BBI Investor Presentation

June 2006

Agenda

1.

Overview of NorthWestern Energy

2.

Operations

Transmission

Distribution

Supply

3.

Regulatory Environment

4.

Financial Summary

5.

Growth Opportunities

6.

Summary

7.

Appendix 1 – Detailed Financials

2

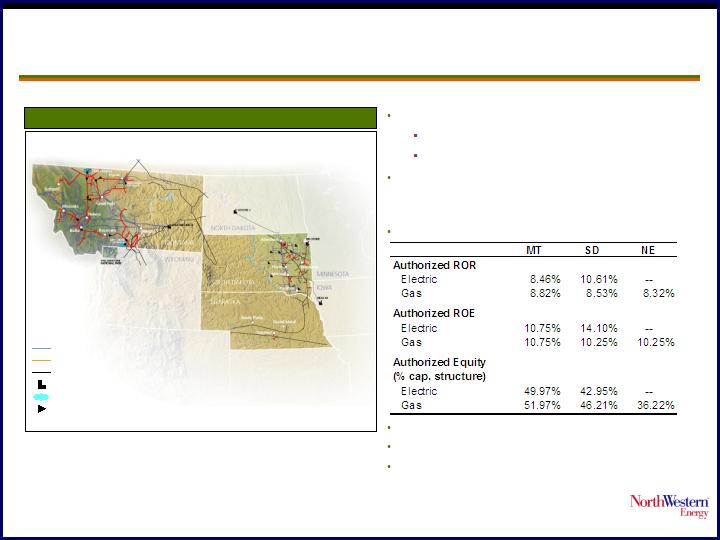

Regulated Operations

NorthWestern Energy

One of the largest providers of electricity and natural gas

in the Upper Midwest and Northwest, serving

approximately 628,500 customers in Montana, South

Dakota and Nebraska

Electric Operations

Montana

Transmits and distributes electricity to 316,000

customers

Revenue by customer class(1): 38.4%

residential, 49.2% commercial, 8.1% industrial

and 4.3% other

Approximately 7,000 miles (11,265 km) of

transmission lines and 20,300 miles (32,480 km)

of distribution lines

South Dakota

Generates, transmits and distributes electricity

to 59,000 customers

Revenue by customer class(1): 41.6%

residential, 56.5% commercial/industrial and

1.9% other

Approximately 3,200 miles (5,150 km) of T&D

lines

Owns 310 net MW of power generation

Gas Operations

Montana

170,000 customers (residential and

commercial)

3,700 miles (5,955 km) of underground

distribution pipelines

2,000 miles (3,218 km) of transmission

pipelines

16.2 Bcf of gas storage

South Dakota/Nebraska

83,500 customers (residential and

commercial)

2,100 miles (3,380 km) of distribution gas

mains

Business Overview

Unregulated Operations

Electric - Primarily consists of a lease of

30% of Colstrip Unit 4, a 740 MW coal-fired

plant in Montana

Gas - Gas supply and distribution services

to high volume customers in SD/NE

(1) Data as percent of total electric rate schedule revenue for 2005A.

3

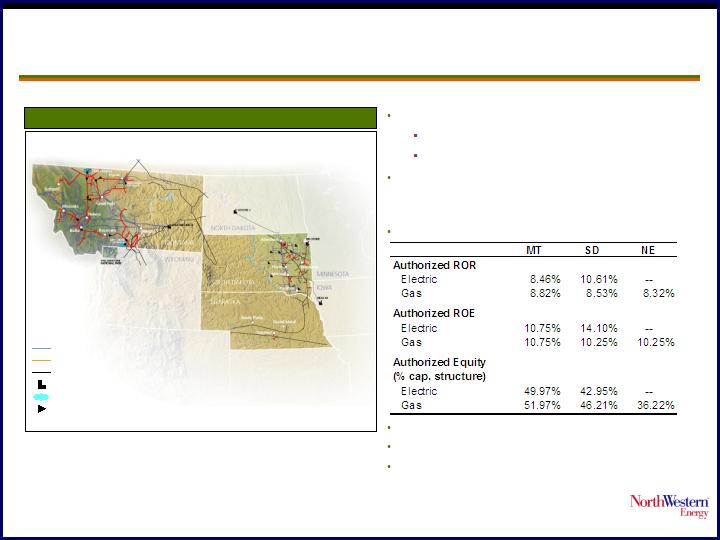

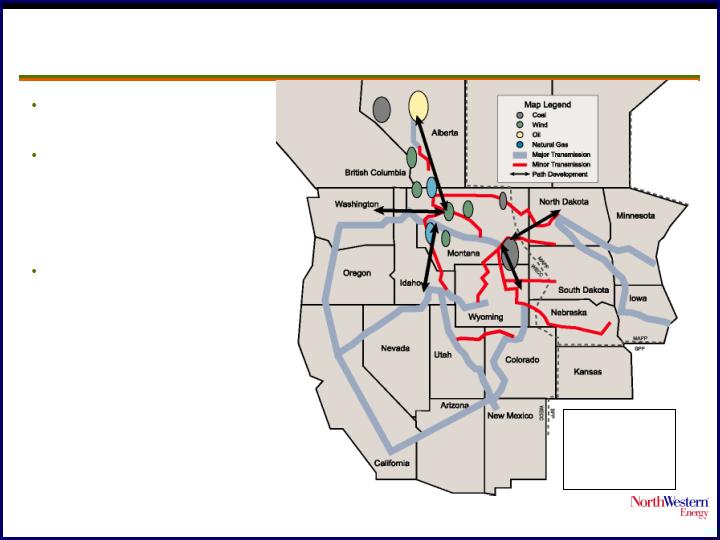

NorthWestern Energy Today

Utility Service Territory

Electric transmission lines

Natural gas distribution lines

Supplier-owned electric or natural gas lines

Electric generating plant

Natural gas storage fields

Natural gas compressor stations

(1) As of 3/31/06.

(2) Book capitalization calculated as short-term debt plus long-term debt plus

shareholders’ equity.

628,500 customers

NWEC electric: 375,000

NWEC gas: 253,500

Approximately 123,000 square miles

(319,800 sq. km) of service territory in South

Dakota, Montana and Nebraska

Allowed Returns:

Total Assets: (1) $2,259 MM

Total Capitalization: (1)(2) $1,445 MM

Total Employees: (1) 1,353

4

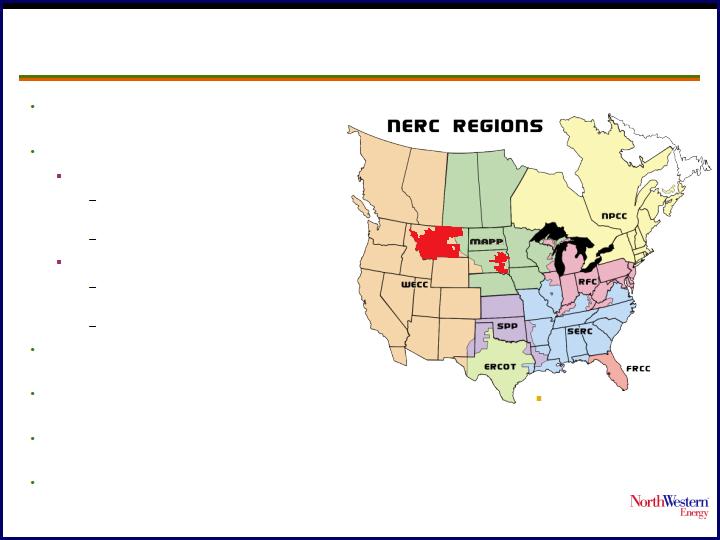

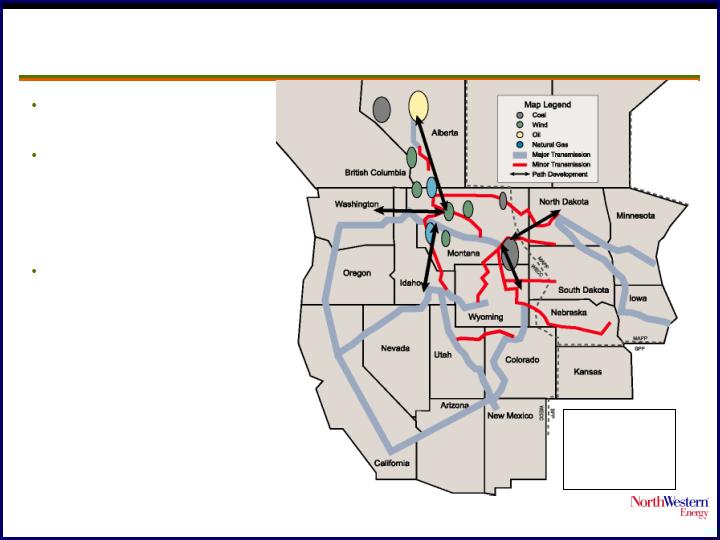

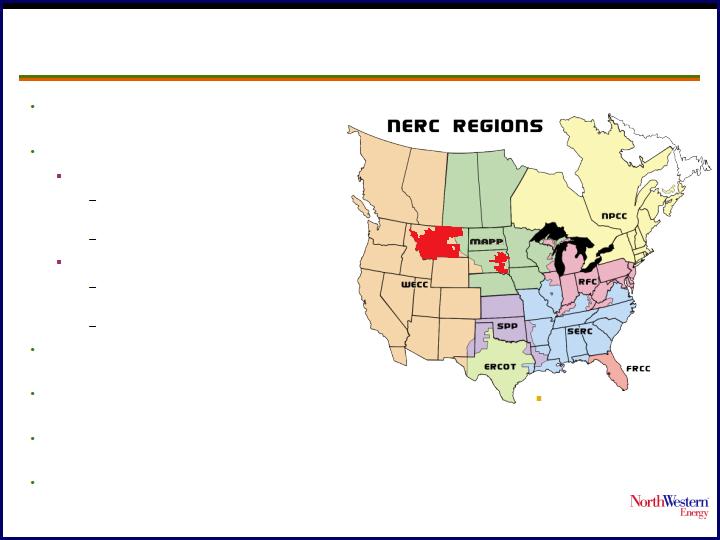

Electric Transmission

Approx. 123,000 square miles

(319,800 sq. km) service territory

Electric transmission operations

Montana

6,940 circuit miles (11,105 km)

of high voltage transmission

53 substations

South Dakota

1,293 circuit miles (2,070 km)

of high voltage transmission

41 substations

Operates in two reliability councils –

WECC and MAPP

Operates in both vertically integrated

(SD) and unbundled markets (MT)

System Dispatch (SOCC) operates gas

and electric for all three states

Montana control area serves more

than 3,000 MW of generation

NorthWestern Service Area

5

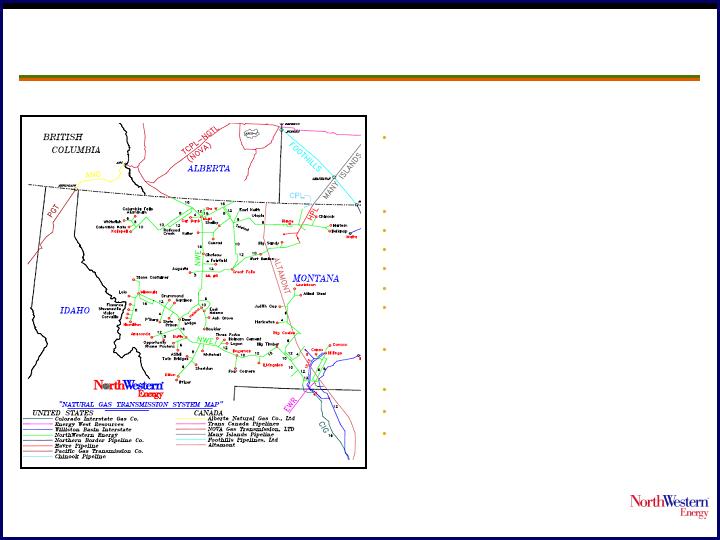

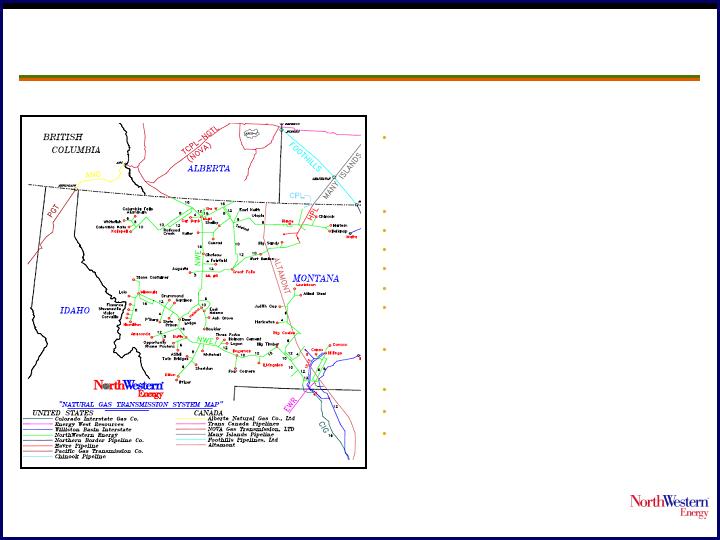

Natural Gas Transmission and Storage

Storage:

Cobb and Dry Creek – 16.2 Bcf of

working gas

System Connections:

TransCanada (NOVA)

Havre Pipeline

Colorado Interstate Gas (CIG)

Williston Basin Interstate Gas (WBI)

Energy West

Encana (gathering system)

System configured to allow

bidirectional transportation

Peak day deliverability: 300 mmcf

42,000 installed HP compression

More than 2,000 miles (3,218 km)

of pipe

2”-20” diameter

6

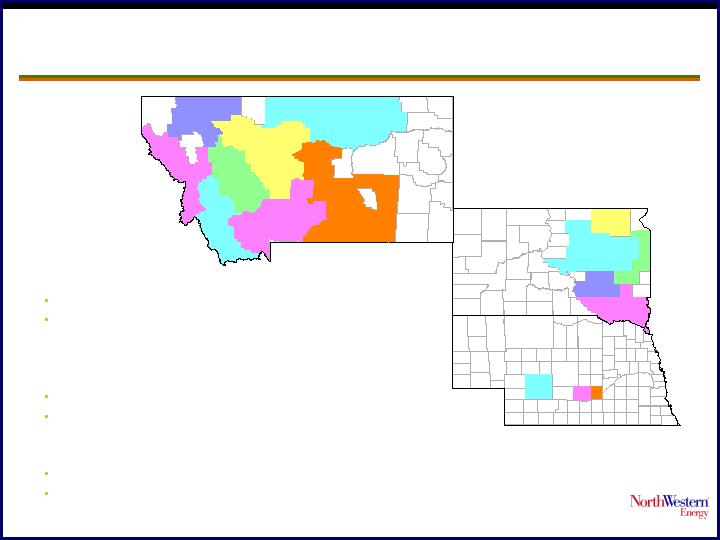

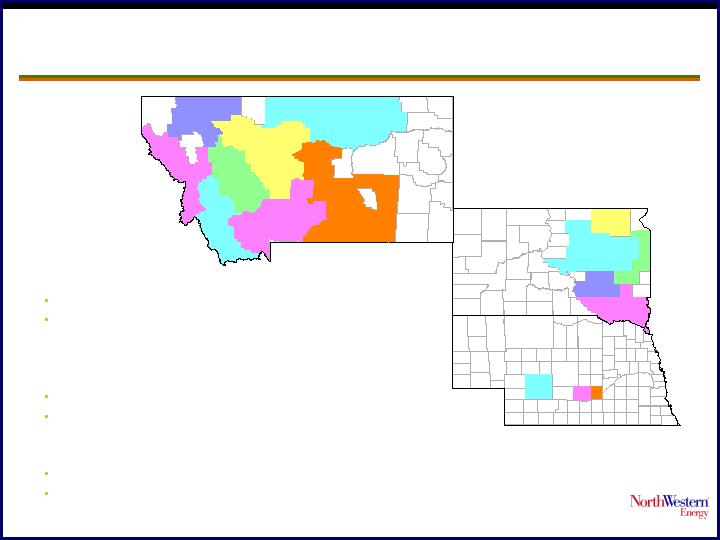

Electric and Natural Gas Distribution

Operations Overview

Electric System

22,500 miles (36,210 km) of distribution lines

375,000 customers, 299 communities in Montana,

eastern South Dakota and Yellowstone National

Park in Wyoming

Natural Gas System

7,300 miles (11,748 km) of distribution pipelines

253,500 customers, 172 communities in Montana,

South Dakota and Nebraska

Employees

630 Internal

Contract additional 200 FTE

Kearny

Grand

Island

Brookings

Huron

Mitchell

Yankton

Butte

Division

Bozeman Division

Billings Division

Helena

Division

Missoula

Division

Great Falls Division

Kalispell District

Havre District

Aberdeen

North

Platte

7

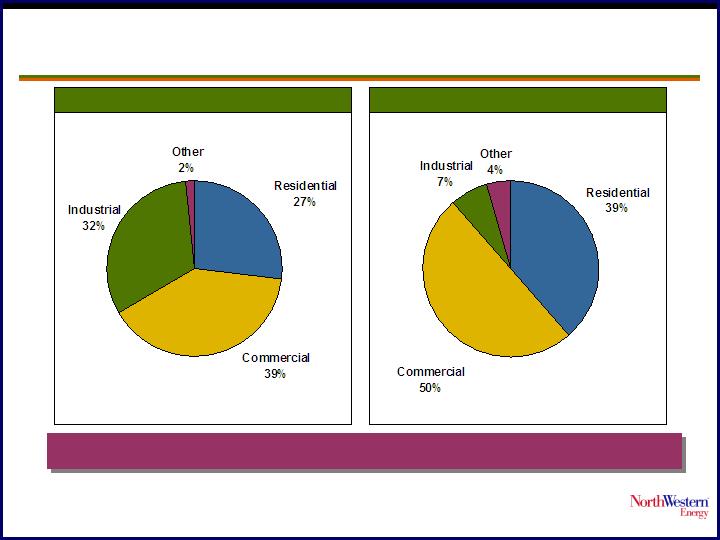

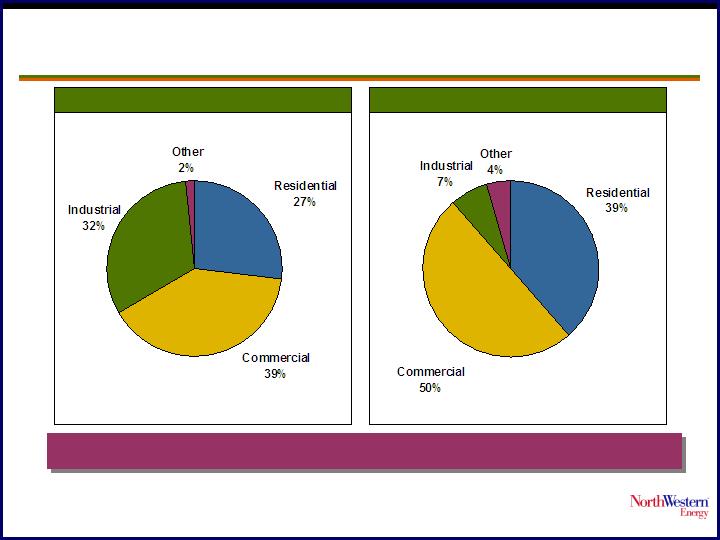

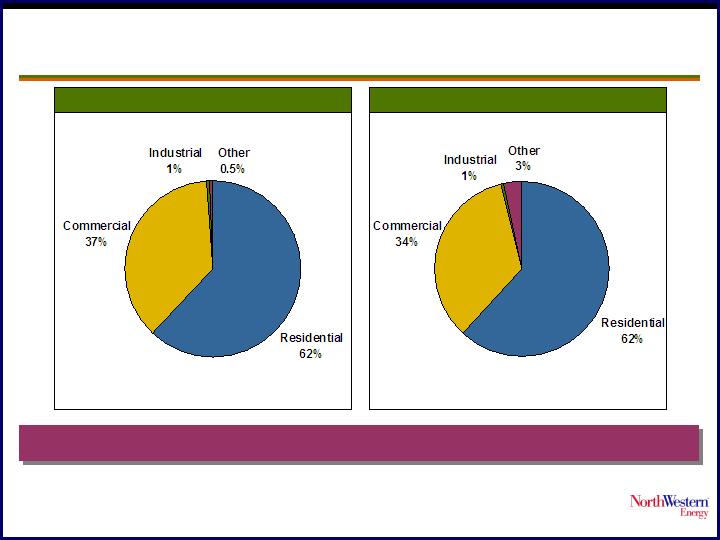

Electric Customer Profile

2005A Volume (MWh)(1)

2005A Revenue ($MM)(1)

(1) Excludes SD wholesale revenue and loads.

(2) Other includes regulatory amortization of $3.8 million. Total regulated electric revenue for 2005A was $631.7 million, comprised of $574.2

million retail rate schedule revenue, $9.8 million SD wholesale rate schedule revenue, $40.2 million of transmission revenue and $7.5 million

of miscellaneous revenue.

Total MWh = 9,598,360

Rate Schedule Revenue(2) = $574.2 MM

(2)

The 10 largest customers in the regulated electric segment are based in MT and represent about 6% of total

rate schedule revenues. The largest customer represents less than 1% of the total rate schedule revenues.

8

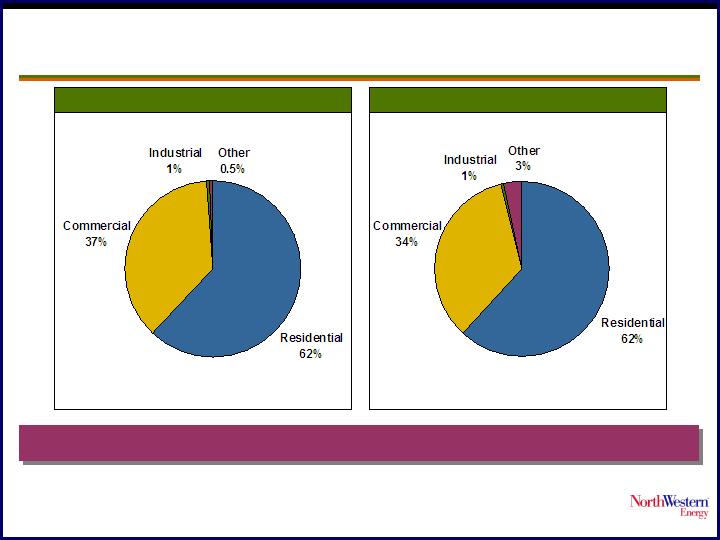

Gas Customer Profile

2005A Volume (MMbtu)(1)

2005A Revenue ($MM)(1)

(1) Excludes non-retail regulated revenues and sales to other utilities.

(2) Other includes $9.4 million of regulatory amortization and $0.4 million of propane revenues. Total regulated gas revenue for 2005A was

$366.0 million, comprised of $323.6 million rate schedule revenue, $20.2 million of wholesale revenue, $17.8 million of transportation revenue

and $4.4 million of miscellaneous revenue.

Total MMbtu = 29,107,170

Rate Schedule Revenue(2) = $323.6 MM

(2)

The 10 largest customers in the regulated gas segment are mainly concentrated in Montana and represent less than

5% of total rate schedule revenues. The largest customer represents about 1.5% of the rate schedule revenues.

9

Regulatory Environment

Regulatory Jurisdictions

Federal Energy Regulatory

Commission

(FERC)

Transmission

Wholesale Generation

Montana Public Service Commission

(MPSC)

Electric and Natural Gas Distribution

Default Supply

South Dakota Public Utility

Commission (SDPUC)

Electric and Natural Gas Distribution

Retail Electric and Gas Sales

Nebraska Public Service Commission

(NPSC)

Natural Gas Distribution

Retail Gas Sales

11

Regulated Return Detail

Note: 2005 return figures have not been normalized for weather or Commission ratemaking adjustments. SD and NE 2005 gas figures have been adjusted

to remove $5.4 million and $0.4 million liability reserve increases associated to manufactured gas plants, respectively.

(1) Test year of last rate case.

($ in millions)

Montana

South Dakota

Nebraska

Electric

Gas

Electric

Gas

Gas

Total

Rate Base

$692.6

$258.3

$165.7

$42.8

$26.5

$1,185.9

Return on Rate Base

Authorized Return on Rate Base

8.46%

8.82%

10.61%

8.53%

8.32%

8.84%

2005 Earned Return on Rate Base

6.76%

7.49%

12.38%

0.88%

3.71%

7.43%

Return on Equity

Authorized Return on Equity

10.75%

10.75%

14.10%

10.25%

10.25%

11.14%

2005 Earned Return on Equity

6.30%

8.50%

17.77%

(8.49%)

(6.58%)

7.50%

Authorized Capital Structure

(1)

Debt

42.17%

40.17%

57.05%

53.79%

59.08%

Trust Preferred

7.86%

7.86%

0.00%

0.00%

4.70%

Equity (Preferred & Common)

49.97%

51.97%

42.95%

46.21%

36.22%

Total

100.00%

100.00%

100.00%

100.00%

100.00%

Other:

Cost Trackers for

Energy Supply and

Property Taxes

Cost Trackers for Energy Supply

12

Financial Highlights

Source: Company reports and SEC filings.

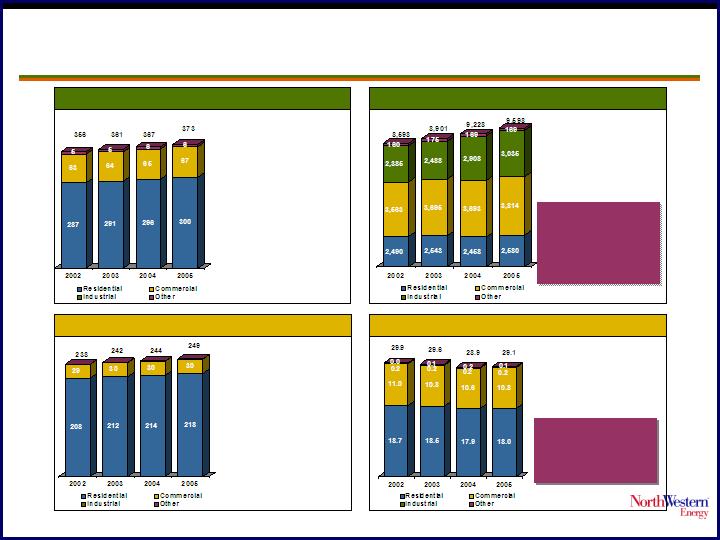

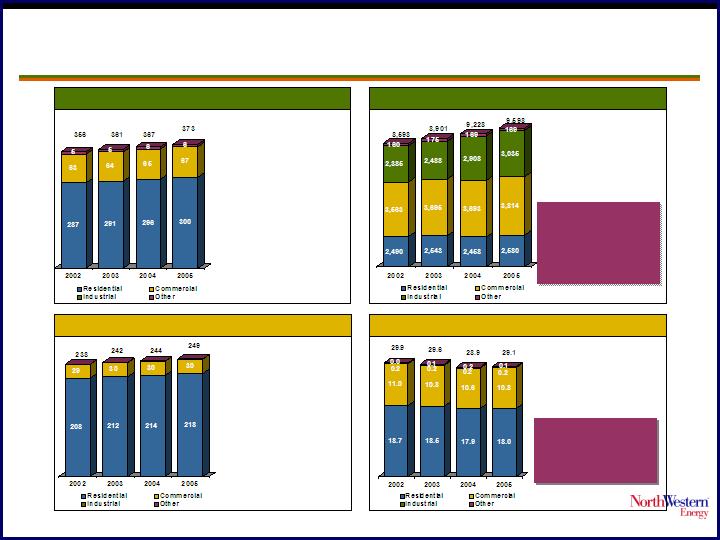

Customer & Volume Statistics

Electric Customers (000)

Electric Volume in MWh (000)

Natural Gas Customers (000)

Gas Volume in Therms Sales (MM MMBtu)

CAGR

’02 to ’05 = 1.6%

CAGR

’02 to ’05 = 3.7%

CAGR

’02 to ’05 = 1.6%

CAGR

’02 to ’05 = -1.0%

Gas customer

growth but offset

by conservation

and warm weather

Electric customer

and volume

growth has been

strong over the

last 3 yrs

14

Source: Company reports and SEC filings.

Note: Full year 2004 results show combined results for NWEC’s predecessor company from January 1, 2004 to October 31, 2004 and for

NWEC from November 1, 2004 to December 31, 2004.

(1) Before reorganization expenses and impairment charge.

(2) Excludes cash used in acquisitions.

(3) 2002 other capital expenditures include $10 million related to Montana’s utility acquisition stipulation, $20 million related to the buyout

of the automatic meter reading lease and $28 million related to MFM.

(4) Cash flow from continuing operations (excludes change in restricted cash).

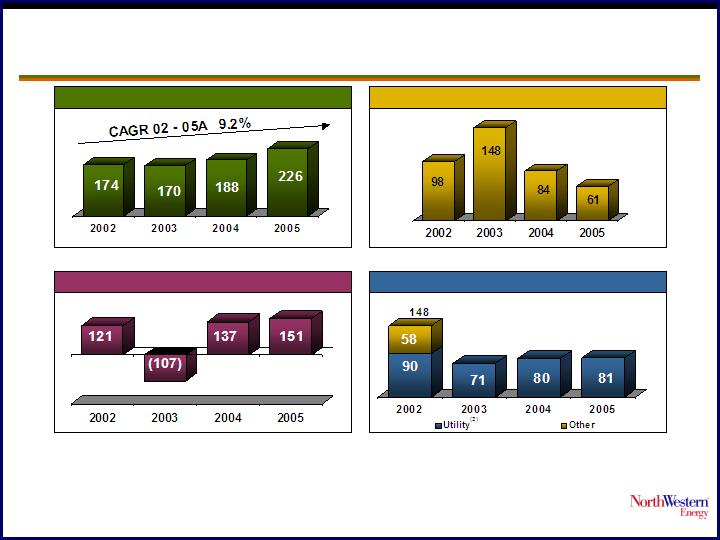

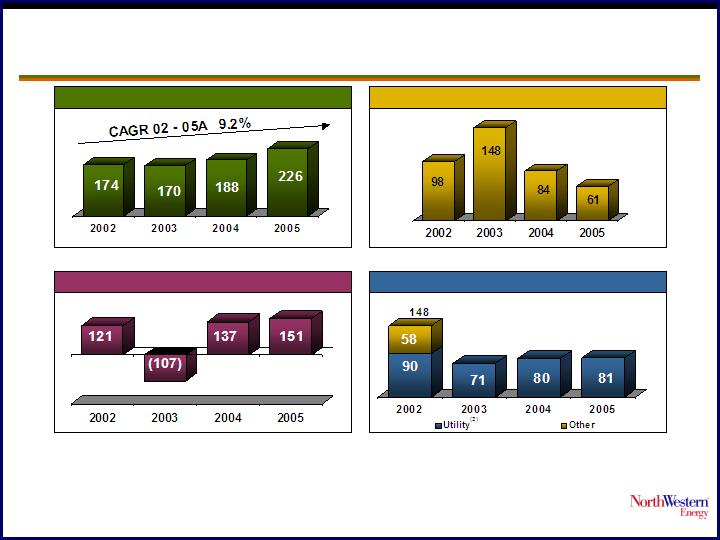

Financial Highlights

EBITDA(1)

Interest Expense

Cash Flow from Operations(4)

Capital Expenditures(2)

($ in millions)

($ in millions)

($ in millions)

($ in millions)

15

Strengthened Balance Sheet

S & P

Moody's

Fitch

Outlook

Negative

Positive

Stable

Sr. Secured

BBB-

Ba1

BBB

Sr. Unsec'd

BB-

Ba2

BBB-

Corporate Rating

BB+

Debt Ratings

($ in millions)

Debt Ratings

BBB-

Except our revolver, all long term debt

is fixed rate. The revolver balance as of

3/31/06 was $35 million, representing

approx. 5% of the total LT debt. A 1%

increase in LIBOR would increase

interest expense < $400k annually.

16

12/31/2004

12/31/2005

3/31/2006

Cash

17.1

2.7

12.0

Restricted Cash

21.4

25.2

26.2

Receivables

141.4

160.9

134.9

Inventories

37.1

40.9

31.7

Other Current Assets

169.3

83.8

55.3

PP&E and Other Assets

2,062.7

2,086.9

2,099.3

Total Assets

2,448.9

2,400.4

2,359.4

Payables

85.1

99.4

59.3

Short Term Debt

73.4

156.5

156.9

Other Current Liabilities

183.7

168.8

185.0

Long Term Debt

763.6

586.5

537.0

Other Liabilities

633.8

651.7

670.3

Shareholders' Equity

709.3

737.5

750.9

Total Liab. And Equity

2,448.9

2,400.4

2,359.4

Capitalization:

Short Term Debt

73.4

156.5

156.9

Long Term Debt

763.6

586.5

537.0

Shareholders Equity

709.3

737.5

750.9

Total Capitalization

1,546.3

1,480.5

1,444.8

Debt/Total Capitalization

54.1%

50.2%

48.0%

Selected Balance Sheet Data

Growth Opportunities

Transmission Investment

Take advantage of our

strategic location

Pursue opportunities

to expand electric and

gas transmission

infrastructure to meet

increased needs

Transmission paths

out of Montana are all

constrained for entities

seeking firm

transmission rights

Path Ratings:

MT-SE 600 MW

MT-E 200 MW

MT-SW 337 MW

MT-W 2,200 MW

18

Northwestern Energy Summary

Attractive

Transmission &

Distribution

Business

Regulated electric and gas businesses contribute 85% of the Company’s gross margin

Regional location of cold winters and hot summers contributes to stability of cash flows

No energy marketing and trading activities; exited all non-energy related businesses

Strong, Predictable

Earnings

Increasing Free

Cash Flow

Significant Earnings

Upside Potential

Restructuring

Effort Effectively

Completed

Strong

Management

Increasing cash flows support ability to grow dividends and growth opportunities

Improving capital structure provides increased financial flexibility

Investment in FERC regulated transmission projects allow growth in rate base and earnings

Potential opportunity to achieve further operating and interest cost reductions

Regional consolidation

Deliver natural gas to ethanol plants

Reduced debt and achieved targeted debt-to-capital ratio

Improved regulatory relationships

Sales of non-core operations and remaining asset sales completed

Core management team has a long track record in successfully operating regulated utility

businesses

Successfully executed financial restructuring

Premier regional T&D utility with stable customer growth

Attractive mix of electric and natural gas customers

Strong competitive position that results from low production and purchased-power costs

Diversified customer base that is not dependent on any one customer or industry

19

Appendix A

Detailed Financials

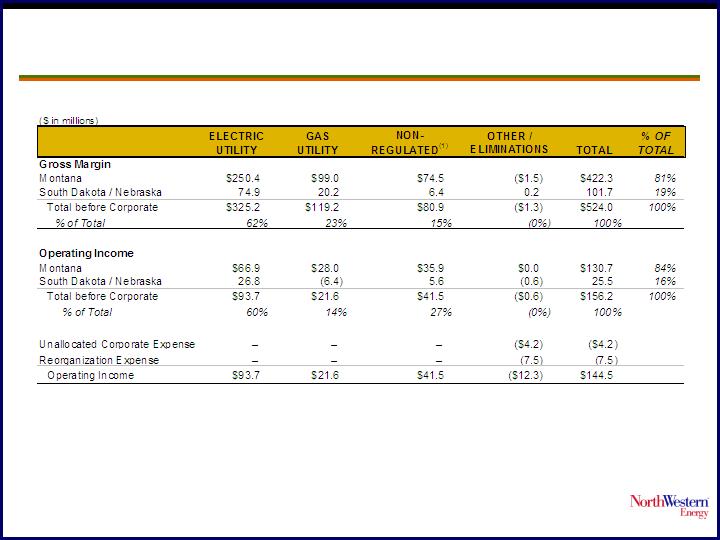

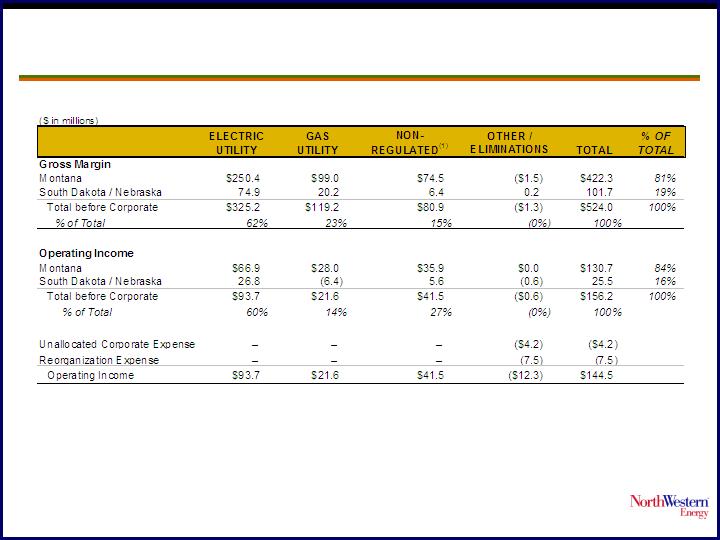

2005 Segment Financials

Source: Company reports.

(1) Includes unregulated gas and electric operations.

21

P&L Summary – 2005

* Results for 2004 combine both the predecessor and successor companies.

(000's)

2005

2004 *

B(W)

Operating Revenues

1,165,750

1,038,989

126,761

Cost of Sales

641,755

563,829

(77,926)

Gross Margin

523,995

475,160

48,835

Operating Expenses

Operating, general & administrative

225,514

221,740

(3,774)

Property and other taxes

72,087

65,135

(6,952)

Depreciation

74,413

72,848

(1,565)

Reorganization Items

7,529

(532,626)

(540,155)

Impairment on Assets held for sale

10,000

10,000

Total Operating Expenses

379,543

(162,903)

(542,446)

Operating Income

144,452

638,063

(493,611)

Interest Expense

(61,295)

(83,843)

22,548

Gain (Loss) on Debt Extinguishment

(548)

(21,310)

20,762

Investment Income and Other

17,448

3,160

14,288

Income (Loss) from Cont. Ops. Before Taxes

100,057

536,070

(436,013)

Benefit (Provision) for Income Taxes

(38,510)

6,299

(44,809)

Income (Loss) from Continuing Operations

61,547

542,369

(480,822)

Discontinued Ops., Net of Taxes

(2,080)

2,064

(4,144)

Net Income (Loss)

59,467

544,433

(484,966)

Year Ended December 31

22

Cash Flow Summary

23

($ in millions)

2005A

2004A

Net Income from Continuing Operations

$61.5

$542.4

Deferred Taxes

40.7

(3.9)

COD Income and Other Noncash Items

74.3

(450.3)

Working Capital

(26.0)

48.9

Cash Flow from Operations

$150.5

$137.1

Restricted Cash

(3.9)

9.3

Capital Expenditures

(80.9)

(80.1)

Asset Sale Proceeds

7.5

15.5

Other, net

4.7

0.2

Cash Flow from Investing

($72.5)

($55.2)

Debt Issuance Costs

(2.3)

(16.2)

Common Dividends

(35.6)

0.0

Treasury Stock

(5.6)

0.0

Debt Increase / (Decrease), net

(94.3)

(82.7)

Other, net

2.5

9.1

Cash Flow from Financing

($135.3)

($89.8)

Discontinued Operations

42.9

9.8

Increase / (Decrease) in Cash

($14.4)

$1.9

Beginning Cash

$17.1

$15.2

Ending Cash

2.7

17.1