- RGEN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Repligen (RGEN) DEF 14ADefinitive proxy

Filed: 1 Apr 24, 4:17pm

☐ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☑ | Definitive Proxy Statement | |||||

☐ | Definitive Additional Materials | |||||

☐ | Soliciting Material Pursuant to §240.14a-12 | |||||

☑ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i) (4) and 0-11. |

Notice of 2024 Annual Meeting of Shareholders

| ANNUAL MEETING | VOTING MATTERS | |||

|

DATE: |

Proposal 1

To elect nine (9) directors, nominated by the Board of Directors, as

Proposal 2

To consider and ratify the selection of Ernst & Young LLP as

Proposal 3

To consider and act upon a non-binding, advisory vote to approve the

NOTE: The Board of Directors will consider and act upon any other | ||

| TIME: 8:00 a.m. EST

| |||

|

LOCATION: | |||

www.virtualshareholdermeeting.com/RGEN2024

| ||||

Important Notice Regarding the Internet Availability of Proxy Materials

for the Stockholder Meeting to Be Held on May 16, 2024

WHO CAN VOTE

Shareholders of Repligen Corporation’s Common Stock as of the close of business on March 18, 2024 (our “Record Date”). It is important that your shares be represented and voted at the 2024 Annual Meeting of Shareholders (the “Annual Meeting”). Whether or not you plan to attend the virtual Annual Meeting, please complete and return the enclosed proxy card in the envelope provided or vote by internet or telephone pursuant to instructions provided with the proxy card.

NOTICE AND ACCESS

We are mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders instead of paper copies of our Proxy Statement. The Notice contains instructions on how to access our Proxy Materials over the internet. The Notice also contains instructions on how shareholders can receive a paper copy of our Proxy Materials, free of charge, including this Proxy Statement and proxy card.

Our Annual Report to Shareholders, containing a letter from our Chief Executive Officer and financial statements for the fiscal year ended December 31, 2023 (the “2023 Annual Report”), is also being provided together with this Proxy Statement to all stockholders entitled to vote at the Annual Meeting.

HOW TO VOTE

Our Annual Meeting will again be held in a virtual meeting format only, via the internet, with no physical in-person meeting. At our virtual Annual Meeting, shareholders will be able to attend, vote and submit questions as set forth in this section.

Voting instructions are the same for registered shareholders (shares are registered in your name with Repligen’s transfer agent, American Stock Transfer) and beneficial owners (shares are held in a stock brokerage account or by a bank or other holder of record). Here’s how to vote prior to the Annual Meeting:

|  |  | ||||||

By internet at www.proxyvote.com | By phone 1-800-690-6903 | By mail, complete and return your proxy card or voting instruction form |

You may also vote at the Annual Meeting via www.virtualshareholdermeeting.com/RGEN2024. You will need the 16-digit control number included with these proxy materials to vote electronically, to vote by phone, and/or to attend the virtual Annual Meeting. A technical support telephone number will be posted on the Annual Meeting login page so that you can call if you encounter any difficulties accessing the Annual Meeting during the check-in or during the meeting.

Execution of a proxy card, or voting by telephone or via the internet prior to the Annual Meeting, will not in any way limit a shareholder’s right to attend the virtual Annual Meeting and vote during the meeting.

HOW TO SUBMIT QUESTIONS

If you are a shareholder of record as of our Record Date, you may ask questions during the Annual Meeting. To do so, you will need to have your 16-digit control number available. During the formal portion of the meeting, your questions must be related to proposals listed under “Voting Matters” above, and more specifically to the particular proposal being discussed at the time. To ask a question during the Annual Meeting, click the Q&A button on the virtual meeting platform and enter your question in the text box. If questions submitted are repetitive as to a particular topic, the Chairperson of the meeting may limit discussion on such topic. We will also hold a question-and-answer period following the formal portion of the meeting, as time permits, during which time we welcome questions not relating to specific proposals.

DATE OF MAILING

It is anticipated that the Notice will be first sent or given to our shareholders on or about April 1, 2024. At this time, the Notice, the Proxy Statement, proxy card, and the 2023 Annual Report are available for viewing, printing, and downloading at www.proxyvote.com.

By Order of the Board of Directors

Jason K. Garland

Chief Financial Officer

April 1, 2024

Table of Contents

| Proxy Statement Summary | 1 | |

| Security Ownership of Certain Beneficial Owners, Directors and Management | 10 | |

| Proposal 1 – Election of Directors | 12 | |

| 12 | ||

| 13 | ||

| 14 | ||

| 18 | ||

| 18 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 22 | ||

| 22 | ||

| 22 | ||

| 23 | ||

| 23 | ||

Sustainability – Environmental, Social and Governance Matters | 23 | |

| 26 | ||

| 26 | ||

| 26 | ||

| 27 | ||

| Proposal 2 – Ratification of Selection of Our Independent Registered Public Accounting Firm | 28 | |

| 28 | ||

| 29 | ||

| Proposal 3 – Advisory Vote on Executive Compensation | 30 | |

| 30 | ||

| 31 | ||

| 31 | ||

| 31 | ||

| 31 | ||

| 31 | ||

| 33 | ||

| 34 | ||

| 37 | ||

| 39 | ||

| 40 | ||

| 40 | ||

| 40 | ||

| 41 | ||

| 56 | ||

| General Annual Meeting Information | 58 | |

| 58 | ||

| 58 | ||

| 58 | ||

| 58 | ||

| 58 | ||

| 59 | ||

| 59 | ||

| 59 | ||

| Additional Information | 60 | |

| 60 | ||

| 60 | ||

| 60 | ||

| 60 | ||

PROXY STATEMENT SUMMARY

We are furnishing this Proxy Statement and the related proxy materials in connection with the solicitation by our Board of Directors (“Board”) of proxies to be voted at the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) and at any adjournment or postponement thereof. We are providing these materials to the holders of record of our Common Stock as of the close of business on March 18, 2024, and are first making available or mailing the materials on or about April 1, 2024. This summary highlights information contained elsewhere in the Proxy Statement. As this summary does not contain all the information that you should consider in connection with the Annual Meeting, we recommend that you read the entire Proxy Statement carefully before voting.

References throughout the Proxy Statement to “Repligen Corporation”, “Repligen”, “we”, “us”, “our”, or the “Company” refer to Repligen Corporation and its subsidiaries, taken as a whole, unless the context otherwise indicates.

VOTING MATTERS

Proposal | Description | Board Recommendation | ||||||

|

| Proposal 1: Election of directors (page 12) | We are asking our shareholders to elect each of the nine (9) directors identified below under “Our Director Nominees”, each to serve until the 2025 Annual Meeting of Shareholders. | FOR each nominee |

| ||||

|

| Proposal 2: Ratification of the selection of the independent registered public accounting firm (page 28) | We are asking our shareholders to ratify our Audit Committee’s selection of Ernst & Young LLP (“EY”) to act as the independent registered public accounting firm for Repligen for the fiscal year ending December 31, 2024. Although shareholder approval of the Audit Committee’s selection of EY is not required, our Board believes we should provide an opportunity for our shareholders to ratify this selection. | FOR |

| ||||

|

| Proposal 3: Advisory vote on executive compensation | We are asking our shareholders to cast a non-binding, advisory vote to approve the compensation of our named executive officers (“NEOs”). In evaluating this year’s “say-on-pay” proposal, we recommend you review our Compensation Discussion and Analysis, describing how the Compensation Committee arrived at its executive compensation actions and decisions for 2023. | FOR |

| ||||

Please see the sections titled “General Annual Meeting Information” on page 58 and “Additional Information” on page 60 for important information about the proxy materials, including voting methods, vote requirements for adoption of each proposal, effect of abstentions and the deadlines to submit shareholder proposals and director nominations for next year’s Annual Meeting of Shareholders.

| REPLIGEN CORPORATION | 1

| 2024 PROXY STATEMENT SUMMARY | |||||||||

OUR DIRECTOR NOMINEES

You are being asked to vote on the election of the following nine (9) nominees to our Board. All directors are elected annually by the affirmative vote of a majority of votes cast. The chart below summarizes our director nominees’ personal information and current committee memberships. You can find detailed information about each director nominee’s background, skill sets and areas of expertise later in this Proxy Statement.

Current Committee Memberships

| ||||||||||||||||||

Name and principal | Age(1) | Director Since | Independent | Other Public Boards | Audit | Compensation | Nominating & Corporate Governance | |||||||||||

Tony J. Hunt Chief Executive Officer, | 60 | 2015 | 1 | |||||||||||||||

Karen A. Dawes, Chairperson President, Knowledgeable | 72 | 2005 | ✓ | 2 | CHAIR | |||||||||||||

Nicolas M. Barthelemy Former President and Chief Executive Officer, | 58 | 2014 | ✓ | - | CHAIR | ✓ | ||||||||||||

Carrie Eglinton Manner President and Chief Executive Officer, OraSure Technologies, Inc. | 50 | 2020 | ✓ | - | ✓ | |||||||||||||

Konstantin Konstantinov, Ph.D. Chief Technology Officer, Ring Therapeutics | 66 | 2022 | ✓ | - | ||||||||||||||

Martin D. Madaus, D.V.M., Ph.D. Senior Operating Executive, | 64 | 2023 | ✓ | 2 | ✓ | ✓ | ||||||||||||

Rohin Mhatre, Ph.D. Executive Vice President and | 59 | 2020 | ✓ | - | ✓ | |||||||||||||

Glenn P. Muir Retired Chief Financial Officer | 65 | 2015 | ✓ | 2 | CHAIR | ✓ | ||||||||||||

Margaret A. Pax Former Vice President, Strategy and Innovation, Thermo-Fisher Scientific(2) | 64 | 2024 | ✓ | 1 | ||||||||||||||

| (1) | Age as of the date of the Annual Meeting. |

| (2) | Ms. Pax joined the Board on March 18, 2024. |

BOARD COMPOSITION

We continuously evaluate our director skill sets and expertise for alignment with Repligen’s strategic goals. Our independent directors bring extensive experience in areas that are critical to the Company’s strategy and long-term success, such as biopharmaceutical manufacturing, global and commercial operations, and finance. Below we highlight the key skills and experiences of our director nominees that are critical to Repligen’s success.

In addition to diversity of skills and experience, we believe that establishing and maintaining a Board that includes diverse demographics, such as gender, race, ethnicity, culture, nationality and sexual orientation, is important because having

| REPLIGEN CORPORATION | 2

| 2024 PROXY STATEMENT SUMMARY | |||||||||

varying perspectives and a breadth of experience improves the quality of dialogue, contributes to more effective decision-making on behalf of the Company and its shareholders, and enhances the overall chemistry and collaborative culture in the boardroom. Our Board includes directors who represent ethnic diversity, and three (3) of our nine (9) director nominees are women, one of whom serves as the Chairperson of our Board.

| Key Skills & Experience | ||||||||||||||||||||

| Director Nominee | Public Company Board/CEO | Risk Oversight | Finance & Capital Markets | Manufacturing & Global | Strategic Planning and M&A | Life Sciences Technology & Innovation | Commercial Sales & Marketing | |||||||||||||

| Tony J. Hunt |

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ||||||||||

| Karen A. Dawes |

| ✓ | ✓ | ✓ |

| ✓ |

| ✓ |

| ||||||||||

| Nicolas M. Barthelemy |

| ✓ | ✓ |

| ✓ | ✓ | ✓ | ✓ |

| ||||||||||

| Carrie Eglinton Manner |

| ✓ | ✓ |

| ✓ | ✓ | ✓ | ✓ |

| ||||||||||

| Konstantin Konstantinov, Ph.D. |

|

| ✓ |

| ✓ |

| ✓ |

|

| ||||||||||

| Martin Madaus, D.V.M., Ph.D. |

| ✓ | ✓ |

| ✓ | ✓ | ✓ | ✓ |

| ||||||||||

| Rohin Mhatre, Ph.D. |

|

| ✓ |

| ✓ |

| ✓ |

|

| ||||||||||

| Glenn P. Muir |

| ✓ | ✓ | ✓ |

| ✓ |

|

|

| ||||||||||

| Margaret A. Pax |

| ✓ | ✓ |

|

| ✓ | ✓ | ✓ |

| ||||||||||

| REPLIGEN CORPORATION | 3

| 2024 PROXY STATEMENT SUMMARY | |||||||||

BOARD COMPOSITION

To see our Board Diversity Matrix as of April 11, 2023, please see our 2023 Definitive Proxy Statement, which we filed with the Securities and Exchange Commission on April 11, 2023.

| Board Diversity Matrix As of April 1, 2024 | ||||||||

Total Number of Directors | 9 | |||||||

Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender | ||||

Directors | 3 | 6 | — | — | ||||

Number of Directors who self-identify in any of the categories below: | ||||||||

African American or Black | — | — | — | — | ||||

Alaskan Native or Native American | — | — | — | — | ||||

Asian | — | 1 | — | — | ||||

Hispanic or Latinx | — | — | — | — | ||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||

White | 3 | 5 | — | — | ||||

Two or More Races or Ethnicities | — | — | — | — | ||||

LGBTQ+ | — | — | — | — | ||||

Did Not Disclose Demographic Background | — | — | — | — | ||||

Supplemental Self-Identification: | ||||||||

Persons with Disabilities | — | — | — | — | ||||

Military Veteran | — | — | — | — | ||||

CORPORATE GOVERNANCE HIGHLIGHTS

Repligen is committed to implementing and maintaining effective corporate governance practices that further long-term shareholder value, promote the Board’s accountability, and align the interests of our executive team with those of our shareholders. The following represent the key elements of our corporate governance programs:

Director Independence |

• All of our director nominees, other than our Chief Executive Officer (“CEO”), are independent • 44.4% of our director nominees represent gender or ethnic diversity • All committee members are independent • Executive sessions of independent directors are held at each Board meeting

| |

Board Refreshment |

• Board refreshment is a key area of focus as shown by the 2023 addition of Dr. Madaus, a former CEO of a major bioprocessing tools company, and the 2024 addition of Ms. Pax, a former senior executive at Thermo Fisher Scientific with expertise in developing and deploying global growth strategies for healthcare and technology-driven firms

| |

Board Governance Practices |

• We conduct annual Board and committee evaluations and self-assessments • All directors and officers are subject to our Second Amended and Restated Code of Business Conduct & Ethics • All directors serving on the Board attended 100% of Board and committee meetings held during the period for which they have been directors and/or on the committees of the Board • Our Chairperson and CEO positions are different individuals

| |

Shareholder Rights |

• All of our directors are elected annually • In uncontested elections, our directors must be elected by a majority of votes cast • Our By-laws include shareholder rights to amend our By-laws • Our By-laws provide for proxy access by shareholders • We have no super-majority voting requirements in our Charter or By-laws • Robust investor communication program including Environmental, Social, and Governance (“ESG”)-focused outreach

| |

Compensation Practices/Policies |

• We have stock ownership guidelines for all directors and NEOs • Our executive compensation program links pay with corporate and individual performance • A significant percentage of target compensation is “at-risk” through short-term and long-term incentive awards • We have anti-hedging, anti-pledging and anti-short sale policies • We have a compensation clawback policy

|

| REPLIGEN CORPORATION | 4

| 2024 PROXY STATEMENT SUMMARY | |||||||||

SHAREHOLDER ENGAGEMENT

We actively seek and highly value the views and insights of our shareholders. We meet regularly with our shareholders through an ongoing schedule of investor discussions, in-person meetings, banking conferences, non-deal roadshows and other events. In addition to our traditional investor relations outreach efforts focused on analysts and portfolio manager communications, we engage with shareholder stewardship and proxy governance teams to discuss proxy proposals, overall governance and executive compensation programs, and ESG reporting and initiatives. These discussions often involve our Board Chairperson and/or Board committee members, our CEO, members of our executive management team as appropriate, and our Global Head of Investor Relations.

Our shareholder engagement activities have guided certain Board meeting agendas and have led to governance enhancements addressing the issues that matter most to our shareholders. We consider this ongoing engagement process important in creating long-term value, and maintaining a culture of integrity, compliance and sustainability.

Conversations with institutional investors in 2023 and into 2024 covered a wide range of topics, primarily focused on the impacts of confluent headwinds on Repligen growth and financial performance, both near- and long-term. Our discussions with investors centered on order growth, rebalancing and rightsizing activities, the impact of our key accounts commercial strategy, the importance of our new product launches in the market, our presence in new modalities end markets, and forward-year expectations for revenue growth and margin expansion.

SUSTAINABILITY – ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

We believe our commitment to sustainability initiatives across all of our global facilities matters and is an important part of creating long-term business value for all stakeholders. We are deeply committed to corporate responsibility and transparency, and we continue to factor sustainability into our business decisions and integrate its core principles into our daily operations.

Together, we are advancing our ESG initiatives at an ambitious pace and taking bold steps to engage stakeholders throughout our upstream and downstream value chain.

To view or download our most recent 2022 sustainability report, “Making An Impact” and/or to access our 2022 reporting frameworks indexes document, please visit www.repligen.com/company/sustainability.

ESG Oversight

Our commitment to sustainability oversight at both the Board and management levels reflects the importance we place on ESG-driven policies and programs to support our long-term strategic plan. The Chair of our Nominating and Corporate Governance (“N&CG”) Committee oversees our ESG initiatives and practices as set forth in the N&CG Committee charter. This Chair also reviews and approves the information contained in our sustainability reports. The N&CG Committee reports to the full Board on ESG matters and the Company’s progress on sustainability programs and initiatives. For more details about our ESG Oversight hierarchy, please see the section titled “ESG Oversight” on page 23.

Compensation-Related ESG Measures

Beginning in 2022, based in part on shareholder input, the N&CG Committee determined that NEOs will annually be assigned certain ESG responsibilities, as appropriate to their roles, to support and advance defined corporate ESG goals. Their level of effectiveness in helping to achieve the corporate ESG goals is considered when determining the individual achievement component of performance-based compensation. For more information about our compensation-related ESG goals and outcomes, please see section titled “Sustainability Goals and Outcomes: 2023” on page 24.

EXECUTIVE COMPENSATION HIGHLIGHTS

Repligen’s compensation philosophy is to provide compensation that will attract and retain high-performing talent in our industry, motivate the Company’s executive officers to create long-term, enhanced shareholder value, provide a fair reward for robust effort and stimulate our executive officers’ professional and personal growth. The Company believes that the compensation of its executive officers should align the executive officers’ interests with those of the shareholders and focus executive officer behavior not only on the achievement of near-term corporate goals, but also on the achievement of long-term business objectives and strategies. For more on compensation philosophy see the section titled “Executive Compensation” on page 34.

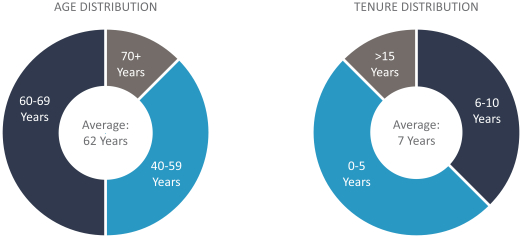

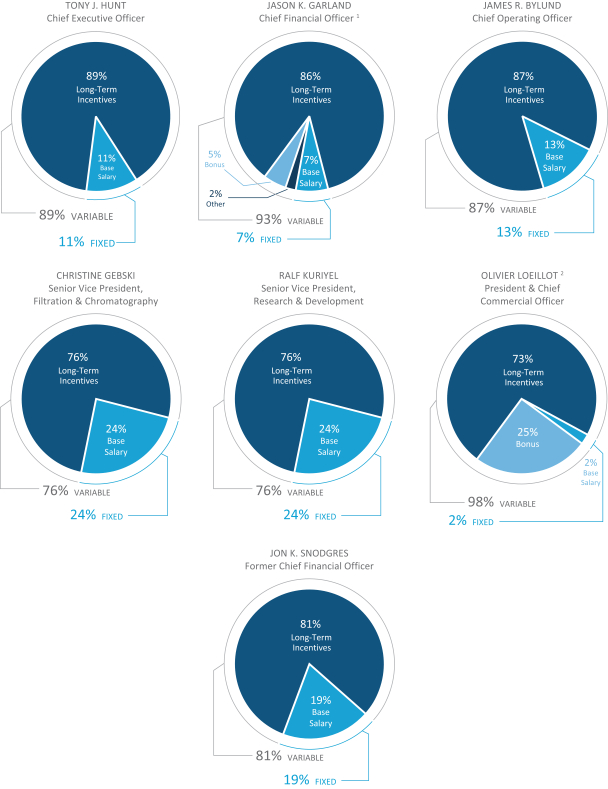

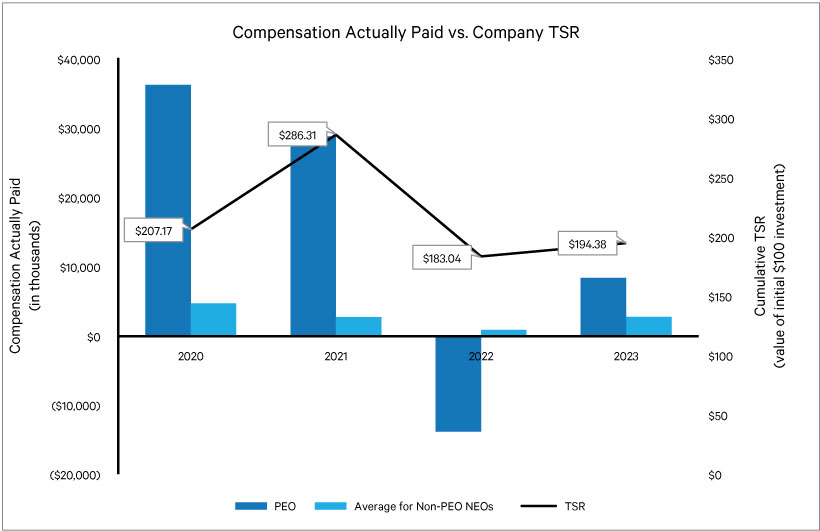

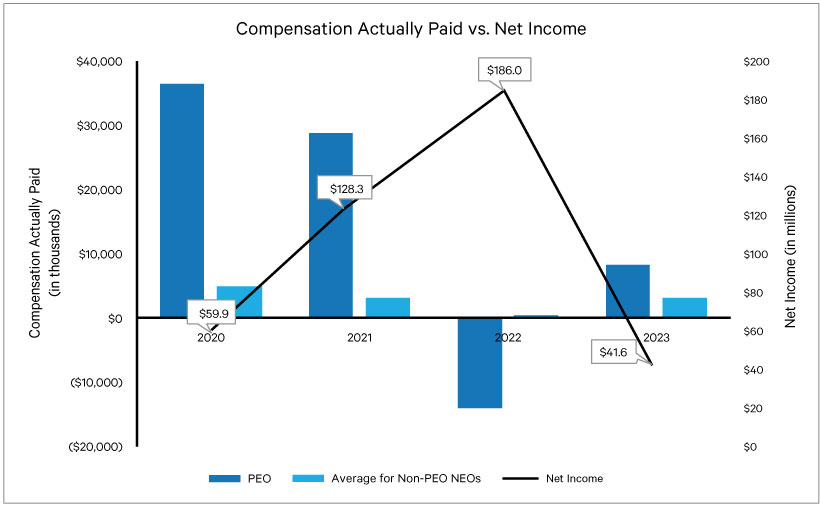

Compensation Earned

The graphs below reflect the allocation of salary, cash incentive compensation and equity incentive compensation earned by the Company’s CEO, Chief Financial Officer (“CFO”), President and Chief Commercial Officer (“CCO”), Chief Operating

| REPLIGEN CORPORATION | 5

| 2024 PROXY STATEMENT SUMMARY | |||||||||

Officer, Senior Vice President, Filtration & Chromatography, and Senior Vice President, Research & Development in 2023, all six of whom were serving as executive officers as of December 31, 2023 as well as our former CFO, Jon Snodgres, who retired from the Company effective October 31, 2023, and who ceased serving as CFO effective upon the hiring of the new CFO on September 25, 2023. We have elected to provide disclosure of compensation information for all of our 2023 executive officers, whom we refer to as NEOs throughout the Proxy Statement for simplicity. Additional NEO compensation detail and notes can be found in the “Executive Compensation Tables — 2023 Summary Compensation Table” on page 41.

2023 Summary Compensation Allocations

| REPLIGEN CORPORATION | 6

| 2024 PROXY STATEMENT SUMMARY | |||||||||

| (1) | The 5% of Mr. Garland’s compensation in 2023 allocated to bonus represents the signing bonus paid to him pursuant to his employment agreement. The 2% of his compensation allocated to other in 2023 represents a relocation stipend and a tax reimbursement with respect to such stipend paid to Mr. Garland in 2023 pursuant to his employment agreement. |

| (2) | The 25% of Mr. Loeillot’s compensation in 2023 allocated to bonus represents the signing bonus paid to him pursuant to his employment agreement. |

The following table sets forth the total compensation earned by the NEOs during 2023. For more information on the total compensation see “Executive Compensation Tables — 2023 Summary Compensation Table” on page 41.

| Name/Title | Total 2023 Compensation | |||||||

Tony J. Hunt Chief Executive Officer | $7,929,275 | |||||||

Jason K. Garland Chief Financial Officer | $2,026,471 | |||||||

James R. Bylund Chief Operating Officer | $3,743,430 | |||||||

Christine Gebski Senior Vice President, Filtration and Chromatography | $1,655,562 | |||||||

Ralf Kuriyel Senior Vice President, Research and Development | $1,661,482 | |||||||

Olivier Loeillot President and Chief Commercial Officer | $5,445,065 | |||||||

Jon K. Snodgres Former Chief Financial Officer | $2,170,932 | |||||||

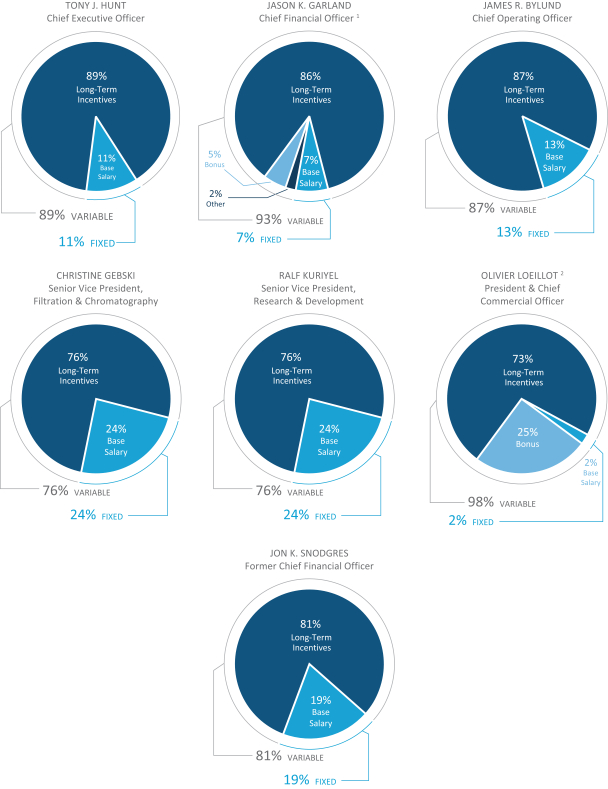

Long-term Equity Incentive Breakout for NEOs

We believe that the mix of time-based and performance-based equity awards under our long-term incentive compensation program provides balance to the program, motivates our executives to drive organizational achievement of our near- and long-term corporate goals and aligns the interests of our executive officers with those of our shareholders.

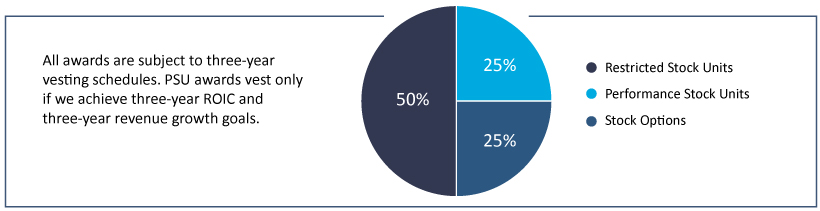

As shown in the graph below, the target split of the annual long-term equity incentive compensation awards made to our NEOs based upon dollar value is 25% performance-based restricted stock units (“PSUs”), 25% stock options subject to time-based vesting, and 50% restricted stock units subject to time-based vesting (“RSUs”). Our Compensation Committee annually reviews our long-term equity incentive program and has determined that the current composition and weightings remain appropriate in furthering our objective of recruiting and retaining top talent in our industry at this time.

PSU awards are earned only if we achieve three-year Adjusted Return on Invested Capital (“Adjusted ROIC”) and specific three-year revenue growth goals, which are set at challenging levels and weighted at 50% each. The revenue growth goals are either based on compound annual growth rate (“CAGR”) or average annual growth rate. The Compensation Committee set sequentially more aggressive three-year Adjusted ROIC and revenue growth goals for the 2021, 2022 and 2023 PSU awards. The revenue goals for the 2021 program reflect three-year average organic revenue growth for the total business. For the 2022-2024 programs, the Compensation Committee set the revenue targets for these programs based on organic growth in base business (“Base Organic Growth”), excluding revenue related to COVID-19 from the programs due to the volatility in demand related to COVID-19 and associated revenues. Base Organic Growth excludes the impact of revenue related to COVID-19, inorganic acquisition-related revenue (revenue recognized by acquired companies during the reporting period for which there is no prior year comparison), and the impact of changes in foreign exchange rates.

Long-term Equity Incentive Payout for NEOs for 2023

In 2021, we granted PSU awards subject to a three-year performance period ending December 31, 2023. As shown in the table below, these PSU awards were earned at 48% of target. This was based on 95% achievement of the organic revenue growth goal and 0% achievement of the Adjusted ROIC goal for the PSU awards, each of which was equally weighted at 50%.

| REPLIGEN CORPORATION | 7

| 2024 PROXY STATEMENT SUMMARY | |||||||||

The following table presents the performance goals and actual achievement for the 2021 program:

Goals and Achievement for the Three-Year Performance Period Ending December 31, 2023

| ||||||||||||||

| Performance Range | ||||||||||||||

| Threshold | Target | Maximum | Achievement | Actual Payout | ||||||||||

| Revenue CAGR 2021-2023 | 15.0% | 25.0% | 30.0% | 23.9% | 95.0% | |||||||||

| Adjusted ROIC(1) | 5.6% | 7.6% | 8.6% | 4.7% | 0.0% | |||||||||

Total weighted payout | — | — | — | — | 48.0% | |||||||||

| (1) | Adjusted ROIC means the Company’s Adjusted NOPAT (as defined below), divided by Adjusted Invested Capital (as defined below). |

Adjusted NOPAT means the Company’s Adjusted Income from Operations (as defined below) multiplied by the Adjusted Tax Rate (as defined below). |

Adjusted Income from Operations means the Company’s income from operations under U.S. generally accepted accounting principles (“GAAP”), adjusted for non-recurring charges for inventory step-up, acquisition and integration costs, restructuring costs and contingent consideration expense, as well as intangible asset amortization. |

Adjusted Tax Rate means the Company’s tax rate under GAAP, adjusted for the tax effect of non-GAAP charges. |

Adjusted Invested Capital means the average of the year-end balances for the final two years of the ROIC performance period of (a) the sum of (i) the Company’s total stockholders’ equity under GAAP and (ii) the Company’s total short-term and long-term debt recorded under GAAP, less (b) the Company’s cash and cash equivalents under GAAP, but excluding in all cases the impact of any business acquisition after the first two acquisitions completed during the plan period. |

We have granted our NEOs performance-based equity awards, including PSUs, each year since 2019 and we anticipate that we will continue to include such equity awards as part of our long-term incentive compensation program going forward for the reasons noted above.

BUSINESS & FINANCIAL HIGHLIGHTS 2023

A Challenging Year for Bioprocessing

2023 proved to be an overall challenging year for our industry and Repligen, as we adjusted to a post-pandemic environment following three years of capacity expansion and hiring to meet unprecedented acceleration in demand for our products. As the pandemic reached endemic status, Repligen and the bioprocessing industry faced multiple headwinds—most significantly were elevated inventory levels at both biopharmaceutical (“Pharma”) and contract development and manufacturing organizations (“CDMO”) customer accounts, as inventory had been secured during the long-lead time supply chain environment. The de-stocking impact of this persisted through 2023. This was coupled with conservative capital spending and project delays at large Pharma accounts. In addition, a high inflationary environment resulted in significant contraction in funding for startup biotech companies, and regionally, the industry was affected by economic deterioration in China, both of which had some impact on Repligen, albeit to a lesser extent than our peers.

Positive Signs by Year End

The first half of 2023 was particularly challenging, as the funnel of opportunities across our customer base was limited. In the second half of 2023, our opportunity funnel started to improve, and by year end, we were encouraged to see positive

| REPLIGEN CORPORATION | 8

| 2024 PROXY STATEMENT SUMMARY | |||||||||

signs of recovery at Repligen. Orders picked up, especially in the third quarter for Pharma accounts, and in the fourth quarter for CDMO accounts. We have many reasons for optimism; most fundamentally, the underlying growth and expansion of the biologics markets we serve, and our unique positioning as a recognized technology leader in bioprocessing.

2023 Business & Financial Highlights

Business Focus: Key Account Strategy, New Modality Inroads, Innovation and Rebalancing Resources

In 2023, we focused our attention on five areas, aligned with our goals set up at the beginning of the fiscal year. We strengthened the commercial team with the addition of a key account team in North America. We intensified our efforts to build a strong opportunity funnel and expand our presence in new modalities. We prioritized research and development (“R&D”) as we continued to focus on innovation, committing similar dollars to R&D as in 2022. In addition to these three areas, we took necessary actions to rebalance the organization in response to margin pressures we faced from lower sales volume in the post-pandemic market. This was balanced with investments in key site upgrades.

| • | Key accounts focus. We advanced our commercial strategy of building a key accounts team to improve our portfolio visibility at key accounts, with a core team in place by mid-year. In October, we hired industry veteran Olivier Loeillot as our President and CCO, to lead our commercial team and oversee our four franchises. Orders from our top 10 Pharma accounts were up 50% in the second half of 2023 compared with the first half, and up 20% for the full year compared to 2022. At our top 10 CDMO accounts, orders in the second half of 2023 were consistent with first half, but up nearly 15% compared to the year 2022. |

| • | New modalities momentum. We made inroads in new modalities, which includes cell and gene therapy, exosome and RNA programs. Driven by several late-stage and commercial wins in 2023, new modalities had a solid year for both orders and sales, with revenue from customers’ new modality programs representing 18% of total revenue. |

| • | New product launches. Innovation remained a top priority, and we successfully launched 10 new products in 2023. Although these were first- and partial-year product offerings, they generated over $12 million in revenue in 2023. |

| • | Rebalancing the organization. Rebalancing of resources was also a top priority in 2023. Our entire team focused on cost containment and the leadership team rolled out programs to right size our organization to address the margin challenges associated with volume decreases and available capacity in 2023; these efforts advanced under the direction of CFO, Jason K. Garland, who joined the company in September 2023. Through this difficult but prudent process, we reduced our workforce by more than 15%, adjusted inventories, contained costs across the organization and are in the process of consolidating several facilities. |

Financial Highlights

| • | Revenue summary. Our full year reported revenue of approximately $639 million included approximately $32 million of COVID-related revenue – down from approximately $141 million in 2022. Our 2023 base revenue – which excludes COVID- and acquisition-related revenue, totaled approximately $599 million and represented a decrease of 9% compared with 2022. For perspective, three-year total reported revenue and base revenue CAGR remained strong at 20% and 23%, respectively. |

| • | Strategic M&A. We completed two strategic acquisitions, aligned to our strict M&A criteria and reflecting our focus on growth through innovation. Our acquisitions of FlexBiosys, Inc. (April 2023) and Metenova Holdings AB (October 2023) support the expansion and diversification of our Fluid Management portfolio within our Filtration franchise. These acquisitions contributed approximately $7 million in revenue in 2023. |

| • | Balance sheet. In December 2023, we strengthened our balance sheet through a private convertible transaction of $600 million aggregate principal amount of 1.00% convertible senior notes. We generated free cash flow of $75 million and reported cash and cash equivalents of approximately $751 million as of December 31, 2023. |

| • | Capital Expenditures. Our capital expenditures decreased by more than 50%, to $39 million in 2023 compared to $88 million in 2022. With our investments in facility modernization and expansion over the previous two years, we have ample capacity to support our expectations for increased demand as we continue to drive long-term growth. |

Sustainability

| • | Sustainability. In November 2023, we published our 2022 Sustainability Report to highlight our progress since 2020. The report reflects our belief that corporate responsibility is essential to sustaining business and economic growth in a manner that can also deliver positive environmental and social impact. Our current sustainability report, and a frameworks index can be downloaded from our website at https://www.repligen.com/company/sustainability. |

| REPLIGEN CORPORATION | 9

| 2024 PROXY STATEMENT SUMMARY | |||||||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of shares of our Common Stock as of March 18, 2024 by: (i) each person who is known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock; (ii) each director or nominee of the Company; (iii) each named executive officer of the Company; and (iv) all directors nominees and executive officers of Repligen as a group. The business address of each director and executive officer is Repligen Corporation, 41 Seyon Street, Building #1, Suite 100, Waltham, Massachusetts 02453.

Beneficial Owner | Amount and Nature of Beneficial Ownerships(1) | Percent of Class(2) | ||||

| BlackRock, Inc.(3) | 7,859,530 | 14.1% | |||

| The Vanguard Group(4) | 5,078,261 | 9.1% | |||

| T. Rowe Price Associates, Inc.(5) | 4,012,851 | 7.2% | |||

| Roy T. Eddleman Living Trust(6) | 3,500,000 | 6.3% | |||

| Tony J. Hunt(7) | 395,445 | * | |||

| Jason K. Garland(8) | — | * | |||

| James R. Bylund(9) | 17,504 | * | |||

| Ralf Kuriyel(10) | 22,941 | * | |||

| Olivier Loeillot(11) | — | * | |||

| Jon K. Snodgres(12) | — | * | |||

| Karen A. Dawes(13) | 96,898 | * | |||

| Nicolas M. Barthelemy(14) | 6,703 | * | |||

| Carrie Eglinton Manner(15) | 10,712 | * | |||

| Konstantin Konstantinov(16) | 4,837 | * | |||

| Martin D. Madaus(17) | 4,640 | * | |||

| Rohin Mhatre, Ph.D.(18) | 11,355 | * | |||

| Glenn P. Muir(19) | 48,016 | * | |||

| Margaret A. Pax(20) | 287 | * | |||

| All directors, nominees and executive officers as a group (15 persons)(21) | 649,049 | 1.2% | |||

| * | Less than one percent |

| (1) | Beneficial ownership, as such term is used herein, is determined in accordance with Rule 13d-3 promulgated under the Securities Exchange Act of 1934, as amended, and includes voting and/or investment power with respect to shares of Common Stock of Repligen. Unless otherwise indicated, the named person possesses sole voting and investment power with respect to the shares. The shares shown include shares that such person has the right to acquire within 60 days of March 18, 2024. |

| (2) | Percentages of ownership are based upon 55,838,548 shares of Common Stock issued and outstanding as of March 18, 2024. Shares of Common Stock that may be acquired pursuant to options that are exercisable or restricted stock units subject to time-based vesting (“RSUs”) that will vest within 60 days of March 18, 2024 are deemed outstanding for computing the percentage ownership of the person holding such options or RSUs but are not deemed outstanding for the percentage ownership of any other person. |

| (3) | Based solely on a Schedule 13G/A filed on January 23, 2024 for the December 31, 2023 filing event. BlackRock, Inc.’s business address is 55 East 52nd Street, New York, NY 10055. BlackRock, Inc. has sole voting power with respect to 7,561,271 shares and sole dispositive power with respect to 7,859,530 shares. |

| (4) | Based solely on a Schedule 13G/A filed on February 13, 2024 for the December 31, 2023 filing event. The Vanguard Group’s business address is 100 Vanguard Blvd., Malvern, PA 19355. The Vanguard Group has shared voting power with respect to 31,387 shares, shared dispositive power with respect to 74,137 shares and sole dispositive power with respect to 5,004,124 shares. |

| (5) | Based solely on a Schedule 13G/A filed on February 14, 2024 for the December 31, 2023, filing event. T. Rowe Price Associates, Inc. business address is 100 E. Pratt Street, Baltimore, MD 21202. T. Rowe Price Associates, Inc. has sole voting power with respect to 859,124 shares and sole dispositive power with respect to 4,010,255 shares. |

| REPLIGEN CORPORATION | 10

| 2024 PROXY STATEMENT | |||||||||

| (6) | Based solely on a Schedule 13G/A filed on February 6, 2024 for the December 31, 2023 filing event. Consists of (i) 2,705,689 shares held by Roy T. Eddleman Living Trust, (ii) 509,318 shares held by Roy T. Eddleman Charitable Remainder Trust #1, and (iii) 284,993 shares held by Roy T. Eddleman Charitable Remainder Trust #2 (collectively, the “Eddleman Trusts”). Nereyda Rubio and Anis Garci serve as co-trustees of the Eddleman Trusts, and each has investment and voting control over the shares held by the Eddleman Trusts (the “Shares”) and may be deemed to have shared voting power and shared investment power with respect to all such Shares. The business address of each of the Eddleman Trusts is c/o TroyGould PC, 1801 Century Park East, 16th Floor, Los Angeles, CA 90067. |

| (7) | Includes 297,337 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024. |

| (8) | Mr. Garland was appointed Chief Financial Officer effective September 25, 2023. |

| (9) | Includes 12,848 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 1,000 RSUs which will vest within 60 days of March 18, 2024. |

| (10) | Includes 5,222 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 1,600 RSUs which will vest within 60 days of March 18, 2024. |

| (11) | Mr. Loeillot was appointed President and Chief Commercial Officer effective October 2, 2023. |

| (12) | Mr. Snodgres retired from the Company effective October 31, 2023, but ceased being an executive officer effective September 25, 2023. |

| (13) | Includes 9,531 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 798 RSUs which will vest within 60 days of March 18, 2024. |

| (14) | Includes 3,936 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 686 RSUs which will vest within 60 days of March 18, 2024. |

| (15) | Includes 7,920 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 686 RSUs which will vest within 60 days of March 18, 2024. |

| (16) | Includes 3,617 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 686 RSUs which will vest within 60 days of March 18, 2024. |

| (17) | Includes 2,332 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 686 RSUs which will vest within 60 days of March 18, 2024. |

| (18) | Includes 9,010 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 686 RSUs which will vest within 60 days of March 18, 2024. |

| (19) | Includes 40,434 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 686 RSUs which will vest within 60 days of March 18, 2024. |

| (20) | Includes 195 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 92 RSUs which will vest within 60 days of March 18, 2024. |

| (21) | See footnotes 7 through 20 above. Includes 397,360 shares issuable pursuant to stock options which are exercisable within 60 days of March 18, 2024 and 8,606 RSUs which will vest within 60 days of March 18, 2024. Ms. Gebski is an executive officer as of March 18, 2024 and although not listed in the table as a named executive officer, her holdings of 29,711 shares are included in this number, including 4,978 shares issuable pursuant to stock options and 1,000 RSUs which are exercisable or vest within 60 days of March 18, 2024. |

| REPLIGEN CORPORATION | 11

| 2024 PROXY STATEMENT | |||||||||

PROPOSAL 1

ELECTION OF DIRECTORS

DIRECTOR NOMINEES

There are nine (9) nominees for director, all of whom are current directors of Repligen that have been nominated by the Nominating and Corporate Governance (“N&CG”) Committee and the Board of Directors (“Board”) for re-election.

If elected, each of the director nominees will hold office until the 2025 Annual Meeting of Shareholders and until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation or removal.

| Nominee’s Name | Year First Elected Director | Position(s) with the Company | ||

Tony J. Hunt | 2015 | Chief Executive Officer and Director | ||

Karen A. Dawes | 2005 | Director, Chairperson of the Board | ||

Nicolas M. Barthelemy | 2014 | Director | ||

Carrie Eglinton Manner | 2020 | Director | ||

Konstantin Konstantinov, Ph.D. | 2022 | Director | ||

Martin D. Madaus, D.V.M., Ph.D. | 2023 | Director | ||

Rohin Mhatre, Ph.D. | 2020 | Director | ||

Glenn P. Muir | 2015 | Director | ||

Margaret A. Pax | 2024 | Director | ||

Shares represented by all proxies received by the Board and not marked or voted to abstain from voting for any individual director or for any group of directors will be voted, unless otherwise indicated, FOR the election of the nominees named above. Proxies may not be voted for a greater number of persons than the number of nominees named. The Board knows of no reason why any nominee should be unable or unwilling to serve, but if any nominee should be unable or unwilling to serve, proxies will be voted in accordance with the judgment of the persons named as attorneys-in-fact on the proxy cards with respect to the directorship for which that nominee was unable or unwilling to serve.

Proposal 1 relates solely to the election of the nine (9) above-named directors nominated by the Company and does not include any other matters relating to the election of directors, including without limitation, the election of directors nominated by any shareholders of the Company.

The Board unanimously recommends a vote FOR each of the nominees for election as directors of the Company. If authorized proxies are submitted without specifying an affirmative or negative vote on any proposal, the shares represented by such proxies will be voted in favor of the Board’s recommendations.

| REPLIGEN CORPORATION | 12

| 2024 PROXY STATEMENT | |||||||||

OCCUPATIONS OF DIRECTORS AND EXECUTIVE OFFICERS

Repligen’s executive officers are appointed by, and serve at the discretion of, the Board. Each executive officer is a full-time employee of Repligen. The current directors, including director nominees, and executive officers of Repligen as of March 18, 2024 are as follows:

|

| Name | Age(1) | Position(s) with the Company |

| ||||

|

| Tony J. Hunt | 60 | Chief Executive Officer and Director |

| ||||

|

| Jason K. Garland(2) | 50 | Chief Financial Officer |

| ||||

|

| James R. Bylund | 61 | Chief Operating Officer |

| ||||

|

| Christine Gebski(3) | 56 | Senior Vice President, Filtration and Chromatography |

| ||||

|

| Ralf Kuriyel | 66 | Senior Vice President, Research and Development |

| ||||

|

| Olivier Loeillot(4) | 54 | President and Chief Commercial Officer |

| ||||

|

| Nicolas M. Barthelemy(5)(6) | 58 | Director |

| ||||

|

| Karen A. Dawes(6) | 72 | Director, Chairperson of the Board |

| ||||

|

| Carrie Eglinton Manner(7) | 50 | Director |

| ||||

|

| Konstantin Konstantinov, Ph.D.(6) | 66 | Director |

| ||||

|

| Martin Madaus, D.V.M., Ph.D.(6)(7) | 64 | Director |

| ||||

|

| Rohin Mhatre, Ph.D.(5) | 59 | Director |

| ||||

|

| Glenn P. Muir(5)(7) | 65 | Director |

| ||||

|

| Margaret A. Pax(8) | 64 | Director |

| ||||

| (1) | Age as of the date of the 2024 Annual Meeting of Shareholders. |

| (2) | Mr. Garland was appointed Chief Financial Officer (“CFO”) effective September 25, 2023. |

| (3) | Ms. Gebski is an executive officer for fiscal year 2023. She is referred to in this Proxy Statement as a named executive officer for simplicity. |

| (4) | Mr. Loeillot was appointed President and Chief Commercial Officer (“CCO”) effective October 2, 2023. |

| (5) | Member of the Compensation Committee. |

| (6) | Member of the N&CG Committee. |

| (7) | Member of the Audit Committee. |

| (8) | Ms. Pax was elected to the Board on March 18, 2024. |

| REPLIGEN CORPORATION | 13

| 2024 PROXY STATEMENT | |||||||||

BIOGRAPHICAL INFORMATION

The following paragraphs provide information about the Company’s continuing directors and executive officers. The information presented includes information about each director’s specific experience, qualifications, attributes and skills that led the Board to the conclusion that he or she should serve as a director.

Executive Officers

| Tony J. Hunt was named President and Chief Executive Officer (“CEO”) and has served on the Board since May 2015. He currently serves as CEO after relinquishing his role as President in October 2023. He joined Repligen in May 2014 as Chief Operating Officer (“COO”), overseeing commercial and manufacturing operations. Before coming to Repligen, Mr. Hunt was President of Bioproduction at Life Technologies Corporation, a global life sciences company which was acquired by Thermo Fisher Scientific (“Thermo Fisher”) in 2014. He joined Life Technologies in 2008, serving as General Manager of Bioproduction Chromatography and Pharma Analytics before being named President of Bioproduction in 2011. From 2000 to 2008, Mr. Hunt was with Applied Biosystems as Senior Director of Pharma Programs where he launched the Pharma Analytics business that in |

2008 became a part of the Bioproduction platform at Life Technologies. Mr. Hunt also serves on the board of directors of one publicly traded company, 908 Devices Inc. Mr. Hunt received a B.S. in Microbiology and an M.S. in Biotechnology from University College in Galway, Ireland, and a M.B.A. from Boston University School of Management. Mr. Hunt brings to the Board his deep understanding of the bioprocessing market.

| Jason K. Garland joined Repligen in September 2023 as the CFO, where he oversees financial operations for the Company. Mr. Garland holds responsibility for all corporate finance and audit functions, capital markets and M&A transactions, financial planning and analysis, budgeting and financial risk management of the Company as well as information technology and investor relations of the Company. Mr. Garland was previously with Integer Holdings Corporation (“Integer”), a medical device outsource manufacturer, where he served for nearly five years as Executive Vice President and CFO, and assumed executive sponsorship of the company’s business process excellence initiatives focused on standardizing and optimizing all non-manufacturing processes. Prior to his role with Integer, Mr. Garland spent three years as Vice President and CFO for the global sales and supply |

divisions of Tiffany & Co., following nearly 20 years of increasing responsibility at General Electric Corporation (“GE”). His rotations and achievements at GE culminated in several leadership positions including his role as CFO for GE Industrial Solutions, then a multi-billion dollar business with over 40 manufacturing sites. Mr. Garland serves on the board of directors and is Audit Committee Chair for Acutus Medical, a publicly-traded medical device company. He holds a B.S. in Chemical Engineering from the University of New Hampshire, and is Lean Six Sigma Black Belt certified.

| James R. Bylund was named COO of the Company in January 2022 and serves as the Company’s principal operating officer. He joined Repligen in March of 2020 as Senior Vice President, Global Operations and IT, overseeing all operations and IT functions on a global basis. Between March 2019 and March 2020, Mr. Bylund also worked in real estate at Inspire Development in Austin, Texas. Prior to joining Repligen, Mr. Bylund spent ten years at Thermo Fisher in a number of roles including Vice President and General Manager of the Single Use Technologies Business Unit and Vice President of Global Operations for the Bioproduction Division. Prior to joining Thermo Fisher, Mr. Bylund also worked for Fiserv (nine years) and Eli Lilly and Company (seven years) in |

a variety of leadership roles. He has significant experience in managing multiple operating sites across the globe and scaling operations to meet rapidly growing demand. Mr. Bylund is a passionate proponent of continuous improvement and has consistently demonstrated the ability to assemble and grow highly effective teams. He holds a B.S. in Accounting from Utah State University and an M.B.A. from Indiana University.

| Christine Gebski joined Repligen in May 2015 and currently serves as the Senior Vice President, Filtration and Chromatography where she oversees the general management and strategy of the Company’s upstream and downstream filtration and chromatography portfolio. Prior to joining Repligen, Ms. Gebski was head of the Chromatography Business Unit within the Bioproduction Division of Thermo Fisher. At Thermo Fisher she managed the Global Process Chromatography Applications and research and development (“R&D”) functions for ten years. Before joining Thermo Fisher, Ms. Gebski was a Process Development Scientist for 15 years in the biotechnology industry, having held positions of increasing responsibility at Genzyme, TKT/Shire and EMD Pharmaceuticals. She has significant experience in product development and commercialization, |

product life cycle management, downstream process development and engineering, technology transfer and validation across a variety of biological molecule classes and diagnostic reagents. She holds a B.S. in Biology from the University of Vermont and a M.S. in Biotechnology from the University of Massachusetts at Lowell.

| REPLIGEN CORPORATION | 14

| 2024 PROXY STATEMENT | |||||||||

| Ralf Kuriyel joined Repligen in October 2016 as the Senior Vice President, R&D where he oversees the Company’s R&D efforts. Mr. Kuriyel was previously Vice President of Applications for the single-use business unit within the Life Sciences division of Pall Corporation (“Pall”), whose acquisition by Danaher Corporation was completed in August 2015. At Pall, Mr. Kuriyel served as Vice President of R&D, Field Applications and Process Development Services from November 2014 to October 2016. In addition, Mr. Kuriyel served as Vice President, Applications R&D at Pall from November 2011 to November 2014. Mr. Kuriyel received a B.S. and an M.S. in Chemical Engineering from Rensselaer Polytechnic Institute and has completed his coursework for the Tufts |

University Ph.D. program in Chemical Engineering. He is an inventor of multiple patents and has co-authored over 30 scientific publications on bioprocessing, including separations technologies, membrane separations methods, protein processing and enhanced microfiltration techniques.

| Olivier Loeillot joined Repligen in October 2023 as President and CCO, where he has responsibility for driving the Company’s commercial strategy and expanding the market impact of Repligen’s business units in bioprocessing. Mr. Loeillot joined Repligen from his most recent role as CEO of Ascensus Specialties, a manufacturer of specialty chemicals for use in the life sciences and pharmaceutical markets. Mr. Loeillot previously served a combined 12 years with Cytiva (a Danaher Corporation company) and GE Healthcare Life Sciences. At Cytiva, he served as Bioprocess President from 2018 to 2022, overseeing the overall Bioprocessing portfolio from cell culture media to purification resins and including process equipment, single-use technologies |

and enterprise solutions. There, he was also instrumental in building and leading the Enterprise Solutions business, managing the Bioprocess Asia business in Singapore, and directing the Genomics and Cellular Research division. Prior to Cytiva, Mr. Loeillot served a combined 12 years with Lonza, advancing to Vice President Sales, Lonza Custom Manufacturing. He also acted as Vice President Sales for Lonza AG’s custom manufacturing business and led the Microbial Biopharmaceuticals group. Mr. Loeillot earned his Master’s degree in Chemistry in 1993 from the European High Institute of Chemistry of Strasbourg, France, and later completed a M.B.A. program at CESMA Business School of EM Lyon.

Directors

| Nicolas M. Barthelemy has served as a director of Repligen since June 2014. Mr. Barthelemy brings over 30 years of industry experience to the director role. Mr. Barthelemy served as President and CEO of bioTheranostics, a molecular diagnostics company, from September 2014 until February 2017. Prior to bioTheranostics, he served as President, Global Commercial Operations at Life Technologies, which was acquired by Thermo in February 2014. Prior to Life Technologies, Mr. Barthelemy was with Biogen Inc. (“Biogen”) for eight years, most recently as Vice President, Manufacturing and General Manager for the company’s manufacturing organization at Research Triangle Park. He began his career with Merck & Co., Inc. as a Senior |

Project Engineer, Vaccine Technology. Mr. Barthelemy also serves on the board of directors of three privately held companies: Biocare Medical LLC, NanoCellect Biomedical, and Slingshot Biosciences. Mr. Barthelemy previously served as a board member of Twist Bioscience, 908 Devices Inc. and Standard BioTools, Inc. (previously Fluidigm Corporation). Mr. Barthelemy received a M.S. in Chemical Engineering from the University of California, Berkeley, and an engineering degree from Ecole Supérieure de Physique et Chimie Industrielles, Paris. Mr. Barthelemy’s qualifications to sit on the Company’s Board include his extensive experience in the bioprocessing field, including large scale biologics manufacturing and commercialization of consumables used in bioprocessing.

| REPLIGEN CORPORATION | 15

| 2024 PROXY STATEMENT | |||||||||

| Karen A. Dawes, Chairperson of the Board, has served as a director of Repligen since September 2005. She is currently President of Knowledgeable Decisions, LLC, a management consulting firm. Ms. Dawes served from 1999 to 2003 as Senior Vice President and U.S. Business Group Head for Bayer Corporation’s U.S. Pharmaceuticals Group (“Bayer”). Prior to joining Bayer, she was Senior Vice President, Global Strategic Marketing, at Wyeth LLC (“Wyeth”), a pharmaceutical company (formerly known as American Home Products), where she held responsibility for worldwide strategic marketing. Ms. Dawes also served as Vice President, Commercial Operations for Genetics Institute, Inc., which was acquired by Wyeth in January 1997, designing and implementing that company's initial commercialization strategy to launch BeneFIX® and Neumega®. |

Ms. Dawes began her pharmaceuticals industry career at Pfizer, Inc. where, from 1984 to 1994, she held a number of marketing positions, serving most recently as Vice President, Marketing of the Pratt Division. At Pfizer, Inc., she directed launches of Glucotrol®/Glucotrol XL®, Zoloft®, and Cardura®. Ms. Dawes also serves on the board of directors of two publicly traded companies: Barinthus Bio (formerly Vaccitech Limited) and Medicenna Therapeutics Corp, one private company, JPA Health, and one not-for-profit company, Medicines 360. Ms. Dawes received a B.A. and M.A. in English from Simmons College and a M.B.A. from Harvard University Graduate School of Business. Ms. Dawes’ qualifications to sit on the Company’s Board include her extensive strategic experience in both a managerial and consulting capacity with pharmaceutical companies as well as her considerable commercial background.

| Carrie Eglinton Manner has served as a director of Repligen since June 2020. She brings to the director role over 25 years of leadership experience across multiple disciplines. Ms. Eglinton Manner currently serves as President and CEO of OraSure Technologies, Inc. (“OraSure”), which she joined in June 2022. OraSure, together with its wholly-owned subsidiaries, DNA Genotek, Diversigen and Novosanis, is a leader in the development, manufacture and distribution of rapid diagnostic tests, sample collection and stabilization devices, and molecular service solutions designed to discover and detect critical medical conditions. Prior to OraSure, Ms. Eglinton Manner served as Senior Vice President, Advanced & General Diagnostics and Clinical Solutions at Quest Diagnostics ("Quest"), which she joined in 2017. In her role at Quest, Ms. Eglinton Manner was responsible for |

value creation across the company’s $10 billion clinical portfolio, driving innovation in R&D, along with partnerships and acquisitions. She helped accelerate growth in Quest’s $2 billion Advanced Diagnostics portfolio, which included its specialty molecular and genetic offerings, along with Quest’s global and pharmaceutical services businesses. Prior to Quest, Ms. Eglinton Manner held various roles of increasing scope and responsibility over a period of 20 years at GE Healthcare. From 2009 through 2016, she served as President & CEO of four distinct GE Healthcare global businesses in the areas of diagnostic imaging, lab services and medical devices, ranging in size from approximately $150 million to $3 billion in revenue. In addition to the Repligen Board, Ms. Eglinton Manner serves as board director for the not-for-profit Thrive Networks, focused on water supply, sanitation and hygiene, economic empowerment, gender equity, healthy cities and resilient community development to serve underserved populations of Southeast Asia, as well as Sapphiros, a KKR-backed platform building the next generation of diagnostic technologies. Ms. Eglinton Manner holds a B.S. in Mechanical Engineering from the University of Notre Dame. Ms. Eglinton Manner’s qualifications to sit on the Company’s Board include her track record of delivering business expansion and profitability for rapidly growing global businesses, including her experience with integrating acquisitions and building operations excellence, with a commitment to quality and process improvements.

| Konstantin Konstantinov, Ph.D., has served as a director of Repligen since May 2022. He has also been a member of our Scientific Advisory Board since March 2016. Dr. Konstantinov is currently Chief Technology Officer at Ring Therapeutics and Operating Partner at Flagship Pioneering. Dr. Konstantinov previously served as Chief Technology Officer at Codiak BioSciences (“Codiak”), and prior to that as Executive Vice President, Manufacturing & Process Sciences. Before joining Codiak, Dr. Konstantinov was responsible for the late-stage bioprocess and technology development at Sanofi’s Boston hub, including all functions, from cell banking to fill/finish/lyophilization. Prior to Sanofi, Dr. Konstantinov worked for Bayer in Berkeley, California for 14 years, advancing to the position of Head of Process Sciences. He has published 60 peer reviewed papers and |

has more than 15 patents and patent applications. During the last 23 years, Dr. Konstantinov has worked on the development and commercialization of various products, including monoclonal antibodies, blood factors and enzymes expressed in mammalian cells. Most recently, he has pioneered the development of an end-to-end integrated continuous biomanufacturing platform, which is becoming a strategic technological trend for the biomanufacturing industry worldwide. Dr. Konstantinov received his Ph.D. in Biochemical Engineering from Osaka University, Japan, which was followed by a post-doctoral assignment at DuPont and the University of Delaware.

| REPLIGEN CORPORATION | 16

| 2024 PROXY STATEMENT | |||||||||

| Martin D. Madaus, Ph.D., has served as a director of Repligen since February 2023. Dr. Madaus joined the Board with over 25 years of industry experience, including five years as Chairman, President and CEO of Millipore Corporation, where he was integral to the company’s transformation into a life science leader, and its acquisition by Merck KGaA in 2010. He is an active board leader, currently serving as a Director at Azenta Life Sciences, a public company focused on assisting life sciences organizations bring impactful breakthroughs and therapies to markets faster, and as Lead Director for Quanterix Corporation, a precision health technology public company. Dr. Madaus previously served as a board member for mass cytometry player Standard BioTools, Inc. (previously Fluidigm Corporation). He also serves on the boards of three private companies: Unchained |

Labs, Emulate Inc. and Syntis Bio. Dr. Madaus is currently a senior operating executive at The Carlyle Group (since 2019), a multinational private equity and asset management services company. He previously served as Chairman and CEO at Ortho-Clinical Diagnostics from 2014 to 2019. His tenure with biopharmaceutical and diagnostic industry leader Roche Holding AG from 1996 to 2004 included his position from 2000 to 2004 as President and CEO, N.A. of Roche Diagnostics Corp. Dr. Madaus began his career as a veterinarian, before joining global pharmaceutical and diagnostic company Boehringer Mannheim Corporation (“Boehringer”). While at Boehringer, he held sales, marketing and product management roles from 1989 to 1996, until his move into general management coincided with the company’s acquisition by Roche in 1996. He holds a D.V.M. from the University of Munich in Germany and a Ph.D. from the University of Veterinary Medicine of Hanover in Germany. Dr. Madaus’ qualifications to sit on the Company’s Board include his extensive bioprocessing and biopharmaceutical industry experience, especially in the areas of strategy, mergers and acquisitions, and commercial operations.

| Rohin Mhatre, Ph.D., was appointed to the Board in March 2020. Dr. Mhatre brings 30 years of relevant experience to the director role, including his current position since October 2023 as Executive Vice President and Chief Technical Officer at FogPharma. Prior to that he served as Senior Vice President, Product and Technology Development of Biogen from 2017 to 2023. Dr. Mhatre has also held numerous other roles of increasing responsibility within Biogen, which he joined in 1996, including six years as Vice President of Biopharmaceutical Development, where he led a team responsible for cell line, cell culture, purification and device development. Earlier in Dr. Mhatre’s career at Biogen, he focused on building out analytical |

development and technical services. Prior to Biogen, Dr. Mhatre led the purification and applications group at Applied BioSystems (formerly Perspective Biosystems). Dr. Mhatre holds a Ph.D. in Chemistry from Northeastern University. Dr. Mhatre’s qualifications to sit on the Board include his extensive technical expertise, his leadership abilities and his deep understanding of the dependencies between biological drug development and efficient manufacturing workflows.

| Glenn P. Muir has served as a director of Repligen since October 2015. Mr. Muir brings over 30 years of experience to the director role, including 26 years with Hologic, Inc. (“Hologic”), a large multi-national medical device and diagnostics company where he most recently served as CFO and Executive Vice President. Mr. Muir retired in May 2014 from Hologic, where he helped steer the company’s evolution from a venture-backed single product company to a publicly-traded diversified organization with over 5,000 employees and $2.5 billion in revenue. He joined Hologic in 1988 and served as CFO since 1992 and Executive Vice President since 2000. Prior to Hologic, Mr. Muir was with Metallon Engineered Materials Co., a private company where, from 1986 to 1988 he held the role of Vice President, Finance. Previously, from 1981 to 1984, he was a Senior |

Auditor with Arthur Andersen & Co. Mr. Muir also serves on the board of directors of two publicly-traded companies: medical technology company, Neuronetics, Inc., and life science company, G1 Therapeutics, Inc. Previously, Mr. Muir served on the board of directors of ReWalk Robotics Ltd. from July 2014 to December 2017. Mr. Muir is a Certified Public Accountant (inactive since 2022) with a B.A. from the University of Massachusetts, Amherst. He also earned a M.S. from Bentley University and a M.B.A. from Harvard University. Mr. Muir’s qualifications to sit on Repligen’s Board include his extensive experience with integrating strategic acquisitions and leading the financial operations for a global manufacturing and commercial organization.

| REPLIGEN CORPORATION | 17

| 2024 PROXY STATEMENT | |||||||||

| Margaret A. Pax has served as a director of Repligen since March 2024. Ms. Pax brings over 25 years of experience leading the development and execution of growth strategies for global companies. This includes eight years with Thermo Fisher, where, from 2016 to 2020, she served as Vice President, Strategy and Innovation for the clinical supply chain business. In this role, she led strategic planning, developed customer-facing innovation programs, and drove the business case for the company’s multi-billion acquisition of Patheon, a leading biopharmaceutical contract manufacturer. Ms. Pax’s background also includes her position as Senior Director, Corporate Development & Strategy at Thermo Fisher from 2013 to 2016, where she led |

post-merger commercial integration for the company’s acquisition of Life Technologies. Earlier in her career with Thermo Fisher, she was the Senior Director, Portable Analytical Instrumentation from 2012 to 2013. From 1989 to 2000, Ms. Pax was with Phillips Healthcare (“Phillips”), a leading medical device company, where she held senior leadership roles in Business Development, Marketing and Product Management. Between her Phillips and Thermo Fisher roles, Ms. Pax held several entrepreneurial leadership positions, including as Vice President, Business and Clinical Development for five years (2006 to 2011) with Microchips Biomedical, an MIT startup company that was acquired by Daré Bioscience. Ms. Pax is currently an independent board director at Alimera Sciences, a Nasdaq-listed pharmaceutical company, where she has served as a director since 2023, and Jellagen, a privately-held UK company. She also sits on the board of the U.S. subsidiary of BioPorto A/S, a Danish-based kidney biomarker company. Ms. Pax advises a range of healthcare and life sciences companies on business strategy, commercial growth, and partnerships. Ms. Pax holds a B.A. from the College of Holy Cross, and an M.B.A. from Harvard Business School, where she currently serves as a board member of the Harvard Business School Healthcare Alumni Association.

CERTAIN RELATIONSHIPS AND RELATED PERSONS TRANSACTIONS

No family relationship exists among the officers and directors of Repligen. The Audit Committee conducts an appropriate review of all related party transactions for potential conflict of interest situations on an ongoing basis, and the approval of the Audit Committee is required for all such transactions. The term “related party transactions” shall refer to transactions required to be disclosed by the Company pursuant to Item 404 of Regulation S-K promulgated by the Securities and Exchange Commission (“SEC”).

DELINQUENT SECTION 16(a) REPORTS

Under U.S. securities laws, directors, certain officers and persons holding more than 10% of our Common Stock must report their initial ownership of our Common Stock and any changes in their ownership to the SEC. The SEC has designated specific due dates for these reports and we must identify in this Proxy Statement those persons who did not file these reports when due. Based solely on our review of copies of the reports filed with the SEC and the written representations of our directors and executive officers, we believe that all reporting requirements for fiscal year 2023 were complied with by each person who at any time during the 2023 fiscal year was a director or an executive officer or held more than 10% of our Common Stock, except for the following: Due to an administrative error, a Form 4 filing misreported the number of shares beneficially owned by Carrie Eglinton Manner, a current member of the Board. The required Form 4 to correct this amount was filed on December 15, 2023.

| REPLIGEN CORPORATION | 18

| 2024 PROXY STATEMENT | |||||||||

CORPORATE GOVERNANCE AND BOARD MATTERS

BOARD INFORMATION

Director Independence

The Board of Directors (“Board”) has determined that each of the directors who has served during the fiscal year ended December 31, 2023 and each of the nominees for director at the 2024 Annual Meeting of Shareholders (the “Annual Meeting”), with the exception of Mr. Hunt, has no material relationship with the Company and is independent within the meaning of the director independence standards of The Nasdaq Stock Market LLC (“Nasdaq”). Furthermore, the Board has determined that each member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance (“N&CG”) Committee of the Board is independent within the meaning of Nasdaq’s director independence standards and that each member of the Audit Committee meets the heightened director independence standards of the Securities and Exchange Commission (“SEC”) for audit committee members.

Board Leadership Structure

The Board is led by its Chairperson, Karen Dawes, who is an independent director. The Board believes that separating the roles of the Chief Executive Officer (“CEO”) and Chairperson of the Board is the most appropriate structure for the Company at this time. Having an independent Chairperson ensures that the CEO is accountable for managing the Company in the best interests of the shareholders while, at the same time, acknowledging that managing the Board is a separate and time-intensive responsibility. Additionally, this structure ensures a greater role for the non-management directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board. The Board also believes that having an independent Chairperson can serve to curb conflicts of interests, promote oversight of risk and manage the relationship between the Board and the CEO.

Executive Sessions

The Board holds executive sessions of the independent directors at each regularly scheduled Board meeting and/or as deemed necessary by the Chairperson. Executive sessions do not include any employee directors of the Company, and the Chairperson of the Board is responsible for chairing the executive sessions.

Director Nomination Policies

Director Qualifications

The N&CG Committee is responsible for selecting and recommending nominees for election as directors to the Board. The full Board participates in an annual Board effectiveness assessment, which includes evaluating the appropriate qualities, skills and characteristics of current Board members and identifying skills and qualifications desired for director nominees. These assessments include consideration of the following minimum qualifications that the N&CG Committee believes must be met by all directors:

| • | Directors must be of high ethical character, have no conflict of interest and share the values of the Company as reflected in the Company’s Second Amended and Restated Code of Business Conduct & Ethics (“Code of Business Conduct & Ethics”); |

| • | Directors must have reputations, both personal and professional, consistent with the image and reputation of the Company; |

| • | Directors must have the ability to exercise sound business judgment; |

| • | Directors must have substantial business or professional experience and be able to offer advice and guidance to the Company’s management based on that experience; and |

| • | Directors must have (at a minimum) a bachelor’s degree or equivalent degree from an accredited college or university. |

The N&CG Committee also considers numerous other qualifications, skills and characteristics when evaluating director nominees, such as:

| • | An understanding of and experience in bioprocessing, biotechnology and pharmaceutical industries; |

| • | An understanding of and experience in accounting oversight and governance, finance and marketing; |

| • | Leadership experience with public companies or other significant organizations; and |

| • | Diversity of background, including diversity of gender, race, ethnicity, culture, nationality, sexual orientation, age, perspectives, personal and professional background, knowledge and experience. |

These factors and others are considered useful by the Board and are reviewed in the context of an assessment of the perceived needs of the Board at a particular point in time.

The N&CG Committee considers candidates for Board membership, including those suggested by shareholders, applying the same criteria for all candidates. If the N&CG Committee identifies a need to replace a current member of the Board, to fill a vacancy on the Board, or to expand the size of the Board, it considers candidates from a variety of sources including third-party search firms that assist in identifying, evaluating and conducting due diligence on potential director candidates. For all potential candidates, our N&CG Committee will consider all factors it deems relevant, including those enumerated above.

| REPLIGEN CORPORATION | 19

| 2024 PROXY STATEMENT | |||||||||

Board Diversity

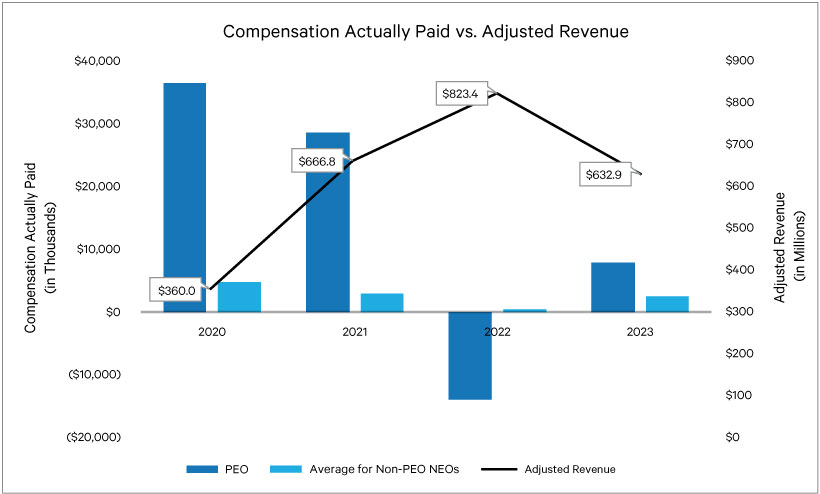

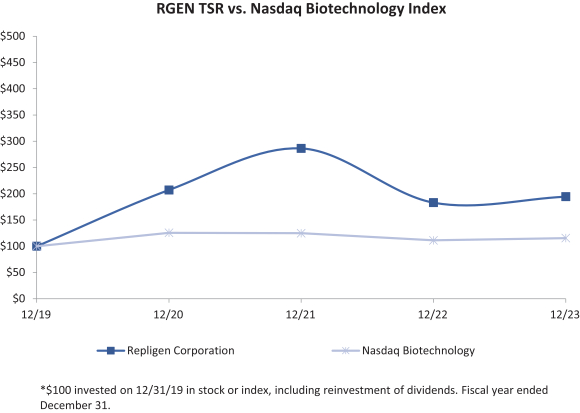

The N&CG Committee is committed to having a diverse Board and considers a variety of candidate attributes, including whether a candidate, if elected, assists in achieving a mix of directors who represent a diversity of backgrounds and experience. A Board that includes diversity, including diversity in gender, race, ethnicity, culture, nationality, sexual orientation, age, perspectives, personal and professional background, knowledge and experience, is important because we believe having varying perspectives and a breadth of experience improves the quality of deliberations, contributes to more effective decision-making on behalf of the Company and its shareholders and enhances the overall chemistry and collaborative culture in the boardroom. Accordingly, the N&CG Committee is committed to actively seeking out Board candidates who are highly qualified women, minorities, and individuals with other diverse backgrounds, skills and experience.