Exhibit 99.2

Forward Looking Statements This presentation includes certain statements that are “forward looking” statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon Thor, and inherently involve uncertainties and risks . These forward looking statements are not a guarantee of future performance . We cannot assure you that actual results will not differ materially from our expectations . Factors which could cause materially different results include, among others, raw material and commodity price fluctuations ; raw material, commodity or chassis supply restrictions ; the impact of tariffs on material or other input costs ; the level and magnitude of warranty claims incurred ; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers ; the costs of compliance with governmental regulation ; legal and compliance issues including those that may arise in conjunction with recently completed transactions ; lower consumer confidence and the level of discretionary consumer spending ; interest rate fluctuations ; the potential impact of interest rate fluctuations on the general economy and specifically on our dealers and consumers ; restrictive lending practices ; management changes ; the success of new and existing products and services ; consumer preferences ; the ability to efficiently utilize production facilities ; the pace of acquisitions and the successful closing, integration and financial impact thereof ; the potential loss of existing customers of acquisitions ; our ability to retain key management personnel of acquired companies ; a shortage of necessary personnel for production ; the loss or reduction of sales to key dealers ; disruption of the delivery of units to dealers ; increasing costs for freight and transportation ; asset impairment charges ; cost structure changes ; competition ; the impact of potential losses under repurchase or financed receivable agreements ; the potential impact of the strength of the U . S . dollar on international demand for products priced in U . S . dollars ; general economic, market and political conditions ; the impact of changing emissions standards in the various jurisdictions in which our products are sold ; and changes to investment and capital allocation strategies or other facets of our strategic plan . Additional risks and uncertainties surrounding the acquisition of EHG include risks regarding the potential benefits of the acquisition and the anticipated operating value creation, the integration of the business, the impact of exchange rate fluctuations and unknown or understated liabilities related to the acquisition and EHG's business . These and other risks and uncertainties are discussed more fully in Item 1 A of our Annual Report on Form 10 - K for the year ended July 31 , 2019 . We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law .

CEO Thor Industries Inc. BOB MARTIN MARTIN BRANDT CEO Erwin Hymer Group SE COLLEEN ZUHL CFO Thor Industries Inc.

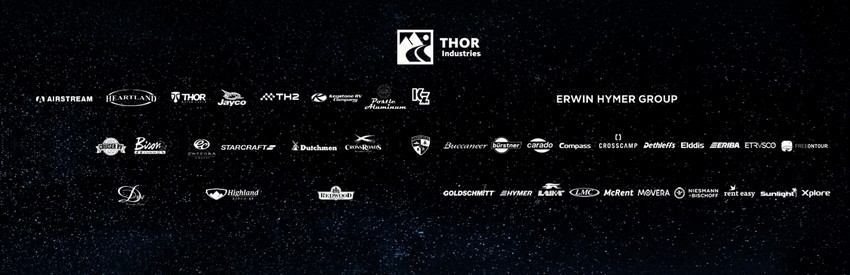

The global leader

$ 7.865 bn 22 0 , 485 21 , 7 50 3,300 EHG included only 2 quarters - for Q3 & Q4

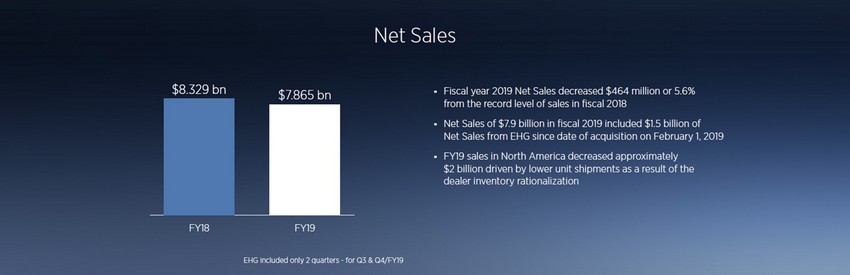

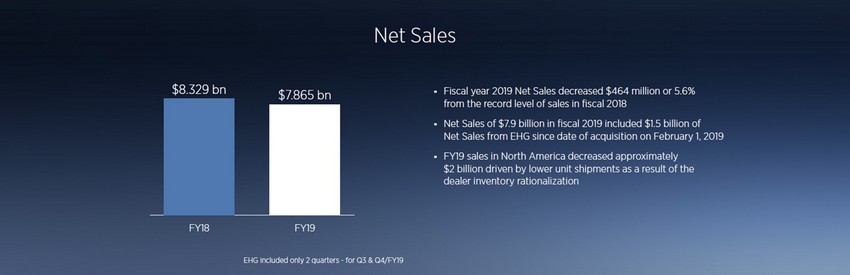

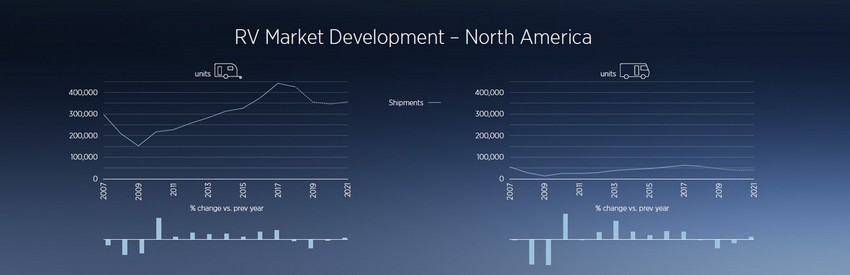

Net Sales FY18 FY19 Ȼ Ȼ Ȼ Fiscal year 2019 Net Sales decreased $464 million or 5.6% from the record level of sales in fiscal 2018 Net Sales of $7.9 billion in fiscal 2019 included $1.5 billion of Net Sales from EHG since date of acquisition on February 1, 2019 FY19 sales in North America decreased approximately $2 billion driven by lower unit shipments as a result of the dealer inventory rationalization $8.328 bn $7.865 bn EHG included only 2 quarters - for Q3 & Q4 /FY19 mtrinske 2019 - 10 - 10 08:15:01 -------------------------------------------- Colleen Talking points:

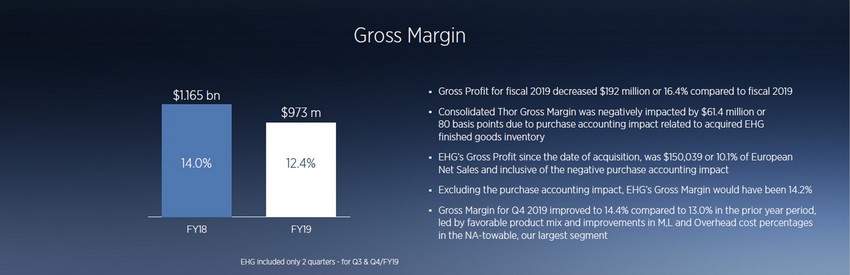

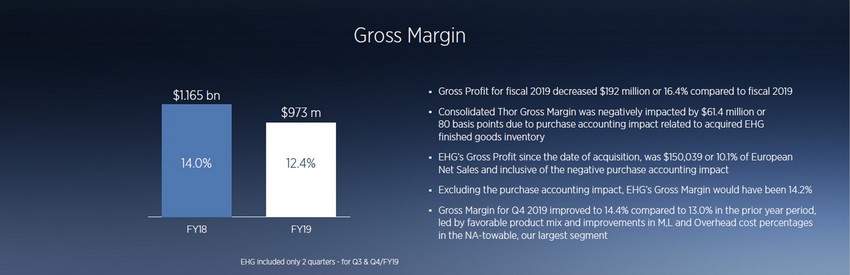

Gross Margin FY18 FY19 Ȼ Ȼ Ȼ Ȼ Ȼ Gross Profit for fiscal 2019 decreased $192 million or 16.4% compared to fiscal 2019 Consolidated Thor Gross Margin was negatively impacted by $ 61 . 4 million or 80 basis points due to purchase accounting impact related to acquired EHG finished goods inventory EHG’s Gross Profit since the date of acquisition, was $150,039 or 10.1% of European Net Sales and inclusive of the negative purchase accounting impact Excluding the purchase accounting impact, EHG’s Gross Margin would have been 14.2% Gross Margin for Q4 2019 improved to 14.4% compared to 13.0% in the prior year period, led by favorable product mix and improvements in M,L and Overhead cost percentages in the NA - towable, our largest segment $1.164 bn $973 m 14.0% 12.4% EHG included only 2 quarters - for Q3 & Q4

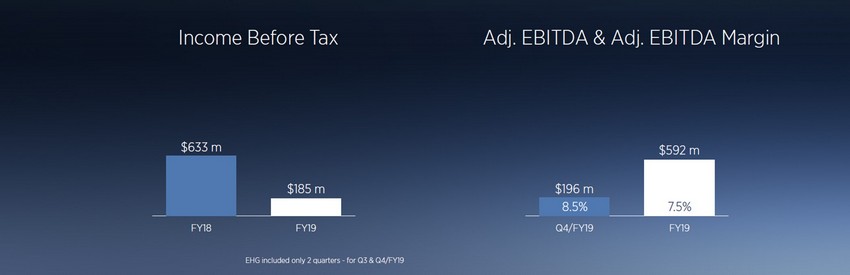

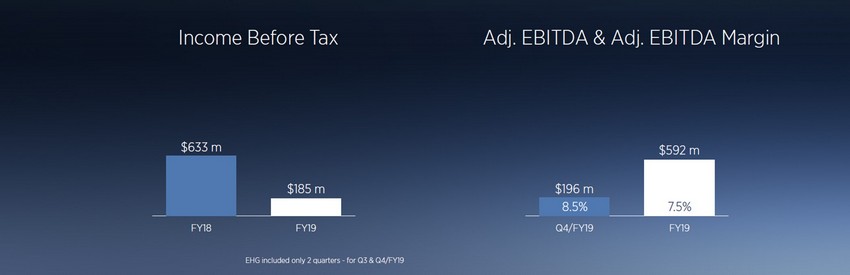

$633 m $592 m $184 m $196 m 8.5% 7.5% FY18 FY19 Q4/FY19 FY19 EHG included only 2 quarters - for Q3 & Q4

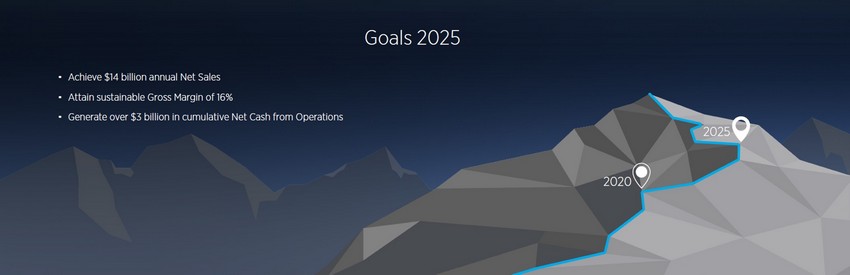

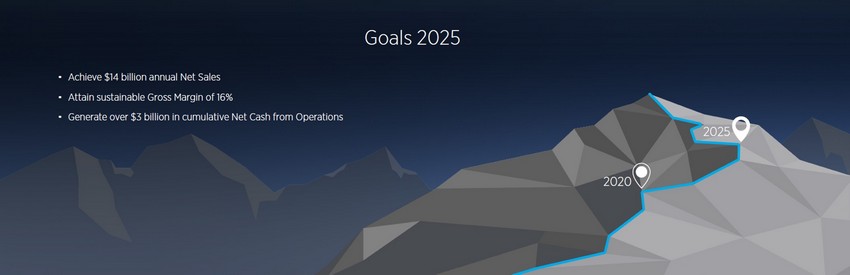

Goals 2025 2 0 25 2020 Pfad raus

Goals 2025 2 0 25 2020 Pfad raus

Lulic 2019 - 10 - 10 05:44:02 -------------------------------------------- expense