- NWE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

8-K Filing

NorthWestern (NWE) 8-KRegulation FD Disclosure

Filed: 5 May 08, 12:00am

AGA Financial Forum

May 5, 2008

forward-looking statement …

During the course of this presentation, there will be forward-

looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements often address our expected

future business and financial performance, and often contain

words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from

those expressed in any forward-looking statements. We undertake

no obligation to revise or publicly update our forward-looking

statements or this presentation for any reason. Although our

expectations and beliefs are based on reasonable assumptions,

actual results may differ materially. The factors that may affect our

results are listed in certain of our press releases and disclosed in

the Company’s public filings with the SEC.

2

who we are …

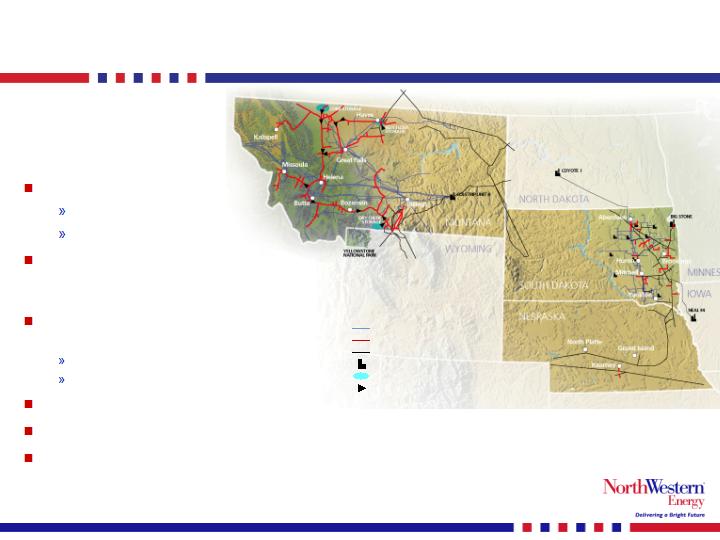

Electric transmission lines

Natural gas distribution lines

Supplier-owned electric or natural gas lines

Electric generating plant

Natural gas storage fields

Natural gas compressor stations

(1) As of 12/31/07

(2)

Book capitalization calculated as total debt, excluding capital leases, plus shareholders’ equity.

650,000 customers

388,000 electric

262,000 natural gas

Approximately 123,000 square miles

of service territory in Montana,

Nebraska and South Dakota

Total Generation (mostly base load coal)

MT – 222 MW – unregulated

SD – 312 MW – regulated

Total Assets: (1) $2,547 MM

Total Capitalization: (1)(2) $1,629 MM

Total Employees: (1) 1,350

3

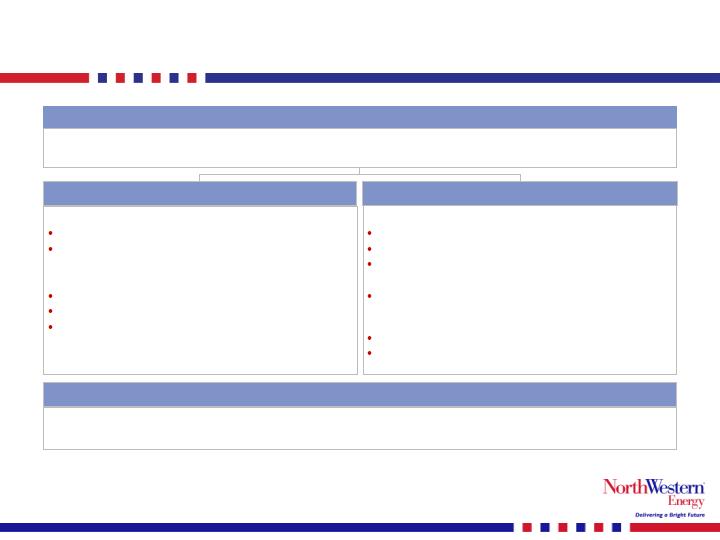

business overview …

Regulated Operations (89% of Gross Margins)

One of the largest providers of electricity and natural gas in the Upper Midwest and Northwest,

serving approximately 650,000 customers in Montana, South Dakota and Nebraska

Electric Operations (65%)

Montana

328,000 customers (transmission/distribution)

Approximately 7,000 miles of transmission

lines and 21,000 miles of distribution lines

South Dakota

60,100 customers (integrated utility)

Approximately 3,200 miles of T&D lines

Owns 312 net MW of power generation

Gas Operations (24%)

Montana

177,000 customers (residential/commercial)

3,900 miles of distribution pipelines

2,000 miles of intrastate transmission

pipelines

16.2 Bcf of gas storage

South Dakota/Nebraska

84,500 customers (residential/commercial)

2,200 miles of distribution pipelines

Unregulated Operations (11%)

Electric — 222 MW - Primarily consists of an equity participation in 30% of Colstrip Unit 4,

a 740 MW coal-fired power plant in Montana

Source: NorthWestern Corporation 10-K.

4

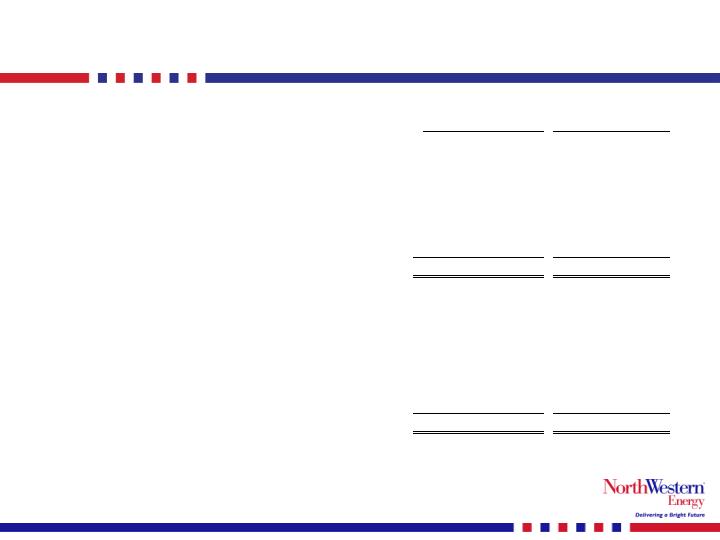

2007 segment information …

Unaudited (Dollars in 000's)

YE Dec 31, 2007

ELECTRIC

UTILITY

GAS

UTILITY

UNREGULATED

ELECTRIC

OTHER /

ELIMINATIONS

TOTAL

Gross Margin

346,976

127,626

56,152

901

531,655

% of Total

65%

24%

11%

0%

Operating Income

90,692

36,067

20,407

(7,073)

140,093

% of Total

65%

26%

15%

-5%

Net Income

33,730

14,599

10,274

(5,412)

53,191

% of Total

63%

27%

19%

-10%

5

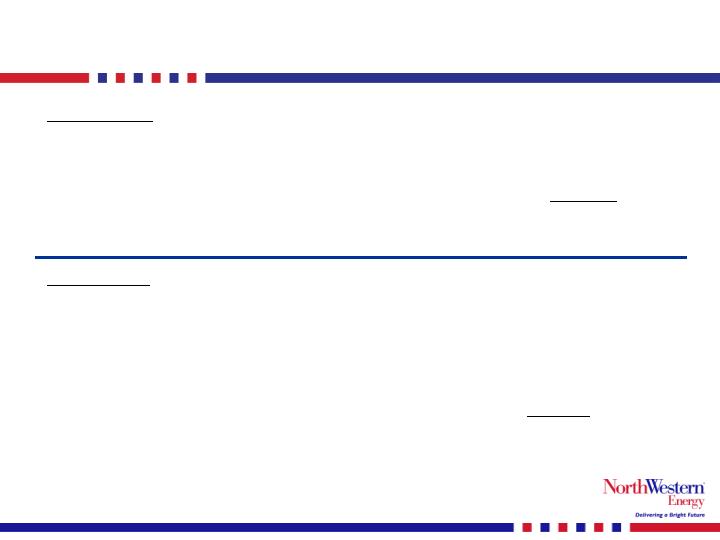

2008 1Q results …

(000's)

2008

2007

B(W)

% change

Operating Revenues

385,975

366,565

19,410

5.3%

Cost of Sales

229,084

219,278

(9,806)

-4.5%

Gross Margin

156,891

147,287

9,604

6.5%

Operating Expenses

Operating, general & administrative

60,071

62,448

2,377

3.8%

Property and other taxes

23,640

20,592

(3,048)

-14.8%

Depreciation

21,091

19,894

(1,197)

-6.0%

Total Operating Expenses

104,802

102,934

(1,868)

-1.8%

Operating Income

52,089

44,353

7,736

17.4%

Interest Expense

(16,080)

(13,220)

(2,860)

21.6%

Investment Income and Other

662

378

284

75.1%

Income (Loss) from Cont. Ops. Before Taxes

36,671

31,511

5,160

16.4%

Benefit (Provision) for Income Taxes

(13,220)

(12,369)

(851)

6.9%

Net Income (Loss)

23,451

19,142

4,309

22.5%

Three Months Ended March 31,

6

strong balance sheet …

Debt Ratings

Unaudited (Dollars in 000's)

March 31

December 31

2008

2007

Cash

33,755

12,773

Restricted Cash

13,904

14,482

Accounts Receivable, Net

142,280

143,482

Inventories

29,579

63,586

Other Current Assets

51,619

44,031

Goodwill

355,128

355,128

PP&E and Other Non-current Assets

1,922,041

1,913,898

Total Assets

2,548,306

$

2,547,380

$

Payables

65,989

91,588

Other Current Liabilities

234,642

209,245

Long & Short Term Capital Leases

39,877

40,391

Long & Short Term Debt

776,212

805,977

Other Non-current Liabilities

597,158

577,155

Shareholders' Equity

834,428

823,024

Total Liabilities and Equity

2,548,306

$

2,547,380

$

Long & Short Term Debt / Total Capitalization

48.2%

49.5%

7

Colstrip Unit 4 strategic alternatives update …

Considerations

Sale of the plant

Evaluate possible transfer to rate base

Retain plant as unregulated

Analyze a long-term index sale to NorthWestern’s regulated customers

Possible sale of NorthWestern’s 30% interest in CU4

Confidential Information Memorandum in market

First round bids received

Site visits and other due diligence in process

Final bids due in late May ‘08

Timing

Decide which alternative to pursue in 2Q ’08

Execute on alternative pursued in second half of ‘08

MPSC’s possible court action

MPSC waived their jurisdiction over this asset in 1985

Customers are already receiving the benefit through supply contracts that are

below market

NorthWestern likely to contest any possible legal action on this matter

Intend to complete its evaluation of options for CU4

8

2008 guidance bridge from 2007 results …

2008 = 2007 plus rate increases in MT, SD, NE

* Estimates by the three sell side firms covering NWEC average $1.71/fully diluted share for 2008.

2008 Guidance

Reported 2007 - EPS fully diluted

1.44

$

Mid-point

Guidance for 2008 - diluted

1.60

$

1.75

$

1.68

$

Yr over yr increase

0.24

$

per share

Bridge to 2008:

Rates - MT

0.23

$

Rates - FERC

0.01

$

Rates - SD

0.04

$

Rates - NE

0.02

$

Anticipated reduction to CU4 earnings in 2008

(0.04)

$

Anticipated yr over yr changes

0.26

$

per share

9

NorthWestern’s future …

Operationally strong

Cost competitive

Above-average reliability

Award-winning customer service

Financially strong

Steady earnings growth

Strong cash flows

Approximately a 50/50 debt to total capitalization ratio

Secured credit ratings of A-(MT) BBB+(SD) / BBB / Baa3

Unsecured credit ratings of investment grade from 2 of 3 agencies

Utilize excess cash flow and debt capacity to invest in the business

Organic growth in existing service territories

Electric generation opportunities in Montana and South Dakota

Electric transmission opportunities (Colstrip 500 kV upgrade and MSTI)

Gas transmission expansion in Nebraska and South Dakota

10

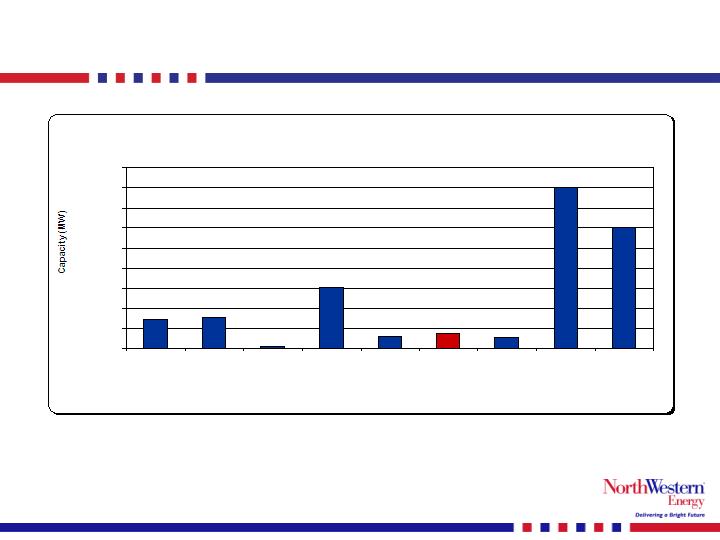

Montana proposed generation landscape …

Potential Generation Development in Montana

722

770

52

1,526

300

375

268

4,012

3,000

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Coal

Gas

Hydro

Wind

MATL

In-Service

Signed

LGIA

Total

MT

Existing

Generation

New transmission is needed to support new generation

11

generation project developments …

Mill Creek Generation Plant

Site selected at Mill Creek, near Anaconda, Montana

Design phase

Filing expected by end of 2Q ‘08

Construction to begin upon approval

Estimated to be on-line at beginning of 2011

Approximately 120 MW of installed capacity

Approximately $150 million project

Expandable project

Current need is about 80 MW of regulating capacity

Regulating capacity need will grow over time

12

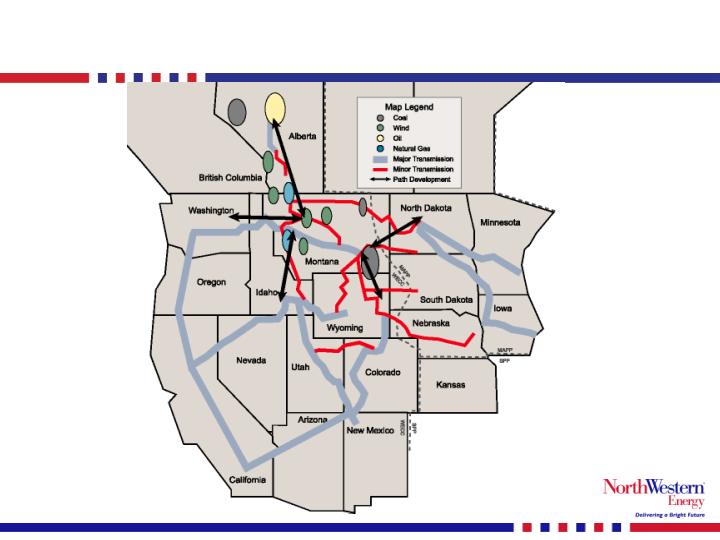

transmission pathway considerations …

13

transmission project developments …

Colstrip 500 KV Upgrade

NorthWestern currently assumes it will be only partner

Renewed interest by certain of the other owners

Significant proposed generation but mix is changing

May effect the timing and the configuration of the project

Looking to make the upgrade a “wind collector system”

Cost estimate = $200M - $250M

Inclusive of the collector system

Estimated to be on-line beginning of 2013

14

transmission project developments cont’d …

MSTI

Permitting for 500 KV line

Will scale this project to committed long term contracts

230KV, 270 mile line to move 430 MWs; cost = $250M - $300M

345KV, 370 mile line to move 800 MWs; cost = $650M - $700M

500KV, 400 mile line to move 1,500 MWs; cost = $750M - $900M

Reservations currently at 639 MWs

Considering strategic partnering

15

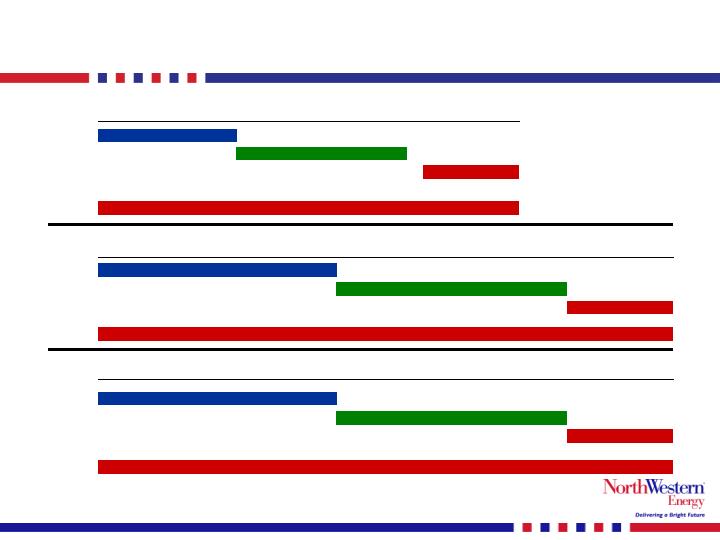

growth project timing…

Mill Creek Generation Plant

Construction

Cumulative Dollars Spent:

$4M-$5M

$100M

$150 M

Colstrip 500 KV upgrade

Cumulative Dollars Spent:

$1M-$2M

$100M

$200M-$250M

MSTI

Cumulative Dollars Spent:

$10M-$12M

$40M-$50M

$200M

$400M

2008

2009

2010

2011

Operation

Planning

2011

2012

2013

2008

2009

2010

Planning & Technical Studies

Construction

Operation

2008

2009

2010

2011

2012

2013

Operation

$750M - $900M

Planning & Technical Studies

Construction

16

growth project actions ‘08/’09 …

Mill Creek

2008

File for approval with the MPSC Q2

Air quality permit received Q4

Expect decision from the MPSC Q4

500 KV upgrade

2008

Complete facilities studies Q4

WECC regional planning process Q4

MSTI

2008

Select preferred route Q2

File MFSA with the MT DEQ Q2

Begin formal EIS process Q3

Mill Creek

2009

Reserve equipment Q1

Engineering design Q1

Begin construction Q3

500 KV upgrade

2009

Run Open Season or subscription

process Q1

Complete regional planning process Q4

MSTI

2009

Draft EIS for public review Q4

FERC tariff and service

agreements Q4

17

growth project potential …

MSTI transmission line

500 KV scenario

37.5

$

to

45.0

$

750.0

$

to

900.0

$

Jan 2013

345 KV scenario

32.5

$

to

35.0

$

650.0

$

to

700.0

$

Jan 2013

230 KV scenario

12.5

$

to

15.0

$

250.0

$

to

300.0

$

Jan 2013

Colstrip 500 kV transmission upgrade

10.0

$

to

12.5

$

200.0

$

to

250.0

$

Jan 2013

Mill Creek Generator

Located by Anaconda, MT

6.3

$

to

7.5

$

125.0

$

to

150.0

$

Jan 2011

Natural Gas Pipeline Extensions

1.0

$

to

2.0

$

20.0

$

to

40.0

$

Thru 2009

*For illustrative purposes = Cost of project times 50% equity ratio times estimated ROE of 10%

Timing

Cost of Project

Annual Earnings

Opportunity*

(in millions)

18

Northwestern – value and growth …

Value

Dividend yield of 5.1%

Currently trading at approximately 1.2x book value

Opportunity for Growth

Possibility of rate base growth in excess of $1 billion

Potential additional annual earnings of approximately

$50 million by 2013

Strong balance sheet/credit ratings

19

summary …

Attractive

Transmission &

Distribution Business

Regulated electric and gas contribute 90% of gross

margins

Cost-based operating structure approved by regulatory

commissions

Increasing cash flows support growth opportunities

Stable and Predictable

Cash Flow

Strong Balance Sheet

Current Value with

Potential for Growth

Conservative capital structure provides increased

flexibility

Improving credit ratings

Dividend yield of 5.1%

Trading at low multiple of book value

Identified projects providing opportunity for rate

base/earnings growth

Regional T&D utility with stable customer growth

Attractive mix of electric and natural gas customers

Reliable and cost competitive operations

20