Supplemental Loan Tables March 27, 2020 Contact: (email) Chuck.Shaffer@SeacoastBank.com (phone) 772.221.7003 (web) www.SeacoastBanking.com

Cautionary Notice Regarding Forward-Looking Statements This press release contains “forward-looking statements” within the meaning, and protections, of Section of assumptions and estimates, as well as differences in, and changes to, economic, market and credit 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, conditions; the impact on the valuation of our investments due to market volatility or counterparty without limitation, statements about future financial and operating results, cost savings, enhanced payment risk; statutory and regulatory dividend restrictions; increases in regulatory capital requirements revenues, economic and seasonal conditions in our markets, new initiatives and improvements to for banking organizations generally; the risks of mergers, acquisitions and divestitures, including our reported earnings that may be realized from cost controls, tax law changes, and for integration of banks ability to continue to identify acquisition targets and successfully acquire desirable financial institutions; that we have acquired, or expect to acquire, as well as statements with respect to Seacoast's objectives, changes in technology or products that may be more difficult, costly, or less effective than anticipated; strategic plans, including Vision 2020, expectations and intentions and other statements that are not our ability to identify and address increased cybersecurity risks; inability of our risk management historical facts, any of which may be impacted by the COVID-19 pandemic and related effects on the U.S. framework to manage risks associated with our business; dependence on key suppliers or vendors to economy. Actual results may differ from those set forth in the forward-looking statements. obtain equipment or services for our business on acceptable terms; reduction in or the termination of our ability to use the mobile-based platform that is critical to our business growth strategy; the effects Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, of war or other conflicts, acts of terrorism, natural disasters, health emergencies, epidemics or expectations, anticipations, assumptions, estimates and intentions about future performance, and pandemics, or other catastrophic events that may affect general economic conditions; unexpected involve known and unknown risks, uncertainties and other factors, which may be beyond our control, outcomes of and the costs associated with, existing or new litigation involving us; our ability to maintain and which may cause the actual results, performance or achievements of Seacoast to be materially adequate internal controls over financial reporting; potential claims, damages, penalties, fines and different from future results, performance or achievements expressed or implied by such forward-looking reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement statements. You should not expect us to update any forward-looking statements. actions; the risks that our deferred tax assets could be reduced if estimates of future taxable income from our operations and tax planning strategies are less than currently estimated and sales of our capital All statements other than statements of historical fact could be forward-looking statements. You can stock could trigger a reduction in the amount of net operating loss carryforwards that we may be able identify these forward-looking statements through our use of words such as “may”, “will”, “anticipate”, to utilize for income tax purposes; the effects of competition from other commercial banks, thrifts, “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” or other similar words and insurance companies, money market and other mutual funds and other financial institutions operating expressions of the future. These forward-looking statements may not be realized due to a variety of in our market areas and elsewhere, including institutions operating regionally, nationally and factors, including, without limitation: the effects of future economic and market conditions, including internationally, together with such competitors offering banking products and services by mail, seasonality; governmental monetary and fiscal policies, including interest rate policies of the Board of telephone, computer and the Internet; and the failure of assumptions underlying the establishment of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes; changes in accounting reserves for possible loan losses. policies, rules and practices; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and All written or oral forward-looking statements attributable to us are expressly qualified in their entirety liabilities; interest rate risks, sensitivities and the shape of the yield curve; uncertainty related to the by this cautionary notice, including, without limitation, those risks and uncertainties described in our impact of LIBOR calculations on securities and loans; changes in borrower credit risks and payment annual report on Form 10-K for the year ended December 31, 2019 under “Special Cautionary Notice behaviors; changes in the availability and cost of credit and capital in the financial markets; changes in Regarding Forward-Looking Statements” and “Risk Factors”, and otherwise in our SEC reports and filings. the prices, values and sales volumes of residential and commercial real estate; our ability to comply with Such reports are available upon request from the Company, or from the Securities and Exchange any regulatory requirements; the effects of problems encountered by other financial institutions that Commission, including through the SEC’s Internet website at www.sec.gov. adversely affect us or the banking industry; our concentration in commercial real estate loans; the failure 2

Total Loans at December 31, 2019 (in thousands) Acquisition, Consumer Development $208,205 & Construction Commercial 4% $325,113 & Financial 6% $778,252 Owner Occupied 15% Commercial Real Estate $1,034,963 20% Construction and land development and commercial real estate loans, as defined in regulatory guidance, represent 38% and 191%, respectively, of total consolidated risk based capital Residential Real Estate $1,507,863 29% Commercial Real Estate $1,344,008 26% 3

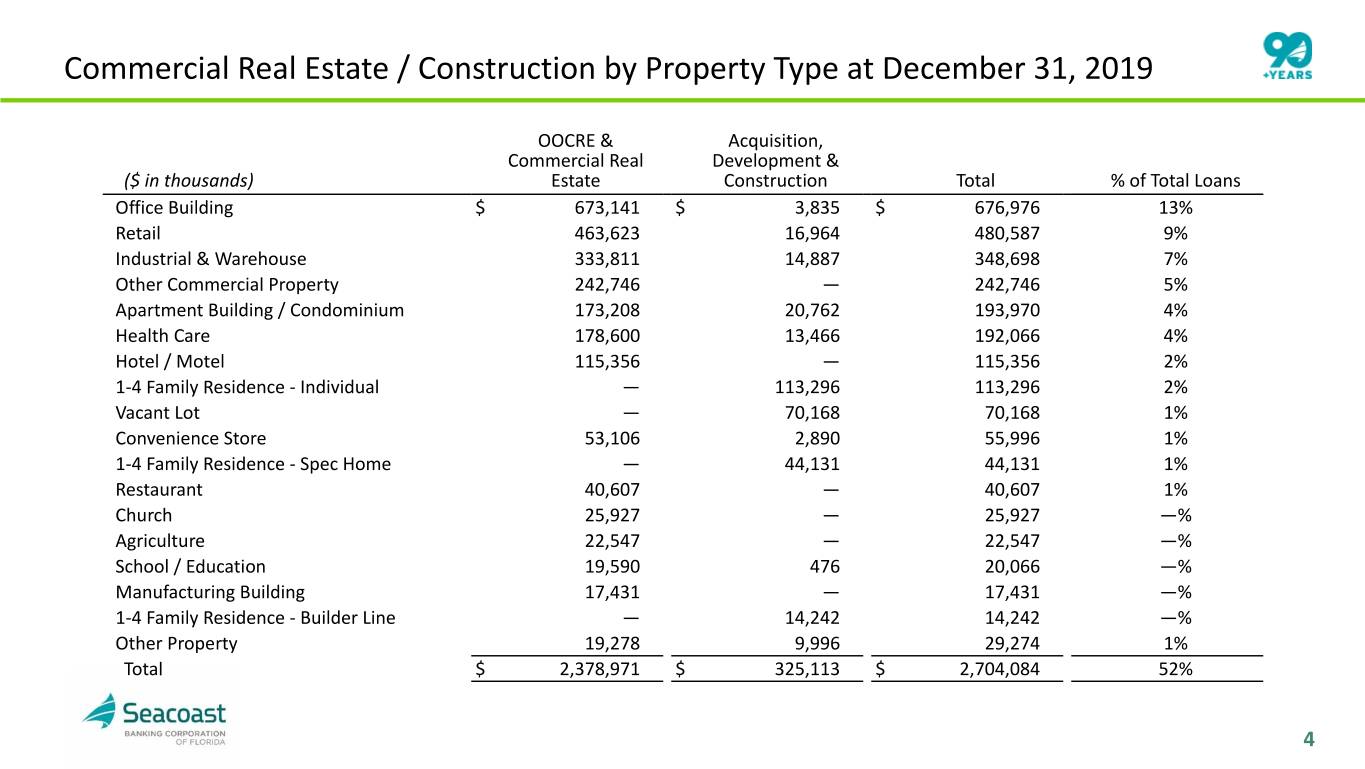

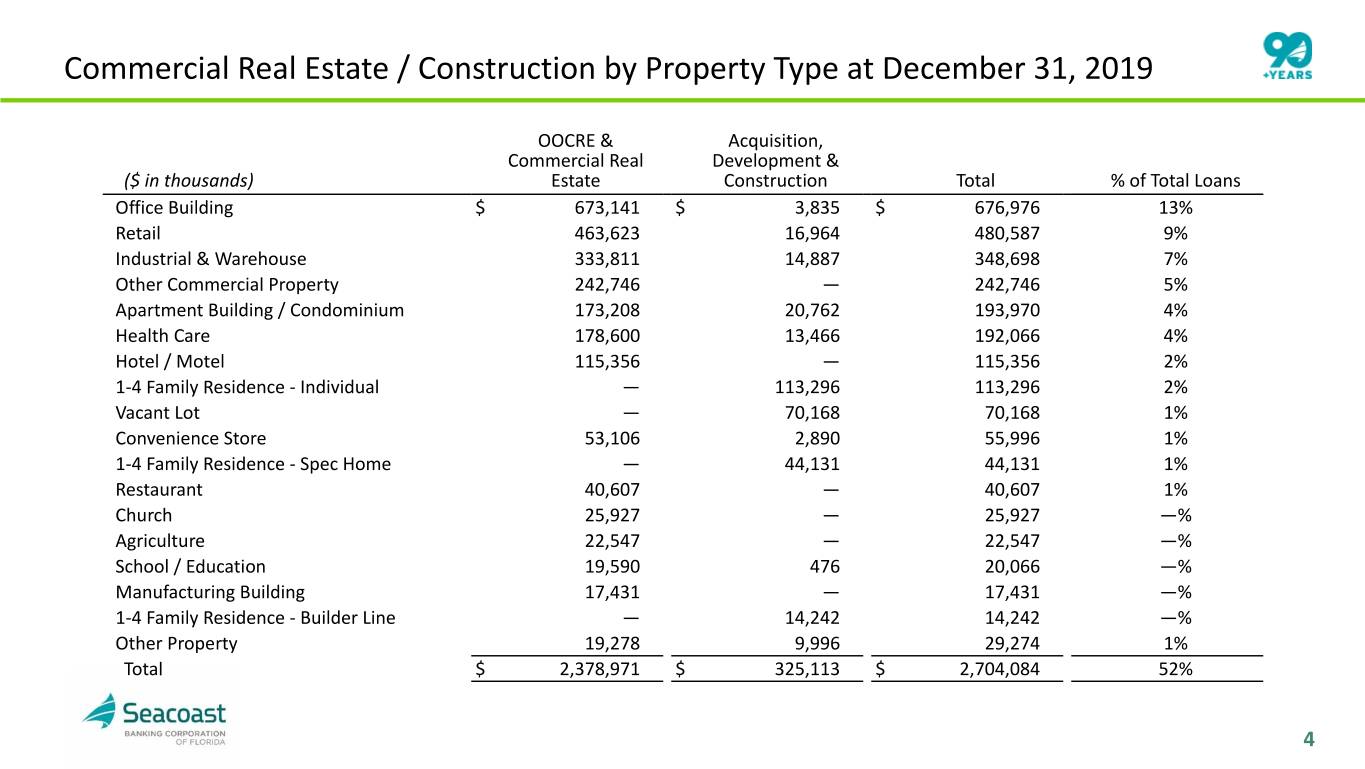

Commercial Real Estate / Construction by Property Type at December 31, 2019 OOCRE & Acquisition, Commercial Real Development & ($ in thousands) Estate Construction Total % of Total Loans Office Building $ 673,141 $ 3,835 $ 676,976 13% Retail 463,623 16,964 480,587 9% Industrial & Warehouse 333,811 14,887 348,698 7% Other Commercial Property 242,746 — 242,746 5% Apartment Building / Condominium 173,208 20,762 193,970 4% Health Care 178,600 13,466 192,066 4% Hotel / Motel 115,356 — 115,356 2% 1-4 Family Residence - Individual — 113,296 113,296 2% VacantBorrowers Lot — 70,168 70,168 1% Convenience Store 53,106 2,890 55,996 1% 1-4 Family Residence - Spec Home — 44,131 44,131 1% Restaurant 40,607 — 40,607 1% Church 25,927 — 25,927 —% Agriculture 22,547 — 22,547 —% School / Education 19,590 476 20,066 —% Manufacturing Building 17,431 — 17,431 —% 1-4 Family Residence - Builder Line — 14,242 14,242 —% Other Property 19,278 9,996 29,274 1% Total $ 2,378,971 $ 325,113 $ 2,704,084 52% 4

Commercial & Financial Loans by Industry Type at December 31, 2019 Commercial & ($ in thousands) Financial % of Total Loans Management Companies1 $ 137,911 3% Finance & Insurance 96,180 2% Construction 85,293 2% Real Estate Rental & Leasing 78,011 2% Health Care & Social Assistance 61,160 1% Professional, Scientific & Technical Services 45,026 1% Other Services 42,355 1% Transportation & Warehousing 41,432 1% Manufacturing 38,842 1% Wholesale Trade 34,403 1% Retail Trade 29,344 1% Accommodation & Food Services 18,498 —% Administrative & Support 16,319 —% Educational Services 15,211 —% Agriculture 14,355 —% Public Administration 11,933 —% Other Industries 11,979 —% Total $ 778,252 15% 1Primarily corporate aircraft and marine vessels associated with high net worth individuals 5