West Coast Utilities

Seminar

Wall Street Access and Berenson & Co.

December 13, 2007

forward-looking statement…

During the course of this presentation, there will be forward-

looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements often address our expected

future business and financial performance, and often contain

words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” or “will.”

These statements are based upon our current expectations and

speak only as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from

those expressed in any forward-looking statements. Although our

expectations and beliefs are based on reasonable assumptions,

actual results may differ materially. The factors that may affect

our results are listed in certain of our press releases and disclosed

in the Company’s public filings with the SEC.

2

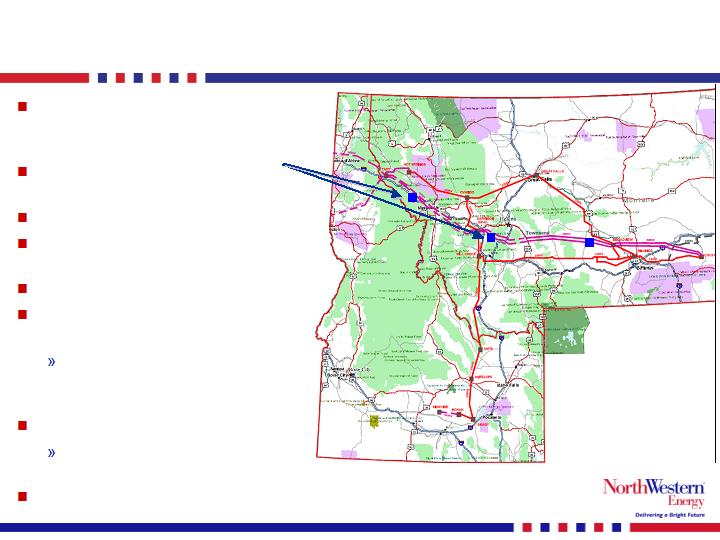

who we are…

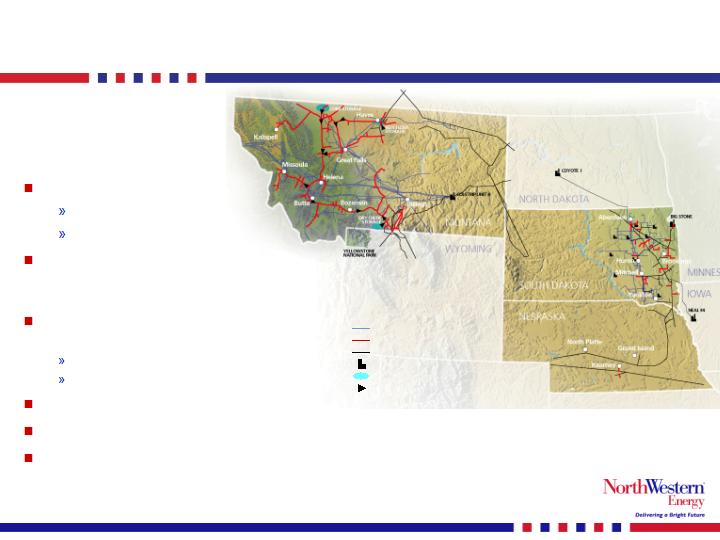

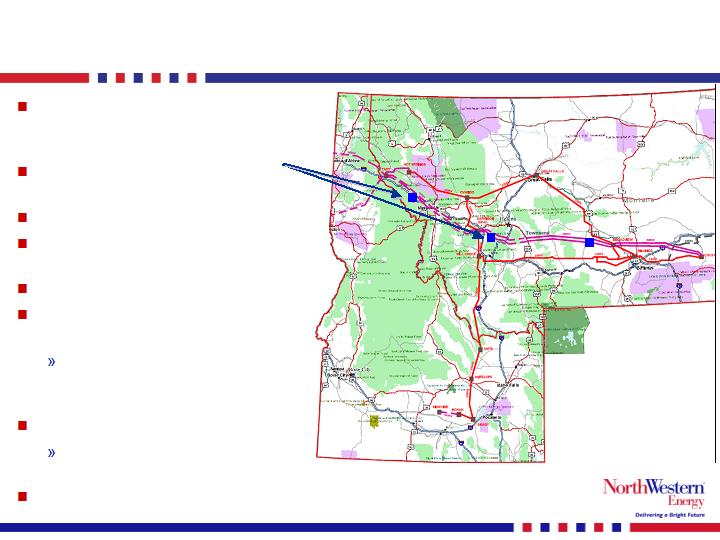

Electric transmission lines

Natural gas distribution lines

Supplier-owned electric or natural gas lines

Electric generating plant

Natural gas storage fields

Natural gas compressor stations

(1) As of 9/30/07.

(2)

Book capitalization calculated as short-term debt plus long-

term debt plus shareholders’ equity.

640,000 customers

382,000 electric

258,000 natural gas

Approximately 123,000 square miles

of service territory in Montana,

Nebraska and South Dakota

Total Generation (mostly base load coal)

MT – 222 MW – unregulated

SD – 310 MW – regulated

Total Assets: (1) $2,386 MM

Total Capitalization: (1)(2) $1,445 MM

Total Employees: (1) 1,350

3

contribution of segments…

$662

$359

83

77

$119

*EBITDA = Op. Inc. + Depr

(trailing twelve months)

Gross Margin Contribution

EBITDA* Contribution

Approximately 90% of gross margin is

provided by the regulated businesses.

Approximately 90% of EBITDA is provided

by the regulated businesses.

4

NorthWestern moving forward…

Company moving forward as a stand alone

company

Proposed merger terminated in July 2007

Regulated electric and natural gas business

Strong financial profile

Rate case settlements pending

Earnings accretive

Allow NWE to earn normal utility return

Avoid expensive and time consuming hearing process

Poised to grow the company

Transmission development

Generation development

5

summary of business drivers…

Organic growth

Customer base and load growth continues

Natural gas pipelines to serve ethanol plants

Other value drivers

Colstrip Unit 4 under valued

NOL value may not be considered by market

Transmission and generation opportunities

Opportunity to double rate base

Opportunity for annual net income of approx $56 million

6

rate case settlements…

Montana*

Rate increase of $15 million annually

Electric increase $10 million annually

Nat. Gas increase $5 million annually

Rate effective the earlier of Jan 1, 2008

or date of approval by the MPSC

Confidential settlement on specific

rate elements, such as capital

structure and the authorized ROE

NWEC foregoes a rate base return on

$19.4 million of capital expenditures

per year for each of 2008 and 2009

NWEC recoups the return of capital

investment over 30 years

An additional 21 MWs of CU4

contracted to default supply **

Contracted price of “Mid C” minus

$19/MWh

Current equivalent of approx. $45/MWh

Period of 78 months

* Subject to approval by the MPSC

** Subject to approval by the FERC

South Dakota*

Revenue increase = $3.1 million

annually

Rates effective December 1, 2007

Confidential agreement on capital

structure and authorized ROE

Nebraska**

Revenue increase = $1.5 million

annually

Rates effective December 1, 2007

ROE of 10.4%

Capital Structure as filed

* Subject to approval by the SDPUC

** Subject to approval by the NPSC

7

rate case impact…

Montana (subject to approval by the MPSC):

Earnings accretive

NWEC and MCC request and support interim rates effective January 1, 2008

Avoids an expensive and time consuming process

Allows company to continue maintenance programs and infrastructure improvements, while

providing normal utility returns

Company can move forward with generation and transmission projects

South Dakota (subject to approval by the SDPUC):

Earnings accretive

$3.1 million annual revenue granted ($3.7 million request)

Rates effective December 1, 2007

Nebraska (subject to approval by the NPSC):

Earnings accretive

$1.5 million annual revenue granted ($2.8 million request)

Rates effective December 1, 2007

Authorized ROE of 10.4%, capital structure as filed

FERC (case not yet settled)

Interim rates in effect since June 1, 2007

8

undervalued assets…

Colstrip Unit 4

Buyout values were repurchased at approximately

$860/kW

Mellon buyout approximately $743/kW

GE buyout approximately $933/kW

Market value today is likely at least double

Net Operating Losses

Balance of approximately $400 million at 12/31/06

FIN 48 reserve of approximately 50%

NPV of tax benefit, net of the FIN 48 reserve is approx.

$68 million

9

poised for significant growth…

Strong balance sheet

debt to cap ratio of 48%

Experienced management team to execute plan

Average 25 years of utility experience

Earnings and cash flow growth from existing businesses

Existing regulated and unregulated businesses provide

stable predictable earnings

Continued customer and load growth

Capital investments continue to increase

Approximately $1 billion of growth capex opportunities

over the next 6 years

All regulated projects (state and FERC )

$1.2 billion rate base as of December 31, 2006

(88% growth potential)

10

growth opportunities…

Existing Business

Service territory

Customer growth –

1.6% annually

Load growth in electric segment –

2%-3% annually

Capital investments have

increased an average of

$4.2 million per year since 2004

Natural gas pipelines – serve the

growing ethanol industry

Assumes a capital deployment of

approximately $20 million in the

next 3 years

Equity investment protected by

letters of credit

Growth Opportunities

Transmission development

Upgrade Colstrip 500kV

transmission line

Mountain States Transmission

Intertie line (MSTI)

Potential generation development

in Montana

Effect of House Bill 25 –

2007 Montana legislative session

11

Colstrip 500 kV upgrade…

“Traditional” pathway to

West Coast and California

markets

New substations near

Townsend and Missoula, MT

Upgrade to existing stations

No new line construction

necessary

Capacity increase: 500-700 MW

Working with other Colstrip

transmission owners

NWEC’s ownership share of

upgrade project is assumed

to be 50%

Capital cost: $250 Million

NWEC’s share dependant on

other owners participation

Assumed ROE: 10%-11%

12

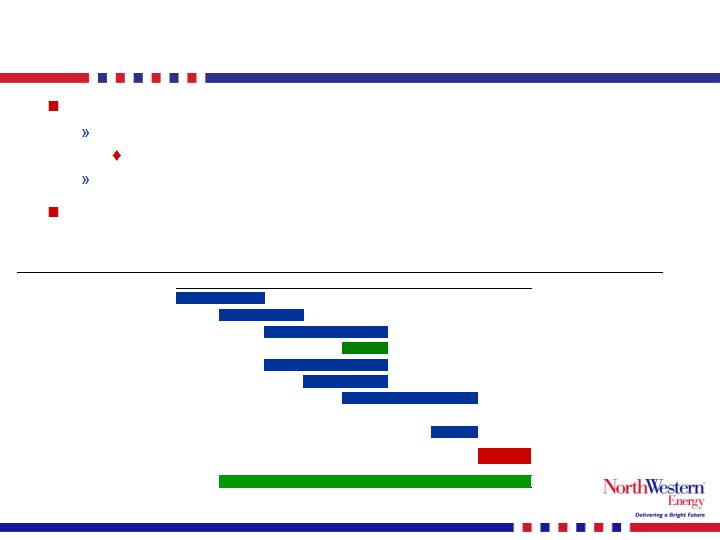

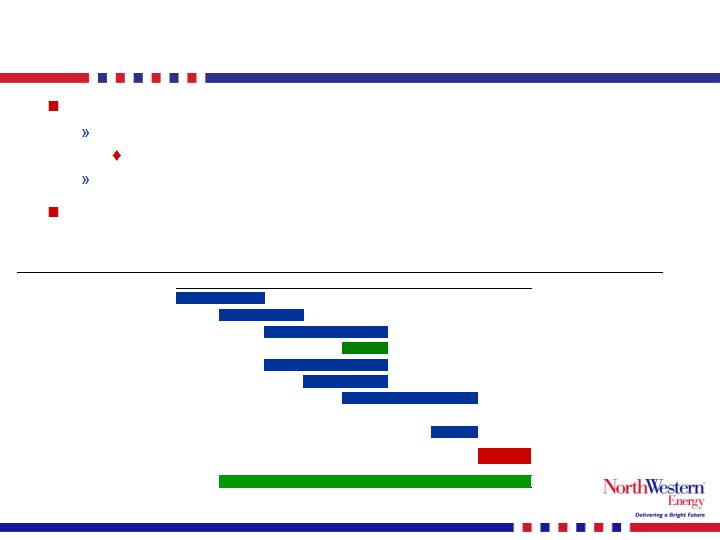

next steps on Colstrip 500 kV upgrade…

Assumes 50% ownership in the project.

The costs represent NorthWestern’s pro rata portion of the capital invested.

Go/No Go

Operation

Cumulative Dollars Spent:

$1-2M

$20-30M

$100-125M

2011

2007

2008

2009

2010

Substation design

WECC planning

Land acquisition

Construction

Engineering studies

Rates with BPA

Tx agreements

WECC approval

13

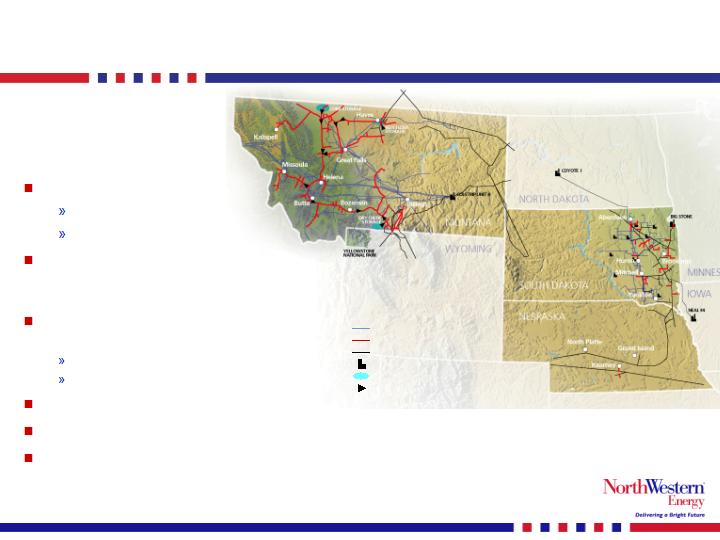

Mountain States Transmission Intertie Line…

500 kV AC Line

Southwestern Montana

to Southeastern Idaho

Length: approx. 400 miles

Capacity: 1,500 MW

Deposits from subscribers

of approx. 1,050 MW

Capital Cost: $800 million

Assumed ROE 10%-13%

14

MSTI timeline…

Go/No Go

Test

Operation

Cumulative Dollars Spent:

$3-5M

$200M

$500M

$800M

2011

2012

2013

Open Season

2007

2008

2009

2010

Rights of Way

Construction

Support of Agencies

Major facility Siting

Contracts

EIS

15

potential for generation development…

2007 Montana Legislature passed House Bill 25:

Allows ownership of rate base generation

Prior legislation didn’t allow generation in rate base

Provides for project approval by PSC prior to construction

NorthWestern is considering a 100-150 MW gas fired

generation facility for wind firming and high demand periods

Go/No Go

Testing

Operation

Cumulative Dollars Spent:

$1-2M

$12-$15M

$100-$125M

Economic analysis

2007

2008

2009

2010

Construction

Reserve equip.

Feasibility study

MPSC review process

Major engineering design

16

cap ex spending – next few years…

Includes more than $1 billion of potential generation

and transmission growth projects

(includes Colstrip 500KV upgrade at 50% ownership of new project)

17

value of growth potential…

Possible earnings capacity of future opportunities

Significant financial opportunity long term

(in millions)

Annual Earnings

Opportunity

On-line

MSTI transmission line

$800 million times 50% equity ratio times estimated ROE of 11%

$44.0

Jan 2013

Colstrip 500 kV transmission upgrade

$120 million times 50% equity ratio times estimated ROE of 10%

$6.0

Jan 2011

Montana Nat Gas generator

$110 million times 50% equity ratio times estimated ROE of 10%

$5.5

July 2010

Ethanol pipelines - SD/NE

$20 million times 50% equity ratio times estimated ROE of 10%

$1.0

Thru 2009

***Disclaimer*** – not intended to be guidance or a prediction of share price.

Intended to be an estimation of intrinsic value drivers of possible outcomes.

18

investment highlights…

Attractive Transmission and Distribution Business

Strong, Predictable Growth in Earnings

Significant Investment Potential in

Transmission and New Generation

Experienced Team Committed to

Shareholder Value

19