures contracts to manage exposure to interest rate and yield curve movements, security prices, foreign currencies, credit quality, and mortgage prepayments; as an efficient means of adjusting exposure to all or part of a target market; to enhance income; as a cash management tool; and/or to adjust portfolio duration and credit exposure. A futures contract provides for the future sale by one party and purchase by another of a specified amount of a particular underlying financial instrument at an agreed-upon price, date, time, and place. The fund currently invests only in exchange-traded futures, which generally are standardized as to maturity date, underlying financial instrument, and other contract terms. Upon entering into a futures contract, the fund is required to deposit with the broker cash or securities in an amount equal to a certain percentage of the contract value (initial margin deposit); the margin deposit must then be maintained at the established level over the life of the contract. Subsequent payments are made or received by the fund each day to settle daily fluctuations in the value of the contract (variation margin), which reflect changes in the value of the underlying financial instrument. Variation margin is recorded as unrealized gain or loss until the contract is closed. The value of a futures contract included in net assets is the amount of unsettled variation margin; net variation margin receivable is reflected as an asset, and net variation margin payable is reflected as a liability on the accompanying Statement of Assets and Liabilities. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values and/or interest rates, and potential losses in excess of the fund’s initial investment. During the year ended February 29, 2012, the fund’s exposure to futures, based on underlying notional amounts, was generally less than 1% of net assets.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $669,625,000 and $327,853,000, respectively, for the year ended February 29, 2012.

NOTE 5 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

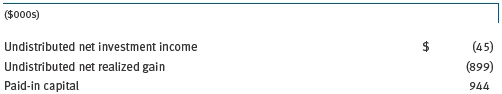

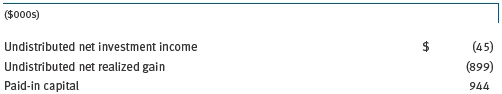

Reclassifications to paid-in capital relate primarily to a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income and/or realized capital gain. For the year ended February 29, 2012, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

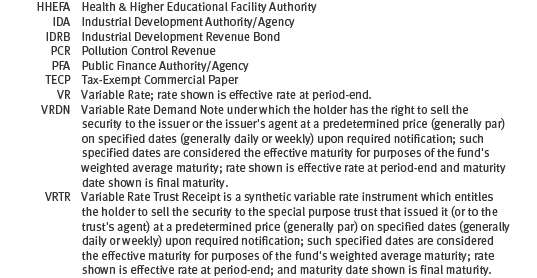

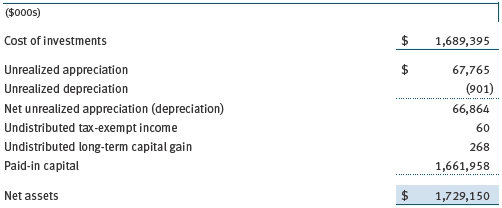

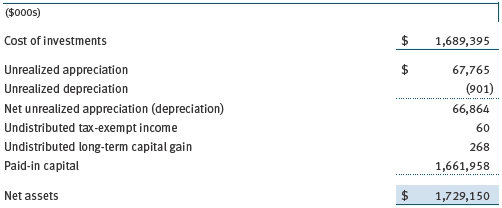

Distributions during the years ended February 29, 2012 and February 28, 2011, totaled $32,012,000 and $32,523,000, respectively, and were characterized as tax-exempt income for tax purposes. At February 29, 2012, the tax-basis cost of investments and components of net assets were as follows:

NOTE 6 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.10% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.28% for assets in excess of $300 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At February 29, 2012, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and a wholly owned subsidiary of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. For the year ended February 29, 2012, expenses incurred pursuant to these service agreements were $92,000 for Price Associates and $209,000 for T. Rowe Price Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

As of February 29, 2012, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 10,889,443 shares of the fund, representing 4% of the fund’s net assets.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of T. Rowe Price

Tax-Free Short-Intermediate Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Tax-Free Short-Intermediate Fund, Inc. (the “Fund”) at February 29, 2012, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at February 29, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

April 13, 2012

| Tax Information (Unaudited) for the Tax Year Ended 2/29/12 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included:

- $469,000 from short-term capital gains.

- $476,000 from long-term capital gains, subject to the 15% rate gains category.

- $32,121,000 which qualified as exempt-interest dividends.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov. The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| Independent Directors | | |

| |

| Name | | |

| (Year of Birth) | | Principal Occupation(s) and Directorships of Public Companies and |

| Year Elected* | | Other Investment Companies During the Past Five Years |

| | | |

| William R. Brody | | President and Trustee, Salk Institute for Biological Studies (2009 |

| (1944) | | to present); Director, Novartis, Inc. (2009 to present); Director, IBM |

| 2009 | | (2007 to present); President and Trustee, Johns Hopkins University |

| | (1996 to 2009); Chairman of Executive Committee and Trustee, |

| | Johns Hopkins Health System (1996 to 2009) |

| | | |

| Jeremiah E. Casey | | Retired |

| (1940) | | |

| 2006 | | |

| | | |

| Anthony W. Deering | | Chairman, Exeter Capital, LLC, a private investment firm (2004 |

| (1945) | | to present); Director, Under Armour (2008 to present); Director, |

| 1983 | | Vornado Real Estate Investment Trust (2004 to present); Director, |

| | Mercantile Bankshares (2002 to 2007); Director and Member of the |

| | Advisory Board, Deutsche Bank North America (2004 to present) |

| | | |

| Donald W. Dick, Jr. | | Principal, EuroCapital Partners, LLC, an acquisition and management |

| (1943) | | advisory firm (1995 to present) |

| 2001 | | |

| | | |

| Karen N. Horn | | Senior Managing Director, Brock Capital Group, an advisory and |

| (1943) | | investment banking firm (2004 to present); Director, Eli Lilly and |

| 2003 | | Company (1987 to present); Director, Simon Property Group (2004 |

| | to present); Director, Norfolk Southern (2008 to present); Director, |

| | Fannie Mae (2006 to 2008) |

| | | |

| Theo C. Rodgers | | President, A&R Development Corporation (1977 to present) |

| (1941) | | |

| 2005 | | |

| | | |

| John G. Schreiber | | Owner/President, Centaur Capital Partners, Inc., a real estate |

| (1946) | | investment company (1991 to present); Cofounder and Partner, |

| 1992 | | Blackstone Real Estate Advisors, L.P. (1992 to present); Director, |

| | General Growth Properties, Inc. (2010 to present) |

| | | |

| Mark R. Tercek | | President and Chief Executive Officer, The Nature Conservancy (2008 |

| (1957) | | to present); Managing Director, The Goldman Sachs Group, Inc. |

| 2009 | | (1984 to 2008) |

| |

| *Each independent director oversees 136 T. Rowe Price portfolios and serves until retirement, resignation, or election of a successor. |

| |

| Inside Directors | | |

| |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| Edward C. Bernard | | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | | Chairman of the Board, Director, and President, T. Rowe Price |

| [136] | | Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Savings |

| | Bank, and T. Rowe Price Services, Inc.; Chairman of the Board, Chief |

| | Executive Officer, and Director, T. Rowe Price International; Chief |

| | Executive Officer, Chairman of the Board, Director, and President, |

| | T. Rowe Price Trust Company; Chairman of the Board, all funds |

| | | |

| Michael C. Gitlin | | Director of Fixed Income, T. Rowe Price (2009 to present); Global |

| (1970) | | Head of Trading, T. Rowe Price (2007 to 2009); Vice President, Price |

| 2010 | | Hong Kong, Price Singapore, T. Rowe Price, T. Rowe Price Group, Inc., |

| [46] | | and T. Rowe Price International; formerly Head of U.S. Equity Sales, |

| | | Citigroup Global Markets (2005 to 2007) |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | | |

| |

| Name (Year of Birth) | | |

| Position Held With Tax-Free | | |

| Short-Intermediate Fund | | Principal Occupation(s) |

| | | |

| M. Helena Condez (1962) | | Vice President, T. Rowe Price |

| Assistant Vice President | | |

| | | |

| G. Richard Dent (1960) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Charles E. Emrich (1961) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Roger L. Fiery III, CPA (1959) | | Vice President, Price Hong Kong, Price |

| Vice President | | Singapore, T. Rowe Price, T. Rowe Price Group, |

| | Inc., T. Rowe Price International, and T. Rowe |

| | Price Trust Company |

| | | |

| John R. Gilner (1961) | | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | | |

| Gregory S. Golczewski (1966) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Trust Company |

| | | |

| Charles B. Hill, CFA (1961) | | Vice President, T. Rowe Price and T. Rowe Price |

| President | | Group, Inc. |

| | | |

| Gregory K. Hinkle, CPA (1958) | | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer | | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly Partner, PricewaterhouseCoopers LLP |

| | (to 2007) |

| | | |

| Dylan Jones, CFA (1971) | | Vice President, T. Rowe Price |

| Assistant Vice President | | |

| | | |

| Marcy M. Lash (1963) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Patricia B. Lippert (1953) | | Assistant Vice President, T. Rowe Price and |

| Secretary | | T. Rowe Price Investment Services, Inc. |

| | | |

| Konstantine B. Mallas (1963) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Hugh D. McGuirk, CFA (1960) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| David Oestreicher (1967) | | Director and Vice President, T. Rowe Price |

| Vice President | | Investment Services, Inc., T. Rowe Price |

| | Retirement Plan Services, Inc., T. Rowe |

| | Price Services, Inc., and T. Rowe Price Trust |

| | Company; Vice President, Price Hong Kong, |

| | Price Singapore, T. Rowe Price, T. Rowe Price |

| | Group, Inc., and T. Rowe Price International |

| | | |

| Deborah D. Seidel (1962) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc.; Assistant Treasurer and Vice |

| | President, T. Rowe Price Services, Inc.; |

| | Assistant Treasurer, T. Rowe Price Retirement |

| | Plan Services, Inc. |

| | | |

| Michael K. Sewell (1970) | | Assistant Vice President, T. Rowe Price |

| Assistant Vice President | | |

| | | |

| Chen Shao (1980) | | Assistant Vice President, T. Rowe Price |

| Assistant Vice President | | |

| | | |

| Timothy G. Taylor, CFA (1975) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Julie L. Waples (1970) | | Vice President, T. Rowe Price |

| Vice President | | |

| | | |

| Edward A. Wiese, CFA (1959) | | Director and Vice President, T. Rowe Price Trust |

| Vice President | | Company; Vice President, T. Rowe Price and |

| | T. Rowe Price Group, Inc.; Chief Investment |

| | Officer, Director, and Vice President, T. Rowe |

| | Price Savings Bank |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

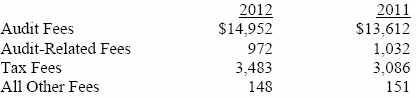

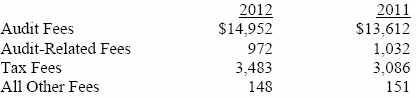

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,704,000 and $1,583,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Tax-Free Short-Intermediate Fund, Inc.

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| | |

| Date April 13, 2012 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| | |

| Date April 13, 2012 | | |

| | |

| | |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| | |

| Date April 13, 2012 | | |