UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-14656

REPLIGEN CORPORATION

(Exact name of registrant as specified in its charter)

| |

Delaware | 04-2729386 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

41 Seyon Street, Bldg. 1, Suite 100 Waltham, MA | 02453 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (781) 250-0111

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

Common Stock, par value $0.01 per share | RGEN | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒.

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒.

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, was $8,911,722,244.

The number of shares of the registrant’s common stock outstanding as of February 17, 2023, was 55,562,583.

Documents Incorporated By Reference

The registrant intends to file a proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended December 31, 2022. Portions of such proxy statement are incorporated by reference into Part III of this Annual Report on Form 10-K.

| | |

Auditor Firm Id | Auditor Name | Auditor Location |

42 | Ernst & Young LLP | Boston, Massachusetts, United States |

Table of Contents

Summary of the Material Risks Associated with Our Business

Our business is subject to numerous risks and uncertainties that you should be aware of in evaluating our business. These risks include, but are not limited to, the following:

•Our product revenue may be negatively impacted by a number of factors, including without limitation, competition in the bioprocessing market, our historical reliance on a limited number of large customers, our ability to develop or acquire additional bioprocessing products in the future, our ability to manufacture our bioprocessing products sufficiently and timely, supply chain issues and/or disruption, and our ability to effectively penetrate the bioprocessing products market.

•We rely on a limited number of suppliers or, for certain of our products, one supplier, and we may not be able to find replacements or immediately transition to alternative suppliers, which could have a material adverse effect on our financial condition, results of operations and reputation.

•The market may not be receptive to our new bioprocessing products upon their introduction.

•If our products do not perform as expected or the reliability of the technology on which our products are based is questioned, we could experience lost revenue, delayed or reduced market acceptance, increased cost and damage to our reputation.

•If we are unable to manufacture our products in sufficient quantities and in a timely manner, our operating results will be harmed, our ability to generate revenue could be diminished and our gross margin may be negatively impacted.

•Our acquisitions expose us to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or technologies.

•Our results of operations could be negatively affected by potential fluctuations in foreign currency exchange rates.

•If we are unable to continue to hire and retain skilled personnel, then we will have trouble developing and marketing our products.

•If we are unable to obtain, maintain and protect our intellectual property rights related to our products, we may not be able to succeed commercially.

•Climate change, climate change-related regulation and sustainability concerns could adversely affect our businesses and the operations of our subsidiaries, and any actions we take or fail to take in response to such matters could damage our reputation.

•Natural disasters, geopolitical unrest, war, terrorism, public health issues, including the COVID-19 pandemic, including all emerging variants of the SARS-CoV-2 coronavirus and the ongoing conflict between Russia and Ukraine, or other catastrophic events could disrupt the supply, delivery or demand of products, which could negatively affect our operations and performance.

•Our internal computer systems, or those of our customers, collaborators or other contractors, may be subject to cyber-attacks or security breaches, which could result in a material disruption of our product development programs.

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Form 10-K”) contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements in this Form 10-K do not constitute guarantees of future performance. Investors are cautioned that express or implied statements in this Form 10-K that are not strictly historical statements, including, without limitation, statements regarding current or future financial performance, potential impairment of future earnings, management’s strategy, plans and objectives for future operations or acquisitions, product development and sales, research and development, selling, general and administrative expenditures, intellectual property and adequacy of capital resources and financing plans constitute forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including, without limitation, the risks identified under the caption “Risk Factors” and other risks detailed in this Form 10-K and our other filings with the Securities and Exchange Commission (the “SEC”). We assume no obligation to update any forward-looking information contained in this Form 10-K, except as required by law.

1

PART I

ITEM 1. BUSINESS

The following discussion of our business contains forward-looking statements that involve risks and uncertainties. When used in this report, the words “intend,” “anticipate,” “believe,” “estimate,” “plan” and “expect” and similar expressions as they relate to us are included to identify forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements and are a result of certain factors, including those set forth under “Risk Factors” and elsewhere in this Annual Report on Form 10-K (“Form 10-K”).

References throughout this Form 10-K to “Repligen Corporation”, “Repligen”, “we”, “us”, “our”, or the “Company” refer to Repligen Corporation and its subsidiaries, taken as a whole, unless the context otherwise indicates.

Overview

Repligen Corporation is a global life sciences company that develops and commercializes highly innovative bioprocessing technologies and systems that increase efficiencies and flexibility in the process of manufacturing biological drugs.

As the overall market for biologics continues to grow and expand, our primary customers – global biopharmaceutical companies, contract development and manufacturing organizations and other life science companies (integrators) – face critical production cost, capacity, quality and time pressures. Built to address these concerns, our products help set new standards for the way biologics are manufactured. We are committed to inspiring advances in bioprocessing as a trusted partner in the production of critical biologic drugs – including monoclonal antibodies (“mAbs”), recombinant proteins, vaccines, and cell and gene therapies (“C>”) – that are improving human health worldwide. Increasingly, our technologies are being implemented to overcome challenges in processing plasmid DNA (a starting material for the production of mRNA) and gene delivery vectors such as lentivirus and adeno-associated viral vectors.

We currently operate as one bioprocessing business, with a comprehensive suite of products to serve both upstream and downstream processes in biological drug manufacturing. Building on over 40 years of industry expertise, we have developed a broad and diversified product portfolio that reflects our passion for innovation and the customer-first culture that drives our entire organization. We continue to capitalize on opportunities to maximize the value of our product platform through both organic growth initiatives (internal innovation and commercial leverage) and targeted acquisitions.

Our corporate headquarters are located in Waltham, Massachusetts, with additional administrative and manufacturing operations worldwide. The majority of our 18 manufacturing sites and assembly centers are located in the United States (California, Massachusetts, New Hampshire, New Jersey, New York and Texas). Outside the United States, we have sites in Estonia, France, Germany, Ireland, the Netherlands and Sweden. Our primary warehouse and distribution centers are located in Massachusetts and California.

Our Products

Our bioprocessing business is comprised of four main franchises: filtration; chromatography; process analytics; and proteins.

Since 2012, we have purposely built a highly diversified portfolio of products offered under these franchises, developing high-value technologies that enable more efficient drug manufacturing processes for our customers, through internal research and development (“R&D”) programs and strategic acquisitions. We are committed to sustainable innovation and have earned a reputation as an innovation leader in bioprocessing. We have consistently introduced disruptive new products that solve for specific bioprocessing challenges faced by customers. Our growth strategy continues to expand our geographic scope and customer base and broaden the applications of our technologies.

To support our sales goals for these products, we make ongoing investments in our commercial organization, our R&D programs, our business systems and our manufacturing capacity. We regularly evaluate and invest in these areas as needed to ensure timely deliveries and to stay ahead of increased customer demand for our products.

2

A majority of our revenue is derived from consumable and/or single-campaign (“single-use”) product sales, as compared to associated equipment. The customization, scalability and plug-and-play convenience of these products, and in many cases the closed nature of our technologies, make them ideal for use in biologics manufacturing processes where contamination risk is a critical concern of our customers.

Filtration

Filtration is our largest franchise with the broadest product offering covering upstream and downstream technologies. Below is a description of some of our key products:

XCell ATF® Cell Retention Systems

Our filtration products offer a number of advantages to manufacturers of biologic drugs and are used in process development and process scale (clinical and commercial) production. Our XCell ATF systems are used in upstream perfusion (continuous) and N-1 (intensified fed-batch or hybrid perfusion) cell culture processing.

XCell ATF is a cell retention technology. The system is comprised of an advanced hollow fiber (“HF”) filtration device, a low shear pump and a controller. The XCell ATF system is connected to a bioreactor and enables the cell culture to be run continuously, with cells being retained in the bioreactor, fresh nutrients (cell culture media) being fed into the reactor continuously, and clarified biological product and cell waste being removed (harvested) continuously. The cells are maintained in a consistent nutrient-rich environment and can reach cell densities two- and three-times higher than those achieved by standard fed-batch culture. As a result, product yield is increased, which improves facility utilization and can reduce the size of a bioreactor required to manufacture a given volume of biologic drug product. XCell ATF systems are available in a wide range of sizes that can easily scale from laboratory use through full production with bioreactors as large as 5,000 liters.

Through internal innovation, we developed and launched single-use formats of the original stainless steel XCell ATF devices to address increasing industry demand for single-use sterile systems with “plug-and-play” technology. The XCell ATF device is now available to customers in both its original configuration (steel housing and single-use filters) in all sizes (2, 4, 6 and 10), and/or as a single-use device (disposable housing/filter combination) in most sizes (2, 6, and 10). The availability of XCell ATF technology in a single-use format reduces implementation time by eliminating the time intensive workflow associated with autoclaving and enables our customers to accelerate evaluations of the product with a lower initial overall cost of ownership.

Tangential Flow Filtration Systems and Consumables

Our systems for tangential flow filtration ("TFF") combine significant configurability with premium quality manufacturing. System designs maximize scalability from small to large (up to 5,000 liters) volumes, flexibility between HF and flat sheet ("FS") filter formats, and ability to use the same system in different unit operations while deploying ready-to-use application-specific flow path assemblies. Our team of sales specialists and applications experts help support rapid start-up and robust operation in cGMP processes.

TangenX® Flat Sheet Cassettes

Our TangenX portfolio of FS TFF cassettes are used primarily in downstream, ultrafiltration processes, e.g., biologic drug concentration, buffer exchange and formulation processes. The TangenX product portfolio includes our single-use SIUS® line and our reusable PRO line of cassettes, providing customers with a high-performance, cost saving alternative to other companies' TFF cassette offerings.

TFF is a rapid and efficient method for the concentration and formulation of biomolecules that is widely used in many applications in biopharmaceutical development and manufacturing. Our TangenX FS TFF cassettes feature high performing-membrane chemistries that offer superior selectivity for a wide range of applications. A controlled manufacturing process that balances flux and selectivity delivers maximum flux for increased productivity and tight control of the membrane pore size for enhanced selectivity and recovery. Each single-use cassette is delivered pre-sanitized and ready to be equilibrated and used for tangential flow, ultrafiltration and diafiltration applications. Use of SIUS TFF cassettes eliminates non-value-added steps (cleaning, testing between uses, storage and flushing) that are required with reusable TFF products, providing cost and time savings. For process economics requiring reusable

3

cassettes, TangenX PRO cassettes are available with the same high performance membranes used in SIUS cassettes. Our TangenX cassettes are interchangeable with filter hardware from multiple manufacturers, simplifying customer trial and adoption.

In 2020, we introduced SIUS Gamma single-use device, which we engineered to harness the performance and efficiencies of TangenX SIUS membranes and cassettes, while also providing the convenience of a fully assembled, aseptically closed and gamma-irradiated, sterile device. The device is delivered as a single unit composed of the cassette, fluid manifold, clamps, tubing and aseptic connectors. The SIUS Gamma device is ideal for adenovirus C> and other processes where large volumes need to be concentrated in a sterile, closed environment.

KrosFlo® TFF Systems - Flat Sheet and Hollow Fiber

Our systems for TFF combined significant configurability with premium quality manufacturing. Our TFF systems are designed for scalability from small to large (up to 5,000 liters) volumes, flexibility between HF and FS filter formats, and the ability to use the same system in different unit operations while deploying ready-to-use application-specific flow paths.

Our KrosFlo TFF systems are turnkey solutions for TFF, offered with either TangenX FS cassettes or with our HF filters.

KrosFlo® Flat Sheet TFF Systems

Our 2020 acquisition of ARTeSYN Biosolutions Holdings Ireland Limited (“ARTeSYN”) enabled us to develop and market KrosFlo RS TFF systems that integrate our consumable and equipment offering, providing greater convenience and efficiency for our customers.

We launched our KrosFlo RS 20 series systems in 2022, focusing their use in mRNA and C> therapy applications, where they are used primarily in downstream formulation. These responsive TFF systems completely automate sanitization, concentration and product recovery processes. The combination of injection molded tubing, over-molded connectors and valve blocks significantly lowers product hold-up volume to maximize product recovery. With the same software, hardware, controls and cGMP compliance built into every system, and with preassembled flow kits for error-free installation, the KrosFlo RS platform offers operational simplicity that can easily scalable from lab- through production-scale use. KrosFlo FS systems integrate over 10 components with specifications to process volumes between 140 milliliters and 500 liters.

KrosFlo® Hollow Fiber TFF Systems

Our filtration business is strengthened by a leading portfolio of Spectrum® HF filtration solutions, including fully integrated KrosFlo TFF systems with Konduit automated process monitoring and ProConnex® Flow Path single-use assemblies. The KrosFlo family of HF TFF systems integrate multiple components with specifications to process volume between 2 milliliters and 5,000 liters – from lab-scale through commercial manufacturing.

KrosFlo systems enable robust downstream ultrafiltration and microfiltration.

KrosFlo® TFDF® Systems

We believe our KrosFlo Tangential Flow Depth Filtration ("TFDF") systems, have the potential to disrupt and displace traditional upstream harvest clarification operations. The KrosFlo TFDF system includes control hardware, novel high throughput tubular depth filters and ProConnex TFDF flow paths. When used for cell culture clarification, single-use KrosFlo TFDF technology delivers unprecedented high flux (>1,000 LMH), high capacity, low turbidity, and minimal dilution, making the technology a high-performance alternative to traditional centrifugation and depth filtration approaches to harvest clarification. TFDF technology also provides benefits such as low hold-up volume, high recovery, small footprint, simple set up and disposal, scalability and reduced process time.

Strengthening our Filtration Franchise through Acquisitions

With our acquisition of Engineered Molding Technology LLC (“EMT”) on July 13, 2020, we added EMT’s silicone-based, single-use components and manifolds to our filtration franchise. These fluid management products are key components in single-use filtration

4

and chromatography systems and will help expand our line of single-use ProConnex flow paths, streamline our supply chain for XCell ATF and provide more flexibility as we scale and expand our single-use and systems portfolios.

With our acquisition of Non-Metallic Solutions, Inc., ("NMS") on October 20, 2020, we expanded our line of single-use systems and associated integrated flow path assemblies, streamlining our supply chain, and giving us more flexibility to scale and expand single-use and systems portfolios.

With our acquisition of ARTeSYN on December 3, 2020, we expanded our filtration offering with state-of-the-art, configurable filtration. With this acquisition we also added single-use components and flow path assemblies for fluid management, providing greater flexibility and market opportunity as we scale and expand our systems portfolio.

With our acquisition of Polymem S.A. (“Polymem”) on July 1, 2021, we further expanded our HF membrane and module production capabilities and added core R&D, engineering and production expertise in HF technology for both industrial and bioprocessing markets. The Polymem business complements our Spectrum HF product line, which includes KrosFlo HF TFF systems and ProConnex fluid management. The acquisition of Polymem accelerated our HF manufacturing buildout and added a Europe-based HF manufacturing center of excellence.

With our acquisition of BioFlex Solutions LLC (“BioFlex”) and Newton T&M Corp. (“NTM”) on December 16, 2021, we complemented and expanded our filtration franchise, as both BioFlex and NTM focus on single-use fluid management components, including single-use clamps, adapters, end caps and hose assemblies. These products are essential components in our upstream and downstream product offerings – especially our systems with line-sets and flow paths. These acquisitions streamline and increase our control over many components in our single-use supply chain, which ultimately should drive reduced lead-times for our customers in the coming years.

The growth of our filtration business has allowed us to substantially increase our direct sales presence in Europe and Asia and diversify our end markets to include all biologic classes, including mAbs, vaccines, recombinant proteins and C>.

Chromatography

Our chromatography franchise includes a number of products used in downstream purification, development, manufacturing and quality control of biological drugs. The main driver of growth in this portfolio is our OPUS® pre-packed column (“PPC”) product line.

In addition to OPUS, with our acquisition of ARTeSYN in 2020, we added chromatography systems to our offerings, providing greater flexibility and market opportunity as we scale and expand our systems portfolio.

Additional chromatography products include our affinity capture resins, such as CaptivA® Protein A resins, which are used in a small number of commercial drug processes and our ELISA test kits, used by quality control departments to detect and measure the presence of leached Protein A and/or growth factor in the final product.

OPUS Pre-Packed Columns

Our chromatography franchise features a wide range of OPUS columns, which we deliver to our customers sealed and pre-packed with their choice of resin. These are single-use or campaign-use disposable columns that replace the use of customer-packed glass columns for downstream purification. By designing OPUS columns to be a technologically advanced and flexible option for the purification of biologics from process development through clinical and commercial-scale manufacturing, Repligen has become a leader in the PPC market. Our biomanufacturing customers value the significant cost savings that OPUS columns can deliver by reducing set up time, labor, equipment and facility costs – in addition to delivering product consistency and “plug-and-play” convenience.

We launched our first production scale OPUS columns in 2012 and have since added larger diameter options that scale up to use with 2,000 liter bioreactors. Our OPUS 80R column is the largest available PPC on the market for use in late-stage clinical or commercial purification processes. We offer unique features such as a resin recovery port on our larger columns, which allows our customers to remove and reuse the recovered resin in other applications. We believe the OPUS 5-80R product line is the most flexible product line

5

available in the market, serving the purification needs of customers manufacturing mAbs and other biologics such as vaccines and C>.

In addition to our larger scale OPUS columns, our portfolio includes our smaller-scale OPUS columns, including our RoboColumn®, MiniChrom® and ValiChrom® columns used for process development (“PD”) and validation. These columns are used in high-throughput PD screening, viral clearance validation studies and scale down validation of chromatography processes.

We maintain customer-facing centers in both the United States and Europe for our OPUS column customers, and offer a premier ability to pack any of hundreds of chromatography capture resins available, as per our customers’ choice.

KRM™ Chromatography Systems

Through our acquisition of ARTeSYN in 2020, we gained state-of-the-art, configurable chromatography systems that can integrate a wide range of hardware, components and consumable products to simplify bioprocessing operations for our customers. Our KRM chromatography systems are precision engineered for high product recovery (low hold-up volumes), high bioactivity (less stress on the product of interest) and reduced risk of deviation (simple changeovers and pre-assembled flow kits). The KRM systems contain closed single-use flow paths (less risk of contamination and product loss) and other advanced fluid management technologies (over-molded connectors, pump heads, filters and pressure sensors), intuitive software and our process analytics technology enabled.

Process Analytics Technologies

Our process analytics products complement and support our filtration, chromatography and proteins franchises as they allow end-users to make at-line or in-line absorbance measurements allowing for the determination of protein concentration in filtration, chromatography formulation and fill-finish applications.

SoloVPE® Device

Our SoloVPE slope spectroscopy system is the industry standard for offline and at-line absorbance measurements for protein concentration determination in process development, manufacturing and quality control settings.

FlowVPE® Device

Our FlowVPE slope spectroscopy system enhances the power of slope spectroscopy and provides in-line protein concentration measurement for filtration, chromatography and fill-finish applications. A key benefit of this in-line solution is the ability to monitor a manufacturing process in real time.

FlowVPX® System

FlowVPX slope spectroscopy system is our next-generation FlowVPE launched at the beginning of 2021 and designed to meet the rigors of regulatory GMP requirements. FlowVPX offers reliable real-time results with integrated ease for concentration measurements during every stage of the downstream GMP-compliant production-scale biologics manufacturing.

Use of slope spectroscopy systems delivers multiple process benefits for our biopharmaceutical manufacturing customers, compared to traditional UV-Vis approaches. Key benefits include: the elimination of manual dilutions and sample transfers from process development/manufacturing to labs, rapid time to results (minutes versus hours), improved precision, built-in data quality for improved reporting and validation, and ease of use.

KrosFlo® KR2i RPM™ System with integrated FlowVPX® Technology

In 2022, we completed the development of a HF system with integrated FlowVPX processing monitoring and measurement technology, which launched in January 2023. The KrosFlo® KR2iRPM™ system includes first-to-market real-time process monitoring for in-line protein concentration management. This "walk-away automation" system monitors concentration during ultrafiltration/diafiltration runs without having to depend on mass inputs and off-line fixed pathlength UV-Vis spectrophotometers. Risk is mitigated with fully enclosed ProConnex custom flow paths a part of the automated TFF process. This system allows for processing of volumes from 10 milliliters to 10 liters to meet both lab and clinical production requirements, enabling low volume, high

6

concentration applications. This solution provides key process insights to the users to reduce cycling time and minimize batch risks, both highly value attributes for bioprocessing users.

Culpeo® QCL-IR Liquid Analyzer

Pursuant to a 15-year license agreement that we entered into with DRS Daylight Solutions, Inc. ("Daylight") in September 2022, we obtained the exclusive right to use Daylight's quantum cascade laser technology ("QCL"), including its Culpeo® QCL-IR Liquid Analyzer ("Culpeo") specifically in the field of bioprocessing. Culpeo is a compact, intelligent spectrometer that uses the power of QCL to analyze and identify chemicals. Our in-licensing of these rights complements our existing process analytics franchise. Adding mid-IR (higher sensitivity QCL-IR) to UV spectroscopy, we believe this will serve to accelerate and expand adoption of off-line and in-line process monitoring in the bioprocessing industry. Additionally, we are focused on expanding the QCL portfolio, with plans to integrate these solutions into our chromatography and filtration systems.

Proteins

Our proteins franchise is represented by our Protein A affinity ligands and viral vector affinity ligands and resins. Our proteins franchise also includes cell culture growth factor products, which are a key component of cell culture media used in upstream bioprocessing to increase cell density and improve product yield.

Protein A Affinity Ligands

We are a leading provider of Protein A affinity ligands to other life sciences companies (integrators), whose final products are Protein A resins. Protein A ligands are an essential “binding” component of Protein A affinity chromatography resins used in the purification of virtually all mAb-based drugs on the market or in development. We manufacture multiple forms of Protein A ligands under long-term supply agreements with major life sciences companies including Cytiva (a standalone operating company owned by Danaher Corporation), MilliporeSigma and Purolite, an Ecolab Inc. company ("Purolite"), who in turn sell their Protein A chromatography resins to end users (mAb manufacturers). We have two manufacturing sites supporting overall global demand for our Protein A ligands: one in Lund, Sweden and the other in Waltham, Massachusetts.

Protein A chromatography resins are considered the industry "gold standard" for purification of antibody-based therapeutics due to the ability of the Protein A ligand to very selectively bind to or “capture” antibodies from crude protein mixtures. Protein A resins are packed into the first chromatography column of typically three columns used in a mAb purification process. As a result of Protein A’s high affinity for antibodies, the mAb product is highly purified and concentrated within this first capture step before moving to polishing steps.

Our Affinity Ligand Collaborations

In June 2018, we entered into an agreement with Navigo Proteins GmbH (“Navigo”) for the exclusive co-development of multiple affinity ligands for which Repligen holds commercialization rights. We manufacture and exclusively supply the first of these ligands, NGL-Impact® A, to Purolite, for use with their Praesto® Jetted A50 Protein A resin product.

In September 2021, the Company and Navigo successfully completed co-development of a novel affinity ligand that addresses aggregation issues associated with pH sensitive antibodies and Fc-fusion proteins. We are manufacturing and supplying this ligand, NGL-Impact® HipH, to Purolite for use in a platform use resin product.

We have a long-term supply agreement with Purolite for NGL-Impact and potential additional affinity ligands that may advance from our Navigo collaboration.

Our Purolite Agreement

In October 2022, we extended our long-term supply agreement with Purolite through 2032 and broadened its scope to include affinity ligands targeting antibody fragments in addition to those targeting mAbs and Fc-fusion proteins. This extension and product line expansion aligns with our Proteins strategy and supports the acceleration in market adoption of the Praesto® affinity resin portfolio. It provides Purolite with exclusive access to mAb fragment ligands developed at Avitide, Inc. ("Avitide"), in addition to the NGL

7

portfolio developed at Navigo. Repligen will continue to receive access to Purolite's leading-edge base bead technology, as we proceed with the development and commercialization of novel affinity resins focused on new modalities and C>.

mAb Fragment Affinity Ligands and Resins from Avitide

Our acquisition of Avitide also led to our development and 2022 launch of AVIPure® CH1, a cross-linked agarose-based resin specifically engineered for the capture of the CH1 region of antigen-binding fragments (Fabs) from human immunoglobins (IgGs) and monoclonal antibodies 9mAbs). We believe that the high dynamic binding capacity for Fab and IgG1 even at short residence times position these resins well for market success.

Adeno-Associated Virus Affinity Ligands and Resins from Avitide

In September 2021, we completed our strategic acquisition of Avitide, a market leader in affinity ligand discovery and development. This acquisition was a major step forward in building our proteins franchise, moving Repligen into affinity resin solutions for C> and other emerging modalities.

In February 2022, we launched three advanced affinity chromatography resins for use in gene therapy manufacturing workflows. The resins AVIPure®-AAV9; AVIPure®-AAV8; and AVIPure®-AAV2, were developed by Avitide and are specific to the major adeno-associated virus ("AAV") C> vectors used today. AAV vectors are the leading platform for gene delivery for the treatment of a variety of human diseases.

We are integrating these high performance AVIPure® resins with our OPUS PPC and ARTeSYN chromatography systems to provide our customers with a seamless chromatography solutions. Caustic stability has been a challenge that the AVIPure resins are designed to overcome without sacrificing high dynamic binding capacity. We believe customers will benefit from superior process economics, including multi-cycle resin capabilities.

Growth Factors

Most biopharmaceuticals are produced through an upstream mammalian cell culture process. In order to stimulate increased cell growth and maximize overall yield from a bioreactor, manufacturers often add growth factors, such as insulin, to their cell culture media. Our cell culture growth factor additives include LONG® R3 IGF 1, our insulin-like growth factor that has been shown to be up to 100 times more biologically potent than insulin (the industry standard), thereby increasing recombinant protein production in cell culture fermentation applications.

Corporate Information

We are a Delaware corporation with our global headquarters in Waltham, Massachusetts. We were incorporated in 1981 and became a publicly traded company in 1986. Our common stock is listed on the Nasdaq Global Market under the symbol “RGEN”. We have over 2,000 employees and operate globally with offices and manufacturing sites located at multiple locations in the United States, Europe and Asia. Our principal executive offices are located at 41 Seyon Street, Waltham, Massachusetts 02453, our website is www.repligen.com and our telephone number is (781) 250-0111.

2021 Acquisitions

BioFlex Solutions LLC and Newton T&M Corp.

On November 29, 2021, the Company entered into an Equity Purchase Agreement with BioFlex, NTM and each of Ralph Meola and Jason Nisler, to acquire 100% of the outstanding securities of BioFlex and NTM (collectively, the “NTM Acquisition”). The NTM acquisition closed on December 16, 2021.

NTM, which is headquartered in Newton, New Jersey, is the parent company of BioFlex and focuses on manufacturing of products, while BioFlex, also headquartered in Newton, New Jersey, commercializes branded products to biotechnology companies. The NTM Acquisition is a strong fit with the Company’s fluid management portfolio of products as the industry migrates to single-use flow paths solutions for mAb, vaccine and C> applications, with a focus on single-use fluid management components, including single-use clamps, adapters, end caps and hose assemblies. The NTM Acquisition streamlines and increases our control over many

8

components in our single-use supply chain which ultimately should drive reduced lead-times for Repligen customers in the coming years.

Avitide, Inc.

On September 16, 2021, the Company entered into an Agreement and Plan of Merger and Reorganization (“Avitide Merger Agreement”) with Avalon Merger Sub, Inc., a Delaware corporation and a wholly owned direct subsidiary of the Company, Avalon Merger Sub LLC, a Delaware limited liability company and a wholly owned direct subsidiary of the Company, Avitide, and Shareholder Representative Services LLC, a Colorado limited liability company, solely in its capacity as the representative, agent and attorney-in-fact of Avitide's securityholders to purchase Avitide for $150.0 million in upfront consideration, comprised of cash and our common stock, and up to an additional $125.0 million (undiscounted) in contingent consideration for performance-based earnout payments over the three years following the transaction closing on September 20, 2021.

Avitide, which is headquartered in Lebanon, New Hampshire, offers diverse libraries and leading technology in affinity ligand discovery and development resulting in best-in-class ligand discovery and development lead-times. The acquisition gives the Company a new platform for affinity resin development, including C>, and advances and expands the Company’s proteins and chromatography franchise to address the unique purification needs of gene therapies and other emerging modalities.

Polymem S.A.

On June 22, 2021, the Company entered into a Stock Purchase Agreement with Polymem, a company organized under the laws of France, and Jean-Michel Espenan and Franc Saux, acting together jointly and severally as the representatives of the sellers pursuant to which we acquired all of the outstanding common stock of Polymem for approximately $47 million in cash. The transaction closed on July 1, 2021.

Polymem, which is headquartered outside of Toulouse, France, is a manufacturer of HF membranes, membrane modules and systems for industrial and bioprocessing applications. Polymem products complement and expand the Company’s portfolio of HF systems and consumables. This acquisition substantially also increases the Company’s membrane and module manufacturing capacity and establishes a world-class center of excellence in Europe to address the accelerating global demand for these innovative products.

2020 Acquisitions

ARTeSYN Biosolutions Holdings Ireland Limited

On October 27, 2020, we entered into an Equity and Asset Purchase Agreement with ARTeSYN, a company organized under the laws of Ireland, Third Creek Holdings, LLC, a Nevada limited liability company, Alphinity, LLC, a Nevada limited liability company (“Alphinity”, and together with Third Creek Holdings, LLC the “ARTeSYN Sellers”), and Michael Gagne, solely in his capacity as the representative of the ARTeSYN Sellers, pursuant to which we acquired (i) all of the outstanding equity securities of ARTeSYN and (ii) certain assets from Alphinity related to the business of ARTeSYN (collectively, the “ARTeSYN Acquisition”) for approximately $200 million in cash and the Company's common stock. The transaction closed on December 3, 2020.

ARTeSYN, which is headquartered in Waterford, Ireland, conducts its operations in Ireland, the United States and Estonia. Its suite of single-use solutions has been developed with the goal of enabling “abundance in medicine” by allowing greater efficiency in biologics manufacturing. The ARTeSYN team has created a number of solutions targeting the single-use space from single-use valves with fully disposable valve liners, XO® skeletal supports, a hybrid small parts offering for de-bottlenecking traditional facilities, to fully automated SU process systems that have quickly become leading solutions in the bioprocessing industry. ARTeSYN has established downstream processing leadership with its portfolio of state of the art single-use systems for chromatography, filtration, continuous manufacturing and media/buffer prep workflows. In addition, the Company has integrated unique flow path assemblies utilizing the Company’s silicone extrusion and molding technology, to deliver highly differentiated, low hold-up volume systems that minimize

9

product loss during processing. The ARTeSYN portfolio expands on the market success of the Company’s HF systems and complements its chromatography and TFF filtration product lines.

Non-Metallic Solutions, Inc.

On October 15, 2020, we entered into a Stock Purchase Agreement with NMS, and each of William Malloneé and Derek Masser, the legal and beneficial owners of NMS, to purchase NMS, which transaction subsequently closed on October 20, 2020.

NMS, which is headquartered in Auburn, Massachusetts, is a manufacturer of fabricated plastics, custom containers, and related assemblies and components used in the manufacturing of biologic drugs. NMS’s fluid management products complement and expand Repligen’s single-use product offerings. Effective December 31, 2021, NMS was absorbed into the Company by way of “short-form” merger pursuant to Massachusetts and Delaware law, which did not require a vote of the Company’s shareholders.

Engineered Molding Technology LLC

On June 26, 2020, we entered into a Membership Interest Purchase Agreement with EMT and each of Michael Pandori and Todd Etesse, the legal and beneficial owners of EMT to purchase EMT, a manufacturer of single-use silicone assemblies and components used in the manufacturing of biologic drugs. This transaction closed on July 13, 2020.

Effective July 11, 2021, EMT was absorbed into the Company by way of “short-form” merger pursuant to New York and Delaware law, which did not require a vote of the Company’s shareholders.

Our Market Opportunity

Bioprocessing Addressable Market

The global addressable market for bioprocessing products is estimated to be approximately $25 billion of which we estimate Repligen’s addressable market to be approximately $8.5 billion at year end 2022. This market includes products used to manufacture therapeutic antibodies, recombinant proteins and vaccines, as well as C>s.

Monoclonal Antibody Market

Antibody-based biologics alone accounted for approximately $169 billion of global biopharma revenue in 2021. Industry sources project the mAbs market to grow in the range of approximately 10% to 12% annually through 2026, driven by new approvals and expanded clinical uses for marketed antibodies, as well as the emergence of biosimilar versions of originator mAbs. As of December 31, 2022, over 140 mAbs were approved by the U.S. Food and Drug Administration (“FDA”) to treat a diverse range of diseases. Biological R&D remains robust, with more than 1,500 active mAb clinical trials ongoing to address a wide range of medical conditions.

In addition to investments in the discovery and development of novel biologic drugs, there has been substantial investment in follow-on products (biosimilars) by generic and specialty pharmaceutical as well as large biopharmaceutical companies. Development of follow-on products accelerated as the first major mAbs came off patent in the European Union and United States. Due to the high cost of biologic drugs, many countries in developing and emerging markets have been aggressively investing in biomanufacturing capabilities to supply lower cost biosimilars for the local markets. For both originator and follow-on biologics manufacturing, Repligen products are well-positioned to enable greater manufacturing flexibility, production yields and lower costs through improved process efficiencies.

Cell and Gene Therapy Market

C> has emerged in the past few years to become a rapidly growing area of biological drug development, with over 1,100 active clinical trials underway at year-end 2021 according to industry sources. Statements by the FDA are supported by industry reports that estimate annual revenue growth of over 25% for the C> market over the next several years. This scientifically advanced therapeutic approach has unique manufacturing challenges that many of our products can help address. We believe we are well positioned to participate in C> production, particularly in the manufacture of plasmids and viral vectors. Within the C> market, mRNA-based therapeutic programs have become an area of focus and investment by several large biopharmaceutical

10

companies, following the regulatory approval of mRNA-based vaccines for the COVID-19 pandemic, including all subsequent variants of the SARS-CoV-2 coronavirus ("COVID-19").

Our Strategy

We are focused on the development, production and commercialization of highly differentiated, technology-leading systems and solutions that address specific pressure points in the biologics manufacturing process and deliver substantial value to our customers. Our products are designed to optimize our customers’ workflow to maximize productivity and we are committed to supporting our customers with strong customer service and applications expertise.

We intend to build on our history of developing market-leading solutions and delivering strong financial performance through the following strategies:

•Continued innovation. We plan to capitalize on our internal technological expertise to develop products that address unmet needs in upstream and downstream bioprocessing. We continue to invest in platform and derivative products to support our proteins, filtration, chromatography and process analytics franchises. We plan to strengthen our existing product lines with complementary products and technologies, including fluid management products, that are designed to allow us to provide customers with an integrated, more automated and more efficient manufacturing process on one or more measures including flexibility, convenience, time savings, cost reduction and product yield.

•Platforming our products. A key strategy for accelerating market adoption of our products is delivery of enabling technologies that become the standard, or “platform,” technology in markets where we compete. We focus our efforts on winning early-stage technology evaluations through direct interaction with the key biomanufacturing decision makers in process development labs. This strategy is designed to establish early adoption of our enabling technologies at key accounts, with opportunity for customers to scale up as the biologic advances to later stages of development and potential commercialization. We believe this approach can accelerate the implementation of our products as platform products, thereby strengthening our competitive advantage and contributing to long-term growth.

•Targeted acquisitions. We intend to continue to selectively pursue acquisitions of innovative technologies and products. We intend to leverage our balance sheet to acquire technologies and products that improve our overall financial performance by improving our competitiveness in filtration, chromatography, fluid management or process analytics or by moving us into adjacent markets with common commercial call points.

•Geographical expansion. We intend to expand our global commercial presence by continuing to selectively build out our global sales, marketing, field applications and services infrastructure.

•Operational efficiency. We seek to expand operating margins through capacity utilization and process optimization strategies designed to increase our manufacturing yields. We plan to invest in systems to support our global operations, optimizing resources across our global footprint to maximize productivity.

Research and Development

Our research activities are focused on developing new high-value bioprocessing products across all of our franchises. We strive to continue to introduce truly differentiated products that address specific pain points in the biologics manufacturing process. Our commitment to innovation is core to the Repligen culture and our success as a company.

Sales and Marketing

Our sales and marketing strategy supports our objective of strengthening our position as a leading provider of products and services, addressing upstream, downstream and quality control needs of bioprocessing customers in the biopharmaceutical industry.

Our Commercial Team

To support our sales goals for our direct-to-consumer products, we have invested in our commercial organization. Since 2018, we have significantly expanded our global commercial organization from 103, to a commercial team of 322 employees as of December 31, 2022. This includes 257 people in field positions (sales, field applications and field service), 40 people in customer service and 25

11

in marketing. Geographically, 177 members of our commercial team are located in North America, 69 in Europe and 76 in Asia-Pacific ("APAC") regions.

Our bioprocess account managers are supported in each region by bioprocess sales specialists with expertise in filtration, chromatography or process analytics, and by technically trained field applications specialists and field service providers, who can work closely with customers on product demonstrations, implementation and support. We believe that this model helps drive further adoption at our key accounts and also open up new sales opportunities within each region.

Ligand Supply Agreements

For our proteins franchise, we are committed to be a partner of choice for our customers with distributor and supply agreements in place with large life sciences companies such as Cytiva, MilliporeSigma and Purolite. The Cytiva Protein A supply agreement relating to our Waltham, Massachusetts facility was amended in September 2021 and pursuant to its amended terms, runs through 2025. Cytiva moved a portion of its ligand manufacturing in house in 2020 and under the terms of our existing long-term supply agreements, Cytiva has the ability to move additional manufacturing in house in 2023. Our Protein A supply agreement with MilliporeSigma runs, pursuant to its terms, through 2023, and our Protein A amended supply agreement with Purolite that runs, pursuant to its amended terms, to August 2026 with an option for renewal through 2028 was amended again in October 2022 and extended through 2032. Our dual manufacturing capability provides strong business continuity and reduces overall supply risk for our ligand customers.

COVID-19 Considerations and Responses

In March 2020, the World Health Organization declared the COVID-19 outbreak to be a pandemic. COVID-19 resulted in government authorities around the world implementing numerous unprecedented measures such as travel restrictions, quarantines, shelter in place orders, factory shutdowns and vaccine mandates. During 2021 and 2020, our revenues were positively affected by demand related to Repligen products used by developers and manufacturers of COVID-19 vaccines, particularly mRNA vaccines. We continued to generate COVID-19 related revenue in 2022. COVID-19 related revenue represented approximately $141 million, or 18% of our total revenue in 2022, approximately $190 million, or 28% of total revenue in 2021, and approximately $46 million, or 13% of total revenue in 2020. While we anticipate additional COVID-19 related revenue in 2023, we expect that, as in 2022, COVID-19 related revenue will be at a reduced level from 2021, as the pandemic has evolved and global demand for COVID-19 vaccines is declining. We also intend to pursue other mRNA therapeutic development opportunities, which have increased following the success of mRNA-based vaccines for COVID-19. The extent to which COVID-19 will continue to affect our future financial results and operations will depend on future developments, which are highly uncertain and cannot be predicted, including the recurrence, severity and/or duration of COVID-19, and current or future domestic and international actions to contain and treat COVID-19.

For further discussion of the risks relating to COVID-19, see “The COVID-19 pandemic, or similar public health crises, could have a material adverse impact on our business, financial condition and results of operations, including our product sales, and our stock price” in Item 1A. “Risk Factors,” below.

Significant Customers and Geographic Reporting

Customers for our bioprocessing products include major life sciences companies, contract manufacturing organizations, biopharmaceutical companies, diagnostics companies and laboratory researchers.

The following table represents the Company’s total revenue by geographic area (based on the location of the customer):

| | | | | | | | | | | | |

| | For the Years Ended December 31, | |

| | 2022 | | | 2021 | | | 2020 | |

Revenue by customers' geographic locations: | | | | | | | | | |

North America | | | 43 | % | | | 41 | % | | | 48 | % |

Europe | | | 37 | % | | | 40 | % | | | 38 | % |

APAC/Other | | | 20 | % | | | 19 | % | | | 14 | % |

Total revenue | | | 100 | % | | | 100 | % | | | 100 | % |

12

There was no revenue from customers that represented 10% or more of the Company's total revenue for the year ended December 31, 2022. Revenue from Pfizer Inc. accounted for 10% of total revenue for the year ended December 31, 2021, and MilliporeSigma accounted for 11% of total revenues in the year ended December 31, 2020.

Human Capital

Employees

Repligen performs in a highly competitive industry and recognizes that our continued success hinges upon our ability to attract, develop and retain a diverse team of talented individuals. We place high value on the satisfaction and well-being of our employees and operate with fair labor standards and industry-competitive compensation and benefits globally. As of December 31, 2022, we employed 2,025 full-time and part-time employees, an increase of 173 since December 31, 2021. This total includes 322 employees in our commercial organization (257 field and 65 internal), 239 in engineering and R&D, 853 in manufacturing, 221 in quality, 93 in supply chain roles and 297 in administrative functions. Each of our employees has signed a confidentiality agreement. None of our U.S. employees are covered by collective bargaining agreements. We have one collective bargaining agreement with two unions that covers our 114 employees in Sweden, comprising approximately 6% of our total workforce. We renewed this collective bargaining agreement in November 2020, and it expires at the end of March 2023. In France, 86 employees are under the relevant national and local collective bargaining agreements for metallurgy, comprising approximately 4% of our total workforce.

Code of Business Conduct and Ethics

Repligen is committed to conducting business in accordance with the highest ethical standards. This means how we conduct ourselves and our global work is more than just a matter of policy and law; it’s a reflection of our core principles. Our Second Amended and Restated Code of Business Conduct and Ethics reflects Repligen’s five core principles – (1) trustworthiness, (2) respectfulness, (3) responsibility, (4) fairness and (5) corporate citizenship. Our Second Amended and Restated Code of Business Conduct and Ethics applies to all Repligen employees, including those who are integrated into the Company through acquisitions.

Diversity, Equity and Inclusion

Repligen supports the values of diversity, equity and inclusion (“DE&I”), reflecting our resolute commitment to a diverse, equitable and inclusive workplace. We have established talent acquisition processes, as well as training and employee engagement resources, including the formation of a DE&I council, to drive the promotion of diversity and inclusion at all levels of our organization.

Employee Engagement

We regularly conduct engagement surveys to gain insight on employee perspectives. Additional channels for employee engagement include CEO-led town halls and Company-wide all-hands meetings. We are committed to colleague recognition, which includes acknowledging, appreciating and celebrating each other's contributions and achievements. Our CEO-led town halls and Company-wide all-hands meetings serve as a platform for CEO awards and platinum awards, which reward and recognize both teams and individual colleagues who have made significant and notable contributions to Repligen's success.

Health, Safety and Well-Being

We actively promote the safety, health and well-being of our employees and end users of our products. Creating a culture where all employees feel supported and valued is paramount to our corporate mission. Our well-being goals are for employees to physically thrive, flourish mentally and emotionally, be socially connected and achieve financial security. We are proud to provide all of our full time employees in the United States with access to an employee assistance program ("EAP"). Our EAP offers employees and their eligible dependents counseling and well-being resources 24 hours a day, seven days a week by phone, online or via the mobile site. Our environmental health and safety policy advances our vision of zero workplace incidents and our efforts to reduce our environmental impacts.

Repligen Performance System

In 2022, we formalized the Repligen Performance System ("RPS"), to provide the tools and a framework for engaging employees across the organization to "find a better way every day" to continuously improve operational performance, with a focus on product quality, customer lead times, material supply, production costs and sustainability. Through a standard implementation network, all teams were empowered to implement just-do-it process improvements, solve priority problems through stand-up meetings and

13

improve key processes through kaizen events. We believe RPS improved our teams' ability to continuously resolve customer challenges, enhance product quality and improve operational efficiencies. The impact of RPS was seen during 2022 in productivity savings, customer lead-time reductions, manufacturing capacity expansions, product quality improvements and significant reductions in manufacturing scrap at several key sites.

Sustainability - Environmental, Social and Governance Matters

Our Commitment to Sustainability

We believe our commitment to Environmental, Social and Governance ("ESG") matters at all our global facilities is an important part of creating long-term business value for all stakeholders. We are strongly committed to corporate responsibility and transparency, and we continue to factor sustainability into our business decisions and operations.

In establishing a formal approach to ESG, we joined the United Nations Global Compact in 2020 in support of its Ten Principles related to human rights, labor, the environment, and anti-corruption. The actions we have taken as we have built our ESG strategy demonstrate our long-term commitment to being a responsible global corporate citizen.

In preparation of our initial sustainability report, published in 2021, we formed a Corporate Responsibility Team (“CRT”) with oversight by our Board of Directors. The CRT is headed by a member of our operations leadership team and represents multiple disciplines within the organization. We completed our first materiality assessment gleaning insights from internal and external stakeholders, and we established a financial grade ESG software platform to inform current and future ESG-related reporting and decisions.

In 2022, we established a dedicated internal ESG team to build out our sustainability initiatives and enhance related processes and reporting capabilities.

Our Reporting Frameworks

We have become an active participant in the sustainability reporting ecosystem through membership with the Sustainability Accounting Standards Board ("SASB"), part of the Value Reporting Foundation, and the Global Reporting Initiative ("GRI"). By extension and through their own efforts to integrate reporting standards, these organizations also keep us connected to guidance and criteria of the Greenhouse Gas Protocol, the Science Based Targets Initiative and the Task Force on Climate-related Financial Disclosures, among others.

Our initial sustainability report reflects the ambitious nature of our company and employees. We included both SASB and GRI reporting indexes and committed to embedding the UN Global Compact Ten Principles into our core business strategies and operations to advance the Sustainability Development Goals.

Oversight of ESG Matters

The Nominating and Corporate Governance ("N&CG") Committee of our Board oversees our ESG program. The N&CG Committee meets regularly and reviews and advises on ESG strategy and apprises the full Board in order to ensure that our ESG program and strategy align with the Company's mission. In addition, the Audit Committee of the Board regularly reviews ESG-related topics such as enterprise risk management, anticorruption, ethics and compliance, supply chain management, human rights protections, and cybersecurity and data privacy.

The CRT, under strategic direction of our Chief Executive Officer, is responsible for the development and implementation of our expanding ESG program. With representation across all key business functions, the mandate of the CRT is to consider our existing ESG efforts, understand stakeholder perspectives, identify business-relevant areas of opportunity to make a positive impact on global ESG efforts, and work collaboratively to support programs designed to accelerate our ESG initiatives.

Our Sustainability Pillars

Our sustainability initiatives are organized around four pillars that reflect our ESG priorities: Principles, People, Product and Planet. Our "4Ps" embody the belief shared by our Board and the executive leadership team that corporate responsibility is essential to sustaining business and economic growth in a manner that can also deliver positive environmental and social impact.

Our ESG pillars are as follows:

14

1.Principles. Our core principles guide how we operate, respecting that our stakeholders depend on us to conduct business honestly, fairly and responsibly.

2.People. We recognize that our success as a company depends on the skills and contributions of a diverse group of employees who are engaged as individuals and teams. We perform in a highly competitive industry and recognize that our continued success and growth hinges upon our ability to attract, develop and retain an all-inclusive team of talented and diverse individuals.

3.Product. Our diversified portfolio of bioprocessing technology solutions unlocks opportunity by enabling our customers to speed the development and manufacture of biological drugs. Our products empower biopharmaceutical manufacturers to generate more product in less space and with less waste, ultimately making a positive impact on overall human health and well-being.

4.Planet. Social and environmental impacts of business are a growing concern for our stakeholders and a priority for us. We are vigorously working to ingrain sustainability into our corporate culture, and with respect to the environment, we are taking company-wide action to reduce our climate impact.

Intellectual Property

We are committed to protecting our intellectual property through a combination of patents, trade secrets, copyrights and trademarks, as well as confidentiality and material transfer agreements. As further described below, we own or have exclusive rights to at least 263 active patent grants and 353 pending patent applications in the United States and other foreign jurisdictions including Australia, Canada, China, France, Germany, India, Japan, South Korea, Sweden and the United Kingdom.

Our policy is to require each of our employees, consultants, business partners, potential collaborators and customers to execute confidentiality agreements upon the commencement of an employment, consulting, business relationship, or product related audit or research evaluation. These agreements provide that all confidential information developed or made known to the other party during the course of the relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees and consultants, the agreements generally provide that all inventions conceived by the individual in the course of rendering services to Repligen shall be our exclusive property and must be assigned to Repligen.

Filtration

For our filtration franchise, our patent grants include coverage for, ATF filtration, TFDF and TFF HF and FS systems, membranes, filters, flow paths and single-use technologies. We continually seek to improve upon these technologies and have multiple new patent filings including patents covering next generation TFDF filters, next generation ATF filtration technologies, and proprietary reduced cost system components.

Chromatography

Our patent grants include coverage for certain unique methods and features of our OPUS PPC, including methods of manufacturing column components, systems for removing air using specialized tubing and valve systems, medium recovery systems, methods for packing, as well as systems for testing chromatography columns. We strive to improve upon our chromatography technologies, including developing potentially disruptive technology related to gamma irradiated columns and resin packing methods.

Through the ARTeSYN Acquisition in 2020, our patent portfolio includes exo-technology, valves, integrated sensors and integrated flow path systems. We also have multiple patent grants pertaining to our single-use replacement valves and liners used in combination with our modular configurable encapsulated flow systems to provide sterilized flow paths for various bioprocessing applications.

Process Analytics

Through our 2019 acquisition of C Technologies, Inc. ("C Technologies"), we hold patent grants to various slope spectroscopy instruments, including interactive variable pathlength devices and related methods of use. C Technologies’ scientists are continually developing new analytical tools using our state-of-the-art slope spectroscopy technology, which we continue to file patent applications for.

15

Proteins

We currently hold a patent grant for “Nucleic Acids Encoding Recombinant Protein A,” which claims sequences that encode a truncated recombinant Protein A but are otherwise identical to the natural Protein A, which is used for bioprocessing applications.

Pursuant to our collaboration with Navigo, we also have multiple patent grants and multiple pending patent applications globally covering Protein A-based affinity ligands through our collaboration with Navigo. These include ligands for antibody purification, as well as ligands for purifying COVID-19 vaccines.

In addition, following the acquisition of Avitide in September 2021, we continue to file multiple patent applications globally covering affinity ligands.

Trademarks

We procure and maintain trademark registrations globally for the Repligen trademark and our various product brands. We prioritize our “housemarks”, (e.g., Repligen, the stylized “R” logo, Spectrum, TangenX, C Technologies, ARTeSYN, Polymem, Avitide, etc.), and ensure continued protection globally. We also have trademark registrations for various product lines, including OPUS, XCell, XCell ATF, TFDF, KrosFlo, SIUS, ProConnex, Spectra/Por, NGL-Impact, SoloVPE, FlowVPE, FlowVPX, XO and AVIPure, that provide valuable company recognition and goodwill with our customers.

We have a comprehensive branding policy that includes trademark usage guidelines to ensure Repligen trademarks are used in accordance with our worldwide registrations and we actively police any unauthorized trademark usage as well as enforce the rights we have under our trademarks.

Licensing Agreements

We have entered into multiple licensing and collaboration relationships with third-party business partners in an effort to fully exploit our technology and advance our bioprocessing business strategy. Most recently, we entered into a 15-year exclusive License Agreement with Daylight (the "Daylight Agreement"), giving us exclusive license and commercialization rights to use certain technology and intellectual property subject to conditions set forth in the Daylight Agreement. See Note 12, "Commitments and Contingencies" to our consolidated financial statements included in this report for more information on this license agreement.

Competition

Our bioprocessing products compete on the basis of value proposition, performance, quality, cost effectiveness, and application suitability with numerous established technologies. Additional products using new technologies that may be competitive with our products may also be introduced. Many of the companies selling or developing competitive products have greater financial and human resources, R&D, manufacturing and marketing experience than we do. They may undertake their own development of products that are substantially similar to or compete with our products and they may succeed in developing products that are more effective or less costly than any that we may develop. These competitors may also prove to be more successful in their production, marketing and commercialization activities. We cannot be certain that the research, development and commercialization efforts of our competitors will not render any of our existing or potential products obsolete.

Manufacturing

A majority of our 18 manufacturing sites are located in the United States (California, Massachusetts, New Jersey, New Hampshire, New York and Texas). Outside the United States, we have manufacturing sites in Estonia, France, Germany, Ireland, the Netherlands and Sweden.

The proteins products we provide are manufactured at our sites in Waltham, Massachusetts and Lund, Sweden. Native Protein A ligands and our growth factor products are manufactured in Lund, while recombinant Protein A ligands are manufactured in both Waltham and Lund. Our primary chromatography assembly and manufacturing sites are located in Waltham, Massachusetts, Ravensburg, Germany and Breda, the Netherlands. Our primary filtration manufacturing sites are located in Marlborough, Massachusetts, Rancho Dominguez, California and Toulouse, France. The Repligen facility in Marlborough, is focused on XCell ATF and FS TFF products, while in Rancho Dominguez the focus is on Spectrum HF, TFDF and ProConnex products. Our process

16

analytics products are manufactured in Bridgewater, New Jersey. Our operating room products are manufactured in Irving, Texas. As part of our capacity expansion activities, we have added a site in Hopkinton, Massachusetts that serves as an assembly center for single-use products and will also have the capacity to manufacture our protein products when the current buildout is completed. With our three acquisitions in 2021, we gained manufacturing sites in Toulouse, France (Polymem), Newton, New Jersey (NTM and BioFlex) and Lebanon, New Hampshire (Avitide). With our three acquisitions in 2020, we gained manufacturing sites in Clifton Park, New York (EMT) and Auburn, Massachusetts (NMS) for fluid management consumables. ARTeSYN’s primary manufacturing sites for fluid management products and systems are located in Waterford, Ireland and Tallinn, Estonia, with additional sites in California.

We utilize our facilities in Waltham, Massachusetts and Lund, Sweden to carry out fermentation and recovery operations, and purification, immobilization, packaging and quality control testing of our protein-based bioprocessing products. Our facilities located in Waltham, Massachusetts; Marlborough, Massachusetts; Lund, Sweden; Ravensburg, Germany; Bridgewater, New Jersey; Clifton Park, New York; and Rancho Dominguez, California among other sites, are ISO® 9001:2015 certified and maintain formal quality systems to maintain process control, traceability, and product conformance. Additionally, our facilities in Irving, Texas and Auburn, Massachusetts are ISO® 13485:2016 certified. We practice continuous improvement initiatives based on routine internal audits as well as external feedback and audits performed by our partners and customers. In addition, we maintain a business continuity management system that focuses on key areas such as contingency planning, security stocks and off-site storage of raw materials and finished goods to ensure continuous supply of our products.

Available Information

We maintain a website with the address www.repligen.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this Form 10-K. We make available free of charge through our website our Form 10-Ks, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such materials with, or furnish such materials to, the SEC. Our Second Amended and Restated Code of Business Conduct and Ethics is also available free of charge through our website.

Our filings with the SEC may be accessed through the SEC’s Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system at www.sec.gov.

17

ITEM 1A. RISK FACTORS

Investors should carefully consider the risk factors described below before making an investment decision.

If any of the events described in the following risk factors occur, our business, financial condition or results of operations could be materially harmed. In that case, the trading price of our common stock could decline and investors may lose all or part of their investment. Additional risks and uncertainties that we are unaware of or that we currently deem immaterial may also become important factors that affect Repligen.

This Annual Report on Form 10-K (“Form 10-K”) contains forward looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this Form 10-K.

Risks Related to Our Business

Risks Related to Competition, Sales and Marketing

We compete with life sciences, pharmaceutical and biotechnology companies who are capable of developing new approaches that could make our products and technology obsolete.

The bioprocessing market is intensely competitive, subject to rapid change and significantly affected by new product introductions and other market activities of industry participants.

We compete with several medium and small companies in each of our product categories as well as several large companies, including Danaher Corporation (Pall Corporation and Cytiva), Thermo Fisher Scientific Inc., MilliporeSigma and Sartorius. Many of our competitors are large, well-capitalized companies that may have greater financial, manufacturing, marketing, research and development ("R&D") resources than we have, as well as stronger name recognition, longer operating histories and benefits derived from greater economies of scale. As a consequence, they are able to spend more aggressively on product development, marketing, sales and other product initiatives than we can, and may have additional lines of products and the ability to bundle products.

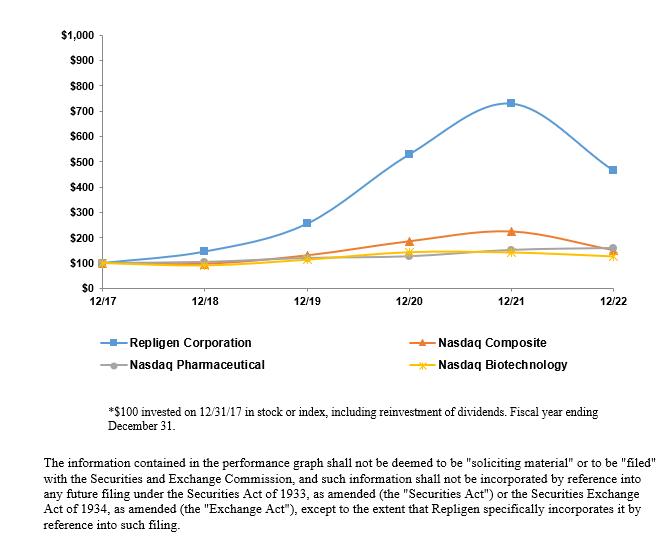

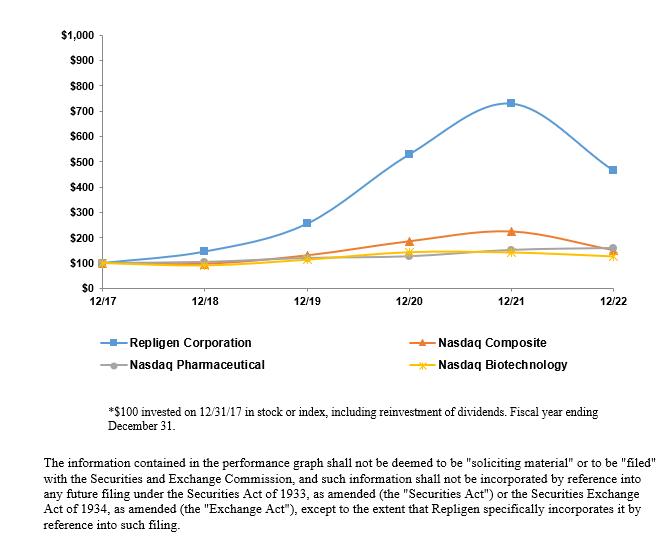

These factors, among others, may enable our competitors to market their products at lower prices or on terms more advantageous to customers than what we can offer. Competition may result in price reduction, reduced gross margins and loss of market share, any of which could have a material adverse effect on our business, financial condition and results of operations.