- NWE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

8-K Filing

NorthWestern (NWE) 8-KRegulation FD Disclosure

Filed: 9 Oct 07, 12:00am

Morgan Stanley

Electric Utilities Corporate Access Day

October 9, 2007

forward-looking statement…

During the course of this presentation, there will be forward-

looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements often address our expected

future business and financial performance, and often contain

words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” or “will.”

These statements are based upon our current expectations and

speak only as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from

those expressed in any forward-looking statementsAlthough our

expectations and beliefs are based on reasonable assumptions,

actual results may differ materially. The factors that may affect

our results are listed in certain of our press releases and

disclosed in the Company’s public filings with the SEC.

2

who we are…

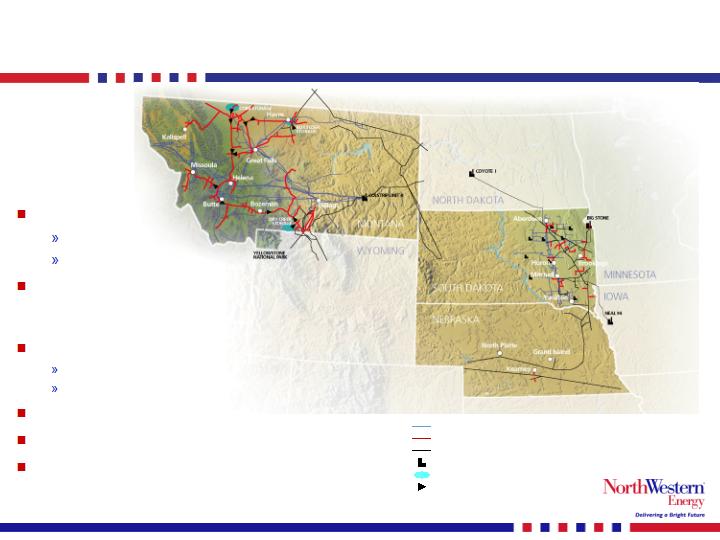

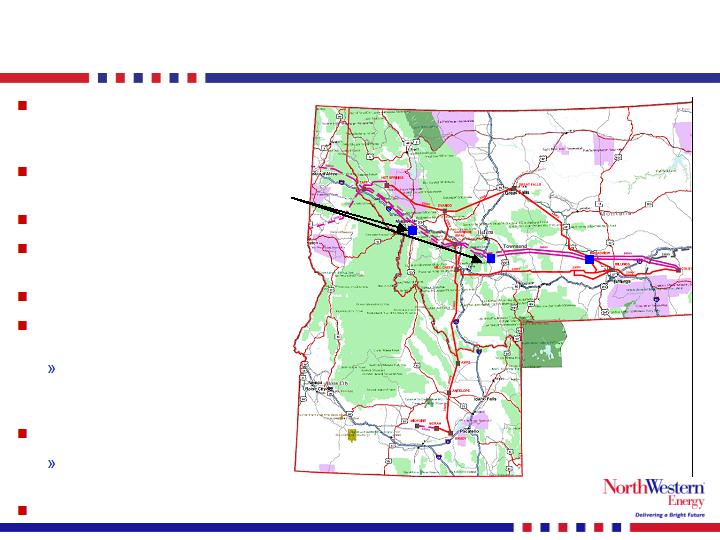

Electric transmission lines

Natural gas distribution lines

Supplier-owned electric or natural gas lines

Electric generating plant

Natural gas storage fields

Natural gas compressor stations

(1) As of 6/30/07.

(2)

Book capitalization calculated as short-term debt plus long-

term debt plus shareholders’ equity.

640,000 customers

382,000 electric

258,000 natural gas

Approximately 123,000 square miles

of service territory in Montana,

Nebraska and South Dakota

Total Generation

MT – 222 MW – unregulated

SD – 310 MW - regulated

Total Assets: (1)$2,353 MM

Total Capitalization: (1)(2)$1,448 MM

Total Employees: (1) 1,350

3

business overview…

Regulated Operations

One of the largest providers of electricity and natural gas in the Upper Midwest and Northwest,

serving approximately 640,000 customers in Montana, South Dakota and Nebraska

Electric Operations

Montana

322,000 customers (transmission/distribution)

Revenue by customer class(1):

35% residential, 51% comm./ind., 14% other

Approximately 7,000 miles of transmission

lines and 20,700 miles of distribution lines

South Dakota

59,700 customers (integrated utility)

Revenue by customer class(1):

37% residential, 51% comm./ind.,

12% other

Approximately 3,200 miles of T&D lines

Owns 310 net MW of power generation

Gas Operations

Montana

174,000 customers (residential/commercial)

3,800 miles of underground distribution

pipelines

2,000 miles of intrastate transmission

pipelines

16.3 Bcf of gas storage

South Dakota/Nebraska

83,900 customers (residential/commercial)

2,200 miles of distribution gas mains

Unregulated Operations

Electric —222 MW - Primarily consists of a equity participation of 30% of Colstrip Unit 4,

a 740 MW coal-fired plant in Montana (portion leased/portion owned)

(1) Data as percent of total electric rate schedule revenue for 2006.

4

senior leadership…

Michael J. Hanson, President & Chief Executive Officer

Board member since May 2005

26 years utility experience

Brian B. Bird, VP & Chief Financial Officer

21 years financial management experience; 10 years energy experience

Thomas J. Knapp, VP, General Counsel and Corporate Secretary

30 years legal experience; 16 years regulatory experience

Patrick R. Corcoran, VP–Regulatory & Government Affairs

28 years regulatory experience

David G. Gates, VP–Wholesale Operations

29 years utility experience

Curtis T. Pohl, VP–Retail Operations

21 years utility experience

Bobbi L. Schroeppel, VP–Customer Care & Communications

14 years utility experience

Gregory G. A. Trandem, VP–Administrative Services

31 years utility experience

25 years utility experience on average.

5

NorthWestern’s future…

Operationally strong

Above average reliability

Award winning customer service

Financially strong

Stable earnings and cash flow profile

Approximately a 50/50 debt to total capitalization ratio

Credit metrics support Baa2/BBB unsecured credit

ratings

Utilize excess cash flow and debt capacity to

invest in the business

Organic growth in existing service territories

Gas transmission (natural gas pipes to Ethanol plants)

Electric generation opportunities (MT Legislation HB 25)

Transmission opportunities (Colstrip 500 kV upgrade and

MSTI)

6

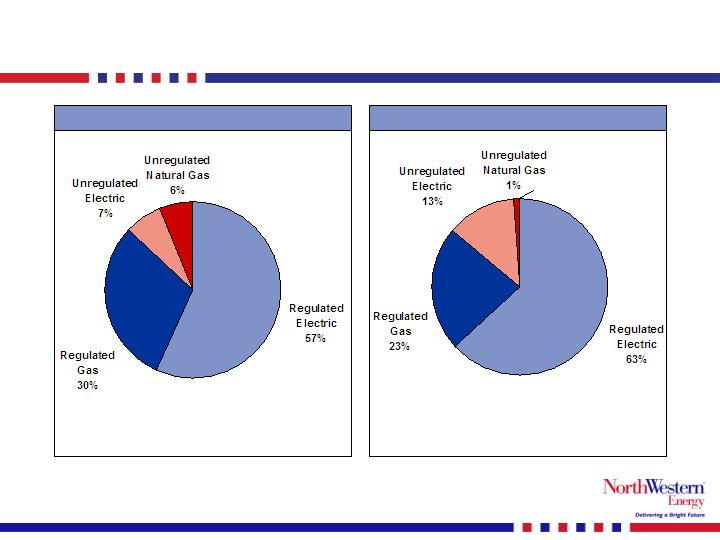

contribution of segments - 2006…

Gross Revenue (MM) - 2006

Gross Margin (MM) - 2006

$662

$359

83

77

$329

$119

$66

$6

Note: Revenue and Gross Margin exclude $48 million and $1 million of intercompany eliminations, respectively. Revenue and Gross

Margin reported in NorthWestern’s 10-K filing of $1.1 billion and $519 million incorporate the effect of such eliminations.

Total $1.1 billion

Total $519 million

7

2007 first half financial results…

Unaudited (Dollars in 000's)

2007

2006

B(W)

Operating Revenues

626,173

593,668

32,505

Cost of Sales

360,534

337,398

(23,136)

Gross Margin

265,639

256,270

9,369

Operating Expenses

Operating, general & administrative

121,125

129,972

8,847

Property and other taxes

41,252

38,178

(3,074)

Depreciation

40,687

37,580

(3,107)

Total Operating Expenses

203,064

205,730

2,666

Operating Income

62,575

50,540

12,035

Interest Expense

(27,747)

(29,058)

1,311

Other Income

737

8,417

(7,680)

Income (Loss) from Cont. Ops. Before Taxes

35,565

29,899

5,666

Benefit (Provision) for Income Taxes

(13,989)

(11,738)

(2,251)

Income (Loss) from Continuing Operations

21,576

18,161

3,415

Discontinued Ops., Net of Taxes

-

418

(418)

Net Income (Loss)

21,576

18,579

2,997

Six Months Ended June 30,

CONSOLIDATED INCOME STATEMENT

8

2007 first half operating income - segment…

9

Y-T-D - June 2007

(in 000's)

Electric

Nat Gas

Electric

Nat Gas

Other

Total

Revenues

349,073

220,221

36,879

32,786

(12,786)

626,173

Cost of sales

(180,679)

(152,134)

(8,441)

(31,173)

11,893

(360,534)

Gross Margin

168,394

68,087

28,438

1,613

(893)

265,639

O,A & G expense

(65,339)

(34,148)

(15,904)

(713)

(5,021)

(121,125)

Property taxes

(28,644)

(10,940)

(1,635)

(26)

(7)

(41,252)

Depreciation

(30,658)

(8,057)

(1,370)

(86)

(516)

(40,687)

Operating income/(loss)

43,753

14,942

9,529

788

(6,437)

62,575

Y-T-D - June 2006

(in 000's)

Electric

Nat Gas

Electric

Nat Gas

Other

Total

Revenues

319,108

217,710

38,510

50,629

(32,289)

593,668

Cost of sales

(160,626)

(154,743)

(6,420)

(47,056)

31,447

(337,398)

Gross Margin

158,482

62,967

32,090

3,573

(842)

256,270

O,A & G expense

(66,043)

(32,555)

(20,456)

(822)

(10,096)

(129,972)

Property taxes

(26,732)

(9,586)

(1,800)

(45)

(15)

(38,178)

Depreciation

(28,963)

(7,302)

(705)

(201)

(409)

(37,580)

Operating income/(loss)

36,744

13,524

9,129

2,505

(11,362)

50,540

Regulated

Unregulated

Regulated

Unregulated

2007 first half results…

Variance Analysis: First Half Year 2007 versus First Half Year 2006

First half 2007 increased earnings from prior yearwere primarily due to higher margins, lower operating

expenses and lower interest expense. Decreased other income and higher income taxes partially offset

these increases.

Margin increases from prior yeardriven by:

Increased volumes driven by customer growth (regulated electric) and colder weather (regulated gas)

Loss recorded in 2006 as a result of stipulation with MCC (regulated electric)

Offset partially by lower market prices and higher coal cost (unregulated electric), and renegotiated

supply & services contract (unregulated gas)

Operating and Admin expense decreased from prior yeardriven by:

Lower transaction related costs pursuant to the proposed BBI acquisition

Reduced lease expense for Colstrip Unit 4 generating facility

Offset partially by: i) increased MT property tax expense over prior year due to higher valuation

assessment in MT service territory, ii) increased depreciation due to higher plant and property in

service and iii) increased expense related to restricted stock awards granted in 2006

Interest expense decreased from prior yeardue to refinancing transactions completed in 2006, partially

offset by interest on debt assumed related to the purchase of owner participant interest in a portion of the

Colstrip Unit 4 generating facility in 2007

Other income down from prior yeardue to gains recognized during 2006 related to an interest rate swap

and the sale of a partnership interest in oil and gas properties

Increase in income taxes from prior yeardue mainly to higher pre-tax income

10

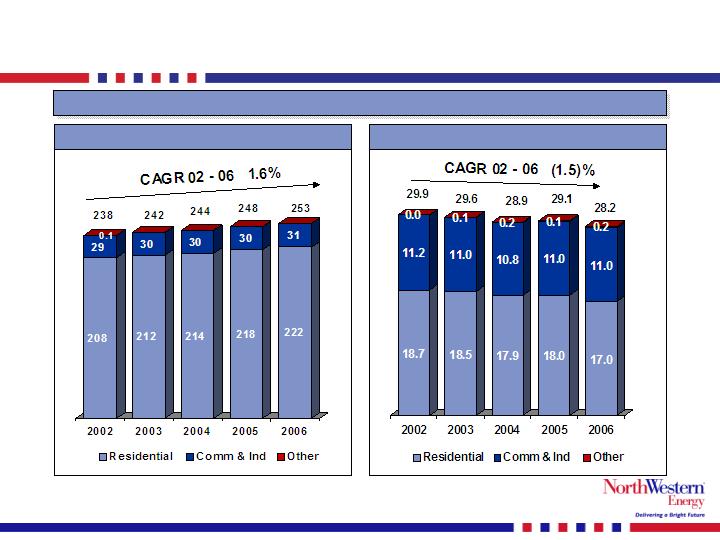

historical growth – regulated electric…

Customers (000)

Volume (MWh 000)

(1)

2002 data is pro forma for full year results of Montana operations.

Actual revenues reported in 10-K included Montana results from February through December of 2002.

Volume growth rates have exceeded customer growth rates over the last few years.

(1)

11

historical growth – regulated natural gas…

Therms Sales (MM MMBtu)

(1) 2002 data is pro forma for full year results of Montana operations.

Actual revenues reported in 10-K included Montana results from February through December of 2002.

(1)

Gas volumes have decreased over the last few years as homes become more efficient.

Customers (000)

12

financial highlights…

Source: Company reports and SEC filings.

Note: Full year 2004 results show combined results for NWEC’s predecessor company from January 1, 2004 to

October 31, 2004 and for NWEC from November 1, 2004 to December 31, 2004.

(1)

Red – Relates to capital expenditures for system

(2)

Blue - Relates to investments in ethanol related pipelines

(3)

Light Red - Relates to the buy out of the Mellon lease at Colstrip Unit 4

(4)

Dark green – High end of guidance

Total Capital Expenditures (1) (2) (3)

Cash Flow from Operations (4)

($ in millions)

($ in millions)

13

Colstrip unit 4…

Coal-fired mine mouth unit constructed in 1985

778 MW (nameplate) and 740 MW (capability)

Operated by PPL Montana

Unit has wet scrubbers for particulate and sulfur dioxide removal

NWEC has a 30% undivided economic participation in Unit 4

(222 MW capability)

Supported by adequate mine mouth coal supply through the

term of the lease in 2018

NWEC's share of Colstrip 4 output has the current off take

relationships

Sale of 97 MW to Puget through 2010

Unit contingent contract

Ave price of approximately $56/MWh

Sale of 90 MW to Montana regulated electric customers until 2018

Ave price of $35.80/MWh

Sale of 35 MW on a merchant basis

Includes two offsetting (buy/sell) contracts with a net cost of

$7.66/MWh expiring in 2010

110 MW’s (netted vs. revenues)

Bankruptcy hold over

14

2007 forecasted results…

Guidance for 2007 EPS ranges from $1.45 - $1.60 share

Assumptions:

Interim rates

FERC – started June 1, 2007 (2007 impact of $3.1 million)

SDPUC and NPSC starting by Dec. 1, 2007 (2007 impact of $.3

million)

MT interim rate request of $30.4 million (annual) pending

Financial impact of interim rates on 2007 would be pro rata

and contingent on a MPSC decision

If interim rates granted in Q4 (high end of range)

No interim rates in Q4 (low end of range)

Average shares outstanding for 2007 35.6 million shares

Basic shares will be higher as a result of warrant exercises

Depends on the number of warrants exercised by Nov 1, 2007

Normal weather for the last three months of 2007

15

value drivers…

Near Term

Rate case review

Up to $57 million in revenue relief

Colstrip Unit 4 impacts

90 MW default supply contact starting 7-1-07

Bought out the Mellon lease

Intermediate Term

Continued organic growth

Customer and volume growth

Increasing rate base

Natural Gas pipeline growth – Serves the ethanol industry

Potential Generation in MT - Effect of HB 25

Colstrip Unit 4

DB buyback of 110 MW’s with net loss of $7.66/MWH expires in 2010

Puget contract expires in 2010 – 97 MW’s goes to mkt pricing

Colstrip Unit 4 cash rent relief in 2011

Long Term

Upgrade the jointly owned Colstrip 500kV transmission line

Mountain States Transmission Intertie (MSTI)

16

rate case filings…

Montana

Last case was in 2000 (test year 1999); requesting revenue increase of

approximately $41.9 million annually

FERC

Requesting revenue increase of approximately $8.6 million annually

South Dakota

Last natural gas rate case was in 1998 (test year 1997); requesting revenue

increase of approximately $3.7 million annually

Nebraska

Last natural gas rate case was in 2000 (test year 1999); requesting revenue

increase of approximately $2.8 million annually

Total revenue requests are approximately $57 million annually.

(All ’06 test years)

17

earnings potential of rate case filings…

Net earnings potential of rate base after rate requests

(A)

(B)

(A * B)

Currently

Requested

Requested

Requested

Rate Base

Authorized

Requested

Requested

Filed Debt

Capital Adj.

Capital Adj.

Requested

Net Income

in millions

ROE

ROE

Equity/Cap

Costs

Debt %

Equity %

ROR

in millions

+

=

MT Electric

667.4

$

10.75%

12.00%

51.46%

5.76%

2.80%

6.18%

8.98%

41.3

$

MT Natural Gas

264.5

$

10.75%

11.75%

51.46%

5.76%

2.80%

6.05%

8.85%

16.0

$

SD Natural Gas

53.2

$

10.25%

11.25%

51.46%

6.60%

3.20%

5.79%

8.99%

3.1

$

NE Natural Gas

25.6

$

10.25%

11.25%

51.46%

6.60%

3.20%

5.78%

8.98%

1.5

$

SD Electric

165.7

$

Total

1,176.4

$

18

timetable on rate cases…

Montana

Nov 9, 2007 – Intervenor pre-

filed testimony due

Dec 14, 2007 – Company

rebuttal to pre-filed testimony

Jan 25, 2008 – Final day of

pre-hearing memorandum

Jan 30, 2008 – Hearing begins

Feb 29, 2008 – Company

initial post hearing brief due

Mar 14, 2008 – Intervenor post

hearing brief due

Mar 21, 2008 – Company post

hearing reply due

Apr 30, 2008 – target date for

Final Order from MPSC

South Dakota

Oct 19 – Staff and intervenor

pre-filed testimony due

Nov 1 - Company rebuttal

testimony due

Nov 7 & 8, 2007 – Hearing in

Pierre, SD

Nov 28, 2007 – Target date for

Final Order from SDPUC

FERC

October 2007 –Interim rates in

effect June 1, 2007 at 100% of

the requested revenue increase

(subject to rebate).

Nov 30, 2007 – Estimated date

of settlement with FERC. Date

not a firm deadline.

If no settlement occurs - judge

determines if a hearing is

required.

Nebraska

Oct 1, 2007 –Cities hire

consultant to negotiate directly

with the three cities

Oct 14, 2007 – Original

estimated date of completing the

negotiation with the cities

Nov 14, 2007 – Modified

estimated date of completing

negotiations with the cities

Dec 1, 2007 – Interim rates

expected to be in place

Dec 15, 2007 – NPSC gets 30

days to review the settlement and

issue Final Order

19

Colstrip unit 4 impacts…

Near Term Impacts at Colstrip Unit 4:

Sale of 90 MW to Montana regulated electric

customers until 2018

Ave price of $35.80/MWh

Will reduce margins by approximately $5.9 million in 2008

($15/MWh * 90MW * 180 days * 24 hrs)

Purchased the Mellon lease for 79 MW in 2007

Net increase to pre-tax income of approximately ($3.2 for

full yr vs. $1.9 benefit in 2007) $1.3 million in 2008

Net estimated impact on 2008 compared to 2007

Approximate reductionof pre-tax incomeof $4.6 million

A reduction of $2.7 million in net incomeor $.07/share

20

intermediate term drivers…

Intermediate Term

Continued organic growth

Customer growth – 1.6% annually

Load growth in electric segment – 3.2% annually

Significant capital expenditure growth since 2005

Increasing regulated rate base

Natural Gas pipeline – Serves the growing ethanol industry

Growth in the South Dakota and Nebraska jurisdictions

Potential for capital deployment of approximately $40 million in the

next 3 years

EBITDA tends to be approximately 15% annually of the capital

expended

Potential Generation development in MT

Effect of House Bill 25 – 2007 Montana legislative session

Colstrip Unit 4

DB sale and buyback of 110 MW’s with net loss of $7.66/MWh expires

in 2010

Puget contract expires in 2010 – 97 MW’s goes to mkt pricing

Colstrip Unit 4 cash rent relief in 2011

Cash rent reduces by $11.5 million annually

GAAP rent expense remains $14.2 million annually

21

potential for generation development…

2007 Montana Legislature passed House Bill 25:

Allows ownership of rate base generation

Prior legislation didn’t allow generation in rate base

Opportunity to provide new supply options to

NorthWestern’s customers

Reduce reliance on PPL’s generation to default supply

Approximately 65% of NorthWestern’s MT default supply is contracted

with PPL

Would assist Company with ancillary service

requirements for its control area

Provides for project approval by PSC priorto

construction

Company is considering a 100 – 150 MW gas fired

generation facility for peaking/intermediate purposes

22

next steps on generation development…

Activity Timing Cumulative Cost

Economic analysis of gas fired facility Dec. 2007

Feasibility study April 2008

Begin application process June 2008

Submit application for approval with MPSC July 2008

MPSC pre-approval April 2009

“go/no go” decision April 2009 $1 million

Proceed with detailed engineering design Sept. 2008

Reserve major equipment July 2008 $12-$15 million

Construction �� April 2009

Start up and commercial operation July 2010 $100 - 125 million

23

long term drivers…

Transmission Development

Western Electricity Coordinating Council estimates 30,000 MW

of additional capacity is needed in next decade for the West

Proposed 3,000 MW’s of new generation in Montana looking for

markets

Recently 350 MW’s added in Montana

Hardin plant (coal)

Judith Gap project (wind)

Transmission network is constrained

NorthWestern planned transmission expansion

Upgrade Colstrip 500kV transmission line

500 MW increased capacity on west path from Montana

Expected cost of total project is approximately $250 million

Provides better reliability

Mountain States Transmission Intertie line

(MSTI)

Up to 1,500 MW increased capacity on southwest path from

Montana

Expected to be a $800 - $850 million capital project

24

NWE strategically located for transmission

Located between generation and customers

25

Planned western transmission projects…

Projects Route Cost

Mountain States Intertie W. Mt to Mid-Idaho (500 kV) $800-$850 million

Frontier Line 500 kV DC WY to CA $3 - $5 billion

TransWest Express 500 kV $2 - $5 billion

SouthWest Intertie Project* Idaho to Las Vegas 500 kV (500 mi.) $750M - $1.5B

Developer: LS Power

TransCanada/Northern Lts 500 kV DC – Canada to Las Vegas $1.2 - $1.8 billion

Eastern Nevada Intertie So. Nevada to Eli Center (500 kV DC) $515 million

* Would link NorthWestern’s MSTI project in Idaho to Las Vegas

26

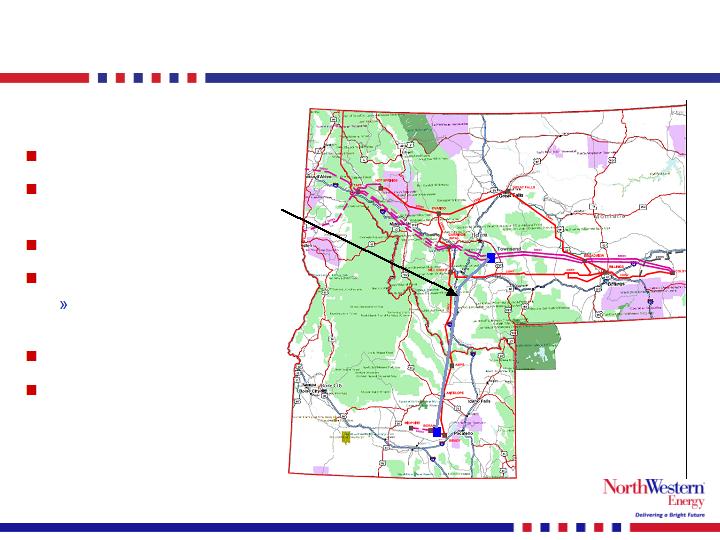

Colstrip 500 kV upgrade…

“Traditional” pathway to

West Coast and California

markets

New substations near

Townsend and Missoula, MT

Upgrade to existing stations

No new line construction

necessary

Capacity increase: 500-700 MW

Working with other Colstrip

transmission owners

NWEC’s ownership share of

upgrade project is assumed

to be 50%

Capital cost: $250 Million

NWEC’s share dependant on

other owners participation

Assumed ROE: 10.13%

27

next steps on Colstrip 500 kV upgrade…

Activity Timing Cumulative Cost

WECC planning & path rating analysis during 2008

Agreement with BPA on rates Oct. 2008

Transmission Agreements in place Oct. 2008

Initial WECC approval Sept. 2008

“Go/no go” decision Oct. 2008 $1-2 million

Various engineering studies approved June 2009

Finish substation design July 2009

Land acquisition for sub station sites to end 2009 $20-30 million

Construction 2009-2010

Transmission upgrade in service Jan. 2011 $100-125 million

Assumes 50% ownership in the project. The costs represent NorthWestern’s pro rata portion of the

capital invested.

28

Mountain States Transmission Intertie Line…

500 kV AC Line

Southwestern Montana

to Southeastern Idaho

Length: Approx. 400 miles

Capacity: 1,500 MW

Deposits from subscribers

of approx. 1,050 MW

Capital Cost: $800 million

Assumed ROE of 13%:

ROE range on recent

FERC-regulated projects

of 9%-13.5%

29

next steps on MSTI…

Activity Timing Cumulative Cost

Conclude process of participant interest Oct. 2007

Gain support of state & federal agencies Feb. 2008

File Major Facility Siting Act Application in MT Mar. 2008

Complete project siting, permitting, and EIS Nov. 2009

Commercial contracts in place Dec. 2009

“Go/no go” decision Dec. 2009 $3-$5 million

Obtain land and right of ways June 2010 $60-$75 million

Construction 2010-2012 $715-$730 million

Test/Energize the completed Tx line Jan. 2013 $800-850 million

30

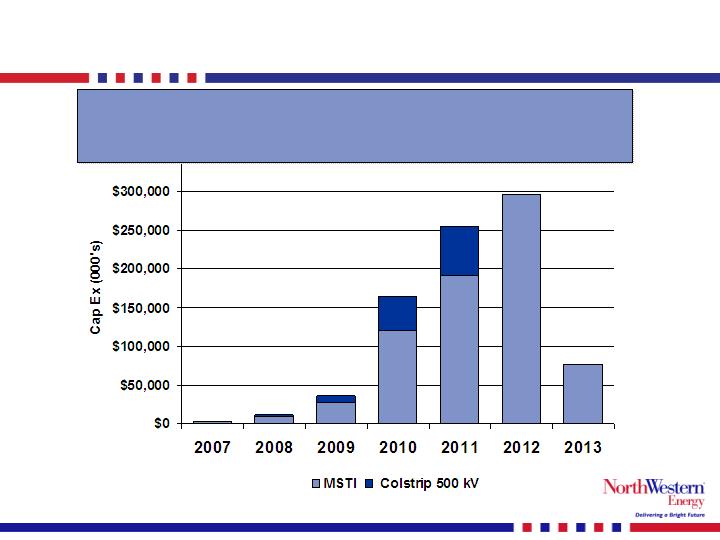

transmission growth projects capital spending…

More than $900 million of identified transmission growth

projects

(includes Colstrip 500KV upgrade at 50% ownership of new project)

31

financial objectives…

Investment grade capital structure

Currently investment grade on secured debt

Striving to achieve investment grade on unsecured debt / corporate

rating

S&P recently revised its outlook on NWEC corp. rating to positive

Long-term dividend payout of 60–70%

Quarterly dividend increase to $.33/share for September 30, 2007

Grow earnings per share

Utilize excess cash flow and debt capacity to invest in the business

Invest in organic growth in existing service territories

Invest in gas transmission (natural gas pipes to Ethanol plants)

Invest in electric generation opportunities

Invest in transmission opportunities (500 kV upgrade and MSTI)

Obtain analyst coverage

Attract analyst coverage that did not exist during sale process

32

investment highlights…

Attractive Transmission and Distribution Business

Strong, Predictable Earnings

Increasing Gross Margin, Earnings and

Free Cash Flow (Increased Dividend in Q3 ‘07)

Significant Investment Potential

Experienced Management

33