Investor Presentation THIRD QUARTER 2019 RESULTS THIRD QUAR TER 2 019

Cautionary Notice Regarding Forward-Looking Statements This press release contains “forward-looking statements” within the meaning, and protections, of the failure of assumptions and estimates, as well as differences in, and changes to, economic, market Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and credit conditions; the impact on the valuation of our investments due to market volatility or including, without limitation, statements about future financial and operating results, cost savings, counterparty payment risk; statutory and regulatory dividend restrictions; increases in regulatory enhanced revenues, economic and seasonal conditions in our markets, and improvements to reported capital requirements for banking organizations generally; the risks of mergers, acquisitions and earnings that may be realized from cost controls, tax law changes, and for integration of banks that we divestitures, including our ability to continue to identify acquisition targets and successfully acquire have acquired, or expect to acquire, as well as statements with respect to Seacoast's objectives, desirable financial institutions; changes in technology or products that may be more difficult, costly, or strategic plans, including Vision 2020, expectations and intentions and other statements that are not less effective than anticipated; our ability to identify and address increased cybersecurity risks; historical facts. Actual results may differ from those set forth in the forward-looking statements. inability of our risk management framework to manage risks associated with our business; dependence on key suppliers or vendors to obtain equipment or services for our business on Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, acceptable terms; reduction in or the termination of our ability to use the mobile-based platform that expectations, anticipations, assumptions, estimates and intentions about future performance, and is critical to our business growth strategy; the effects of war or other conflicts, acts of terrorism, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, natural disasters or other catastrophic events that may affect general economic conditions; and which may cause the actual results, performance or achievements of Seacoast to be materially unexpected outcomes of, and the costs associated with, existing or new litigation involving us; our different from future results, performance or achievements expressed or implied by such forward- ability to maintain adequate internal controls over financial reporting; potential claims, damages, looking statements. You should not expect us to update any forward-looking statements. penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that our deferred tax assets could be reduced if All statements other than statements of historical fact could be forward-looking statements. You can estimates of future taxable income from our operations and tax planning strategies are less than identify these forward-looking statements through our use of words such as “may”, “will”, “anticipate”, currently estimated and sales of our capital stock could trigger a reduction in the amount of net “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, operating loss carryforwards that we may be able to utilize for income tax purposes; the effects of “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” or other similar words competition from other commercial banks, thrifts, mortgage banking firms, consumer finance and expressions of the future. These forward-looking statements may not be realized due to a variety companies, credit unions, securities brokerage firms, insurance companies, money market and other of factors, including, without limitation: the effects of future economic and market conditions, mutual funds and other financial institutions operating in our market areas and elsewhere, including including seasonality; governmental monetary and fiscal policies, including interest rate policies of the institutions operating regionally, nationally and internationally, together with such competitors Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes; changes offering banking products and services by mail, telephone, computer and the Internet; and the failure in accounting policies, rules and practices; the risks of changes in interest rates on the level and of assumptions underlying the establishment of reserves for possible loan losses. composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; All written or oral forward-looking statements attributable to us are expressly qualified in their uncertainty related to the impact of LIBOR calculations on securities and loans; changes in borrower entirety by this cautionary notice, including, without limitation, those risks and uncertainties credit risks and payment behaviors; changes in the availability and cost of credit and capital in the described in our annual report on Form 10-K for the year ended December 31, 2018 under “Special financial markets; changes in the prices, values and sales volumes of residential and commercial real Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors”, and otherwise in our estate; our ability to comply with any regulatory requirements; the effects of problems encountered SEC reports and filings. Such reports are available upon request from the Company, or from the by other financial institutions that adversely affect us or the banking industry; our concentration in Securities and Exchange Commission, including through the SEC’s Internet website at www.sec.gov. commercial real estate loans; T H I R D QUAR TER 2 019 2

Agenda 1 ABOUT SEACOAST BANK 2 COMPANY PERFORMANCE 3 SEACOAST’S DIFFERENTIATED STRATEGY 4 SEACOAST’SAPPENDIX DIFFERENTIATED STRATEGY T H I R D QUAR TER 2 019 3

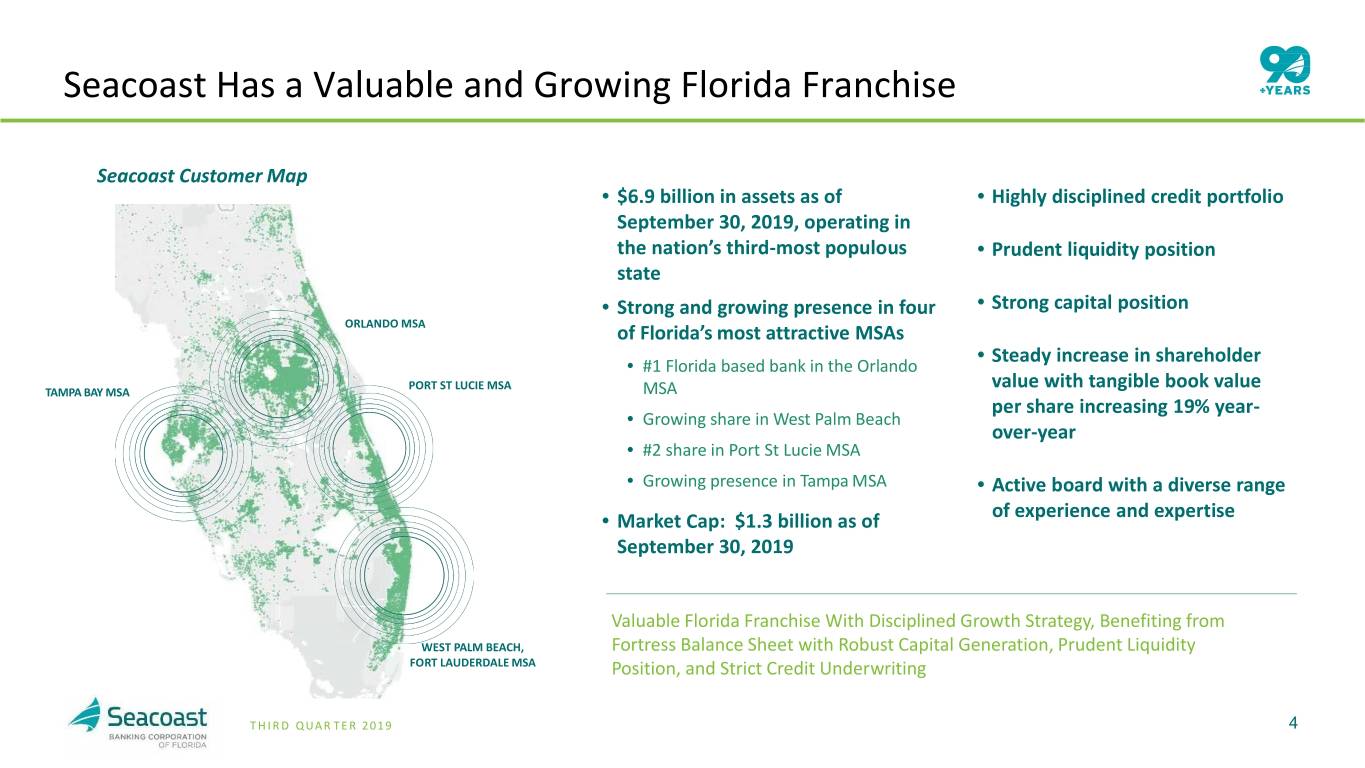

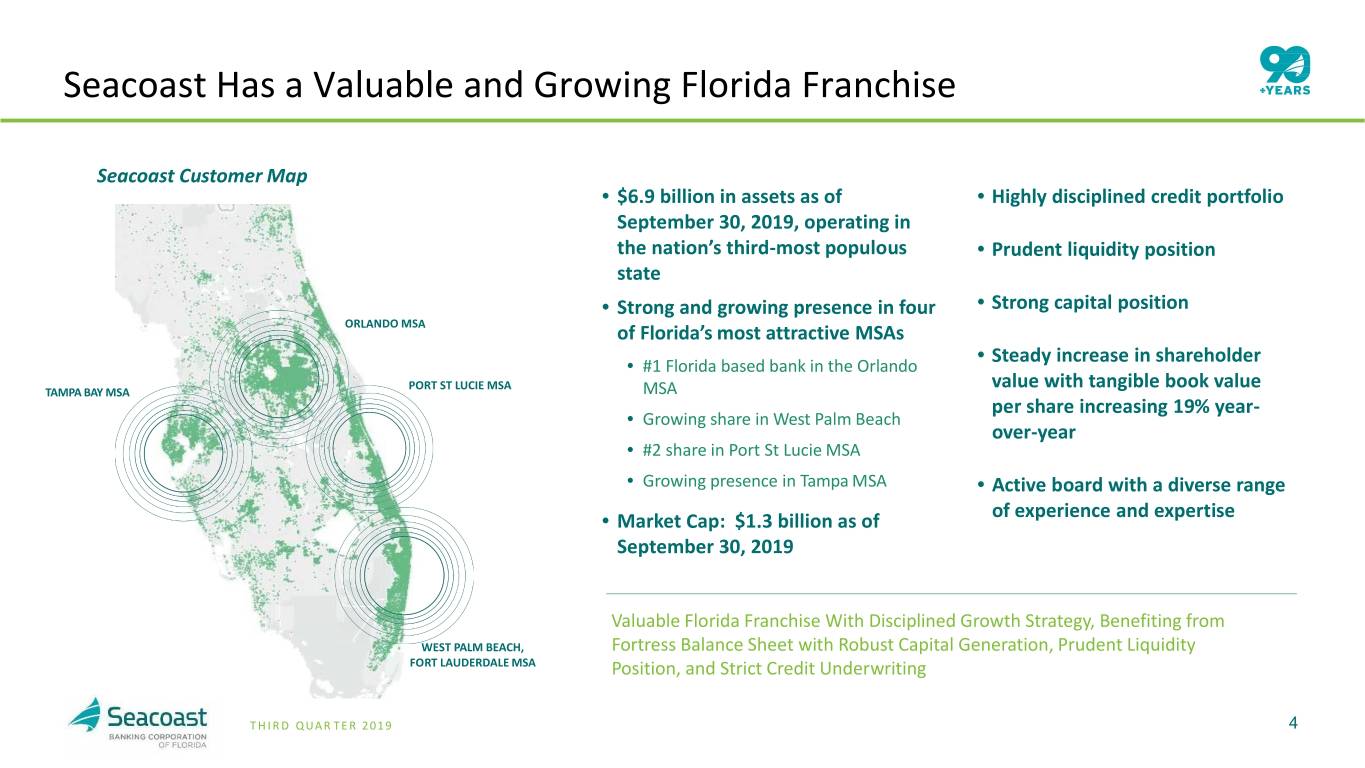

Seacoast Has a Valuable and Growing Florida Franchise Seacoast Customer Map • $6.9 billion in assets as of • Highly disciplined credit portfolio September 30, 2019, operating in the nation’s third-most populous • Prudent liquidity position state • Strong and growing presence in four • Strong capital position ORLANDO MSA of Florida’s most attractive MSAs • Steady increase in shareholder • #1 Florida based bank in the Orlando PORT ST LUCIE MSA value with tangible book value TAMPA BAY MSA MSA per share increasing 19% year- • Growing share in West Palm Beach over-year • #2 share in Port St Lucie MSA • Growing presence in Tampa MSA • Active board with a diverse range of experience and expertise • Market Cap: $1.3 billion as of September 30, 2019 Valuable Florida Franchise With Disciplined Growth Strategy, Benefiting from WEST PALM BEACH, Fortress Balance Sheet with Robust Capital Generation, Prudent Liquidity FORT LAUDERDALE MSA Position, and Strict Credit Underwriting T H I R D QUAR TER 2 019 4

Agenda 1 ABOUT SEACOAST BANK 2 COMPANY PERFORMANCE 3 SEACOAST’S DIFFERENTIATED STRATEGY 4 SEACOAST’SAPPENDIX DIFFERENTIATED STRATEGY T H I R D QUAR TER 2 019 5

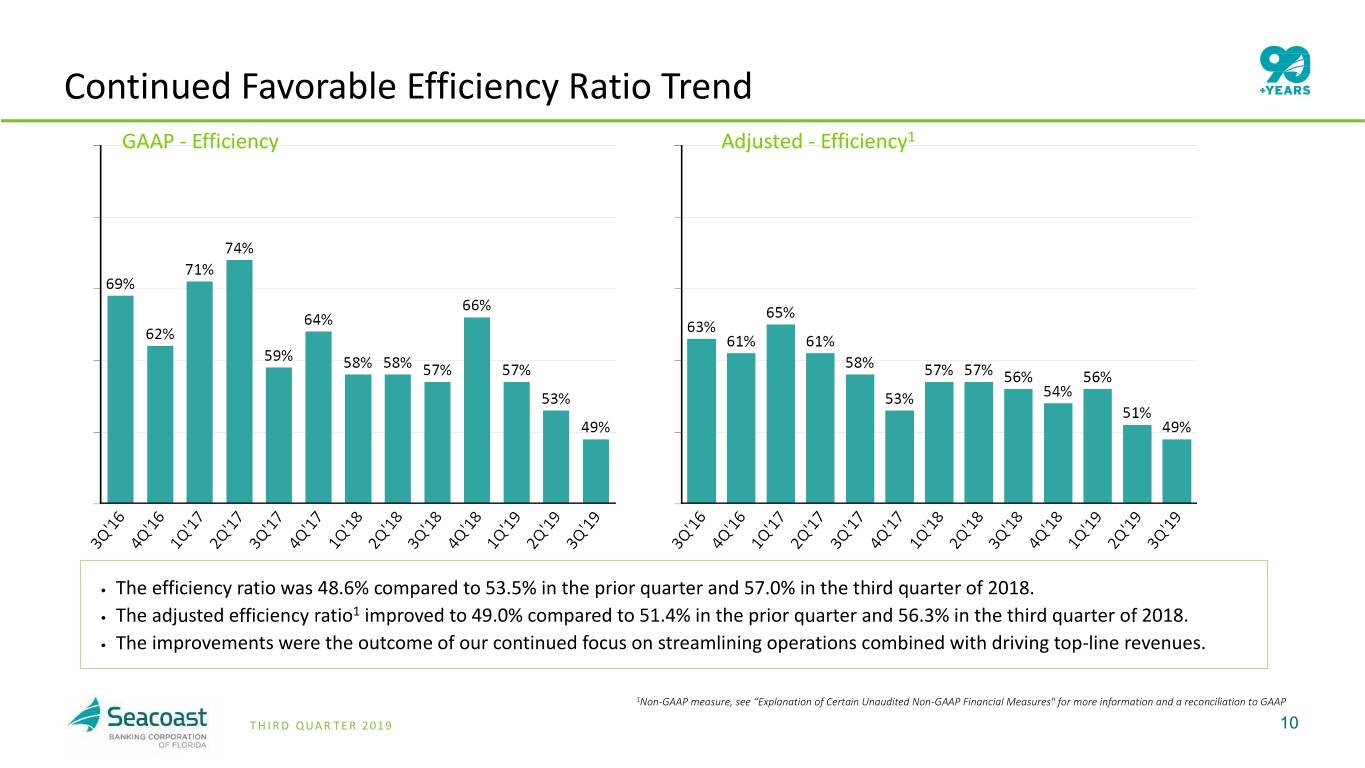

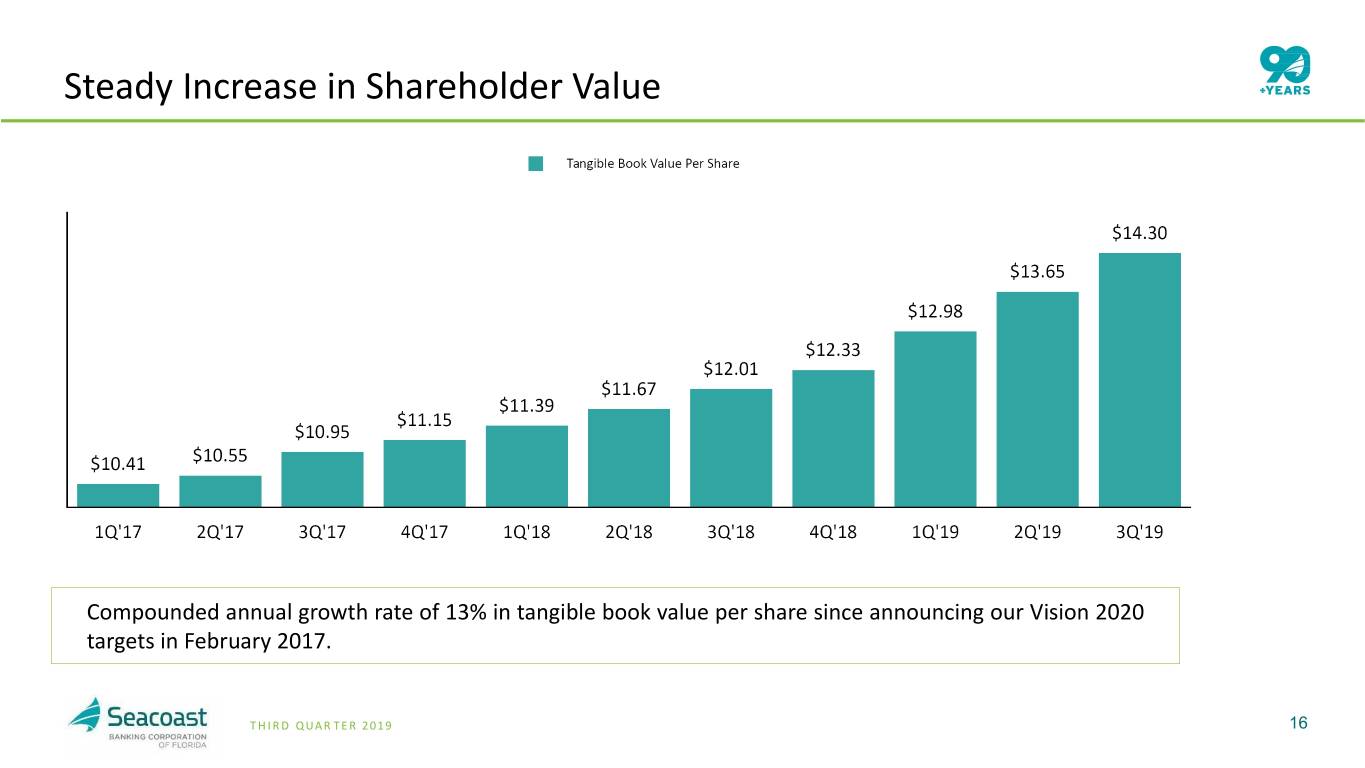

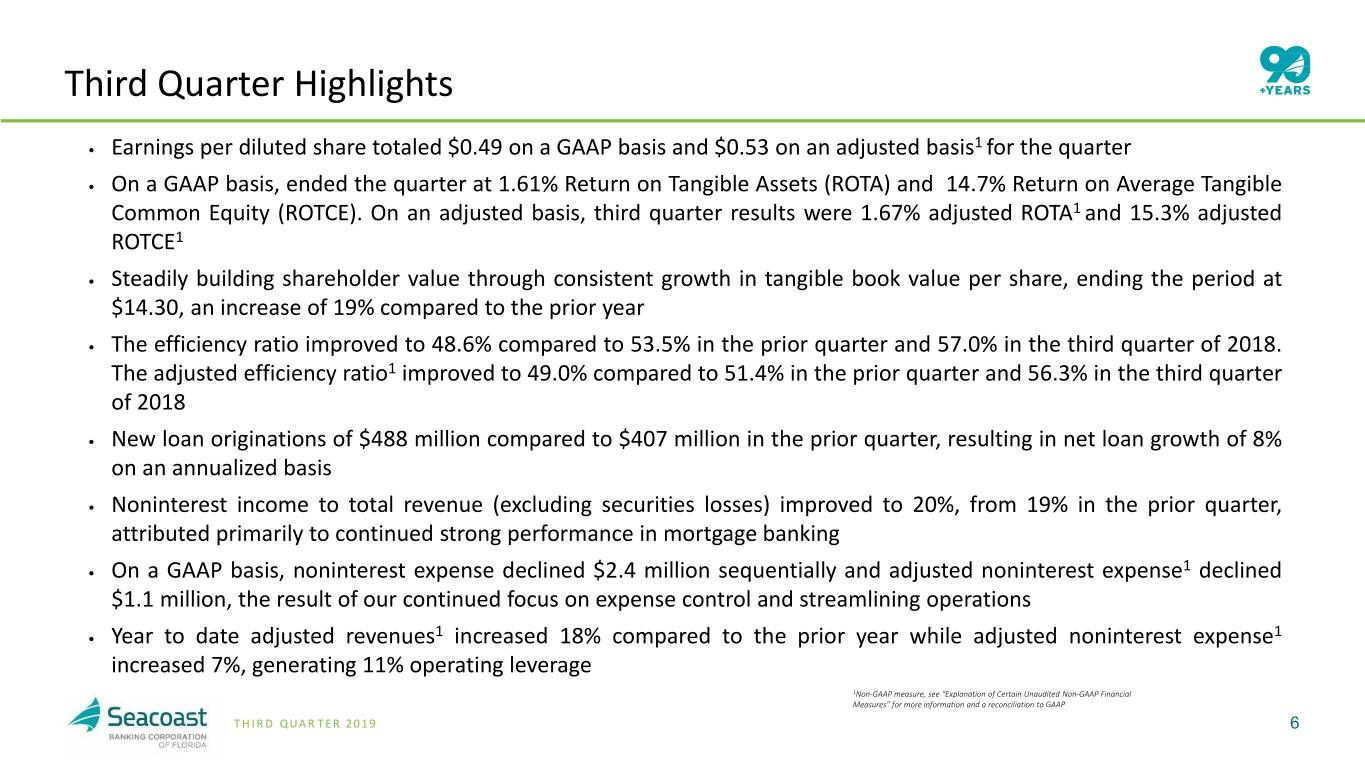

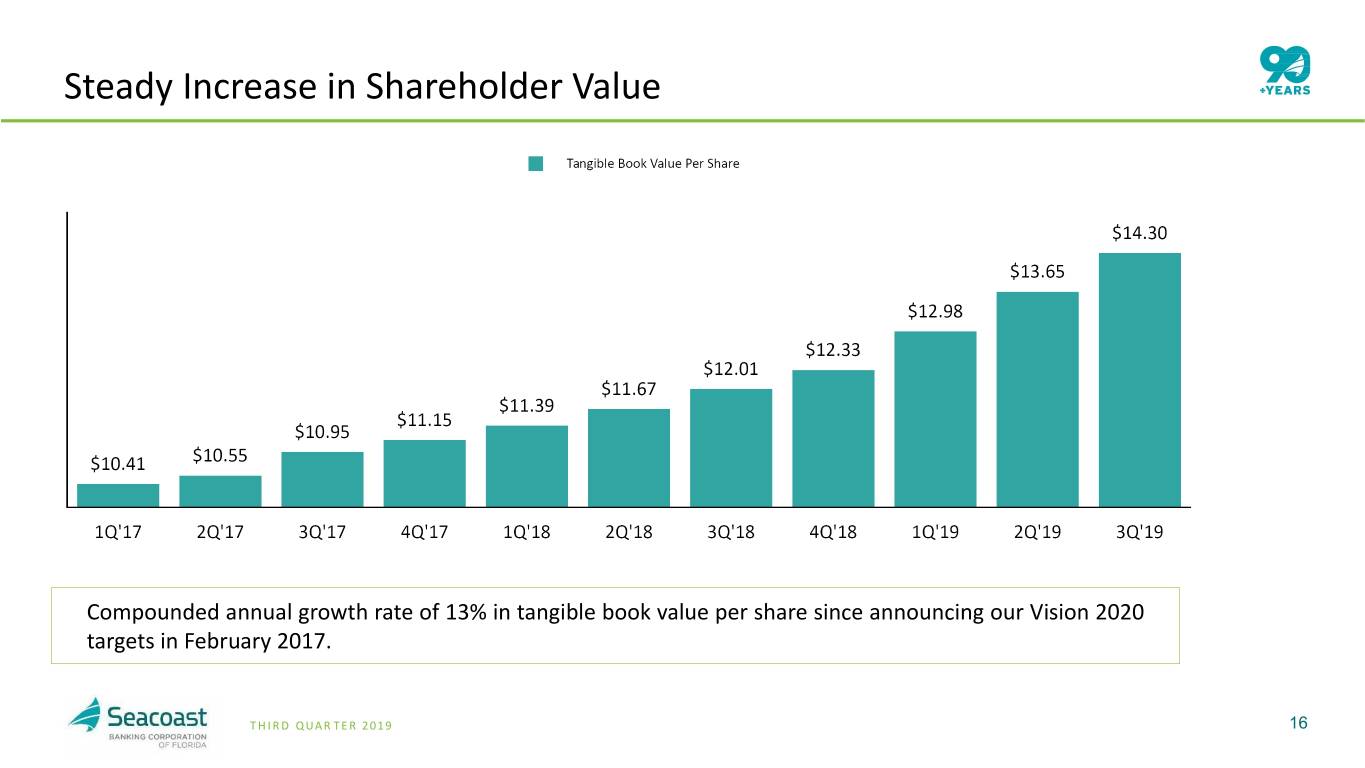

Third Quarter Highlights 1 • Earnings per diluted share totaled $0.49 on a GAAP basis and $0.53 on an adjusted basis for the quarter • On a GAAP basis, ended the quarter at 1.61% Return on Tangible Assets (ROTA) and 14.7% Return on Average Tangible Common Equity (ROTCE). On an adjusted basis, third quarter results were 1.67% adjusted ROTA1 and 15.3% adjusted ROTCE1 • Steadily building shareholder value through consistent growth in tangible book value per share, ending the period at $14.30, an increase of 19% compared to the prior year • The efficiency ratio improved to 48.6% compared to 53.5% in the prior quarter and 57.0% in the third quarter of 2018. The adjusted efficiency ratio1 improved to 49.0% compared to 51.4% in the prior quarter and 56.3% in the third quarter of 2018 • New loan originations of $488 million compared to $407 million in the prior quarter, resulting in net loan growth of 8% on an annualized basis • Noninterest income to total revenue (excluding securities losses) improved to 20%, from 19% in the prior quarter, attributed primarily to continued strong performance in mortgage banking 1 • On a GAAP basis, noninterest expense declined $2.4 million sequentially and adjusted noninterest expense declined $1.1 million, the result of our continued focus on expense control and streamlining operations 1 1 • Year to date adjusted revenues increased 18% compared to the prior year while adjusted noninterest expense increased 7%, generating 11% operating leverage 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP T H I R D QUAR TER 2 019 6

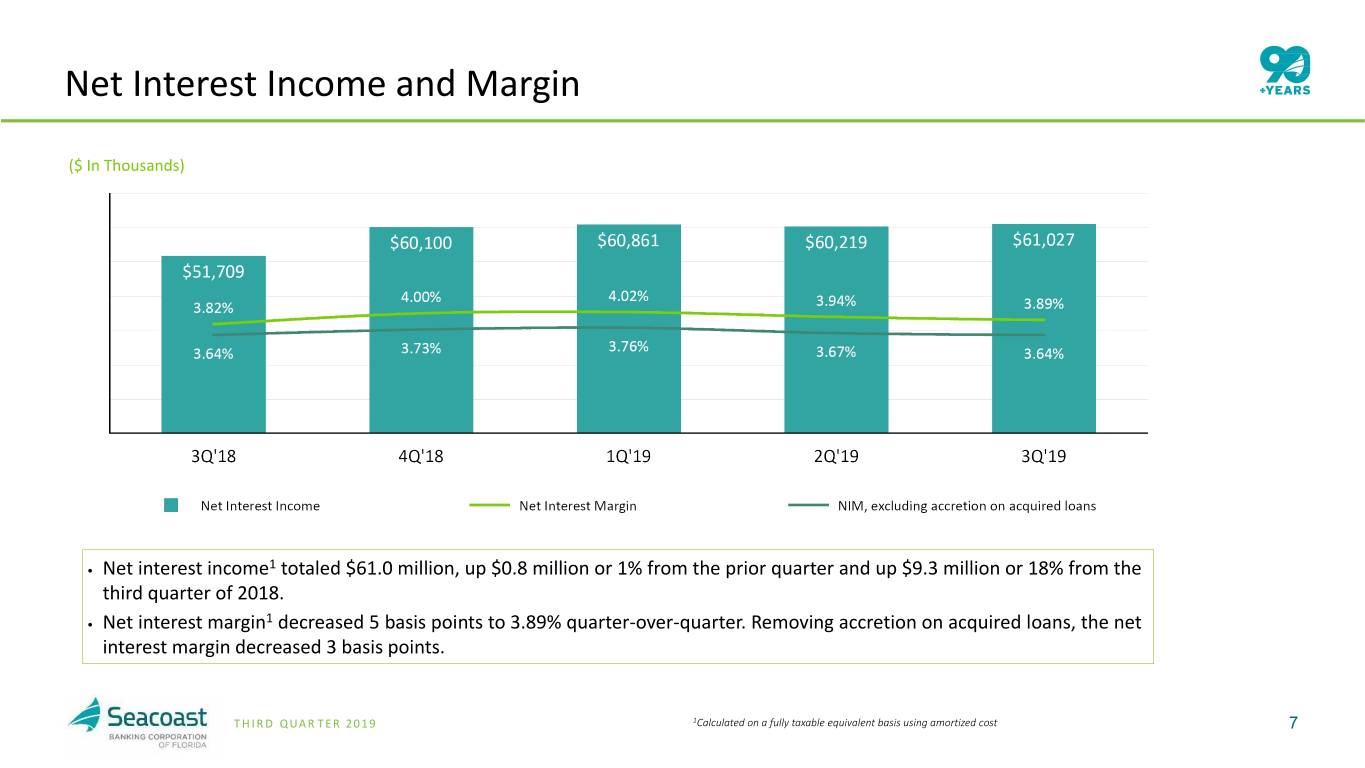

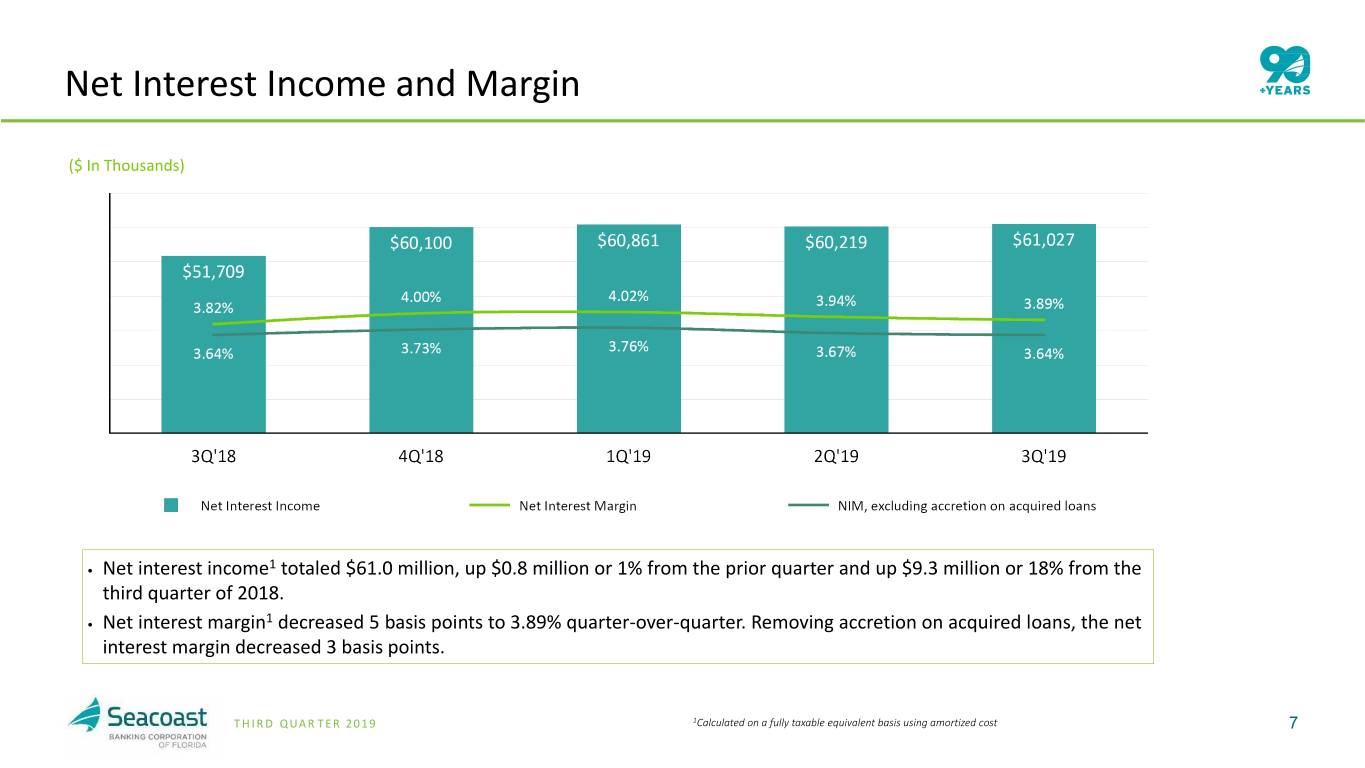

Net Interest Income and Margin ($ In Thousands) 1 • Net interest income totaled $61.0 million, up $0.8 million or 1% from the prior quarter and up $9.3 million or 18% from the third quarter of 2018. 1 • Net interest margin decreased 5 basis points to 3.89% quarter-over-quarter. Removing accretion on acquired loans, the net interest margin decreased 3 basis points. T H I R D QUAR TER 2 019 1Calculated on a fully taxable equivalent basis using amortized cost 7

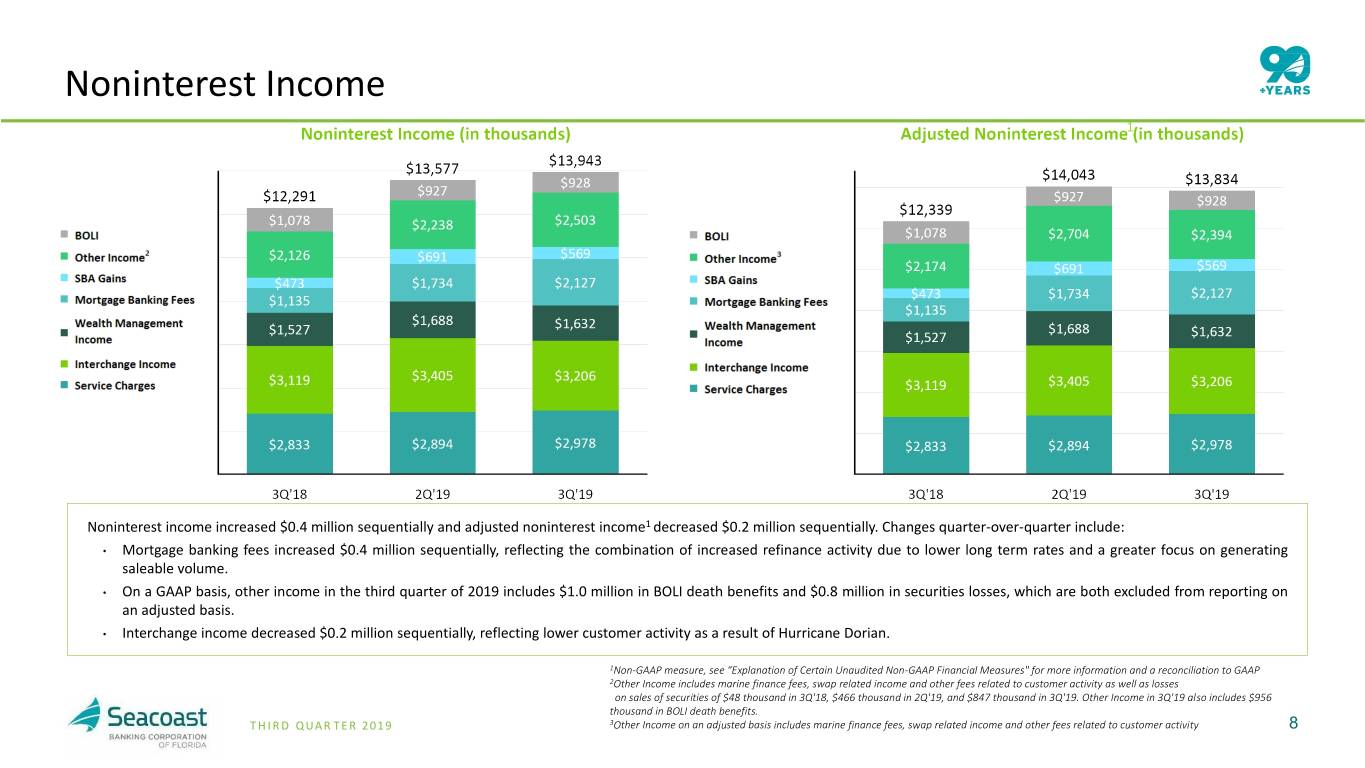

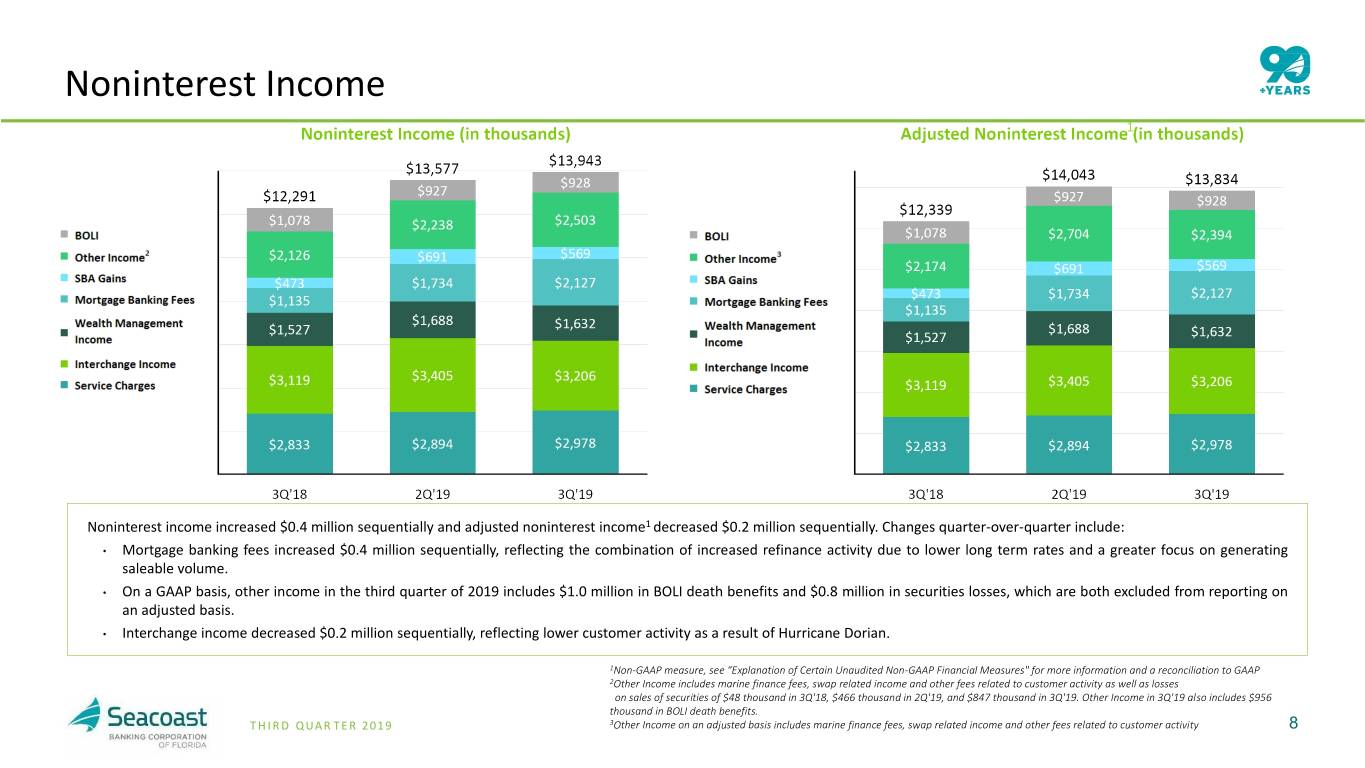

Noninterest Income 1 Noninterest income increased $0.4 million sequentially and adjusted noninterest income1 decreased $0.2 million sequentially. Changes quarter-over-quarter include: • Mortgage banking fees increased $0.4 million sequentially, reflecting the combination of increased refinance activity due to lower long term rates and a greater focus on generating saleable volume. • On a GAAP basis, other income in the third quarter of 2019 includes $1.0 million in BOLI death benefits and $0.8 million in securities losses, which are both excluded from reporting on an adjusted basis. • Interchange income decreased $0.2 million sequentially, reflecting lower customer activity as a result of Hurricane Dorian. 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP 2Other Income includes marine finance fees, swap related income and other fees related to customer activity as well as losses on sales of securities of $48 thousand in 3Q'18, $466 thousand in 2Q'19, and $847 thousand in 3Q'19. Other Income in 3Q'19 also includes $956 thousand in BOLI death benefits. T H I R D QUAR TER 2 019 3Other Income on an adjusted basis includes marine finance fees, swap related income and other fees related to customer activity 8

Proven Success at Disciplined Expense Control 1 Noninterest expense declined $2.4 million and adjusted noninterest expense1 declined $1.1 million sequentially. Changes quarter-over-quarter include: · Salaries and benefits on a GAAP basis decreased $1.0 million, reflecting the impact of $1.1 million in severance costs in the prior quarter · Our continued focus on efficiency and streamlining operations resulted in decreases across several expense categories, including $0.7 million in occupancy and telephone, $0.4 million in legal and professional and $0.2 million in data processing costs. On a GAAP basis, the third quarter of 2019 includes $0.2 million in expenses across these same categories associated with branch consolidation activity and our Hurricane Dorian response efforts. · Other expenses include a $0.3 million decrease in FDIC assessments. The FDIC announced the achievement of their target insurance reserve ratio, resulting in our ability to apply previously awarded credits in the third quarter. Our remaining credits, totaling $1.2 million, will be applied to future assessments if the reserve remains above the target threshold. 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP T H I R D QUAR TER 2 019 2Other expense includes marketing expenses and other expenses associated with ongoing business operations. 9

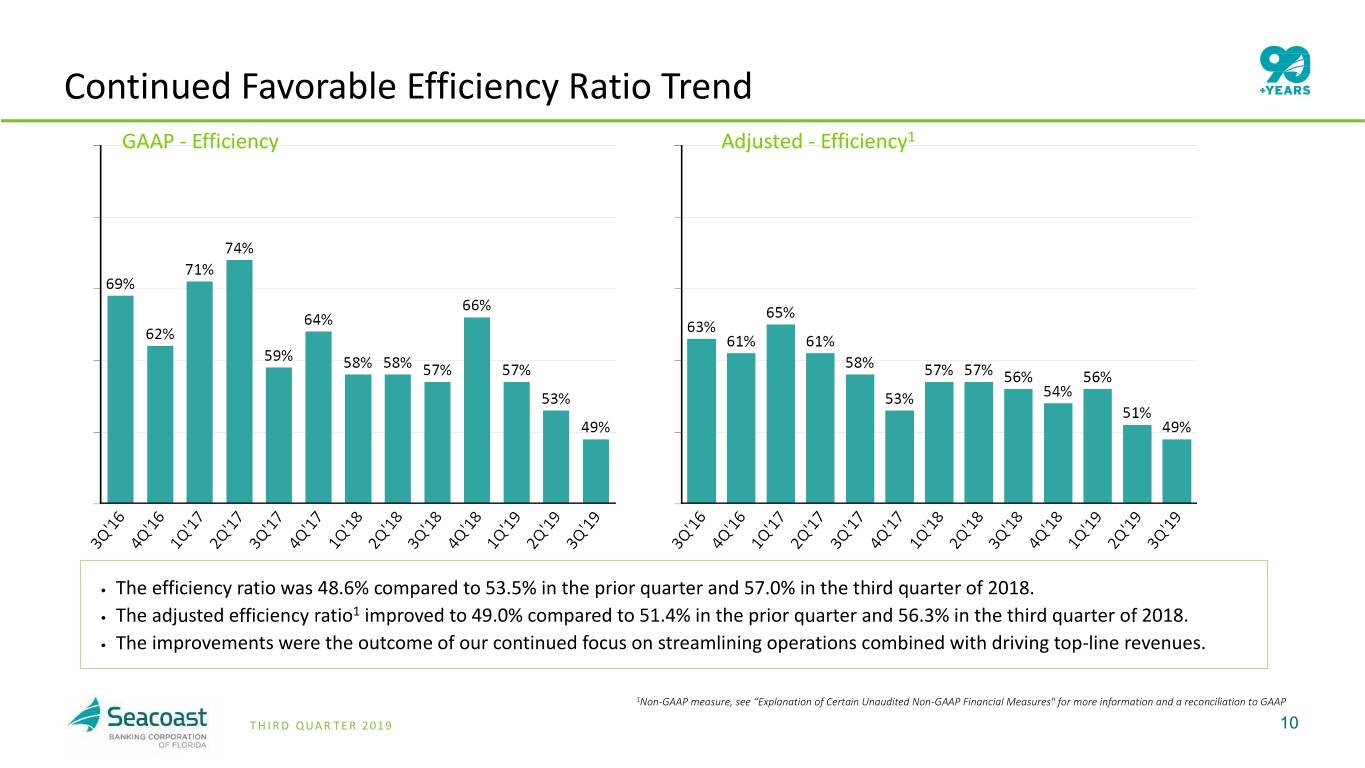

Continued Favorable Efficiency Ratio Trend GAAP - Efficiency Adjusted - Efficiency1 • The efficiency ratio was 48.6% compared to 53.5% in the prior quarter and 57.0% in the third quarter of 2018. 1 • The adjusted efficiency ratio improved to 49.0% compared to 51.4% in the prior quarter and 56.3% in the third quarter of 2018. • The improvements were the outcome of our continued focus on streamlining operations combined with driving top-line revenues. 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP T H I R D QUAR TER 2 019 10

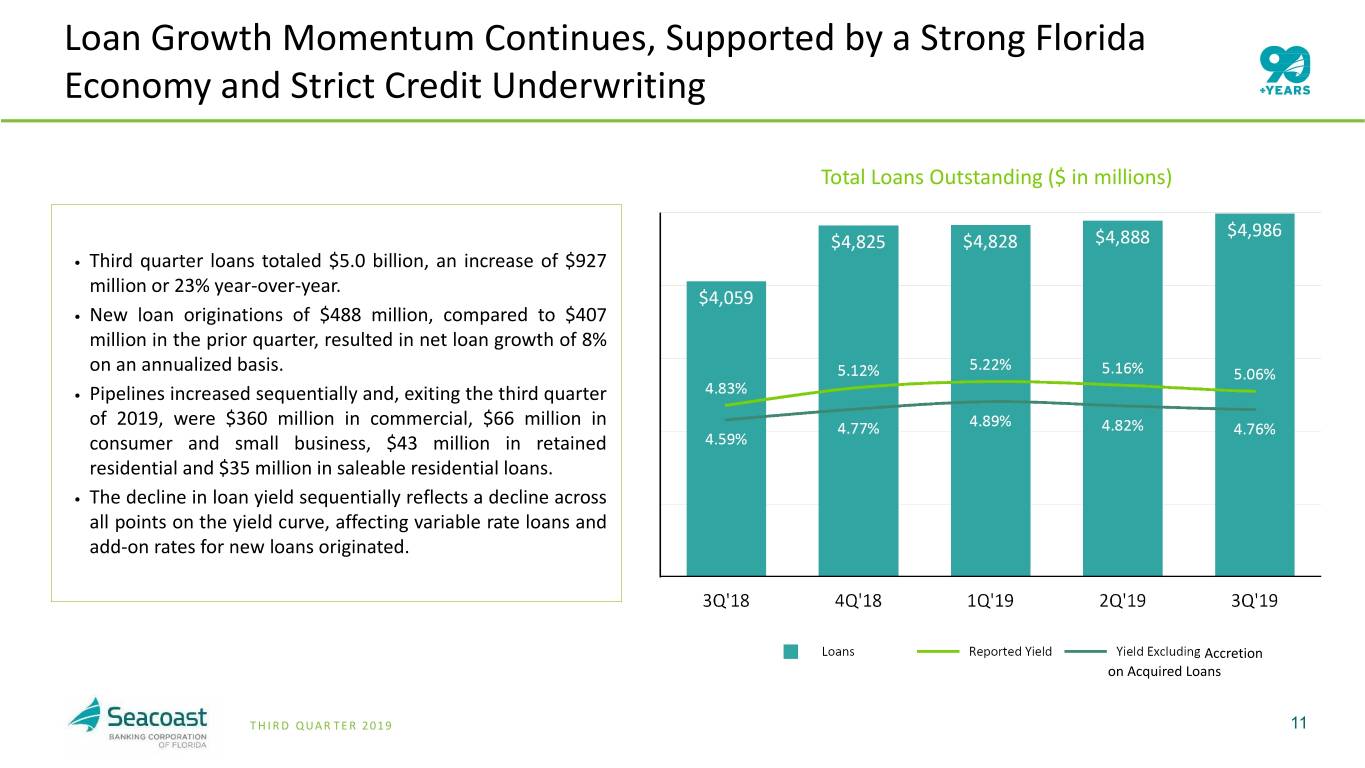

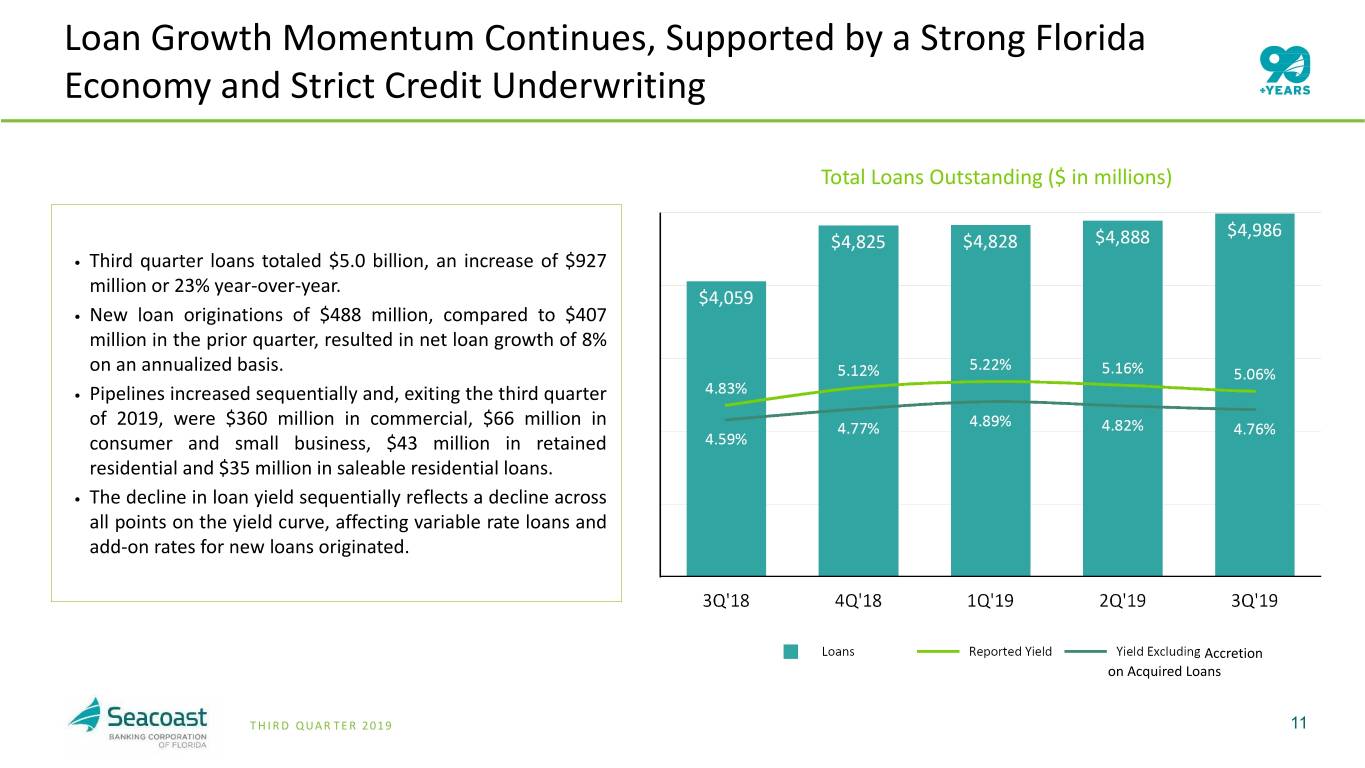

Loan Growth Momentum Continues, Supported by a Strong Florida Economy and Strict Credit Underwriting Total Loans Outstanding ($ in millions) • Third quarter loans totaled $5.0 billion, an increase of $927 million or 23% year-over-year. • New loan originations of $488 million, compared to $407 million in the prior quarter, resulted in net loan growth of 8% on an annualized basis. • Pipelines increased sequentially and, exiting the third quarter of 2019, were $360 million in commercial, $66 million in consumer and small business, $43 million in retained residential and $35 million in saleable residential loans. • The decline in loan yield sequentially reflects a decline across all points on the yield curve, affecting variable rate loans and add-on rates for new loans originated. Accretion on Acquired Loans T H I R D QUAR TER 2 019 11

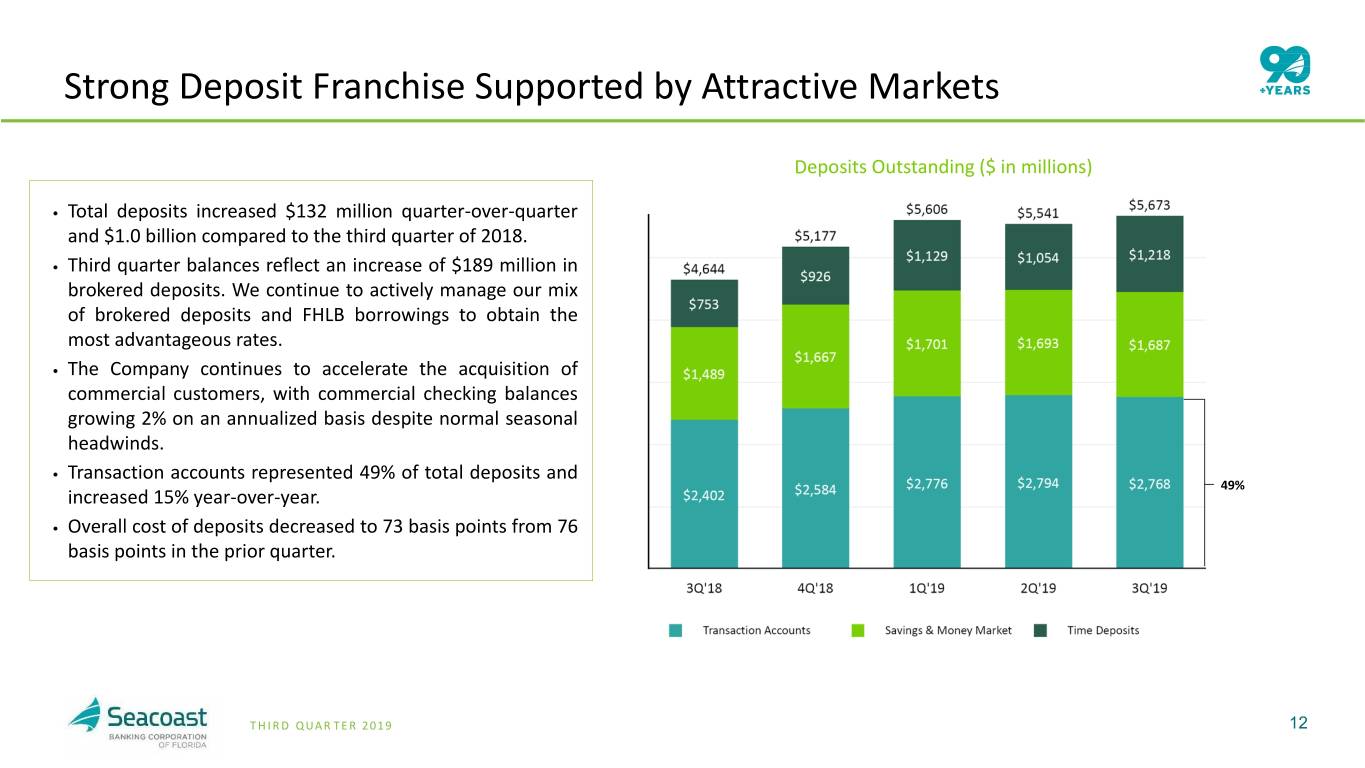

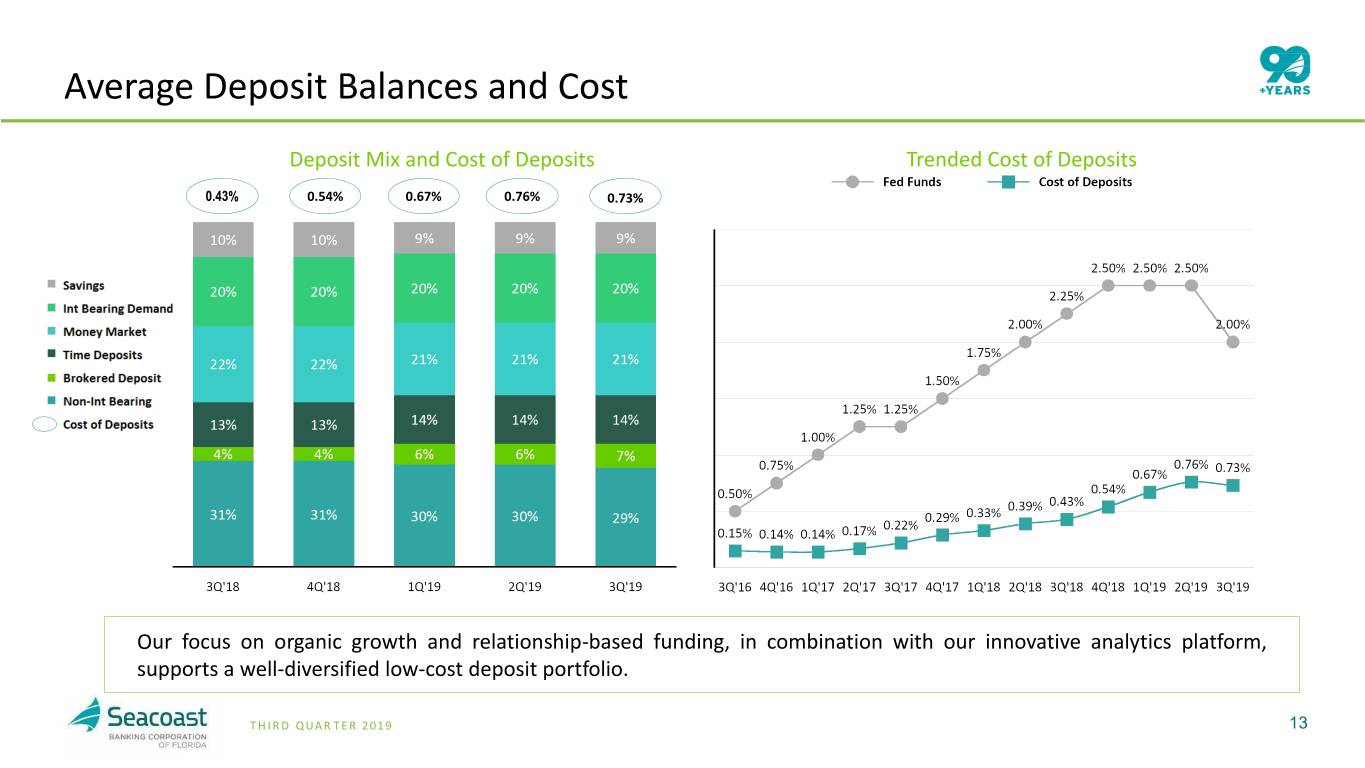

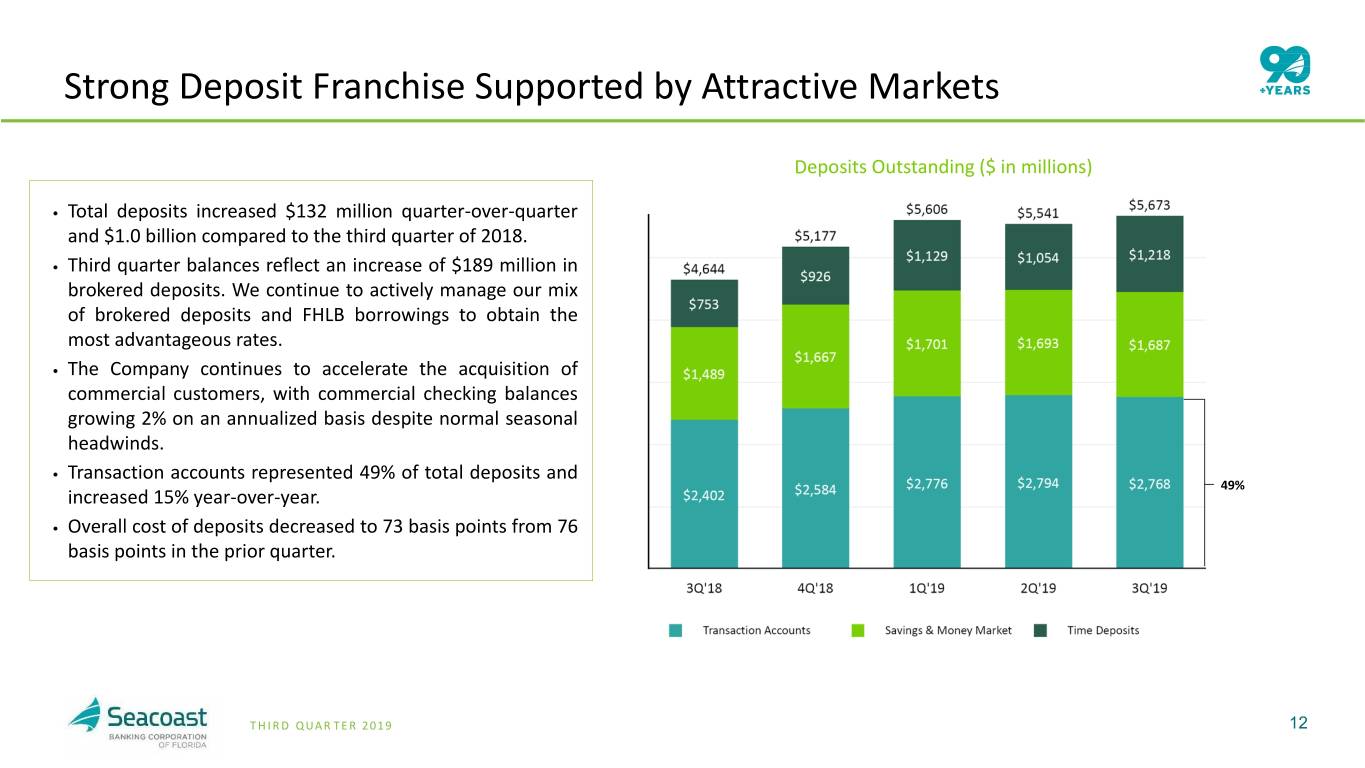

Strong Deposit Franchise Supported by Attractive Markets Deposits Outstanding ($ in millions) • Total deposits increased $132 million quarter-over-quarter and $1.0 billion compared to the third quarter of 2018. • Third quarter balances reflect an increase of $189 million in brokered deposits. We continue to actively manage our mix of brokered deposits and FHLB borrowings to obtain the most advantageous rates. • The Company continues to accelerate the acquisition of commercial customers, with commercial checking balances growing 2% on an annualized basis despite normal seasonal headwinds. • Transaction accounts represented 49% of total deposits and 49% increased 15% year-over-year. • Overall cost of deposits decreased to 73 basis points from 76 basis points in the prior quarter. T H I R D QUAR TER 2 019 12

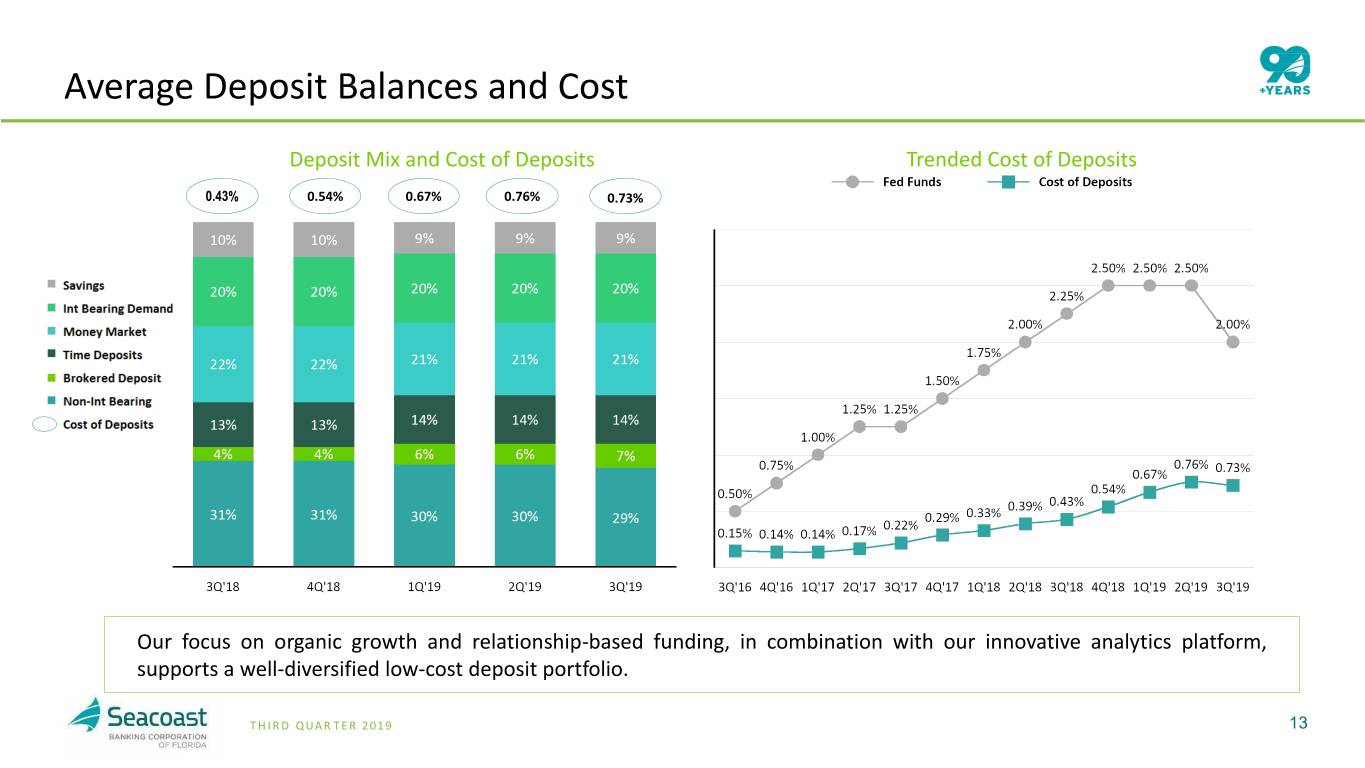

Average Deposit Balances and Cost Deposit Mix and Cost of Deposits Trended Cost of Deposits 0.43% 0.54% 0.67% 0.76% 0.73% Our focus on organic growth and relationship-based funding, in combination with our innovative analytics platform, supports a well-diversified low-cost deposit portfolio. T H I R D QUAR TER 2 019 13

Continued Strong Asset Quality Trends ($ in thousands) $3,749 1 2 1Includes charge off of $3.0 million for a single impaired loan. T H I R D QUAR TER 2 019 2As a percentage of total risk-based capital 14

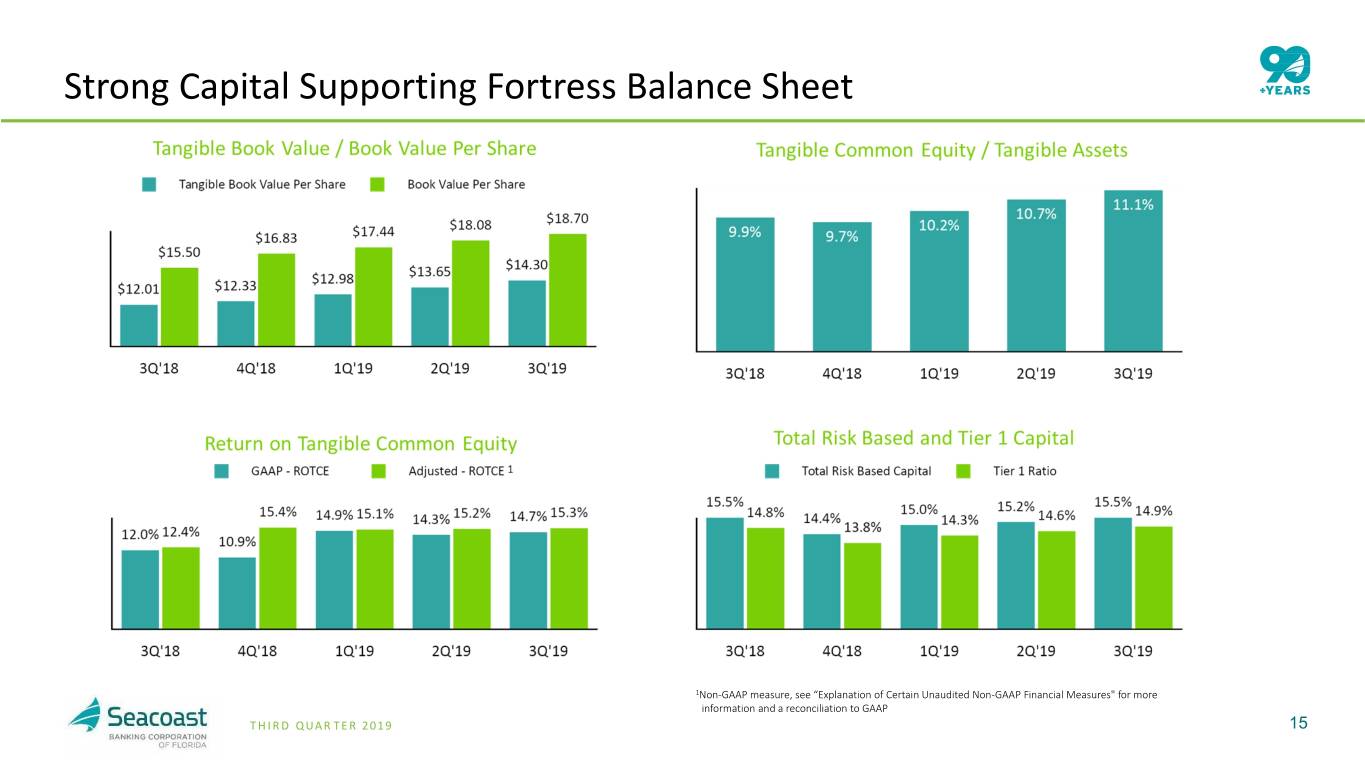

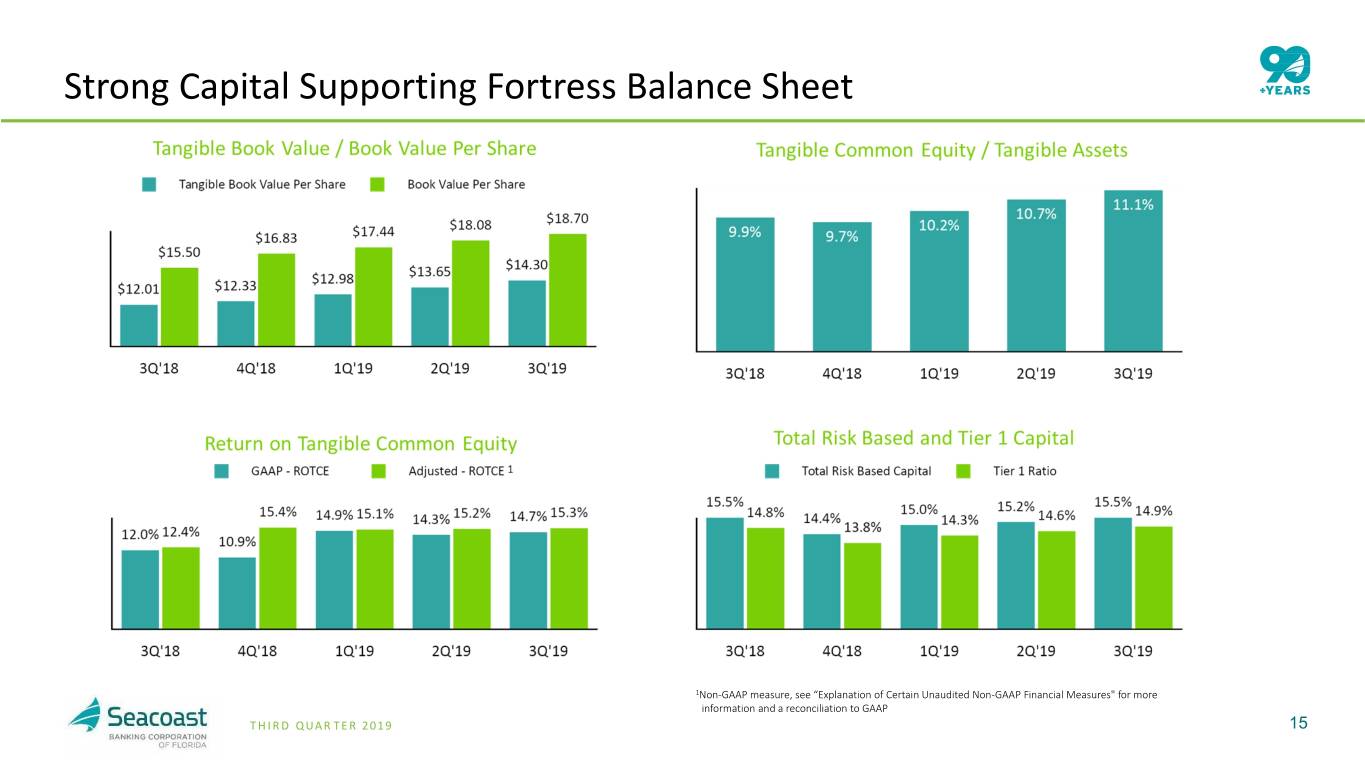

Strong Capital Supporting Fortress Balance Sheet 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP T H I R D QUAR TER 2 019 15

Steady Increase in Shareholder Value Compounded annual growth rate of 13% in tangible book value per share since announcing our Vision 2020 targets in February 2017. T H I R D QUAR TER 2 019 16

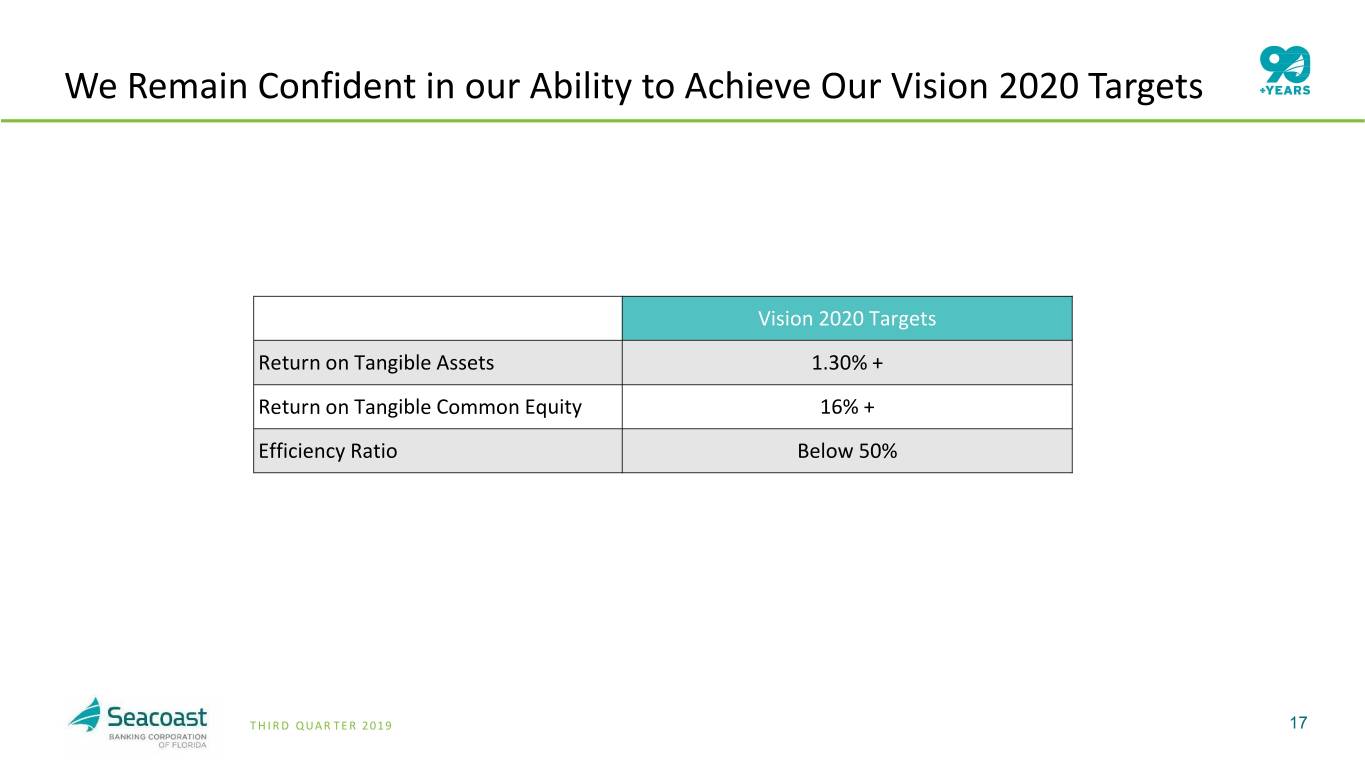

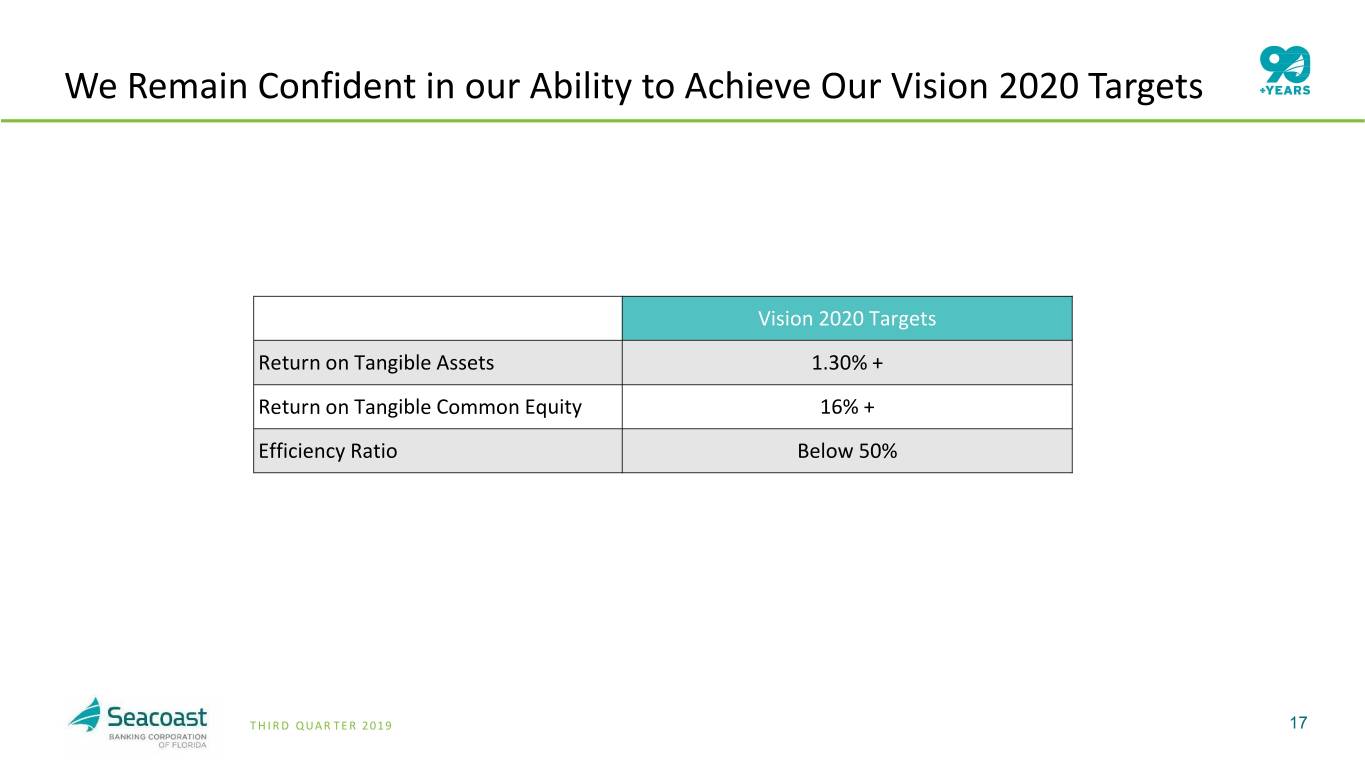

We Remain Confident in our Ability to Achieve Our Vision 2020 Targets Vision 2020 Targets Return on Tangible Assets 1.30% + Return on Tangible Common Equity 16% + Efficiency Ratio Below 50% T H I R D QUAR TER 2 019 17

Agenda 1 ABOUT SEACOAST BANK 2 COMPANY PERFORMANCE 3 SEACOAST’S DIFFERENTIATED STRATEGY 4 SEACOAST’SAPPENDIX DIFFERENTIATED STRATEGY T H I R D QUAR TER 2 019 18

Seacoast Executes a Differentiated Strategy from Other Community Banks Focus on Controls Capitalize on Complete Disciplined, Business Banking Opportunities Accretive Acquisitions That Expand Our Footprint Continue to Evolve Retail Model for Leverage Our Analytics Capabilities Profitability and Efficiency To Expand Customer Relationships T H I R D QUAR TER 2 019 19

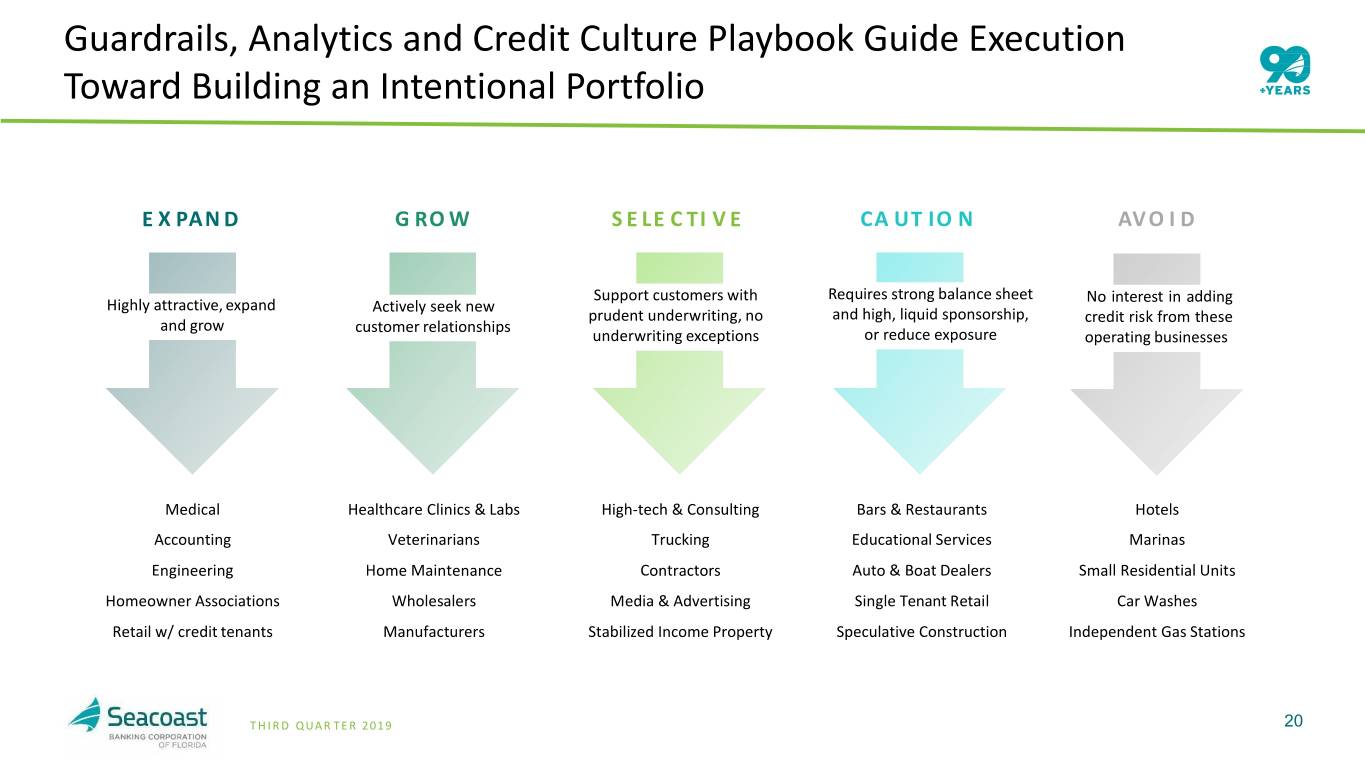

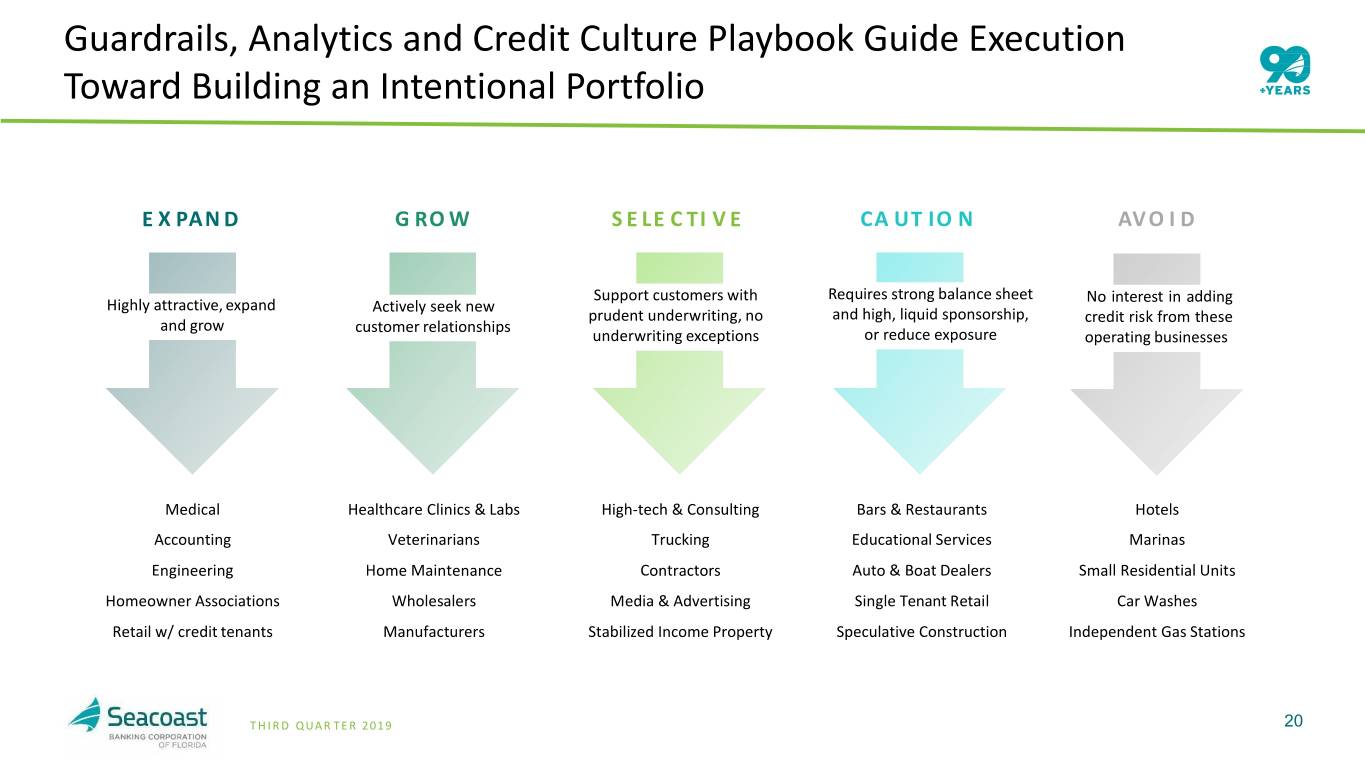

Guardrails, Analytics and Credit Culture Playbook Guide Execution Toward Building an Intentional Portfolio E X PAN D G RO W S E LE C TI V E CA UT IO N AV O I D Support customers with Requires strong balance sheet No interest in adding Highly attractive, expand Actively seek new prudent underwriting, no and high, liquid sponsorship, credit risk from these and grow customer relationships underwriting exceptions or reduce exposure operating businesses Medical Healthcare Clinics & Labs High-tech & Consulting Bars & Restaurants Hotels Accounting Veterinarians Trucking Educational Services Marinas Engineering Home Maintenance Contractors Auto & Boat Dealers Small Residential Units Homeowner Associations Wholesalers Media & Advertising Single Tenant Retail Car Washes Retail w/ credit tenants Manufacturers Stabilized Income Property Speculative Construction Independent Gas Stations T H I R D QUAR TER 2 019 20

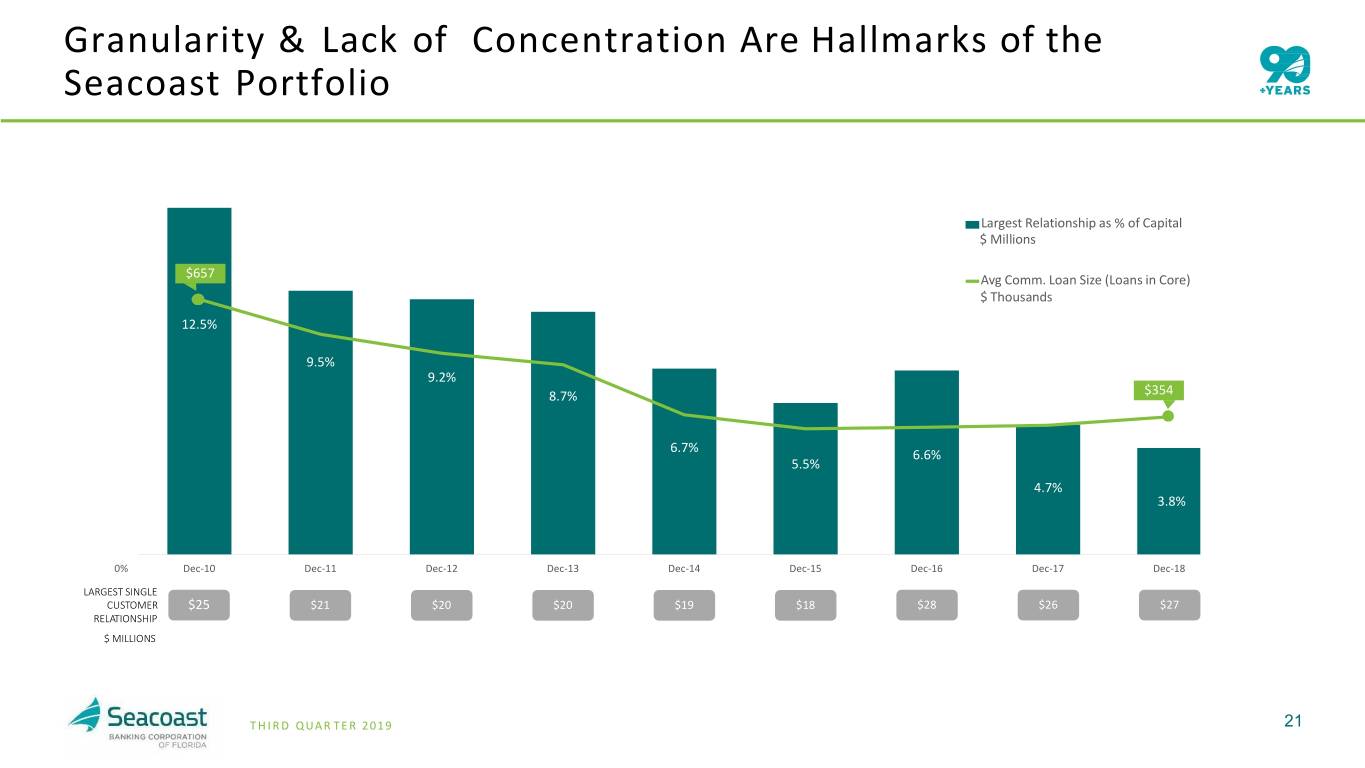

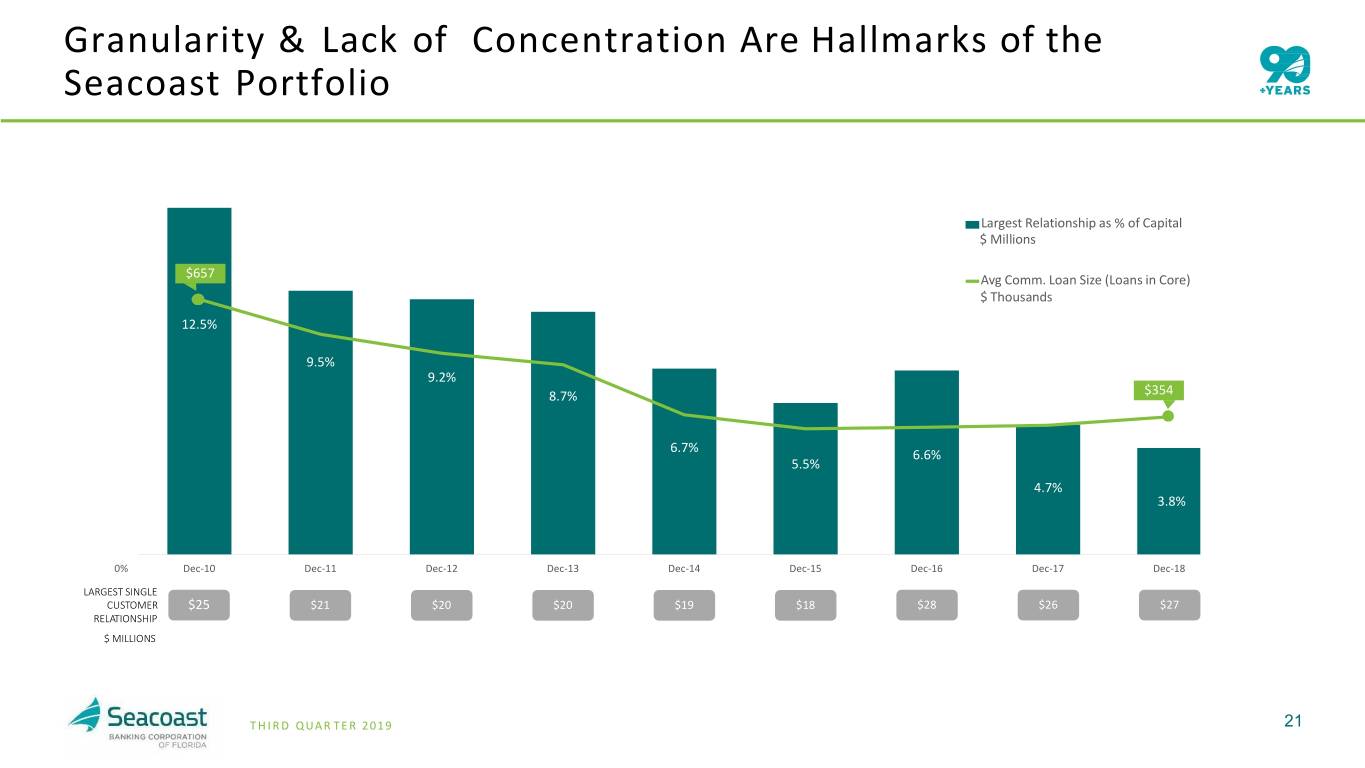

Granularity & Lack of Concentration Are Hallmarks of the Seacoast Portfolio 14% 12% Largest Relationship as % of Capital $ Millions $657 10% Avg Comm. Loan Size (Loans in Core) $ Thousands 12.5% 8% 9.5% 9.2% 6% 8.7% $354 6.7% 4% 6.6% 5.5% 4.7% 3.8% 2% 0% Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 LARGEST SINGLE CUSTOMER $25 $21 $20 $20 $19 $18 $28 $26 $27 RELATIONSHIP $ MILLIONS T H I R D QUAR TER 2 019 21

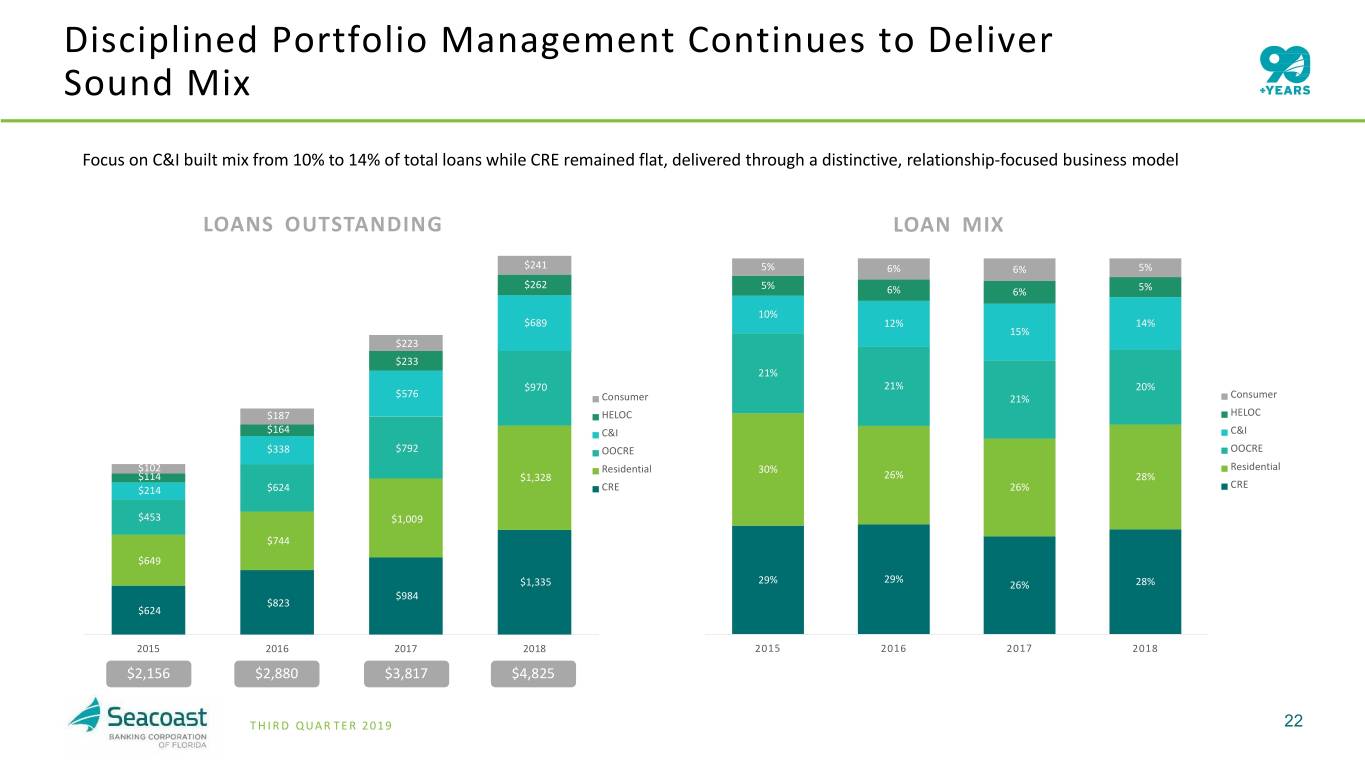

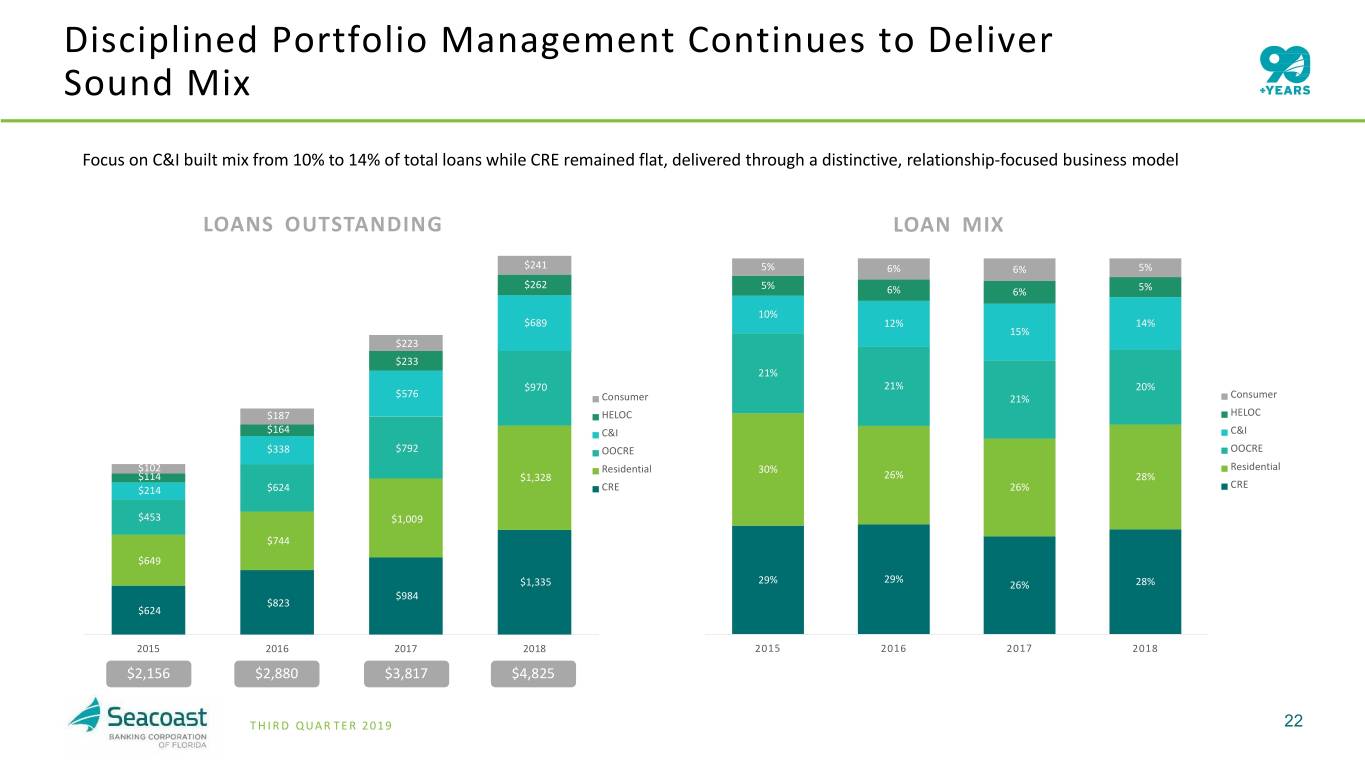

Disciplined Portfolio Management Continues to Deliver Sound Mix Focus on C&I built mix from 10% to 14% of total loans while CRE remained flat, delivered through a distinctive, relationship-focused business model LOANS OUTSTANDING LOAN MIX $241 5% 6% 6% 5% $262 5% 6% 6% 5% 10% $689 12% 14% 15% $223 $233 21% $970 21% 20% $576 Consumer 21% Consumer $187 HELOC HELOC $164 C&I C&I $338 $792 OOCRE OOCRE $102 Residential 30% Residential $114 $1,328 26% 28% CRE $214 $624 CRE 26% $453 $1,009 $744 $649 $1,335 29% 29% 28% 26% $984 $823 $624 2015 2016 2017 2018 2015 2016 2017 2018 $2,156 $2,880 $3,817 $4,825 T H I R D QUAR TER 2 019 22

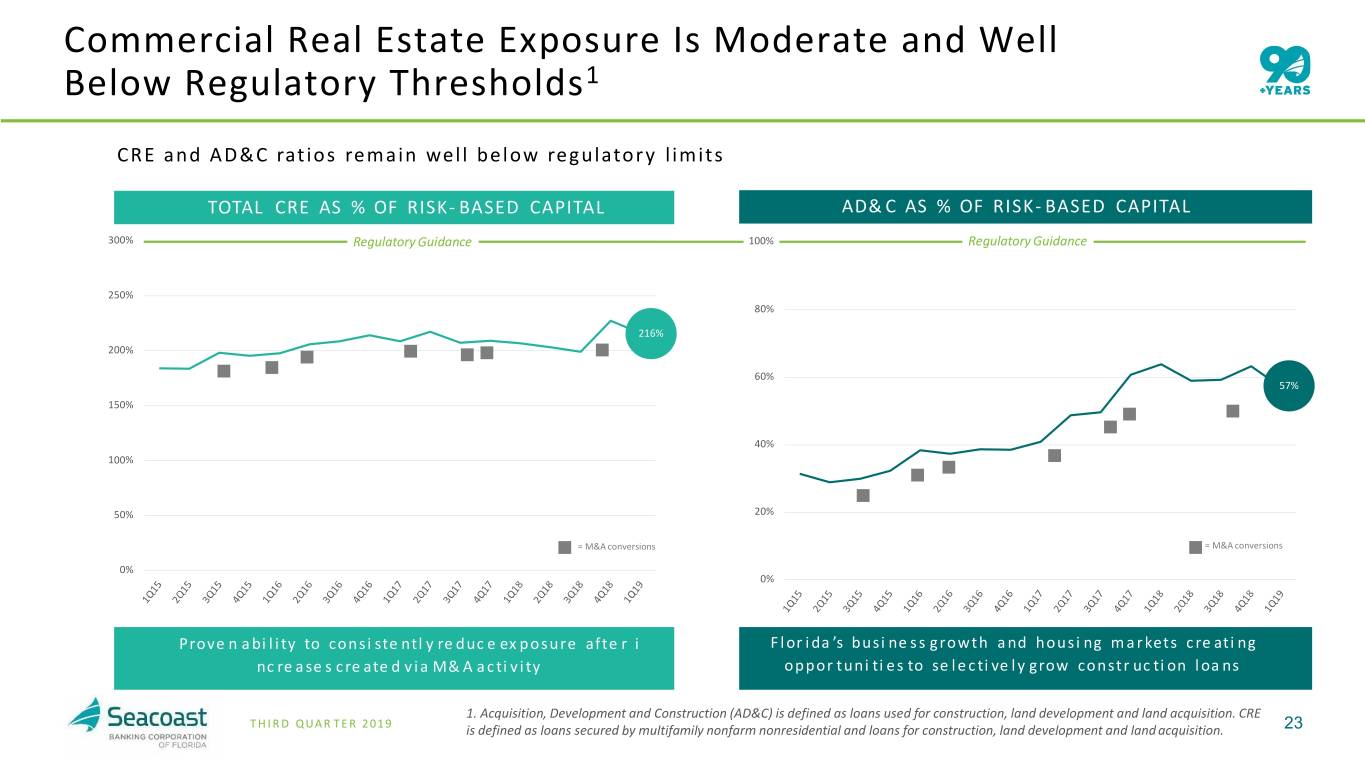

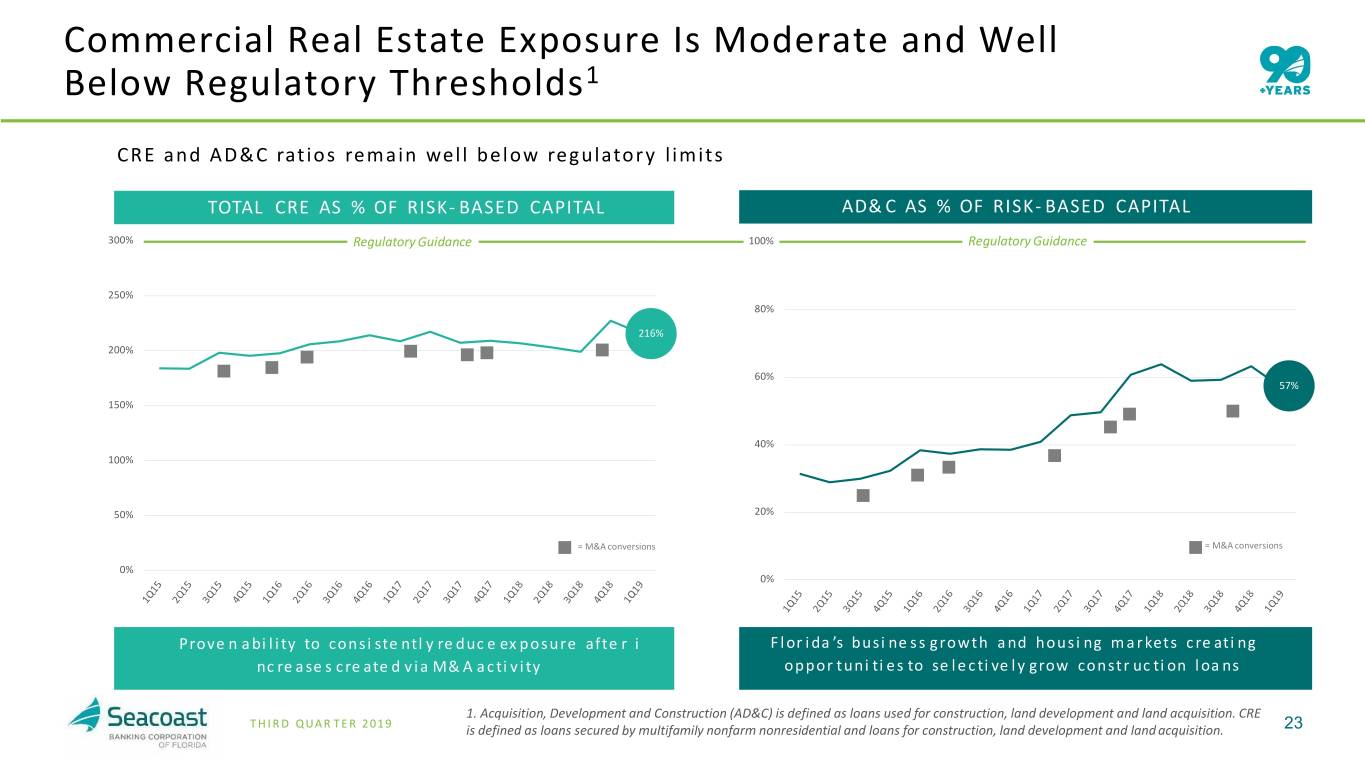

Commercial Real Estate Exposure Is Moderate and Well Below Regulatory Thresholds1 CRE and AD& C ratios remain well below regulatory limits TOTAL CRE AS % OF RISK- BASED CAPITAL AD& C AS % OF RISK- BASED CAPITAL 300% Regulatory Guidance 100%100% Regulatory Guidance 250% 80% 216% 200% 60% 57% 150% 40% 100% 50% 20% = M&A conversions = M&A conversions 0% 0% Prove n a bi l i ty to consi ste ntl y re duc e ex posure afte r i F l or i da ’s busi ne s s growth a nd housi ng m a r kets c re ati ng nc re a se s c re ate d v i a M& A a c ti v i ty oppor tuni ti e s to se l e c ti ve l y grow constr uc ti on l oa ns 1. Acquisition, Development and Construction (AD&C) is defined as loans used for construction, land development and land acquisition. CRE T H I R D QUAR TER 2 019 is defined as loans secured by multifamily nonfarm nonresidential and loans for construction, land development and land acquisition. 23

Seacoast’s Model Is Built to Perform Through Business Cycles SELECTIVE on new construction projects (Residential and Commercial) Requiring more pre-sales and pre-leasing requirements on construction AVOID lending on HIGH RISK industries Increasing borrower equity requirements STRICTER COVENANTS on new deals Effectively shut down speculative construction CONTINUOUS active portfolio MONITORING for risk deterioration Deeper acquisition discounts using an adverse economic forecast T H I R D QUAR TER 2 019 24

Seacoast Executes a Differentiated Strategy from Other Community Banks Focus on Controls Capitalize on Complete Disciplined, Business Banking Opportunities Accretive Acquisitions That Expand Our Footprint Continue to Evolve Retail Model for Leverage Our Analytics Capabilities Profitability and Efficiency To Expand Customer Relationships T H I R D QUAR TER 2 019 25

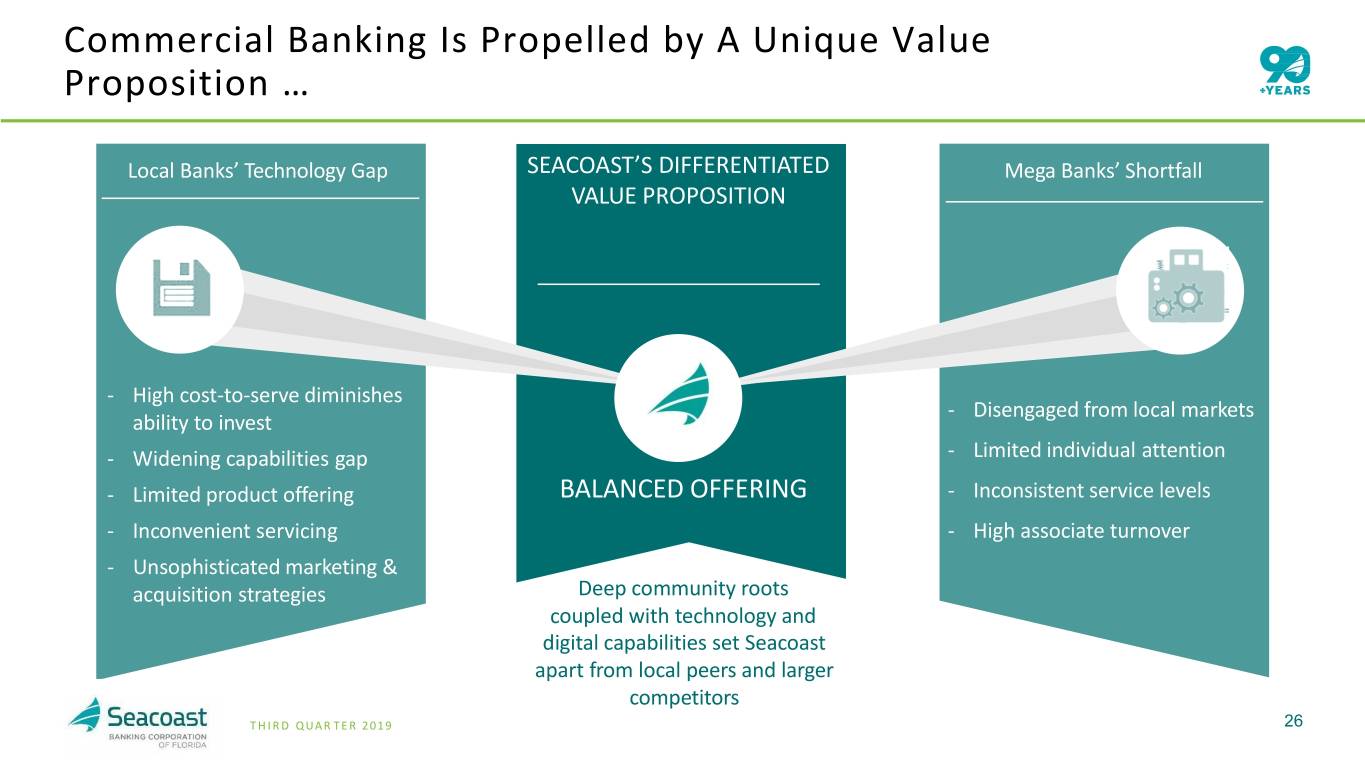

Commercial Banking Is Propelled by A Unique Value Proposition … Local Banks’ Technology Gap SEACOAST’S DIFFERENTIATED Mega Banks’ Shortfall VALUE PROPOSITION - High cost-to-serve diminishes - Disengaged from local markets ability to invest - Widening capabilities gap - Limited individual attention - Limited product offering BALANCED OFFERING - Inconsistent service levels - Inconvenient servicing - High associate turnover - Unsophisticated marketing & acquisition strategies Deep community roots coupled with technology and digital capabilities set Seacoast apart from local peers and larger competitors T H I R D QUAR TER 2 019 26

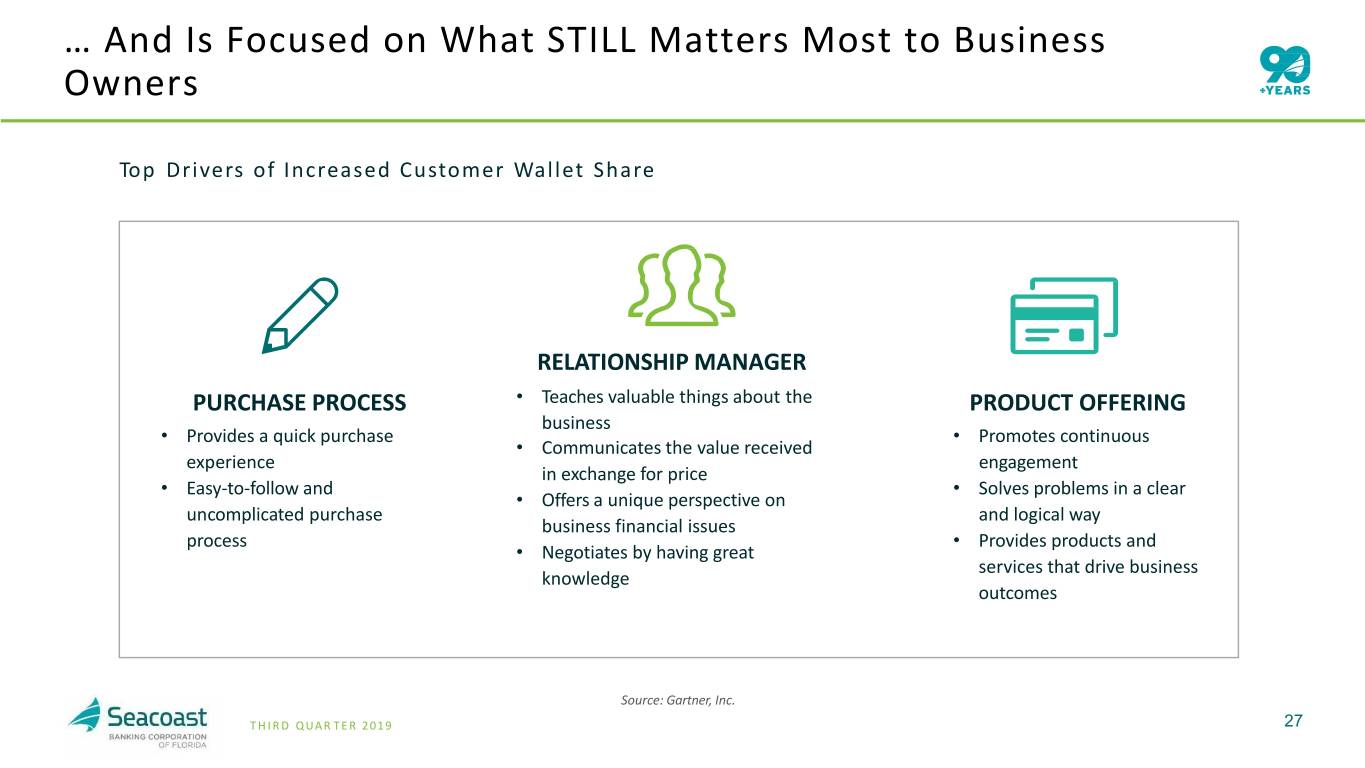

… And Is Focused on What STILL Matters Most to Business Owners Top Drivers of Increased Customer Wallet Share RELATIONSHIP MANAGER PURCHASE PROCESS • Teaches valuable things about the PRODUCT OFFERING business • Provides a quick purchase • Promotes continuous • Communicates the value received experience engagement in exchange for price • Easy-to-follow and • Solves problems in a clear • Offers a unique perspective on uncomplicated purchase and logical way business financial issues process • Provides products and • Negotiates by having great services that drive business knowledge outcomes Source: Gartner, Inc. T H I R D QUAR TER 2 019 27

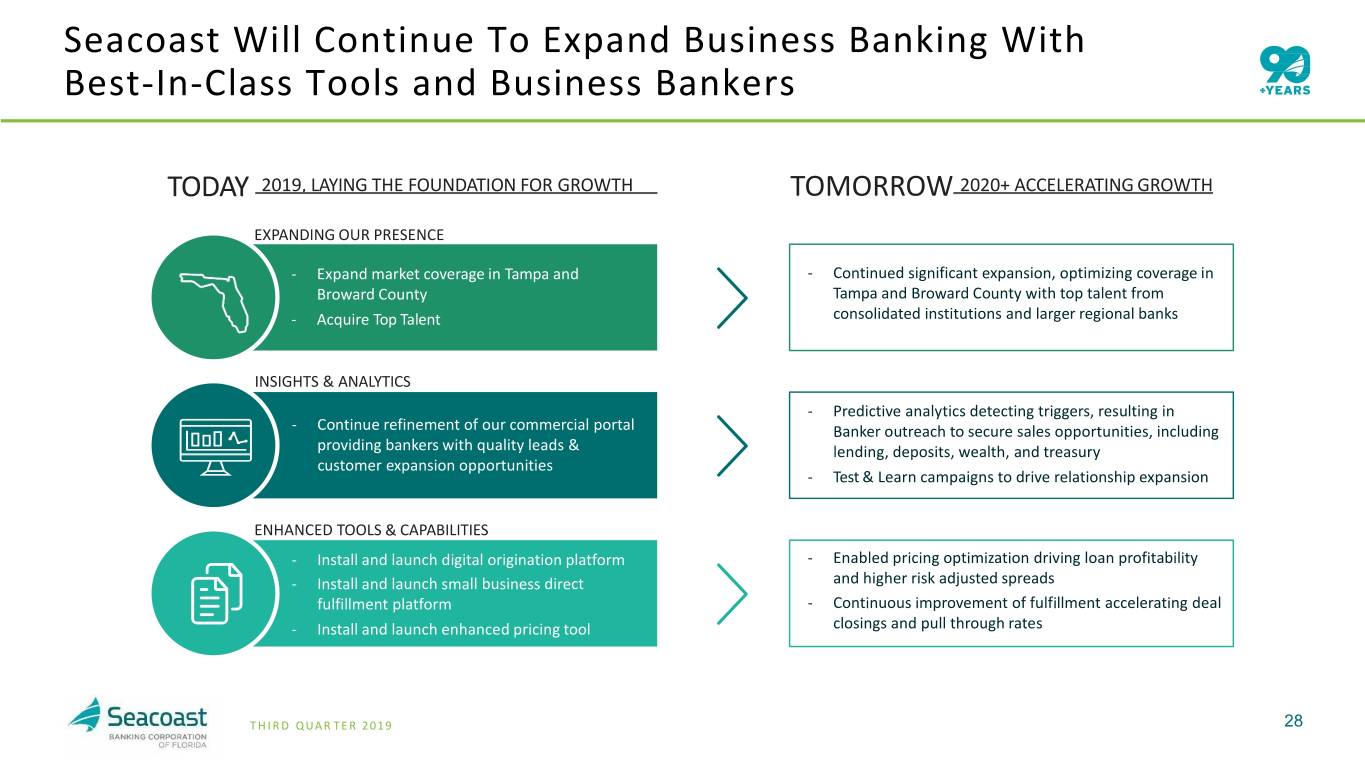

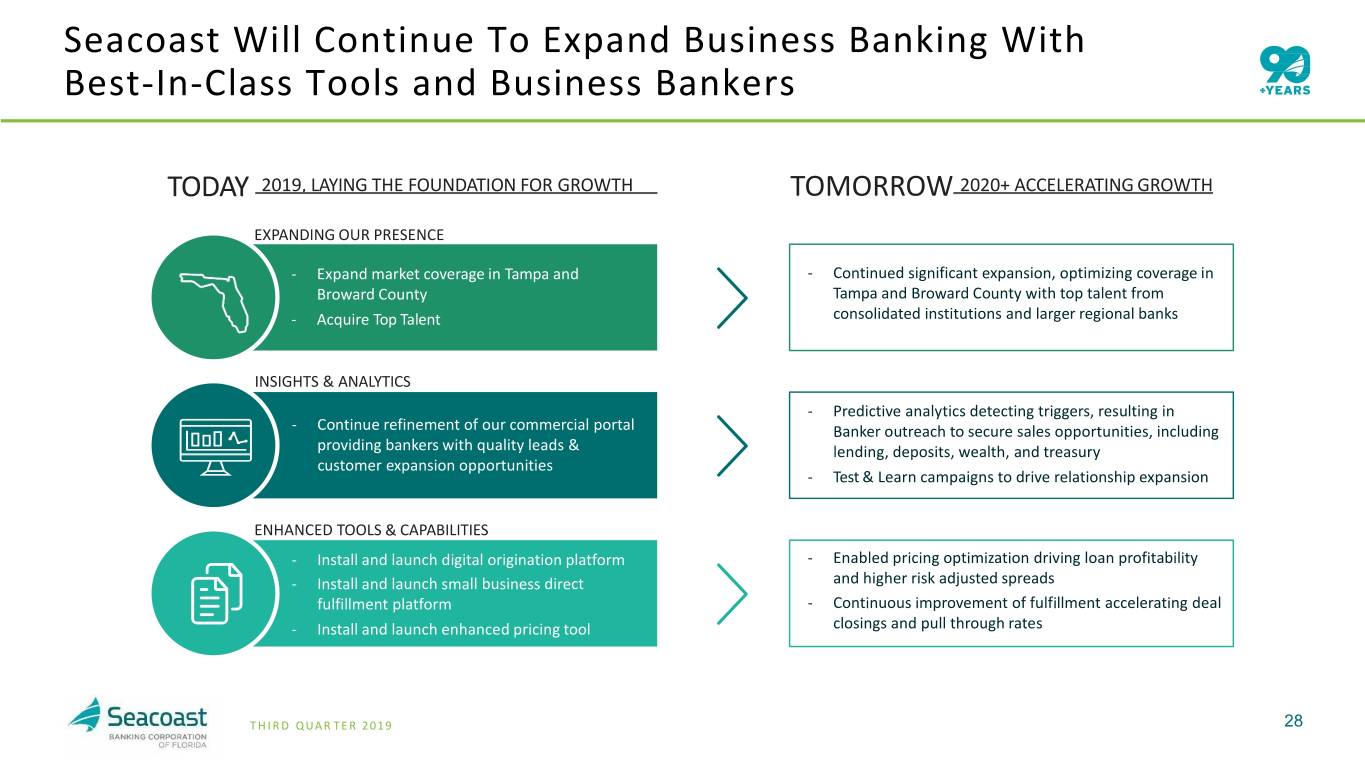

Seacoast Will Continue To Expand Business Banking With Best-In-Class Tools and Business Bankers TODAY 2019, LAYING THE FOUNDATION FOR GROWTH TOMORROW 2020+ ACCELERATING GROWTH EXPANDING OUR PRESENCE - Expand market coverage in Tampa and - Continued significant expansion, optimizing coverage in Broward County Tampa and Broward County with top talent from - Acquire Top Talent consolidated institutions and larger regional banks INSIGHTS & ANALYTICS - Predictive analytics detecting triggers, resulting in - Continue refinement of our commercial portal Banker outreach to secure sales opportunities, including providing bankers with quality leads & lending, deposits, wealth, and treasury customer expansion opportunities - Test & Learn campaigns to drive relationship expansion ENHANCED TOOLS & CAPABILITIES - Install and launch digital origination platform - Enabled pricing optimization driving loan profitability - Install and launch small business direct and higher risk adjusted spreads fulfillment platform - Continuous improvement of fulfillment accelerating deal - Install and launch enhanced pricing tool closings and pull through rates T H I R D QUAR TER 2 019 28

Seacoast Executes a Differentiated Strategy from Other Community Banks Focus on Controls Capitalize on Complete Disciplined, Business Banking Opportunities Accretive Acquisitions That Expand Our Footprint Continue to Evolve Retail Model for Leverage Our Analytics Capabilities Profitability and Efficiency To Expand Customer Relationships T H I R D QUAR TER 2 019 29

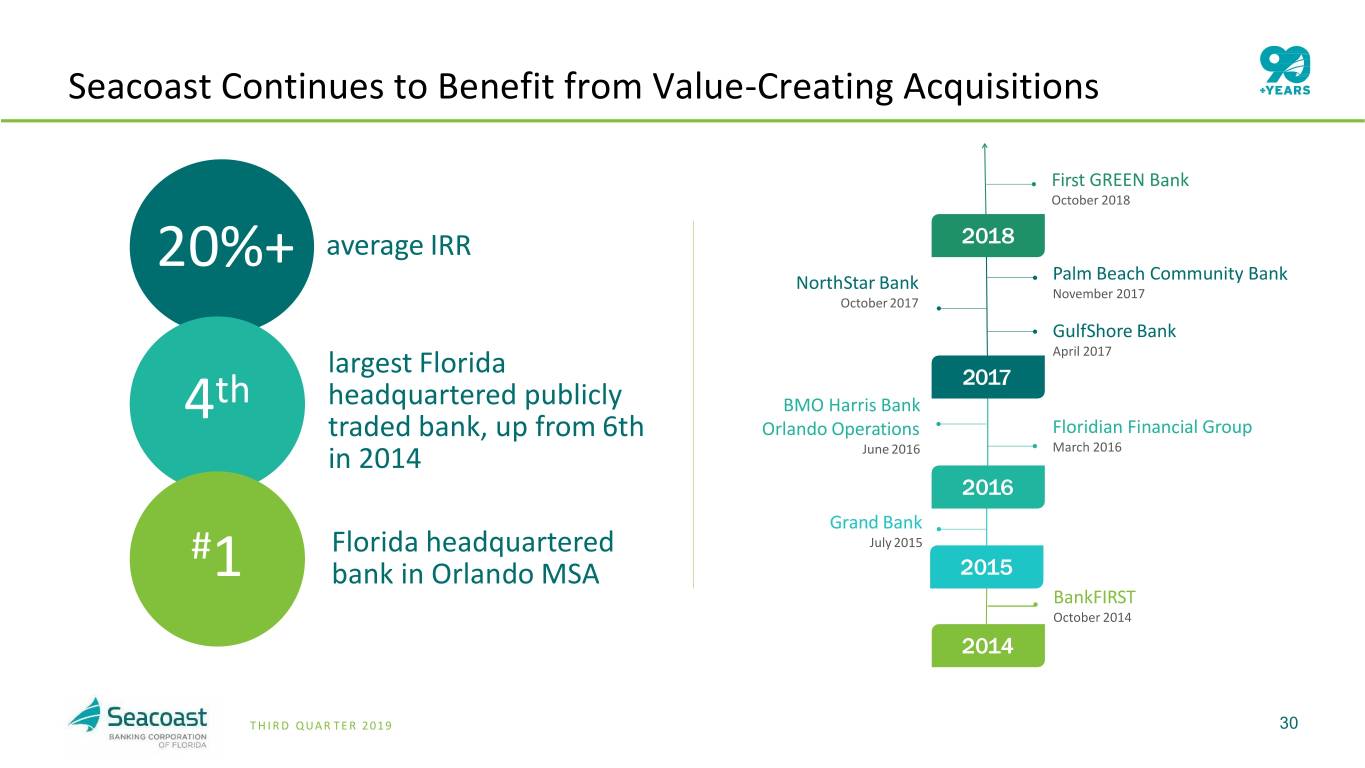

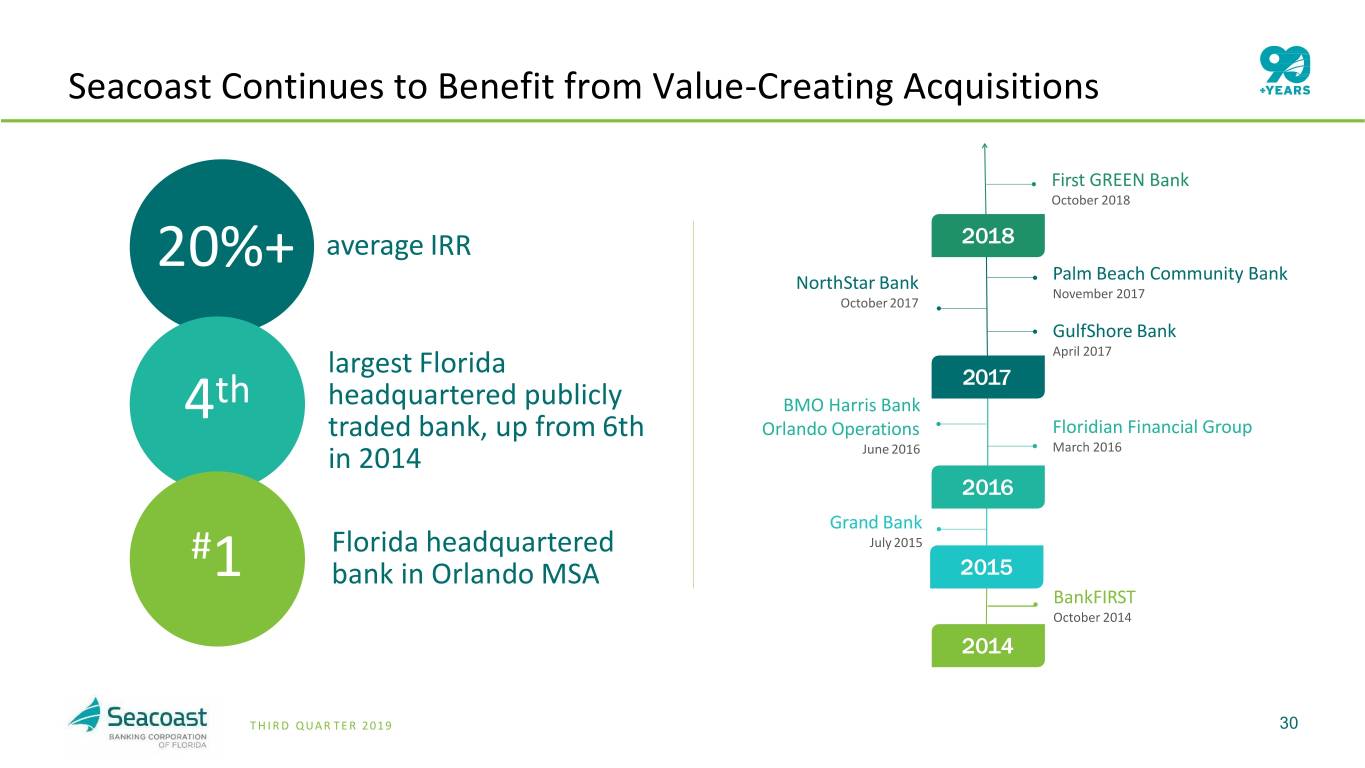

Seacoast Continues to Benefit from Value-Creating Acquisitions First GREEN Bank October 2018 20%+ average IRR 2018 NorthStar Bank Palm Beach Community Bank November 2017 October 2017 GulfShore Bank April 2017 largest Florida 2017 th headquartered publicly BMO Harris Bank 4 traded bank, up from 6th Orlando Operations Floridian Financial Group in 2014 June 2016 March 2016 2016 Grand Bank # Florida headquartered July 2015 1 bank in Orlando MSA 2015 BankFIRST October 2014 2014 T H I R D QUAR TER 2 019 30

Seacoast Executes a Differentiated Strategy from Other Community Banks Focus on Controls Capitalize on Complete Disciplined, Business Banking Opportunities Accretive Acquisitions That Expand Our Footprint Continue to Evolve Retail Model for Leverage Our Analytics Capabilities Profitability and Efficiency To Expand Customer Relationships T H I R D QUAR TER 2 019 31

Seacoast’s Community Bank Operates a Tested and Winning Strategy ACQUIRE THE RIGHT CUSTOMERS Targeted Expansion into Attractive Markets Expanding Analytic Capabilities Inform Outreach Campaigns ACQUIRE DEEPEN DEEPEN RELATIONSHIPS WITH EXISTING CUSTOMERS LOWER COST Cross Sell Opportunities Inside & Outside of Branch Product Structures Incentivize Relationship Deepening REPEAT LOWER THE COST TO SERVE Adoption of Lower Cost Servicing Channels – Mobile, ATM, Online Branch Rationalization Given Digital Adoption & Streamlined Operations REPEAT Strategy Applied to New Customers Sourced Organically & Through M&A Powered by a Winning Culture T H I R D QUAR TER 2 019 32

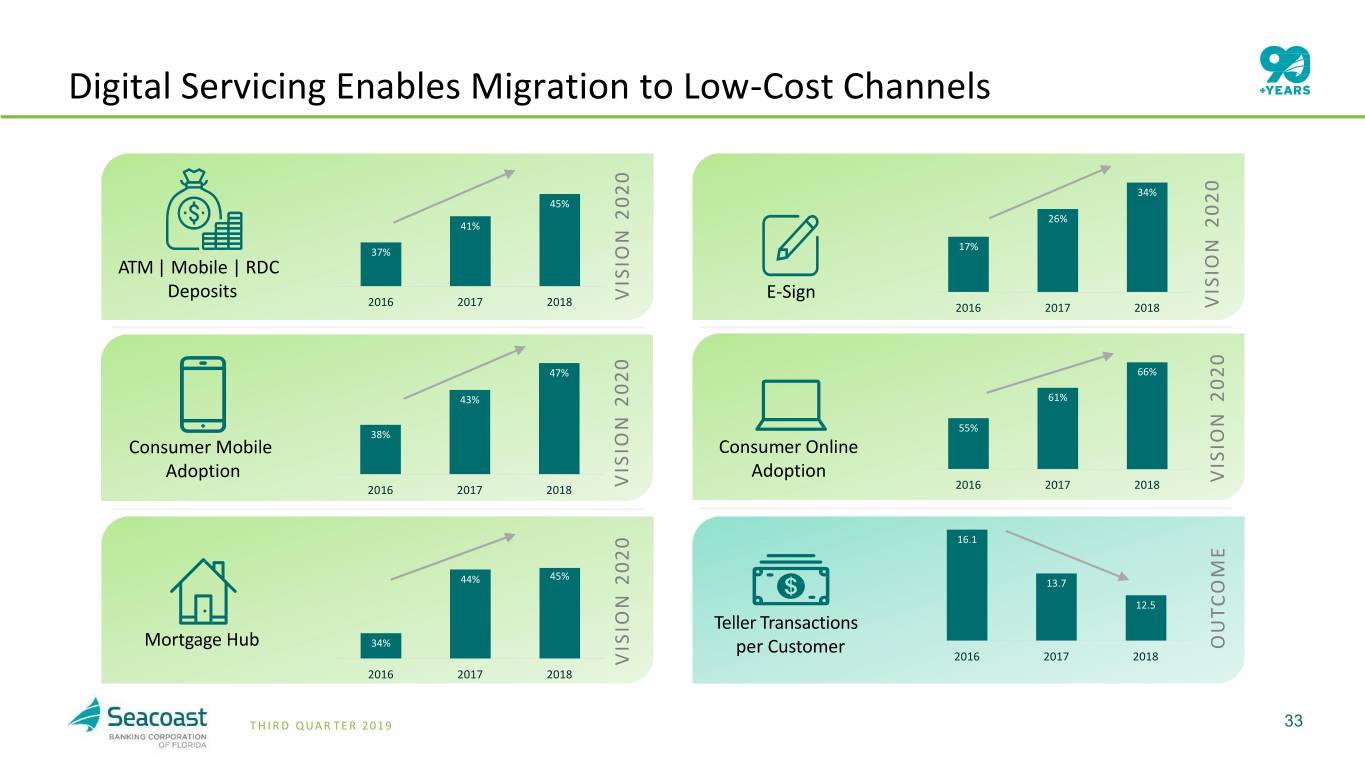

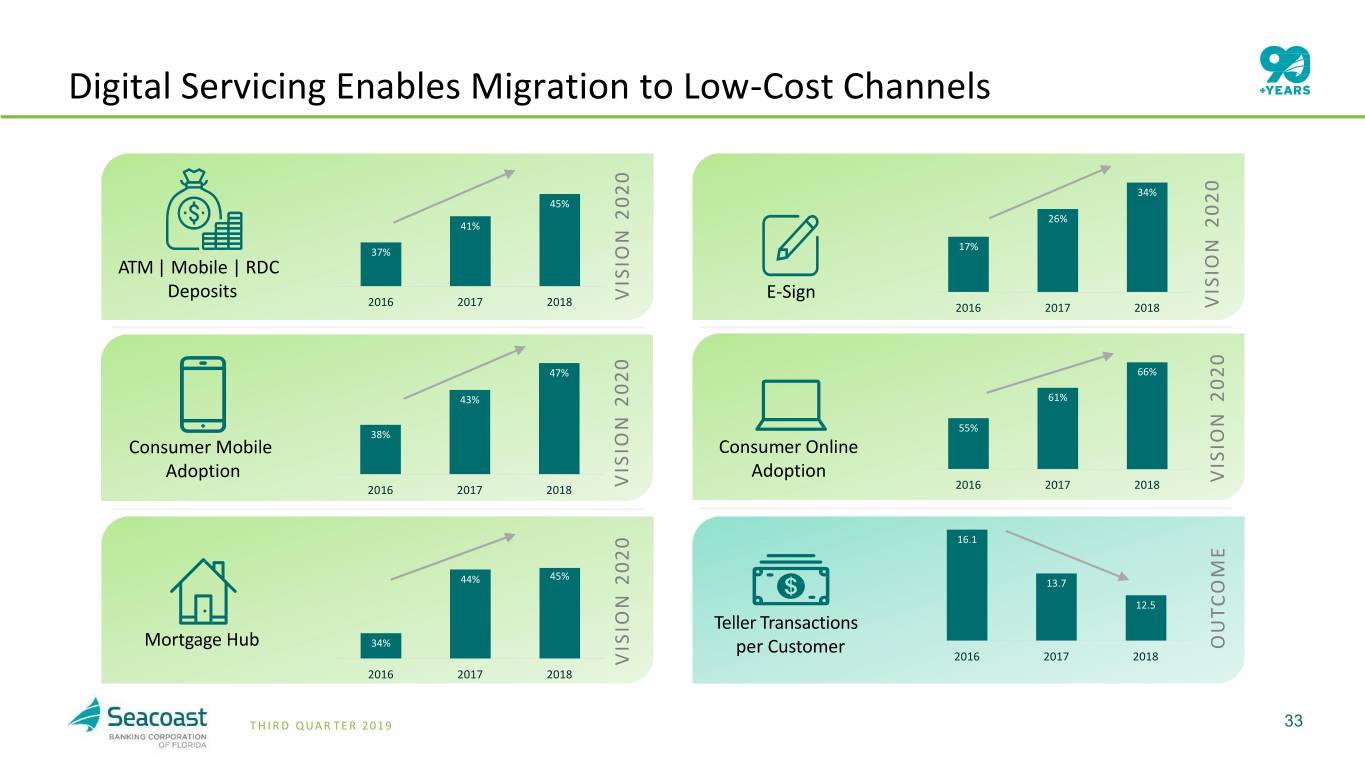

Digital Servicing Enables Migration to Low to Migration Enables Servicing Digital ATM Consumer Mobile Mortgage | Adoption Deposits Mobile Hub | RDC D R I H T QUA R TER TER 2 2016 2016 2016 019 38% 34% 37% 2017 2017 2017 43% 44% 41% 2018 2018 2018 47% 45% 45% VISION 2020 VISION 2020 VISION 2020 Teller Consumer Online per - Adoption Transactions Cost Channels Cost E Customer - Sign 2016 2016 2016 16.1 55% 17% 2017 2017 2017 13.7 61% 26% 2018 2018 2018 12.5 66% 34% OUTCOME VISION 2020 VISION 2020 33

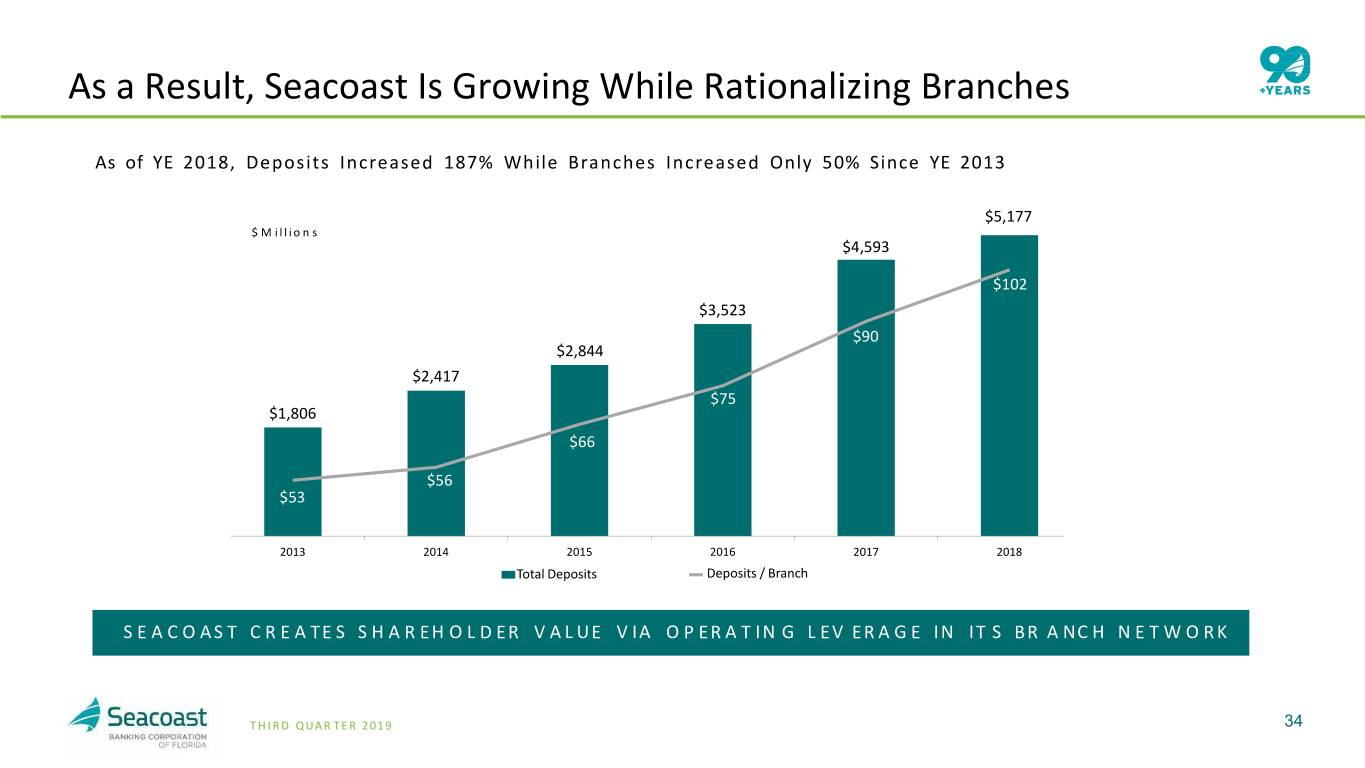

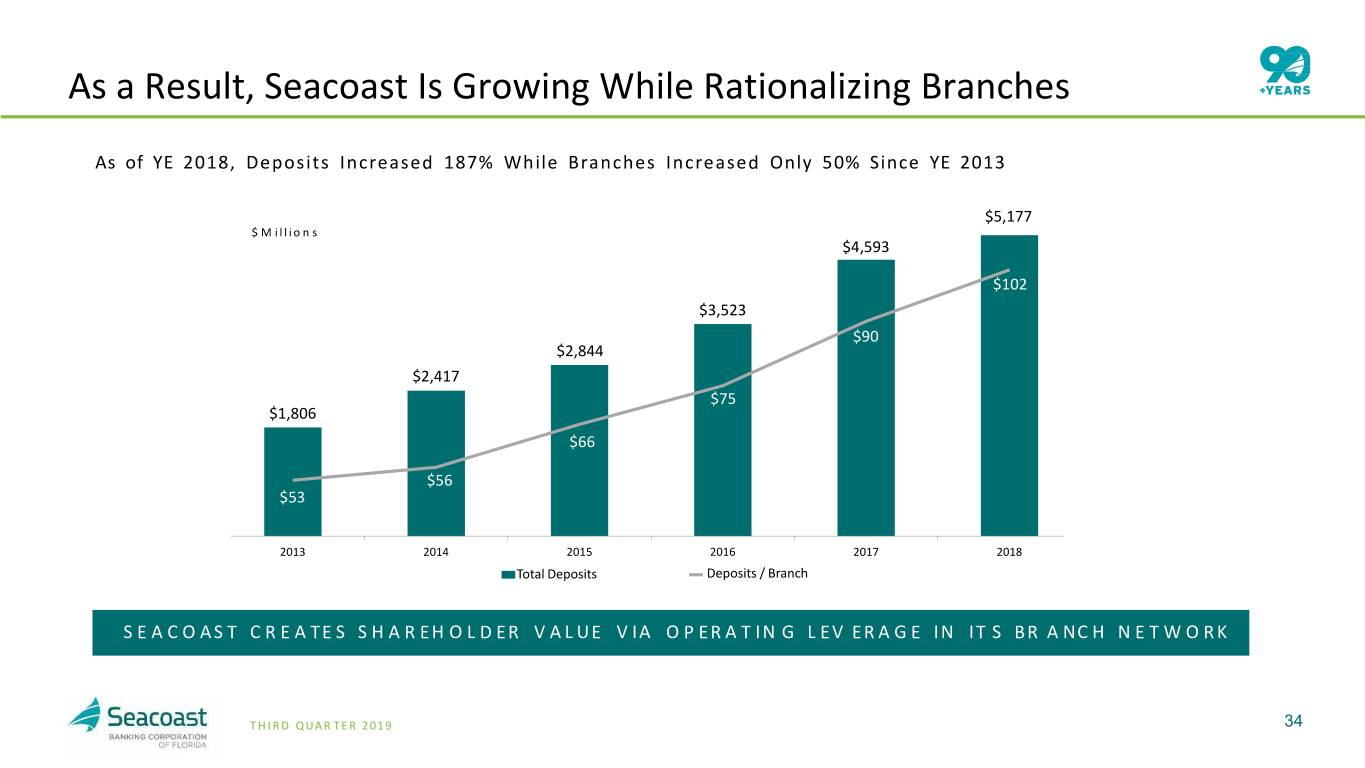

As a Result, Seacoast Is Growing While Rationalizing Branches As of YE 2018, Deposits Increased 187% While Branches Increased Only 50% Since YE 2013 $5,177 $5,000 $ M illio n s $1 10 $4,593 $4,500 $1 00 $102 $4,000 $3,523 $9 0 $3,500 $90 $2,844 $3,000 $8 0 $2,417 $2,500 $75 $1,806 $7 0 $2,000 $66 $1,500 $6 0 $1,000 $56 $53 $5 0 $500 $4 0 $0 2013 2014 2015 2016 2017 2018 Total Deposits Deposits / Branch S E A C O A S T C R E A T E S S H A R EH O L D ER V A L UE V IA O P ER A T IN G L EV ER A G E IN IT S BR A N C H N E T W O R K T H I R D QUAR TER 2 019 34

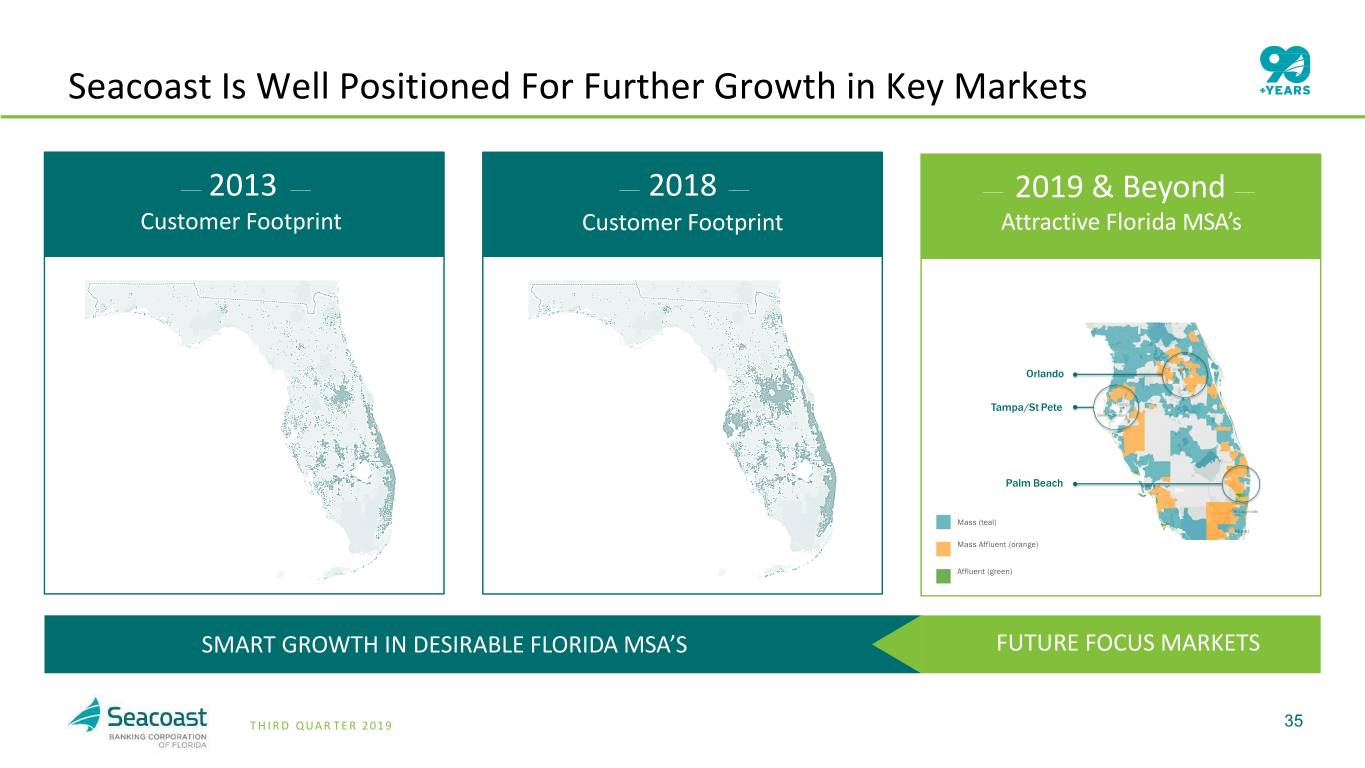

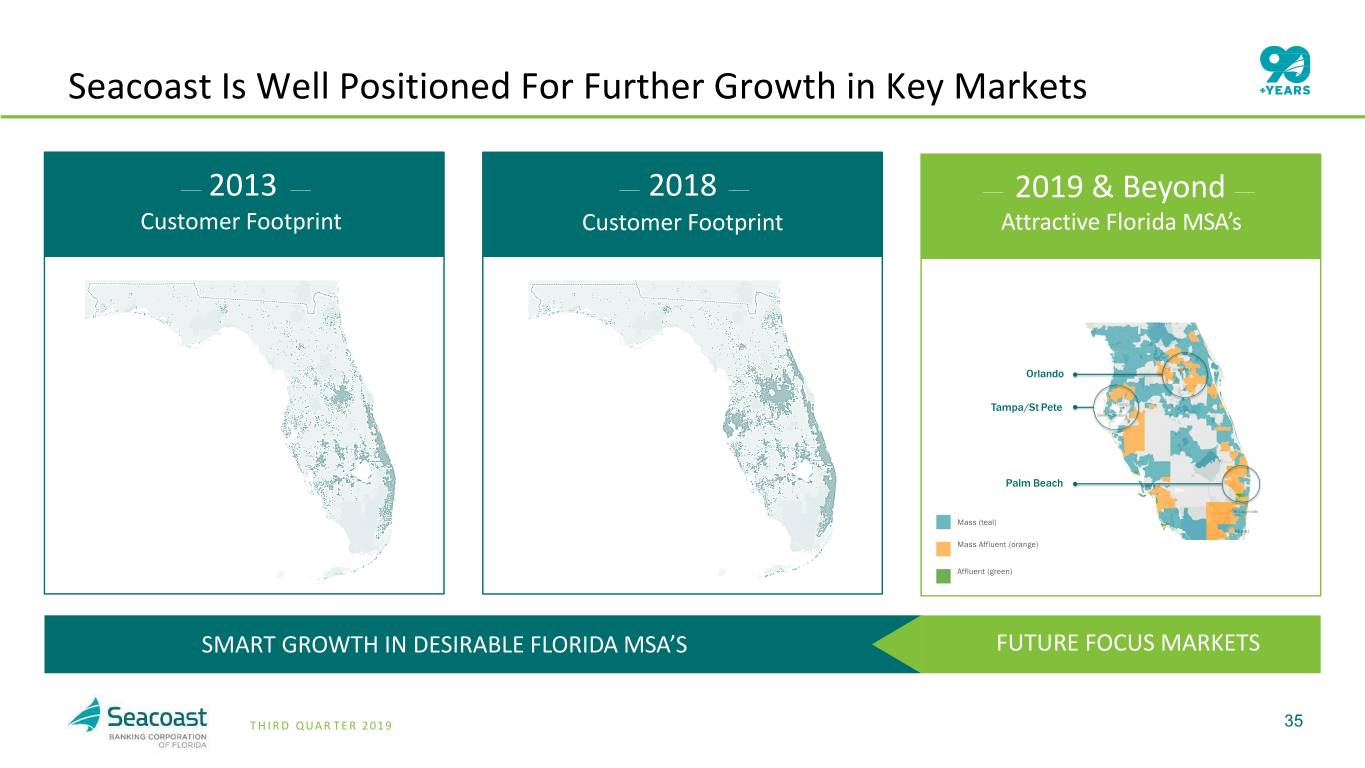

Seacoast Is Well Positioned For Further Growth in Key Markets 2013 2018 2019 & Beyond Customer Footprint Customer Footprint Attractive Florida MSA’s Orlando Tampa/St Pete Palm Beach Mass (teal) Mass Affluent (orange) Affluent (green) SMART GROWTH IN DESIRABLE FLORIDA MSA’S FUTURE FOCUS MARKETS T H I R D QUAR TER 2 019 35

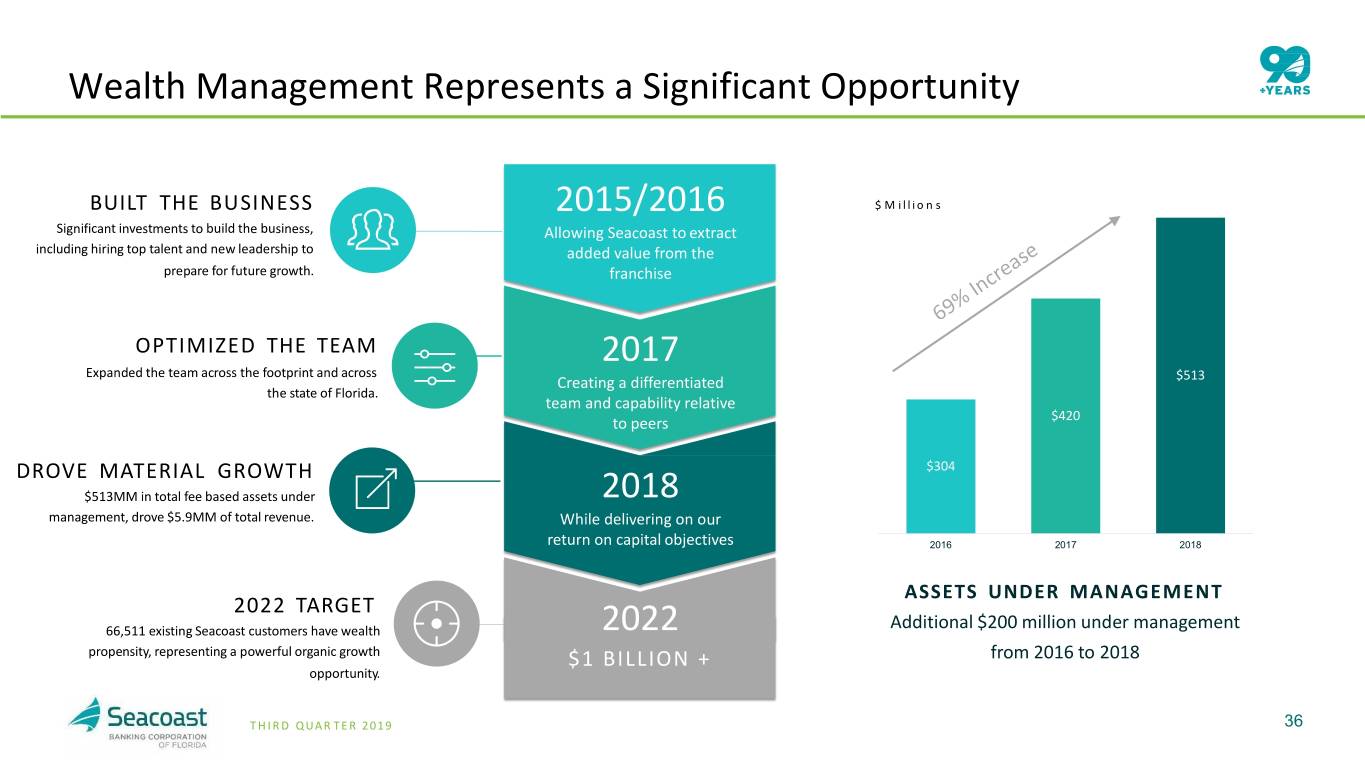

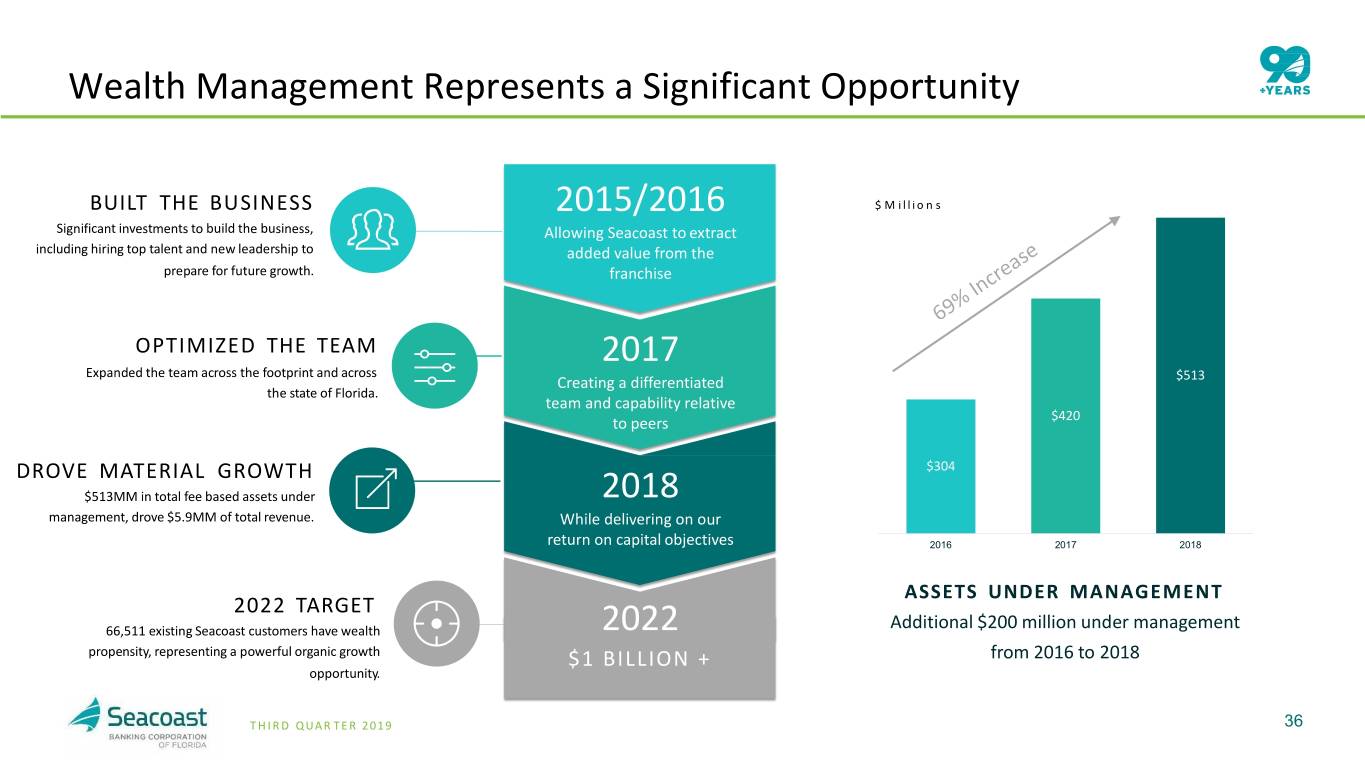

Wealth Management Represents a Significant Opportunity BUILT THE BUSINESS 2015/2016 $ M illio n s Significant investments to build the business, Allowing Seacoast to extract including hiring top talent and new leadership to added value from the prepare for future growth. franchise OPTIMIZED THE TEAM 2017 Expanded the team across the footprint and across Creating a differentiated $513 the state of Florida. team and capability relative to peers $420 DROVE MATERIAL GROWTH $304 $513MM in total fee based assets under 2018 management, drove $5.9MM of total revenue. While delivering on our return on capital objectives 2016 2017 2018 ASSETS UNDER MANAGEMENT 2022 TARGET 66,511 existing Seacoast customers have wealth 2022 Additional $200 million under management propensity, representing a powerful organic growth $ 1 BILLION + from 2016 to 2018 opportunity. T H I R D QUAR TER 2 019 36

Seacoast Executes a Differentiated Strategy from Other Community Banks Focus on Controls Capitalize on Complete Disciplined, Business Banking Opportunities Accretive Acquisitions That Expand Our Footprint Continue to Evolve Retail Model for Leverage Our Analytics Capabilities Profitability and Efficiency To Expand Customer Relationships T H I R D QUAR TER 2 019 37

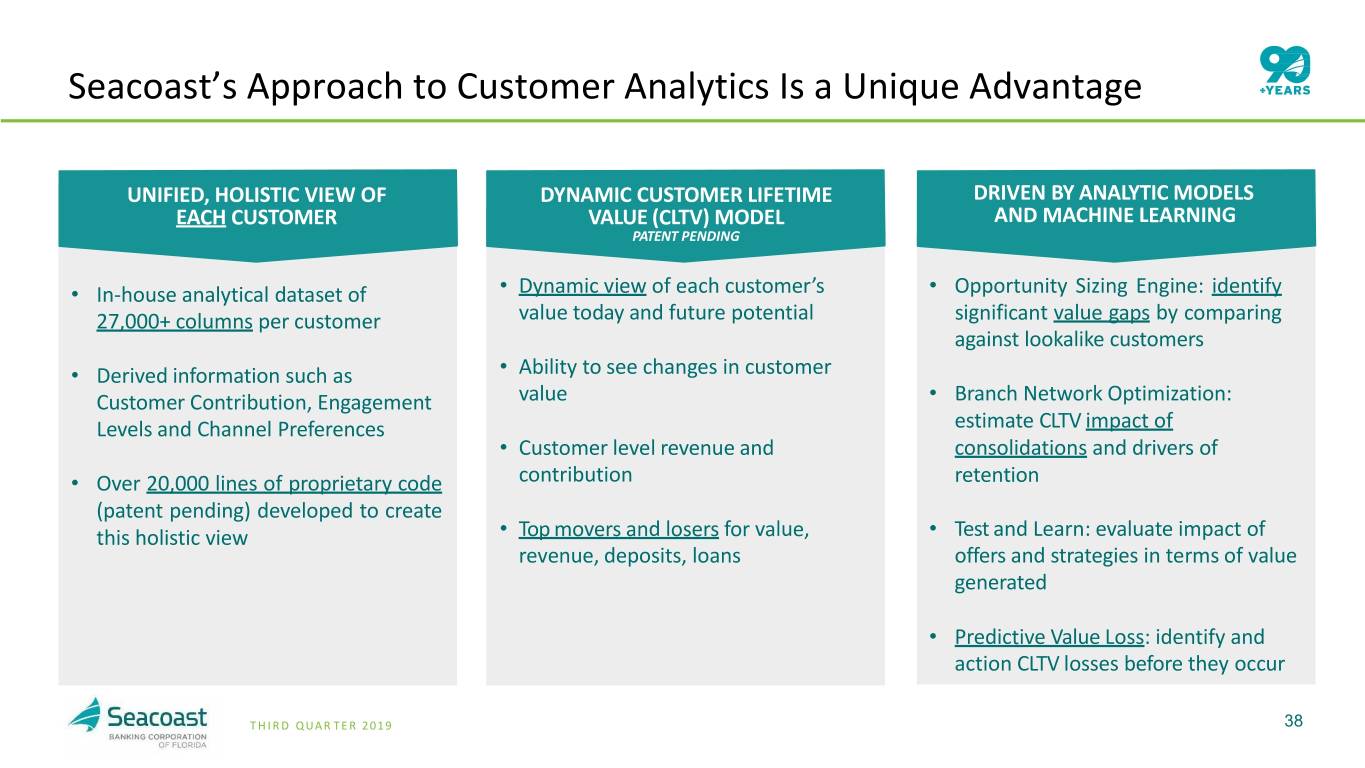

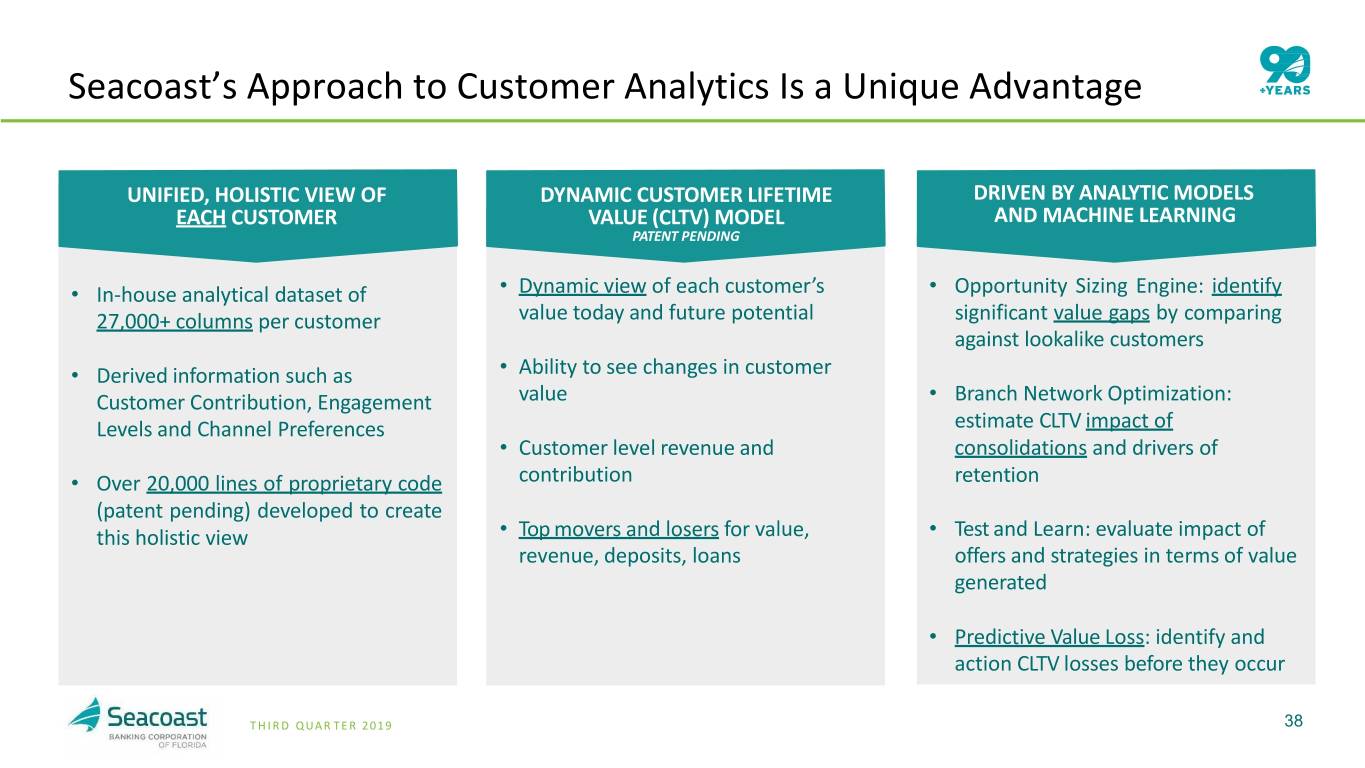

Seacoast’s Approach to Customer Analytics Is a Unique Advantage UNIFIED, HOLISTIC VIEW OF DYNAMIC CUSTOMER LIFETIME DRIVEN BY ANALYTIC MODELS EACH CUSTOMER VALUE (CLTV) MODEL AND MACHINE LEARNING PATENT PENDING • In-house analytical dataset of • Dynamic view of each customer’s • Opportunity Sizing Engine: identify 27,000+ columns per customer value today and future potential significant value gaps by comparing against lookalike customers • Derived information such as • Ability to see changes in customer Customer Contribution, Engagement value • Branch Network Optimization: Levels and Channel Preferences estimate CLTV impact of • Customer level revenue and consolidations and drivers of • Over 20,000 lines of proprietary code contribution retention (patent pending) developed to create this holistic view • Top movers and losers for value, • Test and Learn: evaluate impact of revenue, deposits, loans offers and strategies in terms of value generated • Predictive Value Loss: identify and action CLTV losses before they occur T H I R D QUAR TER 2 019 38

Unique Approach to Growing Customer Value Patent Pending Unlike Other Community Banks, Seacoast Uses its Vast Data Set and Machine Learning to Drive Value Creation BEHAVIORAL & FINANCIAL DATA CUSTOMER TREATMENT PLANS Current Customers • Face to Face1 • ATMs New Customers • Outbound Call1 • Online Banking 1 Bank Acquisitions • Inbound Call • Direct Mail • Email • Mobile Banking A single view of the customer Multi-channel approach to connecting + Extensive use of advanced analytics customers with opportunities + + Three machine learning(1) models already in place 70 fully automated campaigns 1Proprietary tools developed by Seacoast T H I R D QUAR TER 2 019 39 XXXXXXX

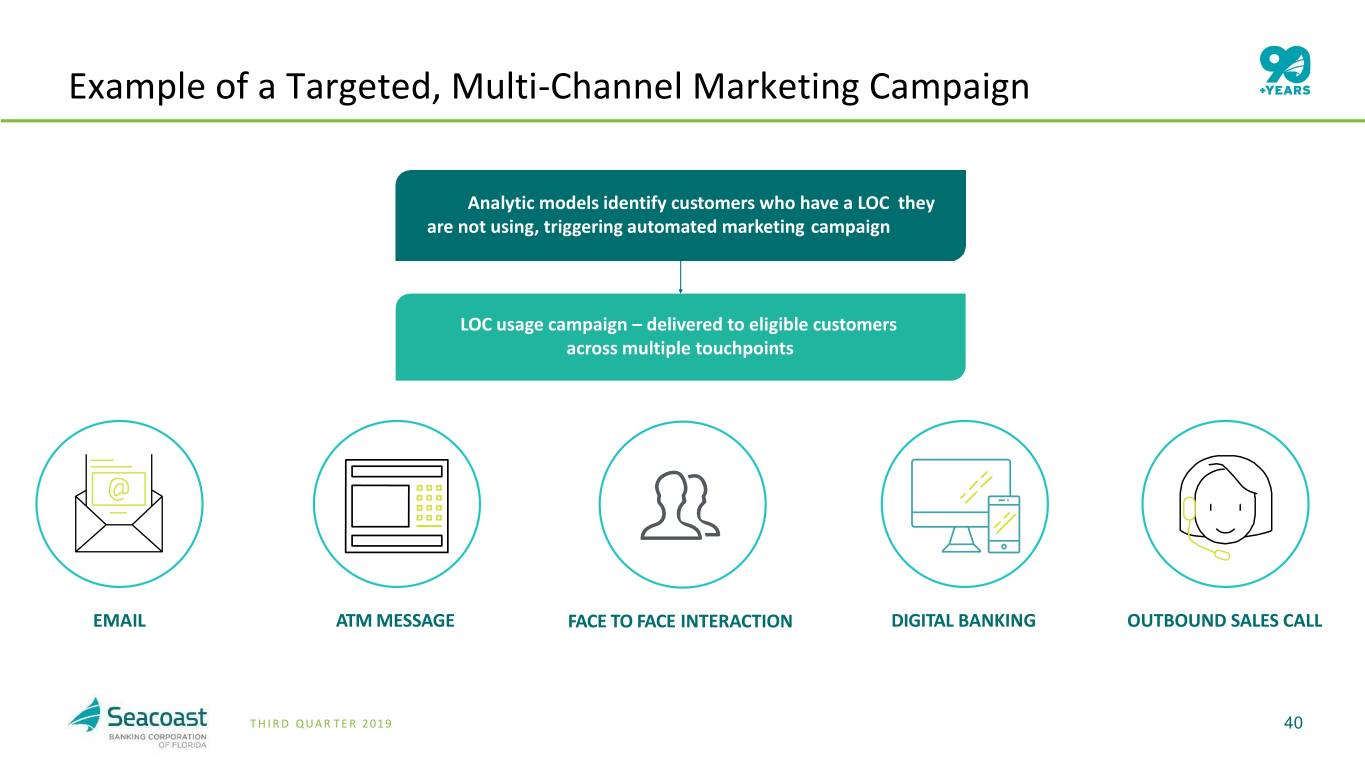

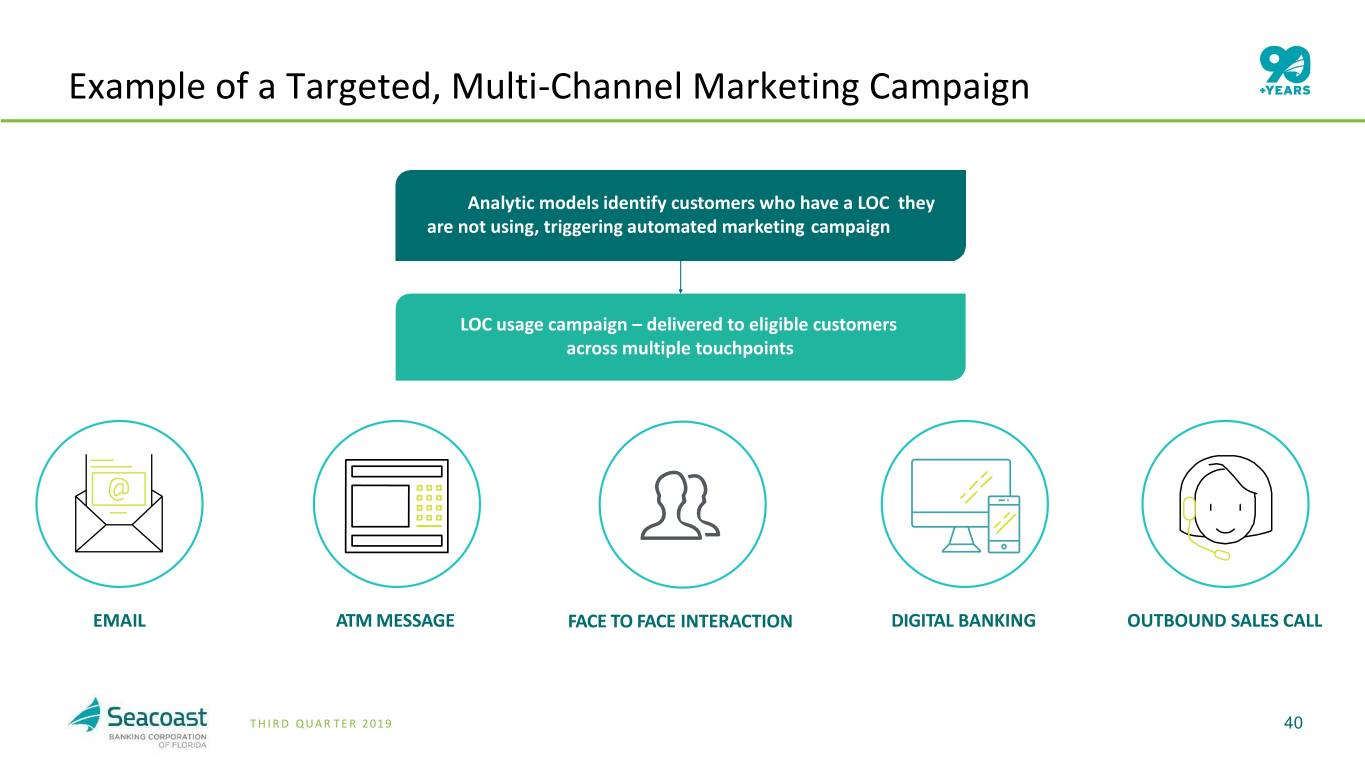

Example of a Targeted, Multi-Channel Marketing Campaign Analytic models identify customers who have a LOC they are not using, triggering automated marketing campaign LOC usage campaign – delivered to eligible customers across multiple touchpoints EMAIL ATM MESSAGE FACE TO FACE INTERACTION DIGITAL BANKING OUTBOUND SALES CALL T H I R D QUAR TER 2 019 40

Contact Details: Seacoast Banking Corporation of Florida Charles M. Shaffer Executive Vice President Chief Financial Officer (772) 221-7003 Chuck.Shaffer@seacoastbank.com INVESTOR RELATIONS www.SeacoastBanking.com NASDAQ: SBCF T H I R D QUAR TER 2 019 41

Agenda 1 ABOUT SEACOAST BANK 2 COMPANY PERFORMANCE 3 SEACOAST’S DIFFERENTIATED STRATEGY 4 SEACOAST’SAPPENDIX DIFFERENTIATED STRATEGY T H I R D QUAR TER 2 019 42

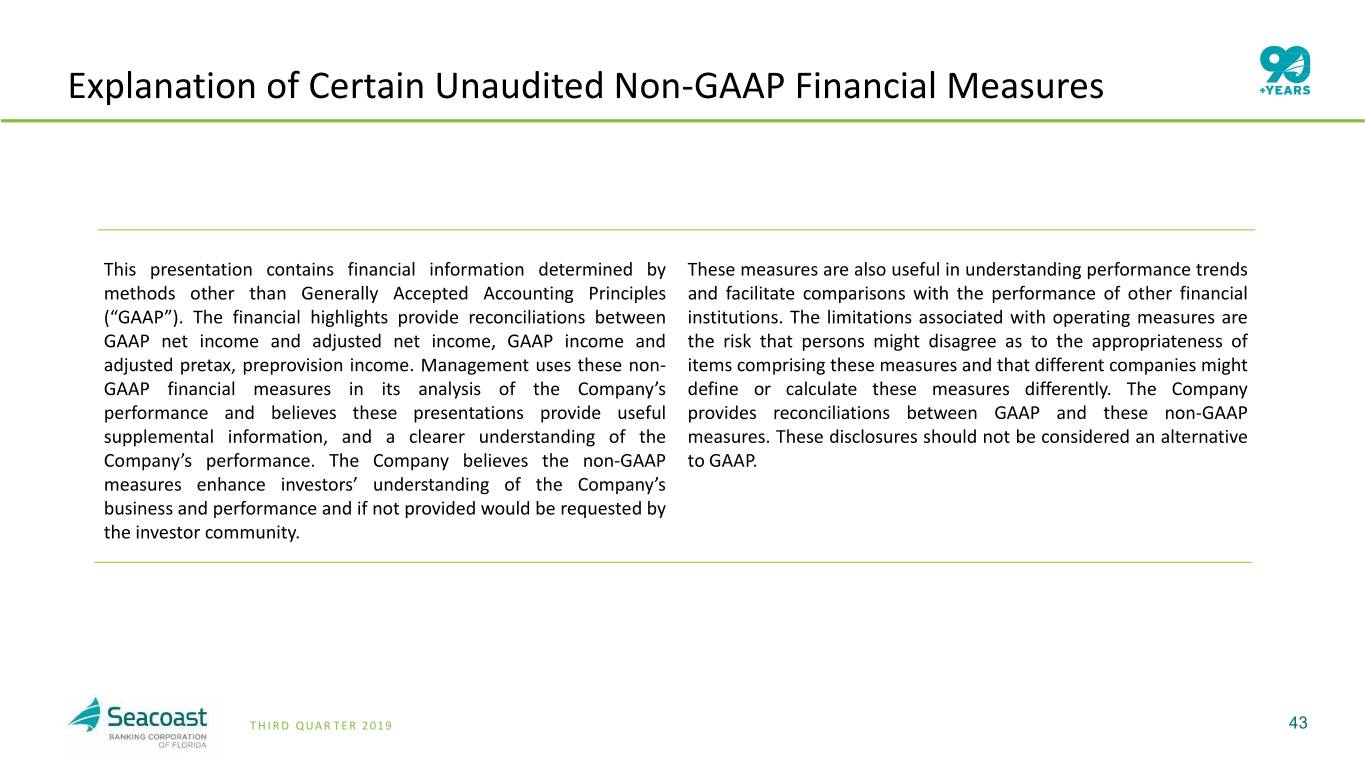

Explanation of Certain Unaudited Non-GAAP Financial Measures This presentation contains financial information determined by These measures are also useful in understanding performance trends methods other than Generally Accepted Accounting Principles and facilitate comparisons with the performance of other financial (“GAAP”). The financial highlights provide reconciliations between institutions. The limitations associated with operating measures are GAAP net income and adjusted net income, GAAP income and the risk that persons might disagree as to the appropriateness of adjusted pretax, preprovision income. Management uses these non- items comprising these measures and that different companies might GAAP financial measures in its analysis of the Company’s define or calculate these measures differently. The Company performance and believes these presentations provide useful provides reconciliations between GAAP and these non-GAAP supplemental information, and a clearer understanding of the measures. These disclosures should not be considered an alternative Company’s performance. The Company believes the non-GAAP to GAAP. measures enhance investors’ understanding of the Company’s business and performance and if not provided would be requested by the investor community. T H I R D QUAR TER 2 019 43

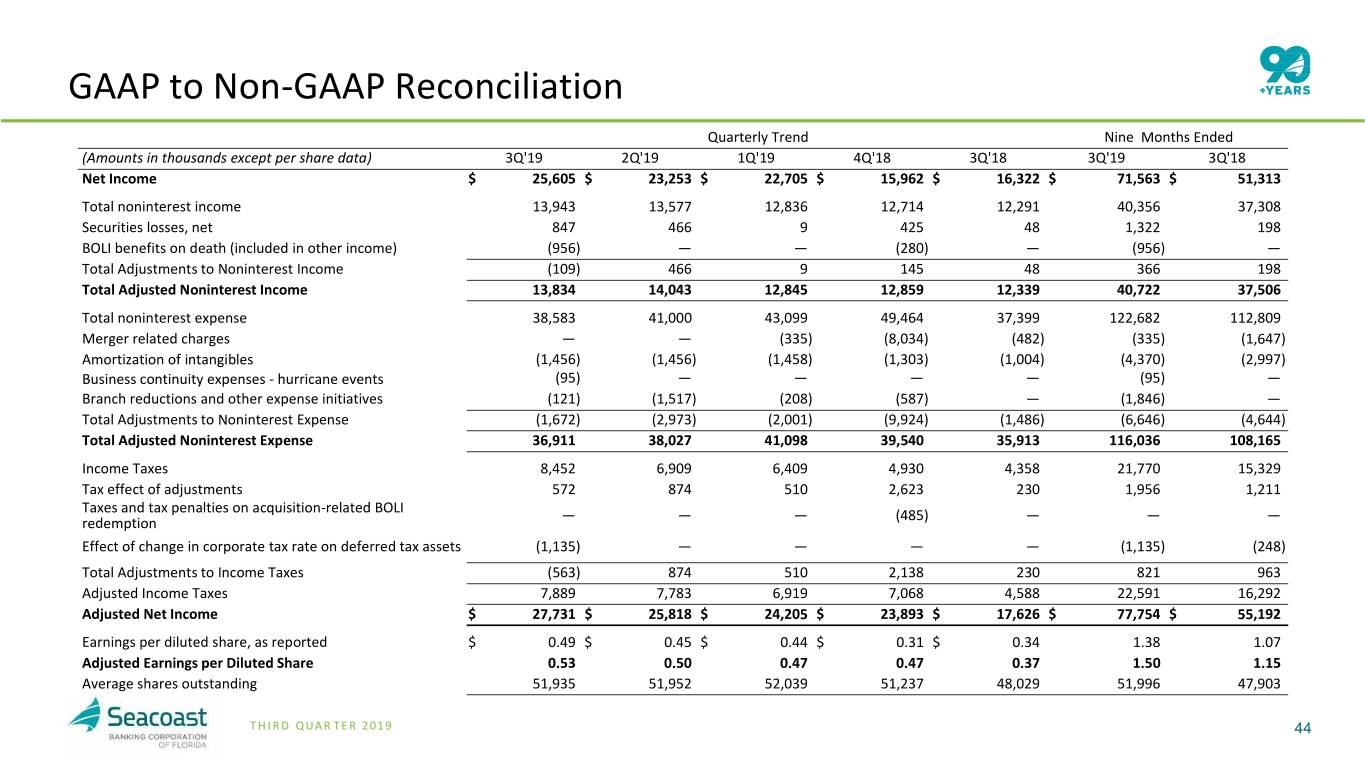

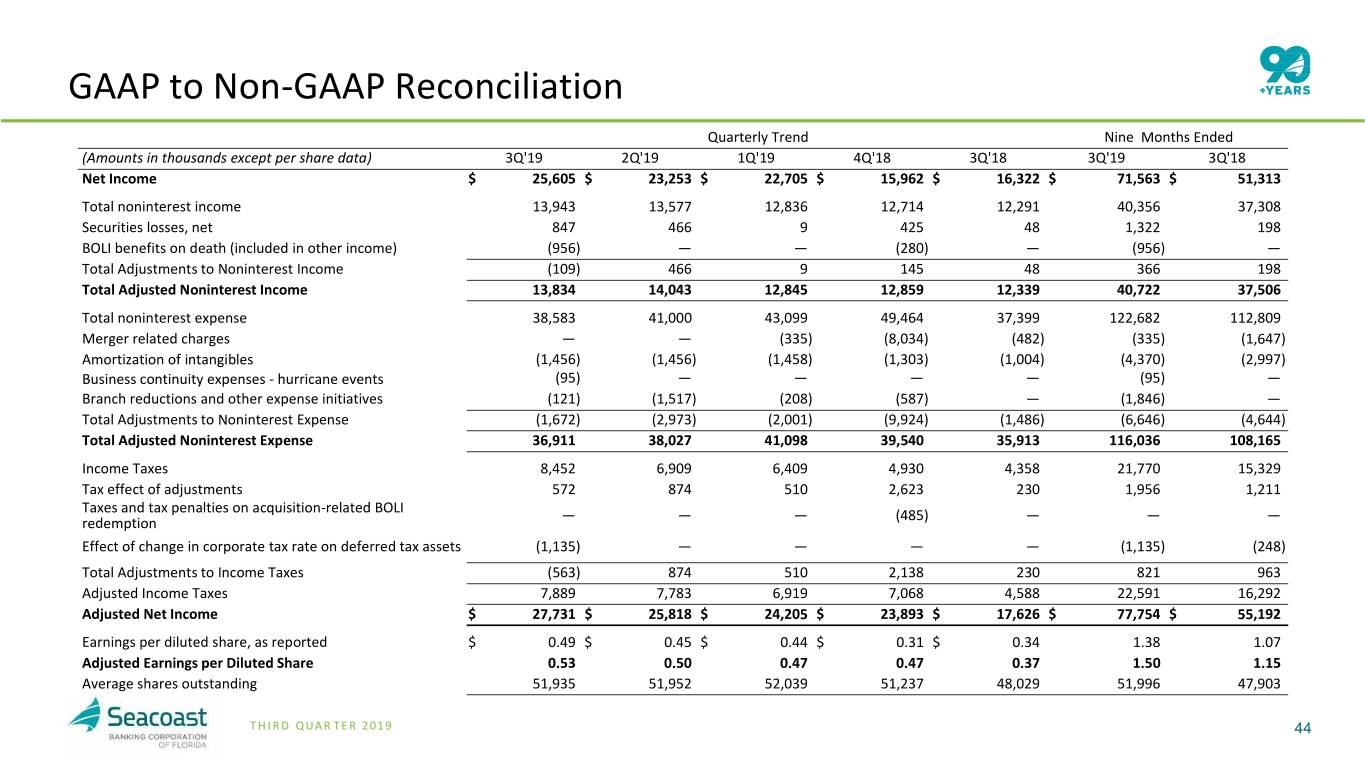

GAAP to Non-GAAP Reconciliation Quarterly Trend Nine Months Ended (Amounts in thousands except per share data) 3Q'19 2Q'19 1Q'19 4Q'18 3Q'18 3Q'19 3Q'18 Net Income $ 25,605 $ 23,253 $ 22,705 $ 15,962 $ 16,322 $ 71,563 $ 51,313 Total noninterest income 13,943 13,577 12,836 12,714 12,291 40,356 37,308 Securities losses, net 847 466 9 425 48 1,322 198 BOLI benefits on death (included in other income) (956 ) — — (280 ) — (956 ) — Total Adjustments to Noninterest Income (109 ) 466 9 145 48 366 198 Total Adjusted Noninterest Income 13,834 14,043 12,845 12,859 12,339 40,722 37,506 Total noninterest expense 38,583 41,000 43,099 49,464 37,399 122,682 112,809 Merger related charges — — (335 ) (8,034 ) (482 ) (335 ) (1,647 ) Amortization of intangibles (1,456 ) (1,456 ) (1,458 ) (1,303 ) (1,004 ) (4,370 ) (2,997 ) Business continuity expenses - hurricane events (95 ) — — — — (95 ) — Branch reductions and other expense initiatives (121 ) (1,517 ) (208 ) (587 ) — (1,846 ) — Total Adjustments to Noninterest Expense (1,672 ) (2,973 ) (2,001 ) (9,924 ) (1,486 ) (6,646 ) (4,644 ) Total Adjusted Noninterest Expense 36,911 38,027 41,098 39,540 35,913 116,036 108,165 Income Taxes 8,452 6,909 6,409 4,930 4,358 21,770 15,329 Tax effect of adjustments 572 874 510 2,623 230 1,956 1,211 Taxes and tax penalties on acquisition-related BOLI — — — (485 ) — — — redemption Effect of change in corporate tax rate on deferred tax assets (1,135 ) — — — — (1,135 ) (248 ) Total Adjustments to Income Taxes (563 ) 874 510 2,138 230 821 963 Adjusted Income Taxes 7,889 7,783 6,919 7,068 4,588 22,591 16,292 Adjusted Net Income $ 27,731 $ 25,818 $ 24,205 $ 23,893 $ 17,626 $ 77,754 $ 55,192 Earnings per diluted share, as reported $ 0.49 $ 0.45 $ 0.44 $ 0.31 $ 0.34 1.38 1.07 Adjusted Earnings per Diluted Share 0.53 0.50 0.47 0.47 0.37 1.50 1.15 Average shares outstanding 51,935 51,952 52,039 51,237 48,029 51,996 47,903 T H I R D QUAR TER 2 019 44

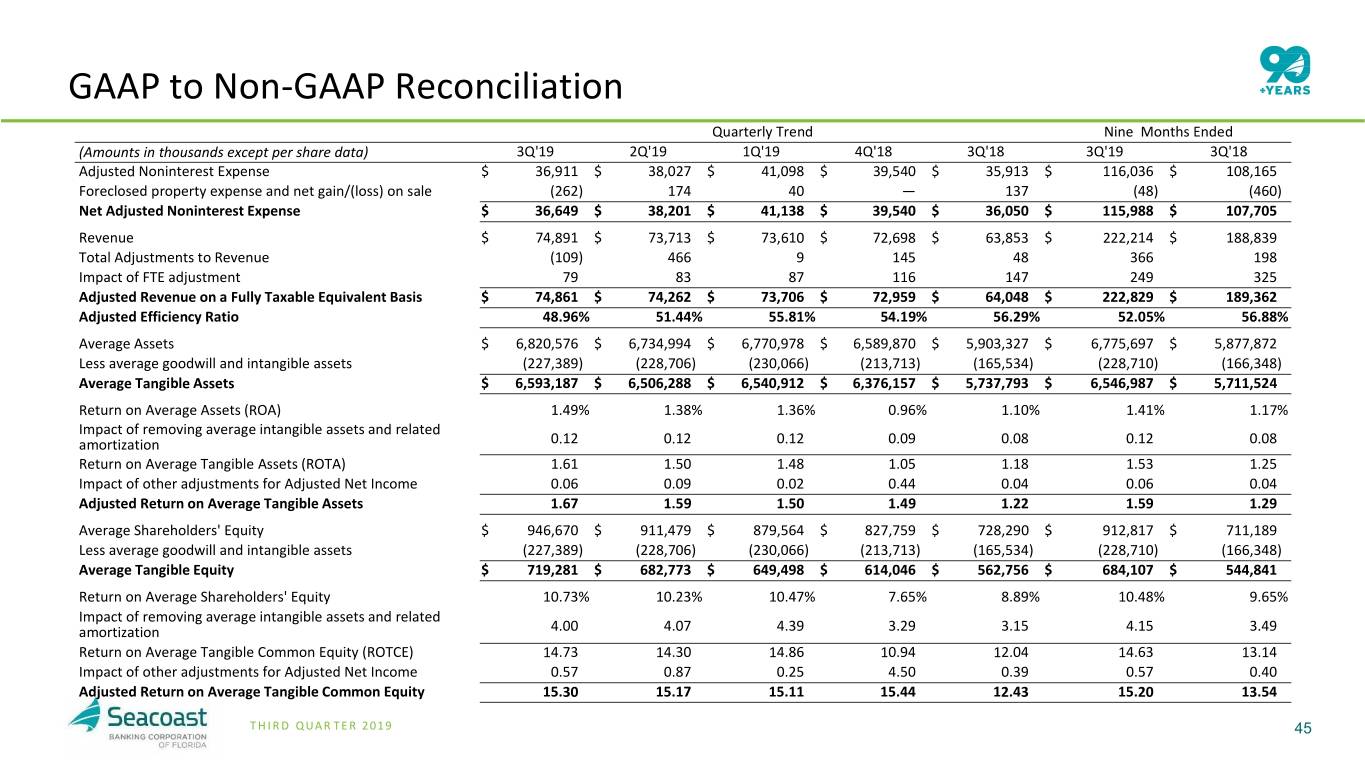

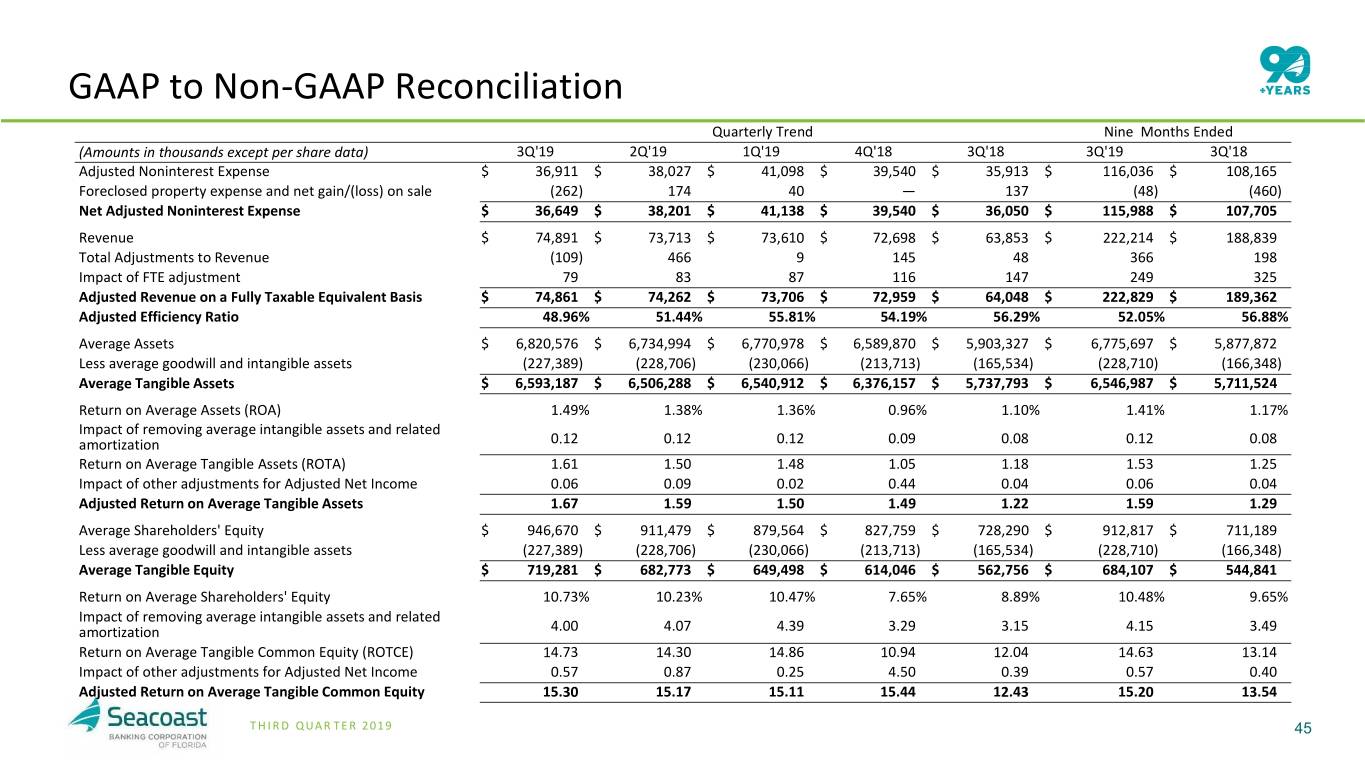

GAAP to Non-GAAP Reconciliation Quarterly Trend Nine Months Ended (Amounts in thousands except per share data) 3Q'19 2Q'19 1Q'19 4Q'18 3Q'18 3Q'19 3Q'18 Adjusted Noninterest Expense $ 36,911 $ 38,027 $ 41,098 $ 39,540 $ 35,913 $ 116,036 $ 108,165 Foreclosed property expense and net gain/(loss) on sale (262 ) 174 40 — 137 (48 ) (460 ) Net Adjusted Noninterest Expense $ 36,649 $ 38,201 $ 41,138 $ 39,540 $ 36,050 $ 115,988 $ 107,705 Revenue $ 74,891 $ 73,713 $ 73,610 $ 72,698 $ 63,853 $ 222,214 $ 188,839 Total Adjustments to Revenue (109 ) 466 9 145 48 366 198 Impact of FTE adjustment 79 83 87 116 147 249 325 Adjusted Revenue on a Fully Taxable Equivalent Basis $ 74,861 $ 74,262 $ 73,706 $ 72,959 $ 64,048 $ 222,829 $ 189,362 Adjusted Efficiency Ratio 48.96 % 51.44 % 55.81 % 54.19 % 56.29 % 52.05 % 56.88 % Average Assets $ 6,820,576 $ 6,734,994 $ 6,770,978 $ 6,589,870 $ 5,903,327 $ 6,775,697 $ 5,877,872 Less average goodwill and intangible assets (227,389 ) (228,706 ) (230,066 ) (213,713 ) (165,534 ) (228,710 ) (166,348 ) Average Tangible Assets $ 6,593,187 $ 6,506,288 $ 6,540,912 $ 6,376,157 $ 5,737,793 $ 6,546,987 $ 5,711,524 Return on Average Assets (ROA) 1.49 % 1.38 % 1.36 % 0.96 % 1.10 % 1.41 % 1.17 % Impact of removing average intangible assets and related amortization 0.12 0.12 0.12 0.09 0.08 0.12 0.08 Return on Average Tangible Assets (ROTA) 1.61 1.50 1.48 1.05 1.18 1.53 1.25 Impact of other adjustments for Adjusted Net Income 0.06 0.09 0.02 0.44 0.04 0.06 0.04 Adjusted Return on Average Tangible Assets 1.67 1.59 1.50 1.49 1.22 1.59 1.29 Average Shareholders' Equity $ 946,670 $ 911,479 $ 879,564 $ 827,759 $ 728,290 $ 912,817 $ 711,189 Less average goodwill and intangible assets (227,389 ) (228,706 ) (230,066 ) (213,713 ) (165,534 ) (228,710 ) (166,348 ) Average Tangible Equity $ 719,281 $ 682,773 $ 649,498 $ 614,046 $ 562,756 $ 684,107 $ 544,841 Return on Average Shareholders' Equity 10.73 % 10.23 % 10.47 % 7.65 % 8.89 % 10.48 % 9.65 % Impact of removing average intangible assets and related amortization 4.00 4.07 4.39 3.29 3.15 4.15 3.49 Return on Average Tangible Common Equity (ROTCE) 14.73 14.30 14.86 10.94 12.04 14.63 13.14 Impact of other adjustments for Adjusted Net Income 0.57 0.87 0.25 4.50 0.39 0.57 0.40 Adjusted Return on Average Tangible Common Equity 15.30 15.17 15.11 15.44 12.43 15.20 13.54 T H I R D QUAR TER 2 019 45

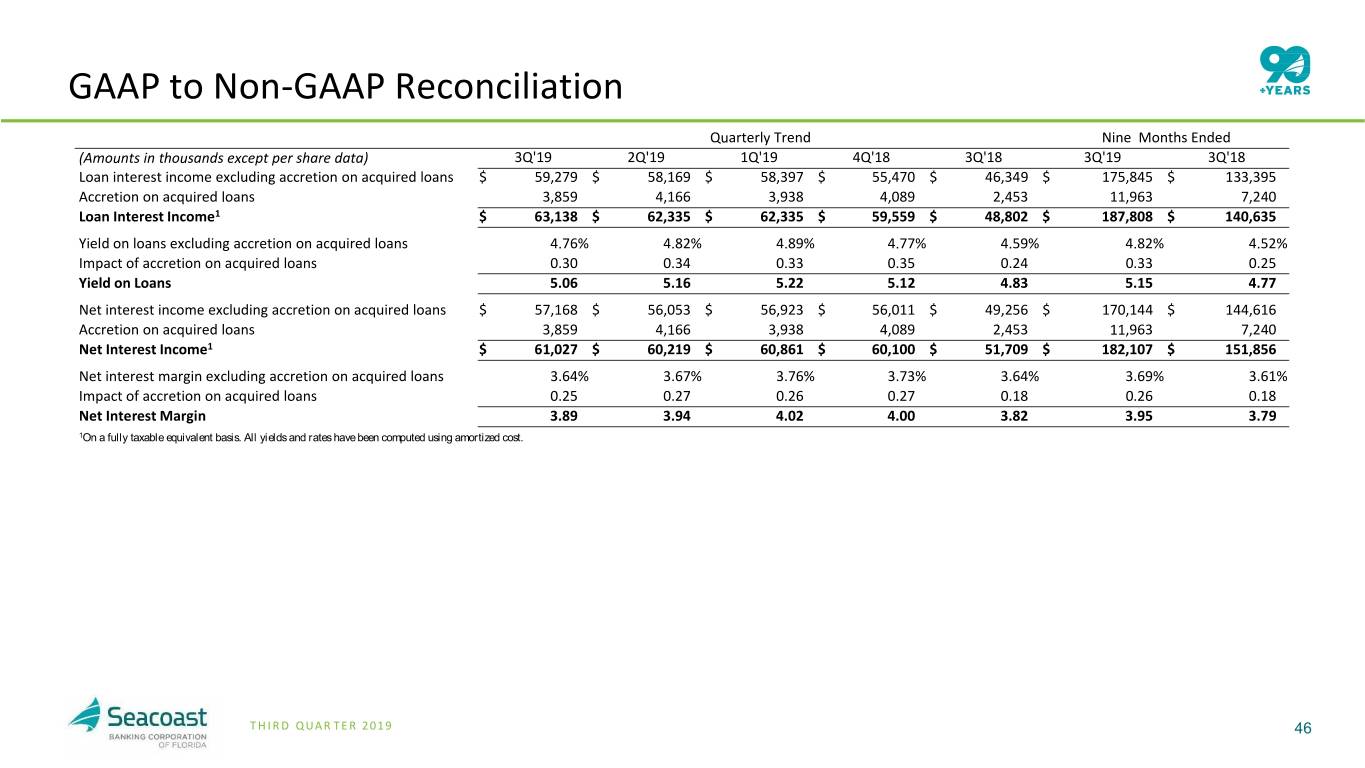

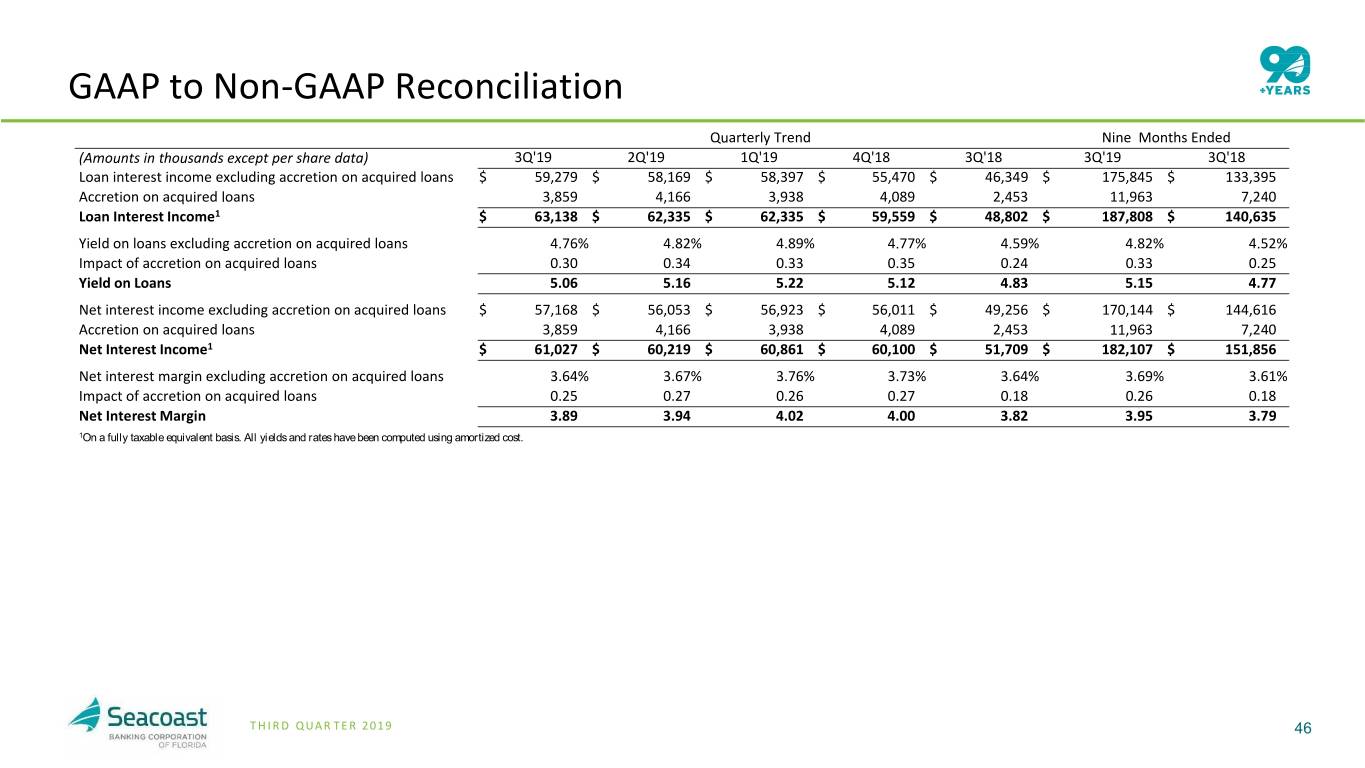

GAAP to Non-GAAP Reconciliation Quarterly Trend Nine Months Ended (Amounts in thousands except per share data) 3Q'19 2Q'19 1Q'19 4Q'18 3Q'18 3Q'19 3Q'18 Loan interest income excluding accretion on acquired loans $ 59,279 $ 58,169 $ 58,397 $ 55,470 $ 46,349 $ 175,845 $ 133,395 Accretion on acquired loans 3,859 4,166 3,938 4,089 2,453 11,963 7,240 Loan Interest Income1 $ 63,138 $ 62,335 $ 62,335 $ 59,559 $ 48,802 $ 187,808 $ 140,635 Yield on loans excluding accretion on acquired loans 4.76% 4.82% 4.89% 4.77 % 4.59% 4.82 % 4.52 % Impact of accretion on acquired loans 0.30 0.34 0.33 0.35 0.24 0.33 0.25 Yield on Loans 5.06 5.16 5.22 5.12 4.83 5.15 4.77 Net interest income excluding accretion on acquired loans $ 57,168 $ 56,053 $ 56,923 $ 56,011 $ 49,256 $ 170,144 $ 144,616 Accretion on acquired loans 3,859 4,166 3,938 4,089 2,453 11,963 7,240 Net Interest Income1 $ 61,027 $ 60,219 $ 60,861 $ 60,100 $ 51,709 $ 182,107 $ 151,856 Net interest margin excluding accretion on acquired loans 3.64% 3.67% 3.76% 3.73 % 3.64% 3.69 % 3.61 % Impact of accretion on acquired loans 0.25 0.27 0.26 0.27 0.18 0.26 0.18 Net Interest Margin 3.89 3.94 4.02 4.00 3.82 3.95 3.79 1On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. T H I R D QUAR TER 2 019 46