Investor Update

July 22, 2008

forward-looking statement…

During the course of this presentation, there will be forward-

looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements often address our expected

future business and financial performance, and often contain

words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from

those expressed in any forward-looking statements. We undertake

no obligation to revise or publicly update our forward-looking

statements or this presentation for any reason. Although our

expectations and beliefs are based on reasonable assumptions,

actual results may differ materially. The factors that may affect our

results are listed in certain of our press releases and disclosed in

the Company’s public filings with the SEC.

who we are…

Electric transmission lines

Natural gas distribution lines

Supplier-owned electric or natural gas lines

Electric generating plant

Natural gas storage fields

Natural gas compressor stations

(1) As of 12/31/07

(2)

Book capitalization calculated as total debt, excluding capital leases, plus shareholders’ equity.

650,000 customers

388,000 electric

262,000 natural gas

Approximately 123,000 square miles

of service territory in Montana,

Nebraska and South Dakota

Total Generation (mostly base load coal)

MT – 222 MW – unregulated

SD – 312 MW – regulated

Total Assets: (1) $2,547 MM

Total Capitalization: (1)(2) $1,629 MM

Total Employees: (1) 1,350

business overview…

Regulated Operations (89% of Gross Margins)

One of the largest providers of electricity and natural gas in the Upper Midwest and Northwest,

serving approximately 650,000 customers in Montana, South Dakota and Nebraska

Electric Operations (65%)

Montana

328,000 customers (transmission/distribution)

Approximately 7,000 miles of transmission

lines and 21,000 miles of distribution lines

South Dakota

60,100 customers (integrated utility)

Approximately 3,200 miles of T&D lines

Owns 312 net MW of power generation

Gas Operations (24%)

Montana

177,000 customers (residential/commercial)

3,900 miles of distribution pipelines

2,000 miles of intrastate transmission

pipelines

16.2 Bcf of gas storage

South Dakota/Nebraska

84,500 customers (residential/commercial)

2,200 miles of distribution pipelines

Unregulated Operations (11%)

Electric — 222 MW - Primarily consists of an equity participation in 30% of Colstrip Unit 4,

a 740 MW coal-fired power plant in Montana

Source: NorthWestern Corporation 2007 10-K.

2007 segment information…

Unaudited (Dollars in 000's)

YE Dec 31, 2007

ELECTRIC

UTILITY

GAS

UTILITY

UNREGULATED

ELECTRIC

OTHER /

ELIMINATIONS

TOTAL

Gross Margin

346,976

127,626

56,152

901

531,655

% of Total

65%

24%

11%

0%

Operating Income

90,692

36,067

20,407

(7,073)

140,093

% of Total

65%

26%

15%

-5%

Net Income

33,730

14,599

10,274

(5,412)

53,191

% of Total

63%

27%

19%

-10%

2008 1Q results…

(000's)

2008

2007

B(W)

% Change

Operating Revenues

385,975

366,565

19,410

5.3%

Cost of Sales

229,084

219,278

(9,806)

-4.5%

Gross Margin

156,891

147,287

9,604

6.5%

Operating Expenses

Operating, general & administrative

60,071

62,448

2,377

3.8%

Property and other taxes

23,640

20,592

(3,048)

-14.8%

Depreciation

21,091

19,894

(1,197)

-6.0%

Total Operating Expenses

104,802

102,934

(1,868)

-1.8%

Operating Income

52,089

44,353

7,736

17.4%

Interest Expense

(16,080)

(13,220)

(2,860)

21.6%

Investment Income and Other

662

378

284

75.1%

Income (Loss) from Cont. Ops. Before Taxes

36,671

31,511

5,160

16.4%

Benefit (Provision) for Income Taxes

(13,220)

(12,369)

(851)

6.9%

Net Income (Loss)

23,451

19,142

4,309

22.5%

Three Months Ended March 31,

Source: Company reports and SEC filings.

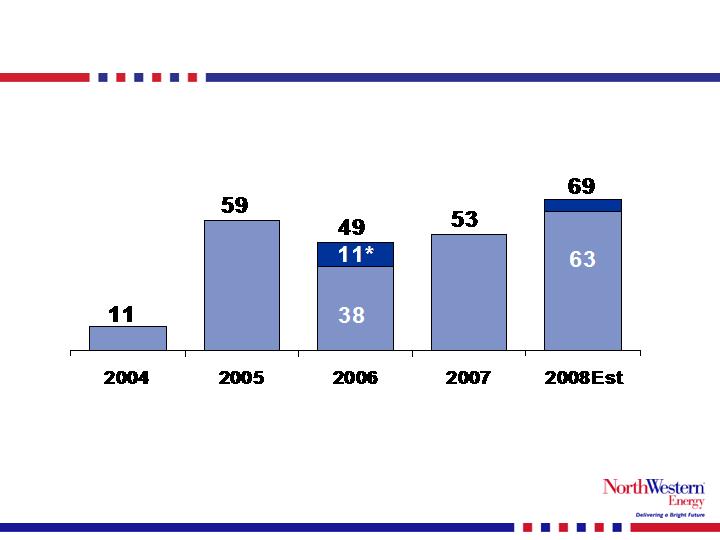

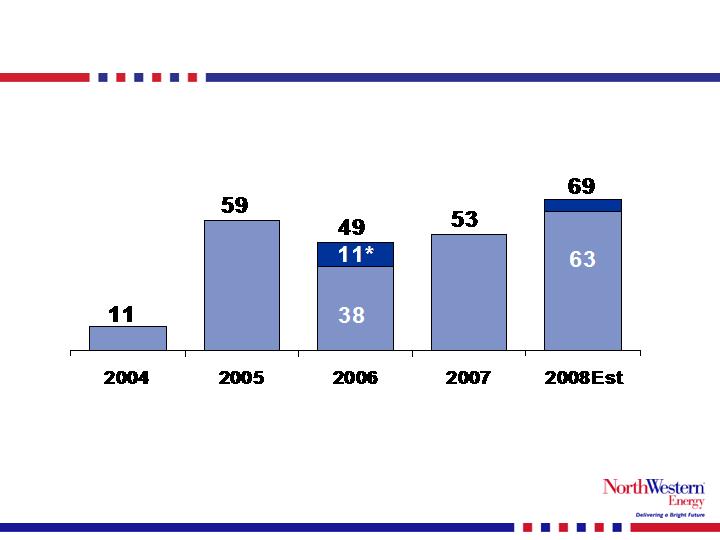

Note: Full year 2004 results show combined results for NorthWestern's predecessor company from January 1, 2004 to

October 31, 2004 and for NorthWestern from November 1, 2004 to December 31, 2004 and excludes debt

extinguishment income.

*Impact of Ammondson litigation.

earnings trend…

($ in millions)

Net Income

strong balance sheet…

Debt Ratings

Unaudited (Dollars in 000's)

March 31

December 31

2008

2007

Cash

33,755

12,773

Restricted Cash

13,904

14,482

Accounts Receivable, Net

142,280

143,482

Inventories

29,579

63,586

Other Current Assets

51,619

44,031

Goodwill

355,128

355,128

PP&E and Other Non-current Assets

1,922,041

1,913,898

Total Assets

2,548,306

$

2,547,380

$

Payables

65,989

91,588

Other Current Liabilities

234,642

209,245

Long & Short Term Capital Leases

39,877

40,391

Long & Short Term Debt

776,212

805,977

Other Non-current Liabilities

597,158

577,155

Shareholders' Equity

834,428

823,024

Total Liabilities and Equity

2,548,306

$

2,547,380

$

Long & Short Term Debt / Total Capitalization

48.2%

49.5%

2008 guidance bridge from 2007 results…

2008 = 2007 plus rate increases in MT, SD, NE

* Estimates by the three sell side firms covering NWEC average $1.71/fully diluted share for 2008.

2008 Guidance

Reported 2007 - EPS fully diluted

1.44

$

Mid-point

Guidance for 2008 - diluted

1.60

$

1.75

$

1.68

$

Yr over yr increase

0.24

$

per share

Bridge to 2008:

Rates - MT

0.23

$

Rates - FERC

0.01

$

Rates - SD

0.04

$

Rates - NE

0.02

$

Anticipated reduction to CU4 earnings in 2008

(0.04)

$

Anticipated yr over yr changes

0.26

$

per share

NorthWestern’s future…

Operationally strong

Cost competitive

Above-average reliability

Award-winning customer service

Financially strong

Steady earnings growth

Strong cash flows

Approximately a 50/50 debt to total capitalization ratio

Secured credit ratings of A-(MT) BBB+(SD) / BBB / Baa2

Unsecured credit ratings of investment grade from Moody’s, S&P, Fitch

Utilize excess cash flow and debt capacity to invest in the business

Organic growth in existing service territories

Electric generation opportunities in Montana and South Dakota

Electric transmission opportunities (Colstrip 500 kV upgrade and MSTI)

Gas transmission expansion in Nebraska and South Dakota

generation growth highlights…

Mill Creek Generating Unit in Montana

What: 120-150 MW – built for regulation services to balance supply and load;

estimated to cost around $200 million to complete

Why: Existing services are becoming more expensive and scarce

Anticipated 3Q 2008 filing with the MPSC

South Dakota Peaking Generation

What: Construction of two 45 MW combustion turbines – one unit in Mitchell

and the second in Aberdeen; estimated to cost approx. $80-$90 million

Why:

To meet rapidly increasing peak demand within our South Dakota service territory

Load growth projections for 2008-2010 are 15% versus historical 1%-2%

South Dakota’s peaking contract with MidAmerican Energy expires in 2009 with no

option of renewal and replacement contracts are not available in the region

South Dakota Base Load Generation

What: Evaluate ownership participation in regional coal-based plants that are

currently permitted and under development

Why:

Increased demand for energy in our South Dakota service territory.

Load forecasts for 2008-2010 are 15% versus a historical 1%-2% CAGR

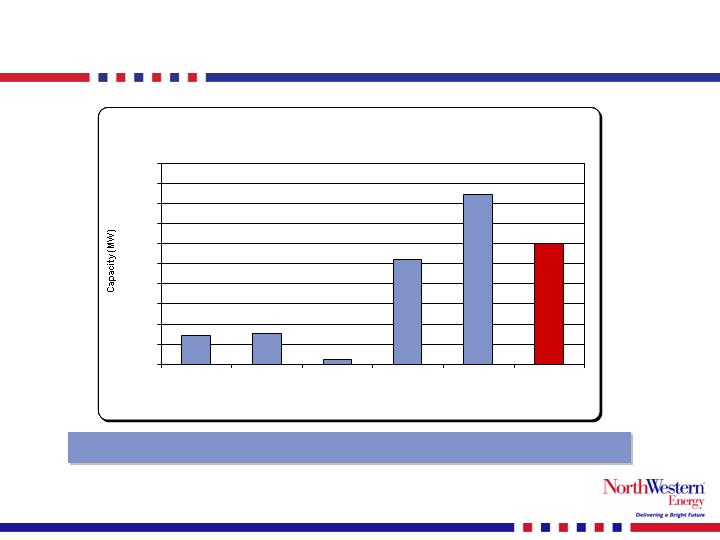

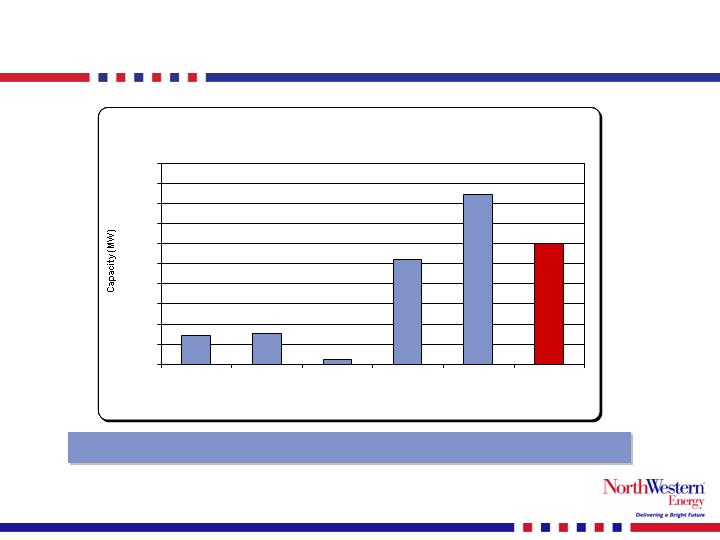

Montana proposed generation landscape…

New transmission is needed to support new generation

Potential Generation Development in Montana

722

770

116

2,606

4,213

3,000

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

Coal

Gas

Hydro

Wind

Total

MT Existing

Generation

transmission project developments…

Colstrip 500 KV Upgrade

NorthWestern may partner with others on the project

Renewed interest by certain of the other line owners

Significant proposed generation but mix is changing

May effect the timing and the configuration of the project

Looking to make the upgrade a “wind collector system”

Represents a change in scope of the project

Cost estimate of entire project = $200M - $250M

Inclusive of the collector system

Estimated to be on-line beginning of 2013

transmission project developments cont’d…

MSTI

Permitting for 500 KV line

Will scale this project to committed long term contracts

230KV, 270 mile line to move 430 MWs; cost = $250M - $300M

345KV, 370 mile line to move 800 MWs; cost = $650M - $700M

500KV, 400 mile line to move 1,500 MWs; cost = $750M - $900M

Major Facility Siting Act (MFSA) Application filed with Mont.

Department of Environmental Quality (MDEQ) in July 2008

Environmental review process takes about 2 years

Environmental review to be submitted to BLM in July 2008

Construction begins after environmental review

Indications of interest currently at 639 MW

Considering strategic partnering

distribution growth highlights…

South Dakota/Nebraska Natural Gas

Pipeline Expansions

What:

Potential acquisition of a South Dakota pipeline

Upgrade that pipeline for POET, Big Stone Ethanol expansion in SD ($10.5M)

Construction of a 44-mile pipeline from Trailblazer pipeline to Grand Island,

Nebraska and the St. Paul Ethanol Plant ($30M)

Why: Meet growing demand by ethanol plants for natural gas

Organic Growth

What: Currently our maintenance capital expenditures exceed our

depreciation by about $20 million annually

Why: Meet the organic growth of the communities we serve

growth project potential…

Current Estimated

Estimated

Timing

Mill Creek Generation Station

8.8

$

to

10.0

$

175.0

$

to

200.0

$

Jan 2011

South Dakota Peaking generation

3.8

$

to

4.5

$

75.0

$

to

90.0

$

Jan 2011

South Dakota Baseload generation

6.3

$

to

10.0

$

125.0

$

to

200.0

$

Jan 2014

Natural Gas Pipeline Extensions

1.0

$

to

2.0

$

20.0

$

to

40.0

$

Thru 2009

MSTI transmission line

(500 kV scenario)

37.5

$

to

45.0

$

750.0

$

to

900.0

$

Jan 2013

Colstrip 500 kV transmission upgrade

10.0

$

to

12.5

$

200.0

$

to

250.0

$

Jan 2013

* For illustrative purposes = Cost of project times 50% equity ratio times estimated ROE of 10%

Cost of Project

Annual Earnings

Opportunity *

(in millions)

Colstrip Unit 4 update…

Announced proposed transaction with Bicent on June 10, 2008

Proposal to pay NorthWestern $404 million in cash

Offer for the balance of plant (111 MW to 222 MWs) to NorthWestern at price

of Mid C minus $3/MWh from Nov 2010 to Dec 2020

Offer for an additional 50 MW to NorthWestern at price below Mid C from

Nov 2010 to Dec 2020

Allows NorthWestern the ability to work with interested parties on the

viability of placing into rate base at economics similar to the Bicent proposal

Submitted filing to rate base on June 27, 2008

Filed for $407 million into rate base ($404M + $6.25M break up fee - $3.25M

avoided transaction cost)

Requested cap structure = 50% debt/50% equity

Requested authorized ROE = 10.75%

Procedural schedule set by MPSC shows an October 2008 decision

Either conclusion is good news

If sold, capital infusion for growth projects and/or share repurchase

If rate based at requested structure, annual earnings potential of $21.8 M

2007 earnings at CU4 = $10.3 million

Consistent with NWE’s strategy to be a purely regulated entity

NorthWestern scorecard…

What we said at EEI (Nov 6, 2007) –

Rate case revenue opportunity

up to $57 million annually

Natural Gas generation for wind

firming in Montana

$110 million project

Completion expected July 2010

Colstrip 500 kV upgrade

$125 million project

Completion expected Jan 2011

MSTI

500 kV line

$800 million project

Completion expected Jan 2013

What occurred since then –

Rate increases approved

of approx. $21 million annually

Mill Creek site selected

$175 -$200 million project

Completion expected Jan 2011

Application with MPSC est. 3Q ‘08

Colstrip 500 kV upgrade

Wind collection system (scope change)

$200 - $250 million project

Completion expected 2013

MSTI

Between 230 kV and 500 kV line

$250 million - $900 million project

Completion expected 2013

Steady progress at the Company

NorthWestern scorecard cont’d…

What we said at EEI (Nov 6, 2007) –

GE Lease opportunity

Colstrip Unit 4

Reprice opportunity approx. $23 million

Earnings Guidance for 2007

$1.45 - $1.50 share

37 million shares outstanding

Ending Stock price – November 5, 2007

$27.14

Ending index value – November 5, 2007

DJU = 529.58

UTY = 565.88

What occurred since then –

GE Lease bought out

Approx $4 million annual savings

Colstrip Unit 4

Transaction announced with Bicent at

approx. $200 million over book value

Option to rate base at Bicent’s

purchase price and economic value

Earnings Guidance for 2008

$1.60 - $1.75 share

39 million shares outstanding

Ending Stock price – July 18, 2008

$24.47 (-6.19% - including dividends of

$.99/share paid since Nov. 5, 2007)

Ending index value – July 18, 2008

DJU = 493.40 (-6.83%)

UTY = 516.33 (-8.71%)

This analysis does not include the conclusion of Magten

litigation and introduction of share repurchase program.

Northwestern – value and growth…

Value

Dividend yield of 5.4%

Currently trading at approximately 1.14x book value

Opportunity for Growth

Possibility of rate base growth in excess of $1 billion

Potential additional annual earnings of more than

$50 million by 2013

Strong balance sheet/credit ratings

Moody’s recently upgraded Northwestern debt

All unsecured debt is now investment grade with

Moody’s, S&P and Fitch

summary…

Core regulated

business

Superior cash flows

Strong balance sheet

Investment grade rated debt

Poised for growth

Solid foundation

Excellent Growth

Prospects

Unique geographic location to expand electric

and natural gas infrastructure

Increasing need to move energy through our

service area

Identified projects providing opportunity to nearly

double rate base and earnings

Nearly all consolidated earnings from regulated

business

Rate relief received in all jurisdictions

Outstanding bankruptcy litigation nearly completed

Attained investment grade ratings