Investor Update

Fort Worth, Austin, and Houston, TX

March 24 & 25, 2009

forward-looking statement…

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from those

expressed in any forward-looking statements. We undertake no obligation

to revise or publicly update our forward-looking statements or this

presentation for any reason. Although our expectations and beliefs are

based on reasonable assumptions, actual results may differ materially.

The factors that may affect our results are listed in certain of our press

releases and disclosed in the Company’s public filings with the SEC.

who we are…

(1)

As of 12/31/08

(2)

Book capitalization calculated as total debt, excluding capital leases, plus shareholders’ equity.

656,000 customers

392,000 electric

264,000 natural gas

Approximately 123,000 square

miles of service territory in

Montana, Nebraska and South Dakota

Total generation (mostly base load coal)

MT – 222 MW – regulated as of 1/1/09

SD – 312 MW – regulated

Total Assets: $2,762 MM (1)

Total Capitalization: $1,626 MM (1)(2)

Total Employees: 1,385 (1)

Located in relatively stable economies with potential grid expansion in the Northwest.

NorthWestern’s attributes …

Increasing earnings

Colstrip Unit 4 into rates effective Jan. 1, 2009

Expected to add $9 million or $.25/share in earnings over 2008

Rate case to be filed in Montana on electric and gas distribution business in 2Q ‘09

Strong cash flows

Steady earnings growth and strong cash flow

NOL’s provide an effective tax shield until 2012

Strong debt ratings

Secured credit ratings of A-(MT) BBB+(SD) / BBB+ / Baa1

Moody’s has on “positive” outlook

Growth prospects strong

Electric generation and transmission opportunities

Operationally strong

Cost competitive

Above-average reliability

Award-winning customer service

Solid operations with growth prospects.

regulatory update…

Rate case to be filed in Montana in 2009

Filing will include both electric and natural gas distribution businesses

Expect to file in 3Q 2009 on 2008 test year

Expect decision by July 1, 2010

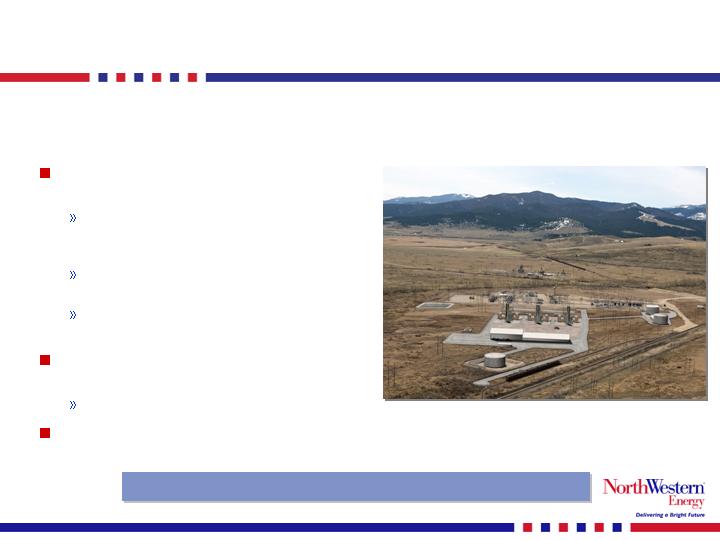

Mill Creek Generation Station filed with MPSC

Filed for pre-approval on the plant in August 2008

Hearings occurred in February 2009

Expect decision by June 30, 2009

FERC Filing on MSTI expected in early ‘09

Relates to the “open season”

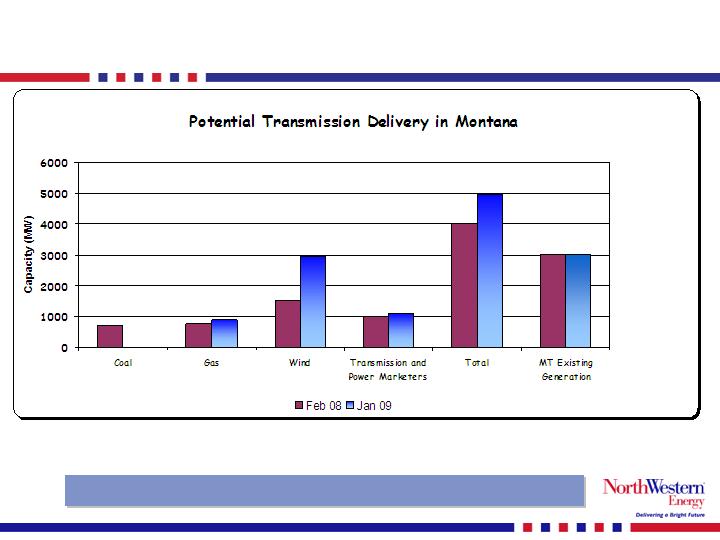

Reflects the change and increase in the generation queue in Montana

Establishing constructive regulatory regulations in all jurisdictions.

generation growth highlights…

120-150 MW plant near

Anaconda, MT

To be built for regulation

services to balance supply and

load for NWE’s Balancing Area

Rate-based cost of service

investment

Estimated to cost approximately

$200 million

Public hearing in front of MPSC

held

Decision expected 2Q ‘09

Existing services are becoming

more expensive and scarce

In service date for Mill Creek Generation Station = Jan 1, 2011

Mill Creek Generating Unit in Montana

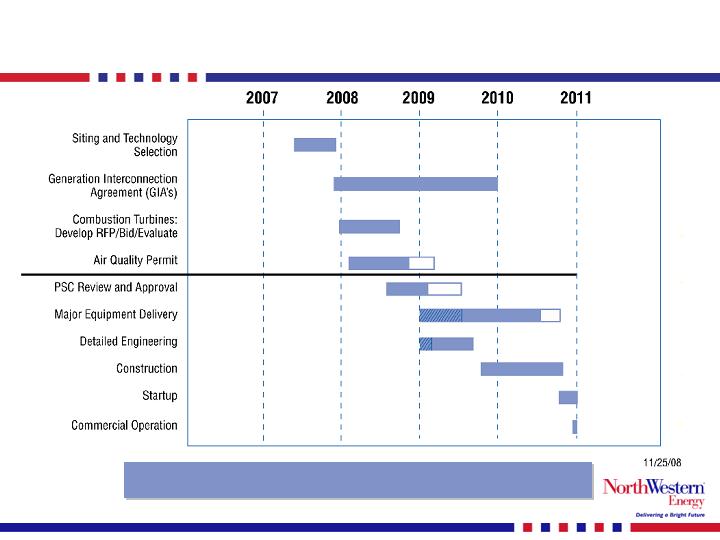

Mill Creek timeline…

The Mill Creek Generation Station has been filed for pre-approval,

with the MPSC w/decision expected in 2Q ’09.

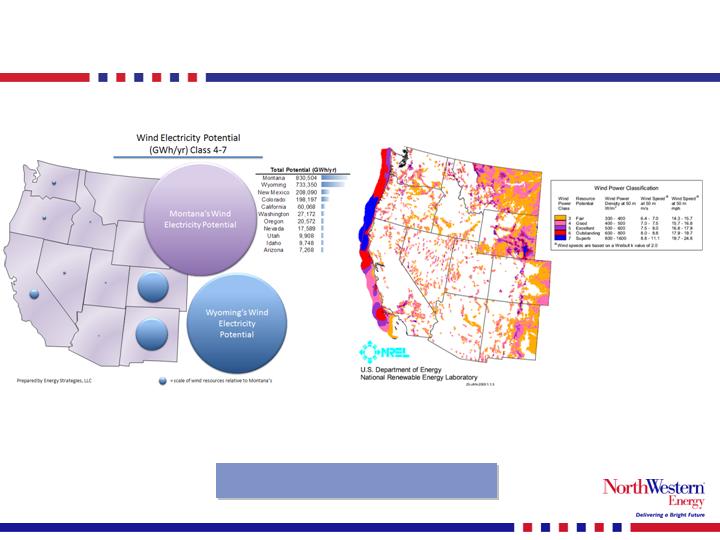

generation plans shifting to wind …

New generation in Montana mostly wind and will need to find an end user.

demand - renewable standards…

The current renewable percentage of NorthWestern’s electric supply in

Montana is a little more than 8%.

our transmission developments…

Line already exists – represents an

upgrade

Upgrades substation capacity

Increases load capacity of existing line by 500-600

MW’s

NorthWestern announced joint

development agreement with others

Portland General

Puget Sound Energy

Pacificorp

Avista

Bonneville Power Authority

Needed to relieve congestion to the West

Market interest is increasing for

Montana’s high quality wind profile

Cost estimate of ourportion of 500 kV

upgrade = $50M - $75M

Anticipated ownership interest of 30% on upgrade

In service date of January 1, 2012.

Colstrip 500 kV Upgrade

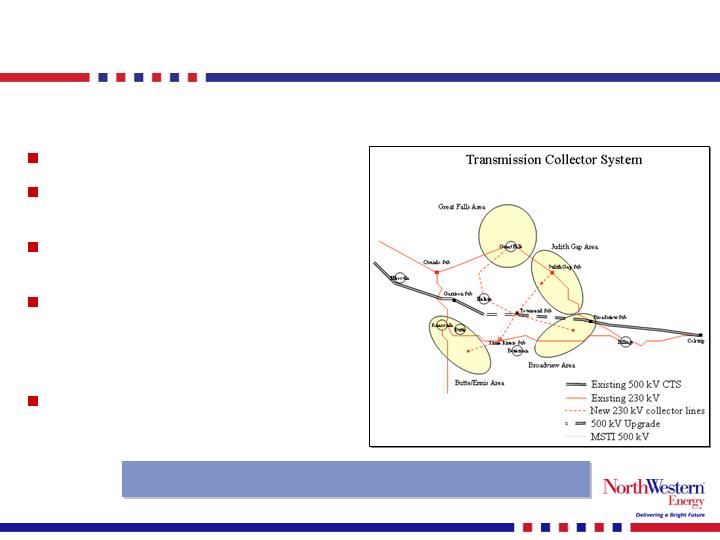

transmission project developments…

In service date sometime in 2014.

230 kV “Collector System”

Our project with no partners

Informational meeting with

customers in Spring 2009

Open Season early ‘09 to

determine configuration

Provides gathering system for

new generation to access

MSTI and network system

benefits

Cost estimate of “collector”

project = $200M

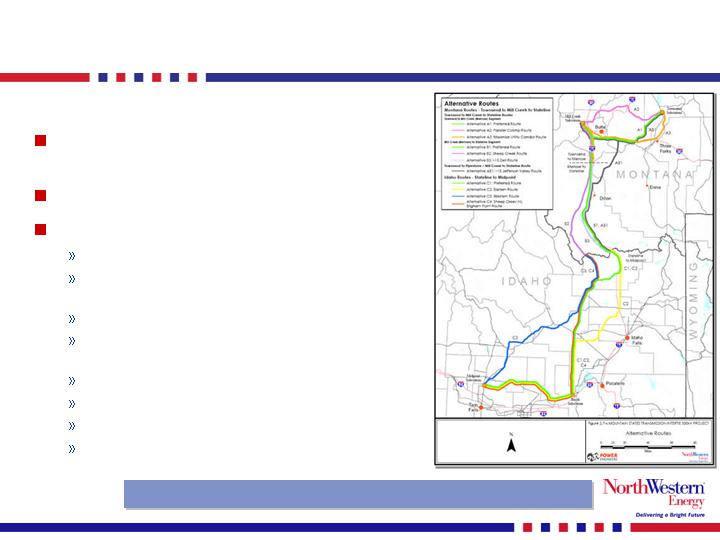

transmission project developments cont’d…

Total project cost estimated from

$800 million to $1 billion

Considering strategic partners

Plan to be operational in 2014

FERC filing in January ’09

Information meeting with FERC in

March ‘09

Open Season anticipated in summer ‘09

Draft Environmental Impact Statement

published late summer ‘09

Final EIS Q1 2010

Record of decision – Q3 2010

Start construction 2011

For current information:

www.MSTI500kV.com

Estimated to be on line early 2014.

MSTI

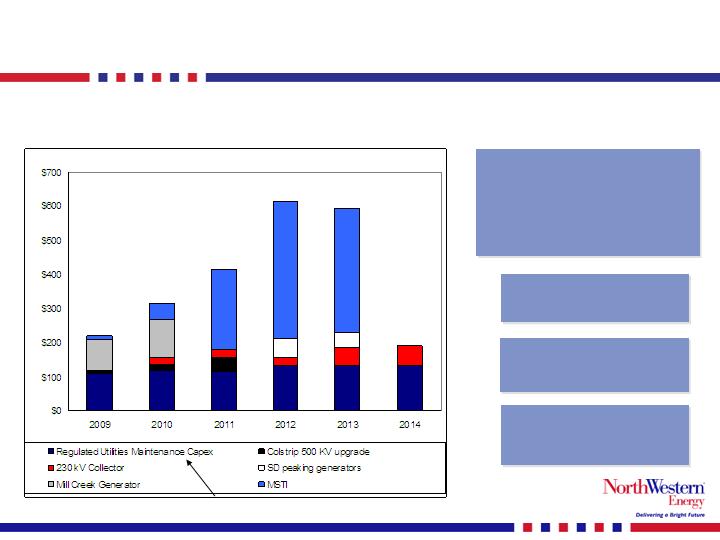

cap ex spending – next few years…

Includes more than $1 billion of potential generation

and transmission growth projects.

Non-discretionary

capex is funded 100%

by free cash flow.

Company doesn’t anticipate

needing equity unless we

proceed with MSTI.

We will move forward with

the funding of these projects

only when they make

economic sense.

MSTI project is now slated for

early 2014 and capex has

been modified accordingly.

Non-discretionary

growth project potential…

Possibility to double and diversify earnings as compared with our

existing $1.5 billion rate base as of 1/1/09.

(in millions)

Timing

Mill Creek Generation Station

200

$

to

200

$

10.0

$

to

10.0

$

Jan 2011

Colstrip 500 kV transmission upgrade **

50

$

to

60

$

2.5

$

to

3.0

$

Jan 2012

South Dakota Peaking generation

75

$

to

90

$

3.8

$

to

4.5

$

Jan 2013

230 kV Wind Collector system

150

$

to

200

$

7.5

$

to

10.0

$

Jan 2014

MSTI transmission line

750

$

to

1,000

$

37.5

$

to

50.0

$

Jan 2014

Totals

1,225

$

to

1,550

$

61.3

$

to

77.5

$

* For illustrative purposes = Cost of project times 50% equity ratio times estimated ROE of 10%.

** Assumes a 30% ownership of the $200 million project.

Cost of Project

Annual Earnings

Opportunity *

2009 income guidance…

Drivers

CU4 increase expected to be approximately $9 million

or $.25/share

Retail electric and natural gas volumes expected to

approximate 2008

Pension expense expected to be flat compared to 2008

Normal weather in our service territories

Expect increase of 5% to 13% over 2008 earnings of $1.77/share .

$1.85 to $2.00 per fully diluted share

credit ratings…

Fitch S&P Moody’s

Senior Secured Rating BBB+ A- (MT) Baa1

BBB+ (SD)

Senior Unsecured BBB BBB Baa2

Outlook Stable Stable Positive

Fitch upgraded in January 2009 and Moody’s upgraded in March 2009.

Debt to total capital ratio is 53%.

Plan to maintain a 50%-55% debt to total capitalization ratio.

2009 financing plan …

Issue up to $350 million of long-term senior debt securities

refinance our Colstrip loan maturing in December 2009

finance a portion of the proposed Mill Creek Generation Station and/or

fund utility capital expenditures

provide funds for general corporate purposes

Enter into a new revolving credit facility with availability between

$200 and $300 million to replace our current revolving credit facility

maturity in Nov. 2009

Current liquidity of approximately of $130 million and no other

significant maturities until 2014

summary …

Value

Dividend yield in excess of 6.0%

Currently trading at approximately book value

Improved regulatory relationships

Opportunity for growth

January 1, 2009 rate basing our 222 MW interest in CU4

Montana T&D rate case to be filed in 2009

expecting a rate increase request

effective in 2010

Possibility of increasing rate base on growth projects with

investment in excess of $1 billion

Potential additional annual earnings of more than $60 million post 2014

Strong financial profile

All debt is investment grade rated

2009 earnings expected to increase 5% - 13% over 2008

Strong cash flows from increasing earnings and NOL’s expected into

2012

Current value with growth opportunities.