ACQUISITION OF FIRST BANK OF THE PALM BEACHES November 19, 2019

Cautionary Notice Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in our markets, new initiatives and improvements to reported earnings that may be realized from cost controls, tax law changes, and for integration of banks that we have acquired, or expect to acquire, as well as statements with respect to Seacoast's objectives, strategic plans, including Vision 2020, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. You should not expect us to update any forward-looking statements. All statements other than statements of historical fact could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may”, “will”, “anticipate”, “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the effects of future economic and market conditions, including seasonality; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes; changes in accounting policies, rules and practices; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; uncertainty related to the impact of LIBOR calculations on securities and loans; changes in borrower credit risks and payment behaviors; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate; our ability to comply with any regulatory requirements; the effects of problems encountered by other financial institutions that adversely affect us or the banking industry; our concentration in commercial real estate loans; the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of our investments due to market volatility or counterparty payment risk; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including our ability to continue to identify acquisition targets and successfully acquire desirable financial institutions; changes in technology or products that may be more difficult, costly, or less effective than anticipated; our ability to identify and address increased cybersecurity risks; inability of our risk management framework to manage risks associated with our business; dependence on key suppliers or vendors to obtain equipment or services for our business on acceptable terms; reduction in or the termination of our ability to use the mobile-based platform that is critical to our business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters or other catastrophic events that may affect general economic conditions; unexpected outcomes of, and the costs associated with, existing or new litigation involving us; our ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that our deferred tax assets could be reduced if estimates of future taxable income from our operations and tax planning strategies are less than currently estimated and sales of our capital stock could trigger a reduction in the amount of net operating loss carryforwards that we may be able to utilize for income tax purposes; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market areas and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the Internet; and the failure of assumptions underlying the establishment of reserves for possible loan losses. The risks relating to the proposed First Bank merger include, without limitation, failure to obtain the approval of shareholders of First Bank in connection with the merger; the timing to consummate the proposed merger; the risk that a condition to the closing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly and effectively integrate the businesses of Seacoast and First Bank, including unexpected transaction costs, the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger; the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; the difficulties and risks inherent with entering new markets. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2018 under “Special Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors”, and otherwise in our SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC’s Internet website at www.sec.gov. 2

Important Information For Investors And Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Seacoast Banking Corporation of Florida ("Seacoast") will file with the Securities and Exchange Commission (the "SEC") a registration statement on Form S-4 containing a proxy statement of First Bank of the Palm Beaches (“First Bank”) and a prospectus of Seacoast, and Seacoast will file other documents with respect to the proposed merger. A definitive proxy statement/prospectus will be mailed to shareholders of First Bank. Investors and security holders of Seacoast and First Bank are urged to read the entire proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and other documents filed with the SEC by Seacoast through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Seacoast will be available free of charge on Seacoast's internet website or by contacting Seacoast. Seacoast, First Bank, their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Seacoast is set forth in its proxy statement for its 2019 annual meeting of shareholders, which was filed with the SEC on April 5, 2019 and its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. 3 3

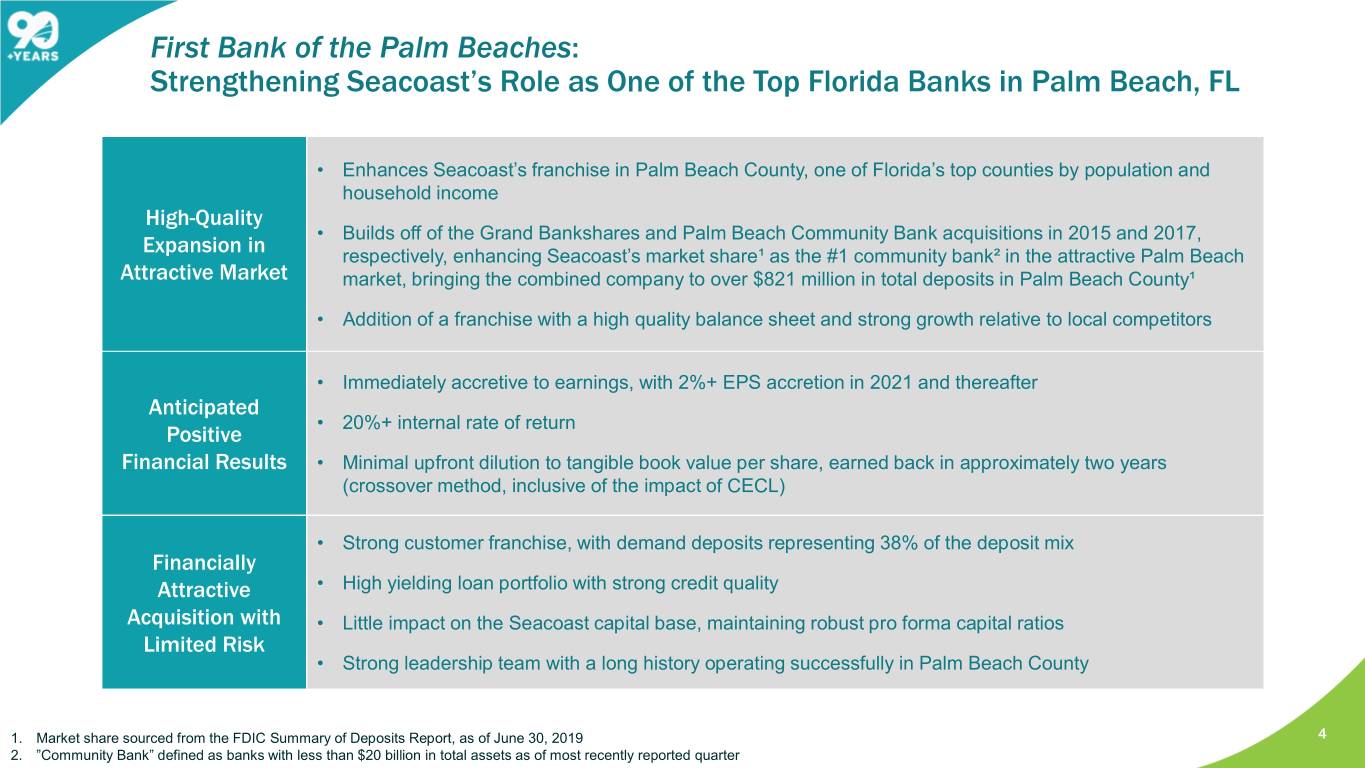

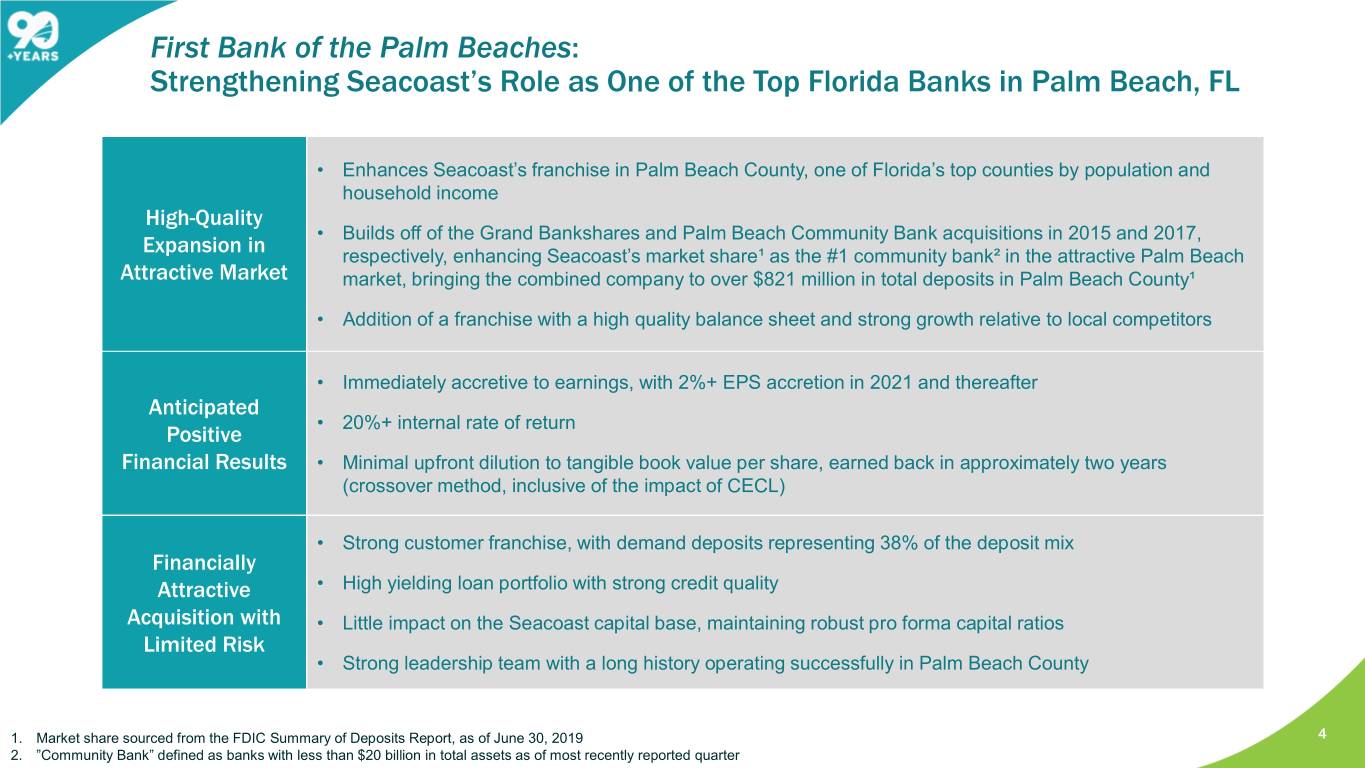

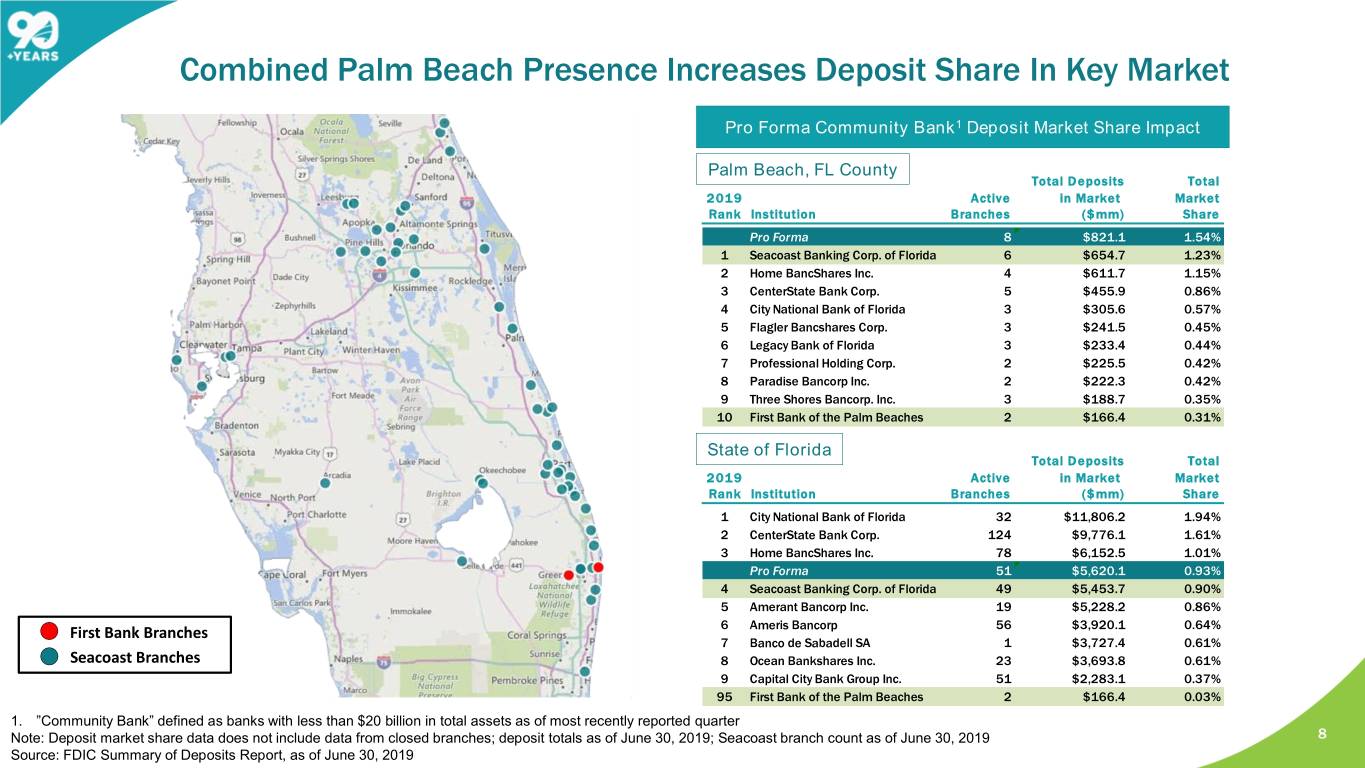

First Bank of the Palm Beaches: Strengthening Seacoast’s Role as One of the Top Florida Banks in Palm Beach, FL • Enhances Seacoast’s franchise in Palm Beach County, one of Florida’s top counties by population and household income High-Quality • Builds off of the Grand Bankshares and Palm Beach Community Bank acquisitions in 2015 and 2017, Expansion in respectively, enhancing Seacoast’s market share¹ as the #1 community bank² in the attractive Palm Beach Attractive Market market, bringing the combined company to over $821 million in total deposits in Palm Beach County¹ • Addition of a franchise with a high quality balance sheet and strong growth relative to local competitors • Immediately accretive to earnings, with 2%+ EPS accretion in 2021 and thereafter Anticipated • 20%+ internal rate of return Positive Financial Results • Minimal upfront dilution to tangible book value per share, earned back in approximately two years (crossover method, inclusive of the impact of CECL) • Strong customer franchise, with demand deposits representing 38% of the deposit mix Financially Attractive • High yielding loan portfolio with strong credit quality Acquisition with • Little impact on the Seacoast capital base, maintaining robust pro forma capital ratios Limited Risk • Strong leadership team with a long history operating successfully in Palm Beach County 1. Market share sourced from the FDIC Summary of Deposits Report, as of June 30, 2019 4 2. ”Community Bank” defined as banks with less than $20 billion in total assets as of most recently reported quarter 4

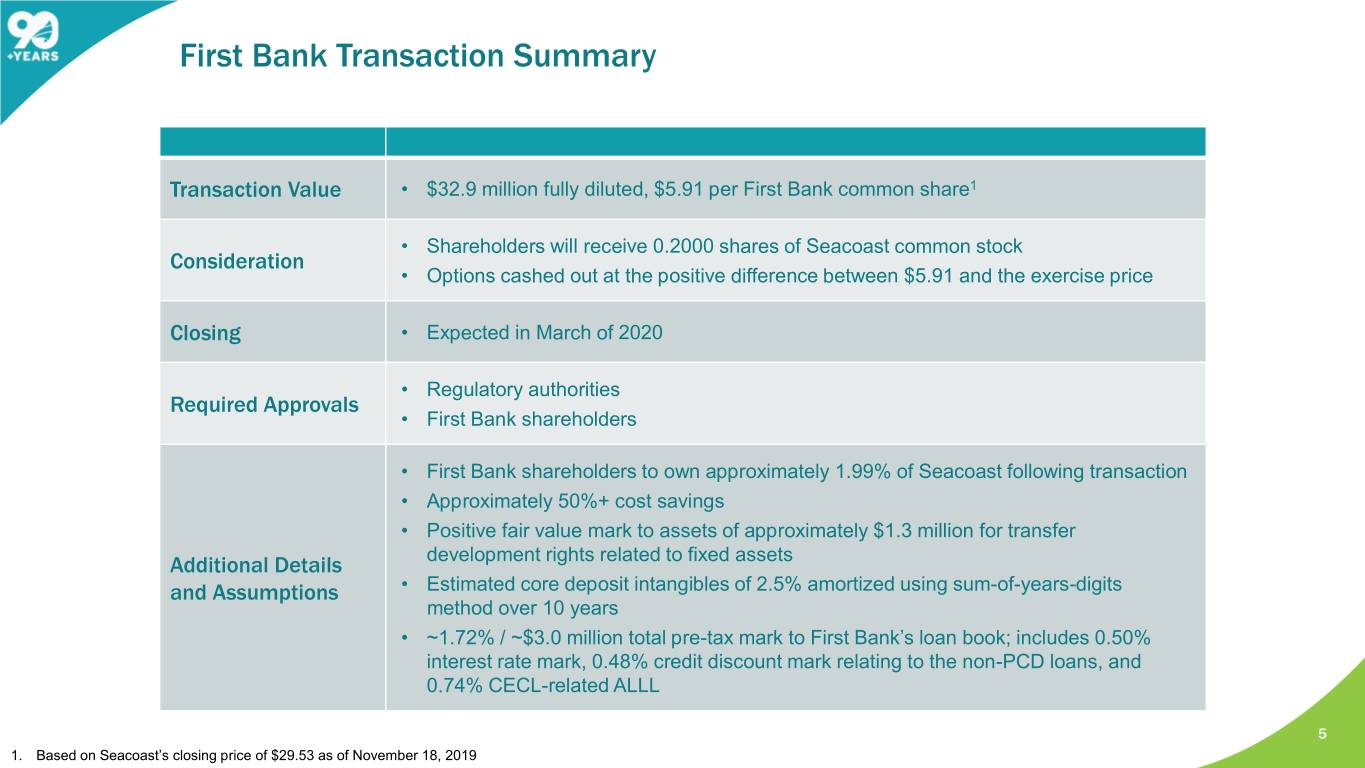

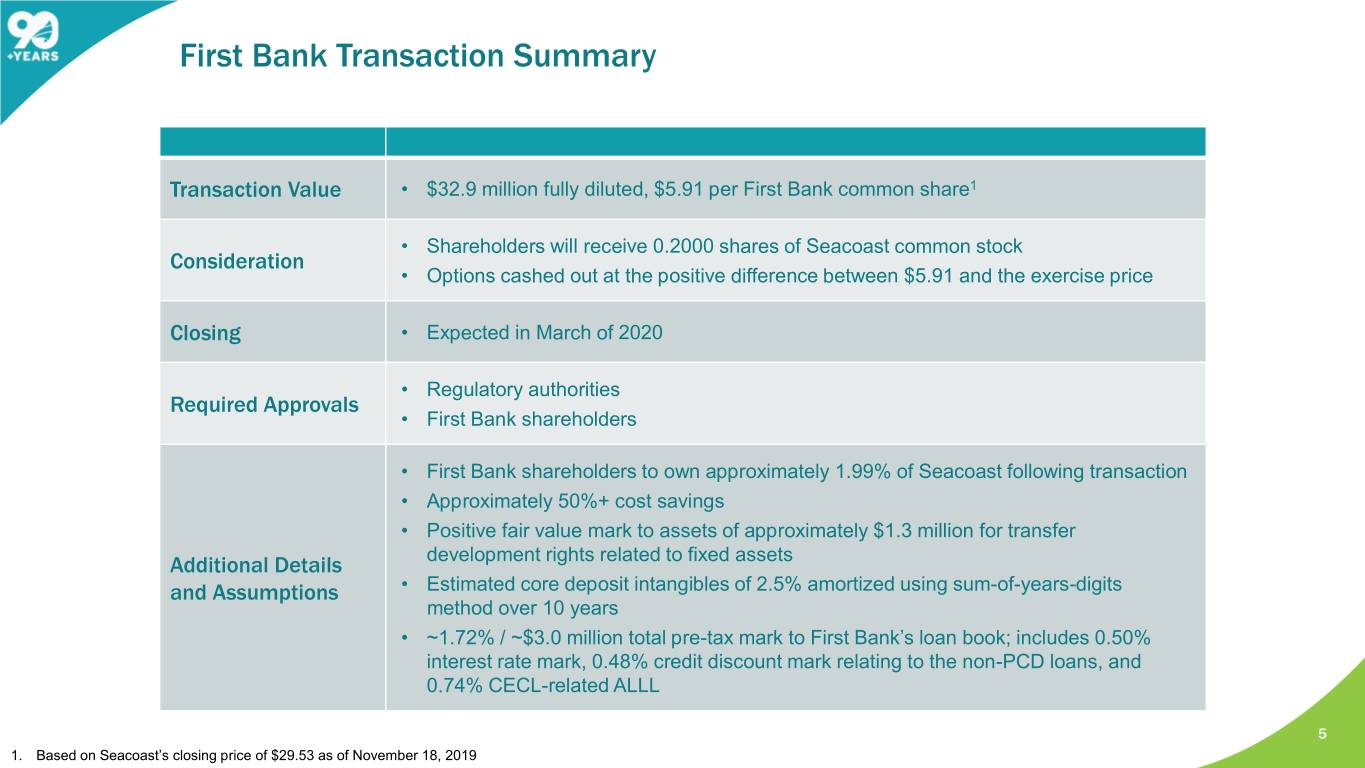

First Bank Transaction Summary Transaction Value • $32.9 million fully diluted, $5.91 per First Bank common share1 • Shareholders will receive 0.2000 shares of Seacoast common stock Consideration • Options cashed out at the positive difference between $5.91 and the exercise price Closing • Expected in March of 2020 • Regulatory authorities Required Approvals • First Bank shareholders • First Bank shareholders to own approximately 1.99% of Seacoast following transaction • Approximately 50%+ cost savings • Positive fair value mark to assets of approximately $1.3 million for transfer Additional Details development rights related to fixed assets and Assumptions • Estimated core deposit intangibles of 2.5% amortized using sum-of-years-digits method over 10 years • ~1.72% / ~$3.0 million total pre-tax mark to First Bank’s loan book; includes 0.50% interest rate mark, 0.48% credit discount mark relating to the non-PCD loans, and 0.74% CECL-related ALLL 5 1. Based on Seacoast’s closing price of $29.53 as of November 18, 2019 5

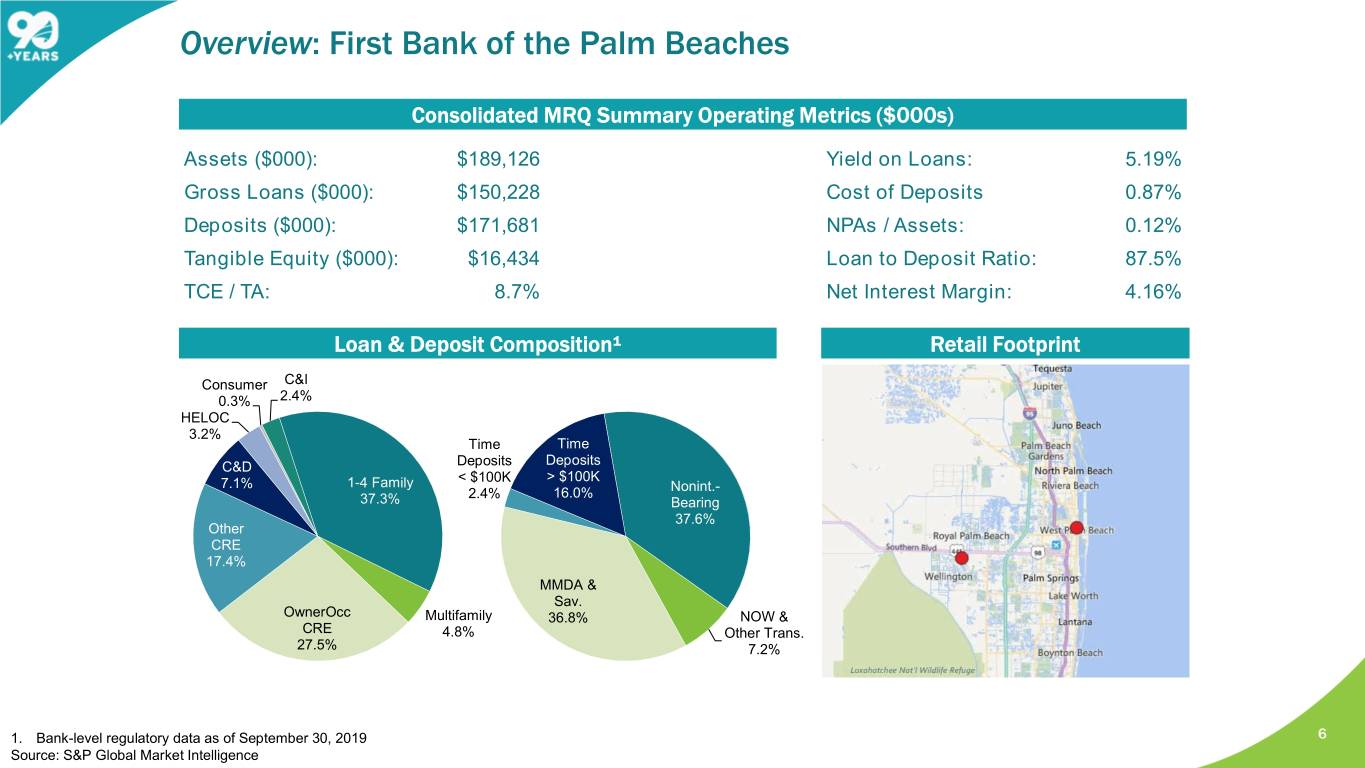

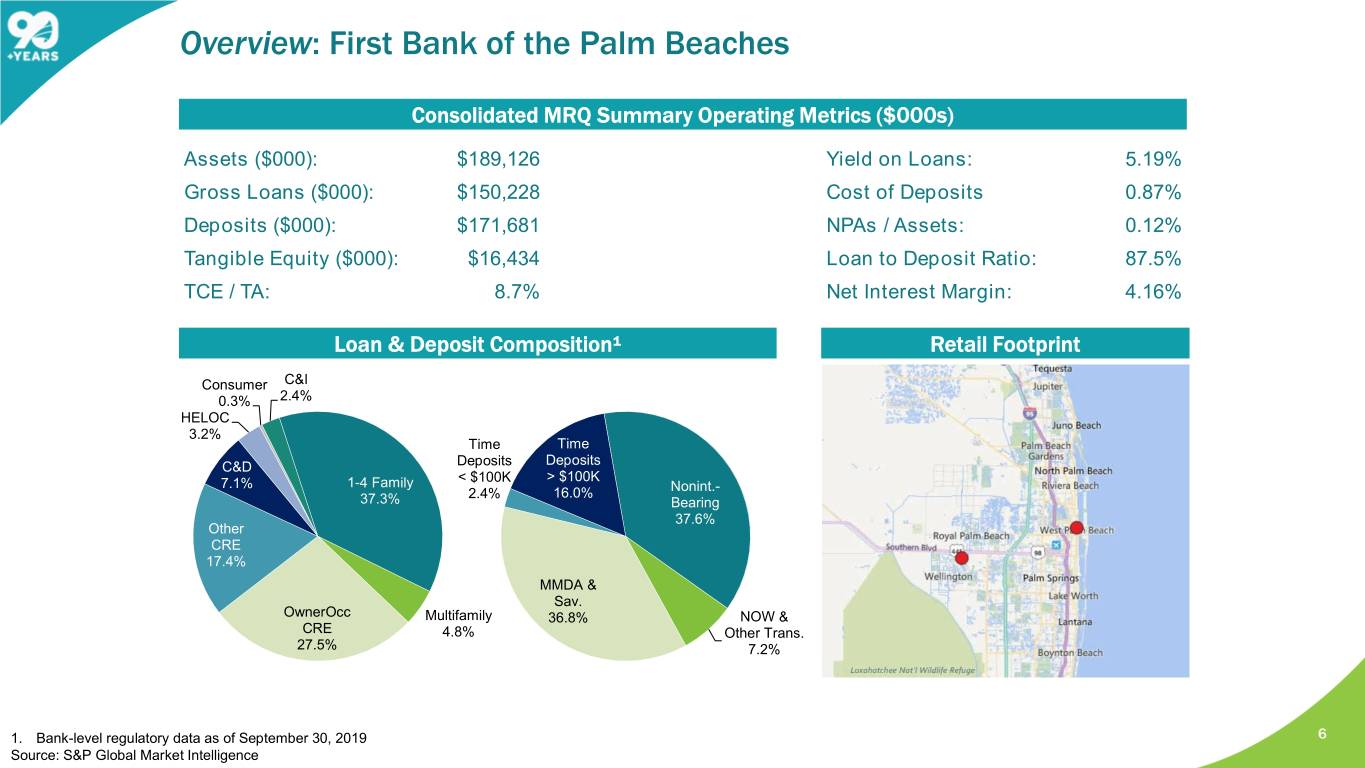

Overview: First Bank of the Palm Beaches Consolidated MRQ Summary Operating Metrics ($000s) Assets ($000): $189,126 Yield on Loans: 5.19% Gross Loans ($000): $150,228 Cost of Deposits 0.87% Deposits ($000): $171,681 NPAs / Assets: 0.12% Tangible Equity ($000): $16,434 Loan to Deposit Ratio: 87.5% TCE / TA: 8.7% Net Interest Margin: 4.16% Loan & Deposit Composition¹ Retail Footprint Consumer C&I 0.3% 2.4% HELOC 3.2% Time Time C&D Deposits Deposits < $100K > $100K 7.1% 1-4 Family Nonint.- 2.4% 16.0% 37.3% Bearing 37.6% Other CRE 17.4% MMDA & Sav. OwnerOcc Multifamily 36.8% NOW & CRE 4.8% Other Trans. 27.5% 7.2% 1. Bank-level regulatory data as of September 30, 2019 6 Source: S&P Global Market Intelligence 6

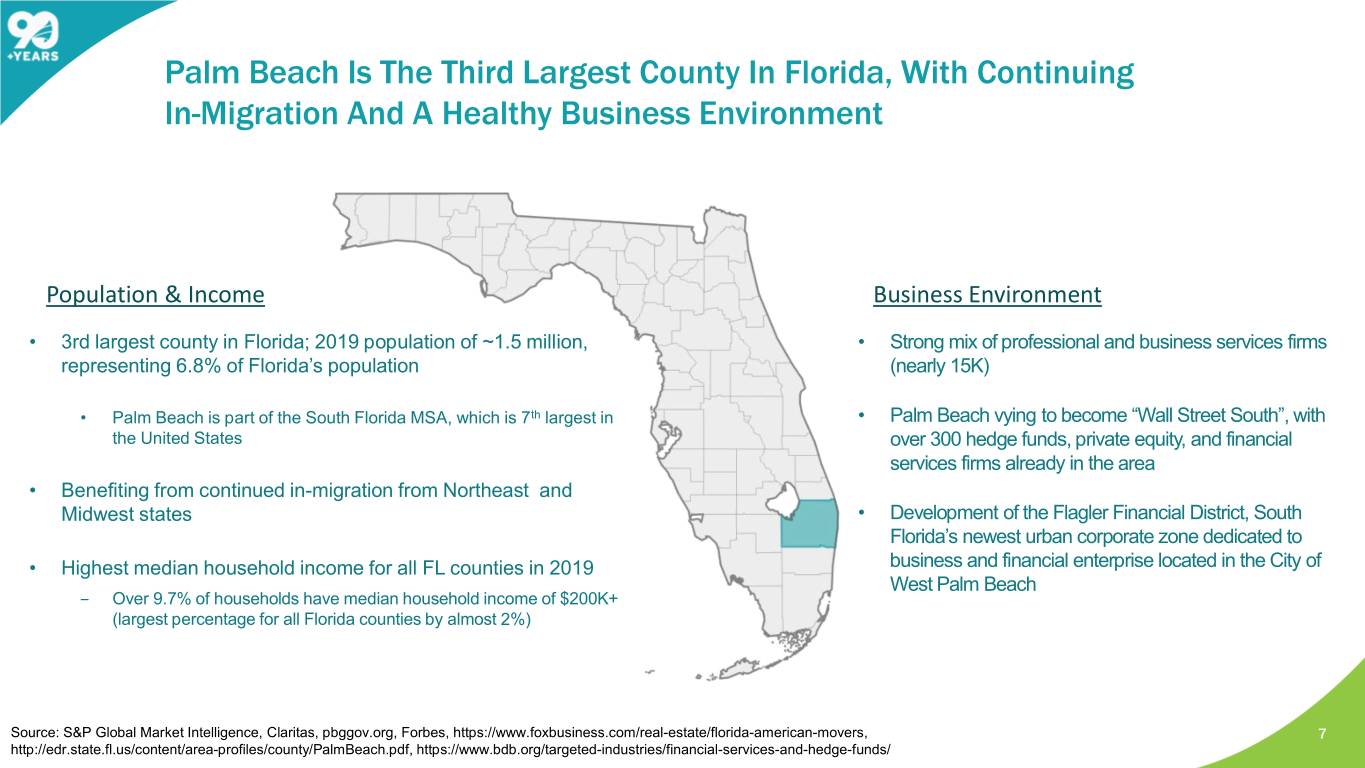

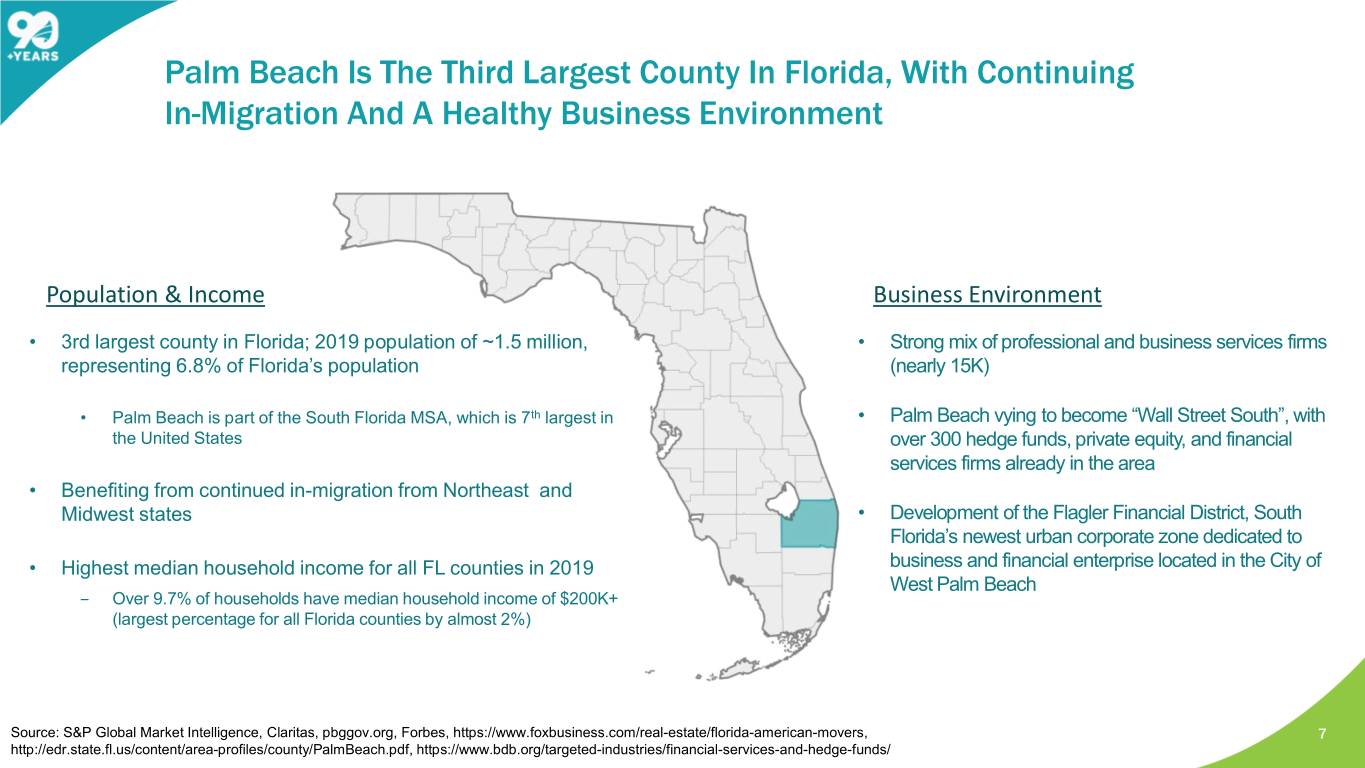

Palm Beach Is The Third Largest County In Florida, With Continuing In-Migration And A Healthy Business Environment Population & Income Business Environment • 3rd largest county in Florida; 2019 population of ~1.5 million, • Strong mix of professional and business services firms representing 6.8% of Florida’s population (nearly 15K) • Palm Beach is part of the South Florida MSA, which is 7th largest in • Palm Beach vying to become “Wall Street South”, with the United States over 300 hedge funds, private equity, and financial services firms already in the area • Benefiting from continued in-migration from Northeast and Midwest states • Development of the Flagler Financial District, South Florida’s newest urban corporate zone dedicated to • Highest median household income for all FL counties in 2019 business and financial enterprise located in the City of West Palm Beach ‒ Over 9.7% of households have median household income of $200K+ (largest percentage for all Florida counties by almost 2%) Source: S&P Global Market Intelligence, Claritas, pbggov.org, Forbes, https://www.foxbusiness.com/real-estate/florida-american-movers, 7 http://edr.state.fl.us/content/area-profiles/county/PalmBeach.pdf, https://www.bdb.org/targeted-industries/financial-services-and-hedge-funds/

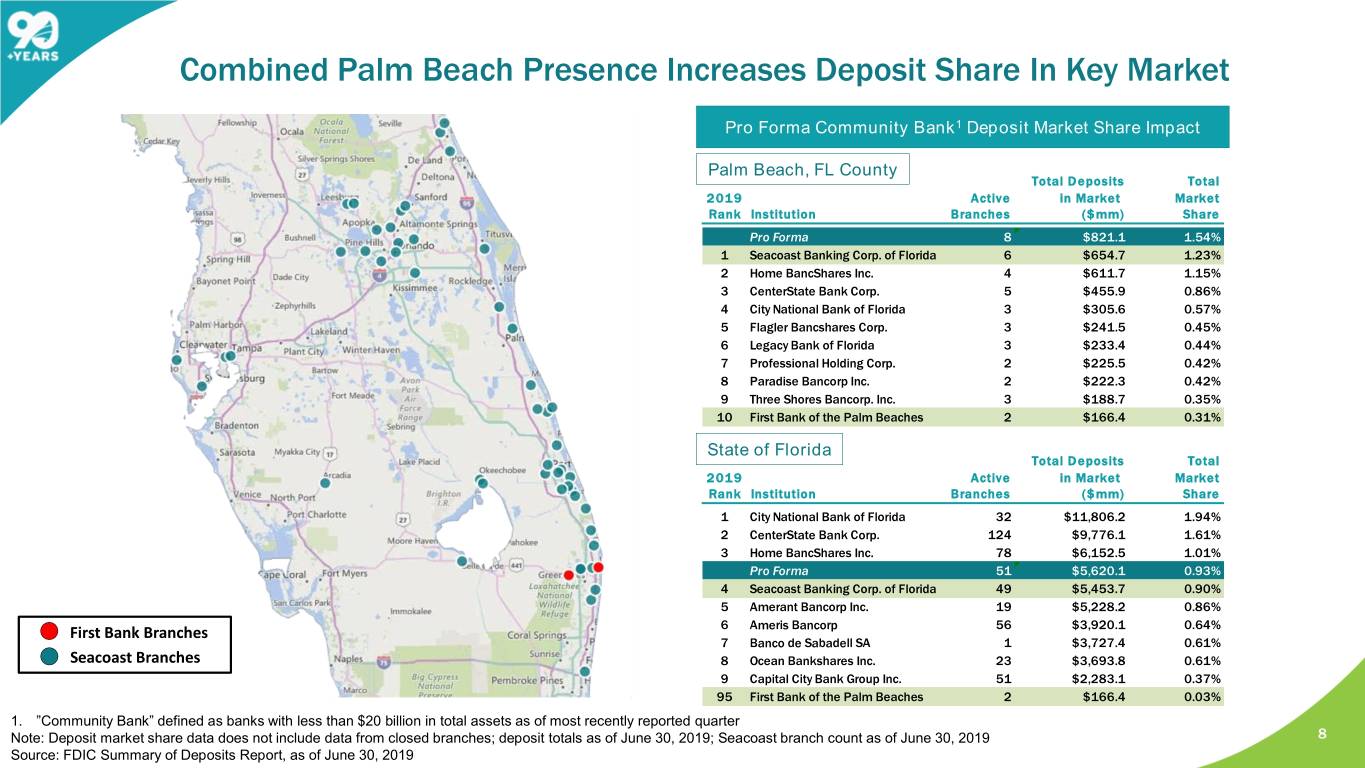

Combined Palm Beach Presence Increases Deposit Share In Key Market Pro Forma Community Bank1 Deposit Market Share Impact Palm Beach, FL County Total Deposits Total 2019 Active in Market Market Rank Institution Branches ($mm) Share Pro Forma 8 $821.1 1.54% 1 Seacoast Banking Corp. of Florida 6 $654.7 1.23% 2 Home BancShares Inc. 4 $611.7 1.15% 3 CenterState Bank Corp. 5 $455.9 0.86% 4 City National Bank of Florida 3 $305.6 0.57% 5 Flagler Bancshares Corp. 3 $241.5 0.45% 6 Legacy Bank of Florida 3 $233.4 0.44% 7 Professional Holding Corp. 2 $225.5 0.42% 8 Paradise Bancorp Inc. 2 $222.3 0.42% 9 Three Shores Bancorp. Inc. 3 $188.7 0.35% 10 First Bank of the Palm Beaches 2 $166.4 0.31% State of Florida Total Deposits Total 2019 Active in Market Market Rank Institution Branches ($mm) Share 1 City National Bank of Florida 32 $11,806.2 1.94% 2 CenterState Bank Corp. 124 $9,776.1 1.61% 3 Home BancShares Inc. 78 $6,152.5 1.01% Pro Forma 51 $5,620.1 0.93% 4 Seacoast Banking Corp. of Florida 49 $5,453.7 0.90% 5 Amerant Bancorp Inc. 19 $5,228.2 0.86% 6 Ameris Bancorp 56 $3,920.1 0.64% First Bank Branches 7 Banco de Sabadell SA 1 $3,727.4 0.61% Seacoast Branches 8 Ocean Bankshares Inc. 23 $3,693.8 0.61% 9 Capital City Bank Group Inc. 51 $2,283.1 0.37% 95 First Bank of the Palm Beaches 2 $166.4 0.03% 1. ”Community Bank” defined as banks with less than $20 billion in total assets as of most recently reported quarter Note: Deposit market share data does not include data from closed branches; deposit totals as of June 30, 2019; Seacoast branch count as of June 30, 2019 8 Source: FDIC Summary of Deposits Report, as of June 30, 2019 8

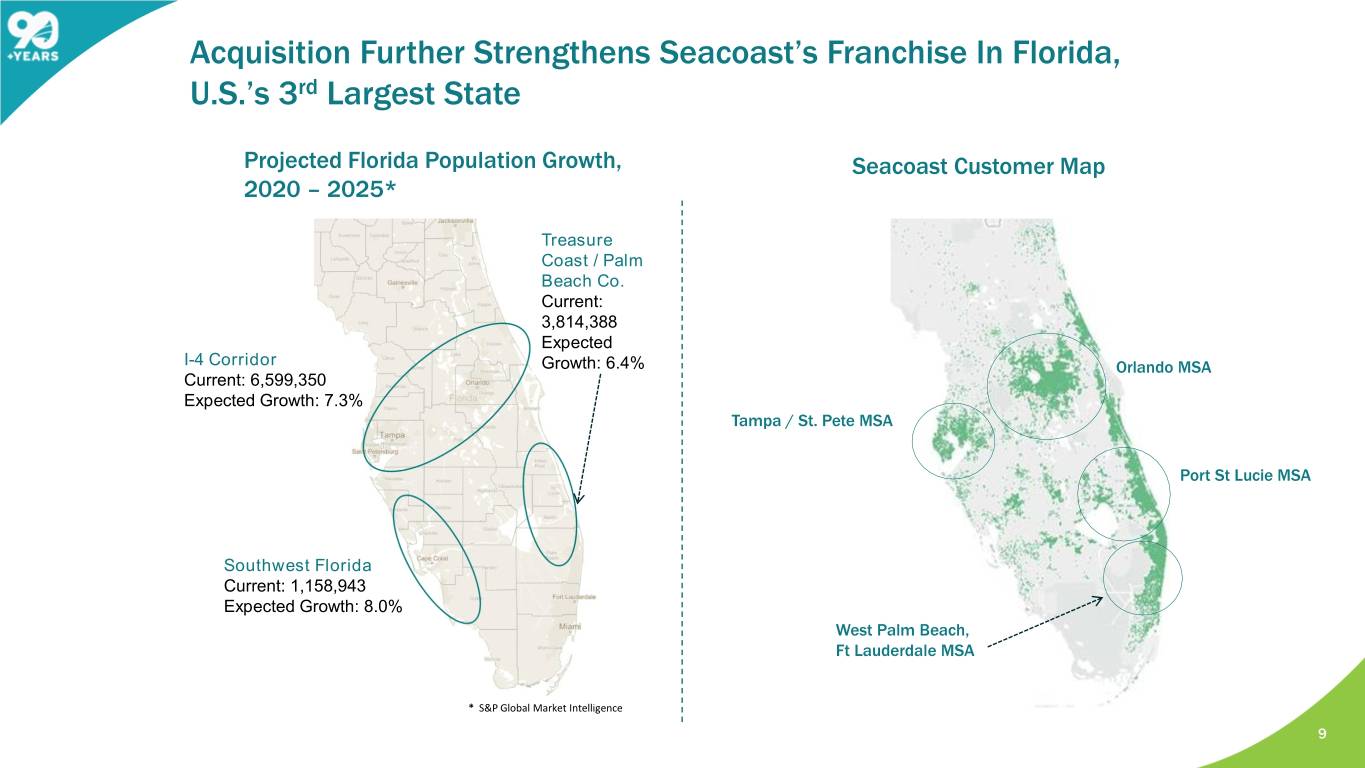

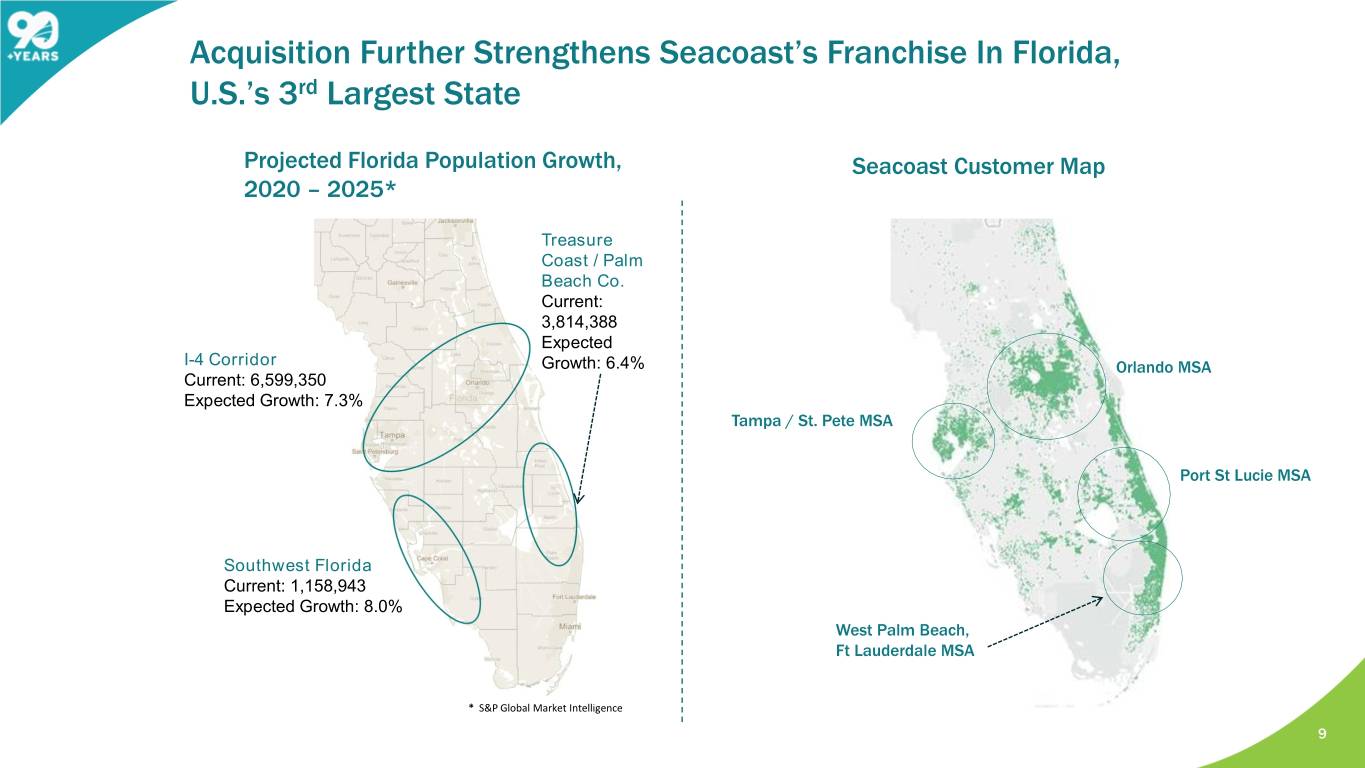

Agenda Acquisition Further Strengthens Seacoast’s Franchise In Florida, U.S.’s 3rd Largest State Projected Florida Population Growth, Seacoast Customer Map 2020 – 2025* Treasure Coast / Palm Beach Co. Current: 3,814,388 Expected I-4 Corridor Growth: 6.4% Orlando MSA Current: 6,599,350 Expected Growth: 7.3% Tampa / St. Pete MSA Port St Lucie MSA Southwest Florida Current: 1,158,943 Expected Growth: 8.0% West Palm Beach, Ft Lauderdale MSA * S&P Global Market Intelligence 9

Transaction Summary: First Bank of the Palm Beaches o In-market acquisition of core deposit franchise with high-yielding loan portfolio in the attractive Palm Beach County market o Improves Seacoast’s projected profitability and returns 2%+ EPS accretion in 2021 o Minimal impact to TBV o Leverages Seacoast’s proven integration capabilities o Strengthens Seacoast’s attractive Florida franchise and position within the Palm Beach County market 10

Appendix 11

First Bank Transaction Summary – Loan Portfolio Mark and CECL Assumptions • Loans to be separated into purchased credit deteriorated (PCD) and non-purchased credit deteriorated (non-PCD) PCD Loans • The credit mark from purchase accounting relating to PCD loans will be recorded as ALLL CECL Impact • The credit mark from purchase accounting relating to the non-PCD loans will be recorded on a net basis (a contra loan balance without any allowance), and in addition to this purchase Non-PCD accounting discount, will require a separate ALLL established through provision Loans • The non-PCD credit mark relating to the purchase accounting is assumed to be accreted back through income over the life of the loans • ~1.24% / ~$2.2 million gross pre-tax credit and interest rate mark on the loan portfolio ‒ ~$0.5 million pre-tax, or ~3.24% mark on PCD loans (~0.27% of gross loans), recorded as ALLL ‒ ~$0.8 million pre-tax, or ~0.52% mark on non-PCD loans (~0.48% of gross loans), recorded as a contra-loan discount; assumed to be accreted through income over 4 years Credit and ‒ ~$0.8 million pre-tax, or 0.50% interest rate mark on total loans, recorded as a contra loan discount Interest Rate • ~$0.8 million pre-tax, or 0.52% recorded in provision expense through the income statement, established on Day Mark One on the First Bank non-PCD loans (in addition to the non-PCD credit mark above) • ~1.72% / ~$3.0 million total pre-tax mark to First Bank’s loan book; includes 0.50% interest rate mark, 0.48% credit discount mark relating to the non-PCD loans, and 0.74% CECL-related ALLL ‒ ~$1.7 million of the mark is accreted back through income (mark equal to 0.98% of total loans) ‒ ~$1.3 million of the mark is not accreted back through income (mark equal to 0.74% of total loans); recorded as ALLL 12 1 2

Prudent Loan Portfolio Mix Maintained Post Consolidation Other 1.0% 1-4 Family 21.6% Combined Pro Forma Portfolio Mix C&I Multifamily 14.2% 2.8% Consumer Other 4.2% 0.8% $5,013 million1 HELOC OwnerOcc 7.0% CRE 20.4% 1-4 Family C&D C&I 22.1% Multifamily C&D Ratio: 42.0% 6.5% 13.9% CRE Ratio: 203.9% Other 2.8% CRE Consumer 22.3% 4.1% C&I Consumer HELOC 2.4% OwnerOcc 0.3% 6.9% HELOC CRE 20.7% 3.2% C&D C&D 6.5% 7.1% 1-4 Family 37.3% Other CRE 22.2% $150 million1 Other CRE 17.4% Combined $5,163 million2 C&D Ratio: 60.9% OwnerOcc Multifamily CRE Ratio: 251.0% CRE 4.8% 27.5% C&D Ratio: 42.7%³ CRE Ratio: 206.2%³ 1. Bank-level regulatory data as of September 30, 2019 2. Does not include fair value adjustments 3. Adjusted for reversal of the First Bank’s ALLL included in total capital and impact of estimated after-tax one-time transaction-related costs; excludes other purchase accounting adjustments Note: Standalone and Pro Forma C&D & CRE ratios are shown at the bank level 13 Source: S&P Global Market Intelligence 1 3