- NWE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

8-K Filing

NorthWestern (NWE) 8-KRegulation FD Disclosure

Filed: 21 May 08, 12:00am

Annual Meeting

of Stockholders

New York Marriott Downtown Hotel

May 21, 2008

forward-looking statement…

During the course of this presentation, there will be forward-

looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements often address our expected

future business and financial performance, and often contain

words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from

those expressed in any forward-looking statements. We undertake

no obligation to revise or publicly update our forward-looking

statements or this presentation for any reason. Although our

expectations and beliefs are based on reasonable assumptions,

actual results may differ materially. The factors that may affect our

results are listed in certain of our press releases and disclosed in

the Company’s public filings with the SEC.

2

stated objectives upon emergence…

Focus on core transmission and distribution

business

Resolve outstanding bankruptcy litigation

Asset sales of unregulated businesses

Attain investment grade rating

Develop strategy to redeploy excess free

cash flow

.

3

then – and now…

*Evaluating strategic alternatives on our ownership in Colstrip Unit 4.

(in thousands except otherwise indicated)

At emergence

Currently

Operations

# Unregulated Businesses (units)

4

1 *

# Of Customers

617.2

649.6

Annual Volumes

Electric (thousands of megawatt hours)

9,228

9,952

Natural Gas (thousands dekatherms)

28,886

28,894

Annual Capital Expenditures

$80,100

$117,000

Financial:

Book Value of Company

$709,335

$834,428

Annual Interest Expense

$83,843

$56,942

Secured Debt Rating

Sub Investment Grade

Investment Grade

Unsecured Debt Rating

Not rated

LT Debt to Total Capital Ratio

51.84%

47.58%

Annual Dividend per Share

–

$1.32

Listing Exchange

NASDAQ

NYSE

2 of 3 at

investment grade

4

environmental stewardship…

Montana

Sediment removal at Milltown Dam

Dam spillway was removed in 2008

River is free flowing

Have met current Renewable Portfolio Standards

Seeking new sources of wind power to meet state

requirements for 2010 and 2015

South Dakota

Reclamation of century old manufactured gas plant in

Aberdeen, SD

Coal tar removed in Moccasin Creek

Request for proposal issued in November 2007 for wind

power to meet increasing electric demand

.

Significant reduction of environmental issues.

5

financial results – 2007 income…

(Dollars in 000's)

2007

2006

Variance

% Change

Operating Revenues

1,200,060

1,132,653

67,407

Cost of Sales

668,405

613,582

54,823

Gross Margin

531,655

519,071

12,584

2.4%

Operating Expenses

Operating, general & administrative

221,566

240,215

(18,649)

Property and other taxes

87,581

74,187

13,394

Depreciation

82,415

75,305

7,110

Ammondson verdict

-

19,000

(19,000)

Total Operating Expenses

391,562

408,707

(17,145)

-4.2%

Operating Income

140,093

110,364

29,729

26.9%

Interest Expense

(56,942)

(56,016)

(926)

Investment Income and Other

2,428

9,065

(6,637)

Income (Loss) from Cont. Ops. Before Taxes

85,579

63,413

22,166

Benefit (Provision) for Income Taxes

(32,388)

(25,931)

(6,457)

Income (Loss) from Continuing Operations

53,191

37,482

15,709

Discontinued Ops., Net of Taxes

-

418

(418)

Net Income (Loss)

53,191

37,900

15,291

40.3%

Year Ended December 31,

6

financial results – 2007 balance sheet…

Debt Ratings

Unaudited (Dollars in 000's)

December 31,

2007

2006

Cash

12,773

1,930

Restricted Cash

14,482

15,836

Accounts Receivable, Net

143,482

149,793

Inventories

63,586

60,543

Other Current Assets

44,031

40,372

Goodwill

355,128

435,076

PP&E and Other Non-current Assets

1,913,898

1,692,387

Total Assets

2,547,380

$

2,395,937

$

Payables

91,588

78,739

Other Current Liabilities

209,245

192,504

Long & Short Term Capital Leases

40,391

42,462

Long & Short Term Debt

805,977

704,655

Other Non-current Liabilities

577,155

634,806

Shareholders' Equity

823,024

742,771

Total Liabilities and Equity

2,547,380

$

2,395,937

$

Long & Short Term Debt / Total Capitalization

49.5%

48.7%

7

Source: Company reports and SEC filings.

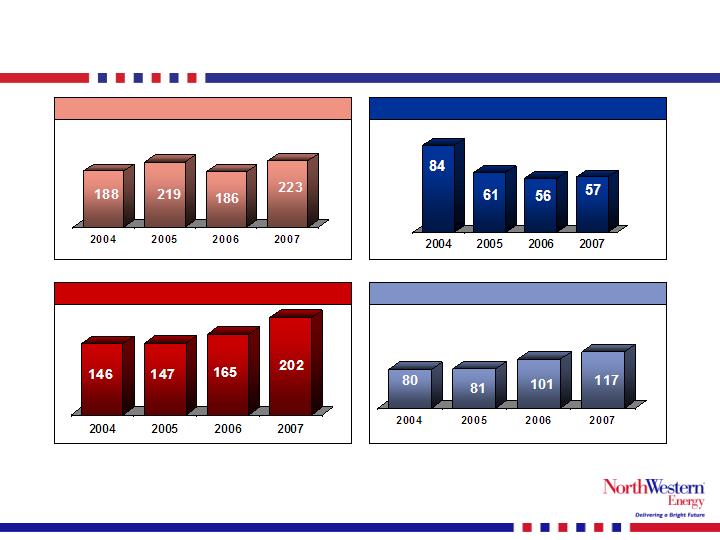

Note: Full year 2004 results show combined results for NorthWestern’s predecessor company from January 1, 2004 to

October 31, 2004 and for NorthWestern from November 1, 2004 to December 31, 2004.

(1) EBITDA is calculated as total operating income plus depreciation. For 2004, EBITDA excludes reorganization items

and impairment on asset sales.

(2) Excludes cash used in acquisitions.

financial highlights…

EBITDA(1)

Interest Expense

Cash Flow from Operations

Capital Expenditures(2)

($ in millions)

($ in millions)

($ in millions)

($ in millions)

8

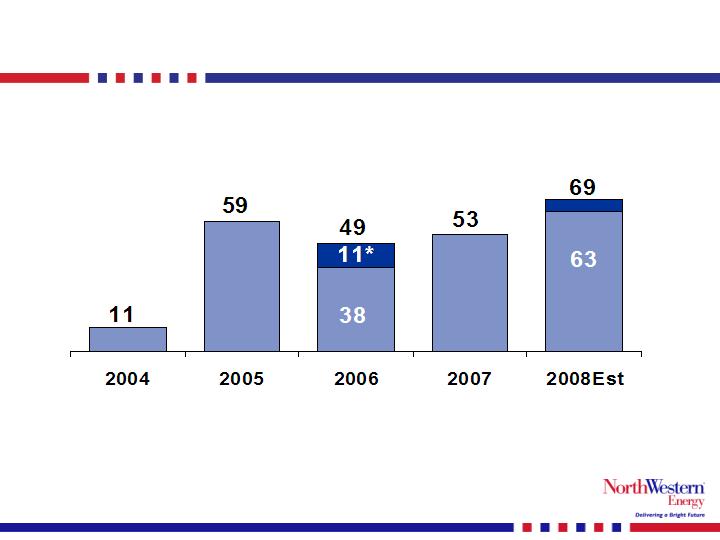

Source: Company reports and SEC filings.

Note: Full year 2004 results show combined results for NorthWstern’s predecessor company from January 1, 2004 to

October 31, 2004 and for NorthWestern from November 1, 2004 to December 31, 2004 and excludes debt

extinguishment income.

*Impact of Ammondson litigation.

earnings trend…

($ in millions)

Net Income

9

drivers to improve near term earnings…

Current rate case relief

Rate cases approved in South Dakota and Nebraska

Settled natural gas rate case with a base rate increase of

$4.6 million annually beginning December 1, 2007

FERC

Awaiting FERC approval of proposed settlement in the

transmission rate case with a margin increase of approximately

$3.0 million annually

Montana

Proposed settlement in electric and natural gas rate case with a

base rate increase of $15 million annually

Anticipate response from the MPSC by the first half of 2008

Magten settlement pending

Provides approximately $4 million payment to NorthWestern

for past legal fees

Stops legal fees to defend

.

Earnings Per Share Guidance for 2008: $1.60 to $1.75 per diluted share.

10

2008 1Q results…

(000's)

2008

2007

B(W)

% Change

Operating Revenues

385,975

366,565

19,410

5.3%

Cost of Sales

229,084

219,278

(9,806)

-4.5%

Gross Margin

156,891

147,287

9,604

6.5%

Operating Expenses

Operating, general & administrative

60,071

62,448

2,377

3.8%

Property and other taxes

23,640

20,592

(3,048)

-14.8%

Depreciation

21,091

19,894

(1,197)

-6.0%

Total Operating Expenses

104,802

102,934

(1,868)

-1.8%

Operating Income

52,089

44,353

7,736

17.4%

Interest Expense

(16,080)

(13,220)

(2,860)

21.6%

Investment Income and Other

662

378

284

75.1%

Income (Loss) from Cont. Ops. Before Taxes

36,671

31,511

5,160

16.4%

Benefit (Provision) for Income Taxes

(13,220)

(12,369)

(851)

6.9%

Net Income (Loss)

23,451

19,142

4,309

22.5%

Three Months Ended March 31,

11

delivering a bright future…

Operationally strong

Above-average reliability

Award-winning customer service

ServiceOne award for fourth consecutive year

Financially strong

Steady earnings growth

Superior cash flows

Consistent credit rating increases over past few years

Well positioned for future

Very strong balance sheet

Strong operational core competency

Significant growth opportunity

VISION: To be the top performing utility in our region.

12

generation growth highlights…

Mill Creek Generating Unit in Montana

What: 120-150 MW – built for regulation services to balance supply and load

Why: Existing services are becoming more expensive and scarce

South Dakota Peaking Generation

What: Construction of two 45 MW combustion turbines – one unit in Mitchell

and the second in Aberdeen

Why:

To meet rapidly increasing peak demand within our South Dakota service territory

Load growth projections for 2008-2010 are 15% versus historical 1%-2%

South Dakota’s peaking contract with MidAmerican Energy expires in 2009 with no

option of renewal and replacement contracts are not available in the region

South Dakota Base Load Generation

What: Evaluate ownership participation in regional coal-based plants that are

currently permitted and under development

Why:

Increased demand for energy in our South Dakota service territory.

Load forecasts for 2008-2010 are 15% versus a historical 1%-2% annual

growth rate

13

transmission growth highlights…

500 KV Upgrade and Collector System in Montana

What:

Upgrade the existing Colstrip 500 kV line to add approximately

500 to 600 MW of additional transfer capability

Construction of a 230 kV line from Great Falls to Three Rivers that will tie

into MSTI at the new Townsend substation

Why: To meet growing demand for transmission capacity related to

new generation sources within and out of Montana

Mountain States Transmission Intertie (“MSTI”)

What: Construction of a new 500 kV line from Southwest Montana to

central Idaho

Why: To meet growing demand for transmission service from

customers and relieve congestion and constraints on the high-

voltage transmission system in the region

14

distribution growth highlights…

South Dakota/Nebraska Natural Gas

Pipeline Expansions

What:

Potential acquisition of a South Dakota pipeline

Upgrade that pipeline for POET, Big Stone Ethanol expansion in SD ($10.5M)

Construction of a 44-mile pipeline from Trailblazer pipeline to Grand Island,

Nebraska and the St. Paul Ethanol Plant ($30M)

Why: Meet growing demand by ethanol plants for natural gas

Organic Growth

What: Currently our maintenance capital expenditures exceed our

depreciation by about $20 million annually

Why: Meet the organic growth of the communities we serve

15

growth project potential…

Opportunity to nearly double the rate base and earnings over the next few years.

Timing

Mill Creek Generator

7.5

$

to

10.0

$

150.0

$

to

200.0

$

Jan 2011

South Dakota Peaking generation

3.8

$

to

4.5

$

75.0

$

to

90.0

$

Jan 2011

South Dakota Baseload generation

6.3

$

to

10.0

$

125.0

$

to

200.0

$

Jan 2014

Natural Gas Pipeline Extensions

1.0

$

to

2.0

$

20.0

$

to

40.0

$

Thru 2009

MSTI transmission line

500 KV scenario

37.5

$

to

45.0

$

750.0

$

to

900.0

$

Jan 2013

345 KV scenario

32.5

$

to

35.0

$

650.0

$

to

700.0

$

Jan 2013

230 KV scenario

12.5

$

to

15.0

$

250.0

$

to

300.0

$

Jan 2013

Colstrip 500 kV transmission upgrade

10.0

$

to

12.5

$

200.0

$

to

250.0

$

Jan 2013

* For illustrative purposes = Cost of project times 50% equity ratio times estimated ROE of 10%

Cost of Project

Annual Earnings

Opportunity *

(in millions)

16

Northwestern – value and growth…

Montana regulatory clarity forthcoming

General rate case stipulation

Montana Consumer Council request for investigation

related to bankruptcy stipulation

Colstrip Unit 4

Value

Dividend yield of 5.4%

Currently trading at approximately 1.1x book value

Opportunity for Growth

Possibility of rate base growth in excess of $1 billion

Potential additional annual earnings of approximately

$50 million by 2013

Strong balance sheet and credit ratings to fund

growth projects

17

Colstrip Unit 4 strategic alternatives…

Options under consideration

Sale of the plant

Retain plant and place into rate base

Retain plant as unregulated

Next steps

Complete strategic review to maximize value of

the asset

Complete the bid process related to sale option

Work with regulators to determine viability of

rate base option

Expect resolution in third quarter 2008

18

summary…

Objectives achieved

related to focus on

core business

Superior cash flows

Strong balance sheet

Investment grade rated debt

Poised for growth

Solid foundation

Excellent Growth

Prospects

Unique geographic location to expand electric

and natural gas infrastructure

Increasing need to move energy through our

service area

Identified projects providing opportunity to nearly

double rate base and earnings

Nearly all consolidated earnings from regulated

business

Rate relief received in all jurisdictions

Outstanding bankruptcy litigation nearly completed

Attained investment grade ratings

19