Earnings Presentation FOURTH QUARTER 2020 RESULTS Contact: (email) Tracey.Dexter@SeacoastBank.com (phone) 772.403.0461 (web) www.SeacoastBanking.com

2 FOURTH QUARTER 2020 EARNINGS PRESENTATION Cautionary Notice Regarding Forward-Looking Statements This press release contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in our markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that we have acquired, or expect to acquire, as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts, any of which may be impacted by the COVID-19 pandemic and related effects on the U.S. economy. Actual results may differ from those set forth in the forward-looking statements. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forward- looking statements. You should not expect us to update any forward-looking statements. All statements other than statements of historical fact could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may”, “will”, “anticipate”, “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the effects of future economic and market conditions, including seasonality and the adverse impact of COVID-19 (economic and otherwise); governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes; changes in accounting policies, rules and practices, including the impact of the adoption of CECL; our participation in the Paycheck Protection Program ("PPP"); the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; uncertainty related to the impact of LIBOR calculations on securities and loans; changes in borrower credit risks and payment behaviors; changing retail distribution strategies, customer preferences and behavior; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate; our ability to comply with any regulatory requirements; the effects of problems encountered by other financial institutions that adversely affect us or the banking industry; our concentration in commercial real estate loans; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of our investments due to market volatility or counterparty payment risk; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including our ability to continue to identify acquisition targets and successfully acquire desirable financial institutions; changes in technology or products that may be more difficult, costly, or less effective than anticipated; our ability to identify and address increased cybersecurity risks; inability of our risk management framework to manage risks associated with our business; dependence on key suppliers or vendors to obtain equipment or services for our business on acceptable terms; reduction in or the termination of our ability to use the mobile-based platform that is critical to our business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions; unexpected outcomes of and the costs associated with, existing or new litigation involving us; our ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that our deferred tax assets could be reduced if estimates of future taxable income from our operations and tax planning strategies are less than currently estimated and sales of our capital stock could trigger a reduction in the amount of net operating loss carryforwards that we may be able to utilize for income tax purposes; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market areas and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the Internet; and the failure of assumptions underlying the establishment of reserves for possible loan losses. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2019 and quarterly reports on Form 10-Q for the quarters ended March 31, 2020, June 30, 2020, and September 30, 2020 under “Special Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors”, and otherwise in our SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC’s Internet website at www.sec.gov.

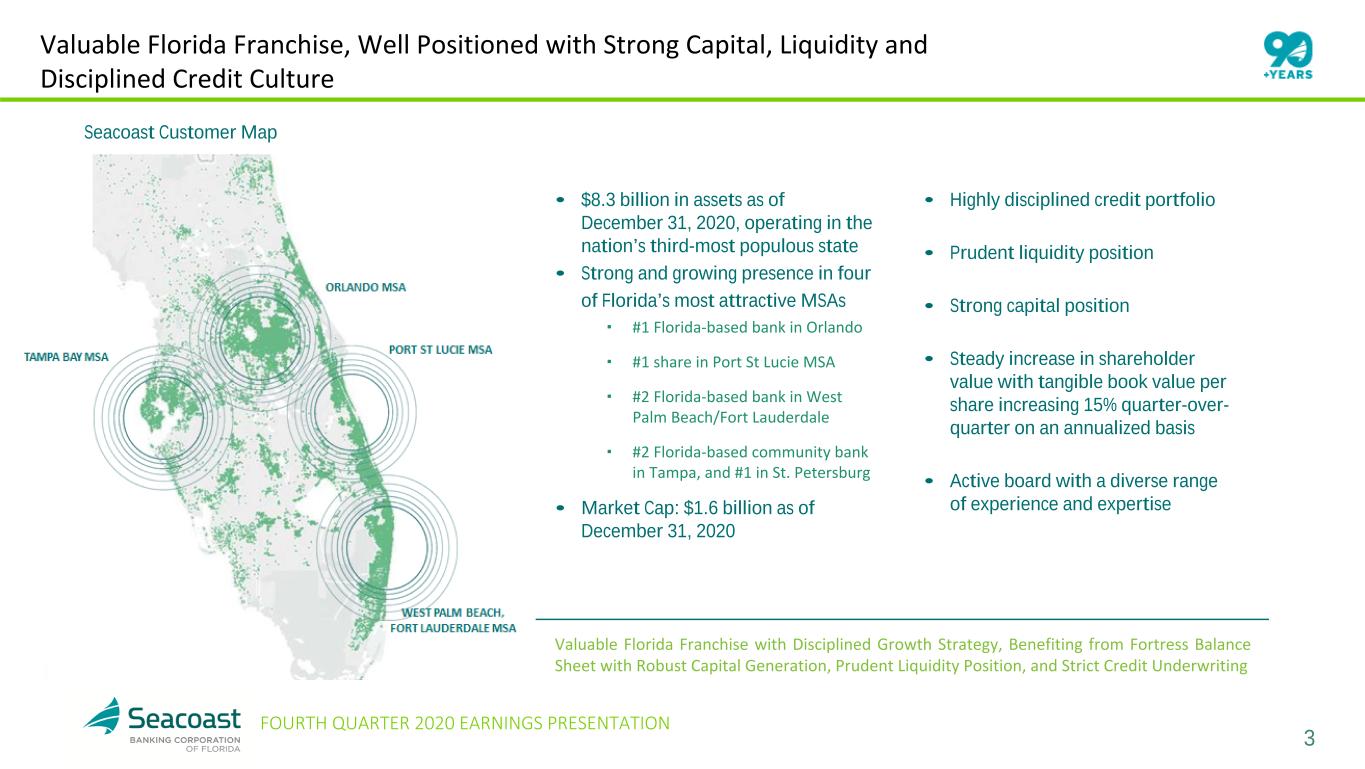

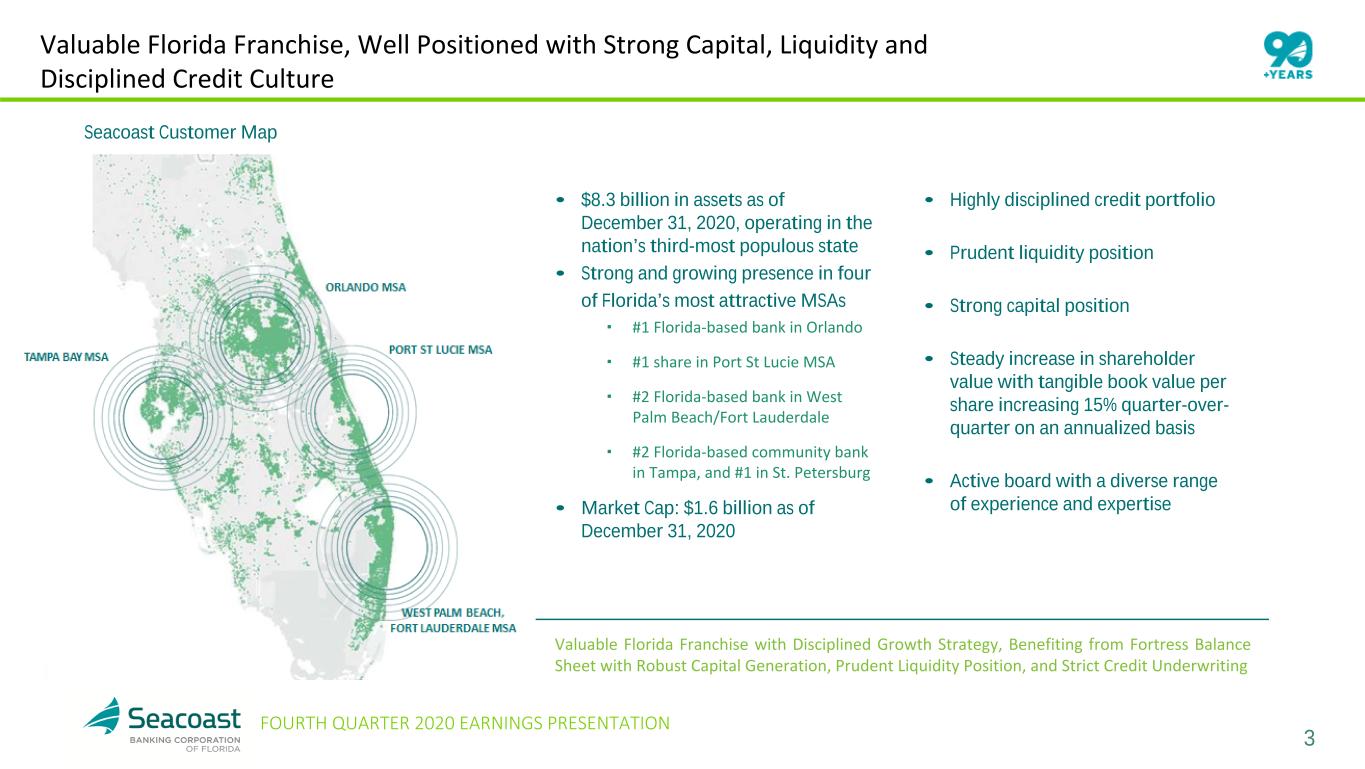

3 FOURTH QUARTER 2020 EARNINGS PRESENTATION • Highly disciplined credit portfolio • Prudent liquidity position • Strong capital position • Steady increase in shareholder value with tangible book value per share increasing 15% quarter-over- quarter on an annualized basis • Active board with a diverse range of experience and expertise Valuable Florida Franchise, Well Positioned with Strong Capital, Liquidity and Disciplined Credit Culture Valuable Florida Franchise with Disciplined Growth Strategy, Benefiting from Fortress Balance Sheet with Robust Capital Generation, Prudent Liquidity Position, and Strict Credit Underwriting • $8.3 billion in assets as of December 31, 2020, operating in the nation’s third-most populous state • Strong and growing presence in four of Florida’s most attractive MSAs ▪ #1 Florida-based bank in Orlando ▪ #1 share in Port St Lucie MSA ▪ #2 Florida-based bank in West Palm Beach/Fort Lauderdale ▪ #2 Florida-based community bank in Tampa, and #1 in St. Petersburg • Market Cap: $1.6 billion as of December 31, 2020 Seacoast Customer Map

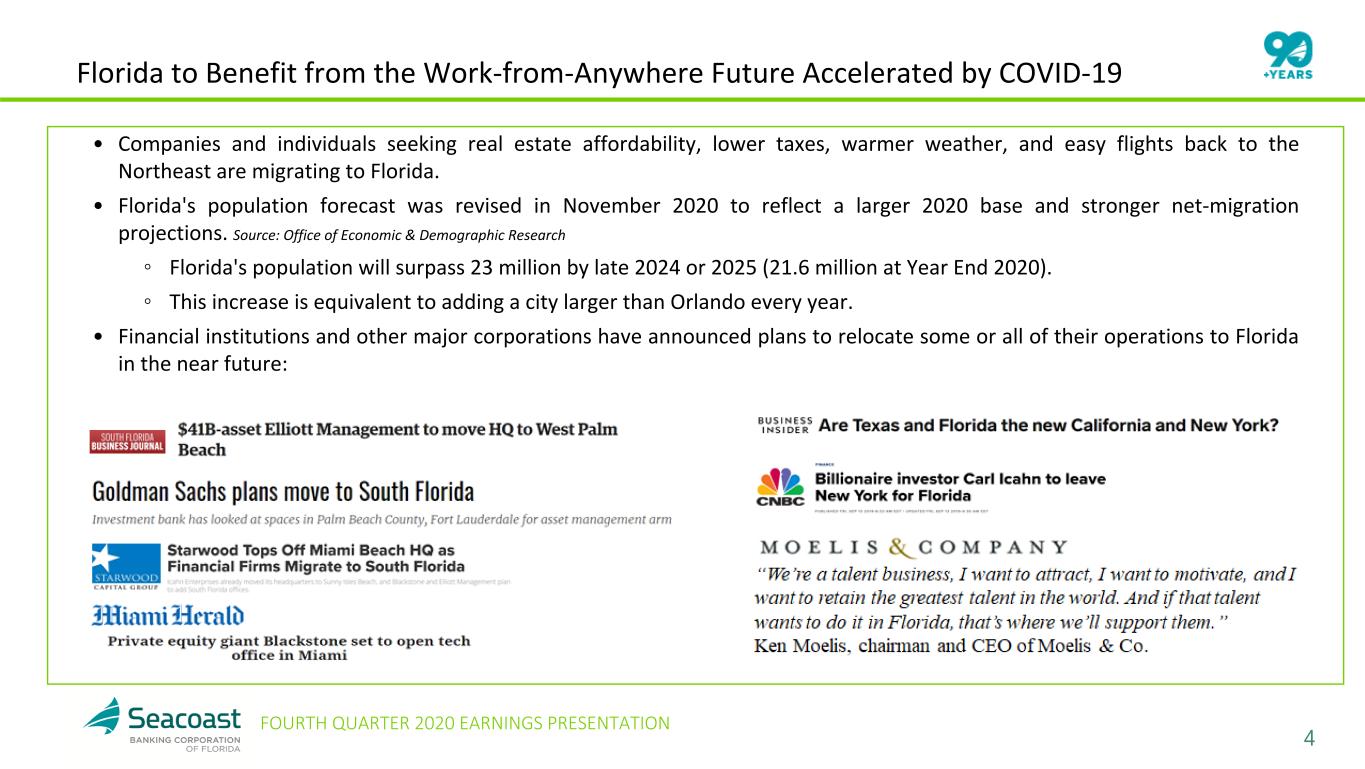

4 FOURTH QUARTER 2020 EARNINGS PRESENTATION Florida to Benefit from the Work-from-Anywhere Future Accelerated by COVID-19 • Companies and individuals seeking real estate affordability, lower taxes, warmer weather, and easy flights back to the Northeast are migrating to Florida. • Florida's population forecast was revised in November 2020 to reflect a larger 2020 base and stronger net-migration projections. Source: Office of Economic & Demographic Research ◦ Florida's population will surpass 23 million by late 2024 or 2025 (21.6 million at Year End 2020). ◦ This increase is equivalent to adding a city larger than Orlando every year. • Financial institutions and other major corporations have announced plans to relocate some or all of their operations to Florida in the near future:

5 FOURTH QUARTER 2020 EARNINGS PRESENTATION Seacoast’s Integrated Delivery Model Supports Our Growth Strategy All metrics compare full year 2020 to 2019 58% % of consumer deposits completed outside of the branch. Up 9% over prior year 11% % increase in consumer online users $600MM+ PPP originations and forgiveness supported by fully digital platform 138k+ Number of outreach calls triggered by Seacoast's proprietary Connections platform 11k+ Number of branch appointments set via digital appointment tool on Seacoast's website 21% % Residential sales originated from alternative delivery channels 43% % of business deposits completed outside of the branch. Up 13% over prior year Strong momentum in usage of digital tools and other non-branch delivery channels, and tools to equip our teams to outperform 23% % increase in business online users

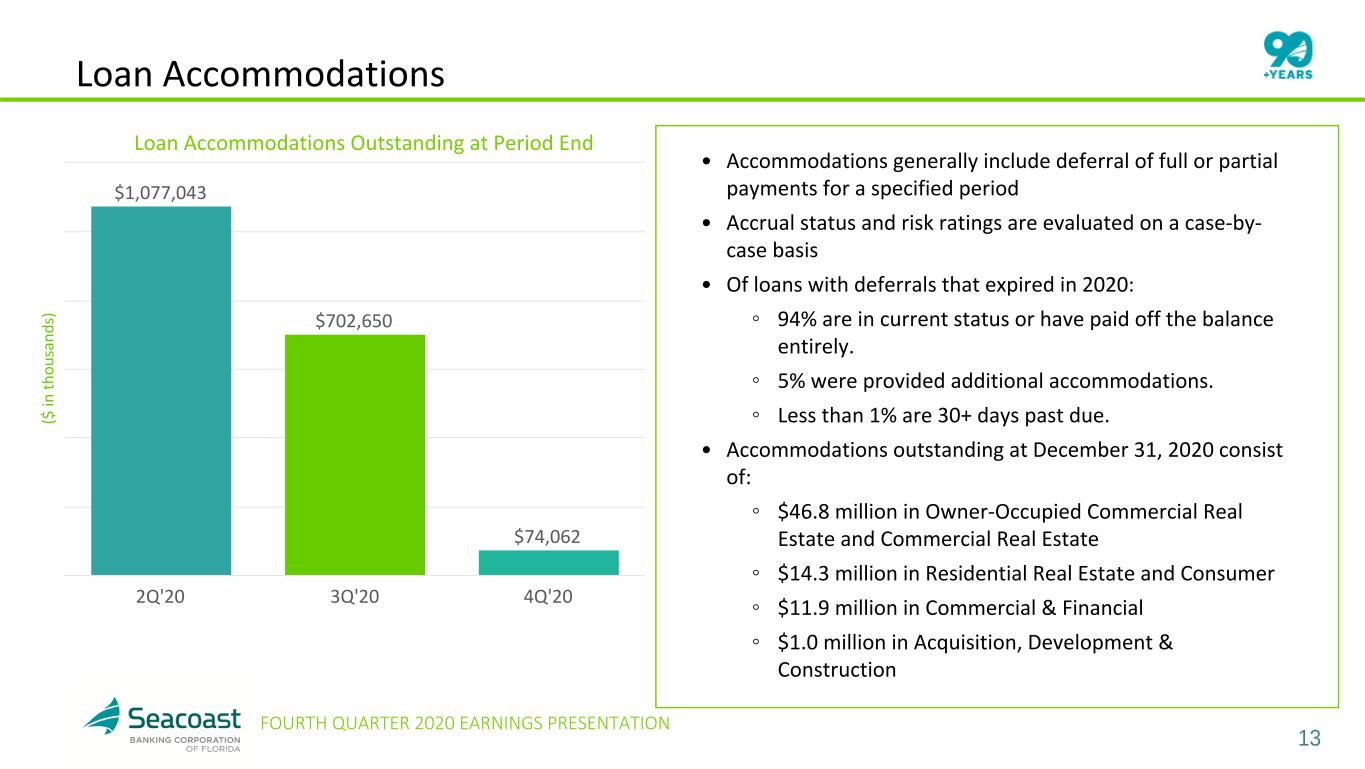

6 FOURTH QUARTER 2020 EARNINGS PRESENTATION Fourth Quarter Highlights • Earnings per share of $0.53 compared to $0.42. Adjusted earnings per share1 increased to $0.55 from $0.50. • On a GAAP basis, ended the quarter at 1.49% Return on Tangible Assets (ROTA) and 13.87% Return on Tangible Common Equity (ROTCE). On an adjusted basis, fourth quarter results were 1.50% adjusted ROTA1 and 14.00% adjusted ROTCE1. • Steadily building shareholder value through consistent growth in tangible book value per share, ending the period at $16.16, an increase of 15% on an annualized basis. • The efficiency ratio improved to 48.2% compared to 61.6%. The adjusted efficiency ratio1 improved to 48.8% compared to 54.8%. • Cost of deposits decreased by five basis points. • Commercial originations during the fourth quarter of 2020 were $277.4 million, compared to $88.2 million in the third quarter of 2020. Seacoast continues to maintain conservative underwriting guidelines in the current economic environment, while extending credit to well-qualified customers that can demonstrate the ability to navigate significant economic stress. • Continued strong wealth management results with 33% AUM growth year-over-year. • Loans with repayment accommodations down 89% from prior quarter to $74.1 million, or 1% of total loans excluding PPP, in line with expectations. All comparisons are to third quarter 2020 unless otherwise stated. 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP

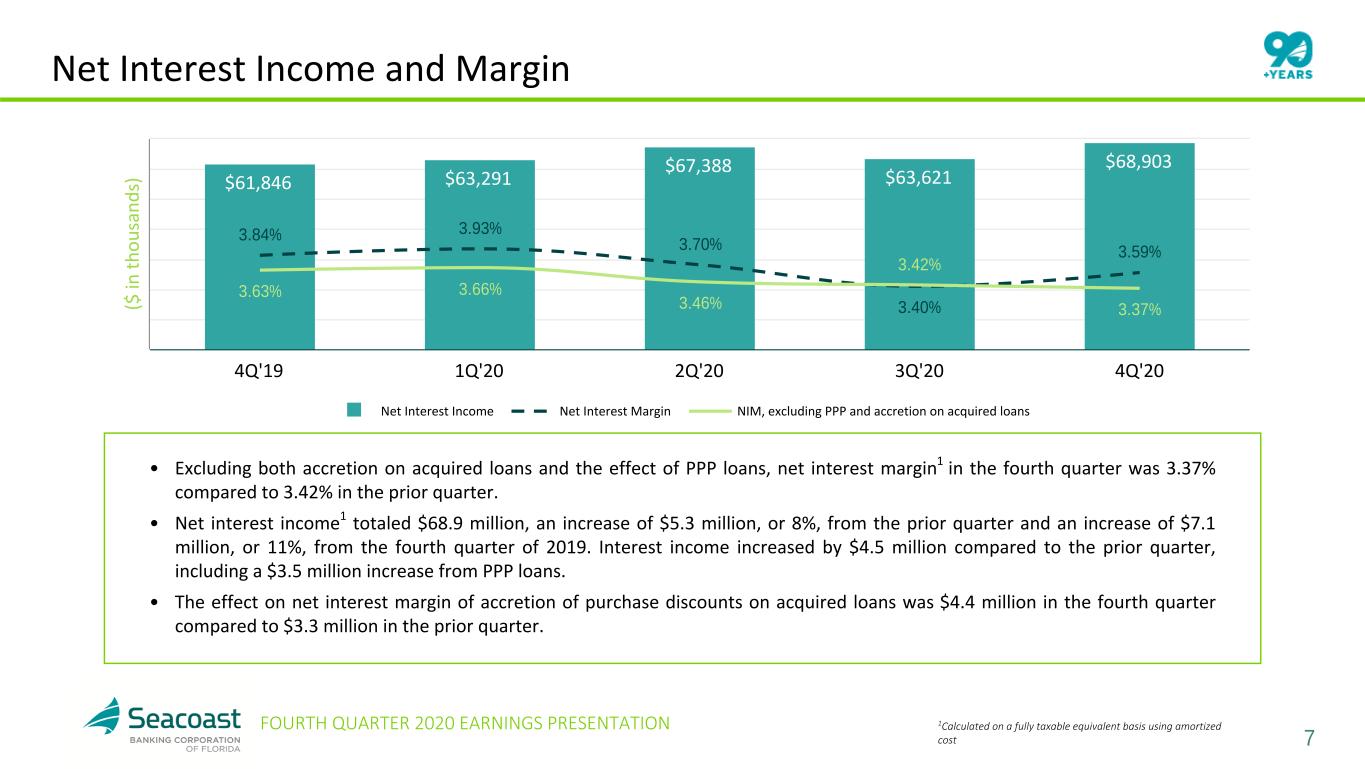

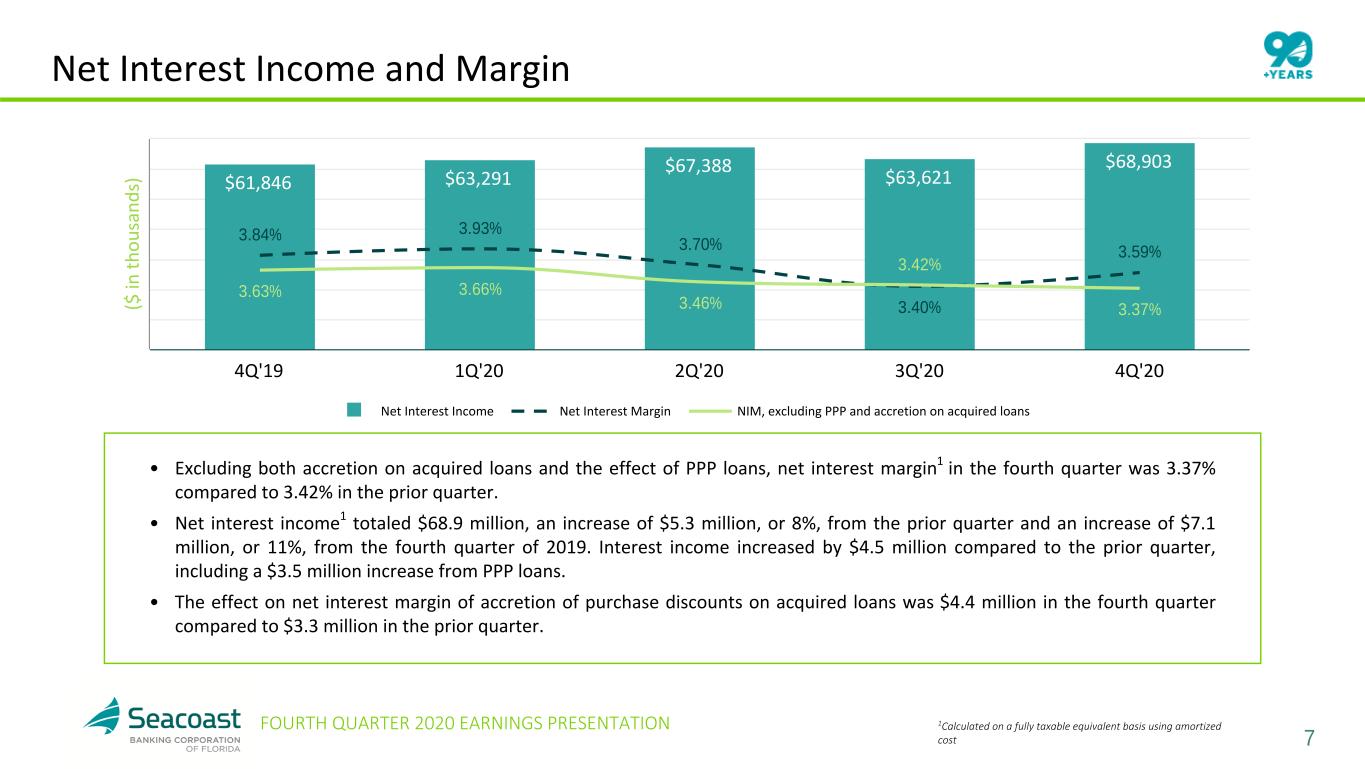

7 FOURTH QUARTER 2020 EARNINGS PRESENTATION Net Interest Income and Margin • Excluding both accretion on acquired loans and the effect of PPP loans, net interest margin1 in the fourth quarter was 3.37% compared to 3.42% in the prior quarter. • Net interest income1 totaled $68.9 million, an increase of $5.3 million, or 8%, from the prior quarter and an increase of $7.1 million, or 11%, from the fourth quarter of 2019. Interest income increased by $4.5 million compared to the prior quarter, including a $3.5 million increase from PPP loans. • The effect on net interest margin of accretion of purchase discounts on acquired loans was $4.4 million in the fourth quarter compared to $3.3 million in the prior quarter. ($ in t h o u sa n d s) $61,846 $63,291 $67,388 $63,621 $68,903 3.84% 3.93% 3.70% 3.40% 3.59% 3.63% 3.66% 3.46% 3.42% 3.37% Net Interest Income Net Interest Margin NIM, excluding PPP and accretion on acquired loans 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Calculated on a fully taxable equivalent basis using amortized cost

8 FOURTH QUARTER 2020 EARNINGS PRESENTATION Continued Strength in Noninterest Income $13,837 $16,942 $14,948 $2,960 $2,242 $2,423 $3,387 $3,682 $3,596 $1,579 $1,973 $1,949 $1,514 $5,283 $3,646$576 $252 $113$2,917 $2,611 $2,332$904 $899 $889 BOLI Other Income SBA Gains Mortgage Banking Wealth Management Interchange Income Service Charges 4Q'19 3Q'20 4Q'20 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP 2Other Income includes marine finance fees, swap related income and other fees related to customer activity as well as securities losses of $2.5 million in 4Q'19. 3Other Income on an adjusted basis includes marine finance fees, swap related income and other fees related to customer activity. $16,376 $16,946 $14,930 $2,960 $2,242 $2,423 $3,387 $3,682 $3,596 $1,579 $1,972 $1,949 $1,514 $5,283 $3,646$576 $252 $113 $5,456 $2,616 $2,314 $904 $899 $889 BOLI Other Income SBA Gains Mortgage Banking Wealth Management Interchange Income Service Charges 4Q'19 3Q'20 4Q'20 Adjusted Noninterest Income1 ($ in thousands) 2 3 Noninterest income decreased $2.0 million sequentially to $14.9 million, and adjusted noninterest income1 also decreased $2.0 million to $14.9 million sequentially. Changes include: • Mortgage banking fees were $3.6 million for the quarter, compared to a record $5.3 million in the prior quarter. Low interest rates continue to fuel refinance demand, though at lower levels, while the Florida housing market remains strong and continues to benefit from an influx of new residents and businesses. • Wealth management income was $1.9 million, compared to a record $2.0 million in the third quarter. A determined and consistent focus on building relationships continues to generate growth in assets under management, with a 33% increase from prior year to $870 million at December 31, 2020. • Interchange revenue was $3.6 million, compared to a record $3.7 million in the third quarter. In 2020, Seacoast customers used their debit cards at an accelerated pace, driving record interchange results for the year that exceeded pre-pandemic levels. • Service charges on deposits increased $0.2 million compared to the third quarter of 2020. Service charges remain lower than pre-pandemic levels, the result of higher average deposit balances for both business and consumer customers. Noninterest Income ($ in thousands)

9 FOURTH QUARTER 2020 EARNINGS PRESENTATION Continued Focus on Disciplined Expense Control Noninterest expense decreased $8.0 million and adjusted noninterest expense1 decreased $3.5 million sequentially. Results for the third quarter included $4.3 million in merger- related expenses and $0.5 million in branch consolidation costs, both of which are excluded on an adjusted basis. Changes quarter-over-quarter on an adjusted basis include: • Salaries and benefits decreased by $1.5 million, or 6%, primarily reflecting the impact of higher expense deferrals associated with accelerated commercial loan originations in the fourth quarter. • Legal and professional fees decreased due to a one-time recovery of certain legal expenses. • Other expenses decreased by $1.1 million, including lower marketing expenses, lower mortgage production-related expenses, and a $0.8 million release of reserves for unfunded commitments, reflecting the impact of an improved economic forecast in relevant segments. These decreases were partially offset by a $1.3 million increase in foreclosed property expense, largely the result of write-downs on two properties upon receipt of updated valuations. $35,967 $45,432 $41,906 $20,595 $26,541 $25,060 $3,648 $4,207 $4,265$5,430 $5,445 $5,629 $1,419 $1,714 $496 $4,875 $7,525 $6,456 Other Expense Legal & Professional Occupancy & Telephone Data Processing Cost Salaries & Benefits 4Q'19 3Q'20 4Q'20 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP 2Other Expense includes marketing expenses, provision for credit losses on unfunded commitments, foreclosed property expense and net loss/(gain) on sale and other expenses associated with ongoing business operations. $38,056 $51,674 $43,681 $20,586 $27,120 $25,405$1,456 $1,497 $1,421 $3,645 $6,128 $4,233$5,435 $6,139 $5,645 $2,025 $3,018 $509$4,910 $7,772 $6,468 Other Expense Legal & Professional Occupancy & Telephone Data Processing Cost Amortization of Intangibles Salaries & Benefits 4Q'19 3Q'20 4Q'20 2 Adjusted Noninterest Expense1 ($ in thousands) 2 Noninterest Expense ($ in thousands)

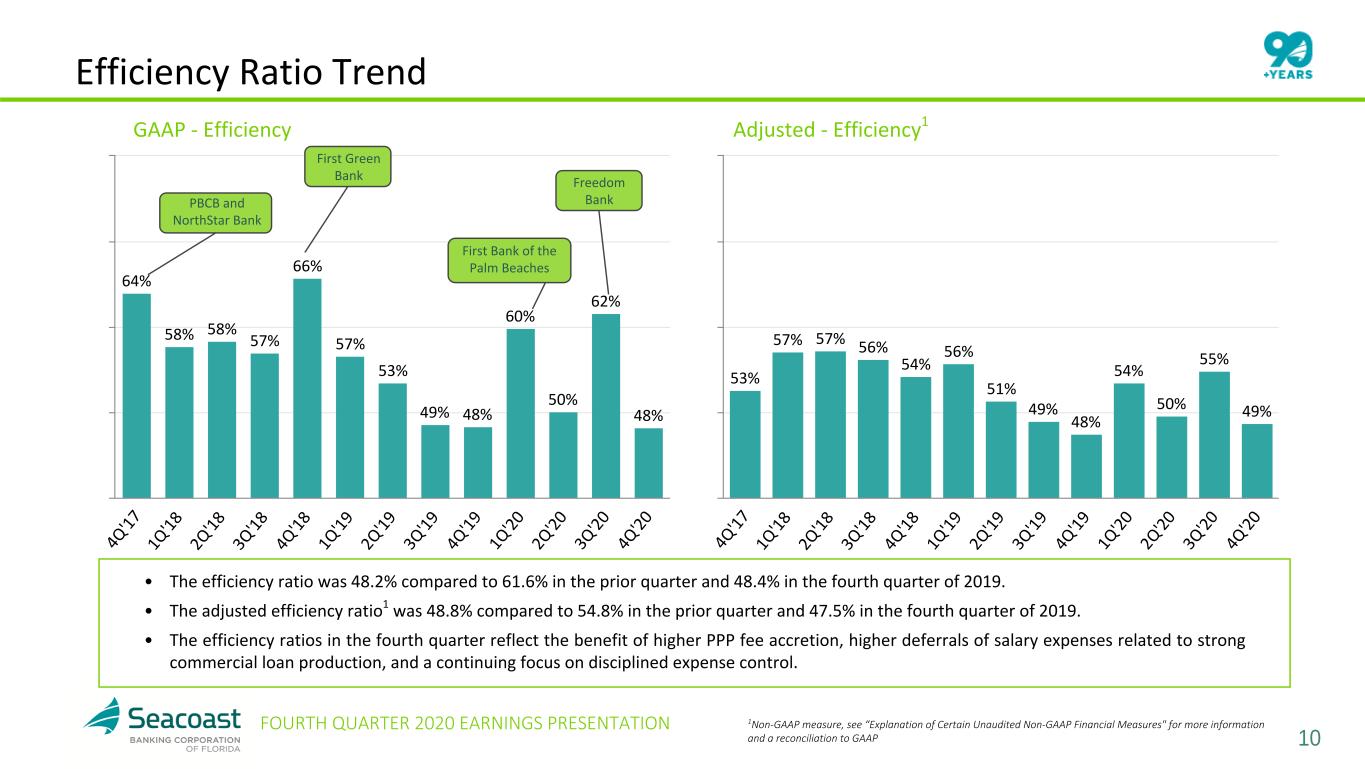

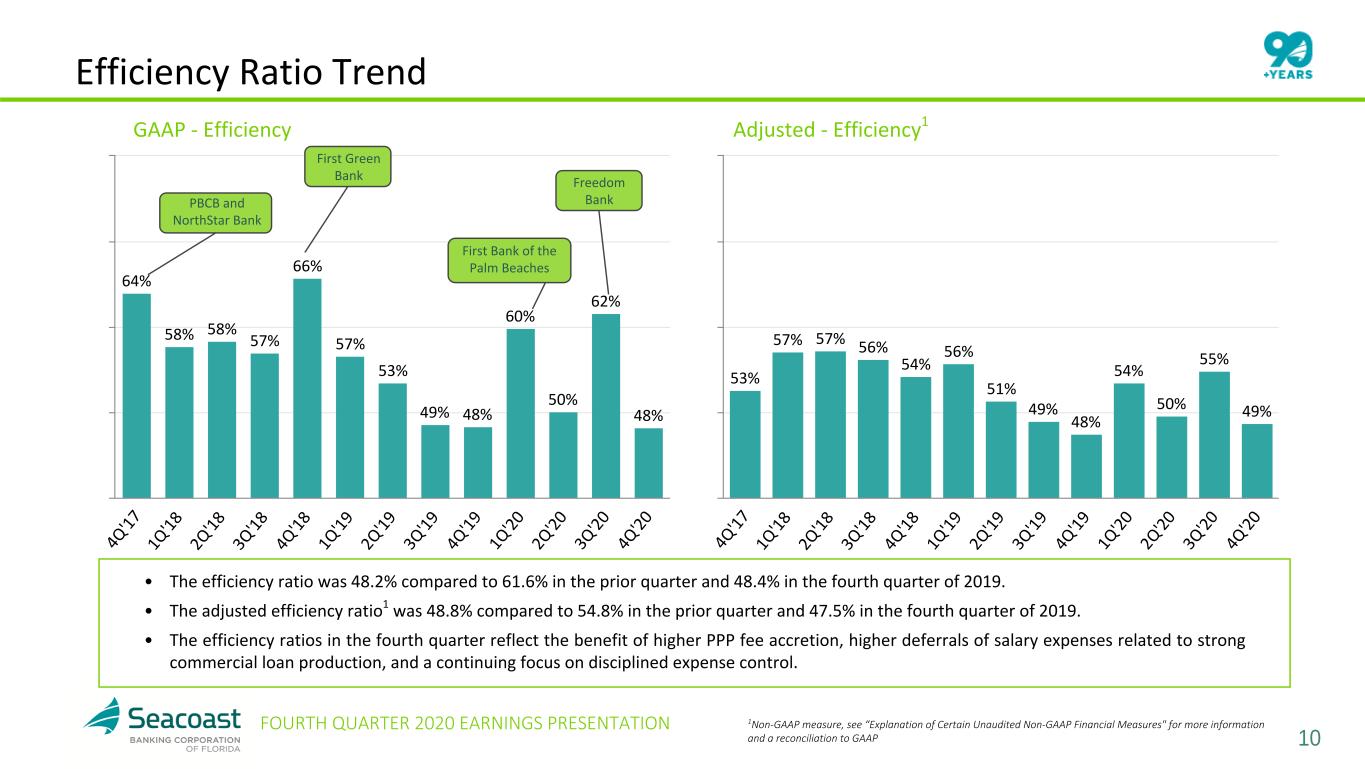

10 FOURTH QUARTER 2020 EARNINGS PRESENTATION Palm Beach Community Bank and North Star Bank Acquisitions P al m B ea ch C o m m u n it y an d N o rt h S ta r B an k A cq u is it io n Efficiency Ratio Trend • The efficiency ratio was 48.2% compared to 61.6% in the prior quarter and 48.4% in the fourth quarter of 2019. • The adjusted efficiency ratio1 was 48.8% compared to 54.8% in the prior quarter and 47.5% in the fourth quarter of 2019. • The efficiency ratios in the fourth quarter reflect the benefit of higher PPP fee accretion, higher deferrals of salary expenses related to strong commercial loan production, and a continuing focus on disciplined expense control. 64% 58% 58% 57% 66% 57% 53% 49% 48% 60% 50% 62% 48% 4Q '1 7 1Q '1 8 2Q '1 8 3Q '1 8 4Q '1 8 1Q '1 9 2Q '1 9 3Q '1 9 4Q '1 9 1Q '2 0 2Q '2 0 3Q '2 0 4Q '2 0 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP 53% 57% 57% 56% 54% 56% 51% 49% 48% 54% 50% 55% 49% 4Q '1 7 1Q '1 8 2Q '1 8 3Q '1 8 4Q '1 8 1Q '1 9 2Q '1 9 3Q '1 9 4Q '1 9 1Q '2 0 2Q '2 0 3Q '2 0 4Q '2 0 GAAP - Efficiency Adjusted - Efficiency1 First Bank of the Palm Beaches First Green Bank Freedom BankPBCB and NorthStar Bank

11 FOURTH QUARTER 2020 EARNINGS PRESENTATION Disciplined Approach to Lending in an Uncertain Environment • Loans outstanding totaled $5.7 billion, an increase of $537 million, or 10%, year-over-year. • Loan originations increased 60% to $541 million in the fourth quarter compared to $338 million in the prior quarter. Seacoast continues to maintain conservative underwriting guidelines in the current economic environment while extending credit to well-qualified customers that can demonstrate the ability to navigate significant economic stress. • Excluding PPP loans, loans outstanding decreased by $51 million quarter-over-quarter. • $72 million in PPP loan forgiveness was processed during the fourth quarter. • Exiting the fourth quarter of 2020, pipelines were $167 million in commercial, $18 million in consumer, and $117 million in residential mortgages, compared to $256 million, $17 million, and $183 million, respectively, in the prior quarter. • The yield on loans, excluding PPP and accretion on acquired loans, increased from 4.22% in the third quarter of 2020 to 4.23% in the fourth quarter. $5,198 $5,317 $5,772 $5,858 $5,735 $5,196 $5,219 $5,168 $576 $639 $567 4.89% 4.90% 4.56% 4.11% 4.42% 4.63% 4.57% 4.31% 4.22% 4.23% Yield Excluding PPP and Accretion on Acquired Loans Reported Yield PPP Loans Loans Excluding PPP 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 Total Loans Outstanding ($ in millions)

12 FOURTH QUARTER 2020 EARNINGS PRESENTATION Commercial Real Estate $1,395,854 24% Residential Real Estate $1,342,628 23% • Construction and land development and commercial real estate loans, as defined in regulatory guidance, represent 24% and 157%, respectively, of total consolidated risk based capital. • Portfolio diversification in terms of asset mix, industry, and loan type, has been a critical element of the Company's lending strategy. Exposure across industries and collateral types is broadly distributed. • The Company does not have any purchased loan syndications, shared national credits, or mezzanine finance. • Since the outbreak of COVID-19, the Company has not experienced any material increase in consumer or commercial line utilization. • Excluding PPP loans, Seacoast's average commercial loan size is $399 thousand. Seacoast's Lending Strategy Has Produced and Sustains a Diverse Loan Portfolio At December 31, 2020 ($ in thousands) Owner Occupied Commercial Real Estate $1,141,310 21% Acquisition, Development & Construction $245,108 4% Paycheck Protection Program $566,961 10%Consumer $188,735 3% Commercial & Financial $854,753 15%

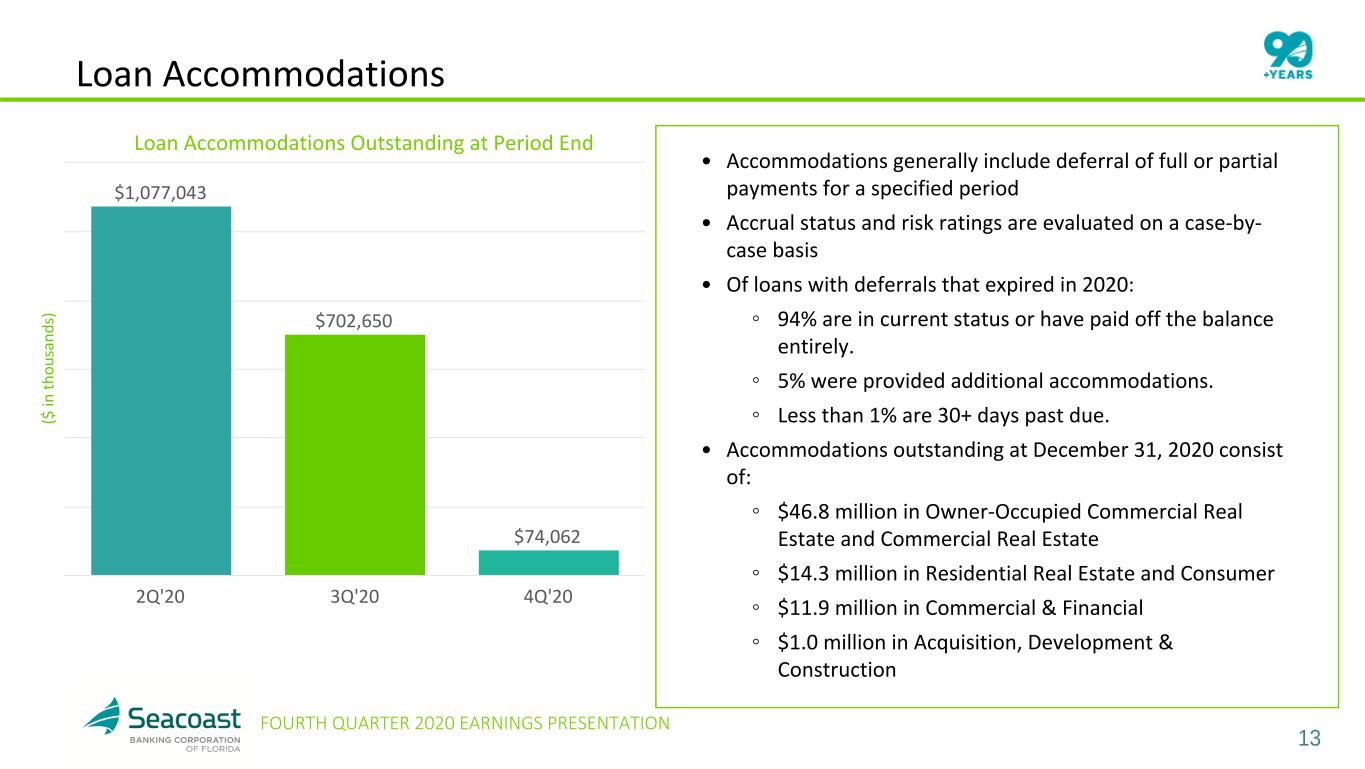

13 FOURTH QUARTER 2020 EARNINGS PRESENTATION • Accommodations generally include deferral of full or partial payments for a specified period • Accrual status and risk ratings are evaluated on a case-by- case basis • Of loans with deferrals that expired in 2020: ◦ 94% are in current status or have paid off the balance entirely. ◦ 5% were provided additional accommodations. ◦ Less than 1% are 30+ days past due. • Accommodations outstanding at December 31, 2020 consist of: ◦ $46.8 million in Owner-Occupied Commercial Real Estate and Commercial Real Estate ◦ $14.3 million in Residential Real Estate and Consumer ◦ $11.9 million in Commercial & Financial ◦ $1.0 million in Acquisition, Development & Construction Loan Accommodations Loan Accommodations Outstanding at Period End ($ in t h o u sa n d s) $1,077,043 $702,650 $74,062 2Q'20 3Q'20 4Q'20

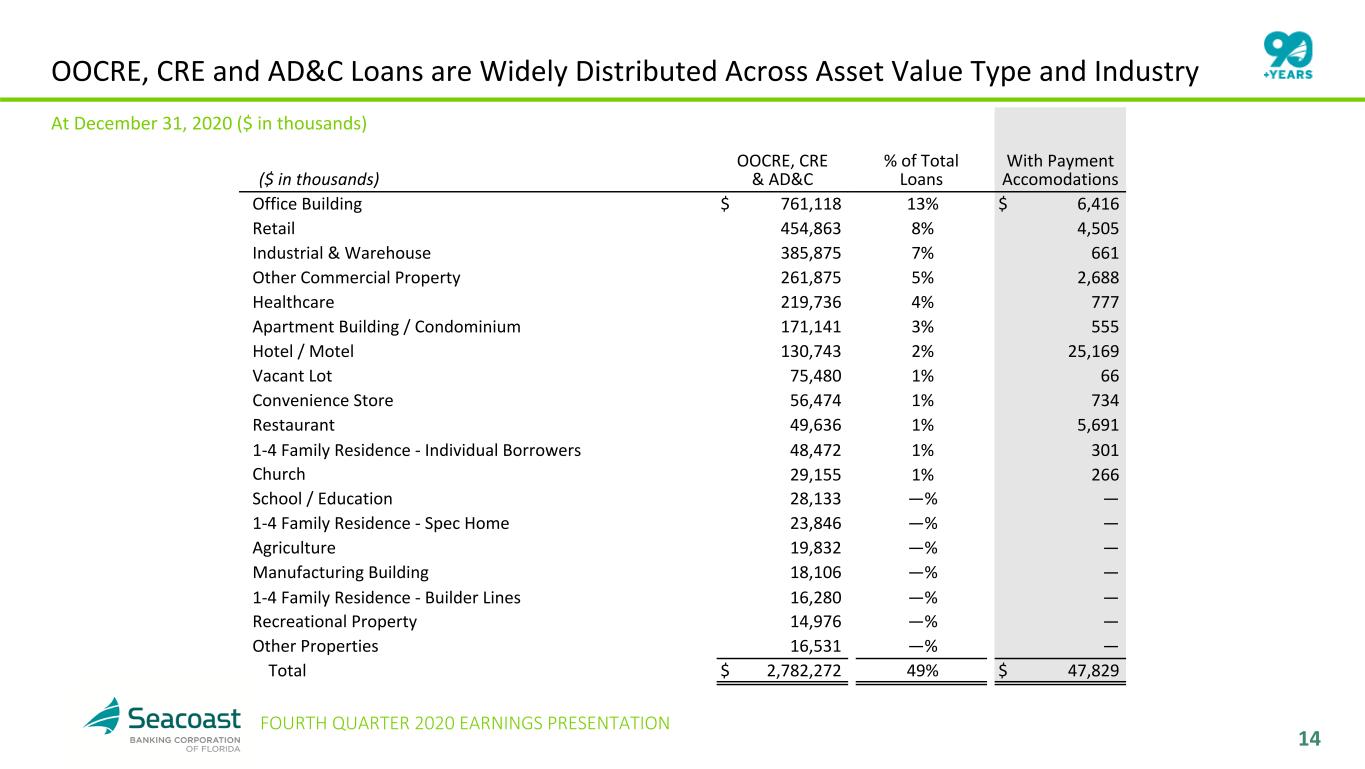

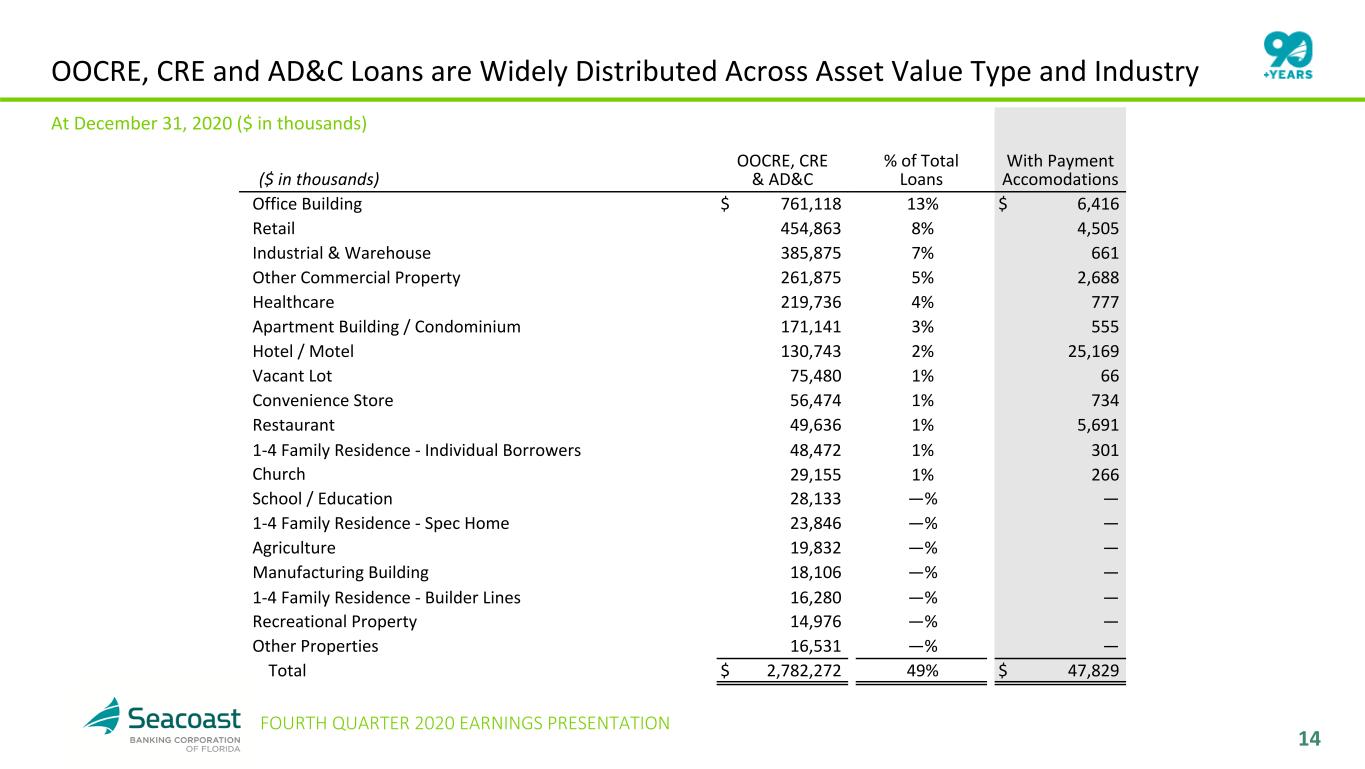

14 FOURTH QUARTER 2020 EARNINGS PRESENTATION ($ in thousands) OOCRE, CRE & AD&C % of Total Loans With Payment Accomodations Office Building $ 761,118 13% $ 6,416 Retail 454,863 8% 4,505 Industrial & Warehouse 385,875 7% 661 Other Commercial Property 261,875 5% 2,688 Healthcare 219,736 4% 777 Apartment Building / Condominium 171,141 3% 555 Hotel / Motel 130,743 2% 25,169 Vacant Lot 75,480 1% 66 Convenience Store 56,474 1% 734 Restaurant 49,636 1% 5,691 1-4 Family Residence - Individual Borrowers 48,472 1% 301 Church 29,155 1% 266 School / Education 28,133 —% — 1-4 Family Residence - Spec Home 23,846 —% — Agriculture 19,832 —% — Manufacturing Building 18,106 —% — 1-4 Family Residence - Builder Lines 16,280 —% — Recreational Property 14,976 —% — Other Properties 16,531 —% — Total $ 2,782,272 49% $ 47,829 OOCRE, CRE and AD&C Loans are Widely Distributed Across Asset Value Type and Industry At December 31, 2020 ($ in thousands)

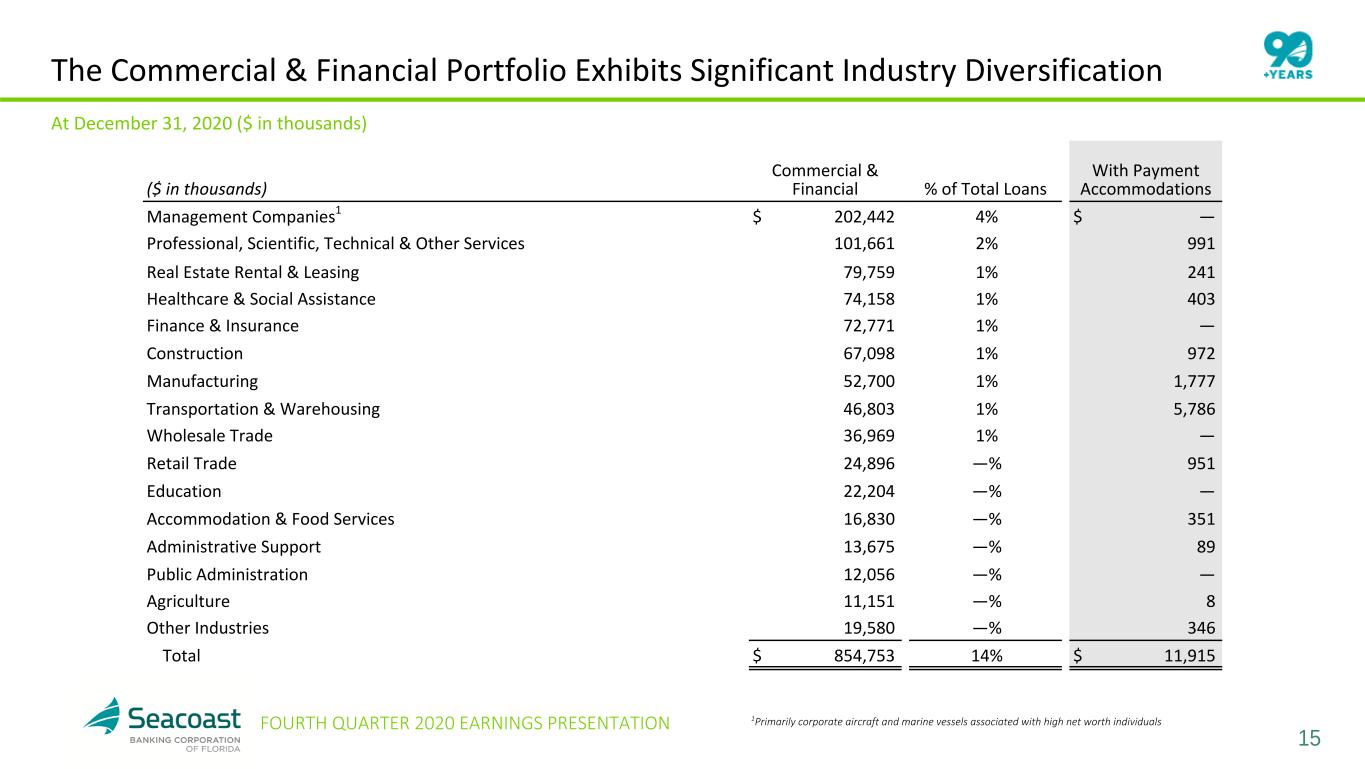

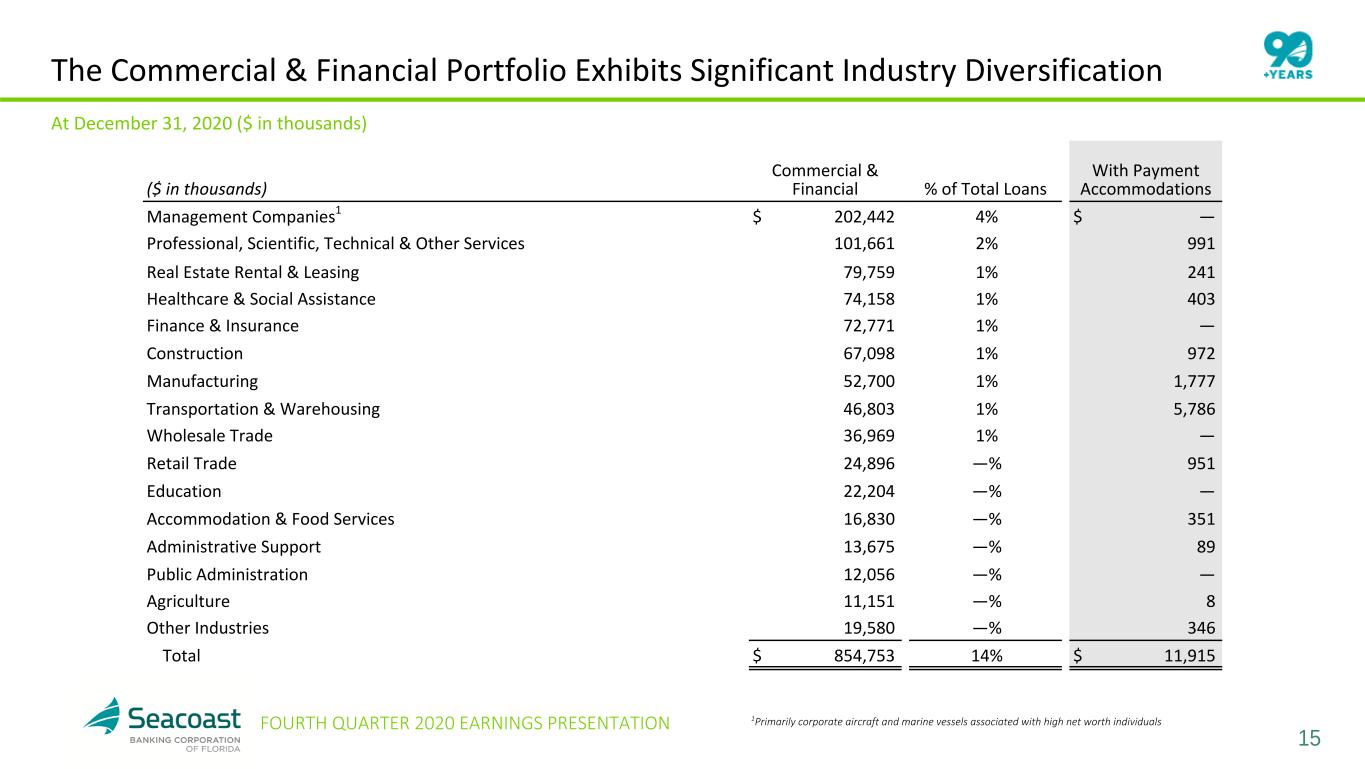

15 FOURTH QUARTER 2020 EARNINGS PRESENTATION The Commercial & Financial Portfolio Exhibits Significant Industry Diversification ($ in thousands) Commercial & Financial % of Total Loans With Payment Accommodations Management Companies1 $ 202,442 4% $ — Professional, Scientific, Technical & Other Services 101,661 2% 991 Real Estate Rental & Leasing 79,759 1% 241 Healthcare & Social Assistance 74,158 1% 403 Finance & Insurance 72,771 1% — Construction 67,098 1% 972 Manufacturing 52,700 1% 1,777 Transportation & Warehousing 46,803 1% 5,786 Wholesale Trade 36,969 1% — Retail Trade 24,896 —% 951 Education 22,204 —% — Accommodation & Food Services 16,830 —% 351 Administrative Support 13,675 —% 89 Public Administration 12,056 —% — Agriculture 11,151 —% 8 Other Industries 19,580 —% 346 Total $ 854,753 14% $ 11,915 1Primarily corporate aircraft and marine vessels associated with high net worth individuals At December 31, 2020 ($ in thousands)

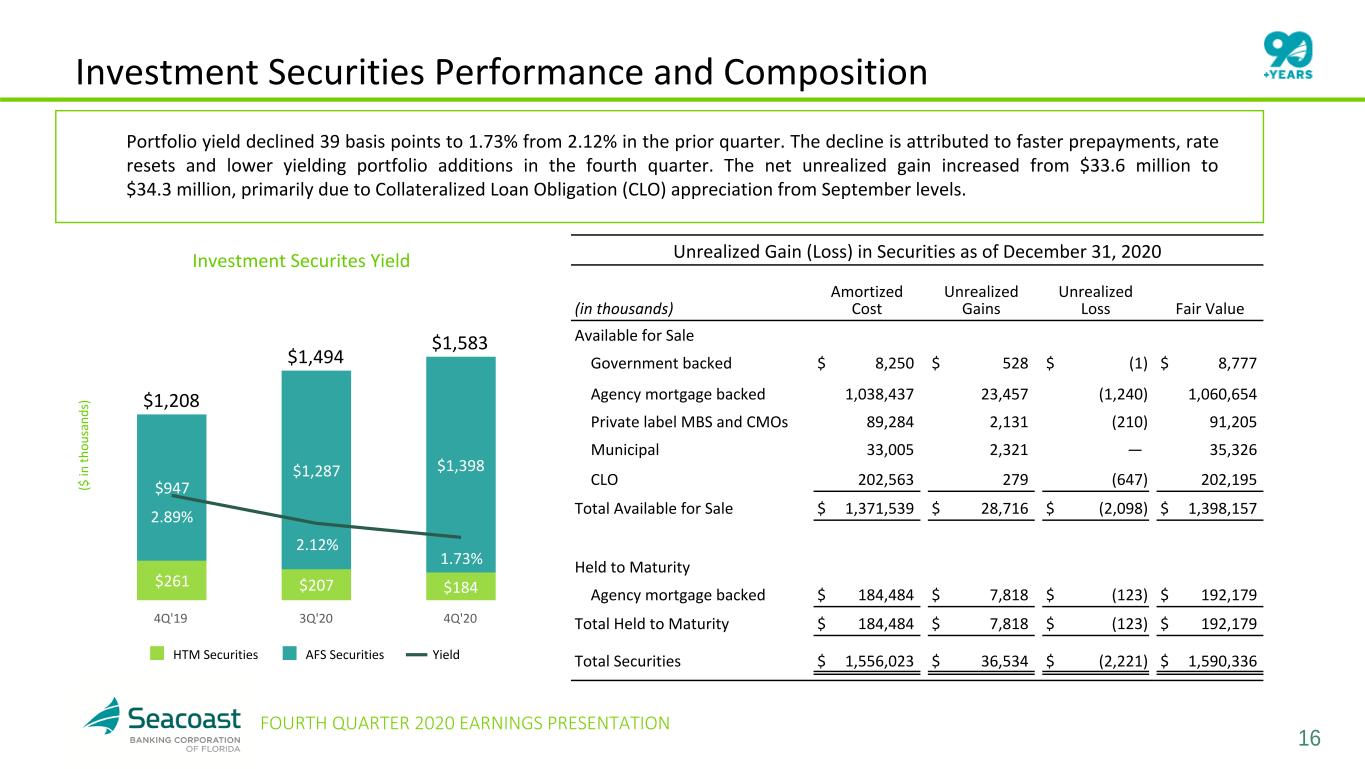

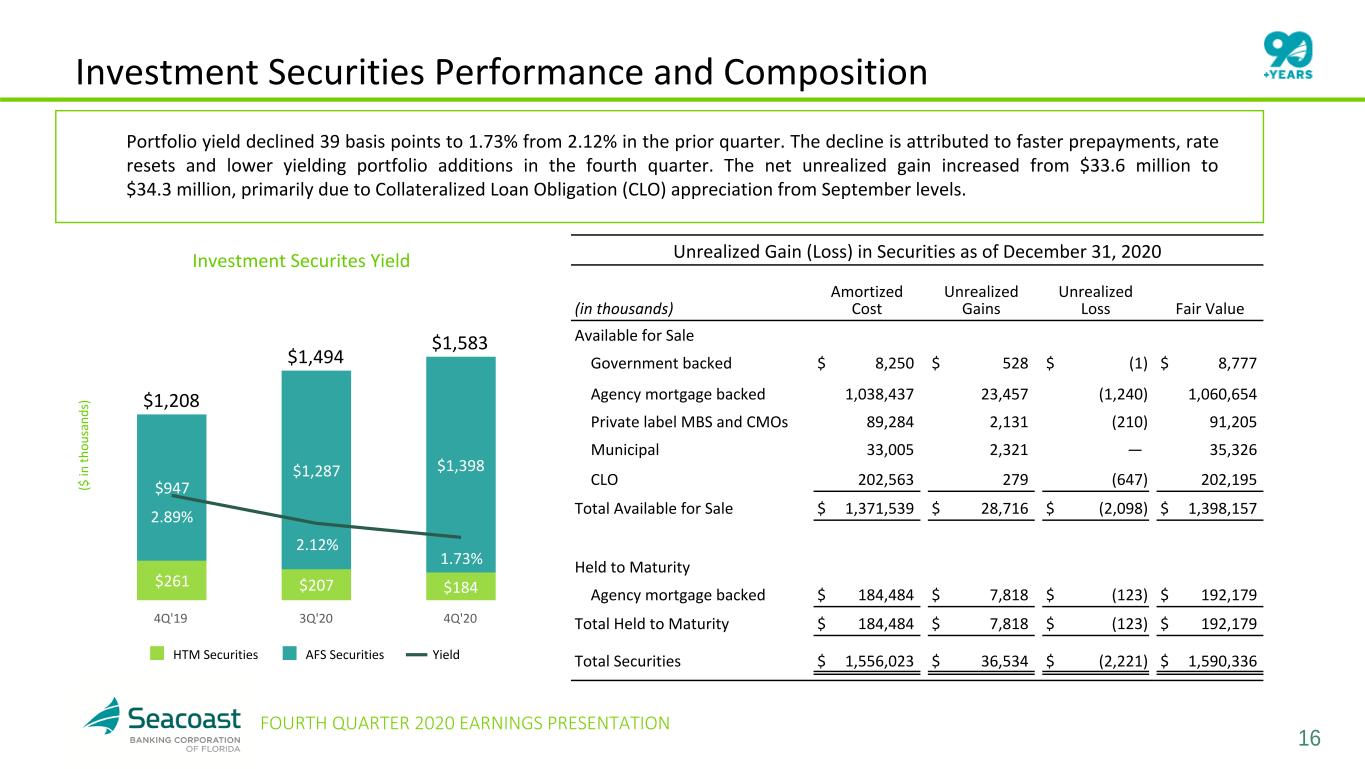

16 FOURTH QUARTER 2020 EARNINGS PRESENTATION Investment Securities Performance and Composition Unrealized Gain (Loss) in Securities as of December 31, 2020 (in thousands) Amortized Cost Unrealized Gains Unrealized Loss Fair Value Available for Sale Government backed $ 8,250 $ 528 $ (1) $ 8,777 Agency mortgage backed 1,038,437 23,457 (1,240) 1,060,654 Private label MBS and CMOs 89,284 2,131 (210) 91,205 Municipal 33,005 2,321 — 35,326 CLO 202,563 279 (647) 202,195 Total Available for Sale $ 1,371,539 $ 28,716 $ (2,098) $ 1,398,157 Held to Maturity Agency mortgage backed $ 184,484 $ 7,818 $ (123) $ 192,179 Total Held to Maturity $ 184,484 $ 7,818 $ (123) $ 192,179 Total Securities $ 1,556,023 $ 36,534 $ (2,221) $ 1,590,336 Portfolio yield declined 39 basis points to 1.73% from 2.12% in the prior quarter. The decline is attributed to faster prepayments, rate resets and lower yielding portfolio additions in the fourth quarter. The net unrealized gain increased from $33.6 million to $34.3 million, primarily due to Collateralized Loan Obligation (CLO) appreciation from September levels. ($ in t h o u sa n d s) Investment Securites Yield $1,208 $1,494 $1,583 $261 $207 $184 $947 $1,287 $1,398 2.89% 2.12% 1.73% HTM Securities AFS Securities Yield 4Q'19 3Q'20 4Q'20

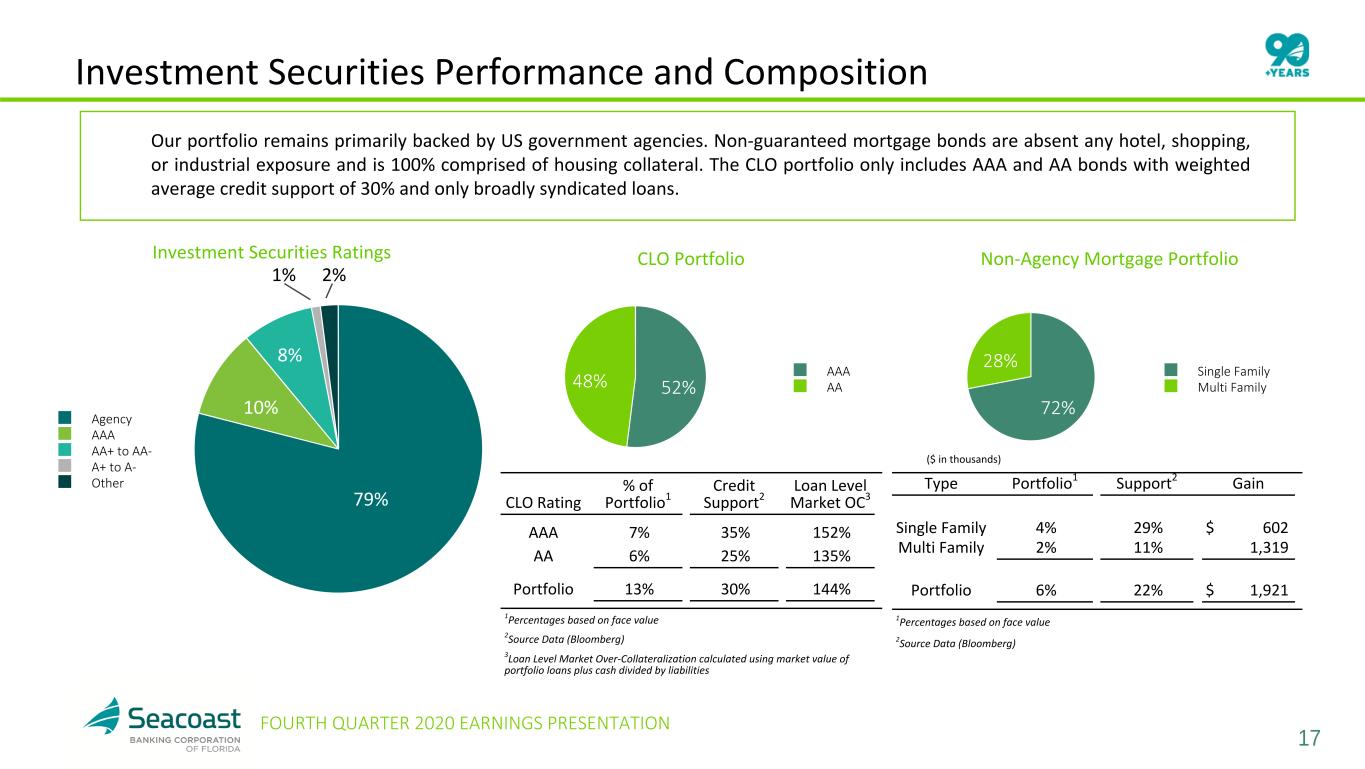

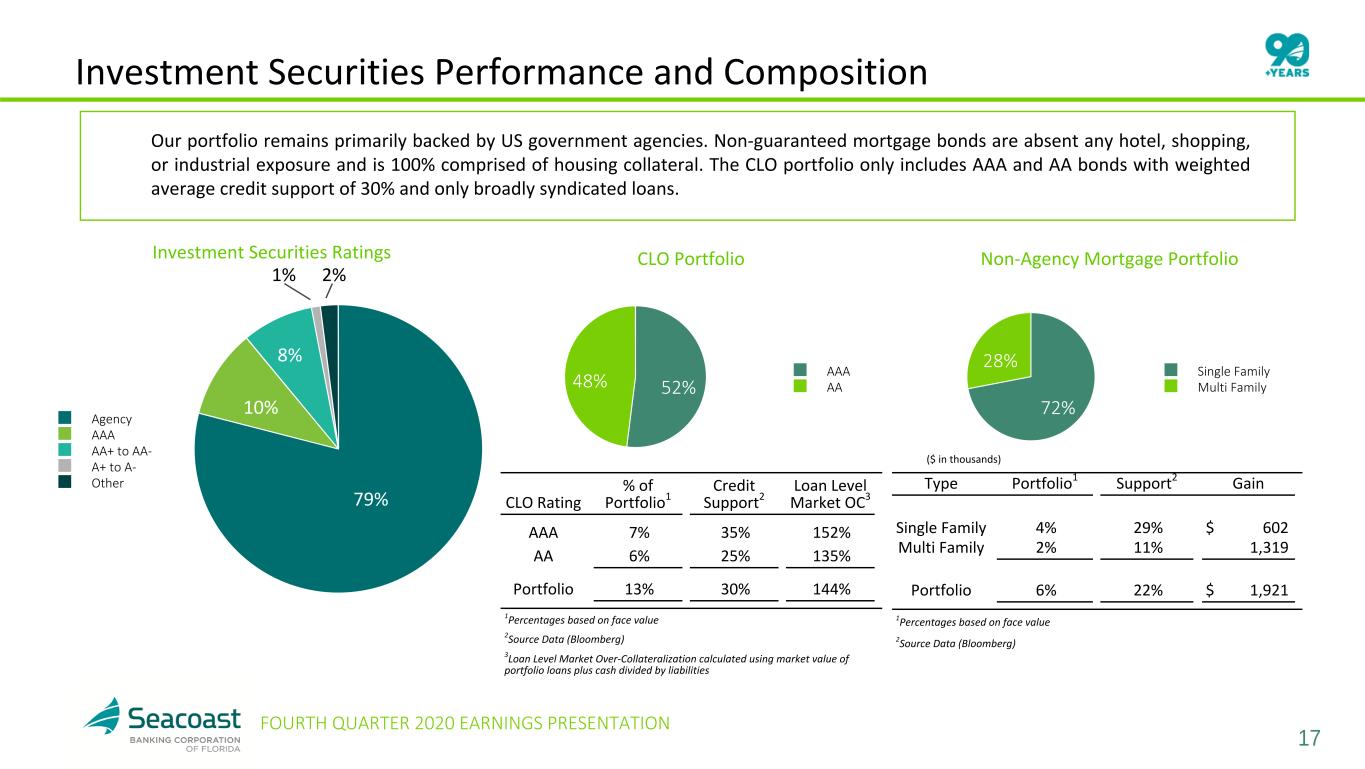

17 FOURTH QUARTER 2020 EARNINGS PRESENTATION Investment Securities Performance and Composition Our portfolio remains primarily backed by US government agencies. Non-guaranteed mortgage bonds are absent any hotel, shopping, or industrial exposure and is 100% comprised of housing collateral. The CLO portfolio only includes AAA and AA bonds with weighted average credit support of 30% and only broadly syndicated loans. CLO Rating % of Portfolio1 Credit Support2 Loan Level Market OC3 AAA 7% 35% 152% AA 6% 25% 135% Portfolio 13% 30% 144% 1Percentages based on face value 2Source Data (Bloomberg) 3Loan Level Market Over-Collateralization calculated using market value of portfolio loans plus cash divided by liabilities 52%48% AAA AA CLO Portfolio 79% 10% 8% Agency AAA AA+ to AA- A+ to A- Other Collateral Type % of Portfolio1 Credit Support2 Unrealized Gain Single Family 4% 29% $ 602 Multi Family 2% 11% 1,319 Portfolio 6% 22% $ 1,921 1Percentages based on face value 2Source Data (Bloomberg) 72% 28% Single Family Multi Family Non-Agency Mortgage PortfolioInvestment Securities Ratings ($ in thousands) 1% 2%

18 FOURTH QUARTER 2020 EARNINGS PRESENTATION Strong Deposit Franchise Supported by Attractive Markets • Total deposits increased $18 million quarter- over-quarter and increased $1.3 billion, or 24%, compared to the fourth quarter of 2019. Fourth quarter balances include a decrease of $92 million in brokered deposits. • Overall cost of deposits decreased to 19 basis points from 24 basis points in the prior quarter. • Transaction accounts increased 39% year- over-year, reflecting continued strong growth in core customer balances, and represent 56% of overall deposit funding. $5,585 $5,887 $6,667 $6,915 $6,933 $2,772 $2,938 $3,636 $3,786 $3,856 $1,628 $1,679 $1,852 $2,112 $2,246$1,185 $1,270 $1,179 $1,017 $831 Transaction Accounts Savings & Money Market Time Deposits 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 56% Deposits Outstanding ($ in millions)

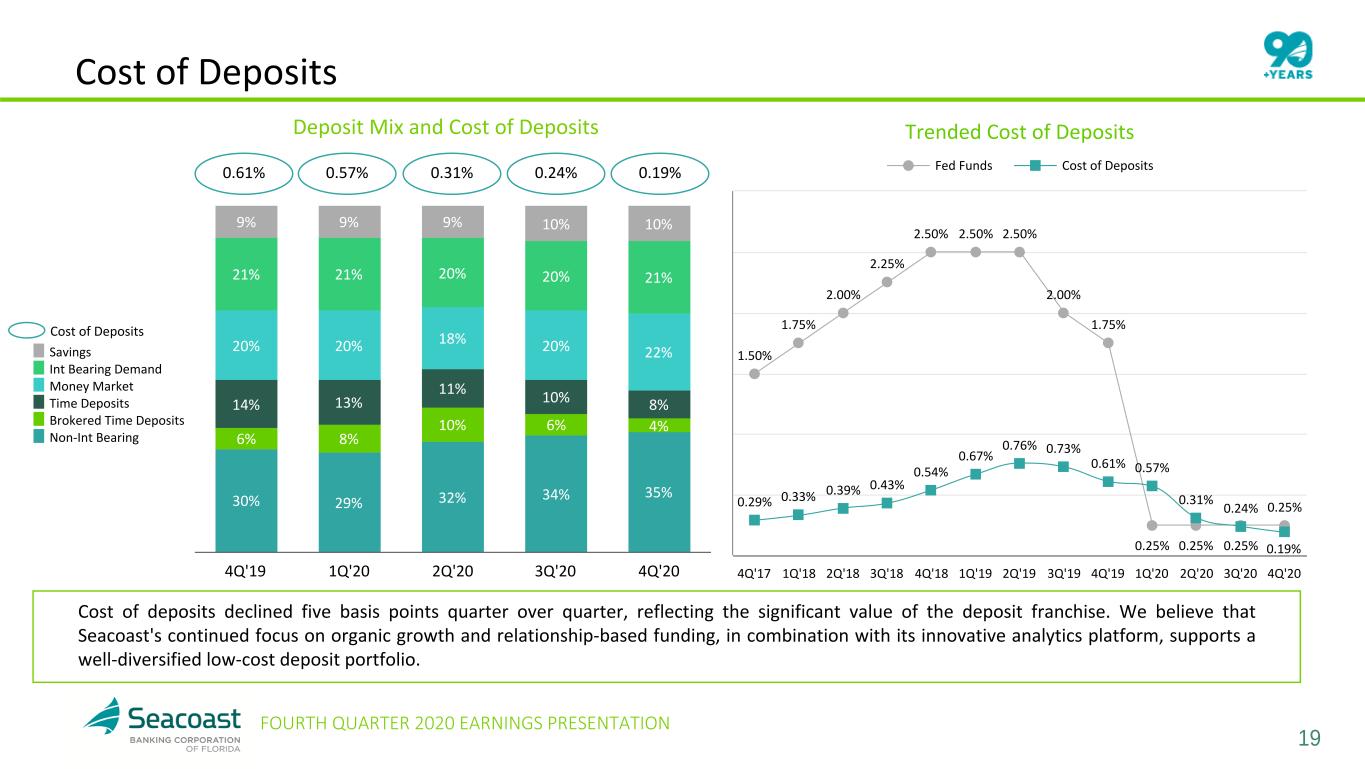

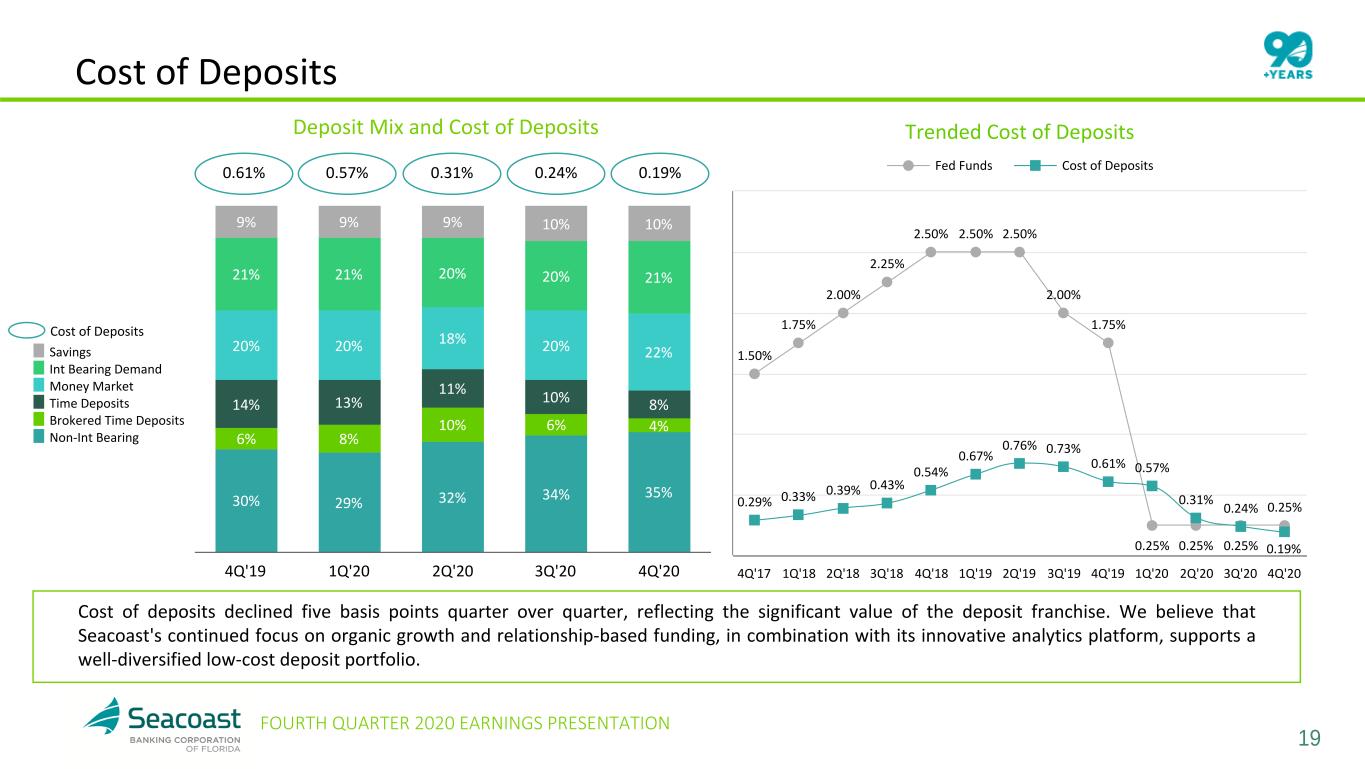

19 FOURTH QUARTER 2020 EARNINGS PRESENTATION Cost of Deposits 30% 29% 32% 34% 35% 6% 8% 10% 6% 4% 14% 13% 11% 10% 8% 20% 20% 18% 20% 22% 21% 21% 20% 20% 21% 9% 9% 9% 10% 10% Savings Int Bearing Demand Money Market Time Deposits Brokered Time Deposits Non-Int Bearing 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 0.61% 0.57% 0.31% 0.24% 0.19% Trended Cost of Deposits 1.50% 1.75% 2.00% 2.25% 2.50% 2.50% 2.50% 2.00% 1.75% 0.25% 0.25% 0.25% 0.25%0.29% 0.33% 0.39% 0.43% 0.54% 0.67% 0.76% 0.73% 0.61% 0.57% 0.31% 0.24% 0.19% Fed Funds Cost of Deposits 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 Deposit Mix and Cost of Deposits Cost of Deposits Cost of deposits declined five basis points quarter over quarter, reflecting the significant value of the deposit franchise. We believe that Seacoast's continued focus on organic growth and relationship-based funding, in combination with its innovative analytics platform, supports a well-diversified low-cost deposit portfolio.

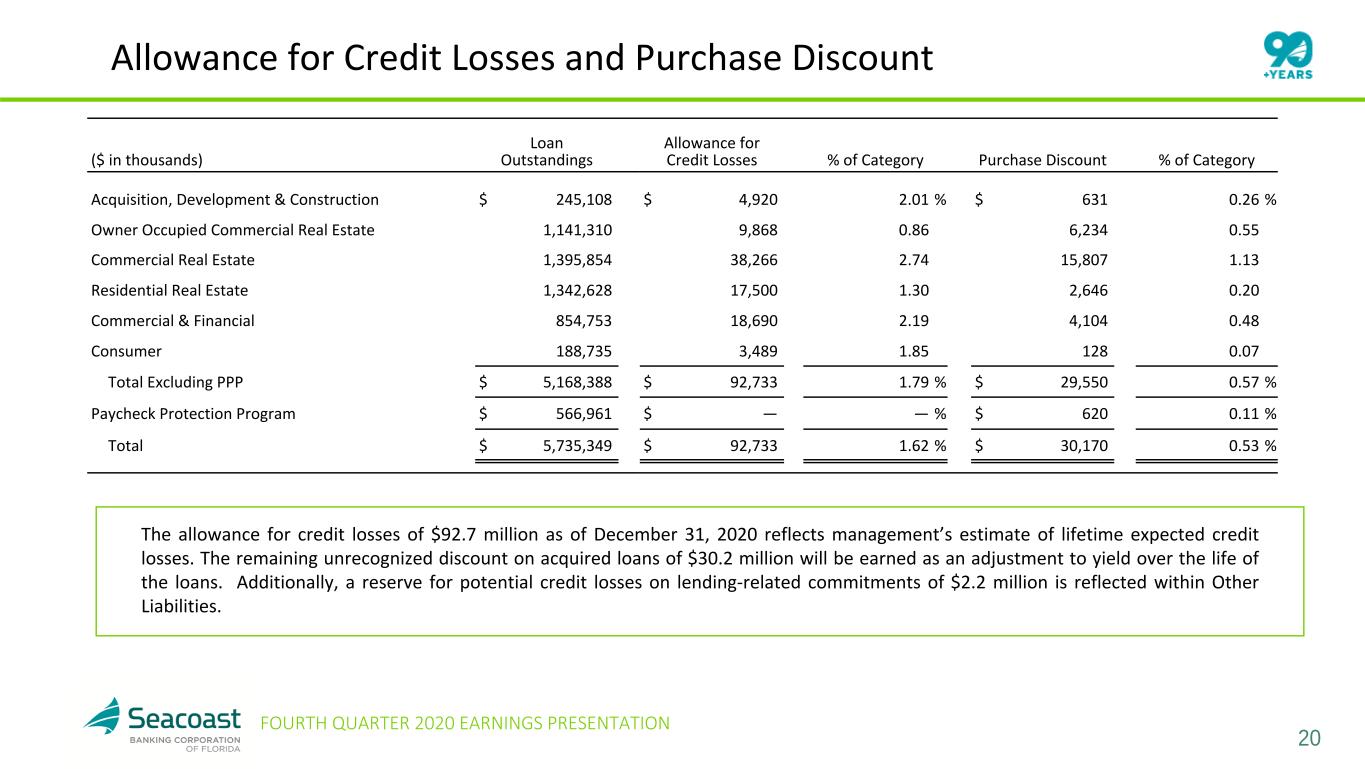

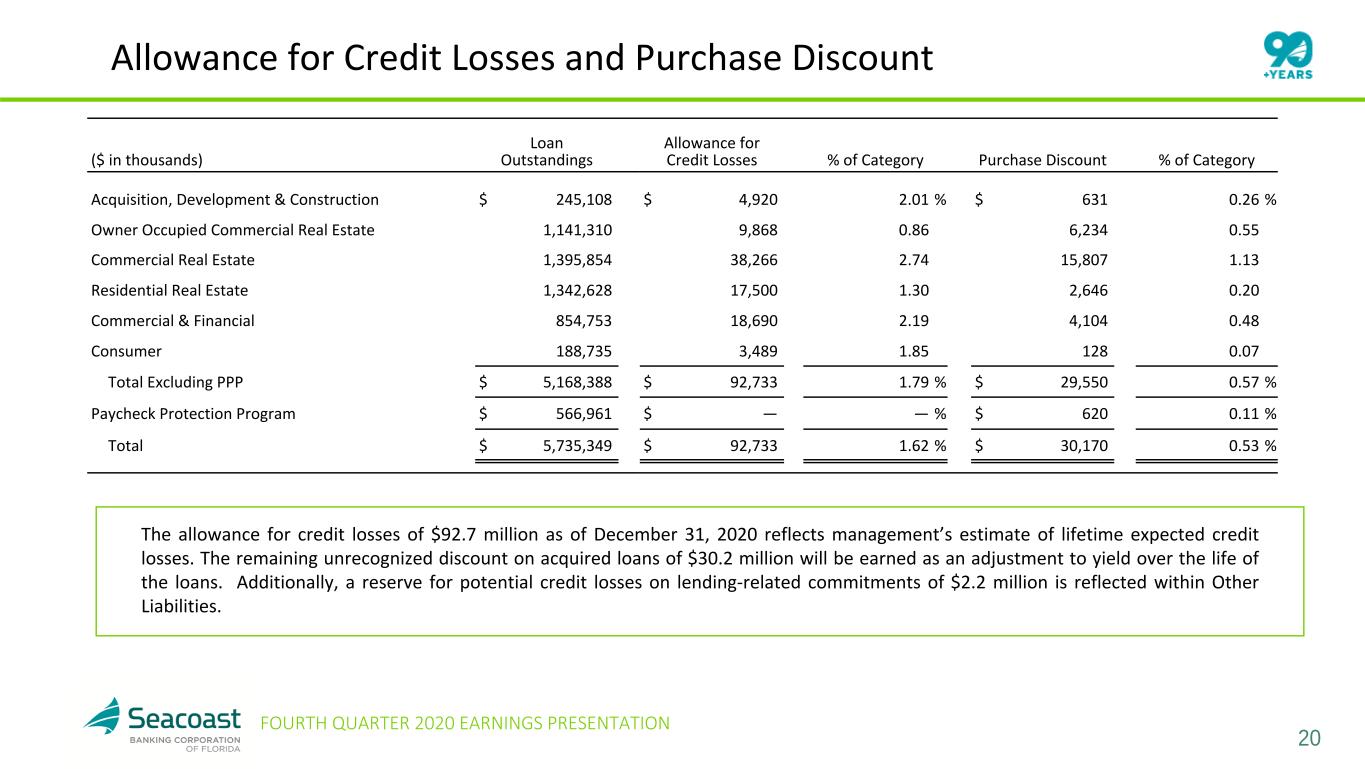

20 FOURTH QUARTER 2020 EARNINGS PRESENTATION Allowance for Credit Losses and Purchase Discount ($ in thousands) Loan Outstandings Allowance for Credit Losses % of Category Purchase Discount % of Category Acquisition, Development & Construction $ 245,108 $ 4,920 2.01 % $ 631 0.26 % Owner Occupied Commercial Real Estate 1,141,310 9,868 0.86 6,234 0.55 Commercial Real Estate 1,395,854 38,266 2.74 15,807 1.13 Residential Real Estate 1,342,628 17,500 1.30 2,646 0.20 Commercial & Financial 854,753 18,690 2.19 4,104 0.48 Consumer 188,735 3,489 1.85 128 0.07 Total Excluding PPP $ 5,168,388 $ 92,733 1.79 % $ 29,550 0.57 % Paycheck Protection Program $ 566,961 $ — — % $ 620 0.11 % Total $ 5,735,349 $ 92,733 1.62 % $ 30,170 0.53 % The allowance for credit losses of $92.7 million as of December 31, 2020 reflects management’s estimate of lifetime expected credit losses. The remaining unrecognized discount on acquired loans of $30.2 million will be earned as an adjustment to yield over the life of the loans. Additionally, a reserve for potential credit losses on lending-related commitments of $2.2 million is reflected within Other Liabilities.

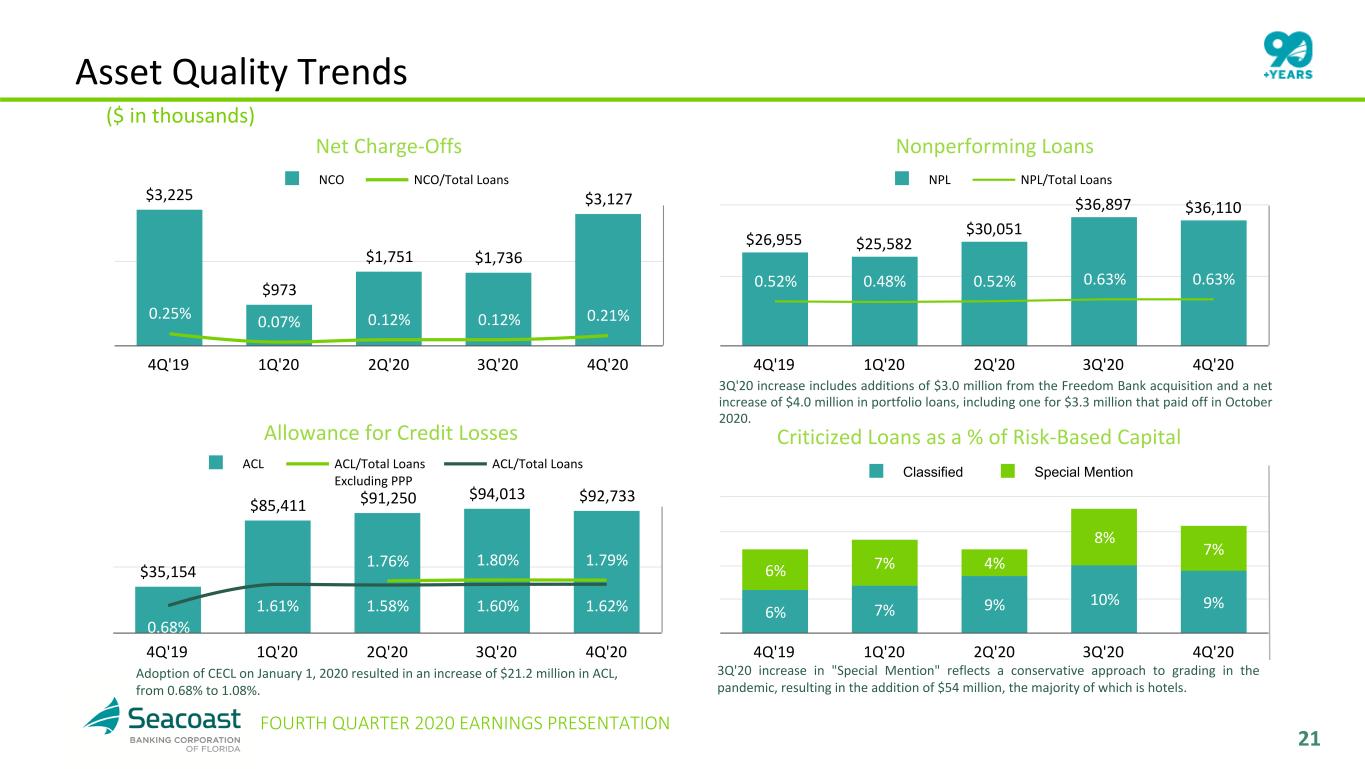

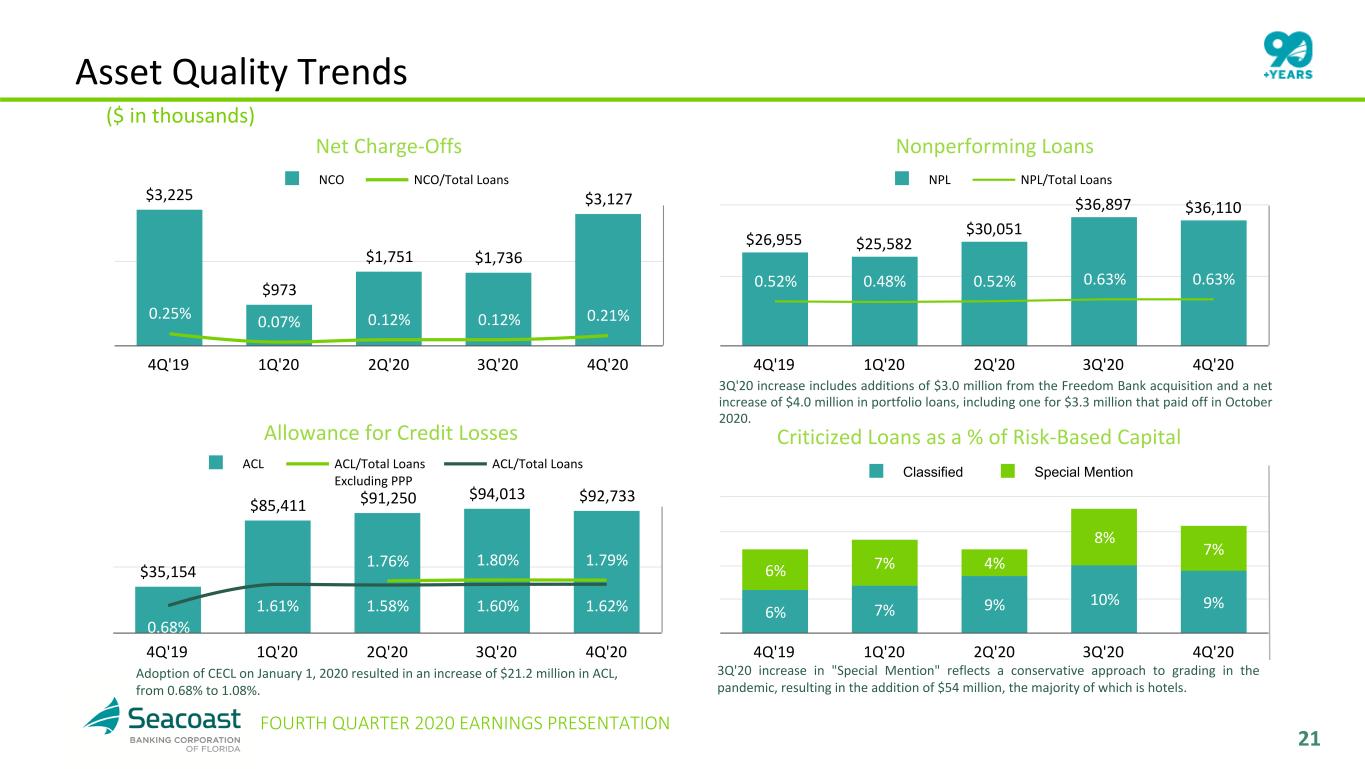

21 FOURTH QUARTER 2020 EARNINGS PRESENTATION Asset Quality Trends Net Charge-Offs $3,225 $973 $1,751 $1,736 $3,127 0.25% 0.07% 0.12% 0.12% 0.21% NCO NCO/Total Loans 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 Nonperforming Loans $26,955 $25,582 $30,051 $36,897 $36,110 0.52% 0.48% 0.52% 0.63% 0.63% NPL NPL/Total Loans 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 $35,154 $85,411 $91,250 $94,013 $92,733 1.76% 1.80% 1.79% 0.68% 1.61% 1.58% 1.60% 1.62% ACL ACL/Total Loans Excluding PPP ACL/Total Loans 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 6% 7% 9% 10% 9% 6% 7% 4% 8% 7% Classified Special Mention 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 Adoption of CECL on January 1, 2020 resulted in an increase of $21.2 million in ACL, from 0.68% to 1.08%. Allowance for Credit Losses ($ in thousands) Criticized Loans as a % of Risk-Based Capital 3Q'20 increase includes additions of $3.0 million from the Freedom Bank acquisition and a net increase of $4.0 million in portfolio loans, including one for $3.3 million that paid off in October 2020. 3Q'20 increase in "Special Mention" reflects a conservative approach to grading in the pandemic, resulting in the addition of $54 million, the majority of which is hotels.

22 FOURTH QUARTER 2020 EARNINGS PRESENTATION Strong Capital Supporting a Fortress Balance Sheet $14.76 $14.42 $15.11 $15.57 $16.16 $19.13 $18.82 $19.45 $19.91 $20.46 Tangible Book Value Per Share Book Value Per Share 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 11.1% 10.7% 10.2% 10.7% 11.0% 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 15.7% 16.5% 17.6% 17.9% 18.5% 15.0% 15.5% 16.4% 16.8% 17.4% Total Risk Based Capital Tier 1 Ratio 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 15.0% 1.0% 13.5% 11.4% 13.9%14.2% 2.9% 13.1% 13.1% 14.0% GAAP - ROTCE Adjusted - ROTCE 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP 2FDICIA defines well capitalized as 10.0% for total risk based capital and 8.0% for Tier 1 ratio at a total Bank level Tangible Book Value and Book Value Per Share Tangible Common Equity / Tangible Assets Total Risk Based and Tier 1 CapitalReturn on Tangible Common Equity 1 10.0%2 8.0%2

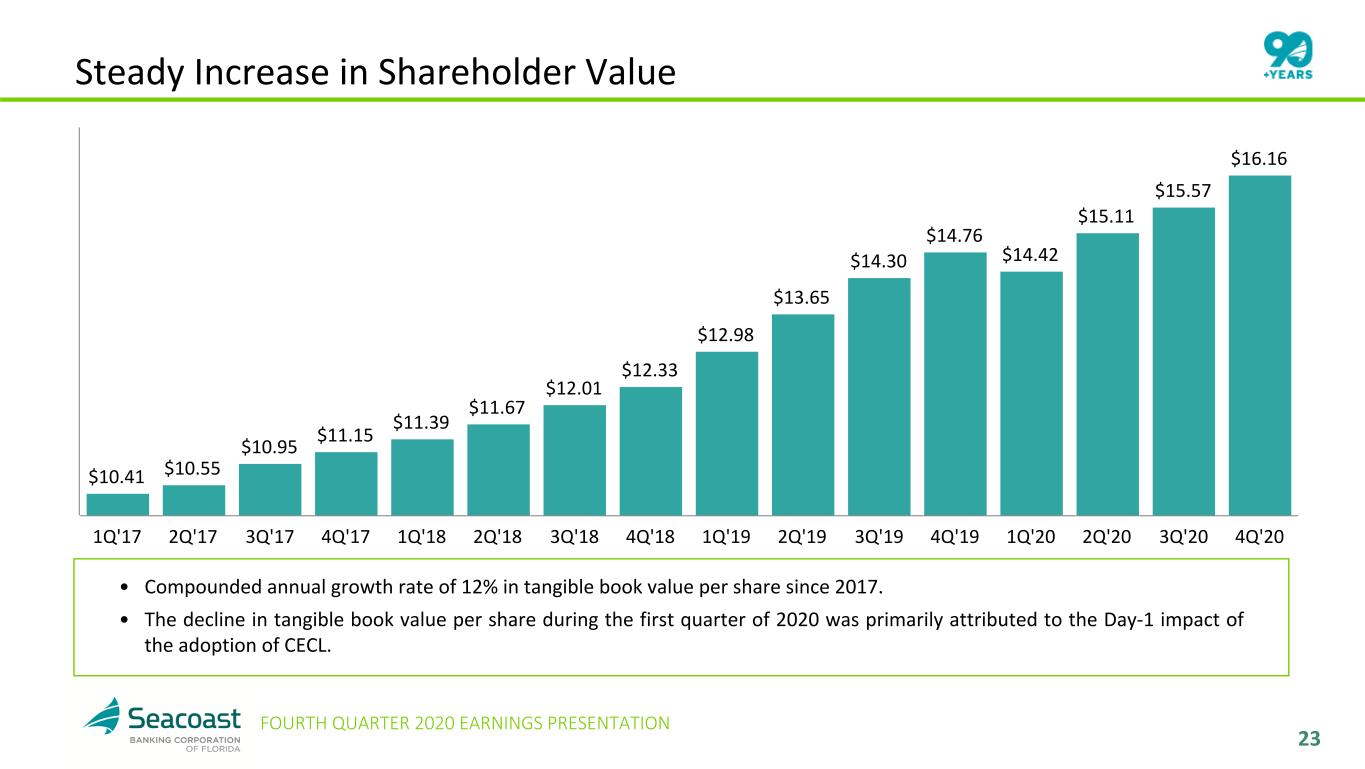

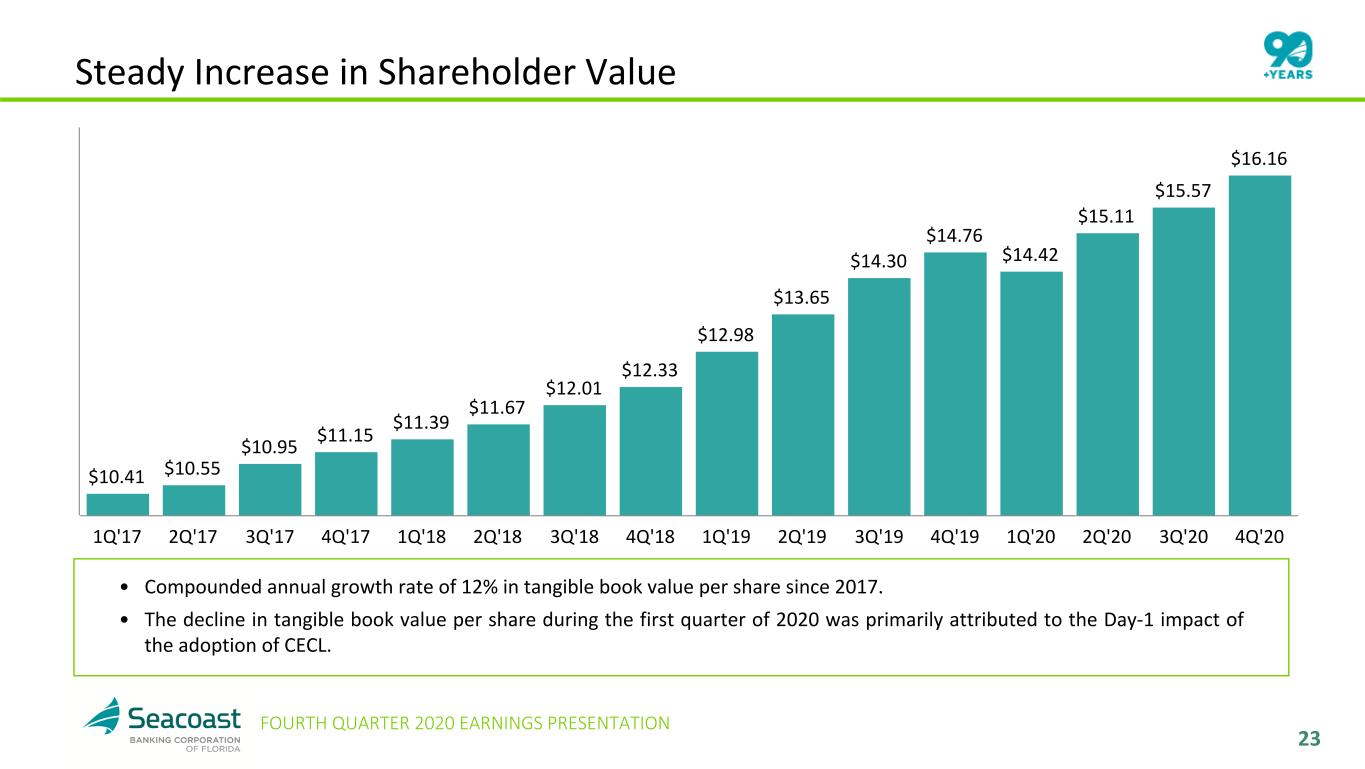

23 FOURTH QUARTER 2020 EARNINGS PRESENTATION Steady Increase in Shareholder Value $10.41 $10.55 $10.95 $11.15 $11.39 $11.67 $12.01 $12.33 $12.98 $13.65 $14.30 $14.76 $14.42 $15.11 $15.57 $16.16 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 • Compounded annual growth rate of 12% in tangible book value per share since 2017. • The decline in tangible book value per share during the first quarter of 2020 was primarily attributed to the Day-1 impact of the adoption of CECL.

24 FOURTH QUARTER 2020 EARNINGS PRESENTATION Contact Details: Seacoast Banking Corporation of Florida Tracey L. Dexter Executive Vice President Chief Financial Officer (772) 403-0461 INVESTOR RELATIONS NASDAQ: SBCF

25 FOURTH QUARTER 2020 EARNINGS PRESENTATION Appendix

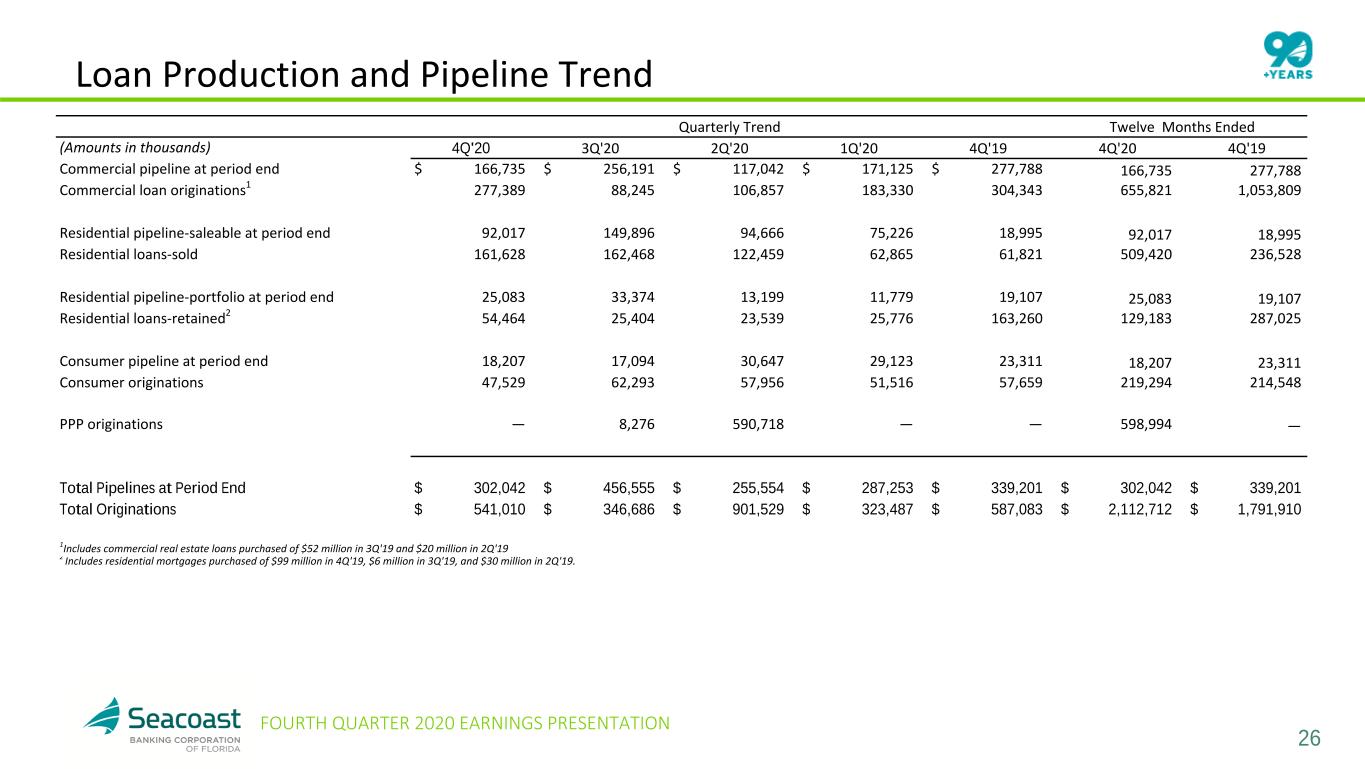

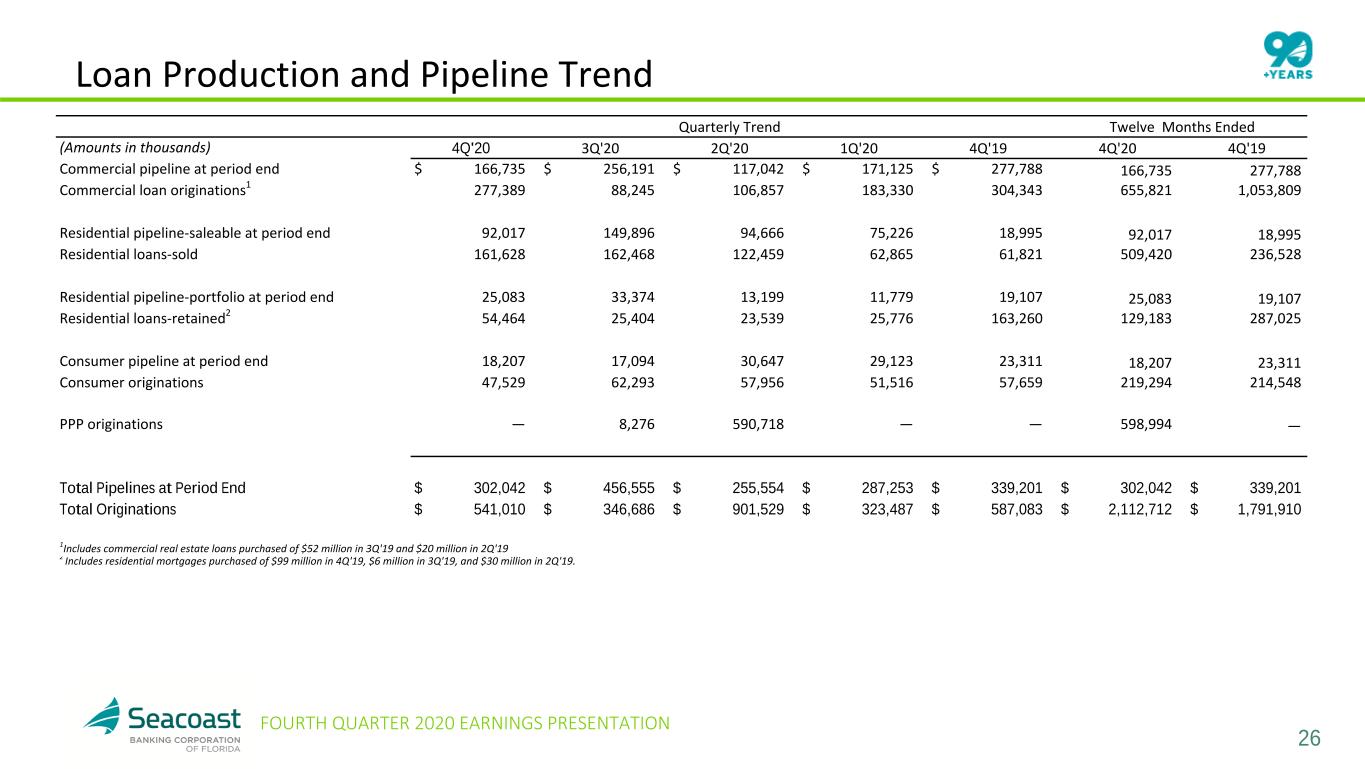

26 FOURTH QUARTER 2020 EARNINGS PRESENTATION Quarterly Trend Twelve Months Ended (Amounts in thousands) 4Q'20 3Q'20 2Q'20 1Q'20 4Q'19 4Q'20 4Q'19 Commercial pipeline at period end $ 166,735 $ 256,191 $ 117,042 $ 171,125 $ 277,788 166,735 277,788 Commercial loan originations1 277,389 88,245 106,857 183,330 304,343 655,821 1,053,809 Residential pipeline-saleable at period end 92,017 149,896 94,666 75,226 18,995 92,017 18,995 Residential loans-sold 161,628 162,468 122,459 62,865 61,821 509,420 236,528 Residential pipeline-portfolio at period end 25,083 33,374 13,199 11,779 19,107 25,083 19,107 Residential loans-retained2 54,464 25,404 23,539 25,776 163,260 129,183 287,025 Consumer pipeline at period end 18,207 17,094 30,647 29,123 23,311 18,207 23,311 Consumer originations 47,529 62,293 57,956 51,516 57,659 219,294 214,548 PPP originations — 8,276 590,718 — — 598,994 — Total Pipelines at Period End $ 302,042 $ 456,555 $ 255,554 $ 287,253 $ 339,201 $ 302,042 $ 339,201 Total Originations $ 541,010 $ 346,686 $ 901,529 $ 323,487 $ 587,083 $ 2,112,712 $ 1,791,910 1Includes commercial real estate loans purchased of $52 million in 3Q'19 and $20 million in 2Q'19 2 Includes residential mortgages purchased of $99 million in 4Q'19, $6 million in 3Q'19, and $30 million in 2Q'19. Loan Production and Pipeline Trend

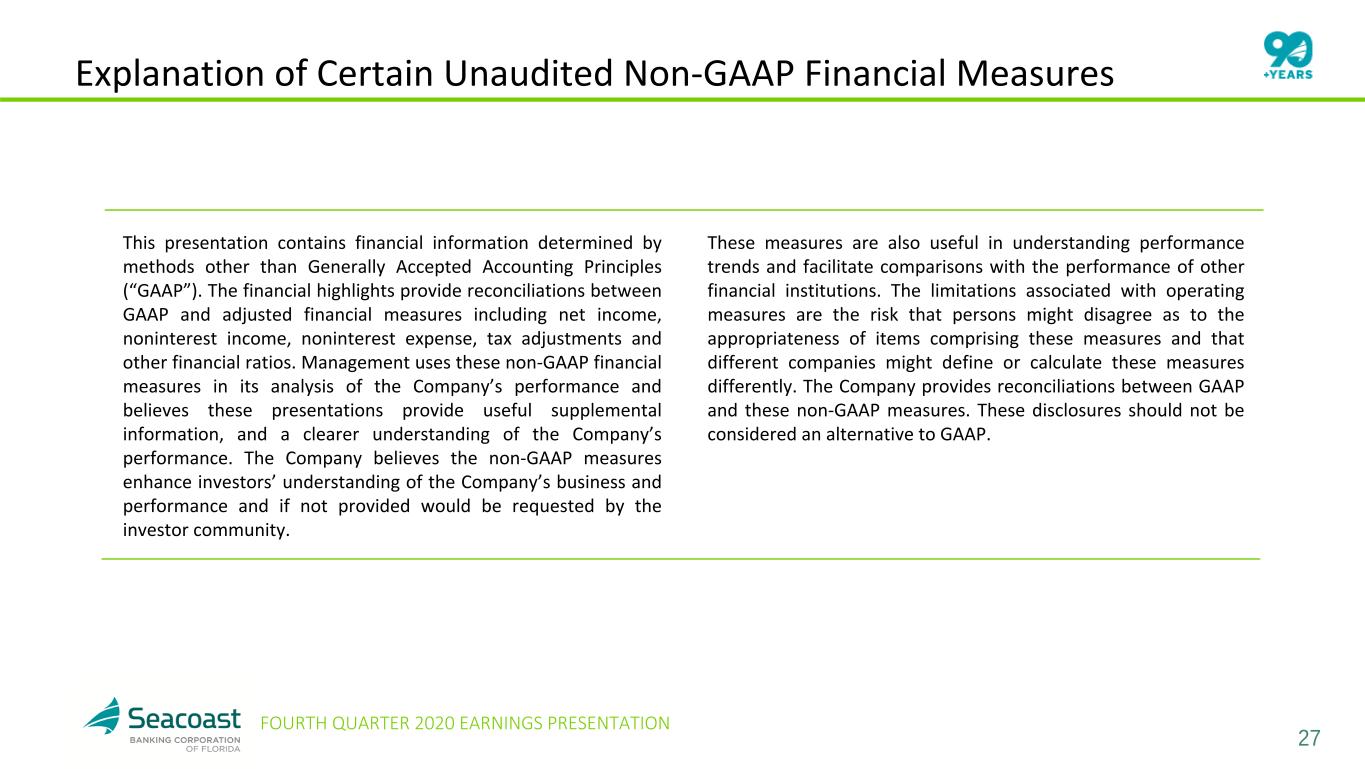

27 FOURTH QUARTER 2020 EARNINGS PRESENTATION Explanation of Certain Unaudited Non-GAAP Financial Measures This presentation contains financial information determined by methods other than Generally Accepted Accounting Principles (“GAAP”). The financial highlights provide reconciliations between GAAP and adjusted financial measures including net income, noninterest income, noninterest expense, tax adjustments and other financial ratios. Management uses these non-GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. The Company believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance and if not provided would be requested by the investor community. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might define or calculate these measures differently. The Company provides reconciliations between GAAP and these non-GAAP measures. These disclosures should not be considered an alternative to GAAP.

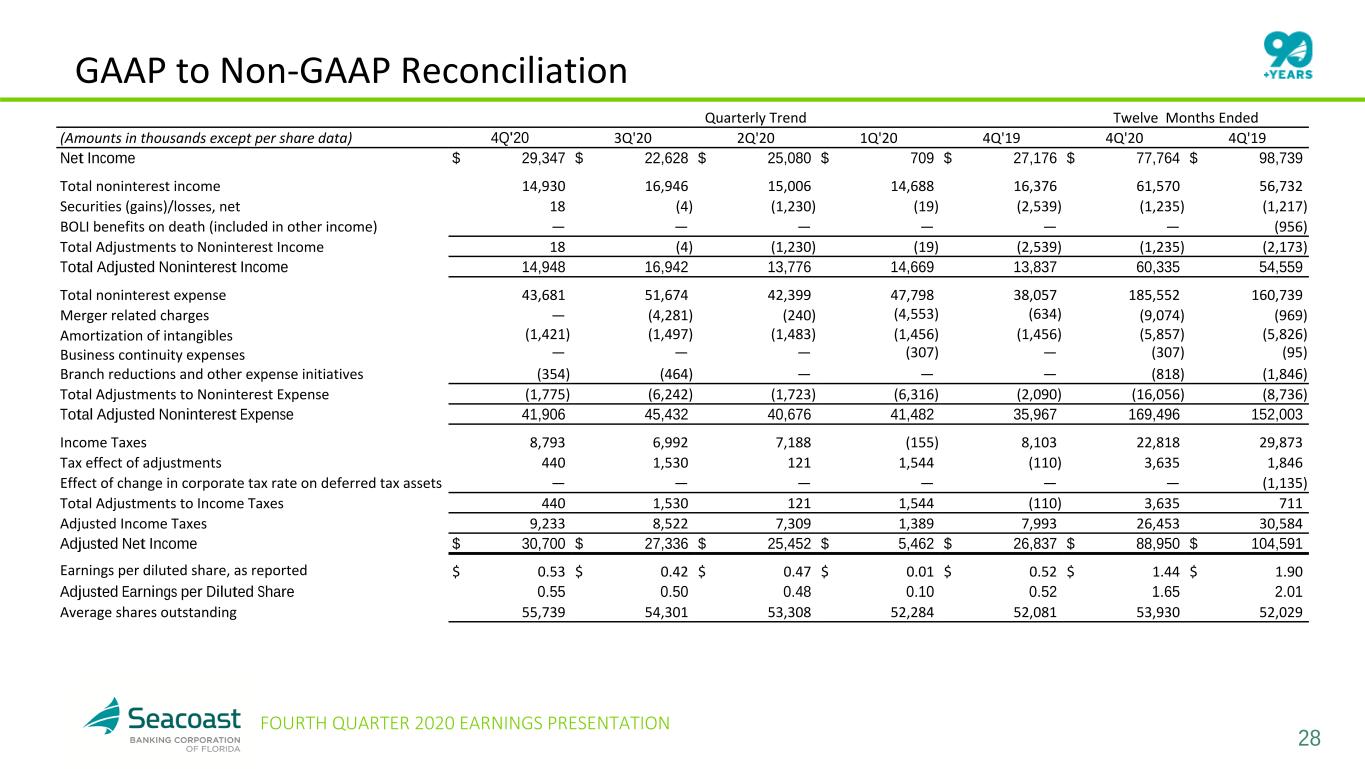

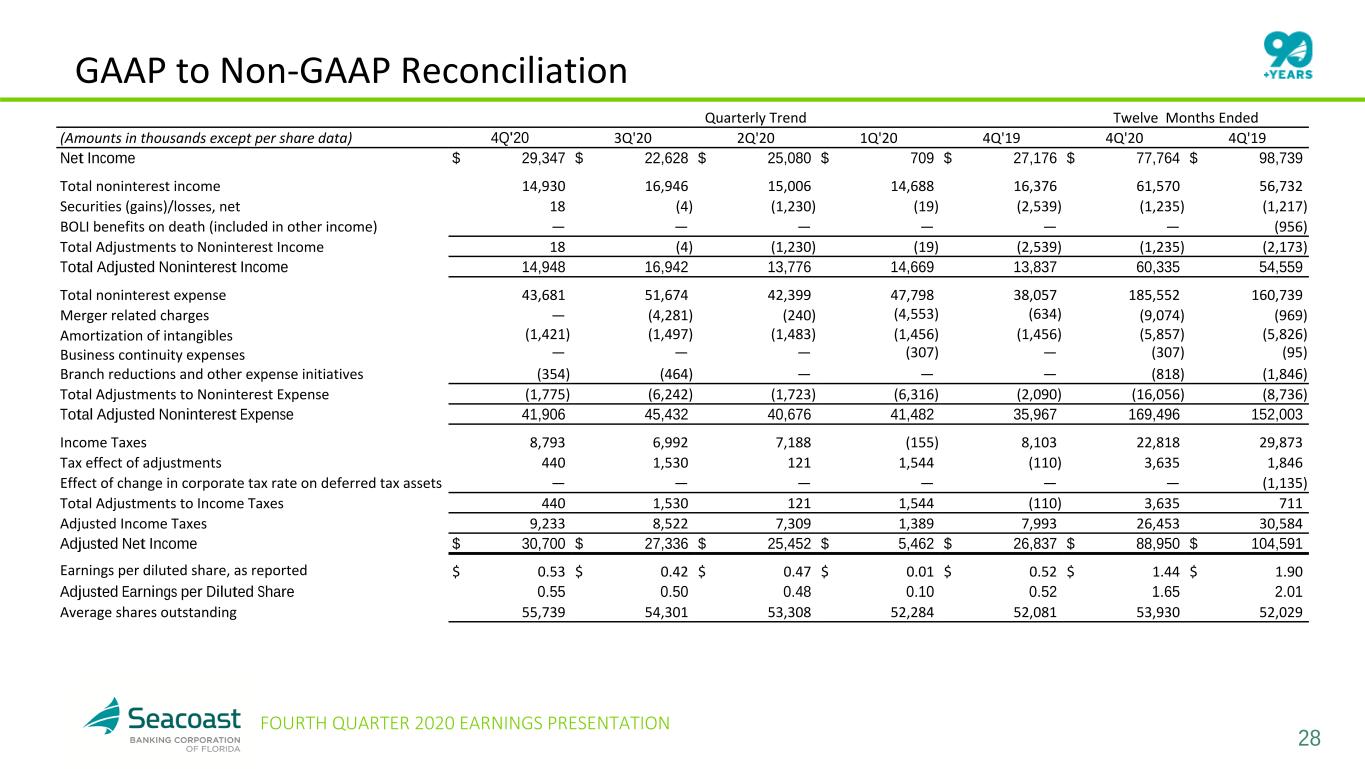

28 FOURTH QUARTER 2020 EARNINGS PRESENTATION GAAP to Non-GAAP Reconciliation Quarterly Trend Twelve Months Ended (Amounts in thousands except per share data) 4Q'20 3Q'20 2Q'20 1Q'20 4Q'19 4Q'20 4Q'19 Net Income $ 29,347 $ 22,628 $ 25,080 $ 709 $ 27,176 $ 77,764 $ 98,739 Total noninterest income 14,930 16,946 15,006 14,688 16,376 61,570 56,732 Securities (gains)/losses, net 18 (4) (1,230) (19) (2,539) (1,235) (1,217) BOLI benefits on death (included in other income) — — — — — — (956) Total Adjustments to Noninterest Income 18 (4) (1,230) (19) (2,539) (1,235) (2,173) Total Adjusted Noninterest Income 14,948 16,942 13,776 14,669 13,837 60,335 54,559 Total noninterest expense 43,681 51,674 42,399 47,798 38,057 185,552 160,739 Merger related charges — (4,281) (240) (4,553) (634) (9,074) (969) Amortization of intangibles (1,421) (1,497) (1,483) (1,456) (1,456) (5,857) (5,826) Business continuity expenses — — — (307) — (307) (95) Branch reductions and other expense initiatives (354) (464) — — — (818) (1,846) Total Adjustments to Noninterest Expense (1,775) (6,242) (1,723) (6,316) (2,090) (16,056) (8,736) Total Adjusted Noninterest Expense 41,906 45,432 40,676 41,482 35,967 169,496 152,003 Income Taxes 8,793 6,992 7,188 (155) 8,103 22,818 29,873 Tax effect of adjustments 440 1,530 121 1,544 (110) 3,635 1,846 Effect of change in corporate tax rate on deferred tax assets — — — — — — (1,135) Total Adjustments to Income Taxes 440 1,530 121 1,544 (110) 3,635 711 Adjusted Income Taxes 9,233 8,522 7,309 1,389 7,993 26,453 30,584 Adjusted Net Income $ 30,700 $ 27,336 $ 25,452 $ 5,462 $ 26,837 $ 88,950 $ 104,591 Earnings per diluted share, as reported $ 0.53 $ 0.42 $ 0.47 $ 0.01 $ 0.52 $ 1.44 $ 1.90 Adjusted Earnings per Diluted Share 0.55 0.50 0.48 0.10 0.52 1.65 2.01 Average shares outstanding 55,739 54,301 53,308 52,284 52,081 53,930 52,029

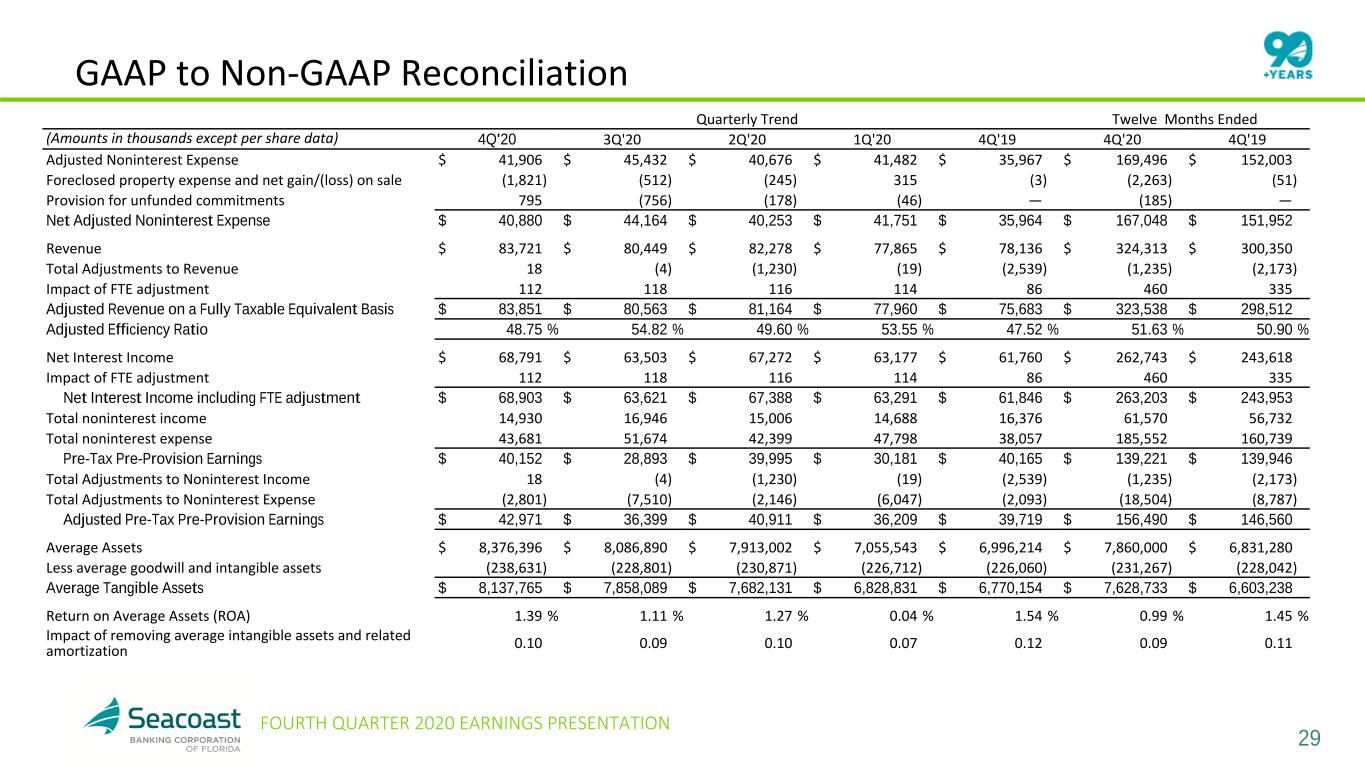

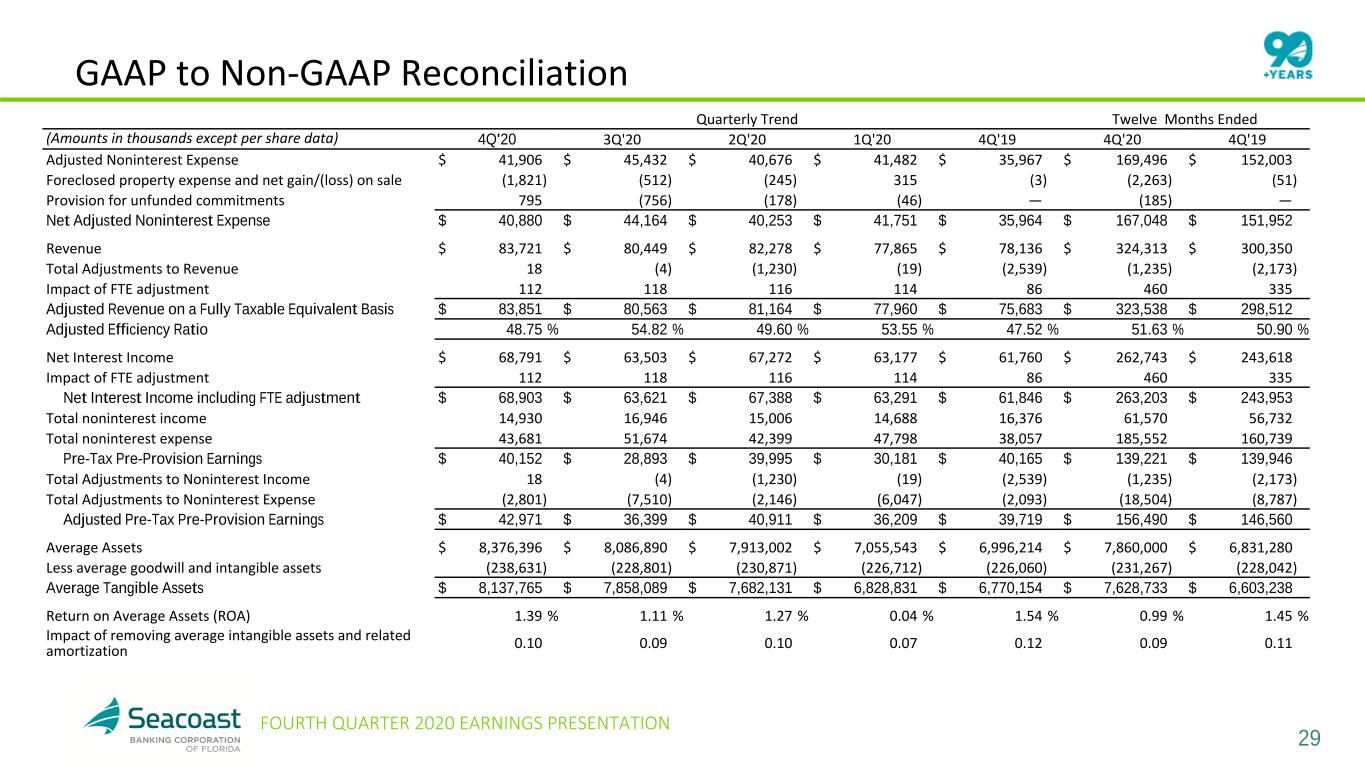

29 FOURTH QUARTER 2020 EARNINGS PRESENTATION GAAP to Non-GAAP Reconciliation Quarterly Trend Twelve Months Ended (Amounts in thousands except per share data) 4Q'20 3Q'20 2Q'20 1Q'20 4Q'19 4Q'20 4Q'19 Adjusted Noninterest Expense $ 41,906 $ 45,432 $ 40,676 $ 41,482 $ 35,967 $ 169,496 $ 152,003 Foreclosed property expense and net gain/(loss) on sale (1,821) (512) (245) 315 (3) (2,263) (51) Provision for unfunded commitments 795 (756) (178) (46) — (185) — Net Adjusted Noninterest Expense $ 40,880 $ 44,164 $ 40,253 $ 41,751 $ 35,964 $ 167,048 $ 151,952 Revenue $ 83,721 $ 80,449 $ 82,278 $ 77,865 $ 78,136 $ 324,313 $ 300,350 Total Adjustments to Revenue 18 (4) (1,230) (19) (2,539) (1,235) (2,173) Impact of FTE adjustment 112 118 116 114 86 460 335 Adjusted Revenue on a Fully Taxable Equivalent Basis $ 83,851 $ 80,563 $ 81,164 $ 77,960 $ 75,683 $ 323,538 $ 298,512 Adjusted Efficiency Ratio 48.75 % 54.82 % 49.60 % 53.55 % 47.52 % 51.63 % 50.90 % Net Interest Income $ 68,791 $ 63,503 $ 67,272 $ 63,177 $ 61,760 $ 262,743 $ 243,618 Impact of FTE adjustment 112 118 116 114 86 460 335 Net Interest Income including FTE adjustment $ 68,903 $ 63,621 $ 67,388 $ 63,291 $ 61,846 $ 263,203 $ 243,953 Total noninterest income 14,930 16,946 15,006 14,688 16,376 61,570 56,732 Total noninterest expense 43,681 51,674 42,399 47,798 38,057 185,552 160,739 Pre-Tax Pre-Provision Earnings $ 40,152 $ 28,893 $ 39,995 $ 30,181 $ 40,165 $ 139,221 $ 139,946 Total Adjustments to Noninterest Income 18 (4) (1,230) (19) (2,539) (1,235) (2,173) Total Adjustments to Noninterest Expense (2,801) (7,510) (2,146) (6,047) (2,093) (18,504) (8,787) Adjusted Pre-Tax Pre-Provision Earnings $ 42,971 $ 36,399 $ 40,911 $ 36,209 $ 39,719 $ 156,490 $ 146,560 Average Assets $ 8,376,396 $ 8,086,890 $ 7,913,002 $ 7,055,543 $ 6,996,214 $ 7,860,000 $ 6,831,280 Less average goodwill and intangible assets (238,631) (228,801) (230,871) (226,712) (226,060) (231,267) (228,042) Average Tangible Assets $ 8,137,765 $ 7,858,089 $ 7,682,131 $ 6,828,831 $ 6,770,154 $ 7,628,733 $ 6,603,238 Return on Average Assets (ROA) 1.39 % 1.11 % 1.27 % 0.04 % 1.54 % 0.99 % 1.45 % Impact of removing average intangible assets and related amortization 0.10 0.09 0.10 0.07 0.12 0.09 0.11

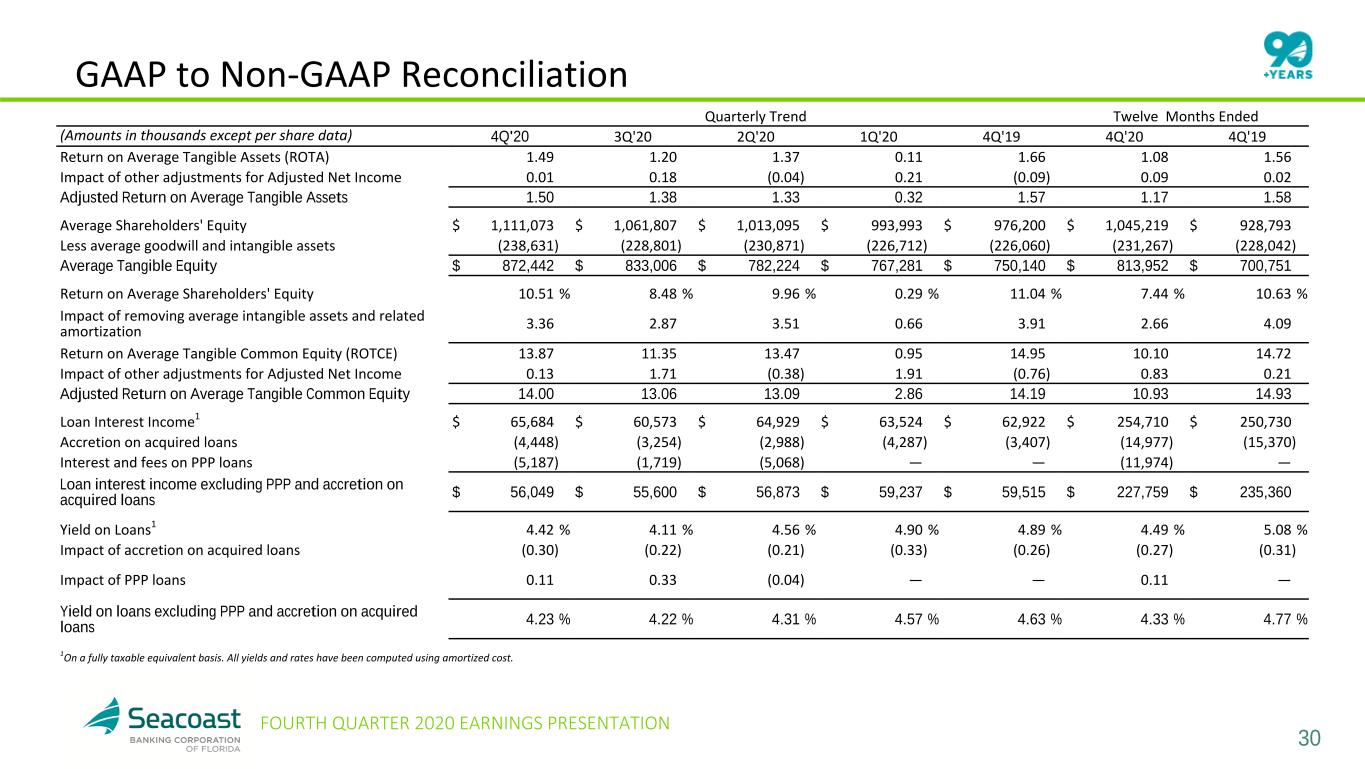

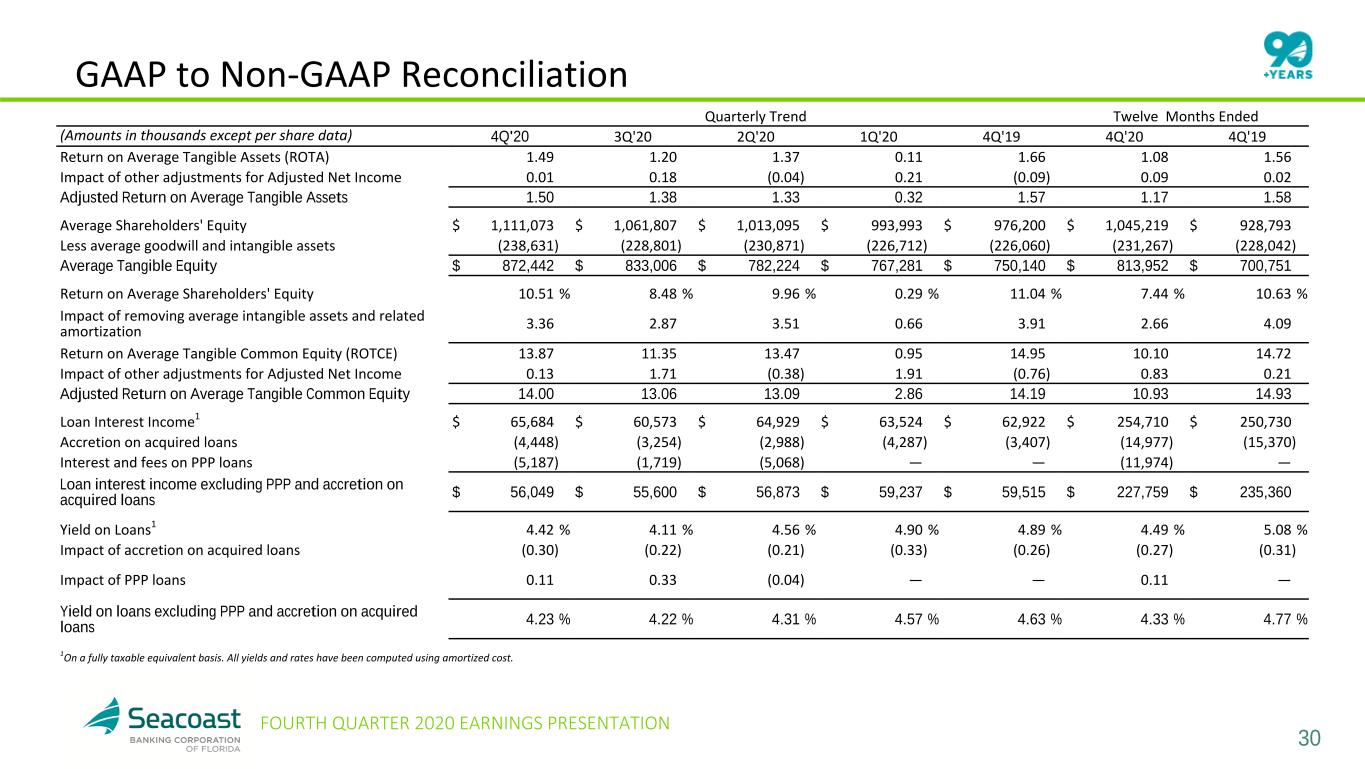

30 FOURTH QUARTER 2020 EARNINGS PRESENTATION GAAP to Non-GAAP Reconciliation Quarterly Trend Twelve Months Ended (Amounts in thousands except per share data) 4Q'20 3Q'20 2Q'20 1Q'20 4Q'19 4Q'20 4Q'19 Return on Average Tangible Assets (ROTA) 1.49 1.20 1.37 0.11 1.66 1.08 1.56 Impact of other adjustments for Adjusted Net Income 0.01 0.18 (0.04) 0.21 (0.09) 0.09 0.02 Adjusted Return on Average Tangible Assets 1.50 1.38 1.33 0.32 1.57 1.17 1.58 Average Shareholders' Equity $ 1,111,073 $ 1,061,807 $ 1,013,095 $ 993,993 $ 976,200 $ 1,045,219 $ 928,793 Less average goodwill and intangible assets (238,631) (228,801) (230,871) (226,712) (226,060) (231,267) (228,042) Average Tangible Equity $ 872,442 $ 833,006 $ 782,224 $ 767,281 $ 750,140 $ 813,952 $ 700,751 Return on Average Shareholders' Equity 10.51 % 8.48 % 9.96 % 0.29 % 11.04 % 7.44 % 10.63 % Impact of removing average intangible assets and related amortization 3.36 2.87 3.51 0.66 3.91 2.66 4.09 Return on Average Tangible Common Equity (ROTCE) 13.87 11.35 13.47 0.95 14.95 10.10 14.72 Impact of other adjustments for Adjusted Net Income 0.13 1.71 (0.38) 1.91 (0.76) 0.83 0.21 Adjusted Return on Average Tangible Common Equity 14.00 13.06 13.09 2.86 14.19 10.93 14.93 Loan Interest Income1 $ 65,684 $ 60,573 $ 64,929 $ 63,524 $ 62,922 $ 254,710 $ 250,730 Accretion on acquired loans (4,448) (3,254) (2,988) (4,287) (3,407) (14,977) (15,370) Interest and fees on PPP loans (5,187) (1,719) (5,068) — — (11,974) — Loan interest income excluding PPP and accretion on acquired loans $ 56,049 $ 55,600 $ 56,873 $ 59,237 $ 59,515 $ 227,759 $ 235,360 Yield on Loans1 4.42 % 4.11 % 4.56 % 4.90 % 4.89 % 4.49 % 5.08 % Impact of accretion on acquired loans (0.30) (0.22) (0.21) (0.33) (0.26) (0.27) (0.31) Impact of PPP loans 0.11 0.33 (0.04) — — 0.11 — Yield on loans excluding PPP and accretion on acquired loans 4.23 % 4.22 % 4.31 % 4.57 % 4.63 % 4.33 % 4.77 % 1On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost.

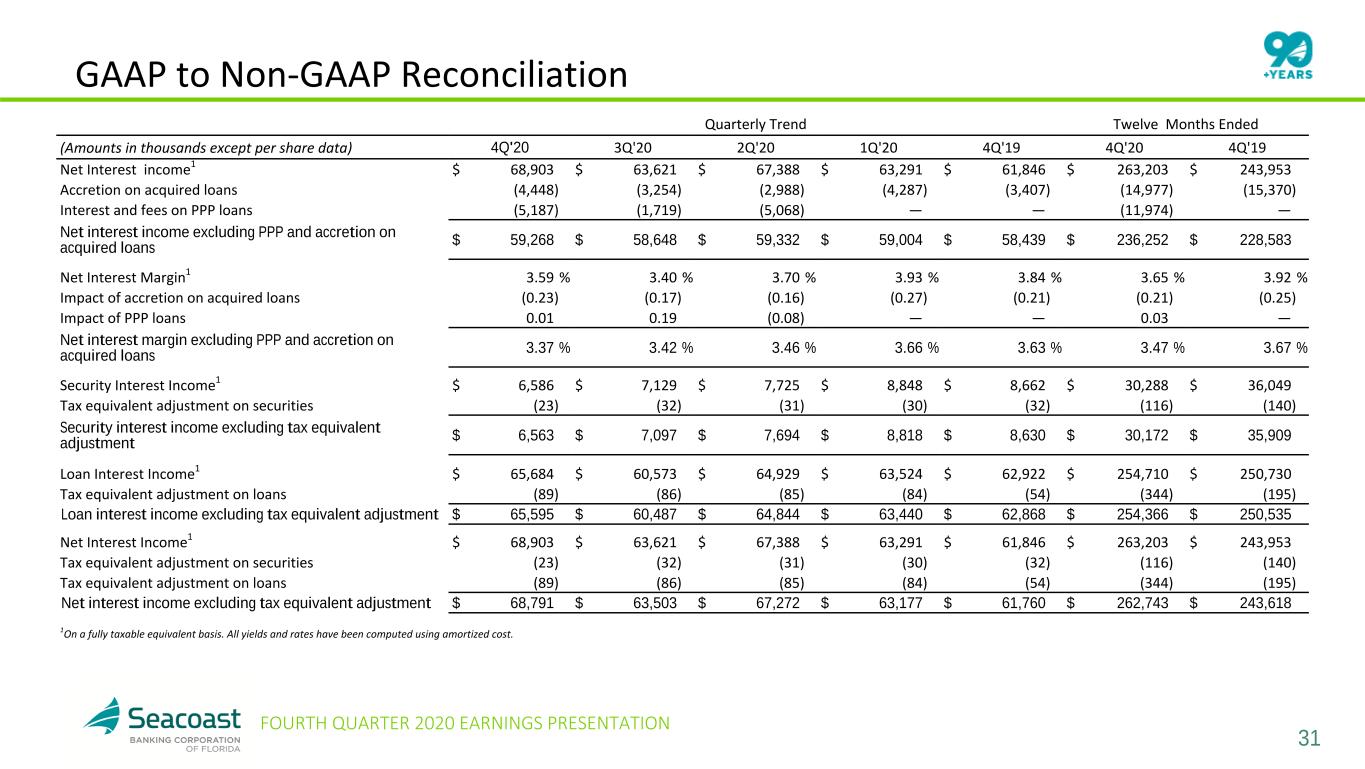

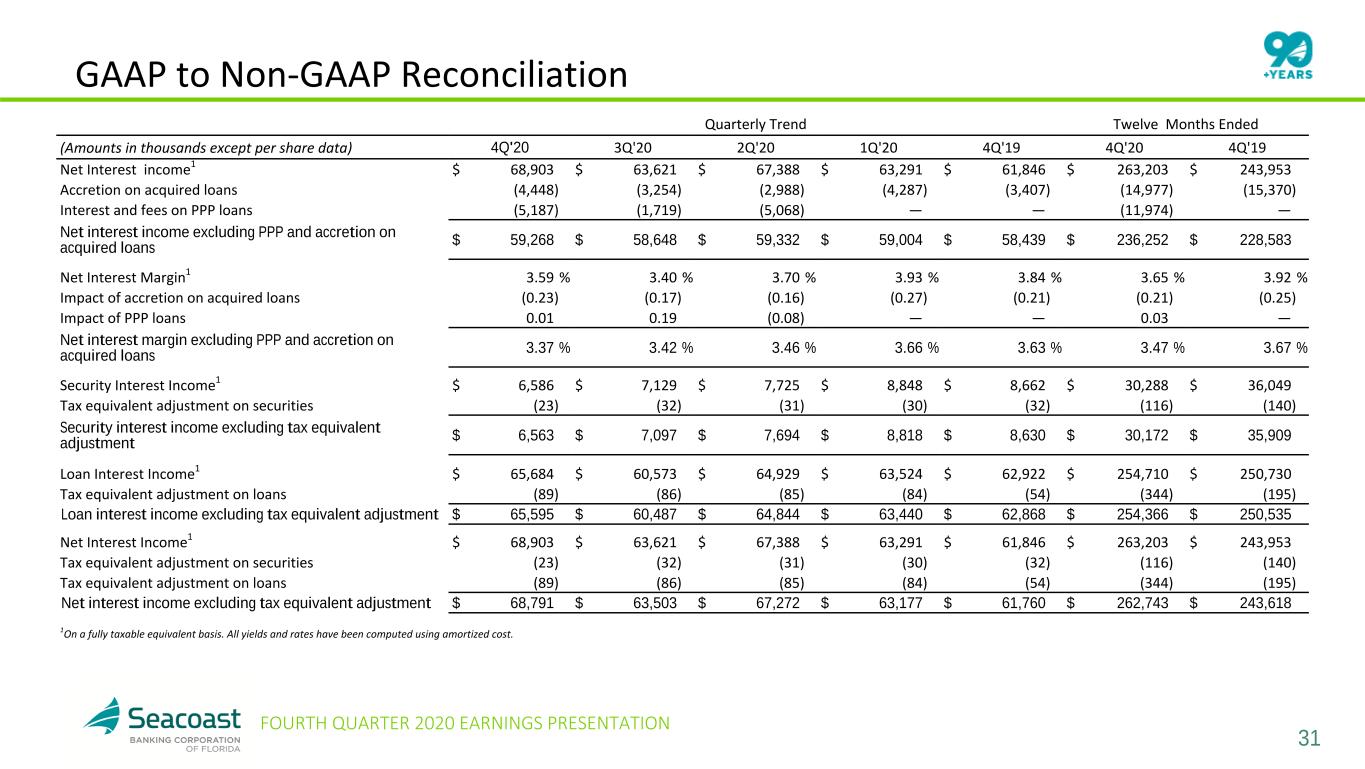

31 FOURTH QUARTER 2020 EARNINGS PRESENTATION Quarterly Trend Twelve Months Ended (Amounts in thousands except per share data) 4Q'20 3Q'20 2Q'20 1Q'20 4Q'19 4Q'20 4Q'19 Net Interest income1 $ 68,903 $ 63,621 $ 67,388 $ 63,291 $ 61,846 $ 263,203 $ 243,953 Accretion on acquired loans (4,448) (3,254) (2,988) (4,287) (3,407) (14,977) (15,370) Interest and fees on PPP loans (5,187) (1,719) (5,068) — — (11,974) — Net interest income excluding PPP and accretion on acquired loans $ 59,268 $ 58,648 $ 59,332 $ 59,004 $ 58,439 $ 236,252 $ 228,583 Net Interest Margin1 3.59 % 3.40 % 3.70 % 3.93 % 3.84 % 3.65 % 3.92 % Impact of accretion on acquired loans (0.23) (0.17) (0.16) (0.27) (0.21) (0.21) (0.25) Impact of PPP loans 0.01 0.19 (0.08) — — 0.03 — Net interest margin excluding PPP and accretion on acquired loans 3.37 % 3.42 % 3.46 % 3.66 % 3.63 % 3.47 % 3.67 % Security Interest Income1 $ 6,586 $ 7,129 $ 7,725 $ 8,848 $ 8,662 $ 30,288 $ 36,049 Tax equivalent adjustment on securities (23) (32) (31) (30) (32) (116) (140) Security interest income excluding tax equivalent adjustment $ 6,563 $ 7,097 $ 7,694 $ 8,818 $ 8,630 $ 30,172 $ 35,909 Loan Interest Income1 $ 65,684 $ 60,573 $ 64,929 $ 63,524 $ 62,922 $ 254,710 $ 250,730 Tax equivalent adjustment on loans (89) (86) (85) (84) (54) (344) (195) Loan interest income excluding tax equivalent adjustment $ 65,595 $ 60,487 $ 64,844 $ 63,440 $ 62,868 $ 254,366 $ 250,535 Net Interest Income1 $ 68,903 $ 63,621 $ 67,388 $ 63,291 $ 61,846 $ 263,203 $ 243,953 Tax equivalent adjustment on securities (23) (32) (31) (30) (32) (116) (140) Tax equivalent adjustment on loans (89) (86) (85) (84) (54) (344) (195) Net interest income excluding tax equivalent adjustment $ 68,791 $ 63,503 $ 67,272 $ 63,177 $ 61,760 $ 262,743 $ 243,618 1On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. GAAP to Non-GAAP Reconciliation