- NWE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

8-K Filing

NorthWestern (NWE) 8-KRegulation FD Disclosure

Filed: 10 Nov 08, 12:00am

EEI Financial Conference

November 10, 2008

JW Marriott

Phoenix, Arizona

forward-looking statement…

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from those

expressed in any forward-looking statements. We undertake no obligation

to revise or publicly update our forward-looking statements or this

presentation for any reason. Although our expectations and beliefs are

based on reasonable assumptions, actual results may differ materially.

The factors that may affect our results are listed in certain of our press

releases and disclosed in the Company’s public filings with the SEC.

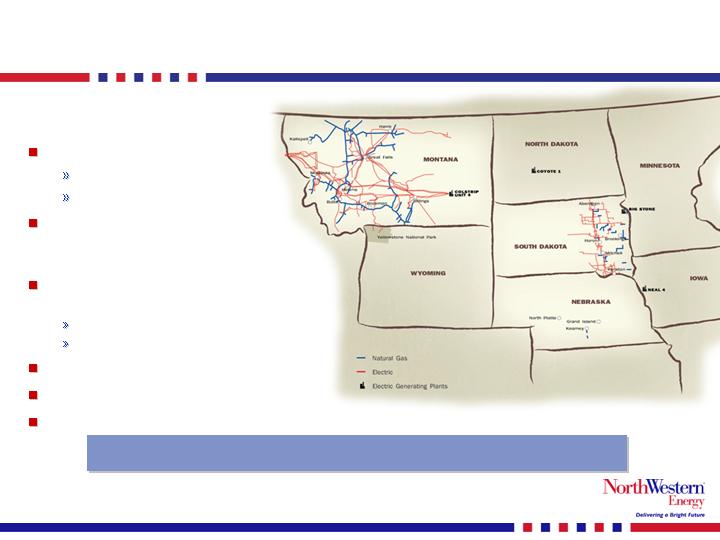

who we are…

(1)

As of 12/31/07

(2)

As of 9/30/08

(3)

Book capitalization calculated as total debt, excluding capital leases, plus shareholders’ equity.

650,000 customers

388,000 electric

262,000 natural gas

Approximately 123,000 square

miles of service territory in

Montana, Nebraska and South Dakota

Total generation (mostly base load coal)

MT – 222 MW – unregulated

SD – 312 MW – regulated

Total assets: $2,593 MM (2)

Total capitalization: $1,629 MM (2)(3)

Total employees: 1,360 (1)

Located in stable economies with potential grid expansion in the Northwest.

business segment contribution…

YE Dec 31, 2007

ELECTRIC

UTILITY

GAS

UTILITY

UNREGULATED

ELECTRIC

OTHER /

ELIMINATIONS

TOTAL

Gross Margin

346,976

127,626

56,152

901

531,655

% of Total

65%

24%

11%

0%

Operating Income

90,692

36,067

20,407

(7,073)

140,093

% of Total

65%

26%

15%

-5%

Net Income

33,730

14,599

10,274

(5,412)

53,191

% of Total

63%

27%

19%

-10%

Nearly all income from regulated assets.

2008 third quarter year-to-date results…

Earnings have increased 33% over prior year.

2008

2007

B(W)

Operating Revenues

934,725

892,036

42,689

Cost of Sales

508,941

499,555

(9,386)

Gross Margin

425,784

392,481

33,303

Operating Expenses

Operating, general & administrative

177,348

173,611

(3,737)

Property and other taxes

65,898

61,645

(4,253)

Depreciation

63,608

61,412

(2,196)

Total Operating Expenses

306,854

296,668

(10,186)

Operating Income

118,930

95,813

23,117

Interest Expense

(47,478)

(42,380)

(5,098)

Investment Income and Other

1,640

1,646

(6)

Income (Loss) from Cont. Ops. Before Taxes

73,092

55,079

18,013

Benefit (Provision) for Income Taxes

(26,759)

(20,326)

(6,433)

Net Income (Loss)

46,333

34,753

11,580

Nine Months Ended September 30,

Unaudited (dollars in 000's)

2008 guidance…

2008 = 2007 plus rate increases in all jurisdictions

Increased guidance after third quarter results

Increased from $1.60 to $1.75 per fully diluted share

Includes an increase in pension expense

Increase due to –

Share buyback

Lower legal costs (insurance recoveries)

Better pricing at Colstrip Unit 4 (hedge in place)

$1.65 to $1.80/fully diluted share

free cash flow…

Existing core business not in need of equity.

Free cash flow in 2008 was used to buy back company stock

The 2009 increase in pension funding expense will be offset by

reducing growth cap ex

The debt maturing in late 2009 is expected to be refinanced but

free cash flow can alleviate those maturities

(in millions)

Projected 2008

Cash flow from operations

245,000

Maintenance cap ex

(105,000)

Growth cap ex

(20,000)

Dividends

(50,000)

Free cash flow

70,000

strong balance sheet…

Plan to maintain a 50%-55% debt to total capitalization ratio.

Unaudited (Dollars in 000's)

September 30

2008

2007

Cash

8,575

12,773

Restricted Cash

16,166

14,482

Accounts Receivable, Net

108,540

143,482

Inventories

90,896

63,586

Other Current Assets

54,077

44,031

Goodwill

355,128

355,128

PP&E and Other Non-current Assets

1,960,432

1,913,898

Total Assets

2,593,814

$

2,547,380

$

Payables

72,340

91,588

Other Current Liabilities

275,152

209,245

Long & Short Term Capital Leases

38,335

40,391

Long & Short Term Debt

825,365

805,977

Other Non-current Liabilities

628,393

577,155

Shareholders' Equity

754,229

823,024

Total Liabilities and Equity

2,593,814

$

2,547,380

$

Long & Short Term Debt / Total Capitalization

52.3%

49.5%

liquidity highlights…

Total liquidity currently in the $145 million range

Debt maturities in late 2009

Unsecured revolver matures on Nov. 1, 2009

Current balance is $50 million

Letters of credit balance is approximately $17 million

Current rate is LIBOR + .75%

The $100 million non-recourse loan to purchase our interest in

Colstrip Unit 4 matures on Dec. 28, 2009

If Colstrip Unit 4 is rate based, we expect to refinance in late ‘09

If Colstrip Unit 4 is sold, the proceeds will pay off this loan

Current rate is LIBOR + 1.25%

Increase in pension expense will be offset by delaying the

SD peakers to better match local reserve margins

Liquidity position remains strong

More than 75% of the long-term debt matures after 2009

(most of that is due in 2014 or after)

credit ratings…

Fitch S&P Moody’s

Senior Secured Rating BBB A- (MT) Baa2

BBB+ (SD)

Senior Unsecured BBB- BBB Baa3

Corporate Rating BBB- BBB N/A

Outlook Positive Stable Positive

Either Colstrip Unit 4 outcome is expected to be ratings positive.

Colstrip Unit 4 update…

Rate base option before the MPSC

MPSC held work session on Oct. 31

Passed motion to draft an order –

To rate base CU4 at $407M

Recognize that $161M NOL balance belongs to the company

The draft order is due to be reviewed by the MPSC on Nov. 13

MPSC may revise its position until final order issued

Investigation of violation of prior MPSC order related to CU4

MPSC held work session on Oct. 31

Passed motion to draft an order –

That NorthWestern violated prior order in four instances

Total fine to be determined but estimated to be less than $1 million

NorthWestern will carefully review the final order

Final order anticipated to be issued in mid-November.

NorthWestern’s future…

Operationally strong

Cost competitive

Above-average reliability

Award-winning customer service

Financially strong

Steady earnings growth and strong cash flow

Sufficient liquidity with no significant maturities within next

12 months

Secured credit ratings of A-(MT) BBB+(SD) / BBB / Baa2

Unsecured credit ratings are investment grade from Moody’s,

S&P, Fitch

Growth prospects strong

Electric generation and transmission opportunities

Solid operations with growth prospects.

generation growth highlights…

Mill Creek Generating Unit in Montana

What: 120-150 MW plant near Anaconda, Montana

Built for regulation services to balance supply and load

Estimated to cost around $200 million

Why: Existing services are becoming more expensive and scarce

South Dakota Peaking Generation

What: Construction of two 45 MW combustion turbines

Estimated to cost around $90 million

Why:

To meet increasing peak demand within our South Dakota service territory

In service dates

Mill Creek = 2011 SD Peaking Units = 2013

transmission project developments…

Colstrip 500 kV Upgrade

NorthWestern announced partnership with others on

the project

Avista, PacifiCorp, Portland General, Puget Sound Energy

Needed to relieve congestion to the West

Cost estimate of 500 kV upgrade = $50M - $75M

Anticipate ownership interest of 25% on upgrade

230 kV “wind collector system”

Our project with no partners

Needed to collect the potential wind generation in Montana

Cost estimate of “collector” project = $150M - $200M

In service dates

500kV Upgrade = 2012 230kv Collector = 2014

transmission project developments cont’d…

MSTI

Developing a request for FERC declaratory order on incentive

rate principles

Beginning an updated Open Season for long term contracts to

be completed by early 2009

Continuing the public outreach process

Expect to complete the WECC path rating process Q1 ’09

Expect to publish an Environmental Impact Statement in late

’09 or early ‘10

Construction begins after environmental review

Considering strategic partnering

Estimated to be on line early 2014.

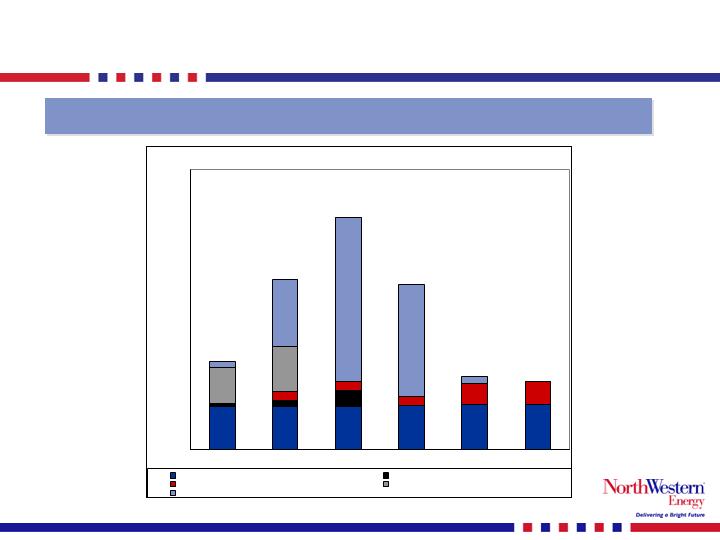

cap ex spending – next few years…

Includes more than $1 billion of potential generation and transmission growth projects.

$0

$100

$200

$300

$400

$500

$600

$700

2009

2010

2011

2012

2013

2014

Regulated Utilities Maintenance Capex

Colstrip Upgrade

230 kV Collector

Mill Creek Generator

MSTI

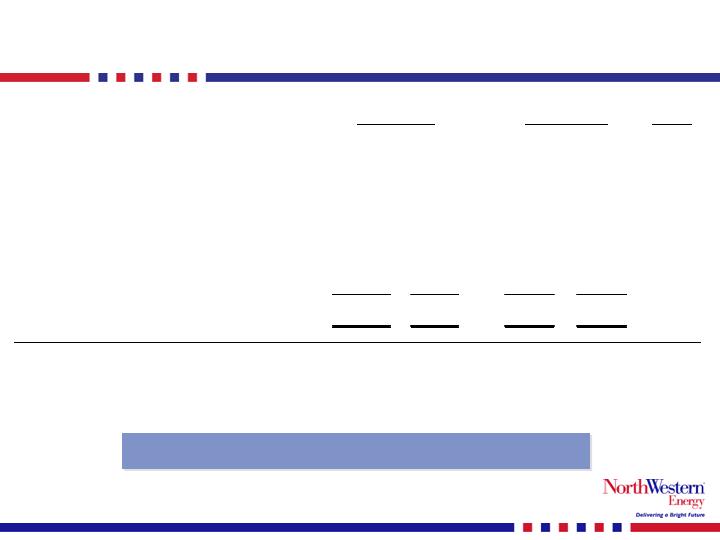

growth project potential…

Possibility to double and diversity earnings.

(in millions)

Timing

Mill Creek Generator

10.0

$

to

11.3

$

200

$

to

225

$

Jan 2011

Colstrip 500 kV transmission upgrade**

2.5

$

to

3.0

$

50

$

to

60

$

Jan 2012

South Dakota Peaking generation

3.8

$

to

4.5

$

75

$

to

90

$

Jan 2013

230 kV Wind Collector system

7.5

$

to

10.0

$

150

$

to

200

$

Jan 2014

MSTI transmission line (500 kV scenario)

37.5

$

to

50.0

$

750

$

to

1,000

$

Jan 2014

Totals

61.3

$

to

78.8

$

1,225

$

to

1,575

$

* For illustrative purposes = Cost of project times 50% equity ratio times estimated ROE of 10%.

** Assumes a 25% ownership of the $200 million project.

Cost of Project

Annual Earnings

Opportunity *

NorthWestern = value…

Value

Dividend yield of approximately 6.7%

Currently trading at approximately .95x book value

Opportunity for growth

Possibility of rate basing our 222 MW interest in CU4

Possibility of increasing rate base on growth projects

with investment in excess of $1 billion

Potential additional annual earnings of more than

$60 million post 2014

Strong balance sheet/credit ratings

Moody’s recently upgraded Northwestern debt

All unsecured debt is now investment grade with

Moody’s, S&P and Fitch

Current value with growth opportunities.

summary…

Objectives achieved

related to focus on

core business

Strong balance sheet

No equity required for existing core business

Modest debt maturities in short term

Investment grade rated debt

Increasing regulatory clarity

Solid foundation

Growth prospects

Unique geographic location to expand electric

and natural gas infrastructure

Increasing need to move energy through our

service area

Identified projects provide opportunity to nearly

double rate base and earnings

Nearly all earnings from regulated business

Recent rate relief received in all jurisdictions

Outstanding bankruptcy litigation nearly completed