EARNINGS PRESENTATION SECOND QUARTER 2024 2024

2SECOND QUARTER 2024 EARNINGS PRESENTATION Cautionary Notice Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in the Company’s markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that the Company has acquired, or expects to acquire, as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements. Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of Seacoast Banking Corporation of Florida (“Seacoast” or the “Company”) or its wholly-owned banking subsidiary, Seacoast National Bank (“Seacoast Bank”), to be materially different from results, performance or achievements expressed or implied by such forward-looking statements. You should not expect the Company to update any forward-looking statements. All statements other than statements of historical fact could be forward-looking statements. You can identify these forward- looking statements through the use of words such as "may", "will", "anticipate", "assume", "should", "support", "indicate", "would", "believe", "contemplate", "expect", "estimate", "continue", "further", "plan", "point to", "project", "could", "intend", "target" or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the impact of current and future economic and market conditions generally (including seasonality) and in the financial services industry, nationally and within Seacoast’s primary market areas, including the effects of inflationary pressures, changes in interest rates, slowdowns in economic growth, and the potential for high unemployment rates, as well as the financial stress on borrowers and changes to customer and client behavior and credit risk as a result of the foregoing; potential impacts of adverse developments in the banking industry including those highlighted by high- profile bank failures, and including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto (including increases in the cost of our deposit insurance assessments), the Company's ability to effectively manage its liquidity risk and any growth plans, and the availability of capital and funding; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes including proposed overdraft and late fee caps, including those that impact the money supply and inflation; the risks of changes in interest rates on the level and composition of deposits (as well as the cost of, and competition for, deposits), loan demand, liquidity and the values of loan collateral, securities, and interest rate sensitive assets and liabilities; interest rate risks (including the impacts of interest rates on macroeconomic conditions, customer and client behavior, and on our net interest income), as well as the impact of prolonged elevated interest rates on our financial projections and models, sensitivities and the shape of the yield curve; changes in accounting policies, rules and practices; changes in retail distribution strategies, customer preferences and behavior generally and as a result of economic factors, including heightened inflation; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate, especially as they relate to the value of collateral supporting the Company’s loans; the Company’s concentration in commercial real estate loans and in real estate collateral in Florida; Seacoast’s ability to comply with any regulatory requirements; the risk that the regulatory environment may not be conducive to or may prohibit or delay the consummation of future mergers and/or business combinations, may increase the length of time and amount of resources required to consummate such transactions, and may reduce the anticipated benefit; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of Seacoast’s investments due to market volatility or counterparty payment risk, as well as the effect of a decline in stock market prices on our fee income from our wealth management business; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including Seacoast’s ability to continue to identify acquisition targets, successfully acquire and integrate desirable financial institutions and realize expected revenues and revenue synergies; changes in technology or products that may be more difficult, costly, or less effective than anticipated; the Company’s ability to identify and address increased cybersecurity risks, including those impacting vendors and other third parties which may be exacerbated by developments in generative artificial intelligence; fraud or misconduct by internal or external parties, which Seacoast may not be able to prevent, detect or mitigate; inability of Seacoast’s risk management framework to manage risks associated with the Company’s business; dependence on key suppliers or vendors to obtain equipment or services for the business on acceptable terms; reduction in or the termination of Seacoast’s ability to use the online- or mobile-based platform that is critical to the Company’s business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, including hurricanes in the Company’s footprint, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions and/or increase costs, including, but not limited to, property and casualty and other insurance costs; Seacoast’s ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines, costs and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that deferred tax assets could be reduced if estimates of future taxable income from the Company’s operations and tax planning strategies are less than currently estimated, the results of tax audit findings, challenges to our tax positions, or adverse changes or interpretations of tax laws; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, non-bank financial technology providers, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions; the failure of assumptions underlying the establishment of reserves for expected credit losses; risks related to, and the costs associated with, environmental, social and governance matters, including the scope and pace of related rulemaking activity and disclosure requirements; a deterioration of the credit rating for U.S. long- term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding the federal budget and economic policy; the risk that balance sheet, revenue growth, and loan growth expectations may differ from actual results; and other factors and risks described under “Risk Factors” herein and in any of the Company's subsequent reports filed with the SEC and available on its website at www.sec.gov. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s annual report on Form 10-K for the year ended December 31, 2023 and in other periodic reports that the Company files with the SEC. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC's Internet website at www.sec.gov.

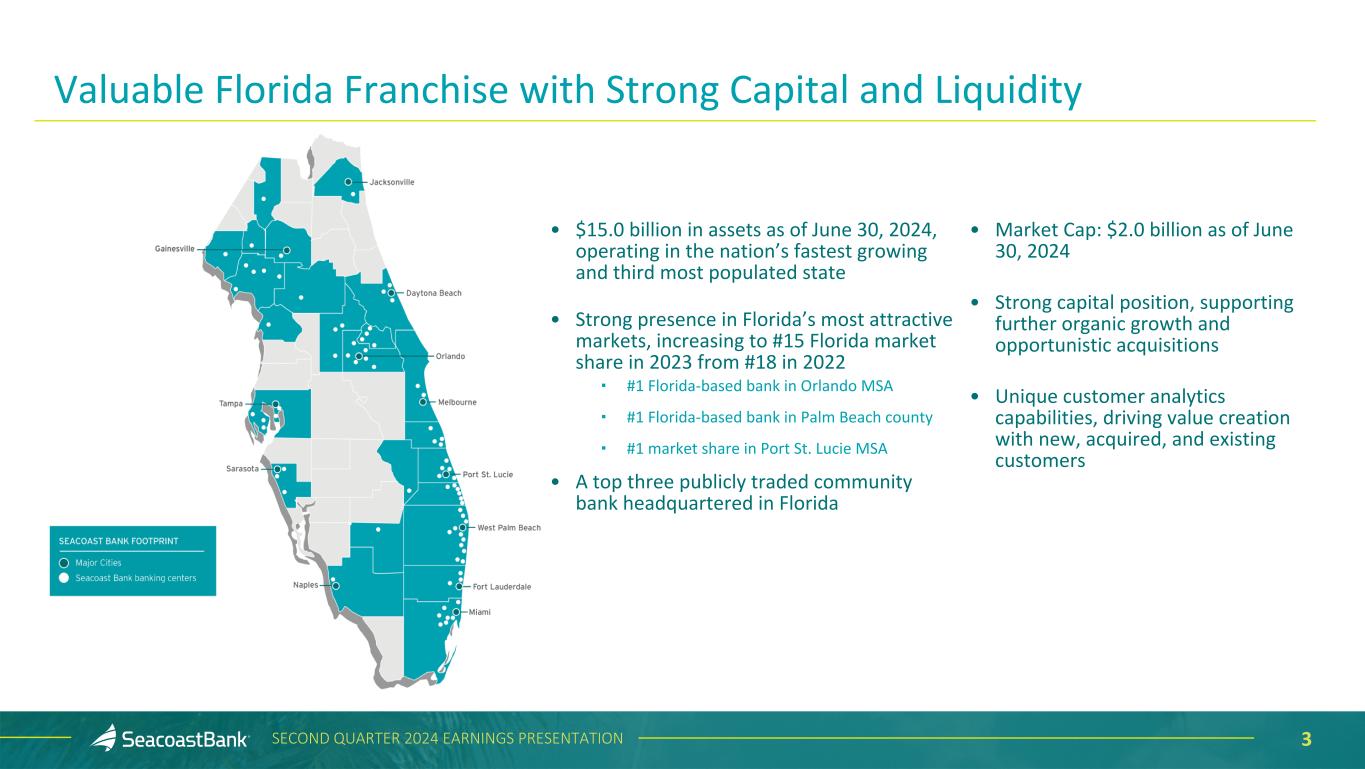

3SECOND QUARTER 2024 EARNINGS PRESENTATION • $15.0 billion in assets as of June 30, 2024, operating in the nation’s fastest growing and third most populated state • Strong presence in Florida’s most attractive markets, increasing to #15 Florida market share in 2023 from #18 in 2022 ▪ #1 Florida-based bank in Orlando MSA ▪ #1 Florida-based bank in Palm Beach county ▪ #1 market share in Port St. Lucie MSA • A top three publicly traded community bank headquartered in Florida • Market Cap: $2.0 billion as of June 30, 2024 • Strong capital position, supporting further organic growth and opportunistic acquisitions • Unique customer analytics capabilities, driving value creation with new, acquired, and existing customers Valuable Florida Franchise with Strong Capital and Liquidity

4SECOND QUARTER 2024 EARNINGS PRESENTATION • Net income of $30.2 million, or $0.36 per diluted share. • Four consecutive quarters of lower adjusted noninterest expense1, demonstrating the Company’s focus on driving efficiency while making investments for organic growth. • During the quarter, the cost of deposits began to stabilize in conjunction with emerging loan growth supporting net interest income and the net interest margin. • Pre-tax pre-provision earnings on an adjusted basis1 increased $2.0 million to $44.5 million from the prior quarter. • Continued success in wealth management, with assets under management increasing 12% year to date to reach a record $1.9 billion. • Continued growth in lending pipelines, with the overall pipeline increasing to $834.4 million. • Asset quality remains well controlled, including a reduction in nonperforming loans compared to the prior quarter. • Tangible book value per share increased to $15.41. • Strong capital position, with a Tier 1 capital ratio of 14.8%, and a tangible common equity to tangible assets ratio of 9.3%. • Repurchased 39,892 shares of our common stock at a weighted average price of $22.06. Second Quarter 2024 Highlights 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. Comparisons are to the first quarter of 2024 unless otherwise stated

5SECOND QUARTER 2024 EARNINGS PRESENTATION Net Interest Income ($ in th ou sa nd s) $127,153 $119,505 $111,035 $105,298 $104,657 3.86% 3.57% 3.36% 3.24% 3.18% 3.42% 3.13% 3.02% 2.91% 2.87% Net Interest Income Net Interest Margin NIM, excluding accretion on acquired loans 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 • Net interest income1 totaled $104.7 million, a decrease of $0.6 million, or 1%, from the prior quarter. • Net interest margin contracted six basis points to 3.18% and, excluding the effect of accretion on acquired loans, net interest margin contracted four basis points to 2.87%. • Securities yields increased 22 basis points to 3.69% benefiting from new securities acquired year to date. • Loan yields increased three basis points from the prior quarter to 5.93%. Excluding the effect of accretion on acquired loans, yields increased four basis points to 5.52%, benefiting from higher rates on new production. • The cost of deposits increased 12 basis points to 2.31%, but began to stabilize in May and June. 1Calculated on a fully taxable equivalent basis using amortized cost.

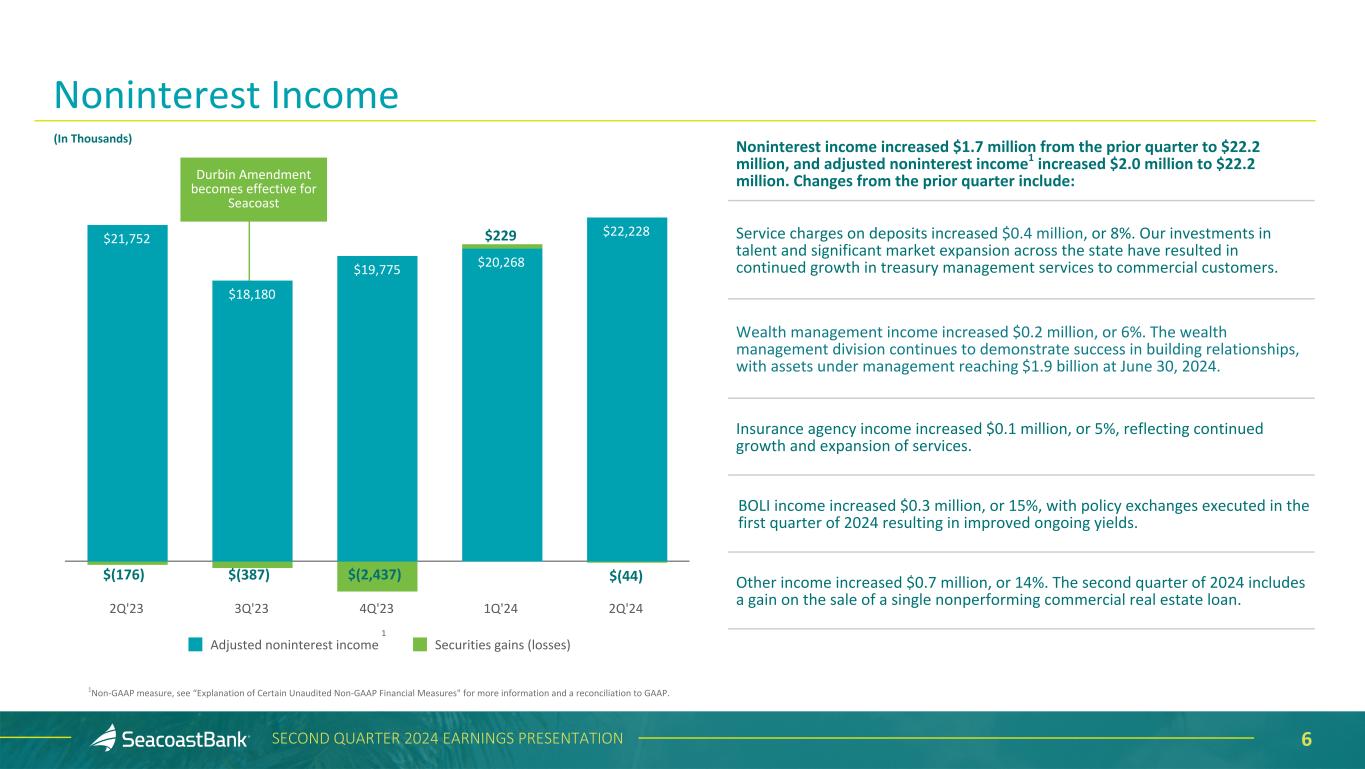

6SECOND QUARTER 2024 EARNINGS PRESENTATION Noninterest income increased $1.7 million from the prior quarter to $22.2 million, and adjusted noninterest income1 increased $2.0 million to $22.2 million. Changes from the prior quarter include: Service charges on deposits increased $0.4 million, or 8%. Our investments in talent and significant market expansion across the state have resulted in continued growth in treasury management services to commercial customers. Wealth management income increased $0.2 million, or 6%. The wealth management division continues to demonstrate success in building relationships, with assets under management reaching $1.9 billion at June 30, 2024. Insurance agency income increased $0.1 million, or 5%, reflecting continued growth and expansion of services. BOLI income increased $0.3 million, or 15%, with policy exchanges executed in the first quarter of 2024 resulting in improved ongoing yields. Other income increased $0.7 million, or 14%. The second quarter of 2024 includes a gain on the sale of a single nonperforming commercial real estate loan. 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. Noninterest Income $21,752 $18,180 $19,775 $20,268 $22,228 $(44) Adjusted noninterest income Securities gains (losses) 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 (In Thousands) 1 $229 $(176) $(387) $(2,437) Durbin Amendment becomes effective for Seacoast

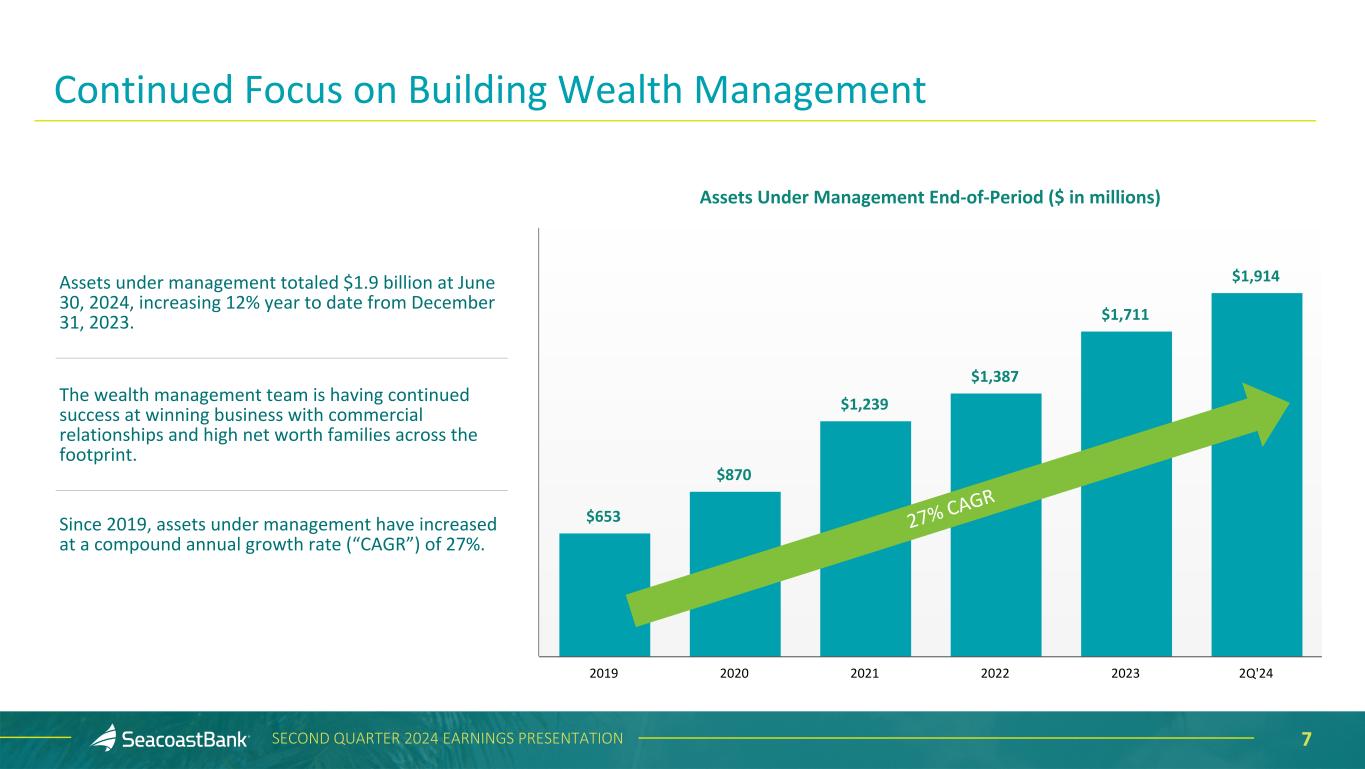

7SECOND QUARTER 2024 EARNINGS PRESENTATION Assets Under Management End-of-Period ($ in millions) $653 $870 $1,239 $1,387 $1,711 $1,914 2019 2020 2021 2022 2023 2Q'24 27% CAGR Continued Focus on Building Wealth Management Assets under management totaled $1.9 billion at June 30, 2024, increasing 12% year to date from December 31, 2023. The wealth management team is having continued success at winning business with commercial relationships and high net worth families across the footprint. Since 2019, assets under management have increased at a compound annual growth rate (“CAGR”) of 27%.

8SECOND QUARTER 2024 EARNINGS PRESENTATION Noninterest Expense Noninterest expense totaled $82.5 million, a decrease of $7.8 million, or 9%, from the prior quarter, and on an adjusted basis1, declined $0.7 million, or 1%. Changes compared to the prior quarter include: Salaries and wages decreased $1.4 million, or 3%, to $38.9 million. The first quarter of 2024 included $2.1 million in severance-related expenses arising from a reduction in the workforce. Employee benefits decreased $1.0 million, or 13%, to $6.9 million as a result of higher seasonal payroll taxes and 401(k) contributions impacting the first quarter of 2024. Outsourced data processing costs decreased $3.9 million, or 32%, to $8.2 million, with the first quarter reflecting $4.1 million in charges associated with contract terminations and modifications to consolidate systems. Occupancy costs decreased $0.9 million, or 11%, to $7.2 million. The first quarter of 2024 included $0.8 million in charges associated with early lease terminations and consolidation of locations completed during the first quarter. Marketing expenses increased $0.6 million, or 23%, to $3.3 million, the result of a focused effort on branding across all of our markets, supporting strong results in customer acquisition. Other noninterest expenses decreased $0.7 million, or 10%, to $5.9 million, benefiting from ongoing expense discipline. $91,646 $90,610 $86,367 $83,277 $82,537 $16,219 $3,305 $7,094 56.4% 60.2% 60.3% 61.1% 60.2% Adjusted noninterest expense NonGAAP adjustments Adjusted efficiency ratio 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 (In Thousands) 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. 11

9SECOND QUARTER 2024 EARNINGS PRESENTATION $285 $353 $393 $573 $834 $519 $245 $478 $394 $538 Pipeline Originations 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Loan Pipeline End-of-Period vs Originations (in millions) $10,118 $10,011 $10,063 $9,978 $10,039 5.89% 5.93% 5.85% 5.90% 5.93% 5.31% 5.34% 5.40% 5.48% 5.52% Yield Excluding Accretion on Acquired Loans Reported Yield Total Loans 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Total Loans End-of-Period ($ in millions) Disciplined Approach to Lending in a Strong Florida Economy Loans outstanding increased by $60.5 million, or 2.4% annualized, from the prior quarter. Loan pipelines increased by 46% from the prior quarter to $834.4 million. Loan yields increased three basis points from the prior quarter to 5.93%. Excluding the effect of accretion on acquired loans, yields increased four basis points to 5.52%, with increases from higher rates and new production.

10SECOND QUARTER 2024 EARNINGS PRESENTATION At June 30, 2024 Loan Portfolio Mix Seacoast's lending strategy results in a diverse and granular loan portfolio. Seacoast’s average loan size is $345 thousand and the average commercial loan size is $758 thousand. Portfolio diversification in terms of asset mix, industry, and loan type, has been a critical element of the Company’s lending strategy. Exposures across industries and collateral types are broadly distributed. Construction and land development and commercial real estate loans, as defined in regulatory guidance, represent 34% and 222%, respectively, of total consolidated risk based capital. CRE-Retail, 11.3% CRE-Office, 5.3% CRE-Multifamily 5+, 4.1% CRE-Hotel/Motel, 3.7% CRE-Industrial/Warehouse, 3.8% CRE-Other, 5.8% OOCRE, 16.5% Construction & Land Development, 5.9% Commercial & Financial, 15.8% Residential, 25.5% Consumer, 2.3% Construction & Land Development and CRE Loans to Total Risk Based Capital 252% 222% 59% 34% CRE Construction & Land Development Peers SBCF Peer Source: 1Q’24 S&P Capital

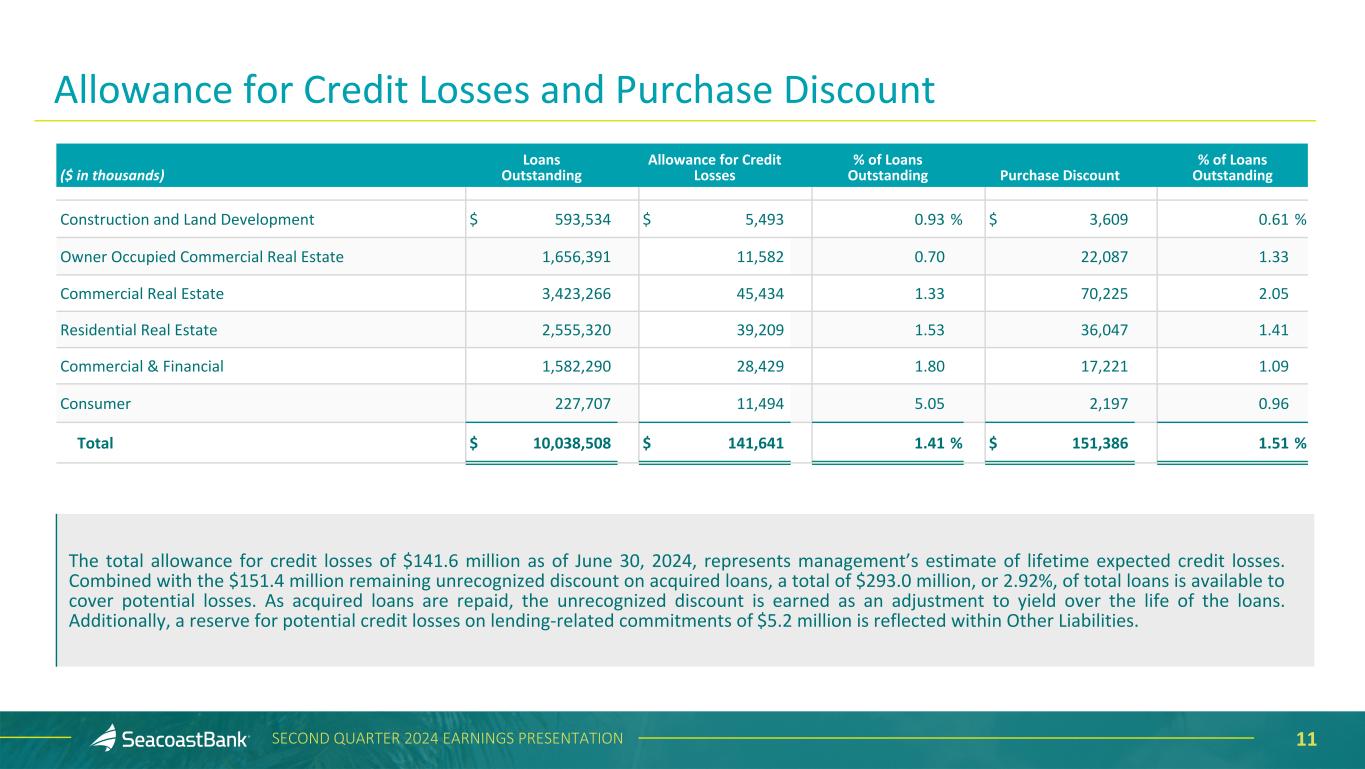

11SECOND QUARTER 2024 EARNINGS PRESENTATION Allowance for Credit Losses and Purchase Discount ($ in thousands) Loans Outstanding Allowance for Credit Losses % of Loans Outstanding Purchase Discount % of Loans Outstanding Construction and Land Development $ 593,534 $ 5,493 0.93 % $ 3,609 0.61 % Owner Occupied Commercial Real Estate 1,656,391 11,582 0.70 22,087 1.33 Commercial Real Estate 3,423,266 45,434 1.33 70,225 2.05 Residential Real Estate 2,555,320 39,209 1.53 36,047 1.41 Commercial & Financial 1,582,290 28,429 1.80 17,221 1.09 Consumer 227,707 11,494 5.05 2,197 0.96 Total $ 10,038,508 $ 141,641 1.41 % $ 151,386 1.51 % The total allowance for credit losses of $141.6 million as of June 30, 2024, represents management’s estimate of lifetime expected credit losses. Combined with the $151.4 million remaining unrecognized discount on acquired loans, a total of $293.0 million, or 2.92%, of total loans is available to cover potential losses. As acquired loans are repaid, the unrecognized discount is earned as an adjustment to yield over the life of the loans. Additionally, a reserve for potential credit losses on lending-related commitments of $5.2 million is reflected within Other Liabilities.

12SECOND QUARTER 2024 EARNINGS PRESENTATION Net Charge-Offs 0.13% 0.05% 0.01% 0.22% 0.27% NCO/Average Loans 2020 2021 2022 2023 2024 (YTD Annualized) Nonperforming Loans and Past Dues 0.63% 0.52% 0.35% 0.65% 0.60% 0.18% 0.10% 0.40% 0.30% 0.39% NPL/Total Loans Accruing Past Due / Total Loans 2020 2021 2022 2023 2Q'24 1.62% 1.41% 1.40% 1.48% 1.41% ACL/Total Loans 2020 2021 2022 2023 2Q'24 Allowance for Credit Losses Historical Asset Quality Trends 16.85% 14.29% 12.63% 14.94% 16.43% 2.85% 2.77% 2.11% 2.32% 2.59% Criticized and Classified Loans / Tier 1 Capital Criticized and Classified Loans / Total Loans 2020 2021 2022 2023 2Q'24 Criticized and Classified Loans

13SECOND QUARTER 2024 EARNINGS PRESENTATION Net Charge-Offs $705 $12,748 $4,720 $3,630 $9,9460.50% 0.19% 0.15% 0.40% NCO NCO/Average Loans 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 ($ in thousands) $159,715 $149,661 $148,931 $146,669 $141,641 1.58% 1.49% 1.48% 1.47% 1.41% ACL ACL/Total Loans 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Allowance for Credit Losses Continued Strong Asset Quality Trends 0.03% Nonperforming Loans and Past Dues $48,326 $41,508 $65,104 $77,205 $59,927 0.48% 0.41% 0.65% 0.77% 0.60% 0.25% 0.33% 0.30% 0.30% 0.39% NPL NPL/Total Loans Accruing Past Due / Total Loans 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Criticized and Classified Loans $210,070 $201,483 $233,916 $239,185 $260,040 2.08% 2.01% 2.32% 2.40% 2.59% Criticized and Classified Loans Criticized and Classified Loans / Total Loans 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24

14SECOND QUARTER 2024 EARNINGS PRESENTATION Investment Securities Performance and Composition Portfolio yield increased 22 basis points to 3.69% from 3.47% in the prior quarter due to favorable yields on bonds purchased. AFS securities ended the quarter with a net unrealized loss of $224.7 million compared to a net unrealized loss of $220.0 million at March 31, 2024. HTM securities ended the quarter with a net unrealized loss of $130.7 million compared to a net unrealized loss of $129.7 million at March 31, 2024. High quality AFS portfolio consisting of 85% agency backed securities, with the remainder comprised primarily of highly-rated investment grade bonds. CLO portfolio is entirely AA/AAA rated. AFS portfolio duration of 4.5, total portfolio duration of 4.8. Unrealized Loss in Securities as of June 30, 2024 (in thousands) Amortized Cost Fair Value Net Unrealized Loss △ from 1Q'24 Total Available for Sale $ 2,191,952 $ 1,967,204 $ (224,748) $ (4,782) Total Held to Maturity 658,055 527,327 (130,728) (992) Total Securities $ 2,850,007 $ 2,494,531 $ (355,476) $ (5,774) ($ in m ill io ns ) $708 $691 $680 $670 $658 $1,916 $1,842 $1,836 $1,949 $1,967 3.13% 3.32% 3.42% 3.47% 3.69% HTM Securities AFS Securities Yield 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24

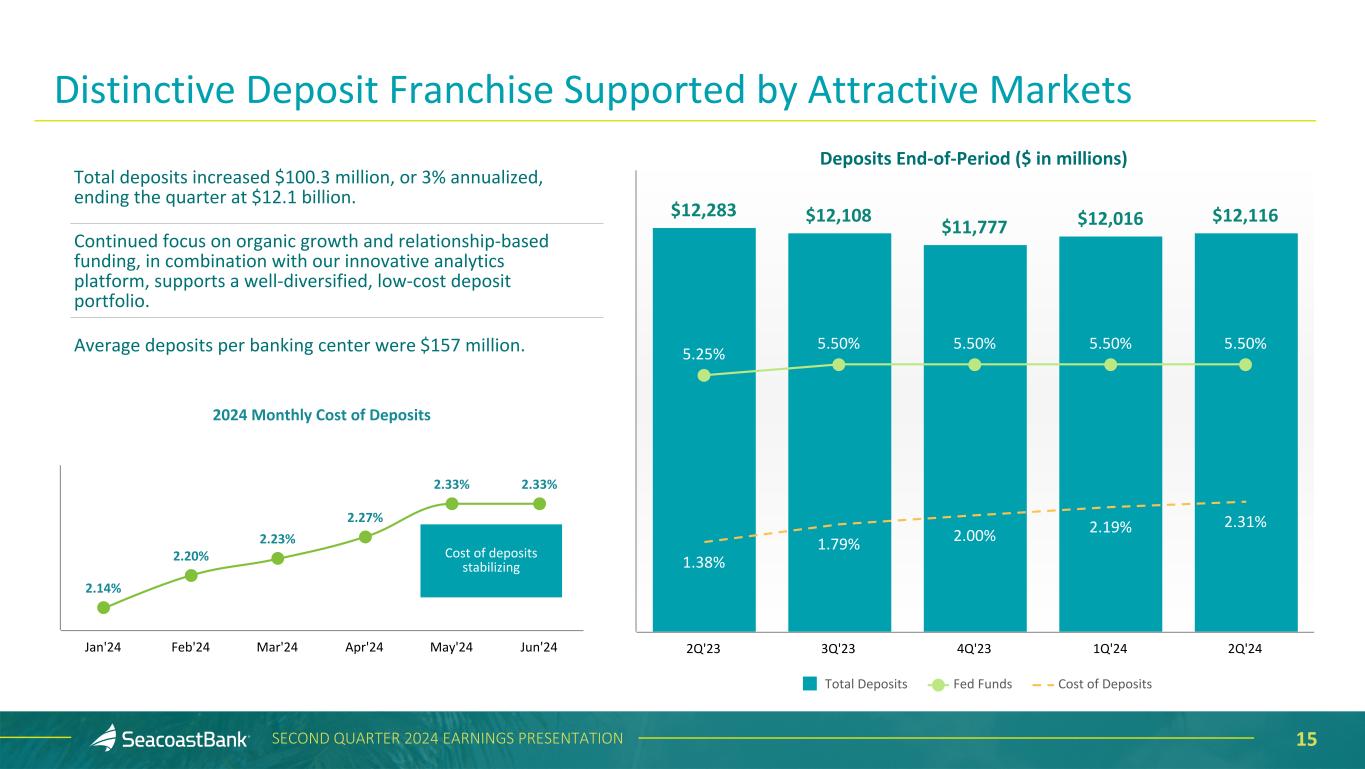

15SECOND QUARTER 2024 EARNINGS PRESENTATION Deposits End-of-Period ($ in millions) $12,283 $12,108 $11,777 $12,016 $12,116 5.25% 5.50% 5.50% 5.50% 5.50% 1.38% 1.79% 2.00% 2.19% 2.31% Total Deposits Fed Funds Cost of Deposits 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Distinctive Deposit Franchise Supported by Attractive Markets Total deposits increased $100.3 million, or 3% annualized, ending the quarter at $12.1 billion. Continued focus on organic growth and relationship-based funding, in combination with our innovative analytics platform, supports a well-diversified, low-cost deposit portfolio. Average deposits per banking center were $157 million. 2024 Monthly Cost of Deposits 2.14% 2.20% 2.23% 2.27% 2.33% 2.33% Jan'24 Feb'24 Mar'24 Apr'24 May'24 Jun'24 Cost of deposits stabilizing

16SECOND QUARTER 2024 EARNINGS PRESENTATION Deposits End-of-Period ($ in millions) $12,283 $12,108 $11,777 $12,016 $12,116 Transaction Accounts Savings Money Market Brokered Time Deposits 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 Granular, Diverse and Relationship-Focused Customer Funding Base The Company benefits from a granular deposit franchise, with the top ten depositors representing approximately 4% of total deposits. Customer transaction account balances represent 50% of total deposits. Consumer deposits represent 42% of total deposits, with an average balance per account of $25 thousand. Business deposits represent 58% of total deposits, with an average balance per account of $109 thousand. The average tenure for a Seacoast customer is 10 years. 50%52%54%55%57% 5%5%6%6%7% 23% 26% 28% 29% 30% 5% 3% 1% 1% 3% 8% 10% 11% 13% 12%

17SECOND QUARTER 2024 EARNINGS PRESENTATION $14.24 $14.26 $15.08 $15.26 $15.41 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 8.5% 8.7% 9.3% 9.3% 9.3% 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 14.7% 15.1% 15.9% 16.1% 16.2% 13.5% 14.0% 14.5% 14.7% 14.8% Total Risk Based Capital Tier 1 Ratio 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 12.1% 11.9% 11.2% 9.6% 10.8% 16.1% 12.8% 11.8% 11.2% 10.8% GAAP - ROTCE Adjusted - ROTCE 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. 2FDICIA defines well capitalized as 10.0% for total risk based capital and 8.0% for Tier 1 ratio at a total Bank level. Tangible Book Value Per Share Tangible Common Equity / Tangible Assets Total Risk Based and Tier 1 CapitalReturn on Tangible Common Equity 1 10.0%2 8.0%2 Robust Capital Position Supporting a Fortress Balance Sheet

Tracey L. Dexter Chief Financial Officer Tracey.Dexter@SeacoastBank.com (772) 403-0461 Michael Young Treasurer & Director of Investor Relations Michael.Young@SeacoastBank.com (772) 403-0451 INVESTOR RELATIONS NASDAQ: SBCF

19SECOND QUARTER 2024 EARNINGS PRESENTATION Appendix

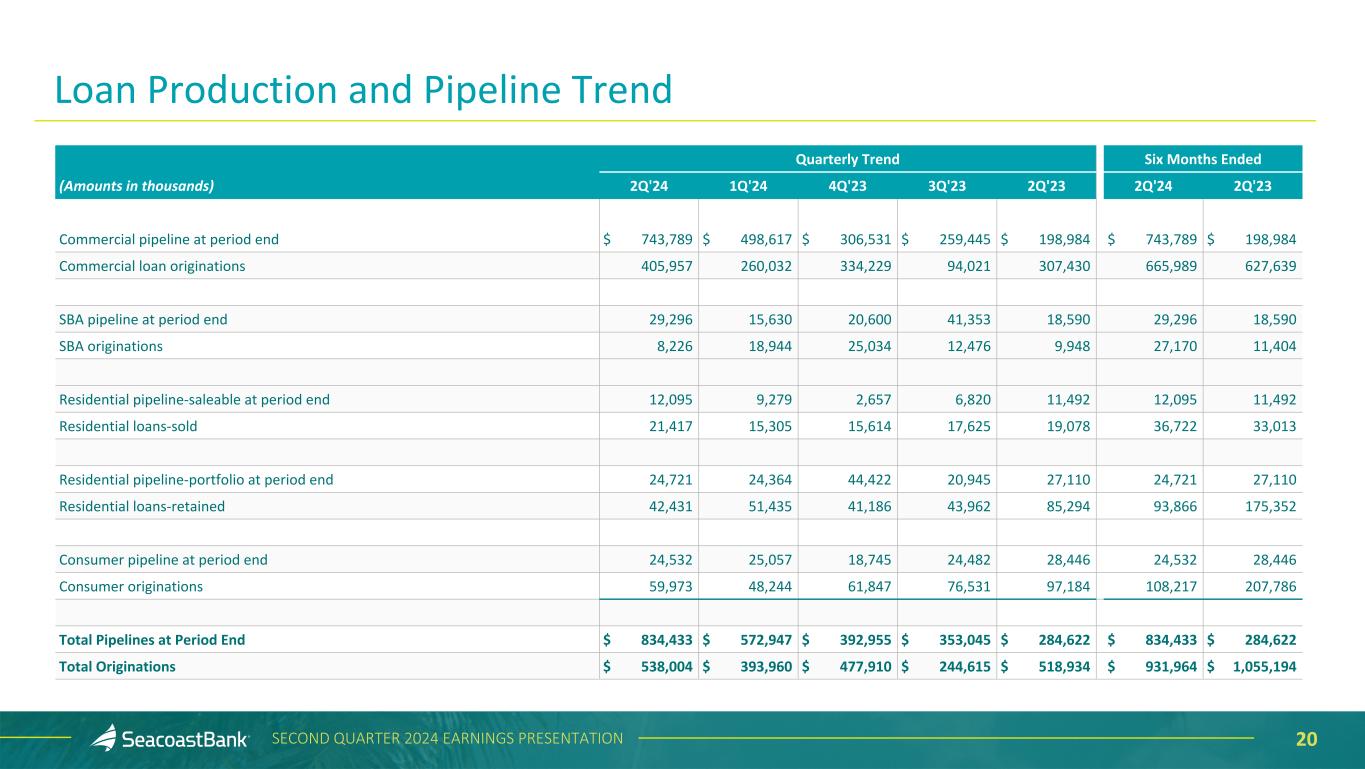

20SECOND QUARTER 2024 EARNINGS PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands) 2Q'24 1Q'24 4Q'23 3Q'23 2Q'23 2Q'24 2Q'23 Commercial pipeline at period end $ 743,789 $ 498,617 $ 306,531 $ 259,445 $ 198,984 $ 743,789 $ 198,984 Commercial loan originations 405,957 260,032 334,229 94,021 307,430 665,989 627,639 SBA pipeline at period end 29,296 15,630 20,600 41,353 18,590 29,296 18,590 SBA originations 8,226 18,944 25,034 12,476 9,948 27,170 11,404 Residential pipeline-saleable at period end 12,095 9,279 2,657 6,820 11,492 12,095 11,492 Residential loans-sold 21,417 15,305 15,614 17,625 19,078 36,722 33,013 Residential pipeline-portfolio at period end 24,721 24,364 44,422 20,945 27,110 24,721 27,110 Residential loans-retained 42,431 51,435 41,186 43,962 85,294 93,866 175,352 Consumer pipeline at period end 24,532 25,057 18,745 24,482 28,446 24,532 28,446 Consumer originations 59,973 48,244 61,847 76,531 97,184 108,217 207,786 Total Pipelines at Period End $ 834,433 $ 572,947 $ 392,955 $ 353,045 $ 284,622 $ 834,433 $ 284,622 Total Originations $ 538,004 $ 393,960 $ 477,910 $ 244,615 $ 518,934 $ 931,964 $ 1,055,194 Loan Production and Pipeline Trend

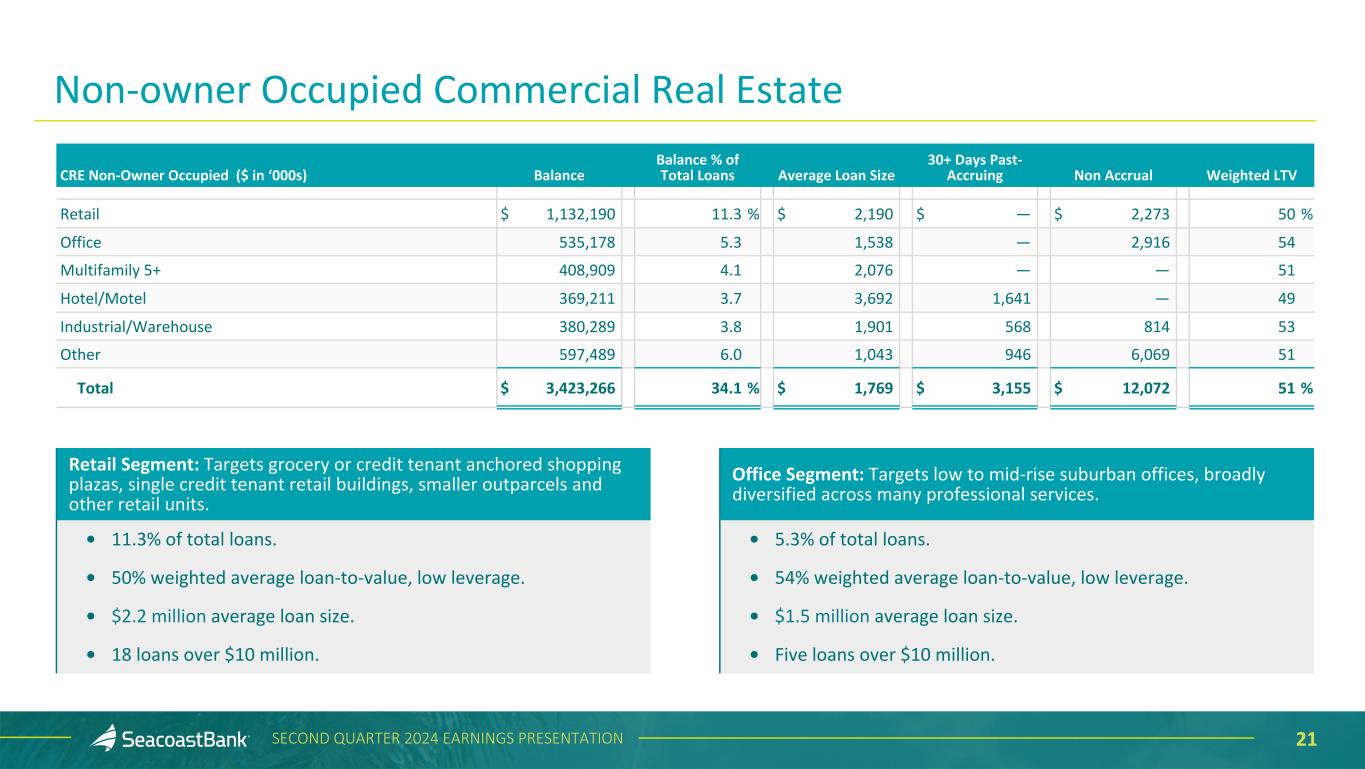

21SECOND QUARTER 2024 EARNINGS PRESENTATION Non-owner Occupied Commercial Real Estate CRE Non-Owner Occupied ($ in ‘000s) Balance Balance % of Total Loans Average Loan Size 30+ Days Past- Accruing Non Accrual Weighted LTV Retail $ 1,132,190 11.3 % $ 2,190 $ — $ 2,273 50 % Office 535,178 5.3 1,538 — 2,916 54 Multifamily 5+ 408,909 4.1 2,076 — — 51 Hotel/Motel 369,211 3.7 3,692 1,641 — 49 Industrial/Warehouse 380,289 3.8 1,901 568 814 53 Other 597,489 6.0 1,043 946 6,069 51 Total $ 3,423,266 34.1 % $ 1,769 $ 3,155 $ 12,072 51 % Retail Segment: Targets grocery or credit tenant anchored shopping plazas, single credit tenant retail buildings, smaller outparcels and other retail units. • 11.3% of total loans. • 50% weighted average loan-to-value, low leverage. • $2.2 million average loan size. • 18 loans over $10 million. Office Segment: Targets low to mid-rise suburban offices, broadly diversified across many professional services. • 5.3% of total loans. • 54% weighted average loan-to-value, low leverage. • $1.5 million average loan size. • Five loans over $10 million.

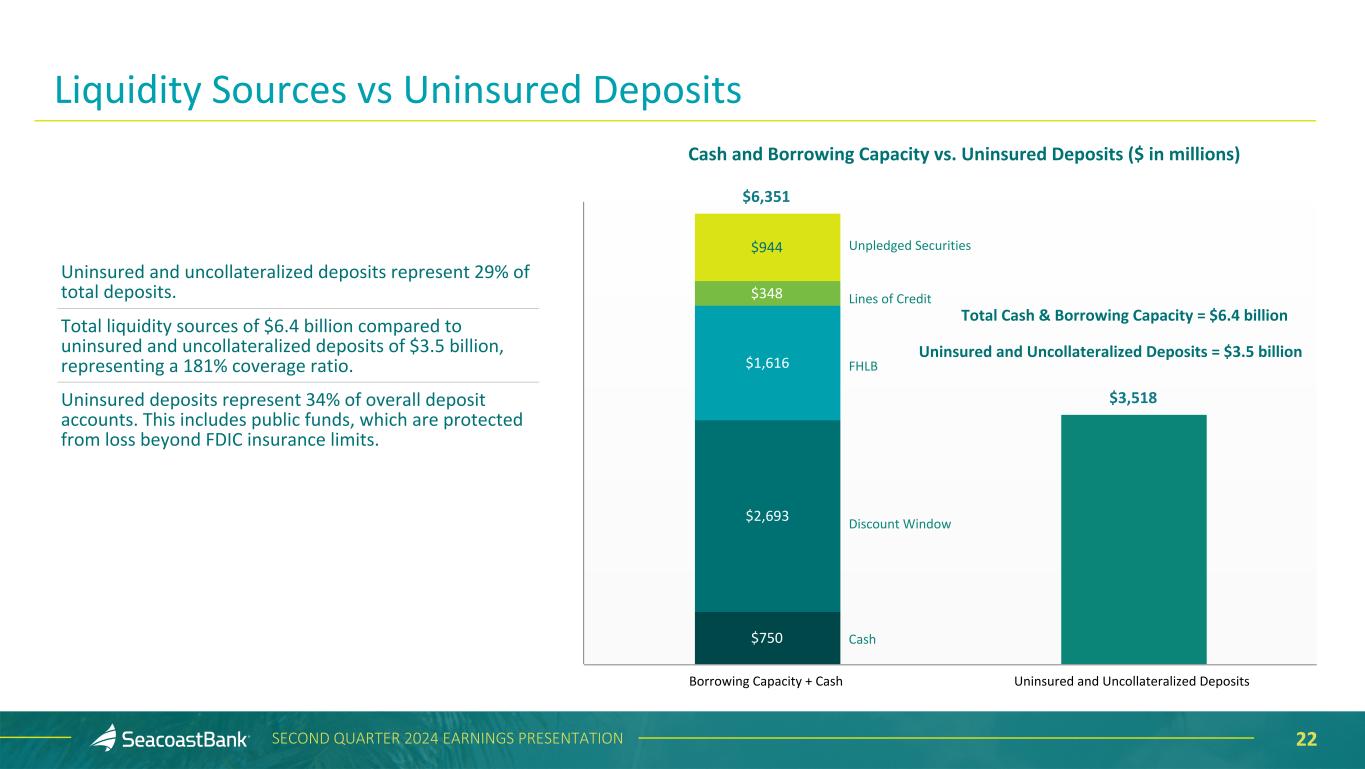

22SECOND QUARTER 2024 EARNINGS PRESENTATION Liquidity Sources vs Uninsured Deposits Cash and Borrowing Capacity vs. Uninsured Deposits ($ in millions) $6,351 $3,518 $750 $2,693 $1,616 $348 $944 Borrowing Capacity + Cash Uninsured and Uncollateralized Deposits Total Cash & Borrowing Capacity = $6.4 billion Uninsured and Uncollateralized Deposits = $3.5 billion Uninsured and uncollateralized deposits represent 29% of total deposits. Total liquidity sources of $6.4 billion compared to uninsured and uncollateralized deposits of $3.5 billion, representing a 181% coverage ratio. Uninsured deposits represent 34% of overall deposit accounts. This includes public funds, which are protected from loss beyond FDIC insurance limits. Unpledged Securities Lines of Credit Discount Window Cash FHLB

23SECOND QUARTER 2024 EARNINGS PRESENTATION This presentation contains financial information determined by methods other than Generally Accepted Accounting Principles (“GAAP”). The financial highlights provide reconciliations between GAAP and adjusted financial measures including net income, noninterest income, noninterest expense, tax adjustments and other financial ratios. Management uses these non-GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. The Company believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance and if not provided would be requested by the investor community. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might define or calculate these measures differently. The Company provides reconciliations between GAAP and these non-GAAP measures. These disclosures should not be considered an alternative to GAAP. Explanation of Certain Unaudited Non-GAAP Financial Measures

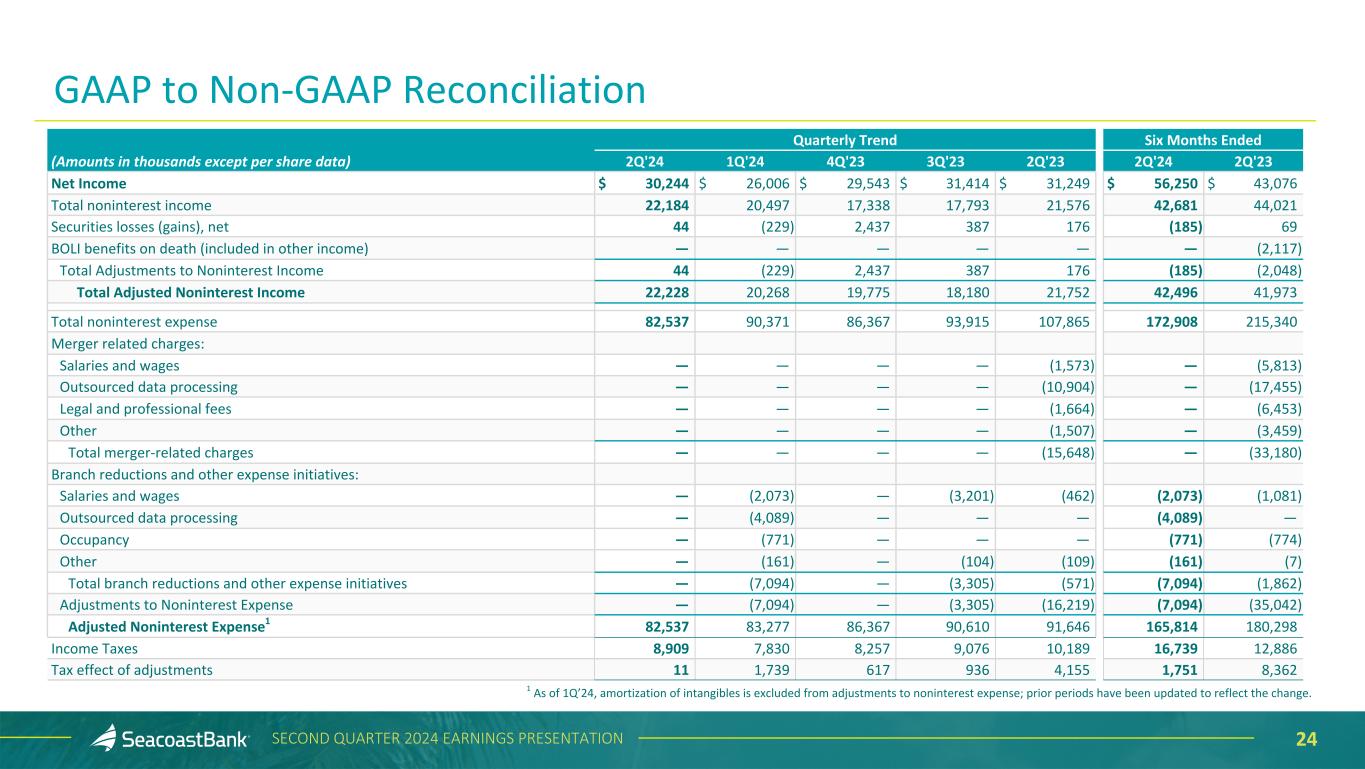

24SECOND QUARTER 2024 EARNINGS PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands except per share data) 2Q'24 1Q'24 4Q'23 3Q'23 2Q'23 2Q'24 2Q'23 Net Income $ 30,244 $ 26,006 $ 29,543 $ 31,414 $ 31,249 $ 56,250 $ 43,076 Total noninterest income 22,184 20,497 17,338 17,793 21,576 42,681 44,021 Securities losses (gains), net 44 (229) 2,437 387 176 (185) 69 BOLI benefits on death (included in other income) — — — — — — (2,117) Total Adjustments to Noninterest Income 44 (229) 2,437 387 176 (185) (2,048) Total Adjusted Noninterest Income 22,228 20,268 19,775 18,180 21,752 42,496 41,973 Total noninterest expense 82,537 90,371 86,367 93,915 107,865 172,908 215,340 Merger related charges: Salaries and wages — — — — (1,573) — (5,813) Outsourced data processing — — — — (10,904) — (17,455) Legal and professional fees — — — — (1,664) — (6,453) Other — — — — (1,507) — (3,459) Total merger-related charges — — — — (15,648) — (33,180) Branch reductions and other expense initiatives: Salaries and wages — (2,073) — (3,201) (462) (2,073) (1,081) Outsourced data processing — (4,089) — — — (4,089) — Occupancy — (771) — — — (771) (774) Other — (161) — (104) (109) (161) (7) Total branch reductions and other expense initiatives — (7,094) — (3,305) (571) (7,094) (1,862) Adjustments to Noninterest Expense — (7,094) — (3,305) (16,219) (7,094) (35,042) Adjusted Noninterest Expense1 82,537 83,277 86,367 90,610 91,646 165,814 180,298 Income Taxes 8,909 7,830 8,257 9,076 10,189 16,739 12,886 Tax effect of adjustments 11 1,739 617 936 4,155 1,751 8,362 GAAP to Non-GAAP Reconciliation 1 As of 1Q’24, amortization of intangibles is excluded from adjustments to noninterest expense; prior periods have been updated to reflect the change.

25SECOND QUARTER 2024 EARNINGS PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands except per share data) 2Q'24 1Q'24 4Q'23 3Q'23 2Q'23 2Q'24 2Q'23 Adjusted Income Taxes 8,920 9,569 8,874 10,012 14,344 18,490 21,248 Adjusted Net Income1 $ 30,277 $ 31,132 $ 31,363 $ 34,170 $ 43,489 $ 61,408 $ 67,708 Earnings per diluted share, as reported $ 0.36 $ 0.31 $ 0.35 $ 0.37 $ 0.37 $ 0.66 $ 0.52 Adjusted Earnings per Diluted Share 0.36 0.37 0.37 0.40 0.51 0.72 0.81 Average diluted shares outstanding 84,816 85,270 85,336 85,666 85,536 84,799 83,260 Adjusted Noninterest Expense $ 82,537 $ 83,277 $ 86,367 $ 90,610 $ 91,646 $ 165,814 $ 180,298 Provision for credit losses on unfunded commitments (251) (250) — — — (501) (1,239) Other real estate owned expense and net gain (loss) on sale 109 26 (573) (274) 57 135 (138) Amortization of intangibles (6,003) (6,292) (6,888) (7,457) (7,654) (12,295) (14,381) Net Adjusted Noninterest Expense $ 76,392 $ 76,761 $ 78,906 $ 82,879 $ 84,049 $ 153,153 $ 164,540 Net adjusted noninterest expense $ 76,392 $ 76,761 $ 78,906 $ 82,879 $ 84,049 $ 153,153 $ 165,540 Average tangible assets 14,020,793 13,865,245 13,906,005 14,066,216 14,044,301 13,943,019 13,623,131 Net Adjusted Noninterest Expense to Average Tangible Assets 2.19 % 2.23 % 2.25 % 2.34 % 2.40 % 2.21 % 2.44 % Net Revenue $ 126,608 $ 125,575 $ 128,157 $ 137,099 $ 148,539 $ 252,183 $ 302,136 Total Adjustments to Net Revenue 44 (229) 2,437 387 176 (185) (2,048) Impact of FTE adjustment 233 220 216 199 190 452 389 Adjusted Net Revenue on a fully taxable equivalent basis $ 126,885 $ 125,566 $ 130,810 $ 137,685 $ 148,905 $ 252,450 $ 300,477 Adjusted Efficiency Ratio 60.21 % 61.13 % 60.32 % 60.19 % 56.44 % 60.67 % 54.76 % Net Interest Income $ 104,424 $ 105,078 $ 110,819 $ 119,306 $ 126,963 $ 209,502 $ 258,115 Impact of FTE adjustment 233 220 216 199 190 452 389 Net Interest Income Including FTE adjustment $ 104,657 $ 105,298 $ 111,035 $ 119,505 $ 127,153 $ 209,954 $ 258,504 Total noninterest income 22,184 20,497 17,338 17,793 21,576 42,681 44,021 Total noninterest expense less provision for credit losses on unfunded commitments 82,286 90,121 86,367 93,915 107,865 172,407 214,101 1 As of 1Q’24, amortization of intangibles is excluded from adjustments to noninterest expense; prior periods have been updated to reflect the change. GAAP to Non-GAAP Reconciliation

26SECOND QUARTER 2024 EARNINGS PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands except per share data) 2Q'24 1Q'24 4Q'23 3Q'23 2Q'23 2Q'24 2Q'23 Pre-Tax Pre-Provision Earnings $ 44,555 $ 35,674 $ 42,006 $ 43,383 $ 40,864 $ 80,228 $ 88,424 Total Adjustments to Noninterest Income 44 (229) 2,437 387 176 (185) (2,048) Total Adjustments to Noninterest Expense including other real estate owned expense and net (gain) loss on sale (109) 7,068 573 3,579 16,162 6,959 35,180 Adjusted Pre-Tax Pre-Provision Earnings1 $ 44,490 $ 42,513 $ 45,016 $ 47,349 $ 57,202 $ 87,002 $ 121,556 Average Assets $ 14,839,707 $ 14,690,776 $ 14,738,034 $ 14,906,003 $ 14,887,289 $ 14,765,241 $ 14,420,227 Less average goodwill and intangible assets (818,914) (825,531) (832,029) (839,787) (842,988) (822,222) (797,096) Average Tangible Assets $ 14,020,793 $ 13,865,245 $ 13,906,005 $ 14,066,216 $ 14,044,301 $ 13,943,019 $ 13,623,131 Return on Average Assets (ROA) 0.82 % 0.71 % 0.80 % 0.84 % 0.84 % 0.77 % 0.60 % Impact of removing average intangible assets and related amortization 0.18 0.18 0.19 0.20 0.22 0.17 0.20 Return on Average Tangible Assets (ROTA) 1.00 0.89 0.99 1.04 1.06 0.94 0.80 Impact of other adjustments for Adjusted Net Income — 0.15 0.05 0.08 0.35 0.08 0.36 Adjusted Return on Average Tangible Assets 1.00 1.04 1.04 1.12 1.41 1.02 1.16 Pre-Tax Pre-Provision return on Average Tangible Assets 1.45 % 1.22 % 1.39 % 1.43 % 1.39 % 1.33 % 1.52 % Impact of adjustments on Pre-Tax Pre-Provision earnings — 0.20 0.09 0.12 0.46 0.10 0.49 Adjusted Pre-Tax Pre-Provision Return on Tangible Assets1 1.45 1.42 1.48 1.55 1.85 1.43 2.01 Average Shareholders' Equity $ 2,117,628 $ 2,118,381 $ 2,058,912 $ 2,072,747 $ 2,070,529 $ 2,118,005 $ 1,984,264 Less average goodwill and intangible assets (818,914) (825,531) (832,029) (839,787) (842,988) (822,222) (797,096) Average Tangible Equity $ 1,298,714 $ 1,292,850 $ 1,226,883 $ 1,232,960 $ 1,227,541 $ 1,295,783 $ 1,187,168 Return on Average Shareholders' Equity 5.74 % 4.94 % 5.69 % 6.01 % 6.05 % 5.34 % 4.38 % Impact of removing average intangible assets and related amortization 5.01 4.61 5.53 5.89 6.03 4.81 4.76 Return on Average Tangible Common Equity (ROTCE) 10.75 9.55 11.22 11.90 12.08 10.15 9.14 Impact of other adjustments for Adjusted Net Income 0.01 1.60 0.58 0.89 4.00 0.80 4.18 1 As of 1Q’24, amortization of intangibles is excluded from adjustments to noninterest expense; prior periods have been updated to reflect the change. GAAP to Non-GAAP Reconciliation

27SECOND QUARTER 2024 EARNINGS PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands except per share data) 2Q'24 1Q'24 4Q'23 3Q'23 2Q'23 2Q'24 2Q'23 Adjusted Return on Average Tangible Common Equity 10.76 % 11.15 % 11.80 % 12.79 % 16.08 % 10.95 % 13.32 % Loan Interest Income1 $ 147,518 $ 147,308 $ 148,004 $ 150,048 $ 148,432 $ 294,826 $ 283,773 Accretion on acquired loans (10,178) (10,595) (11,324) (14,843) (14,580) (20,773) (30,522) Loan interest income excluding accretion on acquired loans $ 137,340 $ 136,713 $ 136,680 $ 135,205 $ 133,852 $ 274,053 $ 253,251 Yield on Loans1 5.93 % 5.90 % 5.85 % 5.93 % 5.89 % 5.92 % 5.88 % Impact of accretion on acquired loans (0.41) (0.42) % (0.45) (0.59) (0.58) (0.42) (0.64) Yield on loans excluding accretion on acquired loans 5.52 % 5.48 % 5.40 % 5.34 % 5.31 % 5.50 % 5.24 % Net Interest income1 $ 104,657 $ 105,298 $ 111,035 $ 119,505 $ 127,153 $ 209,954 $ 258,504 Accretion on acquired loans (10,178) (10,595) (11,324) (14,843) (14,580) (20,773) (30,522) Net interest income excluding accretion on acquired loans $ 94,479 $ 94,703 $ 99,711 $ 104,662 $ 112,573 $ 189,181 $ 227,982 Net Interest Margin1 3.18 % 3.24 % 3.36 % 3.57 % 3.86 % 3.21 % 4.09 % Impact of accretion on acquired loans (0.30) (0.33) (0.34) (0.44) (0.44) (0.31) (0.49) Net interest margin excluding accretion on acquired loans 2.87 % 2.91 % 3.02 % 3.13 % 3.42 % 2.89 % 3.60 % Security Interest Income1 $ 24,195 $ 22,434 $ 21,451 $ 21,520 $ 21,018 $ 46,629 $ 40,393 Tax equivalent adjustment on securities (7) (7) (13) (22) (23) (14) (49) Security interest income excluding tax equivalent adjustment $ 24,188 $ 22,427 $ 21,438 $ 21,498 $ 20,995 $ 46,615 $ 40,344 Loan Interest Income1 $ 147,518 $ 147,308 $ 148,004 $ 150,048 $ 148,432 $ 294,825 $ 283,773 Tax equivalent adjustment on loans (226) (213) (203) (177) (167) (438) (340) Loan interest income excluding tax equivalent adjustment $ 147,292 $ 147,095 $ 147,801 $ 149,871 $ 148,265 $ 294,387 $ 283,433 Net Interest Income1 $ 104,657 $ 105,298 $ 111,035 $ 119,505 $ 127,153 $ 209,954 $ 258,504 Tax equivalent adjustment on securities (7) (7) (13) (22) (23) (14) (49) Tax equivalent adjustment on loans (226) (213) (203) (177) (167) (438) (340) Net interest income excluding tax equivalent adjustment $ 104,424 $ 105,078 $ 110,819 $ 119,306 $ 126,963 $ 209,502 $ 258,115 1 On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. GAAP to Non-GAAP Reconciliation