EXHIBIT 99.3

To Form 8-K dated April 25, 2013

Seacoast Banking Corporation of Florida

First Quarter 2013

April 26, 2013

Cautionary Notice Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements about future financial and operating results, ability to realized deferred tax assets, cost savings, enhanced revenues, economic and seasonal conditions in our markets, and improvements to reported earnings that may be realized from cost controls and for integration of banks that we have acquired, as well as statements with respect to Seacoast’s objectives, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements.

Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. You should not expect us to update any forward-looking statements.

You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “support”, “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “further”, “point to,” “project,” “could,” “intend” or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the effects of future economic and market conditions, including seasonality; governmental monetary and fiscal policies, as well as legislative, tax and regulatory changes; changes in accounting policies, rules and practices; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market areas and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the Internet; and the failure of assumptions underlying the establishment of reserves for possible loan losses. The risks of mergers and acquisitions, include, without limitation: unexpected transaction costs, including the costs of integrating operations; the risks that the businesses will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; the potential failure to fully or timely realize expected revenues and revenue synergies, including as the result of revenues following the merger being lower than expected; the risk of deposit and customer attrition; any changes in deposit mix; unexpected operating and other costs, which may differ or change from expectations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers by competitors; as well as the difficulties and risks inherent with entering new markets.

All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2012 under “Special Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors”, and otherwise in our SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC’s Internet website at http://www.sec.gov.

Generating Momentum – Highlights Q1 2013

Building Shareholder Value

| · | Quarterly net income totaled $2.0 million, up from $0.9 million in the first quarter of 2012 |

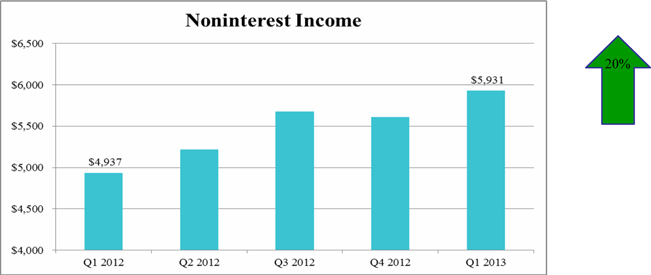

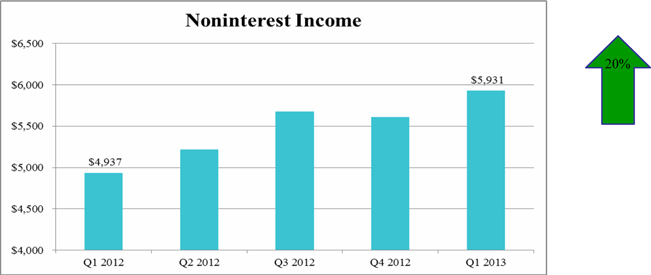

| · | Quarterly noninterest income* revenue up 20.1%, the result of stronger results by multiple business lines |

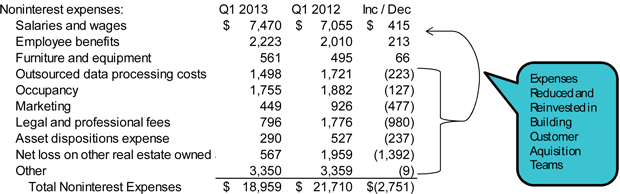

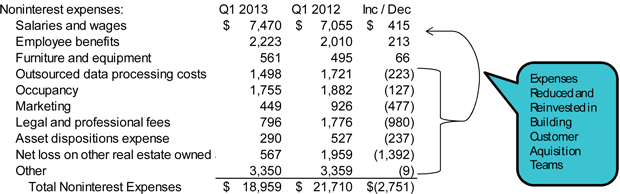

| · | Performance restoration plan results in noninterest expense reduction of 12.7% or $2.8 million when compared to the first quarter of 2012 |

Growing Our Franchise

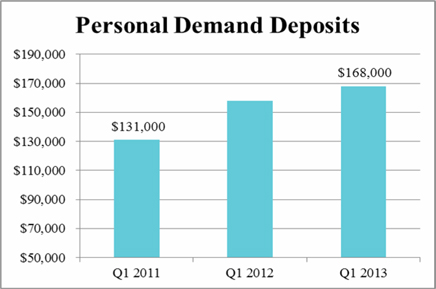

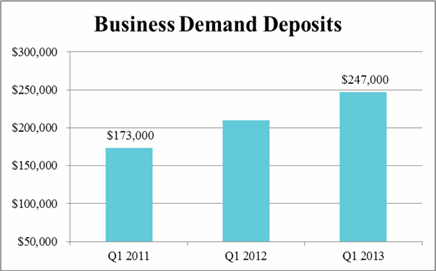

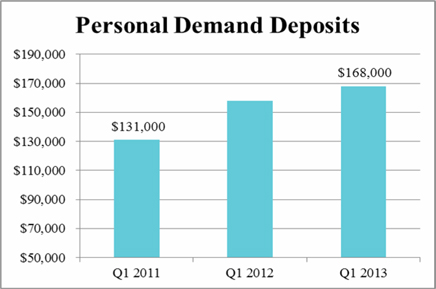

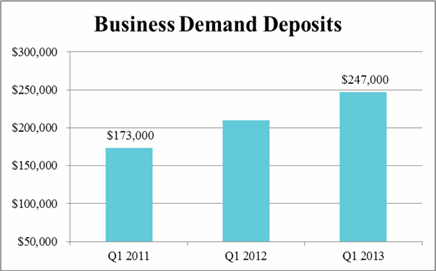

| · | Customer demand deposits increased 22.1%, year over year |

| · | Originated $119 million in loans in the first quarter |

| · | Added seasoned lenders in key markets, more to be added in second quarter |

Reducing our Risk Posture

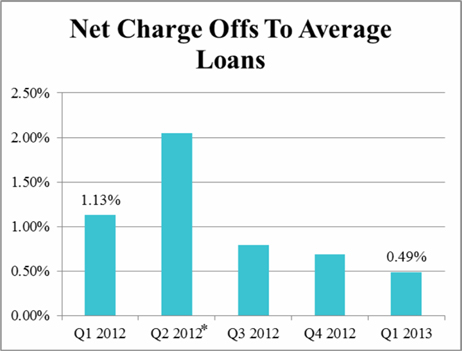

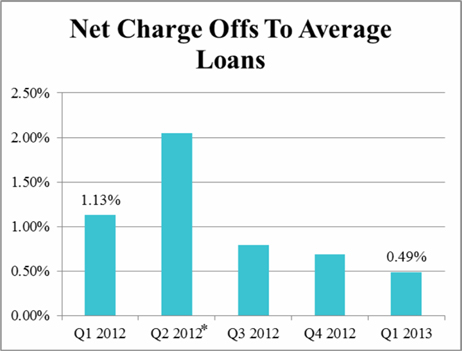

| · | Net charge-offs declined to $1.5 million in the first quarter |

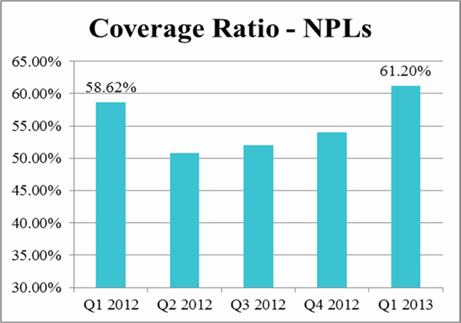

| · | Nonperforming loans declined by $5.7 million compared to year end |

| · | Nonperforming assets to total assets of 3.7% |

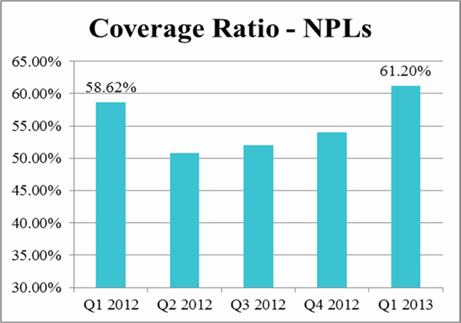

| · | Allowance coverage for nonperforming loans increased to 61.2% |

* excludes securities gains

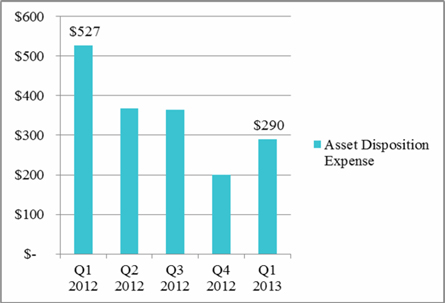

Expenses Reduced and Reallocated to Customer Acquisition

| · | Invested in lending capacity while simultaneously reducing overhead in multiple areas. |

| · | Approximately $538 thousand in overhead in Q1 was attributable to commercial lenders with less than nine months with Seacoast |

(Dollars in Thousands)

Deposit Fee Increases, Increased Wealth Production and Stronger Mortgage Banking Fees Result in 20% Growth in Fee Revenue

| · | Mortgage banking fees increased significantly from the first quarter last year due to better production and higher profit margin |

| · | Fee changes and deposit product restructuring resulted in higher service charges and interchange income |

| · | Greater focus and investment in Wealth Management resulted in better growth |

(Dollars in Thousands)

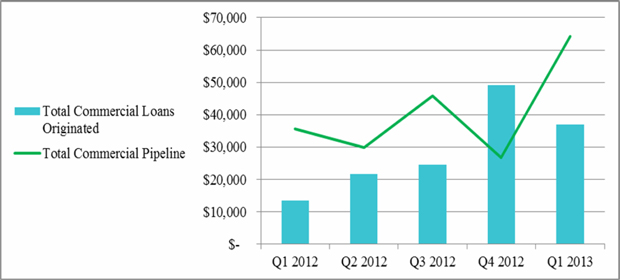

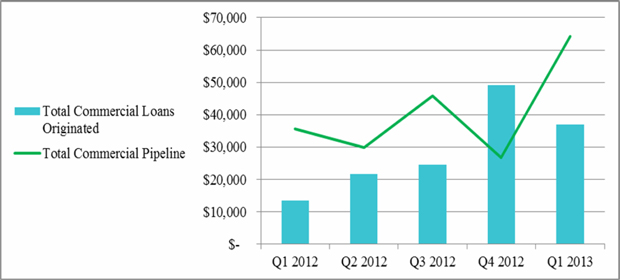

Commercial Loan Production Remains Strong, Despite Challenging Competitive Environment

| · | Investment in lending capacity allowed us to defend performing loan portfolio liquidation and refinance loans from larger institutions. |

| · | Seasoned lenders hired have placed us in a position to significantly increase originations over the remainder of 2013 |

(Dollars in Thousands)

* Loans in underwriting and approval, or approved and not yet closed

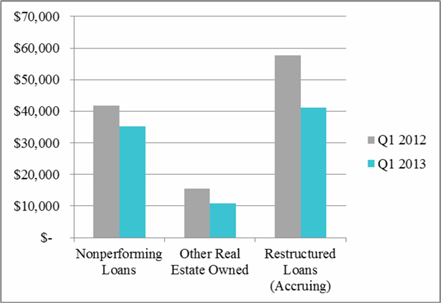

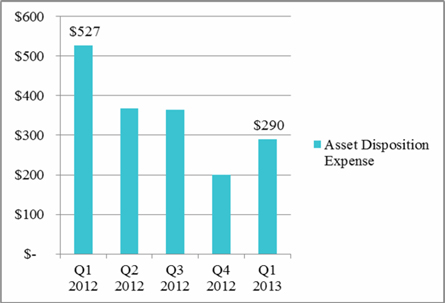

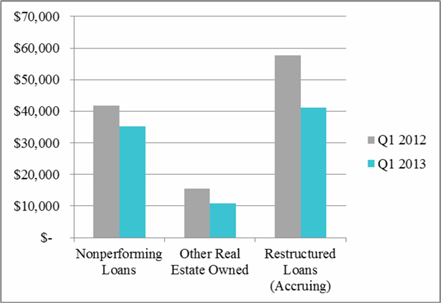

Nonperforming Assets and Associated Workout Expenses Declining

| · | Moderate economic expansion and increasing real estate values is leading to quicker resolution of problem loans and opportunities to sell OREO at more favorable pricing. |

| · | Expense associated with workouts is expected to decline as historical credit issues are becoming less meaningful |

(Dollars in Thousands)

(Dollars in Thousands)

Net Charge Offs Declining, Coverage Ratio Increasing

| · | Risk posture declining as credit issues abate |

| · | Less volatility expected going forward |

* Second quarter charge offs affected by a single large participation credit which was held for sale at year end and sold during the first quarter

Seacoast Retail Franchise Continues to Accrete Value

| · | Seacoast continues to be well positioned with positive net new household acquisition |

| · | Investment in sales coaching in Q4 is yielding additional accounts per customer and higher customer balances on average |

| · | Looking to further enhance value proposition in late 2013, launching smart phone deposit capture, enhanced transfer capabilities, enhanced tablet platform and enhanced ATM capabilities |

| · | Cost of deposits is near zero, with 75% of customer account openings in non-free checking products |

(Dollars in Thousands)

2013 Priorities

Building Shareholder Value

| · | Continue expense control posture, maximize revenue opportunities and position the bank for stronger earnings in 2014 |

| · | Continue reducing risk posture, positioning for an exit of the formal agreement and DTA recovery |

| · | Position for offensive strategic opportunities and double digit ROE in 2014 |

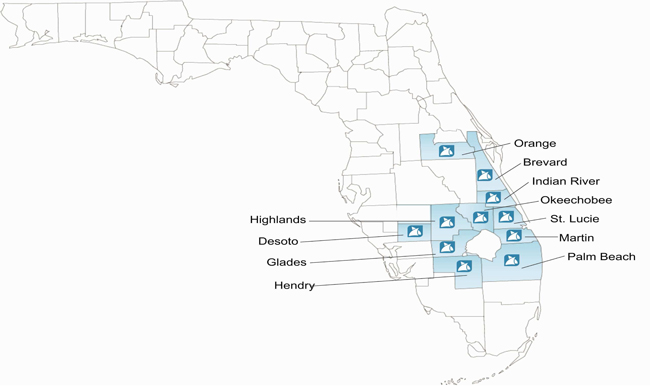

Growing Our Franchise

| · | Enhance value proposition with innovative digital product offerings and enhanced customer interactions |

| · | Examine branch network for opportunities for reinvestment and enhancements to increase customer experience |

| · | Continue refining our commercial and business banking strategy; develop our branding and presence in Orlando, Boca Raton and Ft. Lauderdale |

| · | Look for opportunities to expand our presence into the deeper markets of Orlando and South Florida. |