Annual Meeting of Stockholders

August 2, 2006

Forward-Looking Statement

During the course of this presentation today,

we will be discussing certain subjects including

those pertaining to our strategy, and our

discussions may contain forward-looking

information. Although our expectations and

beliefs are based on reasonable assumptions,

actual results may differ materially. These

factors that may affect our results are listed in

certain of our press releases and disclosed in

the company’s public filings with the SEC.

2

Agenda

1.

Overview and Update

2.

Financial Summary

3.

Proposed Merger with BBI

a)

Description of Merger

b)

Approvals Required

c)

Timeline

4.

Comments/Questions

3

Overview and Update

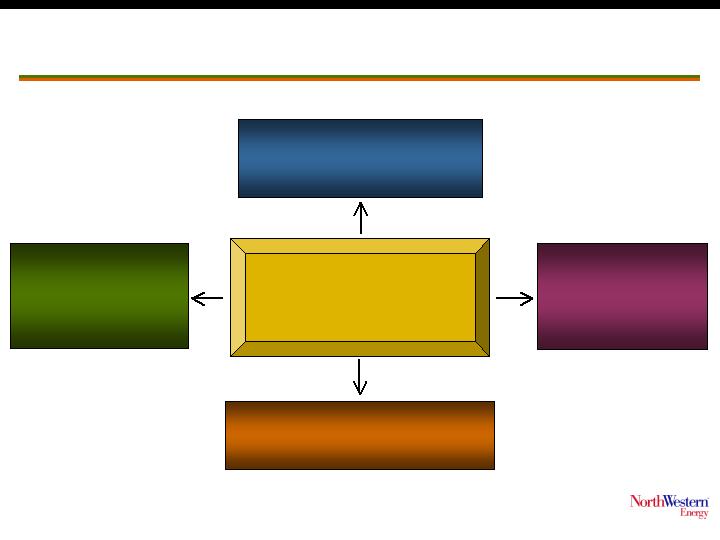

NorthWestern Energy’s Goals

Provide

high quality

reliable

service

Provide

energy at

reasonable

prices

We have streamlined our operations to

better focus on our energy business

Provide

attractive

return to our

owners

5

Regulated Operations (85%*)

NorthWestern Energy

628,500 customers in Montana, South Dakota and Nebraska

Electric Operations (73%**)

Montana

316,000 customers in 187 communities

7,000 miles of transmission lines

20,300 miles of distribution lines

South Dakota

59,000 customers in 110 communities

3,200 miles of T&D lines

Owns 310 net MW of power generation

Gas Operations (27%**)

Montana

170,000 customers in 105 communities

3,700 miles of underground distribution

pipelines

2,000 miles of transmission pipelines

16.3 Bcf of gas storage

South Dakota/Nebraska

83,500 customers in 59 communities in

SD and 4 communities in NE

2,100 miles of distribution gas mains

Business Overview

Unregulated Operations (15%*)

Electric - Primarily consists of a lease of 30% of Colstrip Unit 4, a 740 MW coal-fired plant in MT

Natural Gas - Gas supply and distribution services to high volume customers in SD/NE

* = % of 2005 consolidated gross margin

** = % of 2005 regulated operations gross margin

6

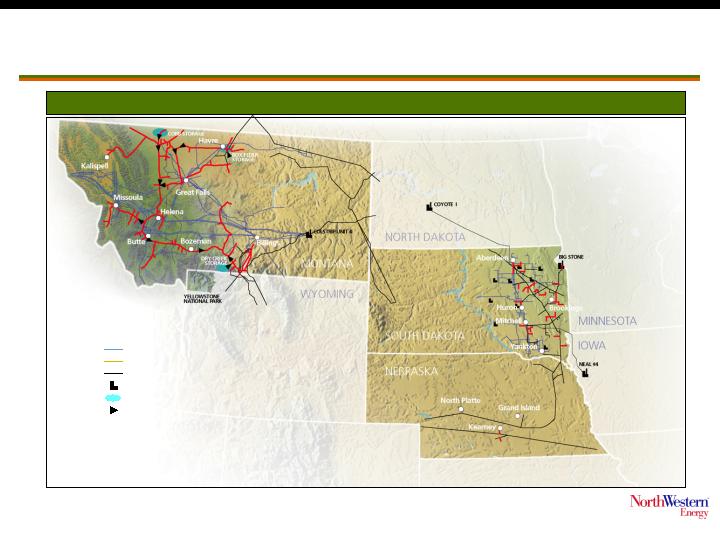

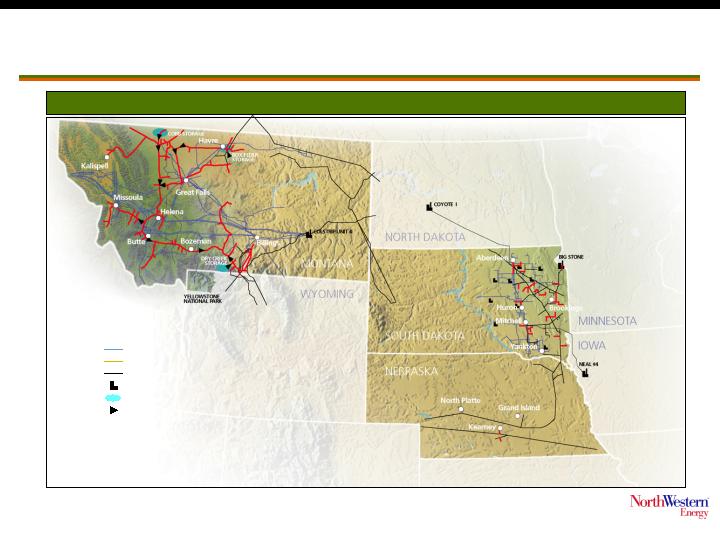

NorthWestern Energy

Utility Service Territory

Electric transmission lines

Natural gas distribution lines

Supplier-owned electric or natural gas lines

Electric generating plant

Natural gas storage fields

Natural gas compressor stations

7

Source: Company reports and SEC filings.

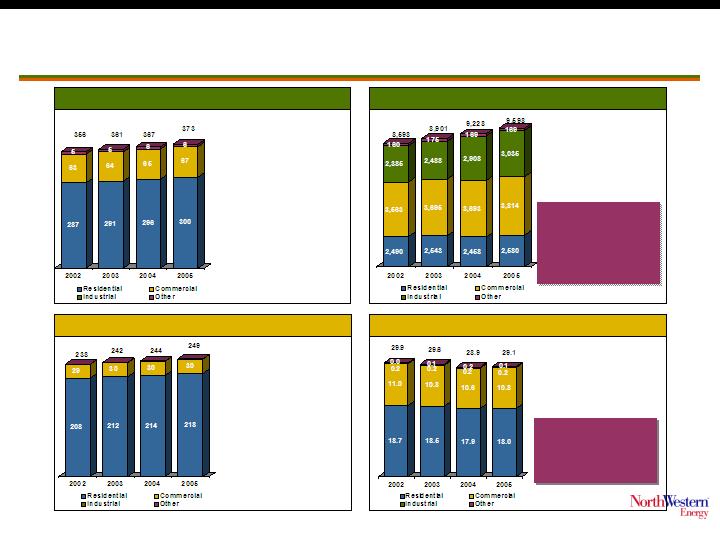

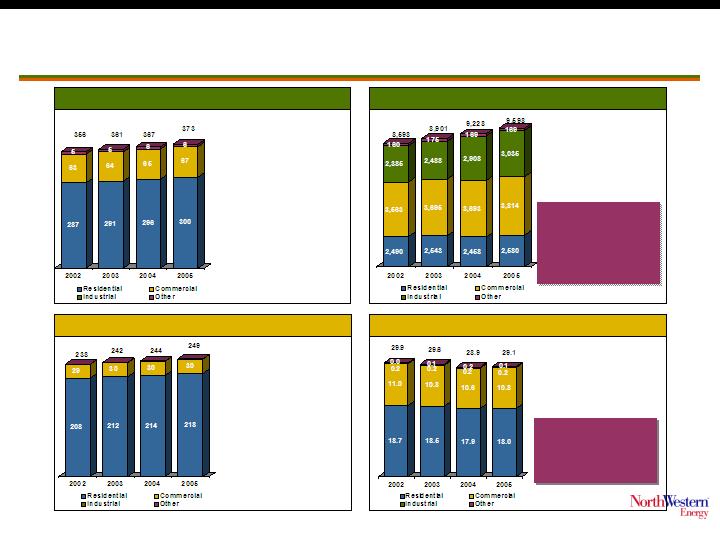

Customer and Volume Statistics

Electric Customers (000)

Electric Volume in MWh (000)

Natural Gas Customers (000)

Gas Volume in Therms Sales (MM MMBtu)

CAGR

’02 to ’05 = 1.6%

CAGR

’02 to ’05 = 3.7%

CAGR

’02 to ’05 = 1.6%

CAGR

’02 to ’05 = -1.0%

Gas customer

growth but offset

by conservation

and warm weather

Electric customer

and volume

growth has been

strong over the

last 3 yrs

8

Highlights Since Last

Stockholder Meeting

Operational Achievements

Procured electric supply contract for Montana

7 yr agreement at a substantial price discount to current market rates

Comparing to estimated forward pricing curves, the contract starts

about $22 below market rates and ends about $8 above market rates

with March 2012 being the crossover point

Allows flexibility to pursue more permanent electric supply options

1st quartile for Customer Average Interruption Duration Index

Nationwide survey by PA Consulting for 2004

Using IEEE criteria

Timely response to winter storm in South Dakota

More than 1,000 route miles of electric lines were flattened by

the storm

All electric customers lost service at some point of storm

Initial restoration done sooner than expected and without accident

or injury

9

Highlights Since Last

Stockholder Meeting

Customer Service Achievements

Received ServiceOne™ Award for second consecutive year

Conducted community weatherization events to prepare

customers for higher winter gas prices

Established the Challenge Grant of $1 million for customers

10

Highlights Since Last

Stockholder Meeting

Financial Achievements

Completed divestiture of non-core assets

Received $49 million from Netexit bankruptcy settlement

Paid down $94 million of debt to achieve debt to cap ratio of

just under 50%

Debt Refinancings

Amended the secured $250 million credit facility to be an

unsecured $200 million facility and reduced the interest rate

Refinanced $170 million in Pollution Control Bonds lowering the

interest rate more than 1% annually

Improved Credit Ratings

Achieved investment grade credit ratings with two of the three

agencies that rate our secured debt

Increased shareholder dividend from an annual rate of

$1.00/share to an annual rate $1.24/share

11

Highlights Since Last

Stockholder Meeting

Resolution of Significant Litigation

All bankruptcy claims resolved except Magten matters

Settled stockholder securities class action and derivative cases

Received $9 million for settlement of NorthWestern v. PPL

Montana breach of contract lawsuit and bankruptcy claims

Provided for PPLM to withdraw and release all of its claims in the

NorthWestern bankruptcy and federal court litigation

Ruling that entitled Company to $9.5 million payment

Relates to 2002 insurance coverage dispute

Proceeds expected in 3rd qtr. 2006

12

Highlights Since Last

Stockholder Meeting

Regulatory Achievements

Utility

MPSC approval of the 2005 MT Electric and Natural Gas Default

Supply Costs Trackers

Completed review by the MPSC of the 2005 Electric and Natural Gas

Default Supply Procurement Plans

NWE/BBI Sales Transaction

Filed applications for approval of merger with BBI for FERC, MT,

SD, NE and CFIUS

CFIUS approval on July 31, 2006

HSR and FCC to be filed in next few months

13

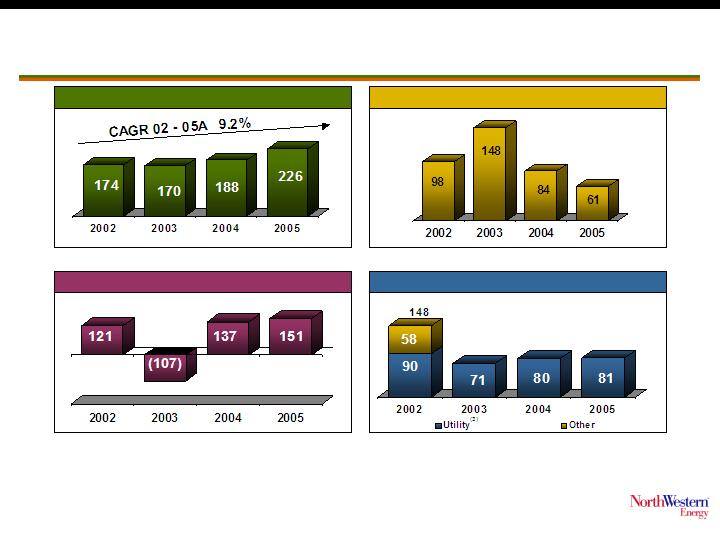

Financial Highlights

Source: Company reports and SEC filings.

Note: Full year 2004 results show combined results for NWEC’s predecessor company from January 1, 2004 to October 31, 2004 and for

NWEC from November 1, 2004 to December 31, 2004.

(1) Before reorganization expenses and impairment charge.

(2) Excludes cash used in acquisitions.

(3) 2002 other capital expenditures include $10 million related to Montana’s utility acquisition stipulation, $20 million related to the buyout

of the automatic meter reading lease and $28 million related to MFM.

(4) Cash flow from continuing operations (excludes change in restricted cash).

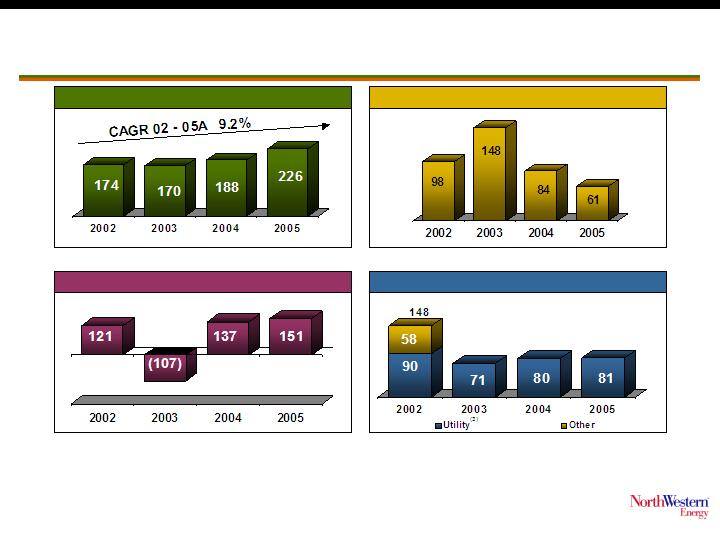

Financial Highlights

EBITDA(1)

Interest Expense

Cash Flow from Operations(4)

Capital Expenditures(2)

($ in millions)

($ in millions)

($ in millions)

($ in millions)

15

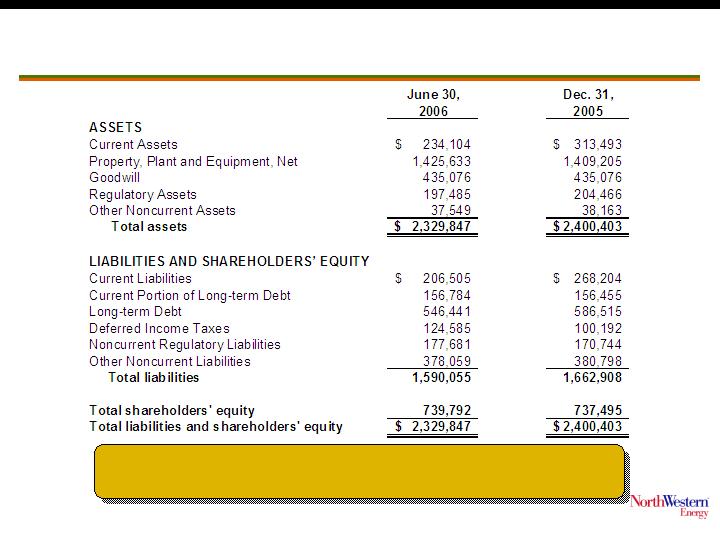

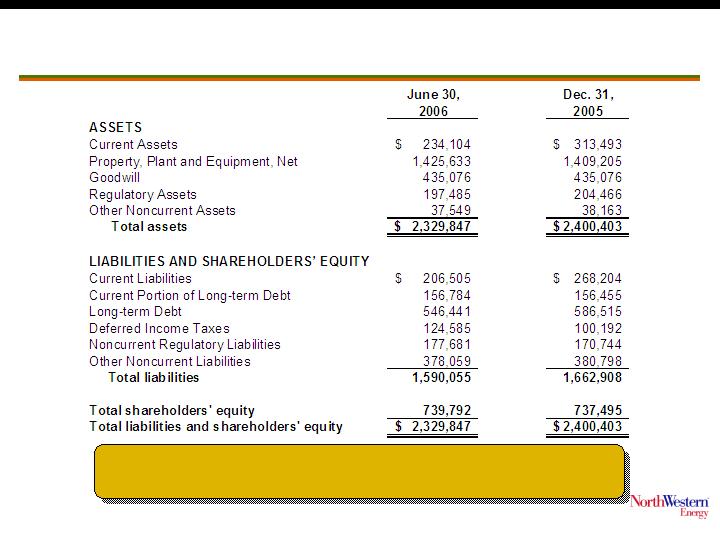

Stronger Balance Sheet

Debt Ratings

Debt to total capitalization ratio is down to 48.7%

(from 50.2% at 12/31/05)

16

Proposed Transaction

Proposed Transaction Summary

$37/share

Cash to shareholders

Buyer is Babcock &

Brown Infrastructure

* Enterprise value of $2.2 billion

18

Best Value and Risk Profile for

NorthWestern Stockholders

Fairness opinions from widely

recognized firms Credit Suisse

and Blackstone

Positive outcome

for stockholders

Offer does not

increase NWEC debt

and includes

adequate protection

for stockholders

All-cash price a

15.3% premium to

our closing share

price prior to

announcing merger

Best value for stockholders

of proposals received during

the process

19

Who is Babcock and Brown Infrastructure?

Listing: ASX: BBI (on Australian Stock Exchange)

Total Assets: $4,500 million

2005 Revenue: $745 million

Headquarters: Sydney, New South Wales, Australia

Website: www.bbinfrastructure.com

BBI is a long-term, conservative, utility asset owner

with a proven track record of owning energy

distribution, transmission and other regulated assets.

20

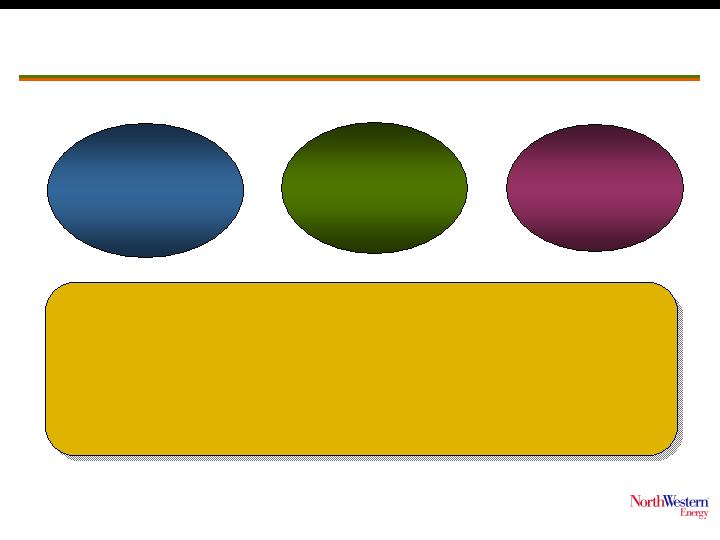

Why BBI?

Access to

Capital

Stability

In addition to providing the highest

shareholder value, BBI is the type of owner

who will support NorthWestern’s

commitment to service excellence and

community growth in the future.

Access to

Expertise

21

Approvals Required

Stockholder approval

Federal Energy Regulatory

Commission (FERC)

Montana Public Service

Commission (MPSC)

South Dakota Public Utilities

Commission (SDPUC)

Nebraska Public Service

Commission (NPSC)

Clearance under Hart-Scott-

Rodino Act (HSR)

Federal Communications

Commission (FCC)

Committee on Foreign

Investment in U.S. (CFIUS)

We have filed, or will be filing in the

near future, in all required jurisdictions

to gain merger approval

22

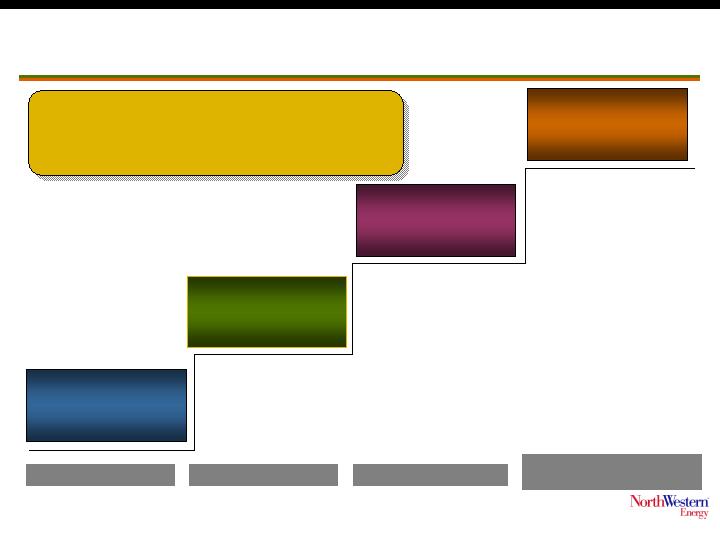

Approval Steps for

Regulatory Commissions

File regulatory

applications

Procedural

Schedules and

Data Exchange

Hearings

Regulatory

approval

The procedural schedules have

suggested timelines to effect

approval mid-2007

45 days

120 - 180 days

75 - 90 days

Approval 240 - 315 days

after announcement

23

Comments/Questions