Annual Stockholder

Meeting

August 8, 2007

forward-looking statement…

During the course of this presentation, there will be forward-

looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements often address our expected

future business and financial performance, and often contain

words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” or “will.”

These statements are based upon our current expectations and

speak only as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from

those expressed in any forward-looking statementsAlthough our

expectations and beliefs are based on reasonable assumptions,

actual results may differ materially. The factors that may affect

our results are listed in certain of our press releases and

disclosed in the Company’s public filings with the SEC.

2

agenda…

Termination of proposed BBI transaction

Overview of NorthWestern Energy

The future for NorthWestern Energy

3

termination of BBI merger…

Stockholders approved a merger of NorthWestern with

Babcock & Brown Infrastructure Limited at last year’s

annual meeting

The necessary clearances had been received from:

Department of Justice

Committee on Foreign Investment in the United States

Federal Energy Regulatory Commission

Federal Communications Commission

Nebraska Public Service Commission

South Dakota Public Utilities Commission

The last condition necessary was from the Montana

Public Service Commission (“MPSC”)

The MPSC denied the joint application

BBI terminated the merger agreement

4

reasons for MPSC denial…

Too much debt as part of the purchase price

Assumed additional costs could ultimately be passed

on to ratepayers

Premium to be paid was too large

Concerned the premium eventually would get reflected

in rates

Concern that BBI would deplete future cash and

equity of the utility through excessive dividends

to parent

MPSC wants more certainty surrounding the

electric and natural gas utility

Preference for status quo

5

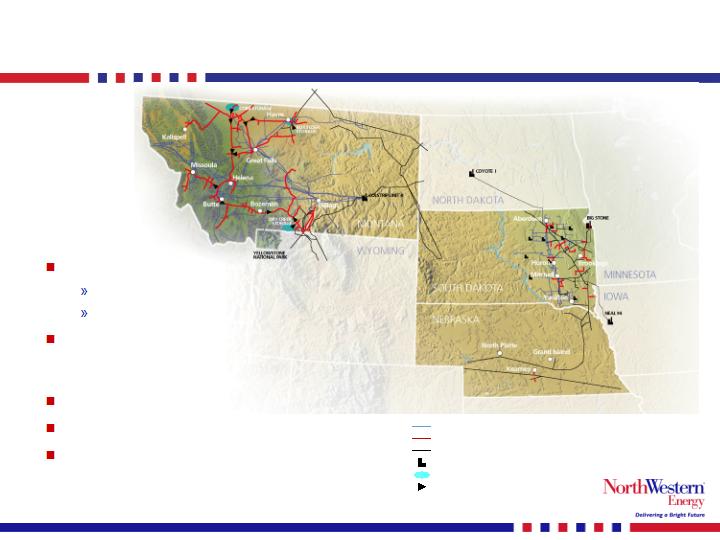

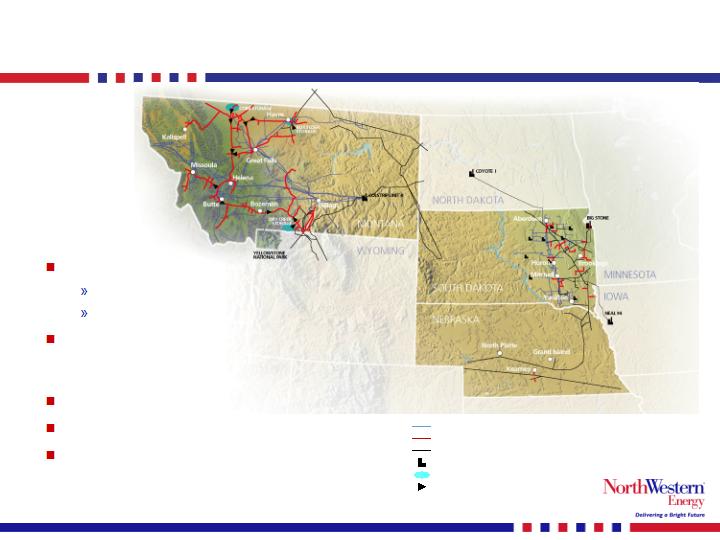

who we are…

Electric transmission lines

Natural gas distribution lines

Supplier-owned electric or natural gas lines

Electric generating plant

Natural gas storage fields

Natural gas compressor stations

(1) As of 3/31/07.

(2)

Book capitalization calculated as short-term debt plus long-

term debt plus shareholders’ equity.

640,000 customers

382,000 electric

258,000 natural gas

Approximately 123,000 square miles

of service territory in Montana,

Nebraska and South Dakota

Total Assets: (1)$2,340 MM

Total Capitalization: (1)(2)$1,445 MM

Total Employees: (1) 1,350

6

business overview…

Regulated Operations

One of the largest providers of electricity and natural gas in the Upper Midwest and Northwest,

serving approximately 640,000 customers in Montana, South Dakota and Nebraska

Electric Operations

Montana

322,000 customers (transmission/distribution)

Revenue by customer class(1):

35% residential, 51% comm./ind., 14% other

Approximately 7,000 miles of transmission

lines and 20,700 miles of distribution lines

South Dakota

59,700 customers (integrated utility)

Revenue by customer class(1):

37% residential, 51% comm./ind.,

12% other

Approximately 3,200 miles of T&D lines

Owns 310 net MW of power generation

Gas Operations

Montana

174,000 customers (residential/commercial)

3,800 miles of underground distribution

pipelines

2,000 miles of intrastate transmission

pipelines

16.3 Bcf of gas storage

South Dakota/Nebraska

83,900 customers (residential/commercial)

2,200 miles of distribution gas mains

Unregulated operations

Ethanol supply contracts

Moving to regulated business

Unregulated Operations

Electric —Primarily consists of a equity participation of 30% of Colstrip Unit 4,

a 740 MW coal-fired plant in Montana (portion lease/portion owned)

(1) Data as percent of total electric rate schedule revenue for 2006.

7

senior leadership…

Michael J. Hanson, President & Chief Executive Officer

Board member since May 2005

26 years utility experience

Brian B. Bird, VP & Chief Financial Officer

21 years financial management experience; 10 years energy experience

Thomas J. Knapp, VP, General Counsel and Corporate Secretary

30 years legal experience; 16 years regulatory experience

Patrick R. Corcoran, VP–Regulatory & Government Affairs

28 years regulatory experience

David G. Gates, VP–Wholesale Operations

29 years utility experience

Curtis T. Pohl, VP–Retail Operations

21 years utility experience

Bobbi L. Schroeppel, VP–Customer Care & Communications

14 years utility experience

Gregory G. A. Trandem, VP–Administrative Services

31 years utility experience

More than 20 years utility experience on average.

8

contribution of segments…

Gross Revenue (MM) - 2006

Gross Margin (MM) - 2006

$662

$359

83

77

$329

$119

$66

$6

Note: Revenue and Gross Margin exclude $48 million and $1 million of intercompany eliminations, respectively. Revenue and Gross

Margin reported in NorthWestern’s 10-K filing of $1.1 billion and $519 million incorporate the effect of such eliminations.

Total $1.1 billion

Total $519 million

9

current operations…

Reliability

South Dakota is in the first quartile as ranked by IEEE benchmarking

Montana is in the second quartile as ranked by IEEE

EEI Emergency Recovery Award for 2005

Recognized for outstanding efforts to restore service following ice storm in SD

One of six utilities nationwide that received this award

Customer Service

NorthWestern Energy is the only three-time recipient of the ServiceOne™

Award from PA Consulting

JD Power ratings related to image and value are below industry average

but are improving

Our overall JD Power customer satisfaction ratings are above average

Cost effectiveness

No increase in customer base rates for the past eight years

Filed for rate cases requesting revenue increases for 2008 rates

Safety

Our safety results are below the industry average

Implementing a comprehensive safety improvement program

10

historical growth – regulated electric…

Customers (000)

Volume (MWh 000)

(1)

2002 data is pro forma for full year results of Montana operations.

Actual revenues reported in 10-K included Montana results from February through December of 2002.

Volume growth rates have exceeded customer growth rates over the last few years.

(1)

11

historical growth – regulated natural gas…

Therms Sales (MM MMBtu)

(1) 2002 data is pro forma for full year results of Montana operations.

Actual revenues reported in 10-K included Montana results from February through December of 2002.

(1)

Gas volumes have decreased over the last few years as homes become more efficient.

Customers (000)

12

financial highlights…

Source: Company reports and SEC filings.

Note: Full year 2004 results show combined results for NWEC’s predecessor company from January 1, 2004 to

October 31, 2004 and for NWEC from November 1, 2004 to December 31, 2004.

(1) 2006 includes impact of reorganization expenses and charge for litigation verdict.

EBITDA(1)

Total Capital Expenditures

Gross Margin

($ in millions)

Cash Flow from Operations

($ in millions)

($ in millions)

($ in millions)

13

NorthWestern’s future…

Operationally strong

Above average reliability

Award winning customer service

Becoming financially stronger

Earnings and cash flow continue to grow

Approximately a 50/50 debt to total capitalization ratio

Investment grade ratings on senior secured basis

Increased September 30 dividend from $.31/share to

$.33/share

Opportunities to expand current cash flows

Aligning revenues with operating costs

Expanding transmission and distribution lines

Continuing to bring supply stability to our customers

Owning rate-based/regulated generation

Adding renewables in all jurisdictions where we serve electricity

14

near term strategic focus…

Operational effectiveness and cost control

Continue to enhance reliability

Continue to improve customer satisfaction

Strengthen cost effectiveness and efficiency

Proactively invest in infrastructure-related

regulated utility assets

Transmission and distribution upgrades

Electric transmission expansion projects (in excess of

$875 million planned for NorthWestern)

Montana generation

Proceed with rate cases in all jurisdictions

15

investment opportunities…

Company in strategic location in U.S. for

transmission expansion

Existing transmission opportunities

Montana States Intertie Transmission Line

($800 million planned)

Colstrip 500 kV upgrade with partners ($250 million is

total project; our portion $75 million)

Other potential opportunities

Gas pipelines to supply new ethanol plants

Montana generation (House Bill #25 law change in ’07)

Seek out opportunities for new regulated investments

16

Montana States Intertie Transmission Line…

500 kV AC Line Option

Southwestern Montana

to Southeastern Idaho

Length: Approx. 400 miles

Capacity: 1,500 MW

Capital Cost: $808 million

Assumed ROE of 13%:

ROE range on recent

FERC-regulated projects

of 9%-13.5%

17

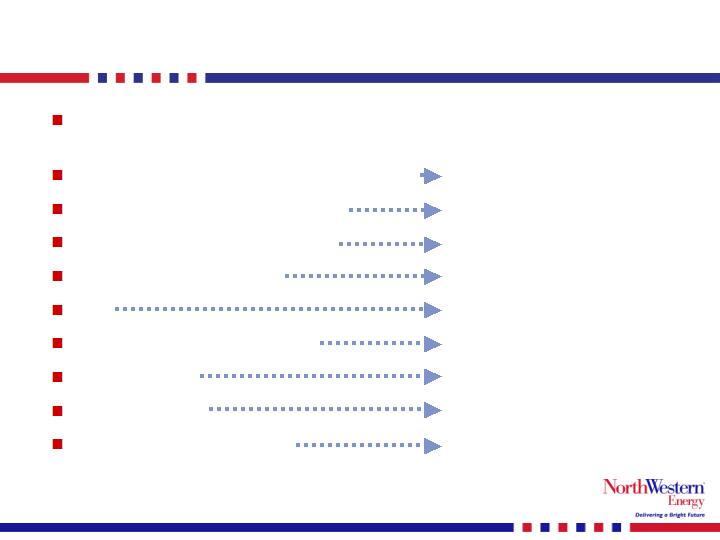

next steps on MSTI…

Open Season –study process ongoing; more than 50% capacity

interest through transmission deposits

FERC “Enhanced Or” rate approval Dec. 2006

Regional Planning Process Ongoing

MFSA Application process Through Dec. 2009

NEPA/MEPA Scoping Through Dec. 2009

EIS 2009 through 2010

Right of Way Acquisition 2009 through 2011

Engineering Through Dec. 2011

Construction 2010 through mid 2013

Target In-Service Date 1st half of 2013

18

Colstrip 500 kV upgrade…

“Traditional” pathway to

West Coast and California

markets

New substations near

Townsend and Missoula, MT

Upgrade to existing stations

No new line construction

necessary

Capacity increase: 500-700 MW

Working with other Colstrip

transmission owners

NWEC’s current ownership

share approx. 30%

Capital cost: $250 Million

NWEC’s share dependant on

other owners participation

Assumed ROE: 10.13%

19

next steps on Colstrip 500 kV upgrade…

Complete Coordinated Studies with BPA Summer 2007

Regional Planning Process Begin Q3 2007

Staged Development Analysis Q3 2007

Identify Ownership and Investment Options Q4 2007

Final Engineering, Siting and Permitting 2008

Incremental upgrade construction

timed to match shippers needs 2009-2010

On line date 2nd half 2010

20

transmission growth projects capital spending…

More than $875 million of identified growth projects.

21

rate case filings…

Montana

Last case was in 2000 (test year 1999); requesting revenue increase of

approximately $41.9 million annually

FERC

Requesting revenue increase of approximately $8.6 million annually

South Dakota

Last natural gas rate case was in 1998 (test year 1997); requesting

revenue increase of approximately $3.7 million annually

Nebraska

Last natural gas rate case was in 2000 (test year 1999); requesting

revenue increase of approximately $2.8 million annually

Total revenue requests are approximately $57 million annually.

(All ’06 test years)

Rate Base

Requested

Requested

Requested

Existing

2006

in millions

ROE

Equity

ROR

ROE

ROR

MT Electric

667.4

12.00%

51.46%

8.98%

10.75%

6.14%

MT Natural Gas

264.5

11.75%

51.46%

8.85%

10.75%

6.45%

SD Natural Gas

53.2

11.25%

51.46%

8.99%

10.25%

4.50%

NE Natural Gas

25.6

11.25%

51.46%

8.98%

10.25%

2.40%

SD Electric

165.7

Total

1,176.4

22

financial objectives…

Investment grade capital structure

Currently investment grade on secured debt

Striving to achieve investment grade on unsecured debt / corporate

rating

Long-term dividend payout of 60–70%

Quarterly dividend increase to $.33/share for September 30, 2007

Grow earnings per share

Utilize excess cash flow and debt capacity to invest in the business

Invest in organic growth in existing service territories

Invest in transmission opportunities (MSTI and 500 kV upgrade)

Invest in gas transmission (natural gas pipes to Ethanol plants)

Invest in electric generation opportunities (MT gas plant)

Provide annual earnings guidance

$1.45 - $1.60 for 2007

Provide earnings guidance on 2008 later this year

Obtain analyst coverage

Attract analyst coverage that did not exist during sale process

23

investment highlights…

Attractive Transmission and Distribution Business

Strong, Predictable Earnings

Increasing Gross Margin, Earnings and

Free Cash Flow (Increased Dividend in Q3 ‘07)

Significant Investment Potential

Experienced Management

24